- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-07-2012

The euro tumbled to the lowest level in more than a month versus the dollar after the European Central Bank cut its key interest rate to a record 0.75 percent and reduced its deposit rate to zero for the first time. The euro tumbled against the dollar as Draghi said some “downside risks to the euro-area economic outlook have materialized.”

The bank refrained from announcing any additional steps to cap debt yields in Spain and Italy. Spain’s bonds slid today after borrowing costs rose as it sold 3 billion euros ($3.7 billion) of debt, adding to concern Europe has yet to resolve its debt crisis. The yield on the nation’s 10-year debt rose as much as 43 basis points, or 0.43 percentage point, to 6.84 percent, the highest since June 29.

Both South Pacific currencies gained briefly after China cut its key interest rate for the second time in a month and the BOE raised its asset-purchase target by 50 billion pounds ($78 billion) to 375 billion pounds.

The Dollar Index, which Intercontinental Exchange Inc. uses to track the U.S. currency against those of six trade partners, climbed as much as 1.4 percent, the biggest intraday jump since Nov. 9, to 82.950 after U.S. employment reports. It later traded at 82.795, up 1.2 percent.

ADP Employer Services, based in Roseland, New Jersey, said U.S. companies added 176,000 workers in June, exceeding a forecast survey for a 100,000 advance. Applications for jobless benefits fell by 14,000 last week to 374,000, the fewest since mid-May, Labor Department data showed today. The Labor Department will report tomorrow that U.S. payrolls added 953,000 jobs in June, the third straight month below 100,000.

Canada’s dollar strengthened to a two-year high against Europe’s shared currency. It touched $1.2532 per euro, the strongest level since June 2010, before trading at C$1.2555, up 1.1 percent. The loonie, as the Canadian currency is nicknamed, was little changed versus the U.S. dollar at C$1.0129.

European stocks retreated as European Central Bank President Mario Draghi said downside risks to the economy remain, offsetting monetary policy easing by countries from China to the U.K.

The ECB cut interest rates to a record low and said it won’t pay anything on overnight deposits. The central bank reduced its main refinancing rate to 0.75 percent from 1 percent and cut its deposit rate to zero from 0.25 percent.

Draghi, the central bank’s president, said some “downside risks to the euro-area economic outlook have materialized. The main downside risks relate to weaker-than-expected economic activity.”

In the U.K, the Bank of England restarted bond buying two months after halting its asset-purchase program. The Monetary Policy Committee led by Governor Mervyn King raised its target by 50 billion pounds ($78 billion) to 375 billion pounds.

National benchmark indexes fell in 14 of the 18 western- European markets. Germany’s DAX declined 0.5 percent and France’s CAC 40 retreated 1.2 percent. The U.K.’s FTSE 100 gained 0.1 percent.

UniCredit SpA and Intesa Sanpaolo SpA, Italy’s largest banks, slumped 5.1 percent to 2.81 euros and 4.4 percent to 1.04 euros, respectively. Italy’s 10-year government bonds extended their decline, pushing the yield on the securities above 6 percent earlier today. Yields on two-year notes advanced 27 basis points to 3.70 percent.

In Spain, Banco Bilbao Vizcaya Argentaria SA plunged 4.8 percent to 5.46 euros and Banco Santander SA, the country’s largest lender, fell 3.9 percent to 5.10 euros.

Volkswagen climbed 5.1 percent to 134.50 euros after Europe’s largest carmaker agreed to buy the controlling stake in Porsche’s automotive business for 4.46 billion euros ($5.5 billion), ending a seven-year takeover saga that has divided two of Germany’s most powerful families.

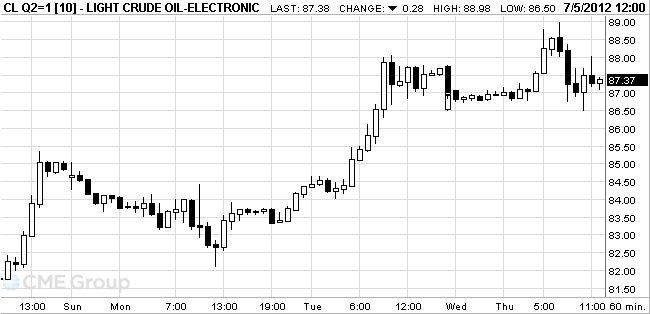

Crude fluctuated after a U.S. Energy Department report showed that stockpiles dropped and as the dollar rose against the euro on the European Central Bank’s reduction of interest rates to a record low.

Supplies fell 4.27 million barrels to 382.9 million last week, the biggest decrease since December, the report showed. Inventories were forecast to decline 2.3 million barrels, according to a Bloomberg survey. Oil decreased as much as 1.3 percent earlier after ECB President Mario Draghi said economic risks remain after the bank cut rates and the dollar gained.

Crude for August delivery surged to $88.98 earlier, the highest level since May 30. Prices are down 11 percent this year.

Brent oil in London rose as Statoil ASA (STL), Norway’s largest crude producer, prepared to halt output. The Norwegian Oil Industry Association, which represents employers, will ban all members of three labor unions who are covered by offshore pay agreements from midnight on July 9, Statoil said.

The planned lockout of oil workers in Norway will halt the nation’s entire offshore production, which totals about 2 million barrels a day of oil equivalent, Bard Glad Pedersen, a spokesman for Statoil ASA, said by phone today from Oslo.

Brent oil for August settlement advanced $1.60, or 1.6 percent, to $101.37 a barrel on the London-based ICE Futures Europe exchange. It touched $102.34 during the session, the highest level since June 7.

In the morning, gold prices were close to a maximum of two weeks at a time, as investors awaited the European Central Bank decision on interest rates.

After the announcement of the ECB's decision to reduce the key refinancing rate by 25 basis points and Mario Draghi pessimistic comments about the state of the economy the dollar rose sharply and took the gold price down.

Bank of England on Thursday launched the third round of "quantitative easing" by announcing that buys the assets for a further 50 billion pounds, and kept the key interest rate at 0.5 percent per annum, as expected.

On Friday, the U.S. employment report released in June, which could prompt the Fed to new measures to stimulate economic growth. According to the forecasts of economists, the number of jobs in June rose by 90,000, while unemployment remained at 8.2 percent.

Low interest rates are beneficial for gold, not bearing interest, because it reduces the loss of profit from investments in precious metals.

Investment demand for gold has declined in recent months due to economic uncertainty, as investors prefer the U.S. dollar as a safe asset.

The physical demand in India - the world's largest consumer of gold - fell because of the depreciation of the rupee and seasonal downturn.

August gold futures on the COMEX today, went up to 1624.5 dollars per ounce, then fell to 1597.5, and the dollar is currently trading at around 1608.8 dollars per ounce.

Resistance 3: 1660 (MA (200) for D1)

The resistance of 2:1640 (high of June, MA (100) for D1)

Resistance 1:1619 / 24 (resistance line from Jun 6, session high, Jul 3 high)

Current Price: 1608.70

Support 1:1595 (session low, Jul 3 low)

Support 3: 1587 (Jul 2 low)

Support 3: 1550 (low of June, resistance line from May 16)

Resistance 3: 95,00 (61.8% FIBO $ 106 - $ 77)

Resistance 2:91,60 / 90 (50.0% FIBO $ 106 - $ 77, Jun 29 high)

Resistance 1:88,70 (session high)

Current Price: 87.68

Support 1:86,20 (session low, Jul 4 low)

Support 2:82,00 (Jun 2 low, MA (200) for H1)

Support 3:77,50 (low of June)

Resistance of 3:1420 (highs of 2012)

Resistance of 2:1410 (highs of May)

Resistance of 1:1374 (session high)

Current Price: 1363.00

Support 1:1350 (Jul 2 low)

Support 2:1337 (MA (55) and MA (20) for D1)

Support 3:1302 (MA (200) for D1, Jun 25-26 lows)

U.S. stock futures fell as optimism with jobless claims data fizzled after European Central Bank President Mario Draghi said economic risks remain.

Investors also awaited tomorrow’s jobs report, which may show the weakest quarter for employment in more than two years.

Global Stocks:

Nikkei 9,079.8 -24.37 -0.27%

Hang Seng 19,809.13 +99.38 +0.50%

Shanghai Composite 2,201.35 -25.96 -1.17%

FTSE 5,687.38 +2.91 +0.05%

CAC 3,241.71 -26.04 -0.80%

DAX 6,524.92 -39.88 -0.61%

Crude oil $87.38 (+0,38%)

Gold fell 0.62% to $1605.00

- ECB Plans To Make Full Use Of Becoming Bank Supervisor

- New ECB Tasks Will Imply More Democratic Accountability

- We Stand Ready To Raise Standards Of Democratic Accountability

- New Tasks In Supervisory Area Should Be Rigorously Separated From Monetary Policy

- ECB Should Have No Contamination From Banking Supervision Task

- ECB Will Work With National Supervisors

- ECB Should Be Placed To Carry Out Banking Supervision Without Risk To Reputation

- EU Council Decision On Unified Banking Supervision Is Important Step

- Banks Lending To Real Economy Generates Collateral Vs ECB Funds

- ECB Must Make Sure It Doesn't Engage In Monetary Financing

- Idea of ECB Channelling Funds Via Banks To Specific Category Of Firms, Households Is Wrong

- Some Price Falls Are Part Of "Good" Rebalancing In EMU

- Deflation Has To Be Generalized Across Product Groups, Countries

- Deflation Is A Protracted, Generalized Drop In Price Level

- Growth Risks Relate To Potential Rise In Energy Prices

- Inflation Likely To Decline Further In Course of 2012

- ECB Still Expects Inflation To Fall Below 2% In Early 2013

- Underlying Price Pressures To Remain Moderate Amid Modest Growth

Data

01:30 Australia Trade Balance May -0.20 -0.51 -0.285

07:00 United Kingdom Halifax house price index June +0.5% -0.3% +1.0%

07:00 United Kingdom Halifax house price index 3m Y/Y June -0.1% -0.8% -0.5%

10:00 Germany Factory Orders s.a. (MoM) May -1.4% +0.2% +0.6%

10:00 Germany Factory Orders n.s.a. (YoY) May -3.4% -6.0% -5.4%

11:00 United Kingdom BoE Interest Rate Decision - 0.50% 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement -

11:45 Eurozone ECB Interest Rate Decision - 1.00% 0.75% 0.75%

12:15 U.S.DP Employment Report June 133 101 176

During the European session, the euro traded cautiously to the ECB's decision regarding interest rates. After application of the reduction rate to the level of 0.75% euro fell sharply, despite the fact that this decision, many analysts predicted. After this news demand for the dollar has risen sharply, which caused its purchase in huge quantities. Now the dollar is growing relative to other major currencies. Pound during the session rose sharply after the announcement of the Bank of England decision on interest rates, which remained the same. Also on the growth of the pound has affected the bank's accompanying statement, which caused an unprecedented enthusiasm among market participants. But the growth did not last long, because after the announcement of the ECB to lower interest rates the dollar rose, causing a depreciation of the pound. Significant growth is also now shown commodity exchange, which was caused by a statement of the People's Bank of China to lower rates for loans and deposits. This news caused a great interest in buying these currencies. In this regard, the Australian and New Zealand dollar reached its maximum value, updating the previous day's highs. The Canadian dollar also reacted positively to the news and declined to levels nearly two month low.

EUR / USD: during the European session the pair was trading with a slight decline, but fell sharply after the decision of the ECB and is now trading near the 1.2410 level

GBP / USD: a pair of rose sharply at later returned to their previous levels and is now trading near the minimum values of the session

USD / JPY: during the session, the pair dropped by then abruptly increased and is now near the maximum values of the previous day.

At 12:30 GMT the euro area will be press conference of the ECB. At the same time there are data on initial applications for unemployment benefits. At 14:00 GMT the U.S. will be published by PMI in service in June. Finish the day at 15:00 GMT U.S. data on the change oil according to the Department of Energy.

EUR/USD

Offers $1.2650, $1.2625/30, $1.2600/10, $1.2580/81, $1.2550

Bids $1.2480, $1.2450, $1.2400

AUD/USD

Offers $1.0450, $1.0400, $1.0350, $1.0320 Strong offers, $1.0290/00

Bids $1.0245/40, $1.0235/30, $1.0200, $1.0150

EUR/JPY

Offers Y101.00, Y100.85/90, Y100.50, Y100.00

Bids Y99.50, Y99.00, Y98.70/60, Y98.50, Y98.00

EUR/GBP

Offers stg0.8100, stg0.8080/90, stg0.8050

Bids stg0.8000, stg0.7965/60

GBP/USD

Offers $1.5700, $1.5650, $1.5620/25

Bids $1.5560/50, $1.5450

USD/JPY

Offers Y80.50, Y80.25, Y80.00

Bids Y79.50, Y79.00

Resistance 3: Y80.90 (50.0% FIBO Y84,20-Y77,60)

Resistance 2: Y80.60 (MA (100) for D1, May and June high)

Resistance 1: Y80.10 (session high)

Current price: Y79.71

Support 1: Y79.30 (July 2 low)

Support 2: Y79.15 (June 29 low)

Support 3: Y78.80 (June 20 low)

Resistance 3: Chf0.9680 (area of peaks 4-5 and 28 June)

Resistance 2: Chf0.9650 (88,2% FIBO $ 0,9465 - $ 0,9680, June 26 high)

Resistance 1: Chf0.9630 (76,4% FIBO $ 0,9465 - $ 0,9680, June 25 high)

Current price: Chf0.9609

Support 1: Chf0.9560/65 (July 2-3 high)

Support 2: Chf0.9510 (July 3 low)

Support 3: Chf0.9460 (June 29 low)

Resistance 3: $ 1.5720 (July 2 high)

Resistance 2: $ 1.5650/60 (MA (100) for H1, June 26 high and July 3 low)

Resistance 1: $ 1.5620/30 (MA (200) for H1, 38,2% FIBO $ 1,5486 - $ 1,5716)

Current Price: $ 1.5574

Support 1: $ 1.5540 (76,4% FIBO $ 1,5486 - $ 1,5716)

Support 2: $ 1.5515 (88,2% FIBO $ 1,5486 - $ 1,5716)

Support 3: $ 1.5480/70 (June 14-15 and 28 lows)

Resistance 3: $ 1.2695 (June 29 high)

Resistance 2: $ 1.2625 (23,6% FIBO $ 1.2410-$ 1.2690, July 3 high)

Resistance 1: $ 1.2550/60 (50% FIBO $ 1.2410-$ 1.2690, July 3 low)

Current Price: $ 1.2508

Support 1: $ 1.2475 (76,4% FIBO $ 1.2410-$ 1.2690)

Support 2: $ 1.2440 (88,2% FIBO $ 1.2410-$ 1.2690, support line from 06/01/12 and 06/28/12)

Support 3: $ 1.2410 (June 28 low)

EUR/USD $1.2400, $1.2440, $1.2450, $1.2500, $1.2600, $1.2620, $1.2700, $1.2715

USD/JPY Y79.50, Y80.00, Y80.50, Y80.55, Y82.00

GBP/USD $1.5700

AUD/USD $1.0015, $1.0200, $1.0345

AUD/CAD C$1.0375

E1.239bln of 4.00% July 2015 Bono; cover 2.28 vs 3.18 previous

E1.015bln of 4.25% Oct 2016 Bono; cover 2.56 vs 2.56 previous

E747mln of 5.85% Jan 2022 Obligacion; cover 3.18 vs 3.29 previous

Asian stocks fell, with the regional benchmark index heading for its first decline in in seven days as a deepening economic slump in Europe outweighed expectations the region’s central bank will ease rates today.

Nikkei 225 9,079.8 -24.37 -0.27%

S&P/ASX 200 4,169.19 -2.96 -0.07%

Shanghai Composite 2,201.35 -25.96 -1.17%

Nippon Sheet Glass Co. , which counts Europe as its biggest market, fell 1.2 percent in Tokyo.

Aquarius Platinum Ltd. tumbled 8.2 percent in Sydney after the world’s fourth-largest producer of the precious metal said output will fall.

Li Ning Co. surged 7.3 percent after founder and Olympic gold medalist Li Ning stepped in as chief executive officer and TPG Capital pledged to boost investment in the sportswear retailer if needed.

01:30 Australia Trade Balance May -0.20 -0.51 -0.285

The euro remained lower against the yen following a decline yesterday before German factory data that may add to signs Europe’s debt crisis is damping growth. Factory orders in Germany, the euro zone’s biggest economy, probably declined 6 percent in May from a year earlier, according to the median estimate of economists in a Bloomberg survey before today’s figure. Orders fell 3.8 percent in April.

The European Central Bank will probably reduce borrowing costs at a policy meeting today to stimulate the euro-area’s flagging economy, according to a Bloomberg News poll. The ECB is likely to lower its main refinancing rate by a quarter-percentage point from a record low of 1 percent, a separate Bloomberg poll of economists shows.

Spain is scheduled to auction 3-, 4- and 10-year bonds today. The nation’s benchmark 10-year yield jumped 16 basis points yesterday, the most since June 26, to 6.41 percent. That compared with a euro-era high of 7.29 percent reached June 18.

The pound maintained a three-day slide on speculation the Bank of England will extend its so-called quantitative easing program today. The central bank will probably raise its target for bond purchases by 50 billion pounds ($78 billion) to 375 billion pounds, according to 30 of 41 economists in a Bloomberg survey.

The yen touched the lowest in more than a week versus the dollar before erasing losses as Asian shares declined. The Bank of Japan will continue powerful monetary easing, Governor Masaaki Shirakawa said today to the central bank’s regional branch managers in Tokyo. Nervousness is seen in global financial markets and there’s uncertainty in the worldwide economy, he said.

EUR / USD: during the Asian session the pair receded from yesterday's low.

GBP / USD: during the Asian session the pair holds in range $1.5580-$1.5600.

USD / JPY: during the Asian session the pair showed a new week's high, but declined later .

The focus for Thursday is clearly on the monetary police decision due from the Bank of England and European Central Bank. Ahead of then, data is limited with German manufacturing orders at 1000GMT expected to come in at 0.2% m/m, -5.6% y/y. The Bank of England is up first with it's policy decision due at 1100GMT. The near consensus view is that the Bank of England's Monetary Policy Committee will expand quantitative easing at this month's meeting - the debate is all about by how much. The ECB decision is then due, at 1145GMT. MNI sent an ECB sources story earlier this week in which senior Eurozone central bankers told MNI that the surprisingly far-reaching Summit decisions by EU leaders have cleared the way for the ECB to cut interest rates, though a definitive decision by the Governing Council has not yet been taken.

Yesterday the euro fell against the dollar and the yen after growth, in anticipation of tomorrow's auction of Spanish bond and the meeting of the European Central Bank. Reduction was also caused by the publication of economic data for the EU, which showed weak growth. Dollar during the session showed a stable and steady growth, as many market participants are waiting for report on U.S. employment, which should surprise the good data. Positively to the dollar also affected by the representative of the ECB Knothe, who discussed the program of purchases of bonds.

The pound fell sharply after disappointing data on the PMI index in the services sector, which until eight months minimum.

Also during the session showed a significant reduction in the Swiss franc, which is against the backdrop of economic data from the EU renewed the maximum of the previous day.

Asian stocks rose for a sixth day, with the regional benchmark index heading for its longest winning streak this year, as U.S. factory orders topped estimates and commodities climbed to a two-month high amid speculation central banks will act to boost economic growth.

Nikkei 225 9,104.17 +37.58 +0.41%

S&P/ASX 200 4,172.16 +44.94 +1.09%

Shanghai Composite 2,227.31 -1.88 -0.08%

BHP Billiton Ltd. jumped 2.1 percent to lead gains among commodity stocks as a surge in raw-materials prices boosted the earnings outlook at the world’s largest mining company.

Komatsu Ltd., a Japanese maker of construction equipment that gets 23 percent of sales in the U.S., rose 2 percent.

Real Nutriceutical Group Ltd. soared 13 percent after billionaire Li Ka-shing increased his stake in the provider of health products.

European stocks were little changed as speculation that central banks will ease monetary policy offset service-industry measures in the U.K. and Germany that missed economists’ forecasts.

The European Central Bank and the Bank of England will announce interest-rate decisions tomorrow. ECB officials will cut their benchmark rate by 25 basis points to a record low 0.75 percent, according to the median forecast.

A U.K. gauge of services activity based on a survey of purchasing managers fell to 51.3 in June, an eight-month low, from 53.3 in May, Markit Economics and the Chartered Institute of Purchasing and Supply said. The median forecast of 25 economists in a Bloomberg survey was for a reading of 52.9. A measure above 50 indicates expansion.

A German services PMI dropped to 49.9 last month from 51.8 in May, according to a separate report from Markit.

National benchmark indexes fell in 10 of the 18 western European markets. Germany’s DAX and France’s CAC 40 lost 0.3 percent. The U.K.’s FTSE 100 dropped 0.2 percent.

Mediaset SpA, the broadcaster controlled by former Italian Prime Minister Silvio Berlusconi, advanced 6.5 percent to 1.48 euros. The stock climbed following an Il Sole report that RTL Group and Al-Jazeera are seeking a partnership with the company for pay television.

EON AG dropped 1.6 percent to 16.91 euros after analysts downgraded the shares. Germany’s biggest utility was cut to neutral from overweight at JPMorgan, while Citigroup Inc. reduced its recommendation to sell from neutral.

Asian stocks rose for a sixth day, with the regional benchmark index heading for its longest winning streak this year, as U.S. factory orders topped estimates and commodities climbed to a two-month high amid speculation central banks will act to boost economic growth.Nikkei 225 9,104.17 +37.58 +0.41%

S&P/ASX 200 4,172.16 +44.94 +1.09%

Shanghai Composite 2,227.31 -1.88 -0.08%

BHP Billiton Ltd. jumped 2.1 percent to lead gains among commodity stocks as a surge in raw-materials prices boosted the earnings outlook at the world’s largest mining company.

Komatsu Ltd., a Japanese maker of construction equipment that gets 23 percent of sales in the U.S., rose 2 percent.

Real Nutriceutical Group Ltd. soared 13 percent after billionaire Li Ka-shing increased his stake in the provider of health products.

European stocks were little changed as speculation that central banks will ease monetary policy offset service-industry measures in the U.K. and Germany that missed economists’ forecasts.

The European Central Bank and the Bank of England will announce interest-rate decisions tomorrow. ECB officials will cut their benchmark rate by 25 basis points to a record low 0.75 percent, according to the median forecast.

A U.K. gauge of services activity based on a survey of purchasing managers fell to 51.3 in June, an eight-month low, from 53.3 in May, Markit Economics and the Chartered Institute of Purchasing and Supply said. The median forecast of 25 economists in a Bloomberg survey was for a reading of 52.9. A measure above 50 indicates expansion.

A German services PMI dropped to 49.9 last month from 51.8 in May, according to a separate report from Markit.

National benchmark indexes fell in 10 of the 18 western European markets. Germany’s DAX and France’s CAC 40 lost 0.3 percent. The U.K.’s FTSE 100 dropped 0.2 percent.

Mediaset SpA, the broadcaster controlled by former Italian Prime Minister Silvio Berlusconi, advanced 6.5 percent to 1.48 euros. The stock climbed following an Il Sole report that RTL Group and Al-Jazeera are seeking a partnership with the company for pay television.

EON AG dropped 1.6 percent to 16.91 euros after analysts downgraded the shares. Germany’s biggest utility was cut to neutral from overweight at JPMorgan, while Citigroup Inc. reduced its recommendation to sell from neutral.

Resistance 3: Y81.45 (Apr 27 high )

Resistance 2: Y80.65 (Jun 25 high )

Resistance 1: Y80.10 (session high Jul 5)

Current price: Y79.76

Support 1: Y79.60 (Jul 3 low)

Support 2: Y79.80 (Jul 2 low)

Support 3: Y79.10 (Jun 29 low)

Resistance 3: Chf0.9680 (Jun 28 high )

Resistance 2: Chf0.9625 (76.4% FIBO Chf 0.9460-Chf0.9680)

Resistance 1: Chf0.9605 (Jul 4 high )

Current price: Chf0.9590

Support 1: Chf0.9565 (Jul 3 high )

Support 2: Chf0.9510 (Jul 3 low )

Support 3: Chf0.9480 (lJul 2 ow )

Resistance 3: $ 1.5720 (Jul 2 high )

Resistance 2: $ 1.5680 (high of the European session on Jul 4)

Resistance 1: $ 1.5610 (high of the American session on Jul 4)

Current Price: $ 1.5592

Support 1: $ 1.5575 ( Jul 4 low)

Support 2: $ 1.5540 (76.4% FIBO $ 1.5720-$ 1.5485)

Support 3: $ 1.5485 (Jun 28 low)

Resistance 3: $ 1.2625 (Jul 3 high)

Resistance 2: $ 1.2600 (high of the European session on Jul 4)

Resistance 1: $ 1.2545 (high of the U.S. session on Jul 4)

Current Price: $ 1.2527

Support 1: $ 1.2505 (Jul 4 low )

Support 2: $ 1.2475 (76.4% FIBO $ 1.2695-$ 1.2407)

Support 3: $ 1.2405 (Jun 28 low )

Change % Change Last

Gold 1,615 -7 -0.41%

Oil 87.01 -0.65 -0.74%

Change % Change Last

Nikkei 225 9,104.17 +37.58 +0.41%

S&P/ASX 200 4,172.16 +44.94 +1.09%

Shanghai Composite 2,227.31 -1.88 -0.08%

FTSE 100 5,684.47 -3.26 -0.06%CAC 40 3,267.75 -3.45 -0.11%

DAX 6,564.8 -13.41 -0.20%

Dow closed

Nasdaq closed

S&P 500 closed

(pare/closed(00:00 GMT +02:00)/change, %)

GBP/USD $1,5594 -0,59%

USD/CHF Chf0,9587 +0,65%

USD/JPY Y79,86 +0,05%

EUR/JPY Y100,05 -0,56%

GBP/JPY Y124,54 -0,52%

AUD/USD $1,0750 +4,37%

NZD/USD $0,8039 +0,04%

USD/CAD C$1,0128 +0,06%

01:30 Australia Trade Balance May -0.20 -0.51 -0.285

07:00 United Kingdom Halifax house price index June +0.5% -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y June -0.1% -0.8%

10:00 Germany Factory Orders s.a. (MoM) May -1.9% +0.2%

10:00 Germany Factory Orders n.s.a. (YoY) May -3.8% -6.0%

11:00 United Kingdom BoE Interest Rate Decision - 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement -

11:45 Eurozone ECB Interest Rate Decision - 1.00% 0.75%

12:15 U.S. ADP Employment Report June 133 101

12:30 Eurozone ECB Press Conference -

12:30 U.S. Initial Jobless Claims - 386 385

14:00 U.S. ISM Non-Manufacturing June 53.7 53.1

15:00 U.S. Crude Oil Inventories - -0.1

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.