- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- XAG/USD stays firm and climbs as the US Dollar remains offered across the board.

- Silver Price Analysis: Range-bound but could turn bullish above $24.50; otherwise, it could re-test the 50-DMA.

Silver price extended its gains for the second consecutive day, cleared Thursday’s daily high of $23.93, and held its ground above the 20-day Exponential Moving Average (EMA), reaching a new two-day high at $24.07. Nevertheless, as the North American session progressed, the XAG/USD retraced below $24.00 and is trading at $23.93.

Silver Price Analysis: XAG/USD Technical Outlook

XAG/USD daily chart suggests the white metal is peaking at around the $24.50 area, despite breaching the 20-day EMA on Thursday. After testing the YTD high of $24.54 twice during the month, XAG/USD dropped to its 2023 low of $23.12 and, since then, has not been able to crack the $24.00 figure decisively. Further, the Relative Strength Index (RSI) resumed its upward trajectory, but the Rate of Change (RoC) suggests that buyers are gathering some momentum.

Given the above scenario, if XAG/USD clears $24.50, that would keep buyers in charge, and it would open the door to test the $25.00 psychological level. A break above will expose the April 18 daily high at $26.21.

As an alternate scenario, the XAG/USD first support would be the 20-day Exponential Moving Average (EMA) at 23.69. A breach of the latter would send Silver sliding toward the January 19 pivot low of $23.17, ahead of the $23.00 figure, which sits slightly above the 50-day EMA at $22.91.

Silver Key Technical Levels

- EUR/JPY bounced off the day’s lows at 139.03 and hit a daily high of 141.19 before losing steam.

- The EUR/JPY reclaiming and achieving a daily close above the 200-day EMA keeps bulls hopeful of higher prices.

The Euro (EUR) rallies sharply on Friday, ahead of the weekend, as the Japanese Yen (JPY) weakened following the Bank of Japan’s (BoJ) monetary policy meeting, with the BoJ resolute in keeping its dovish stance, and the Yield Curve Control (YCC). Therefore, the EUR/JPY gains traction and exchanges hands at 140.63, above its opening price by more than 1%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart portrays the pair reclaiming the 20 and 200-day Exponential Moving Averages (EMAs), each at 140.45 and 140.15, respectively, keeping bulls hopeful for higher prices. Additionally, the Relative Strength Index (RSI) aims north and is about to turn bullish, further cementing the neutral-to-upward bias, while the Rate of Change (RoC) portrays strong bullish sentiment in the pair.

Therefore, the EUR/JPY path of least resistance is upwards. Hence, the EUR/JPY’s first resistance would be the January 20 high of 141.19, followed by the January 18 daily high at 141.68, and by the figure at 142.00. As an alternate scenario, EUR/JPY’s failure t crack 141.00 could pave the way for further downside. The EUR/JPY key support levels would be the 140.00 psychological level, followed by the January 20 daily low of 139.03, and then the January 19 swing low of 137.91.

EUR/JPY Key Technical Levels

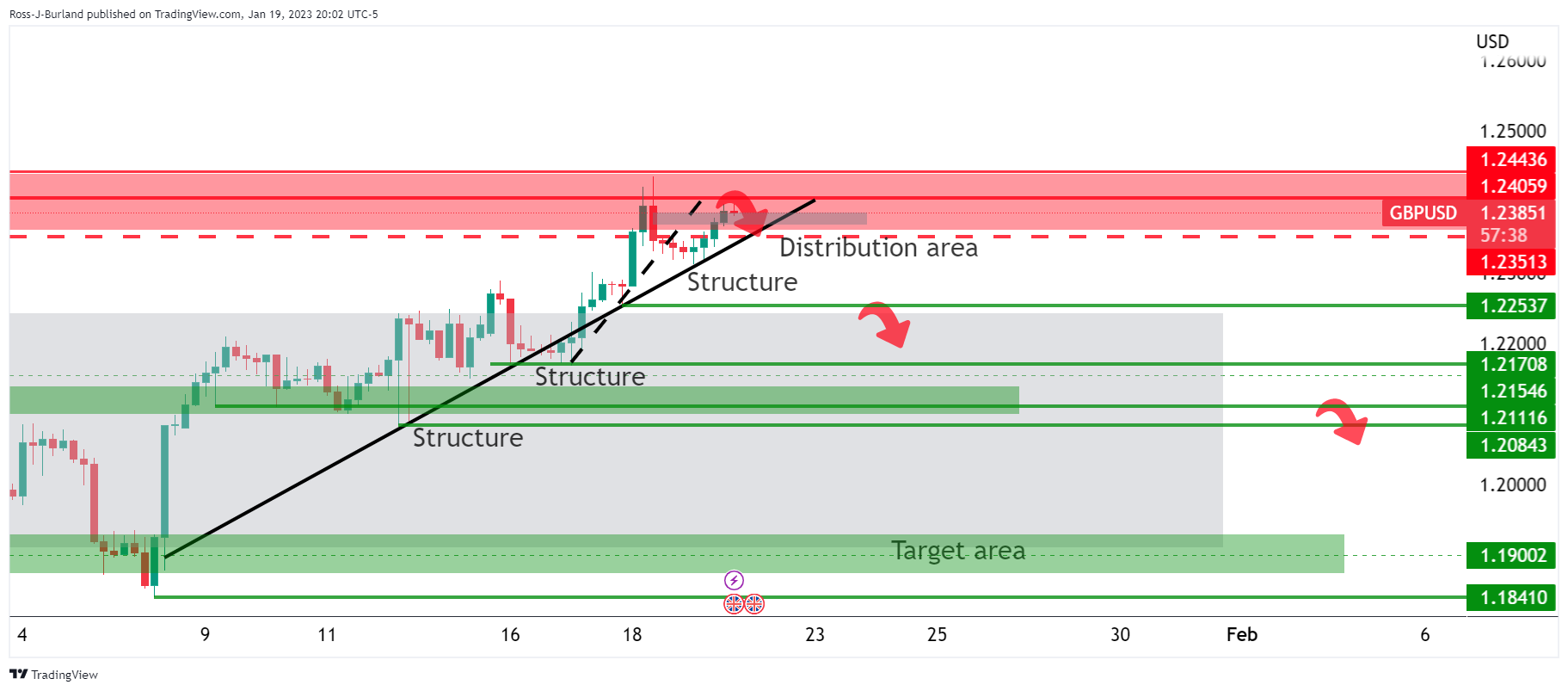

- GBP/USD is almost flat due to the US Dollar erasing its earlier gains and on a risk-on impulse.

- Data in the US showed that the housing market remains dampened, a headwind for the US Dollar.

- Fed’s Waller: Supports 25 bps rate hikes, though does not expect rate cuts by year-end.

GBP/USD seesaws during the North American session, around the 1.2360-1.2390 region, around the London Fix, unable to gain a clear direction. Risk appetite increased, which usually favors the Pound Sterling (GBP), but soft UK economic data weighed on the GBP/USD. At the time of writing, the GBP/USD exchanges hands at 1.2391.

GBP/USD fluctuates between gains/losses as the US Dollar retraces

Sentiment remains upbeat. The US Dollar (USD) retraced from earlier highs, as shown by the US Dollar Index, at 102.552, clings to minuscule gains of 0.05% at around 102.103. Therefore, the GBP/USD climbed from daily lows of around 1.2330s, aiming to cut its earlier losses.

Data-wise, the US economic calendar revealed that Existing Home Sales dropped 1.5% and reached their lowest level since 2010, a report of the National Association of Realtors showed. The Federal Reserve’s (Fed) tightening cycle pushed the housing market into recession. But lately, some Fed officials revealed its intentions to slow the pace of rate hikes, emphasizing the need to hold rates higher for longer.

Philadelphia Fed President Patrick Harker supports the idea of hiking rates at a slower pace and said, “Hikes of 25 basis points will be appropriate going forward.” Harker expects the US economy to grow by 1% and the unemployment rate to jump to 4.5% from 3.5%. Later, KansasCiti Fed President Esther George said that the Federal Reserve must be “patient” to see if inflation in the services sector is waning.

Of late, Fed Board member Christopher Waller said that the market’s perception of terminal rate is not far from where the Federal Funds rate (FFR) stands and adds that the US Central Bank would need to keep rates high, “not cut rates by year-end.”

Meanwhile, Uk Retail Sales for November fell sharply and sent the GBP/USD tumbling down. Figures showed that sales plunged 1% MoM, signaling that inflation and the Bank of England’s (BoE) rate hikes are hitting Britons. Another report stated that UK’s consumer confidence dropped for the first time in three months, returning to historic lows.

What to watch?

Next week’s economic calendar in the UK will feature the Flash Manufacturing and Services PMIs, and the Producer Price Index (PPI). On the US front, Flash Manufacturing and Services PMIs, the Advanced Gross Domestic Product (GDP) for Q4, Durable Good Orders, and the Fed’s preferred gauge for inflation, the Core PCE.

GBP/USD Key Technical Levels

- A risk-on impulse favored risk-perceived currencies like the Australian Dollar.

- The US housing market continues to deteriorate, as shown by Existing Home Sales plunging.

- Fed officials favor a deceleration of rate hikes, though the higher-for-longer stance remains unchanged.

The AUD/USD edged higher in the mid-North American session on Friday, following a soft employment report from Australia that spurred a fall beneath 0.6900. Friday, the story is different, with the AUD/USD recovering some ground while the US Dollar (USD) is pairing its earlier gains. At the time of writing, the AUD/USD is trading at 0.69600, above its opening price by 0.74%.

AUD/USD climbed, underpinned by investors upbeat mood, soft USD

Wall Street continues to portray investors’ positive mood. Data from the United States (US) flashes deterioration, as Existing Home Sales for December plunged 1.5%, its lowest level since November 2010, according to the National Association of Realtors.

“December was another difficult month for buyers, who continue to face limited inventory and high mortgage rates,” said NAR Chief Economist Lawrence Yun. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

Meanwhile, a retracement in the US Dollar Index, which tracks the buck’s performance against its peers, prints minimal gains of 0.06%, at 102.123, after hitting a daily high of 102.552. Contrarily, US Treasury yields advance, with the 10-year benchmark note rate up nine bps, at 3.488%.

In the meantime, a couple of Fed officials crossed newswires. Philadelphia Fed President Patrick Harker, opened the door for a downshift in interest rate increases, saying, “Hikes of 25 basis points will be appropriate going forward.” He expects the US economy to grow by 1% and the unemployment rate to jump to 4.5% from 3.5%. Later, KansasCiti Fed President Esther George said that the Federal Reserve must be “patient” to see if inflation in the services sector is waning.

AUD/USD Key Technical Levels

Next week, the Bank of Canada will have its monetary policy meeting. Analysts at TD Securities expect a 25 basis points rate hike in line with market consensus. They point out the Canadian Dollar (CAD) may not receive much direction bias from the meeting.

Key quotes:

“We look for the BoC to hike by 25bp in January, and we expect this will be the last hike this cycle (though the forward-looking component will not preclude future hikes).”

“While this is expected to be the last hike, the CAD may not receive much directional bias from this meeting as the curve may continue to be biased about looking at the other side of this interest rate cycle. That said, the CAD may be more sensitive to any dovish elements should the BOC emphasize elements from the BOS. We see a differentiated dynamic playing out on the crosses given risk correlations.”

Data released on Friday showed retail sales in Canada dropped 0.1% in November, an improvement from the preliminary estimate of a 0.5% slide. Analysts at CIBC point out that some of the detail wasn't as encouraging, and the underlying trend still shows retail sales moving broadly sideways in volume terms. They expected the Bank of Canada to hike interest rates by 25 basis points next week.

Key quotes:

“On a more positive note, the advance estimate for December showed a gain in overall sales of 0.5%, which should look even better in volume terms given the sharp decline in gasoline prices that was seen during the month. Overall then, the two months together suggest a bumpy ride still for Canadian retailers, but it is at least a ride that is going broadly sideways still rather than downwards.”

“Retail sales in volume terms aren't rising, but they are not falling either, suggesting that accumulated savings during the pandemic may be protecting consumption to a certain extent from the impact of higher interest rates. However, with savings no longer as bloated as they once were, particularly in inflation-adjusted terms, and with rates having been raised further, household consumption could still see some modest declines in the first half of 2023. We continue to see one final 25bp hike from the Bank of Canada next week.”

- US Existing Home Sales continue to deteriorate and weigh on the US Dollar.

- Retail Sales in Canada dropped, though improved in November, compared with October.

- Fed’s Patrick Harker supports 25 bps rate hike increases to the Federal Funds rate.

USD/CAD is registering moderate losses during the North American session, falling from daily highs nearby 1.3500 after the release of US and Canadian data, bolstering the Loonie (CAD), which is trimming some of its weekly losses. At the time of writing, the USD/CAD exchange hand is at 1.3418, below its opening price.

US Existing Home Sales deteriorated, while Canada’s Retail Sales improved

Wall Street portrays an upbeat sentiment. The economic calendar in the United States (US) reported that Existing Home Sales for December retreated for the eleventh consecutive month. Sales retreated by 1.5% from November.

“December was another difficult month for buyers, who continue to face limited inventory and high mortgage rates,” said NAR Chief Economist Lawrence Yun. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

Across the border, Canada’s docket reported retail sales, which dropped by -0.1% MoM in November but improved as October’s data showed sales plunging -0.5%, according to Statistics Canada.

Aside from economic data releases, the USD/CAD was also underpinned by an upbeat market sentiment. The pair dropped beneath the 20-day Exponential Moving Average (EMA) at 1.3470 and also tumbled below the 100-day EMA at 1.3426. Hence, the USD/CAD bias is shifting from neutral-biased to neutral-bearish.

Elsewhere, a slew of Fed officials, namely Philadelphia Fed President Patrick Harker, opened the door for a downshift in interest rate increases, saying “Hikes of 25 basis points will be appropriate going forward.” He expects the US economy to grow by 1% and the unemployment rate to jump to 4.5% from 3.5%. Later, KansasCiti Fed President Esther George said that the Federal Reserve must be “patient” to see if inflation in the services sector is waning.

USD/CAD Key Technical Levels

- Japanese Yen among worst G10 performers after BoJ status quo.

- US Dollar mixed between higher yields and risk sentiment.

- USD/JPY attempts recovery, still limited below the 20-day SMA.

The USD/JPY moved off daily highs during the American session on Friday, pulling back under 130.00. The pair peaked at 130.60, the highest level in two days. The greenback weakened late on Friday amid an improvement in risk appetite.

Regarding economic data, on Friday the National Association of Realtors said US Existing Home sales fell to 4.02 million (annual rate) in December, above the market consensus of 3.95 million. Earlier, Japan reported that the Core Consumer Price Index in December rose 4.0% from a year earlier, the highest level in 41 years.

The trend in USD/JPY is still bearish, although it has been moving sideways during the last five days, in a wide range between the 127.50 area and the 20-day Simple Moving Average near 131.00. The mentioned line has become a critical dynamic resistance. If the Dollar manages to break above, a profound recovery seems likely.

A volatile week for JPY, more to come

Despite ending far from the top, the US Dollar is on its way to the biggest weekly gain in months versus the Japanese Yen. The fact that the Bank of Japan did not “pivot” from its current ultra-accommodative monetary policy weighed on the Yen. Still, market participants await a shift during the second quarter when Kuroda’s term expires in April. Japan’s latest Core CPI numbers favor that Change.

Also, sharp moves in government bond yields favored volatility in Yen’s crosses. Fears about the economic outlook boosted the demand for safety but also, central bankers continued to talk about the necessity of higher interest rates for a some time, limiting the downside in yields.

Attention will turn next week from the BoJ to the Fed. The FOMC will announce its decision on February 1. A 25 basis points rate hike is expected. However, market participants will look for clues about how far the Fed is willing to go on tightening monetary policy and how it sees the economic outlook.

Technical levels

Silver prices have risen by 27% since mid-October 2022. Economists at ANZ Bank expect XAG/USD to perform well in 2023.

Silver should not be ignored

“We expect prices to correct in the short-term, but fundamentals are likely to be supportive over the next 12 months.”

“The supply-demand balance looks strong. The growing adoption of green energy sources continues to favour fabrication demand for Silver. Silver stocks are falling at exchanges, suggesting a tighter market. Bar and coin demand continued to be high, and the premium for coins remains elevated.”

“We expect Silver to perform well, in tandem with Gold, as investors look for cheaper alternatives to the yellow metal.”

- Swiss Franc among worst performers on Friday.

- USD/CHF heads for weekly loss, but off lows.

- EUR/CHF extends rebound, approaches parity.

The USD/CHF is up on Friday, but still down for the week. The pair surged to 0.9234, hitting the highest level in two days and then pulled back toward 0.9200, amid a weaker US Dollar.

On a weekly basis the pair is down by less than 50 pips, after recovering from 0.9080. The weekly close far from the bottom shows some difficulties for the Swiss franc extending the rally.

Dollar lows

The greenback lost momentum following the London fix and US economic data. Existing Home Sales dropped in December from 4.08 million to 4.02 million in December, above the 3.96 million of market consensus.

Kansas City Federal Reserve President Esther George said in Friday the US Economy is responding to Fed’s actions. She added it is encouraging to see inflation coming down but warned they have to be more patient in assessing if inflation is on a sustainable path down.

Swiss National Bank (SNB) Chairman Thomas Jordan said on Friday that “absolute priority should be to bring inflation down to price stability level.” He added that he won’t hesitate to reinstate negative interest rates to deal with negative inflation.

Analysts at Commerzbank, forecast the USD/CHF will move higher over the next months, reaching 0.95 by June and see it ending the year at 0.94 and resuming the upside in 2024.

The EUR/CHF rose sharply on Friday, with EUR/CHF approaching again the parity area. “Inflation in Switzerland has recently become more benign, which means that the SNB could soon have reached the end of its rate hike cycle. The ECB, on the other hand, is likely to put the brakes on monetary policy for a bit longer. We have therefore adjusted our EUR/CHF forecast slightly upward”, said analyst at Commerzbank. They see the cross at 1.01 by June and 1.02 in September.

Technical levels

Gold price booked a fifth straight weekly gain. XAU/USD could extend the uptrend to $1,950, as FXStreet’s Dhwani Mehta notes.

Daily technical setup favors Gold bulls

“Gold price rebound from the horizontal trendline support around $1,897 levels has revived the uptrend, with buyers positioned for a test of the $1,950 psychological level. The next stop is envisioned at the April 20 and April 22 highs around $1,958. A sustained break above the latter will trigger a fresh rally toward the critical $2,000 threshold.”

“Gold sellers will once again challenge support just beneath $1,900 should investors resort to profit-taking on their Gold longs, in the face of the recent upsurge. Daily closing below the said downside cap will open floors for a further correction toward the $1,865 region, where January 11 high and the ascending 21-Daily Moving Average (DMA) merge.”

The Yen saw a boost from the BoJ initiating the beginning of the end to its Yield-Curve-Control. Economists at Danske Bank expect the USD/JPY pair to edge lower towards the 125 over the coming months.

Tightening cycle commencing

“Japanese monetary policy has taken over as a key driver of USD/JPY, while global inflation, bond yields and commodity prices are still important to watch.”

“We look for a stronger JPY to come as Bank of Japan tightens monetary policy and the tightening cycle concludes in the US and Europe.”

“We now forecast USD/JPY at 128 (1M), 125 (3M), 125 (6M) and 125 (12M).”

- Gold price is set to finish the week around $1920s after hitting a multi-month high of nearly $1938.

- Thursday’s US economic data was mixed, showing that the labor market is far from portraying an upcoming recession.

- Gold Price Analysis: The 100-DMA crossed above the 200-DMA, further cementing the upward bias.

Gold price retreats from multi-month highs ahead of the weekend due to the US Dollar (USD) recovering some ground and elevated US Treasury bond yields, despite recessionary fears around the US economy. Hence, the XAU/USD is retracing from daily highs of $1937.91, exchanging hands at $1926.42, down 0.28%.

Gold’s reman lackluster on a jump of US bond yields, and strong USD

The US equity markets opened in the green, portraying investors’ optimism. US big tech companies are reporting earnings, keeping investors positive. Layoffs reported by Microsoft, Amazon, and Google’s Alphabet, are grabbing the headlines ahead of the release of US housing data. Existing Home Sales are foreseen to drop to 3.96M compared to the last month’s reading of 4.09M, while the MoM reading is estimated to improve to -5.4%, from November’s -7.7% fall.

In the meantime, Thursday’s economic docket featured Initial Jobless Claims for the last week, printing 190K beneath the 214K expected and the lowest reading since September. In other data, US Housing Starts edged lower to 1.382M YoY vs. 1.358M estimated, and Building Permits fell to 1.333M vs. 1.365M projected.

The US Dollar Index (DXY), a measure of the American Dollar (USD) value against a basket of currencies, advances 0.38%, up at 102.447, taken off Gold’s bright ahead of the weekend. Additionally, the US 10-year benchmark note rate is yielding 3.459%, gaining six and a half bps, a headwind for XAU/USD.

Aside from this, Fed speakers continued their hawkish rhetoric that portrayed St. Louis and Cleveland Fed Presidents Bullard and Mester on Wednesday, each saying that rates need to be “slightly above” 5%. The Federal Reserve Vice Chair Lael Brainard said, “Even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2%.” That said, with Fed’s Brainard being one of the doves of the Federal Reserve Board, it reiterates the US central bank stance of holding for longer.

Gold Price Analysis: Technical outlook

Technically speaking, the XAU/USD uptrend is intact, further cemented by the cross of the 100-day Exponential Moving Average (EMA) at $1786.83, above the 200-day EMA at $1782.90. However, it could be subject to a deeper pullback as the Relative Strength Index (RSI) retraces from overbought territory and the Rate of Change (RoC) pushes above its higher reading in the week. XAU/USD key resistance levels lie at $1937.51, followed by $1950, ahead of the $2000 mark. On the flip side, Gold’s demand zones would be $1920.77, followed by the $1900 figure.

Near-term ECB policy outlook has been the driver of EUR volatility this week. A diverging monetary plicy between Fed and ECB is set to boost the Euro, according to economists at MUFG Bank.

ECB policy rate to reach 3.00% by the end of this quarter

“We are sticking with our forecast for the policy rate to reach 3.00% by the end of this quarter. A scenario that is not fully priced into the eurozone rate market which is currently expecting a total of 93 bps of hikes to be delivered at the February and March policy meetings.”

“We expect ECB and Fed policies to diverge at the start of this year with the Fed set to slow the pace of hikes to 25 bps in February in response to further evidence of softening US inflation. It continues to favour a stronger Euro alongside the improving cyclical outlook for the Eurozone that is currently being priced into markets as recession risks are pared back.”

The Loonie continues to find it difficult to hold its ground. Economists at Commerzbank see limited CAD recovery potential in the medium term.

CAD is likely to have a hard time for the time being against the EUR

“In view of the robust economy and active BoC, we see further limited CAD recovery potential against the USD in the medium term, supported by weakening USD strength. The interest rate differential could temprarily narrow somewhat if the Fed lowers its key rate from the end of 2023, as we expect, and the BoC does not follow suit (to the same extent).”

“The CAD is likely to have a hard time for the time being against the EUR, which has gained in attractiveness, for instance, due to the pricing out of an energy crisis and as a result of rising interest rate hike expectations. But rising interest rates in the euro area should increasingly be reflected in weaker economic indicators there as well. This should limit the CAD losses against the EUR.”

“In the medium term, the Loonie should recover if the EUR trends weaker in 2024, as we expect.”

- EUR/USD comes under pressure but remains bolstered by 1.0800.

- Next on the upside emerges the key barrier at 1.0900 the figure.

EUR/USD fades the initial test of the 1.0860 region and returns to the negative territory on Friday.

Extra range bound mood looks likely for the time being, while the surpass of the so far YTD top at 1.0887 (January 18) should rapidly allow a move to the round level at 1.0900.

While above the short-term support line near 1.0620, extra gains should remain in store for the pair.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0307.

EUR/USD daily chart

Economists at HSBC think USD/JPY will fall by year-end 2023 on a range of factors from future BoJ policy announcements to improvements in Japan’s balance of payments and a revival of the JPY’s “safe haven” status.

A revival of Yen’s ‘safe haven’ status could weigh on USD/JPY

“There are many upcoming events that could lead to a change in the BoJ’s policy later. PM Kishida will likely nominate the next BoJ governor sometime in February. Governor Kuroda will chair his last monetary policy meeting on 10 March. The first result tabulation of Shunto (annual wage negotiations) will likely be announced around mid-March. The new governor will chair his first monetary policy meeting on 28 April.”

“Aside from the BoJ, there are other plausible developments that could drive USD/JPY lower in 2023: resident investors FX-hedging their foreign investments; an improvement in Japan’s core balance of payments due to JPY undervaluation and tourism resumption; and a revival of the JPY’s counter-cyclical nature and ‘safe haven’ status during risk-off episodes (as US yields fall).”

USD/ZAR briefly challenged the 200-Day Moving Average recently, however, it has quickly rebounded after forming a low near 16.70. The pair is set to extend its advance on a break past 17.41/45, economists at Société Générale report.

Receding downward momentum

“Daily MACD has been posting positive divergence denoting receding downward momentum.”

“17.41/17.45, the 38.2% retracement of recent down move is initial resistance. Once this is overcome, USD/ZAR is expected to extend the bounce towards 17.95 and the high of October/November at 18.58.”

“The 200DMA at 16.87 is first support.”

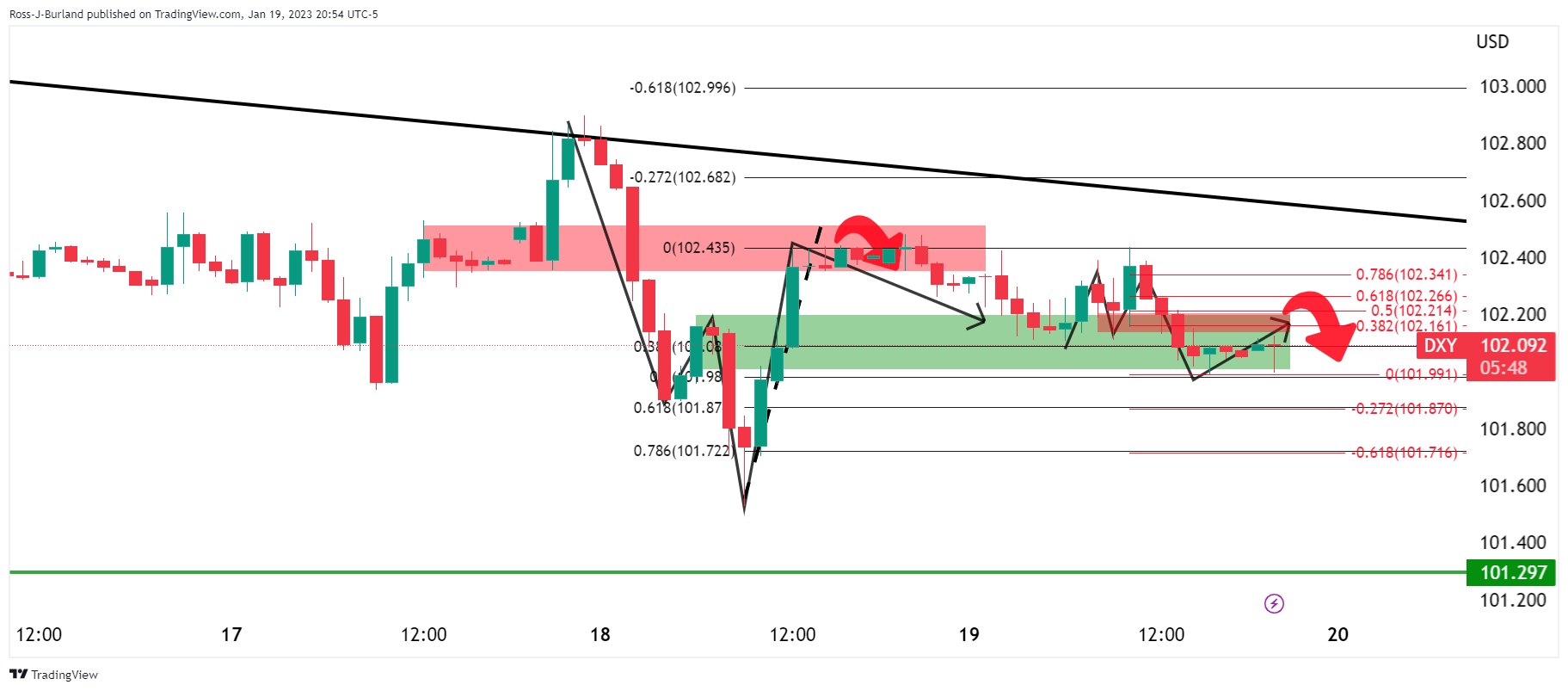

- The index keeps the range bound theme intact above 102.00.

- The dollar appears supported by the YTD low near 101.80.

The index advances to 2-day highs and retests the mid-102.00s at the end of the week.

So far, the continuation of the side-lined mood looks the most likely scenario for the dollar in the very near term. In case bears regain the upper hand, the loss of the January low at 101.77 (January 16) should put a potential deeper drop to the May 2022 low around 101.30 (May 30) back on the investors’ radar prior to the psychological 100.00 level.

In the meantime, while below the 200-day SMA at 106.44 the outlook for the DXY should remain tilted to the negative side.

DXY daily chart

EUR/USD has held in a sideways consolidation range for much of the week. Economists at Scotiabank expect the pair to test levels above 1.10.

Hawkish policy prospects will underpin the EUR

“We expect the ECB to lift rates 50 bps in Feb and March at least and do not exclude a third 50 bps increase in May. Hawkish policy prospects will underpin the EUR.”

“Spot has met better selling pressure on gains through the upper 1.08s but the pattern of trade plus solidly bullish trend strength signals really suggest that new highs and a push on to 1.10+ are a matter of time.”

“Support is 1.0775. Resistance is 1.0890/00.”

- EUR/JPY rebounds strongly and surpasses the 141.00 barrier.

- A convincing breakout of the 200-day SMA (140.74) allows for further upside.

EUR/JPY picks up strong upside traction and reverses the weekly consolidative theme, breaking above the critical 200-day SMA at the same time.

A sustainable breakout of the 200-day SMA, today at 140.74, should shift the outlook to a more constructive one and open the door to a probable visit to the key resistance area near 143.00 (high December 28, January 11).

On the downside, initial contention remains around the 138.00 zone for the time being.

EUR/JPY daily chart

Gold price climbed to a nine-month high of $1,935 on Thursday. Economists at Commerzbank note that Gold demand in China decreased, which could drag the yellow metal down.

Short-term investors more and more optimistic for Gold

“A troy ounce of Gold costs more than $1,900 again – more than at any time in nearly nine months. Physical demand in China, the largest consumer market, has not been the driver so far, as low Chinese net imports from Hong Kong and Switzerland are likely to confirm.

“It is above all speculative financial investors who have been expanding their net long positions. A setback could be looming if they were forced to adjust their expectations with regard to the Fed’s policy.”

EUR/GBP is rising again. Kit Juckes, Chief Global FX Strategist at Société Générale, notes that Europe’s balance of payments is more euro-friendly now.

UK consumer spending decoupled from GDP – temporarily

“The current account surplus peaked in 2018, before slipping into deficit in the year to August 2022. Long-term capital outflows, driven by bond flows, surged in in 2020-2021. The capital account picture improved through 2022, but the current account went the other way. Now, things are set to improve: Lower energy prices will turn the current account around, while higher rates/yields, and the pivot from QE to QT, will provide plenty of Euro-denominated bonds for investors to buy. There are debt issues to worry about, but the Euro will benefit.”

“Real spending dramatically out-performed GDP in 2020-2022 in the UK but higher inflation has brought that to a dramatic end. The nominal series is much less volatile, but it looks as though, until inflation falls, 2023 will be payback time after the over-spending of the last three years.”

GBP/USD is on the back foot, having faced rejection at 1.2400. Economists at Scotiabank expect the pair to move higher and retest key resistance at 1.2450/60.

Bullish pennant consolidation

“Late week price action in the Pound has seen Cable move sideways within a steadily narrowing range – a bullish pennant consolidation.”

“Support is seen at 1.2335.”

“Bullish-leaning trend strength studies favour a topside break out and push on to retest key resistance at 1.2450/60 and beyond.”

See: GBP underperformance unlikely to persist – HSBC

USD/CAD is holding little changed in the session. There seems little real appetite to move the pair either way at the moment, economists at Scotiabank note.

Pretty solid support in the 1.3450 area

“The intraday charts indicate generally better USD selling pressure but also highlight pretty solid USD support on modest weakness to the 1.3450 area so far.”

“USD gains yesterday tested the 40-Day Moving Average (1.3509), which held and should now impose some downward pressure on funds generally. But there seems little real appetite to move USD/CAD either way at the moment which is reflected in flat, short-term trend signals.”

“Resistance is 1.3475/00. Support is 1.3440/50.”

Norges Bank could be near to end of the rate cycle. But in the view of economists at Commerzbank, there is a high potential for surprises in EUR/NOK at the lower end.

End of the rate cycle in Norway in sight?

“It seems as if the end of the rate cycle in Norway is slowly approaching, as long as there are no surprises on the inflation and economic front. However, as the market is already expecting that and is pricing in rate cuts for the end of the year, this prospect is not putting pressure on NOK.

“If the economic data was to improve with price data coming in above expectations the market is likely to reduce its rate cut expectations again, which is likely to support NOK.”

“There is a higher potential for surprises in EUR/NOK at the lower end.”

Economists at Nordea are quite optimistic on the Yen and expect the USD/JPY pair to potentially dip under 120 by the end of the year.

Converging monetary policy should support JPY

“With inflation reaching the highest point in decades and an outlook for higher wage growth ahead, the time will be ripe for a normalisation of BoJ’s very stimulative monetary policy. This will support further strengthening of the JPY with moves below 120 being on the cards towards year-end.”

“The full reopening of Japan for foreign tourists, in particular from China, should also be in favour of a stronger JPY.”

“Finally, JPY’s safe-haven status should come in handy if the negative risk outlook for the global economy and stocks materialise, and other G10 central banks are forced to cut rates as markets currently expect.”

Economists at Commerzbank see a modest recovery of the Forint during 2023 after inflation moderates to some extent, but once again a weaker HUF in 2024 when the Euro resumes depreciating.

HUF underperformance is likely to extend through 2024

“We forecast a modest recovery of the Forint during 2023 because inflation is likely to moderate to some extent through 2023, which will narrow down the negative real interest rate and make the central bank’s monetary stance appear more justified. In this window, we see EUR/HUF at below 400.

“We once again forecast a weaker Forint in 2024 when inflation proves stubborn globally and the Euro resumes depreciating.”

On the 7th of December China surprised friend and foe with an abrupt zero-covid U-turn. This year’s forecast has considerable up- and downside risks. Still, economists at Rabobank believe that from a medium-term perspective, China’s economic prospects have become more favourable after abandoning zero-Covid policy.

A pivotal pivot?

“While from a long-term perspective China’s decision to abandon its zero-covid policy is to be heralded, the short-term effects will likely turn out to be grim. The absence of (reliable and recent) data regarding new cases, hospitalization, deaths and many other relevant time series that could shed a light on the current situation, greatly complicates any attempt to make a solid impact analyses.”

“We expect a relatively mild recession that already started in the last quarter of last year and should end after the first quarter of this year. We further expect that most of the recovery hinges on a recovery in aggregate consumption and more specifically private consumption. All in all this should see the Chinese economy grow by 4.2% this year, but the uncertainty surrounding the impact of covid and the real estate sector ensure that it will likely be both an exciting and challenging year!”

Bank of Japan (BoJ) Governor Haruhiko Kuroda is speaking in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?" at the World Economic Forum (WEF), in Davos this Friday.

Key quotes

Decision taken by the board last month was not a mistake, will carry on accommodative monetary policy.

Expect wages to accelerate growth, and that will eventually help us to meet the 2% inflation target in a stable manner.

Japan's economy can grow 1-2% in the next 2 years.

Two years of 2% growth means the GDP gap is closing.

Expect inflation rates to start to decline from February, overall 2023 to see inflation less than 2%.

Hopes digital transformation to raise growth potential in coming years.

Market reaction

USD/JPY is consolidating its renewed upside on Kuroda’s comments. The pair is trading at 129.45, adding 0.80% on the day.

- USD/JPY gathers extra steam and trades closer to the 130.00 mark.

- US, Japanese yields advance along with the rebound in the dollar.

- Inflation Rate in Japan extended the uptrend in December.

Further selling pressure around the Japanese yen lifts USD/JPY to fresh daily highs in the vicinity of the key 130.00 hurdle at the end of the week.

USD/JPY focuses on dollar, yields

USD/JPY keeps the choppy price action well in place on Friday, leaving behind the previous daily pullback and regain composure near the 130.00 neighbourhood in context where the greenback manages to stage a decent bounce and yields march further up.

On the latter, the US 10-year yields approach the 3.45% region, while their Japanese counterparts leave behind two daily pullbacks and reclaim the 0.40% hurdle so far, as the effects of dovish hold from the BoJ (January 18) continue to fizzle out.

Data wise in the Japanese docket, the headline Inflation Rate and the Core Inflation Rate rose 4.0% in the year to December, while inflation Rate Ex-Food and Energy gained 3% from a year earlier.

What to look for around JPY

The 3-month negative streak in USD/JPY met some initial support in the 127.20 region so far (January 16).

The pair, in the meantime, continues to track developments from the Fed’s normalization process and the opposing views from the markets – which continue to favour a pivot in the near term – and the hawkish narrative from FOMC governors, which defend a rapid move further up in rates (5%-5.25%).

In the more domestic scenario, market participants are expected to closely follow any hint from the BoJ indicating a potential exit strategy from the current ultra-accommodative policy stance and/or another tweak of the Yield Curve Control (YCC).

USD/JPY levels to consider

As of writing the pair is gaining 0.88% at 129.53 and faces the next up barrier at 131.57 (weekly high January 18) seconded by 134.77 (2023 high January 6) and then 136.69 (200-day SMA). On the downside, a break below 127.21 (2023 low January 16) would aim to 126.36 (monthly low May 24 2022) and finally 121.27 (weekly low March 31 2022).

European Central Bank (ECB) President Christine Lagarde is speaking in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?" at the World Economic Forum (WEF), in Davos this Friday.

Key quotes

"Stay the course" is my mantra on monetary policy.

China's reopening will have inflationary pressure.

developing story ...

Speaking on the topic titled "Global Economic Outlook: Is this the End of an Era?" at the World Economic Forum (WEF), in Davos this Friday, the International Monetary Fund (IMF) Managing Director Kristalina Georgieva said that global “outlook is less bad than we feared a couple of months ago.”

Additional quotes

What has improved is potential for China to boost growth.

For China we project 4.4% 2023 growth.

Ukraine war remains "tremendous risk" for confidence especially in Europe.

Nonetheless sees no "dramatic improvement" in current imf 2023 global growth forecast of 2.7%.

Related reads

- USD to come under renewed pressure if Fed rate cuts become more likely – Commerzbank

- Forex Today: US Dollar bears take a breather despite risk reset

From the central bank's perspective, in view of high inflation and extremely low unemployment, the focus is currently exclusively on the inflation target. Economists at Commerzbank analyze how Fed rate cuts wil impact bonds and FX markets.

10y US Treasury yield to rise to 4% in the first quarter

“If price pressures ease, the Fed should see scope at the end of 2023 to reduce the high key interest rates at least somewhat. However, if the recession does not materialize, there would probably be no easing.”

“In the bond market, the current improvement in the US economy suggests that the market will question the rate cuts expected this year in the coming months. We therefore expect the 10y US Treasury yield to rise to 4% in the first quarter. With clearer signs of a recession, inflation rates continuing to fall sharply and the Fed rate cuts we expect, we then see potential for a decline to 3% by the end of the year.”

“If Fed rate cuts become more likely, the USD is likely to come under renewed pressure on the currency market. However, too much additional dollar weakness is no longer to be expected, as the market has already factored in Fed rate cuts.”

- Gold price refreshed nine-month highs above $1,935 in European trading.

- The uptick in US Treasury yields is capping Gold’s upside amid the subdued US Dollar.

- Upside bias remains intact for Gold price amid a bullish daily technical setup.

Gold price is retreating from the highest level seen in nine months at $1,938 in the Europen session, as the renewed uptick in the US Treasury bond yields is aiding the recovery in the US Dollar. Meanwhile, the US Dollar also seems to benefit from cautious optimism, amid dovish Federal Reserve expectations, mixed US corporate earnings reports and weak domestic economic data.

Investors are also resorting to repositioning heading into the Fed’s ‘blackout period’ and China’s Lunar New Year holidays, starting next week. Meanwhile, the focus will remain on the speeches by the Fed policymakers Patrick Harker and Christopher Waller for the next directional move in the Gold price, as those will be the last words from the US central bank ahead of its February 2 policy announcement.

Gold price technical outlook

Gold price: Daily chart

To the upside, Gold buyers gather strength for a test of the $1,950 psychological level, above which the confluence of April 20 and April 22 highs around $1,958 will come into play.

The 14-day Relative Strength Index (RSI) is peeping into the overbought territory, at around 71.00, suggesting that there is more room to the upside.

On the flip side, Gold sellers will once again challenge the horizontal support line just beneath $1,900.

Further south, the correction could resume toward the $1,865 region, the meeting point of the January 11 high and the ascending 21-Daily Moving Average (DMA) merge.

The CEE region remains strongly supported. However, economists at ING note that the Czech Korune and the Hungarian Fortin could be due for a mild correction today.

Koruna to return to 24.00 and Forint back to 396 against the Euro

“Today, we could see a slight retracement of gains in the region resulting from yesterday's correction in equity markets and the deterioration in sentiment after the new year rally in Europe.”

“We expect the Koruna to return to 24.00 EUR/CZK and the Forint back to 396 EUR/HUF.”

- EUR/USD extends the rebound to the 1.0860 region.

- Germany’s Producer Prices surprised to the upside in December.

- ECB Lagarde will speak again at the WEF in Davos.

The optimism around the European currency remains well in place for another session and encourages EUR/USD to retest the 1.0860 zone at the end of the week.

EUR/USD looks at Lagarde, risk trends

EUR/USD advances for the third consecutive session and revisits the 1.0860 area amidst alternating risk appetite trends and humble gains in the greenback.

Indeed, the appetite for the risk complex appears somewhat subdued amidst the mild bid bias in the dollar and rising yields on both sides of the ocean on Friday.

Earlier in the session Producer Prices in Germany contracted 0.4% MoM in December and rose 21.6% over the last twelve months. Later, ECB Chairwoman C.Lagarde will participate in a panel discussion on “Global Economic Outlook: Is this the End of an era?” at the World Economic Forum in Davos.

In the NA session, Existing Home Sales for the month of December are due followed by speeches by Philly Fed P.Harker (voter, hawk) and FOMC C.Waller (permanent voter, centrist).

What to look for around EUR

EUR/USD reclaims the area beyond the 1.0800 mark in a context dominated by the absence of clear direction in the global markets on Friday.

Price action around the European currency should continue to closely follow dollar dynamics, as well as the impact of the energy crisis on the euro bloc and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst diminishing probability of a recession in the region. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.12% at 1.0841 and faces the next up barrier at 1.0887 (monthly high January 18) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022). On the flip side, the breakdown of 1.0766 (weekly low January 17) would target 1.0529 (55-day SMA) en route to 1.0481 (monthly low January 6).

Will the ECB reduce the speed of rate hikes in March following a 50 bps hike in February? ECB intends to remain on course and that is seen as positive by the FX market, economists at Commerzbank report.

Credible ECB

“ECB President Christine Lagarde said that the ECB was determined to return it to the inflation target of 2% in a timely manner. As far as rate hikes were concerned the ECB would stay its course. As part of the last ECB meeting in December Lagarde had signalled a number of 50 bps rate hikes for the coming meetings.”

“Contrary to what is happening with the Fed, the market seems to be believing the ECB’s assertions, as rate expectations have hardly changed over the past few days. As far as monetary policy is concerned EUR is likely to be one step ahead. However, unless the rate expectations are fuelled further, it might well become increasingly difficult for EUR to appreciate further against USD.”

“It is possible that the sentiment indicators due for publication next week will provide additional momentum. If sentiment were to improve further, fears of a recession might be further pushed into the background, which could allow EUR to benefit.”

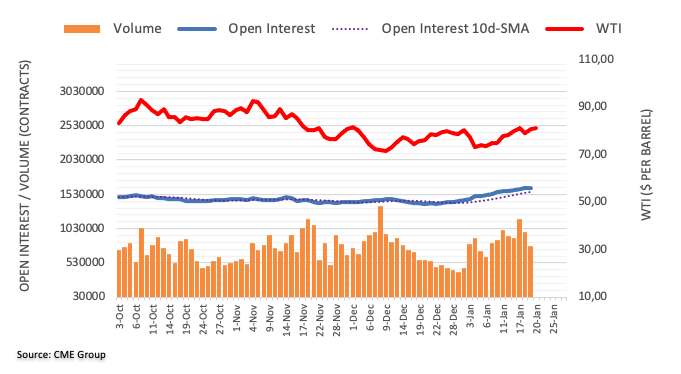

Open interest in crude oil futures markets left behind three consecutive daily builds and shrank by around 5.5K contracts on Thursday considering advanced prints from CME Group. In the same line, volume dropped for the second session in a row, this time by around 215.1K contracts.

WTI: Another test of $72.50 should not be ruled out

Prices of the barrel of the WTI resumed the uptrend on Thursday and managed to close the session just above the key $80.00 mark. The move, however, was amidst shrinking open interest and volume, which hints at the idea that further upside could be running out of steam.

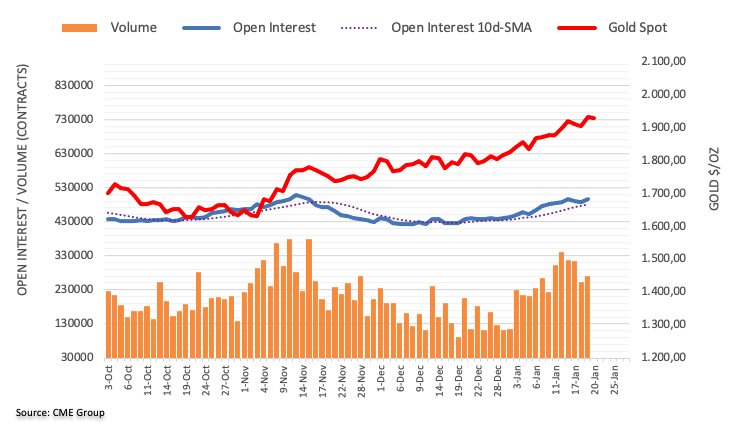

CME Group’s flash data for gold futures markets noted traders increased their open interest positions by around 8.7K contracts on Thursday, reversing at the same time two consecutive daily pullbacks. Volume followed suit and went up by around 17.3K contracts after three straight daily drops.

Gold: Door open to extra gains near term

Gold prices rose markedly to new peaks past the $1930 mark per ounce troy on Thursday. The strong uptick was on the back of increasing open interest and volume and this is supportive of the continuation of the uptrend in the very near term. The next target of note, in the meantime, remains at the key $2000 mark.

Dollar losses have abated amid deteriorating risk sentiment. Economists at ING expect the US Dollar Index to hold above 102.00.

Taking a breather

“Markets may feel comfortable with the current Dollar levels ahead of next week’s fresh round of data releases in the US.”

“DXY could hold above 102.00 today, with some focus on housing data and two Federal Reserve speakers (Patrick Harker and Christopher Waller).”

“Discussions over the US debt ceiling are set to be an important driver for markets, but we currently see this having a material impact on the FX market only around the late summer.”

Swiss National Bank (SNB) Chairman Thomas Jordan said in a scheduled speech on Friday, “absolute priority should be to bring inflation down to price stability level.”

Additional quotes

“We should not underestimate second-round effects of inflation.”

“Firms are not hesitating to increase prices, not easy to bring inflation back to 2%.”

“Once inflation is high, pressure from wages is here.”

Economists at ING expect the EUR/USD pair to test the 1.0900/1.0950 area as ECB squashed market expectations of smaller rate increments.

ECB dovish speculation didn’t last long

“The ECB provided a very reasonable amount of pushback against reports earlier this week that suggested 25 bps increases were being considered. Christine Lagarde reiterated her recent hawkish rhetoric yesterday and the minutes from the December meeting all but confirmed the growing pressure from the hawks in the governing council.”

“This is good news for the Euro, and as long as US data remains on the soft side, EUR/USD should benefit from a rather supportive rate differential.”

“A test of 1.0900/1.0950 next week looks on the cards, but things may be rather quiet today since the Eurozone calendar is quite empty and Christine Lagarde should not surprise with anything new as she speaks again in Davos.”

FX option expiries for Jan 20 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0650 1.1b

- 1.0800 381m

- 1.00001.6b

- GBP/USD: GBP amounts

- 1.2000 435m

- AUD/USD: AUD amounts

- 0.6700 361m

- 0.6800 463m

- 0.6900 2.4b

- 0.7000 394m

- 0.7200 2.0b

- USD/CAD: USD amounts

- 1.3450 420m

- 1.3500 500m

Since autumn 2022, oil and natural gas markets in Europe have been characterised by a sharp fall in prices. These declines in oil and gas prices are of course good news, but we should not be overly enthusiastic about them, in the opinion of analysts at Natixis.

The situation during the winter of 2023-2024 is likely to be more difficult

“These low prices are linked to the exceptionally mild start to the winter in Europe and weak energy demand in China; the major natural gas and electricity suppliers are charging well above the short-term market price.”

“Even at the current low level of natural gas prices in Europe, natural gas remains 6 times more expensive in Europe than in the United States; and 4 times more expensive than in 2018.”

“High energy prices are likely to return in the winter of 2023-2024, as natural gas stocks cannot be replenished in the summer of 2023.”

Gold started the year with a bang. Economists at hold a constructive view for Gold over the next 12 months, but a short-term correction looks likely if a hawkish Fed surprises the market.

Several factors favour Gold in 2023

“We expect Gold to remain in favour as inflation retreats and interest rates near their peak. We see the following drivers supporting the precious metal: A potential pause in the Fed’s interest rate cycle in Q2, rising recession risks, potential downside in the USD, geopolitical risks remaining high and strong physical demand.”

“The recent rally nevertheless looks vulnerable to a price correction as it was largely driven by expectations that the Fed will turn dovish. Any disappointment on the monetary policy front could see prices correcting in the short term.”

“We keep our 12-month price target unchanged at $1,900.”

- GBP/USD renews intraday low while snapping three-day uptrend after the key UK data.

- British Retail Sales slumped to -1.0% MoM in December versus 0.5% expected and -0.4% prior.

- Hawkish Fedspeak allows US Dollar to pare recent losses despite downbeat US data.

- Upbeat comments from BOE’s Bailey, JP Morgan’s upbeat outlook for UK economy put a floor under the Cable price.

GBP/USD takes offers to refresh intraday low near 1.2350 as UK Retail Sales disappoint during early Friday. It’s worth noting, however, that the recently hawkish comments from Bank of England (BoE) Governor Andrew Bailey and upbeat forecasts from JP Morgan seem to put a floor under the Cable pair.

UK Retail Sales for December marked a contraction of 1.0% MoM compared to market expectations favoring 0.5% growth and -0.4% previous readings. Given the UK Retail Sales’ lion's share in the British Gross Domestic Product (GDP), the GBP/USD drops after the key data.

Also read: UK Retail Sales fall 1.0% MoM in December vs. 0.5% expected

On Thursday, Bank of England (BoE) Governor Andrew Bailey noted, “Fall in the December inflation is the beginning of a sign that a corner has been turned.” The policymaker also adds that they think there will be a recession while also stating that the recession will be a shallow one by historic standards.

Elsewhere, JP Morgan came out with an upbeat outlook for the Q2 2023 UK interest rate, to 4.5% versus 4.25% prior estimation. On the same line, the investment bank estimates the UK Fiscal Year 2023 (FY2023) GDP growth to improve to -0.1% versus -0.3% previous forecasts.

It should be observed that the talks of fuel duty cut in the UK and expectations of no more tax relief to the rich ones in Britain in the next budget seem to probe the GBP/USD traders.

On a different page, the US Dollar Index (DXY) consolidates the previous day’s losses, the biggest in over a week, as Fed policymakers favor higher rates during their last public appearances before the 15-day silence period ahead of the February Federal Open Market Committee (FOMC) meeting. Even so, mixed US data probe the GBP/USD bears. That said, the US Unemployment Claims dropped to the lowest levels since late April 2022 and the Philadelphia Fed Manufacturing Survey Index also improved. However, US Building and Housing Starts joined the previously release downbeat US Retail Sales and Producer Price Index (PPI) to propel fears of a recession in the world’s largest economy, earlier backed by the softer wage growth and activity data from the US.

Amid these plays, the key US Treasury bond yields struggle to extend the previous day’s rebound from the multiday low while the S&P 500 Futures print mild gains. That said, stocks in the Asia-Pacific region trade mixed at the latest.

As a result, the GBP/USD pair is likely to remain sidelined even as bears have started witnessing welcome notes of late.

Technical analysis

GBP/USD retreats from a downward-slopping resistance line from May 2022, around 1.2400 by the press time. Even so, the pair’s successful trading beyond the two-week-old ascending support line, close to 1.2315 at the latest, keeps buyers hopeful.

- The UK Retail Sales came in at -1.0% MoM in December, a big miss.

- Core Retail Sales for the UK dropped by 1.1% MoM in December.

- The Cable tests lows near 1.2350 on the downbeat UK data.

The UK Retail Sales arrived at -1.0% over the month in December vs. 0.5% expected and -0.5% previous. The Core Retail Sales, stripping the auto motor fuel sales, fell by 1.1% MoM vs. 0.4% expected and -0.3% previous.

On an annualized basis, the UK Retail Sales plunged 5.8% in December versus -4.1% expected and -5.7% prior while the Core Retail Sales tumbled 6.1% in the reported month versus -4.4% expectations and -5.6% previous.

Main points (via ONS)

Sales volumes were 1.7% below their pre-coronavirus (COVID-19) February levels.

Non-food stores sales volumes fell by 2.1% over the month, with continued feedback from retailers and other wider evidence that consumers are cutting back on spending because of increased prices and affordability concerns.

Food store sales volumes fell by 0.3% in December 2022 from a rise of 1.0% in November, with comments from some retailers suggesting that customers stocked up early for Christmas.

FX implications

GBP/USD is under moderate selling pressure following the release of the downbeat UK Retail Sales data. The spot was last seen trading at 1.2357, down 0.24% on the day.

Economists at Commerzbank forecast CNY to appreciate mildly through this year due to the earlier-than-expected Covid reopening and the expectation of more market-friendly economic policies.

Yuan gains appeal

“The Covid policy U-turn has actually improved the growth outlook for this year. Once the infection waves are over, economic activity could return to normal in the second quarter or even as early as March.”

“A shift in the government’s economic policy is contributing to a better outlook for this and next year. The government is keen to restore confidence.”

“The PBoC will optimize expectation management to maintain CNY exchange rates at a ‘reasonable equilibrium level’.”

“Due to the earlier-than-previously-expected Covid reopening and an expected peak in the Dollar strength, we now forecast CNY will continue to appreciate mildly through this year.”

Here is what you need to know on Friday, January 20:

The US Dollar is licking its wound, what looks like another down week, as dovish US Federal Reserve expectations continue to play out. Reuters poll reported that a majority of the economists expect 25 basis points (bps) rate hike in the first quarter of this year, followed by a pause in its tightening cycle. Risk sentiment is in a better spot so far this Friday, with the Asian stocks recovering ground while the US S&P 500 futures add 0.20% on the day. Markets are shrugging off the negative close on Wall Street overnight, with investors adjusting their positions ahead of the Lunar New Year holidays in China. Further, a jump in subscribers of the US streaming giant Netflix added to the market optimism. Netflix ended last year with over 230 million global subscribers, beating market expectations.

The upbeat market mood is weighing on the US government bonds, motivating US Treasury bond yields to attempt a tepid bounce from multi-month troughs. The USD/JPY pair is advancing above 129.00 amid firmer yields and a pause in the US Dollar downtrend, although maintains its Bank of Japan (BoJ) decision range.

Meanwhile, investors assess the latest commentary from Federal Reserve policymakers heading into the Fed’s ‘blackout period’ from Saturday. Fed Vice Chair Lael Brainard said, "Even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2 percent on a sustained basis." Meanwhile, New York Fed President John Williams said that “The destination, not speed, is the key issue for the rate hike question.”

Friday will see speeches from Philadelphia Fed President and dove Patrick Harker and Governor Christopher Waller, with the policymakers getting the last chance ahead of the February 2 monetary policy announcements.

AUD/USD and NZD/USD are holding onto their recent recovery gains while USD/CAD is trading steady at around 1.3450 amid a minor bounce in the US Dollar and retreating WTI prices. The US oil pares gains amid looming recession risks and an increase in the US EIA crude stockpiles.

EUR/USD is extending its range play above 1.0800, awaiting European Central Bank (ECB) President Christine Lagarde’s speech. On Thursday, Lagarde said that “inflation is way too high” and therefore, the central bank will “stay the course with rate hikes,” squashing market expectations of smaller ECB rate increments.

GBP/USD is on the back foot, having faced rejection at 1.2400 earlier in the Asian session. Investors look forward to the UK Retail Sales data for fresh trading impetus.

Gold price is easing from near nine-month highs of $1,935 amid an uptick in the US Treasury bond yields, All eyes remain on the Fed-speak due later in the day.

Bitcoin is stuck in a narrow range just below the $21,000 level, marginally lower on the day while Ethereum is struggling above the $1,500 barrier amidst news that Crypto lender Genesis files for bankruptcy.

- NZD/USD clings to mild gains during two-week uptrend.

- Cautious optimism in the market joins sluggish US Treasury yields, USD to favor buyers.

- Hawkish Fedspeak, recession fears probe upside momentum amid light calendar.

NZD/USD remains mildly bid around 0.6415 as the Kiwi bulls cheer the upbeat sentiment amid sluggish hours of early Friday’s trading. In doing so, the quote reverses the previous day’s losses while bracing for the second consecutive weekly gain.

The risk-on mood could be linked to the hopes of more stimulus from China, mainly after the People’s Bank of China’s (PBOC) fifth monthly inaction. On the same line could be the challenges for the Federal Reserve’s (Fed) rate hike trajectory emanating from the downbeat US data.

On Thursday, the US Unemployment Claims dropped to the lowest levels since late April 2022 and the Philadelphia Fed Manufacturing Survey Index also improved However, US Building and Housing Starts joined the previously release downbeat US Retail Sales and Producer Price Index (PPI) to propel fears of a recession in the world’s largest economy, earlier backed by the softer wage growth and activity data from the US.

It should be observed that New Zealand’s Business NZ PMI for December and Visitor Arrivals for November both eased in their latest readings and challenge the Kiwi pair buyers of late.

Alternatively, the US Dollar Index (DXY) picks up bids to 102.15 as it consolidates the previous day’s losses, the biggest in over a week, as Fed policymakers favor higher rates during their last public appearances before the 15-day silence period ahead of the February Federal Open Market Committee (FOMC) meeting. It’s worth noting that the latest tension surrounding Taiwan also seems to probe the NZD/USD bulls.

Amid these plays, the key US Treasury bond yields struggle to extend the previous day’s rebound from the multiday low while the S&P 500 Futures print mild gains. That said, stocks in the Asia-Pacific region trade mixed at the latest.

Moving on, a lack of major data/events, as well as hawkish Fedspeak, could challenge the NZD/USD pair’s upside ahead of the key week comprising multiple activities, inflation and growth numbers for the key economies.

Technical analysis

The 100-bar Exponential Moving Average (EMA) joins the 50-EMA and the weekly support-turned-resistance to challenge the NZD/USD bulls around 0.6415. However, the previous day’s low of 0.6365 restricts the immediate downside of the quote, a break of which will highlight the 61.8% Fibonacci retracement level of the NZD/USD pair’s January 06-18 upside, near 0.6315.

- The index extends the consolidative theme around the 102.00 region.

- Risk appetite trends looks mixed so far at the end of the week.

- Housing data, Fedspeak next on tap in the US docket.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main rivals, extends further the consolidation theme on Friday, always around the 102.00 neighbourhood.

USD Index appear capped by 103.00

The index exchanges gains with losses around the 102.00 region on Friday, always within the multi-session range bound theme and amidst the inconclusive risk appetite trends.

In the meantime, the Fed’s tighter-for-longer narrative was reinforced once again by recent comments from Fed rate setters against the backdrop of some incipient weakness in some US fundamentals and the unabated resilience of the labour market.

In the US money markets, yields so far extend the tepid bounce following multi-week lows recorded earlier in the week.

In the US data space, Existing Home Sales for the month of December will be the only release later in the day seconded by speeches by Philly Fed P.Harker (voter, hawk) and FOMC C.Waller (permanent voter, centrist).

What to look for around USD

The dollar remains side-lined in the lower end of the recent range near the 102.00 mark at the end of the week.

The idea of a probable pivot in the Fed’s policy continues to weigh on the greenback and keeps the price action around the DXY depressed. This view, however, also comes in contrast to the hawkish message from the latest FOMC Minutes and recent comments from fed’s rate-setters, all pointing to the need to advance to a more restrictive stance and stay there for longer, at the time when rates are seen climbing above the 5.0% mark.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and the continuation of its hiking cycle.

Key events in the US this week: Existing Home Sales (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Prospects for extra rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gains 0.10% at 102.15 and faces the next up barrier at the weekly high at 102.89 (January 18) followed by 105.63 (monthly high January 6) and then 106.44 (200-day SMA). On the flip side, the breakdown of 101.77 (monthly low January 16) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level).

- GBP/JPY is approaching 160.00 as investors are still confused about forward Bank of Japan’s policy stance.

- Bank of England might discover a meaningful downtrend in inflation from the late spring amid tight monetary policy.

- Bank of Japan could look for an exit from the expansionary policy as inflation is stably rising.

- GBP/JPY might display a power-pack action after the release of the United Kingdom Retail Sales data.

GBP/JPY has extended its recovery move above the critical resistance of 159.00 in the early European session. The cross is marching towards the round-level resistance of 160.00 ahead of the United Kingdom Retail Sales data.

On Thursday, the asset rebounded from 157.70 after the Bank of Japan (BOJ) maintained the status quo by keeping the interest rates and yields target unchanged. Bank of Japan (BoJ) Governor Haruhiko Kuroda kept the interest rate at -0.10% and the 10-year Japanese Government Bonds (JGBs) around 0% steady, commented that there is “no need to further expand the bond target band.” He further added that Japan’s economy is still on the path towards recovery from the pandemic and the BoJ is aiming to achieve a 2% inflation target sustainably, stably in tandem with wage growth.

BOE’s Bailey sees a sheer declining inflation trend in the late Spring

Policymakers at the Bank of England (BOE) have put severe efforts for decelerating the pace of the Consumer Price Index (CPI) by accelerated interest rates. December’s CPI report has shown a consecutive decline in the inflation trend for the first time since the Covid-19 pandemic period, led by declining energy prices. The United Kingdom has been one of the laggards in slowing down the pace of inflation.

On Thursday, Bank of England Governor Andrew Bailey cited “He expects that inflation will fall quite rapidly this year, probably starting in the late spring. While commenting on the terminal rate, the Bank of England Governor sees the interest rate peak near the market expectations at 4.5%. The Bank of England Governor is seeing a shallow recession than the historic ones.

Earlier, Bank of England policymakers cited rising wages as responsible for escalating inflation. Bargaining power has been shifted in the favor of job-seekers due to a shortage of labor.

Investors await United Kingdom Retail Sales for fresh cues

For further guidance, investors will keep an eye on the United Kingdom Retail Sales data, which is scheduled for Friday. As per the projections, the annual Retail Sales (Dec) data could contract by 4.1% vs. a contraction of 5.9% reported in the prior same period. However, the monthly economic data is expected to expand by 0.5% against the contraction of 0.4%. A recovery in the retail demand on a monthly basis could be the outcome of rising employment bills due to employees’ bargaining power, which is leaving more funds in the palms of households for disposal.

A better-than-projected retail demand could spurt the forward inflation expectations, which could accelerate hawkish Bank of England bets.

Mixed Japan’s inflation fails to provide any boost to the Japanese Yen

Bank of Japan’s unchanged monetary policy-inspired gains in GBP/JPY faded later as investors still believe that the central bank will look for an exit from its decade-long ultra-loose monetary policy. A rising trend in inflation and the administration’s effort to increase wages could end the expansionary monetary policy ahead. However, the release of the National CPI indicates that investors should wait further before reaching to a conclusion.

Japan’s National headline CPI has landed at 4.0%, lower than the consensus of 4.4% but higher than the former release of 3.8%. While the core inflation that excludes oil and food prices has soared to 3.0% higher than the expectations of 2.9% and the prior release of 2.8%. National CPI that excludes fresh food has remained in line with the estimates at 4.0%.

GBP/JPY technical outlook

-638097920630283504.png)

The recovery move from GBP/JPY around the upward-sloping trendline of the Ascending Triangle chart pattern plotted from January 13 low at 155.65 has pushed it above the 20-period Exponential Moving Average (EMA) at 159.22. There is no denying the fact that the short-term trend is bullish now. The horizontal resistance of the volatility contraction chart pattern is placed from January 9 high at 160.92.

Meanwhile, the Relative Strength Index (RSI) (14) has scaled above 60.00, which indicates that the upside momentum is active now. Broadly, the cross might find barricades after reaching the horizontal resistance mentioned above.

- Silver edges higher on Friday, albeit lacks follow-through beyond the $24.00 mark.

- The technical setup favours bullish traders and supports prospects for further gains.

- A convincing break below the trend-channel support will negate the positive outlook.

Silver builds on the previous day's goodish rebound from the $23.15 area, or a two-week low and edges higher during the Asian session on Friday. The white metal, however, struggles to find acceptance or extend the momentum beyond the $24.00 mark and has now trimmed a part of its modest intraday gains.

From a technical perspective, the XAG/USD on Thursday managed to defend support marked by the lower end of over a one-one-month-old ascending channel. The subsequent move-up suggests that this week's pullback from the $24.50 resistance zone has run its course. Moreover, oscillators on the daily chart just manage to hold in the bullish territory and have again started gaining positive traction on hourly charts.

The aforementioned technical setup supports prospects for a further appreciating move, though the lack of follow-through buying warrants some caution for aggressive bullish traders. Nevertheless, the XAG/USD still seems poised to retest the multi-month peak, around the $24.50 area, before eventually aiming to challenge the trend-channel resistance. The latter is currently pegged just ahead of the $25.00 psychological mark.

On the flip side, the 200-period SMA on the 4-hour chart, around the $23.55 region, seems to protect the immediate downside. This is closely followed by the trend-channel support, near the $23.40-$23.35 zone and the overnight swing low, around the $23.15 area. A convincing break below the said support levels will be seen as a fresh trigger for bearish traders and make the XAG/USD vulnerable to weaken below the $23.00 mark.

The next relevant support is pegged near the $22.60-$22.55 region before the XAG/USD eventually drops to the $22.10-$22.00 zone. The latter represents a static resistance breakpoint and might help limit any further losses, at least for the time being.

Silver 4-hour chart

Key levels to watch

- Gold price retreats from nine-month high as bulls struggle to defend one-month-old winning streak.

- Hawkish Federal Reserve comments, pick-up in yields allow US Dollar to lick its wounds and probe the XAU/USD buyers.

- Preliminary PMIs for January, advance readings of US Q4 2022 GDP will provide fresh impulse during pre-Fed silence.

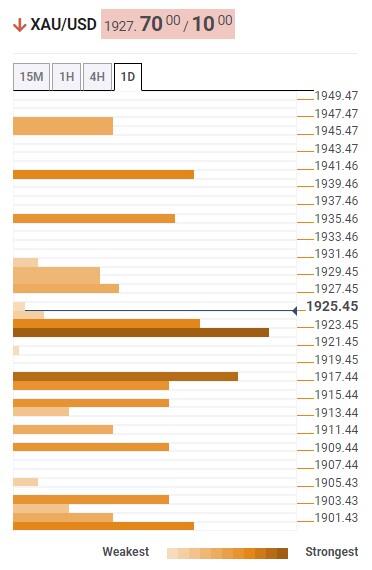

Gold price (XAU/USD) pares recent gains as bulls take a breather at the highest levels since April 2022 amid a recent pick-up in the US Dollar. Also likely to probe the Gold buyers could be the cautious mood ahead of the key data/events, as well as the pre-Fed blackout period.

That said, Federal Reserve Bank of New York President John Williams and Fed Vice Chair Lael Brainard was the latest ones to back the higher rates as policymakers sneak into the pre-February Federal Open Market Committee (FOMC) mum starting this Saturday. On the other hand, downbeat US data and looming fears of inflation keep the recession risk on the table and weigh on the Gold price, due to the US Dollar’s haven demand. It’s worth noting that the US Treasury bond yields recover from the multi-month low and allow the greenback to probe the XAU/USD bulls of late.

Moving on, Gold traders will have a busy week as the first readings of January’s activity data and the US fourth quarter (Q4) Gross Domestic Product (GDP) are on the calendar. Also important will be the Fed’s preferred inflation gauge, namely the Core Private Consumption Expenditure (PCE) Price Index, for December.

Also read: Gold Price Forecast: Buyers maintain the pressure with eyes on $2,000

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the Gold price floats above the key $1,920 support comprising the previous weekly high and Fibonacci 38.2% on one day. Also challenging the short-term XAU/USD downside is the $1,917 mark that encompasses Pivot Point one month R3.

Following that, Fibonacci 23.6% and 38.2% in one week can challenge the Gold bears around $1,910 and $1,901 respectively.

It’s worth noting that the $1,900 could act as the last defense of the XAU/USD buyers.

Alternatively, the previous high on one day and four-hour join the upper Bollinger on the 15 minutes to restrict the immediate upside of the Gold price near $1,936.

In a case where Gold buyers manage to cross the $1,936 hurdle, a convergence of the Pivot Point one week R1 and Upper Bollinger on one hour, close to $1,941, could challenge the XAU/USD bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- USD/JPY gains positive traction on Friday and draws support from a combination of factors.

- A further recovery in the US bond yields helps revive the USD demand and acts as a tailwind.

- A positive risk tone undermines the safe-haven JPY and provides an additional lift to the pair.

The USD/JPY pair attracts some buyers on the last day of the week and steadily climbs back above the 129.00 mark during the Asian session. Spot prices, however, remain confined in a familiar range held since the beginning of this week, warranting caution for bullish traders before positioning for any further intraday positive move.

The US Dollar draws some support from a further recovery in the US Treasury bond yields and turns out to be a key factor acting as a tailwind for the USD/JPY pair. In fact, the yield on the benchmark 10-year US government bond move away from its lowest level since mid-September touched on Thursday amid uncertainty over the Fed's rate-hike path.

In fact, the markets have been pricing in a greater chance of a smaller 25 bps Fed rate hike move in February. That said, the upbeat US macro data released on Thursday, along with the recent hawkish rhetoric from several Fed officials, suggest that borrowing costs are likely to remain elevated for longer, which, in turn, favours the USD bulls.

Apart from this, a generally positive tone around the equity markets undermines the safe-haven Japanese Yen and lends support to the USD/JPY pair. Investors turn optimism over a recovery in the world's second-largest economy after the People’s Bank of China (PBoC) kept its benchmark loan prime rate at historic lows for a fifth straight month on Friday.

The upside for the USD/JPY pair, meanwhile, remains capped, at least for the time being, amid fresh speculation that high inflation may invite a more hawkish stance from the Bank of Japan (BoJ) later this year. It is worth recalling that the BoJ earlier this week decided to leave its monetary policy settings unchanged, defying expectations for more hawkish signals.

Nevertheless, the fundamental backdrop supports prospects for some meaningful upside for the USD/JPY pair, though the lack of a strong follow-through buying warrants caution. Market participants now look to the US Existing Homes Sales data, which, along with speeches by influential FOMC members, will drive the USD and provide some impetus to the USD/JPY pair.

Technical levels to watch

- USD/MXN is oscillating in a narrow range below the critical resistance of 19.00.

- The market mood is quite confusing as the S&P500 futures and US Treasury yields are showing a recovery.

- The Fed might announce two more 25 bps interest rate hikes before pausing the policy tightening program.

The USD/MXN pair is showing a balanced auction below the round-level resistance of 19.00 in the early European session. The asset is expected to surpass the immediate resistance as Federal Reserve (Fed) policymakers are continuously passing hawkish commentaries for the terminal rate and sustenance of higher interest rates to tame the stubborn inflation.

Market mood is quite confusing as the S&P500 futures are showing a recovery move after a three-day losing spell and also the 10-year US Treasury yields have extended their recovery above 3.41%. The US Dollar Index (DXY) has climbed to near 101.80 after a rebound to near 101.60. Thanks to the hawkish commentary from Fed policymakers, which are acting as a cushion for the US Dollar.

New York Fed Bank President John Williams cited that “With inflation still high and indications of continued supply-demand imbalances, it is clear that monetary policy still has more work to do to bring inflation down to our 2% goal on a sustained basis”, as reported by Reuters.