- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | Australia | Consumer Inflation Expectation | December | 3.5% | |

| 00:30 (GMT) | Australia | RBA Bulletin | |||

| 05:00 (GMT) | Japan | Eco Watchers Survey: Current | November | 54.5 | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Outlook | November | 49.1 | |

| 07:00 (GMT) | United Kingdom | Manufacturing Production (YoY) | October | -7.9% | -8.4% |

| 07:00 (GMT) | United Kingdom | Industrial Production (YoY) | October | -6.3% | -6.5% |

| 07:00 (GMT) | United Kingdom | Manufacturing Production (MoM) | October | 0.2% | 0.3% |

| 07:00 (GMT) | United Kingdom | Industrial Production (MoM) | October | 0.5% | 0.3% |

| 07:00 (GMT) | United Kingdom | GDP, y/y | October | -8.4% | |

| 07:00 (GMT) | United Kingdom | GDP m/m | October | 1.1% | 0.4% |

| 07:00 (GMT) | United Kingdom | Total Trade Balance | October | 0.6 | |

| 07:45 (GMT) | France | Industrial Production, m/m | October | 1.4% | 0.4% |

| 12:45 (GMT) | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | November | 5520 | 5335 |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | December | 712 | 725 |

| 13:30 (GMT) | Eurozone | ECB Press Conference | |||

| 13:30 (GMT) | U.S. | CPI, m/m | November | 0% | 0.1% |

| 13:30 (GMT) | U.S. | CPI excluding food and energy, m/m | November | 0% | 0.1% |

| 13:30 (GMT) | U.S. | CPI excluding food and energy, Y/Y | November | 1.6% | 1.6% |

| 13:30 (GMT) | U.S. | CPI, Y/Y | November | 1.2% | 1.1% |

| 14:00 (GMT) | United Kingdom | NIESR GDP Estimate | November | 10.2% | |

| 19:00 (GMT) | U.S. | Federal budget | November | -284 | |

| 21:30 (GMT) | New Zealand | Business NZ PMI | November | 51.7 | |

| 21:45 (GMT) | New Zealand | Food Prices Index, y/y | November | 2.7% |

The Commerce

Department announced on Wednesday the U.S. wholesale inventories rose 1.1

percent m-o-m in October, better than the preliminary estimate of a 0.9 percent

m-o-m growth. This was the largest monthly rise in wholesale inventories since January

2019.

Economists had

forecast the reading to stay unrevised at +0.9 percent m-o-m.

In September,

wholesale inventories increased 0.9 percent m-o-m.

According to

the report, durable goods inventories rose 0.3 percent m-o-m in October, while

stocks of nondurable goods climbed 2.5 percent m-o-m.

In y-o-y terms,

wholesale inventories dropped 2.2 percent in October.

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories surged

by 15.189 million barrels in the week ended December 4. This was the largest

increase since the week ended April 10. Economists had forecast a decline of 1.424

million barrels.

At the same

time, gasoline stocks climbed by 4.222 million barrels, while analysts had

expected a gain of 2.271 million barrels. Distillate stocks jumped by 5.222

million barrels, while analysts had forecast an increase of 1.414 million

barrels.

Meanwhile, oil

production in the U.S. remained unchanged at 11.100 million barrels a day.

U.S. crude oil

imports averaged 6.5 million barrels per day last week, increased by 1.1

million barrels per day from the previous week.

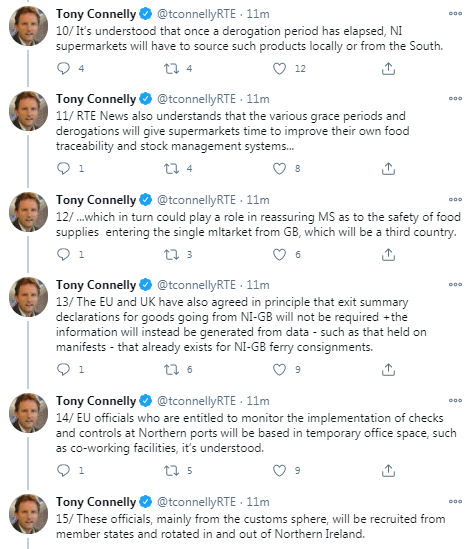

- UK and EU positions are so far apart at this stage that the likelihood of striking a deal tonight is low

The Job

Openings and Labor Turnover Survey (JOLTS) published by the Labor Department on

Wednesday revealed a 2.4 percent m-o-m increase in the U.S. job openings in October

after a revised 2.2 percent m-o-m gain in September (originally a 1.3 percent

m-o-m advance).

According to

the report, employers posted 6.652 million job openings in October compared to

the September figure of 6.494 million (revised from 6.436 million in the

original estimate) and economists’ expectations of 6.300 million. The job

openings rate was 4.5 percent in October, up from an upwardly revised 4.4

percent in the prior month. The report showed that the number of job openings rose

in health care and social assistance (+122,000 jobs) and state and local

government education (+23,000).

Meanwhile, the

number of hires fell 1.3 percent m-o-m to 5.812 million in October from a

revised 5.886 million in September. The hiring rate was 4.1 percent in October,

down from a revised 4.2 percent in September. The hires declined in wholesale

trade (-81,000), other services (-74,000), and federal government (-12,000).

The separation

rate in October was 5.107 million or 3.6 percent, compared to 4.844 million or

3.4 percent in September. Within separations, the quits rate was 2.2 percent (flat

m-o-m), and the layoffs rate was 1.2 percent (+0.2 pp m-o-m).

The Bank of

Canada (BoC) maintained its benchmark interest rates unchanged at 0.25 percent

on Wednesday, as widely expected.

In its policy

statement, the Canadian central bank noted:

- Governing Council will hold the policy interest rate at effective lower bound until economic slack is absorbed so that 2-percent inflation target is sustainably achieved;

- BoC is maintaining its extraordinary forward guidance, reinforced and supplemented by its QE program, which continues at its current pace of at least CAD4 billion per week;

- Recent news on development of effective vaccines is providing reassurance that pandemic will end and more normal activities will resume, although the pace and breadth of the global rollout of vaccinations remain uncertain;

- Stronger demand is pushing up prices for most commodities, including oil;

- Broad-based decline in the US exchange rate has contributed to further appreciation of CAD;

- Canada’s national accounts data for Q3 were consistent with the Bank’s expectations of sharp economic rebound;

- Labour market continues to recoup the jobs that were lost at start of the pandemic, albeit at slower pace; Activity remains highly uneven across different sectors and groups of workers;

- Economic momentum heading into Q4 appears to be stronger than was expected in October;

- Recent re-imposition of COVID-19 restrictions can be expected to weigh on growth in Q1 of 2021 and contribute to choppy trajectory until vaccine is widely available;

- Recently announced measures by federal government should help maintain business and household incomes during this second wave of the pandemic and support recovery;

- Outlook for inflation remains in line with the October MPR projection; considerable economic slack is expected to continue to weigh on core inflation for some time;

- Canada’s economic recovery will continue to require extraordinary monetary policy support;

- Bank will continue its QE program until the recovery is well underway and will adjust it as required to help bring inflation back to target on sustainable basis.

FXStreet notes that platinum (XPT/USD) is in new highs for the year at 1086.37. According to Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, the precious netal may see some near-term consolidation below the long-term Fibonacci resistance at 1092.

“The market has maintained upside pressure and has charted new highs for the year at 1086.37. It has eroded the January 2020 and February 2017 highs at 1046.03/1050.51 and in doing so targets the 1199.51 2016 high and the 1208.53 200-month ma.

“Please note that the 28.2% retracement of the entire move down from 2011 lies at 1092 and we may see some consolidation here ahead of further gains.”

- If progress can be made at political level, talks between negotiators could resume in the coming days

- PM believes there's good deal to be done, but both PM and EC head think there needs to be political impetus

- PM will make clear to von der Leyen that he cannot accept any deal that undermines Britain's ability to control laws or waters

U.S. stock-index futures traded mixed on Wednesday, as hopes for economic recovery, supported by a rollout of effective COVID-19 vaccines, and progress in fiscal stimulus talks between Democrats and Republicans boosted demand for economically sensitive stocks such as banks and industrials.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,817.94 | +350.86 | +1.33% |

Hang Seng | 26,502.84 | +198.28 | +0.75% |

Shanghai | 3,371.96 | -38.21 | -1.12% |

S&P/ASX | 6,728.50 | +40.80 | +0.61% |

FTSE | 6,584.84 | +26.02 | +0.40% |

CAC | 5,580.27 | +19.60 | +0.35% |

DAX | 13,408.41 | +129.92 | +0.98% |

Crude oil | $45.88 | +0.61% | |

Gold | $1,865.30 | -0.51% |

FXStreet notes that the S&P 500 maintains its break above key trend resistance from February and analysts at Credit Suisse maintain a bullish outlook with resistance seen next at 3720/25, then 3765/85.

“The S&P 500 continues its steady push higher and with the 3700 psychological barrier cleared we maintain our immediate bullish bias with resistance seen next at 3720/25, which we look to cap at first. Above in due course though should see what we look to be a tougher test of a cluster of Fibonacci projection levels in the 3765/85 band, from which we would look for a fresh consolidation phase. Big picture though, we continue to eventually look for the ‘measured triangle objective’ at 3900.”

“Our main concerns remain the ‘euphoric’ state of the rally – 91% S&P 500 stocks are above their 200-day average (a level not seen since 2013) and the market is well above the upper end of what we see as its ‘typical’ extreme (15% above its 200-day average) – but these on their own do not for now prohibit us looking for further gains.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 174 | 1.54(0.89%) | 1277 |

ALCOA INC. | AA | 23.55 | 0.26(1.12%) | 20391 |

ALTRIA GROUP INC. | MO | 42.4 | 0.17(0.40%) | 16093 |

Amazon.com Inc., NASDAQ | AMZN | 3,185.23 | 7.94(0.25%) | 19029 |

American Express Co | AXP | 123.25 | -0.27(-0.22%) | 4780 |

AMERICAN INTERNATIONAL GROUP | AIG | 39.74 | 0.22(0.56%) | 233 |

Apple Inc. | AAPL | 124.85 | 0.47(0.38%) | 764419 |

AT&T Inc | T | 31.03 | 0.22(0.71%) | 227565 |

Boeing Co | BA | 238.99 | 2.42(1.02%) | 147510 |

Caterpillar Inc | CAT | 179 | 0.16(0.09%) | 1296 |

Chevron Corp | CVX | 92.55 | 1.01(1.10%) | 9521 |

Cisco Systems Inc | CSCO | 44.27 | -0.10(-0.23%) | 33627 |

Citigroup Inc., NYSE | C | 58.82 | 0.46(0.79%) | 24790 |

Exxon Mobil Corp | XOM | 42.77 | 0.53(1.25%) | 119347 |

Facebook, Inc. | FB | 282.78 | -0.62(-0.22%) | 49187 |

FedEx Corporation, NYSE | FDX | 303.59 | 2.14(0.71%) | 10790 |

Ford Motor Co. | F | 9.33 | 0.08(0.86%) | 262944 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 24.63 | 0.16(0.65%) | 37927 |

General Electric Co | GE | 11.03 | 0.07(0.64%) | 312059 |

General Motors Company, NYSE | GM | 44.21 | 0.41(0.94%) | 75584 |

Goldman Sachs | GS | 239.75 | 0.91(0.38%) | 3899 |

Google Inc. | GOOG | 1,811.88 | -6.67(-0.37%) | 3202 |

Hewlett-Packard Co. | HPQ | 23.26 | -0.26(-1.11%) | 6465 |

Home Depot Inc | HD | 263.06 | 1.34(0.51%) | 8752 |

Intel Corp | INTC | 50.35 | -0.34(-0.67%) | 74905 |

International Business Machines Co... | IBM | 126.21 | 0.50(0.40%) | 4555 |

International Paper Company | IP | 49.21 | 0.12(0.24%) | 254 |

Johnson & Johnson | JNJ | 152.98 | 1.43(0.94%) | 38750 |

JPMorgan Chase and Co | JPM | 122.81 | 0.81(0.66%) | 8531 |

McDonald's Corp | MCD | 208.9 | 0.51(0.24%) | 2962 |

Merck & Co Inc | MRK | 83.75 | 0.57(0.69%) | 6329 |

Microsoft Corp | MSFT | 215.31 | -0.70(-0.32%) | 83718 |

Nike | NKE | 139.95 | 0.83(0.60%) | 7021 |

Pfizer Inc | PFE | 43.17 | 0.61(1.43%) | 1766979 |

Starbucks Corporation, NASDAQ | SBUX | 101.52 | 0.31(0.31%) | 3247 |

Tesla Motors, Inc., NASDAQ | TSLA | 653 | 3.12(0.48%) | 1327727 |

The Coca-Cola Co | KO | 53.38 | 0.20(0.38%) | 5705 |

Twitter, Inc., NYSE | TWTR | 47.21 | -0.22(-0.46%) | 13323 |

Verizon Communications Inc | VZ | 61.5 | 0.05(0.08%) | 6585 |

Visa | V | 214 | 1.23(0.58%) | 4139 |

Wal-Mart Stores Inc | WMT | 149.98 | 0.53(0.35%) | 11705 |

Walt Disney Co | DIS | 156.2 | 2.48(1.61%) | 70160 |

Yandex N.V., NASDAQ | YNDX | 69.8 | 0.83(1.20%) | 23651 |

Walt Disney (DIS) initiated with an Overweight at KeyBanc Capital Markets; target $177

Chevron (CVX) target raised to $95 from $88 at Cowen

American Express (AXP) downgraded to Hold from Buy at DZ Bank; target $128

Walt Disney (DIS) upgraded to Overweight from Equal Weight at Wells Fargo; target raised to $182

- It remains to be seen if talks today can rescue the situation

- Situation is 50-50; we are on knife edge

FXStreet reports that ahead of today’s Bank of Canada meeting, economists at Credit Suisse retain a constructive near-term bias on the loonie and hold a 1.2750-1.2780 target range for USD/CAD. A uniquely strong national vaccine procurement outlook and hopes of US fiscal stimulus are new supportive developments for the Canadian dollar.

“Our bias is to view the improvements on the medical outlook front as more relevant from a risk management standpoint, especially as markets are likely to view the recent increase in fiscal spending introduced on November 30 by the Trudeau administration as partially offsetting the likely negative growth impact of renewed lockdown measures. This leaves us looking for no major change in the BoC key policy measures and in forward guidance.”

“The latest COVID-19 vaccine procurements data shows Canada as having booked the single largest amount of vaccine dose on a population scaled basis in the world.”

“While the outcome of negotiations in US Congress on a possible stimulus bill remains uncertain, the tone of the dialogue appears to have improved over the past week, with more evidence of compromise in the pipeline. CAD, due to its gearing to US growth and to its pro-cyclical traits, stands as more likely to benefit than other pro-cyclical currencies from further constructive developments on this front.”

- A good deal is still there to be done

- EU wants to take away our control over our fishing waters; no PM can accept that

- We will prosper with or without a deal

- We had oven-ready deal, which was the Withdrawal Agreement

USD fell against its major rivals in the European session on Wednesday as anticipations of a rollout of effective COVID-19 vaccines and progress in fiscal stimulus talks between Democrats and Republicans boosted investors' risk appetite.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, edged down 0.1% to 90.89.

The U.S. Food and Drug Administration is to meet on Thursday to discuss an emergency use authorization of the Pfizer/BioNTech's coronavirus vaccine. On 17 December, the FDA will also consider the emergency use approval of the vaccine, designed by Moderna. The vaccine rollout is expected in the days that follow the approvals.

Late Tuesday, U.S. Treasury Secretary Steven Mnuchin offered a new $916 bln stimulus bill to Democrats, which, however, doesn't include supplementary jobless benefits. The House Speaker Nancy Pelosi said any bill must include unemployment benefit payments to get Democratic support. Anyway, a surprise coronavirus relief proposal marked progress in stimulus talks between the Republican and Democratic leaders, rising hopes that the agreement could be reached before the end of the week.

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. decreased 1.2 percent in the week ended December 4, following a 0.6

percent drop in the previous week.

According to

the report, applications to purchase a home plunged 5.0 percent, while refinance

applications rose 2.0 percent.

Meanwhile, the

average fixed 30-year mortgage rate dropped from 2.92 percent to a survey low

of 2.90 percent.

“The increase

in refinance applications was driven by FHA and VA refinances, while

conventional activity fell slightly,” noted Joel Kan, an MBA economist. “The

purchase market is also poised to finish 2020 on a strong note. Applications

fell slightly last week but were around 3% higher than the two weeks leading up

to Thanksgiving. Reversing the recent trend, there was also a shift in the

composition of applications, with an increase in government loans pushing the

average loan balance lower,” Kan added.

FXStreet notes that the MSCI All Country World Index returned 12.2% in November, its best-ever monthly performance and has gained a further 2.4% in December so far. Economists at UBS see further upside based on widespread vaccine availability in 2Q21, a broadening of the economic recovery, additional US fiscal stimulus and continued global monetary policy support.

“Equities can rally further and that investors should look through the near-term uncertainty created by rising case numbers and hospitalizations. Our view is based on widespread vaccine availability in 2Q21 allowing an easing of restrictions and a broadening of economic recovery, additional US fiscal stimulus and continued global monetary policy support.”

“Rollout of the Pfizer/BioNTech vaccine begins in the UK this week. The US Food and Drug Administration also meets this week to discuss an Emergency Use Authorization of the Pfizer/BioNTech vaccine and Vice President Mike Pence has said that distribution could begin next week. On 17 December, the FDA meets again to discuss Emergency Use Authorization for the Moderna vaccine.”

“US fiscal talks appear to be making progress on a USD908 B bipartisan stimulus package, according to press reports. Hopes for a deal before January were raised on Friday as weaker-than-expected non-farm payroll data prompted a rally in both US equities and yields. Investors appear to be taking the view that slowing labor market momentum may provide a catalyst for dealmakers to reach an agreement.”

FXStreet reports that analysts at Credit Suisse apprise that AUD/USD is seeing another attempt to break higher above the 0.7450/53 highs, removal of which on a closing basis would reassert the uptrend.

“A break above 0.7453 would reassert the uptrend, reinforce our bullish bias and open the door for a move to the July 2018 high at 0.7484, where we would expect to see a first attempt to cap.”

“Our medium-term objective is eventually seen at a cluster of long-term Fibonacci retracements at 0.7574/7638, where we would expect to see another concerted pause.”

FXStreet reports that Lisa Shalett, Chief Investment Officer, Wealth Management at Morgan Stanley, expects the US economy to surge early next year.

“Never before have we seen such high unemployment (currently 6.7%) accompanied by rising personal incomes, a savings rate that has doubled in one year, lower credit-card balances and higher net worth. The power of increased spending capacity matched with pent-up demand for deferred vacations, restaurant meals, sporting events and entertainment could fuel economic growth, as the pandemic starts to recede sometime next year.”

“Federal Reserve stimulus has dramatically expanded the money supply. Price declines in the service sector, due to the COVID-19 recession, have so far helped to mask that pressure on inflation. But if services inflation returns to its three-year pre-pandemic trend of roughly 3%, the Consumer Price Index, a key gauge of inflation, may quickly overshoot the Fed’s 2% target next year.”

Reuters reports that Ireland’s Foreign Minister Simon Coveney warned that failure in trade talks with Britain was a “distinct possibility” that the European Union needed to prepare for.

“This is something that can be resolved with the right approach from both sides this evening. But the inability to resolve it to date means failure is a distinct possibility,” Coveney said.

FXStreet reports that Derek Halpenny, Head of Research, Global Markets EMEA & International Securities at MUFG Bank, expects the US dollar to depreciate by year-end due to the stimulus and larger FOMC’s bond purchases.

“US Treasury Secretary Steve Mnuchin presented a new plan to Nancy Pelosi and Chuck Schumer. The USD916 B plan includes state and local government aid and liability protection for businesses.”

“While the new plan is a positive development, the Democrats still appear more supportive of the bi-partisan USD908 B plan, given the Democrats believe it has the best hope of progress through Congress.”

“A plan confirmed just ahead of the FOMC on December 16 would be intriguing and potentially set the markets up for a double-whammy of fiscal and monetary stimulus combined. A confirmed stimulus plan and the FOMC announcing an increase in purchases of longer-dated UST bonds would be a recipe for the US dollar to weaken into the end of the year.”

CNBC reports that Philippine Central Bank Governor Benjamin Diokno said that the renewed outbreak of Covid-19 infections in some parts of the world has dampened the global economic outlook in the near term.

“Recent events, I think, point to a deterioration rather than an improvement in the short run,” Diokno said.

“So I would look at the fourth quarter up to maybe the first quarter of next year as worse than the IMF forecasts,” he added.

The International Monetary Fund said in October that the global economy would contract by 4.4% this year — a projection that Diokno said was “kind of optimistic.”

That latest IMF forecast was an upward revision from its previous projection made in June.

Bloomberg reports that Ray Dalio stressed the importance of diversification and said that a “flood of money and credit” was unlikely to recede.

“Assets will not decline when measured in the depreciating value of money,” the billionaire investor told.

“I believe that with the enormous amount of debt and money that has been created and will be created in the future, the most important thing to pay attention to is the value of debt and money relative to the value of assets and other currencies.”

Dalio added that he saw no reason that stocks couldn’t trade at 50 times earnings and recommended “smart diversification” among asset classes, currencies and countries.

FXStreet reports that in the opinion of UOB Group’s FX Strategists, USD/CNH is seen facing some consolidation.

Next 1-3 weeks: “We noted last Wednesday that ‘downward momentum is improving but USD has to close below the year-to-date low of 6.5319 in order to indicate that next down-leg has started’. USD plummeted to a low of 6.5070 last Friday before closing at 6.5170 (-0.29%). While oversold shorter-term conditions could lead to a couple of days of consolidation first, USD is expected to weaken to 6.4960. Looking forward, the next support is at 6.4700. All in, the current weak phase is deemed as intact as long as USD does not move above 6.5650 (‘strong resistance’ level).”

Reuters reports that Chancellor of the Duchy of Lancaster Michael Gove said that Britain sees scope for a compromise on fishing in Brexit trade negotiations.

"I think there can be scope for compromise but the compromise exists on the way in which European boats can continue to access UK waters," Gove told.

"But what is not up for compromise is the principle that the UK will be an independent coastal state, and that it will be a matter for negotiation between the UK and the EU, with the UK in control of our waters," Gove said.

"You know, countries like Iceland and Norway, even jurisdictions like the Faroes have control over who enters their waters," Gove said.

eFXdata reports that Bank of America Global Research likes to sell the USD Index (DXY).

"We think the US dollar index (DXY) is vulnerable to another technical breakdown and decline in 1H2021. We see potential for a double top pattern to form, present a bearish wave count that favors a retest of the early 2017 lows. The now declining 200wk SMA supports our view," BofA notes.

"Tactically, we can't rule out a bounce into yearend. A rounded base may form at trend line support similar to 2017, 2014, 2011 and 2008," BofA adds.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:30 | China | PPI y/y | November | -2.1% | -1.8% | -1.5% |

| 01:30 | China | CPI y/y | November | 0.5% | 0% | -0.5% |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | November | -5.9% | 8% | |

| 07:00 | Germany | Current Account | October | 25.2 | 22.5 | |

| 07:00 | Germany | Trade Balance (non s.a.), bln | October | 20.6 | 19.4 |

During today's Asian trading, the euro rose against the US dollar in anticipation of the European Central Bank (ECB) meeting.

Since ECB President Christine Lagarde, as well as some of the key members of the Central Bank's leadership, have previously clearly indicated that they plan to take new steps to support the economy in the face of a new wave of COVID-19 pandemics and restrictive measures, no one doubts the expansion of stimulus.

The consensus forecast of analysts provides for an increase in the volume of the European Central Bank's emergency asset purchase program by 500 billion euros and an extension of its validity for six months-until December 2021.

The Chinese yuan strengthened against the dollar on the back of high risk appetite in global markets due to hopes for the early adoption of the next package of fiscal incentives in the United States, as well as positive news about COVID-19 vaccines.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.2%.

According to the latest KPMG and REC, UK Report on Jobs survey, a further drop in permanent placements across the UK contrasted with a sustained upturn in temp billings in November. Panel members frequently mentioned that staff hiring was dampened by uncertainty related to the coronavirus disease 2019 (COVID-19) pandemic as well as the renewed lockdown measures in November, with firms often opting for short-term workers for current business needs.

Concurrently, overall demand for staff fell solidly, driven by a marked fall in permanent job vacancies. Redundancies related to the pandemic meanwhile led to greater availability of both permanent and temporary candidates. Higher staff supply and weak demand meant that downward pressure on starting pay persisted, with recruiters signalling lower starting salaries and temp wages. The report is compiled by IHS Markit from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

RTTNews reports that data released by the National Bureau of Statistics showed that China's consumer prices declined for the first time in more than a decade in November due to the fall in pork prices.

Consumer prices fell unexpectedly by 0.5 percent year-on-year in November after rising 0.5 percent a month ago. This was the first decline since October 2009. Economists had forecast an increase of 0.8 percent.

Food prices decreased 2 percent annually due to a notable 12.5 percent fall in pork prices. Pork prices had logged a sharp increase in the last year due to the shortage caused by the African swine flu.

Core inflation that excludes food and energy prices climbed 0.5 percent from last year in November.

On a monthly basis, consumer prices were down 0.6 percent versus the expected fall of 0.2 percent.

Statistical office reported that producer prices decreased 1.5 percent on year in November but slower than October's 2.1 percent decline. Prices were expected to fall 1.8 percent.

According to the report from the Federal Statistical Office (Destatis), in October 2020, German exports were up 0.8% and imports 0.3% on September 2020 after calendar and seasonal adjustment. Based on provisional data, Destatis also reports that, after calendar and seasonal adjustment, exports were by 6.8%, and imports by 5.2%, lower than in February 2020, the month before restrictions were imposed due to the corona pandemic in Germany.

Germany exported goods to the value of 112.0 billion euros and imported goods to the value of 92.7 billion euros in October 2020. Compared with October 2019, exports decreased by 6.5%, and imports by 5.9% in October 2020.

The foreign trade balance showed a surplus of 19.4 billion euros in October 2020. In October 2019, the surplus amounted to 21.3 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 18.2 billion euros in October 2020.

The German current account of the balance of payments showed a surplus of 22.5 billion euros in October 2020, which takes into account the balances of trade in goods (+20.0 billion euros), services (-0.2 billion euros), primary income (+7.1 billion euros) and secondary income (-4.3 billion euros). In October 2019, the German current account showed a surplus of 19.0 billion euros.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2217 (1422)

$1.2197 (851)

$1.2182 (1655)

Price at time of writing this review: $1.2140

Support levels (open interest**, contracts):

$1.2067 (427)

$1.2046 (1425)

$1.2021 (2899)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 59460 contracts (according to data from December, 8) with the maximum number of contracts with strike price $1,1800 (4074);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3507 (305)

$1.3480 (643)

$1.3458 (1534)

Price at time of writing this review: $1.3387

Support levels (open interest**, contracts):

$1.3303 (285)

$1.3273 (642)

$1.3234 (946)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 54468 contracts, with the maximum number of contracts with strike price $1,4000 (32971);

- Overall open interest on the PUT options with the expiration date January, 8 is 26558 contracts, with the maximum number of contracts with strike price $1,2800 (3941);

- The ratio of PUT/CALL was 0.49 versus 0.50 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 48.74 | 0.29 |

| Silver | 24.533 | 0.29 |

| Gold | 1870.636 | 0.42 |

| Palladium | 2313.77 | -1.22 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -80.36 | 26467.08 | -0.3 |

| Hang Seng | -202.29 | 26304.56 | -0.76 |

| KOSPI | -44.51 | 2700.93 | -1.62 |

| ASX 200 | 12.7 | 6687.7 | 0.19 |

| FTSE 100 | 3.43 | 6558.82 | 0.05 |

| DAX | 7.49 | 13278.49 | 0.06 |

| CAC 40 | -12.71 | 5560.67 | -0.23 |

| Dow Jones | 104.09 | 30173.88 | 0.35 |

| S&P 500 | 10.29 | 3702.25 | 0.28 |

| NASDAQ Composite | 62.82 | 12582.77 | 0.5 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 (GMT) | China | PPI y/y | November | -2.1% | -1.8% |

| 01:30 (GMT) | China | CPI y/y | November | 0.5% | 0% |

| 06:00 (GMT) | Japan | Prelim Machine Tool Orders, y/y | November | -5.9% | |

| 07:00 (GMT) | Germany | Current Account | October | 26.3 | |

| 07:00 (GMT) | Germany | Trade Balance (non s.a.), bln | October | 20.8 | |

| 15:00 (GMT) | U.S. | Wholesale Inventories | October | 0.7% | 0.9% |

| 15:00 (GMT) | U.S. | JOLTs Job Openings | October | 6.436 | |

| 15:00 (GMT) | Canada | Bank of Canada Rate | 0.25% | 0.25% | |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | December | -0.679 | -1.514 |

| 17:00 (GMT) | United Kingdom | BOE Financial Stability Report | |||

| 23:50 (GMT) | Japan | BSI Manufacturing Index | Quarter IV | 0.1 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.74095 | -0.09 |

| EURJPY | 126.08 | 0.12 |

| EURUSD | 1.2105 | -0.01 |

| GBPJPY | 139.068 | -0.04 |

| GBPUSD | 1.33524 | -0.16 |

| NZDUSD | 0.70434 | 0.17 |

| USDCAD | 1.28179 | 0.15 |

| USDCHF | 0.88885 | -0.1 |

| USDJPY | 104.149 | 0.11 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.