- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- USD/JPY whipsawed around BoJ mystery.

- It is likely speculation of another adjustment to YCC will build again in March.

USD/JPY is down some 0.2% as we head into Tokyo following a turbulent time over the past few session due to the Bank of Japan deliberations that resulted in a surprise for financial markets not knowing at first quite what to make of it. At the time of writing, USD/JPY is trading at 128.58 and has moved within a range of between 128.44 and 128.88.

BoJ unravelled

To unravel the mystery behind the Bank of Japan here, a number of insights from various banks make for informative reading. Firstly, analysts at Westpac summed up the BoJ event as follows: ''The BoJ opted to keep the 10yr JGB yield target range at +/-0.5%, made no change to short end rates or the outlook and while nudging up CPI forecasts slightly, still projected core inflation below the 2% target by 2024. This sparked a bounce in USD/JPY from 128.50 to as high as 131.58, later steadying around 130.75 as Governor Kuroda spoke. The decision to keep loose policy sparked a sharp rally in Japanese equities, the Nikkei 225 closing up 2.5%.''

Looking forward, the BoJ — despite many arguments to the contrary — is expected to initiate a monetary tightening in the near future that will significantly support the yen, analysts at Commerzbank argued: ''But especially if the BoJ tightens its monetary policy now, that argues for the yen to remain a low-interest rate currency (and thus arguably a safe haven, much like the Swiss franc and gold). Because it then becomes likely that Japan will also remain a special case in terms of its return to zero or low inflation.''

The next BoJ policy meeting is scheduled for March 10. This will be the final meeting for Governor Kuroda. ''By the time the April BoJ meeting takes place, with the new governor in place, the outcome of the spring wage talks should be known. Additionally, both January and February CPI inflation releases will have been printed, in addition to Japanese Q4 GDP and a range of activity indicators for the early part of this year. This suggests that any further widening in the YCC band could be delayed until April,'' analysts at Rabobank explained who argue that It is very unlikely that there will be an aggressive change in BoJ policy settings this year.

''It is likely speculation of another adjustment to YCC will build again in March, although we would expect the April meeting to be a more likely source of change. Our 1 month USD/JPY130 forecast crudely reflects our view that both today’s and March’s policy meetings could bring steady policy,'' the analysts at Rabobank argued. ''That said, we forecast USD/JPY at 128 in a 3-month view and 126 in 6 months.''

- Hawkish commentaries from Fed policymakers have infused fresh blood into the US Dollar.

- A Spinning Top formation indicates indecisiveness in investors’ sentiment for further action.

- Upward-sloping 20-EMA and oscillation of the RSI (14) in the bullish range still favor the upside bias.

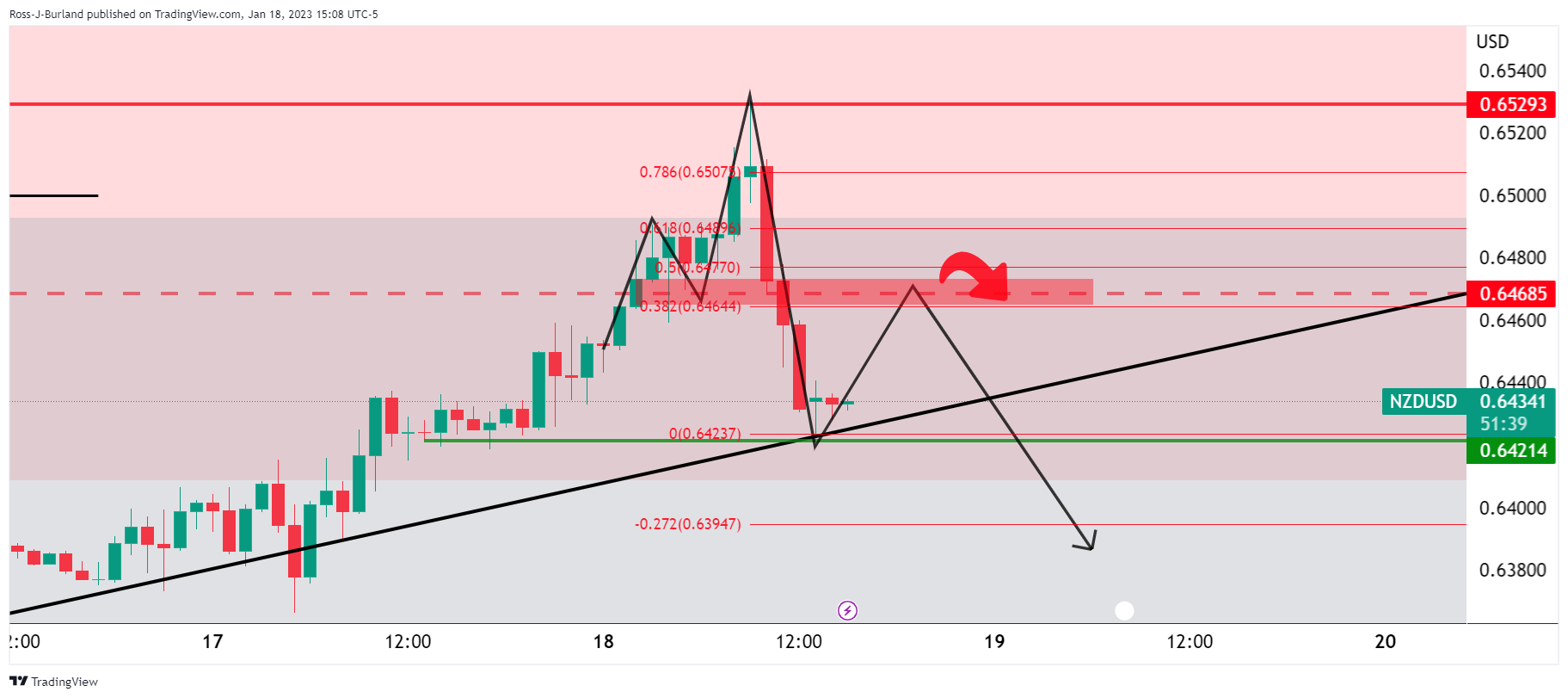

The NZD/USD pair is displaying a sideways auction profile in the early Asian session after a sell-off from above the psychological resistance of 0.6500 on Wednesday. The Kiwi asset is expected to witness pressure ahead as the risk appetite of the market participants has dropped vigorously after hawkish commentaries from Federal Reserve (Fed) policymakers.

S&P500 witnessed a massive sell-off amidst earnings season as lower bargaining power in the favor of producers will trim operating margins. Also, lower inflation projections due to the soft Producers Price Index (PPI) report were responsible for a plunge in the 10-year US Treasury yields to 3.37%. The US Dollar Index (DXY) is juggling around 102.00 after a V-shape recovery from a fresh seven-month low at 101.20.

NZD/USD is demonstrating signs of a bearish reversal led by the formation of a Spinning Top candlestick pattern. The aforementioned candlestick indicates indecisiveness in the sentiment of investors for further action, which also marks a reversal in the ongoing trend.

Other filters such as Exponential Moving Averages and momentum oscillators have not displayed signs of reversal yet, due to their lagging characteristic.

The 20-period EMA at 0.6366 is still upward-sloping, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00 but still needs to sustain above for bullish momentum.

For a downside move, a breakdown below January 16 high at 0.6426 will drag the Kiwi asset toward January 17 low at 0.6366 followed by January 12 low around 0.6300.

On the contrary, a decisive break above Wednesday’s high at 0.6530 will drive the asset toward June 3 high at 0.6576. A breach of the latter will expose the asset to the round-level resistance at 0.6600.

NZD/USD daily chart

-638096827773212687.png)

December month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders.

Market consensus suggests that the headline Unemployment Rate may remain unchanged at 3.4% on a seasonally adjusted basis whereas Employment Change could ease to 22.5K versus the previous addition of 64.0K. Further, the Participation Rate is expected to remain unchanged at 66.8% prior level.

Considering the Reserve Bank of Australia (RBA) policymakers’ recent retreat from the hawkish bias, in line with their global counterpart, today’s Aussie jobs report become crucial for the AUD/USD pair traders.

Ahead of the event, analysts at Westpac said,

Leading indicators suggest there will be another robust print for employment growth in December (Westpac forecast: 30k). The unemployment rate should meanwhile hold steady (Westpac forecast: 3.4%).

On the same line, analysts at the ANZ mentioned,

Given the tightness in the labor market, we expect solid employment growth to have continued in December with a 35k rise, participation to stay around November’s record high and the unemployment rate to remain steady at 3.4%. While job vacancies dropped 5% q/q in November, they are still very high relative to history and NAB’s Employment Index is also well above average.

How could the data affect AUD/USD?

AUD/USD picks up bids to consolidate the biggest daily loss in two weeks while staying around the highest levels since mid-August 2022, mildly bid near 0.6945 by the press time. In doing so, the Aussie pair cheers the broad US Dollar weakness and stays hopeful of witnessing upbeat data, not to forget cautious optimism in the market.

However, the recent Fed talks suggest a hawkish move and contrast the other central bankers which are on the verge of announcing less aggressive monetary policies going forward. As a result, the market’s sentiment remains mixed and can weigh on the AUD/USD prices should the scheduled Aussie numbers fail to impress the pair buyers.

Technically, Wednesday’s U-turn from the highest levels since mid-August 2022 portrays a rising wedge bearish chart pattern on the daily formation, currently between 0.7020 and 0.6810.

Key Notes

AUD/USD pauses pullback from five-month high near 0.6950 ahead of Aussie employment data

AUD/USD Forecast: Bearish case should gain adepts once below 0.6930

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

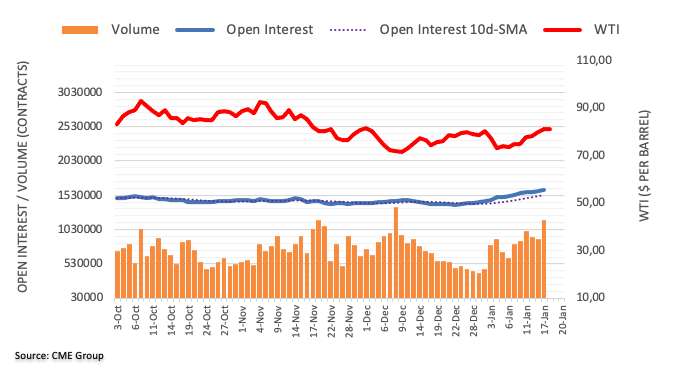

- WTI remains pressured after reversing from six-week high.

- Fears of US recession supersede hopes of more energy demand from China.

- Firmer US Dollar, hawkish Fedspeak also exert downside pressure on the Oil price.

- EIA inventories, risk catalysts will be crucial for fresh impulse.

WTI crude oil holds lower ground near $79.50 amid early Thursday, after witnessing a heavy sell-off from the 1.5-month high the previous day. In doing so, the black gold struggles to justify the hopes of more energy demand from China amid fresh economic slowdown fears emanating from the US. Also exerting downside pressure on the energy benchmark could be the firmer US Dollar and the recently hawkish comments from the Federal Reserve (Fed) officials.

Downbeat US data renewed fears of economic slowdown and weighed on the Oil prices the previous day. That said, US Retail Sales marked the biggest slump in a year while posting 1.1% MoM contraction for December, versus -0.8% market forecasts and -1.0% prior (revised). On the same line, Producer Price Index dropped to the lowest levels in six months with -0.5% MoM figure compared to -0.1% expected and 0.2% prior (revised).

Even so, the Fed policymakers remained hawkish as St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede. On the same line, President of the Federal Reserve Bank of Cleveland Loretta Mester praised the Fed’s actions to tame inflation and Kansas City Fed President Esther George mentioned that the central bank must restore price stability, "that means returning to 2% inflation." Recently, Dallas Federal Reserve President Lorie Logan supported slower rate hike pace but also mentioned possibly higher stopping point.

Elsewhere, analysts at the Goldman Sachs expected stronger China growth and favored hopes of more energy demand from the dragon nation. However, fears of the US-China tension outweigh the optimism of late. US Treasury Secretary Janet Yellen and Chinese China’s Vice Premier Liu He met in Germany on Wednesday and initially boosted the risk appetite, together with the BOJ’s inaction. However, the diplomats’ mentioning of the areas of disagreement raised market fears of another round of US-China tension. Previously, the South China Morning Post (SCMP) mentioned that Beijing ‘should be wary’ as the US and Taiwan seeks closer economic ties.

On a different page, the American Petroleum Institute’s (API) Weekly Crude Oil Stock came in as 7.615M versus 14.865M prior.

Amid these plays, Wall Street closed in the red and yields were down too while the US Dollar recovered after refreshing the lowest levels since late May. That said, the US Dollar Index (DXY) also bounced off the lowest levels since May 31.

Moving on, risk catalysts will be more important than the weekly oil inventory data from the US Energy Information Administration, expected -1.75M versus 18.962M prior.

Technical analysis

Despite failing to cross the 100-DMA, around $81.90 by the press time, the WTI crude oil price remains above the 50-DMA support surrounding $78.20, which in turn suggests limited downside for the black gold.

- Silver extended its losses to two-consecutive days, down by 1.97% on Wednesday.

- From a daily chart perspective, the XAG/USD is neutral to upward biased but needs to hold prices above $23.00 to extend its gains.

- XAG/USD Price Analysis: Neutral-to-downward biased, and once it clears $23.00, that could expose Silver to lower prices.

Silver price plummeted for the second straight day, extending its losses below $23.50 on Wednesday, as late US Dollar (USD) strength erased the greenback losses in the day, a headwind for the white metal. At the time of writing, the XAG/USD is trading at $23.45, below its opening price by 1.97%.

Silver Price Forecast: XAG/USD Technical Outlook

The XAG/USD daily chart suggests Silver is neutral-to-upward biased. Even though the pullback cleared the 20-day Exponential Moving Average (EMA), a decisive break below the January 5 daily low of $23.12 is needed to shift the bias to neutral; additionally, it will expose the 50-day EMA at $22.86. Oscillators like the Relative Strength Index (RSI) suggest that sellers are beginning to gather momentum, so the last line of defense for XAG/USD buyers would be $23.00.

Analyzing Silver from an intraday perspective, the XAG/USD 4-hour chart portrays the pair as neutral-to-downward biased, as the Exponential Moving Averages (EMAs) reside above XAG/USD price. However, to further extend its downtrend, the white metal needs to clear the 200-EMA at $23.33, which, once cleared, could open the door for further losses. Therefore, the XAG/USD first support would be the January 5 swing low at $23.22. Once cleared, it would expose the December 19 daily low of $23.10, followed by the December 16 pivot low at $22.52.

Silver Key Technical Levels

- USD/CHF is expected to extend its gains above 0.9180 considering the strength in the USD Index.

- The lower-than-projected US PPI report weighed heavily on S&P500 and US Treasury yields.

- Fed Harker sees inflation at 2% in CY2025 and a terminal rate in a 5.25-5.50% range despite lower retail demand.

The USD/CHF pair is oscillating in a narrow range below the crucial hurdle of 0.9180 in the early Tokyo session. On Wednesday, the Swiss Franc asset displayed a V-shape recovery after recording a fresh 14-month low at 0.9085 as the United States Producer Price Index (PPI) and retail sales December report remained lower than anticipation. Hawkish commentaries from Federal Reserve (Fed) policymakers remained responsible for infusing strength into the US Dollar again and pushing USD/CHF to near 0.9180.

Declining prices of goods and services at factory gates, according to the US PPI report, triggered the risk of expensive valuation for equities due to lower projections for net profit margins. This forced investors to dump US stocks, which weighed heavily on S&P500 and supported the risk-aversion theme. Also, it sent the return on US Treasury bonds into the bearish territory as the lower Producer Price Index is a pre-requisite for lower Consumer Price Index (CPI) projections. The 10-year US Treasury yields nosedived to 3.37%.

Hawkish commentaries from Fed policymakers came as a savior for the US Dollar Index (DXY). Although Fed policymakers are favoring slowing down the pace of hiking interest rates but expect terminal rate projection steady in a 5.25-5.50% range and achievement of 2% inflation in CY2025, cited by Philadelphia Fed President Patrick Harker, as reported Reuters.

Meanwhile, Swiss franc investors are awaiting the release of the Producer and Import Prices (Dec) data, which is scheduled for Thursday. According to the consensus, annual data will drop to 3.1% vs. the former release of 3.8%. While the monthly data will expand by 0.1% against a contraction of 0.5% released earlier.

More than half of Japanese companies, 53% to be exact, are planning to raise wages this year, according to a Reuters monthly poll. This meets a key request from Prime Minister Fumio Kishida to help workers cope with surging consumer prices, reported Reuters.

Also read: Japan’s PM Kishida calls on firms to give wage hikes that exceed inflation

Additional findings

Ahead of spring "shunto" labour negotiations, managers at 24% of the companies polled said they planned on across-the-board bumps in base salary along with regularly scheduled wage increases. Another 29% said they would carry out regular pay increases only, while 38% were undecided.

A total of 34% of firms said they planned wage increases of at least 3%, a jump from 10% in a Reuters survey in October.

The survey showed companies are less eager to bear the brunt of another Kishida plan: unprecedented military spending to counter growing threats from China and North Korea.

Among 495 firms polled, 54% supported the defence spending plan, but just 29% backed the increase in corporate tax rates.

Asked what expenses would be curtailed if corporate levies go up, the top answer was capital spending, at 42%, followed by dividends and wages.

On the overall business environment, corporate managers turned slightly more pessimistic, with 81% saying conditions would be "not so good" to "bad" in the next three months, compared with 77% in the December survey.

USD/JPY retreats

Following the news, USD/JPY fades the bounce off 127.57 while declining to 128.60 by the press time.

- EUR/USD holds lower ground inside a one-week-old bullish chart pattern.

- 50-SMA restricts immediate downside but bearish MACD signals, steady RSI hints at further weakness.

- Monthly horizontal support, 200-SMA add to the downside filters.

- Bulls need validation from 1.0890 to break the monotony.

EUR/USD stays pressured around 1.0790 amid the early hours of Thursday’s Asian session, after refreshing the nine-month high but posting a daily negative. In doing so, the major currency pair remains inside a weekly bullish channel, poking the 50-SMA immediate support as of late.

However, the bearish MACD signals and steady RSI (14), not to forget the weekly trading range, keeps the EUR/USD sellers hopeful of breaking the 1.0780 immediate support and approaching the 1.0770 key level comprising the stated channel’s lower line.

It’s worth noting that the quote’s weakness past 1.0770 could quickly drag it to the horizontal area comprising levels marked since 2022’s end, around 1.0710. Following that, the 200-SMA level of 1.0642 could probe the EUR/USD bears.

Alternatively, recovery moves may initially aim for the 1.0830 hurdle before challenging the aforementioned channel’s top line, close to 1.0890 by the press time.

Also acting as an upside filter is the 1.0900 threshold, a break of which could propel the EUR/USD prices towards poking the April 2022 peak near 1.0935. Even so, lows marked during late March 2022, around 1.0945 could challenge the EUR/USD buyers afterward.

EUR/USD: Four-hour chart

Trend: Further downside expected

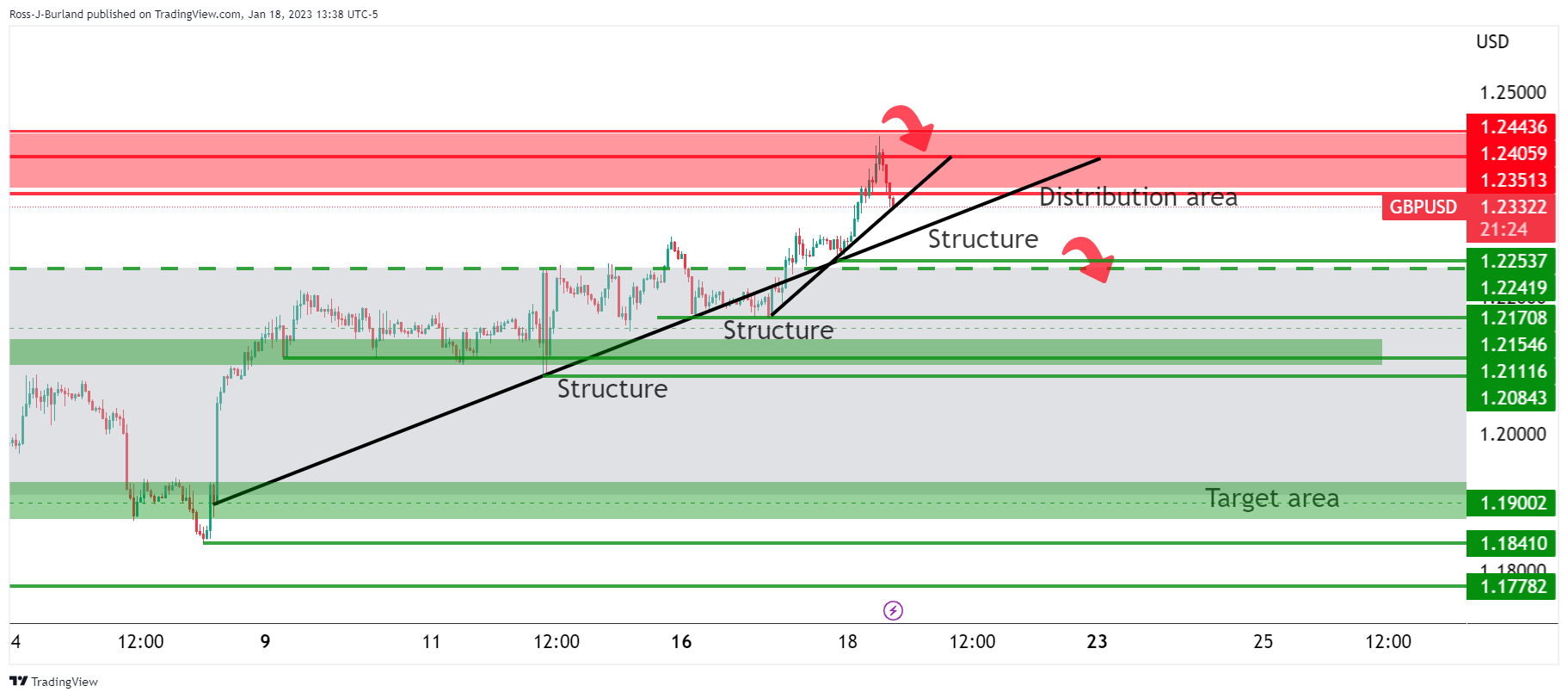

- GBP/USD is jugging below 1.2350, preparing for further downside amid a risk-off mood.

- Fed Harker sees the achievement of 2% inflation in CY2025 but has favored slower rate hikes ahead.

- The BOE might continue its hawkish stance on interest rates despite a lower-than-expected December inflation report.

The GBP/USD pair is displaying back-and-forth moves after a south-side drive below the critical resistance of 1.2350 in the early Tokyo session. The Cable witnessed sheer selling pressure on Wednesday after failing to sustain above 1.2435 as hawkish commentaries from Federal Reserve (Fed) policymakers trimmed the risk appetite of the market participants heavily.

Weaker-than-projected United States Producer Price Index (PPI) and Retail Sales data weighed on S&P500. The 500-stock basket weighed down as lower PPI and retail sales figures guarantee that firms will demonstrate weaker operating margins amidst the quarterly earnings season. However, a meaningful drop in the prices of goods and services at factory gates supports weaker inflation projections, which resulted in a heavy drop in the 10-year US Treasury yields to 3.37%.

Contrary to the plunging yields, the US Dollar Index (DXY) displayed a V-shape recovery after refreshing its seven-month low at 101.20 and recaptured the critical resistance of 102.00. The release of the lower-than-anticipated US PPI and Retail Sales data failed to trim the hawkish stance in Fed policymakers’ commentaries.

To achieve price stability in the United States economy, St. Louis Fed's President James Bullard still sees the interest rate peak in a 5.25-5.50% range. Also, Philadelphia Fed President Patrick Harker favored slower interest rates hike ahead but see inflation at 2% in CY2025, which indicates that Fed chair Jerome Powell will remain restrictive beyond CY2024.

On the United Kingdom front, inflation softening below expectations both in headline and core numbers might fail to restrict the Bank of England (BOE) from hiking interest rates further. A note from ING states that "Depending on the resilience of December UK CPI data, it seems too early to dismiss the risk of another 50 basis points (bps) rate hike.”

- USD/CAD has witnessed an intermediate resistance around 1.3500 after a juggernaut rally.

- US equities witnessed a massive sell-off as retail demand and PPI figures dropped heavily.

- Fed’s Bullard remained restrictive on interest rate projections despite weaker inflation projections.

The USD/CAD pair has witnessed a pause after a juggernaut rally around the psychological resistance of 1.3500 in the early Asian session. The Loonie asset is expected to turn sideways as the US Dollar bulls will need more fuel to extend the rally further. The major witnessed a steep fall amid a plunge in the oil price, which weakened the Canadian Dollar.

S&P500 witnessed an intense sell-off from the market participants after a lower-than-projected release of the United States Producer Price Index (PPI) and monthly Retail Sales data. The fight against stubborn inflation is demanding a cost from the economy in terms of weaker bargaining power in favor of producers and lower productivity due to rising interest rates by the Federal Reserve (Fed).

A sheer decline in the headline PPI (Dec) to 6.2% on an annual basis vs. the expectations of 6.8% and core PPI at 5.5% against the consensus of 5.9%, cleared that producers are forced to trim the prices of goods and services to maintain equilibrium due to declined retail demand. Apart from that, monthly Retail Sales data contracted by 1.1% while the street was expecting a contraction of -0.8%.

A decline in the US economic data cleared that inflation projections are expected to trim further, which supported the demand for US government bonds and a nosedive move in the 10-year US Treasury yields to 3.37%. The US Dollar Index (DXY) sensed a recovery after recording a fresh seven-month low at 101.20 to near 102.00 after hawkish commentary from St. Louis Fed's President James Bullard. Fed policymaker projected the interest rate peak in a 5.25-5.50% range despite a sheer fall in US PPI and Retail Sales data.

On the oil front, oil prices dropped firmly as weaker retail demand in the United States is going to trim oil demand. Producers will be forced to slash their production activities amid falling retail demand, which might impact oil demand heavily. This led to a plunge in the oil price to $79.40. It is worth noting that Canada is a leading oil exporter to the United States and lower oil prices may impact the Canadian Dollar.

Dallas Federal Reserve President Lorie Logan laid out a case for slowing the pace of the U.S. central bank's interest-rate hikes so as to better calibrate monetary policy to an uncertain economic outlook, but signaled rates could ultimately rise further than many now expect, reported Reuters on late Wednesday.

Key comments

If you’re on a road trip and you encounter foggy weather or a dangerous highway, it’s a good idea to slow down.

That’s why I supported the (Fed's) decision last month to reduce the pace of rate increases. And the same considerations suggest slowing the pace further at the upcoming meeting.

My own view is that we will likely need to continue gradually raising the Fed funds rate until we see convincing evidence that inflation is on track to return to our 2% target in a sustainable and timely way.

The most important risk I see is that if we tighten too little, the economy will remain overheated, and we will fail to keep inflation in check.

Need to be flexible, robust.

Not helpful at this time to lock in peak rate or precise rate path.

Some signs of slower labor market, but would need to see a lot more data to be convinced it is no longer overheated.

Tightening too much or too fast could weaken labor market more than necessary.

Confident we have room to continue reducing balance sheet 'for quite some time'.

Would be comfortable seeing temporary use of fed's standing repo facility.

Market reaction

Considering the usual inactivity during the early market hours on Thursday, the US Dollar remained unimpressive of these comments while keeping the late Wednesday’s rebound from the lowest levels since May 31, 2022.

- AUD/USD remains sidelined after positing the daily loss by reversing from five-month high.

- Sour sentiment, cautious mood ahead of Aussie data underpinned AUD/USD weakness.

- Hawkish Fedspeak, fears of US recession and mixed headlines on China gained major attention.

- Australian employment numbers for December will be crucial amid fears of east rate hikes.

AUD/USD stabilizes around the mid-0.6900s as traders await the key Australia jobs report for December, after taking a U-turn from the highest levels in nearly five months and posting the biggest daily loss in a fortnight the previous day.

The Aussie pair’s losses on Wednesday could be linked to the market’s fresh fears of recession, even if the Bank of Japan (BOJ) tried to please the bulls earlier in the day. Adding strength to the bearish move could be the mixed headlines surrounding China and the cautious mood ahead of Australia’s December employment data.

The risk-aversion could be linked to the hawkish Fedspeak and downbeat US data, as well as fears of the US-China tension.

That said, St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede. On the same line, President of the Federal Reserve Bank of Cleveland Loretta Mester praised the Fed’s actions to tame inflation and Kansas City Fed President Esther George mentioned that the central bank must restore price stability, "that means returning to 2% inflation."

Elsewhere, US Retail Sales marked the biggest slump in a year while posting 1.1% MoM contraction for December, versus -0.8% market forecasts and -1.0% prior (revised). On the same line, Producer Price Index dropped to the lowest levels in six months with -0.5% MoM figure compared to -0.1% expected and 0.2% prior (revised).

It should be noted that US Treasury Secretary Janet Yellen and Chinese China’s Vice Premier Liu He met in Germany on Wednesday and initially boosted the risk appetite, together with the BOJ’s inaction. However, the diplomats’ mentioning of the areas of disagreement raised market fears of another round of US-China tension. Previously, the South China Morning Post (SCMP) mentioned that Beijing ‘should be wary’ as the US and Taiwan seeks closer economic ties.

Amid these plays, Wall Street closed in the red and yields were down too while the US Dollar recovered after refreshing the lowest levels since late May.

Looking forward, AUD/USD traders will pay attention to Australia’s employment numbers for December amid talks of easing hawkish bias at the major central banks, including the Reserve Bank of Australia (RBA). Hence, a softer outcome may exert more downside pressure on the AUD/USD prices. Forecasts suggest the headline Employment Change to ease to 22.5K versus 64K prior while the Unemployment Rate is expected to remain unchanged at 3.4%.

Technical analysis

Wednesday’s U-turn from the highest levels since the mid-August 2022 portrays a rising wedge bearish chart patter on the daily formation, currently between 0.7020 and 0.6810.

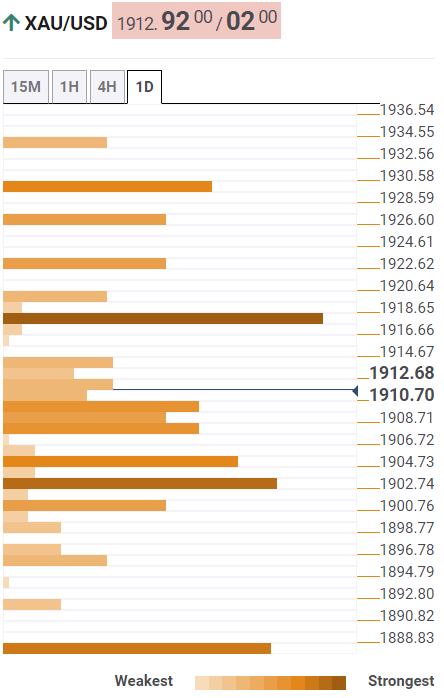

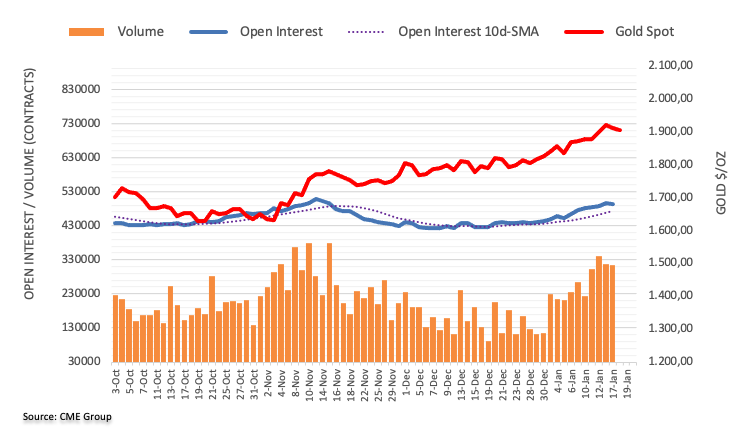

- Gold holds near $1,900 critical support as Fed hawks keep the greenback bid.

- The US dollar flipped bullish in the US session, leaving the outlook for Gold price bearish on a break below support.

Gold is holding near $1,900 towards the close for the day. XAU/USD travelled between a low of $1,896.67 and a high of $1,925.94 on the day but fell into the lows despite the US session as a weak US Dollar gained traction on hawkish comments from Federal Reserve speakers.

St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

However, investors expect the Federal Reserve to raise interest rates by just 25 basis points when its policy committee meets at month's end.

Fed official Loretta Mester also warned more hikes are needed and said,'' we're beginning to see the kind of actions that we need to see."

Her comments to the Associated Press fall in following today's slew of economic data, specifically the Producer Price Index and Retail Sales. These showed disinflationary tendencies in the data and reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

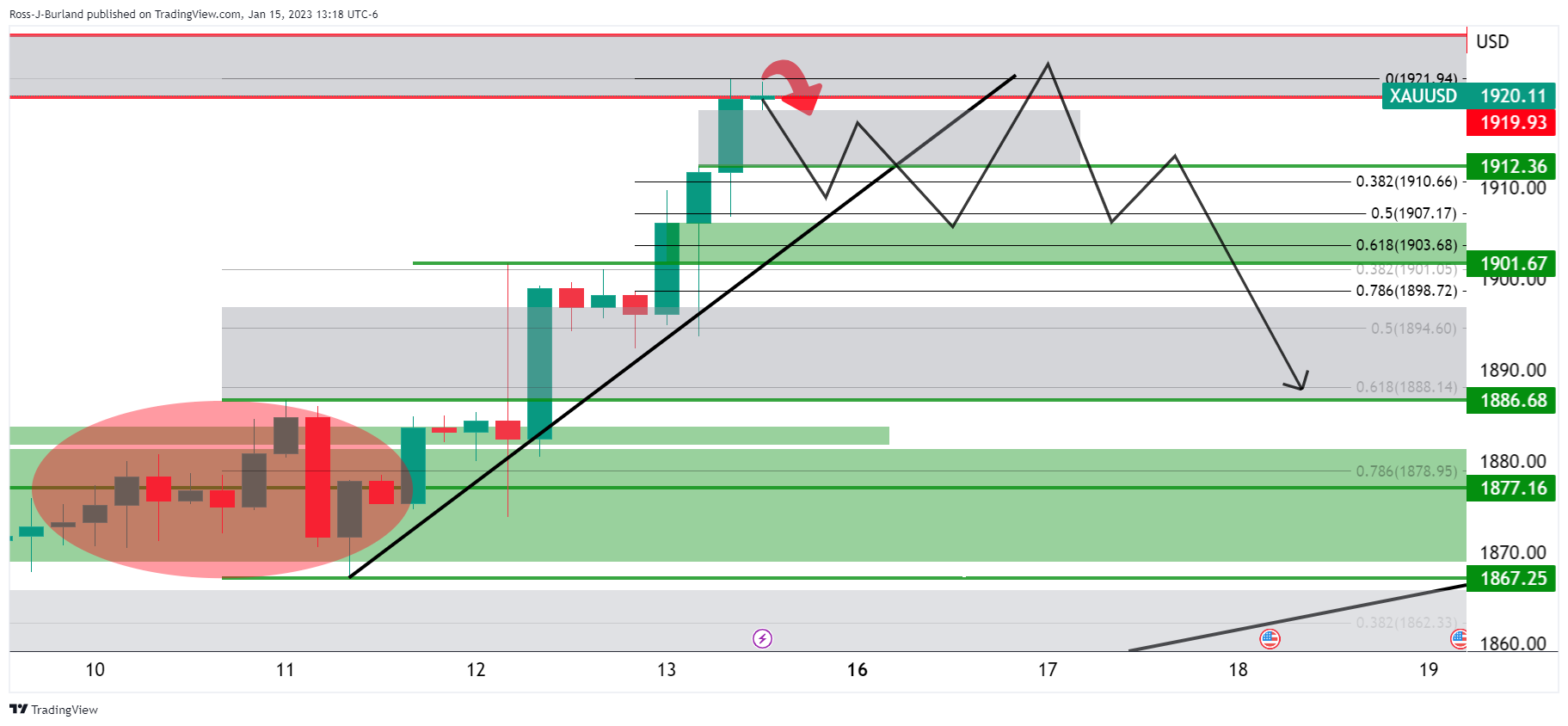

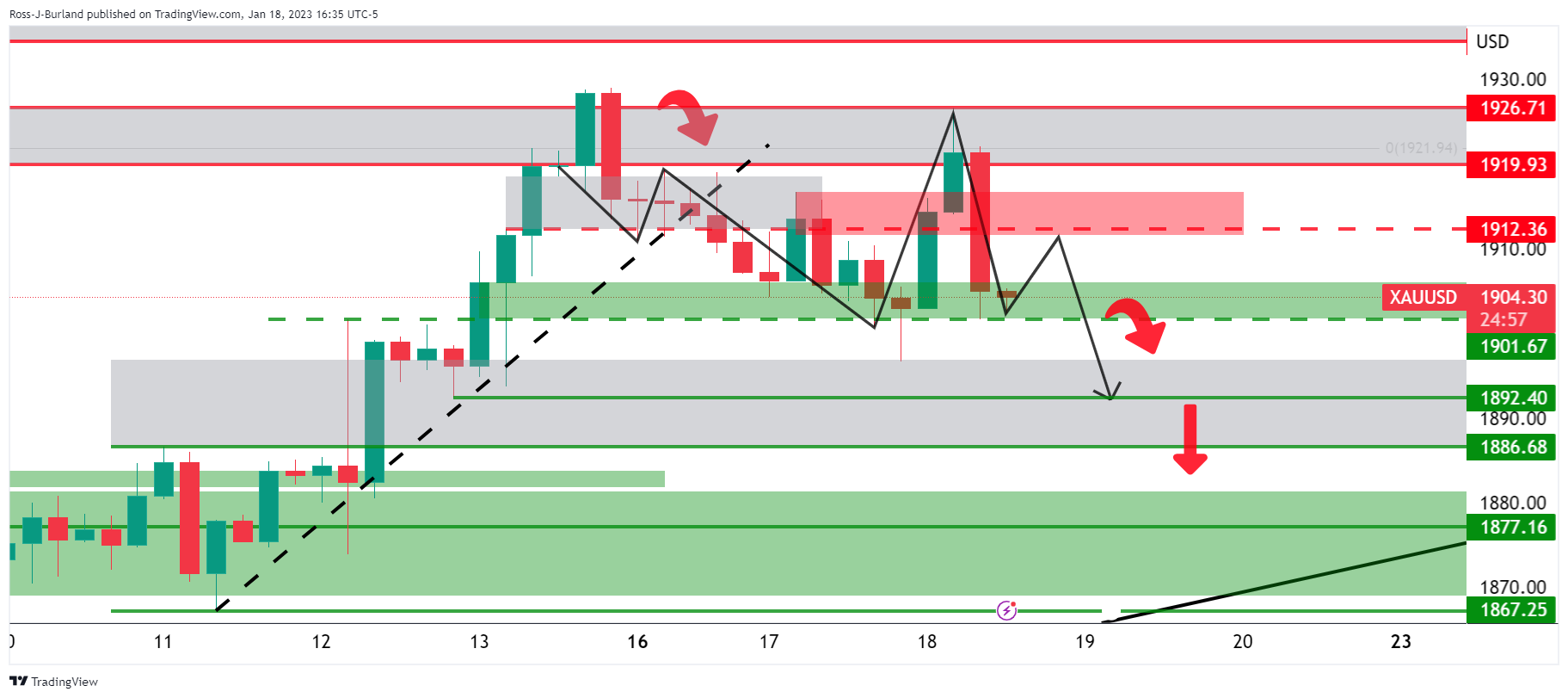

Gold technical analysis

In this week's pre-open Gold price analysis, Gold, Chart of the Week: XAU/USD meets $1,920 resistance area, eyes on 4-hour structures to the downside, it was explained that the Gold price bears need to get the market on the backside of the 4-hour trendline as follows:

The above Gold price schematic was illustrated as typical of such a breakdown and deceleration of the trend, in a) breaking the trendline, b) retesting the peak formation highs and c), eventually breaking the horizontal support structure.

Gold update

We have seen all of the criteria met for a move lower to $1,890 and then $1,880:

- US Retail Sales plummet while PPI cools down, effects of the Federal Reserve’s monetary policy.

- US Industrial Production stumbles for the second consecutive month.

- WTI Price Analysis: Daily close below the 50-day EMA could exacerbate a fall beneath $78.00.

The US crude oil Western Texas Intermediate collapsed from around daily highs reached during the North American session at $82.35 due to recession fears back in play following the release of soft US economic data. That, alongside hawkish Fed commentary, paired the greenback’s earlier losses, a headwind for oil prices. At the time of typing, WTI trades at $79.08 per barrel.

Wall Street’s finished Wednesday session with losses due to sentiment shifting sour on a gloomy economic outlook in the US. Inflation data at the factory gate, also known as the Producer Price Index (PPI) for December, plunged on its monthly reading, data that could encourage Fed officials to slow down the pace of rate hikes. Retail Sales for the same period shrank by some margin, while Industrial Production dropped.

“Coming on the back of the weakness in retail sales, the steep drop in industrial production and news of more job lay-offs adds to fears the US could already be in recession,” analysts at ING wrote in a note.

Another reason that put a lid on WTI’s rally was the comeback of the greenback. The US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, dropped to an 8-month low but bounced off and erased those losses, exchanging hands at 102.392, almost unchanged.

But what was the reason behind the US Dollar (USD) recovery? Two Fed officials, namely St. Louis Fed President James Bullard and Cleveland’s Loretta Mester, emphasized the need for the US Federal Reserve (Fed) to raise rates above the 5% threshold, with the former stating “as quickly as we can.”

In the meantime, China’s lifting of Covid-19 restrictions should boost oil demand, per the International Energy Agency (IEA)., though Russia’s oil embargo could dent supply.

WTI Technical Analysis

From a daily chart perspective, WTI’s could continue to press upwards, though Wednesday’s high clashed and failed to break above the 100-day Exponential Moving Average (EMA) at $82.87 PB, exacerbating its drop towards $79.00, slightly below the 50-day EMA at 79.17. The Relative Strength Index (RSI), although above the 50 midlines, is accelerating toward its central line, about to cross under, which would open the door to open fresh shorts. WTI key support lie at $79.00, followed by $78.00 and the e0-day EMA at $77.73.

WTI Key Technical Levels

Reuters reports that Philadelphia Federal Reserve President Patrick Harker reiterated on Wednesday that he's ready for the US central bank to move to a slower pace of interest rate rises amid some signs that hot inflation is cooling off.

"High inflation is a scourge, leading to economic inefficiencies and hurting Americans of limited means disproportionately," Harker said in prepared remarks for a speech that closely followed remarks from earlier in the month. To get inflation under control, the Fed's "goal is to slow the economy modestly and to bring demand more in line with supply," he told a group in Newark, Delaware.

More to come...

US Dopllar update

More to come...

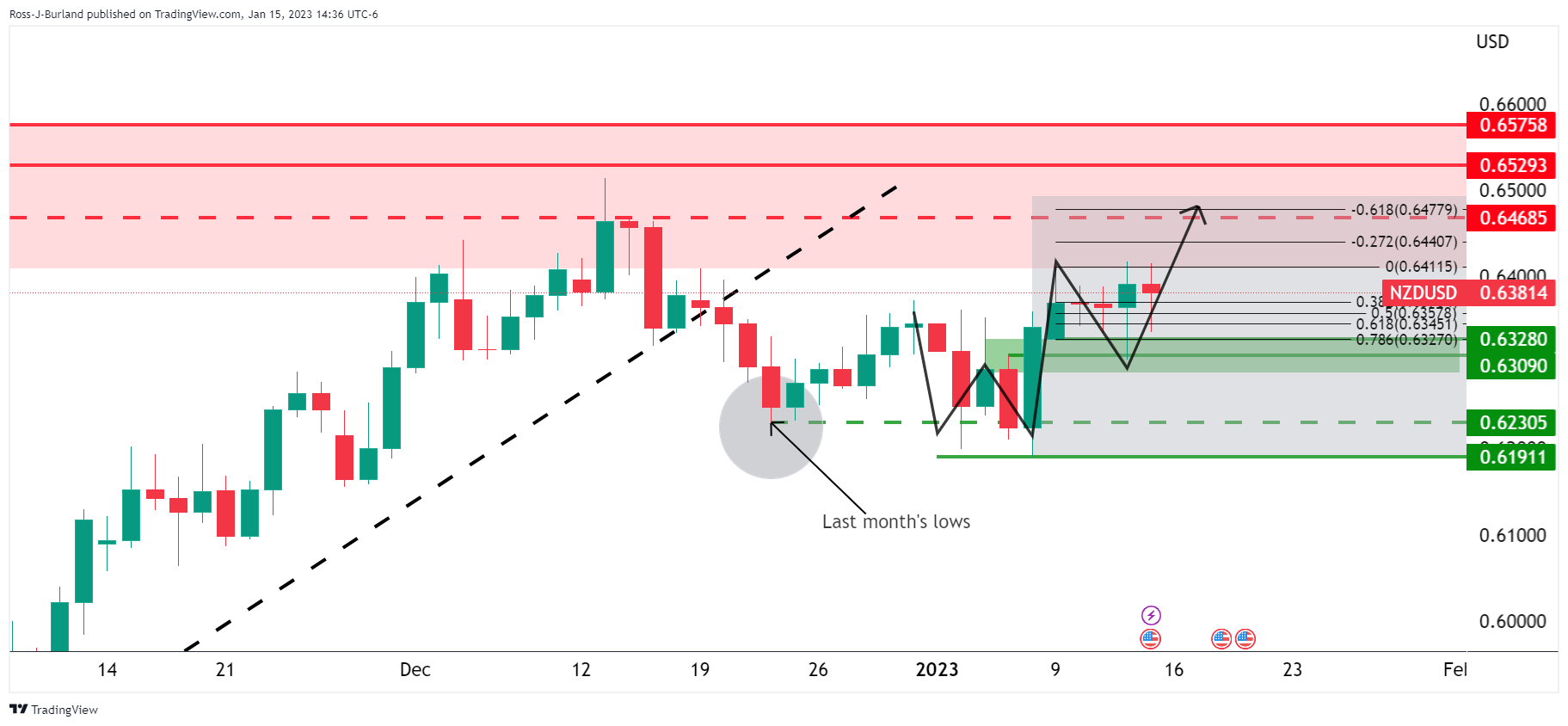

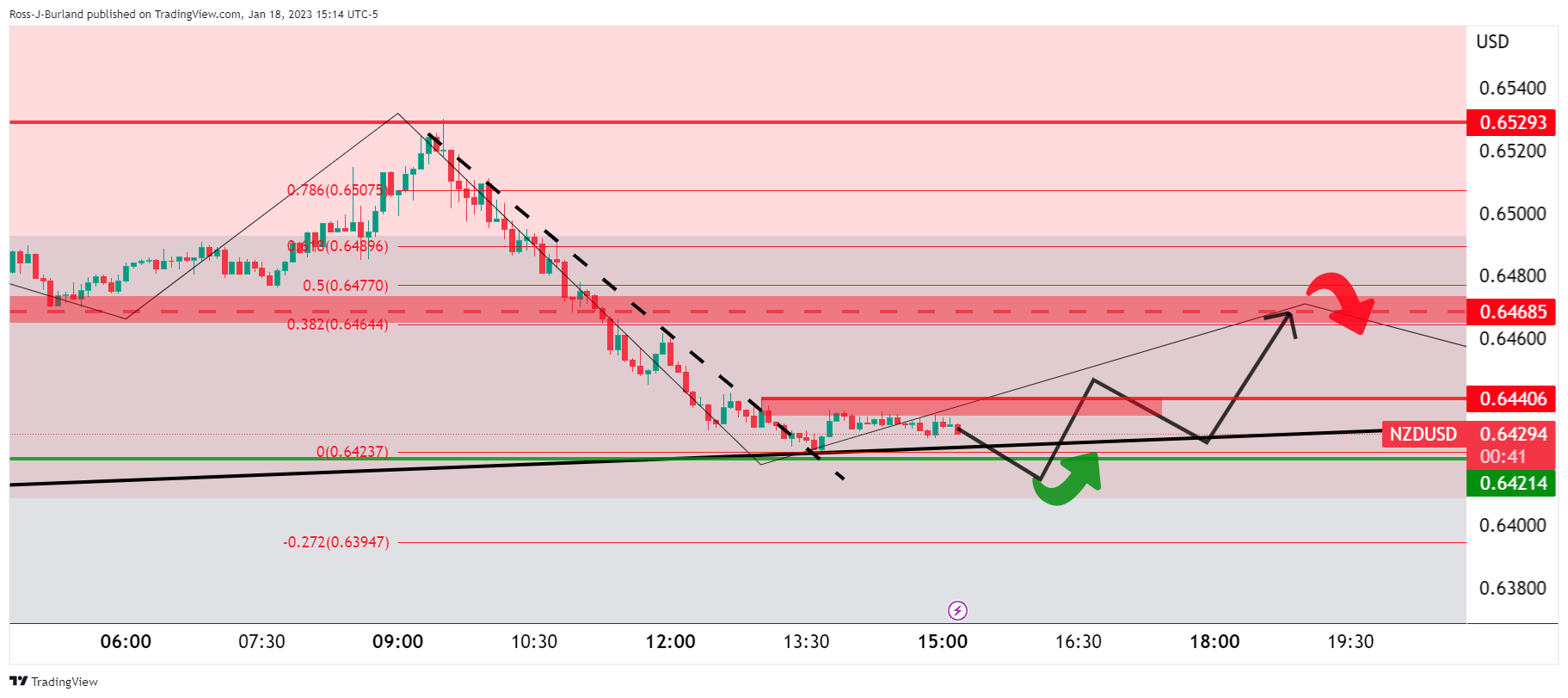

- NZD/USD backs off from fresh bull cycle highs on hawkish Fed speakers.

- However, bulls can eye a move towards a 38.2% Fibonacci retracement near the 0.6470s.

- However, key support structure is eyed for a significant sell-off with 0.6200 a target area.

NZD/USD has been testing the 0.6420s in recent trade and a break thereof opens the risk of a significant downside correction for the week's cycle. The pair was sold off from critical resistance near the day's highs of 0.6530 and a low of 0.6418 has been achieved so far as market sentiment flips bearish.

''Global financial market sentiment remains fickle – bond yields are falling everywhere as recession fears bite, but at the same time many think the prospect of fewer hikes or eventual easing is a positive thing,'' analysts at ANZ Bank said in a note at the start of the early Asian day. ''Expect volatility to remain elevated into local Consumer Price Index data next week and the Federal Reserve decision the following week,'' the analysts said.

''NZ food prices today will be watched closely; many economists will finalise their CPI picks once it’s in hand. As these estimates are published, the Kiwi may see yet more volatility.''

Meanwhile, the US dollar is gaining traction despite weaker data that portrayed disinflationary tones, fueling the belief that the Federal Reserve will continue to reduce its tightening pace in upcoming meetings. However, Fed speakers later poured cold water on that which helped the US Dollar to pare back losses from the weak data. For instance, St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

NZD/USD technical analysis

In prior analysis, it was shown that while being on the backside of the daily bullish impulse and trend, there were still prospects of a move into the trendline resistance, acting as the final push before a major bearish breakout:

The W-formation was highlighted as a bullish bottoming pattern and the fact that the price broke the monthly lows, we had breakout traders trapped.

The upside towards 0.6480 was a probable scenario for this week to meet prior highs:

NZD/USD update

The price shot higher and exceeded the 0.6480s target, meeting higher resistance and the start of last year's lows as follows:

The bulls need to break out of these highs or face the prospects of a significant correction for days ahead towards 0.6200:

NZD/USD H1 chart

However, while on the front side of the micro supporting trendline on the hourly time frame, as illustrated below, there are prospects of a revisit to retest the M-formations neckline as follows:

The bulls can eye a move towards the 38.2% Fibonacci retracement of the prior bearish impulse from trendline support to target the 0.6470s on lower time frames, such as the 15-minute and 5-minute charts. A break of 0.6440 structure will be key in this regard.

What you need to take care of on Thursday, January 19:

The US Dollar ended Wednesday with gains against most major rivals, reverting early losses that saw it trade at fresh multi-month lows against most major rivals. The Bank of Japan (BoJ) announced its monetary policy at the beginning of the day, triggering quite a volatile reaction. The central bank decided to maintain its benchmark rate at -0.10%, and the JGB yield target unchanged at 0.00%, with an upper limit of 0.50%. BoJ's Governor Haruhiko Kuroda then noted that they will maintain their ultra-loose monetary policy until achieving sustainable, stable inflation while adding that there was "no need to further expand bond target band."

Global yields plunged, initially weighing on the American Dollar, later reflecting risk aversion and rising alongside the Greenback. Softer-than-expected US data revived recession fears. The US Producer Price Index (PPI) increased at an annual pace of 6.2%, declining from 7.3% in November. On the other hand, December Retail Sales contracted by 1.1% MoM, while Industrial Production declined 0.7% in the same month, both missing the market expectations. On a positive note, MBA Mortgage Approvals for the week ended January 13 were up a whopping 27.9%, as interest rates dropped to their lowest point in months.

Wall Street started the day with modest gains but ended up collapsing, with the Dow Jones Industrial Average roughly 500 points down in the day.

The EUR/USD pair hit a multi-month high of 1.0886 but settled at around 1.0790. On the other hand, GBP/USD jumped to 1.2435 following the release of UK inflation figures. The Consumer Prices Index (CPI) rose at an annualized pace of 10.5% in December, below the 10.7% posted in November. The pair later retreated on demand for safety towards the 1.2330 price zone.

European Central Bank policymaker Francois Villeroy de Galhau said on Wednesday that it is "too early to speculate about what we will do in March." His words partially offset speculation the ECB would hike rates by 25 bps in March.

St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede. Also, Fed's Loretta Mester, president of the Federal Reserve Bank of Cleveland, welcomed actions to tame inflation, while Fed's Esther George said that the central bank must restore price stability, "that means returning to 2% inflation." Overall, Fed speakers maintained their hawkish stance and hinted at more rate hikes ahead.

The AUD/USD pair peaked at 0.7063 but settled in the red at 0.9640. The USD/CAD pair approaches the 1.3500 level. Finally, the USD/JPY pair soared to 131.57 but trimmed most of its intraday gains to end at around 128.80.

Gold changes hand at $1,903 a troy ounce, while the negative momentum of US equities weighed on oil prices. The barrel of WTI trades at $70.50.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD erases its earlier gains, despite registering a 9-month high around 1.0887.

- Big Tech companies slashing 28K jobs, and weaker US economic data, sparked recession fears.

- Fed officials support interest rate hikes until 5% or slightly above.

EUR/USD reversed its course after hitting a nine-month high around 1.0887 on Wednesday after US economic data could further cement the case for US Federal Reserve (Fed) officials to slow down the pace of tightening. Additionally, the US Dollar (USD) found a bid and erased all of its losses at the time of writing. The EUR/USD exchanges hands at 1.0793, still above its opening price.

US big tech companies cutting jobs, and soft US economic data, weighed on the EUR

Wall Street edged lower as crossing newswires announced that Microsoft and Amazon are set to slash 28K jobs. Therefore, investors’ moods dampened, as earlier US economic data showed signs of deterioration in the US economy. Data released showed that inflation continued to ease, with December’s US Producer Price Index (PPI) sliding to 6.2% YoY, below estimates of 6.8%, while the core PPI advances by 5.5% YoY, beneath 5.7% forecasts.

In the meantime, US Retail Sales plunged 1.1% MoM in December, below the downward revised November’s figures, which shrank by 1%. However, annually based were unchanged at 6%. Later, Industrial Production decreased by 0.7% MoM and 1.7% in Q4, as reported by the Federal Reserve.

Later, two Fed officials, namely St. Louis Fed President Bullard and Cleveland’s President Loretta Mester, said that the Federal Funds rate (FFR) needs to be at around 5%, at the minimum. Bullard commented that the central bank needs to get “as quickly as we can,” while Mester added that rates need to be above 5%, per her forecasts.

What to watch?

Thursday’s economic calendar in the Eurozone would feature the EU’s Current Account, ECB’s Monetary Policy Meeting Accounts, and ECB’s Lagarde speech. Across the pond, the US docker will reveal housing data, the Philadelphia Fed Index, Initial Jobless Claims, and Fed speak.

EUR/USD Key Technical Levels

The Federal Reserve's Beige Book shows that since the previous report, overall economic activity has remained relatively stable and overall, contacts expected little growth in the coming months.

Key notes

Selling prices increased at a modest or moderate pace in most districts, though many said that the pace of increases had slowed from that of recent reporting periods.

Employment continued to grow at a modest to moderate pace for most districts.

On balance, contacts generally expected little growth in the months ahead.

Wage pressures remained elevated across districts, though five reserve banks reported that these pressures had eased somewhat.

US Dollar update

Earlier in the day, the US Dollar was pressured following US economic reports, the Producer Price Index and Retail Sales, which showed disinflationary tendencies in the data, reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

It is also worth noting that today's US Atlanta Fed GDPNow Q4: 3.5% (prev 4.1%).

However, hawkish Federal Reserve speakers have seen markets come under pressure again, fuelling a bid back into the US Dollar:

The DXY index, above, shows the US Dollar meeting resistance in a W-formation on the hourly chart. A correction of the bid could be expected to meet the 102.00/20s in the coming sessions as the price reverts to the neckline of the pattern in a 38.2% Fibonacci correction.

About the Beige Book

The Beige Book reports on the current US economic situation. Interviews with key business contacts, economists, market experts, and other sources are gathered by each of the 12 Federal Reserve Districts. The survey gives a picture of the overall US economic growth. An optimistic view of those authorities is considered positive, or bullish for the USD, whereas a pessimistic view is considered negative, or bearish for the Dollar.

Federal Reserve's Esther George explained that the Fed must restore price stability, ‘that means returning to 2% inflation’.

She also said that markets may have a different view of what the Fed needs to do but the central bank's commitment is to 2%.

Her comments follow today's economic data, specifically the Producer Price Index and Retail Sales. The data showed disinflationary tendencies in the data and reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

US Dollar update

The Fed's Beige Book is coming up and Fed's Patrick Harker will also speak on the economy, both of which could be a catalyst for the greenback that has been whipsawed today in conflicting sentiment surrounding the Fed. The data spared a sell-off in the greenback but the moves in forex have been faded due to hawkish commentary from Fed officials.

- GBP/USD momentarily bid on United Kingdom's Consumer Price Index and weak United states economic data.

- The British Pound reached critical highs before a fade to test key technical dynamic support.

- Bank of England and Federal Reserve sentiment in the hot seat.

- GBP/USD's micro-trendline support guards structure around 1.2250 and then 1.2170.

The GBP/USD bulls got what they wished for from the United Kingdom's Consumer Price Index that showed while inflation fell to a three-month low of 10.5% in December, it remains near 40-year highs. Specifically, the increase in services inflation and accelerating food and drink prices are a cause for some concern for the Bank of England's policy-makers.

GBP/USD, as per analysis written earlier in the week, was propelled towards last month's six-month high of 1.2446, reaching a high of 1.2435 on the day so far from a low of 1.2253. However, a recent rally in the US Dollar and softer US stocks are fuelling a sell-off in the pound currently, dragging the price a buck lower to $1.2345.

Given a gloomy domestic economic outlook and recession fears due to high inflation and a cost-of-living crisis, this may ultimately weigh on the British Pound. Nevertheless, a hawkish Bank of England could inject some resilience into the pound.

GBP/USD buoyed by Bank of England expectations

The Bank of England's Governor Andrew Bailey suggested earlier this week that a shortage of workers in the labour market posed a “major risk to inflation coming down”. ''The implication is that the Bank could remain more hawkish on its policy decisions this year,'' analysts at Rabobank said. ''We expect another 50 bps rate hike in February and then three more 25 bps moves as the Bank struggles to slice the final few percentage points from services sector inflation, which will be most impacted by wage growth,'' the analysts at Rabobank argued.

Analysts at ING Bank, commenting on today's consumer Price Index concur and said "it's important to note that core services jumped from 6.4% to 6.8%, a development that the BoE should particularly take into consideration, and when added to yesterday’s wage data should tilt the balance towards a 50 bps hike in February." Of note, the BoE has hiked interest rates nine times since December 2021 to try to lower inflation. Money markets are currently placing an 82% chance of a 50 bps rate hike at the next meeting, set for Feb 2.

US Dollar bid in midday US session

The US Dollar was injected with a bout of demand following hawkish comments from Federal Reserve officials that sparked worries that the central bank may not be pausing interest rate hikes any time soon. GBP/USD dropped with St. Louis Federal Reserve's President James Bullard saying US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

GBP/USD technical analysis

As per the prior analysis, GBP/USD bulls move in on a critical area on the charts ahead of the key Consumer Price Index, where GBP/USD was headed towards 1.24s resistance, the area was achieved but a fade on the rally was anticipated:

GBP/USD update

On the hourly time frame, GBP/USD's micro-trendline support guards structure around 1.2250. A break there will open the risk of a blow-off in GBP/USD to test 1.2170 and then 1.2080 structure.

- After bad US data, AUD/USD reversed its course and dived below 0.7000.

- Federal Reserve officials pushed back against interest rates peaking below 5%.

- AUD/USD Price Analysis: FAilres at 0.7000, exacerbated the fall toward 0.6960s.

AUD/USD erases its earlier gains after hitting a multi-month high at 0.7063, plunges below 0.7000, and turning down in the day by 0.27%. Risk appetite deteriorated amidst the lack of catalyst, though US data showed the economy is decelerating, which could have been the reason for sentiment shifting sour. The AUD/USD is trading at 0.6961.

US economic indicators were worse than expected but bolstered the USD

Wall Street is registering losses between 0.77% and 1.21%. Retail Sales for December in the United States (US) were reported by the Commerce Department, with figures shrinking by 1.1% MoM, more than the 0.8% contraction estimated and worst than November’s downward revision to 1%. On an annual basis, sales were unchanged at 6%.

At the same time, the Department of Labor (DoL) revealed that the Producer Price Index (PPI) for December plunged to -0.5% MoM, smashing estimates of 0.1%. Year-over-year figures rose by 6.2%, beneath forecasts of 6.8%, while core PPI advanced 5.5%, vs. 5.7% estimates.

Aside from that, the Federal Reserve reported that Industrial Production in the US decreased -0.7% in December and -1.7% in Q4. Additionally, US manufacturing output fell -1.3% last month, albeit November’s data was downward revised -1.3%.

Elsewhere a slew of Federal Reserve officials, led by the St. Louis Fed President James Bullard, crossed wires. Bullard said policymakers should get “as quickly” as they can rate above 5%. Echoing some of his comments, Cleveland’s Fed President Loretta Mester said that rates need to rise “a little bit” above 5%, emphasizing that it would be needed according to her projections.

After those remarks, the AUD/USD reversed its course after trading above the 0.7000 mark. No catalyst spurred the market’s reaction, only hawkish comments by Fed officials, which had been repeated since the beginning of the year.

AUD/USD Price Analysis: Technical outlook

From a technical perspective, the AUD/USD daily chart is forming an inverted hammer, which, if it closes below Tuesday’s open of 0.697, would exacerbate a deeper pullback, with the 20-day Exponential Moving Average (EMA) at 0.6863 as the first support. AUD/USD price action achieved successive series of higher highs, while the Relative Strength Index (RSI) failed to crack its previous peak. So, a negative divergence between price action and the RSI could pave the way for further downside.

The AUD/USD key support levels would be the January 17 low of 0.6929, followed by the January 12 daily low of 0.6869, ahead of the abovementioned 20-day EMA at 0.6863.

Federal Reserve's Loretta Mester, president of the Federal Reserve Bank of Cleveland, crossed the wires in recent trade and said,'' we're beginning to see the kind of actions that we need to see."

Her comments to the Associated Press fall in following today's slew of economic data, specifically the Producer Price Index and Retail Sales. These showed disinflationary tendencies in the data and reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

"Good signs that things are moving in the right direction ... That's an important input into how we're thinking about where policy needs to go.

US Dollar update

It has been a volatile spell in the forex space with the US Dollar whipsawed on the day during the Bank of Japan deliberations and subsequent announcements combined around the weak US data.

We are seeing the bulls move into the greenback as follows:

The hourly W-formation is a reversion pattern and the resistance could prove to be a tough nut to crack for the rest of the day.

US Industrial Production in the US fell 0.7% in December and November’s numbers were revised lower. With industrial production having fallen in six of the past eight months, the largest of which being November and December, it is evident that the manufacturing sector is already in recession, said analysts at Wells Fargo.

Key quotes:

“This is not an encouraging report for industrial activity particularly for the manufacturing sector which comprises roughly three quarters of all output and where the decline in December was a larger 1.3%.”

“Manufacturers are not blind to the challenges they face. Slower demand for consumer goods, higher borrowing costs and fear of recession are all weighing on activity. In our own discussions with clients, many of them have been intrigued by the deviating dynamic between a slowing in U.S. industrial production and still elevated industrial backlogs and trying to figure out when those will converge.”

“While we suspect the slowdown in activity doesn't bode well for overall economic growth, the fact that manufacturers are more 'wise to the game' this cycle suggests they may be better positioned to weather an economic slowdown.”

- USD/MXN rebounds sharply from lowest level in almost three years.

- Strong support area above 18.50 and risk aversion triggers rebound.

The USD/MXN is rising on Wednesday after hitting at 18.55, the lowest level since February 2020. The rebound represents a correction after falling constantly since the beginning of the year.

The ongoing run is facing resistance at 18.75. A break higher would target 18.85. The next vital resistance stands at 19.00/05 that should limit the upside. Above then comes 19.20 that if broken should weaken the Mexican Peso.

A deterioration in market sentiment favored the correction in USD/MXN that would continue to receive support as stocks in Wall Street keep falling.

The Mexican peso needs to hold below 18.70 in order to keep the doors open to another test of the 18.55 area and the 2020 low at 18.50. A break lower would target 18.30

USD/MXN daily chart

-638096589618823355.png)

St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

US Dollar update

It has been a volatile spell in the forex space with the US Dollar whipsawed on the day after a slew of weak data suggested the world's largest economy is finally slowing down. Wednesday's economic reports, Producer Price Index and Retail Sales which showed disinflationary tendencies in the data, reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

The data followed a turbulent Bank of Japan event. At a two-day policy meeting, the BOJ kept intact its YCC targets and made no change to its guidance that allows the 10-year bond yield to move 50 basis points on either side of its 0% target. The yen was broadly weaker, supporting the US Dollar momentarily before the Yen walked back some of its losses amid speculation that the BOJ was likely to tighten policy soon.

DXY index:

We are getting a burst of life from the bulls in recent trade as follows:

The hourly W-formation is a reversion pattern and the resistance could prove to be a tough nut to crack for the rest of the day.

- USD/JPY trims some of its Asian session gains courtesy of the Bank of Japan’s decision.

- USD/JPY Price Analysis: Failure to conquer the 20-day EMA exacerbated a 200-plus pip fall beneath 128.50.

The USD/JPY clings to gains after hitting a daily high of 131.57 following the release of the Bank of Japan’s (BoJ) monetary policy decision, which sparked a 400 pip rally. However, throughout the North American session, the Japanese Yen (JPY) stages a comeback against its counterpart, the US Dollar (USD), and so far is down 0.24%. At the time of writing, the USD/JPY is trading at 128.56.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart portrays the major tested the confluence of the 20-day Exponential Moving Average (EMA) and the day’s high at 131.37 and failed to sustain the uptrend. Furthermore, on its way down, the USD/JPY retraced below a four-month downslope resistance trendline that passed around 130.30 ad extended its downtrend beneath 129.00 toward the current spot price.

However, oscillators like the Relative Strength Index (RSI although at bearish territory, its slope aims up, which could mean a reversal could happen. But the Rate of Change (Roc) suggests buyers are losing momentum as it retraces to the zero level.

The path of least resistance in the USD/JPY is downward biased, though if the USD/JPY prints a daily close above 128.46, that could open the door for further upside and might test the 129.00 mark. Otherwise, the USD/JPY first support would be 128.00. A breach of the latter will expose the May 24 swing low of 126.36, followed by the March 31 daily low of 121.27.

USD/JPY Key Technical Levels

Economist at Danske Bank point out the after the stronger-than-expected growth data for the fourth quarter data as well as indications that the Covid wave has peaked earlier, they lift their GDP forecast and PMI profile once again.

More frontloaded recovery

“We now look for an even more frontloaded recovery starting already in early Q1 rather than late Q1 as the service sector is already showing clear signs of rebounding and companies are likely to raise production in anticipation of better demand in the coming quarters. It follows a Q4 GDP release on Monday that came out flat at 0.0% q/q versus our expectations of -1.0% q/q.”

“The frontloading lifts our GDP forecast for 2023 to 5.5% from 4.6% as 1) the stronger-than-expected Q4 lifts the carry over into 2023 and 2) an increase in the Q1 forecast lifts the starting point for 2023 further. However, a more front loaded recovery leaves room for less growth in 2024 as the effect from pent-up demand fades earlier.”

Data released on Wednesday in the US showed Retail Sales dropped more than expected in December by falling 1.1%. Analysts at Wells Fargo point out that ten of 13 retailers saw sales fall in December while back-to-back declines in control group sales suggest a weak end to the year for goods spending. They see more weakness ahead as excess savings and recent real income gains fade.

Rough Finish to 2022 Sets the Stage for Spending Slowdown in 2023

“December was another ugly month for retail sales. Not only did sales decline 1.1% in the month, which was more than expected, but revisions to prior data left overall sales even lower. Excluding autos and gas stations, sales still fell 0.7% in December with ten of 13 categories posting declines.”

“Consumer goods prices slipped 1.1% in December, marking the fifth decline in six straight months, and so we estimate real retail sales were flat in the month. But slowing inflation wasn't enough to offset slowing demand. In short, even the "bright spots" in this report were rather grim.”

“We still broadly expect a gradual spending slowdown, and on goods specifically, is underway as tighter financial conditions, a slowing labor market and low-confidence weigh on spending this year.”

- Swiss Franc rises sharply versus Dollar and Euro.

- Expectations about a less hawkish ECB support the Swiss Franc.

- USD/CHF falls for the fifth consecutive day on Wednesday.

The USD/CHF is falling by almost a hundred pips on Wednesday after trimming some losses during the last hour. The pair bottomed at 0.9084, the lowest level since November 2021 and then rebounded rising back above 0.9100.

The decline in European and US government bond yields weakened the US Dollar and favored the Swiss Franc. The Switzerland 10-year bond yield dropped to 1.05%, the lowest since early December and the US 10-year yield fell to 3.38%, lowest since September.

The demand for European bond strengthened after data showed a slowdown in inflation and some “not so bad” activity figures; and particularly following a media report on Tuesday that mentioned European Central Bank policymakers are starting to consider a slower pace of interest rate hikes after the February meeting.

Expectations of a less hawkish ECB sent the Euro to the downside, and it continues to be a drag. EUR/CHF has fallen sharply, reversing sharply from six-month highs near 1.0100 to levels under 0.9900.

Economic data released on Wednesday weighed further on USD/CHF. Inflation numbers came in below expectations, while Retail Sales and Industrial Production dropped more than market consensus.

USD/CHF breaks 0.9200

The USD/CHF is consolidating below 0.9200, reinforcing the bearish bias. On the flip side, the next critical support is the 0.9100 area. A daily close below would open the doors to more losses. A recovery back above 0.9220 would alleviate the negative tone.

Technical levels

The Yen did not take long to reverse its post-BoJ meeting weakness, as the Dollar fell again. Kit Juckes, Chief Global FX Strategist at Société Générale, thinks that delaying the end of YCC will not stop the Yen’s bounce.

Delaying the end of YCC will not stop the Yen

“The sheer scale of the Yen’s decline in the last three years means that once the tide has turned, there is lot of scope for it to strengthen.”

“There’s plenty of room left for the Yen to bounce, even if the market must wait a while longer before yield curve control (YCC) is adjusted and then abandoned.”

“The Dollar reached its highest level in real terms since 1985 last September, and if the Yen has fallen far enough to have lot of potential upside, the USD has reached high enough heights to be able to fall a long way before it will appear absurdly cheap.”

The US Dollar strengthened strongly against G10 currencies during 2022, before paring back some gains during the winter. Looking ahead, economists at Nordea see a weaker USD and forecast EUR/USD at 1.15 by the end of the year.

Weaker USD ahead

“We believe global factors are in favour of a weaker USD against the EUR and see EUR/USD at 1.15 by year-end of this year. However, the tensions in markets will likely continue.”

“An economic recession and stock market taking a leg lower (earnings recession) is a risk to our USD view, but we are in the cautiously optimistic camp. Moreover, it is quite difficult to pinpoint exactly if and when stock markets will fall.”

- US Retail Sales plummeted, while PPI flashed that inflation continues to ease.

- Industrial Production in the United States shranks for two consecutive months.

- Gold Price Analysis: A daily close above $1900 is needed to exacerbate a rally to $2000.

Gold price snaps two days of straight losses, gaining traction on Wednesday, as the US Dollar (USD) slides to eight-month lows, as shown by the US Dollar Index (DXY). Data released in the United States (US) showed an improvement in inflation, while retail sales slowed a tick, further cementing the case for the US Federal Reserve (Fed) to slow down its tightening policy. At the time of writing, XAU/USD exchanges hand at $1914.91.

Retail Sales in the United States plunged

Wall Street opened in the green, bolstered by US data. The US Commerce Department reported that December Retail Sales plunged -1.1% MoM, below estimates of a -0.8% contraction, tumbling for two consecutive months. November figures were downward revised to -1.0% from -0.6%. Retail Sales on an annual basis rose 6%, unchanged from November’s data.

US inflation at the gate, also known as PPI, eases

Inflation-wise, the US Producer Price Index (PPI) for December slides from -0.1% to -0.5% MoM data that could encourage the Federal Reserve to raise rates significantly higher. Excluding volatile items like food and energy, the so-called core PPI rose by 0.1% MoM, unchanged when compared to consensus and lower than November’s 0.2%. Annually based figures showed an increase of 6.2% in PPI, below estimates of 6.8%, while core PPI rose by 5.5%, beneath the 5.7% expected.

Industrial Production in the US contracts for two straight months

Aside from that, the Federal Reserve reported that Industrial Production in the US decreased -0.7% in December and -1.7% in Q4. Additionally, US manufacturing output fell -1.3% last month, albeit November’s data was downward revised -1.3%.

Fed’s Bullard insists on increasing rates above 5%

Elsewhere Fed officials began crossing newswires, led by the St. Louis Fed President James Bullard. He said the Fed should get rates above 5% “as quickly as we can” before pausing rate hikes as the US central bank tries to curb sticky inflation. Bullard added that inflation “will probably recede in 2023 but not as fast as financial markets expect.”

In the meantime, the US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, tumbled to eight-month lows around 101.528 but lately has recovered some ground and exchanged hands around 101.871. Another reason that keeps the XAU/USD underpinned is falling US Treasury bond yields, with the 10-year benchmark note rate plunging below 3.40%, at 3.390%, as it slides 16 bps.

Gold Price Analysis: Technical outlook

Technically speaking, the XAU/USD extended its gains, though retraced somewhat from its daily highs of $1925.88, probably influenced by a mild recovery of the greenback and the Relative Strength Index (RSI) entering overbought conditions. The Rate of Change (RoC) suggests that buying pressure begins to wane. If XAU/USD misses printing a daily close above $1900, that will exacerbate a resume of a downtrend toward the 20-day Exponential Moving Average at $1862.60. Otherwise, and the path of least resistance, the XAU/USD might test the YTD high at $1928.95, followed by the April 21 high of $1957.72, ahead of the $2000 mark.

USD/CAD remains in a bullish trend, but recent price action has been soft. Economists at Rabobank expect the pair to head gradually higher over the coming months towards 1.37.

More downward pressure in the short term

“The technical picture points to more downward pressure in the short term, but we expect strong support at 1.3230 and are of the view that the 1.32 handle will hold.”

“As we move into the middle of the year, we see room for USD strength to re-emerge as the market prices out potential Fed rate cuts. Although we expect a true consumer-driven recession south of the border, inflation will remain well above target, and unemployment is likely to rise slower than is usually seen heading at that stage of the cycle.”

“Our expectation of a USD retracement means we see USD/CAD trading around the 1.37 level towards the end of 2023. However, we expect price action to be a rocky ride and see room for USD/CAD implied to head higher.”

- US Dollar weakens across the board after US data.

- Loonie among wakens currencies following Canadian inflation numbers.

- USD/CAD slightly below 1.3400, without clear direction.

The USD/CAD is moving toward 1.3400 as the US Dollar trims some of its recent losses that followed the releases of US economic data. The pair held around daily highs despite the slide of the greenback supported by Canadian data.

Loonie weakens after Canadian data

Inflation numbers from Canada came in below expectations on Wednesday. The Industrial Product Price Index (IPPI) declined 1.1% month over month, lower than the slide of 0.3% of market consensus. Compared to a year ago it was up 7.6%. The Raw Materials Price Index (RMPI) fell 3.1% in December against expectations of a 1.3% slide.

“These decreases were partially influenced by lower prices for crude oil, which fell partially on macroeconomic concerns as well as global production slightly in excess of demand. Diesel prices remained relatively higher than gasoline prices, partially due to the effects of the Russian invasion of Ukraine. Russia was a major supplier of diesel to Europe, which increased its imports from other sources”, said Statistics Canada in its report.

The Loonie weakened after the numbers. The USD/CAD held around 1.3375 after the numbers even amid a slide of the US Dollar following US data. In the US, the Producer Price Index declined 0.5% in December, versus market consensus of a 0.1% slide; and the annual rate dropped to 6.2%, the lowest since March 2021. A different report showed Retail Sales fell 1.1% in December, more than the 0.8% decline expected. Industrial Production contracted by 0.7% in December.

US bond yields tumbled after the numbers, hitting fresh multi-day lows across the curve. The DXY fell below 101.80, to the lowest level since May.

Despite the weaker dollar, USD/CAD is hovering near 1.3400, moving without a clear direction. On the upside, the pair faces initial resistance at 1.3410 and then 1.3445/50. A consolidation above 1.3450 should open the doors to more gains. On the flip side, support is located at 1.3365 followed by 1.3350 (daily low).

On a wider perspective, risks are tilted to the downside in USD/CAD. Losses seem limited as long as it holds above 1.3350 on a closing basis.

Technical levels

Economists at Credit Suisse are now neutral on EUR/CHF, following the pair’s breach of 1.0050 last week.

SNB policymakers are due to speak

“In our last update on EUR/CHF, we aimed for 0.9500 by the end-Q1. The pair briefly traded through the 1.0050 level, where we said our view would be invalidated. This leaves us neutral on EUR/CHF for now. Still, our bias would be for a stronger Franc versus the Euro, but we suggest waiting for more clarity regarding the SNB’s future monetary policy stance.”

“SNB President Thomas Jordan and Governing Board member Martin Schlegel are due to speak on January 20 and 19, respectively. If they insist on a continued restrictive monetary policy stance, it should stop the recent trend of wider interest rate differentials and could even reverse it, with EUR/CHF lower as a result. Should the outcome be neutral, we expect EUR/CHF to trade in a 1.0200-0.9800 trading range.”

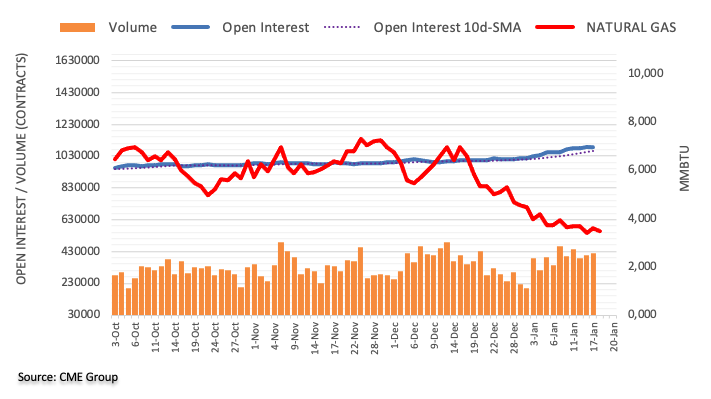

Economists at Danske Bank pencil in 2023 to be a good year for the Norwegian Krone. They forecast EUR/NOK at 10.40 and 10.10 in three and twelve months, respectively.

EUR/NOK at 10.40 in 3M and 10.10 in 12M

“If we are right in our base case that the global recession does not prove too severe or deep and/or energy will prove a top-performing equity sector in the coming years, this leaves a much improved backdrop for NOK in 2023.”

“We forecast EUR/NOK at 10.40 in 3M and 10.10 in 12M.”

“A severe global recession and a sharp sell-off in risk could send EUR/NOK substantially above our projection. On the other hand, a persistent move higher in oil and natural gas prices combined with an improved growth outlook could send EUR/NOK even lower than what we project.”

- EUR/USD advances markedly and prints new tops near 1.0890.

- The dollar sinks to new multi-month lows near 101.50.

- US Retail Sales, Producer Prices disappointed expectations.

EUR/USD gathers extra steam and advances to fresh YTD highs near 1.0890 on Wednesday.

EUR/USD stronger on USD sharp selling

The bullish sentiment continues to grow around the risk complex on the back of the pronounced sell-off in the dollar, which reached new 8-month lows near 101.50 when tracked by the USD Index (DXY).

Against that backdrop, EUR/USD reversed the recent 3-day weakness and climbed to the boundaries of the 1.0890 level, recording at the same time new highs in an area last visited in late April 2022.

Collaborating with the better tone in the single currency emerges comments from ECB’s Board member O.Rehn, who suggested that significant rate raises appear justified in the short term to keep inflation expectations contained.

In the domestic calendar, results for the month of December in the euro bloc saw New Car Registrations expand 12.8% YoY, while the final CPI rose 9.2% YoY and 5.2% YoY when it comes to the Core CPI.

In the US, Retail Sales contracted 1.1% MoM in December and Producer Prices dropped at a monthly 0.5% in the same period. In addition, MBA Mortgage Applications rose 27.9% in the week to January 13 and Industrial Production contracted 0.7% in December vs. the previous month.

Later in the session comes the NAHB Index, Business Inventories, TIC Flows and the Fed’s Beige Book.

Furthermore, FOMC’s Bostic, Bullard, Harker and Logan are also due to speak.

What to look for around EUR

EUR/USD gathered renewed steam and now trades closer to the key round level at 1.0900, always in response to the persevering selling bias surrounding the dollar.

Price action around the European currency should continue to closely follow dollar dynamics, as well as the impact of the energy crisis on the euro bloc and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: EMU New Car Registrations / Final Inflation Rate (Wednesday) – ECB Lagarde, ECB Accounts (Thursday) - ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst diminishing probability of a recession in the region. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.68% at 1.0860 and faces the next up barrier at 1.0887 (monthly high January 18) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022). On the flip side, the breakdown of 1.0776 (weekly low January 17) would target 1.0481 (monthly low January 6) en route to 1.0443 (weekly low December 7).

Mexican Peso (MXN) was one of the best-performing currencies in 2022. MXN is likely to stay firm in the near term but economists at Rabobank expect USD/MXN to hit 20.50 later in the year.

Support at 18.50 likely to hold

“We disagree with the view that the Fed will cut rates this year, but in the short term, the market is unlikely to change its outlook. This is currently providing support for risk assets across the board. As a result, we see MXN as likely to remain firm on a 1-3 month view, with the pair likely to stay below 19.80. That said, we see support at 18.50 as likely to hold.”

“As we move into the middle of the year and the peak for Fed funds has been reached, we expect the Fed to continue extolling the view that it won’t cut rates this year.”

“We expect a true consumer-driven US recession this year, but this recession is likely to be accompanied by a more robust labor market than in previous cycles. To our mind, that creates a scenario where the Fed holds through the recession. Risk assets are likely to take a hit when this becomes clear to the market.”

“MXN will be somewhat insulated given we expect a terminal rate of 10.75% in Mexico (a final 25 bps hike on February 9), but a move towards 20.50 is highly likely.”

After spiking towards a peak around 131.50 from near 128.50 right after the BoJ decision, USD/JPY quickly retraced all the way back below 129.00. Economists at Credit Suisse still believe that the pair could slump to 120.00.

BoJ stood its ground this time

“The decision to leave YCC intact, and also to leave current 10y JGB targets and trading bands unchanged, was a disappointment to many in the market. But JPY price action since the meeting is in line with our inclination to anticipate another wave of speculation that YCC will end at the March meeting.”

“Our USD/JPY view in our Q1 Outlook was to sell rallies, with an initial target at 125.00 and a possible extension as far as 120.00 in high-vol environments. We see no reason to change this, despite the fact that the BoJ stood its ground this time.”

The GBP is looking quite robust on the session. Economists at Scotiabank expect the GBP/USD to retest the mid-December high at 1.2445/50.

GBP is developing a strong uptrend

“The GBP is developing a strong uptrend on the short-term charts and has been looking in relatively good form technically, at least, since its rebound from sub-1.19 levels in the first week of Jan.”

“Trend momentum is bullish on the intraday chart and new, short-term cycle highs above 1.23 target a retest of the mid-Dec peak at 1.2445/50 at least.”

- USD/JPY retreats over 350 pips from the daily low amid aggressive intraday USD selling.

- The USD adds to its losses following the release of weaker-than-expected US macro data.

- A positive risk tone might undermine the safe-haven JPY and help limit losses for the pair.

The USD/JPY pair surrenders its intraday gains that followed the Bank of Japan policy decision and retreats to the lower end of its daily range during the early North American session. The pair is currently placed around the 128.00 mark and has now moved well within the striking distance of its lowest level since May 2022 touched earlier this week.

As investors digest the BoJ's dovish stance, the emergence of aggressive US Dollar selling turns out to be a key factor leading to the USD/JPY pair's sharp intraday fall of over 350 pips. The USD adds to its heavy losses and drops to a seven-month low following the release of softer-than-expected US macro data, which boosted bets for smaller rate hikes by the Federal Reserve.