- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- GBP/JPY climbs despite forming a head-and-shoulders chart pattern in the 4-hour chart.

- The UK and Japan were on holiday on Monday, meaning volumes would increase during Tuesday’s session.

- If the GBP/JPY clears the 164.30 mark, that will invalidate the head-and-shoulders chart pattern, paving the path for further gains.

The GBP/JPY snapped four days of consecutive losses and climbed above the 20, 50, and 100-day EMAs on Monday, gaining 0.28%, despite a risk-off impulse in the FX markets. As the Asian session begins, the GBP/JPY is trading at 163.84, above its opening price by 0.08%, at the time of writing.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart, remains neutral-to-upward biased, though it should be noted that buyers regained control, clearing resistance levels at the 20, 50, and 100-day EMAs.Furthermore, the Relative Strength Index (RSI) bounced at around the 50-midline, renewing GBP buyers’ hopes for a re-test of the YTD high. A clear break of the 164.30 would pave the way for further gains.

The GBP/JPY 4-hour chart confirms the bearish bias in the near term. A head-and-shoulders chart pattern remains in place, which, measured by the distance of the head-to-the-neckline, would target a drop from current spot prices toward 161.50. Nevertheless, during the last couple of sessions, the GBP/JPY edged towards the neckline at around 164.30, which, once cleared, would negate the pattern, opening the door for higher prices. Otherwise, the GBP/JPY first support would be the daily pivot at 163.50. Break below will expose the S1 pivot at 163.12. A breach of the latter will expose the 200-EMA at 162.93, followed by the S2 daily pivot at 162.69, ahead of the 161.50 targets.

GBP/JPY Key Technical Levels

- GBP/JPY is on the verge of overstepping the immediate hurdle of 164.00.

- The odds of widening BOE-BOJ policy divergence are supporting the pound bulls.

- Japan’s National CPI has landed higher at 3.0% vs. 2.6% as expected.

The GBP/JPY pair is on the verge of overstepping the round-level resistance of 164.00 in the early Asian session. The asset has extended its gains after delivering an upside break of the consolidation formed in a narrow range of 162.78-163.60. The risk-sensitive currency has picked significant bids as risk-on impulse rebounds and is expected to advance further.

The cross is likely to deliver a fresh rally as the Bank of England (BOE)-Bank of Japan (BOJ) policy divergence is expected to widen further. The BOE is set to announce one more 50 basis points (bps) rate hike on Thursday as a step further to fixing the inflation chaos. The recent decline in the headline Consumer Price Index (CPI) to 9.9% vs. the expectation of 10.2% and the prior release of 10.1% is not going to trim the extent of the rate hike.

The UK inflation rate is near the double-digit figure, the highest among the G-7 nations, and is also facing an energy crisis. A significant decline in the price pressures is highly required otherwise it will continue to harm the confidence of the households, which are already forced to make higher payouts.

On the Tokyo front, the BOJ officials are worried over the prolonged depreciation of the Japanese yen and are expected to shift their stance this time. A prolonged ultra-dovish stance will conclude and the BOJ will approach the ‘neutral’ stance. But that does not warrant a drop in the BOE-BOJ policy divergence.

Meanwhile, the Statistics Bureau of Japan has reported the National CPI at 3%, higher than the forecasts and the prior release of 2.6%. Also, the core CPI that excludes food and oil prices has improved to 1.6% that the former figure of 1.2% but remained lower than the expectations of 1.7%.

- Silver price grinds higher as buyers attack short-term key hurdle amid impending bullish moving average cross.

- Sustained bounce off 38.2% Fibonacci retracement, firmer RSI keep buyers hopeful.

- 61.8% Fibonacci retracement level, monthly high also tests further upside.

Silver price (XAG/USD) seesaws around $19.50 as buyers attack immediate resistance amid a looming bullish crossover during Tuesday’s Asian session. In doing so, the metal prices defend the previous day’s rebound from the 200-SMA while trying to keep buyers hopeful.

Successful trading beyond the key SMAs join firmer RSI (14), not overbought, to favor XAG/USD bulls as they attack one-week-old resistance around $19.60 by the press time.

As the 50-SMA inches closer to piercing the 200-SMA from below, the bulls are bracing for an upside past the immediate resistance. However, the monthly high near the $20.00 psychological magnet will be an extra challenge for the silver buyers to tackle before retaking control.

Following that, the previous monthly peak surrounding $20.90 and the $21.00 threshold will be in focus.

Alternatively, pullback moves need not only decline below the 200-SMA level surrounding $19.30 but should also remain below the $19.20 support comprising the 50-SMA to tease XAG/USD sellers.

Even so, the 38.2% Fibonacci retracement level of the August-September downside, near $18.80, could challenge the silver price downside.

Silver: Four-hour chart

Trend: Further upside expected

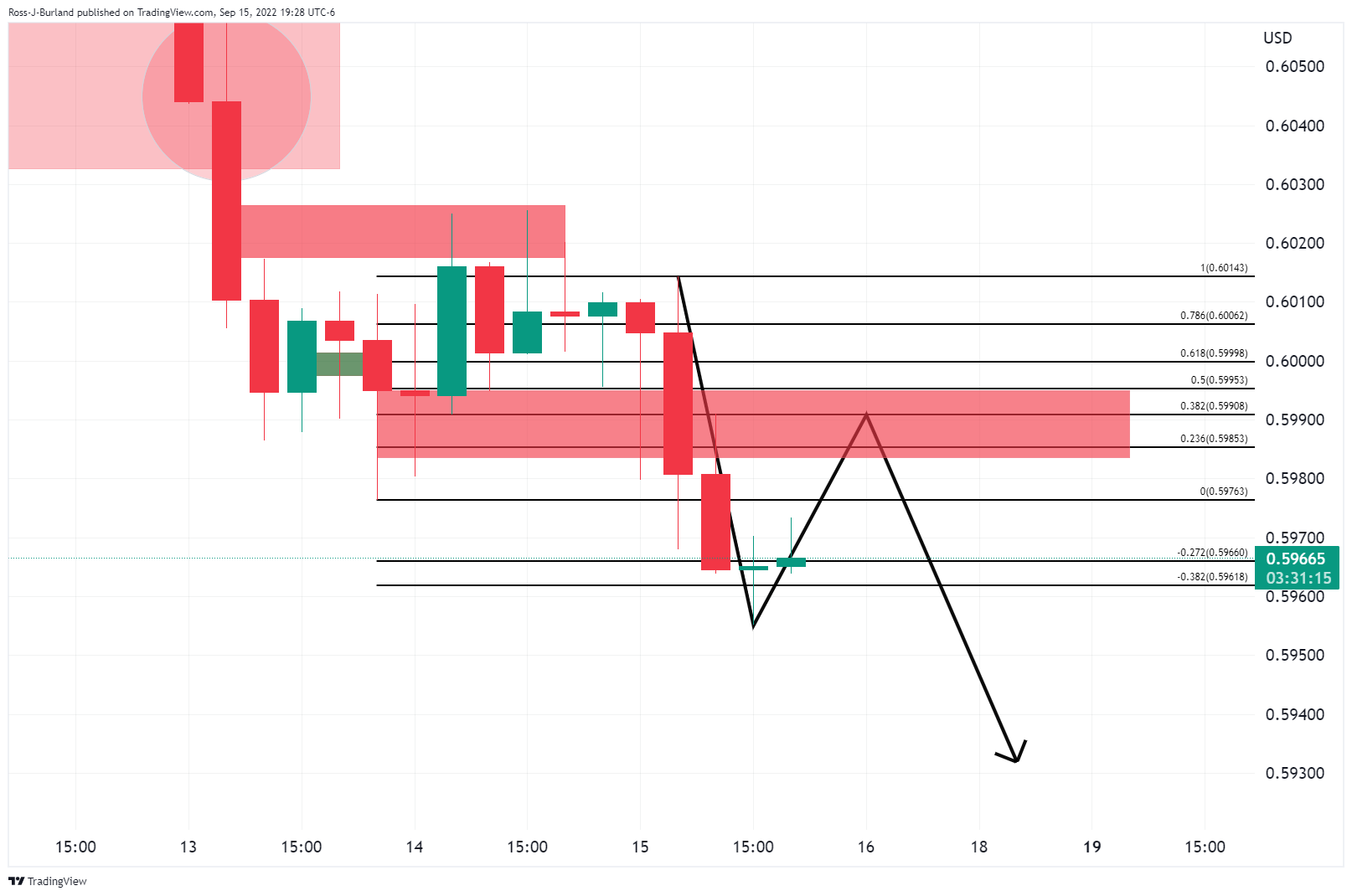

- NZD/USD bulls take on the offers around the 50% mark.

- 61.8% ratio has a confluence with a structure that could be the last defense ahead of a significant push from the bulls to challenge the prior swing highs.

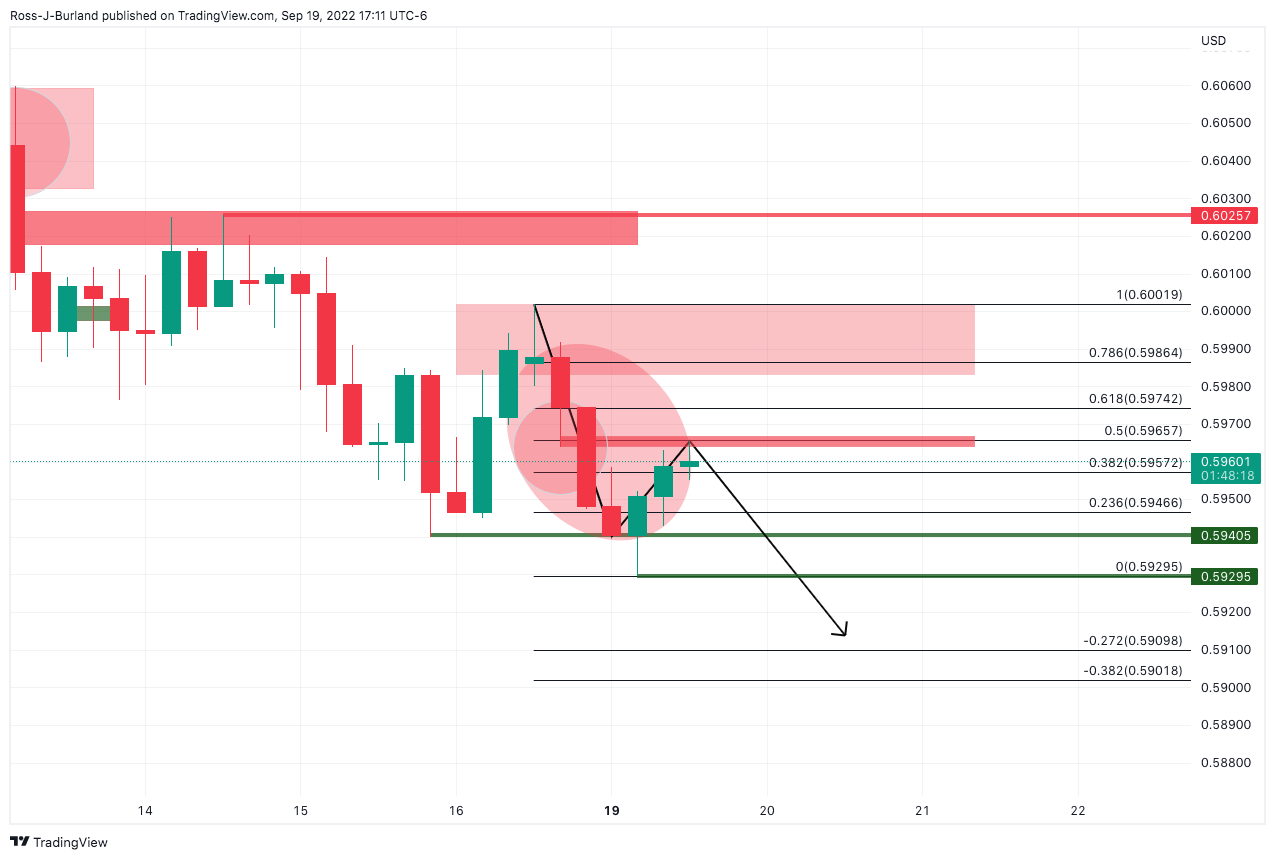

The Kiwi is correcting from a key support area following a solid move to the downside and rejection from a critical resistance. As per the prior analysis, NZD/USD Price Analysis: Bulls take control ahead of the Fed, but bears could pounce, the bears moved in and the following illustrates prospects for a downside continuation.

NZD/USD H4 prior analysis

NZD/USD updates

The 4-hour chart sees the price rejected at a prior low in a creeping correction to the 50% mean reversion mark. Should resistances start to play in, there will be prospects for a downside continuation for the week ahead.

The hourly chart is attempting to take on the offers around the 50% mark in the latest move from support. Beyond the 50% mark, the 61.8% ratio has a confluence with a structure that could be the last defense ahead of a significant push from the bulls to challenge the prior swing highs.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, dropped for the third consecutive day as traders await the key central bank decisions, including those from the Federal Open Market Committee (FOMC). That said, the aforementioned inflation cursor dropped to the lowest levels since late July, to 2.34%by the end of Monday’s North American trading session.

More importantly, the 5-year breakeven inflation rate per the FRED data dropped to the lowest levels since September 2021, at 2.44% at the latest. The same raised concerns about the market’s surprise reaction to the hawkish Fed bets.

Given the slump in the US inflation expectations, the fears of a short squeeze in the EUR/USD gain major attention and help the EUR/USD prices to remain firmer. “If Fed rhetoric after Wednesday's meeting were to reinforce signals from swaps and consumers, U.S. rates and the dollar should weaken, which would likely drive a big EUR/USD short squeeze,” said Reuters.

Also read: EUR/USD steadies above parity as traders await ECB’s Lagarde, Fed

- USD/CHF has sensed a sigh of relief after declining to near 0.9640 as DXY loses steam.

- The Fed should come out with an ‘out of the box’ solution to cool off the red-hot inflation sooner.

- A 75 bps rate hike by the SNB will push the interest rates to a positive zone after a period of 10 years.

The USD/CHF pair is attempting to build a base of around 0.9640 in the early Asian session. Earlier, the asset witnessed a steep fall after failing to strike the round-level resistance of 0.9700. The correction in the asset ensures the unavailability of sheer momentum and will conclude sooner. A lackluster performance is expected from the asset ahead as investors will await the announcement of the monetary policies for making informed decisions.

Recent events clear the responsiveness of change in the inflation rate is not desired as per the change in the interest rates by the Federal Reserve (Fed). The current pace of hiking interest rates by the Fed is extremely high and disappointment with the resulting outcome will force the Fed either to come out with an ‘out of the box’ solution or scale up the current pace to bring price stability sooner and the overall demand could accelerate further.

So expectations of a full percent rate hike by the Fed cannot be ruled out as the Fed will deploy its entire chaos to achieve its foremost priority. For a longer-term perspective, the Financial Times has come forward with an interest rate target of 4-5% in 2023, which will sustain beyond 2023 and only a series of slowdowns in price pressures will compel the Fed to turn ‘neutral’.

On the Swiss franc front, the interest rate decision from the Swiss National Bank (SNB) will also hog the limelight. The inflation rate in the Swiss region is rising at a modest pace and has landed at 3.5% in August 2022. Considering the market consensus, SNB Chairman Thomas J. Jordan will announce a rate hike by 75 basis points (bps), which will push the interest rates into the positive territory to 0.5%. The SNB interest rates will enter positive territory after a period of 10 years.

- USD/CAD justifies bearish candlestick formation, bullish channel rejection at multi-day high.

- Downbeat MACD, RSI conditions also keep sellers hopeful to test the key HMAs.

- Recovery moves need validation from the recent high to convince bulls.

USD/CAD remains pressured around 1.3345 after reversing from the 22-month high the previous day. In doing so, the Loonie pair justifies the bearish candlestick formation at the multi-day top, as well as a rejection of the previously bullish chart formation, during Tuesday’s Asian session.

Given the RSI and the MACD both support the latest weakness in the USD/CAD prices, the quote is likely to witness further downside.

However, 100-HMA and 200-HMA, respectively around 1.3225 and 1.3135, could challenge the pair sellers before directing them to the 1.3000 psychological magnet.

Even if the quote remains below the 1.3000 mark, the monthly low near 1.2950-55 will act as the final defense for the USD/CAD bulls.

Alternatively, recovery moves may initially aim for the one-week-old bullish channel’s support line, now resistance near 1.3300.

Following that, the top of the “Gravestone Doji”, near 1.3380, will be crucial as an upside break which could reject the bearish signals flashed by the candlestick at the multi-day top. In that case, October 2020 peak surrounding 1.3390 will be in focus.

USD/CAD: Hourly chart

Trend: Further weakness expected

- The EUR/JPY approaches the top of the 142.50-143.60 range, eyeing a break that could bolster the cross toward 145.00.

- Short term, the EUR/JPY is neutral biased, but recent verbal Intervention by Japanese authorities in the last week bolstered the yen.

On Monday, the EUR/JPY erased last Friday’s losses, though remained trading subdued, amidst an upbeat Wall Street session, with most US equities finishing the day in the green. At the time of writing, the EUR/JPY is trading at 143.62, above the opening price by 0.06%, as the Asian session begins.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY continues to trade within the 142.50-143.60 range for the third consecutive trading session. Even though buyers reclaimed control, they need a clear break above the top of the range to challenge the psychological 144.00 figure. If that scenario plays out, EUR/JPY traders should be aware that the Relative Strength Index (RSI) exited overbought conditions, with readings of 64, aiming upwards, meaning that the upward move might be capped nearby the YTD highs at 145.63

Short term, the cross-currency pair remains neutral. Even though most of the EMAs reside below the exchange rate, price action in the last three days consolidated to a narrow range, forming a bearish rectangle after the EUR/JPY reached the YTD high at 145.63. Therefore, the EUR/JPY could be headed to the downside, bolstered by technical factors and Japanese authorities’ verbal intervention in the FX markets.

Therefore, the EUR/JPY first support would be the 20-EMA at 143.17. Break below will immediately expose the S1 pivot at 143.00, followed by the S2 daily pivot at 142-49.

EUR/JPY Key Technical Levels

- EUR/USD remains sidelined after witnessing a sluggish start to the key week.

- Economic fears surrounding Eurozone join hawkish Fed bets and Sino-American tension to keep bears hopeful.

- Pre-Fed consolidation of stocks join downbeat US housing data to weigh on DXY, despite firmer yields.

- Second-tier US data, risk catalysts will be in focus ahead of the FOMC.

EUR/USD dribbles around 1.0030 during Tuesday’s Asian session, after witnessing a four-day uptrend, as markets brace for the key central bank events. In doing so, the major currency pair fails to justify the economic fears at home, as well as geopolitical tensions emanating from China and Russia.

Downbeat US housing market numbers and a mostly priced-in 75 basis points (bps) rate hike from the Fed appear to help the EUR/USD pair amid a light calendar and an absence of the UK and Japan. Also keeping the pair buyers hopeful were firmer equities and inflation concerns.

Elsewhere, Reuters mentioned the correlation between the US 5-year/5-year inflation-linked swaps and the March 2023 Eurodollar prices, a key gauge of terminal Fed rate expectations until early Q2, to suggest the fear of a short squeeze. “If Fed rhetoric after Wednesday's meeting were to reinforce signals from swaps and consumers, U.S. rates and the dollar should weaken, which would likely drive a big EUR/USD short squeeze,” said Reuters.

Also positive could be the EU policymakers’ readiness to use emergency powers to avoid a supply crisis. Reuters reports after obtaining the European Union (EU) draft rules. “Under draft rules, the EU is to ask companies to accept priority rated orders for critical products.”

On the same line, European Central Bank (ECB) Vice President Luis de Guindos said on Monday that “growth slowdown is not enough to ease inflation.”

Furthermore, US Dollar Index (DXY) started Monday on a positive footing before downbeat US housing data and hawkish Fed bets raised doubts on the upside gap available for the greenback to react to the Fed’s 0.75% rate hike, which is mostly priced in. That said, the NAHB Housing Market Index fell for a ninth consecutive month to 46 versus 48 expected and 49 prior.

Alternatively, the Bundesbank said on Monday that it expects the German economy to shrink markedly in the autumn and winter months amid reduced or rationed energy consumption, as reported by Reuters.

Further, US President Biden said, “I'm more optimistic than I have been in a long time.” The national leader also stated that they are going to get control of inflation. However, US President Biden’s readiness to back Taiwan in case China attacks Taipei and the hawkish hopes for the Fed seemed to weigh on the EUR/USD price ahead of the key monetary policy announcements. In a response to US President Biden’s comments, China’s Foreign Ministry said on Monday that Beijing “deplores and firmly opposes this and has lodged stern representations.”

Against this backdrop, Wall Street closed positive and the US Treasury yields refreshed cycle tops but the DXY remains pressured.

Looking forward, a few more US housing data and comments from ECB President Christine will entertain the EUR/USD traders ahead of the key Wednesday. Should ECB’s Lagarde choose to remain hawkish, the pair may witness further upside while preparing the ground for bears.

Technical analysis

Gradually firmer RSI and MACD signals keep buyers hopeful to overcome the 50-SMA immediate hurdle surrounding 1.0035, after witnessing multiple defeats to cross the same in the last week. If not, then the 0.9945 support holds the key to the EUR/USD pair’s fresh downside.

- A double bottom formation has resulted in a firmer rebound in the asset.

- The RSI (14) is on the verge of shifting into the bullish range of 60.00-80.00.

- A slippage below the two-year low at 1.1350 will drag the cable into unchartered territory.

The GBP/USD pair has witnessed a firmer rebound after defending its two-year low at 1.1350, recorded last week. The cable has extended its gains after overstepping the round-level resistance of 1.1400 and has reached its critical hurdle of 1.1440. The rebound move seems full of confidence and is expected to stay in bullish territory for a while, however, the broader picture is extremely brutal.

On an hourly scale, the asset has rebounded after forming a Double Bottom around a two-year low at 1.1350. A re-test of potential lows with lower selling pressure and absorption of the same with higher buying interest pushed the asset higher.

It is worth noting that the cable has crossed the 20-and 50-period Exponential Moving Averages (EMAs) at 1.1413 and 1.1426 respectively while the 50-EMA is still above the shorter one. This signals the strength of the pound bulls.

Also, the Relative Strength Index (RSI) (14) is on the verge of shifting into the bullish range of 60.00-80.00, which will trigger pound bulls for sheer upside momentum.

Should the asset drop below the fresh two-year low at 1.1350, greenback bulls will drag the cable towards the round-levels support of 1.1300. A slippage below the latter will drag the asset towards the 7 January 1985 low at 1.1245.

On the flip side, a break above Friday’s high at 1.1480 will send the asset towards Thursday’s high at 1.1542, followed by the round-level resistance at 1.1600.

GBP/USD hourly chart

-637992237217156235.png)

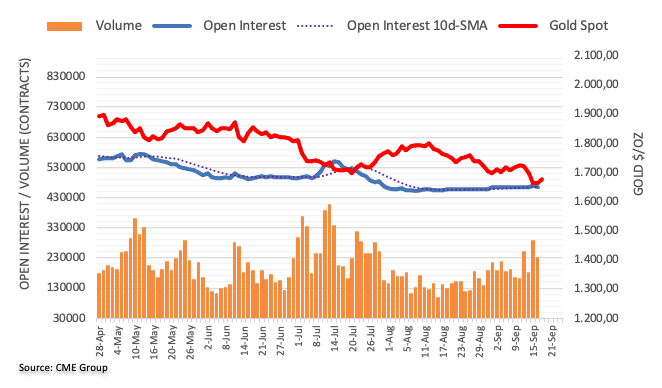

- Gold price begins the key week in a cautious mode, keeping the bounce off yearly low.

- Yields, stocks improved but DXY pares previous gains.

- Absence of Japan, UK joined light calendar to restrict market moves but Fed hawks remained unmoved.

- Pre-Fed anxiety to keep XAU/USD on a dicey ground but US dollar pullback may entertain countertrend traders.

Gold price (XAU/USD) holds onto the recent rebound from the yearly low of around $1,675 as traders brace for major central bank decisions. In addition to the pre-event cautious, a light calendar and quiet macro also contribute to the metal’s inaction during the early Tuesday morning in Asia.

The market began the key week comprising multiple central bank announcements in a dicey mode amid a lack of major updates and bank holidays in Japan and the UK. Also keeping the bullion traders cautious were mixed updates surrounding China and the US dollar’s sluggish performance before Wednesday’s Federal Open Market Committee (FOMC).

The US Dollar Index (DXY) started Monday on a positive footing before downbeat US housing data and hawkish Fed bets raised doubts on the upside gap available for the greenback to react to the Fed’s 0.75% rate hike, which is mostly priced in. That said, the NAHB Housing Market Index fell for a ninth consecutive month to 46 versus 48 expected and 49 prior.

US President Biden said, “I'm more optimistic than I have been in a long time.” The national leader also stated that they are going to get control of inflation. However, US President Biden’s readiness to back Taiwan in case China attacks Taipei and the hawkish hopes for the Fed seemed to weigh on the gold price ahead of the key monetary policy announcements. In a response to US President Biden’s comments, China’s Foreign Ministry said on Monday that Beijing “deplores and firmly opposes this and has lodged stern representations.”

Elsewhere, upbeat covid updates from China, as it unlocked Dalian and Chengdu cities while witnessing zero coronavirus cases in Beijing and one, versus zero the previous day, outside Shanghai’s quarantine zone, favored the risk appetite. China’s Premier Li Keqiang told the state media on Monday that the Chinese economy maintains a recovering trend overall, as reported by Reuters. Earlier on Monday, China’s State Planner, National Development and Reform Commission said, “Foundation of domestic economic recovery is still weak despite positive changes in main economic indicators.”

Amid these plays, Wall Street closed positive and the US Treasury yields refreshed cycle tops but the DXY remains pressured.

Moving on, a few more US housing data and the full markets will entertain the XAU/USD traders ahead of the key Wednesday. Given the already priced-in Fed rate hike, the gold price may witness a recovery in case the FOMC fails to provide any major hawkish reason to back the monetary policy tightening.

Technical analysis

Gold justifies the upside break of a four-day-old descending resistance line, now support around $1,670, to aim for the support-turned-resistance line from September 01, around $1,698 by the press time. Also acting as an upside filter is the 200-HMA hurdle surrounding the $1,700 threshold.

It’s worth noting that the RSI (14) is speedily approaching the overbought territory and the metal’s upside past the $1,700 threshold appears difficult.

That said, a pullback move below the $1,670 previous support could quickly fetch the XAU/USD price towards the recently flashed yearly low surrounding $1,655.

In a case where the gold price remains bearish past $1,655, the April 2020 low surrounding $1,570 will gain the market’s attention.

Gold: Hourly chart

Trend: Limited upside expected

- AUD/USD is scaling higher towards 0.6750 as the negative market sentiment has trimmed.

- The Fed looks to announce a surprise hike by a full percent to fix the inflation chaos.

- A detailed version of the RBA monetary policy will support investors in making informed decisions.

The AUD/USD pair is hovering around the critical hurdle of 0.6730 in the early Tokyo session. The asset is advancing towards the crucial resistance of 0.6750 as the risk-on profile accelerates. On Monday, the asset witnessed a firmer rebound after defending the novel two-year low at 0.6670, recorded last week.

The asset displayed a firmer rebound after the US dollar index (DXY) witnessed a steep fall while attempting to recapture the two-decade low at 110.79. The DXY slipped despite the soaring odds of an extreme hawkish stance on interest rates by the Federal Reserve (Fed). The monetary policy meeting is scheduled for September 22 and investors are expecting a third consecutive rate hike by 75 basis points (bps). An occurrence of the same will push the interest rates to 3.00-3.25%.

The DXY has surrendered the majority of its gains but that doesn’t warrant a bearish reversal as investors are also expecting a surprise rate hike with a higher-than-expected extent. Considering the stubbornness in the price pressures, a rate hike by a full percent could be announced. The Fed has room to take a bold decision amid a supportive labor market and robust retail demand.

On the Aussie front, investors are awaiting the release of the Reserve Bank of Australia (RBA) minutes, which will provide the ideology of RBA Governor Philip Lowe behind announcing the fourth consecutive rate hike. Also, a detailed version of the economic situation of Australia and its economic catalysts such as growth rate, trade activities, and demand pattern will be of utmost importance.

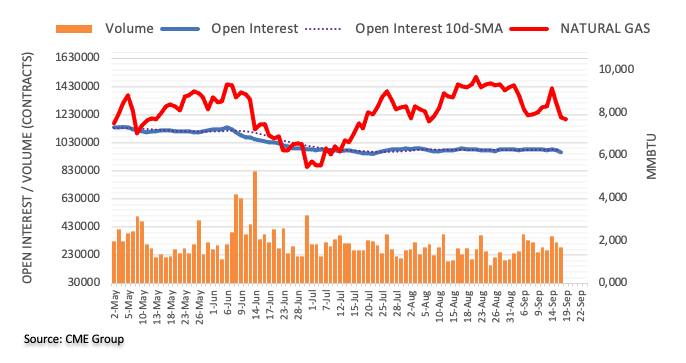

- West Texas Intermediate is up on the day with eyes on the Fed.

- US will sell 10 million bbls of oil from its strategic reserve.

West Texas Intermediate is up 0.11% on the day and has traded between $82.11 and $86.21bbls so far. The black gold was reversing early offers that lead to the lows even as the US dollar bulls moved in as markets remain in anticipation of the Federal Reserve and a slew of other central banks that meet this week.

Fed funds futures have priced in a 79% chance of a 75-basis-point rate hike this week and a 21% probability of a 100-basis-point increase at the conclusion of the Fed committee's two-day policy meeting. However, some observers argue that the central bank could move to raise rates by a full percentage point after August inflation ran hotter than expected. With the combination of the worries, major economies will tip into recession, oil could see less demand at the same time the US dollar picks up a safe haven bid that is already close to its 20-year high as per the DXY index.

Nevertheless, China lifted a two-week lockdown on the 21-million citizens of Chengdu, returning normal activity to the Sichuan capital, which could be a contributing factor to the rise in oil prices at the start of the week. On the other hand, there was also news that the US will sell 10 million bbls of oil from its strategic reserve for delivery in November, the Department of Energy said on Monday.

''Markets are increasingly skeptical about the prospects for an immediate resolution on the Iran file as well, which translates into a resurgence in energy supply risks despite the ongoing slump in prices. As markets reprice supply risk premia, the lack of liquidity could also exacerbate upside volatility in crude,'' analysts at TD Securities said.

- NZD/USD dropped close to 0.60%, spurred by a risk-off impulse in the FX complex.

- Investors remain at bay as worries about an aggressive Fed increased.

- Higher US Treasury bond yields weighed on the NZD/USD.

The NZD/USD tumbles to a fresh year-to-date low at 0.5929 during the North American session, as Wall Street finished positive, ahead of Fed’s decision on Wednesday. Factors like an aggressive tightening cycle by the Federal Reserve, threatening to spur a US recession, keep investors on their toes.

As the North American session finishes, the NZD/USD is edging lower after hitting a daily high at 0.6002US trading at 0.5955, below its opening price by 0.57%.

Late in the New York session, sentiment improved. The lack of US economic data maintained market participants awaiting Fed’s decision on Wednesday, where Chair Powell and Co. are expected to raise rates by 75 bps. Even though US equities rose, US Treasury bond yields, mainly the 10-year benchmark note, increased to 3.494%.

Data-wise, the US NAHB housing market index fell for the ninth straight month, signaling a deceleration in the housing market. At 46, the index is well off its post-pandemic high, portraying the influence of higher interest rates.

Aside from this, the New Zealand docket featured the Performance of Services Index (PSI), which rose sharply by 58.6, exceeding estimates and the previous month’s reading. According to the report, significant gains were witnessed in new activity/sales and order/business.

What to watch

An absent New Zealand economic docket will leave traders leaning on US data. The US calendar will reveal Building Permits alongside Housing Starts

NZD/USD Key Technical Levels

- EUR/USD bulls encroach on key resistances.

- Bears are lurking and eye a downside extension.

EUR/USD is attempting to pull out of a phase of consolidation following a drop from close to 1.02 the figure at the start of last week. However, the price may find resistance in the coming sessions if the bulls stay on the collision course for a deep-rooted trendline. The following analysis illustrates a downside bias for the days ahead.

EUR/USD H1 chart

The hourly chart hs the price attempting a break of horizontal resistance but a break of trendline support would be expected to see the price turn quickly to the downside again and back within the sideways channel.

EUR/USD daily charts

EUR/USD is correcting in a creeping trend on the daily charts within the bearish cycle and below trendline resistance. A 50% mean reversion will bring the price into close proximity to the resistance and failures will bring the lows back into focus with prospects of a downside extension of the broader bear trend.

What you need to take care of on Tuesday, September 20:

The week started in slow motion amid a scarce macroeconomic calendar, a holiday in the UK, and multiple central banks’ announcements scheduled for later in the week.

The dollar appreciated throughout the first half of the day but gave up in the American session, ending the day with modest losses against most of its major rivals. The currency moved alongside the markets’ sentiment, the latter set by equities. Asian and European indexes closed in the red, but Wall Street shrugged off the negative tone and trimmed most of its early losses.

Financial markets will likely remain in wait-and-see ahead of central banks’ decisions. This week, over fifteen institutions are set to decide between Wednesday and Thursday, including the US Federal Reserve, the Bank of England, the Bank of Japan, and the Switzerland National Bank. Massive quantitative tightening will be announced in the upcoming days, regardless of the potential effects on economic growth.

Meanwhile, Russia and China agreed to extend their cooperation on defense, focusing on joint exercises and weighing on the market’s mood.

Asian and European indexes closed in the red on Monday, but Wall Street trimmed most of its losses, with major indexes ending the day mixed. US Treasury yields maintained the upward pressure, with the near-term bonds yielding the most.

The EUR/USD pair trades around 1.0020, while GBP/USD hovers around 1.1430. The AUD/USD pair currently trades at 0.6725, while USD/CAD is down to 1.3255. Finally, the USD/JPY pair remained stable and changes hands at 143.20.

Commodities fell at the beginning of the day but finished it flat, with gold trading at $1,674 a troy ounce and WTI at $84.90 a barrel at the end of the American session.

Early on Tuesday, the focus will be on the RBA Meeting Minutes. Market players will be looking for clues on future rate hikes.

Ethereum Price Prediction: A dangerous knife to catch

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bulls come up for air in the face of a softer US dollar in NY.

- The focus for the week is on the Fed and BoE.

GBP/USD is back to trading flat on the day as the bulls move in from the lows of 1.1355, taking on the 1.14 area again. The greenback is a touch softer on the US session in some two-way business while traders remain in anticipation of the Federal Reserve and Bank of England meetings this week.

The sentiment surrounding surging inflation and tighter monetary policy continues to run the show, favoring the US dollar more so as the UK economy fares poorly vs. the US economy. The greenback remains close to two-decade highs as per the US dollar index DXY which measures the currency against six counterparts. DXY was up at 110.18 the high on Monday, not far from 20-year high of 110.79 hit on September. 7.

Risk-off sentiment is also contributing to a higher US dollar in the face of the aggressive tightening path that global banks are on as they try to contain uncomfortably high inflation. A slew of central banks will meet this week and Fed funds futures have priced in a 79% chance of a 75-basis-point rate hike this week and a 21% probability of a 100-basis-point increase at the conclusion of the Fed committee's two-day policy meeting. Meanwhile, the BoE is expected to raise rates by either 50bps and 75bps.

''We look for the BoE to deliver a 75bps hike, although the decision will likely be closely balanced between 50 and 75bps,'' analysts at TD Securities said.

''While headline inflation recently fell to match the MPC's latest forecast, red-hot wage growth and record low unemployment argue in favor of a 75bps increase. We also expect the MPC to approve the start of asset sales at a pace of £10bn per quarter.''

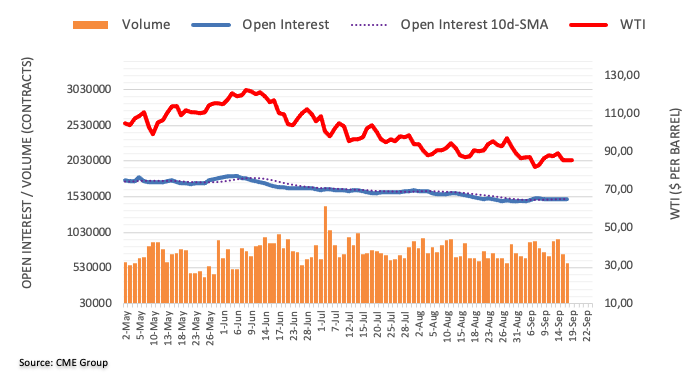

- Despite a firmer dollar, technically, gold bulls are eyeing the prospects of a move toward the prior lows in a 50% mean reversion.

- The focus remains on the global central banks as the US dollar and Treasury yields continue to dictate the show

The gold price came under some pressure at the start of the week, down some 0.20% after falling from a high of $1679 to a low of $1,659 on the day and near a 29-month low scored on Friday. The US dollar and Treasury yields continue to dictate the show as traders remain in anticipation of the Federal Reserve this week and expect the US central bank to deliver a steep interest rate hike when it meets this week.

The sentiment surrounding surging inflation and tighter monetary policy continues to strip the opportunity cost of holding zero-yield precious metals. At the same time, the greenback remains close to two-decade highs, making greenback-priced bullion more expensive for overseas buyers. The dollar index DXY which measures the currency against six counterparts, was up 0.4% at 109.98, not far from 20-year high of 110.79 hit on September. 7.

Risk-off sentiment is also contributing to a higher US dollar in the face of the aggressive tightening path that global banks are on as they try to contain uncomfortably high inflation. A slew of central banks will meet this week and Fed funds futures have priced in a 79% chance of a 75-basis-point rate hike this week and a 21% probability of a 100-basis-point increase at the conclusion of the Fed committee's two-day policy meeting.

Meanwhile, analysts at TD Securities said they ''expect continued outflows from money managers and ETF holdings to weigh on prices, which ultimately raises the probability of a pending capitulation from the small number of family offices and proprietary trading shops who hold complacent length in gold.''

''The persistence of inflation continues to support an aggressive effort by the Fed, and we now expect the FMOC to raise the target rate by 75bp at its meeting next week, deliver another 75bp hike in November, and hike a further 50bp in December. In this context, while prices are certainly weak, precious metals' price action could still have further to fall as the restrictive rates regime is set to last for longer.''

Gold Monthly chart

Gold is on the verge of a key breakout as per the monthly chart above However, if the bulls move in before the month is out, we could be looking at an equally significant recovery and a correction that brings up the following prior lows into focus as potential resistances:

Gold, daily chart

From a daily perspective, the M-formation is laying out with bulls moving in and eyeing the prospects of a move toward the prior lows in a 50% mean reversion.

- The EUR/GBP advances 0.11% during Monday’s North American session.

- Medium-term, as shown by the EUR/GBP daily chart, the pair is upward biased.

- Negative divergence in the 4-hour scale, to tumble the EUR/GBP towards the 0.8700 figure.

The EUR/GBP edges up during the North American session, reaching a fresh YTD high at around 0.8787 but retreated towards the 0.8760s mark, forming a doji, meaning that buyers/sellers are at an equilibrium point. At the time of writing, the EUR/GBP is trading at 0.8767, up by 0.10%.

EUR/GBP Price Analysis: Technical outlook

From a daily chart perspective, the EUR/GBP is upward biased, but as the Relative Strength Index (RSI) gets into overbought territory, it might open the door for some consolidation. Additionally, it’s worth noting that there is a negative divergence between price action and the RSI, suggesting that the cross-currency might drop towards the 0.8700 figure or below before resuming its uptrend.

In the near term, the EUR/GBP four-hour scale portrays a divergence, with price action registering higher highs, contrary to RSI’s printing lower highs, meaning that sellers are gathering momentum. Hence, the EUR/GBP in the short term is downward biased.

Therefore, the EUR/GBP first support is the daily pivot of 0.8752. Break below will expose the confluence of the 20-EMA and the S1 daily pivot at the 0.8719/24 range, followed by the 50-EMA at 0.8696, ahead of the S2 daily pivot at 0.8680.

EUR/GBP Key Technical Levels

- The AUD/USD begins the week on the right foot, slightly up by 0.12%.

- On Wednesday, the US Federal Reserve is expected to hike 75 bps, but there’s a slim chance of a 100 bps.

- The Aussie economic docket will feature the RBA minutes ahead of the Fed’s decision.

The AUD/USD climbs during the North American session, above its opening price by 0.12%, as sentiment fluctuates between risk-off/on, courtesy of increasing recession fears in the US spurred by an aggressive Federal Reserve. At the time of writing, the AUD/USD is trading at 0.6713.

Of late, US equities are fluctuating as investors prepare for the Fed’s decision on Wednesday. At the same meeting, policymakers are expected to update their forecasts regarding interest rates, unemployment, and US GDP growth. AUD/USD traders should be aware that it will include projections for 2025.

AUD/USD gains some ground ahead of the RBA minutes and Fed’s decision

The Federal Reserve Open Market Committee (FOMC) is expected to raise rates by 75 bps, to the 3-3.25% threshold, amidst an environment of headline inflation above 8%, below the YTD peak around 9%, while core CPI it’s getting higher, at around 7%.

Reflection of the above-mentioned is higher US Treasury bond yields, with the 10-year benchmark note rate gaining almost three bps at 3.473%, underpinning the greenback, which, as portrayed by the US Dollar Index, gains 0.10% at 109.754.

Aside from this, in the Asian session, the Reserve Bank of Australia (RBA) head of domestic markets Jonathan Kearns said that “higher interest rates reduce borrowing capacity and increase loan repayments,” meaning that increasing borrowing costs would trigger a decline in the housing market.

In the meantime, RBA Governor Philip Lowe last week opened the door for a less aggressive monetary policy at “some point,” putting 25 bps rate hikes in play for the October monetary policy meeting.

Analysts at TD Securities expect the RBA to hike 50 bps in October while “retaining 25bps hikes for the Nov, Dec and Feb ’23 meetings, taking our terminal cash forecast from 3.35% to 3.60%.”

The Aussie calendar will feature the RBA minutes on Tuesday, and the RBA’s Governor Michele Bullock will cross newswires on Wednesday. On the US front, the FOMC will unveil its monetary decision on Wednesday, alongside the press conference of Chair Jerome Powell, 30 minutes after the decision.

AUD/USD Key Technical Levels

Analysts from TD Securities see the USD/CAD pair moving to the upside and they have an idea of buying the pair at levels near 1.3300 with a target at 1.3500 and a stop-loss at 1.3180.

Key Quotes:

“The debt party that has supported the last two major expansions is over and the CAD will need to act as a relief valve for the macro imbalances that exist in the household sector as rates push higher. We project a record rise in household debt servicing ratios by year-end. That should prevent the BOC from keeping up with the Fed. Our estimate of the Fed's terminal rate is well above 4%.

“We believe the BOC has neared theirs. We expect Canada's debt problem and higher rates to kick off a data domino into Q4. There is nothing to like about the CAD at this time; it is the worst-ranked currency on our scorecard with almost all macro drivers leaning in the negative.”

“With global PMIs weakening, it will be difficult for the CAD to rally. We are also wary that a 'Volcker' kind of messaging emerges at the Fed, hampering the CAD. Key USDCAD support in 1.3200/1.3230 as it marks a break of triple top.”

The USD/BRL is falling on Monday after posting last Friday, the highest daily close since early August. Analysts at Rabobank see the USD/BRL pair at 5.30 by the end of the year.

Key Quotes:

“We still believe the Fed will remain hawkish, the USD will remain holding its safe haven status, and domestically the traditional electoral cycle will weigh on local assets. We still see the USDBRL at 5.30 by end-22.”

“Coming up next, all eyes are on the Copom (Wed). The decision comes right after the FOMC’s one, and we foresee the Brazilian monetary authority announcing a hawkish pause (0bp) to the hiking cycle that brought the Selic rate from 2.00% in February 2021 to 13.75% in the August 2022 meeting.”

- USD/JPY fluctuates around 143.00 amid a negative market sentiment, spurred by recession fears on Fed’s aggressive tightening path.

- The USD/JPY daily chart portrays buyers in control, but price action remains constrained.

- Short term, the USD/JPY is range-bound, trapped in the 142.60-143.60 range.

The USD/JPY seesaws around 24-year highs above the 143.00 psychological level, for the third consecutive trading session, amidst a risk-off impulse, courtesy of fears that the Fed’s aggression would likely tip the US economy into a recession. At the time of writing, the USD/JPY is trading at 143.24, above its opening price by 0.24%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart keeps illustrating that buyers are in charge, albeit price action remains subdued. The daily moving averages (DMAs) reside below the exchange rate, while the Relative Strength Index (RSI) exited from overbought conditions, a respite for US dollar buyers that would like to re-test the USD/JPY year-to-date high at around 145.00. However, it should be noted that once 143.00 gives way, it would pave the way for a fall towards the 20-day EMA at 140.92.

Short term, the four-hour scale depicts the USD/JPY sideways, trapped in the 142.50-143.60 range. Oscillators led by the Relative Strength Index (RSI) is almost flat, hoovering around the 50-midline, displaying that neither buyers nor sellers are committed to opening fresh bets against the rise/fall of the major.

On the upside, the USD/JPY first resistance would be 144.00, ahead of the YTD high at around 144.99. on the flip side, the USD/JPY first support would be the daily pivot at 143.15, followed by the psychological 143.00, ahead of the S1 pivot point at 142.61.

USD/JPY Key Technical Levels

The USD/CNY continues to face upside pressure according to analysts from Danske Bank. They point out that the difference between interest rates in China and the US clearly favor the US dollar.

Key Quotes:

“USD/CNY has taken another leg higher lately on a stronger USD and wider US-China spread.”

“Relative rates clearly in favour of higher USD/CNY. US money market rates now far above Chinese.”

“Stock markets weaker lately on global recession fears, more US restrictions on Chinese tech, continued property crisis and weaker CNY.”

“PMIs dropped back in August, but the credit impulse is still robust. Retail sales surprised to the upside in August but remain weak. Confidence is low. The property sector is still in a deep crisis although stress among developers has eased somewhat lately.”

- US dollar losses momentum amid an improvement in risk sentiment.

- Wall Street turns green, US yields modestly off highs.

- EUR/USD continues to consolidate ahead of the FOMC meeting.

The EUR/USD rose after the beginning of the American session and recently climbed to 1.0017, before pulling back to the parity area. It is posting modest losses on Monday, as it continues to trade in a range.

The move higher in EUR/USD took place amid a small retreat of the US dollar as Wall Street indexes turned positive. US yields are off highs but still near multi-year highs ahead of the FOMC meeting on Wednesday.

The US central bank is expected to raise interest rates by 75basis points on Wednesday. The combination of an aggressive Fed and a cautious tone among investors regarding signs of a global economic slowdown supports the greenback. “The repricing of Fed tightening risks is likely to keep the dollar bid across the board near-term. As we said during this most recent dollar correction lower, nothing has really changed fundamentally and the global backdrop continues to favor the dollar and U.S. assets in general”, explained analysts at Brown Brother Harriman.

Range prevails

The EUR/USD continues to trade around the parity level, as it had been the case since last Wednesday. A break above 1.0030 should strengthen the euro while on the flip side, the critical support is the 0.9950 area. A firm break under 0.9950 would expose the next support at 0.9910. The next support is 0.9870, the last defence to fresh multi-year lows.

Technical levels

- GBP/USD began the week on the right foot, awaiting Fed and BoE’s monetary policy decisions.

- Most analysts estimate the Fed would hike 75 bps in September’s meeting.

- GBP/USD Price Analysis: Remains downward biased, but a break above 1.1500 could shift the bias to neutral.

The British pound loses some traction against the greenback, after hitting a daily low at 1.1355, exchanges hands above its opening price by 0.04%, amidst a slightly positive market sentiment. During the week, the Bank of England, and the Federal Reserve, are expected to hike rates, with the BoE estimated to go 50 bps, while the latter has forecasts of 75 bps or even 100 bps.

The major began trading at around the 1.1400 figure. At the time of writing, the GBP/USD spot price is at 1.1401, clinging to the 1.1400 figure, in a thin trading session, due to the London holiday, in observance of Queen Elizabeth II’s funeral.

GBP/USD seesaws around 1.1400, with light calendars on Monday and Tuesday

US economic data released in September further emphasized the need for increasing interest rates. Most bank analysts estimate that Jerome Powell and Co would hike 75 bps, even though the Consumer Price Index (CPI) ticker is lower, yet remains above the 8% threshold. Contrarily, core inflation in the US surpassed the 7% YoY threshold, portraying a scenario of inflation broadening in the economy.

Worth noting that September’s Fed meeting will update the Summary of Economic Projections (SEP), and forecasts for 2025 will begin. Analysts at Deutsche Bank expect the Fed to hike 75 bps and also estimate that the Fed will update the Unemployment Rate towards 4.5%, as they aim to achieve a soft landing.

On the UK’s side, the Bank of England is expected to increase the Bank’s Rate by 50 bps on Thursday. Deutsche Bank analysts estimate the BoE’s terminal rate at 4%, a 150 bps upgrade, over their previous forecast.

What to watch

The UK economic docket is absent. On the US front, housing data would shed some light on the effects of higher interest rates.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD remains downward biased. During the day, the major dropped below the 1.1400 figure but fell short of registering a fresh 37-year low and reclaimed the 1.1400 figure. Traders should know that the Relative Strength Index (RSI) is registering higher lows, contrary to Sterling’s price action. Unless GBP/USD buyers reclaim the 1.1500 figure, the pair’s likely scenario is to remain range-bound, with central bank decisions looming.

The British pound remains weak with the GBP/USD pair trading below the 1.14 level. Economists at Scotiabank expect cable to suffer more losses.

Key resistance not seen until 1.1740/50

“Sterling is soft and continues to pressure minor support (last week’s low) at the 1.1350/55 area.”

“The broader trend lower in cable remains intense and deeply entrenched across multiple timeframes and the lack of obvious support points below the market leave the GBP/USD pair vulnerable to more losses.”

“Key resistance is a distant 1.1740/50.”

EUR/USD continues to consolidate after last week’s tumble from resistance around the 1.02 zone. Economists at Scotiabank expect the world’s most popular currency pair to hover around the 0.9950 area.

Euro to retain a weak bias

“Firm gains Friday have failed to hold and spot continues to press support at 0.9950, ahead of a renewed test of the upper 0.98s.”

“Look for more range trading around 0.9950 in the short run but, absent a clear move through the 1.02 range, the EUR will retain a weak bias.”

- Gold meets with a fresh supply and slides back closer to the YTD low set on Friday.

- Resurgent USD demand turns out to be a key factor exerting downward pressure.

- The risk-off impulse helps limit losses ahead of key central bank meetings this week.

Gold maintains its offered tone through the early North American session and is currently placed near the $1,665 region, just above the daily low. A stronger US dollar is seen weighing on the dollar-denominated commodity, which remains well within the striking distance of its lowest level since April 2020 touched on Friday.

Expectations that the Federal Reserve will stick to its aggressive rate-hike path to tame uncomfortably high inflation continue to underpin the greenback. A fall in the near-term inflation expectations for consumer prices in the US to a one-year low in September forced investors to scale back bets for a full 100 bps Fed rate hike move. The US central bank, however, is expected to deliver at least a 75 bps at the end of a two-day monetary policy meeting on Wednesday, which continues to underpin the greenback.

This, in turn, remains supportive of elevated US Treasury bond yields. This, along with the prospects for a faster interest rate hike by other major central banks, further contributes to driving flows away from the non-yielding yellow metal. That said, the prevalent risk-off environment, as depicted by a fresh leg down in the equity markets, offers some support to traditional safe-haven assets. This turns out to be the only factor lending some support to gold and limiting the downside, at least for now.

Investors also seem reluctant to place aggressive bets and prefer to move to the sidelines ahead of a flurry of central bank meetings this week. The Fed is scheduled to announce its decision on Wednesday, which will play a key role in influencing the near-term USD price dynamics. This will be followed by the Bank of Japan (BoJ), the Swiss National Bank (SNB) and the Bank of England (BoE) on Thursday. This, in turn, should assist investors to determine the next leg of a directional move for gold.

Technical levels to watch

- USD/TRY trades in new highs around the 18.30 region.

- The lira depreciates further and flirts with the 18.30 level vs. the dollar.

- The CBRT decision will be a close call later in the week.

Further weakness in the Turkish currency motivates USD/TRY to print new record highs around the 18.30 level at the beginning of the week.

USD/TRY now looks to the Fed, CBRT

USD/TRY extends the march north albeit at a snail pace on Monday, this time reaching the 18.30 region, or new all-time peaks on the back of the firmer note in the dollar and the omnipresent depreciation of the lira.

Later in the week, the Turkish central bank (CBRT) will have its monthly monetary policy gathering. Consensus around the event appears divided between those who expect further rate cuts and many others who lean towards a wait-and-see stance in order to assess the effects on the economy (if any at all) of the August’s surprising interest rate cut.

Furthermore, the lira has already lost more than 38% in 2022 and closed with losses in every month of the year so far.

Extra upside pressure for the pair would likely come from the FOMC gathering on Wednesday, where a 75 bps rate hike by the Fed is largely anticipated, which should keep the sentiment in the risk complex and the EM FX space depressed.

What to look for around TRY

USD/TRY maintains the underlying gradual upside well in place and already flirts with the 18.30 level.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: Consumer Confidence, CBRT Interest Rate decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.55% at 18.2944 and faces the next hurdle at 18.3033 (all-time high September 19) seconded by 19.00 (round level). On the downside, a break below 17.8743 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low August 9).

- A combination of factors pushes USD/CAD to its highest level since November 2020 on Monday.

- The formation of an ascending trend channel points to a well-established short-term bullish trend.

- The technical set-up favours bullish traders and supports prospects for a further appreciating move.

The USD/CAD pair builds on last week's stronger US CPI-inspired rally from the vicinity of mid-1.2900s and gains some follow-through traction on Monday. The pair maintains its bid tone through the early North American session and is currently placed just above the 1.3300 mark, or the highest level since November 2020.

The US dollar is back in demand amid firming expectations that the Fed will deliver a supersized rate hike at the end of a two-day policy meeting on Wednesday. Apart from this, bearish crude oil prices continue to undermine the commodity-linked loonie and remain supportive of the USD/CAD pair's ongoing positive momentum.

Looking at the broader picture, the recent move up along a multi-month-old ascending channel points to a well-established short-term bullish trend. This, along with last week's convincing break through the 1.3210-1.3220 supply zone and a subsequent move beyond the 1.3300 mark, supports prospects for additional gains.

The constructive set-up is reinforced by the fact that technical indicators on the daily chart have been gaining positive traction and are still far from being in the overbought territory. Hence, some follow-through strength towards the ascending channel resistance, around the 1.3400 mark, looks like a distinct possibility.

On the flip side, any meaningful corrective decline could find decent support near the 1.3220-1.3210 resistance breakpoint. Any further pullback below the 1.3200 mark could be seen as a buying opportunity and remain limited near the 1.3160-1.3150 region. The latter should now act as a strong base for the USD/CAD pair and a pivotal point.

USD/CAD daily chart

-637991906174523186.png)

Key levels to watch

- EUR/USD reverses three daily gains in a row on Monday.

- There is an initial resistance at the 7-month line near 1.0160.

EUR/USD comes under some selling pressure and deflates below the parity region at the beginning of the week.

The pair seems to have embarked on a consolidative range ahead of the key FOMC event on Wednesday. Immediately to the upside comes the interim 55-day SMA at 1.0101 ahead of the key 7-month resistance line, today near 1.0160. A move beyond the latter is needed to mitigate the downside pressure and allow spot to confront the September high at 1.0197 (September 12) ahead of potential extra gains.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0722.

EUR/USD daily chart

- AUD/USD meets with a fresh supply on Monday and slides back closer to the YTD low.

- Aggressive Fed rate hike bets, the risk-off mood lifts the USD and exerts some pressure.

- The fundamental backdrop favours bearish traders ahead of the crucial FOMC meeting.

The AUD/USD pair struggles to capitalize on its modest intraday uptick and attracts fresh sellers near the 0.6000 psychological mark on Monday. The intraday descent extends through the mid-European session and drags spot prices to the 0.6675-0.6670 area, or its lowest level since June 2020 touched on Friday.

A combination of factors assists the US dollar to regain positive traction on the first day of a new week, which, in turn, is seen exerting pressure on the AUD/USD pair. Firming expectations that the Fed will hike interest rates at a faster pace to tame inflation continues to act as a tailwind for the greenback. Apart from this, the prevalent risk-off environment offers additional support to the safe-haven buck and contributes to driving flows away from the risk-sensitive aussie.

The market sentiment remains fragile amid worries that rapidly rising borrowing costs will lead to a deeper global economic downturn. This, along with headwinds stemming from China's zero-covid policy, the protracted Russia-Ukraine war and the deteriorating US-China relationship, tempers investors' appetite for perceived riskier assets. In fact, US President Joe Biden said the US will defend Taiwan in the event of an attack by China and triggers a fresh leg down in the equity markets.

The fundamental backdrop seems tilted firmly in favour of bearish traders and supports prospects for a further near-term depreciating move for the AUD/USD pair. Investors, however, might refrain from placing aggressive bets and prefer to move to the sidelines ahead of the two-day FOMC policy meeting, starting on Tuesday. The US central bank is scheduled to announce its decision on Wednesday and is universally expected to deliver at least a 75 bps interest rate increase.

The markets have also been pricing in a small chance of full 100 bps lift-off. Hence, the focus will be on the so-called dot-plot, which along with updated economic projections and Fed Chair Jerome Powell's remarks at the post-meeting press conference, might provide fresh clues about the US central bank's policy outlook. This, in turn, will play a key role in influencing the USD price dynamics and help determine the next leg of a directional move for the AUD/USD pair.

Technical levels to watch

Statistics Canada will release August Consumer Price Index (CPI) data on Tuesday, September 20 at 12:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming Canadian inflation data.

The August Canada inflation rate is expected to fall to -0.1% from 0.1% MoM, clocking in at 7.3% from 7.6% YoY. The Bank of Canada's Core CPI, which excludes volatile food and energy prices, is estimated to decline to 0.3% MoM, sitting at 6.0% on yearly basis from the 6.1% previous.

RBC Economics

“We look for a dip from 7.6% in July to 7.2% in August – down from a recent peak of 8.1% in June. But beneath the weakening headline number, some prices are still powering up. Food price growth likely accelerated again. And we look for the rate excluding food and energy products to hold steady at 5.5%. Alongside this, the Bank of Canada’s preferred core inflation measures also likely remained elevated. We continue to believe the headline inflation rate has hit its peak as lower commodity prices and easing global supply chain pressures lower growth in goods prices. But we don’t expect ‘core’ measures to peak until later this year when higher interest rates start to cut deeply into consumer demand.”

NBF

“If our forecasts materialize, annual inflation should have continued its downward trend to 7.0% last month (compared to 7.6% in July) due to a 0.4% MoM decline (NSA). It turns out that gasoline plunged another 9% in August, following a similar pullback in July. A negative contribution is also expected from air transportation, as a reversal is very likely after the staggering 26% increase the previous month. While price increases could still be sustained in the services sector, we expect goods prices to moderate due to lower transportation prices and easing supply chain issues. All in all, that should lead to a moderation in both CPI-Median (4.9% from 5.0%) and CPI-Trim (5.3% from 5.4%).”

TDS

“We look for a modest dip in headline CPI to 7.3% YoY as another large drop in energy drives a 0.1% MoM decline. Food, shelter, and travel-related components will provide a key source of strength to offset the drag from gasoline. We also look for core CPI measures to push higher, driven in large part by revisions to CPI-common, which will give a hawkish tinge to the report.”

CIBC

“The continued downtrend in gasoline prices will be key behind a 0.1% decline in CPI during August and a deceleration in the annual rate of inflation to 7.2%. However, the earlier US figure suggests that food and other goods prices, including autos, may have remained strong positive contributors to inflation, despite reductions in shipping costs and agricultural commodity prices suggesting that there may be some good news later in the year on these fronts. One difference between the US and Canadian figures that should bring a larger deceleration north of the border is the treatment of owned accommodation. Homeowners’ rebuilding costs should be broadly flat month-over-month, while the other owned accommodation category (largely real estate agents’ fees) should be a big negative again as it picks up the ongoing correction in house prices.”

Citibank

“Canada CPI NSA MoM (Aug) Citi: -0.1%, prior: 0.1%; CPI YoY – Citi: 7.3%, prior: 7.6%. Canada’s headline CPI should decline 0.1% MoM with shelter prices expected to continue to slow with a further moderation in home prices. However, market attention is likely to be more focused on core CPI and inflation expectations as key inputs into BoC’s assessment of how high rates need to rise. While there are some signs that core CPI could be moderating slightly by year-end, we see risks skewed towards core CPI remaining at an uncomfortably high level that keeps BoC raising rates for longer and/or by large amounts.”

The US Dollar Index (DXY) is rising to the 110.00 area following Friday's retreat. This week’s FOMC meeting could send the DXY lower if the Fed is perceived less hawkish than expected, in the opinion of economists at OCBC Bank.

Caution to keep USD supported on dips in the lead-up to FOMC

“While a hawkish Fed is now the baseline scenario, we caution that a Fed that is perceived as less hawkish could see DXY ease lower post-decision. Meantime, in the lead-up to FOMC, expect caution to keep USD broadly supported on dips.”

“Support at 109.30 (21 DMA), 108.45 (38.2% Fibo retracement of Aug low to Sep high) and 107.70 levels (50-DMA, 50% Fibo).”

“Resistance at 110.30 before 110.78 (previous high).”

USD/JPY reclaimed 143.00 early Monday. As economists at OCBC Bank note, bullish trend channel stays intact but gains are slowing.

Break under 141.50 to open the door towards 140.10 and 139.35

“Bullish momentum on daily chart shows signs of waning while RSI is falling from overbought conditions. Risks skewed to the downside though bullish trend channel intact for now.”

“Support at 142.50 (channel lower bound), 141.50 (23.6% Fibo retracement of Aug low to Sep double top). Decisive break below 141.50 puts next support at 140.10 (21-DMA) and 139.35 (38.2% Fibo).”

“Resistance at 145 (interim double top).”

EUR/USD is trading just below parity. Economists at BBH expect the world’s most popular currency pair to challenge the 0.9865 mark.

Bundesbank noted growing risks of recession in Germany

“With the fundamentals deteriorating, we still look for a test of this month’s cycle low near 0.9865.”

“Bundesbank noted ‘there are increasing signs of a recession of the German economy in the sense of a clear, broad-based and longer-lasting decline in economic output.’ September PMI readings out this Friday should confirm what markets already know, and that is Germany is already in recession.”

China’s Premier Li Keqiang told the state media on Monday that the Chinese economy maintains a recovering trend overall, as reported by Reuters.

China will increase imports of agricultural products from Vietnam, Li further noted.

Market reaction

These comments don't seem to be having a noticeable impact on risk perception and safe haven flows continue to dominate the financial markets. As of writing, the US Dollar Index was up 0.25% on the day at 109.90 and the US stock index futures were losing between 0.75% and 0.9%.

- DXY keeps the choppy trade unchanged around 110.00.

- Extra upside could see the cycle high near 110.80 revisited.

DXY resumes the upside following Friday’s daily retracement.

Despite the ongoing consolidation trade, the dollar’s short-term bullish view remains unchanged while above the 7-month support line near 106.50. Against that, another bull run to the YTD peak around 110.80 remains well on the cards for the time being.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 101.73.

DXY daily chart

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggests USD/IDR could see its upside momentum dwindled below 14,890.

Key Quotes

“Our expectations for USD/IDR to ‘consolidate between 14,770 and 14,920’ were incorrect as it soared to 14,960 last Friday (16 Sep) before extending its advance today. Upward momentum is improving quickly and USD/IDR is likely to advance further this week.”

“That said, July’s peak of 15,033 is likely out of reach for now (there is another resistance at 15,000). On the downside, a breach of 14,890 would indicate that USD/IDR is unlikely to advance further.”

- EUR/JPY keeps the erratic performance above 143.00 on Monday.

- Next on the upside comes the cycle highs past 145.00.

EUR/JPY keeps the choppiness well and sound above the 143.00 mark at the beginning of the week.

Price action around the cross remains inconclusive for the time being and would not be surprising to see this stance extend in the next sessions. That said, a break above the this range bound theme exposes the 2022 peaks around 145.60, while the 139.00 zone – where the 55- and 100-day SMAs coincide – should offer initial contention.

In the meantime, while above the 200-day SMA at 135.30, the prospects for the pair should remain constructive.

EUR/JPY daily chart

- Silver comes under renewed selling pressure and reverses Friday’s modest gains.

- Repeated failures near a descending trend-line warrant some caution for bulls.

- Strength beyond the $20.00 mark is needed to support prospects for further gains.

Silver struggles to capitalize on Friday's goodish rebound from a one-week low and meets with a fresh supply on the first day of a new week. The white metal maintains its offered tone through the first half of the European session and is currently placed near the daily low, around the $19.30 region.

From a technical perspective, the XAG/USD, so far, has been struggling to make it through a descending trend-line resistance extending from the May swing high. Repeated failures near the said barrier suggest that the recent recovery from over a two-year low, the $17.55 area might have already run out of steam.

That said, technical indicators on the daily chart are holding with a mild positive bias and support prospects for the emergence of some dip-buying at lower levels. Hence, it will be prudent to wait for some follow-through selling below the $19.00 mark before positioning for any further depreciating move.

The next relevant support is pegged near Friday's swing low, around the $18.80-$18.75 region, which if broken decisively will shift the near-term bias back in favour of bearish traders. The XAG/USD might then accelerate the fall to the $18.45-$18.40 intermediate support en route to the $18.00 round-figure mark.

On the flip side, the aforementioned descending trend-line, currently around the $19.85 region, might continue to act as an immediate strong barrier. This is closely followed by the $20.00 psychological mark. A sustained strength beyond the latter is needed to confirm a near-term bullish breakout and additional gains.

The subsequent move up has the potential to lift the XAG/USD to the 100-day SMA, near the $20.30 area. The momentum could further get extended towards the $20.50 region, above which spot prices could aim to reclaim the $21.00 round-figure mark before eventually climbing further towards the $21.50 area.

Silver daily chart

-637991806897565428.png)

Key levels to watch

The Bundesbank said on Monday that it expects the German economy to shrink markedly in the autumn and winter months amid reduced or rationed energy consumption, as reported by Reuters.

German central bank further noted that that the economy would still likely contract even if outright rationing was avoided.

Market reaction

Markets remain risk-averse during the European trading hours on Monday with Germany's DAX 30 losing nearly 1% on the day. Meanwhile, EUR/USD was trading at 0.9980 at the time of writing, down 0.4% on a daily basis.

Further upside could prompt USD/MYR to meet the next resistance of note at 4.5550, note FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“While we expected USD/MYR to strengthen last week, we were of the view it ‘could advance further but the resistance at 4.5100 is unlikely to come into view for now’. We underestimated the upward momentum as USD/MYR soared to 4.5330 last Friday before extending its advance today. Upward momentum is strong and USD/MYR is likely to strengthen further.”

“That said, deeply overbought short-term conditions could ‘limit’ gains to 4.5550. Support is at 4.5300 but only a breach of 4.5150 would indicate the current strong upward pressure has eased.”

- GBP/USD meets with a fresh supply on Monday and is pressured by resurgent USD demand.

- The UK’s bleak economic outlook undermines the GBP and contributes to the intraday slide.

- Investors now look to the FOMC and the BoE policy meetings for a fresh directional impetus.

The GBP/USD pair comes under some renewed selling pressure on Monday and extends its steady intraday descent through the first half of the European session. The pair is currently placed around the 1.1360 area, just a few pips above its lowest level since 1985 touched on Friday.

In the absence of any fresh catalyst, a bleak outlook for the UK economy continues to undermine the British pound and exerts some downward pressure on the GBP/USD pair. The UK Office for National Statistics reported on Friday that monthly Retail Sales recorded the biggest fall since December 2021 and fell much more than expected in August. This is seen as another sign that the economy is sliding into recession.

Apart from this, resurgent US dollar demand is seen as another factor contributing to the offered tone surrounding the GBP/USD pair. The stronger US CPI report released last week bolstered expectations that the Fed will tighten its monetary policy at a faster pace. In fact, the markets have been pricing in at least a 75 bps rate hike and a small chance of a full 100 bps lift-off at this week's FOMC meeting starting Tuesday.

Furthermore, the prevalent risk-off environment provides an additional lift to the safe-haven buck. The market sentiment remains fragile amid worries that rapidly rising borrowing costs, along with headwinds stemming from China's zero-covid policy and the protracted Russia-Ukraine war, would lead to a deeper global economic downturn. This, along with the worsening US-China relationship, tempers investors' appetite for riskier assets.

The aforementioned factors, to a larger extent, offsets rising bets for more aggressive rate hikes by the Bank of England, which, so far, has failed to lend any support to the GBP/USD pair. Bearish traders, however, might prefer to wait on the sidelines ahead of this week's key central bank event risks before placing fresh bets. The Fed will announce its policy decision on Wednesday and will be followed by the BoE meeting on Thursday.

In the meantime, the USD price dynamics might continue to influence the GBP/USD pair amid relatively thin liquidity on the back of a holiday in the UK in observance of the funeral of Queen Elizabeth. There isn't any major market-moving economic data due for release on Monday, either from the UK or the US. Hence, traders might take cues from the broader risk sentiment, which will drive the USD demand and provide some impetus to the GBP/USD pair.

Technical levels to watch

In the opinion of FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research, USD/THB could move into a consolidative phase in the short term.

Key Quotes

“Last Monday (12 Sep, spot at 36.45), we highlighted that USD/THB is likely to weaken but we were of the view that ‘any weakness is expected to encounter solid support at 36.10’. USD/THB subsequently dropped to 36.19 before lifting off and surged to 37.10. The rapid improvement in upward momentum is likely to lead to further USD/THB strength.”

“That said, short-term conditions are overbought and USD/THB could consolidate for a few days before heading higher to 37.20. Support wise, a breach of 36.45 would indicate that the build-up of upward momentum has fizzled out.”

European Central Bank (ECB) Vice President Luis de Guindos said on Monday that “growth slowdown is not enough to ease inflation.”

“Inflation expectations need to be well anchored,” the central bank policymaker said.

Market reaction

The shared currency is unfazed by the above comments, with EUR/USD losing 0.37% on the day to trade at 0.9971 at the time of writing.

- Gold meets with a fresh supply on Monday amid a goodish pickup in the USD demand.

- Aggressive Fed rate hike bets, elevated US bond yields continue to underpin the buck.

- The risk-off impulse fails to impress bullish traders or lend any support to the XAU/USD.

Gold struggles to capitalize on Friday's goodish rebound from its lowest level since April 2020 and meets with a fresh supply on the first day of a new week. The XAU/USD continues losing ground through the early European session and drops to a fresh daily low, around the $1,660 area in the last hour.

The intraday descent is sponsored by the emergence of fresh buying around the US dollar, which tends to undermine demand for the dollar-denominated commodity. The stronger US consumer inflation data released last week all but cemented expectations that the Fed will tighten its monetary policy at a faster pace.

In fact, the markets have been pricing in a small chance of a full 100 bps rate increase at this week's FOMC meeting. This remains supportive of elevated US Treasury bond yields, which continue to act as a tailwind for the greenback and contributes to driving flows away from the non-yielding yellow metal.

Even the prevalent risk-off environment fails to impress bullish traders or offer any support to the safe-haven gold. The rapidly rising borrowing costs, along with the economic headwinds stemming from China's zero-covid policy and the protracted Russia-Ukraine war, have been fueling recession fears.

Adding to this, the worsening US-China relationship tempers investors' appetite for perceived riskier assets, which is evident from a generally weaker tone around the equity markets. In the latest development, US President Joe Biden said the US would defend Taiwan in the event of an attack by China.

It, however, remains to be seen if bearish traders can maintain their dominant position or opt to lighten their bets ahead of the central bank event risks. The Fed, the Bank of Japan, the Swiss National Bank and the Bank of England will announce their respective policy decisions during the latter part of the week.

In the meantime, the prospects for a more aggressive policy tightening by major central banks should continue to act as a headwind for gold. This, in turn, suggests that any meaningful recovery attempt could be seen as a selling opportunity amid absent relevant market-moving economic data from the US.

Technical levels to watch

The European Commission proposed on Monday emergency power to avoid a supply crisis. Reuters reports after obtaining the European Union (EU) draft rules.

Key highlights

“Under draft rules, the EU is to ask companies to accept priority rated orders for critical products.”

“Under EU draft rules EU countries may ask companies to expand or repurpose production lines.”

“EU countries may have to build up stockpiles under EU draft rules.”

Related reads

- EUR/USD looks offered, extends the downside below parity

- Bulgaria says Gazprom is ready to discuss gas supply proposals

- The pair loses the grip and breaches parity once again.

- The dollar looks bid amidst higher US yields on Monday.

- ECB-speak, EMU Construction Output next on tap.

Sellers regain control around the European currency and drag EUR/USD back below the psychological parity zone at the beginning of the week.

EUR/USD faces next support at the 2022 low

EUR/USD so far reverses three consecutive daily builds and refocuses on the downside against the backdrop of the weak performance in the risk complex and fresh buying interest surrounding the dollar ahead of the interest rate decision by the Fed on Wednesday.

On the latter, the probability of a ¾ point rate hike hovers around the 80% as per CME Group’s Fed Watch Tool, while the likeliness of a 100 bps rate raise lost momentum as of late.

In the German debt market, the 10-year Bund yields extend the gradual multi-week rally and flirt with the 1.80% region so far.