- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 (GMT) | Germany | CPI, m/m | November | 0.1% | -0.8% |

| 07:00 (GMT) | Germany | CPI, y/y | November | -0.2% | -0.3% |

| 13:30 (GMT) | Canada | Capacity Utilization Rate | Quarter III | 70.3% | 77.5% |

| 13:30 (GMT) | U.S. | PPI excluding food and energy, m/m | November | 0.1% | 0.2% |

| 13:30 (GMT) | U.S. | PPI excluding food and energy, Y/Y | November | 1.1% | 1.5% |

| 13:30 (GMT) | U.S. | PPI, y/y | November | 0.5% | 0.8% |

| 13:30 (GMT) | U.S. | PPI, m/m | November | 0.3% | 0.2% |

| 15:00 (GMT) | U.S. | Reuters/Michigan Consumer Sentiment Index | December | 76.9 | 76.5 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | December | 246 |

According to ActionForex, analysts at TD Bank Financial Group note that the U.S. consumer prices rose 0.2% month/month in November, one tick above expectations, and total CPI was up 1.2% year-on-year in November, unchanged from October. Meanwhile, core inflation was also up 0.2% in November, after remaining unchanged in October. As a result, core inflation was up 1.6% on a year/year basis, unchanged from the prior month.

"Within core inflation, the shelter index rose a modest 0.1% month/month for the fourth month in a row. However, that gain was driven entirely by a rebound in prices for lodging away from home, which rose 3.9% m/m in November after falling 3.2% in October. Other price rebounds were seen in household furnishing and operations (+0.7%), apparel (+0.9% m/m) and motor vehicle insurance (+1.1% m/m). Another notable price increase was a 1.8% m/m gain for transportation services, boosted by a 3.5% increase in airline fares in November. However, airline fares remained 17% below their year-ago levels."

"Zooming out from all those monthly moves, price pressures for core goods and services continued to trend in opposite directions. Core services prices rose 0.2% m/m in November, a pick-up from October. However, on a year/year basis, core services inflation was only 1.7%, the softest pace since 2011. On the other side of the coin, core goods inflation was up 0.1%, and is now +1.4% year/year in October, the fastest pace since early 2012."

"Energy prices picked up a bit, rising 0.4% on the month in November, and are still down 9.4% versus a year ago. Food prices fell 0.1% m/m in November, but still remain 3.7% higher than a year ago."

"While there are still a lot of sizeable month-to-month price swings given the pandemic, overall inflation pressures remained reasonably benign in November. It’s true that core inflation did move up a tick, but remained subdued overall."

According to ActionForex, analysts at Wells Fargo Securities believe that while vaccines offer a light at the end of the tunnel, the labor market will remain under pressure in the short run as 853K people filed claims in the first week of December, an increase of 137K from the prior week.

"We can no longer think of claims being in a trend decline given the fact that they have increased in three out of the past five weeks and are higher today than at any point since September."

"Still, it could have been worse, unadjusted claims figures climbed to 947.5K, but since the seasonal factors were expecting an increase of 92K, the seasonally adjusted print resulted in an increase of “only” 137K, the largest weekly jump since March."

"In an indication of the increased difficulty people are having finding a replacement job, continuing claims rose for the first time since they hit a peak in May."

FXStreet reports that according to analysts at ANZ Bank, AUD/USD will likely test 0.80 in 2021 as the aussie will do well on its strong domestic starting point, the country’s pandemic containment, good value and leverage to the global growth cycle.

“2021 is likely to mirror 2020 in one respect: global dynamics will be more important than the domestic story. Greater stability in trade policy and geopolitics should support global trade volumes. Continued progress towards re-opening should boost cyclical asset allocations and portfolio flows biased towards emerging markets and Asia, which will benefit from a lower USD. Accommodative policy settings will keep interest rates at record lows, pushing investors up the risk curve and supporting equities. All of this creates an environment where the AUD tends to perform well.”

“The headwind created by recent RBA action is likely to dissipate. It has now probably made its final move for some time, joining the rest of the world’s central banks in embarking on a new QE program aimed at suppressing long-end yields. To us, this policy is more about capping strength than driving outright weakness and price action, and the announcement has supported this view.”

“While the recovery will be incremental and a portion of this story is already priced in, we think the AUD’s undervaluation provides ample room for more improvement into 2021. As such, we’ve set our AUD/USD year-end target at 0.80.”

FXStreet notes that the European Central Bank (ECB) left its policy rate at -0.50% but eased policy via a EUR500 B increase in its PEPP facility, which was also extended to run through to the end of March 2022. This was largely in line with consensus expectations, but markets seem to be a bit disappointed that the ECB didn't do more, especially on liquidity, with the EUR and rates higher, per TD Securities.

“The ECB left the deposit rate unchanged, but announced a EUR500 B expansion of its PEPP facility, bringing the total to €1.85tn, and extending the programme to run to at least the end of March 2022. The bank also eased the terms of its TLTROs, with extending the low -1.0% rate (though not cutting it) by one year until June 2022, with three additional operations between June and December 2021.”

“EUR/USD caught an initial bid in the immediate aftermath of the decision, but we are not yet inclined to read too much into the move - at least with respect to the specific policy changes implemented. There may be some mild degree of disappointment for those who were looking for a bigger package from the Governing Council. That was probably too much to hope for, however.”

“We are keeping an eye on intraday trendline resistance around 1.2130/35. We see this as a possible technical trigger for any possible extension higher. We would need to see a sustained move above 1.2147, however, to think that such a move might have longer legs.”

U.S. stock-index futures traded fell on Thursday, as investors were frustrated by a bigger-than-expected climb in weekly jobless claims in the U.S., which suggested a stalling recovery in the country’s labor market, as well as little progress in talks on additional stimulus measures between Democrats and Republicans.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,756.24 | -61.70 | -0.23% |

Hang Seng | 26,410.59 | -92.25 | -0.35% |

Shanghai | 3,373.28 | +1.31 | +0.04% |

S&P/ASX | 6,683.10 | -45.40 | -0.67% |

FTSE | 6,596.87 | +32.58 | +0.50% |

CAC | 5,534.94 | -11.88 | -0.21% |

DAX | 13,271.89 | -68.37 | -0.51% |

Crude oil | $46.08 | +1.23% | |

Gold | $1,847.90 | +0.52% |

- Eurozone's economy is seen shrinking in Q4

- The depth and duration of the second coronavirus wave is bigger than expected

- Q4 GDP growth seen at -2.2%

- Service sector activity is severely curbed

- Inflation remains very low

- PEPP envelope needs not be used in full

- Envelope can be recalibrated if needed

- ECB sees 2020 GDP growth at -7.3% vs. -8% seen in September

- Sees 2021 GDP growth at 3.9% vs. 5% seen in September

- sees 2022 GDP growth at 4.2% vs. 3.2% seen in September

- Sees 2023 GDP growth at 2.1%

- Says risks to growth remain to the downside, but have become less pronounced

- ECB sees 2020 inflation at 0.2% vs. 0.3% seen in September

- Sees 2021 inflation at 1.0% vs. 1.0% in September

- Sees 2022 inflation at 1.1% vs. 1.3% seen in September

- Says fiscal message should be targeted, temporary

- Risks of delayed recovery warrants fiscal support

- ECB doesn't target the exchange rate

- Euro appreciation is important, puts downward pressure on prices

- ECB will very carefully monitor the exchange rate

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 173.53 | -1.76(-1.00%) | 1688 |

ALCOA INC. | AA | 22.85 | 0.14(0.62%) | 3773 |

ALTRIA GROUP INC. | MO | 43.1 | 0.12(0.28%) | 17561 |

Amazon.com Inc., NASDAQ | AMZN | 3,081.00 | -23.20(-0.75%) | 40659 |

American Express Co | AXP | 121.61 | -0.08(-0.07%) | 4356 |

AMERICAN INTERNATIONAL GROUP | AIG | 39.92 | -0.02(-0.05%) | 608 |

Apple Inc. | AAPL | 120.48 | -1.30(-1.07%) | 994705 |

AT&T Inc | T | 31.4 | -0.06(-0.19%) | 165136 |

Boeing Co | BA | 228.4 | -3.66(-1.58%) | 173704 |

Caterpillar Inc | CAT | 179.41 | -0.66(-0.37%) | 2040 |

Chevron Corp | CVX | 90.9 | 0.46(0.51%) | 19150 |

Cisco Systems Inc | CSCO | 44.41 | -0.28(-0.63%) | 43675 |

Citigroup Inc., NYSE | C | 58.52 | -0.43(-0.73%) | 62456 |

Exxon Mobil Corp | XOM | 42.97 | 0.17(0.40%) | 231296 |

Facebook, Inc. | FB | 275.58 | -2.34(-0.84%) | 415443 |

FedEx Corporation, NYSE | FDX | 293.82 | -1.50(-0.51%) | 9343 |

Ford Motor Co. | F | 9.39 | -0.06(-0.63%) | 110382 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 24.73 | 0.27(1.11%) | 59408 |

General Electric Co | GE | 11.25 | -0.14(-1.23%) | 504005 |

General Motors Company, NYSE | GM | 44.28 | -0.15(-0.34%) | 49352 |

Goldman Sachs | GS | 241.58 | -1.24(-0.51%) | 3959 |

Google Inc. | GOOG | 1,780.00 | -4.13(-0.23%) | 5106 |

Hewlett-Packard Co. | HPQ | 22.89 | -0.30(-1.29%) | 6391 |

Home Depot Inc | HD | 265 | -0.58(-0.22%) | 6508 |

Intel Corp | INTC | 49.69 | -0.38(-0.76%) | 89263 |

International Business Machines Co... | IBM | 126.8 | 0.01(0.01%) | 6994 |

JPMorgan Chase and Co | JPM | 120.11 | -0.94(-0.78%) | 11672 |

Merck & Co Inc | MRK | 83.6 | 0.13(0.16%) | 2322 |

Microsoft Corp | MSFT | 210.85 | -0.95(-0.45%) | 245209 |

Nike | NKE | 139.21 | 0.42(0.30%) | 7638 |

Pfizer Inc | PFE | 41.96 | 0.11(0.26%) | 1073368 |

Procter & Gamble Co | PG | 136.83 | 0.42(0.31%) | 1161 |

Starbucks Corporation, NASDAQ | SBUX | 103.52 | 3.12(3.11%) | 87554 |

Tesla Motors, Inc., NASDAQ | TSLA | 572.46 | -32.02(-5.30%) | 2595449 |

The Coca-Cola Co | KO | 53.4 | 0.07(0.13%) | 28246 |

Twitter, Inc., NYSE | TWTR | 46.97 | -0.26(-0.55%) | 32003 |

UnitedHealth Group Inc | UNH | 345.81 | 1.40(0.41%) | 300 |

Verizon Communications Inc | VZ | 61.32 | -0.14(-0.23%) | 5933 |

Visa | V | 208.8 | -0.78(-0.37%) | 12075 |

Wal-Mart Stores Inc | WMT | 147.77 | 0.04(0.03%) | 28793 |

Walt Disney Co | DIS | 154.2 | -0.23(-0.15%) | 33127 |

Yandex N.V., NASDAQ | YNDX | 68.71 | -0.32(-0.46%) | 21116 |

The Labor

Department announced on Thursday the U.S. consumer price index (CPI) rose 0.2

percent m-o-m in November after being flat m-o-m in the previous month.

Over the last

12 months, the CPI increased 1.2 percent y-o-y last month, the same pace as in

the 12 months through October.

Economists had

forecast the CPI to edge up 0.1 percent m-o-m and to climb 1.1 percent y-o-y in

the 12-month period.

According to

the report, the November gain in the all items index was broad-based, with no

component accounting for more than a quarter of the increase. The food index edged

down 0.1 percent m-o-m in November, while the index for energy rose 0.4 percent

m-o-m.

The core CPI

excluding volatile food and fuel costs also increased 0.2 percent m-o-m in November

after an unrevised flat m-o-m performance in the previous month.

In the 12

months through November, the core CPI surged 1.6 percent, the same pace as in

the 12 months ending October.

Economists had

forecast the core CPI to gain 0.1 percent m-o-m and to jump 1.6 percent y-o-y

last month.

Walt Disney (DIS) initiated with a Buy at Truist; target $175

Starbucks (SBUX) target raised to $102 from $94 at Telsey Advisory Group

Tesla (TSLA) downgraded to Neutral from Buy at New Street; target $578

Yandex N.V. (YNDX) downgraded to Hold from Buy at HSBC Securities

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment rose much more than forecast last week.

According to

the report, the initial claims for unemployment benefits increased by 137,000

to 853,000 for the week ended December 5. This was the highest total since the

week ended September 20.

Economists had

expected 725,000 new claims last week.

Claims for the

prior week were revised upwardly to 716,000 from the initial estimate of 712,000.

Meanwhile, the

four-week moving average of claims grew to 776,500 from an upwardly revised 740,500

in the previous week.

Continuing

claims rose to 5,757,000 million from an upwardly revised 5,527,000 in the

previous week.

FXStreet reports that analysts at Credit Suisse note that the S&P 500 Index has been unable to maintain its move to new highs, leaving in place a small bearish “reversal day” and support at 3650/44 needs to hold to keep the immediate risk higher.

“With the market remaining seen in a ‘euphoric’ state (91% S&P 500 stocks are above their 200-day average and the market is well above the upper end of what we see as its ‘typical’) the rally is now seen at a more critical and vulnerable state and supports need to now be watched very carefully, especially with daily MACD momentum slowing.”

“Key near-term remains seen 3650/44 – key price/gap support and the 13-day exponential average. We need to see this hold to suggest the immediate risk can still stay higher with resistance seen at 3698 initially, above which is needed to clear the way for strength back to 3712, then 3720/25, which we look to cap at first. Above in due course though should see what we look to be a tougher test of a cluster of Fibonacci projection levels in the 3765/85 band.”

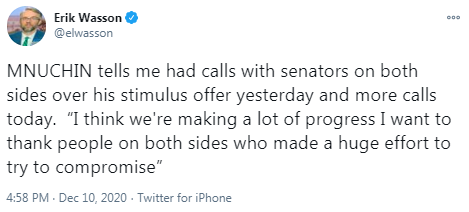

- Says that Republicans will agree to state and local government funding if Democrats agree to liability protection

- There is remaining money from CARES Act for state and local governments

- There is a lot of reappropriation of existing funding in stimulus proposal

The European

Central Bank (ECB) left its main refinancing rate unchanged at 0.00 percent on

Thursday, as widely expected. Its interest rates on the marginal lending

facility and the deposit facility were also left unchanged at 0.25 percent and

-0.50 percent, respectively.

In its policy

statement, the ECB said:

- Governing Council expects key ECB interest rates to remain at their present or lower levels until it has seen inflation outlook robustly converge to level sufficiently close to, but below, 2 percent;

- Governing Council decided to increase envelope of its pandemic emergency purchase programme (PEPP) by EUR500 billion to a total of EUR1,850 billion; extended the horizon for net purchases under the PEPP to at least the end of March 2022;

- Governing Council also decided to extend reinvestment of principal payments from maturing securities purchased under the PEPP until at least the end of 2023;

- Governing Council decided to further recalibrate conditions of third series of targeted longer-term refinancing operations (TLTRO III); decided to raise total amount that counterparties will be entitled to borrow in TLTRO III operations from 50 percent to 55 percent of their stock of eligible loans;

- Governing Council decided to extend to June 2022 duration of the set of collateral easing measures adopted by Governing Council on 7 and 22 April 2020;

- Governing Council also decided to offer four additional pandemic emergency longer-term refinancing operations (PELTROs) in 2021, which will continue to provide effective liquidity backstop;

- Net purchases under asset purchase programme (APP) will continue at monthly pace of EUR20 billion;

- Governing Council also intends to continue reinvesting, in full, principal payments from maturing securities purchased under APP for extended period of time past date when it starts raising key ECB interest rates;

- Eurosystem repo facility for central banks (EUREP) and all temporary swap and repo lines with non-euro area central banks will be extended until March 2022;

- Governing Council decided to continue conducting its regular lending operations as fixed rate tender procedures with full allotment at the prevailing conditions for as long as necessary;

- Uncertainty remains high, including with regard to dynamics of the pandemic and the timing of vaccine roll-outs;

- We will continue to monitor developments in exchange rate with regard to their possible implications for medium-term inflation outlook;

- Governing Council, therefore, continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in sustained manner, in line with its commitment to symmetry.

GBP declined against its major rivals in the European session on Thursday as the latest developments in the UK-EU talks on post-Brexit trade relations raised investors' fears that the sides might fail to agree on a free trade deal.

After the meeting with the UK's Prime Minister Boris Johnson last night, the European Commission's (EC) president Ursula von der Leyen stated that the EU and the UK's positions on outstanding issues still "remain far apart". She also added that the two sides agreed to try to resolve these essential issues and come to a decision by the end of the weekend. Meanwhile, the EC proposed targeted contingency measures to prepare for a possible “no-deal” scenario. The aim of the measures is to cater for the period during which there is no agreement in place, the EC said. The measures will ensure basic reciprocal air and road connectivity between the EU and the UK, as well as allowing for the possibility of reciprocal fishing access by EU and UK vessels to each other's waters.

The disappointing outcome of the meeting of Johnson and von der Leyen made a no-deal Brexit looking more likely, putting pressure on the pound. But hopes of a last-minute deal still remain.

FXStreet reports that Jane Foley, Senior FX Strategist at Rabobank, discusses some of the factors that could curtail upside potential in EUR/USD in the coming months. The pair could slide below the 1.20 level.

“For the US to record lower than expected inflation, this may necessitate either a slower than expected US economic recovery, which could be related to the pandemic. Or, higher than expected nominal interest rates across the board. This could be a function of growth and possibility of less QE than expected by the Fed. The market needs to keep an eye on the Treasury’s fiscal response and how this impacts Fed policy to gauge the chances of this scenario.”

“The ECB could surprise the market by cutting the discount rate further into negative territory. While there are various counter-arguments surrounding the benefits of using negative interest rates for a prolonged period, this would likely have a noticeable impact on weakening the EUR. A souring of political cohesion in the eurozone or the EU could also undermine the EUR.”

“There could be a short squeeze in the USD on negative geopolitical events or if there was a deterioration in the relationship between the US and China. The consensus appears to have adopted the view that US/China relations will be less tense under a Biden Administration than under Trump.”

“While there is the possibility that China concerns could undermine risk appetite, the generous liquidity provision made available by the Fed and other central banks suggests that investors' sensitivity to bad news has been dulled somewhat. This suggests that the size of pullbacks on bad news could be limited in the current environment, though there is likely scope for dips back below EUR/USD 1.20 dependent on the newsflow.”

FXStreet reports that analysts at Credit Suisse note that EUR/JPY maintains a large base and is expected to see a clear break above its long-term downtrend from 2018 around 126.54 with next resistance at 127.08.

“Consolidation extends at the long-term downtrend from 2018 around 126.54, but with the market still well supported in our view. Indeed, with a large ‘head & shoulders’ base in place above the October and November highs at 124.99/125.18 – we remain of the view a more important trend higher is underway.”

“Above 126.67/69 should reassert the uptrend with resistance then seen next at the 127.08 September high, above which should add further momentum to the uptrend with resistance then seen next at 127.52 and with the ‘measured base objective’ seen higher at 128.70.”

FXStreet notes that the global economy appears to be more resilient than expected, an effective vaccine is available and is being rolled out globally, and 2021 will see a Biden administration that is expected to bring more stability on the geopolitical front. This allows room for cautious optimism though there are still some substantial risks out there such as the rising share of zombie firms and the increasing debt overhang, economists at Rabobank inform.

“We have revised our economic forecasts upwards and expect the global economy to contract by 3.8% this year (up from -4.4%) and grow by 4.5% in 2021 (up from 4%) and 4% in 2022. We expect all major economies to shrink in 2020, with the exception of China, where we expect a positive print in 2020.”

“President-elect Joe Biden will (almost certainly) become the 46th president of the United States in January. We have calculated that Biden’s spending plans would result in higher economic growth of the US economy compared to our baseline scenario, thanks to higher productivity growth via innovation, and investment in human capital.”

“Recent research by Bloomberg based on financial data of 3,000 listed US companies shows that 20% of the examined companies are zombie firms. The share of zombie firms among SMEs is likely even higher. By providing credit and capital to firms hit hard by the corona crisis, governments might have averted pain in the short-term”

“The US zombie firms examined by Bloomberg have been ramping up on debt by USD1,000 B. A recent study by the Fed shows that heavily leveraged firms experienced less favorable patterns in employment, assets and investment in the aftermath of the global financial crisis compared to firms with lower debt levels. Given these results, the authors conclude that the surge in debt as a result of the COVID-19 crisis might result in a 10% decrease in growth for firms in industries hit hardest by the pandemic.”

FXStreet reports that strategists at ANZ Bank believe demand recovery, president-elect Biden’s supportive foreign policy, prospects of additional fiscal support and American and Chinese climate policies are key factors shaping the industrial metals demand in 2021.

“We expect support from supply issues to diminish next year, with demand driving market tightness. Better economic activity will be key to supporting demand growth. China’s infrastructure investments and strategic restocking are keeping demand strong, while a growing focus on the green energy sector should keep investor sentiment high.

“Chinese demand for copper will be the dominating factor in 2021. Recent months have seen strong growth in sales of consumer goods and automobiles, and China’s infrastructure and grid investments have driven strong growth in demand, providing a solid base for 2021.

“Geopolitics could normalise, relatively speaking, in 2021. The president-elect has at least confirmed that the US-China relationship, which has been a key risk for all the metals since 2018, will not worsen. With accelerating economic growth, rising demand from new energy sector and limited geopolitical risk, copper prices could push towards USD9,000/t over 2021.”

CNBC reports that with a new deadline of Sunday to decide on the future of Brexit trade talks, analysts closely following the negotiations say the chances of an agreement are quickly diminishing.

Mujtaba Rahman, managing director of Europe at Eurasia Group, said his team had reduced the probability of a deal from 60% to 55%.

Talks between the UK’s chief negotiator David Frost and his EU counterpart Michel Barnier will resume in Brussels Thursday. Key sticking points remain fishing rights and regulatory requirements, Raab noted Thursday, as well competition rules (the so-called “level playing field”) and governance of any deal.

If no deal is struck by Dec. 31, the U.K. will have to trade with the EU on World Trade Organization terms — which means import tariffs and higher costs of business for firms on both sides of the English Channel.

“Fundamentally, now, this is a dispute about the conditions the EU is setting to enter its market, and how the U.K. views these conditions. As it has very serious ‘across economy’ implications for the U.K., it’s very unclear whether Johnson will be able to agree,” Rahman said.

Reuters reports that the DIW economic institute said that Germany’s economic output could return to pre-crisis levels toward the end of 2021.

The German economy will grow by 5.3% next year, after shrinking by 5.1% in 2020 as two lockdowns to curb infections hit growth in Europe’s largest economy, DIW said.

“If this is not successful and the restrictions continue well into spring, economic output in Germany in 2021 could be one and a half percentage points lower than in the more optimistic scenario,” DIW said in a statement.

FXStreet reports that strategists at ANZ Bank expect the recovery from the COVID-19-related closures to continue, accelerated by a widely available vaccine.

“The commodity market is set for a positive year amid an improving economic backdrop. The recovery from the pandemic will accelerate once a vaccine is widely available, further supported by ongoing fiscal and monetary stimulus from governments around the world. A strong global growth pulse will likely see the US dollar weaken, which is normally a prerequisite for a rally in commodity markets.”

“We see rapidly evolving technology and the developments in the new energy sector having big impacts on commodity markets. Compared to the oversupplied energy sector, metals are well placed to benefit from these dynamics.”

“The downside risks should not to be dismissed. The strong rally in 2020 combined with extreme positioning by investors raises the risk that the improvement in the growth outlook may already have been priced in.”

CNBC reports that Natixis’ chief economist for Asia-Pacific said that hope is fading for a significant change in U.S.-China relations under President-elect Joe Biden.

Relations between the U.S. and China have spiraled downward under President Donald Trump’s administration in the last four years.

Ahead of the election, Natixis economists had hoped the two countries could return to better terms under new leadership in the White House.

“Frankly speaking, the first words we’ve heard from Biden aren’t very appealing,” Garcia-Herrero said.

As the Biden administration seeks to rebuild relationships with American allies, analysts expect the new leader to keep a firm line on China.

Garcia-Herrero pointed to increasingly tough talk on China from Europe, Australia, U.S. Congress and Nato, the North Atlantic Treaty Organization. The tone from Beijing is also very defensive, she added.

FXStreet reports that economists at Standard Chartered believe the USD/CNH pair has further scope to fall.

“USD/CNH continues to track lower from its May peak around 7.200 and has some further scope to fall, in our view. We expect significant technical support around the 6.450-6.470 region could be tested soon, but that this level may hold as the pair treads water awaiting the incoming Biden administration.”

“Recent comments from Biden suggest that nothing much will change for US-China relations initially, and we anticipate stability would be a preferred approach from the PBoC.”

eFXdata reports that MUFG Research maintains a bearish bias on the USD into the year-end.

"US Treasury Secretary Steve Mnuchin presented a new plan to Nancy Pelosi and Chuck Schumer for 916 billion," MUFG notes.

"A plan confirmed just ahead of the FOMC on 16th December would be intriguing and potentially set the markets up for a double-whammy of fiscal and monetary stimulus combined. The FOMC will be under pressure to act given the escalation of COVID and the restrictions that go with it. A confirmed stimulus plan and the FOMC announcing an increase in purchases of longer-dated UST bonds would in our view be a recipe for the US dollar to weaken into the end of the year," MUFG adds.

Reuters reports that Ireland's European Commissioner Mairead McGuinness said she believed "there is a deal to be done" with Britain in trade talks in the coming days but that it was impossible to predict if negotiations would be successful.

"I hope that we all get a Christmas present over the weekend. An early one. And that there is a trade agreement, because I think from all our sides ... that would be the best possible outcome," McGuinness told.

FXStreet reports that strategists at TD Securities are optimistic on the oil market into 2021.

“In sharp contrast to what many bulls were looking for following an accretive OPEC+ meeting, the EIA report showed crude oil inventories unexpectedly jumped a record 15.19 million bbls vs an expected one million bbl decline.”

“In the short run, the raging pandemic and the associated rising death toll will very likely continue to keep demand weak, as it will take time to deploy the highly effective vaccines.”

“TD Securities sees WTI approaching $50/b, once the economy normalizes. The Biden Administration and other major economies around the world will want to provide sizable stimulus, which is expected to drive demand higher in the US and around the world. At the same time, OPEC + is likely to increase production in a way such that the current excessive inventories continue to be unwound, with US shale and other producers only mustering modest supply gains for the foreseeable future.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | Australia | Consumer Inflation Expectation | December | 3.5% | 3.5% | |

| 00:30 | Australia | RBA Bulletin | ||||

| 07:00 | United Kingdom | Manufacturing Production (YoY) | October | -7.9% | -8.4% | -7.1% |

| 07:00 | United Kingdom | Manufacturing Production (MoM) | October | 0.2% | 0.3% | 1.7% |

| 07:00 | United Kingdom | Industrial Production (YoY) | October | -6.3% | -6.5% | -5.5% |

| 07:00 | United Kingdom | Industrial Production (MoM) | October | 0.5% | 0.3% | 1.3% |

| 07:00 | United Kingdom | GDP m/m | October | 1.1% | 0.4% | 0.4% |

| 07:00 | United Kingdom | GDP, y/y | October | -8.4% | -8.2% | |

| 07:00 | United Kingdom | Total Trade Balance | October | 0.6 | -1.7 | |

| 07:45 | France | Industrial Production, m/m | October | 1.6% | 0.4% | 1.6% |

During today's Asian trading, the Euro rose against the US dollar and the yen on expectations of the outcome of the European Central Bank (ECB) meeting.

At the end of today's meeting, the ECB is likely to extend the term of the emergency asset purchase program for six months, until December 2021, and increase its volume by 500 billion euros, to 1.85 trillion euros, according to the consensus forecast of analysts and economists.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.04%.

Traders are also waiting for the release of data from the US Labor Department on consumer prices for November, as well as on the number of initial jobless cClaims last week.

The pound fell more than 0.6% against the US dollar. British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed to determine by next Sunday whether there is a chance to conclude an agreement on the parties ' relations after Brexit, British media reported.

According to media reports, Johnson and von der Leyen, after hours of talks that ended on Thursday night, stated that while the UK and the EU can not overcome a number of controversial issues.

According to the report from INSEE, in October 2020, output slowed down in the manufacturing industry (+0.5%, after +2.3%) while it rose again in the whole industry (+1.6%, after +1.6%). Economists had expected a 0.4% increase in the whole industry.

Compared to February (the last month before the beginning of the first general lockdown), output remained significantly lower in the manufacturing industry (−5.0%), as well as in the whole industry (−3.6%).

In October, output bounced back in mining and quarrying, energy, water supply (+7.9% after −2.7%). It went on increasing in “other manufacturing” (+1.2% after +1.1%), in the manufacture of machinery and equipment goods (+1.0% after +3.9%) and it grew up strongly again in the manufacture of coke and refined petroleum (+13.0% after +19.5%). However output of transport equipment fell back (−2.7% after +9.2%) and output of food products and beverages decreased slightly (−0.3% after a virtual stability).

Output of the last three months was lower than that of the same months of 2019 (−6.4%) in the manufacturing industry, as well as in the whole industry (−5.5%).

Over this one-year period, output slumped in the manufacture of coke and refined petroleum products (−22.3%) and in the manufacture of transport equipment (−17.4%). It diminished sharply in the manufacture of machinery and equipment goods (−6.8%), in “other manufacturing” (−4.6%) and more moderately in mining and quarrying, energy, water supply (−0.3%) and in the manufacture of food products and beverages (−1.9%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.2257 (1043)

$1.2198 (1402)

$1.2157 (1653)

Price at time of writing this review: $1.2093

Support levels (open interest**, contracts):

$1.2046 (460)

$1.2006 (3387)

$1.1946 (1924)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 60449 contracts (according to data from December, 9) with the maximum number of contracts with strike price $1,1800 (4073);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3553 (570)

$1.3514 (643)

$1.3494 (1530)

Price at time of writing this review: $1.3331

Support levels (open interest**, contracts):

$1.3255 (770)

$1.3201 (653)

$1.3139 (1482)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 57990 contracts, with the maximum number of contracts with strike price $1,4000 (32994);

- Overall open interest on the PUT options with the expiration date January, 8 is 27296 contracts, with the maximum number of contracts with strike price $1,2800 (3952);

- The ratio of PUT/CALL was 0.47 versus 0.49 from the previous trading day according to data from December, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to the report from Office for National Statistics, production output rose by 1.3% between September 2020 and October 2020, with all sectors showing growth: manufacturing rose by 1.7%; electricity and gas rose by 0.3%; mining and quarrying rose by 0.2%; and water supply rose by 0.6%. Industrial production was expected to grow by 0.3%.

In October 2020, the index of production was 4.4% below February 2020, the previous month of “normal” trading conditions prior to the coronavirus (COVID-19) pandemic.

The monthly increase of 1.7% in manufacturing output was led by manufacturing of transport equipment; 11 of the 13 subsectors displayed upward contributions.

Total production output increased by 7.6% for the three months to October 2020, compared with the three months to July 2020; this was primarily because of the strength displayed during July 2020.

For the three months to October 2020, compared with the three months to October 2019, production output decreased by 6.1%; this was led by a fall in manufacturing of 7.8%.

According to the report from Office for National Statistics, with a backdrop of further national measures being introduced in response to the coronavirus pandemic, monthly GDP grew by 0.4% in October 2020. This is the sixth consecutive monthly increase following a record fall of 19.5% in April 2020.

October 2020 GDP is now 23.4% higher than its April 2020 low. However, it remains 7.9% below the levels seen in February 2020, before the full impact of the coronavirus pandemic.

In October 2020, the services sector grew by 0.2%, following growth of 1.0% in September. The services sector saw growth in 11 out of the 14 sub-sectors, however the accommodation and food service activities sub-sector acted as a drag on growth in October, falling by 14.4% as tightening coronavirus (COVID-19) measures had an adverse impact on activity and a subsequent lack of demand.

Production grew by 1.3% in October 2020, with manufacturing growing by 1.7%. The manufacturing sector saw 11 out of its 13 sub-sectors increasing following large falls across March and April 2020. The largest contribution was from the manufacture of transport equipment, which grew by 5.4% in October 2020. This is a result of growth from large businesses to meet increased demand, however, it is still 18.2% below its February 2020 level.

Despite growth in the latest month, production output is 4.4% lower than the level in February 2020, with manufacturing 6.6% lower.

Output in construction grew by 1.0% compared with the previous month following a record fall of 41.2% in April 2020. This is the sixth consecutive month of growth; it is important to note that since the record monthly growth of 21.8% in June, growth in construction output has slowed.

All components of repair and maintenance saw positive growth in October 2020 where some components of new work fell. The latest increase was driven by public other new work and non-housing repair and maintenance, which grew 7.5% and 5.1% respectively. Private new housing acted as a drag on growth in October, falling by 1.9%.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 48.98 | 0.41 |

| Silver | 23.932 | -2.45 |

| Gold | 1839.376 | -1.6 |

| Palladium | 2262.65 | -2.1 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 350.86 | 26817.94 | 1.33 |

| Hang Seng | 198.28 | 26502.84 | 0.75 |

| KOSPI | 54.54 | 2755.47 | 2.02 |

| ASX 200 | 40.8 | 6728.5 | 0.61 |

| FTSE 100 | 5.47 | 6564.29 | 0.08 |

| CAC 40 | -13.85 | 5546.82 | -0.25 |

| Dow Jones | -105.07 | 30068.81 | -0.35 |

| S&P 500 | -29.43 | 3672.82 | -0.79 |

| NASDAQ Composite | -243.82 | 12338.95 | -1.94 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | Australia | Consumer Inflation Expectation | December | 3.5% | |

| 00:30 (GMT) | Australia | RBA Bulletin | |||

| 05:00 (GMT) | Japan | Eco Watchers Survey: Current | November | 54.5 | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Outlook | November | 49.1 | |

| 07:00 (GMT) | United Kingdom | Manufacturing Production (YoY) | October | -7.9% | -8.4% |

| 07:00 (GMT) | United Kingdom | Industrial Production (YoY) | October | -6.3% | -6.5% |

| 07:00 (GMT) | United Kingdom | Manufacturing Production (MoM) | October | 0.2% | 0.3% |

| 07:00 (GMT) | United Kingdom | Industrial Production (MoM) | October | 0.5% | 0.3% |

| 07:00 (GMT) | United Kingdom | GDP, y/y | October | -8.4% | |

| 07:00 (GMT) | United Kingdom | GDP m/m | October | 1.1% | 0.4% |

| 07:00 (GMT) | United Kingdom | Total Trade Balance | October | 0.6 | |

| 07:45 (GMT) | France | Industrial Production, m/m | October | 1.4% | 0.4% |

| 12:45 (GMT) | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | November | 5520 | 5335 |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | December | 712 | 725 |

| 13:30 (GMT) | Eurozone | ECB Press Conference | |||

| 13:30 (GMT) | U.S. | CPI, m/m | November | 0% | 0.1% |

| 13:30 (GMT) | U.S. | CPI excluding food and energy, m/m | November | 0% | 0.1% |

| 13:30 (GMT) | U.S. | CPI excluding food and energy, Y/Y | November | 1.6% | 1.6% |

| 13:30 (GMT) | U.S. | CPI, Y/Y | November | 1.2% | 1.1% |

| 14:00 (GMT) | United Kingdom | NIESR GDP Estimate | November | 10.2% | |

| 19:00 (GMT) | U.S. | Federal budget | November | -284 | |

| 21:30 (GMT) | New Zealand | Business NZ PMI | November | 51.7 | |

| 21:45 (GMT) | New Zealand | Food Prices Index, y/y | November | 2.7% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.744 | 0.45 |

| EURJPY | 125.923 | -0.08 |

| EURUSD | 1.2081 | -0.17 |

| GBPJPY | 139.696 | 0.45 |

| GBPUSD | 1.34029 | 0.38 |

| NZDUSD | 0.70219 | -0.21 |

| USDCAD | 1.28183 | 0.03 |

| USDCHF | 0.88924 | 0.08 |

| USDJPY | 104.225 | 0.07 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.