- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 06-07-2012

The dollar strengthened to a two-year high against the euro as investors sought safety after U.S. employers added fewer jobs in June than forecast.

Payrolls increased by 80,000 jobs after a revised gain of 77,000 in May, Labor Department data showed today in Washington. Economists projected an increase of 100,000, according to the median estimate. Private employment, which excludes government agencies, grew 84,000 in June, the weakest in 10 months.

The euro weakened earlier as Spanish industrial production adjusted for the number of working days fell 6.1 percent in May from a year earlier, after an 8.3 percent decline in April, the National Statistics Institute said in Madrid. Spain’s recession probably intensified in the second quarter as Europe’s debt crisis worsened, the central bank said on June 27.

The Spanish 10-year yield rose as much as 26 basis points, or 0.26 percentage point, to 7.04 percent after jumping 37 basis points yesterday.

The pound rose for a third day against the euro as traders bet the Bank of England’s bond-purchase program will weigh less on the currency than the policies of other central banks.

European stocks extended declines for a third day as payrolls in the world’s biggest economy increased less than forecast in June.

German industrial output rebounded more than economists forecast in May as construction buttressed Europe’s largest economy against the sovereign debt crisis.

Production rose 1.6 percent from April, when it dropped 2.1 percent, the Economy Ministry in Berlin said today. Economists forecast an increase of 0.2 percent. Production was unchanged from a year earlier when adjusted for working days.

Spanish industrial production fell for the ninth month in May as the recession in the euro area’s fourth-largest economy worsened amid rising borrowing costs.

Output at factories, refineries and mines adjusted for the number of working days fell 6.1 percent from a year earlier, after an 8.3 percent decline in April, the National Statistics Institute in Madrid said today.

National benchmark indexes fell in 16 of the 18 western- European markets. Germany’s DAX and France’s CAC 40 each declined 1.9 percent. The U.K.’s FTSE 100 lost 0.5 percent.

Peugeot, Europe’s second-largest carmaker, slid 7.7 percent, the most since November, to 7.08 euros. The company said first-half sales declined to 1.62 million trucks from 1.86 million a year earlier as demand slumped in European markets.

BBVA tumbled 5.1 percent to 5.18 euros after HSBC downgraded the stock to neutral from overweight, meaning investors shouldn’t buy more of the shares.

Air France-KLM gained 4.4 percent to 4.06 euros after it reported a 4.6 percent increase in June passenger traffic and unions said an agreement had been reached on cutting ground- staff positions.

Arkema SA, a French maker of industrial chemicals, surged 11 percent to 59.28 euros. The company may have received “multiple takeover approaches” valuing the business at 5.5 billion euros ($6.8 billion) or more, FT Alphaville reported.

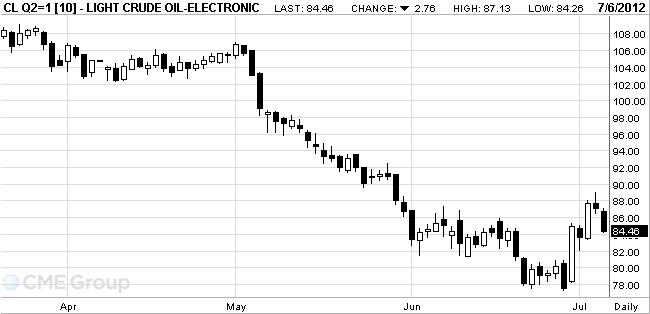

Oil fell for a second day after a report showed U.S. employers hired fewer workers than forecast in June, increasing concern that slower economic growth will reduce demand for oil.

Oil erased its weekly gain after the Labor Department said payrolls rose 80,000 last month, less than the 100,000 increase forecast by economists. The International Monetary Fund will reduce its estimate for global growth this year, Managing Director Christine Lagarde said today.

Oil for August delivery fell to $84.26 a barrel on the New York Mercantile Exchange. Crude is down 15 percent this year and 0.6 percent this week.

Brent oil for August settlement declined $2.72, or 2.7 percent, to $97.98 a barrel on the London-based ICE Futures Europe exchange.

U.S. stocks declined as slower-than- forecast growth in payrolls trailed fueled concern that the economic recovery is slowing.

Equities fell as Labor Department figures showed payrolls rose 80,000 last month after a 77,000 increase in May. Economists projected a 92,000 gain. The unemployment rate held at 8.2%.

Currently:

Dow 12,720.55 -176.12 -1.37%

Nasdaq 2,926.09 -50.03 -1.68%

S&P 500 1,350.42 -17.16 -1.25%

Slovenia does not plan to ask for help in the foreseeable future

ESM will be activated this summer

Resistance 1:1619 / 24 (Jul 3 and 5 highs)

The resistance of 1:1617 (resistance line from Jun 6)

The resistance of 1:1610 (session high)

Current Price: 1587.50

Support 1:1583 (session low)

Support 2: 1555 (resistance line from May 16)

Support 3: 1548 (low of June)

The question of who will succeed Juncker at the head of the Eurogroup, is still open

Gold prices eventually declined due to the growth of the dollar against the euro after the publication of a report on employment in the U.S. in June, which demonstrated a smaller increase in the number of jobs in non-agricultural sectors than expected.

After the release of data in the price of gold soared to $ 15, peaking at $ 1610.60. However, later, the price of precious metals returned to earlier levels.

Also, the pressure on the precious metal helped the growth of the dollar to a five-week high against the euro after a decline in interest rates of the European Central Bank on Thursday.

Demand for the physical market is low, because buyers are waiting for lower prices, and sellers - its rise above $ 1,620 an ounce, dealers said. Deliveries of gold from Hong Kong to China in May fell 26 percent in April to 75.456 tons.

Stocks of the world's largest gold ETF-secured fund SPDR Gold Trust, and secured the largest silver ETF iShares Silver Trust on Thursday, unchanged compared with the medium.

August gold futures on the COMEX today, went up to 1610.6 dollars per ounce, then fell to 1582.2, and the dollar is currently trading at around 1587.8 dollars per ounce.

Resistance 3:91,60 / 90 (50.0% FIBO $ 106 - $77, Jun 29 high)

Resistance 2:88,70 (Jul 5 high)

Resistance 1:86,20 (earlier support, Jul 4-5 lows)

Current Price: 84.15

Support 1:84,00 (session low)

Support 2:83,00 (MA (200) for H1)

Support 3:82,00 (Jun 2 low)

Resistance of 3:1420 (highs of 2012)

Resistance of 2:1410 (high of May)

Resistance of 1:1374 (Jul 5 low)

Current Price: 1348.25

Support 1:1337 (MA (55) and MA (20) for D1)

Support 2:1302 (MA (200) for D1, Jun 25-26 lows)

Support 3:1265 (low of June)

EUR/JPY

Offers Y100.00, Y99.65/70, Y99.50, Y99.35/40, Y98.55/60

Bids Y98.00, Y97.50, Y97.00

USD/JPY

Offers Y80.50, Y80.25, Y80.10, Y80.00

Bids Y79.50, Y79.00

AUD/USD

Offers $1.0400, $1.0350, $1.0320, $1.0290/00, $1.0265/70

Bids $1.0200, $1.0150, $1.0100

U.S. stock-index futures declined as growth in payrolls trailed forecasts in June, fueling concern that the economic recovery is slowing.

Global Stocks:

Nikkei 9,020.75 -59.05 -0.65%

Hang Seng 19,800.64 -8.49 -0.04%

Shanghai Composite 2,223.58 +22.23 +1.01%

FTSE 5,669.67 -22.96 -0.40%

CAC 3,201.26 -28.10 -0.87%

DAX 6,476.7 -58.86 -0.90%

Crude oil $84.67 (-2,92%)

Gold -$1588.10 (1.32%)

Data

05:00 Japan Leading Economic Index May 95.6 95.3 95.9

05:00 Japan Coincident Index May 96.9 95.7 95.8

07:00 Switzerland Foreign Currency Reserves June 303.8 364.9

07:15 Switzerland Consumer Price Index (MoM) June 0.0% -0.3% -0.3%

07:15 Switzerland Consumer Price Index (YoY) June -1.0% 1.0% -1.1%

08:30 United Kingdom Producer Price Index - Input (MoM) June -2.5% -2.1% -2.2%

08:30 United Kingdom Producer Price Index - Input (YoY) June +0.1% -2.2% -2.3%

08:30 United Kingdom Producer Price Index - Output (MoM) June -0.2% -0.2% -0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) June +2.8% +2.4% +2.3%

10:00 Germany Industrial Production s.a. (MoM) May -2.1% +0.3% +1.6%

10:00 Germany Industrial Production (YoY) May -0.6% -1.2% +0.0%

During the European session, the euro traded in a narrow range. The pair reached the previous day, but after the release of economic data from the UK euro rose slightly. The growth did not last long and the couple retreated back to the old values

Today, market participants are influenced by yesterday's events that caused the sharp appreciation of the dollar against other currencies. Also today, the euro may affect the data from the U.S. to change the number of employed and unemployment rate for June. It is expected that the number of people employed in non-agricultural sectors will increase significantly, while the unemployment rate will remain the same

Pound during the session, fell sharply, by updating the minimum of the previous day, but after the release of data on the UK price index rate rose to the level of 1.5550. After the excitement of the news on the decline, the pound began a gradual decline and is now trading near the average of the day. The Canadian dollar rose slightly today, updating the maximum values of the previous day. Now the pair is trading near the maximum values achieved and is on the eve of release of data on unemployment and the change in the number of employees. It is expected that the unemployment rate will not change, and the number of employees will decrease.

EUR / USD: during the European session, the pair consolidated after yesterday's sharp decline and is now trading between $ 1.2364 - $ 1.2400

GBP / USD: pair dropped to 1.5505, and then gradually began to recover and is now trading near 1.5540

USD / JPY: during the session, the pair traded in a narrow band at 79.85

At 12:30 GMT, Canada will announce the change of volume of building permits issued in May. Also at this time there are data on changes in the number of employed and unemployment rate for June. At 12:30 GMT the United States will inform the unemployment rate for June. At the same time becomes aware of change in the number of people employed in non-agricultural sector, in private and in the manufacturing sector in June. The latest news from the U.S. will be information about the change in average hourly wages for June. Finish the day at 14:00 GMT Canada data on the index of the PMI Ivey (adjusted for seasonality and without) in June.

EUR/USD

Offers $1.2490/500, $1.2450, $1.2420

Bids $1.2350, $1.2325/20, $1.2300

GBP/USD

Offers $1.5620/25, $1.5600/10, $1.5580, $1.5550/55

Bids $1.5500, $1.5480/70, $1.5450

EUR/GBP

Offes stg0.8100, stg0.8080/90, stg0.8040/50, stg0.8020/25, stg0.8010, stg0.8000/05, stg0.7985

Bids stg0.7960, stg0.7950, stg0.7900, stg0.7875/70

USD/JPY

Offers Y80.50, Y80.25, Y80.10, Y80.00

Bids Y79.50, Y79.30

EUR/JPY

Offers Y100.35/40, Y100.00, Y99.65/70, Y99.50, Y99.35/40

Bids Y98.50, Y98.00

AUD/USD

Offers $1.0450, $1.0400, $1.0350, $1.0320, $1.0290/00

Bids $1.0245/40, $1.0235/30, $1.0200, $1.0150

Resistance 3: Y80.90 (50.0% FIBO Y84,20-Y77,60)

Resistance 2: Y80.60 (MA (100) for D1, May and June high)

Resistance 1: Y80.10 (July 5 high)

Current price: Y79.86

Support 1: Y79.30 (July 2 low)

Support 2: Y79.15 (June 29 low)

Support 3: Y78.80 (June 20 low)

Resistance 3: Chf0.9770 (June 1 high)

Resistance 2: Chf0.9730 (88,2% FIBO $ 0,9425 - $ 0,9770)

Resistance 1: Chf0.9715 (July 5 high)

Current price: Chf0.9701

Support 1: Chf0.9680/85 (June 28 high, session low)

Support 2: Chf0.9655 (76,4% FIBO $ 0,9465 - $ 0,9715)

Support 3: Chf0.9590/95 (50% FIBO $ 0,9465 - $ 0,9715, MA (100) and MA (200) for H1)

Resistance 3: $ 1.5660/65 (23,6% FIBO $ 1,5486 - $ 1,5720, July 3 low)

Resistance 2: $ 1.5605/15 (MA (200) for N1, 50% FIBO $ 1,5486 - $ 1,5720)

Resistance 1: $ 1.5575 (61.8% FIBO $ 1,5486 - $ 1,5720)

Current Price: $ 1.5545

Support 1: $ 1.5505/15 (session low, 88,2% FIBO $ 1,5486 - $ 1,5720)

Support 2: $ 1.5485 (June 28 low)

Support 3: $ 1.5475 (June 14-15 low)

Resistance 3: $ 1.2525/30 (50% FIBO $ 1.2365-$ 1.2695, MA(100) and MA(200) for H1)

Resistance 2: $ 1.2440/50 (23.6% at FIBO $ 1.2365-$ 1.2695, resistance line from 06/01/12 and 06/28/12)

Resistance 1: $ 1.2400 (session high, the psychological level, 11.8% FIBO $ 1.2365-$ 1.2695)

Current Price: $ 1.2378

Support 1: $ 1.2364 (session low)

Support 2: $ 1.2345 (88,2% FIBO $ 1.2290-$ 1.2740)

Support 3: $ 1.2290 (June 1 low)

EUR/USD $1.2250, $1.2300, $1.2375, $1.2400, $1.2500

USD/JPY Y79.50, Y79.75, Y80.00

GBP/USD $1.5450, $1.5600 $1.5630

EUR/GBP stg0.8000

AUD/USD $1.0200, $1.0300

AUD/JPY Y81.80

Asian stocks fell for a second day, paring this week’s gain, as sales at Samsung Electronics Co. missed analysts’ estimates and interest-rate cuts in Europe and China failed to boost confidence in the global economy.

Nikkei 225 9,020.75 -59.05 -0.65%

S&P/ASX 200 4,157.81 -11.39 -0.27%

Shanghai Composite 2,223.58 +22.23 +1.01%

Canon Inc., a Japanese camera maker that gets 31 percent of its sales in Europe, slid 2.5 percent.

Australian miner BHP Billiton Ltd., whose biggest market is China, fell 1 percent as investors sold shares of companies with earnings tied to economic growth.

Agricultural Bank of China Ltd. led a slide among Chinese banks, dropping 2.8 percent.

Parco Co. climbed 2.5 percent in Tokyo after J Front Retailing Co. said it will buy a majority stake in the rival department-store operator.

05:00 Japan Leading Economic Index May 95.6 95.3 95.9

05:00 Japan Coincident Index May 96.9 95.7 95.8

The euro headed for its biggest weekly decline in more than six months amid signs the region’s debt crisis is weighing on economic growth.

The 17-nation currency held a two-day fall against the yen before data today forecast to show industrial production in Germany and Spain declined. German industrial output probably declined 1.2 percent in May from a year ago, according to economists surveyed by Bloomberg News before the Economy Ministry in Berlin releases its figures.

The European Central Bank and the People’s Bank of China cut their benchmark borrowing costs yesterday, while the Bank of England expanded the size of its asset-purchase program. “Downside risks to the euro-area economic outlook have materialized,” ECB President Mario Draghi said yesterday after cutting the main refinancing rate by a quarter-percentage point to a record low and reducing interest on overnight deposits to zero. “Economic growth in the euro area continues to remain weak with heightened uncertainty,” he said.

Demand for yen was limited after China cut its key interest rate for the second time in a month yesterday and the Bank of England raised the target in its asset-purchase stimulus program by 50 billion pounds ($78 billion) to 375 billion pounds.

EUR / USD: during the Asian session the pair fell to yesterday’s low.

GBP / USD: during the Asian session the pair holds in range $1.5515-$1.5535.

USD / JPY: during the Asian session the pair rose to Y80.00.

There is a busy data calendar on Friday, with the main focus on the US labor market data at 1230GMT. Ahead of then, European data starts at 0645GMT with France foreign trade and government deficit data. At 1000GMT, German industrial output data for May is expected to come in at +0.2% m/m, -1.9% y/y. US data starts at 1230GMT with the main labor market data for June, where non-farm payrolls are forecast to rise by 100,000 after relatively modest readings in the previous two months. The unemployment rate is forecast to hold steady at 8.2% after rising in May.

Yesterday The euro tumbled to the lowest level in more than a month versus the dollar after the European Central Bank cut its key interest rate to a record 0.75 percent and reduced its deposit rate to zero for the first time. The euro tumbled against the dollar as Draghi said some “downside risks to the euro-area economic outlook have materialized.”

The bank refrained from announcing any additional steps to cap debt yields in Spain and Italy. Spain’s bonds slid today after borrowing costs rose as it sold 3 billion euros ($3.7 billion) of debt, adding to concern Europe has yet to resolve its debt crisis. The yield on the nation’s 10-year debt rose as much as 43 basis points, or 0.43 percentage point, to 6.84 percent, the highest since June 29.

Both South Pacific currencies gained briefly after China cut its key interest rate for the second time in a month and the BOE raised its asset-purchase target by 50 billion pounds ($78 billion) to 375 billion pounds.

The Dollar Index, which Intercontinental Exchange Inc. uses to track the U.S. currency against those of six trade partners, climbed as much as 1.4 percent, the biggest intraday jump since Nov. 9, to 82.950 after U.S. employment reports. It later traded at 82.795, up 1.2 percent.

ADP Employer Services, based in Roseland, New Jersey, said U.S. companies added 176,000 workers in June, exceeding a forecast survey for a 100,000 advance. Applications for jobless benefits fell by 14,000 last week to 374,000, the fewest since mid-May, Labor Department data showed. The Labor Department will report today that U.S. payrolls added 953,000 jobs in June, the third straight month below 100,000.

Canada’s dollar strengthened to a two-year high against Europe’s shared currency. It touched $1.2532 per euro, the strongest level since June 2010, before trading at C$1.2555, up 1.1 percent. The loonie, as the Canadian currency is nicknamed, was little changed versus the U.S. dollar at C$1.0129.

Asian stocks fell, with the regional benchmark index heading for its first decline in in seven days as a deepening economic slump in Europe outweighed expectations the region’s central bank will ease rates today.

Nikkei 225 9,079.8 -24.37 -0.27%

S&P/ASX 200 4,169.19 -2.96 -0.07%

Shanghai Composite 2,201.35 -25.96 -1.17%

Nippon Sheet Glass Co. , which counts Europe as its biggest market, fell 1.2 percent in Tokyo.

Aquarius Platinum Ltd. tumbled 8.2 percent in Sydney after the world’s fourth-largest producer of the precious metal said output will fall.

Li Ning Co. surged 7.3 percent after founder and Olympic gold medalist Li Ning stepped in as chief executive officer and TPG Capital pledged to boost investment in the sportswear retailer if needed.

European stocks retreated as European Central Bank President Mario Draghi said downside risks to the economy remain, offsetting monetary policy easing by countries from China to the U.K.

The ECB cut interest rates to a record low and said it won’t pay anything on overnight deposits. The central bank reduced its main refinancing rate to 0.75 percent from 1 percent and cut its deposit rate to zero from 0.25 percent.

Draghi, the central bank’s president, said some “downside risks to the euro-area economic outlook have materialized. The main downside risks relate to weaker-than-expected economic activity.”

In the U.K, the Bank of England restarted bond buying two months after halting its asset-purchase program. The Monetary Policy Committee led by Governor Mervyn King raised its target by 50 billion pounds ($78 billion) to 375 billion pounds.

National benchmark indexes fell in 14 of the 18 western- European markets. Germany’s DAX declined 0.5 percent and France’s CAC 40 retreated 1.2 percent. The U.K.’s FTSE 100 gained 0.1 percent.

UniCredit SpA and Intesa Sanpaolo SpA, Italy’s largest banks, slumped 5.1 percent to 2.81 euros and 4.4 percent to 1.04 euros, respectively. Italy’s 10-year government bonds extended their decline, pushing the yield on the securities above 6 percent earlier today. Yields on two-year notes advanced 27 basis points to 3.70 percent.

In Spain, Banco Bilbao Vizcaya Argentaria SA plunged 4.8 percent to 5.46 euros and Banco Santander SA, the country’s largest lender, fell 3.9 percent to 5.10 euros.

Volkswagen climbed 5.1 percent to 134.50 euros after Europe’s largest carmaker agreed to buy the controlling stake in Porsche’s automotive business for 4.46 billion euros ($5.5 billion), ending a seven-year takeover saga that has divided two of Germany’s most powerful families.

U.S. stocks declined, halting a three-day advance for the Standard & Poor’s 500 Index, amid disappointment over Europe’s efforts to tame the region’s debt crisis as investors awaited tomorrow’s American jobs report.

Equities fell as European Central Bank President Mario Draghi said today’s cut in interest rates to a record low may have only a limited impact on the euro-area economy. China also reduced rates in a bid to spur growth. Tomorrow’s Labor Department data may show the pace of hiring in the U.S. accelerated in June while remaining at less than half the average for the first quarter of the year, economists said.

Today’s economic reports showed that fewer Americans filed jobless claims and hiring beat estimates. Service industries expanded at a slower pace, underscoring Federal Reserve concern that growth isn’t strong enough to reduce unemployment.

JPMorgan Chase & Co. slumped 4.2 percent, the most in the Dow, to $34.38. The lender was ordered by a federal judge to explain why it shouldn’t be compelled to turn over e-mails sought by U.S. regulators in a probe of potential energy-market manipulation. Bank of America slid 3 percent to $7.82.

Netflix Inc. soared 13 percent, the most since January, to $81.72. The largest video-subscription service also had the biggest gain in the S&P 500 (SPX) after an analyst said the company’s online audience exceeds cable and TV networks.

Resistance 3: Y81.45 (Apr 27 high)

Resistance 2: Y80.65 (Jun 25 high)

Resistance 1: Y80.10 (Jul 5 high)

Current price: Y79.90

Support 1: Y79.55 (Jul 5 low)

Support 2: Y79.80 (Jul 2 low)

Support 3: Y79.10 (Jun 29 low)

Resistance 3: Chf0.9850 (Dec 13 high 2010)

Resistance 2: Chf0.9770 (Jun 4 high)

Resistance 1: Chf0.9605 (Jul 4 high)

Current price: Chf0.9702

Support 1: Chf0.9685 (session low)

Support 2: Chf0.9565/80 (area of Jul 3 high and Jul 5 low)

Support 3: Chf0.9510 (Jul 3 low)

Resistance 3: $ 1.5680 (high of the European session on Jul 4)

Resistance 2: $ 1.5605/20 (area of Jul 5 highs)

Resistance 1: $ 1.5535 (session high)

Current Price: $ 1.5526

Support 1: $ 1.5485/95 (area of June 28 low and Jul 5 high)

Support 2: $ 1.5450 (Jun 12 low)

Support 3: $ 1.5400 (Jun 8 low)

Resistance 3: $ 1.2625 (Jul 3 high)

Resistance 2: $ 1.2540/55 (area of Jul 5 high and Jul 3 low)

Resistance 1: $ 1.2400 (session high)

Current Price: $ 1.2383

Support 1: $ 1.2365 (Jul 5 low)

Support 2: $ 1.2285 (Jun 1 low)

Support 3: $ 1.2200 (psychological level)

Change % Change Last

Gold 1,604 -18 -1.09%

Oil 86.90 -0.76 -0.87%

Change % Change Last

Nikkei 225 9,079.8 -24.37 -0.27%

S&P/ASX 200 4,169.19 -2.96 -0.07%

Shanghai Composite 2,201.35 -25.96 -1.17%

FTSE 100 5,692.63 +8.16 +0.14%CAC 40 3,229.36 -38.39 -1.17%

DAX 6,535.56 -29.24 -0.45%

Dow 12,897 -47 -0.36%

Nasdaq 2,976 +0 +0.00%

S&P 500 1,368 -6 -0.47%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,23 -1,11% 1,2527

GBP/USD $1,5521 -0,47% 1,5594

USD/CHF Chf0,9693 +1,09% 0,9587

USD/JPY Y79,90 +0,05% 79,86

EUR/JPY Y99,00 -1,06% 100,05

GBP/JPY Y124,00 -0,44% 124,54

AUD/USD $1,0287 -4,50% 1,0750

NZD/USD $ 0,8036 -0,04% 0,8039

USD/CAD C$1,0144 +0,16% 1,0128

05:00 Japan Leading Economic Index May 95.6 95.3

05:00 Japan Coincident Index May 96.9 95.7

07:00 Switzerland Foreign Currency Reserves June 303.8

07:15 Switzerland Consumer Price Index (MoM) June 0.0% -0.3%

07:15 Switzerland Consumer Price Index (YoY) June -1.0% 1.0%

08:30 United Kingdom Producer Price Index - Input (MoM) June -2.5% -2.1%

08:30 United Kingdom Rightmove House Price Index (YoY) June +0.1% -2.2%

08:30 United Kingdom Producer Price Index - Output (MoM) June -0.2% -0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) June +2.8% +2.4%

10:00 Germany Industrial Production s.a. (MoM) May -2.2% +0.3%

10:00 Germany Industrial Production (YoY) May -0.7% -1.2%

12:30 U.S. Unemployment Rate June 8.2% 8.2%

12:30 U.S. Nonfarm Payrolls June 69 92

12:30 U.S. Average hourly earnings June +0.1% +0.2%

12:30 U.S. Average workweek June 34.4 34.4

12:30 Canada Building Permits (MoM) May -5.2% -0.7%

12:30 Canada Unemployment rate June 7.3% 7.3%

12:30 Canada Employment June 7.7 5.2

14:00 Canada Ivey Purchasing Managers Index June 60.5 55.1

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.