- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- NZD/USD is seeking more upside above 0.6500 as the risk profile is supporting risk-perceived assets.

- US inflation softening resulted in a decline in the US Dollar Index below 101.60.

- Investors are awaiting the release of the US S&P PMI and NZ Inflation data for fresh cues.

The NZD/USD pair is aiming to extend its upside journey above the psychological resistance of 0.6500 in the early Asian session. The kiwi asset is eyeing a recovery extension amid a cheerful market mood. Soaring expectations of a further slowdown in the pace of policy tightening by the Federal Reserve (Fed) is infusing strength into the risk-sensitive assets.

In early Tokyo, S&P500 futures are showing marginal losses after a bullish Monday. Caution is stemming, however, the overall market sentiment is strictly positive. Investors’ risk appetite is still solid as meaningful softening United States inflation is setting grounds for a deceleration in the interest rates hiking pace.

The US Dollar Index (DXY) has dropped to near 101.60 after sensing selling pressure while attempting to cross the critical resistance of 101.87 after commentary from US Treasury Secretary Janet Yellen. US Yeller cited on Monday that overall, she has a “good feeling that inflation is coming down.” However, it reiterated the fact that the “US labor market is still very tight,”

The next move that might trigger volatility in the US Dollar is the release of the preliminary United States S&P PMI (Jan) data, which is seen on Tuesday. Investors should brace for a contraction in economic activities. The Manufacturing PMI is seen lower at 46.1 while the Services PMI might contract to 44.5.

On the kiwi front, the New Zealand Dollar will display a power-pack action after the release of Wednesday’s Consumer Price Index (CPI) data. Annual Consumer Price Index (CPI) data for the fourth quarter of CY2022 is seen declining marginally to 7.1% from the former release of 7.2%. On a quarterly basis, the inflation rate might trim to 1.3% from the prior release of 2.2%.

- WTI retreats from multi-day high amid lack of major positives, cautious mood ahead of key data.

- Sluggish markets, Lunar New Year in China limit energy buyers’ optimism.

- Preliminary PMIs for January, weekly oil inventory data from API could direct intraday moves.

WTI crude oil remains sidelined around $81.70, after refreshing the multi-day high above $82.00 the previous day. In doing so, the black gold portrays the market’s inaction amid an absence of Chinese players due to the Lunar New year (LNY) holidays. Adding strength to the Oil price inaction could be the cautious mood ahead of the preliminary readings of January’s activity numbers from the key economies.

That said, the broad US Dollar weakness and easing recession fears, mainly backed by China-linked optimism, seemed to have propelled the WTI crude oil to $82.68, the highest level since December 05, 2022.

Adding strength to the energy market’s positive outlook could be the news suggesting a five-month high in India’s crude oil imports and Pakistan’s readiness to push back the power shortage with international help. It should be noted that the hopes of improved festive demand from China also propels the WTI crude oil prices of late.

Furthermore, the European Union and Group of Seven (G7) coalition’s price cap on Russian Oil exports also adds strength to the energy benchmark.

Alternatively, hawkish comments from the major central banks, despite chatters of policy normalization, join the talks of more output from the key suppliers to probe the WTI crude oil buyers.

Looking forward, the first readings of January’s activity data for Germany, the Eurozone and the US will be crucial for immediate directions. Additionally, the weekly oil inventory data from the industry player American Petroleum Institute (API), prior 7.615M, will also be important for the commodity’s immediate direction.

Technical analysis

Monday’s Doji candlestick on the Daily chart challenges Oil buyers unless the quote offers a daily closing beyond the 100-DMA, close to $81.75 by the press time.

- AUD/JPY has remained muted around 91.80 despite softening of the Australian PMI.

- Australia’s Manufacturing PMI has contracted consecutive for the seventh month to 49.8.

- Further appreciation in the Japanese Yen looks possible on an exit from BoJ’s expansionary policy.

The AUD/JPY pair has continued to remain sideways around 91.80 despite the release of the downbeat Australian S&P500 PMI data. Manufacturing PMI has trimmed consecutively for the seven-month to 49.8 while the street was expected an expansion to 50.3. Also, the Services PMI has dropped vigorously to 48.3 from the consensus of 49.7.

Rising interest rates by the Reserve Bank of Australia (RBA) in its fight against stubborn inflation are leading to a contraction in economic activities. The absence of easy money for firms to execute investment and expansion plans along with bleak economic demand has trimmed the scale of economic activities.

Australian economic activities could recover ahead as China is on the path of recovery now after dismantling Covid-inspired lockdown curbs. According to a note from JPMorgan, Australia’s economy could be no small beneficiary of an end to China’s zero-Covid policy over the next two years. Also, China’s reopening could boost Australia’s economy by 1%.

Going forward, the risk barometer will dance to the tunes of the Australian Consumer Price Index (CPI) data for the fourth quarter of CY2022. As per the consensus, the annual CPI is expected to escalate marginally to 7.5% from the prior release of 7.3%. While monthly inflation is seen sharply higher at 7.7% from the former release of 7.3%.

Australian Treasurer Jim Chalmers cited that the worst part of the country's inflation crisis was over. He believes "The Australian economy will begin to soften a bit this year and that is the inevitable likely consequence of higher interest rates and a slowing global economy.”

On the Tokyo front, chatters over Bank of Japan (BoJ) Governor Haruhiko Kuroda’s successor is hogging the limelight. Analysts at Commerzbank believe that criticism of Kuroda’s expansionary monetary policy by the succession might result in further appreciation in the Japanese Yen. BoJ officials see difficulties in keeping inflation levels above 2% for a longer period despite gradually escalating CPI in Japan’s region.

- The GBP/JPY reached a 4-week high at 161.80, eyeing the confluence of the 50 and 200-day EMAs.

- GBP/JPY Price Analysis: Double bottom looms, but a death-cross looming suggests further downside is expected.

The GBP/JPY extended its gains for two straight days and climbed towards a wall of resistance, with the confluence of the 50 and 200-day Exponential Moving Averages (EMAs) around 161.90-162.20. As the Asian Pacific session begins, the GBP/JPY is trading at 161.61, below its opening price by 0.05%.

GBP/JPY Price Analysis: Technical outlook

After reaching a daily high of 161.80, the GBP/JPY fell short of reclaiming the 50-day EMA at 161.87. even though buyers reclaimed the 161.00 figure and cleared last Friday’s high of 161.2, the GBP/JPY aims upwards, though it would face solid resistance ahead.

The GBP/JPY key resistance levels lie at the 50-day EMA at 161.87. A breach of the latter would expose 162.00, followed by the 200-day EMA at 162.18, followed by the 100-day EMA at 162.87.

As an alternative scenario, if the GBP/JPY reverses Monday’s price action, its first support would be the 161.00 figure. Break below will expose the 20-day EMA at 160.04, followed by the January 23 swing low of 159.00.

GBP/JPY Key Technical Levels

- USD/CHF grinds higher after two-day uptrend crossed 11-week-old resistance line.

- Sluggish oscillators, multiple hurdles to the north challenge buyers.

- Sellers need validation from 0.9180 to retake control.

USD/CHF makes rounds to 0.9220-25 as it struggles to extend the key resistance break during Tuesday’s sluggish Asian session. In doing so, the Swiss Franc (CHF) pair probes the previous two-day uptrend at the latest.

That said, the major currency pair crossed a downward-sloping resistance line from November 04 the previous day, now support around 0.9200. However, the sluggish MACD and RSI indicators show the buyers’ lack of conviction ahead of a slew of hurdles to the north.

Among them, a 12-day-old resistance line close to 0.9275 appears the immediate challenge for the USD/CHF buyers to tackle.

Following that, a descending trend line from November 21, surrounding 0.9350 at the latest, could probe the USD/CHF pair’s upside moves.

It’s worth noting that the quote’s successful trading above 0.9350 could enable the buyers to aim for the 200-DMA hurdle near 0.9640, which holds the key to the bull’s dominance.

On the flip side, pullback moves remain elusive unless the quote stays beyond the 0.9200 previous resistance.

Following that, a one-week-old ascending support line, close to 0.9180 by the press time, will be important for the USD/CHF bears to conquer to retake control.

In a case where the USD/CHF price remains weak past 0.9180, the odds of witnessing a fresh month low, currently around 0.9085, can’t be ruled out.

USD/CHF: Daily chart

Trend: Further recovery expected

- USD/CAD is looking to extend its downside towards a weekly low around 1.3340 amid the risk-on market mood.

- The BoC is expected to hike interest rates further by 25 bps to 4.50% this week.

- Oil prices might deliver a recovery amid optimism over China’s economic recovery.

The USD/CAD pair has dropped to near 1.3367 gradually in early Asia after failing to shift its auction above the round-level resistance of 1.3400. The Loonie asset is expected to stretch its downside journey to near the weekly low around 1.3340 as the risk-taking capacity of the market participants has improved.

The risk appetite theme solidified amid easing recession fears in the United States on expectations of a smaller interest rate hike by the Federal Reserve (Fed) next week. S&P500 witnessed a decent buying interest on Monday, supported by a recovery in tech-savvy stocks. Meanwhile, fading risk aversion among the market participants could propel further sell-off in the US Dollar Index (DXY).

The USD Index is hovering near the lower end of its trading range in the 101.56-101.87 territory. The alpha generated by the US government bonds is still solid as terminal rate projections have not trimmed despite continuous inflation softening. The 10-year US Treasury yields have extended above 3.52%

On the Loonie front, investors are awaiting the announcement of the interest rate decision by the Bank of Canada (BoC), which is scheduled for Wednesday, for fresh cues. Canada’s inflation is declining gradually and has dropped to 6.3% but is still beyond the 2% inflation target, therefore expectations of a further hike in the interest rates cannot be ruled out.

According to a poll from Reuters, BoC Governor Tiff Macklem’s aggressive policy tightening campaign is expected to calm further as the street sees a further interest rate hike by 25 basis points (bps) to 4.50%. On the oil front, the oil price has witnessed selling pressure after failing to overstep previous week’s high at $82.50. The upside bias is still solid as China’s economic recovery is expected to keep oil demand at elevated levels. It is worth noting that Canada is a leading exporter of oil to the United States and the higher oil price will provide support to the Canadian Dollar.

- The USD/JPY post gains for two straight days and meanders around the 20-day EMA.

- USD/JPY Price Analysis: Range-bound capped around the 130.00-131.00 mark.

The USD/JPY prolonged its gains to two consecutive days on Monday, though it faltered to crack the 20-day Exponential Moving Average (EMA) at 130.91, which would pave the way for further upside. Nevertheless, as the Asian session begins, the USD/JPY is trading at 130.60, registering minuscule losses of 0.02%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY tested the 20-day EMA during Monday’s session, though the pair retreated and closed at 130.64. However, the USD/JPY pair remains tilted to the downside, but it might consolidate around 131.00. This is because the Relative Strength Index (RSI), albeit at bearish territory, is almost flat, while the Rate of Change (RoC) portrays buyers gathering momentum.

For the USD/JPY to resume upwards in the near term, it needs to break January’s 18-daily high of 131.57. Break above will expose the 132.00 mark, followed by a falling slope resistance trendline around 132.18, followed by the 50-day EMA at 134.10. As an alternate scenario, if the downtrend resumes, the USD/JPY first support would be the January 23 daily low of 129.04, followed by January 16 at 127.21.

USD/JPY Key Technical Levels

- AUD/USD bulls take a breather around five-month high, sidelined of late.

- Preliminary readings of S&P Global Manufacturing and Services PMIs softened, Composite PMI improved for January.

- Receding fears of strong recession in 2023, optimism surrounding China underpin bullish bias.

- US PMIs eyed for intraday directions, US Q4 GDP are the key for fresh impulse.

AUD/USD justifies the recent activity data from Australia as the pair buyers take a breather around the highest levels since August, marked the last week, following the downbeat release of Aussie S&P Global PMIs for January. Also challenging the risk barometer pair could be the recently cautious mood ahead of the key US PMIs, as well as the US four-quarter (Q4) Gross Domestic Product (GDP).

Australia’s S&P Global Manufacturing PMI dropped below 50.0 for the first time since June 2020, to 49.8 versus 50.3 expected and 50.2 prior. Further, the Services PMI also suggested the activity contraction by declining below the 50.0 figure even after improving from 47.3 prior, to 48.3 versus 49.7 market forecasts. With this, the S&P Global Composite PMI rose to 48.2 compared to 47.5 prior.

Given the softer activity data from Australia, the receding odds of the Reserve Bank of Australia’s (RBA) retreat from the previously hawkish bias appear legitimate to expect, which in turn probe the AUD/USD bulls despite the broad US Dollar weakness. However, this week’s Australia Consumer Price Index (CPI) and RBA Trimmed Mean CPI for December will be crucial for the clear directions.

Other than the data at home, softer prints of the US Conference Board’s Leading Index for December, to -1.0% versus -0.7% expected and -1.1% prior, added weakness to the US Dollar and favored the AUD/USD buyers.

On a different page, an absence of Chinese players due to the Lunar New Year Holidays and receding fears of the strong recession in 2023 also seemed to have improved the market’s mood and underpinned the AUD/USD pair’s upside, due to its risk-barometer status.

Looking forward, the first readings of January’s S&P Global PMIs for the US will offer intraday directions while Aussie inflation and the US Q4 GDP will be crucial for the week for clear directions.

Technical analysis

A 10-week-old ascending resistance line, around 1.0745 by the press time, restricts immediate upside of the AUD/USD pair. The pullback moves, however, remain unimpressive until the quote stays beyond the 200-DMA support level of 0.6815.

- Gold price is looking for establishing the auction above $1,930.00 as the risk-on profile has strengthened.

- US yields have scaled above 3.52% as the Fed policymakers have not toned down interest rate projections.

- The release of the US S&P PMI data will result in a power-pack action in the Gold price.

Gold price (XAU/USD) is looking to sustain above the immediate resistance of $1,930.00 in the early Tokyo session. The precious metal has extended its responsive buying action move from $1,912.50 to near $1,930.00 and is aiming to stretch further as the risk appetite of the market participants is firmer.

S&P500 ended Monday’s session with significant gains amid a decent quarterly result season. The US Dollar Index (DXY) dropped after failing to surpass the critical resistance of 101.80 despite multiple attempts. The 10-year US Treasury yields scaled above 3.52% as the Federal Reserve (Fed) policymakers have not trimmed their interest rate peak projections despite the presence of indicators that claim further decline in inflation projections.

Gold price is likely to display a power-pack action after the release of the preliminary United States S&P PMI data (Jan), which is scheduled for Tuesday. The Manufacturing PMI is seen lower at 46.1 while the Services PMI might contract to 44.5. Weaker demand projections and the unavailability of cheap money from the Fed due to higher interest rates might impact the US Dollar as fears of recession will soar further. This could also impact the strength of the S&P500.

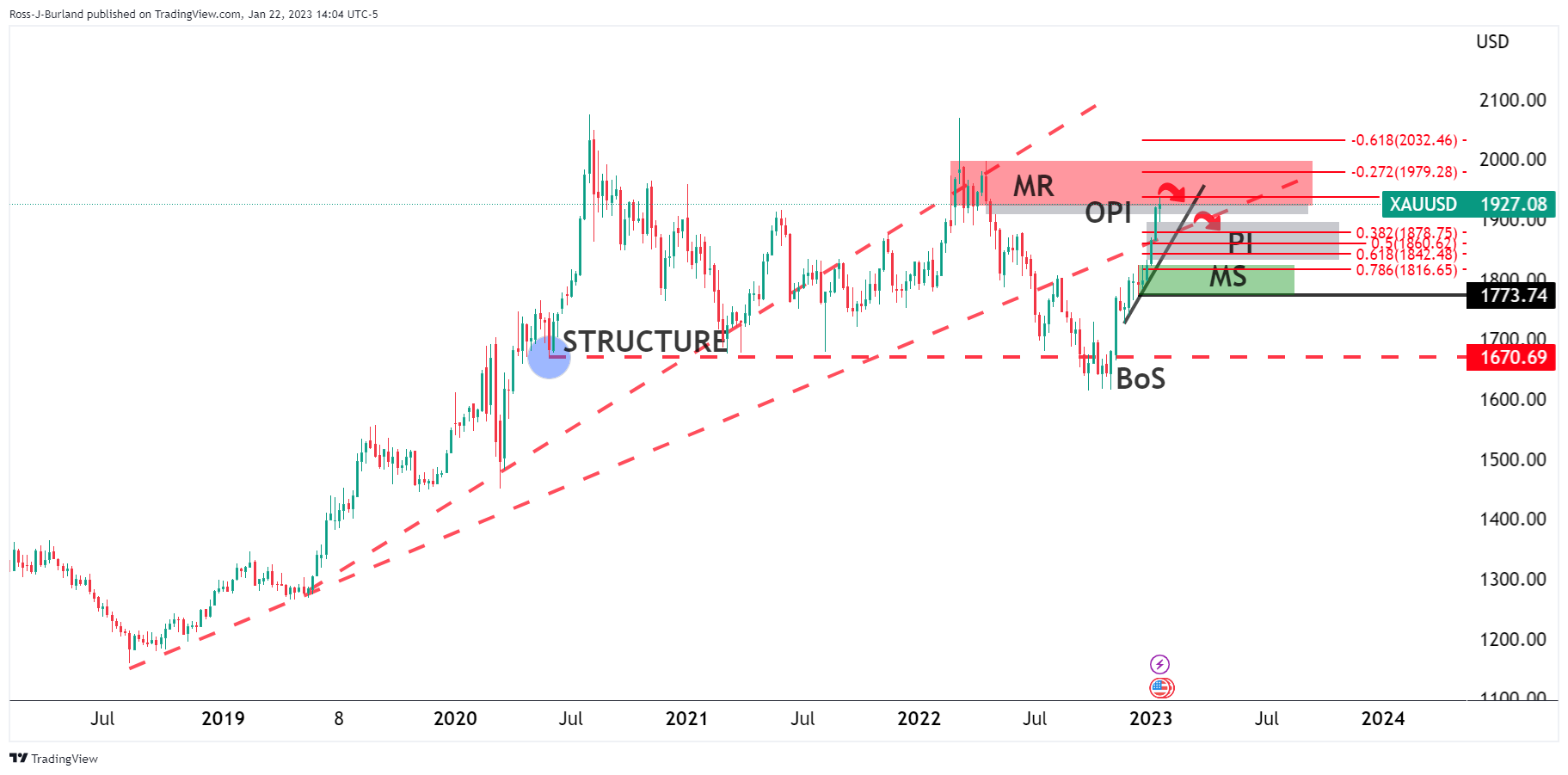

Gold technical analysis

Gold price is demonstrating signs of a loss in the upside momentum as the Relative Strength Index (RSI) is showing a negative bearish divergence formation. The Gold price is forming higher highs and higher lows while the momentum oscillator RSI (14) had formed a lower high when the asset formed a high of $1,937.57 on Friday, which indicates exhaustion in the bullish momentum.

The downside bias is not completely developed as the asset has not formed a lower low, which might be established on a breakdown of horizontal support plotted from January 18 low at $1,896.63.

The 20-period Exponential Moving Average (EMA) at $1,923.02 is still providing support to the Gold bulls.

Gold four-hour chart

- EUR/USD picks up bids to reverse the previous day’s pullback from multi-day high.

- ECB hawks propelled prices in absence of Fed talks, softer US data adds to the US Dollar weakness.

- Preliminary readings of January month PMIs for Germany, Eurozone and US will be eyed for intraday directions.

EUR/USD stays firmer around 1.0870, despite late Monday’s retreat from a multi-day high, as the European Central Bank (ECB) hawks favor the pair buyers ahead of the key monthly activity data for the bloc, as well as for the US. Adding strength to the major currency pair’s upside momentum were the downbeat US statistics and market’s cautious optimism amid an absence of the Federal Reserve (Fed) policymakers’ speech due to the pre-Federal Open Market Committee (FOMC) blackout period.

ECB President Christine Lagarde’s comments suggesting further rate hikes to tame inflation were the latest to favor the EUR/USD bulls. However, major attention was given to ECB Governing Council Member Peter Kazimir who said, “I am convinced that we need to deliver two more hikes by 50 basis points." The idea of 50 bps rate hike was something that many policymakers have refrained in recent days.

On the other hand, softer prints of the US Conference Board’s Leading Index for December, to -1.0% versus -0.7% expected and -1. 1% prior, added weakness into the US Dollar.

It should be noted that an absence of Chinese players due to the Lunar New Year Holidays and receding fears of the strong recession in 2023 also seemed to have improved the market’s mood and favored the EUR/USD bulls.

Moving on, the EUR/USD buyers are likely to keep the reins amid cautious optimism and hawkish ECB commentary. However, the first readings of January’s activity data for Germany, the Eurozone and the US will be crucial for immediate directions. As per the forecasts, the S&P Global PMIs for Germany and the Eurozone are likely to improve while the US numbers may ease during the stated month and hence the pair buyers may witness additional support from the scheduled activity numbers.

Technical analysis

EUR/USD is well-set to visit the 1.1000 round figure unless declining below the 1.0765 level comprising the last weekly low.

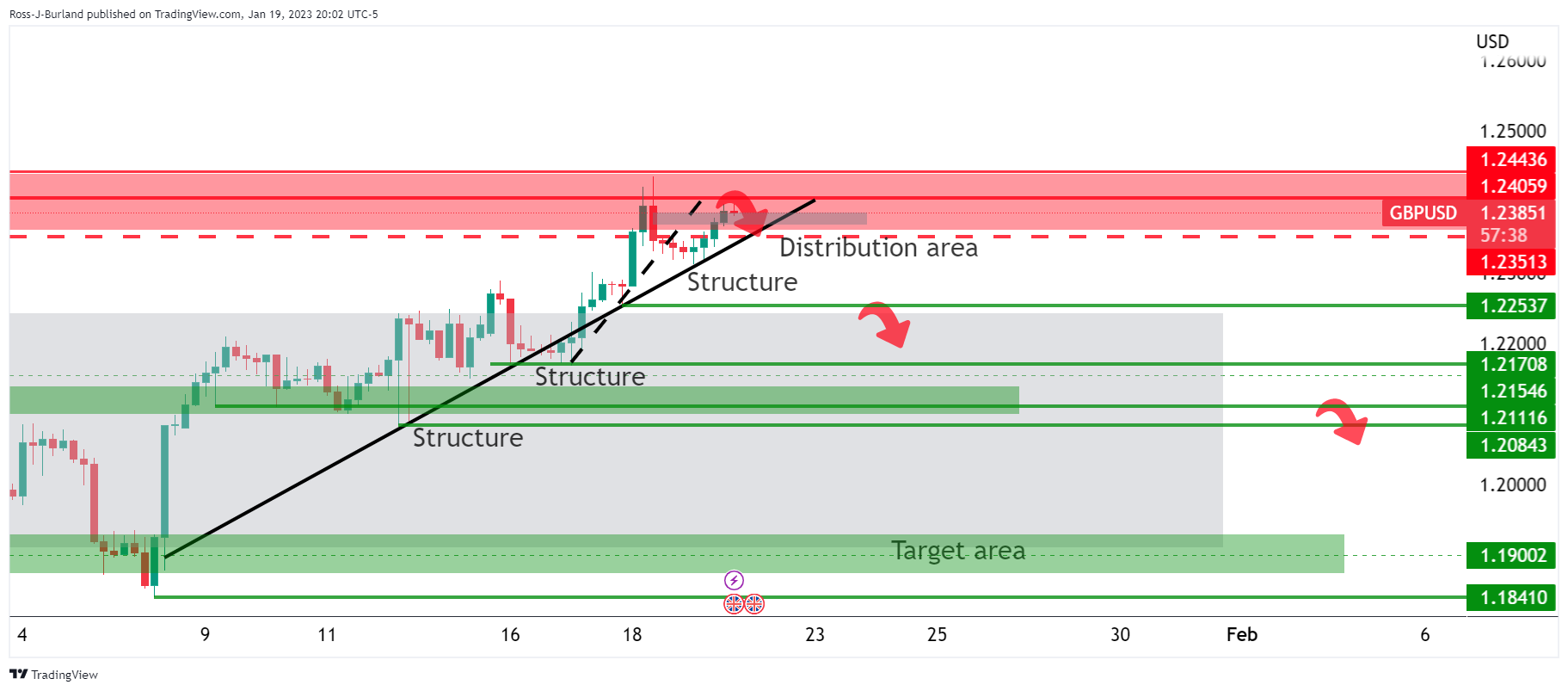

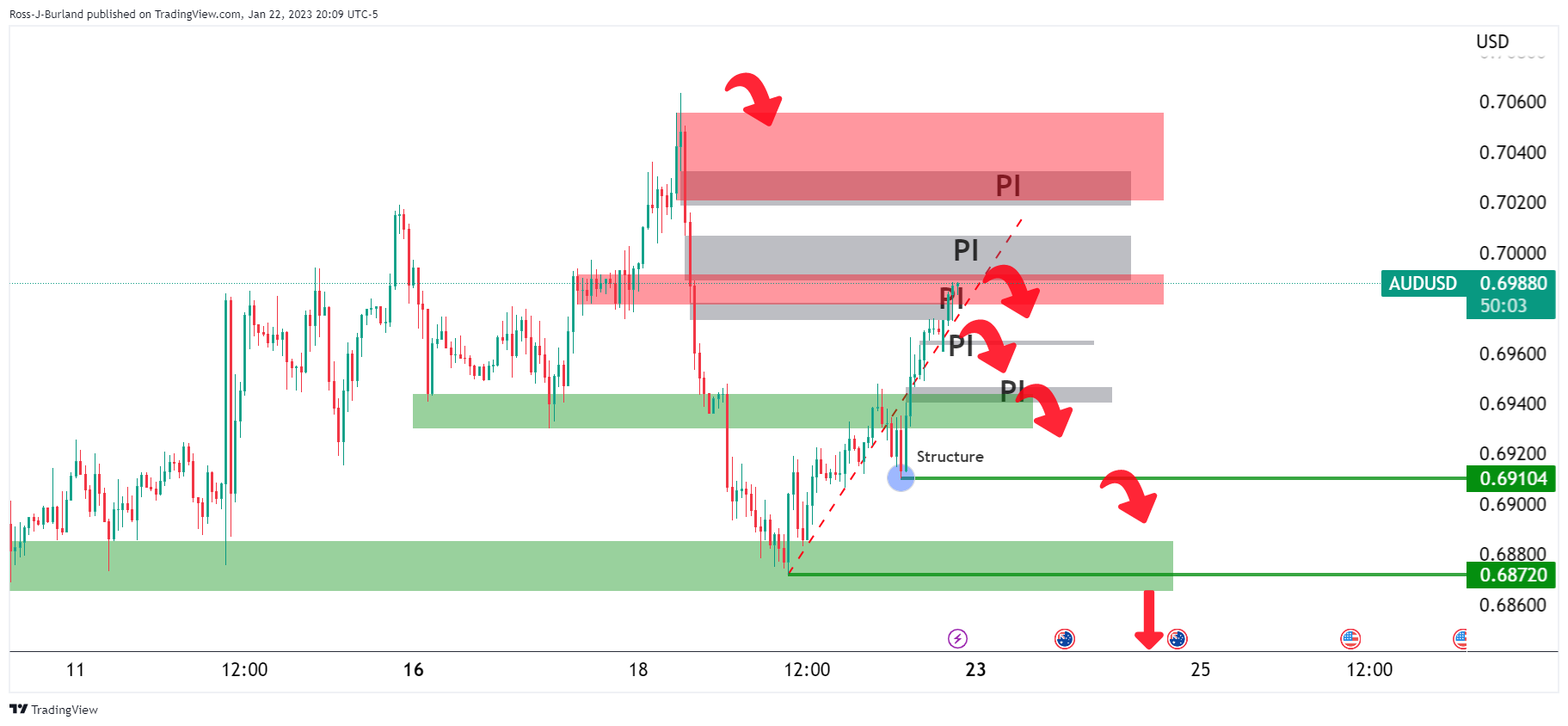

- GBP/USD bulls have been testing the commitments of the bears that are now tracking control on the backside of the trend.

- Bears need to break 1.2350/30 for a shot at 1.2250 and then 1.2170.

As per the prior analysis, whereby it was stated that the technical bias for GBP/USD remains bearish while below 1.2400, a break of the trendline was anticipated to ignite a frenzy of offers to test 1.2250 support.

GBP/USD prior analysis

The bears were moving in at the end of last week as illustrated on the 4-hour chart above. We have seen a push lower following tests in the 1.24 area that indeed failed.

GBP/USD update

1.2170 will be eyed in the coming session if the bears stay the course and if the US Dollar can breakout to the upside for a run above trendline resistance in the DXY index:

- Silver prices dived more than 2% on Monday as US Treasury yields gained traction.

- Silver Price Analysis: In consolidation, though appears to be peaking around $24.00.

Silver prices appear to have peaked following Monday’s price action, with the white metal unable to hold to the $24.00 figure, collapsing as low as $22.76, beneath the 50-day Exponential Moving Average (EMA) at $22.93, though trimmed some of its earlier losses. Nevertheless, the XAG/USD is still down 2%, exchanging hands at $23.44.

Silver Price Analysis: XAG/USD Technical Outlook

XAG/USD prices, throughout Monday’s session, have been trading in a wide range but reclaimed a 22-day upslope support trendline that passes around $23.30. Although it erased some of its earlier losses, the XAG/USD has fallen short of reclaiming the 20-day Exponential Moving Average (EMA) at $23.67. Therefore, Silver would consolidate around the $23.30-$24.00 area unless it cracks the top/bottom of the range.a breach of the day’s high of $24.15 would put into play the YTD high of $24.54 and the psychological $25.00 mark.

As an alternative scenario, the XAG/USD first support would be $23.00. Once cleared, the XAG/USD next support would be the 50-day EMA at $22.93, followed by the 100-day EMA at $22.05.

Oscillator-wise, the Relative Strength Index (RSI) crossed below its 50-midline, so further downside is expected, while the Rate of Change (RoC) suggests that buyers stepped in around Wall Street’s close.

Therefore, the XAG/USD remains neutral biased in the near term.

Silver Key Technical Levels

Here is what you need to know for January 25th The dollar index bottomed around the 102 neighbourhood, hovering close to levels not seen since May 2022, as concerns about a US recession and prospects of a less aggressive Federal Reserve spooked investors away from the greenback. This led to widespread volatility on the day across both commodities and the forex space with Gold price, in particular, flying around as the Euro ran higher on the back of hawkish commentary from the Europen Central Bank officials.

The Federal Oen Market Committee is in its blackout period while investors believe that the central bank will hike rates by just 25bp at the February meeting where the main attention will stay with Fed Chair Powell’s tone around the level for “appropriately restrictive” interest rates. Fed fund futures have priced out almost any chance the Fed could move by 50 basis points next month and have steadily lowered the likely peak for rates to 4.75% to 5.0%, from the current 4.25% to 4.50%.

Meanwhile, ECB Governing Council hawks have been calling for 50bp rate hike. This has seen the Euro reach as high as $1.0927 vs. the dwindling US Dollar and to trade at its highest level since April last year. The Euro Stoxx 50 rose 0.8%.

The US Dollar still managed to perform pretty well relatively speaking vs. the Japanese Yen after the Bank of Japan (BOJ) defied market pressure to reverse its ultra-easy bond control policy last week. USD/JPY rose to 130.88 but sits between last week's range of 127.22 and 131.58.

The Great British Pound was pressured to a seven-month high against the US Dollar despite recent data showing that the British economy was performing better than feared. Nevertheless, the bears were on board and took the Pond Sterling to a low of 1.2323.

The Canadian dollar was treading water while investors held off from making major bets ahead of a Bank of Canada interest rate decision balancing around 1.3380 to the greenback and pulling back from its strongest intraday level since Jan. 13 at 1.3343.

As for commodities and crypto, the oil price dipped with WTI easing 0.2% to $81.5/bbl. However, the main volatility in the complex came with the Gold price that was broadly unchanged at USD1,927.4/oz by the end of the day but trading within a wide range of between $1,911 and $1,935/oz. Meanwhile, bitcoin, BTCUSD was little changed on the day at $ 22,849, steadying after having jumped by about a third in value since early January. There are no major news events on the Asian calendar on Tuesday.

- NZD/USD bulls are taking on major resistance as the greenback falters.

- Bulls eye a break of recent highs but bears are lurking.

NZD/USD has come up into a major resistance and it begs the question as to whether the bulls will stay the course as we head into critical events on both the United States and New Zealand's calendar.

The following illustrates the recent surge higher on the back of the US Dollar'ssoftness and the prospects of a meanwhile correction for the sessions ahead.

NZD/USD daily chart

As illustrated, the Kiwi has bottomed leaving behind a W-formation:

The price is meeting a daily trendline resistance and has left the harmonic pattern as a reversion prospect to 0.6200:

DXY index

Meanwhile, the US Dollar is under pressure still while below its own resistance trendline:

The US Dollar index bottomed around the 102 neighbourhood despite global and US recession concerns. Nonetheless, the prospects of a less aggressive Federal Reserve have spooked investors away from the greenback. Unless the bulls can get on the backside of the trend, there are serious prospects of a blow-off that could properly the Kiwi much higher.

- A higher-than-expected Consumer Price Index (CPI) in Australia could offer a chance to break above 0.7100.

- The US calendar will feature S&P Global PMIs on Tuesday and GDP on Wednesday.

- AUD/USD: Failure to gain traction above 0.7050 will expose the pair to sellers; otherwise, a 0.7100 test is on the cards.

The Australian Dollar (AUD) climbs sharply against the US Dollar (USD) even though the greenback is positing minimal gains, spurred by risk appetite improvement. Also, Australia’s inflation report on Wednesday could trigger a reaction by the Reserve Bank of Australia (RBA). At the time of writing, the AUD/USD is trading at 0.7025.

AUD/USD holds steadily above 0.7000 despite a bid US Dollar

The AUD/USD has extended us gains, though slightly capped by the buck. The US Dollar Index (DXY), a gauge of the buck’s value against six peers, is gaining 0.13%, at 102.124, underpinned by US Treasury bond yields rising. The 10-year benchmark note rate advances three and a half bps at 3.521%.

Following the Wall Street opening, the Conference Board (CB) reported its Leading Economic Index (LEI), which dropped for the tenth month in December. The US LEI fell sharply again in December—continuing to signal recession for the US economy in the near term,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.”

In the meantime, money market futures expect the Federal Reserve (Fed) to hike the 25 bps rate hikes at the February 1 meeting, leaving the Federal Funds rate (FFR) at 4.50-4.75%.

Elsewhere, the Reserve Bank of Australia (RBA) is expected to hike rates by 25 bps, the cash rate on February 7 to 3.35%. Markets had priced in an 80% chance for the RBA lifting rates, and the cash rate is seeing peaking at 3.55%-3.60%.

In the meantime, Wednesday’s release of the Australian Consumer Price Index (CPI) for the fourth quarter is expected to rise 1.5% QoQ and 7.4% YoY. According to Westpac analysts, that should be the cycle peak for inflation. A softer reading would send the AUD/USD diving below 0.7000; otherwise, it could open the door for further upside and test the 0.7100 mark.

On the US front, its calendar will feature the S&P Global PMIs, ahead of Wednesday’s Gross Domestic Product (GDP) for the fourth quarter and the entire year of 2022.

AUD/USD Technical Analysis

Although the AUD/USD extended its gains above the 0.7000 figure, the YTD high of 0.7063 remains intact, with sellers stepping in around the 0.7050 area and lowering prices. Failure to gain traction above 0.7063 has kept the AUD/USD from testing the August 11 swing high of 0.7136 and sent the pair diving beneath the 0.7000 mark. Break below the latter would expose the 20-day Exponential Moving Average (EMA) at 0.6889.

- EUR/USD bulls come up for more air on hawkish ECB commentary.

- Eyes will turn to red calendar events this week.

EUR/USD has been trading near a 9-month high for the best part of the start of the week as the market's bank on rate hikes from the European Central Bank at the same time that they start to price a less aggressive Federal Reserve. EUR/USD vaulted the prior higher and scored a fresh bull cycle high of 1.0927.

In trade on Monday, futures have priced out almost any chance the Fed could move by 50 basis points next month and have steadily lowered the likely peak for rates to 4.75% to 5.0%, from the current 4.25% to 4.50%. By contrast, ECB policymaker Peter Kazimir said on Monday that inflation easing was good news but added that it was not a reason to slow the pace of interest rate hikes, as reported by Reuters.

"I am convinced that we need to deliver two more hikes by 50 basis points," Kazimir said and acknowledged that the Eurozone economy was faring better than expected one-two months ago.

Governing Council member Ignazio Visco also said on Monday that Italy can deal with the impact of a 'gradual but necessary' rate of monetary policy tightening.

"Alarms that are sometimes raised about effects that further ECB rate increases could have on the Italian economy cannot be shared," Visco added. "I believe it is entirely possible to reach the ECB target of inflation at 2% while avoiding particularly negative impact on the eurozone economy and the labour market."

Governing Council member and Governor of Austria's central bank Olli Rehn made some comments on the central bank’s interest rates policy during his appearance over the weekend.

He said that he sees grounds for "significant interest rate increases from the ECB this winter and the coming spring.”

Reuters also reported that the European Central Bank (ECB) is set to raise interest rates by 50 basis points in both February and March and will continue to raise rates in the months after, ECB governing council member Klaas Knot said in an interview with Dutch broadcaster WNL on Sunday.

"Expect us to raise rates by 0.5% in February and March and expect us to not be done by then and that more steps will follow in May and June," Knot said.

In more recent trade, ECB President Christine Lagarde largely repeated the bank's most recent policy guidance. "We have made it clear that ECB interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive, and stay at those levels for as long as necessary," Lagarde said in a speech.

Looking ahead for EUR/USD

Later in the week, flash surveys on January economic activity due this week are forecast to show more improvement in Europe amid falling energy costs than in the United States.

We also have red news on the US calendar. Core PCE prices likely accelerated to a 0.3% MoM pace in Dec, though a 0.4% gain can't be discarded. The YoY rate likely slowed to 4.5%, suggesting prices continue to moderate but remain sticky at high levels, analysts at TD Securities pointed out. In terms of Gross Domestic Product, the analysts said, ''we also look for Gross Domestic Product growth to have stayed strong in Q4, posting another above-trend gain. Growth was likely supported by firm showings from the consumer and inventories.''

With regards to the outlook at the Federal Reserve, analysts at Brown Brothers Harriman explained that they are of the opinion that the market is underestimating the potential for a higher for longer Federal Reserve. ''Core Personal Consumption Expenditures, PCE, has largely been in a 4.5-5.5% range since November 2021,'' they said. ''We think the Fed needs to see further improvement before even contemplating any sort of pivot.''

Analysts at Rabobank said that while there 1-month forecast stands at 1.09, they see room for a move lower to 1.06 on a 3-month view. ''This assumes the Fed reasserts a more hawkish position on policy than the market currently expects. It also takes into account the risk that Europe’s energy crisis is far from over.''

- USD/CAD seesawed around 1.3342-1.3417, ahead of the Bank of Canada monetary policy decision.

- Analysts expect the BoC to raise rates by 25 bps and to pause.

- The BoC would release monetary policy minutes for the first time in its history.

The USD/CAD erases some of its earlier losses, climbs toward the 1.3370 region after briefly touching its daily low of 1.3342, ahead of a crucial week for the Canadian Dollar (CAD), with the Bank of Canada (BoC) setting rates for the first time in 2023. In addition, a late US Dollar (USD) bid keeps the USD/CAD from breaking to test the 200-day EMA. The USD/CAD is trading at 1.3375.

USD/CAD is almost unchanged ahead of the Bank of Canada's meeting

Traders mood remains upbeat amid the lack of Fed speakers due to the blackout period, ahead of the first Federal Reserve (Fed) meeting in 2023. The Canadian economic docket featured housing data, with the New Housing Price Index MoM edging to 0%, above estimates for a 0.2% contraction, while YoY eased from 4.1% to 3.9%. The Conference Board (CB) Leading Index in the US dropped to -1%, beneath the -0.7% estimates.

“The US LEI fell sharply again in December - continuing to signal recession for the US economy in the near term,” Ataman Ozyildirim, the Conference Board’s senior director for economics, said in a statement.

Aside from this, the BoC monetary policy decision on Wednesday could keep the USD/CAD pair subdued. Analysts expect a 25 bps rate hike, to 4.50%, with a good portion of them estimating that the BoC would pause.

TD Securities Analysts estimate the BoC would hike rates by 25 bps, adding, “We expect this to be the final move in the BoC’s tightening cycle, while markets are only pricing a small probability (20%) of further hikes.” It should be said that for the first time, the Bank of Canada would release monetary policy minutes, which according to analysts, “will help restore credibility lost last year amid soaring inflation and encourage out-of-the-box thinking,” according to Reuters.

USD/CAD Technical Analysis

Therefore, the USD/CAD would likely remain subdued around the 1.3316-1.3424 area, which sits the 100-day Exponential Moving Average (EMA). The Relative Strength Index (RSI) is almost flat at bearish territory, suggesting that sellers remain on the sidelines, bracing for the BoC’s decision, while the Rate of Change (RoC) suggests bears are stepping in. If the USD/CAD holds below 1.3400, that would pave the way for further downside. Key support lies at 1.3300, followed by the 200-day EMA at 1.3249.

ECB's Laragre says inflation is far too high and the euro is rallying on the back of the speech.

Key quotes

Iinflation in europe is far too high, e must bring inflation down.

ECB made it clear interest rates will still have to rise significantly at steady pace.

ECB to stay the course to ensure timely return to inflation target.

More to come...

EUR/USD update

EUR/USD has found support on the European Central Bank officials' comments this week so far as they are signalling additional jumbo interest rate rises in Europe. At the time of writing, EUR/USD is moving up on Lagard's comments and has rallied from a low of 1.0845 to a high of 1.0926 so far.

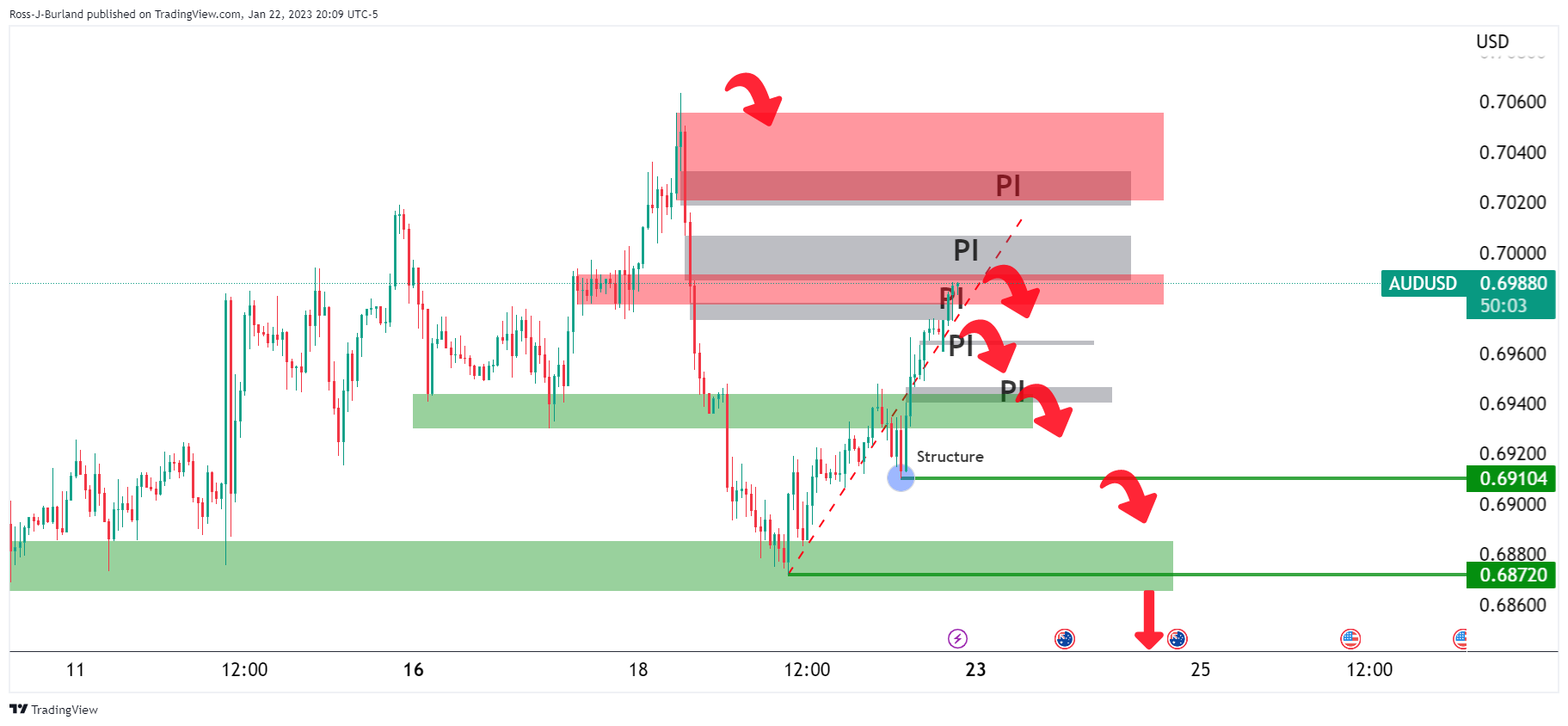

- AUD/USD bulls are in charge at the start of the week but bears are lurking.

- The US Dollar bulls need to show up to enable the Aussie is going to break the downside structure.

As per the start of the week's analysis, AUD/USD Price Analysis: Bulls eye 0.7020, bears target a break of H1 structure, 0.6910 and then AUD/USD starts off bid and eyes are on 0.7000/20, we have seen the initial balance continue to run higher, a touch above the 0.7020 stop hunt area into 0.7039 so far.

The bears are now on the lookout for the US dollar to firm up and how who is still the boss of the forex board. that might be a tall order considering the market's speculation that the Federal Reserve is on the verge of a major pivot, but the technicals speak for themselves.

The following illustrates the prospects for a downside correction in AUD/USD should all of the stars align this week, considering the red news scheduled on both the Aussie and US calendar.

AUD/USD prior analysis

As per the above's pre-market analysis, the initial balance for the week was on track for scoring territory into the price imbalances:

It was stated that there had been the potential for a move-up in the initial balance for the week to mitigate the imbalances to test the peak formation left behind from Wednesday's highs last week. The key areas to the downside were sighted as being 0.6950 and then 0.6910 ahead of 0.6870.

AUD/USD update

We have since seen the Asian, London and US opening hours conclude with the price reaching the extreme price imbalance and paint a W-formation on the trendline support. Given the price is now testing major resistance, a downside correction would be expected at this juncture to test the prior resistance around 0.7010.

However, if the downside thesis from that point is going to gather momentum, the US Dollar needs to make its move.

DXY technical analysis

The bulls are attempting to commit and 102.25 will be a key milestone if they can breach the level and get over the trendline resistance.

- GBP/USD printed a new two-day low around 1.2323, though stabilized around 1.2370s, but stayed negative in the day.

- Money market futures expect the Bank of England would hike 50 bps at its next meeting.

- US economic docket would be busy, though, featuring GDP, unemployment claims, and the Fed’s preferred inflation gauge.

The Pound Sterling (GBP) is retreating after hitting a seven-month high at 1.2447, though it lacked the strength to hold to the 1.2400 figure and is meandering in the 1.2380s area. At the time of writing, the GBP/USD exchanges hands at 1.2375, below its opening price by a minimal margin.

US Dollar climbs underpinned by high US Treasury yields

Sentiment remains upbeat, as shown by Wall Street’s trading in the green. Factors like a steady US Dollar and US Treasury bond yields holding to its gains weigh the GBP/USD pair. The lack of US and UK economic data keeps investors leaning on last week’s news and expectations for interest rate hikes.

Last week’s UK’s Consumer Price Index (CPI) report, with inflation staying at 10.5% though eased from 10.7% of its last month’s previous reading. That increased the likelihood of a 50 bps rate hike by the Bank of England (BoE), which according to Reuters, stand at a 70% chance, while a 25 bps rate lift is fully priced in.

In the meantime, National Grid has asked some UK households to cut energy use today and is likely to extend that request to tomorrow due to a drop in wind power coupled with freezing temperatures across the nation.

On the US front, Fed officials entered its blackout period so that traders would lean on the current week’s economic calendar. The US docket will feature Gross Domestic Product (GDP) results for Q4 with around 2.6% QoQ estimates. Also, Flash PMIs, Unemployment Claims, Durable Good Orders, and the Fed’s favorite gauge for inflation, Personal Consumption Expenditures (PCE), would provide fresh impetus to Gold traders.

GBP/USD Key Technical Levels

- XAG/USD suffers the worst daily decline in months.

- Price hits the lowest level in five weeks, under pressure after losing key support levels.

- Gold remains steady, US stocks rise.

Silver price is falling sharply on Monday, even as the US Dollar holds relatively steady and despite rising equity prices. XAG/USD recently hit a fresh one-month low at $22.73 before rebounding toward $23.00.

During the Asian session, silver hit a five-day high at $24.15 but It failed to hold above $24.00. After moving sideways during most of the European session, XAG/USD broke the $23.60 support area, and tumbled, also losing the $23.10/20 zone.

At some point of the day, silver was losing more than 5% before trimming some losses. The sharp decline takes place even as gold trades practically flat for the day and even as Wall Street rises. The Dow Jones is up by 0.80% and the S&P 500 gains 1.05%.

The technical outlook has deteriorated significantly for XAG/USD. The 20-day Simple Moving Average, today at $23.70 is starting to turn south. The next strong support emerges at $22.50.

A recovery back above $23.20 would alleviate the bearish pressure. A daily close well above $24.10 should open the doors to more gains over the medium term.

XAG/USD 4-hour chart

-638100866182665540.png)

EUR/USD has briefly traded above the 1.09 level. Economists at Rabobank stick to a one-month forecast of 1.09 but note that a move lower to 1.06 is on the cards over the coming months.

Still smiling

“Optimism surrounding the EUR may have further to run. That said, while any pullbacks near term may be viewed as buying opportunities, a bigger test for EUR bulls may appear in a three-to-six-month view as the market faces a possible next phase of the energy crisis.”

“While our 1-month forecast stands at 1.09, we see room for a move lower to 1.06 on a three-month view. This assumes the Fed reasserts a more hawkish position on policy than the market currently expects. It also takes into account the risk that Europe’s energy crisis is far from over.”

EUR/HUF’s correction is set to extend if 391 gives way, analysts at Société Générale report.

404 must be reclaimed to negate the break

“The HUF is outperforming in CEE4 this year, and the thawing of relations with the EU means the currency could stay in demand.”

“EUR/HUF recently confirmed a Head and Shoulders pattern and broke below the 200DMA highlighting potential downside.”

“EUR/HUF is now challenging intermittent support of 392/391 which happens to be the low of last August and the 50% retracement from January 2022. This is first layer of support. In case this gets violated, the down move could extend towards projection of 384.”

“The neckline at 404 must be reclaimed to negate the break.”

Preliminary January PMIs by S&P Global for the Eurozone will be reported Tuesday, January 24 at 09:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of three major banks regarding the upcoming data.

Headline manufacturing PMI is expected at 48.5 vs. 47.8 in December, services PMI is expected at 50.2 vs. 49.8 in December, and the composite is expected at 49.8 vs. 49.3 in December.

Commerzbank

“We do not expect the recent improvement in sentiment to be sustainable. However, the averting of a gas shortage could cause the purchasing managers' index for the service sector to rise again slightly in January. We expect a value of 50. The index for the manufacturing sector should also improve slightly at best. It is true that supply problems now appear to have eased somewhat, allowing companies to reduce their still very high order backlogs more quickly. But in the medium term, the significant decline in new orders is likely to impact sentiment. Specifically, we expect the purchasing managers' index for the manufacturing sector to come in at 48.0 in January.”

TDS

“We think EZ PMIs continued to improve in Jan – further suggesting that the economic outlook might not be as bad as previously thought. We look for a third straight increase in the German mfg PMI as wholesale energy prices fell further and material availability improved. In France, we think slight improvements in mobility indicators suggest another small increased in the svcs PMI.”

SocGen

“We expect the flash estimate for the manufacturing and services PMI indices in January to increase by 0.7pts to 48.5 and 1.1pts to 50.9, respectively, leading to an increase in the composite PMI of 1.0pts to 50.3.”

- Gold price drops more than 0.60% on Monday amidst upbeat market sentiment

- Elevated US Treasury bond yields underpinning the US Dollar, a headwind for XAU/USD.

- Gold Price Forecast: Bulls take a respite but break below $1900, which could expose the 20-day EMA.

Gold price retraces from around daily highs hit at $1935.51 and drops beneath $1915 as US Treasury bond yields recover some ground and underpin the US Dollar (USD), although market sentiment remains upbeat. Therefore, the yellow metal remains lackluster, and the XAU/USD exchanges hands at around $1914.49, down by more than 0.60%.

Buoyant US Dollar and elevated US bond yields the main drivers of Gold’s price

Factors like US Treasury bond yields advancing, particularly the 10-year benchmark note rate up three and a half bps, at 3.517%, is weighing on Gold prices. Consequently, the greenback edges up 0.16%, as shown by the US Dollar Index, a measure of the buck’s value against a basket of peers, trading at 102.142, a headwind for XAU/USD.

Risk appetite improved, as shown by US equities opening in green territory bolstered by the lack of Fed officials speaking, due to the blackout period, ahead of the Federal Reserve’s Open Market Committee (FOMC) meeting on January 31 – February 1.

Sources cited by Reuters commented that “Gold still looking well supported despite the pullback from last week’s peaks, and currently has support at $1,896 and could well gain further momentum once next week’s central bank meetings are out of the way.”

Elsewhere, a slew of Fed policymakers expressed their support for gradual interest rate hikes during the last week, though they emphasized that rates would not be cut in 2023 and would remain higher for longer.

Data-wise, the US economic calendar would unveil the Gross Domestic Product (GDP) results for the fourth quarter in the United States (US), with estimates of around 2.6% QoQ. Additionally, Flash PMIs, Unemployment Claims, Durable Good Orders, and the Fed’s favorite gauge for inflation, Personal Consumption Expenditures (PCE), would provide fresh impetus to Gold traders.

Gold Technical Analysis

Technically, the XAU/USD continues to be upward biased, though failure to crack last week’s nine-month high at $1937.51 exacerbated its fall beneath the $1915 mark. Gold bulls should be aware that any break below $1900 could put into play January’s 18 daily low of $1896.76, which, once cleared, that would expose the 20-day Exponential Moving Average (EMA) at $1877.31.

USD/ZAR has quickly rebounded after forming a low near 16.70. A move beyond 17.41/17.45 is essential to affirm a bullish extension, analysts at Société Générale report.

Failure to defend 16.87 can lead to continuation in down move

“Daily MACD has been posting positive divergence denoting receding downward momentum.”

“17.41/17.45, the 38.2% retracement of recent down move is near term resistance. Once this is overcome, USD/ZAR is expected to extend the bounce towards 17.95 and the high of October/November at 18.58.”

“Failure to defend the 200DMA at 16.87 can lead to continuation in down move.”

- Consumer confidence in the Euro area and the EU improved in early January.

- EUR/USD trades flat on the day at around 1.0850.

The data published by the European Commission revealed on Friday that the Consumer Confidence Indicator in the Euro area improved to -20.9 in January's flash estimate from -22.2 in December. This reading came in better than the market expectation of -22.5.

In the European Union, the Consumer Confidence Indicator rose by 1.4 points to -22.4.

Market reaction

The EUR/USD pair showed no immediate reaction to these data and was last seen trading virtually unchanged on a daily basis at 1.0855.

USD/MXN has rebounded after retesting 2020 lows near 18.50/18.30. The 19.40 mark must be overcome to extend the bounce, economists at Société Générale report.

Signals of reversal still not visible

“USD/MXN has reached the earlier highlighted target of 18.50/18.30 representing the low of 2020. Holding above this zone, a rebound is expected. However, last May's low of 19.40 is likely to be a short-term resistance. Failure to reclaim would mean continuation in phase of decline.”

“If the pair establishes itself below 18.50/18.30, the down move could persist towards projections of 17.60.”

- USD/JPY extends the upside to the vicinity of 131.00.

- US yields keep marching north across the curve.

- The CB Leading Index comes next in the US calendar.

The now better tone in the greenback helps USD/JPY advance to the area just below 131.00 the figure at the beginning of the week.

USD/JPY up on dollar, yields gains

USD/JPY trades with strong gains and adds to Friday’s decent advance in response to the change of direction in the buck and the continuation of the upside momentum in US yields across the curve.

In the Japanese money market, instead, JGB 10-year benchmark yields remain in the negative territory around the 0.40% region following the release of the BoJ Minutes of the January gathering.

On the latter, Board members emphasized that the recent announcement regarding a wider YCC band did not imply any plans to start normalizing the monetary stance.

What to look for around JPY

The 3-month negative streak in USD/JPY met some initial support in the 127.20 region so far (January 16).

The pair, in the meantime, continues to track developments from the Fed’s normalization process and the opposing views from the markets – which continue to favour a pivot in the near term – and the hawkish narrative from FOMC governors, which defend a rapid move further up in rates (5%-5.25%).

In the more domestic scenario, market participants are expected to closely follow any hint from the BoJ indicating a potential exit strategy from the current ultra-accommodative policy stance and/or another tweak of the Yield Curve Control (YCC) in the next months.

USD/JPY levels to consider

As of writing the pair is gaining 0.92% at 130.75 and faces the next up barrier at 131.57 (weekly high January 18) seconded by 134.77 (2023 high January 6) and then 136.71 (200-day SMA). On the downside, a break below 127.21 (2023 low January 16) would aim to 126.36 (monthly low May 24 2022) and finally 121.27 (weekly low March 31 2022).

Brent is now close to the upper band of the wedge pattern near $89/90. A move above here is needed to extend the race higher, strategists at Société Générale report.

Downside momentum ebbing

“A falling wedge generally denotes receding downward momentum; this is also highlighted by daily MACD which held on to last July's lows and has entered positive territory. However, reclaiming the upper limit of the wedge at $89/90 is essential to affirm an extended up-move towards $94 and graphical levels of $98/100.”

“If Brent is unable to defend the 50DMA near $84, the down move is likely to resume. Next potential supports could be at low of December at $75.10 and projections of $73/72.”

EUR/USD is virtually unchanged on a daily basis. Economists at BBH expect the pair to test March high around 1.1185 on a break past the April peak of 1.0935.

Hard to see how the Eurozone does not avoid recession

“The Euro is trading flat after making a new cycle high today near 1.0925, just shy of the April high near 1.0935. Break above that would set up a test of the March high near 1.1185.”

“Yes, some sentiment indicators have improved in recent months but the bulk of the ECB’s 250 bps of tightening so far hasn’t really been felt yet due to the lags in monetary policy. With another 150 bps of tightening expected this year, it’s hard to see how the Eurozone doesn’t avoid recession. The warmer-than-normal weather has helped, as has news of China reopening, but we don’t think that’s enough to stave off recession.”

- The index bounces off the area of multi-month lows near 101.60.

- The resurgence of the risk-off sentiment props up the dollar.

- The CB Leading Index, short-term auctions come next in the session.

The USD Index (DXY), which tracks the greenback vs. a basket of its main rival currencies, manages to leave behind the earlier pessimism and reclaims the area beyond the 102.00 yardstick at the beginning of the week.

USD Index rebounds from the 101.60 region

The index attempts a moderate recovery and sets aside two consecutive daily pullbacks on the back of the re-emergence of the risk-off mood, while further gains in US yields also prop up the upside bias in the dollar on Monday

Indeed, US yields across the curve and the German 10-year benchmark extend the recent recovery and navigate the area of multi-day peaks.

Later in the NA session, the Conference Board will publish its Leading Index followed by 3-month/6-month bill auctions.

What to look for around USD

Dollar bears still find it difficult to break below the 102.00 support on a convincing fashion.

The idea of a probable pivot in the Fed’s policy continues to weigh on the greenback and keeps the price action around the DXY depressed. This view, however, also comes in contrast to the hawkish message from the latest FOMC Minutes and recent comments from fed’s rate-setters, all pointing to the need to advance to a more restrictive stance and stay there for longer, at the time when rates are seen climbing above the 5.0% mark.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and the continuation of its hiking cycle.

Key events in the US this week: CB Leading Index (Monday) – Flash Manufacturing/Services PMIs (Tuesday) – MBA Mortgage Applications (Wednesday) – Durable Goods Orders, Advanced Q4 GDP Growth Rate, Chicago Fed National Activity Index, Initial Jobless Claims, New Home Sales (Thursday) – PCE, Core PCE, Personal Income, Personal Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Prospects for extra rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index advances 0.20% at 102.19 and faces the next up barrier at the weekly high at 102.89 (January 18) seconded by 105.63 (monthly high January 6) and then 106.45 (200-day SMA). On the downside, the breach of 101.52 (2023 low January 18) would open the door to 101.29 (monthly low May 30 2022) and finally 100.00 (psychological level).

GBP/USD climbed toward 1.2450 but erased its daily gains. Economists at BBH note that the pair could test the May high near 1.2665 on a break past the December high near 1.2445.

The UK is still facing tight power markets as cold weather hits

“Sterling is trading lower near 1.2350 after making a new cycle high today near 1.2450 and just above the December high near 1.2445. Clean break above that would set up a test of the May high near 1.2665.”

“National Grid has asked some UK households to cut energy use today and is likely to extend that request to tomorrow due to a drop in wind power coupled with freezing temperatures across the nation. Of note, this emergency measure to reduce electricity demand was previously in test mode but has now gone live.”

The US Dollar Index is approaching a multi month descending trend line and in proximity to last May trough of 101.30. A break below here could open up further falls, economists at Société Générale report.

Rejection of 103 could trigger further losses

“Daily MACD has started posting positive divergence which denotes receding downward momentum; however last week high of 103 must be overcome to affirm a short-term up move.”

“Failure to hold 101.30 could mean persistence in decline towards next potential support of 100.60/100.00 representing the peak of 2015.”

European Central Bank (ECB) Governing Council member Ignazio Visco said on Monday that Italy can deal with the impact of a 'gradual but necessary' rate of monetary policy tightening.

"Alarms that are sometimes raised about effects that further ECB rate increases could have on the Italian economy cannot be shared," Visco added. "I believe it is entirely possible to reach the ECB target of inflation at 2% while avoiding particularly negative impact on the eurozone economy and the labour market."

Market reaction

EUR/USD, which climbed to a multi-month high above 1.0900 earlier in the day, stays on the back foot following these comments and was last seen trading at 1.0855, where it was virtually unchanged on a daily basis.

USD/CAD started the new week with a soft undertone and retested the mid-Jan low at just under 1.3350. A break below here would open up further losses, economists at Scotiabank report.

Near-term risks tilted to the downside

“Late week USD losses last week tilt near-term risks to the downside somewhat and do suggest firm resistance above the market in the short run at least around the 1.35 zone.”

“A clear and sustained break of 1.3350 intraday should see spot (finally) reach the upper 1.32s.”

- EUR/USD prints new multi-month tops near 1.0930 on Monday.

- Extra gains now look at 1.0936 ahead of the key 1.1000 level.

EUR/USD extends further the auspicious start of the new year and advances past the 1.0900 barrier for the first time since April 2022.

The continuation of the uptrend now focuses on the weekly high at 1.0936 (April 21 2022). A sustainable break above this level could pave the way for a challenge of the key barrier at 1.1000 the figure in the not-so-distant future

In the meantime, while above the short-term support line near 1.0630, extra gains should remain in store for the pair.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0308.

EUR/USD daily chart

GBP/USD softened after retesting recent peaks in the mid-1.24 zone. Losses should slow nearer the low-1.23s, economists at Scotiabank report.

Cable struggles to get clearly above the 1.2450/60 area

“Cable is clearly struggling to get clearly above the 1.2450/60 area that marks the 61.8% retracement of its 2022 decline.”

“Losses may extend a little below minor trend support at 1.2365 intraday. The broader technical tone here is positive though so losses should slow nearer the low-1.23s.”

“News of a government probe into the Tory party chairman’s tax affairs may be weighing on GBP sentiment at the margin but these sorts of embarrassments are hardly uncommon for this government.”

- The index comes under pressure and revisits the 101.60 area.

- A deeper decline should target the May 2022 low near 101.30.

DXY kicks in the week in an offered stance and rebounds from earlier lows in the 101.60/55 band on Monday.

The index seems to be gradually losing ground amidst the broader bearish outlook for the greenback. In case bears push harder, the loss of the so far 2023 low at 101.52 (January 18) could trigger a potential deeper drop to the May 2022 low around 101.30 (May 30) prior to the psychological 100.00 level.

In the meantime, while below the 200-day SMA at 106.45 the outlook for the index should remain tilted to the negative side.

DXY daily chart

EUR/USD gains have extended to trade on a 1.09 handle for the first time since last April. New cycle highs are set to keep the focus on gains extending to the 1.10+ zone, according to economists at Scotiabank.

Undertone remains bullish

“Intraday gains to new cycle highs plus solid-looking trend oscillators across the short, medium and long term DMIs all point to EUR gains extending. But spot’s drop back from the session peak is leaving a negative print on the intraday chart which may see more EUR losses early in the American session.”

“Look for minor dips (mid-1.08s) to remain well supported.”

“We look for EUR gains to reach 1.1000/50 shortly.”

AUD/USD is up +1.7% from Thursday’s low. The pair is expected to head towards the target of 0.7090/0.7130 representing last August's high, according to economists at Société Générale.

Favour return over 0.70

“AUD/USD has recently overcome the 200DMA and crossed above the consolidation since December; this affirms persistence in upward momentum. Defending the Moving Average at 0.6830/0.6810 would be crucial for further up move.”

“The pair is expected to inch higher gradually towards last August's high of 0.7090/0.7130. This could be next potential resistance zone.”

- EUR/JPY climbs further and retakes the 142.00 mark.

- Further gains could see the resistance area around 143.00 revisited.

EUR/JPY adds to Friday’s strong bounce and leaves behind the key 142.00 hurdle at the beginning of the week.

A sustainable breakout of the 200-day SMA, today at 140.76, should shift the outlook to a more constructive one and open the door to a probable visit to the key resistance area near 143.00 in the short-term horizon (high December 28, January 11).

On the downside, there is an initial contention around the 138.00 zone for the time being.

EUR/JPY daily chart

USD/INR is approaching crucial support zone of 80.50/79.80. A break below here would open up further losses, economists at Société Générale report.

November low of 80.50/79.80 is important support

“A retest of November low near 80.50/79.80 is not ruled out. This is also the 200DMA and is likely to be an important support zone. Only a break below would denote a deeper downtrend.”

“Achievement of above mentioned objective is likely to result in a bounce. The trend line at 82.10 and 82.95 are near term hurdles.”

European Central Bank (ECB) policymaker Peter Kazimir said on Monday that inflation easing was good news but added that it was not a reason to slow the pace of interest rate hikes, as reported by Reuters.

"I am convinced that we need to deliver two more hikes by 50 basis points," Kazimir said and acknowledged that the Eurozone economy was faring better than expected one-two months ago.

Market reaction

These comments don't seem to be having a significant impact on the Euro's performance against its rivals. As of writing, the EUR/USD pair was up 0.28% on the day at 1.0885.

In its monthly economic report published on Monday, the German central bank, Bundesbank, noted that recent data releases were better overall than assumed in the December projections.

"Gross domestic product growth is likely to have roughly stagnated in the final quarter of 2022, exceeding earlier expectations," the Bundesbank added and said that the economy was proving more resilient than expected amid easing stress on energy markets.

Market reaction

EUR/USD showed no immediate reaction to these comments and was last seen trading slightly below 1.0900, where it was up 0.35% on a daily basis.

US Dollar struggles to recover. Kit Juckes, Chief Global FX Strategist at Société Générale, expects the greenback to stay under bearish pressure.

A spoonful of optimism helps the Dollar go down

“Somewhere, a rabbit is poking its head out of a burrow and being greeted by a pale sun failing to thaw the frozen grass. Meanwhile, as the Chinese celebrate the new year, economists are turning less bearish about growth and investors are optimistic about non-Dollar assets.”

“Slight upward revisions to consensus growth forecasts in the US, Eurozone, UK and even Japan, don’t deliver changes in relative GDP growth but they do lift the mood (despite the chill in the air).”

“Today is so light on news the optimism may survive: Eurozone consumer confidence and US leading indicators were worth watching (for surprises),but aren’t often market-moving.”

In the FX market, not much changed for the CEE region last week. Economists at ING share their views on the likes of EUR/HUF, EUR/CZK and EUR/PLN for the coming days.

All eyes on the Hungarian Forint

“Higher EUR/USD, improving sentiment in Europe and low gas prices should remain supportive for FX in the CEE region.”

“We believe the Forint will find a way to maintain its current strong values at the end of the week despite higher volatility. A deterioration in the outlook should not be a major surprise for the market and we also expect the hawkish NBH to dampen the current market speculation on an early rate cut, which should be positive for the forint. On the other hand, positioning is on the long side according to our estimates though if everything goes according to plan, we could test 390 EUR/HUF.”

“We see the Czech Koruna still near 24.00 EUR/CZK and the Polish Zloty should go below 4.70 EUR/PLN.”

What does matter to analysts at Commerzbank is how insistence to stick to the ultra-expansionary monetary policy is seen within the BoJ and the government. That is set to determine the path of the Yen.

Kuroda’s imminent retirement

“The BoJ might be correct in assuming that high inflation levels are a temporary phenomenon and that inflation rates will ease below the BoJ’s target very soon. However, it seems to become increasingly clear that the government wants to end this consensus.”

“Kishida’s intention to discuss this consensus with Kuroda’s successor makes the question of who will become Kuroda’s successor all the more important. If it will be someone who so far gave the impression of favouring Kuroda’s policy that will be JPY negative, if it is going to be someone who criticises Kuroda’s policy, further significant JPY appreciation is possible.”

Sterling continues to perform well and is holding onto the gains made last week. Economists at ING expect the GBP/USD pair to struggle to surpass the 1.2450/2500 area.

Marked improvement in the perception of UK sovereign risk

“The market now prices a 45 bps Bank of England (BoE) hike at next week's meeting. The firming up of BoE tightening expectations has allowed Sterling to match this year's strength of the Euro. And certainly, there has been a marked improvement in the perception of UK sovereign risk as evidenced by the five-year sovereign CDS trading back down to 22 bps last week.”

“We suspect GBP/USD might not have the momentum to sustain a break above 1.2450/2500 this week, while EUR/GBP should find support in the 0.8700/8730 area.”

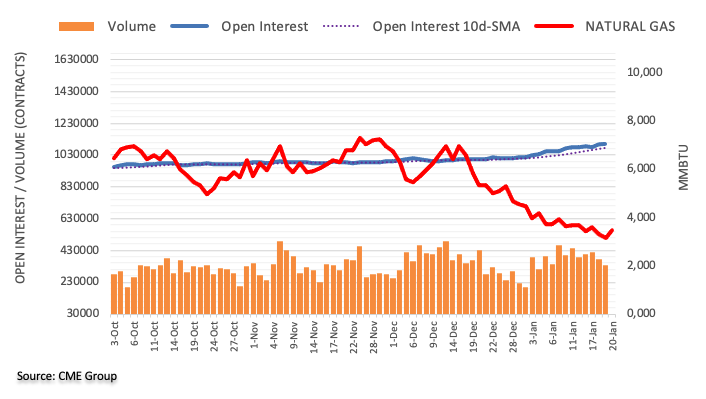

Considering advanced prints from CME Group for natural gas futures markets, open interest rose for the second consecutive session on Friday, this time by around 1.2K contracts. On the opposite direction, volume retreated for the second day in a row, now by more than 36K contracts.

Natural Gas: A test of $3.00 looms closer

Prices of natural gas retreated further at the end of last week. The daily retracement was on the back of increasing open interest and supports the idea that a deeper pullback lies ahead for the time being. On this, the commodity faces the next contention of note at the $3.00 mark per MMBtu, an area last traded back in late May 2021.

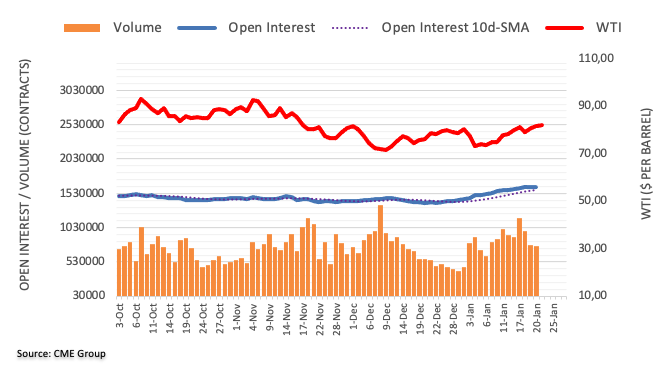

CME Group’s flash data for crude oil futures markets noted traders added nearly 2K contracts to their open interest positions on Friday, resuming the uptrend after the previous drop. On the flip side, volume went down for the third straight session, this time by almost 10K contracts.

WTI now targets the December peak above $83.00

Prices of the barrel of the WTI climbed further north of the key $80.00 on Friday. The move higher was in tandem with increasing open interest, which is supportive of further gains in the very near term at least. That said, the December 2022 high at $83.30 now emerges as the next hurdle of note for the commodity.

US Treasury Secretary Janet Yellen said on Monday that overall, she has a “good feeling that inflation is coming down.”

“US labor market is still very tight,” Yellen added.

Market reaction

The US Dollar Index remains vulnerable below 102.00 on the above comments. The spot is trading at 101.75, down 0.26% so far.

EUR/USD gained traction to start the week and touched its highest level since mid-April above 1.0900. However, economists at ING expect the pair to remain below the 1.0950/1000 region.

Bullish wildcard for Euro could come from comments on new joint EU bond issuance

“We suspect investors may be reluctant to chase EUR/USD through resistance at 1.0950/1000 ahead of next week's central bank event risks.”

“Germany's Ifo on Wednesday will be particularly interesting to see whether the expectations component picks up anywhere near as sharply as the German ZEW investor survey.”

“A bullish wildcard for the Euro could come from any further comments on new joint EU bond issuance to support green investments, as European politicians attempt to support local industry in the face of President Biden's Inflation Reduction Act.”

Ahead of Wednesday’s Australian quarterly Consumer Price Index (CPI) data release, the country’s Treasurer Jim Chalmers said that the worst part of the country's inflation crisis was over.

Key quotes

"The Australian economy will begin to soften a bit this year and that is the inevitable likely consequence of higher interest rates and a slowing global economy.”

"That's why our economic plan is cost-of-living relief in a responsible way and growing the economy without adding to these inflationary pressures."

"Energy is a bigger part of our inflation challenge in our economy.”

Market reaction

AUD/USD was last seen trading at 0.6997, up 0.47% on the day.

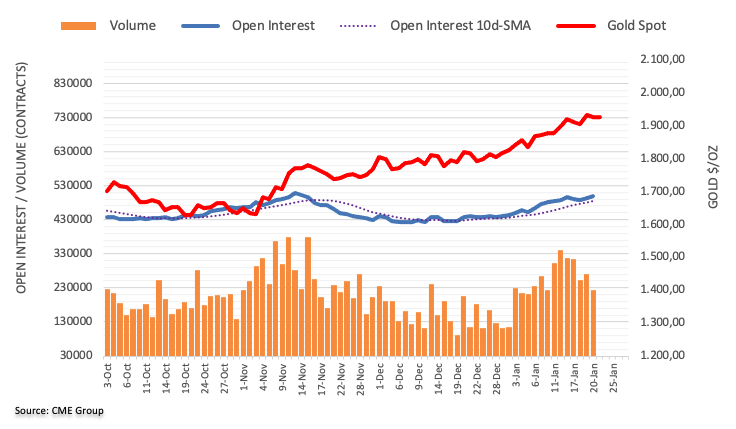

Open interest in gold futures markets increased for the second session in a row on Friday, this time by around 5.4K contracts according to preliminary readings from CME Group. Volume, instead, reversed the previous build and shrank by around 48.6K contracts.

Gold: Near term top in place?

Prices of the ounce troy of gold corrected lower at the end of last week. The daily downtick was on the back of rising open interest, which could allow for some extra weakness in the very near term. Against that said, the precious metal could have charted a short-term top near $1940 on January 20.

The Dollar starts the week gently offered. The US Dollar Index declined below 102.00 – economists at ING expect DXY to find support in the 101.30/102.00 range.

Dollar to stay gently offered

“The data calendar in theory should keep the Dollar on the soft side this week. However, DXY has come quite a long way already and we doubt whether the market is ready to add to short Dollar positions ahead of next week's FOMC meeting – which could pose a positive event risk to the Dollar should the Fed push back on the 50 bps of easing the market now prices for this year.”

“DXY may find support in the 101.30/102.00 range this week.”

Euro moves one step closer to 1.10. Can EUR/USD have a go at 1.10? Economists at Société Générale discuss the pair’s outlook

Hedge funds are not getting carried away

“Interestingly, 2y2y forwards (3 bps wider in favour of USD this morning) are not keeping track with the currency. Hedge funds are not getting carried away either. Long euro positions were fractionally lower last week.”

“Euro PMIs tomorrow and the German IFO on Wednesday are forecast to reinforce cautious optimism that the economy will dodge recession this winter.”

EUR/USD is trading around 1.09. In the opinion of Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, it is still much too early to become EUR sceptical.

ECB comments seem successful

“As long as the ECB gives the impression that it is fighting inflation and as long as the market can assume that these efforts might be successful, the Euro will not suffer. In that case, one could even come up with a EUR-positive argument.”

“The FX market does not seem to mind so much whether we really will see only 25 bps in March as it minds whether the ECB is already committing to that. Because the latter would point to reduced sensitivity. That would be damaging for EUR. The purpose of the ECB comments is likely to be to dispel this impression. And they seem successful to me.”

“At the moment the disillusionment of the market, which we expect to see at some point, is still a long, long way away. And that is why it is still much too early to become EUR sceptical.”

The economic outlook for the UK remains quite gloomy, while at the same time, inflation stays at high levels. Against this backdrop, the Bank of England is likely to act only hesitantly, which should weigh on the Pound, economists at Commerzbank report.

An economic downturn is probably unavoidable

“An economic downturn is probably unavoidable. This is because inflation, which remains high, will continue to dampen consumer sentiment and the BoE's interest rate hikes to date will be increasingly felt. In addition, fiscal policy has little scope for expansionary measures due to the tight budget situation.”

“As long as the BoE maintains its hesitant stance, monetary policy will remain a burdening factor for the Pound.”

“Another burdening factor is the consequences of Brexit, which are becoming increasingly noticeable in the economy. This also clouds the economic outlook in the long term.”

“We expect the BoE to cut its key rate in 2024, so the Pound's weakness is likely to persist.”

Gold ended up closing modestly lower on Friday. XAU/USD bulls need to cross $1,940 for a sustained upside, FXStreet’s Dhwani Mehta reports.

Strong support seen at $1,917

“Gold price is facing an immediate hurdle at the rising trendline resistance at $1,940 on its renewed upside. Should buyers find a strong foothold above the latter, a fresh upswing toward the $1,950 psychological level will be in the offing.”

“To the downside, strong support is seen at the lower boundary of the wedge, now at $1,917, although Friday’s low at $1,921 could come to Gold buyers’ rescue before. Further south, the January 18 low at $1,897 could challenge bullish commitments.”

- GBP/USD pares intraday gains after refreshing multi-day top.

- Overbought RSI, six-week-old horizontal hurdle challenge Cable buyers.

- 21-SMA adds strength to 1.2365 key support, successful break of 1.2530 will defy rising wedge formation.

GBP/USD struggles to defend the 1.2400 threshold during a five-day uptrend to Monday’s European session, after rising to the highest levels since June 2022 earlier in the day.

In doing so, the Cable pair eases from the six-week-old horizontal resistance surrounding 1.2450 as the RSI (14) hits the overbought territory.

In addition to the quote’s repeated failures to cross the 1.2450 hurdle and the overbought RSI conditions, a 13-day-old rising wedge bearish chart formation also teases the GBP/USD bears around the multi-day top.

However, the 21-SMA level adds strength to the 1.2365 support, a break of which will confirm the rising wedge bearish pattern.

Following that, the 1.2100 and the 1.2000 round figures may entertain the GBP/USD bears during the theoretical south-run targeting the 1.1800 levels.

It should be noted that the sluggish MACD signals challenge the pair’s intraday momentum and hence restrict the bear’s entry.

On the contrary, successful trading beyond the 1.2450 hurdle isn’t an open invitation to the GBP/USD bulls as the stated wedge’s top line, near 1. 2530 by the press time, will act as an additional upside filter for the pair.

In a case where the GBP/USD remains firmer past 1.2530, a run-up towards May 2022 high near 1.2665 can’t be ruled out.

GBP/USD: Four-hour chart

Trend: Limited upside expected

Here is what you need to know on Monday, January 23:

The US Dollar started the new week under modest bearish pressure and the US Dollar Index declined below 102.00 during the Asian trading hours on Monday. The market mood seems to have turned cautious with the US stock index futures trading modestly lower on the day, while the benchmark 10-year US Treasury bond yield stays slightly below 3.5% following Friday's decisive rebound. Later in the session, Germany's Bundesbank will publish its monthly report and the European Commission will release the preliminary Consumer Confidence Index for the Euro area. The US economic docket will feature the Federal Reserve Bank of Chicago's National Activity Index for December.

Nevertheless, market action remains relatively subdued amid thin trading volumes on the Chinese New Year Holiday. In the Asian session, the Bank of Japan (BoJ) released the minutes of its December monetary policy meeting. According to the publication, some members noted that the BoJ must reiterate and clearly explain that the widening of the yield band was not a move eyeing an exit from the ultra-loose policy. USD/JPY, which registered gains last week, extended its rebound and was last seen trading in positive territory at around 130.00.

As the 10-year US Treasury bond yield gained nearly 3% on Friday, Gold price struggled to preserve its bullish momentum ahead of the weekend. After having touched a multi-month high of $1,937, XAU/USD ended up closing modestly lower on Friday. At the time of press, the pair was moving up and down in a tight range above $1,920.