- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 (GMT) | China | PPI y/y | November | -2.1% | -1.8% |

| 01:30 (GMT) | China | CPI y/y | November | 0.5% | 0% |

| 06:00 (GMT) | Japan | Prelim Machine Tool Orders, y/y | November | -5.9% | |

| 07:00 (GMT) | Germany | Current Account | October | 26.3 | |

| 07:00 (GMT) | Germany | Trade Balance (non s.a.), bln | October | 20.8 | |

| 15:00 (GMT) | U.S. | Wholesale Inventories | October | 0.7% | 0.9% |

| 15:00 (GMT) | U.S. | JOLTs Job Openings | October | 6.436 | |

| 15:00 (GMT) | Canada | Bank of Canada Rate | 0.25% | 0.25% | |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | December | -0.679 | -1.514 |

| 17:00 (GMT) | United Kingdom | BOE Financial Stability Report | |||

| 23:50 (GMT) | Japan | BSI Manufacturing Index | Quarter IV | 0.1 |

- Senate majority leader McConnell needs to give up hard-line positions

- Our focus has been on keeping interest rates low and ensuring that there is good access to liquidity

- New versions of old tools have made the Riksbank even better equipped to fulfil its tasks; but objective of attaining inflation target still remains

- We stand constantly ready to develop new tools and make new kinds of analysis so that we can reach our inflation target

- Changes in the central bank’s holdings of various assets will be important part of monetary policy for a long time to come

- Policy rate will remain an important instrument

- We have not abandoned negative rates if we were to need them in the future

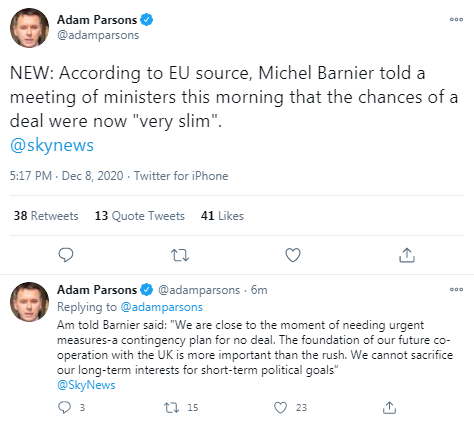

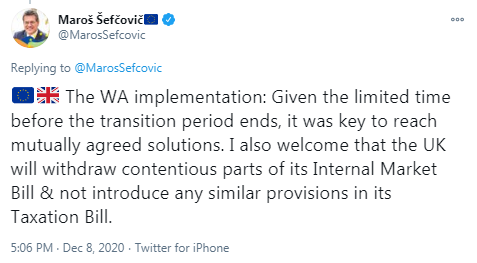

- There is no substantial progress in trade talks with UK

- The only thing new in Brexit negotiations is the meeting between UK's PM Johnson and EC president von der Leyen

U.S. stock-index futures fell on Tuesday, as investors kept an eye on negotiations for additional fiscal stimulus between Democrats and Republicans, while the U.S. coronavirus case rates continue to surge.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,467.08 | -80.36 | -0.30% |

Hang Seng | 26,304.56 | -202.29 | -0.76% |

Shanghai | 3,410.18 | -6.43 | -0.19% |

S&P/ASX | 6,687.70 | +12.70 | +0.19% |

FTSE | 6,532.63 | -22.76 | -0.35% |

CAC | 5,545.87 | -27.51 | -0.49% |

DAX | 13,258.85 | -12.15 | -0.09% |

Crude oil | $45.50 | -0.57% | |

Gold | $1,873.30 | +0.39% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 169.74 | -0.41(-0.24%) | 1054 |

ALCOA INC. | AA | 23.21 | -0.18(-0.77%) | 3498 |

ALTRIA GROUP INC. | MO | 41.5 | -0.19(-0.46%) | 12074 |

Amazon.com Inc., NASDAQ | AMZN | 3,153.52 | -4.48(-0.14%) | 17077 |

American Express Co | AXP | 122.67 | -1.27(-1.02%) | 1936 |

AMERICAN INTERNATIONAL GROUP | AIG | 39.56 | -0.23(-0.58%) | 2089 |

Apple Inc. | AAPL | 124.61 | 0.86(0.70%) | 1778344 |

AT&T Inc | T | 29.58 | -0.06(-0.20%) | 43216 |

Boeing Co | BA | 239.45 | 1.28(0.54%) | 301143 |

Caterpillar Inc | CAT | 177.57 | -1.14(-0.64%) | 612 |

Chevron Corp | CVX | 90.1 | -0.66(-0.73%) | 14198 |

Cisco Systems Inc | CSCO | 44.02 | -0.33(-0.74%) | 19340 |

Citigroup Inc., NYSE | C | 57.75 | -0.38(-0.65%) | 29966 |

Deere & Company, NYSE | DE | 251 | -1.01(-0.40%) | 409 |

E. I. du Pont de Nemours and Co | DD | 65.97 | 0.54(0.83%) | 3063 |

Exxon Mobil Corp | XOM | 40.58 | -0.32(-0.78%) | 84040 |

Facebook, Inc. | FB | 285.99 | 0.41(0.14%) | 191304 |

FedEx Corporation, NYSE | FDX | 297.7 | 0.66(0.22%) | 14042 |

Ford Motor Co. | F | 9.19 | -0.03(-0.33%) | 181581 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 24.2 | -0.38(-1.55%) | 148607 |

General Electric Co | GE | 10.94 | 0.08(0.74%) | 913822 |

General Motors Company, NYSE | GM | 44 | -0.31(-0.70%) | 506222 |

Goldman Sachs | GS | 237.86 | -0.59(-0.25%) | 1427 |

Google Inc. | GOOG | 1,810.52 | -8.96(-0.49%) | 2876 |

Hewlett-Packard Co. | HPQ | 23.51 | 0.02(0.10%) | 2966 |

Home Depot Inc | HD | 262.06 | -0.58(-0.22%) | 2245 |

Intel Corp | INTC | 49.79 | -0.41(-0.82%) | 110526 |

International Business Machines Co... | IBM | 124.45 | -0.25(-0.20%) | 4871 |

Johnson & Johnson | JNJ | 148.7 | -0.27(-0.18%) | 191090 |

JPMorgan Chase and Co | JPM | 121.08 | -0.80(-0.66%) | 9477 |

McDonald's Corp | MCD | 208.16 | -0.73(-0.35%) | 3733 |

Merck & Co Inc | MRK | 82.22 | -0.29(-0.35%) | 330147 |

Microsoft Corp | MSFT | 213.5 | -0.79(-0.37%) | 81045 |

Nike | NKE | 138.5 | -0.25(-0.18%) | 9205 |

Pfizer Inc | PFE | 41.45 | 0.20(0.48%) | 2287668 |

Procter & Gamble Co | PG | 137.8 | 0.12(0.09%) | 251875 |

Starbucks Corporation, NASDAQ | SBUX | 100.88 | -0.53(-0.52%) | 5632 |

Tesla Motors, Inc., NASDAQ | TSLA | 627.35 | -14.41(-2.25%) | 3598882 |

The Coca-Cola Co | KO | 52.97 | -0.02(-0.04%) | 21783 |

Travelers Companies Inc | TRV | 134 | 0.10(0.07%) | 758 |

Twitter, Inc., NYSE | TWTR | 47.68 | -0.22(-0.46%) | 17757 |

UnitedHealth Group Inc | UNH | 346 | -1.86(-0.53%) | 852 |

Verizon Communications Inc | VZ | 61.29 | -0.06(-0.10%) | 2693 |

Visa | V | 211.6 | -1.05(-0.49%) | 4521 |

Wal-Mart Stores Inc | WMT | 147.95 | -0.16(-0.11%) | 234673 |

Walt Disney Co | DIS | 152.97 | -0.71(-0.46%) | 10501 |

Yandex N.V., NASDAQ | YNDX | 68.01 | 0.01(0.01%) | 22649 |

The revised

data from the U.S. Labour Department showed on Tuesday that nonfarm business

sector labor productivity in the United States increased 4.6 percent q-o-q in

the third quarter of 2020, as output surged 43.4 percent q-o-q and hours worked

climbed 37.1 percent q-o-q (seasonally adjusted). That was slightly worse that the initial estimate of a gain of 4.9 percent q-o-q. In the second quarter, labor productivity surged 10.6 percent

q-o-q.

In y-o-y terms,

the labor productivity rose 4.0 percent, reflecting a 3.4-percent fall in

output and a 7.1-percent drop in hours worked.

Meanwhile, unit

labor costs in the nonfarm business sector in the third quarter fell 6.6

percent q-o-q compared to an initial estimate of an 8.9 percent q-o-q plunge

and a revised 12.3 percent q-o-q surge in the prior quarter (originally a 9.0

percent q-o-q advance).

Unit labor

costs quarterly decrease reflected a 2.3-percent q-o-q drop in compensation per

hour and a 4.6-percent q-o-q rise in productivity.

Compared to the

corresponding period of 2019, unit labor costs rose 4.0 percent.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 10:00 | Eurozone | Employment Change | Quarter III | -2.9% | 1% | |

| 10:00 | Eurozone | ZEW Economic Sentiment | December | 32.8 | 54.4 | |

| 10:00 | Germany | ZEW Survey - Economic Sentiment | December | 39 | 45.5 | 55.0 |

| 10:00 | Eurozone | GDP (QoQ) | Quarter III | -11.7% | 12.6% | 12.5% |

| 10:00 | Eurozone | GDP (YoY) | Quarter III | -14.7% | -4.4% | -4.3% |

EUR rose against most of its major counterparts in the European session on Tuesday, supported by stronger-than-expected data on investors’ economic sentiment from Germany, the EU's biggest economy.

The latest ZEW Economic Sentiment survey for Germany showed that economic confidence improved notably in December due to coronavirus vaccine hope. According to the report, the ZEW indicator of economic sentiment climbed to 55.0 in December from 39.0 in the previous month. Economists had expected a reading of 45.5. The ZEW’s President Achim Wambach suggested that the December improvement in sentiment was most likely due to the announced forthcoming Covid-19 vaccine approvals. In the meantime, the assessment of the economic situation in Germany slightly worsened this month. The ZEW current situation index fell to -66.5 from -64.3 in November. Economists had forecast the indicator to decline to -66.0.

In addition, Eurostat reported that the Eurozone's economy recorded its biggest expansion since 1995 in the third quarter, boosted by a rebound in activity and demand as Covid-19 restrictions were gradually lifted. According to the report, the Eurozone's GDP grew 12.5 percent q/q, reversing an 11.7 percent q/q contraction in the second quarter. Germany's GDP was up 8.5 percent q/q in the third quarter.

- No plans for Johnson to meet Macron, Merkel

- Negotiations to be concluded by year-end

- Talks will not continue into next year

FXStreet reports that FX Strategists at UOB Group suggest that cable could move into a consolidative theme between 1.3200 and 1.3500 in the next weeks.

24-hour view: “While we noted yesterday that last Friday’s 1.3540 high ‘could be an interim top’, we did not quite anticipate the sharp sell-off in GBP to a low of 1.3325. The decline was however short-lived as GBP rebounded strongly and quickly from the low. The rapid swings have resulted in a mixed outlook and GBP could continue to trade in a choppy manner for today, likely between 1.3270 and 1.3450.”

Next 1-3 weeks: “GBP sliced through the ‘strong support’ at 1.3320 and plunged to a low of 1.3225 before rebounding strongly. The risk for a sustained advance has more or less dissipated and from here, GBP could trade in a choppy manner within a broad range of 1.3200/1.3500.”

FX Strategists at ING note that GBP has stabilised after the initial sell-off yesterday and pared most of its losses as Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed to meet in Brussels this week (likely ahead of the EU summit on Thursday).

"We think a UK-EU trade deal narrowly remains the most likely outcome of talks, which should lead to an eventual but modest GBP rebound. We reiterate what we see as an asymmetric GBP reaction function to the UK-EU trade negotiation outcome, with modest upside in the case of a deal but profound downside in the event of no deal as fairly limited risk premium is currently priced into GBP. This is evident in our short term financial fair value model as well as in speculative positioning (where we recently saw position-squaring of GBP shorts). In our base case of a deal, we look for EUR/GBP to dip to 0.88 and range trade around this level throughout next year."

NZD/USD: A move lower is not ruled out - UOB

FXStreet reports that in the opinion of FX Strategists at UOB Group, NZD/USD could have charted a short-term top and is now seen entering into a consolidative phase.

24-hour view: “We expected NZD to ‘drift lower’ yesterday but we were of the view that ‘the strong support at 0.7010 may not be easy to crack’. However, NZD briefly dropped below 0.7010 (low of 0.7006) before rebounding to close little changed at 0.7042 (+0.01%). The outlook is mixed and NZD could trade between 0.7010 and 0.7065 for today.”

Next 1-3 weeks: “The ‘strong support’ level was breached as NZD dropped to a low of 0.7006. The price action suggests that last Thursday’s (03 Dec) high of 0.7104 is a short-term top. In other words, this level may not come back into the picture within these couple of weeks. Overall, while there is room for NZD to edge lower from here, any weakness is viewed as part of a broader 0.6950/0.7090 range.”

FXStreet reports that UOB Group’s FX Strategists note that USD/JPY still seen within the 103.70-104.80 range in the next weeks.

24-hour view: “USD traded between 103.90 and 104.31 yesterday, relatively close to our expected sideway-trading range of 103.85/104.30. The price actions offer no fresh clues and we continue to expect USD to trade sideways between 103.85 and 104.30.”

Next 1-3 weeks: “USD subsequently dropped briefly to a low of 103.65 before rebounding. The outlook remains mixed and we continue to hold the view that only a clear break below 103.70 or above 104.80 would indicate the start of a more direction price action.”

- We need a school - even a university - of patience

Bert Colijn, a Senior Economist at ING, notes that Eurozone's GDP growth for the third quarter was revised down slightly to 12.5% but this is still a surprisingly strong recovery from the first lockdown period.

"In the third quarter, GDP was still 4.4% below the pre-coronavirus peak in activity reached in the fourth quarter of 2019. While this means that over two-thirds of the output losses of the crisis had been recouped, it is worth remembering that eurozone GDP was down 5% at the bottom of the Global Financial Crisis. So a gap as bad as that seen in 2008 still remains, although we have to bear in mind that the economy was not completely open in the third quarter either."

"Of all expenditure categories, government spending leads the way. This makes sense, with record stimulus announcements early on in the crisis, it has increased by 1.8% compared to the fourth quarter of 2019. This is just the start of what is to come and we should expect elevated government spending for a few quarters to come on the back of stimulus promises."

"Household consumption has recovered far better than investment so far. The recovery of household consumption has been roughly similar to GDP in general and stands -4.6% below 4Q levels. This relatively quick recovery has been boosted by furlough schemes across the eurozone, which have supported incomes and has resulted in relatively stable consumption despite the fact that services consumption continues to be dampened by restrictions."

"A final take away is that productivity growth has fallen back to pre-crisis rates. This was to be expected despite hopes that some improvement in this metric was here to stay. It may be too soon to expect structural changes anyway. The number of hours worked recovered sharply in the third quarter, more or less in line with GDP developments. Compared to 3Q last year, labour productivity is now 0.4% higher, down from above 2% during the first lockdown. There's no sign of a structural boost to productivity yet as workers have increased hours more or less in line with GDP."

Reuters reports that a ZEW survey showed that German investor sentiment rose in December on expectations that vaccines against the coronavirus will boost the economic outlook.

Investors' economic sentiment index moved up to 55.0 from 39.0 in the previous month. Economists had expected an increase to 45.5.

A separate gauge of current conditions decreased to -66.5 from -64.3 in the previous month. That compared with a consensus forecast of -66.0 points.

"The announcement of imminent vaccine approvals makes financial market experts more confident about the future," ZEW President Achim Wambach said in a statement.

According to an estimate published by Eurostat, in the third quarter of 2020, seasonally adjusted GDP increased by 12.5% in the euro area and by 11.5% in the EU compared with the previous quarter. These were by far the sharpest increases observed since time series started in 1995, and a rebound compared with the second quarter of 2020, when GDP had decreased by 11.7% in the euro area and by 11.3% in the EU.

Compared with the same quarter of the previous year, seasonally adjusted GDP decreased by 4.3% in the euro area and by 4.2% in the EU in the third quarter of 2020, which represents a partial recovery after -14.7% and -13.9% respectively in the previous quarter.

During the third quarter of 2020, GDP in the United States increased by 7.4% compared with the previous quarter (after -9.0% in the second quarter of 2020). Compared with the same quarter of the previous year, GDP decreased by 2.9% (after -9.0% in the previous quarter).

France (+18.7%), Spain (+16.7%) and Italy (+15.9%) recorded the sharpest increases of GDP compared to the previous quarter. These countries were also among the highest decreases in the second quarter. Greece (+2.3%), Estonia and Finland (both +3.3%) and Lithuania (+3.8%) had the lowest increases of GDP. Except for Greece, which registered a decrease of 14.1%, these other countries also had less pronounced declines during the second quarter.

According to an estimate published by Eurostat, in the third quarter of 2020, seasonally adjusted GDP increased by 12.5% in the euro area and by 11.5% in the EU compared with the previous quarter. Economists had expected a 12.6% increase in the euro area. These were by far the sharpest increases observed since time series started in 1995, and a rebound compared with the second quarter of 2020, when GDP had decreased by 11.7% in the euro area and by 11.3% in the EU.

Compared with the same quarter of the previous year, seasonally adjusted GDP decreased by 4.3% in the euro area and by 4.2% in the EU in the third quarter of 2020, which represents a partial recovery after -14.7% and -13.9% respectively in the previous quarter.

During the third quarter of 2020, GDP in the United States increased by 7.4% compared with the previous quarter (after -9.0% in the second quarter of 2020). Compared with the same quarter of the previous year, GDP decreased by 2.9% (after -9.0% in the previous quarter).

Reuters reports that Prime Minister Yoshihide Suga said that Japan's latest economic stimulus package to help the country recover from its coronavirus-driven slump will likely boost gross domestic product by around 3.6%.

Suga's cabinet on Tuesday endorsed the $708 billion stimulus package, which will include about 40 trillion yen in direct fiscal spending and initiatives targeted at reducing carbon emissions and boosting adoption of digital technology.

FXStreet reports that according to FX Strategists at UOB Group, USD/CNH is expected to drop further in the next weeks.

Next 1-3 weeks: “We noted last Wednesday that ‘downward momentum is improving but USD has to close below the year-to-date low of 6.5319 in order to indicate that next down-leg has started’. USD plummeted to a low of 6.5070 last Friday before closing at 6.5170 (-0.29%). While oversold shorter-term conditions could lead to a couple of days of consolidation first, USD is expected to weaken to 6.4960. Looking forward, the next support is at 6.4700. All in, the current weak phase is deemed as intact as long as USD does not move above 6.5650 (‘strong resistance’ level).”

Reuters reports that industry data showed that November was the most lucrative month ever for the UK grocery market, with 10.9 billion pounds spent, as out of home eating and drinking was restricted by England's second national lockdown.

Market researcher Kantar said grocery sales rose by 11.3% in the 12 weeks to Nov. 29 year-on-year and were up 13.9% year-on-year in the last four of those weeks.

England's second lockdown to stem rising COVID-19 infections started on Nov. 5 and ran until Dec. 1.

"November as a whole saw shopper frequency hit its highest level since the beginning of the pandemic, suggesting more confidence among people going into stores," said Fraser McKevitt, head of retail and consumer insight at Kantar.

Kantar forecast spending would be close to 12 billion pounds in December, around 1.5 billion pounds more than December last year.

eFXdata reports that MUFG Research discusses its expectations for this week's ECB policy meeting.

"The ECB is set to “recalibrate its instruments” this week and while we would argue the forecasts to be published won’t change dramatically, we are likely to see a EUR 500bn increase in PEPP, which will be utilised to extend the degree of monetary stimulus through to the end of 2021. However, with the EUR 120bn addition to the APP ending this month, the overall PEPP size increase could be EUR 600bn in order to ensure the current QE pace can be maintained. TLTROs will also be added to the 2021 calendar, likely on the same terms as now (potential for rate of -1.0%). We expect the deposit rate to remain at -0.50%," MUFG notes.

"We do not expect any major surprises this week and hence EUR is set to remain well supported within what looks like a new trading range of 1.2000-1.2500," MUFG adds.

Bloomberg reports that China could post its first year-on-year decline in consumer prices in over a decade, but that trend is likely to be short-lived and have limited impact on monetary policy.

The official consumer price index hasn’t posted a negative reading since 2009. A government report due Wednesday will likely show zero inflation in the economy in November, according to the median estimate of economists.

Unlike the earlier deflationary period, the slowdown in consumer prices this time around is mainly being driven the price of a single commodity: pork. After soaring last year when outbreaks of African Swine Fever reduced production of the country’s most popular meat, pork prices have gradually eased in recent months, eventually declining in October for the first time since 2019. The meat is heavily weighted in the basket used to calculate the consumer price index and so its price affects the broader index.

But like last year’s surge, the drop in pork costs and broader consumer prices will likely be temporary. Consumer spending has shown signs of growth in recent months, while producer price deflation has been easing since June as China’s economy began to recover from shutdowns due to the coronavirus pandemic.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | November | 3 | 12 | |

| 00:30 | Australia | House Price Index (QoQ) | Quarter III | -1.8% | 0.8% | |

| 05:00 | Japan | Eco Watchers Survey: Current | November | 54.5 | 45.6 | |

| 05:00 | Japan | Eco Watchers Survey: Outlook | November | 49.1 | 36.5 | |

| 06:30 | France | Non-Farm Payrolls | Quarter III | -0.9% | 1.6% | |

| 06:45 | Switzerland | Unemployment Rate (non s.a.) | November | 3.2% | 3.3% | 3.3% |

| 07:45 | France | Trade Balance, bln | October | -5.6 | -4.9 |

During today's Asian trading, the pound was supported by hopes for a meeting between British Prime Minister Boris Johnson and European Commission chief Ursula von der Leyen in Brussels.

Meanwhile, concerns about an increase in coronavirus cases have slowed the dollar's decline.

The british currency played back most of the sharp decline the day before and reached $1.3350 in Asian trading after falling to $1.3225 on Monday.

"The idea is that Boris Johnson is not going to Brussels to return without an agreement," said Chris Weston from the Pepperstone brokerage company.

Meanwhile, concerns about a new surge in the US coronavirus epidemic cast a shadow over optimism about the vaccine and budget incentives, reducing demand for risky assets and providing an influx of investment in safe haven assets.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose by 0.12%.

eFXdata reports that Bank of America Global Research likes structural long USD/CHF exposure in 2021.

"We identify three key risks to the prevailing USD bearish view. 1- Cyclical weakness & risk aversion. 2- Inflation & potential rates shifts. 3- Positioning. While we are bearish USD as part of our base case, we believe it prudent to hedge this consensus view as part of an effective FX strategy. Long USD/CHF exposure through a lower-cost options structure with potentially high leverage provides investors with an effective hedge," BofA adds.

FXStreet reports that FX Strategists at UOB Group noted the positive outlook for EUR/USD.

24-hour view; “We expected EUR to ‘edge downwards within a lower range of 1.2090/1.2160’ yesterday and we were of the view ‘a sustained decline below 1.2090 is not expected’. EUR subsequently dipped to a low of 1.2077 before rebounding quickly to an overnight high of 1.2166. The current movement is still viewed as part of a consolidation phase. That said, the weakened underlying tone suggests EUR is likely to trade within a lower range of 1.2065/1.2150.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.2257 (1015)

$1.2233 (1423)

$1.2199 (1656)

Price at time of writing this review: $1.2112

Support levels (open interest**, contracts):

$1.2045 (1413)

$1.2018 (2909)

$1.1952 (1992)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 59220 contracts (according to data from December, 7) with the maximum number of contracts with strike price $1,1800 (4193);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3614 (981)

$1.3548 (305)

$1.3502 (1534)

Price at time of writing this review: $1.3344

Support levels (open interest**, contracts):

$1.3301 (642)

$1.3255 (891)

$1.3200 (654)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 51919 contracts, with the maximum number of contracts with strike price $1,4000 (32975);

- Overall open interest on the PUT options with the expiration date January, 8 is 25816 contracts, with the maximum number of contracts with strike price $1,2800 (3434);

- The ratio of PUT/CALL was 0.50 versus 0.46 from the previous trading day according to data from December, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to surveys by the State Secretariat for Economic Affairs (SECO), 153,270 unemployed people were registered at the regional employment centers (RAV) at the end of November 2020, 4,152 more than in the previous month. The unemployment rate rose from 3.2% in October 2020 to 3.3% in the reporting month. Compared to the same month last year, unemployment increased by 46,940 people (+ 44.1%). Youth unemployment (15 to 24 year olds) fell by 72 people (-0.4%) to 17,490. Compared to the same month last year, this corresponds to an increase of 5,530 people (+46.2%).

The number of unemployed aged 50-64 increased by 1,398 persons (+3.4%) to 42,289. Compared to the same month of the previous year, this corresponds to an increase of 12,470 persons (+41.8%).

A total of 251’139 job seekers were registered, 9’679 more than in the previous month. Compared to the same period of the previous year, this number thus increased by 68,712 people (+37.7%).

In September 2020, 204’191 people were affected by short-time work, 100’209 people less (-32.9%) than in the previous month. The number of affected farms decreased by 14,595 units (-42.0%) to 20,190. Lost working hours decreased by 4,295,888 (-26.6%) to 11,872,123 hours. In the corresponding period of the previous year (September 2019) 105,753 hours of downtime had been registered, which had spread to 2,090 people in 111 establishments.

According to the report from INSEE, between the end of June and the end of September 2020, payroll employment rebounded by 1.6%, that is 401,100 net job creations after –2,7% (–697,100 jobs) in the first semester. At the end of September 2020, it thus remained below its pre-crisis level at the end of 2019 (–295,900, or –1.2%), but returned to a level comparable to the end of 2018. The rebound over the quarter concerns both the private sector (+312,400 net creations, or +1.6%) and the public service (+88,700 jobs, or +1.5%). Over one year, employment declined in the private sector (–234,300 jobs or –1.2%) but increased in the public service (+27,000 jobs or +0.5%).

In the so-called «non-agricultural market sectors» field (industry, construction and market services), payroll employment has been measured in quaterly time series since the end of 1970. In the third quarter of 2020, it increased by 1.7% after –3.5% in the first semester of 2020. This is the highest quarterly increase recorded in this series.

Temporary employment had fallen by an unprecedented 40.4% in the first quarter (–318,000 jobs). In the second and third quarters of 2020, temporary employment increased sharply: +22.9% then +22.8% (i.e. +107,800 then +131,600 jobs). It nevertheless remains below its level of the previous year: –10.3%, or 81,100 job losses over one year.

In the third quarter of 2020, payroll employment excluding temporary workers rebounded (+1.1% or +269,600) after two quarters of sharp decline. It nevertheless remains below its level at the end of 2019 (–217,300).

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 48.56 | -1.14 |

| Silver | 24.483 | 1.35 |

| Gold | 1862.856 | 1.43 |

| Palladium | 2330.7 | -0.6 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -203.8 | 26547.44 | -0.76 |

| Hang Seng | -329.07 | 26506.85 | -1.23 |

| KOSPI | 13.99 | 2745.44 | 0.51 |

| ASX 200 | 40.9 | 6675 | 0.62 |

| FTSE 100 | 5.16 | 6555.39 | 0.08 |

| CAC 40 | -35.77 | 5573.38 | -0.64 |

| Dow Jones | -148.47 | 30069.79 | -0.49 |

| S&P 500 | -7.16 | 3691.96 | -0.19 |

| NASDAQ Composite | 55.72 | 12519.95 | 0.45 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | National Australia Bank's Business Confidence | November | 5 | |

| 00:30 (GMT) | Australia | House Price Index (QoQ) | Quarter III | -1.8% | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Current | November | 54.5 | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Outlook | November | 49.1 | |

| 06:30 (GMT) | France | Non-Farm Payrolls | Quarter III | -0.9% | |

| 06:45 (GMT) | Switzerland | Unemployment Rate (non s.a.) | November | 3.2% | |

| 07:45 (GMT) | France | Trade Balance, bln | October | -5.8 | |

| 10:00 (GMT) | Eurozone | Employment Change | Quarter III | -2.9% | |

| 10:00 (GMT) | Eurozone | ZEW Economic Sentiment | December | 32.8 | |

| 10:00 (GMT) | Germany | ZEW Survey - Economic Sentiment | December | 39 | 46 |

| 10:00 (GMT) | Eurozone | GDP (QoQ) | Quarter III | -11.8% | 12.6% |

| 10:00 (GMT) | Eurozone | GDP (YoY) | Quarter III | -14.8% | -4.4% |

| 13:30 (GMT) | U.S. | Nonfarm Productivity, q/q | Quarter III | 10.6% | 5% |

| 13:30 (GMT) | U.S. | Unit Labor Costs, q/q | Quarter III | 9% | -8.9% |

| 23:30 (GMT) | Australia | Westpac Consumer Confidence | December | 107.7 | |

| 23:50 (GMT) | Japan | Core Machinery Orders, y/y | October | -11.5% | -11.3% |

| 23:50 (GMT) | Japan | Core Machinery Orders | October | -4.4% | 2.8% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.74183 | -0.17 |

| EURJPY | 125.97 | -0.21 |

| EURUSD | 1.21079 | -0.14 |

| GBPJPY | 139.15 | -0.35 |

| GBPUSD | 1.3375 | -0.26 |

| NZDUSD | 0.70405 | -0.01 |

| USDCAD | 1.28012 | 0.19 |

| USDCHF | 0.89081 | 0.02 |

| USDJPY | 104.035 | -0.07 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.