- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- US Dollar Index remains pressured after declining the most in a week.

- Mostly dull US data renews recession fears, hawkish Fed talks fail to lift the DXY.

- Light calendar, pre-FOMC blackout highlights risk catalysts as the key for fresh impulse.

US Dollar Index (DXY) holds lower ground near 102.00, bracing for the second weekly loss on early Friday amid fears of the US recession. In doing so, the greenback’s gauge versus the six major currencies ignores hawkish comments from the Federal Reserve (Fed) officials.

That said, the US Unemployment Claims dropped to the lowest levels since late April 2022, to 190K for the week ended on January 13 versus 214K expected and 205K prior. Further, the Philadelphia Fed Manufacturing Survey Index improved to -8.9 for January compared to -11.0 market forecasts and -13.7 previous readings. However, US Building Permits eased in December to 1.33M MoM versus 1.37M consensus and 1.351M prior while the Housing Starts also dropped to 1.382M during the stated month from 1.401M in November, versus 1.359M expected. It’s worth noting that the downbeat US Retail Sales and Producer Price Index (PPI) raised fears of an economic slowdown in the world’s largest economy after the softer wage growth and activity data flashed earlier.

It should be noted that Federal Reserve Bank of New York President John Williams said on Thursday that the US central bank has more rate hikes ahead and sees signs inflationary pressures might be starting to cool off from torrid levels. Additionally, Federal Reserve Vice Chair Lael Brainard said that it will take time and resolve to get high inflation down to the fed's 2% target. The policymaker also added, “The policy will need to be sufficiently restrictive for some time.” On the same line, Boston Fed President Collins signaled that the baseline remains that the effective fed funds rate should settle slightly above 5.0%, implying three more 25bp rate rises.

Amid these plays, Wall Street closed with losses for the second consecutive day and the US 10-year Treasury yields also improved. However, receding fears of the Fed’s hawkish move and softer data weigh on the DXY of late.

Moving on, a light calendar emphasizes today’s Fedspeak as the key catalyst due to the pre-Fed blackout starting this Saturday. Should the policymakers keep their hawkish bias, the DXY may lick its wounds. However, the US Dollar rebound needs a solid base to reverse the losses made during 2023.

Technical analysis

Although a four-month-old descending support line puts a floor under the DXY around 101.70, recovery remains elusive unless the quote crosses the previous monthly low surrounding 103.60. That said, oversold RSI conditions hint at limited downside room.

- AUD/JPY is marching towards 89.00 after a recovery move ahead of PBoC’s policy announcement.

- A dovish monetary policy is expected from the PBoC considering China’s reopening reforms.

- The Japanese Yen has managed to recover its BoJ’s unchanged policy-inspired losses.

The AUD/JPY pair is inching higher towards 89.00 in early Tokyo after rebounding from 88.12 on Thursday. Earlier, the risk barometer witnessed an intense sell-off after the release of the downbeat Australian Employment report for December.

The Australian Bureau of Statistics reported that the Australian labor market has witnessed a lay-off of 14.6K employees while the street was expecting an addition of fresh 22.5k jobs. Also, the Unemployment Rate has climbed to 3.5% vs. the expectation and the prior release of 3.4%.

Firms have been forced to rely on retrenchment of a lay-off of employees amid weak growth projections. Higher interest rates by the Reserve Bank of Australia (RBA) are impacting heavily on the e economic activities. However, RBA Governor Philip Lowe could be delighted with an increment in the Unemployment Rate as it will open room for a downside in the Consumer Price Index (CPI), which has been stubborn due to robust consumer spending.

For further action, investors will focus on the interest rate decision by the People’s Bank of China (PBoC). Odds are favoring a dovish monetary policy as reopening reforms are needed to be supported by higher liquidity to spurt the scale of economic activities. Also, the PBoC policymakers are required to support the Chinese vulnerable real estate market. Investors should be aware of the fact that Australia is a leading trading partner of China and a PBoC’s easy monetary policy will provide strength to the Australian Dollar.

On the Tokyo front, after the maintenance of status-quo by Bank of Japan (BoJ) Governor Haruhiko Kuroda, investors are shifting their focus to further development for gauging a successor for BOJ’s Kuroda. The Japanese Yen has managed to recover their losses, which were recorded after the BoJ kept interest rates and bond yields target unchanged. This indicates that investors are still betting on an exit from an expansionary monetary policy by the BoJ ahead.

Reuters reported that Federal Reserve Bank of New York President John Williams said on Thursday the US central bank has more rate hikes ahead and sees signs inflationary pressures might be starting to cool off from torrid levels.

“With inflation still high and indications of continued supply-demand imbalances, it is clear that monetary policy still has more work to do to bring inflation down to our 2% goal on a sustained basis,” Williams said in the text of a speech to be delivered before the Fixed Income Analysts Society in New York.

“Bringing inflation down is likely to require a period of below-trend growth and some softening of labour market conditions,” Williams warned.

Key comments and notes

US inflation is still too high, the Fed has more work to do on rate rises.

Lowering inflation will need a period of slower growth, a softer job market.

Fed must stay the course until inflation is brought back to 2%.

Balance sheet reduction is going well.

Williams sees signs inflation pressures starting to moderate.

Williams expects inflation to cool to 3% this year.

Williams expects US growth of 1% this year.

He expects US Unemployment to rise to 4.5% this year.

He said it is very important for the public to understand Fed's desire to lower inflation.

He explained market pricing is roughly consistent with Fed's rate outlook.

Made sense for the Fed to slow rate rises in December.

Won't prejudge the size of a rate rise at the upcoming FOMC meetings.

Fed still has a ways to go on rate rises.

The hike cycle stopping point is dependent on data.

The jobs market is more resilient than expected.

More to come...

US Dollar update

The price of the DXY index moved into the W-formation's neckline and has since stalled in the support. The new M-formation is the next compelling phenomenon on the charts that may serve to pull the price higher. If the neckline breaks, then 102.20 will be important.

US inflation expectations as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data justify the recent hawkish commentary from Federal Reserve (Fed) Officials and keeps the US Dollar buyers hopeful, despite its latest weakness.

That said, the US Dollar Index (DXY) dropped the most in a week while snapping the three-day recovery the previous day amid mixed data.

It’s worth noting that the latest prints of the 5-year and 10-year inflation expectations portray a rebound from the multi-month low to 2.21% and 2.20% respectively. That said, the 5-year precursor of the inflation dropped to the lowest levels in two years while the 10-year counterpart refreshed a 23-month low on Wednesday.

On Thursday, Federal Reserve Vice Chair Lael Brainard said that it will take time and resolve to get high inflation down to the fed's 2% target. The policymaker also added, “The policy will need to be sufficiently restrictive for some time.” On the same line, Boston Fed President Collins signaled that the baseline remains that the effective fed funds rate should settle slightly above 5.0%, implying three more 25bp rate rises.

Given the recently upbeat US inflation expectations and the hawkish Fedspeak, the riskier assets may witness further hardships.

Also read: Forex Today: The focus remains on sentiment

- EUR/JPY is range-bound around 139.00 awaiting the release of Japanese CPI.

- EUR/JPY Price Analysis: Bullish above 140.00; otherwise, exposed to selling pressure.

The EUR/JPY finished Thursday’s session flat and remained trading sideways ahead of December’s release of the Japanese Consumer Price Index (CPI). As the Asian session begins, the EUR/JPY is trading at 139.06, almost flat.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart portrays the pair as neutral-downward biased, as it remains below the daily Exponential Moving Averages (EMAs). Also, the 20-day EMA at 140.29 is about to cross below the 200-day EMA at 140.14, which would resume the downtrend in the near term. Solid support is found around the last week’s low of 138.01, tested on Thursday, though the EUR/JPY quickly rebounded towards the 139.00 figure.

Oscillators-wise, the Relative Strength Index (RSI) in the bearish territory is flat, while the Rate of Change (RoC), portrays buyers losing momentum. Therefore, the EUR/JPY remains sideways, awaiting a possible breakout.

The EUR/JPY first support would be 138.00. A breach of the latter would send the pair aiming towards 137.38, the YTD low, followed by the September 26 pivot low at 137.36. on the upside, the EUR/JPY first resistance would be the 200-day EMA at 140.14, which, once cleared, could expose additional resistance levels. The 20-day EMA at 140.30 would be put in play, followed by the 141.00 figure.

EUR/JPY Key Technical Levels

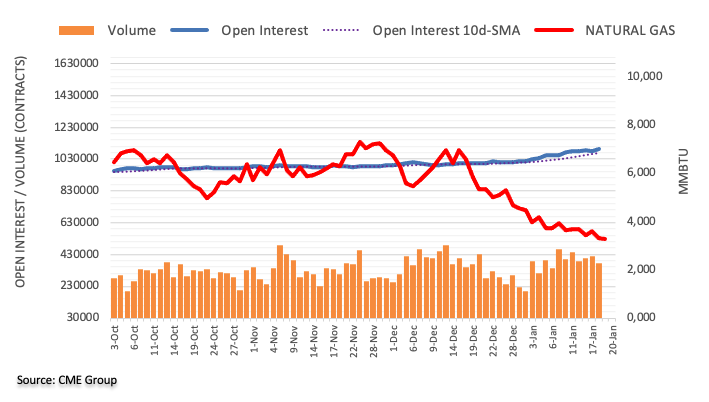

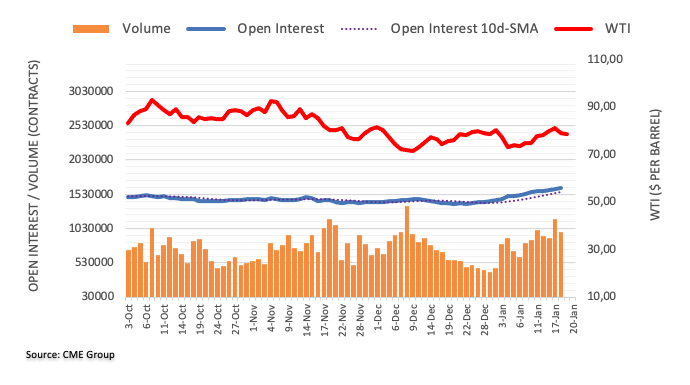

- WTI picks up bids to approach short-term key hurdles during the second consecutive weekly gains near 1.5-month high.

- Successful trading above two-week-old ascending trend line, upbeat RSI favor the black gold’s further upside.

- Three-month-old horizontal resistance precedes 100-DMA to guard immediate run-up.

WTI crude oil stays defensive around $80.85, despite keeping the previous day’s gains, as bulls approach important hurdles toward the north during early Friday in Asia.

In doing so, the energy benchmark braces for the second consecutive weekly gain while staying around the highest levels since early December 2022, marked on Wednesday.

That said, the black gold’s upside momentum could be witnessed by a fortnight-long ascending trend line, as well as a firmer RSI (14), not overbought.

However, a horizontal area comprising multiple levels marked since October 2022, near $81.30 by the press time, appears a tough nut to crack for Oil buyers.

Even if the quote manages to cross the $81.30 hurdle, the 100-DMA level surrounding $81.85 could challenge the energy bulls.

It’s worth noting that the tops marked on Wednesday and in early December, respectively around $82.70 and $83.30, could lure the commodity buyers on breaking the $81.85.

On the flip side, pullback moves remain elusive unless the quote stays beyond the aforementioned two-week-old support line, around $79.00 as we write.

Following that, the September 2022 low near $76.00 and the monthly bottom of $72.64 could gain the WTI bear’s attention.

To sum up, Oil remains on the buyer’s radar but the road towards the north appears bumpy.

WTI: Daily chart

Trend: Limited upside expected

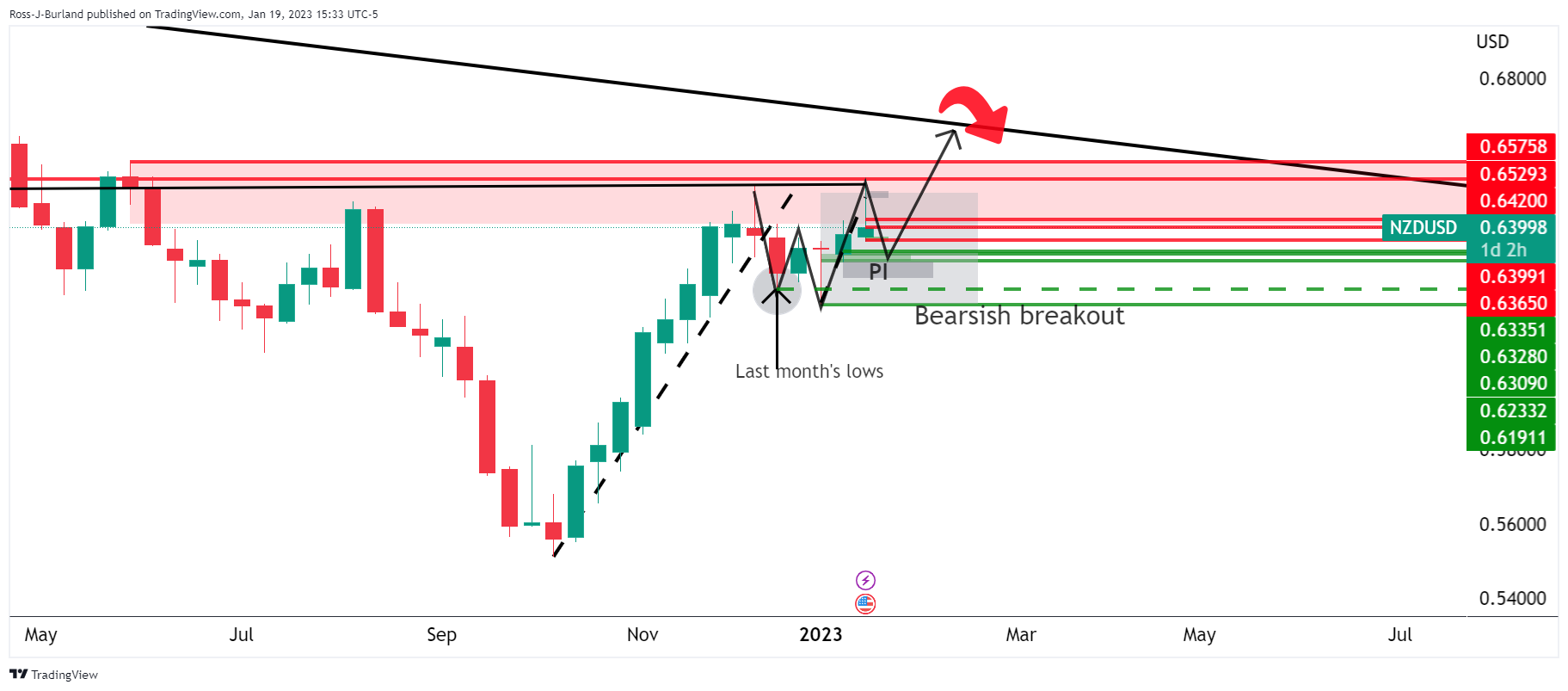

- NZD/USD is displaying a lackluster performance as investors await PBoC’s policy announcement for fresh cues.

- A surprise resignation from Prime Minister Jacinda Ardern has triggered political instability in New Zealand.

- The US Dollar Index is expected to display power-pack action after commentaries from Fed policymakers.

The NZD/USD pair is oscillating in a narrow range around the critical resistance of 0.6400 in the early Tokyo session. The Kiwi asset has turned sideways as investors are awaiting the announcement of the interest rate decision by the People’s Bank of China (PBoC), which is scheduled for Friday.

Considering the recent reopening measures by the Chinese administration to get back on the progress track after remaining locked in the fight against the Covid-19 epidemic, the PBoC might announce an easy monetary policy. It is highly required to inject severe liquidity into the economy to spur the growth rate, provide support to the vulnerable real estate sector, and to boost infrastructure. Therefore, the central bank could trim the Prime Lending Rate (PLR) ahead.

It is worth noting that New Zealand is one of the leading trading partners of China and a loose monetary policy announcement by the PBoC will also provide support to the New Zealand Dollar.

Meanwhile, political instability in the New Zealand economy has grown after a surprise resignation from Prime Minister Jacinda Ardern. This might keep the New Zealand Dollar volatile for a period of time ahead.

The risk profile is highly negative considering the three-day selling spell in risk-perceived assets like S&P500. United States equities witnessed severe selling pressure amid escalating recession worries as Industrial Production has fallen in six out of eight last months. Rising interest rates by the Federal Reserve (Fed) are squeezing the activities in the economy and sooner may dampen the labor market.

The US Dollar Index (DXY) has dropped to near 101.60 after failing to extend recovery above the critical resistance of 102.00. For further guidance, investors will focus on commentaries from Federal Reserve (Fed) policymakers.

- USD/CAD licks its wounds after reversing from two-week high.

- Oil price remains firmer amid softer US Dollar, hopes of China demand.

- Recession woes, hawkish Fedspeak challenge Loonie bears ahead of the key Canadian statistics.

USD/CAD pares the recent losses around 1.3465 as it picks up bids to reverse the previous day’s pullback from a fortnight high during Friday’s Asian session. In doing so, the Loonie pair ignores the firmer prices of Canada’s key export item, namely the WTI crude oil. The reason could be linked to the fresh fears surrounding the US economic growth and the hawkish Fedspeak.

WTI crude oil braces for the second weekly gains as it dribbles near $81.00 despite the US Energy Information Administration (EIA) reporting an increase in weekly Crude Oil Stocks Change with 8.408M versus -1.75M expected and 18.962M. The reason could be linked to the hopes of more energy demand from China, as well as the softer US Dollar. “Chinese oil demand climbed by nearly 1 million barrels per day (bpd) from the previous month to 15.41 million bpd in November, the highest level since February, according to the latest export figures published by the Joint Organisations Data Initiative,” reported Reuters.

On the other hand, the US Dollar Index (DXY) dropped the most in a week to snap a three-day uptrend as mixed data raised fears of a recession in the world’s biggest economy. In doing so, the greenback’s gauge versus the six major currencies failed to cheer the hawkish comments from the Federal Reserve (Fed) officials ahead of the pre-FOMC blackout starting this Saturday.

US Unemployment Claims dropped to the lowest levels since late April 2022, to 190K for the week ended on January 13 versus 214K expected and 205K prior. Further, the Philadelphia Fed Manufacturing Survey Index improved to -8.9 for January compared to -11.0 market forecasts and -13.7 previous readings. Alternatively, US Building Permits eased in December to 1.33M MoM versus 1.37M consensus and 1.351M prior while the Housing Starts also dropped to 1.382M during the stated month from 1.401M in November, versus 1.359M expected. It’s worth noting that the downbeat US Retail Sales and Producer Price Index (PPI) raised fears of an economic slowdown in the world’s largest economy after the softer wage growth and activity data flashed earlier.

That said, Federal Reserve Vice Chair Lael Brainard said that it will take time and resolve to get high inflation down to the fed's 2% target. The policymaker also added, “The policy will need to be sufficiently restrictive for some time.” On the same line, Boston Fed President Collins signaled that the baseline remains that the effective fed funds rate should settle slightly above 5.0%, implying three more 25bp rate rises.

At home, Canadian Wholesale Sales growth eased to -0.5% MoM in November versus the 1.9% expected and prior.

Against this backdrop, Wall Street closed negative while the yields bounced off a multi-day low.

Looking forward, Canadian Retail Sales for November, expected -0.5% versus 1.4% prior, could help the USD/CAD pair to remain firmer on matching market forecasts. However, more attention will be given to the Fed speak and risk catalysts for clear directions.

Technical analysis

A looming bull cross on the MACD and steady RSI backs the USD/CAD pair’s attempt to cross the 100-DMA hurdle, currently around 1.3515, despite failing to cross the same the previous day.

- USD/CHF is displaying a sideways auction amid the absence of a potential trigger.

- The downward-sloping trendline plotted from 0.9137 will act as a major barricade for the US Dollar.

- The US Treasury yields have rebounded after printing a multi-month low.

The USD/CHF pair is displaying topsy-turvy moves above the immediate support of 0.9150 in the early Tokyo session. The Swiss franc asset oscillated in a mere 40-pips range on Thursday amid an absence of a potential trigger that could trigger a power-pack action. Also, the US Dollar Index (DXY) is displaying signs of volatility contraction.

The USD Index has slipped to near 101.60, demonstrating a subdued performance. Meanwhile, the US Treasury yields have rebounded after printing a multi-months low. The 10-year US Treasury Yields have recovered to above 3.39%.

On an hourly scale, USD/CHF is displaying a rangebound structure, which indicates volatility contraction that will be exploded after a critical trigger. The asset witnessed a responsive buying action after dropping to near 0.9085 on Wednesday. The absence of a follow-up buying is indicating that the recovery move could be faded sooner. Apart from that, the downward-sloping trendline from January 13 high at 0.9137 will act as a major barricade for the US Dollar.

The 20-period Exponential Moving Average (EMA) at 0.9162 has overlapped the asset, demonstrating a sideways auction profile.

Also, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, showing a rangebound structure.

For an upside move, USD/CHF needs to break above January 11 low of around 0.9200, which will drive the asset towards January 18 high at 0.9246 followed by January 16 high at 0.9289.

On the contrary, a breakdown of Wednesday’s low at 0.9085 will drag the major towards 4 June 2021 high at 0.9054. A slippage below the latter will drag the asset further towards 4 August 2021 low at 0.9018.

USD/CHF hourly chart

-638097650146714049.png)

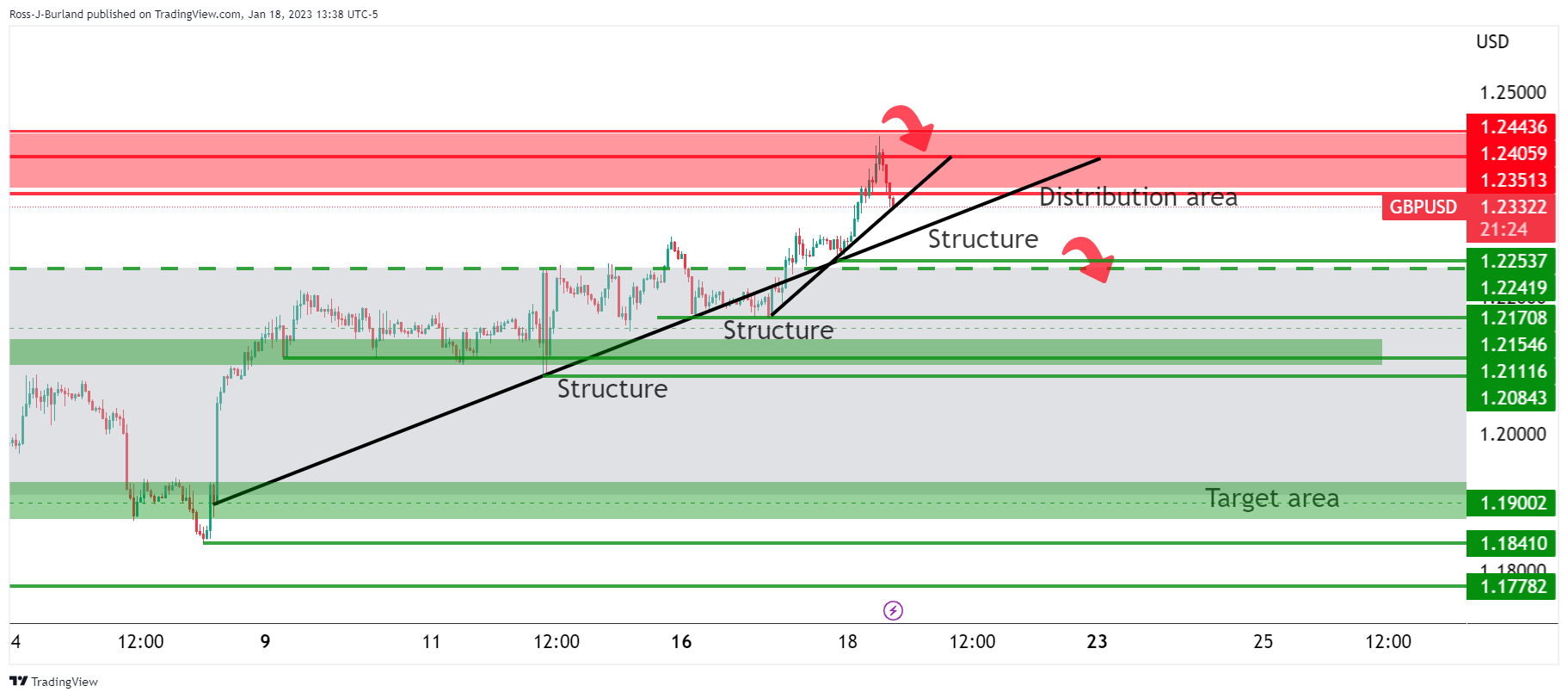

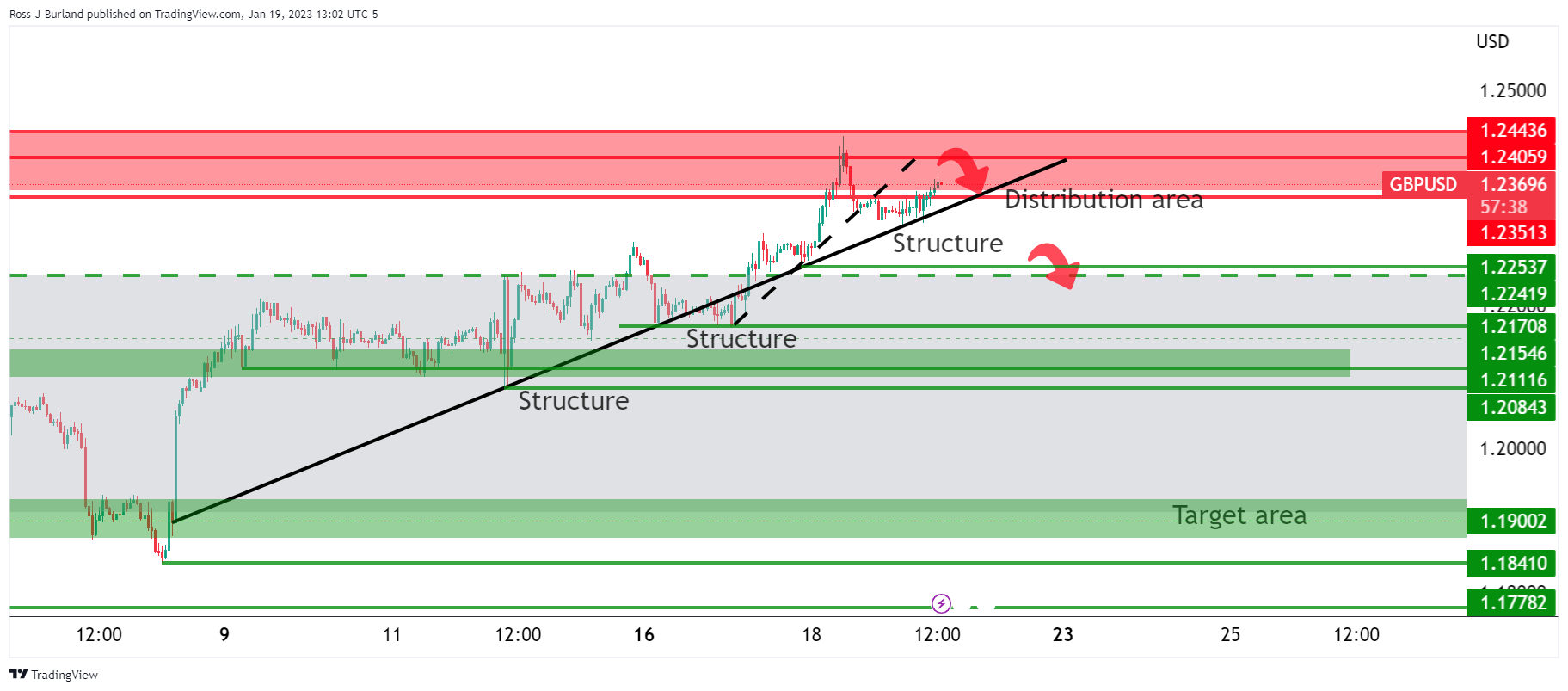

- GBP/USD struggles to refresh five-week high as the key resistance line probe bulls.

- Descending trend line from late May 2022 restricts immediate upside.

- Convergence of 200-DMA, 2.5-month-long ascending support line appears tough nut to crack for bears.

- RSI conditions suggest limited room towards the north.

GBP/USD bulls take a breather around the multi-day high near 1.2400, retreating to 1.2390 by the press time, as a downward-slopping resistance line from May 2022 restricts the immediate upside of the Cable pair.

Adding strength to the bullish bias could be the quote’s successful trading beyond the 200-DMA, as well as the successful rebound from 1.1841.

However, the RSI conditions hint at the limited upside room, which in turn highlights the aforementioned resistance line near 1.2400 as the short-term key hurdle.

Even if the GBP/USD buyers manage to cross the 1.2400 resistance, an ascending resistance line from August 2022, close to 1.2490 at the latest, could act as an additional upside filter.

It’s worth noting that the Cable pair’s run-up beyond 1.2490 could help the buyers approach the May 2022 peak surrounding 1.2665.

Alternatively, pullback moves may initially aim for the August 2022 peak surrounding 1.2290 before witnessing multiple supports near 1.2120 and 1.2100.

Though, a convergence of the 200-DMA and an ascending trend line from the last November, near 1.1980, appears the key support to watch for the GBP/USD bears.

Should the quote breaks the 1.1980 support confluence, the odds of witnessing a fresh monthly low, currently around 1.1840, can’t be ruled out.

GBP/USD: Daily chart

Trend: Further upside expected

- The GBP/JPY finished Thursday’s session with minuscule losses of 0.01%.

- GBP/JPY Price Analysis: Subdued, but once 159.00 is cleared, further downside is expected; otherwise, breaks above the 20-DMA, the uptrend will resume.

The GBP/JPY recovered from earlier losses and finished Thursday’s session with minuscule gains after plummeting to daily lows of 157.56. However, the GBP/JPY stages a comeback and is set to finish the gains almost flat. As the Asian Pacific session begins, the GBP/JPY is trading at 159.04.

GBP/JPY Price Analysis: Technical outlook

The daily chart shows that the GBP/JPY remains neutral-to-downward biased but trendless during the last seven days. Even though the GBP/JPY was hit by a jump in volatility, on the Bank of Japan’s decision, the exchange rate settled at around Thursday’s close.

Oscillators like the Relative Strength Index (RSI), although its slope is almost flat at bearish territory, while the Rate of Change (RoC) suggests that buying pressure is fading. Therefore, the GBP/JPY might continue to be range-bound unless it clears the first support/resistance levels.

The GBP/JPY, the first support level, would be the 159.00 psychological level. Once cleared, the next support would be the 158.00 figure, followed by the January 19 daily low of 157.56. As an alternate scenario, and the least likely, the GBP/JPY first resistance would be the 20-day Exponential Moving Average (EMA) at 159.54, followed by 160.00 and then the January 18 daily high of 161.52.

GBP/JPY Key Technical Levels

- EUR/USD is looking to stretch its recovery move above 1.0840 amid soaring hawkish ECB bets.

- Weakness in S&P500 due to soaring recession fears are restricting the upside in the risk-perceived currencies.

- US Treasury yields have displayed a recovery after printing fresh multi-month lows.

The EUR/USD pair is struggling to extend its rebound above the immediate resistance of 1.0840 in the early Asian session. The major currency pair is expected to stretch its recovery move amid hawkish commentary from European Central Bank (ECB) President Christine Lagarde and hawkish cues from ECB December meeting accounts.

Fineprints from ECB’s Monetary Policy Meeting Accounts indicated that the majority of the policymakers were favoring an interest rate hike by 75 basis points (bps) but later supported the view of ECB President Christine Lagarde that it might dampen the overall demand and favored a 50 bps interest rate hike.

ECB Lagarde at World Economic Forum (WEF), in Davos reiterated the view that inflation is too high, however, the ECB is determined to bring it down to 2% in a timely manner. She further added that “We may only see a small contraction in the Eurozone.”

The market mood remained risk-averse amid escalating chances of a recession in the United States economy. Analysts at Wells Fargo stated that US Industrial Production fell 0.7% in December and November’s numbers were revised lower. With industrial production has fallen in six of the past eight months, the largest of which being November and December, it is evident that the manufacturing sector is already in recession.

Further, Vice Chair Lael Brainard said "significant weakening in the manufacturing sector," a moderation in consumer spending, and other data pointing to now "subdued growth" in 2023.

S&P500 is facing the impact of the solidifying case of recession. The 500-stock basket recorded a three-day losing streak, portraying negative market sentiment. The demand for US government bonds faded after remaining firmer in the past few sessions. The 10-year US Treasury yields rebounded to near 3.39% after recording a fresh five-month low at 3.33%. Meanwhile, the US Dollar index (DXY) has dropped to near 101.60 after surrendering the critical support of 101.80.

- AUD/USD stays pressured after two-day losing streak, braces for the first negative week in five.

- Downbeat Aussie data, mixed statistics in the US keep recession woes on the table.

- Policymakers at Fed, ECB defend hawkish bias while citing inflation fears.

- Final round of Federal Reserve talks ahead of pre-meeting blackout appears crucial amid light calendar.

AUD/USD justifies its risk-barometer status, as well as bears the burden of downbeat statistics at home, as it holds lower ground near 0.6900 after declining for the last two consecutive days. In doing so, the Aussie pair braces for the first negative weekly closing in five while keeping the reversal from the highest levels since August.

On Thursday, Australia’s Consumer Inflation Expectations for January improved to 5.6% versus 5.2%. However, the employment numbers for December disappointed the AUD/USD pair traders afterward as the headline Employment Change turned negative on a seasonally adjusted basis, printing a -14.6K figure versus 22.5K expected and 64K prior. Further, the Unemployment Rate also rose to 3.5% compared to the market consensus of witnessing no change in the 3.4% previous readings.

On the other hand, US Unemployment Claims dropped to the lowest levels since late April 2022, to 190K for the week ended on January 13 versus 214K expected and 205K prior. Further, the Philadelphia Fed Manufacturing Survey Index improved to -8.9 for January compared to -11.0 market forecasts and -13.7 previous readings. Alternatively, US Building Permits eased in December to 1.33M MoM versus 1.37M consensus and 1.351M prior while the Housing Starts also dropped to 1.382M during the stated month from 1.401M in November, versus 1.359M expected.

It’s worth noting that the downbeat US Retail Sales and Producer Price Index (PPI) raised fears of an economic slowdown in the world’s largest economy after the softer wage growth and activity data flashed earlier.

Elsewhere, Federal Reserve Vice Chair Lael Brainard said that it will take time and resolve to get high inflation down to the fed's 2% target. The policymaker also added, “The policy will need to be sufficiently restrictive for some time.” On the same line, Boston Fed President Collins signaled that the baseline remains that the effective fed funds rate should settle slightly above 5.0%, implying three more 25bp rate rises. The same view was shared by most Fed speakers as they sneak into the pre-FOMC blackout period from this Saturday.

Amid these plays, Wall Street closed negative while the yields bounced off multi-day low but the US Dollar struggled to improve.

Moving on, a lack of major data/events highlights Fedspeak as the key catalyst.

Technical analysis

Rising wedge confirmation favors the AUD/USD bears. That said, the monthly support line near 0.6835 appears the immediate target for sellers.

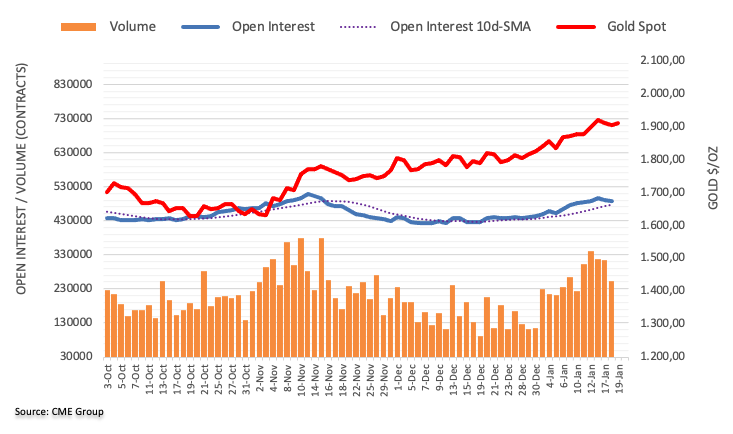

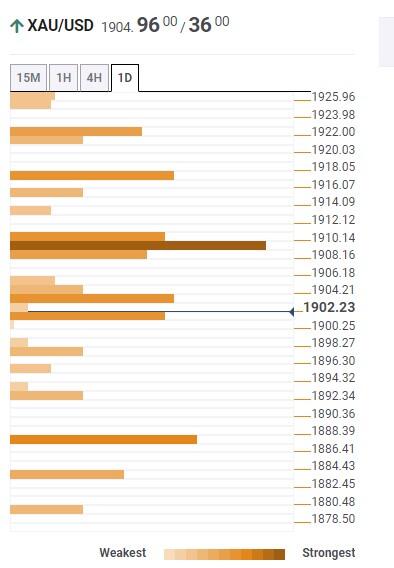

- Gold price is pressured from recent cycle highs and bears eye a correction to the 38.2% Fibo.

- US Dollar needs to get over 102.20 to assist the Gold bears.

Gold price made a strong move to test $1,935 on Thursday, denying the bears a free ride into low-hanging fruit below $1,900 and hitting stops at $1,920 and above. At the time of writing, Gold price is 1.45% higher at around the highs of the day after rallying from a low of $1,901.

US Dollar pressured to W-formation support

A risk-off session on Wall Street did little to support the greenback, with the US dollar index caving to a low of 101.99 in a move that had been telegraphed in prior analysis as follows:

The US Dollar index, DXY, has subsequently been unable to pick itself up from the floor, an area on the charts that was highlighted as a downside target as follows:

''The DXY index, above, shows the US Dollar meeting resistance in a W-formation on the hourly chart. A correction of the bid could be expected to meet the 102.00/20s in the coming sessions as the price reverts to the neckline of the pattern in a 38.2% Fibonacci correction.''

US Dollar index update:

102.20 is now important, guarding a move to the upside.

Meanwhile, there are a number of themes in play following yet more disinflationary economic data on Thursday that has shown that the US economy is losing momentum. Also, the Yen has been rebounding as traders continued to bet the Bank of Japan, BoJ, will shift away from an ultra-loose monetary policy.

Initial jobless claims fell to 190k from an average of 218k over December, suggesting the January labour market report may improve a touch. However, the Philadelphia Federal Reserve's monthly manufacturing survey showed a notable improvement in the prices paid index, which skidded to 24.5 in January from 36.3 last month, the reading, however, which is a key measure of inflation at the producer level, was the lowest since August 2020. The fourth-quarter earnings outlook also ''looks bleak'', as reported by Reuters: ''Companies are reporting earnings 2.6% above expectations, compared to a long-term average of 4.1% since 1994 and 5.3% for the past four quarters, according to IBES data from Refinitiv.''

On Wednesday, the Federal Reserve's Beige Book showed that since the previous report, overall economic activity has remained relatively stable and overall, contacts expected little growth in the coming months.

Key notes

Selling prices increased at a modest or moderate pace in most districts, though many said that the pace of increases had slowed from that of recent reporting periods.

Employment continued to grow at a modest to moderate pace for most districts.

On balance, contacts generally expected little growth in the months ahead.

Wage pressures remained elevated across districts, though five reserve banks reported that these pressures had eased somewhat.

Prior to that release, the Producer Price Index, PPI, and Retail Sales, which showed disinflationary tendencies in the data, reinforced expectations that the Federal Reserve will continue to reduce its tightening pace in upcoming meetings.

It is also worth noting that the US Atlanta Fed GDPNow Q4: 3.5% (prev 4.1%).

Fed speakers remain hawkish

Despite the series of deflationary data this week, US Federal Reserve speakers remained hawkish this week. Vice Chair Lael Brainard stated on Thursday that "even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2 percent on a sustained basis," Brainard said.

Earlier in the week, St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said. “Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, the Fed hawk added. Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

Nevertheless, Gold price has shown resilience in the face of such hawkishness and has found fresh bids on any pullback taking directional input from the softness in the US Dollar.

Gold technical analysis

A move into the 38.2% Fibonacci could be in order for the Asian session. this meets the prior resistance for mid-January near 41,929. Below there, there will be a risk to the trendline support should the greenback get over 102.20 and stay bid into Friday.

- USD/JPY hovers around Wednesday’s close of 128.85, aiming to close below to extend its downtrend.

- Unemployment claims in the US came lower than expected, as traders expect further tightening.

- Japanese inflation data is expected to edge higher; what would the BoJ do?

The USD/JPY reverses its course and edges lower late in the North American session, down by 0.33% on Thursday. Risk aversion weighed on the US Dollar (USD), which extended its losses but was capped by the rise in US Treasury bond yields. At the time of writing, the USD/JPY is trading at 128.33 after hitting a daily high of 128.88.

USD/JPY in choppy trading before Japanese CPI release

Wall Street continues to show a dampened mood. Thursday’s economic data in the United States (US) pointed to a tight labor market, as Initial Jobless Claims for the last week edged lower, by 190K less than the 214K consensus. Further data reported that the US housing market continues to deteriorate. Housing Starts and Building Permits missed estimates, while the Philadelphia Fed Manufacturing Index, although in contractionary territory at -8.9, improved compared to November’s -13.7 reading.

As traders brace for a critical Japanese inflation report, the USD/JPY has been hovering around 128.40 for the last three hours.

Last month’s inflation in Japan rose by 3.8% YoY in November, exceeding October’s 3.7%. Excluding fresh foods but including fuel costs rose by 3.7% YoY vs. 3.6% on its previous reading. Excluding food and energy, the so-called core Consumer Price Index (CPI) rose by 2.8%.

If the Japanese CPI increased above last month’s figures, that could result in the USD/JPY prolonging its downtrend, and it might test the YTD low of 127.21, followed by a challenge to the May 24 swing low at 126.36.

Elsewhere. the US Dollar Index, a measure of the buck against a basket of peers, extended its losses for two straight days, sliding 0.34% to 102.034.

Also read: USD/JPY Price Analysis: The yen strengthens, as bears stepped in around 128.60s

What to watch?

The Japanese economic calendar will feature inflation figures. On the US front, the US calendar will feature Existing Home Sales alongside Fed speaking.

USD/JPY Key Technical Levels

- NZD/USD W-double bottom has formed and a break of 0.6400 could trigger the bullish bias further for a look-in at 0.6420.

- 0.6420 guards key resistances ahead of the price imbalances (PIs) above.

- If 0.6420 holds, convincingly, i.e. on a number of tests, then the blow-off could come sooner than later.

NZD/USD bulls are making their moves from double-bottom lows following the sell-off that occurred on the back of the Aussie jobs data that attracted bears into the market at key support, taking trapped bulls for a ride to 0.6900 and then 0.6870 lows. NZD/USD has mirrored the Aussie in this regard and the following illustrates the prospects of a move higher before the next slide.

NZD/USD weekly and daily charts

Assuming the price is on course for the trendline resistance, the W-formation is compelling in this regard with support seen at 0.6300 with the 0.6530s targeted to confirm the bias towards 0.6670s trendline resistance.

NZD/USD H1 chart

Dealing with the matter at hand, the price is forming a W-double bottom and a break of 0.6400 could trigger the bullish bias further for a look-in at 0.6420 that guards key resistances ahead of the price imbalances (PIs) above. Given that the price is on the backside of the trendline, however, the bias is to the downside and if 0.6420 holds, convincingly, i.e on a number of tests, then the blow-off could come sooner than later from which point the bullish thesis to the daily trendline resistance will be reassessed vs. a downside continuation below 0.6300.

What you need to take care of on Friday, January 20:

The US Dollar lost some ground on Thursday, as the dismal mood that ruled financial markets eased as the day went by. Still, most European and American indexes closed in the red, as hawkish comments from ECB and US Federal Reserve officials suggested central banks are far from done with quantitative tightening.

On Thursday, Klaas Knot, a member of the Governing Council of the European Central Bank, said that there would be more than one 50 basis points (bps) increase in interest rates, adding that market participants may be underestimating the ECB's commitment to tame prices. Later, President Christine Lagarde, noted that the central bank will stay on course with rate hikes, adding that the job market in Europe has never been as vibrant as now. More relevantly, she said that they are not seeing inflation expectations unanchoring. EUR/USD kept seesawing around 1.0800, ending the day at 1.0820.

The GBP/USD pair gained upward traction ahead of the daily close and approached the 1.2400 figure, AUD/USD recovered the 0.6900 level following a slump to 0.6871, as poor Australian employment and inflation figures weighed on the AUD. USD/CAD retreated and trades at around 1.3450. Finally, USD/JPY spent the day consolidating at around 128.50.

Gold soared in a risk-averse environment, with the bright metal trading around $1,930 a troy ounce. Crude oil picked up and WTI settled at $80.65 a barrel.

Like this article? Help us with some feedback by answering this survey:

- USD/CAD bears are taking on a double bottom near 1.3450 support area.

- Bears eye a 61.8% Fibonacci retracement near 1.3415 should the double bottom (DB) be breached.

USD/CAD is eating into the bullish rally's tracks from yesterday's business with 1.3450/30 eyed as a potential support structure in what has been a choppy descent from above 1.3500 on the day so far. The following illustrates the downside bias prior to the next wave of demand to the upside should the US dollar bulls be motivated by a discount in price in the coming sessions and days ahead.

USD/CAD prior analysis

It was stated at the start of the week, in the following analysis, USD/CAD Price Analysis: Bulls eye a break of 1.3450 for a look in at the 1.35 area, that the price was embarking on a correction but 1.3450 had to give out first:

There was a price imbalance that had been left behind since the major sell-off at the start of the year. There was a thesis of mitigation towards 1.3550.

USD/CAD update

As illustrated, the bullish accumulation schematic played out, with the price respecting the spring and a subsequent break of resistance near 1.3450 leading to a drive to mitigate the price imbalance, albeit not in its entirety.

At this juncture, it is a matter of wait-and-see, but the bias is bullish while above the old resistance:

USD/CAD H4 chart

The price is forming an M-formation on the 4-hour chart. The pattern is a reversion set-up for the sessions ahead where the price would be expected to move back into the bearish impulse and target the neckline near 1.3490. However, the downside may not have been concluded as of yet, although there is a current deceleration near 1.3450 and a 38.2% Fibonacci retracement area of the prior bullish leg's range. Lower time frames can be assessed to gauge whether the bears are throwing in the towel which might prompt a move by the bulls in the day ahead:

USD/CAD 15-min chart

As per the 15-min chart, there are two price imbalances (PIs) that could be mitigated on the way to a 61.8% Fibonacci retracement near 1.3415 should the double bottom (DB) be breached.

- Silver’s bounced off daily lows nearby the $23.00 figure and is climbing sharply, gaining 1.33%.

- US Dollar continued to weaken, but US Treasury bond yields put a lid on XAG/USD’s rally.

- XAG/USD is exposed to selling pressure below $23.60; otherwise, it could re-test the YTD high.

Silver price is trimming some of Wednesday’s losses and probes the 20-day Exponential Moving Average (EMA) around $23.65 on a trading session characterized by a weaker US Dollar (USD) and a downbeat market mood spurred by recession fears after dismal US data. Therefore, the XAG/USD is trading at $23.74 after hitting a daily low of $23.17.

Silver Price Analysis: XAG/USD Technical Outlook

Silver's daily chart suggests the white metal could peak around the $24.50s area. The non-yielding metal hasn’t been able to crack the latter, keeping Silver bears hopeful. As XAG/USD has reached higher peaks, the Relative Strength Index (RSI) did not, opening the door for a negative divergence. In addition, the Rate of Change (RoC) in the last two days suggests bearish momentum increased. Hence, a pullback in XAG/USD is on the cards.

For that scenario to play out, the XAG/USD needs to drop below $23.17, so the $23.00 psychological level could be exposed. A breach of the latter will open the door to test the 50-day EMA at $22.87, which, once cleared, will send XAG/USD dropping toward the December 16 low of $22.56.

As an alternate scenario, if Silver reclaims and achieves a daily close above the 20-day EMA, that could pave the way for a re-test of the YTD high of $24.54. Firstly, reclaiming the former would expose the $24.00 handle. The break above will reveal the YTD high at $24.54.

Silver Key Technical Levels

Vice Chair Lael Brainard states that ''there are reasons to think high inflation in the more labour sensitive “core services ex-housing” basket might reflect the pass-through of pandemic and war one-offs and not solely cyclical strength from tight labour markets.

"Inflation has been declining over the past several months against a backdrop of moderate growth," Brainard said in prepared remarks for a speech that noted a "significant weakening in the manufacturing sector," a moderation in consumer spending, and other data pointing to now "subdued growth" in 2023.

Key comments

"It is likely that the full effect on demand, employment, and inflation of the cumulative tightening that is in the pipeline still lies ahead," Brainard said in the remarks for a speech at the University of Chicago's Booth School of Business.

"It remains possible that a continued moderation in aggregate demand could facilitate continued easing in the labor market and reduction in inflation without a significant loss of employment," Brainard said.

"Even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2 percent on a sustained basis," Brainard said.

Key notes

The recent downshift in the pace of rate hikes allows u.s. central bank to assess more data as it moves policy to a sufficiently restrictive level.

It will take time and resolve to get high inflation down to the fed's 2% target.

.

The policy will need to be sufficiently restrictive for some time.

Inflation has been declining, and data point to subdued growth ahead.

Monetary policy's drag on US economic growth and employment 'likely to increase' in 2023.

Tentative signs labour demand is cooling says labour supply likely to remain constrained.

Wages do not appear to be driving inflation, and sees no 1970s-style wage-price spiral.

Sees tentative signs of moderating wage growth.

Says risk-management posture needed to defend inflation expectations anchor.

US Dollar update

Despite continued hawkish rhetoric from the Fed officials this week, the US dollar has been on the backfoot owing to disinflationary data contrary to the hawkishness at the Fed:

The US Dollar index, DXY, has subsequently been unable to pick itself up from the floor, an area on the charts that was highlighted as a downside target as follows:

''The DXY index, above, shows the US Dollar meeting resistance in a W-formation on the hourly chart. A correction of the bid could be expected to meet the 102.00/20s in the coming sessions as the price reverts to the neckline of the pattern in a 38.2% Fibonacci correction.''

- GBP/USD bears could be lurking and ready to move in while below 1.2400.

- US data remains a thorn in the side of the US Dollar bulls.

GBP/USD is higher on the day having traded up to 1.2377 in recent trade while the US Dollar tails off and gives flight to risky assets and risk-on forex such as GBP. The Great British Pound rallied from a low of 1.2312 as interest rate sentiment for the Bank of England continues to support the currency despite the bearish technical developments on the charts (more on that below),

Meanwhile, there are a number of themes in play: The US Dollar, for one, has been under pressure following yet more disinflationary economic data on Thursday that has shown that the US economy is losing momentum. Then, the Yen has been rebounding as traders continued to bet the Bank of Japan, BoJ, will shift away from an ultra-loose monetary policy.

United States of America's disinflationary backdrop

In terms of data, yesterday, the Federal Reserve's Beige Book showed that since the previous report, overall economic activity hasd remained relatively stable and overall, contacts expected little growth in the coming months.

Key notes

Selling prices increased at a modest or moderate pace in most districts, though many said that the pace of increases had slowed from that of recent reporting periods.

Employment continued to grow at a modest to moderate pace for most districts.

On balance, contacts generally expected little growth in the months ahead.

Wage pressures remained elevated across districts, though five reserve banks reported that these pressures had eased somewhat.

Prior to that release, the Producer Price Index, PPI, and Retail Sales, which showed disinflationary tendencies in the data, reinforced expectations that the Federal Reserve will continue to reduce its tightening pace in upcoming meetings.

It is also worth noting that the US Atlanta Fed GDPNow Q4: 3.5% (prev 4.1%).

Meanwhile, on Thursday, while the Philadelphia Federal Reserve's monthly manufacturing survey showed a notable improvement in the prices paid index, which skidded to 24.5 in January from 36.3 last month, the reading, however, which is a key measure of inflation at the producer level, was the lowest since August 2020.

The fourth-quarter earnings outlook also ''looks bleak'', as reported by Reuters: ''Companies are reporting earnings 2.6% above expectations, compared to a long-term average of 4.1% since 1994 and 5.3% for the past four quarters, according to IBES data from Refinitiv.''

US Dollar on the backfoot

The US Dollar index, DXY, has subsequently been unable to pick itself up from the floor, an area on the charts that was highlighted as a downside target as follows:

''The DXY index, above, shows the US Dollar meeting resistance in a W-formation on the hourly chart. A correction of the bid could be expected to meet the 102.00/20s in the coming sessions as the price reverts to the neckline of the pattern in a 38.2% Fibonacci correction.''

US Dollar index update:

Bank of England outlook supports GBP/USD

Nevertheless, the British Pound Sterling has been unable to really take off on its own accord despite the United Kingdom's Consumer Price Index showing the prior day that it remains near 40-year highs. Specifically, the data showed yesterday that there was an increase in services inflation and accelerating food/drink prices which will be a cause for some concern for the Bank of England's policy-makers. Analysts at ING Bank, making remarks on the Consumer Price Index said "it's important to note that core services jumped from 6.4% to 6.8%, a development that the BoE should particularly take into consideration, and when added to wage data should tilt the balance towards a 50 bps hike in February."

Therefore, a hawkish Bank of England could still inject some resilience into the pound. The Bank of England's Governor Andrew Bailey argued at the start of the week that a shortage of workers in the labour market posed a “major risk to inflation coming down”.

''The implication is that the Bank of England could remain more hawkish on its policy decisions this year,'' analysts at Rabobank said. ''We expect another 50 bps rate hike in February and then three more 25 bps moves as the Bank struggles to slice the final few percentage points from services sector inflation, which will be most impacted by wage growth,'' the analysts at Rabobank argued.

GBP/USD technical analysis

On the hourly time frame, it was noted yesterday that GBP/USD's micro-trendline support guarded structure around 1.2250. A break there was explained to be a key development if it occurred, as it would open the risk of a blow-off in GBP/USD to test 1.2170 and then 1.2080 structure.

GBP/USD update

As seen, the GBP/USD price has indeed broken the micro trendline. It is perfectly natural for the subsequent price action, as a function of the market, to eat into prior highs and that is what we are seeing: mitigation of price imbalances left behind:

Therefore, the technical bias for GBP/USD remains bearish while below 1.2400.

- AUD/USD failed to gain traction on rising US recession fears and poor Ausslie’s employment data.

- US Initial Jobless Claims were better than expected, cushioning the US Dollar fall.

- RBA’s odds for a rate hike lie around 60%, while 40% expects no change to its monetary policy.

AUD/USD slides for the second consecutive day, registering a new weekly low of 0.6871 due to a risk-off impulse spurred by recession worries mounting after US economic data, indeed showed the economy is slowing. Hawkish Fed commentary spooked investors, who flew to safety. At the time of writing, the AUD/USD is trading at 0.6901, below its opening price by 0.61%.

Growing concerns in the US, a headwind for the AUD/USD

The AUD/USD continues to weaken, even though the US Dollar (USD), remains offered across the board. Wednesday’s inflation data in the United States (US) cooled down, reflecting the tightening monetary conditions imposed by the US Federal Reserve (Fed). However, consumers are feeling the effects, as Retail Sales plunged on a monthly basis, while Industrial Production (IP) fell for the second straight month.

Thursday’s US economic docket witnessed unemployment claims rising by 190,000, 24,000 below expectations, while the Continuing Claims edged lower. At the same time, Housing Starts and Building Permits missed estimates, while the Philadelphia Fed Manufacturing Index, although in contractionary territory at -8.9, improved compared to November’s -13.7 reading.

The US Dollar Index, a measure of the buck against a basket of peers, extended its losses for two straight days, sliding 0.24% to 102.165. Nevertheless, a late recovery in US Treasury yields, namely the 10-year bond rate, climbs four bps at 3.411%, a headwind for the AUD/USD.

On the Australian side, employment figures unexpectedly fell in December, a headwind for the Aussie (AUD). Money market futures imply a 60% probability for the Reserve Bank of Australia (RBA) to lift rates in February, but there’s also a 40% chance the RBA will pause, given rates have risen by 300 bps.

What to watch?

An absent Australian economic docket will leave AUD/USD traders leaning on US Dollar dynamics. The US calendar will feature Existing Home Sales alongside Fed speaking.

AUD/USD Key Technical Level

- The USD/JPY daily chart is bearish biased, though it remains unable to extend its losses beneath 128.00

- The USD/JPY is trading sideways in the near term, awaiting a break above/below 129.00/128.00.

On Thursday, the USD/JPY fails to hold to its gains and trades beneath its opening price by 0.33% after hitting a daily high of 128.88. At the time of writing, the USD/JPY exchanges hand at 128.40, amidst a risk-off impulse and a soft US Dollar (USD).

USD/JPY Price Analysis: Technical outlook

Failure to crack the 20-day Exponential Moving Average (EMA) at 131.13 exposed the USD/JPY to selling pressure. In addition, price action dived back below a three-month-old downslope resistance trendline, which tracks the USD/JPY downtrend. Therefore, the path of least resistance is downwards, but a decisive break below the YTD low of 127.21 is needed, so the USD/JPY might get poised towards the May 24 daily low of 126.36.

Short term, the USD/JPY 4-hour chart suggests the pair as range bound, although the Relative Strength Index (RSI) is at bearish territory. The Rate of Change (RoC) shows buyers gathering momentum. Hence, mixed signals surrounding the USD/JPY pair might refrain traders from opening fresh positions unless a decisive break is achieved.

The USD/JPY key resistance levels are 129.00, the daily pivot at 129.33, and the 50-EMA at 129.60. On the other hand, the USD/JPY first support would be 128.00, followed by the January 18 daily low of 127.55, ahead of 127.00.

USD/JPY Key Technical Levels

The decade-long bull market in the US Dollar may be leveling off, but economists at Charles Schwab do not anticipate a major bear market in 2023.

Further narrowing in the yield gap in early 2023

“For the Dollar in 2023, we look for further downside in the near term, but expect it to stabilize by mid-year.”

“With the pace of Fed tightening likely to slow, the Dollar has room to retreat further in early 2023 should central bank policies become more aligned.”

“A reasonable target would be the average of the range that prevailed prior to the pandemic, or about 3% to 5% lower.”

- Mexican Peso remains under pressure versus the US Dollar

- USD/MXN tests levels above 19.00, up 2.5% from Wednesday’s low.

The USD/MXN is trading slightly above 19.00, looking at the weekly high it hit earlier on Thursday at 19.05. The pair resume the upside after a brief pullback to 18.89. On Wednesday, it traded as low as 18.56, the lowest since February 2020.

The Mexican Peso has been unable to benefit from the rebound in commodity prices. At the same time, the US Dollar remains firm supported by economic data and higher US yields.

New data, the old debate and a new member for Banxico

Economic data released on Thursday in the US came in above expectations (Initial Jobless Claims and Philly Fed) and helped market sentiment. Still, Wall Street's indexes are in red. Emerging market currencies remain under pressure, extending the correction from multi-day highs. The rebound in commodity prices on Thursday is being offset by higher US yields.

The US hit the debt limit and the Treasury started to implement special measures to avoid a default. The debate on raising the debt ceiling at Congress is set to be complex as Republicans hold the House and Democrats the Senate.

In Mexico, Congress voted to confirm Omar Mejía, the government’s nominee for the Bank of Mexico for an eight-year period. Relatively unknown to market participants prior to his nomination, Mejía’s first vote at the board will be at the next meeting February 9. He backed the current interest rate hike cycle and promised transparency and independence.

USD/MXN technical outlook

The USD/MXN is staging a solid rebound. Technical indicators are turning to the upside in the daily chart. Price still remains below the 20-day Simple Moving Average that awaits at 19.17. If the pair manages to break and hold above 19.00/05, the next strong barrier emerges at 19.30.

A slide back to 18.80 would be seen as a normal correction to the recent rally. If it drops below, the Mexican Peso would recover some strength.

USD/MXN daily chart

-638097403631248783.png)

ECB’s Governing Council (GC) is determined to deliver considerable further rate hikes, economists at Nordea report.

Firmly on a road of further 50 bps rate hikes

“We think the ECB continues to be determined to deliver further several 50 bps rate hikes.”

“Market pricing of rate cuts looks quite aggressive compared to the ECB’s current thinking.”

“Risks tilted towards the ECB proceeding faster in reducing its bond holdings.”

See: Euro to come under pressure if inflation not ease back to target lower rate levels by summer – Commerzbank

AUD is no longer the best performing G10 currency in the year to date, as it was just a few days ago. Economists at Rabobank believe that the AUD/USD pair could drop to the 0.67 mark over the next quarter before recovering later in the year.

Australian economy will avoid recession this year

“We see risks that AUD/USD could dip back to the 0.67 level on a three-month view on a combination of US recession concerns, a still hawkish Fed and expectations that the RBA is close to a peak in policy. However, on the expectation that the Australian economy will avoid recession this year we expect AUD/USD to find support and edge higher again in the second half of the year.”

“We forecast a move to 0.71 in 12 months.”

- Gold buyers stepped in around $1901 and lifted the yellow metal amidst an offered US Dollar.

- Weak US economic data revealed on Wednesday increased the likelihood of a US recession.

- Sentiment remains dampened, although US unemployment claims edged lower.

- Federal Reserve officials continued to express the need to lift rates above 5%.

Gold price snaps two days of losses and grinds higher on Thursday, lifted by a weak US Dollar (USD) and a dampened market mood, as Wall Street opened with losses. Soft US economic data released on Wednesday sounded the alarms of an upcoming recession amidst a high inflation environment. Therefore, the XAU/USD is trading at 1921.54, above its opening price by 0.95%.

Gold rises after US economic data and weakening USD

Before the US cash equity markets opened, the US Department of Labor revealed that Initial Jobless Claims for the week ending January 14 rose by 190K, less than the 214K estimated. The same report updated Continuing Jobless Claims rising to 1647K beneath the 1660K foreseen. At the same time, Building Permits dropped less than estimates, and the percentage change compared to November’s -10.6%, improved to -1.6%.

Staying in the US housing market data, Housing Starts slid to -1.4%, less than November’s -1.8% contraction. Aside from this, the Philadelphia Fed Manufacturing Index in the US rose to -8.9 in January from a revised -13.7 plunge in December. The report showed that more than 33% of the firms reported declines in activity.

Elsewhere, the US Dollar Index, a gauge of the buck’s value against a basket of G7 currencies, slides 0.17%, down at 102.239, while US bond yields recover some ground. The 10-year benchmark note rate sits at 3.397%, up two bps.

Money market futures traders are pricing in a 25 bps rate hike at the Federal Reserve’s January 31-February 1 meeting.

Despite softer-than-expected US economic data revealed on Wednesday, with Retail Sales plunging and Industrial Production nosediving, nevertheless, Fed officials stayed the course, vocal about lifting rates at least to the 5% threshold.

On Thursday, Boston Fed President Susan Collins said that it was appropriate to slow the pace of rate increases, though she emphasized its need to move above 5% and be held around for “some time.”

Gold Technical Analysis

XAU/USD daily chart supports the thesis of higher Gold prices. But buyers need to decisively clear the January 16 swing high of $1928 if they want to climb toward $2000. Once XAU/USD clears the former, that would pave the way to a $1958.April 20 swing high, ahead of the $2000 figure. Otherwise, a correction to $1900 is on the cards.

The recent GBP underperformance is largely due to a less hawkish BoE and sluggish domestic activity data but its underperformance is unlikely to continue in the light of a rebound in global risk sentiment and improving domestic dynamics, economists at HSBC report.

GBP to benefit from the UK’s improving external balance

“With inflation in the UK having likely peaked and potentially set to decelerate more than consensus expects, a less aggressive tightening tone from the BoE now may mean a less abrupt turn of stance later in the year, which may end up becoming a marginal positive for the GBP in the months ahead. A shift towards better-than-expected domestic data should also be positive for the GBP.”

“The UK’s external rebalancing continues at pace, due to the combination of a cheaper currency and higher interest rates. Indeed, the UK’s trade balance for 3Q22 showed the narrowest deficit since December 2021. This may bode well for the GBP.”

“GBP has a very strong tie to global risk appetite in recent years. A bottoming out in global growth dynamics (compared to excessively pessimistic expectations), as well as a peak in global interest rates on the back of softening inflation pressure could allow the GBP to strengthen against the USD in an environment where risk appetite looks less febrile.”

- US economic data helped risk appetite and the New Zealand Dollar on Thursday.

- Wall Street is in red after the opening but off lows, commodities rebound.

- NZD/USD attempts to regain 0.6400, still negative for the day.

- NZ Prime Minister Jacinda Arden is to step down.

The NZD/USD rebounded from the lowest level since last Friday and climbed to 0.6402, supported by an improvement in market sentiment following the release of better-than-expected US economic data. The New Zealand Dollar is still down for the day, unaffected by the resignation of NZ PM Jacinda Ardens.

Positive economic news from the US

Thursday is proving to be a different day than Wednesday when Retail Sales and Industrial Production reports showed larger-than-expected declines for December. Data released on Thursday came in mostly above expectations. Initial Jobless Claims fell below 200K to the lowest level in four months. The Philly Fed rose more from -13.7 to -8.9.

Wall Street in red, but sentiment improves

The economic figures helped the US Dollar but also risk appetite that ended up weighing more on the Greenback, pushing NZD/USD away from the lows. Equity prices in Wall Street are still down but off lows, falling on average 0.50%. Crude Oil and Gold are rising by around 0.54%.

Politics in New Zealand

New Zealand Prime Minister Jacinda Ardern announced her term would end by February 7. She “does not have the energy” to seek re-election in the general elections that will take place on October 14. A new leader will be voted in a few days. The announcement had little impact on the Kiwi. The NZ main stock index fell 0.28%.

Volatility in AUD/NZD

The AUD/NZD bottomed during the Asian session at 1.0735 following the weaker-than-expected Australian employment report and then rebounded and turned positive for the day. It is back above 1.0800.

NZD/USD technical outlook

The NZD/USD is looking to trade back in the range with support at 0.6330/50 and resistance at 0.6410/20, after the retreat from the multi-month high it reached on Wednesday at 0.6529. The bias is still to the upside, as it holds above the 20-day Simple Moving Average that stands at 0.6335.

A firm daily close above 0.6450 should point to a test of the recent top and toward more gains. If NZD/USD is unable to do so in the short term, a deeper correction seems likely.

Technical levels

If the energy crisis is really over, there is a long way for the Euro to rise, according to economists at Société Générale.

EUR/USD can get close to 1.20

“Our end-2022 forecast for EUR/USD is 1.12, and we’re conscious that the currency is rising much faster than expected. If we could get our heads properly around the idea that the energy crisis is over despite the war in Ukraine rumbling on and Russian gas flows to Europe having largely dried up, we’d need to raise the forecast to around 1.20.”

“No need for a risk premium due to the fragility of gas supplies? No doubts that the global LNG market can grow in time for next winter? Take out those concerns and European recession risks melt away, leaving all the focus on the ECB.”

Gold price hit levels last seen in April 2022 above $1,900. Economists at ANZ bank believe that the yellow metal has a bright outlook in the year ahead.

Central bank purchases of Gold are likely to continue

“A deteriorating economic outlook will add to safe-haven demand for Fold. Geopolitical risks are also likely to remain elevated for the second year, encouraging investors to hedge.”

“We expect jewellery demand to grow 4% YoY, surpassing 2021he prospects for physical demand have also improved. As China’s economic activity normalises in the aftermath of its reopening, consumer demand for Fold is likely to rebound. India is relatively well positioned, underpinning jewellery demand. We levels.”

“Central bank purchases of Gold are likely to continue, albeit at a slower pace from record purchases this year. Elevated geopolitical risks, trade tensions and currency risks will continue to prompt them to diversify their foreign reserves into Gold.”

- EUR/USD meets initial hurdle near 1.0840 on Thursday.

- ECB Accounts showed members initially favoured a 75 bps rate hike.

- The US Philly Fed Index improved to -8.9 in January.

Bulls remain in control of the sentiment around the single currency, with EUR/USD charting decent gains above the 1.0800 mark as the European session draws to a close on Thursday.

EUR/USD: Weekly performance capped near 1.0890

EUR/USD adds to Wednesday’s small advance and manages well to keep business above 1.0800 the figure so far on Thursday.

Indeed, the selling interest around the greenback allows the continuation of the improvement in the risk complex and helps with the pair’s upside bias, while hawkish ECB-speak also props up the march north in spot.

From the ECB, the Accounts of the latest meeting showed an initial attempt to hike rates by 75 bps and some participants advocated for a quicker reduction of the APP.

In the US calendar, Building Permits contracted 1.6% MoM in December and Housing Starts shrank at a monthly 1.4%. Additionally, Initial Claims went up by 190K in the week to January 14 and the Philly Fed Manufacturing Index improved to -8.9 for the current month.

What to look for around EUR

EUR/USD bounces off recent lows in the 1.0770/65 band and manages to regain the 1.0800 mark and beyond amidst the better mood in the risk-associated universe.

Price action around the European currency should continue to closely follow dollar dynamics, as well as the impact of the energy crisis on the euro bloc and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: ECB Lagarde, ECB Accounts (Thursday) - ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst diminishing probability of a recession in the region. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.25% at 1.0821 and faces the next up barrier at 1.0887 (monthly high January 18) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022). On the flip side, the breakdown of 1.0766 (weekly low January 17) would target 1.0513 (55-day SMA) en route to 1.0481 (monthly low January 6).

EUR/USD rebounds from sub-1.08 levels. Economists at Scotiabank note ongoing upside risks.

Support looks pretty solid in the upper 1.07s

“The EUR has run into solid resistance in the upper 1.08s on a number of occasions in the past week but losses remain limited and the short-term charts continue to suggest a consolidation (bull flag) ahead of another push higher.”

“Trend intensity signals remain bullishly aligned for the EUR across a range of timeframes which should serve to sustain this situation (i.e., limited EUR losses and ongoing upside risks).”

“The charts suggest firm support on minor dips to the upper 1.07s and ongoing upside pressure for gains towards 1.1000/50.”

- USD/CAD retreats from over a one-week high and is pressured by a combination of factors.

- A modest uptick in crude oil prices underpins the Loonie and acts as a headwind for the pair.

- The USD remains on the defensive amid bets for smaller Fed rate hikes and exerts pressure.

- The prevalent risk-off mood could lend support to the safe-haven buck and help limit losses.

The USD/CAD pair edges lower during the early North American session and drops to a fresh daily low, around the 1.3480-1.3475 region in the last hour.

The US Dollar continues to be weighed down by expectations for a less aggressive policy tightening by the Fed and acts as a headwind for the USD/CAD pair. In fact, investors now seem convinced that the US central bank will soften its hawkish stance and the current market pricing indicates a greater chance of a smaller 25 bps rate hike in February.

Apart from this, a modest bounce in oil prices underpins the commodity-linked Loonie and further contributes to capping the upside for the USD/CAD pair. The USD bulls, meanwhile, seem unimpressed by the better-than-expected release of the Philly Fed Manufacturing Index and Weekly Initial Jobless Claims, which does little to provide any impetus.

That said, worries about a deeper global economic downturn might continue to keep a lid on the black liquid. Apart from this, a fresh wave of the global risk-aversion trade - as depicted by a sea of red across the global equity markets - could lend some support to the safe-haven buck and the USD/CAD pair, warranting caution for bearish traders.

From a technical perspective, spot prices, so far, have struggled to find acceptance above the 1.3500 psychological mark or build on the momentum beyond the 100-day SMA. This makes it prudent to wait for strong follow-through buying before placing fresh bullish bets around the USD/CAD pair and positioning for any further appreciating move.

Technical levels to watch

Markets Strategist at UOB Group Quek Ser Leang suggests further losses lie ahead for USD/CNH in the short term.

Key Quotes

“… when USD/CNH was trading at 6.8900, we noted that ‘the rapid pace of drop suggests USD/CNH could break both 6.8400 and the 55-week exponential moving average (currently at 6.8240)’.”

“While our view was correct, we did not quite expect the steep selloff as USD/CNH plunged below both 6.8400 and 6.8240 and nosedived to a low of 6.7045 last week before extending its decline to 6.6982 yesterday (16 Jan). It is worth noting that on a 2-week basis, USD/CNH lost a whopping 1.71% last Friday, the biggest 2-week drop on record.”

“Further USD/CNH weakness is not ruled out but after such a sharp drop over a short time, the risk is for USD/CNH to consolidate first before heading lower at a later stage. Even if USD/CNH were to weaken further, the pace of any decline is likely to be slower especially when there are several strong support levels between 6.5730 and 6.6670. Resistance-wise, a breach of 6.8550 would indicate that the sharp drop in USD/CNH over the past few weeks has stabilized.”

- Housing Starts and Building Permits in the US declined in December.

- The US Dollar Index stays on the defensive around the 102.00 mark.

The monthly data published by the US Census Bureau revealed on Thursday showed that Housing Starts declined by 1.4% on a monthly basis in December following November’s 1.8% drop.

In the same period, Building Permits fell by 1.6% as compared to the 10.6% fall recorded in November.

Market reaction

The data does little to impress the US Dollar bulls amid growing acceptance that the Fed will soften its hawkish stance and rising bets for a smaller 25 bps rate hike in February.

- Initial Jobless Claims in the US declined by 15,000 last week.

- The US Dollar Index stays on the defensive near 102.00.

There were 190,000 initial jobless claims in the week ending January 13, data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 205,000 and came in better than the market expectation of 214,000.

Further details of the publication revealed that the 4-week moving average was 206K, a decrease of 6,500 from the previous week's average of 212.5K

Market reaction

The US Dollar Index continues with its struggle to gain any meaningful traction and remains on the defensive around the 102.00 mark amid rising bets for smaller Fed rate hikes.

- Philly Fed Manufacturing Index improved modestly in January.

- The US Dollar fails to gain any respite and remains depressed.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity improves to -8.9 in January from -13.8 in December. This print comes in better than market expectations, though does little to provide any meaningful impetus.

Market reaction

The US Dollar remains on the defensive amid rising bets for a less aggressive policy tightening by the Fed, though a fresh wave of the global risk-aversion trade helps limit the downside.

The Canadian Dollar cannot avoid pull from stock market trends, accrodign to strategists at Scotiabank.

Firm resistance at 1.3520, losses limited to 1.3490

“Weak stocks suggest limited potential for the CAD to recover at the moment.”

“The USD rise has run into firm resistance at 1.3520, with losses limited to 1.3490; a move either side of this range will determine short-term gains or losses (of 30-40 pips) but might also point towards either a return to the 1.36 area or a drop back to the low 1.34s.”

- GBP/USD struggles to gain any meaningful traction and oscillates in a range on Thursday.

- Recession fears weigh on investors’ sentiment and benefit the greenback, capping gains.

- The prospects for more BoE rate hikes underpin the British Pound and acts as a tailwind.

The GBP/USD pair finds some support ahead of the 1.2300 round figure on Thursday and for now, seems to have stalled the previous day's pullback from its highest level since December 14. The pair, however, struggles to gain any meaningful traction and remains confined in a range below mid-1.2300s through the mid-European session.

A fresh wave of the global risk-aversion trade - amid rising fears of a potential recession - benefits the US Dollar's relative safe-haven status and caps the upside for the GBP/USD pair. Investors remain concerned about headwinds stemming from the worst COVID-19 outbreak in China and the protracted Russia-Ukraine war. Adding to this, the weaker US macro data released on Wednesday further fuels worries about a deeper global economic downturn and take its toll on the risk sentiment.

The USD bulls, however, remain on the defensive amid firming expectations for a less aggressive policy tightening by the Fed. In fact, the markets now seem convinced that the US central bank will soften its hawkish stance and have been pricing in a smaller 25 bps rate hike in February. This leads to a further decline in the US Treasury bond yields and weighs on the buck. Furthermore, speculations that the Bank of England will stick to a more hawkish stance extends support to the GBP/USD pair.

Investors expect the UK central bank to continue raising interest rates to combat stubbornly high inflation. The bets were lifted by the stronger wage growth data released on Tuesday, which could keep inflation elevated. Furthermore, the headline UK CPI - though fell to a three-month low in December - is still running at levels last seen in the early 1980s. This might continue to act as a tailwind for the British Pound and supports prospects for a further appreciating move for the GBP/USD pair.

Next on tap is the US economic docket, featuring the release of the Philly Fed Manufacturing Index, the usual Weekly Initial Jobless Claims and housing market data. This, along with speeches by influential FOMC members, the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to the GBP/USD pair. Nevertheless, the fundamental backdrop favours bulls, suggesting that any pullback could attract fresh buyers and remain limited.

Technical levels to watch

GBP/USD is expected to remain below the 1.2445/47 December highs for now, in the view of analysts at Credit Suisse.

Support seen at 1.2204, then 1.2169

“We maintain our view that the 1.2245/47 December high is likely to remain a tough barrier and we thus continue to look for this to cap for now, even if the broader trend is still seen higher.”

“Support stays seen at 1.2301/1.2291 initially, then the 13-day exponential average at 1.2204.”

“A close below 1.2169 remains needed to ease the immediate upside bias to clear the way for a retest of support at 1.2099/89, with the 55-day average now at 1.2045.”

“Resistance is seen at 1.2355, then 1.2417. An eventual break above 1.2447 should see strength extend to 1.2668/1.2758 – the May 2022 high and 61.8% retracement of the 2021/22 fall.”

Fall in the December inflation is the beginning of a sign that a corner has been turned, notes Bank of England (BoE) Governor Andrew Bailey.

Key quotes:

The most likely outcome is that inflation will fall quite rapidly this year, probably starting in the late spring.

There is more optimism now that we are going to get through the next year with an easier path on inflation.

We don’t target a particular peak for rates.

I am not endorsing a 4.5% bank rate peak, but in December is that we did not include the comment about the market being in our view rather out of line

We think there will be a recession.

The recession will be a shallow one by historic standards.

The labour force has shrunk, and that is putting pressure on the labour market.

Below are key highlights from the European Central Bank (ECB) Monetary Policy Meeting Accounts released earlier this Thursday.

Key points: