- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

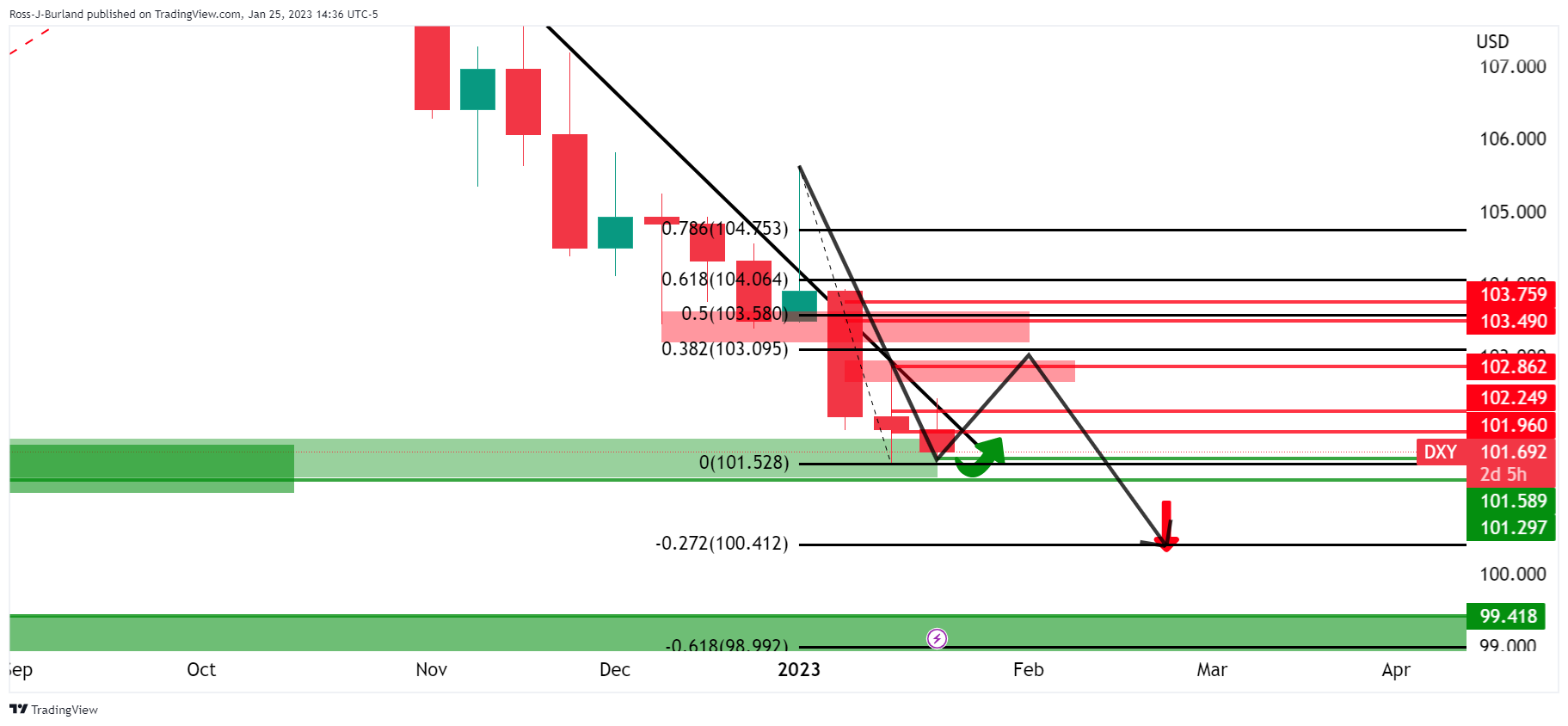

- US Dollar Index holds lower ground near the six-month bottom marked the last week.

- Divergence between Fed and ECB policymakers’ latest comments, as well as data from Europe and US, weigh on DXY.

- Treasury bond yields, Wall Street remain mixed ahead of the key catalysts.

US Dollar Index (DXY) remains on the back foot as sellers attack the multi-month low marked the last week around 101.30, close to 101.55 by the press time of early Thursday. In doing so, the greenback’s gauge versus the six major currencies braces for the third consecutive weekly fall while renewing the intraday low.

It’s worth noting that hopes of a dovish Federal Open Market Committee (FOMC) grew stronger amid the Fed blackout and weigh on the DXY. The reason could be linked to the previously downbeat US data surrounding wages for December and activities for January. “Traders broadly expect the Fed to increase rates by 25 basis points (bps) next Wednesday, a step down from a 50 bps increase in December,” said Reuters.

Additionally weighing the US Dollar could be the hawkish comments from the European Central Bank (ECB), as well as the upbeat data from the bloc. On Wednesday, Germany’s IFO Business Climate Index matched 90.2 forecasts for January versus 88.6 prior but the Current Assessment eased from 94.4 to 94.1, versus 95.0 expected. Further, the IFO Expectations for the said month also came in higher-than-consensus 85.0 while rising to 86.4, compared to 83.2 previous readings.

That said, ECB Governing Council member Gabriel Makhlouf became the last policymaker from the bloc’s central bank to fire the hawkish shot, suggesting a 50 bps rate hike, ahead of the one-week blackout pre-ECB. "We need to continue to increase rates at our meeting next week – by taking a similar step to our December decisions," said ECB’s Makhlouf. Makhlouf further added that they need to increase rates again at the March meeting.

Elsewhere, cautious optimism in the market adds strength to the bearish bias for the US Dollar Index as traders expect a China-inspired economic rebound to push back the recession fears.

Against this backdrop, as well as taking clues from the mixed earnings report, Wall Street closed mixed and the US Treasury bond yields remained sidelined near 3.45. The S&P 500 Futures also remain sluggish around 4,036 by the press time.

While the DXY bears are in control, their further dominance depends upon the first readings of the US fourth quarter (Q4) Gross Domestic Product (GDP), expected to print annualized growth of 2.6% versus 3.2% prior. Also important to watch will be the US Durable Goods Orders for December and the Q4 Personal Consumption Expenditure (PCE) data. Should the scheduled data print upbeat outcomes, the US Dollar Index traders may get a reason to pare latest losses.

Also read: US Gross Domestic Product Preview: Three reasons to expect a US Dollar-boosting outcome

Technical analysis

Although December 2022 low near 101.45 restricts short-term US Dollar Index rebound, the DXY’s further downside remains elusive unless the quote breaks a six-week-old descending support line, currently around 101.10.

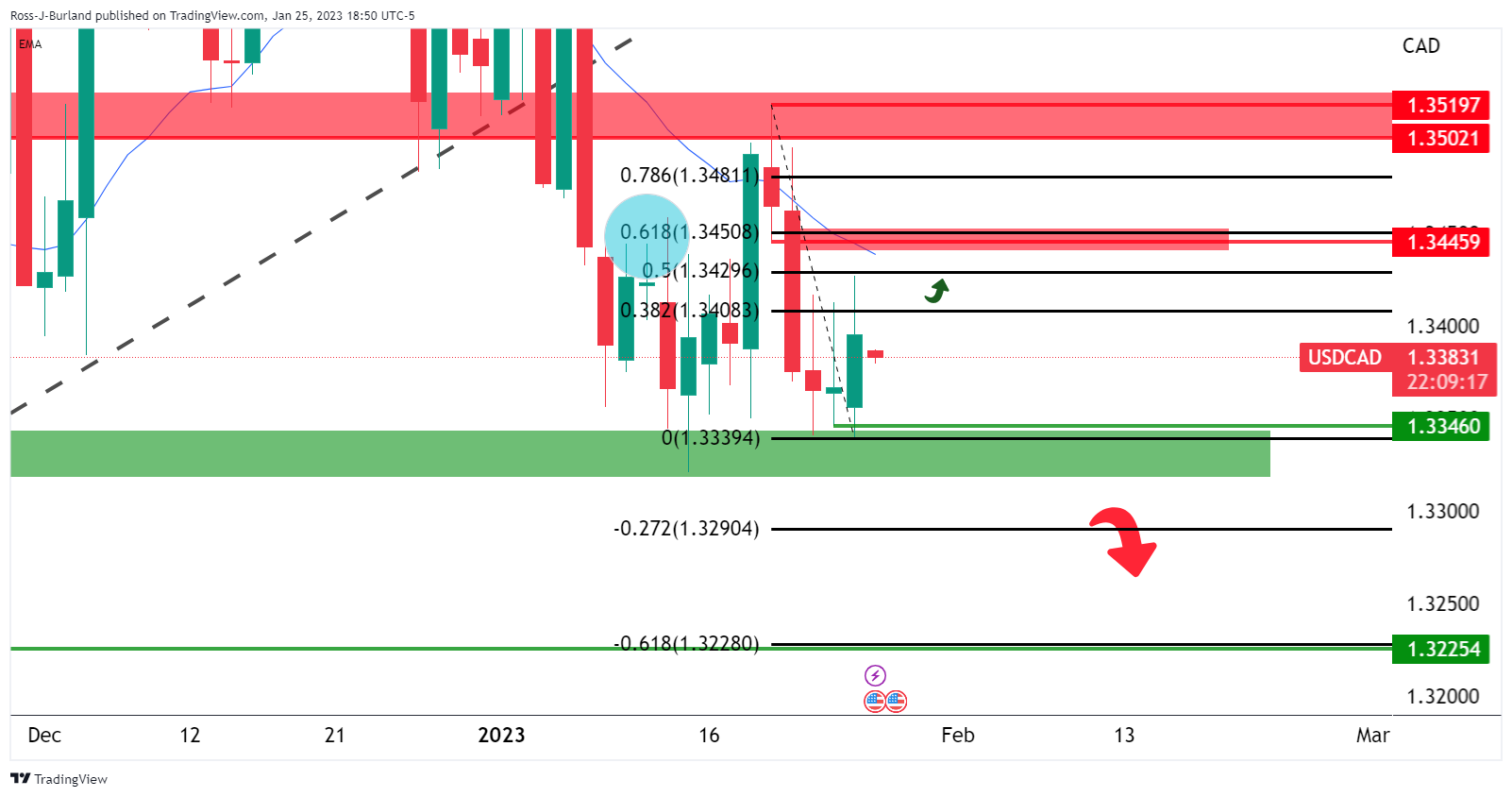

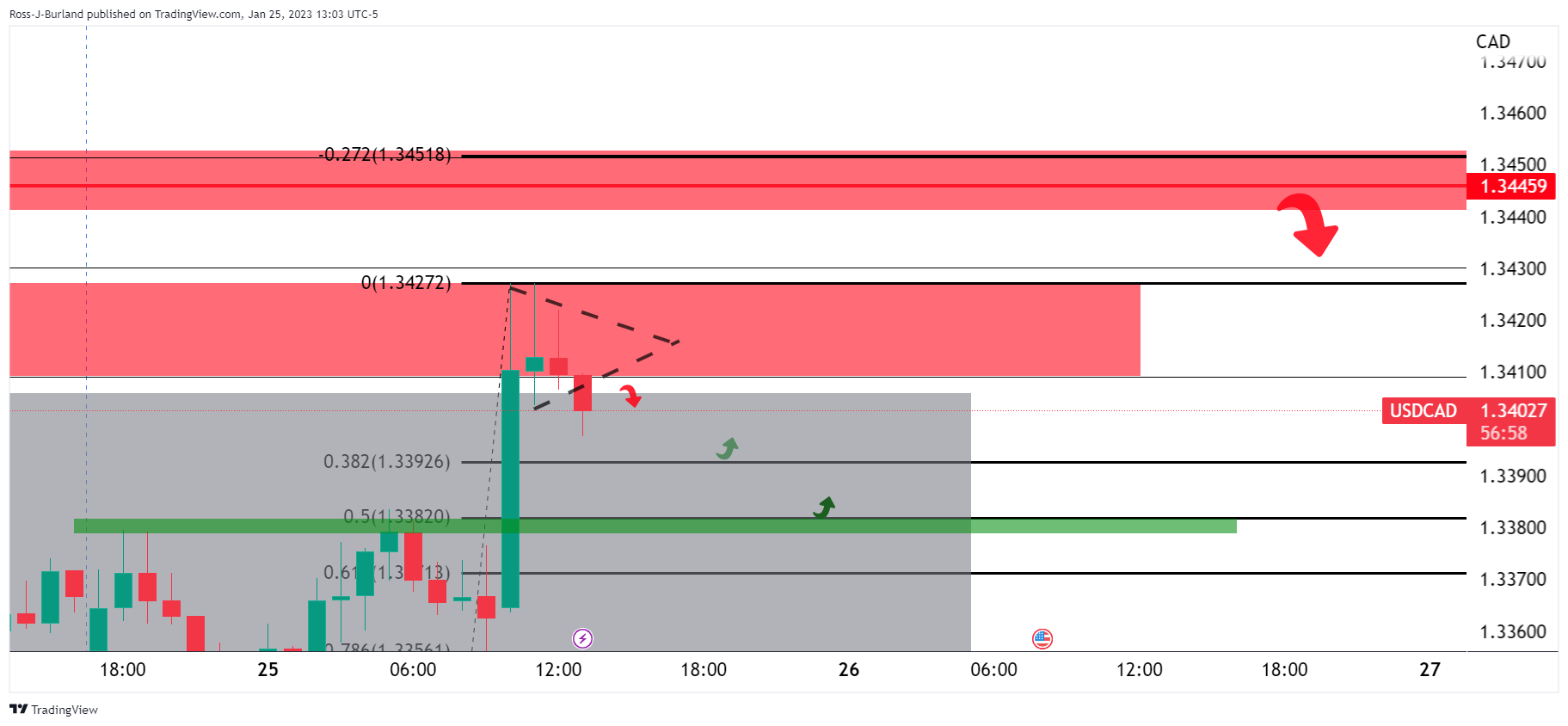

- USD/CAD stalls on the correction post-BoC and bulls are holding the first at a 50% mean reversion.

- USD/CAD's daily 61.8% Fibonacci resistance is a compelling target that meets structure and the 20 EMA.

USD/CAD was a mover on Wednesday due to the Bank of Canada's interest rate decision whereby the pair shifted gears on the announcement, rallying from a low of 1.3340 to score a high of 1.3428 prior to correcting back into the rally following a consolidation around the BoC's governor, Tiff Macklem's, comments on the policy outlook and responses to questions from the press.

The following illustrates the price action that occurred over the event and prospects for a move higher, depending on the outcome of today;'s critical pre-Fedral Reserve meeting US economic data.

USD/CAD H1 chart

The correction has stalled at the 50% mean reversion of the move. This area also has a confluence with the prior resistance earlier in the week which raises the probability of a move up from here over the course of the next sessions, namely the London and US trade.

USD/CAD daily chart

there would be prospects of a bullish breakout as per the above daily chart above should the bulls break above 1.3520. However, 1.3450 is guarded by the 20-day EMA and 1.3500 could also prove a tough area to break above. Meanwhile, the 61.8% Fibonacci resistance is a compelling target that meets structure and the 20 EMA:

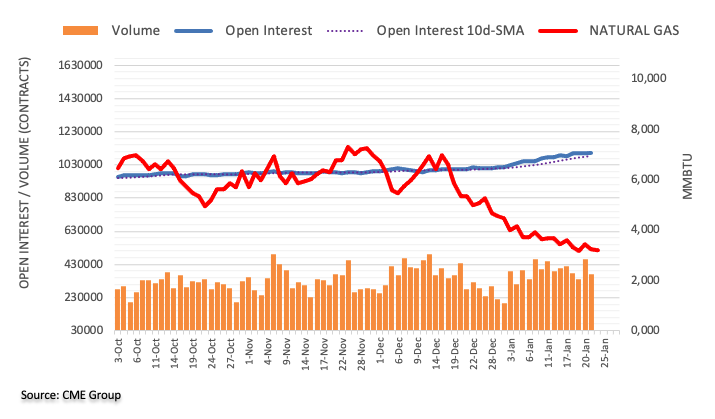

- Oil price is oscillating around $80.50 as investors await US GDP for fresh cues.

- The black gold has not shown any power-pack action despite a smaller-than-expected jump in oil inventories.

- United States President Joe Biden is considering refilling the Strategic Petroleum Reserve.

West Texas Intermediate (WTI), futures on NYMEX, is displaying back-and-forth moves around $80.50 in the early Asian session. The black gold is displaying a sideways auction as investors are awaiting the release of the United States Gross Domestic Product (GDP) data for fresh impetus. According to the estimates, the US GDP is expected to shrink to 2.8% vs. the prior release of 3.2%.

The declining scale of economic activities indicates the consequences of rising interest rates by the Federal Reserve (Fed). A contraction in economic activities clears that the oil demand is facing pressure, which could hurt the oil prices ahead. On the same note, the chances of a slowdown in the pace of the interest rate hike by the Fed will accelerate as a contraction in economic activities will also strengthen recession fears.

The oil price has not shown a power-pack action despite the release of the lower-than-anticipated increase in the oil inventories reported by the US Energy Information Administration (EIA). For the week ending January 20, the EIA has reported an increase in oil stockpiles by 533,000 barrels vs. the expectations of 971,000 barrels.

Meanwhile, celebrations of the Lunar New Year in China have triggered short-term pain in the oil price. Economic activities have dropped significantly which has trimmed the oil demand and might result in a pile-up of oil inventories.

On the supply front, the United States is considering refilling of the Strategic Petroleum Reserve (SPR). US President Joe Biden exploited the oil reserves in CY2022 to fight rising oil prices, which could result in a fresh rally in the oil price ahead.

- USD/CHF takes offers to refresh intraday low and extend the previous day’s losses.

- US Dollar bears approach the six-month low marked the last week amid dovish concerns over FOMC amid Fed blackout.

- Market sentiment remains dicey ahead of multiple US data, including Advance readings of Q4 GDP.

USD/CHF stands on slippery grounds as it drops to 0.9170 during Thursday’s Asian session. In doing so, the Swiss Franc (CHF) pair renews its intraday low to extend the previous day’s pullback from the weekly high.

The quote’s latest south-run seems to take the clues from the broad US Dollar weakness, as well as upbeat Swiss data. That said, the Swiss Zew Survey – Expectations improved to the highest levels since March 2022 while flagging -40.0 figure versus -47.6 expected and -42.8 prior.

On the other hand, the US Dollar Index (DXY) remained on the back foot while bracing for the third consecutive weekly loss around 101.65 as hopes of a dovish Federal Open Market Committee (FOMC) grew stronger. “Traders broadly expect the Fed to increase rates by 25 basis points (bps) next Wednesday, a step down from a 50 bps increase in December,” said Reuters.

It should be noted that dicey markets and a lack of major data/events, not to forget the Fed blackout period and Chinese holidays, also allowed the USD/CHF bears to keep the reins. While portraying the mood, as well as taking clues from the mixed earnings report, Wall Street closed mixed and the US Treasury bond yields remained sidelined near 3.45.

Moving on, a slew of US data will entertain the USD/CHF traders even if the Fed policymakers’ absence from the podium tests momentum. Among them, the first readings of the US fourth quarter (Q4) Gross Domestic Product (GDP), expected to print annualized growth of 2.6% versus 3.2% prior, will be crucial amid the recession talks. Additionally important will be the US Durable Goods Orders for December and the Q4 Personal Consumption Expenditure (PCE) data.

Also read: US Gross Domestic Product Preview: Three reasons to expect a US Dollar-boosting outcome

Technical analysis

A clear downside break of one-week-old ascending trend line, now resistance near 0.9250, directs USD/CHF towards the yearly low marked in the last week around 0.9085.

- AUD/USD seesaws around five-month high as bulls take a breather after four-day uptrend.

- Higher highs on RSI (14) contrast with the lower high on prices to probe the bullish trend.

- Overbought RSI conditions, seven-month-old horizontal hurdle also challenge buyers.

- 61.8% Fibonacci retracement, previous weekly high restrict immediate downside.

AUD/USD pauses the four-day uptrend around the highest level since August 2022 as it makes rounds to 0.7100 during Thursday’s sluggish Asian session. Even so, the Aussie pair braces for the biggest weekly gains since early November.

The quote rose to the multi-month high on crossing the 61.8% Fibonacci retracement level of its April-October 2022 downside. However, the overbought RSI (14) seems to probe the buyers afterward.

Also challenging the upside bias is the hidden bearish RSI divergence, a condition where the price prints lower highs but the indicator prints higher highs.

As a result, the AUD/USD bulls should wait for a confirmation of the latest bullish trend. In doing so, the horizontal area comprising multiple highs marked since June 2022, near 0.7140 will be the key to watch.

Following that, a run-up towards the June 2022 high near 0.7285 can be expected. It’s worth noting that the 0.7200 round figure may act as an intermediate halt during the likely run-up.

Alternatively, pullback moves need to conquer the 61.8% Fibonacci retracement level, also known as the ‘golden ratio’, around 0.7090, to tease the AUD/USD bears.

Even so, the previous weekly high near 0.7065, could act as the additional downside filter before convincing the sellers to attack the 0.7000 psychological magnet.

AUD/USD: Daily chart

Trend: Pullback expected

- Dragonfly doji surfaced as the GBP/JPY recovered from weekly lows around the mid-159/160 mark.

- GBP/JPY Price Analysis: Neutral to downward biased, but in the short term, it could test the 200-DMA.

The GBP/JPY is almost unchanged as the Asian session kicks in, though Wednesday’s session witnessed the cross falling to new weekly lows of 159.50. However, the GBP/JPY pair staged a comeback and formed a dragonfly doji, which suggests bulls are moving in. The GBP/JPY is trading at 160.50 at the time of writing.

GBP/JPY Price Analysis: Technical outlook

From a daily timeframe perspective, the GBP/JPY is still neutral-to-downward biased, with the exchange rate remaining below the trend-setter 200-day Exponential Moving Average (EMA) at 162.14, which is also above the 50-day EMA at 161.74. For the GBP/JPY to continue its downtrend, it would need to crack the 20-day EMA at 160.05, and then, the pair may pose a threat to break below the weekly low of 159.50.

As an alternate scenario, for the GBP/JPY bullish continuation, the pair needs to reclaim the psychological 161.00 figure. Break above will expose the 50-day EMA, followed by the 162.00 mark. Once broken, the bulls could challenge the 200-day EMA at 162.14.

GBP/JPY Key Technical Levels

- EUR/JPY has slipped after sensing selling interest around 141.50 ahead of Tokyo inflation.

- Tokyo’s headline CPI is seen at 4.4% while the core CPI might scale to 2.8%.

- The ECB is constantly reiterating the need for further policy tightening to contain the inflation mess.

The EUR/JPY pair is facing pressure in extending its recovery move above the immediate resistance of 141.50 in the early Tokyo session. The cross attempted a recovery below 141.00 on Wednesday after a massive sell-off move. The Euro faced immense pressure after the release of the German IFO- Business Climate (Jan) data. The economic data remained in line with the estimates at 90.2 but higher than the former release of 88.6.

German IFO Business Survey, the institute’s Economist Klaus Wohlrabe cited that “the German economy is starting the year with cautious optimism.” He added that the economy might not face any recession but the Gross Domestic Product (GDP) will probably shrink slightly in Q1 - mainly due to consumption. It is worth noting that 48.4% of companies complained in Jan about supply bottlenecks vs. 50.7% in Dec.

For further policy tightening European Central Bank (ECB) President Christine Lagarde and other policymakers are continuously reiterating the need for further interest rate hikes to contain the inflation mess.

ECB Governing Council member Gabriel Makhlouf said on Wednesday "We need to continue to increase rates at our meeting next week – by taking a similar step to our December decisions," as reported by Reuters. He further added that they need to increase rates again at the March meeting.

On the Tokyo front, investors will be focusing on the release of the Tokyo inflation, which is scheduled for Friday. The headline Tokyo Consumer Price Index (CPI) (Jan) is seen higher at 4.4% vs. the former release of 4.0%. Also, the core inflation that excludes oil and food prices is expected to increase marginally to 2.8% against the 2.7% released earlier.

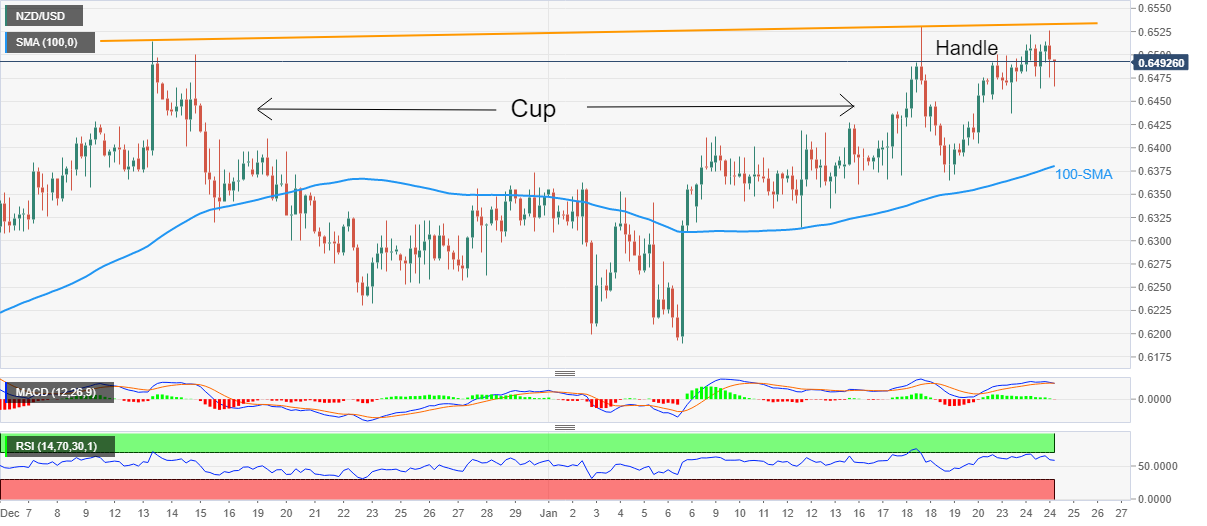

- NZD/USD is marching higher to recapture the 0.6500 hurdle amid the risk-on market mood.

- An absence of inflation softening in New Zealand might force the RBNZ to hike interest rates further.

- The US Dollar will display a power-pack action after the release of the US GDP and Core PCE data.

The NZD/USD pair has rebounded after a minor correction to near 0.6470 in the early Asian session. The kiwi asset is looking to recapture the psychological resistance of 0.6500 amid positive market sentiment. The New Zealand Dollar displayed sheer volatility on Wednesday after the release of the Q4CY2022 Consumer Price Index (CPI) data.

The annual CPI of New Zealand for the fourth quarter increased marginally to 7.2% from the expectations of 7.1% but remained constant in comparison with the prior release. Also, the inflation rate escalated marginally to 1.4% vs. the expectations of 1.3% on a quarterly basis. An absence of inflation softening in the Kiwi zone indicated that the Reserve Bank of New Zealand (RBNZ) might continue to hike interest rates further to contain soaring inflation.

It is worth noting that RBNZ Governor Adrian Orr has already increased the Official Cash Rate (OCR) to 4.25% and might be forced to continue to tighten policy further amid a hot-inflated environment.

Meanwhile, investors’ risk appetite has improved again as S&P500 recovered losses witnessed earlier on Wednesday. The US Dollar Index (DXY) has cracked to a near seven-month low of around 101.40 as the pace of policy tightening by the Federal Reserve (Fed) is set to calm down further. Analysts at Wells Fargo warned that the greenback has already embarked on a prolonged period of depreciation that could last into 2024. They further added that relative economic growth performance and monetary policy outlook have turned less supportive of the US dollar.

Going forward, investors will witness a power-pack action by the US Dollar after the release of the United States Gross Domestic Product (GDP) data, which is expected to contract to 2.6% from the prior release of 3.2%. Apart from that, investors will also focus on Durable Goods Orders and Core Personal Consumption Expenditure (PCE) data.

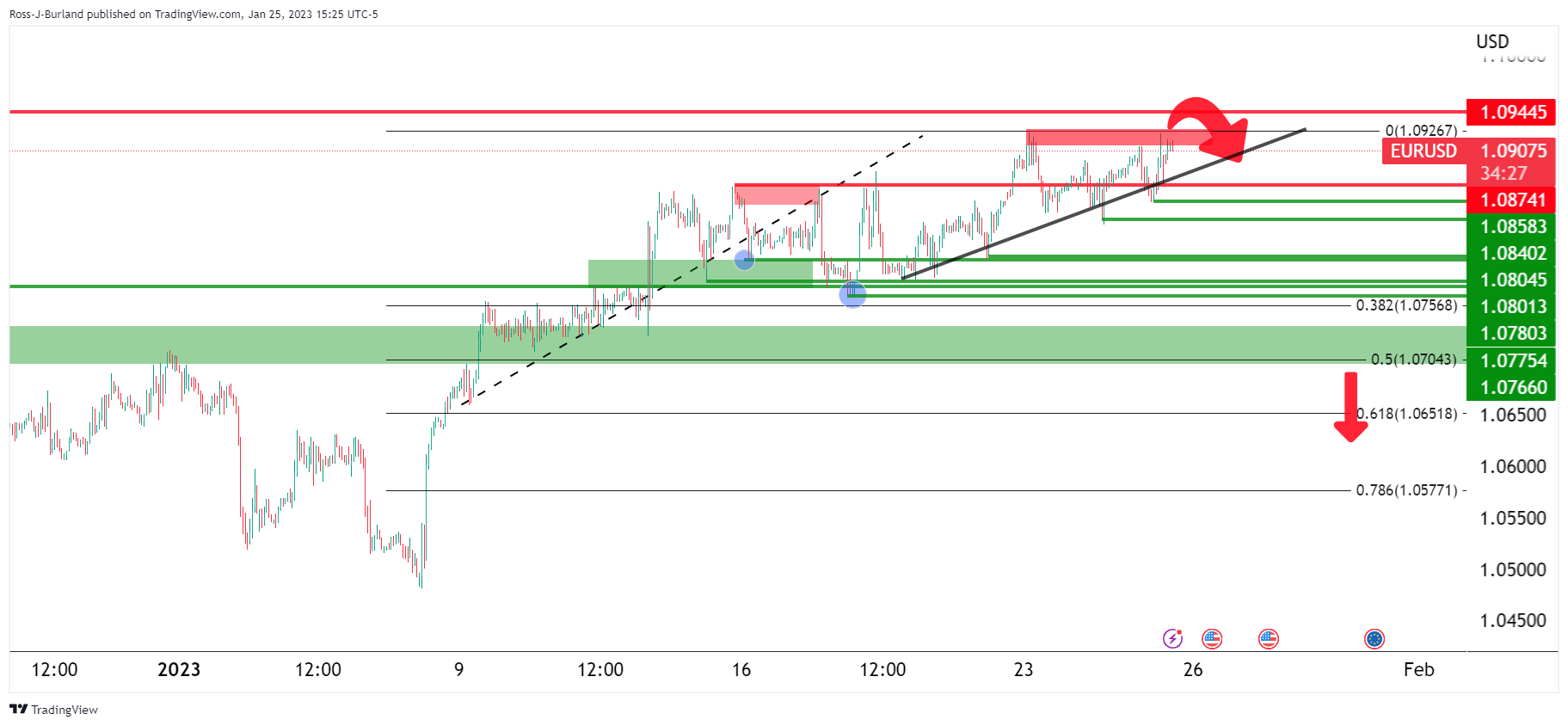

- EUR/USD steadies around nine-month high after five-day uptrend.

- Upbeat German data, pre-Fed consolidation favor bulls amid sluggish market.

- ECB’s Makhlouf fired the last hawkish shot before the one-week silence before monetary policy meeting.

- Advance reading of US Q4 GDP will be crucial ahead of next week’s FOMC.

EUR/USD bulls are in command near the nine-month high, despite recently taking a breather around 1.0915, as the major pair traders await the first readings of the US fourth quarter (Q4) Gross Domestic Product (GDP). The quote cheered broad US Dollar weakness and the upbeat German data, not to forget the hawkish bias surrounding the European Central Bank (ECB), to print a five-day uptrend by the end of Wednesday.

That said, the US Dollar Index (DXY) remained on the back foot while bracing for the third consecutive weekly loss around 101.65 as hopes of a dovish Federal Open Market Committee (FOMC) grew stronger.

On the other hand, Germany’s IFO Business Climate Index matched 90.2 forecasts for January versus 88.6 prior but the Current Assessment eased from 94.4 to 94.1, versus 95.0 expected. Further, the IFO Expectations for the said month also came in higher-than-consensus 85.0 while rising to 86.4, compared to 83.2 previous readings. Following the data release, IFO Economist Klaus Wohlrabe said that “the German economy is starting the year with cautious optimism.”

Elsewhere, ECB Governing Council member Gabriel Makhlouf became the last policymaker from the bloc’s central bank to fire the hawkish shot, suggesting a 50 bps rate hike, ahead of the one-week blackout pre-ECB. "We need to continue to increase rates at our meeting next week – by taking a similar step to our December decisions," said ECB’s Makhlouf. Makhlouf further added that they need to increase rates again at the March meeting.

Amid these plays, market sentiment remained dicey as the calendar was light elsewhere and there were few macros, amid the China holidays and the Fed blackout. That said, Wall Street closed mixed and the US 10-year Treasury bond yields ended Wednesday with minor moves around 3.45%.

Looking forward, a slew of the US data will entertain the EUR/USD traders even if the Fed and the ECB policymakers are restricted from speaking. Among them, the first reading of the US Q4 GDP, expected to print annualized growth of 2.6% versus 3.2% prior, will be crucial amid the recession talks.

Also read: US Gross Domestic Product Preview: Three reasons to expect a US Dollar-boosting outcome

Technical analysis

Although a weekly support line restricts the immediate downside of the EUR/USD pair near 1.0865, the monthly high and April 2022 peak, respectively near 1.0926 and 1.0936, could challenge the bulls.

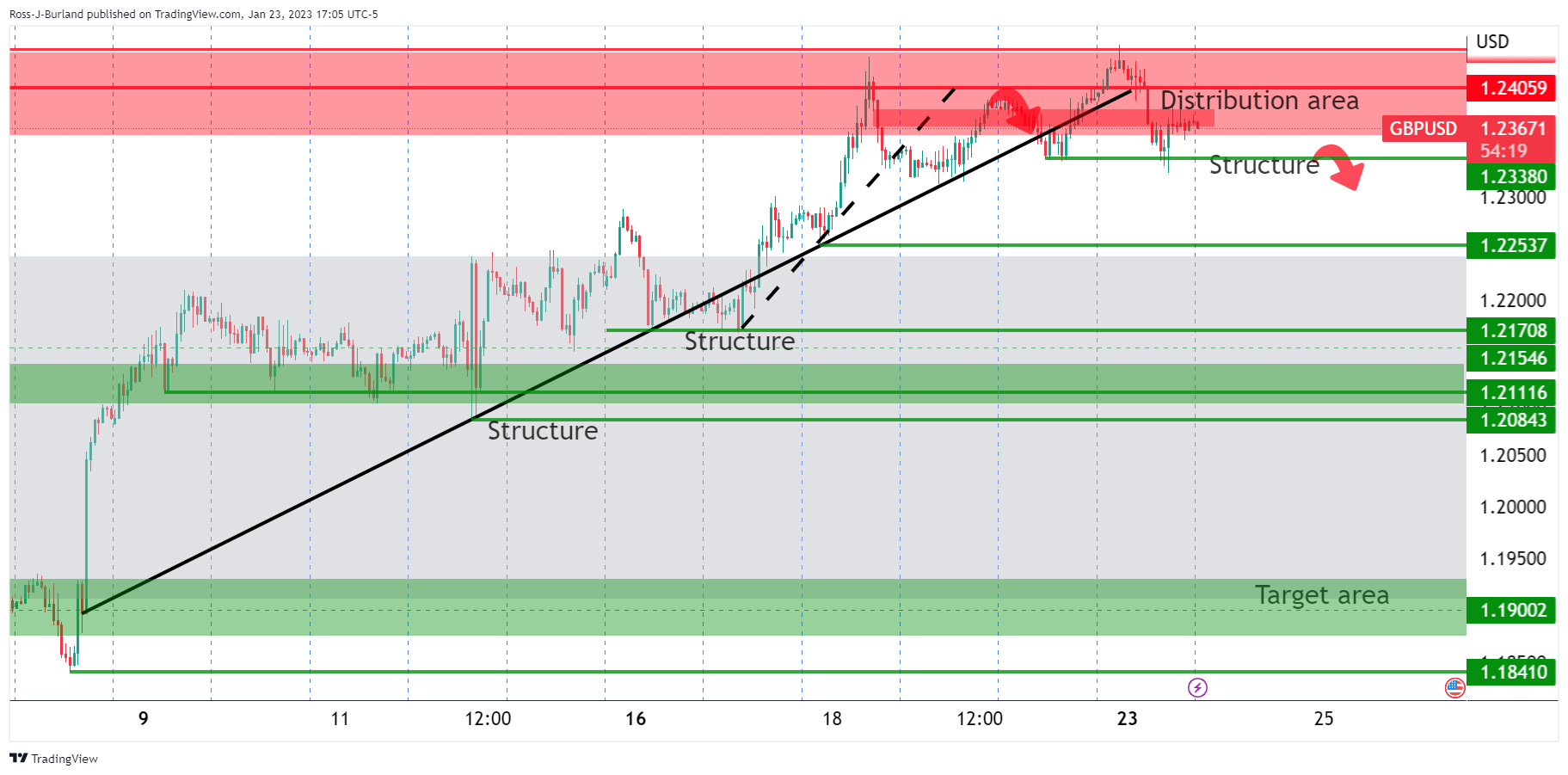

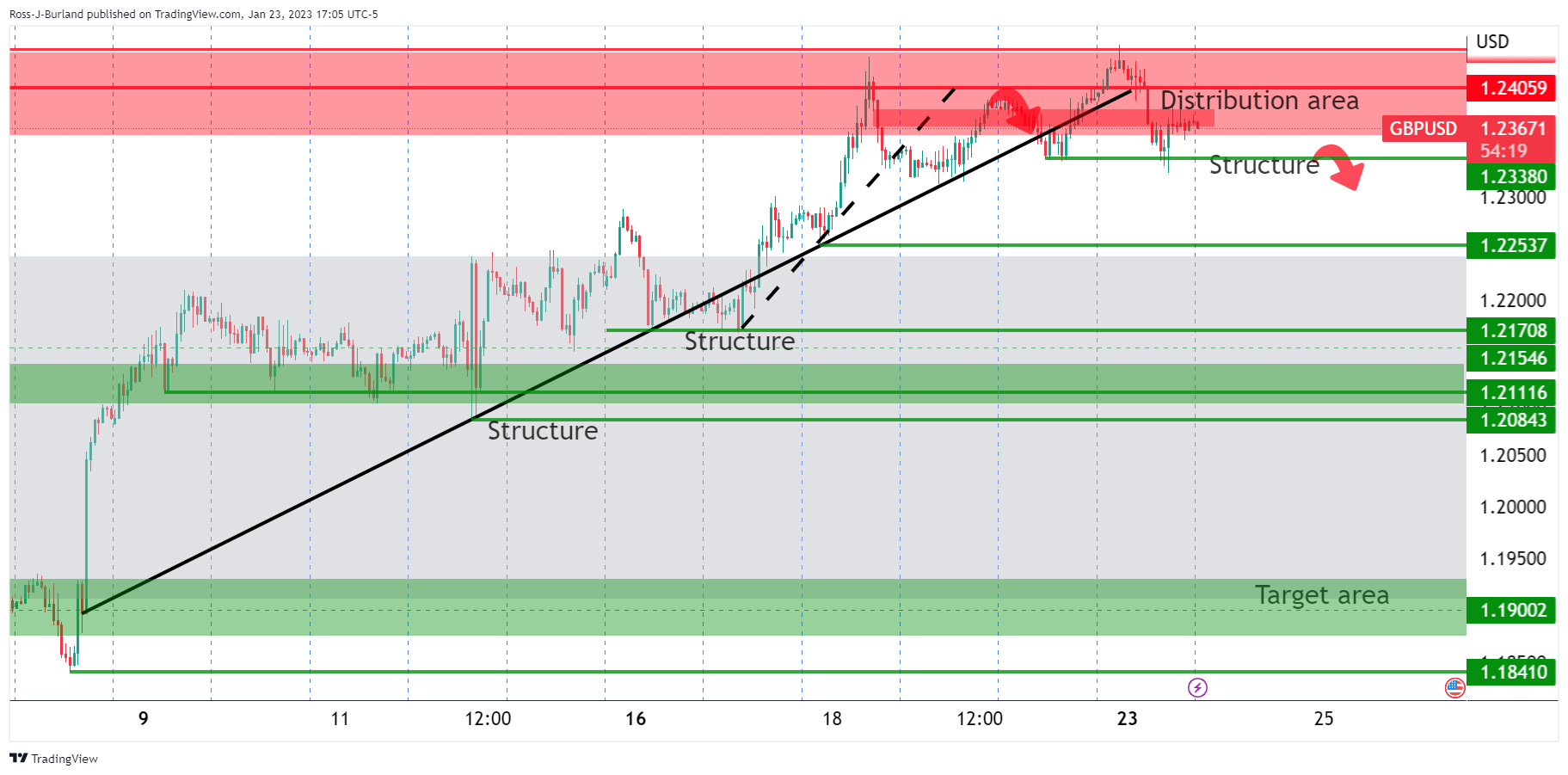

- The daily chart portrays that the GBP/USD is still upward biased.

- Short term, the GBP/USD breaking a downslope trendline paved the way for further upside.

- GBP/USD Price Analysis: Intraday speaking, a test of 1.2400 is on the cards, followed by 1.2440.

The GBP/USD is trading almost flat as the Asian Pacific session begins. On Wednesday, the GBP/USD closed on a higher note, up by a half percent (0.50%), but fell short of achieving a daily close at 1.2400. Nevertheless, the uptrend remains intact, and the GBP/USD exchanges hands at 1.2392, registering minimal losses of 0.04%.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD remains upward biased, with sellers failing to drag prices below the 20-day Exponential Moving Average (EMA) at 1.2254. To further extend its uptrend, GBP/USD bulls need to reclaim 1.2443, which would exacerbate a rally towards June’s high of 1.2597, shy of the 1.2600 figure.

Intraday speaking, the GBP/USD is neutral to upward biased. After breaking above a downslope resistance trendline drawn from January 23 highs, broken around 1.2370/75, opened the door to challenge the 1.2400 mark. Nonetheless, the Relative Strength Index (RSI) slope is aiming downward, which suggests that a pullback to the daily pivot point level at 1.2363 is on the cards. Following that, the GBP/USD might print a leg up towards 1.2400, followed by the R1 daily pivot at 1.2440, followed by the R2 pivot at 1.2483.

GBP/USD Key Technical Levels

- USD/CAD picks up bids to reverse post-BoC losses, eyes the first weekly gain in six.

- BoC matches market forecasts of 0.25% rate hike but rate outlook, comments from Governor Macklem flashed mixed messages.

- WTI crude oil fails to cheer softer US Dollar, EIA data amid fears of supply increase.

- Slew of US data to entertain Loonie pair traders, advance readings of US Q4 GDP is the key.

USD/CAD picks up bids to add to the first weekly gain in six as bulls poke 1.3400 during the early hours of Thursday’s Asian session. In doing so, the Loonie pair consolidates the post-Bank of Canada (BoC) moves amid softer Oil price and a lack of clarity on the BoC’s next moves. Adding strength to the rebound could be the cautious mood ahead of the first readings of the US fourth quarter (Q4) Gross Domestic Product (GDP).

"Prepared to increase policy rate further if needed to return inflation to 2% target; continuing the quantitative tightening program," mentioned the BoC statement after matching 0.25% rate hike expectations. However, the Canadian central bank also mentioned that it will likely hold rates at this level while assessing the impact of recent policy moves. Following that, BoC Governor Tiff Macklem shrugged off rate cut talks. Hence, mixed signals from the BoC allowed USD/CAD buyers to sneak in even if the central bank becomes the first among the majors to talk about the pause in rate lifts.

On the other hand, WTI crude oil struggles to defend $80.00 amid fears of sustained supply cuts from the global oil producers, as well as the US readiness for more Strategic Petroleum Reserve (SPR) release if needed. On the same line could be the fading of China-linked optimism amid the Lunar New Year (LNY) holidays, as well as a cautious mood ahead of the key data/events. Alternatively, a smaller inventory rise in the US, per the US Energy Information Administration’s (EIA) Crude Oil Stocks Change data for the week ended on January 20, 0.533M versus 0.971M expected and 8.408M prior, as well as the softer US Dollar failed to inspire the energy bulls.

It should be noted that the market sentiment remained dicey amid a light calendar elsewhere and the lack of major macro, amid the China holidays and the Fed blackout. That said, Wall Street closed mixed and the US 10-year Treasury bond yields ended Wednesday with minor moves around 3.45%. However, the US Dollar Index (DXY) remained on the back foot for the third consecutive week.

Having witnessed the BoC-led moves, the USD/CAD traders are likely to witness a volatile day as a slew of US data is up for release. Among them, the first reading of the US Q4 GDP will be crucial amid the recession talks and due to the next week’s Federal Open Market Committee (FOMC) meeting.

Also read: US Gross Domestic Product Preview: Three reasons to expect a US Dollar-boosting outcome

Technical analysis

USD/CAD appears clubbed between 10-week-old support and a downward-sloping resistance line from January 06, respectively near 1.3345 and 1.3440.

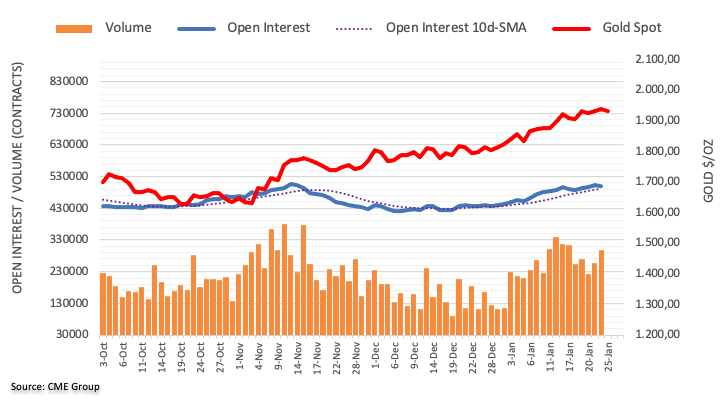

- Gold price is looking to test the $1,950.00 resistance amid volatility in the USD Index.

- A pause in BoC’s policy tightening conveys that major central banks are near to the terminal rate.

- More-than-projected contraction in the US Q4 GDP might accelerate recession fears.

Gold price (XAU/USD) is aiming to test the $1,950.00 resistance for the first time in the past nine months as the US Dollar Index has faced immense pressure. The precious metal displayed a vertical rally after dropping to near $1,920.00amid rising hopes that the Federal Reserve (Fed) has no other option than to announce a smaller interest rate hike ahead. Also, a pause announced in the policy tightening by the Bank of Canada (BoC) has conveyed a message that major central banks have reached to the terminal rate.

The US Dollar Index (DXY) has dropped to near seven-month low of around 101.20 and a downside break will trigger massive selling from the market participants. S&P managed to recover losses, portrayed optimism in the market and dips are being capitalized as a buying opportunity in the risk-perceived assets by the market participants. The 10-year US Treasury yields dropped to 3.44%.

For further guidance, investors will keep an eye on the release of the preliminary United States Gross Domestic Product (GDP) data for the fourth quarter of CY2022. As per the projections, the annualized GDP is seen lower at 2.6% vs. the prior release of 3.2%. An expression of a contraction in overall economic activities might accelerate recession fears on a broader basis.

Gold technical analysis

Gold price is in a strong uptrend forming higher highs and higher lows on a daily scale. The precious metal has witnessed three consecutive buying tails, which indicates that the market participants are buying the dips with immense interest. On a broader note, horizontal support plotted from June 13 high at $1,879.26 will be a cushion for the Gold price.

The 10-and 20-period Exponential Moving Averages (EMAs) at $1,924.74 and $1,895.26 respectively are aiming higher, which signals more upside ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates that the bullish momentum is active.

Gold daily chart

Here is what you need to know for Thursday 26 January:

The clock is ticking down as we head towards the end of the month and the Federal Reserve/ European Central Bank meetings. A storm is potentially building in the forex space and Thursday's data events will be critical in that regard.

It was somewhat subdued across some pairs, but lively in others as investors and traders roll up their sleeves ahead of today's slew of key economic numbers that will go towards the Federal Reserve's interest rate decision on February 1.

The US Commerce Department set to release its initial advance fourth-quarter Gross Domestic Product estimates at the same time that the nation's Core PCE prices will be due, likely accelerating to a 0.3% moM pace in December, though a 0.4% gain can't be discarded, analysts at TD Securities argued. ''The yoY rate likely slowed to 4.5%, suggesting prices continue to moderate but remain sticky at high levels,'' the analysts argued. In regards to the growth data, the analyst said, ''we also look for Gross Domestic Product growth to have stayed strong in Q4, posting another above-trend gain. Growth was likely supported by firm showings from the consumer and inventories.''

Ahead of this data, WIRP suggests a 25 bp hike on February 1 is fully priced in, with less than 5% odds of a larger 50 bp move. Another 25 bp hike on March 22 is about 80% priced in, while one last 25 bp hike in Q2 is only 35% priced in.

The dovish outlook saw the US Dollar once again fall against the euro on Wednesday, although traders are not seeing this through and EUR/USD stuck to a 1.0875 / 1.0923 range on the day.

Elsewhere, there was some better movement in USD/JPY. The pair closed down the prior day which gave the bears the fuel to continue selling against pullbacks, denying the bulls space into the peak formation set earlier in the week USD/JPY fell from a high of 130.58 to a fresh low of 129.26 when the NY traders came on line, extending London's supply. this made for great opportunities for trades targeting prior support structures on the way down to 129.50 and then the 129.20s.

USD/CAD was another pair that offered traders opportunities with two-way action on the day over the course of the Bank of Canada's interest rate decision. The Bank of Canada, as expected, raised the key interest rate by 25 basis points to 4.5%. In the statement, the central banks mentioned that will likely hold rates at this level while assessing the impact of recent policy moves. The Loonie weakened across the board as a result but soon r found buyers as the BoC's governor Tiff Macklem delivered his remarks on the policy outlook and responded to questions, warning that they are not ruling out further hikes and are data dependent. The USD/CAD rose from 1.3365 to 1.3426. It then pulled back into a prior support structure in the 1.3375s in a 50% mean reversion of the BoC rally.

The Australian Dollar and Kiwi were higher on Wednesday after a surprisingly red-hot inflation report for Australia and as for Yesterday’s Q4 CPI inflation from NZ, (while still far too strong at 7.2% YoY in Q4) analysts at ANZ Bank argue that it ''was much better under the hood than the RBNZ feared at the time of the hawkish November MPS.'' The Kiwi traded between 0.6450 and 0.6504 while the Aussie between 0.7032 and 0.7122 (a key level for the day ahead that guards 0.7150.

Elsewhere, the US 10-year yield was 1bp lower at 3.45% and WTI was down 0.1% to USD80/bbl. Gold popped 0.8% to $1940.4/oz.

- Higher-than-expected Australian inflation data increased the odds of a rate hike by the RBA.

- Sentiment shifted mixed as Wall Street’s fluctuated between gainers/losers.

- AUD/USD Price Analysis: A daily close above 0.7100 will pave the way for further gains.

The Australian Dollar (AUD) rose to a fresh five-month high at 0.7122 against the US Dollar (USD) on Wednesday, following the release of Australian inflation data that cemented the case for further tightening by the Reserve Bank of Australia (RBA). Except for the Australian Dollar, risk aversion keeps high beta currencies pressured. Hence, the AUD/USD is trading at 0.7106 at the time of writing.

Australia’s CPI data justifies another RBA hike

Wall Street shrugs off some of its earlier losses, though it’s a mixed bag with the S&P 500 and Nasdaq posting gains, while the Nasdaq is fluctuating. An absent US economic docket left AUD/USD traders adrift to Australia’s economic data.

Earlier in the Asian session, the Australian Bureau of Statistics revealed that the Consumer Price Index (CPI) surged 1.9% in Q4, above estimates of 1.6%, while the annual rates climbed to 7.8% from 7.3%, its highest level since 1990. Some analysts estimated that the RBA might pause its hiking cycle as global recessionary fears loom. Nevertheless, the CPI report increased the likelihood of a 25 bps rate hike by the RBA at the February 7 meeting, five days after the US Federal Reserve (Fed) monetary policy meeting.

Digging into the report, core trimmed CPI rose by 1.6%, above estimates of 1.4%, while YoY jumped by 6.9%, above the last month’s 6.1%. Therefore, money market futures have begun to price in 50 bps of hikes, implying a peak of 3.60%, compared with 3.40% just before the CPI release.

Consequently, the AUD/USD extended its gains and prepared to test the August 11 daily high of 0.7136, which could soon be the major’s eyes to close above 0.7100.

AUD/USD Technical Analysis

Technically speaking, the AUD/USD remains upward biased, and if it achieves a daily close above 0.7100, it will open the door for further upside. The case is cemented by oscillators confirming the uptrend. Though shy of overbought conditions, the Relative Strength Index (RSI) continues to aim higher. At the same time, the Rate of Change (RoC) witnessed a volatility jump in two consecutive days, suggesting buyers are moving in.

Therefore, the AUD/USD first resistance would be the August 2022 high of 0.7136. The break above will expose the 0.7150, ahead of the 0.7200 psychological level.

- EUR/USD 1.0950 is a key player in the current market structure.

- The bears need to get below 1.0850 or face continued momentum to the upside.

As per the prior day's analysis, EUR/USD Price Analysis: Bears in play while below 1.0950, and the pre-open analysis at the start of this week, the euro remains within the forecasted schematic and below the 1.0950s ahead of critical data on Thursday and the Federal Reserve next week.

EUR/USD prior analysis

EUR/USD update

The bears are still lurking at key resistance and there are prospects of a blow-off to the downside for the end of the week. If the price were to melt below 1.0850, then that could be a significant development.

However, a test of stops above 1.0950 could be on the card to go high before coming down so the London session could be playing a key role in the build-up to the NY sessions.

- US Dollar bulls are lurking at critical support.

- The weekly bearish impulse coupled come undone in the next days and lead to a bullish correction with the 38.2% Fibonacci eyed around 103.10.

- US data nd the Fed will be key in the next cycle of the greenback.

The US Dollar has been pressured this week leading into the key US data events on Thursday although subdued trading is expected form here as investors will be hesitant to make any moves into Thursday and next week's central bank meetings, including the Federal Reserve and the European Central Bank. At the time of writing, DXY is trading down some 0.25% and has travelled between a high of 102.118 and a low of 101.576.

Key US data on the cards

Earlier in the week, the US dollar got a brief boost due to the S&P Global reporting preliminary January PMI readings. The Manufacturing PMI came in at 46.8 vs. 46.0 expected and 46.2 in December, Services PMI came in at 46.6 vs. 45.0 expected and 44.7 in December, and the Composite PMI came in at 46.6 vs. 46.4 expected and 45.0 in December. ''This suggests some upward potential for ISM PMI readings out next week,'' analysts at Brown Brothers Harriman said.

Meanwhile, the US Commerce Department set to release its initial advance fourth-quarter Gross Domestic Product estimates at the same time that the nation's Core PCE prices will be due, likely accelerating to a 0.3% moM pace in December, though a 0.4% gain can't be discarded, analysts at TD Securities argued. ''The yoY rate likely slowed to 4.5%, suggesting prices continue to moderate but remain sticky at high levels,'' the analysts argued. In regards to the growth data, the analyst said, ''we also look for GDP growth to have stayed strong in Q4, posting another above-trend gain. Growth was likely supported by firm showings from the consumer and inventories.''

Federal Reserve outlook

The markets are pricing in a dovish outcome for the months ahead with regard to the Federal Reserve. US stocks have benefitted as have high better currencies that are enjoying some of their domestic data points as well. The combined sentiment and convergence between the central banks have been pressuring the greenback lower in 2023.

Inflation measures have eased in the US but analysts at Brown Brothers Harriman noted that the labour market remains red hot. We will have the nonfarm Payrolls in the next several days also falling in at the start of each new month where the consensus sees 175k for January. ''While down from 223k in December, hiring remains firm,'' the analysts at BBH argued are arguing for a more hawkish longer outcome from the Federal Reserve.

''WIRP suggests a 25 bp hike on February 1 is fully priced in, with less than 5% odds of a larger 50 bp move. Another 25 bp hike March 22 is about 80% priced in, while one last 25 bp hike in Q2 is only 35% priced in. We think these odds are too low,'' they said. ''Furthermore, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

US Dollar remains vulnerable to market sentiment

The US Dollar is likely to remain on the back foot until the market sentiment, if ever, switches back to a more hawkish Federal Reserve. This is what makes tomorrow's data so key. Any publication that points more towards 25 than towards 50bp on February 1 will likely be the nail in the coffin for the DXY index that is hanging over the edge of the abyss as the following technical analysis will illustrate. However, it might take a really outsized outcome in the data to really shift gears considering that the market has already lowered its expectations as regards the next rate step by the Fed.

US Dollar technical analysis

As we can see here on the 4-hour chart, 101.59 and 101.30 are key levels guarding against a move lower as per the weekly structure:

A move to test 100.00 coupled be in store around a dovish Fed. However, it is usual for markets to swing and the current support could be the fuel that is used to ignite a bullish correction and a test of prior supports as follows:

The weekly bearish impulse coupled come undone in the next days and lead to a bullish correction with the 38.2% Fibonacci eyed around 103.10.

- USD/CHF bull’s clashed with the 20-day EMA, then jumped from the boat as bears stepped in.

- The pair is headed toward the psychological 0.9100, which, once broken, could put the YTD low into play.

- USD/CHF: Failure to register a new YTD low could exacerbate an upward correction.

The USD/CHF battles to break above the 20-day Exponential Moving Average (EMA) and slips beneath 0.9200 to fresh two-day lows at 0.9172 as the US Dollar remains offered in the FX space. Also, a risk-off impulse underpins the safe-haven status of the Swiss franc (CHF). Hence, the USD/CHF exchanges hand at 0.9182 after hitting a daily high of 0.9245.

USD/CHF Price Analysis: Technical outlook

The USD/CHF continued its downtrend after hitting a weekly high of 0.9297, unable to reclaim 0.9300, which exacerbated the fall below the 20-day EMA at 0.9241. Also, the path for the USD/CHF pair was opened to test the year-to-date (YTD) lows of 0.9085, though initially, it would need to hurdle demand zones in between.

On its way to the YTD lows, the USD/CHF’s first support level would be this week’s low of 0.9159. Break below will expose the January 20 daily low of 0.9141, ahead of the 0.9100 mark. Once that psychological price level gives way, then the YTD low would be in play.

As an alternate scenario, the USD/CHF first resistance would be the 0.9200 figure. Once cleared, then, the USD/CHF could test the 20-day EMA at 0.9241, followed by a two-month-old downslope trendline around 0.9250/60.

Looking ahead, USD/CHF’s failure to test the YTD low could expose the USD/CHF to some buying pressure, as the pair has been bottoming around 0.9085/0.9160 since December 2022.

USD/CHF Key Technical Levels

The EUR/USD pair has risen 1200 pips during the last three months. Analysts at MUFG Bank are worried that the balance of risks is no longer as favourable for further upside following the rally. They see the pair trading in the 1.0400 – 1.1300 range over the next weeks.

Pricing in a better cyclical outlook for euro-zone economies

“We are sticking to our bullish bias for the EUR/USD although are more wary now that the balance of risks is no longer as favourable for further upside following strong gains in recent months. The pair has already reversed around three-quarters of the sell-off triggered by the start of the Ukraine conflict between late February and September of last year. Prior to the start of the conflict, EUR/USD was trading between 1.1200 and 1.1500 throughout most of last February.”

“We expect the ECB to deliver another 50bps hike at next week’s policy meeting and continue to signal that at least one more larger 50bps hike is likely at the March policy meeting. We only expect a slowdown in the pace of hikes back to 25bps in Q2 when there is more concrete evidence that inflation pressures are easing. It stands in contrast to our expectation for the Fed to further slow the pace of rate hikes by delivering a 25bps hike at next week’s FOMC meeting. We then expect the Fed to pause rate hikes in Q2 but are not expecting the Fed to signal yet that they will pause hikes soon. The Fed’s still relatively hawkish plan for further hikes beyond next week could help to dampen the USD selling pressure for now.”

“There are a number of key downside risks to our bullish EUR bias in the month ahead including: i) the ECB signals it is more open to slowing the pace of hike at the March policy meeting ii) the recent resilience of the euro-zone economies proves to be misleading/short-lived and growth slows sharply with more of lag than expected, and iii) geopolitical tensions between the West and Russia escalate further after tanks are sent to support Ukraine which alongside a pickup in demand from China demand lifts European energy prices.”

The greenback has already embarked on a prolonged period of depreciation that could last into 2024, warn analysts at Wells Fargo. They point out that the relative economic growth performance, and monetary policy outlook have turned less supportive of the US dollar.

No longer forecasting USD strength early this year

“The U.S. dollar has embarked upon a prolonged period of depreciation. Relative growth and monetary policy fundamentals have become less supportive of the greenback. We expect U.S. dollar depreciation to be gradual in early 2023 as the U.S. falls into recession during the second half of this year, but the Federal Reserve hesitates from lowering interest rates prematurely.”

“We expect the U.S. dollar's depreciation to gather pace in 2024 since, even as the U.S. economy begins stabilizing, we believe the Fed will start cutting interest rates quite aggressively starting early next year. From current levels, we forecast the Fed's trade-weighted dollar index versus advanced foreign economies to soften 3% by the end of 2023, and by a cumulative 8.5% by the end of 2024.”

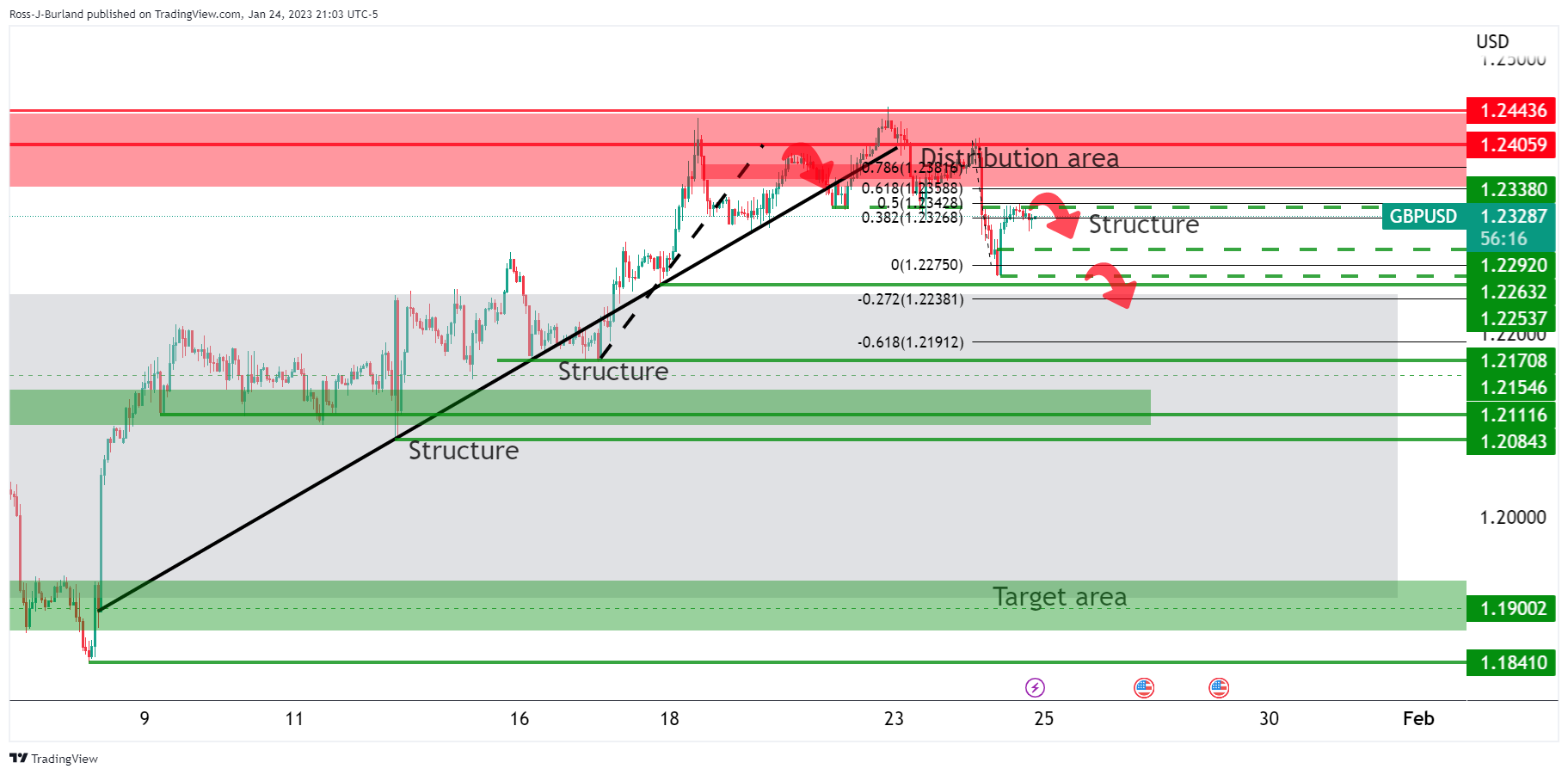

- USD/CAD stop hunt is underway and the bears are eyeing the prior support structures.

- A 38.2% and 61.8% Fibo retracement is on the cards.

USD/CAD has started the stop hunt in the new hour following the conclusion to the Bank of Canada's red calendar event on Wednesday and ahead of key US data on Thursday.

The following illustrates the price action through the event and the move into in-the-money-longs that could continue all the way into the Fibonacci scale, with the 38.2% and 61.8% ratios eyed.

USD/CAD MTF analysis

Before the new hour, the above schematic was playing out bearish due to failures to run higher through resistance and sliding to the backside of the bullish trendline support.

USD/CAD daily charts

That does not mean that there would not be prospects of a bullish breakout as per the above daily chart. There are prospects of a move higher following a stop hunt:

USD/CAD H1 charts

The price is trapped in a box (greyed area) between resistance and support. The BoC rally was decelerating into a triangle and a breakout was inevitable with the path of least resistance to the downside:

The stop hunt is underway as seen above. The Structures are as follows as per the 5-min chart:

The January meeting of the Bank of Canada resulted, as expected, in a 25 basis points rate hike. BOC's Tiff Macklem said it is time to pause and assess whether the policy is sufficiently restrictive. Analysts at CIBC expect that interest rates will stay at 4.5% throughout the balance of this year, before being eased gradually in 2024.

BoC moves onto the sidelines

“The Bank of Canada hiked interest rates one more time, but gave a more explicit signal than anticipated that it was now moving onto the sidelines. The 25bp increase, taking the overnight rate to 4.5%, was well anticipated by the consensus. However the change in guidance was not, with the Bank now explicitly stating that if the economy evolves as it expects, then the policy rate will be kept on hold at its current level.”

“With the Monetary Policy Report's forecasts for GDP growth and inflation little changed from October and a touch stronger than our own, we suspect that the economy will indeed evolve in-line or even a bit weaker than the Bank suspects, and that today's hike in interest rates will mark the final one of this cycle.”

“We had expected that today's 25bp move would be the final one for this cycle, and the change in the Bank's guidance only reaffirms that belief. Even though there is still a slight bias within its communication towards raising interest rates further, today's statement suggests that the Bank will sit on the sidelines for now and wait for the accumulation of a few month's worth of data rather than necessarily reacting to near-term surprises.”

- GBP/USD bounces off weekly lows and reclaims 1.2300 on a soft US Dollar.

- The Producer Price Index in the UK cools down, sparking speculation that the Bank of England could tighten but not as aggressively as foreseen.

- Thursday’s US economic docket would feature GDP, unemployment claims, Durable Good Orders, and core PCE.

The GBP/USD solidly climbs and trims two days of consecutive losses after hitting a weekly low of 1.2263 on Wednesday. Risk aversion is the game’s name, while the US Dollar (USD) is pairing some of its earlier losses, underpinned by US bond yields rising. The GBP/USD is trading at 1.2384, clinging to gains of 0.42%.

UK's Producer Price Index eases, ahead of the BoE's next week meeting

During the European session, the GBP/USD slid to the lows of the day at 1.2282 amidst news that the UK’s Producer Price Index (PPI) for December cooled the most since April 2020, which would ease pressures for the Bank of England (BoE). Input prices paid by factories dropped -1.1% MoM, while the year-over-year data dropped 1.5% from 18% to 16.5%. Regarding Output prices, it fell -0.8% MoM beneath estimates for a 0.1% gain, while on an annual basis, it fell to 14.7% from 16.2%.

Therefore, speculations that the BoE would reassess how much tightening is needed to curb inflation weakened the GBP/USD. Additionally, weaker than-estimated UK PMIs for December, revealed Tuesday, sparked recessionary fears.

Meanwhile, the greenback has continued to weaken across the G8 FX board, as shown by the US Dollar Index, down 0.15%, staying at 101.767. Contrarily, US Treasury bond yields, paired with earlier losses, sit at 3.465%.

Aside from this, traders are bracing for a busy Thursday’s round of US economic data to be unveiled. The US economic docket will feature the Advance in Gross Domestic Product (GDP) for Q4, expected at 2.6%. Further, Durable Good Orders are expected to recover to 2.5%, compared to last month’s -2.1% plunge. Unemployment claims for the last week would also be updated, along with the US Federal Reserve Core PCE inflation reading.

Therefore, with money market futures chances at 75% of witnessing a 50 bps rate hike at the BoE meeting, further GBP/USD upside is expected.

GBP/USD Key Technical Levels

The USD/JPY pair is trading back under 130.00 after being unable to break above 131.00. Analysts at MUFG Bank have a neutral bias on the pair and see it trading in the range 127.00-134.00 over the next weeks.

We may have entered a short-term equilibrium zone

“It is important to stress that the BoJ speculation has played a secondary role when the overall drop of 20 big figures in USD/JPY is considered. The global fundamental backdrop and the intervention by the Japanese authorities combined to give a powerful impetus for a correction lower. A turn in US inflation to the downside, the approach of the expected end to monetary tightening outside of Japan and the collapse in energy prices are all JPY-supportive developments.”

“YCC policy speculation may pick up again. The primary candidates to take over from Governor Kuroda (Amamiya, Nakaso & Yamaguchi) are all expected to move away from ‘Abenomics’ (to differing degrees) which means speculation could well pick-up later in Q2.”

“We have narrowed the range for USD/JPY in the month ahead and assume the big move over the last three months will result in some narrower range trading. An announcement that Hirohide Yamaguchi would be put forward to the Diet could spark a bigger FX move as abrupt YCC changes would be brought forward by the markets. That would imply a sharper move to the downside than expected. To the upside, a 50bp hike by the Fed and a more hawkish FOMC communication would see a larger than expected move to the upside.”

Following the Bank of Canada's (BOC) decision to raise the policy rate by 25 basis points to 4.5%, BoC Governor Tiff Macklem delivers his remarks on the policy outlook and responds to questions from the press.

Key takeaways

"We will be looking for accumulation of evidence to raise rates again."

"It is far too early to be talking about interest rate cuts."

"Finance minister has told me the Bank of Canada will be allowed temporarily to retain earnings for the purpose of covering losses."

- USD/JPY remained pressured as the 50-DMA crossed beneath the 200-DMA.

- Bears stepped in and reclaimed 130.00, as they eye 129.00.

USD/JPY fell as the North American session progressed and tumbled below the 130.00 figure, as buyers failed to crack the 20-day Exponential Moving Average (EMA) at 130.74. Factors like a soft US Dollar (USD) and falling US Treasury bond yields are two fundamental reasons for renewed Japanese Yen (JPY) strength. At the time of writing, the USD/JPY is trading at 129.77.

USD/JPY Price Analysis: Technical outlook

Tuesday’s session was characterized by the USD/JPY reaching a weekly high at 131.11, slightly above the 20-day EMA, but dropped to 130.10. Today, the USD/JPY hit a daily high of 130.58 but extended its losses, while the 50-day Exponential Moving Average (EMA) crossed beneath the 200-day EMA, meaning a death cross emerged in the daily, suggesting that further downside is expected.

Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) aim downwards, supporting lower prices.

Therefore, the USD/JPY first support would be the day’s low of 129.26. Break below will expose the 129.00 psychological level, followed by the January 20 swing low at 128.34 and the YTD low of 127.21. As an alternate scenario, if the USD/JPY reclaims 130.00, the pair could challenge the 20-day EMA.

USD/JPY Key Technical Levels

Following the Bank of Canada's decision to raise the policy rate by 25 basis points to 4.5%, Bank of Canada (BoC) Governor Tiff Macklem delivers his remarks on the policy outlook and responds to questions.

Key takeaways

"Bank of Canada has raised rates rapidly, now it's time to pause and assess whether monetary policy is sufficiently restrictive."

"This is a conditional pause, dependent on the economy developing broadly in line with forecasts."

"If we need to do more to get inflation to the 2% target, we will; if upside risks materialise we are prepared to raise rates further."

"We are turning the corner on inflation, but are still a long way from our target."

"Economic growth and spending in H2 2022 were stronger than forecast, our overheated economy did not cool as much as we had expected."

"Lower gasoline prices are welcome but prices of essentials continue to rise too quickly."

Os Tuesday, Gold XAU/USD registered its highest daily close since April. Strategists at Credit Suisse expect the yellow metal to enjoy further gains.

Initial support aligns at $1,897

“Gold is expected to extend its rally to resistance next at the 78.6% retracement of the 2022 fall and April 2022 high of $1,973/98, with a fresh cap expected here.”

“Only above the $,2070/75 record highs of 2020 and 2022 would suggest we are seeing a significant and meaningful long-term break higher with resistance levels then seen at $2,300, then $2,500.”

“Support is seen at $1,897 initially, below which can see a pullback to $1,825.”

Markets are off to a solid start in 2023. Global equities (MSCI All Country World Index) have gained 5.1% year-to-date, with Europe’s Stoxx 50 climbing 8.6% and the S&P 500 rising a more modest 3.5%. The big question now is whether the rally will prove durable, economists at UBS report.

S&P 500 price targets are 3,700 and 4,000 for June and December

“We don't see much scope for markets to rally in the near term, especially given our outlook for continued pressure on corporate profit growth.”

“Our June and December S&P 500 price targets are 3,700 and 4,000, respectively, versus 3,972 at the end of last week.”

AUD/USD has regained the position of best-performing G10 currency in the year to date. The pair is expected to suffer a drop by the middle of 2023 but economists at Rabobank have edged up their 0.75 target to 12 months from 15 months.

Market will price out expectations of a Fed rate cut before the end of 2023

“We continue to expect the AUD to perform well this year relative to a basket of G10 currencies. That said, we look for a dip in the value of AUD/USD around the middle of the year. This is linked with our expectation that the market will price out expectations of a Fed rate cut before the end of 2023.”

“We have edged up our AUD/USD forecast and have brought forward our 0.75 target to 12 months from 15 months.”

- Gold price slides despite US Dollar weakness and falling US Treasury bond yields.

- Analysts said a technical move or profit-taking could be behind the XAU/USD’s fall.

- Risk aversion is the primary driver of price action on Wednesday.

- Gold Technical Analysis: Stills upward biased, though headed for a correction before resuming the uptrend.

Gold snaps two days of gains and retreats from weekly highs reached around $1942.51, stumbles beneath the $1940 figure amid a risk-off impulse that weighed on safe-haven assets, including the US Dollar (USD). US Treasury bond yields are also edging lower in a gold move that appears to be driven by profit-taking. At the time of writing, the XAU/USD exchanges hands at $1,933.00

Sentiment remains sour, weighed by earnings and US companies lowering forecasts

Wall Street extends its losses at the open, following a warning that Microsoft sales in cloud services might slow down. Other big tech companies are feeling the pain of higher interest rates in the United States (US) as the US Federal Reserve (Fed) tightened 400 basis points, its monetary policy, since March 2022, to curb high inflationary pressures. Nevertheless, the next week’s monetary policy decision, with financial markets widely expecting a 25 bps rate hike to the Federal Funds rate (FFR), could continue to weigh on the greenback.

The US Dollar Index (DXY), a gauge for measurement of the buck’s value vs. a basket of peers, losses 0.10% down at 101.828, undermined by a gloomy economic outlook in the US. The US 10-year Treasury bond yield eases one and a half bps and yields 3.44%.

The World Bank and Swiss Federal Office for Customs and Border Security reported Swiss exports of gold to China surged in 2022, at 478 metric tons. That’s up from 274 tons in 2021.

In the meantime, the US economic docket for Thursday would be busy, led by the Advance in Gross Domestic Product (GDP) for Q4, expected at 2.6%. Further, Durable Good Orders are expected to recover to 2.5%, compared to last month’s -2.1% plunge. Unemployment claims for the last week would also be updated, along with the US Federal Reserve Core PCE inflation reading.

Gold Technical Analysis

Technically speaking, XAU/USD is consolidating around the $1,910-$1,940 range during the last three trading sessions, unable to crack the $1,950 mark. Of note, the Relative Strength Index (RSI) continues at overbought territory, while the Rate of Change (RoC) retraces from its peak of the week, suggesting that buying pressure is waning. Hence, the Gold price might pull back in the near term before resuming its uptrend.

XAU/USD key support levels are $1,900, followed by the $1,896.74 January 18 daily low. Break below will expose the 20-day Exponential Moving Average (EMA) at $1,889.22. On the other hand, for an uptrend continuation, XAU/USD needs to reclaim $1,950 as it aims to rally toward $2,000.

- Bank of Canada rises rates as expected, expects to hold now.

- Loonie weakens after the announcement.

- USD/CAD jumps but then pulls back toward 1.3400.

The USD/CAD jumped by more than 50 pips after the decision of the Bank of Canada and climbed to 1.3425, reaching the highest level since last Friday.

No more hikes?

The Bank of Canada, as expected, raised the key interest rate by 25 basis points to 4.5%. In the statement, the central banks mentioned that will likely hold rates at this level while assessing the impact of recent policy moves.

Following the announcement, the Loonie weakened across the board. The USD/CAD rose from 1.3365 to 1.3426. It then pulled back. Loonie’s crosses remain volatile as market participants digest the decision.

The BoC signals that its intention is to remain on hold which is not a surprise for markets. Analysts were considering that the hike at the January meeting could be the last one, taking into account the current economic outlook.

The USD/CAD retreated under 1.3400 after a few minutes. More volatility is expected. The pair needs to remain well above 1.3400 to keep the doors open to more gains over the next hours. The next resistance stands at 1.3440. The key support is the 1.3340 area and a break lower could trigger a bearish acceleration toward 1.3300.

Technical levels

The current row about the US debt ceiling is slowly becoming an issue for FX analysts. It has always worked out in the end, nonetheless, from the point of view of Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, there are reasons why we should not ignore the debt-ceiling issue completely.

How to deal with the US debt ceiling event risk?

“In conversations, I am often told: it has always worked out in the past; the debate about the debt ceiling is part of the US political foofaraw, in the end an agreement is always reached. And indeed, I tend to agree with that point of view.”

“And please do not believe that the USD levels would correctly reflect this event risk! How risks are valued on the market depends on the risk profile of the ‘average market participant’. At first glance that is a rather hazy concept, but the formal definition is not trivial, and for our purposes a rough idea is quite sufficient.”

“It is not a case of creating a panic if I suggest keeping an eye on the event risk of fiscal chaos in the US and the possible USD negative effects if you are going to enter USD longs. Even if it is likely that it will all end well yet again.”

- Euro supported by ECB monetary policy expectations.

- Pound attempts to recover ground.

- EUR/GBP with bullish bias, near strong barriers.

The EUR/GBP is trading flat, hovering around 0.8815, after rising for three consecutive days. The cross peaked at 0.8851, the highest level in a week before pulling back.

The Euro continues to receive support from European Central Bank’s officials who talk about the need to continue rising interest rates significantly. The latest round of economic data favors that perspective. The Eurozone PMIs surpassed expectations.

On Wednesday, the IFO business climate was released. For January the headline came in slightly below market consensus at 90.2 while the expectations index came in at 86.4. “While the outlook has brightened somewhat, the IFO readings suggest that this is starting to top out and so upside economic risks are likely limited, at least for now”, mentioned analysts at Brown Brother Harriman.

The cloudy outlook for the UK economy still weighs on the Pound. Still, the Bank of England is still seen raising rates at their next meeting.

At the 20-day SMA

The EUR/GBP is hovering at a critical area, around 0.8810/15 which contains the 20-day Simple Moving Average. If it manages to consolidate above, the Euro could gain momentum toward the next resistance at 0.8855/60, the last protection for another test of 0.8895/0.8900.

On the flip side, a daily close below 0.8790 should be a positive development for the Pound suggesting a deeper slide probably to the next support around 0.8740.

EUR/GBP daily chart

The Bank of Canada (BoC) announced on Wednesday that it hiked its benchmark interest rate by 25 basis points to 4.5% following the January policy meeting. This decision came in line with the market expectation.

In its policy statement, the BoC noted that it is likely to hold the rate at this level while assessing the impact of cumulative rate hikes.

Market reaction

With the initial reaction, USD/CAD rose sharply and was last seen rising 0.35% on the day at 1.3415.

Key takeaways from policy statement

"Global growth seen declining from 3.6% in 2022 to 1.9% in 2023; US growth to slow to 2.0% in 2022 and 0.5% in 2023."

"Output gap in Q4 was between 0.50% and 1.50%, down from upwardly revised 0.75% to 1.75% in Q3."

"3-month measures of core inflation have come down, suggesting core inflation has peaked."

"Prepared to increase policy rate further if needed to return inflation to 2% target; continuing the quantitative tightening program."

"There is growing evidence that restrictive economic policy is slowing activity, especially household spending."

"Financial conditions remain restrictive but have eased since October; C$ has been relatively stable vs US$."

"Global inflation remains high and broad-based."

- EUR/USD rebounds from earlier lows near 1.0860 on Tuesday.

- The German 10-year Bund yields drop to 3-day lows.

- Germany’s Business Climate improved in January.

The European currency now looks to extend the bounce off earlier lows in the 1.0860/55 band vs. the greenback and lifts EUR/USD back to the boundaries of 1.0900 the figure on Wednesday.

EUR/USD refocuses on the 1.0900 barrier

EUR/USD so far advances for the sixth session in a row in a context dominated by alternating risk appetite trends, as investors – and global assets in general – remain prudent ahead of the upcoming FOMC and ECB events next week.

Further support for the euro came once again from hawkish comments from ECB rate setters, this time Board members Makhlouf and Vasle, who advocated for half point rate raises and favoured staying in the restrictive territory for a while.

Also collaborating with the optimism around the euro and reinforcing the view that Germany – and the Euroland – could avoid a recession, the German Business Climate improved to 90.2 during January.

Across the pond, the MBA Mortgage Applications expanded 7.0% in the week to January 20.

What to look for around EUR

EUR/USD flirts once again with the 1.0900 neighbourhood following recent 9-month peaks (January 23).

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next steps from the ECB and the Federal Reserve.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency.

Key events in the euro area this week: Germany Ifo Business Climate (Wednesday) – Italy Business Confidence (Thursday) – France Consumer Confidence, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.12% at 1.0895 and faces the next up barrier at 1.0926 (2023 high January 23) followed by 1.0936 (weekly high April 21 2022) and finally 1.1000 (round level). On the flip side, the breakdown of 1.0766 (weekly low January 17) would target 1.0576 (55-day SMA) en route to 1.0481 (monthly low January 6).

Mexico is near the end of the tightening cycle. Thus, economists at CIBC Capital Markets would not chase the current USD/MXN downward trend from current levels.

Reaching the end of the tightening cycle

“Although we agree with Banxico’s governor Jonathan Heath view on the need for at least another 25 bps rate increase given above target core and headline inflation, we see Banxico moving to a data dependent stance next month as CPI comes in slightly below the most recent central bank forecast, likely ending it tightening cycle at 10.75%.”

“Note that the market continues to price aggressive rate cuts during the second half of 2023, bringing the overnight rate closer to 9.25%-9.50% by the end of the year. Hence, though recently breaking lower and pointing to its prepandemic level (18.50-18.52), we would not chase the current USD/MXN downward trend from current levels.”

“Q1 2023: 20.00 | Q2 2023: 21.00 (USD/MXN)”

USD/JPY continues to trade in a relatively tight range above 130.00 as market participants try to figure out how the Bank of Japan's (BoJ) monetary policy will be shaped when the new governor takes over. Economists at Rabobank see the pair at 128 on a three-month view.

There is likely scope for some change in BoJ policy in the coming months

“In the next few weeks, PM Kishida will nominate the next BoJ governor. This may bring its own set of surprises insofar as there is a possibility that speculators may have to accept that the outlook of the new governor may not be drastically different from the old. In our view, there is likely scope for some change in BoJ policy in the coming months. However, this may not be substantial.”

“On the assumption that the BoJ’s yield curve control policy is tweaked in the spring, we are forecasting USD/JPY at 128 on a three-month view but expect volatility around the March policy meeting given the risks that policy is again left unchanged.”

Silver price (XAG/USD) remains depressed. Economists at TD Securities expect the precious metal to stay under pressure.

Beginning of a reversal lower across precious metals

“In the absence of behemoth Chinese purchases, CTA trend follower liquidations in Silver are likely to weigh on prices.”

“We expect weakening upside momentum to spark a selling program as large as -8% of the funds' maximum historical position size, but a break above the $23.72 range could result in a more modest flow totaling -4% of this cohort's max size. This follows the deterioration in precious metal trend signals in Platinum, and could be hinting at the beginning of a reversal lower across the complex.”

“The jury is out on whether large-scale Chinese purchases of Gold will continue following Lunar New Year, but the analogy from India's reopening suggests that ongoing celebrations could mark the peak in retail demand.”

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 15:00 GMT. The Canadian central bank is widely expected to lift its benchmark rate by 25 bps to 4.50% at the end of the January meeting. The markets, however, are also pricing in a small chance of the BoC leaving rates unchanged amid looming recession risks. Hence, the focus will also be on the accompanying policy statement and the post-meeting press conference, which will be looked upon for fresh cues about the future rate-hike path.

According to Dhwani Mehta, Senior Analyst and Asian Session Manager at FXStreet: “a pause in the BoC’s rate hike track could support the economy, especially after the Business Outlook Survey released by the central bank showed last week that more than 70% of Canadian consumers and two-thirds of business firms think a recession is likely in the next 12 months.”

Analysts at ING also offer a brief preview of the upcoming central bank event risk and write: “The BoC is getting close to the end point of its interest rate hiking phase. Inflation is showing signs of coming off, but the jobs market remains hot and as such we expect a final 25 bps interest rate hike. The BoC will likely characterise this as a pause, but we expect it to mark the peak as global recessionary forces are increasingly felt within Canada and inflation numbers continue to subside.”

How Could it Affect USD/CAD?

The BoC is unlikely to hint towards a more aggressive tightening and a dovish signal will be enough to exert heavy downward pressure on the Canadian Dollar. This, along with the emergence of some US Dollar buying, supports prospects for some upside for the USD/CAD pair. That said, the recent bullish run in crude oil prices might continue to underpin the commodity-linked Loonie and cap any meaningful gains for the major, at least for the time being.

Furthermore, traders might also refrain from placing fresh directional bets around the USD/CAD pair and move to the sidelines ahead of the crucial FOMC monetary policy meeting next week. Hence, any immediate market reaction is more likely to remain muted and fade rather quickly.

Key Notes

• Bank of Canada Preview: The final one, with a pause ahead?

• BoC Preview: Forecasts from eight major banks, edging towards a final rate hike

• USD/CAD Forecast: Bias seems tilted in favour of bearish traders, BoC decision awaited

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

"We need to continue to increase rates at our meeting next week – by taking a similar step to our December decisions," European Central Bank (ECB) Governing Council member Gabriel Makhlouf said on Wednesday. per Reuters. Makhlouf further added that they need to increase rates again at the March meeting.

"Our future policy decisions need to continue to be data-dependent given the prevailing uncertainty," Makhlouf explained and reiterated that interest rates will have to rise significantly at a steady pace to reach levels sufficiently restrictive.

Market reaction

EUR/USD pair showed no immediate reaction to these comments and was last seen trading modestly lower on the day at 1.0875.

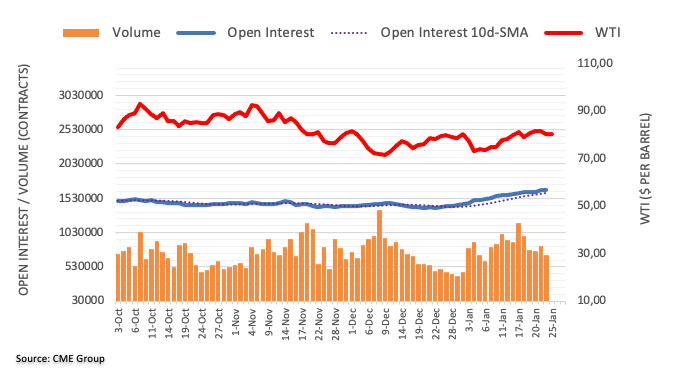

- The barrel of the WTI hovers around the $80.00 region.

- The API reported a nearly 3.4M barrels build late on Tuesday.

- Recession fears, Chinese reopening continue to dictate the price action.

Prices of the WTI trade without a clear direction around the key $80.00 mark per barrel on Wednesday.

WTI focuses on the EIA report, China

Prices of the commodity came under pressure following Monday’s new 2023 high past the $82.00 mark per barrel.

The weekly leg lower, however, seems to have met some contention around the $80.00 region on Wednesday, all ahead of the weekly report by the EIA due later in the NA session.

On this, the API reported a nearly 3.4M barrel build in the week to January 20 late on Tuesday, which appears to have been weighing on the traders’ sentiment so far in the session along with persistent recession concerns and their expected impact on the demand for crude oil.

In the meantime, the next risk event for the commodity will be the OPEC+ gathering on February 1, where the cartel is expected to keep the current status quo regarding the crude oil output.

WTI significant levels

At the moment the barrel of WTI is down 0.02% at $80.19 and a breach of $78.84 (55-day SMA) would aim for $78.18 (weekly low January 19) and then $72.50 (2023 low January 5). On the upside, the next hurdle is located at $82.60 (2023 high January 23) followed by $83.32 (monthly high December 1 2022) and finally $93.73 (monthly high November 7 2022).

EUR/USD dips after another rejection of 1.09. The pair could slump to 1.0790 on a break below 1.0840, economists at Scotiabank report.

Broader bull trend remains intact

“Spot has reversed quite strongly from the daily high just above 1.09, giving the intraday chart a negative look.”

“The near-term outlook turns more EUR-negative below 1.0840 (minor double top trigger) which would put the EUR on course for a test of 1.0790.”

“The broader bull trend remains intact, however, and we continue to anticipate firm support for the EUR on relatively minor dips.”

The Bank of Canada rate decision could push the USD/CAD decisively into a new trading range. Economists at Scotiabank highlight the key breakout points for the pair.

CAD awaits BoC's Decision for next move

“A 25 bps hike and balanced statement should give the CAD a modest lift – considering that swaps have been (and remain) reluctant to fully price in this tightening; USD/CAD could test the upper 1.32s/low 1.33 zone. A more dovish outcome – no hike – will see spot move quickly higher to test the recent peaks around 1.3500/20 at least.”

“Technically, the short-term charts highlight key break-out points for USD/CAD in the short run – above 1.3415, which will prompt a retest of the 1.35 area (last week’s high) or below 1.3325 which should prompt USD losses to the 1.3275 area.”

See – BoC Preview: Forecasts from eight major banks, edging towards a final rate hike

- AUD/USD trims a part of its strong intraday gains to the highest level since August.

- The risk-off impulse benefits the safe-haven USD and caps the risk-sensitive Aussie.

- Bets for further rate hikes by the RBA should limit any deeper pullback for the pair.

The AUD/USD pair retreats nearly 50 pips from its highest level since mid-August touched earlier this Wednesday and is currently placed around the 0.7075 area, still up over 0.40% for the day.

A fresh wave of the global risk-aversion trade drives some haven flows towards the US Dollar and turns out to be a key factor acting as a headwind for the risk-sensitive Aussie. The market sentiment remains fragile amid worries about the economic headwinds stemming from the worst yet COVID-19 outbreak in China. Apart from this, the protracted Russia-Ukraine war has been fueling recession fears and tempers investors' appetite for perceived riskier assets.

The global flight to safety, along with the prospects for a less aggressive policy tightening by the Fed, exert some downward pressure on the US Treasury bond yields. In fact, the CME's FedWatch Tool points to over a 90% probability for a smaller 25 bps rate hike at the next FOMC meeting that concludes on February 1. This could keep a lid on any meaningful upside for the greenback and help limit any meaningful corrective pullback for the AUD/USD pair.

Moreover, the stronger Australian consumer inflation figures released earlier this Wednesday gives the Reserve Bank of Australia (RBA) reasons to keep raising interest rates. This should further contribute to limiting the downside for the AUD/USD pair. Hence, any subsequent pullback might still be seen as a buying opportunity, warranting some caution for bearish traders in the absence of any relevant market-moving economic releases from the United States (US).

Technical levels to watch

GBP/USD is dithering around the 1.23 support zone. Economists at Scotiabank expect the pair to suffer losses in the near term.

Risks still seem tilted towards a drop to 1.22

“The breakdown below the 1.23 noted support point extended briefly yesterday before the market recovered, giving the sense of a ‘false break’. The market has not been eager to give the Pound a big enough lift that would suggest a recovery was in store, however.”

“Risks still seem tilted towards a drop in the Pound to 1.22 before it can retest key resistance at 1.2450 again.”

Economists at Credit Suisse remain neutral on CAD ahead of today’s BoC rate decision, with a 1.3400 USD/CAD target and a 1.3140-1.3800 range for Q1.

A high bar for BoC surprises

“We’ve adopted a neutral bias for Q1 with a 1.34 USD/CAD target in a 1.3140-1.3800 range, and so far do not see a strong reason to change views. Strong pushback from the BoC today, pointing to further rate hikes ahead, might represent a challenge to our view. This said we suspect markets would adopt a data-dependent wait-and-see approach in this case, rather than rush back to price in further rate hikes.”

“A surprise featuring an unchanged outcome, while likely to drive a negative knee-jerk CAD reaction, would also likely be seen as consistent with the generally weak consensus view on Canada’s growth outlook, and as such not shocking or at odds with the priced-in monetary policy outlook.”

“External developments, such as next week’s FOMC, will continue to play a more prominent role in driving USD/CAD price action in coming weeks.”

See – BoC Preview: Forecasts from eight major banks, edging towards a final rate hike

- USD/JPY drift into negative territory for the second straight day amid reviving safe-haven demand.

- Looming recession risks weigh on investors’ sentiment and drive some haven flows towards the JPY.

- A modest pickup in the USD demand could lend support and help limit the downside for the major.

The USD/JPY pair attracts some sellers near the 130.60 area and turns lower for the second successive day on Wednesday. The pair maintains its offered tone heading into the North American session and is currently placed near the daily low, around the 129.75-129.70 region.

A combination of factors provides a modest lift to the Japanese Yen, which, in turn, is seen exerting some downward pressure on the USD/JPY pair. Despite the Bank of Japan's (BoJ) dovish decision last week, market participants seem convinced that high inflation may invite a more hawkish stance from the central bank later this year. Apart from this, a fresh wave of the global risk-aversion trade benefits the JPY's relative safe-haven status.

The market sentiment remains fragile amid looming recession risks, fueled by worries about the economic headwinds stemming from the worst yet COVID-19 outbreak in China and the protracted Russia-Ukraine war. Moreover, the latest report by World Bank noted that the global economy is now in its steepest slowdown following a post-recession recovery since 1970. This, in turn, is seen weighing on investors' sentiment and driving some haven flow to the JPY.