- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | National Australia Bank's Business Confidence | November | 5 | |

| 00:30 (GMT) | Australia | House Price Index (QoQ) | Quarter III | -1.8% | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Current | November | 54.5 | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Outlook | November | 49.1 | |

| 06:30 (GMT) | France | Non-Farm Payrolls | Quarter III | -0.9% | |

| 06:45 (GMT) | Switzerland | Unemployment Rate (non s.a.) | November | 3.2% | |

| 07:45 (GMT) | France | Trade Balance, bln | October | -5.8 | |

| 10:00 (GMT) | Eurozone | Employment Change | Quarter III | -2.9% | |

| 10:00 (GMT) | Eurozone | ZEW Economic Sentiment | December | 32.8 | |

| 10:00 (GMT) | Germany | ZEW Survey - Economic Sentiment | December | 39 | 46 |

| 10:00 (GMT) | Eurozone | GDP (QoQ) | Quarter III | -11.8% | 12.6% |

| 10:00 (GMT) | Eurozone | GDP (YoY) | Quarter III | -14.8% | -4.4% |

| 13:30 (GMT) | U.S. | Nonfarm Productivity, q/q | Quarter III | 10.6% | 5% |

| 13:30 (GMT) | U.S. | Unit Labor Costs, q/q | Quarter III | 9% | -8.9% |

| 23:30 (GMT) | Australia | Westpac Consumer Confidence | December | 107.7 | |

| 23:50 (GMT) | Japan | Core Machinery Orders, y/y | October | -11.5% | -11.3% |

| 23:50 (GMT) | Japan | Core Machinery Orders | October | -4.4% | 2.8% |

- Relying on hope won’t help us

- The situation is getting very serious: these measures will not be enough to get us through winter

The Ivey

Business School Purchasing Managers Index (PMI), measuring Canada’s economic

activity, decreased to 52.7 in November from 54.5 in October. That was the lowest

reading since May.

A reading above

50 signals expansion, while a reading below 50 indicates contraction.

Within

sub-indexes, the employment measure fell to 48.1 in November from 56.1 in the

previous month and the supplier deliveries gauge plunged to 34.3 from 44.8. At

the same time, the inventories indicator rose to 49.3 in November from 45.5 in October

and the prices index increased to 66.1 from 63.0.

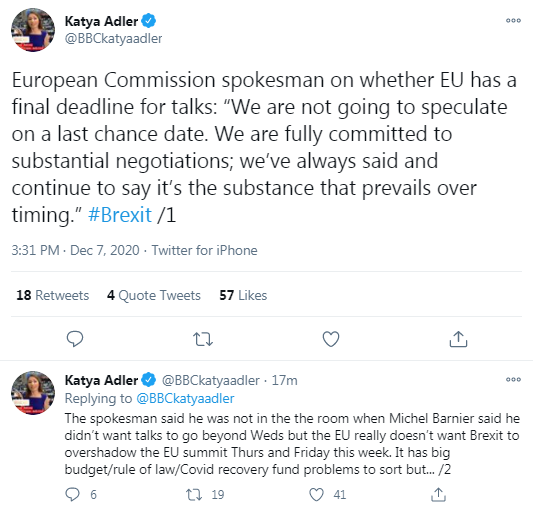

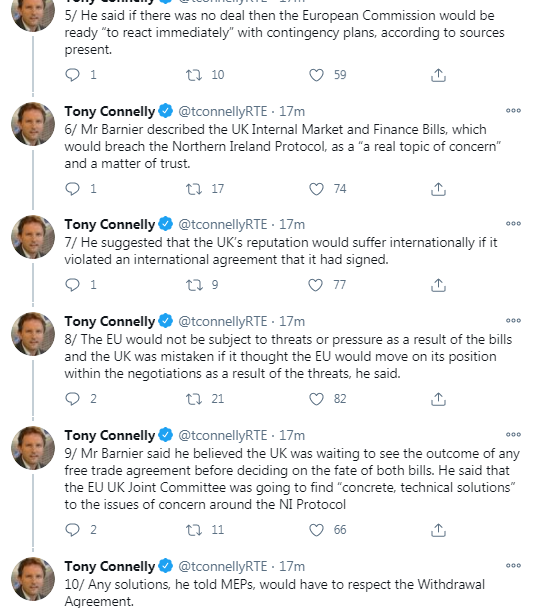

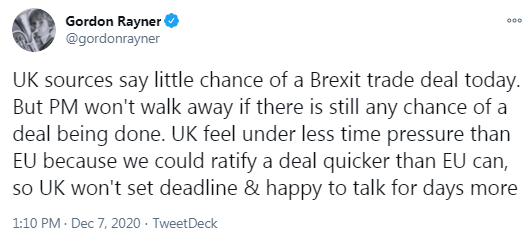

FXStreet notes that the UK press and the financial markets were readying themselves for an imminent post-Brexit trade deal between the UK and the EU at the end of last week. Following disappointing news over the weekend, by this morning expectations had re-grouped and the pound had adjusted lower. Jane Foley, Senior FX Strategist at Rabobank forecast EUR/GBP at 0.88/0.89 on a Brexit deal and at 0.93 on a no-deal outcome.

“A relief rally is likely this week if politicians manage to produce some kind of trade agreement. We see the potential for EUR/GBP to dip a little below 0.88 and for cable to take another run at the upside on this outcome.”

“If a deal is struck, we see EUR/GBP trading in the 0.88/0.89 area in the months ahead. On a no-deal outcome, we expect to see a spike in EUR/GBP to the 0.93 area.”

U.S. stock-index futures traded mixed on Monday, as investors digested fresh China-U.S. tensions over Hong Kong, while awaiting clues on additional fiscal aid from the Congress.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,547.44 | -203.80 | -0.76% |

Hang Seng | 26,506.85 | -329.07 | -1.23% |

Shanghai | 3,416.60 | -27.98 | -0.81% |

S&P/ASX | 6,675.00 | +40.90 | +0.62% |

FTSE | 6,558.69 | +8.46 | +0.13% |

CAC | 5,560.21 | -48.94 | -0.87% |

DAX | 13,242.08 | -56.88 | -0.43% |

Crude oil | $45.75 | -1.10% | |

Gold | $1,842.70 | +0.15% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 171.85 | -0.61(-0.35%) | 3036 |

ALCOA INC. | AA | 23.59 | -0.14(-0.59%) | 18216 |

ALTRIA GROUP INC. | MO | 41.3 | -0.07(-0.17%) | 19087 |

Amazon.com Inc., NASDAQ | AMZN | 3,156.02 | -6.56(-0.21%) | 35574 |

American Express Co | AXP | 124.99 | -0.05(-0.04%) | 2865 |

AMERICAN INTERNATIONAL GROUP | AIG | 40.4 | -0.29(-0.71%) | 1106 |

Apple Inc. | AAPL | 122.36 | 0.11(0.09%) | 498995 |

AT&T Inc | T | 29.73 | 0.19(0.64%) | 351042 |

Boeing Co | BA | 238.35 | 5.64(2.42%) | 452251 |

Caterpillar Inc | CAT | 181.63 | -0.58(-0.32%) | 2618 |

Chevron Corp | CVX | 92.3 | -0.98(-1.05%) | 18679 |

Cisco Systems Inc | CSCO | 44.27 | -0.11(-0.25%) | 22603 |

Citigroup Inc., NYSE | C | 58.24 | -0.38(-0.65%) | 41904 |

Deere & Company, NYSE | DE | 253.36 | -0.03(-0.01%) | 367 |

E. I. du Pont de Nemours and Co | DD | 65.06 | -0.96(-1.45%) | 433 |

Exxon Mobil Corp | XOM | 41.21 | -0.47(-1.13%) | 167678 |

Facebook, Inc. | FB | 279.17 | -0.53(-0.19%) | 47926 |

FedEx Corporation, NYSE | FDX | 296.44 | 1.56(0.53%) | 5635 |

Ford Motor Co. | F | 9.24 | -0.10(-1.07%) | 452110 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 25.03 | -0.03(-0.12%) | 53691 |

General Electric Co | GE | 10.9 | 0.02(0.18%) | 408524 |

General Motors Company, NYSE | GM | 44.21 | -0.19(-0.43%) | 20113 |

Goldman Sachs | GS | 238.4 | -1.18(-0.49%) | 9489 |

Google Inc. | GOOG | 1,826.00 | -1.99(-0.11%) | 898 |

Hewlett-Packard Co. | HPQ | 23.7 | -0.08(-0.34%) | 4807 |

Home Depot Inc | HD | 264.14 | 0.15(0.06%) | 16148 |

HONEYWELL INTERNATIONAL INC. | HON | 213.32 | 0.64(0.30%) | 6305 |

Intel Corp | INTC | 51.4 | -0.59(-1.13%) | 317567 |

International Business Machines Co... | IBM | 126.14 | -1.06(-0.83%) | 7185 |

Johnson & Johnson | JNJ | 149.94 | -0.33(-0.22%) | 7655 |

JPMorgan Chase and Co | JPM | 121.51 | -0.83(-0.68%) | 14443 |

McDonald's Corp | MCD | 209.3 | -1.44(-0.68%) | 24055 |

Merck & Co Inc | MRK | 82.35 | 0.41(0.50%) | 17609 |

Microsoft Corp | MSFT | 214.8 | 0.44(0.21%) | 165914 |

Nike | NKE | 136.5 | -0.69(-0.50%) | 4255 |

Pfizer Inc | PFE | 40.72 | 0.38(0.94%) | 717588 |

Procter & Gamble Co | PG | 137.03 | -0.44(-0.32%) | 5800 |

Starbucks Corporation, NASDAQ | SBUX | 101.96 | -0.32(-0.31%) | 6550 |

Tesla Motors, Inc., NASDAQ | TSLA | 606.17 | 7.13(1.19%) | 1077071 |

The Coca-Cola Co | KO | 53.65 | -0.20(-0.37%) | 19271 |

Travelers Companies Inc | TRV | 135.31 | -0.85(-0.62%) | 205 |

Twitter, Inc., NYSE | TWTR | 47.71 | -0.02(-0.04%) | 12431 |

UnitedHealth Group Inc | UNH | 348.5 | -1.39(-0.40%) | 1130 |

Verizon Communications Inc | VZ | 61.35 | -0.20(-0.32%) | 5992 |

Visa | V | 212.3 | -0.38(-0.18%) | 7695 |

Wal-Mart Stores Inc | WMT | 149.03 | 0.12(0.08%) | 17302 |

Walt Disney Co | DIS | 153.57 | -0.57(-0.37%) | 15221 |

Yandex N.V., NASDAQ | YNDX | 68.8 | 0.75(1.10%) | 9937 |

American Express (AXP) initiated with a Buy at MoffettNathanson; target $155

MasterCard (MA) initiated with a Buy at Seaport Global Securities

Visa (V) initiated with a Buy at Seaport Global Securities

McDonald's (MCD) downgraded to Equal-Weight from Overweight at Stephens; target lowered to $225

Boeing (BA) upgraded to Buy from Neutral at UBS; target raised to $300

Lyft (LYFT) upgraded to Overweight from Neutral at Piper Sandler; target raised to $61

FXStreet reports that according to FX Strategists at UOB Group, there is still room for EUR/USD to test the 1.2200 mark in the next week.

24-hour view: “EUR eked out a fresh high of 1.2177 last Friday (high of 1.2175 on Thursday) before easing off to close slightly lower at 1.2120 (-0.16%). While the overall movement from the high is viewed as part of a broader consolidation phase, the weakened underlying tone suggests room for EUR to edge lower to 1.2090. That said, any weakness is viewed as part of a lower range of 1.2090/1.2160. In other words, a sustained decline below 1.2090 is not expected.”

Next 1-3 weeks: “EUR rose to a high of 1.2177 on Friday and shorter-term overbought conditions could lead to a few days of consolidation first. As long as 1.2040 (‘strong support’ level previously at 1.2010) is intact, there is still chance for EUR to move to 1.2200.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:30 | United Kingdom | Halifax house price index | November | 0.3% | 1.2% | |

| 08:30 | United Kingdom | Halifax house price index 3m Y/Y | November | 7.5% | 7.6% | |

| 09:30 | Eurozone | Sentix Investor Confidence | December | -10.0 | -2.7 |

GBP fell against its major rivals in the European session on Monday as investors digested the media reports, suggesting that the final stage of the EU-UK trade talks could collapse.

Reuters reported that an EU diplomat said on Monday that the UK's chief Brexit negotiator David Frost and his EU's counterpart Michel Barnier made some progress during the latest round of talks but "not quite managed to bridge differences", including stable access to UK waters for the EU fishermen and state aid provisions. “We are at the make-it-or-break-it moment,” he added. Meanwhile, the EU Financial Services Commissioner Mairead McGuinness said that the prospects of the post-Brexit trade negotiations are not looking good as "the UK are failing to understand the significance of the three outstanding issues and the need for the UK to compromise”. The Daily Mirror's political editor reports that the European Commission's (EC) source told her that "things are "stuck" and says "more talks" is best scenario", while some insiders from the office of the British Prime Minister (PM) "feel no-deal is on cards". The RTE's Europe editor reported, citing sources, that Barnier warned the UK that a deal would not be approved by member states if it pressed ahead with passing the Internal Market and the Finance Bills into law. He also said that negotiations could continue until Wednesday but no further. "Barnier told MEPs the talks were in the “endgame” and that there would have to be a decision on whether or not there was to be an agreement by Thursday," the RTE's editor tweeted.

The UK PM Boris Johnson and the EC President Ursula von der Leyen are set to speak today at 16:00 GMT.

- UK's negotiating team continues to work hard to reach a free-trade agreement

- Time is in very short supply, but Britain prepared to negotiate for as long as we have time available if we think a deal is possible

- We are clearly in the final stages now

- UK been clear of our negotiation principles and any agreement must respected them

- Significant differences remain, fisheries is one of them

- PM clear if Britain needs to leave and Australia style terms, Britain will prosper

FXStreet notes that the S&P 500 has finally cleared key trend resistance from February and on markedly improved volume. Economists at Credit Suisse maintain a bullish outlook with resistance above the 3700 psychological barrier seen next at 3720/25.

“The S&P 500 has finally cleared its key inflection point at confirmed trend resistance from February, with OnBalanceVolume surging to clear new highs and with RSI momentum also finally to start moving higher.”

“Our main concerns remain the ‘euphoric’ state of the rally - 91% S&P 500 stocks are now above their 200-day average (a level not seen since 2013) and the market is well above the upper end of what we see as its ‘typical’ extreme (15% above its 200-day average), but these on their own do not, for now, prohibit us looking for further gains and we maintain our immediate bullish bias.”

“Immediate resistance stays seen at the 3700 psychological barrier, ahead of 3720/25, which we look to cap at first. Above in due course though should see what we look to be a tougher test of a cluster of Fibonacci projection levels in the 3765/85 band. Big picture though, we continue to eventually look for the “measured triangle objective” at 3900.”

FXStreet reports that FX Strategists at UOB Group suggests that the upside momentum in AUD/USD appears somewhat mitigated but the pair could still re-test the mid-0.7400s in the near-term.

24-hour view: “Momentum indicators are most neutral and AUD is likely trade sideways for today, expected to be within a 0.7405/0.7455 range.”

Next 1-3 weeks: “In our latest update from last Thursday (03 Dec, spot at 0.7410), we indicated that ‘the positive phase in AUD has likely moved into its next up-leg’ and that ‘the next resistance is at 0.7455 followed by 0.7500’. While AUD subsequently rose to a high of 0.7449, it has not been able to make much headway. Upward momentum has slowed somewhat but as long as 0.7365 is intact (‘strong support’ level previously at 0.7330), we continue to see chance for AUD to push above 0.7455 (next resistance is at 0.7500).”

Fiscal measures reportedly are to comprise around JPY40 trln.

- ~JPY5.9 trln for virus containment measures;

- ~JPY18.4 trln to support structural changes toward post-corona economy;

- ~JPY5.6 trln for disaster management, reduction measures;

- ~JPY5 trln from FY2020's reserve funds

- 5 trln from FY2021's reserve funds

- incl. funding from special accounts, the extra budget spending on measures is worth JPY20.1 trln

FXStreet reports that UOB Group’s FX Strategists keep the mixed outlook unchanged for USD/JPY in the short-term horizon.

24-hour view: “USD rebounded to a high of 104.24 last Friday before closing higher by +0.30% (104.14). The movement is viewed as an on-going consolidation phase. For today, USD is expected to trade sideways, likely between 103.85 and 104.30.”

Next 1-3 weeks: “USD subsequently dropped briefly to a low of 103.65 before rebounding. The outlook remains mixed and we continue to hold the view that only a clear break below 103.70 or above 104.80 would indicate the start of a more direction price action.”

FXStreet reports that analysts at Credit Suisse view the current EUR/GBP strength as temporary.

“EUR/GBP has held support from its rising 55-day average and with a small base in place above the downtrend from September and mid-November high at 0.9001/07, further near-term strength is still seen likely. Our bias though remains to view this phase as temporary ahead of an eventual fall back to retest 0.8866/61.”

“Support at 0.8983 holding can keep the immediate risk higher with key resistance seen at the ‘measured base objective’ at 0.9150. With the October high just above at 0.9165, we would look for a fresh and impotant cap here to maintain the risk that the recent rebound is the ‘right shoulder’ to a larger top.”

CNBC reports that Chinese Foreign Minister Wang Yi said that the U.S. should reduce its “interference” in China’s domestic affairs and development in order to improve relations between the two countries.

Wang also emphasized his hope for cooperation, while pointing out ways in which the U.S. could change its approach.

“The most urgent task at the moment is that both sides should work together and remove all kinds of interference, to achieve a smooth transition of China-U.S. relations,” Wang said.

“In the next phase of China-U.S. relations, (we should) strive to restart dialogue, return to the right track and rebuild mutual trust,” he said, noting any action should be of “mutual benefit” to both sides.

eFXdata reports that ANZ Research discusses AUD/USD outlook for 2021.

"The Australian dollar has emerged from a turbulent year as a winner, topping the G10 and Asia performance rankings since March and cementing its position as the premier global FX risk proxy. Accommodative policy settings will keep interest rates at record lows, pushing investors up the risk curve and supporting equities. This is an environment in which the AUD tends to perform well," ANZ notes.

"While the recovery will be incremental and a portion of this is already priced in, we think the AUD’s undervaluation provides ample room for more improvement into 2021. As such, we’ve set our year-end target at USD0.80," ANZ adds.

FXStreet reports that FX Strategists at UOB Group see USD/CNH consolidating in the near-term.

Next 1-3 weeks: “We noted last Wednesday that ‘downward momentum is improving but USD has to close below the year-to-date low of 6.5319 in order to indicate that next down-leg has started’. USD plummeted to a low of 6.5070 last Friday before closing at 6.5170 (-0.29%). While oversold shorter-term conditions could lead to a couple of days of consolidation first, USD is expected to weaken to 6.4960. Looking forward, the next support is at 6.4700. All in, the current weak phase is deemed as intact as long as USD does not move above 6.5650 (‘strong resistance’ level).”

According to the report from Sentix, the Corona crisis year 2020 will end with a bang, which will set several exclamation marks for the global economy. In our December results, we have a series of all-time highs in the expectation components of various world economic regions. Hopes for an early use of vaccines are fuelling the fantasy that the economy in 2021 will recover more clearly than previously expected from the consensus.

The consensus probably did not expect this at all: The sentix overall economic index for the euro zone rises by 7.3 points to -2.7 points, the highest level since February 2020. The strong increase in the overall index is due to the large increase in economic expectations. The sub index rises to +29.3 points, the highest value since April 2015. Investors are reflecting the improved future prospects for the global economy, which will result from the soon availability of at least three vaccines to fight the Corona Pandemic. The outcome of the U.S. election is also likely to have had a positive effect on the latest survey results.

In addition, the current situation may also recover slightly. The sub index, which describes the status quo of the economy in Euroland, rises by 2 points to -30.3. The so-called "lockdown light" has so far had little effect on investors' assessment of the current economic assessment. There has been no further decline. Overall, Euroland is benefiting from the international tailwind.

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, discusses the prospects of the EUR/JPY.

“EUR/JPY last week reached a major resistance band offered by 126.41/127.50 – this is the location of the 2014-2020 resistance line, the 2020 high at 127.07 and the 2019 high – and we would allow for this to hold the initial test.”

“Dips should find nearby support at the October high at 125.09. Failure here is needed to alleviate immediate upside pressure and cast attention back to the November 19 low at 122.85 and the 121.63 October low.”

Yahoo News reports according to the report from Halifax, UK property prices have seen their strongest five-month run of growth since 2004, despite tighter lockdown restrictions in November.

Average UK property sold last month was bought for £253,243 ($336,195). It marks a 1.2% jump of almost £3,000 on October prices, and a 7.6% increase year-on-year—the biggest annual jump since June 2016.

The data shows continued momentum behind the property market boom seen in recent months, in spite of stricter coronavirus restrictions and their economic fallout.

England’s one-month coronavirus lockdown ended last week, and similar measures were place in Wales, Northern Ireland and areas of Scotland for part of November. Building sites and estate agents in England were able to remain open however, while property viewings and surveys continued.

FXStreet reports that Mitul Kotecha, Senior Emerging Markets Strategist at TD Securities said that Chinese November exports surged at their fastest pace since February 2018. The data is positive for CNY/CNH but sanctions cap gains.

“The data revealed a very strong 21.1% YoY increase in exports and a smaller than consensus 4.5% YoY increase in imports. Exports grew for a sixth straight month, recording the fastest pace of increase since Feb 2018 while imports rose for a third straight month.”

“The data bodes well for Chinese and Asian markets, though this will be mitigated somewhat, by new US sanctions on Chinese officials, and news that FTSE Russell is dropping 8 Chinese companies from its indices, something that could be followed by other equity index providers. In the remaining weeks of President Trump's tenure, further measures are likely.”

“We expect further CNY appreciation in the months ahead. In the near-term, a break below 6.50 USD/CNY looms, though its worth highlighting that the CNY CFETS trade-weighted index is at its lowest levels in around a month, implying relatively less strength compared to its peers recently.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | ANZ Job Advertisements (MoM) | November | 11.9% | 13.9% | |

| 03:00 | China | Trade Balance, bln | November | 58.44 | 53.5 | 75.42 |

| 05:00 | Japan | Leading Economic Index | October | 93.3 | 93.8 | |

| 05:00 | Japan | Coincident Index | October | 84.8 | 89.7 | |

| 07:00 | Germany | Industrial Production s.a. (MoM) | October | 2.3% | 1.6% | 3.2% |

During today's Asian trading, the US dollar fell slightly against the euro and the yen. The focus of traders this week is on negotiations on a new stimulus package in the United States, as well as a meeting of the European Central Bank (ECB).

House speaker Nancy Pelosi said Friday that lawmakers are moving to adopt a compromise budget plan. US President Donald Trump and Republican majority leader in the Senate Mitch McConnell, according to sources, are ready to offer a package of measures to support the economy in the amount of $908 billion.

Weaker-than-expected data on the US labor market, published last Friday, increases the likelihood of a new package of budget incentives, experts say. As reported, the number of jobs in the US economy in November increased by 245 thousand, the lowest rate since May.

Meanwhile, the ECB is expected to announce an increase in the volume of the anti-crisis asset purchase program by 500 billion euros - to 1.85 billion euros at the end of the meeting on December 10. The program is likely to be extended for six months, until the end of 2021. At the same time, experts do not exclude the possibility of extending the program for a whole year - until mid-2022.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.17%.

Reuters reports that a senior diplomat said that the European Union’s Brexit negotiator Michel Barnier told national envoys to the bloc’s hub Brussels there was no agreement yet in UK trade talks.

Barnier said the three most contentious issues in the negotiations have not yet been resolved, according to the diplomat, who was taking part in the closed-door briefing.

Barnier was due to continue talks with his UK counterpart, David Frost, and their teams through the day on Monday before an afternoon call between the head of the EU’s executive, European Commission President Ursula von der Leyen, and British Prime Minister Boris Johnson.

RTTNews reports that according to the report from the General Administration of Customs, China's exports growth accelerated more-than-expected in November driven by strong demand for electronic goods and medical equipments.

Exports advanced 21.1 percent on a yearly basis in November. This was the biggest growth since February 2018. Economists had forecast shipments to grow 12 percent after rising 11.4 percent in October.

Imports grew moderately by 4.5 percent annually, which was faster than the 6.1 percent increase expected by economists but slower than the 4.7 percent increase logged in October.

As a result, the trade surplus increased to $75.4 billion in November. Economists had forecast the surplus to fall to $53.5 billion from $58.44 billion in the previous month.

China's trade surplus with the United States was $37.42 billion in November.

According to the report from the Federal Statistical Office (Destatis), in October 2020, production in industry was up by 3.2% on the previous month on a price, seasonally and calendar adjusted basis. Economists had expected a 1.6% increase. Compared with October 2019, the decrease in calendar adjusted production in industry amounted to 3.0%.

Compared with February 2020, the month before restrictions were imposed due to the corona pandemic in Germany, production in October 2020 was 4.9% lower in seasonally and calendar adjusted terms. Production in the automotive industry - the largest branch of manufacturing - rose by 9.9% on the previous month in October. It was by just under 6% below the level of February 2020.

In October 2020, production in industry excluding energy and construction was up by 3.3%. Within industry, the production of intermediate goods showed an increase by 4.0% and the production of capital goods by 5.2%. The production of consumer goods decreased by 2.4%. Outside industry, energy production was up by 4.0% in October 2020 and the production in construction increased by 1.6%.

In September 2020, the corrected figure on the production in industry shows an increase of 2.3% (provisional: +1.6%) from August 2020.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2267 (1022)

$1.2244 (1397)

$1.2212 (1644)

Price at time of writing this review: $1.2132

Support levels (open interest**, contracts):

$1.2053 (1403)

$1.2025 (2458)

$1.1993 (592)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 56364 contracts (according to data from December, 4) with the maximum number of contracts with strike price $1,1800 (4136);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3584 (217)

$1.3555 (312)

$1.3515 (1526)

Price at time of writing this review: $1.3416

Support levels (open interest**, contracts):

$1.3336 (642)

$1.3290 (849)

$1.3236 (855)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 50750 contracts, with the maximum number of contracts with strike price $1,4000 (32771);

- Overall open interest on the PUT options with the expiration date January, 8 is 23383 contracts, with the maximum number of contracts with strike price $1,2800 (3439);

- The ratio of PUT/CALL was 0.46 versus 1.91 from the previous trading day according to data from December, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 49 | 0.08 |

| Silver | 24.156 | 0.5 |

| Gold | 1836.126 | -0.27 |

| Palladium | 2344.7 | 1.55 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -58.13 | 26751.24 | -0.22 |

| Hang Seng | 107.42 | 26835.92 | 0.4 |

| KOSPI | 35.23 | 2731.45 | 1.31 |

| ASX 200 | 18.8 | 6634.1 | 0.28 |

| FTSE 100 | 59.96 | 6550.23 | 0.92 |

| DAX | 46.1 | 13298.96 | 0.35 |

| CAC 40 | 34.79 | 5609.15 | 0.62 |

| Dow Jones | 248.74 | 30218.26 | 0.83 |

| S&P 500 | 32.4 | 3699.12 | 0.88 |

| NASDAQ Composite | 87.05 | 12464.23 | 0.7 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | ANZ Job Advertisements (MoM) | November | 9.4% | |

| 03:00 (GMT) | China | Trade Balance, bln | November | 58.44 | 53.5 |

| 05:00 (GMT) | Japan | Leading Economic Index | October | 92.5 | |

| 05:00 (GMT) | Japan | Coincident Index | October | 81.1 | |

| 07:00 (GMT) | Germany | Industrial Production s.a. (MoM) | October | 1.6% | 1.5% |

| 08:00 (GMT) | Switzerland | Foreign Currency Reserves | November | 871.5 | |

| 08:30 (GMT) | United Kingdom | Halifax house price index | November | 0.3% | |

| 08:30 (GMT) | United Kingdom | Halifax house price index 3m Y/Y | November | 7.5% | |

| 09:30 (GMT) | Eurozone | Sentix Investor Confidence | December | -10.0 | |

| 15:00 (GMT) | Canada | Ivey Purchasing Managers Index | November | 54.5 | |

| 20:00 (GMT) | U.S. | Consumer Credit | October | 16.21 | 17 |

| 23:30 (GMT) | Japan | Labor Cash Earnings, YoY | October | -0.9% | |

| 23:30 (GMT) | Japan | Household spending Y/Y | October | -10.2% | 2.5% |

| 23:50 (GMT) | Japan | Current Account, bln | October | 1660.2 | 2126.3 |

| 23:50 (GMT) | Japan | GDP, q/q | Quarter III | -8.2% | 5% |

| 23:50 (GMT) | Japan | GDP, y/y | Quarter III | -28.8% | 21.5% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.74298 | -0.06 |

| EURJPY | 126.238 | 0.17 |

| EURUSD | 1.21196 | -0.16 |

| GBPJPY | 139.881 | 0.17 |

| GBPUSD | 1.34301 | -0.11 |

| NZDUSD | 0.70391 | -0.44 |

| USDCAD | 1.27769 | -0.61 |

| USDCHF | 0.89116 | 0.07 |

| USDJPY | 104.153 | 0.29 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.