- Phân tích

- Phân tích thị trường

- Nhận xét thị trường

- US Jobs Report Can Hardly Make a Decisive Contribution to the Market Puzzle

US Jobs Report Can Hardly Make a Decisive Contribution to the Market Puzzle

The overall picture of the sentiment on stock markets looks sound and mainly positive. The four consecutive days of a spectacular growth of the S&P500 and Nasdaq to new highs, as well as a clear improvement in both European and Asian stock markets, is a highly likely indicator of a confident closing of a hectic week. The main "objective" for today's non-farm payrolls report is not to derail it.

But, even if the US jobs figures for the last month and/or the average hourly earnings is relatively disappointing, the market participants will keep the excerpts from the Federal Reserve (Fed) statements right in front of them: "the labour market has continued to strengthen and ... economic activity has been rising at a solid rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low". This clearly supports the conception that the US regulator determines the vector of its monetary policy exclusively based on a long run jobs background. It means the Fed will keep the policy accommodative and stable for the next few months, regardless of the current January report's particular numbers. That's the only thing that really matters when the markets estimate a possible impact of the report on the Greenback and on stock exchanges.

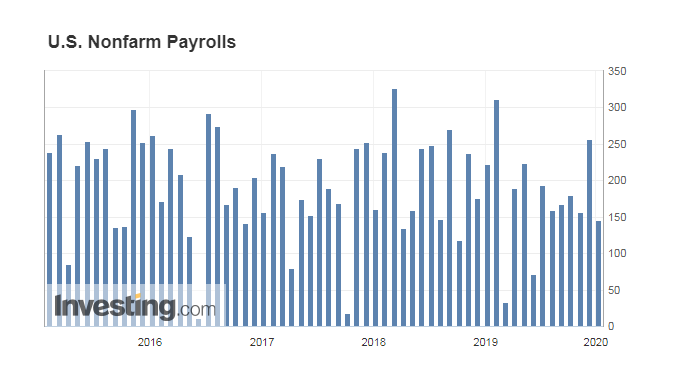

A look at the general charts of American jobs, month by month, could reveal just slightly more modest numbers in 2019 compared to an outstanding 2018, which is considered to be normal in a ten years economic cycle of growth. The non-farm payrolls numbers for the last ten months were very stable, with a good average result near 150K.

Pic.1. US Non-Farm Payrolls for the last 5 years

Source: Investing.com

Any fresh January numbers, whether it's 160K as the Bloomberg poll forecasts or even 291K from the Automatic Data Processing (ADP) fantastically high estimates published last Wednesday, or any "surprise" figures close to 100K today may not be able to rock the US Dollar significantly, but they could, more likely, produce some volatility in the tideway of the already established price range.

Strong new jobs numbers in the private sector may also be important for the ultimate market reaction. These numbers ranged from 122 K to 243 K over the last six months.

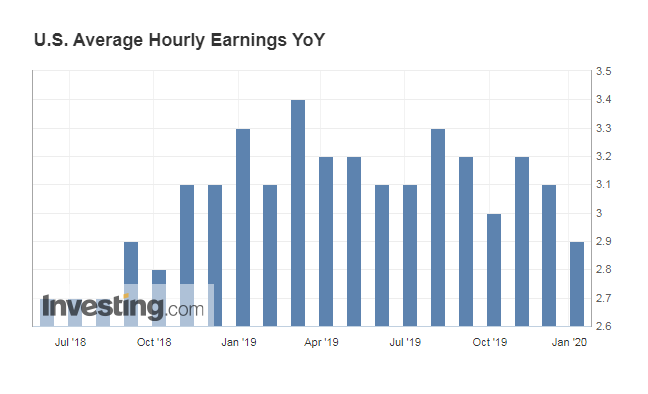

With the same gauge, average earnings could be approached. They may be even more important for today's market. But, even if the earnings growth will maintain the same values of 3.0-3.2% on a year-to-year basis, with only three exceptions for the last fifteen months, one of the exceptions was just 2.9% a month ago. This could hardly hold the labour market from recording another strong numbers to return it back to the usual range.

Pic 2. US average hourly earnings on a year-to-year basis

Source: Investing.com

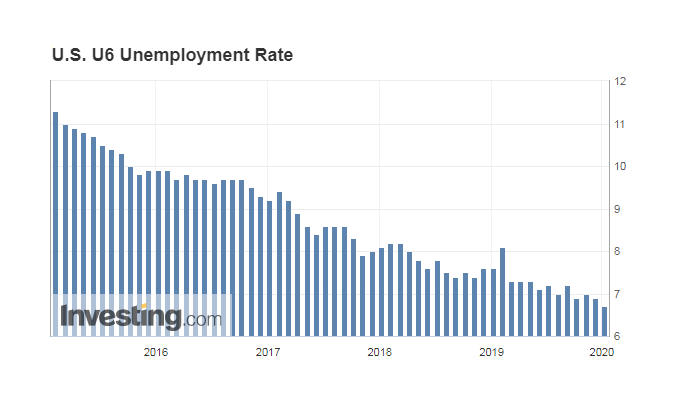

The U3 official unemployment rate, though not often mentioned, is also looking strong and better than U6 indicator (include part-time workers and actively seeking employment during the previous month), which is most remarkable. The U6 could be considered as a main marker of the US economy welfare. In contrast with the U3 the U6 figures, the U6 also includes all persons marginally attached to the labour force, plus total employed part time for economic reasons, as a percent of the civilian labour force, plus all persons marginally attached to the labour force. The point is that since 2008 until 2010 these U6 numbers jumped from an initial eight % to 17%, and the numbers were still in double digits before 2015, which caused a lot of criticism from the economic community against the Obama administration. Many experts argued that too many part-time jobs were created, and because of this, general U3 "normal" statistics were examined through rose-coloured spectacles. But that was definitely not the case for the last four years, when even the U6 unemployment indicator fell below the seven % mark.

Pic 3. US U6 unemployment rate since 2016

Source: Investing.com

Today the labour market data shows all this fascinating picture, and the most paradox consideration is that even weaker than expected figures today may be interpreted by the stock markets as just a source of a temporarily intraday volatility, but not as a reason for a significant correction. The reason for this optimism is the expected additional rate cuts from the Fed in the course of the yea,r if the indicators give the monetary policymaker any reason to spot economic slowdown. Any monetary stimulus, along with lower interest rates or quantitative easing programs might not be good news for the Greenback as a reserve currency, but the glut of cheap money is definitely the best positive signal for shares in the long run.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade.

Indiscriminate reliance on illustrative or informational materials may lead to losses.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.