- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- GBP/USD is holding itself above 1.1250 as the impact of hawkish Fed policy has started fading away.

- The BOE has pushed its interest rates to 2.25, the highest since 2008.

- BOE’s denial of an aggressive policy approach seems the weak economic fundamentals.

The GBP/USD pair is displaying a lackluster performance after declining from the critical resistance of 1.1350 in the early Asian session. The cable is oscillating in a narrow range of 1.1250-1.1266 and is expected to continue the volatility contraction pattern ahead of the PMIs data. Earlier, the asset rebounded firmly after sensing a decent buying interest of around 1.1200. The decline move from 1.1350 is a corrective move, which seems to conclude sooner and an upside journey will resume.

The pound bulls displayed wild swings after the announcement of the interest rate decision by the Bank of England (BOE). BOE Governor Andrew Bailey elevated the interest rates by 50 basis points (bps) and pushed the terminal rate to 2.25%. This has been the highest borrowing cost since 2008.

Investors should note that the UK economy is facing the headwinds of soaring price pressures at most and yet they have not adopted an aggressive approach toward monetary policy. The rationale behind moving calm is the poor economic fundamentals, vulnerable labor market conditions, and weak labor market index. The unavailability of support from domestic economic catalysts kept the BOE policymakers to go all in on interest rate elevation unhesitatingly.

Going forward, UK’s S&P Global PMI data will hog the limelight. An improvement in Manufacturing PMI is expected as the economic data is seen at 47.5 vs. the prior release of 47.3. While the Services PMI is expected to scale lower to 50.0 vs. the former figure of 50.9.

Meanwhile, the US dollar index (DXY) is sensing a decline in the buying interest as the impact of extremely hawkish Federal Reserve (Fed) policy has started fading away. Now, investors have shifted their focus towards the PMI data, which is expected to display a mixed performance. A preliminary reading shows a soft landing of Manufacturing PMI at 51.1 while Service PMI will improve significantly to 45.

- AUD/USD has remained muted despite the release of the Aussie PMI data.

- Manufacturing PMI has released at 53.9 vs. estimates of 54.0 while Services PMI has landed at 50.4 vs. 47.7.

- The DXY could witness a momentum loss ahead of US PMI numbers.

The AUD/USD pair has not responded effectively to the release of the Australian S&P Global PMI data. The asset has continued to trade sideways around 0.6640. Earlier, the major rebounded firmly after picking significant bids below 0.6580.

The Australian S&P Manufacturing PMI has landed in mid of expectations of 54.0 and the prior release of 53.8 at 53.9. While the Services PMI has remained upbeat, released at 50.4, significantly higher than the forecasts of 47.7 and the former release of 50.2.

On a broader note, the aussie bulls have remained in the grip of bears after the release of less-hawkish Reserve Bank of Australia (RBA) minutes. RBA Governor Philip Lowe and his colleagues were also considering the alternative of 25 basis points (bps) for a rate hike.

This indicates that the central bank is not aggressive in hiking its Official Cash Rate (OCR). No doubt, price pressures are also high in the antipodean region but the central bank is not ready to sacrifice the growth rate over inflation. Apart from that, the reason for also discussing the 25 bps rate could be that the conduct of monetary policy every month provides sufficient chances for the central bank to paddle up interest rates.

Meanwhile, the US dollar index (DXY) is expected to display some signs of momentum loss on the upside. The DXY printed a fresh two-decade high of 111.80 on Thursday after a harsh-than-expected tone by the Federal Reserve (Fed) on interest rate guidance. The DXY could witness some long liquidation as the US PMI is expected to display a mixed performance.

The Manufacturing PMI is seen lower at 51.1 vs. the prior release of 51.5. While the Services PMI will improve to 45.0 against the prior print of 43.7.

- EUR/JPY reached a fresh monthly low at around 138.70, though it trimmed some losses.

- Sellers in the EUR/JPY daily and 4-hour chart are gathering momentum, as shown by the RSI.

- EUR/JPY Price Analysis: in the 4-hour chart, a break below 140.00 could pave the way toward 138.00.

The EUR/JPY dropped to fresh monthly lows at around 138.70, though a confluence of moving averages (MAs), namely the 50 and 100-day EMA meandering around the 139.16/19 area, were difficult hurdles to surpass, while bulls moving in helped to re-conquer the 140.00 psychological level. As the Asian Pacific session begins, the EUR/JPY is trading at 140.13, up by 0.11%.

EUR/JPY Price Analysis: Technical outlook

On Thursday, the cross-currency pair seesawed in a 500 pip range as the Bank of Japan (BoJ) intervention in the USD/JPY sent most yen crosses nosediving sharply. Even though the EUR/JPY remains above the 50 and 100-day EMAs, oscillators, particularly the Relative Strength Index (RSI), fell to negative territory, suggesting that sellers are gathering momentum.

The GBP/JPY four-hour chart shows the 20-EM crossing under the 50 and 100-EMAs, keeping the downward bias intact, though failure to record a daily close below the 200-EMA, staying above 139.98, opened the door towards 140.00. Albeit the EUR/JPY is trading above 140.00, risks are skewed to the downside, as the RSI persists in negative territory, alongside buyers needing to step in and lift prices above the 141.00 price level.

Therefore, the EUR/JPY first support would be the 140.00 figure. Once cleared, the next support would be the 200-EMA at 139.70, followed by the 139.00 psychological level, ahead of the S1 pivot at 138.00. On the flip side, the EUR/JPY first resistance would be the daily pivot at 140.81. The break above will immediately expose the 141.00 figure, which, if cleared, could pave the way toward 142.00.

EUR/JPY Key Technical Levels

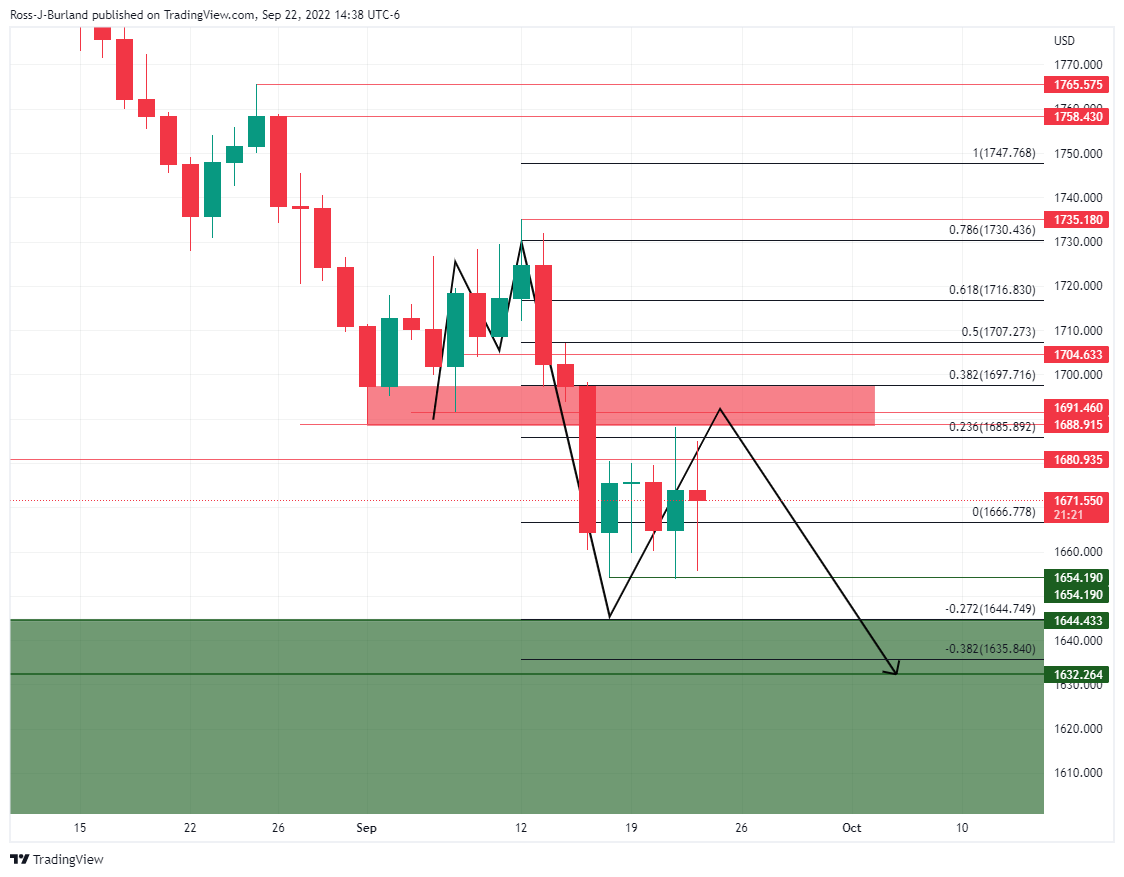

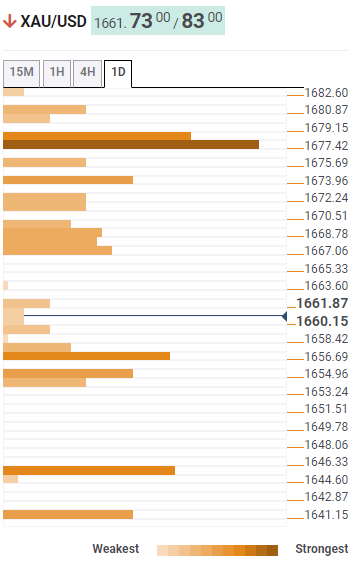

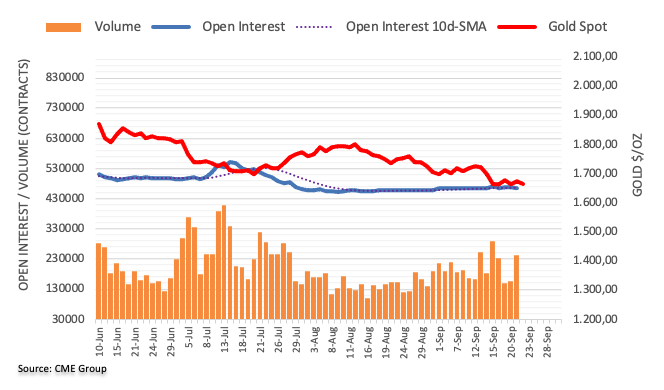

- Gold price has turned sideways after a wild gyration, awaiting a fresh trigger for a decisive break.

- Higher interest rates are forcing corporate to postpone their expansion plans.

- The DXY is aiming to recapture the fresh two-decade high around 111.80.

Gold price (XAU/USD) is bewildered after gyrating in a wider range post the announcement of the monetary policy by the Federal Reserve (Fed). The precious metal bounced sharply after testing a two-year low at $1,654.50. However, the upside seems capped at around $1,685.00, which has shifted the yellow metal back inside the woods.

Federal Reserve (Fed)’s agenda of cooling down the ultra-hot inflation is hurting the corporate at most. Higher obligations on borrowings are forcing them to postpone their current expansion plans and drop investment in fruitful opportunities. This is resulting in a sheer decline in the growth projections and eventually in employment generation. Also, the housing sector is becoming a major victim as higher interest rates are resulting in higher monthly installments, which are forcing them to postpone their home-purchase plans.

Meanwhile, the US dollar index (DXY) is aiming to recapture the two-decade high of 111.81 ahead of S&P Global PMI data. As per the preliminary estimates, the Manufacturing PMI will land lower at 51.1 vs. the prior release of 51.5. While the Services PMI will improve to 45.0 against the prior print of 43.7.

Gold technical analysis

Gold price is displaying topsy-turvy moves in a wider range of $1,654.00-1,690.50 on an hourly scale. The 21-period Exponential Moving Average (EMA) at $1.670.00 is overlapping with the asset price, which signals a consolidation ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating into the 40.00-60.00 range, which seeks a further trigger for a decisive move.

Gold hourly chart

- EUR/USD is oscillating around 0.9840, weakness seems favored after hawkish Fed policy.

- A mixed performance is expected on the US PMI front while Eurozone PMI will slip further.

- ECB’s economic bulletin sees a growth rate in 2022 at 3.1%.

The EUR/USD pair has turned sideways around 0.9840 after rebounding from near the critical support of 0.9813 in the early Tokyo session. A rebound move after multiple tests of Wednesday’s low indicates the strength of the support. It will be worth watching how far the asset can plunge after surrendering the above-mentioned support.

The impact of the harsh-than-predicted tone adopted by the Federal Reserve (Fed) chair Jerome Powell while guiding over the peak of interest rates is going to stay for a tad longer period. An escalation in interest rate projections by a whooping difference from 3.8% to 4.6% is sufficient to accelerate volatility in the economy. For achieving price stability in the economy, the rate hikes will result in a loss of job opportunities, demand for housing and durable goods, and growth rate projections.

Going forwards, the release of the S&P Global PMI data will remain in focus. The Manufacturing PMI is seen lower at 51.1 vs. the prior release of 51.5. While the Services PMI will improve to 45.0 against the prior print of 43.7.

On the Eurozone front, escalating fears of a nuclear attack by Russian leader Vladimir Putin are forcing the market veterans to extend the downside targets for the shared currency bulls. Apart from that, the release of the European Central Bank (ECB)’s Economic Bulletin sees the economy to grow by 3.1% in 2022, 0.9% in 2023, and 1.9% in 2024.

The Eurozone Manufacturing PMI is expected to land at 48.7, lower than the prior release of 49.6. Also, the Services PMI will shift lower to 49.0 vs. the former figure of 49.6.

- GBP/JPY nosedived to fresh 4-month lows below 160.00, though buyers reclaimed the 160.00 figure.

- A decisive break below 160.00 could pave the way towards 158.00; otherwise, a re-test of 161.00 is on the cards.

The GBP/JPY slightly advanced, following Thursday’s volatile session, after the Bank of Japan (BoJ) decided to hold rates unchanged but intervene in the FX market, sending the USD/JPY tumbling from around 145.90 to 140.34 after emphasizing that the Japanese yen weakness, was not aligned with fundamentals. Consequently, the GBP/JPY dropped 1.34% on Thursday, but at the time of writing is trading at 160.25, up 0.05%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY price action illustrates the pair tumbling below the 200-day EMA, hitting a fresh four-month-low at around 159.12; buyers stepped in and reclaimed the previously-mentioned 200-day EMA at 160.27. Traders should note that the Relative Strength Index (RSI) fell below the midline, extending its fall towards the 36.46 reading, suggesting that sellers are in charge. Therefore, the GBP/JPY is downward biased. Once it clears the 200-day EMA, a re-test of the 159.00 area is on the cards.

In the short term, the 4-hour chart illustrates that the GBP/JPY reached the head-and-shoulders chart pattern target at around 161.50; the downtrend extended towards the four-month low before recovering to 160.00. Nevertheless, the GBP/JPY bias shifted downwards, further cemented by the cross of the 20-EMA below the 200 one.

Therefore, the GBP/JPY’s first support would be the 160.00 psychological price level. The break below will expose the four-month low at 159.12, followed by 159.00, ahead of the S1 daily pivot at 158.07.

GBP/JPY Key Technical Levels

- NZD/USD fell to an almost two-year-low, though it’s trimming some of its earlier losses.

- The Fed is expected to lift rates to the 4.4% threshold, according to the FOMC’s Summary of Economic Projections.

- US S&P Global PMIs, alongside Fed Chair Jerome Powell’s speech, are eyed on Friday.

The New Zealand dollar dropped to almost two-year-lows on Thursday amidst increasing fears that a frenzy of central banks tightening monetary conditions would likely tap the global economy into a recession. At the time of writing, the NZD/USD is trading at 0.5845, below its opening price by 0.11%

The US Federal Reserve decided to hike rates by 75 bps on Wednesday and emphasized that it would likely maintain its tightening cycle. The Summary of Economic Projections (SEP) showed that FOMC’s members expect the Federal funds rate (FFR) to end at around 4.4%.

NZD/USD cuts earlier losses but remains on the defensive

During the press conference, Jerome Powell said, “We have got to get inflation behind us,” and added, “I wish there were a painless way to do that. There isn’t.” The SEP updated GDP, PCE, core PCE, and unemployment projections. Most members expect GDP at 0.2%, while PCE and core PCE were revised upward to 5.4% and 4.5% by the year’s end. Concerning the unemployment rate, policymakers revised the number to 3.8%.

Before Wall Street opened, the Labor Department showed that claims for unemployment in the US for the last week, which ended on September 17, increased by 213K, less than the 217K estimated, but above the previous reading, downward revised to 208K.

Meanwhile, US Treasury bond yields rose, led by the 10-year benchmark note rate up by 14 bps, at 3.714%, while the greenback fell, as shown by the US Dollar Index.

In the meantime, the New Zealand economic docket reported that the Consumer confidence for the Q3 improved, from 78.7 to 87.6 in the previous quarter. During the last week, ANZ Bank economists foresee three additional 25 bps rate hikes by the RBNZ at the February, April, and May monetary policy meetings. Therefore, the bank estimates the Overnight Cash Rate (OCR) to finish at around 4.75%.

“The economy is not rolling over, with the tight labour market and strong wage growth partially offsetting the impact of higher interest rates. The low New Zealand dollar is also a meaningful offset to current monetary conditions,” said ANZ Bank analysts.

What to watch

The New Zealand economic docket is empty, leaving traders adrift to US economic data.

The US economic calendar will release the S&P Global Manufacturing. Services and Composite Flash PMIs for September and Fed speakers led by Chair Jerome Powell will cross newswires.

NZD/USD Key Technical Levels

- Gold has managed to hold on despite the resurgence in the US dollar.

- Gold's safe-haven appeal is supporting the price within a familiar daily range.

The gold price is settling in for the end of the North American session around flat for the day having traveled between a low of $1,655.71 and a high of $1,684.95 so far. The yellow metal has found demand on renewed geopolitical concerns following Russia's president, Vladimir Putin, saying he will pour more troops into his war against Ukraine while threatening to use nuclear weapons.

In the face of battlefield setbacks, the Russian leader has doubled down. Russia will mobilize 300,000 additional troops — a number larger than the original invasion force — and Moscow also appears poised to annex Ukrainian territory under its control.

The threat of a wider war is reviving the appeal of the precious metal due to its safe haven role in financial markets despite a bid in the greenback that is trading near the highest in 20 years, supported by the Federal Reserve's 75 basis-point increase to US interest rates on Wednesday and its promise that rates will rise again until inflation is under control.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

In this context, the precious metals' price action could still have further to fall as the restrictive rates regime is set to last for longer, analysts at TD Securities argued. ''Indeed, gold and silver prices have tended to display a systematic underperformance when markets expect the real level of the Fed funds rate to rise above the neutral rate, as estimated by Laubach-Williams.''

Gold technical analysis

Meanwhile, from a technical perspective, there are still prospects of a move higher from out of the sideways channel as per the M-formation which is a reversion pattern.

What you need to take care of on Friday, September 23:

Several central banks announced monetary policy decisions following the US Federal Reserve meeting.

The first one was the Bank of Japan which decided to keep its monetary policy on hold. However, not long after the meeting, the BOJ intervene in the FX market. The USD/JPY pair plunged like a rock, from an intraday high post-meeting of 145.89 to 140.34. It currently trades at around 142.40.

The Switzerland National bank hiked its benchmark rate by 75 bps. However, USD/CHF advanced, ending the day in the 0.9780 price zone. Governor Thomas Jordan said they are ready to intervene to steer monetary conditions for the Swiss Franc.

It was then the turn of the Bank of England, which pulled the trigger by 50 bps, somehow disappointing investors. Governor Andrew Bailey noted they would continue responding “forcefully, as necessary” to inflation, despite the risk of a steeper economic setback.

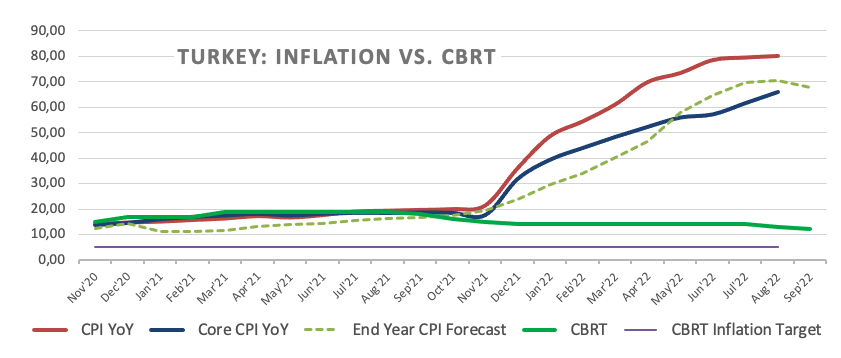

As a note of color, it is worth adding that the Türkiye Central Bank, in fact, cut rates from 13% to 12%. On the other hand, President Erdogan arranged a meeting with Russia to discuss an agreement on payment and possible sanctions. Moscow, in the meantime, threatened the western world with a nuclear war amid the latter help to Ukraine.

Recession seems inevitable as stubbornly high inflation plus the escalation of the war forced policymakers’ hands. Stocks fell, while US government bond yields soared to fresh multi-year highs.

The EUR/USD pair trades around 0.9830, meeting intraday sellers at around 0.9900. The AUD/USD pair posted a modest intraday advance and hovers around 0.6640/50, while USD/CAD trades at 1.3480.

Spot gold posted a modest intraday advance and settled at $1,672 a troy ounce. Crude oil prices finished the day pretty much unchanged, with WTI now changing hands at $83.50 a barrel.

On Friday, S&P Global will release the flash estimates of the September PMIs for major economies.

Russia accepts Bitcoin and crypto for cross-border payments, proposes policy change

Like this article? Help us with some feedback by answering this survey:

Reuters reported that the Bank of England (BoE) policymaker Jonathan Haskel said the central bank was in a difficult position as the government's expansionary fiscal policy appeared to place it at odds with the BoE's efforts to cool inflation.

"We are in a difficult, uncomfortable position, frankly, because I don't like being in a situation where you have one institution - namely the independent central bank - at least being portrayed as set against another institution, the elected government," he said.

"Having a fiscal expansion in the context of tight supply is, I'm afraid, very difficult," he added, during a panel discussion hosted by the North Western Reform Synagogue.

Meanwhile, GBP remains pressured following the BoE surprising with just a 50bps rate hike instead of a 75bps increase. GBP/USD is back to flat at 1.1258 following a move between 1.1364 and 1.1211 on the day.

- USD/CAD bulls step in to test key 1.35s.

- WTI is supporting a recovery in an otherwise Us dollar bid environment.

USD/CAD has been on consolidation in late North American trade while oil prices firm that has helped the Canadian dollar correct from its weakest level in more than two years. At the time of writing, the pair is up come 0.3% having traveled from a low of $1.3409 to a high of 1.3544 on the day.

The greenback has otherwise been supported by the Federal Reserve's hawkish outlook for interest rates and after Russian President, Vladimir Putin ordered the country's first mobilization since World War Two. On safe haven demand, DXY, which measures the currency against a basket of six counterparts hit a high of 111.814, the highest level since mid-2002.

A jump in oil followed news of China's plans to ramp up its exports of refined products, as per Reuters news that said ''Chinese refiners are expecting the government to issue export quotas for 15-million tonnes of export quotas for refined products covering the remainder of the year as Beijing looks to bolster exports from the world's No.1 oil importer.''

Additionally, there have been concerns over a disruption to oil markets caused by sanctions leveled against Russia. Russian president Putin said in a late Tuesday speech he planning to mobilize an additional 300,000 troops to bolster the country's flagging war on Ukraine, where it has surrendered swathes of occupied territory in recent fighting, raising

Elsewhere, supporting the greenback, the Federal Reserve's 75 basis-point increase to US interest rates on Wednesday remains an issue for the market, as the central bank looks to combat inflation by slowing the economy and reducing demand.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

Next on the agenda, we have Canada's retail sales data for July, due on Friday. This could offer markets more to go on as it assesses the Bank of Canada's outlook on rates.

- The EUR/GBP keeps the upward bias intact, despite piercing 0.8700 earlier in Thursday’s session.

- EUR/GBP Price Analysis: Break above 0.8760 to pave the way for higher prices; otherwise, a fall toward 0.8625 is on the cards.

The EUR/GBP climbs after testing a two-week upslope trendline, drawn from the September 2 and 14 lows that pass through the 0.8700 figure. During the day, the EUR/GBP tumbled to the daily low, below the previously-mentioned trendline at 0.8691, but bounced off and hit a daily high at 0.8760 before stabilizing at current exchange rates. At the time of writing, the EUR/GBP trades at 0.8737, above its opening price.

EUR/GBP Price Analysis: Technical outlook

From a daily chart perspective, the EUR/GBP dip towards 0.8700 was on the cards. Oscillators, particularly the Relative Strength Index (RSI), peaked just below entering overbought conditions three times since August 31, opening the door for a retracement. Once the Bank of England’s (BoE) decision was known, the euro gained traction, and buyers reclaimed the 0.8700 thresholds, maintaining the upward bias intact.

Switching to an intraday time frame, the EUR/GBP four-hour chart illustrates the pair as neutral-to-downward biased, with some solid resistance levels above the current exchange rate that might cap the EUR/GBP recovery. Break above the EUR/GBP 0.8760 daily high could pave the way toward the YTD high at 0.8787, ahead of the 0.8800 psychological level.

Contrarily, a drop below the S1 daily pivot at 0.8702 would expose the weekly low at 0.8691, followed by the confluence of the S2 pivot and the 100-EMA at around 0.8680/82, and then the September 14 low at 0.8625.

EUR/GBP Key Technical Levels

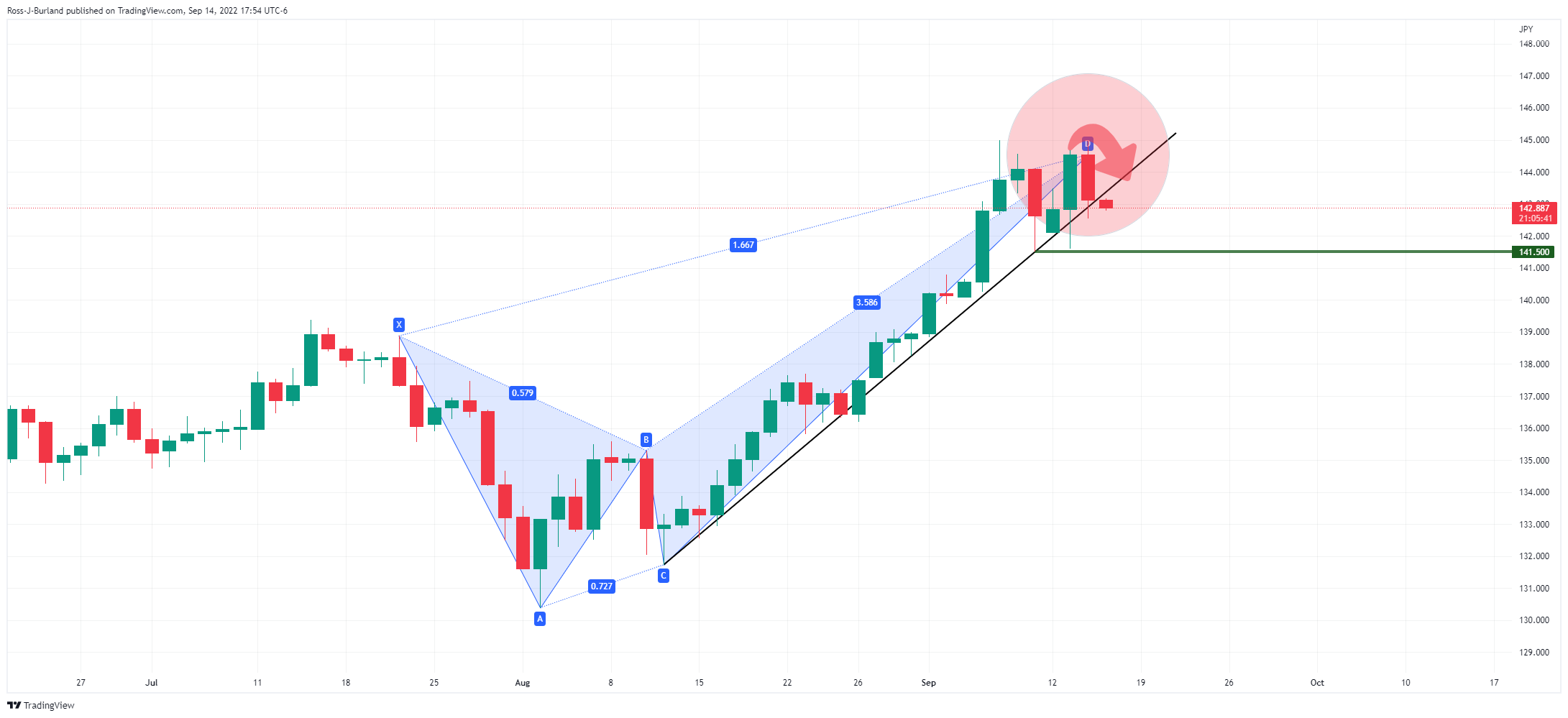

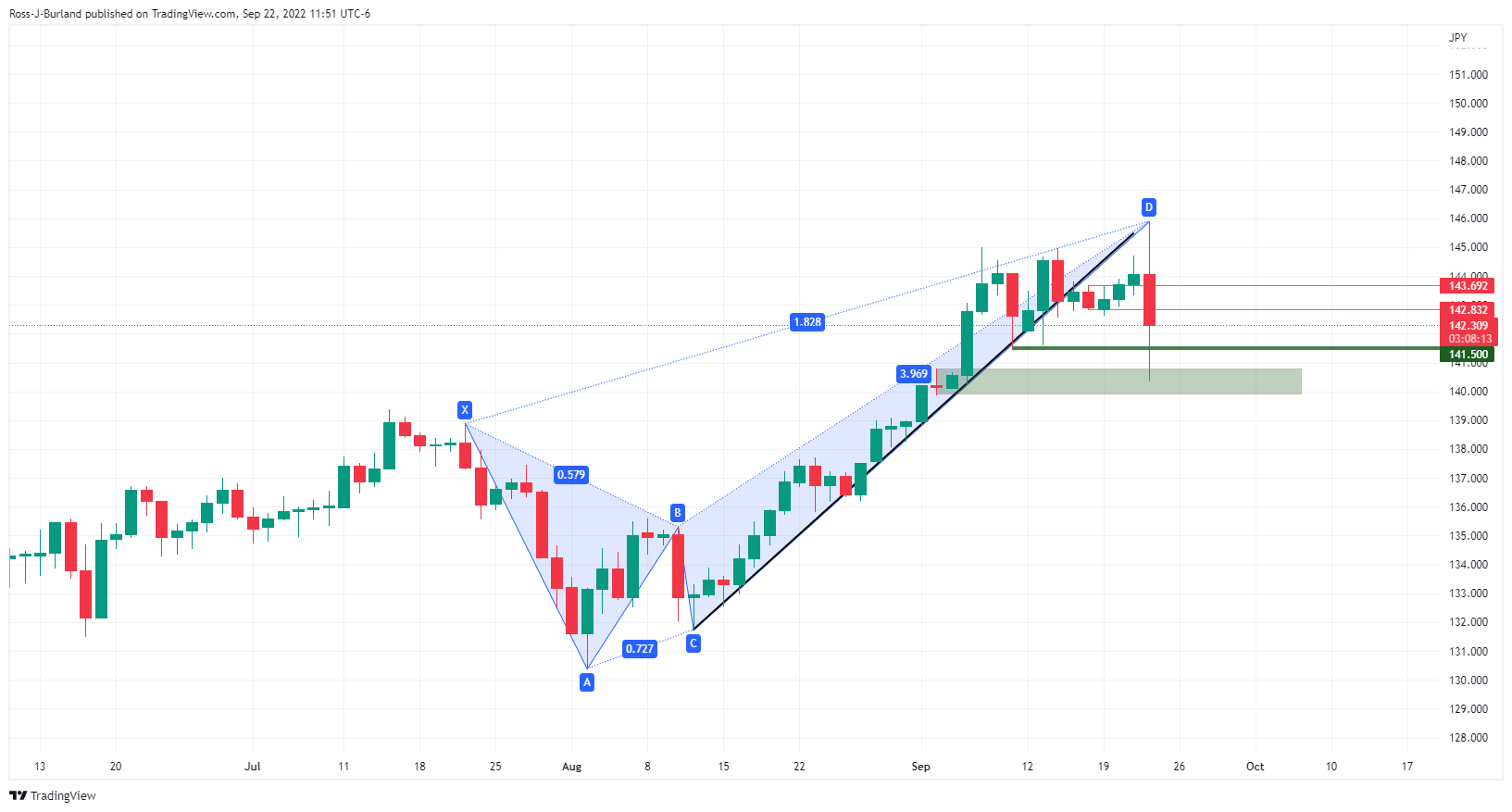

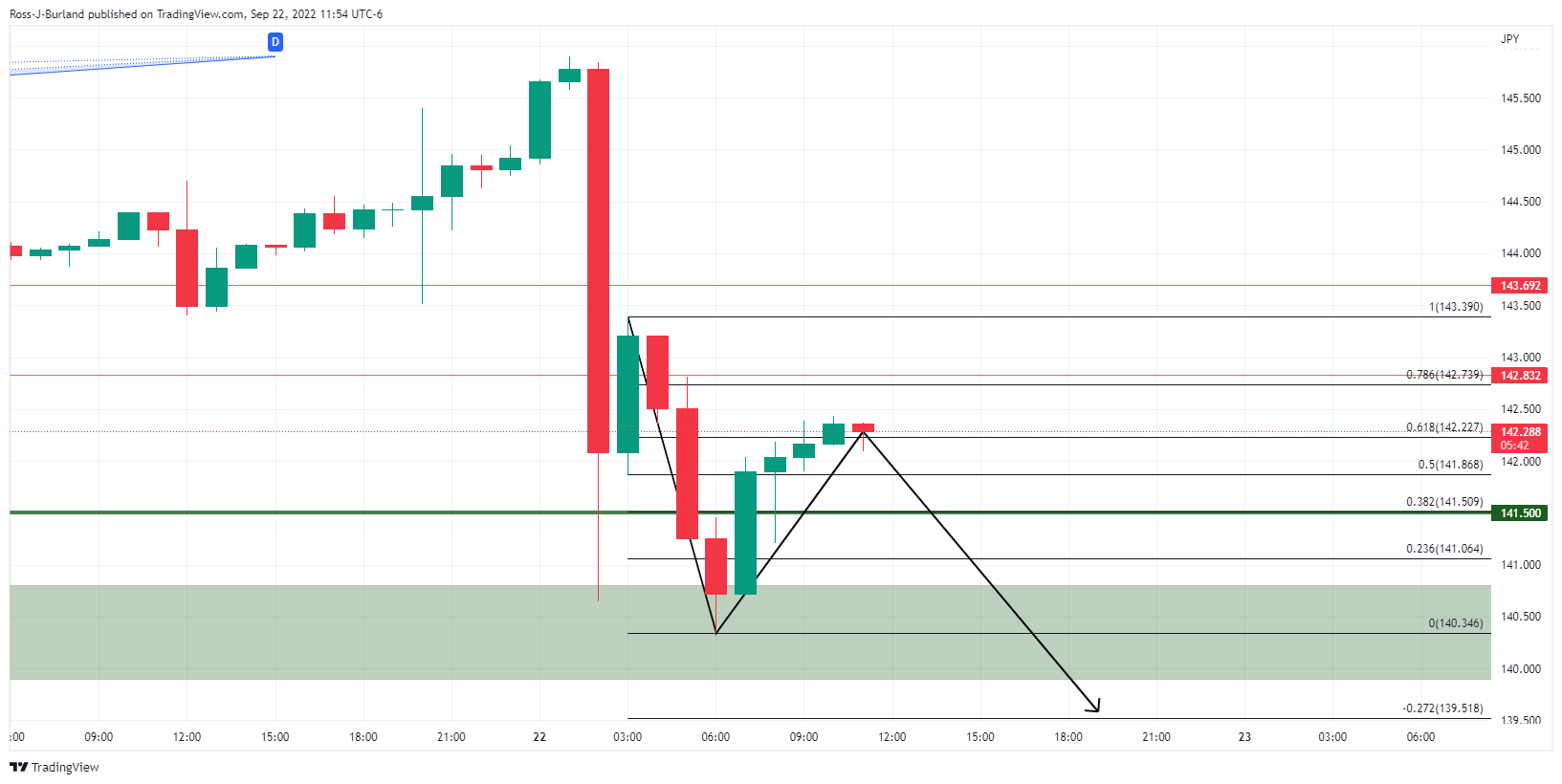

- USD/JPY bears move in at a 61.8% ratio of around 142.20.

- Should the bears commit, a break below 140.50 opens prospects of a downside continuation to take out 140.00.

As per the prior analysis, USD/JPY Price Analysis: Bears about to pounce as US dollar meets 4-hour resistance, the yen continued to defy the bears with the added fuel on the back of fundamentals.

News that the Ministry of Finance (MoF) intervened for the first time since 1998 has sent the pair well on its way to breaking a critical daily structure as follows:

USD/JPY prior analysis

Prior verbal intervention of the Japanese officials had sparked a bid in the yen and helped to see a harmonic pattern in the USD/JPY play out resulting in a continuation as the week progresses.

USD/JPY update

As illustrated, the pair has extended its decline and embarks on a break of the 140.80 support.

Meanwhile, the hourly charts show that the price is decelerating in a creeping correction that could now see the bears move in at a critical level of resistance near a 61.8% ratio around 142.20. Should the bears commit, a break below 140.50 opens prospects of a downside continuation to take out 140.00.

- AUD/USD reached a multi-year low at around 0.6574 but bounced back and is gaining 0.29%.

- The Summary of Economic Projections (SEP) reported that Fed officials see rates at around 4.4% by the end of 2022.

- The US Department of Labor reported that Jobless Claims rose less than estimated but exceeded the previous reading.

The AUD/USD rebounds off YTD lows reached at around 0.6574 and is back above the 0.6600 psychological figure as the greenback weakens, following an aggressive rate hike by the Fed, which opened the door for further increases. Even though the previously mentioned would support the greenback, the AUD/USD climbs, trading at 0.6642 at the time of writing.

Global equities remain on the back foot, recording hefty losses. Worldwide central banks continue to tighten monetary conditions amidst a period of two-digit inflation in some countries. On Wednesday, the Fed raised rates by 75 bps. According to the Summary of Economic Projections (SEP), Fed officials estimate another 120 bps of rate increases, seeing the Federal funds rate (FFR) at around 4.4% by the year-end.

AUD/USD is recovering as the US dollar falls

On Thursday, the Labor Department showed that claims for unemployment in the US for the last week, which ended on September 17, increased by 213K, less than the 217K estimated, but above the previous reading, downward revised to 208K. The number of people receiving benefits after an initial week of aid decreased by 22K to 1.379 million in the week ended on September 10.

In the meantime, an absent Australian economic docket left traders to keep digesting the RBA’s minutes released earlier. The central bank noted that it was not in a “pre-set path and would be balanced to try and keep the economy on an even keel.” Furthermore, most of RBA’s board members have begun to assess the possibility of raising rates at a slower pace as the cash rate rises.

However, Westpac analysts expect the RBA to hike 50 bps in October, followed by 25 bps in November, December, and February, lifting rates to 3.6%.

What to watch

On Friday, the Australian economic docket will feature the S&P Global Manufacturing, Services and Composite PMIs.

The US calendar will also reveal the S&P Global PMIs alongside Fed Chair Jerome Powell’s speech at around 18:00 GMT.

AUD/USD Key Technical Levels

- EUR/USD bounces off YTD lows nearby 0.9800 as price action gets overextended.

- Sentiment remains negative, though it failed to underpin the greenback.

- US jobless claims were better-than-expected, while the EU’s consumer confidence disappointed.

The shared currency is almost flat after hitting a fresh YTD low at 0.9806 after September’s Fed interest rate decision. The central bank further confirmed an aggressive approach, with most policymakers expecting additional increases to the Federal funds rate; therefore, the interest rate differentials between the EU and the US are a headwind for the EUR/USD.

The EUR/USD began trading at around the day’s lows and hit a daily high of 0.9907 before paring those gains and settling around current spot prices. At the time of writing, the EUR/USD is trading at 0.9842, registering minimal gains of 0.03%.

EUR/USD recovers some ground amidst a soft greenback

Global equities remain under pressure after Fed Chair Powell and Co. raised rates. The US Department of Labor reported that Initial Jobless Claims for the week ending on September 17 increased by 213K below the 217K forecasted, delineating the “very tight” labor market, as expressed by Chair Powell on Wednesday’s post-Fed decision presser.

Meanwhile, the US Dollar Index erases some of its earlier gains, down 0.09% at 111.347, a tailwind for the EUR/USD. On the contrary, the US 10-year Treasury bond yield remains positive, up at 3.682%, gaining 14 bps, after hitting an 11-year high at around 3.71%.

In the meantime, adding to an already deteriorated economic scenario in the Euro area, the EU’s consumer confidence in September dived to -28.8, exceeding estimates of -25.0. meanwhile, the ECB Governing Council member Isabel Schnabel commented that inflation is still too high, so further rate increases would be needed. While she failed to acknowledge a recession in the Eurozone, she warned that it might be unavoidable in Germany.

What to watch

The EU’s calendar will feature a tranche of S&P Global PMIs for Spain, France, Germany and the Eurozone. On the US front, the US S&P Global PMIs would also be reported, alongside Fed Chair Jerome Powell’s speech at around 18:00 GMT.

EUR/USD Key Technical Levels

The EUR/USD is trading below 0.9830, on its way to the lowest weekly close in decades. Analysts at MUFG Bank hold a bearish perspective on the EUR/USD pair for October. They see the pair trading in a range between 0.9500 and 1.03000.

Key Quotes:

“In the month ahead, we are maintaining a short EUR/USD bias. The Fed’s commitment to deliver further large rate hikes and the tightening of global financial conditions should continue to favour a stronger US dollar. The Fed has signalled clearly that it wants to see sustained evidence that inflation pressures are easing before delivering a dovish policy pivot. The stronger US CPI report for August has provided an even higher hurdle for a dovish pivot.”

“The main upside risk to our bearish EUR/USD bias could be triggered by a further paring back of more acute energy supply concerns in Europe. If the price of gas continues to fall heading into the winter it would help to ease fears over a sharper slowdown in the euro-zone. At the same time, the EUR could strengthen more than expected if the ECB keeps raising rates at a faster pace while the Fed signals that is considering slowing hikes.”

On Thursday, Japanese authorities intervened in the currency market to limit the depreciation of the yen. The USD/JPY dropped sharply from above 145.00 to as low as 140.35. Analysts at Danske Bank point out Japan has the world’s second-largest FX reserve, thus, it has the ammunition to continue to defend the Japanese yen. However, they warn that in the current economic environment, markets are likely to intensify pressure on the Yield Curve Control policy.

Key Quotes:

“The decision to stem the massive weakening of the yen triggered a USD/JPY decline by five figures to 140.8 levels and then bounced up and down during the following hours. Japan has the world's second largest foreign exchange reserve, so there is some weight behind an intervention like this. But the fact remains that the BoJ pursues a monetary policy that sends more yen into the market. It is hardly a sustainable situation for the BoJ to pursue its inflation target while simultaneously propping up the yen.”

“Today's decision has increased the likelihood that the BoJ will end up giving in to the global pressure for higher yields and abandon the YCC, or allow for a steeper yield curve. It is not least this higher probability that is being priced in the market and which has driven the yen stronger. If the BoJ does not adjust its monetary policy, then it may be difficult to prevent the yen from weakening again, and then we could quickly be back in a situation with a record weak yen again.”

As expected, the Swiss National Bank (SNB) rose the key interest rate by 75 basis points on Thursday. Analysts at Wells Fargo, believe the SNB will continue tightening monetary policy but will deliver rate hikes of smaller magnitude, amid an outlook of slower growth and somewhat more contained inflation next year.

Key Quotes:

“The announcement's forward guidance was not as hawkish compared to many other global central banks' comments. Rather than signaling forceful rate hikes ahead, the SNB instead repeated that it cannot be ruled out that further increases in the SNB policy rate will be necessary to ensure price stability over the medium term. In addition, the central bank indicated it remains willing to intervene in the foreign exchange market as necessary.”

“With the updated SNB forecasts showing annual average inflation of 2.4% for 2023 and 1.7% for 2024, we believe the central bank will continue tightening monetary policy, although larger rate hikes are likely not needed given inflation is expected to be closer to target by the end of 2023.”

“While our base case is for smaller magnitude rate hikes in the coming quarters, we would not fully rule out a 75 bps rate hike in December. Since the SNB only has one monetary policy meeting per quarter, half as many as the ECB, the central bank could opt to deliver a larger rate hike to account for this. The central bank has also repeatedly emphasized its commitment to support the franc in order to soften the blow from higher import prices and inflationary pressures. While its willingness to intervene in foreign exchange markets is an important policy lever, large rate hikes that support the currency could also complement these actions.”

A spokesperson for the US Treasury said on Tuesday that they acknowledge the Bank of Japan's intervention in the foreign exchange market.

"The Bank of Japan today intervened in the foreign exchange market. We understand Japan’s action, which it states aims to reduce recent heightened volatility of the yen," the spokesperson stated, as reported by Reuters.

Market reaction

The USD/JPY pair showed no immediate reaction to this statement and it was last seen losing more than 1% on the day at around 142.00.

The Bank of England announced on Thursday a 50 bps rate hike. Five members of the Monetary Policy Committee voted for that decision, three members wanted at 75 bps hike and one member a 25 hike. According to analysts at Rabobank, the slip decision reflects a very uncertain economic outlook. They point out that strong fiscal easing opens the door to a 75 bps increase in November, especially if the market believes the government borrows too much. But they consider the uncertain growth and inflation outlook continues to favor a more gradual rather than a frontloaded approach.

Key Quotes:

“The Monetary Policy Committee voted to raise the benchmark rate to 2.25% from 1.75%. There was a 3-5-1 split, reflecting uncertainty even as the eventual vote was in line with consensus and our own expectation of a 50 bps hike. Market participants were positioned for a 75 bps increase going into this meeting, following similar recent increases on the part of the Federal Reserve and the European Central Bank. The minutes were, however, seen as fairly hawkish, prompting another leg higher in yields.”

“We stick to our rationale that the change in the expected inflation profile – certainly significantly lower energy-driven inflation in the short-term; probably more persistent demand-driven inflation in the medium-term – should keep the Bank of England on a more gradual but also a more sustained path of rate increases. We therefore call for another 50 bps increase in November.”

“The Bank of England can, however, only maintain such a relatively gradual pace of interest rate increases (vis-à-vis other central banks!) if Truss and her team are able to reassure markets that she has a plan on how she will eventually provide balance in public spending. Today’s price action, with large spikes in gilt yields, shows that just the promise of more growth is certainly not enough.”

- Gold looks vulnerable as government bond yields continue to rise.

- Yellow metal peaked at 1684$ and retreated back to the 1670$ area.

- Price continues to move in a wide range, bearish bias.

Gold rose after the beginning of the American session to 1685$, hitting a fresh daily high but it failed to hold above 1680$ and retreated to 1667$. It is hovering around 1670$, as it continues to move sideways in a wide range between 1655$ and 1685$.

Volatility remains elevated but XAUUSD holds within the range. The consolidation takes place within a bearish trend that remains in place. A firm recovery above 1680$ could open the doors for a larger bullish correction. On the flip side, under 1650$ could trigger an acceleration targeting initially 1640$.

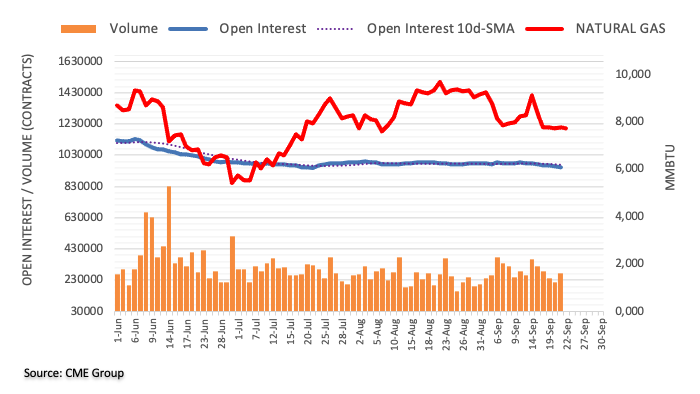

Following the 75 bps rate hike from the Federal Reserve, US yield continues to rise on Thursday. The US 10-year yield are at 3.70%, the highest level since February 2011 while the 2-year reach 4.15%, the highest since 2007. Higher yields are usually not good news for gold bulls. In the current context, bad news could be positive for gold.

Earlier on Thursday, the Japanese government's intervention in the currency market weakened the dollar and favoured the rebound in XAU/USD. However, the recovery was short-lived.

Technical levels

- The BoE raised rates to 2.25%, though the interest rate differential with the Fed capped upward pressure on the GBP/USD.

- US Initial Jobless Claims again exceeded estimations, justifying the case for yesterday’s Fed rate hike.

- On Friday, S&P Global PMIs would be featured for the UK and the US, and Fed Chair Jerome Powell will speak.

The British pound oscillates around its opening price, following consecutive monetary policy decisions of the Bank of England, earlier rising rates by 50 bps, while the Fed hiked 75 bps on Wednesday. Initially, the GBP/USD dropped toward new YTD lows at 1.1211 but bounced off and hit a daily high above 1.1350 before tumbling below the 1.1300 mark. At the time of writing, the GBP/USD trades around 1.1258s.

Overnight, market sentiment remains negative, as shown by global equities trading in the red. The Bank of England lifted rates to the 2.25% mark while saying it would continue to “respond forcefully, as necessary” to elevated prices. Worth noting that three members of the Monetary Policy Committee (MPC), namely Ramsden, Haskel, and Mann, voted for a 75 bps. In contrast, Swati Dhingra, its newest member in place of Michael Saunders, wanted a 25 bps.

GBP/USD seesaws around 1.1250s post-Fed and BoE’s rate hikes

At the same meeting, the MPC voted to reduce the BoE’s GBP 838 Billion by 80 billion pounds over the coming year. The BoE expects inflation to peak at around 11%. Now that September’s meeting is in the rearview mirror, money market futures still estimate the BoE to increase rates towards the 3.75% mark.

Aside from this, the US economic docket featured unemployment claims for the week ending on September 17, which rose by 213K less than estimates of 217K, further confirming yesterday’s Fed decision to hike rates by ¾ of a percent toward the 3.25% threshold, as data shows a solid labor market.

In the meantime, the US Dollar Index, a performance measure of the buck’s vs. six currencies, barely rises 0.05% up at 111.408, while the US 10-year T-bond yield skyrockets 17 bps, toward the 3.704% threshold, for the first time since February of 2011.

Therefore, the GBP/USD would likely remain on the defensive. After the BoE’s projected a 15-month recession, to likely begin by the year’s end, will further exert downward pressure on the pair, as the US dollar will likely continue to strengthen as the Fed prepares to end the 2022 tightening cycle at around 4.4% levels.

What to watch

The UK economic calendar will feature the GfK Consumer Confidence and the S&P Global Services, Manufacturing, and Composite PMIs. On the US front, the US S&P Global PMIs would also be reported, alongside Fed Chair Jerome Powell’s speech at around 18:00 GMT.

GBP/USD Key Technical Levels

- AUD/USD attempts a modest recovery from over a two-year low, though lacks follow-through.

- A sharp USD pullback from a two-decade high turns out to be a key factor lending some support.

- Aggressive Fed rate hike bets, recession fears act as a tailwind for the buck and cap the upside.

The AUD/USD pair recovers nearly 100 pips from its lowest level since May 2020 touched this Thursday, though the momentum stalls near the 0.6670 region. The pair quickly retreats below mid-0.6600s during the early North American session and is currently placed in neutral territory.

A sharp US dollar pullback from a fresh two-decade high turns out to be a key factor that assists the AUD/USD pair to attract some buyers near the 0.6575 region. News that Japanese authorities intervened in the forex market triggers aggressive short-covering around the JPY and prompts traders to take some profits off their USD bullish positions.

That said, a more hawkish stance adopted by the Fed helps limit the USD corrective declines and acts as a headwind for the AUD/USD pair. In fact, the Fed signalled more large rate increases at its upcoming policy meetings. This, along with the cautious mood and rising US Treasury bond yields, underpins the safe-haven buck and caps the risk-sensitive aussie.

Investors remain concerned that a more aggressive policy tightening by major central banks will lead to a deeper global economic downturn. This, along with headwinds stemming from China's zero-covid policy and the risk of a further escalation in the Russia-Ukraine conflict, have been fueling recession fears and denting the global risk sentiment.

The fundamental backdrop suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, any attempted recovery might still be seen as a selling opportunity. Spot prices remain vulnerable to prolonging over a one-month-old descending trend and test the 0.6500 psychological mark in the near term.

Technical levels to watch

- EUR/NOK bounces of the post-Norges Bank lows near 10.12.

- The Norges Bank raised the key policy rate by 50 bps to 2.25%.

- Further rate hikes will depend on how inflation evolves.

The Norwegian Krone gives aways part of the initial gains and now helps EUR/NOK resuming the upside to the area above 10.2000 on Thursday.

EUR/NOK up despite oil gains, dovish NB weighs on NOK

EUR/NOK manages to leave behind Wednesday’s daily decline and regains upside traction, as investors continue to adjust to the somewhat dovish tilt in the Norges Bank.

Indeed, the Scandinavian central bank raised the policy rate by half point to 2.25% at its meeting earlier on Thursday, although it linked the prospects for extra rate hikes to the progress of inflation.

In fact, the Norges Bank reiterated that inflation remains well above the bank’s target, although some signs of cooling in the economy could morph into some deceleration of inflationary pressures. The bank sees rates at around 3% over the winter.

EUR/NOK significant levels

As of writing the cross is gaining 0.48% at 10.2228 and the next resistance emerges at 10.3198 (monthly high September 20) followed by 10.5393 (2022 high June 16) and then 10.6323 (monthly high August 20 2021). On the downside, a drop below 10.1260 (weekly low September 22) would open the door to 9.9884 (200-day SMA) and finally 9.8313 (monthly low September 6).

- USD/JPY retreats sharply from a fresh 24-year peak after Japan intervenes in the FX market.

- The intraday USD corrective pullback from a two-decade high contributes to the steep decline.

- Rising US bond yields, the Fed-BoJ policy divergence limits any further losses, at least for now.

The USD/JPY pair witnessed a dramatic intraday turnaround on Thursday and plunges over 550 pips from the vicinity of the 146.00 mark, or a fresh 24-year high touched this Thursday. The pair maintains its heavily offered tone through the early European session and hits a nearly three-week low in the last hour, though rebounds thereafter.

Japanese authorities intervened in the forex market for the first time since 1998 to stem the rapid decline in the domestic currency and trigger a massive sell-off around the USD/JPY pair. The strong intraday rally in the Japanese yen gives the US dollar bulls to take some profits off the table, especially after the recent strong run-up to a two-decade high. This was seen as another factor that aggravated the bearish pressure surrounding the major.

That said, a recovery in the risk sentiment, as depicted by a generally positive tone around the equity markets, should keep a lid on any further gains for the safe-haven JPY. Apart from this, a fresh leg up in the US Treasury bond yields, bolstered by a more hawkish stance adopted by the Federal Reserve, supports prospects for the emergence of some USD dip-buying. This, in turn, assists the USD/JPY pair to rebound over 100 pips from the daily low.

It is worth recalling that the Fed raised interest rates by another 75 bps on Wednesday and signalled more large rate increases at its upcoming policy meetings. In contrast, the BoJ left its policy settings unchanged and reiterated that it will continue powerful monetary easing. This marks a big divergence in the Fed-BoJ policy outlooks, which has been a key factor behind the yen's slump of over 25% against its American counterpart since the beginning of 2022.

Technical levels to watch

Japanese authorities have today intervened to sell USD/JPY for the first time since 1998. Economists at ING expect the pair to see a volatile 140-145 trading range.

Investors to be happy to buy dollars on dips near 140-141

“Clearly, investors are going to think twice about paying for USD/JPY over 145 now. And one can argue that we will now enter a volatile 140-145 trading range.”

“But expect investors to be happy to buy dollars on dips near 140-141 knowing that Tokyo will find it impossible to turn this strong dollar tide – a tide that should keep the dollar supported through the remainder of this year.”

EUR/CHF is bouncing higher. Nonetheless, the pair remains below 0.9728/17, which keeps the near-term risk lower, according to economists at Credit Suisse.

EUR/CHF set to continue the decline toward 0.9334/9293

“EUR/CHF remains below the 55-day moving average and the downtrend from mid-June at 0.9728/17, which keeps the near-term pressure still pointed to the downside.

“Support now shifts to 0.9503/00 initially and then to 0.9464, below which should support a direct move to our technical objective at a cluster of Fibonacci projection levels at 0.9334/9293.”

“Key resistance remains at 0.9728/17, which ideally holds to prevent yet another pause within the broader downtrend.”

The Bank of England hiked its Bank Rate by 50 bps to 2.25%. In the opinion of economists at TD Securities, the BoE will not do GBP any favours, reflecting the current macro mix that will invite higher inflation and lower real rates.

The BoE hiked Bank Rate by 50 bps to 2.25%

“The BoE opted for the 50 bps hike. They are inching towards more aggressive hikes, but that probably won't do GBP many favours. For starters, monetary policy tightening has advanced to dovetail with the boost to fiscal spending. In turn, the policy mix requires tighter monetary policy just to keep pace with the fiscal spending. In the short term, that will likely exacerbate inflationary conditions, leading to a drop in real rates, especially relative to the USD.”

“We continue to expect further GBP downside, especially against the USD. GBP/USD HFFV sits near 1.18, though we think the pair will continue to trade with a discount in the months ahead. That leaves us looking to fade near-term rallies ahead of 1.15.”

- EUR/USD regains some poise and bounces off 0.9800.

- The loss of this region exposes a drop to the 0.9685 level.

EUR/USD prints new cycle lows around 0.9800 and sparks a marked rebound soon afterwards.

The pair seems to have met some apparent contention in the 0.9800 neighbourhood so far. Further weakness, however, remains well in store for the time being and could force spot to challenge this zone sooner rather than later. The breakdown of this region could lead up to a visit to the October 2022 low at 0.9685.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0701.

EUR/USD daily chart

- Initial Jobless Claims in the US rose by 5,000 in the week ending September 17.

- US Dollar Index stays in negative territory below 111.00.

There were 213,000 initial jobless claims in the week ending September 17, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 208,000 (revised from 213,000) and came in better than the market expectation of 218,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 216,750, a decrease of 6,000 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending September 10 was 1,379,000, a decrease of 22,000 from the previous week's revised level," the DOL reported.

Market reaction

The greenback stays on the backfoot after this data and the US Dollar Index was last seen losing 0.5% on the day at 110.80.

Gold has confirmed a major double top. Strategists at Credit Suisse expect the yellow metal to suffer further weakness.

Break above 55-DMA at $1,734 needed to alleavite downside pressure

“Gold below $1,691/76 has confirmed a large ‘double top’, which turns the risks lower over at least the next 1-3 months, with XAU/USD also now hovering clearly below both the 55-day and 200-day averages, currently seen at $1,734/1,831.”

“We note that the next support is seen at $1,618/16, then $1,560 and eventually $1,451/40.”

“Only a convincing break above the 55-DMA at $1,734 would ease the pressure on the precious metal, with next resistance then seen at the even more important 200-DMA, currently at $1,831.”

The MoF has actioned intervention in the FX market this morning for the first time since 1998 in support of the Japanese yen. Nevertheless, economists at Rabobank continue to target USD/JPY 147.00 on a three-month view.

Divergence between Fed and BoJ policy continues to signal upside potential

“According to Vice Minister of Finance for International Affairs Kanda, the intervention was triggered by the sudden and one-sided nature of the moves in the JPY.”

“Earlier this morning the BoJ reiterated its commitment to its ultra-loose monetary policy settings. This was just hours after the Fed outlined its very hawkish policy outlook. As a consequence, it is unlikely that the MoF expects the intervention to turn USD/JPY lower. Instead, today’s action is likely aimed at slowing down the pace of gains in USD/JPY.”

“In view of our bullish USD view, we retain a three-month target of USD/JPY 147.00.”

- USD/CAD retreats around 130 pips from its highest level since July 2020 touched this Thursday.

- A sharp USD turnaround from a two-decade high turns out to be a key factor exerting pressure.

- An intraday uptick in oil prices underpins the loonie and contributes to the sharp intraday decline.

The USD/CAD pair retreats sharply from its highest level since July 2020 touched earlier this Thursday and remains on the defensive through the early North American session. The pair is currently placed near the lower end of its daily trading range, just above the 1.3400 mark, though any meaningful corrective fall still seems elusive.

The US dollar witnessed a dramatic turnaround from a fresh 20-year peak touched earlier this Thursday. Apart from this, a goodish pickup in crude oil prices underpins the commodity-linked loonie and further contributes to the USD/CAD pair's steep intraday fall of nearly 130 pips. News that the Japanese government intervened in the forex market triggers a massive rally in the Japanese yen and prompts aggressive USD long-unwinding trade.

That said, a more hawkish stance adopted by the Federal Reserve, along with growing recession fears, should act as a tailwind for the safe-haven greenback. Furthermore, worries that a deeper global economic downturn will dent fuel demand could keep a lid on any meaningful upside for the black liquid. This, in turn, supports prospects for the emergence of some buying around the USD/CAD pair, warranting caution before confirming a near-term top.

Even from a technical perspective, the overnight post-FOMC positive move confirmed a fresh bullish breakout through a multi-month-old ascending trend-channel resistance. Hence, any subsequent pullback might still be seen as a buying opportunity and is more likely to remain limited, at least for the time being.

Technical levels to watch

USD/JPY looks set for an incredibly volatile session. However, the market is still holding key support at 139.40 and analysts at Credit Suisse stay biased higher for now.

Scope for a pause

“USDJPY looks set for an aggressive bearish ‘outside day’ following the BoJ’s intervention after the market tried to push above psychological resistance at 145.00, which is becoming an increasingly important line in the sand.”

“We may see a short-term period of consolidation, however, we stay biased higher over the medium-term, with next resistance seen at confirmed trend resistance from late April at 146.80. Thereafter, our core objective remains at 147.62/153.01 – the 1998 high and 38.2% retracement of the entire 1982/2011 bear trend. It is here we would be alert to a potentially important top.”

“Key support stays at 139.42/40, which we expect to hold to keep the risks skewed directly higher.”

GBP/USD has traded at its weakest level since 1985 but pares intraday recovery gains. Still, analysts at Société Générale expect the pair to head lower towards 1.10.

Short-term resistance aligns at 1.1410

“GBP/USD recently broke the lows of 2020 denoting persistence in downtrend. That low of 1.1410 is expected to be a short-term resistance.”

“The pair is expected to head lower towards next potential supports at projections of 1.1210/1.1160 and 1.1000 representing the descending trend line connecting lows of 2016 and 2020.”

EUR/NOK is now close to the upper limit of a multiyear channel at 10.32 which is also the 76.4% retracement from June. Above here, the pair is set to enjoy further gains, economists at Société Générale report.

A short-term pullback is not ruled out

“A short-term pullback is not ruled out towards 200-DMA at 9.99/9.96. This is first layer of support.”

“Weekly MACD is attempting a cross above its trigger and entering positive territory which points towards upside.”

“Once a move beyond 10.32 materializes, an extended rebound is not ruled out.”

- DXY climbs to fresh highs near 112.00 before losing momentum.

- Further upside remains well on the cards for the dollar near term.

DXY corrects lower after two consecutive daily advances, including new 20-year highs just below the 112.00 mark earlier on Thursday.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 106.80. That said, occasional bouts of weakness could be deemed as buying opportunities with the immediate target at the 2022 high at 111.81 (September 22).

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 101.95.

DXY daily chart

- USD/CHF catches aggressive bids on Thursday and rallies over 200 pips from the daily low.

- The SNB’s 50 bps seems to have disappointed traders and weighs heavily on the Swiss franc.

- The USD trims a part of intraday retracement losses and remains supportive of the move up.

The USD/CHF pair catches aggressive bids after the Swiss National Bank announced its policy decision earlier this Thursday and continues scaling higher through the mid-European session. The momentum lifts spot prices to a fresh two-week high, though stalls ahead of the 0.9860-0.9870 supply zone tested in August and earlier this month.

The SNB hikes its policy rate by 75 bps, as was widely expected, though some market participants have been pricing in a more aggressive 100 bps increase going into the decision. This turns out to be a key factor that weighs heavily on the Swiss franc and prompts aggressive short covering around the USD/CHF pair.

The strong intraday ascent takes along some short-term trading stops placed near the 100-day SMA. A subsequent strength and acceptance above the 0.9700 mark prompt some technical buying. This, along with the emergence of some US dollar dip-buying, provides an additional lift to the USD/CHF pair and remains supportive.

The initial market reaction to the news that the Japanese government has intervened in the forex market is fading rather quickly. Apart from this, a more hawkish stance adopted by the Federal Reserve continues to act as a tailwind for the greenback. This, in turn, supports prospects for additional gains for the USD/CHF pair.

Bulls, however, might prefer to wait for a sustained strength beyond the 0.9860-0.9870 region before positioning for any further appreciating move. Next on tap will be the release of the US Weekly Initial Jobless Claims data, which might influence the USD price dynamics and provide some impetus to the USD/CHF pair.

Technical levels to watch

- USD/TRY prints new record peak around 18.40 on Thursday.

- The CBRT reduced the One-Week Repo Rate by 100 bps.

- Türkiye Consumer Confidence improved in September.

Further weakness in the Turkish lira motivated USD/TRY to advance to new all-time highs near the 18.40 yardstick on Thursday.

USD/TRY stronger post-CBRT

USD/TRY trades in the positive territory since Monday and has accentuated the upside on Thursday after the Turkish central bank (CBRT) once again surprised markets and reduced the One-Week Repo Rate by a full point to 12.00%.

In its statement, the CBRT sees the probability of a slowdown in the third quarter in response to the loss of momentum in foreign demand and reiterated that the elevated inflation is bolstered by geopolitical tensions resulting in higher energy costs, price formation that goes in contrast with economic fundamentals and higher food and commodity prices.

The CBRT keeps the medium term inflation target at 5%.

Other than the CBRT meeting, Türkiye’s Consumer Confidence improved slightly to 72.40 in September (from 72.20).

What to look for around TRY

USD/TRY picks up extra pace following another unexpected interest rate cut by the CBRT and flirts with the 18.40 region ono Thursday.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: Consumer Confidence, CBRT Interest Rate decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.34% at 18.3807 and faces the next hurdle at 18.3995 (all-time high September 22) seconded by 19.00 (round level). On the downside, a break below 17.9396 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low

- GBP/USD trims a part of its intraday gains after the BoE delivers a 50 bps rate hike on Thursday.

- The USD remains stuck below a two-decade high but continues to extend some support.

- Aggressive Fed rate hike bets act as a tailwind for the USD and should cap the upside for the pair.

The GBP/USD pair meets with fresh supply and trims a part of its strong intraday gains after the Bank of England announced its policy decision. Spot prices retreat back below the 1.1300 mark, though remain comfortably above the lowest level since 1985 touched earlier this Thursday.

As was widely expected, the UK central bank raised interest rates by 50 bps - the seventh hike since December - at the end of the September policy meeting. This, however, might have disappointed some investors anticipating a more aggressive rate increase and turned out to be a key factor acting as a headwind for the British pound.

The US dollar, on the other hand, is seen consolidating its sharp intraday retracement slide from a new two-decade high and continues to lend some support to the GBP/USD pair. The sharp USD downfall on Thursday follows the news that the Japanese government has intervened in the forex market, which triggers a massive rally in the Japanese yen.

From a technical perspective the pair has today recovered back up to the underside of an important trendline and the base of a long-term falling channel at 1.1315, drawn by connecting the May, June and July 2022 lows. This was breached by the previous day's candle on USD strength following the Fed meeting, however, today's recovery on the back of the BoE meeting announcement has seen a throwback move unfold to the underside of the channel. The prior day's close is a bearish signal and more downside is quite possible. The throwback may provide the perfect low risk entry for short sell orders as price kisses it goodbye for the last time, although a more cautious entry point would be the day's lows at 1.1210. A possible downside target at 1.1100 is the 61.8% Fibonacci extension of the move prior to breakout.

That said, a more hawkish stance adopted by the Federal Reserve should continue to lend some support to the greenback. Apart from this, a bleak outlook for the UK economy might further contribute to keeping a lid on any meaningful upside for the GBP/USD pair, warranting some caution before positioning for any meaningful recovery move in the near term.

Technical levels to watch

Following its September policy meeting, the Bank of England (BoE) announced that it raised the policy rate by 50 basis points (bps) to 2.25%. Although this decision came in line with the market expectation, futures markets were pricing in a strong chance of a 75 bps hike.

Follow our live coverage of the BoE policy announcements and the market reaction.

Key takeaways from policy statement

"MPC votes 5-4 to raise bank rate to 2.25%."

"MPC members Haskel, Mann and Ramsden voted to raise rates to 2.5%; MPC's Dhingra voted for 2%."

"MPC voted 9-0 to reduce stock of government bonds by 80 bln stg over next 12 months to 758 bln stg."

"Reduction in gilt holdings is in line with strategy announced in August."

"Inflation to peak at just under 11% in October (Aug forecast: 13.3% in Oct)."

"CPI expected to remain above 10% for a few months after Oct, before falling."

"Q3 GDP seen -0.1% QQ (Aug forecast: +0.4% QQ), second successive quarter of contraction, meets definition of technical recession."

"UK energy price guarantee will significantly limit further inflation rises, support demand relative to aug forecasts."

"MPC will respond forcefully, as necessary, to more persistent inflation pressures."

"Energy price guarantee adds to inflation pressure in medium term."

"Will assess monetary policy implications of government growth plan in nov forecasts."

"Energy price guarantee may reduce risk of persistent domestic price and wage pressures, but risk remains material."

- EUR/JPY abruptly dropped to 2-week lows near the 139.00 mark.

- Another visit to the 2022 highs beyond 145.00 is not ruled out.

EUR/JPY adds to the weekly pullback and retreats to multi-session lows near 139.00 following the BoJ-Government intervention.

The cross met initial support in the vicinity of the 139.00 neighbourhood, where the 55- and 100-day SMAs coincide. The drop, however, lacked follow through and sparked a rapid rebound to the 140.00 mark and beyond.

Against that, further recovery should not be ruled out just yet and the cross continues to target the YTD peak at 145.63 (September 12) in the relatively short-term horizon.

In the meantime, while above the 200-day SMA at 135.51, the prospects for the pair should remain constructive.

EUR/JPY daily chart

BoE Monetary Policy Decision – Overview

The Bank of England (BoE) is scheduled to announce its monetary policy decision this Thursday at 11:00 GMT and looks poised to hike rates for the seventh time since December to rein in soaring inflation. The broader consensus is that the UK central bank would raise benchmark interest rates by 50 bps. Meanwhile, UK Prime Minister Liz Truss announced an energy relief package for households and businesses, which could help slow inflation and sets the stage for a dovish pivot.

Analysts at Danske Bank offer a brief preview and explain: “We expect BoE to hike the Bank Rate by another 50 bps but acknowledge that it is a close call between 50 bps and 75 bps. We expect further 50 bps hikes in both November and December followed by 25 bps in February. Hence, we lift the end point of our projection to 3.25% (prev. 2.50%). We expect fewer hikes than priced in markets as we emphasise the rising recession risk.”

How could it affect GBP/USD?

Heading into the key event risk, the GBP/USD pair stages a goodish rebound from its lowest level since 1985 touched earlier this Thursday amid a sharp US dollar pullback from a two-decade high. A decision to frontload the rate hike and deliver a supersized 75 bps increase could prompt aggressive short-covering around the British pound. That said, any immediate

market reaction is likely to remain limited amid the looming recession risk.

Conversely, a dovish tilt should weigh heavily on sterling and set the stage for an extension of the GBP/USD pair's recent well-established bearish trend. This, along with a further escalation in the Russia-Ukraine conflict, would be enough to confirm a fresh bearish breakdown and drag the GBP/USD pair further below the 1.1200 round-figure mark.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical overview of the GBP/USD pair and writes: “The Relative Strength Index (RSI) indicator on the four-hour chart stays well below 30, pointing to extremely oversold conditions in the pair. Unless the BoE delivers a hawkish surprise as mentioned above, however, market participants are likely to ignore the technical conditions for the time being.”

Eren also outlines important technical levels to trade the GBP/USD pair: “Interim support seems to have formed at 1.1220 (static level) before 1.1200 (psychological level) and 1.1100 (psychological level). On the upside, initial resistance is located at 1.1250 (former support) ahead of 1.1300 (psychological level) and 1.1350 (static level, 20-period SMA).”

Key Notes

• BOE Interest Rate Decision Preview: GBP/USD braces for volatility storm, eyeing a 75 bps hike

• BoE Preview: Forecasts from 10 major banks, a close call between 50 bps and 75 bps

• GBP/USD Forecast: Can pound find bottom on a 75 bps BoE hike?

About the BoE interest rate decision

The BoE Interest Rate Decision is announced by the Bank of England. If the BoE is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the GBP. Likewise, if the BoE has a dovish view on the UK economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

In a press brief following the Japanese government's intervention in the forex market, Japanese Finance Minister Shunichi Suzuki said that they were concerned about excessive fx moves and noted that they cannot be overlooked, per Reuters.

Suzuki refrained from commenting on the size of the intervention and didn't comment on whether it was a solo act.

"We will take necessary steps against excessive moves," Suzuki reiterated. "We are always closely in touch with currency authorities of other countries."

Meanwhile, Japan's top currency diplomat Masato Kanda told reporters that forex action can be taken "any day, anywhere, including on holidays."

Market reaction

USD/JPY recovered modestly after these comments and was last seen trading t 142.80, where it was still down 0.85% on a daily basis.

Additional takeaways

"Fx intervention having intended effects so far."

"Decided to intervene by examining overall trend."

"Must respect Bank of Japan's independence."

"Shared view with BoJ that recent volatility, one-sided fx moves are undesirable."

"Intervention can't be tied to specific currency level, will watch overall trend."

- EUR/JPY dropped to a fresh multi-week low at 139.25 on Thursday.

- Japanese government finally intervened in the FX market.

- The pair trades deep in negative territory despite latest rebound.

EUR/JPY lost nearly 300 pips during the European trading hours and touched its lowest level in two weeks at 139.25 before staging a rebound. As of writing, the pair was trading at 140.58, where it was still down nearly 1% on a daily basis.

During the Asian trading hours, the Bank of Japan (BoJ) announced that it left the policy rate unchanged at -0.1% as expected and maintained the 10-year Japanese Government bond yield target at 0%. The BoJ's inaction caused the Japanese yen to come under selling pressure and EUR/JPY climbed to a daily high of 143.70.

In a dramatic turn of events, Japan's top currency diplomat Masato Kanda confirmed over that they have intervened in the FX market and JPY recorded impressive gains against its major rivals. With the initial reaction, USD/JPY lost 500 pips, CHF/JPY fell over 3% and GBP/JPY fell from 164.50 to a seven-week low of 159.65.

Japanese Finance Minister Shunichi Suzuki and Kanda are expected to brief reporters on the decision to intervene in the FX market at 0930 GMT.

Later in the day, the European Commission will release the preliminary Consumer Confidence data for September.

Technical levels to watch for

- Gold attracts some dip-buying near the $1,655 region, though lacks any follow-through.

- A sharp USD pullback from a two-decade high offers some support to the commodity.

- Aggressive Fed rate hike bets, a positive risk tone acts as a headwind for the XAU/USD.

Gold reverses an early European session dip to the $1,655 area and climbs to a fresh daily high in the last hour, though lacks follow-through buying. The XAU/USD is currently placed around the $1,670 region and remains confined in a familiar trading range held over the past week or so.

The US dollar witnessed a dramatic turnaround from a fresh 20-year peak touched earlier this Thursday and turns out to be a key factor lending some support to the dollar-denominated gold. The sharp USD downfall is sponsored by a massive rally in the Japanese yen that followed news that the Japanese government has intervened in the forex market. That said, a more hawkish stance adopted by the Federal Reserve could act as a tailwind for the greenback.

As was widely expected, the Fed raised interest rates by another 75 bps on Wednesday and signalled more large rate increases at its upcoming policy meetings. The Fed's so-called dot plot revealed that policymakers expect the benchmark lending rate to top 4% by the end of 2022 and further hikes in 2023, with rate cuts beginning only in 2024. This remains supportive of elevated US Treasury bond yields and caps the upside for the non-yielding gold.

Apart from this, a modest recovery in the risk sentiment - as depicted by a generally positive tone around the equity markets - might further contribute to keeping a lid on the safe-haven precious metal. From a technical perspective, the one-week-old trading range constitutes the formation of a rectangle. Given the recent decline, this might still be categorized as a bearish consolidation phase and supports prospects for a further near-term fall.

The fundamental, as well as the technical backdrop, suggests that the path of least resistance for gold is to the downside. Hence, any meaningful recovery attempt could be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Market participants now look forward to the US Weekly Initial Jobless Claims. This, along with the US bond yields and the broader risk sentiment, might provide some impetus to the commodity.

Technical levels to watch

- CHF/JPY suffered heavy losses during the European trading hours on Thursday.

- SNB hiked its policy rate by 75 bps following September policy meeting.

- Japanese government announced that they intervened in the FX market.

After having touched its highest level since 1980 above 151.00 earlier in the day, the CHF/JPY pair lost over 600 pips in the last hour. As of writing, the pair was down nearly 3% on the day at 145.00.

Earlier in the day, the Bank of Japan (BoJ) announced that it left its policy settings unchanged, keeping the policy rate steady at 0.1% and maintaining the 10-year JGB yield target at 0.00%. With the initial reaction, the JPY weakened against its rivals and allowed CHF/JPY to gather bullish momentum.

During the European trading hours, the Swiss National Bank (SNB) said that it hiked the policy rate by 75 basis points to 0.5%. Since markets have been speculating that the SNB could opt for a 100 bps hike, this decision caused the CHF to lose interest and capped CHF/JPY's upside.

SNB hikes rates by 75 bps to 0.50%, as widely expected.

Finally, Japan's top currency diplomat Masato Kanda said they have intervened in the FX market to limit JPY weakness, adding that the government “took decisive action in the forex market.”

Breaking: USD/JPY corrects sharply below 144.00 as Japan intervenes.

Combined with the SNB's smaller-than-speculated 75 bps hike, the Japanese government's intervention opened the flood gates and caused CHF/JPY to suffer one of the largest one-day declines in its history.

CHF/JPY 15-min chart

- GBP/USD comes under intense selling pressure on news of Japan’s intervention in the FX market.

- A solid intraday recovery in the British pound offers some support and helps limit the downside.

- The market focus remains glued to the crucial BoE monetary policy decision due on Thursday.

The GBP/JPY cross witnessed a dramatic intraday turnaround on Thursday and tumbles nearly 500 pips from the daily high touched during the early European session. The sharp downfall drags spot prices closer to mid-159.00s, or its lowest level since early August and is exclusively sponsored by a massive rally in the Japanese yen.

Japan's top currency diplomat Masato Kanda confirmed this Thursday that the government has intervened in the FX market, which, in turn, prompts aggressive short-covering around the JPY. This, to a larger extent, overshadows the Bank of Japan's dovish stance and turns out to be a key factor exerting heavy downward pressure on the GBP/JPY cross. It is worth recalling that the Japanese central bank decided to leave its policy settings unchanged and vowed to keep purchasing bonds so that 10-year yields remain pinned at zero.

The British pound, on the other hand, stages a solid bounce amid some repositioning trade ahead of the crucial Bank of England policy decision and a sharp US dollar pullback from a two-decade high. This offers some support to the GBP/JPY cross and assists spot prices to quickly bounce back above the 160.00 psychological mark. It, however, remains to be seen if bulls can capitalize on the attempted recovery or Thursday's steep fall marks a bearish breakdown, which might have already set the stage for a further depreciating move.

Technical levels to watch

EUR/USD recovered modestly during the European trading hours. The pair needs to reclaim 0.9880 to extend the rebound, FXStreet’s Eren Sengezer reports.

The dollar could lose interest in case US stocks rebound

“In case Wall Street's main indexes gain traction after the opening bell, the dollar could deepen its downward correction and allow EUR/USD to continue to stretch higher.”