- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

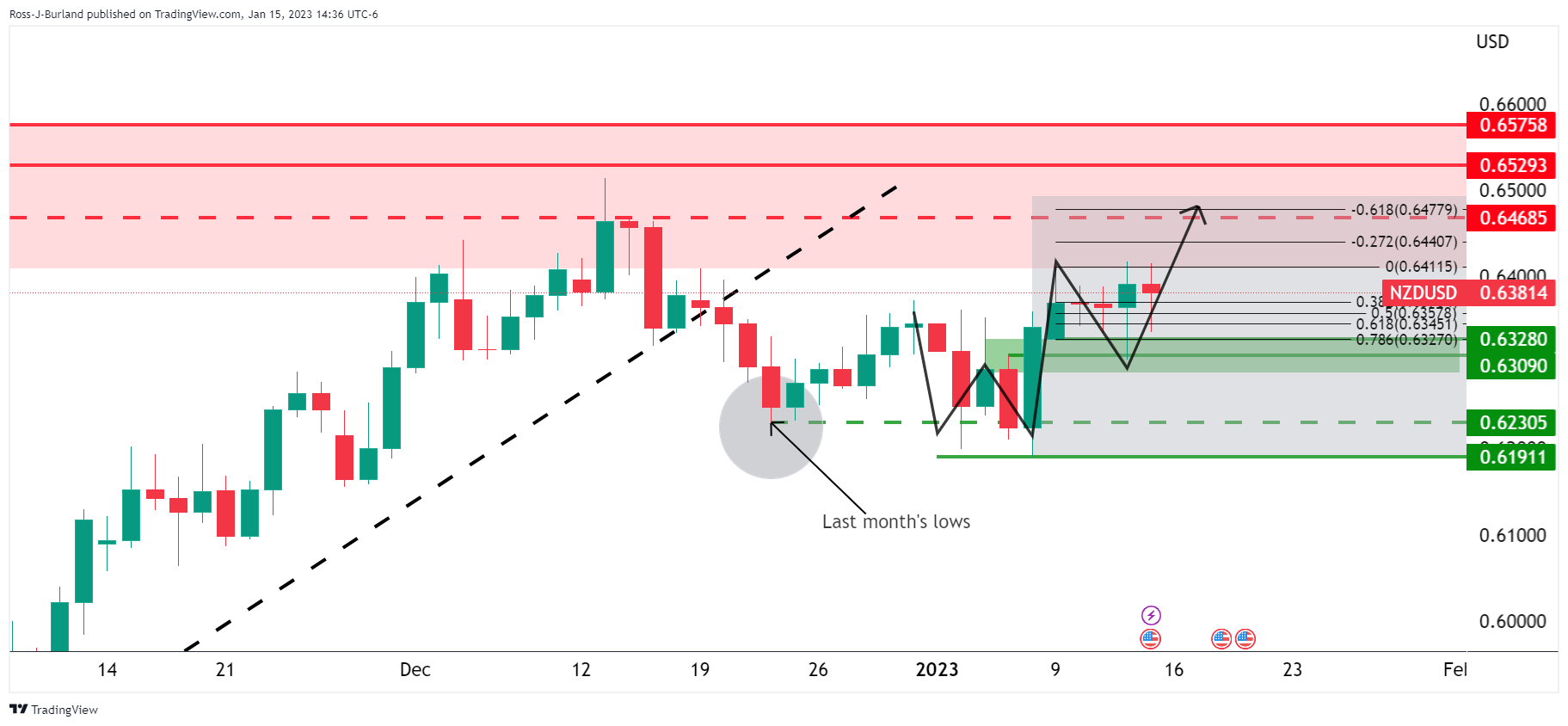

- Fed Barkin’s hawkish commentary on interest rates has failed to impact the Kiwi asset.

- A breakout of the Bullish Pennant pattern has strengthened the New Zealand Dollar.

- Range shift from the RSI (14) into the 60.00-80.00 territory, will trigger a bullish momentum.

The NZD/USD pair is juggling in a narrow range of around 0.6430 in the early Asian session. The Kiwi asset has turned sideways after refreshing the monthly high at 0.6437 despite the risk-off market mood. S&P500 futures are displaying more losses, portraying a further decline in investors’ risk appetite after hawkish commentary from Richmond Federal Reserve (Fed) Bank President Tom Barkin.

The US Dollar Index (DXY) has turned sideways around 102.00 after a V-shape recovery and is expected to extend gains amid a risk-aversion theme. Also, rising 10-year US Treasury yields are likely to infuse fresh blood into the safe-haven assets.

NZD/USD has delivered a breakout of the Bullish Pennant chart pattern that indicates a continuation of the upside momentum after consolidation on an hourly scale. Usually, the consolidation phase of the chart pattern serves as an inventory adjustment in which those participants initiate longs, which prefer to enter an auction after the establishment of a bullish bias.

The 20-and 50-period Exponential Moving Averages (EMAs) at 0.6415 and 0.6401 respectively have resumed their upside journey, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is still struggling to shift into the bullish range of 60.00-80.00. An occurrence of the same will trigger a bullish momentum.

For further upside, the Kiwi asset needs to break above Tuesday’s high at 0.6439, which will drive the asset towards December 15 high at 0.6470 followed by December 13 high at 0.6514.

Alternatively, a break below Monday’s low at 0.6361 will weaken the New Zealand Dollar and will drag the Kiwi asset towards January 12 low at 0.6304. A slippage below the latter will expose the asset for more downside toward December 28 low at 0.6263.

NZD/USD hourly chart

-638095961579533681.png)

- USD/CHF holds lower grounds after posting the biggest daily loss in over a week.

- Softer US data probed US Dollar buyers even as upbeat yields, downbeat EUR probed greenback bears.

- Mixed sentiment, dovish Fed talks highlight the need for softer US data to keep USD/CHF bears on the table.

USD/CHF remains depressed as sellers approach the 0.9200 threshold, close to 0.9215 during the early hours of Wednesday’s Asian session. In doing so, the Swiss currency (CHF) pair cheers the US Dollar’s failure to benefit from upbeat Treasury bond yields and the softer Euro amid softer US data, as well as downbeat comments from the Federal Reserve (Fed) officials.

On Tuesday, the US Dollar Index (DXY) marked a dismal closing around 102.35, after an initially positive performance. That said, the US Treasury bond yields allowed the US Dollar to remain firmer, downbeat prints of the New York manufacturing data, namely the Empire State Manufacturing Index for December, probed the US Dollar bulls and put a floor under the Gold price. That said, the NY Fed’s business gauge dropped sharply in January to -32.9 versus -4.5 market forecasts and -11.2 prior readings.

The data also helped the Federal Reserve Bank of Richmond’s President and CEO Thomas Barkin to state, “My hope is that we have passed the peak of inflation.” As a result, the US Dollar bulls had a tough ride.

It’s worth noting that the dovish concerns surrounding the ECB’s next move, which weighed on the Euro, could be linked to Bloomberg’s news saying, “ECB policymakers are starting to consider a slower pace of interest-rate hikes after a likely 50 basis-point step in February.”

Amid these plays, Wall Street closed mixed and the benchmark 10-year US Treasury bond yields ended the day with nearly four basis points (bps) of an upside to 3.55% even as the two-year counterpart retreated to 4.20%.

Moving on, mixed signals from the recently mixed US consumer-centric data, coupled with the Federal Reserve (Fed) policymakers’ inability to defend the hawkish bias, highlight today’s US Retail Sales and the Producer Price Index (PPI) for December. Forecasts suggest that the headlines US Retail Sales may improve with 0.1% monthly gains, versus the previous contraction of 0.6% while the PPI is likely to ease to -0.1% from 0.3% prior.

Technical analysis

USD/CHF is well-set to refresh the monthly low, around 0.9165 by the press time, unless the quote crosses a two-week-old resistance line, close to 0.9315 at the latest.

“US Secretary of State Antony Blinken said after meeting his British counterpart on Tuesday that Washington welcomed apparent progress in talks between Britain and the European Union aimed at resolving a post-Brexit trade row over Northern Ireland,” reported Reuters late Tuesday.

The news cites talks between US Secretary of State Blinken and Britain's Foreign Secretary James Cleverly's talks at the State Department in Washington for the news. The discussions were mainly focused on support for Ukraine in its war with Russia though.

Key quotes

The US position is that there must be a negotiated settlement that is acceptable to all sides.

We're heartened that in recent days the United Kingdom and the European Union have made substantive progress toward a negotiated solution.

GBP/USD grinds higher

GBP/USD holds onto the previous day’s run-up while picking up bids towards 1.2300.

Also read: GBP/USD aims to recapture 1.2300 ahead of UK CPI data

- Silver Prices plunged even though the US Dollar was on the defensive, and US T-bond yields dropped.

- Silver Price Analysis: The confluence of a double top and an evening star opens the door for further downside.

Silver spot prices, also known as XAG/USD, snapped three days of gains and plunged more than 1.50% on Tuesday, although the US Dollar (USD) remained offered, and US Treasury bond yields dropped. Hence, the XAG/USD is trading at $23.91 a troy ounce after reaching a daily high of $23.92.

Silver Price Analysis: XAG/USD Technical Outlook

After testing the YTD high of $24.54, the XAG/USD formed a double top, which could open the door for further losses. Also, an evening star emerged a three-candlestick chart pattern that could send Silver prices tumbling. With oscillators like the Relative Strength Index (RSI) registering lower peaks and aiming down, alongside the Rate of Change flashing that buyer’s momentum is fading, the XAG/USD downward bias remains intact.

Therefore, if XAG/USD slides below $23.83, silver would be poised to test the 20-day Exponential Moving Average (EMA) at $23.70. Once cleared, XAG/USD will prove January 11 daily low fo $23.22, ahead of $23.00.

Silver (XAG/USD) Key Technical Levels

- GBP/USD is looking to recapture Tuesday’s high around 1.2300 as focus shifts to UK Inflation.

- Higher Average Earnings due to the shortage of labor have accelerated hawkish Bank of England bets.

- Strength in the US Treasury yields has supported the USD Index and has triggered a risk-aversion theme.

The GBP/USD pair is marching higher to recapture the critical resistance of 1.2300 in the early Tokyo session. The Cable has resumed its upside journey after a corrective move to near 1.2247 and is expected to extend gains despite caution in the risk profile. The Pound Sterling has dodged the risk-aversion theme as the release of the higher wage growth has accelerated hawkish Bank of England (BoE) bets.

Average Earnings in the United Kingdom have climbed to 6.4% vs. the projection of 6.3%, which has triggered chances of continuation of an interest rate hike by the BoE. BoE Governor Andrew Bailey has already warned that rising wages due to labor shortage is offsetting the impact of the decline in energy prices.

S&P500 faced gradual selling pressure from the market participants amid volatility inspired by the stretched weekend. Also, further strengthening of the US Treasury yields weighed on investors’ risk appetite. The alpha generated by 10-year US Treasury yields climbed above 3.54%. This also provided a cushion to the US Dollar Index (DXY) and pushed it back toward the critical resistance of 102.00.

Meanwhile, commentary from Tom Barkin, the President, and CEO of the Federal Reserve (Fed) Bank of Richmond favoring the continuation of policy tightening as the inflation rate is well above the median Consumer Price Index (CPI) has also supported the risk-aversion theme.

For further guidance, investors will focus on the release of the United States Producer Price Index (PPI) data, which will release on Wednesday.

On the UK front, December’s inflation report will be keenly watched. Analysts at CitiBank expect headline CPI inflation to moderate further this week to 10.5% on an annual basis. Core CPI may prove somewhat more resilient at 6.2%.

As per the latest Reuters Tankan survey, published early Wednesday, “Business confidence at big Japanese firms slid in January with manufacturers showing a negative reading for the first time in two years.”

The Reuters Tankan index for big manufacturers stood at -6 in January, down from +8 last month. With this, the figures marked the first negative reading since January 2021.

“Morale was much stronger in the service sector, with that index at +20 in January, a drop from +25 in the prior month which was its highest level in more than three years,” per Reuters.

The monthly sentiment survey also asks manufacturers if they expect business conditions to improve or worsen over the coming three months. As a result, the big manufacturers' index saw a 12-point improvement to +6 for April, while for service sector firms the outlook fell 5 points to +15.

USD/JPY picks up bids

The news appears to tease USD/JPY buyers as the Yen pair rebounds from the intraday low to 128.30 by the press time.

Also read: USD/JPY Price Analysis: All eye son the BoJ, bulls need to commit at key H1 support area

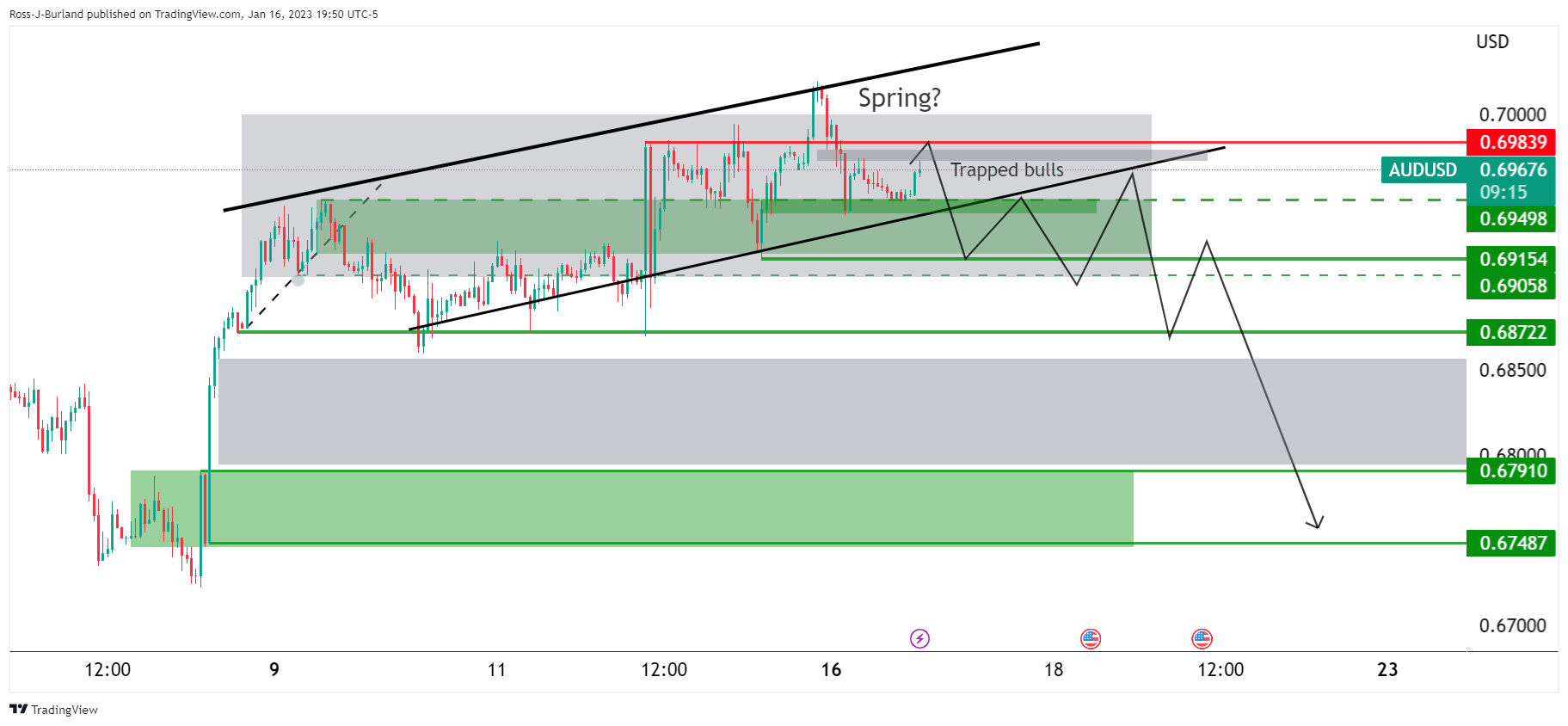

- AUD/USD remains lackluster inside one-week-old bullish channel.

- Looming bull cross on the MACD, sustained trading beyond the key SMA, support line favor Aussie pair buyers.

- Clear break of 0.7050 becomes necessary for bull’s conviction.

AUD/USD bulls take a breather as markets await the key data/events scheduled for release on Wednesday. Even so, the Aussie pair remains inside a one-week-old bullish channel while flashing 0.6985 as the quote by the press time.

In addition to the ascending trend channel, the impending bullish cross on the MACD and the Aussie pair’s successful trading above the 100-bar Simple Moving Average (SMA), as well as a one-month-long ascending support line, keeps AUD/USD buyers hopeful.

However, the bullish bias gets rejected if the quote defies the channel formation by breaking the 0.6935 support, comprising the lower line of the bullish chart pattern.

Following that, the 100-SMA and the aforementioned support line, respectively near 0.6850 and 0.6775 in that order, will be in focus.

It’s worth noting that the AUD/USD weakness past 0.6775 appears a good sign for the bears targeting the previous monthly low surrounding 0.6630.

On the flip side, the 0.7000 psychological magnet and the current monthly peak near 0.7030 could challenge the AUD/USD buyers ahead of the stated channel’s top line, close to 0.7045.

Even if the quote rises past 0.7045, the early August 2022 peak surrounding 0.7050 could act as the last defense of the Aussie pair sellers before pushing the prices towards the 0.7136 mark, comprising the August monthly top.

AUD/USD: Four-hour chart

Trend: Bullish

- EUR/JPY rally stalled around 139.50 and collapsed on ECB’s dovish headlines.

- EUR/JPY Price Analysis: IF it clears 138.00, a fall toward 137.00 is on the cards.

The EUR/JPY reached a two-day high of around 139.61 but plunged due to a news headline crossing wires that stated that European Central Bank (ECB) policymakers could start to consider a slower pace of rate hikes. Therefore, the EUR/JPY plunged toward its daily low of 138.20 before stabilizing at current exchange rates. At the time of writing, the EUR/JPY is trading at 138.30, below its opening price by 0.53%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY Tuesday’s pullback courtesy of headlines accelerated the downtrend ahead of the Bank of Japan (BoJ) monetary policy decision. Its daily high fell shy of testing the 200-day Exponential Moving Average (EMA) by 100 pips and plunged to print fresh weekly lows. In addition, oscillators remain in bearish territory, with the Relative Strength Index (RSI) aiming lower, while the Rate of Change (RoC), flashes bears are in control. Hence, the EUR/JPY might resume its downtrend in the near term.

Therefore, the EUR/JPY needs to clear the 138.00 figure, to prolong its downtrend further. Once cleared, the next stop would be the January 3 daily low of 137.38, followed by the 137.00 mark. As an alternate scenario, if the EUR/JPY reclaims 139.00, that would exacerbate a rally toward 140.00.

EUR/JPY Key Technical Levels

- EUR/USD has observed selling interest around 1.0800 as the risk-aversion theme is gaining traction.

- Fed Barkin is of the view that the inflation peak has been passed but halting policy tightening is not favorable.

- Investors' sentiment towards German prospects has uplifted as the risk of deeper recession has waived off

The EUR/USD pair has faced selling pressure while an attempt of a recovery above 1.0800 in the early Asian session. The major currency pair is expected to deliver a downside move if it fails to sustain above the immediate support of 1.0780 as investors have underpinned the risk-aversion theme amid the result season in the United States.

An end to the four-day winning spell by S&P500 futures on Tuesday conveyed that risk-perceived assets need more strength to extend the rally. Optimism on an overall basis still persists as correction in the 500-stock basket was very limited, which could be considered as a healthy correction for now. Meanwhile, solid return on US Treasury bonds supported the US Dollar Index (DXY) from any downside. The 10-year US Treasury yields climbed above 3.54% ahead of United States Producer Price Index (PPI) data.

The street is expecting a decline in the annual headline and core PPI (Dec) to 6.8% and 5.9% respectively. This might support the Federal Reserve (Fed) to cool down the pace of policy tightening further.

Tom Barkin, the President, and CEO of the Fed Bank of Richmond cited that the economy has passed the peak of inflation but we are still far from the median Consumer Price Index (CPI). Therefore, backing off from interest rate hiking too soon is not favorable.

On the Eurozone front, the German ZEW Survey- Economic Sentiment was released at 16.9 vs. the expectation of -15.5 and the former release of -23.3. Investors' sentiment towards the economic prospects of Germany has been strengthened as the risk of deeper recession has been waived off.

Germany’s Economy Minister Robert Habeck, in an interview with WELT TV, said that “if there is a recession, it would possibly be only very short and not very deep.”

Moreover, European Central Bank (ECB) board member and Bank of Portugal Governor Mario Centeno said on Tuesday, “Fourth quarter growth in Europe will be most likely still positive.”

- Gold price fades the week-start pullback from multi-month high but fails to recover.

- Softer data from United States failed to recall XAU/USD buyers as US Dollar benefits from firmer yields, downbeat Euro.

- US Retail Sales will be the key data, risk catalysts are important too.

Gold price (XAU/USD) remains lackluster as buyers struggle to defend the $1,900 threshold after declining during the first two days of the week. The yellow metal’s defensive performance could be linked to the recent increase in the United States Treasury bond yields and US Dollar despite softer US data. The reason could be linked to the downbeat Euro (EUR), as well as the cautious mood ahead of the key data, not to forget China’s inability to impress XAU/USD bulls despite firmer statistics.

United States Treasury bond yields, US Dollar tease Gold sellers

After a drop to refresh the monthly low on Friday, the United States Treasury bond yields bottomed out in the last three days and underpinned the US Dollar’s gradual rebound from the lowest levels since early June. That said, the benchmark 10-year US Treasury bond yields ended the day with nearly four basis points (bps) of an upside to 3.55% even as the two-year counterpart retreated to 4.20%.

Softer US data restricts XAU/USD downside

While the US Treasury bond yields allowed the US Dollar to remain firmer, downbeat prints of the New York manufacturing data, namely the Empire State Manufacturing Index for December, probed the US Dollar bulls and put a floor under the Gold price. That said, the NY Fed’s business gauge dropped sharply in January to -32.9 versus -4.5 market forecasts and -11.2 prior readings.

The data also helped the Federal Reserve Bank of Richmond’s President and CEO Thomas Barkin to state, “My hope is that we have passed the peak of inflation.” As a result, the US Dollar bulls had a tough ride and so do the Gold bears.

Downbeat Euro defends US Dollar, Gold bears

With the swirling talks of the European Central Bank’s (ECB) slower rate hike starting after February, the bloc’s currency Euro (EUR) had to trim some of the latest gains, which in turn allowed the US Dollar to remain firmer and weigh on the Gold price.

The dovish concerns surrounding the ECB’s next move could be linked to Bloomberg’s news saying, “ECB policymakers are starting to consider a slower pace of interest-rate hikes after a likely 50 basis-point step in February.”

In doing so, the EUR couldn’t cheer upbeat sentiment data from the Zentrum für Europäische Wirtschaftsforschung (ZEW) for Germany and Eurozone. That said, German ZEW headline numbers showed that the Economic Sentiment Index returned to positive territory, arriving at 16.9 in January from -23.3 in December, beating the market expectation of -15.5. On the other hand, the ZEW Economic Sentiment Index for the Eurozone rose to 16.7 from -23.6.

China fails to impress Gold buyers despite upbeat data

China’s inability to impress markets despite posting upbeat data gains the major attention of the Gold sellers. On Tuesday, China’s National Bureau of Statistics (NBS) released the fourth quarter (Q4) Gross Domestic Product (GDP), as well as Industrial Production and Retail Sales figures for December. However, downbeat comments from NBS joined the market’s doubts about the actual numbers seemed to have weighed on the risk profile.

China's Q4 GDP rose 2.9% YoY versus the 1.8% expected and 3.9% prior. Further details suggest that the Industrial Production for December grew 1.3% YoY versus 0.5% market forecasts and 2.2% prior readings. Additionally, Retail Sales improved to -1.8% YoY for December compared to -7.8% consensus and -5.9% prior. Even so, the NBS said that the foundation for economic recovery is not solid yet.

Given China’s condition as one of the world’s biggest Gold consumers, the pessimism surrounding Beijing could easily weigh on the XAU/USD prices.

United States Retail Sales, Producer Price Index eyed

Having witnessed mixed signals from the recently mixed consumer-centric data from the United States, coupled with the Federal Reserve (Fed) policymakers’ inability to defend the hawkish bias, today’s US Retail Sales and the Producer Price Index (PPI) for December will be crucial for the Gold traders.

Forecasts suggest that the headlines US Retail Sales may improve with 0.1% monthly gains, versus the previous contraction of 0.6%, and can favor the XAU/USD bears. However, the anticipated softening in the PPI, to -0.1% from 0.3% prior, could help recall the Gold buyers amid easing inflation fears.

Gold price technical analysis

Gold price grinds lower inside a three-day-old bearish channel amid sluggish signals from the Moving Average Convergence and Divergence (MACD) indicator, as well as the steady Relative Strength Index (RSI) line, placed at 14.

Given the 50-Hour Moving Average (HMA) adding strength to the immediate upside hurdle surrounding $1,915, the sluggish MACD and RSI positions hint at the further weakening of the XAU/USD.

However, the stated channel’s lower line, close to the $1,900 threshold, limits the short-term downside of the bullion, a break of which could drag the quote towards the 200-HMA level surrounding $1,883.

Meanwhile, an upside clearance of the $1,915 resistance confluence won’t hesitate to challenge the multi-month high marked on Monday at around $1,930.

Following that, tops marked during late March 2022 near $1,966 and April 2022 peak of $1,998 could probe the Gold buyers before offering them the $2,000 psychological magnet.

Gold price: Hourly chart

Trend: Further weakness expected

- USD/CAD has picked strength after testing the critical support at 1.3370.

- The end of the four-day winning spell by the S&P500 is portraying caution in the risk impulse.

- Lower-than-anticipated Canada’s December CPI report has delighted the BoC.

The USD/CAD pair has delivered a recovery move after gauging strength near the critical support of 1.3370 in the late New York session. The Loonie asset has sensed demand as investors are getting anxious ahead of the release of the United States Producer Price Index (PPI) data, which is scheduled for Wednesday.

Caution has been observed in the risk profile as S&P500 ended its four-day winning streak on Tuesday after a four-day winning spell. Mixed performance from companies amid the result season has impacted the 500-stock basket, portraying a decline in investors’ risk appetite. The US Dollar Index (DXY) delivered a V-shape recovery after dropping to near 101.60 and has now continued to trade lackluster around 102.00. The recovery in the USD Index was supported by strength in the US Treasury yields. The 10-year US Treasury yields scaled above 3.54%.

Investors are keenly focusing on the release of the US PPI numbers for fresh impetus. As per the consensus, the economic data is expected to decline further. The headline PPI (Dec) is seen lower at 6.8% while the core PPI is seen declining to 5.9%. Producers might look to trim their losses inspired by lower prices through easing wage growth or by lay-offs, which would trim inflation projections further.

On the Loonie front, the weak December Consumer Price Index (CPI) report has delighted the Bank of Canada (BoC). The annual headline CPI (Dec) remained in line with the expectations at 6.3% lower than the former release of 6.8%. While the core inflation that excludes oil and food prices dropped vigorously to 5.4%, however, the street was expecting an increase to 6.1% against the prior release of 5.8%.

- All eyes are on the BoJ today as the price aligns with key technical structures.

- USD/JPY M-formation playing out and a downside impulse in play that targets the key support structures meeting the -272% and -61.8% Fibonacci brackets.

USD/JPY is teed up for the Bank of Japan meeting later today and is correcting on the charts towards a critical area that the following will illustrate. In the prior analysis, there were prospects of a reversion into the M-formation\s bearish impulse on the prior leg:

USD/JPY prior analysis

USD/JPY H1 chart

We are seeing this correction get underway and bulls will now be looking for a bullish structure to lean against in aiming for a reversion of sorts as follows:

As illustrated, the price was on the backside of the trend and a breakout to the upside had been gathering momentum after a test of the structure around 128.80. The 38.2% Fibonacci was a first target near 129.50 with 131.20's eyed thereafter.

USD/JPY update

The bulls have fallen shy of the 38.2% Fibonacci so far and are headed for a bearish close on the day. However, while above 127.50/88, the bulls remain in playing what could be a phase of accumulation as per the hourly chart:

The following shows the price adhering to a textbook schematic with the M-formation playing out and a downside impulse in play that targets the key support structures meeting the -272% and -61.8% Fibonacci brackets.

The support could prove critical in and around the BoJ event guarding 127.20.

A break below here opens the risk of a significant downside extension:

- Upbeat China’s data and the removal of strict Covid-19 measures to boost oil demand.

- A softer US Dollar was a tailwind for WTI.

- WTI Price Analysis: It could aim towards the 100-DMA around $83.00.

US Western Texas Intermediate (WTI) crude oil gains some ground and hits a two-week high above $80.00 per barrel on Tuesday after Chinese data beat estimates and painted an optimistic outlook amidst its borders reopening. Therefore, WTI is trading at $81.11 PB, up by more than 2.50%.

Chinese data revealed during the Asian session improved oil’s outlook for 2023. The National Bureau of Statistics showed that Gross Domestic Product (GDP) for Q4 improved to 2.9%, above estimates of 1.6%, while for the full year, GDP stood at 3% and trailed 2021 at 8.1%. Even though 2022 is the second worst reading since 1970, China’s relaxation of Covid-19 measures would positively impact its domestic economy.

In the meantime, a softer US Dollar makes greenback-denominated oil cheaper for other currency holders.

Elsewhere, the Organization of the Petroleum Exporting Countries (OPEC) said in a monthly report that Chinese oil demand would grow 510,000 barrels per day this year while it kept its 2023 global demand growth forecast unchanged at 2.22 million BPD.

WTI Technical Analysis

After bottoming around 2022 lows of $70.10 PB during December, WTI resumed an uptrend of almost one month that peaked at around $81.44. Last Friday, WTI broke a two-month-old downslope trendline on the upside, which kept WTI prices from falling below $78.00. Additionally, the Relative Strength Index (RSI) aimed higher, while the Rate of Change (RoC) suggests buyers are gathering momentum.

Therefore, WTI’s first resistance level would be $81.00, which, once cleared, would expose $82.00, followed by the 100-day EMA at $82.95.

Tom Barkin, the president and CEO of the Federal Reserve Bank of Richmond, is crossing the wires.

Key comments

My hope is that we have passed the peak of inflation.

The median CPI is still too high for what I want to see.

Cannot declare victory over inflation too soon.

Doesn’t favour backing off too soon, says he wants to see inflation ‘compellingly headed back to target’.

Terminal rate dependent on path of inflation.

US Dollar update

The US Dollar was losing traction on Tuesday with eyes on the Bank of Japan as investors expect the possible policy shift at the central bank that could end its so-called "yield curve control" in what would be a precursor to adopting a tighter monetary policy. At the time of writing, the DXY index is trading at 102.40 and is lower by some 0.15% but well off the lows of the day down at 101.937.

- NZD/USD bulls stay the course and target 0.6450s and then 0.6480s.

- The NZ CPI will be key next week.

NZD/USD is creeping higher towards an aforementioned target in prior analysis from earlier in the week, hovering in 1-month highs. At the time of writing, the bird is flying high by some 0.8% having rallied from a low of 0.6366 and extending the gains since breaking back above last month's lows of 0.6230 and trapping breakout bears, squeezing towards the 0.6470s ahead of critical data next week.

''Although difficult to pinpoint exactly why, the rally was NZ-specific, with strength seen across most crosses,'' analysts at ANZ Bank explained. ''One wonders whether worrying signs of sticky inflation in yesterday’s NZIER QSBO survey gave the Kiwi a boost (even though NZ short-end rates fell yesterday, preferring instead to focus on the collapse in confidence),'' the analysts added further. ''Either way, it’s all a bit messy, but high rates without the growth to boot is hardly a strong sign of confidence for NZ.Inc,'' the analysts at ANZ Bank concluded.

Meanwhile, NZ Consumer Price Index next week will be critical and could be pivotal, leading to a breakout one way or another as the pair heads into a potential stop gar before the data. With regards to the Reserve Bank of New Zealand, ''local markets have swung back to pricing broadly even odds of either a 50bp or 75bp Reserve Bank of New Zealand hike next month; that leaves near-term risks more balanced,'' the analysts at ANZ Bank argued.

NZD/USD technical analysis

In prior analysis, it was shown that while being on the backside of the daily bullish impulse and trend, there were still prospects of a move into the trendline resistance, acing as the final push before a major bearish breakout:

Zoomed in further...

The W-formation was highlighted as a bullish bottoming pattern and the fact that the price broke the monthly lows, we had breakout traders trapped.

The upside towards 0.6480 was a probable scenario for this week to meet prior highs and a -61.8% ratio. The price remains on track for this target area:

Reuters reported that Federal Reserve Bank of New York leader John Williams said on Tuesday that the economy does better when everyone gets a shot at participating.

"An inclusive economy doesn't just help those that are in need of more or different opportunities, rather, it boosts the economy more broadly," Williams said in opening remarks for a conference at his bank.

Williams did not comment on the monetary policy outlook in his brief remarks.

US Dollar update

The US Dollar has been on the back foot on Tuesday in choppy trading. It is all about the Bank of Japan this week as investors expect the possible policy shift at the central bank that could end its so-called "yield curve control" in what would be a precursor to adopting a tighter monetary policy.

At the time of writing, the DXY index is trading at 102.38 and is lower by some 0.17% but well off the lows of the day down at 101.937.

What you need to take care of on Wednesday, January 18:

The US Dollar retained its intrinsic weakness on Tuesday, ending the day with losses against all of its major rivals. The Euro was the worst performer, while the British Pound was the best against the Greenback.

On the one hand, the EUR/USD pair fell to 1.0771 amid market talks suggesting European Central Bank (ECB) officials are considering slowing the pace of tightening. Rumors suggest President Christine Lagarde & co will opt for a 50 basis points (bps) rate hike in February, reducing hikes to 25 bps starting in March.

On the other hand, GBP/USD flirted with 1.2300 after the United Kingdom’s employment-related figures hinted at a relatively tight labour market. The Bank of England would then have room to push the benchmark rate higher and maintain it there for longer. The UK will publish December inflation figures on Wednesday.

The Canadian Consumer Price Index (CPI), rose at an annual pace of 6.3% in December, while the monthly CPI fell by 0.6%. USD/CAD trades around 1.3376.

The AUD/USD pair finished Tuesday near the 0.7000 level, retaining its positive momentum despite the poor tone of global equities.

The USD/JPY pair trades around 128.40 ahead of the Bank of Japan monetary policy decision.

Spot gold trades little changed at around $1,907, while crude oil prices were up, with WTI hovering around $81 per barrel.

Wednesday will bring an update on EU inflation, the US Producer Price Index and the UK CPI.

Like this article? Help us with some feedback by answering this survey:

- United Kingdom's Unemployment Rate data gave rise to a rally in the British Pound with Bank of England in focus.

- GBP/USD is in the hands of the bulls on the front side of an hourly trendline ahead of key Consumer Price Index inflation data Wednesday.

- GBP/USD bears eye a break of the solid trendline support and 1.2170 structure that could then result in a cascade of stops being triggered.

GBP/USD is higher by 0.6% at the time of writing, 14.00hrs New york time. The British Pound moved from a low of 1.2168 to a high of 1.2300 on Tuesday after Britain's Unemployment Rate data showed a tight labour market and accelerating pay growth. The Bank of England, BoE, is in focus in this regard as it battles with inflation at multi-decade highs.

Britain's Unemployment Rate held at 3.7%, close to its lowest level in almost 50 years. This was in line with the consensus and signalled a continued tight labour market. Pay excluding bonuses increased by an annual 6.4% in the September-to-November period, the Office for National Statistics (ONS) said. This was the largest increase since records began in 2001. For ex-bonus wage growth, this is the strongest number outside the COVID distortions. ''Overall, today's strong data should see lower odds of a 25bps hike from the Bank of England, BoE, at its February meeting, and further support our call for a 50bps hike instead,'' analysts at TD Securities said.

UK Consumer Price Index will be key for Bank of England sentiment

The British Pound is the best performing G10 currency on a 1-day view following the data due to the implication that this may mean higher for longer Bank of England, BoE, interest rates. Additionally, the strength of today’s UK earnings data could with hawkish comments by the BoE's Governor Andrew Bailey mean that tomorrow's UK December Consumer Price Index inflation data will be the highlight of the week in the forex space.

The Bank of England Governor Andrew Bailey said on Monday that inflation looks set to fall markedly this year as energy prices decrease. However, he said that a shortage of workers in the labour market poses a "major risk" to this scenario.

"I think that going forwards the major risk to inflation coming down ... is the supply side - and in this country particularly, the question of the shrinkage of the labour force," Bailey told lawmakers on parliament's Treasury Committee.

The ONS's inflation data on Wednesday is expected to be the next major trigger for the pound ahead of the BoE's meeting next month. The consumer price index is expected to have eased to 10.5% on an annual basis last month from 10.7% in November, according to a survey of economists polled by Reuters.

''We look for UK (Consumer Price Index) inflation to continue to soften, with the headline falling to 10.5% YoY (market: 10.5%, Bank of England: 10.9%) and core coming down to a five-month low of 6.2% YoY (market: 6.2%, Bank of England implied forecast of 6.3%),'' analysts at TD Securities said.

''Driving our forecast is primarily a near-5% MoM drop in petrol prices, however, we also look for a notable softness in the core goods component as retailers pushed through significant discounts in an attempt to rid themselves of high inventory levels ahead of Christmas,'' the analysts added.

''While our headline inflation forecast is quite significantly below the Bank of England's, a sizeable chunk of that difference comes from lower petrol prices, which the Bank will look through. Therefore, we think that data in line with our forecasts still supports another 50bps hike in February,'' the analysts at TD Securities concluded.

All eyes on the Bank of England

Meanwhile, looking ahead to next month's meeting, a tenth consecutive hike is expected and the money markets are pricing in a 65% chance of a 50 basis point (bps) hike and a 35% chance of a 25 bps increase.

''Even if the BoE has good reason to step up a hawkish tone, there were various instances last year when this failed to boost GBP, given the backdrop of weak investment growth, low productivity and overhanging uncertainties about the UK’s post-Brexit relationship with the EU,'' analysts at Rabobank said. Money markets are fully pricing in a 25 basis points (bps) rate hike at that meeting, with a roughly 75% chance of a larger 50 bps increase, according to Refinitiv data.

GBP/USD technical analysis

GBP/USD is on the backside of both the bearish trend and the bullish corrective trend making for a mixed outlook longer term, but potentially bearish for the nearer term.

The British Pound bulls are moving in following a break of the 1.2128 structure from swing lows of 1.1841. However, the bulls will need to get GBP/USD over the 1.2294 resistance and then 1.2446 swing highs if they are going to leave any significant spanner in the works for in-the-money shorts. Instead, this could be a typical distribution schematic playing out offering the bears a discount, resulting in a fade on rallies play for the days ahead:

GBP/USD H1 chart

On the hourly chart, GBP/USD bears need to break the solid trendline support and 1.2170 structure that could then result in a cascade of stops being triggered in a waterfall sell-off below 1.2080 to test 1.1900 and below target areas.

- Gold prices fall after printing a doji on Monday, aiming toward $1900.

- The New York Empire State Manufacturing Index plummeted, augmenting expectations for a Fed pivot.

- Gold Price Forecast: An evening star candle pattern suggests further downside is expected.

Gold price retreats from daily highs nearby $1,920 and drops beneath the $1,910 mark, aiming toward $1,900 amidst a risk-off impulse. Even though the US Dollar (USD) continues to trade with losses, and US Treasury bond yields are bear flattening, the non-yielding metal losses traction. At the time of writing, the XAU/USD is trading at $1,906.69.

Gold remains on the defensive, despite an offered US Dollar

Risk aversion is the name of the game, as US equities dropped. Corporate earnings in the US are one of the reasons for a dampened mood. US economic data revealed by the New York Federal Reserve (Fed) showed that manufacturing activity and business conditions worsened. Speculations that the Fed might pivot improved, with traders expecting a 25 bps rate hike in the February 1 decision.

On the latter, sources cited by Bloomberg commented, “The Fed will have reached its terminal Fed funds rate in 1Q, and investors can start reacting to incoming data without the lens of what better news will mean for Monetary Policy. Good news for the economy can become good news for markets.”

Aside from this, the US Dollar Index, which measures the buck’s value vs. a basket of six currencies, losses 0.12%, exchanging hands at 102.440. The US 10-year benchmark note rate is 3.533%, almost unchanged and paired with earlier losses.

US data released that Manufacturing activity in New York plunged to its lowest in January, with business activity contracting sharply, with the index falling 22 points to -32.9. The report showed that new orders and shipments declined substantially, while delivery times were unchanged and inventories edged higher.

What to watch?

The US economic docket will feature the New York Fed President John Williams, crossing newswires Tuesday. On Wednesday, the calendar will feature Retail Sales, prices paid by producers (PPI), and further Fed speaking.

Gold Price Forecast: Technical outlook

From a technical perspective, the XAU/USD daily chart depicts the formation of a three-candlestick chart pattern known as the evening star. Mondays’ price action formed a doji, followed by Tuesday’s $12.00 fall. Nevertheless, a daily close of around $1,905 or below is needed to confirm the pattern validity, suggesting the yellow metal might push for a break below $1,900.

If the above scenario plays out, XAU/USD first support would be $1,900. A breach of the latter will expose last Friday’s low of $1,892.40, followed by the January 11 high of $1,886.63 and $1,870.

- The Australian Dollar got bolstered by China’s upbeat GDP and improvement in Australia’s consumer sentiment.

- New York Fed Empire State Manufacturing Index plunged as business conditions deteriorated, augmenting speculations for a Fed pivot.

- AUD/USD traders are eyeing Fed speaking, US PPI, Retail Sales, and Australia’s employment data.

The Australian Dollar (AUD) is trimming some of its Monday’s losses and rising due to an offered US Dollar (USD) across the board, despite a dampened market mood surrounding Wall Street. US corporate earnings would likely continue to drive the market sentiment amidst the lack of tier 1 data. At the time of writing, the AUD/USD is trading at 0.6974.

AUD/USD climbs but fails to crack 0.7000

Wall Street continues to lose traction as sentiment turns sour. US data released ahead of the US cash market equities open showed that Manufacturing activity in New York plunged to its lowest in January, as reported by the New York Federal Reserve (Fed). Delving into the report, business activity contracted sharply, with the index falling 22 points to -32.9. The report showed that new orders and shipments declined substantially, while delivery times were unchanged and inventories aimed higher.

The softer-than-expected data spurred a jump in the AUD/USD pair, reaching a new daily high of 0.6993, before retracing some of its gains. Meanwhile, the US Dollar Index, which tracks the buck’s value against a basket of six currencies, retraces 0.11%, down at 102.448, undermined by falling US Treasury bond yields.

On the Australian side, upbeat data from China, mainly the Gross Domestic Product (GDP) beating expectations of 1.6%, at 2.9% for Q4, bolstered the Aussie Dollar (AUD). Regarding the annual based data, China’s GDP came at 3%, well below the Communist Party’s 5% projection, and trailed 2021 by 8.1%.

Even though China’s data for the entire year disappointed, its reopening is being cheered by market investors, as the Hang Seng has risen almost 14% since the beginning of 2023. Further, the release of Australian consumer sentiment improved for the second consecutive month at 5.0%, vs. 3.0% in December.

Ahead of the week, the US economic docket will feature the New York Fed President John Williams, crossing newswires Tuesday. On Wednesday, the calendar will feature Retail Sales, prices paid by producers (PPI), and further Fed speaking.

AUD/USD Key Technical Levels

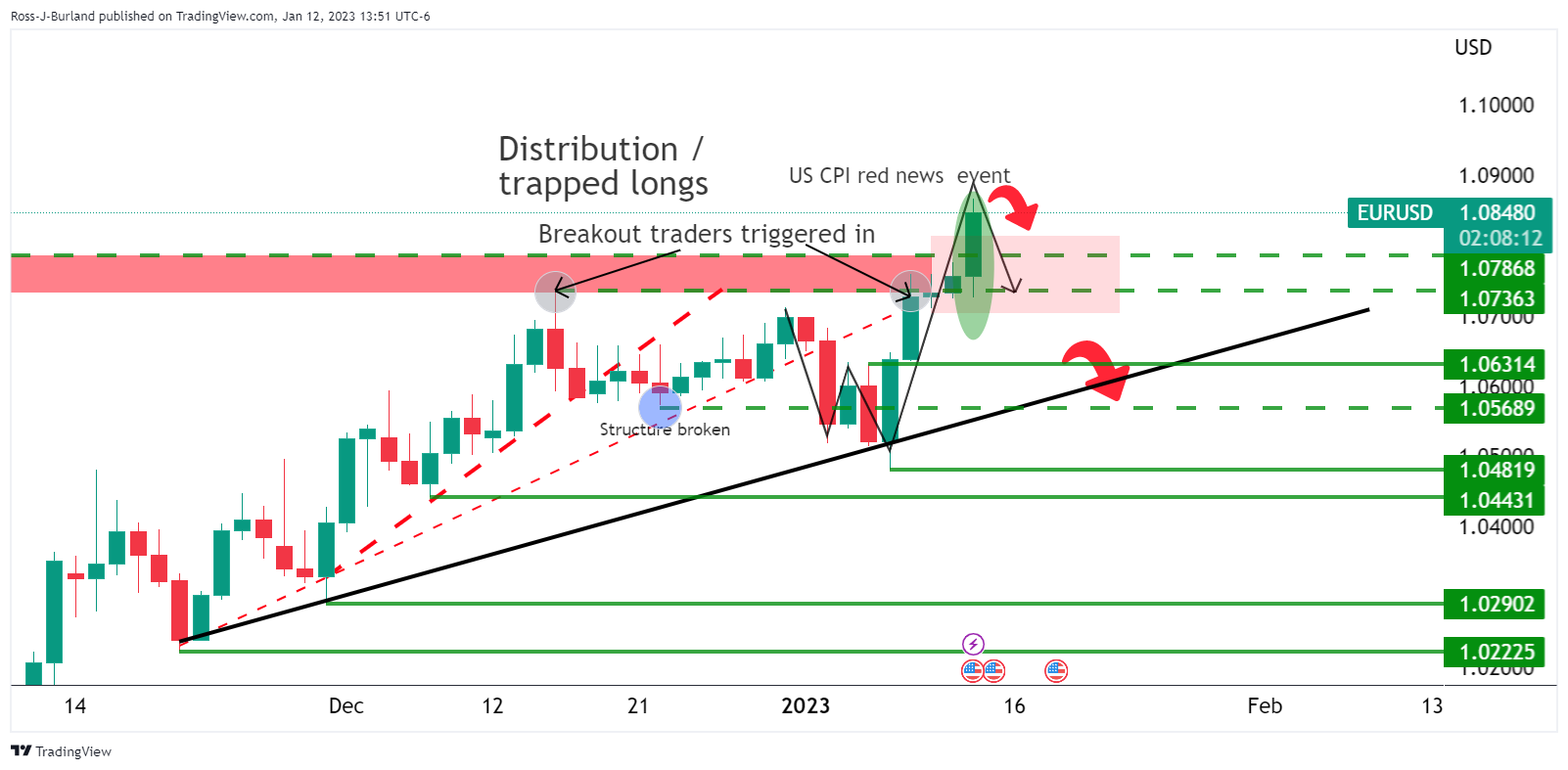

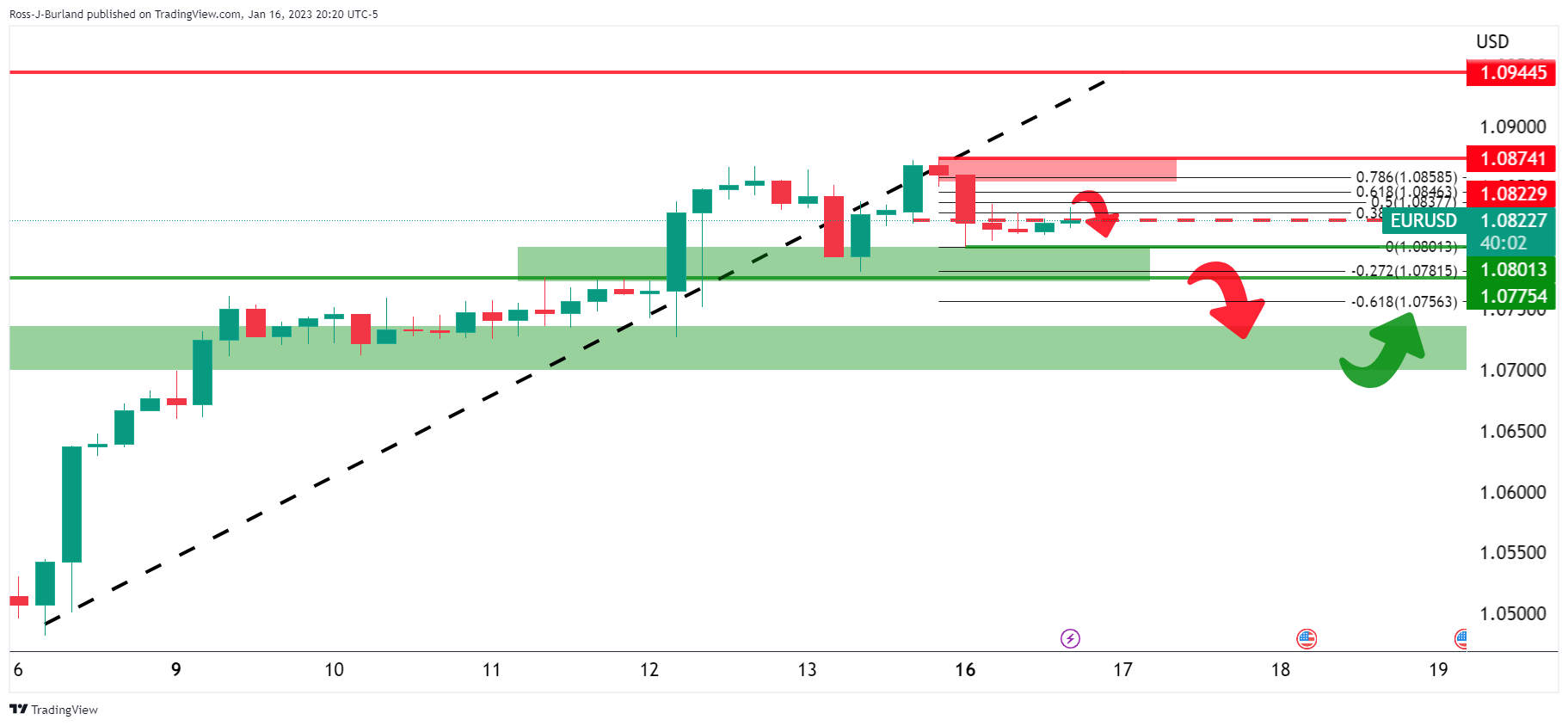

- EUR/USD bears are in control and eye the 38.2% Fibonacci retracement that aligns with the prior resistance near 1.0720.

- 1.0720 guards a deeper move into the Fibo scale and a 50% mean reversion within the scale cannot be ruled out near 1.0680.

- EUR/USD bears need to get below 1.0770 first.

As per the start of the week's analysis, EUR/USD Price Analysis: Bulls have been capped and eyes are on 1.0720, the downside is playing out as the week continues to move along with the price picking up the pace on the offer on Tuesday, helped along by ECB policymakers starting to consider a slower pace of interest-rate hikes.

EUR/USD start of the week analysis

A downside thesis was in play as bulls ran into a trap with breakout traders enthused by the US Consumer Price Index and a move through 1.0800 into 1.0850. However, there has been no follow-through:

The analysis highlighted the downside risks as illustrated above. The price has since stalled and is on track for a re-test of 1.0780s and lower towards 1.0700. However, the bears needed to break trendline support on the lower time frames, such as the 4-hour chart as follows:

EUR/USD update

We got there eventually and today's thrust to the downside likely seals the deal for a deeper bearish correction with a bearish head and shoulders in play:

We have one broken structure at 1.0801 but bears need to get below 1.0780/70 to really nail in the coffin.

Nevertheless, the bears are on track for the daily downside targets as follows:

The 38.2% Fibonacci retracement that aligns with the prior resistance structures could be a target near 1.0720. This structure guards a deeper move into the Fibo scale and a 50% mean reversion within the scale cannot be ruled out near 1.0680.

However, the bears need to get below 1.0770 first.

ECB policymakers are starting to consider a slower pace of interest-rate hikes after a likely 50 basis-point step in February, sources say as reported by Bloomberg.

“The rapid energy-driven decline in headline inflation is giving the ECB a bit of breathing space, but policymakers will remain focused on persistent underlying pressures for now. If, as we expect, the core reading starts to ease from the end of the first quarter, this could be enough for the ECB to slow the pace of hikes to 25 basis points in March, possibly extending the cycle into the second quarter,” Bloomberg reported.

However, President Christine Lagarde indicated in December, a higher pace of tightening than indicated above, laying down the foundations for a 50 basis-point step in February. Nevertheless, the prospect of a smaller 25-point increase at the following meeting in March now has traction in the markets, despite officials saying today that no decisions have been taken, and that policymakers may still deliver the half-point move for the March meeting that Lagarde penciled in on Dec. 15.

The ECB spokesperson declined to comment on future action by the Governing Council.

EUR/USD update

Meanwhile, the euro is under pressure on Tuesday, falling from a high of 1.0869 to a fresh low of 1.0786 in a move signified in prior analysis as follows:

EUR/USD Price Analysis: Daily W-formation could be playing out, eyes on break of 1.0820/00

The W-pattern was regarded as a reversion formation and the price was expected to dip into the bullish impulse for a restest for the prior structure if not all the way into the neckline:

The euro is pressured and in pursuit of the downside targets while money markets ease tightening wagers further out, putting odds on a similarly sized 25bp increase in March at around 70%.

Weaker-than-expected inflation in the euro area, a drop in natural gas prices and the prospect of gentler tightening by the US Federal Reserve have brought some comfort to policymakers at the ECB.

A more resilient Eurozone economy and a more hawkish European Central Bank offer support for the Euro, explain analysts at Well Fargo. They have a forecast for EUR/USD at 1.13 for the first quarter of next year and warn risks are clearly titled to the upside.

Key quotes:

“From a currency perspective, a more resilient (albeit still subdued) Eurozone economic outlook and a more hawkish European Central Bank monetary policy outlook clearly offers a more supportive mix for the euro exchange rate against the U.S. dollar. With respect to our base case forecast, it is quite possible that some of the weakness we had anticipated in the EUR/USD exchange rate in early 2023 may in fact not materialize.”

“The risks to our Q1-2024 target for the EUR/USD exchange rate of $1.13 are clearly tilted to the upside. In the context of recent developments, our outlook for the euro versus the U.S. dollar is shifting appreciably in the direction of a more constructive medium-term trend.”

Analysts at Danske Bank see short-term risks in EUR/SEK titled to the upside. On a long term perspective, they expect a recovery and sustainable support to risk assets and the Swedish Krona and forecast EUR/SEK at 11.00 in 12 months.

Risk for correction, but we stick with bearish view on SEK

“We expect the Riksbank to hike by 50bp at the February meeting, taking the repo rate to 3%. That said, there is a clear risk for an additional 25bp in April. Overall, we expect that relative monetary policy will remain a negative for the SEK in 2023 as well.”

“Current bout of SEK weakness seems disconnected from both broader risk sentiment and relative rates and thus we view the EUR/SEK rally as overdone in the short-term. However, we still expect EUR/SEK to move higher over the coming months to 11.40 on the back of a global economic downturn, relative monetary policy and the Riksbank’s disregard for SEK weakness.”

“Risks are perhaps tilted to the upside as current momentum may favour EUR/SEK to remain elevated. In the medium-term, a Fed pivot, a global ‘soft landing’ and/or a change in Riksbank policy w.r.t the SEK could leave our forecast too elevated in 3-6M. In an even more protracted recession, on the other hand, our 12M point might be too low.”

Data released on Tuesday showed lower-than-expected inflation numbers in Canada. Analysts at CIBC point out the report was largely as anticipated and therefore, they continue to expect the Bank of Canada to raise rates by 25 bps next week before pausing for the rest of the year.

Looking through mortgage costs

“The BoC's core measures CPI-median and CPI-trim also decelerated by one tick to 5.0% and 5.3% respectively, after being revised up in the prior month. While core inflation remains too high, when excluding the increase in mortgage interest costs, which reflect the rapidly rising interest rates, things look better with a monthly gain of about 0.2%. Overall, this report is largely as anticipated and we therefore continue to expect the Bank of Canada to raise rates by 25 bps next week before pausing for the rest of the year.”

“The good news is that inflation is easing, and that will become more noticeable when the big monthly increases seen this past spring start to drop out of the annual calculation this year. Moreover, core inflation excluding mortgage costs is growing at a pace much closer to target. However, given the strong December job's report and tightness in the labour market, that likely won't be enough to deter the Bank of Canada from raising rates 25 bps one last time next week.”

The EUR/USD hit in January the highest levels in months. Analysts at Danske Bank point out their topside risk scenario to the pair has played out. Near-term they acknowledge the risk of this continuing, meanwhile, further ahead they believe too much positivity is priced into the EUR and that markets underestimate the re-tightening potential of financial conditions.

EUR optimism is strong, but eventually set to fade

“We still pencil in Fed hiking policy rates above 5.0% in Q1 and think the inversion embedded into the US curve for H2 2023 is overdone. Markets still price in c. 150bp more of ECB rate hikes, which is more than our base case, although we acknowledge the risk of ECB delivering more. In our view, continued tightening must ensure a re-tightening of financial conditions. This should act as a negative for EUR/USD on 3-6M.”

“EUR/USD remains overvalued on a 1-3Y horizon and unless we see global growth persistently accelerate risks are eventually skewed towards a setback. We lift our profile but still pencil in a lower cross on 3-12M, forecasting the cross at 1.03 in 12M.”

- Euro tumbles following comments from

- Pound among top performers of the day after UK GDP data, ahead of CPI numbers.

- EUR/GBP sharp reversal sends the price under 0.8800 and below the 20-day SMA.

The EUR/GBP is losing more than 50 pips, having the worst day in at least two months. Recently it hits levels under 0.8800 for the first time in a week.

The cross broke below 0.8830 and accelerated the downside. It bottomed at 0.8792 and remains near the lows, under pressure as the Euro tumbles.

ECB contemplating a lower path?

Bloomberg reported that “European Central Bank policymakers are starting to consider a slower pace of interest rate hikes” after a 50 basis points hike in February, “according to officials with knowledge of their discussions.”

The report triggered a decline of the Euro across the board with EUR/USD falling from near 1.0870 to levels under 1.0800. The common currency is the worst performer of the American session.

The Pound was already trading higher versus the Euro, supported by better-than-expected UK economic data. The unemployment rate remains unchanged at 3.7% in November while average weekly earnings, excluding bonuses, arrived at 6.4% in 3Mo/YoY in November versus 6.1% of the previous month and the 6.3% expected. On Wednesday, the UK will report the Consumer Price Index. The headline is expected at 10.6% (annual) in December down from 10.7% in November.

Technical outlook

The EUR/GBP is falling after facing resistance at the 0.8900 level and with the current bearish acceleration, it could test the next crucial support around 0.8770/75, that is the bottom of the recent range.

Technical indicators are turning south and could point to furthers losses if current levels are confirmed. The cross is back below the 20-day Simple Moving Average that stands at 0.8820. A recovery back above 0.8830 would alleviate the bearish pressure. A daily close above 0.8900 would open the doors to more gains.

Technical levels

Gold has pushed above $1,900 for the first time since April 2022. After the recent rally, Gold may need to consolidate over the near term, in the view of analysts at HSBC.

A weaker USD may be key in sustaining high Gold prices over 2023

“Evidence of easing US price pressures has helped buoy risk sentiment and undermine the USD, supporting Gold over the last several months. That said, it is possible that Gold may need to consolidate, or even dip, over the near term, after the recent spate of gains.”

“In the coming 12 months, we expect to see further USD weakness, as the drivers of the 2022 rally (a hawkish Fed, slower global growth, and risk aversion) either diminish or reverse. A weaker USD will likely lend strong support to Gold prices over 2023. That said, a likely peak in the Fed’s tightening cycle in 1Q23 could partially offset the positive impact of a weaker USD on Gold.”

“Whether the Fed sees fit to cut rates later in 2023, or keep rates steady – as implied by Fed rhetoric – will further impact Gold. XAU/USD is historically sensitive to US real yields, however, while there has been some disconnect in this relationship in recent months, we expect the relationship to resume as 2023 unfolds.”

“High Gold prices may weigh on underlying demand for jewellery, or even bars and coins, and moderating inflation may also cut into coin, bar and other Gold demand, while strong central bank demand will likely ease somewhat in 2023 but remain historically high, supported by geopolitical risks and portfolio diversification needs.”

- USD/CHF remains below the 20-day EMA, unable to reclaim 0.9300.

- Although the pair is bearish, solid USD/CHF support to be found around 0.9150.

- If the USD/CHF climbs above the 20-day EMA, that will expose the 0.93 figure, followed by the 50-day EMA.

After failing to clear 0.9360 during the last week, the USD/CHF is extending its downtrend to four consecutive days, staying just below the 20-day Exponential Moving Average (EMA), which sits at around 0.9282, acting as a solid resistance. Hence, the USD/CHF is trading at 0.9213, below its opening price by 0.44%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is neutral-to-downward biased and continues to trade beneath the confluence of a three-month-old downslope trendline and the 20-day EMA. Although the bias suggests further downside, since December 2022, the USD/CHF bottomed around the February 2022 low of 0.9150 and remains unable to crack it. Therefore, bears need to clear the latter, to open the door towards 0.9100 first and then the 0.9000 figure.

As an alternate scenario, if the USD/CHF pair reclaims the 20-day EMA, that could send the pair climbing to 0.9300, followed by the January 12 high of 0.9360, ahead of the 0.9400 mark.

USD/CHF Key Technical Levels

The critical Bank of Japan (BoJ) policy decision due on Wednesday could lift the Yen as much as 5%, economists at Barclays report.

BoJ meeting poses further upside risks to the JPY

“The BoJ meeting poses further upside risks to the JPY. If the BoJ decides on further YCC adjustment, we estimate that the Yen could appreciate by as much as 5%.”

“Even if inaction leads to a knee-jerk USD/JPY rally, expectations for revision will likely remain intact and USD/JPY could stay on a downtrend, especially amid broad USD weakness.”

See – BoJ Preview: Forecasts from eight major banks, no rush to normalize monetary policy

The Bank of Japan (BoJ) will announce its monetary policy decision on Wednesday, January 18 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of eight major banks.

Back in December, the central bank introduced a change to its Yield Curve Control (YCC), lifting the ceiling of what the 10-year note could offer from 0.25% to 0.50%. A hike this week seems unlikely as the BoJ is set to leave its policy unchanged.

Standard Chartered

“We expect the BoJ to keep both the policy balance rate and the 10Y yield target unchanged at -0.1% and 0%, respectively. We believe policymakers will assess the potential impact of the recent decision to widen the 10-year JGB band to +/-50 bps (from +/-25 bps) at its December meeting. Local media reports suggest that policymakers will be looking to review the side effects of current ultra-easy monetary policy and potential risks following the BoJ’s December move. This has likely raised concern among policymakers that unwinding of the negative interest rate policy may result in unintended consequences and risk financial market instability.”

ING

“The BoJ is expected to stand pat after delivering its unexpected decision in December to expand the yield curve band. Governor Haruhiko Kuroda’s future guidance will remain dovish, but apart from that, the market appears to be pricing in additional normalisation steps from the next BoJ governor.”

TDS

“We expect a further widening of the YCC band by another 25 bps at this meeting, and if not now, at the March meeting. Market functioning has not improved as reflected in large unscheduled bond-buying operations. Additionally, there are growing signs of broadening inflation pressures. At the very least we expect the BoJ to revise its inflation forecasts higher.”

SocGen

“Our main scenario for the BoJ is still no change to the YCC policy, but the risk for some changes has risen quickly. We see 25% chance of BoJ scrapping JGB purchase limitation and increasing the types of bonds, and 25% chance of a wider band of ±75 bps for the 10-year yield. What would make BoJ’s job harder is that core CPI likely accelerated again in December to 4%, owing to broad-based inflationary pressure.”

Danske Bank

“Despite some speculations, consensus expects no changes in monetary policy this week, but even if the BoJ was to surprise the market, we think market reactions this time would be more muted.”

Deutsche Bank

“We expect no change in policy (even if we feel there are risks they will) but believe the associated Outlook Report will show an upgrade to the bank's inflation forecast to around 2% for 2022-2024. We expect the BoJ to abandon YCC by the end of Q2 this year, amid forces such as the ‘shunto’ spring wage negotiation, a positive output gap and leadership changes at the bank. If they do change the YCC guidelines this week, we think that another 25 bps widening of the band would be worth around 10 bps on 10yr USTs immediately. The eventual end of YCC would lead to a more substantial and permanent shift in term premium but this will take time.”

Citibank

“We expect YCC to be abolished. The BoJ decided on an unexpected policy change (i.e., widening of the target range for 10-year JGB yields) in December, but 10-year JGB yields have already stuck at the upper limit of the new range of +0.5%, resulting in renewed distortion in the yield curve. Even if the range is widened again, it is unlikely that the distortion of the yield curve will be fundamentally addressed. Moreover, comparing the impact of abolishing YCC under President Kuroda and under the next governor, the former would cause less damage to the organization.”

Wells Fargo

“Recall that in December of last year, the BoJ surprised market participants by adjusting its YCC policy, widening the tolerance band for the 10-year Japanese government bond (JGB) yield to +/- 50 bps (instead of +/- 25 bps) around a target of zero percent. Despite the policy tweak, Governor Kuroda asserted that the change in policy was not a form of monetary tightening, but a move to improve JGB market functioning. While this adjustment has added uncertainty to the outlook and has increased the likelihood of another policy change, we do not expect the BoJ to adjust monetary policy at its January meeting.”

Gold price climbed to $1,930 at the start of the week, thereby reaching its highest level since the end of April 2022. Nonetheless, economists at Commerzbank doubt that the currency increase is sustainable.

Gold price increase still accompanied by speculative buying

”There is still a considerable discrepancy between the interest rate path anticipated by the market and that indicated by the Fed. If the market changes its view and moves more into line with the Fed, the Gold price risks facing serious setback potential.”

“Net long positions held by speculative financial investors increased for the sixth week in a row in the week to 10 January to reach just shy of 62,000 contracts, their highest level since May 2022. Having said that, they were more than twice as high in March 2022, so there can be no talk of any overheating.”

“Since the start of the year, holdings in the gold ETFs tracked by Bloomberg declined by 3.4 tons, which is amazing in view of the steep price rise. This also makes us sceptical about the sustainability of the current upswing. After all, it is primarily the result of the weak USD and declining interest rate expectations.”

- A risk-off impulse, and speculations for the Bank of Japan quitting its YCC, are headwinds for the USD/JPY.

- The New York Fed Empire State Manufacturing report showed further deterioration in the region, sparking recession fears,

- USD/JPY Price Analysis: Failure to clear 129.40s exacerbated a drop below 129.00.

USD/JPY clings to its earlier gains as the North American session begins, though it’s retracing after hitting daily highs of 129.16 before the Wall Street open. The US Dollar (USD) is giving back earlier gains while sentiment continues to deteriorate. At the time of writing, the USD/JPY is trading at 128.46, up by 0.11%.

An offered US Dollar, a headwind for the USD/JPY

Wall Street is set to open lower as US stock futures remain in negative territory. The greenback is fallen off the cliff, as shown by the US Dollar Index, down 0.57% at 101.984. The US 10-year Treasury bond yield, which usually correlates closely with the USD/JPY pair, trims its gains and sits at 3.535%, unchanged.

The US Empire State Manufacturing Report revealed by the New York Federal Reserve showed that business activity contracted sharply, with the index falling 22 points to -32.9. The report showed that new orders and shipments declined substantially, while delivery times were unchanged and inventories aimed higher.

Even though the data was worse than expected, the USD/JPY reaction to it was muted as traders braced for the two-day monetary policy decision of the Bank of Japan.

Expectations for a rate hike are very slim, though the March meeting jumped by 45%. Market analysts think that the BoJ could abandon its Yield Curve Control (YCC) to prepare the markets for its first rate hike at March or April’s meeting.

Ahead of the week, the US economic docket will feature the New York Fed President John Williams crossing the media. On the Japanese front, the Reuters Tankan Index, Machinery Orders, and the so-awaited Bank of Japan monetary policy decision would entertain USD/JPY traders.

USD/JPY Price Analysis: Technical outlook

During the European session, the USD/JPY hit a daily high at 129.16 before pairing those gains. The rally stalled below last Friday’s high of 129.42, which exacerbated the drop toward 128.50. Hence, price action edging lower, oscillators like the Relative Strength Index (RSI) remaining in bearish territory, and the Rate of Change (RoC) pushing further to the downside paved the way for further losses.

Therefore, the USD/JPY first support would be the 128.00 figure, followed by the January 16 daily low of 127.21 and the May 24 pivot low of 126.36.

- Canada: inflation slowdowns further in December.

- US: Empire manufacturing index plummets unexpectedly in December.

- USD/CAD remains sideways, unable to hold above 1.3400.

The USD/CAD broke below 1.3400 following the release of US manufacturing and Canadian economic data. It printed a fresh daily low at 1.3383. It remains near the lows, with a bearish bias as the Loonie outperforms and the US Dollar falls across the board.

Data weighs on USD/CAD

The US Empire Manufacturing Index dropped sharply unexpectedly to the lowest level since May 2020. The index fell from -11.2 to -32.9, against expectations of a recovery to -4.5. Price indicators of the reports showed a slowdown. The Greenback fell after the report.

In Canada, inflation numbers came in below expectations. The Consumer Price Index fell by 0.6% in December with the annual rate slowing down from 6.8% to 6.3%. The Bank of Canada Prince Index Core fell by 0.3% and the yearly rate dropped from 5.8% to 5.4%, versus the 6.1% of markets consensus.

“Big picture, this probably doesn't change much for the Bank of Canada. Yesterday's Business Outlook Survey suggested that tightening is starting to have an impact, but today's data, coupled with the stronger than expected Q4 activity data, reinforces the notion that the economy is in excess demand. The most prudent move is for the BoC to lift rates by 25 bps next week. After last year, the BoC cannot afford to risk falling behind the curve again. We continue to look for 4.50% as the terminal rate”, said analysts at TD Securities.

Sideways, within a bearish trend

Last week, the rebound from monthly lows in USD/CAD was capped by the 1.3450 area. During the current week, the pair is showing difficulties in holding above 1.3400. Recent price action confirms that bearish risks prevail.

On the flip side, an initial support emerges at 1.3345 and then attention would turn to the January low at 1.3320.

Technical levels

Senior Economist at UOB Group Alvin Liew reviews the latest US inflation figures.

Key Takeaways

“US headline consumer price inflation (CPI) declined by -0.1% m/m in Dec, from 0.1% in Nov, exactly in line with Bloomberg’s survey and more importantly, was the first sequential contraction recorded since May 2020. As a result, headline inflation eased off further from the Jun 2022 peak of 9.1% y/y to 6.5% y/y in Dec, against 7.1% in Nov. In comparison, core CPI rose by a faster 0.3% m/m pace (from 0.2% m/m in Nov) which was also the consensus expectation. Despite the m/m increase, core CPI decelerated on a y/y basis to 5.7% against 6.0% in Nov, and exactly in line with Bloomberg’s median estimate and also the smallest y/y rise since Dec 2021.”

“Within the overall CPI, it was the decline in gasoline prices that contributed the most to the overall -0.1% m/m decrease, more than offsetting increases in the shelter cost index. In y/y terms, housing, food and services inflation continued to contribute strongly to overall inflation, while the improvement in the y/y overall CPI inflation was largely driven by declines in gasoline prices and used cars and truck prices.”

“US Inflation Outlook – If the CPI momentum is able to hold at around 0.1%-0.3% m/m in 2023 (vs. average of 0.5% m/m in 2022, 0.6% m/m in 2021), then there is a good chance for the inflation to move towards the US Fed’s target of 2% by the end of 2023. For the full year, we still expect both headline and core inflation to average 3.0% in 2023, above the Fed’s 2% objective. The balance of risk on inflation remains on the upside.”

- EUR/USD picks up a more convincing pace and flirts with 1.0870.

- The risk appetite continues to support the upbeat mood in spot.

- Economic Sentiment in Germany surprised to the upside in January.

Bulls push harder and lift EUR/USD to fresh daily highs near 1.0870 on Tuesday, just pips away from Monday’s YTD peak.

EUR/USD: Further gains need to clear 1.0874

The greenback loses its grip further and allows EUR/USD to gather extra steam and approach Monday’s so far yearly tops near 1.0880.

Indeed, investors remain tilted towards the risk complex on Tuesday, propped up by positive results from the Chinese docket during early trade as well as firm prints from the Economic Sentiment in both Germany (16.9) and the broader euro area (16.7) for the month of January.

The uptick in spot, however, comes in contrast to the weak tone from yields on both sides of the Atlantic.

In the US data space, the NY Empire State Manufacturing Index worsened to -32.9 for the current month (from -11.2).

What to look for around EUR

EUR/USD appears so far well underpinned by the 1.0800 neighbourhood and looks at another test of the 1.0880 region amidst favourable risk appetite trends on Tuesday.

Price action around the European currency should continue to closely follow dollar dynamics, as well as the impact of the energy crisis on the euro bloc and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: ECOFIN Meeting, Germany Final Inflation Rate / ZEW Economic Sentiment, EMU ZEW Economic Sentiment, Italy Final Inflation Rate (Tuesday) - EMU New Car Registrations / Final Inflation Rate (Wednesday) – ECB Lagarde, ECB Accounts (Thursday) - ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst diminishing probability of a recession in the region. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.40% at 1.0864 and faces the next up barrier at 1.0874 (monthly high January 16) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022). On the flip side, the breakdown of 1.0481 (monthly low January 6) would target 1.0476 (55-day SMA) en route to 1.0443 (weekly low December 7).

The United Kingdom will release the Consumer Price Index (CPI) data on Wednesday, January 18 at 07:00 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming UK inflation print.

Headline is expected at 10.6% year-on-year vs. 10.7% in November while Core Inflation is likely to accelerate to 6.6% vs. 6.3% booked in November. If so, Headline would decelerate for the second straight month from the 11.1% peak in October but would remain far above the 2% target.

Nomura

“We are forecasting headline CPI inflation to ease from 10.7% YoY to 10.4% in December and core inflation to fall more gradually from 6.3% to 6.2%.”

TDS

“We look for another large decline in UK headline CPI, largely due to an almost 5% MoM drop in petrol prices but also as retailers pushed through significant discounts in the month to rid themselves of high inventory levels. While our forecast (10.5%) is quite a bit below the BoE's of 10.9% YoY, much of this gap is due to lower petrol prices rather than weaker underlying dynamics.”

SocGen

“The December CPI print is likely to add weight to our belief that the 11.1% recorded in October was the peak in inflation, especially given recent energy price trends. There should be only a modest increase by 0.1pp to 10.8%, driven by higher core and food inflation. More important for the BoE will be core inflation developments. Therefore, our expectation that core prices accelerate from 6.3% to 6.5% in December will worry the Bank, especially because we think it will be driven by services inflation that is more dependent on wages. On the other hand, we see goods inflation softening from 6.3% to 5.9% due to a combination of negative base effects and retailers using discounts to shed excess stock. For the coming year, strong wage growth should see core inflation only gradually falling from our forecasted value of 6.5% in December to 6% by year-end.”

Citibank

“We expect headline CPI inflation to moderate further this week to 10.5% YoY. Core CPI may prove somewhat more resilient at 6.2%. On the core goods side, we see risks to the downside with high inventory levels, in particular, likely to have averted significant further price pressure. Services are trickier to call, with a train strike on the observation date in question and widespread disruption throughout the month.”

ING

“Headline CPI has peaked but is likely to remain in double digits through early 2023. But the Bank’s favoured measure of ‘core services’ inflation, perhaps the cleanest gauge of domestically-driven price pressures, has edged higher in recent months and this will be key. Signs that this is reaching a peak would boost the case for a more modest rate hike in February.”

Economist at UOB Group Ho Woei Chen assesses the latest monetary policy meeting by the Bank of Korea (BoK).

Key Takeaways

“As expected, Bank of Korea (BOK) raised its benchmark 7-day repo rate by 25bps to 3.50% (on January 13), the highest level since Dec 2008.”

“However, the rate decision was not unanimous with 2 policy board members voting for interest rate to be unchanged in Jan. Board members also expressed different opinions on the interest rate outlook with 3 out of 6 (excluding Governor Rhee) indicating possibility for a ‘terminal rate’ of 3.75%. This is a departure from the previous meeting in Nov when the same number indicated that they see the ‘terminal rate’ at 3.50%.”

“Barring a change to global inflation trajectory where price gains are expected to slow this year, we maintain our view that the latest rate hike has marked the end of BOK’s tightening cycle.”

“Indicating how quickly the economic outlook has deteriorated, the BOK suggested that it may further downgrade its GDP forecast at the Feb review from current 1.7% for 2023. The outlook for inflation is largely intact based on BOK’s assessment.”

Further upside in Gold? Economists at Standard Chartered believe that the yellow metal is likely to stabilize in the near term.

Overbought technicals and narrowing investor diversity

“We believe a consolidation could be imminent in the short term. We continue to see real yields as a headwind given the risk of a nominal rebound in US government bonds yields.”

“From a technical standpoint, a stretched RSI (reflecting overbought conditions) and narrowing investor diversity also point to a consolidation.”

See – Gold Price Forecast: XAU/USD continues to face correction risks – TDS

JPY fortunes are reversing. Economists at Deutsche Bank see USD/JPY moving down to 120 by end-2023.

The Yen comeback has further to go

“The JPY was one of the worst FX performers in 2021 and 2022, as a dovish BoJ skirted the rise in global yields, and the energy price spike took Japan’s trade deficit deep into negative territory. This is all changing now.”

“BoJ policy has already started to shift and more is likely in 2023 under new leadership, particularly with the inflation pulse quickly accelerating. The balance of payments should improve, with spot LNG prices halving, and nuclear reactors restarting to cut reliance on fossil fuels. There is also scope for repatriation flows given Japanese institutions’ large USD cash holdings.”

“Forward points are quite depressed, given the large gap between Fed and BoJ rates. But downside hedges still look worthwhile and will pay off as long as USD/JPY goes below 125 over the next year. We see a move to 120 by end-2023.”

- NY Fed Empire State Manufacturing Index dropped sharply in December.

- US Dollar (USD) holds steady and reacts little to the dismal macro data.

The headline General Business Conditions Index of the Federal Reserve Bank of New York's Empire State Manufacturing survey deteriorated further and plunged to -32.9 for January. The reading was well below consensus estimates pointing to a slight improvement to -4.5 from -11.2 in December

Market reaction

The US Dollar (USD), meanwhile, reacts little to the dismal macro data and flat-lines below the 102.00 mark, awaiting fresh catalyst before the next leg of a directional move.

- Annual Core CPI in Canada decelerates to 6.3% in December.

- USD/CAD holds around 1.3400 after Canadian inflation figures.

Inflation in Canada, as measured by the Consumer Price Index (CPI), decelerated from 6.8% in November to 6.3% in December, matching consensus estimates. On a monthly basis, the CPI fell by 0.6% as compared to the 0.1% decline expected and the previous month's flat reading.

Additionally, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, fell 0.3% MoM and unexpectedly eased to 5.4% on a yearly basis.

Market reaction

The USD/CAD pair moves little in reaction to the key macro data and remains confined in a narrow trading band, around the 1.3400 round-figure mark.

- GBP/USD regains positive traction on Tuesday following the release of the UK jobs report.

- Stronger wage growth data might force the BoE to hike further and boosts the British Pound.

- A combination of factors continues to underpin the USD and keeps a lid on any further gains.

The GBP/USD pair attracts fresh buying near the 1.2170-1.2165 region on Tuesday and steadily climbs back closer to a one-month high touched the previous day. The pair, however, trims a part of its intraday gains and retreats below mid-1.2200s during the early North American session.