- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

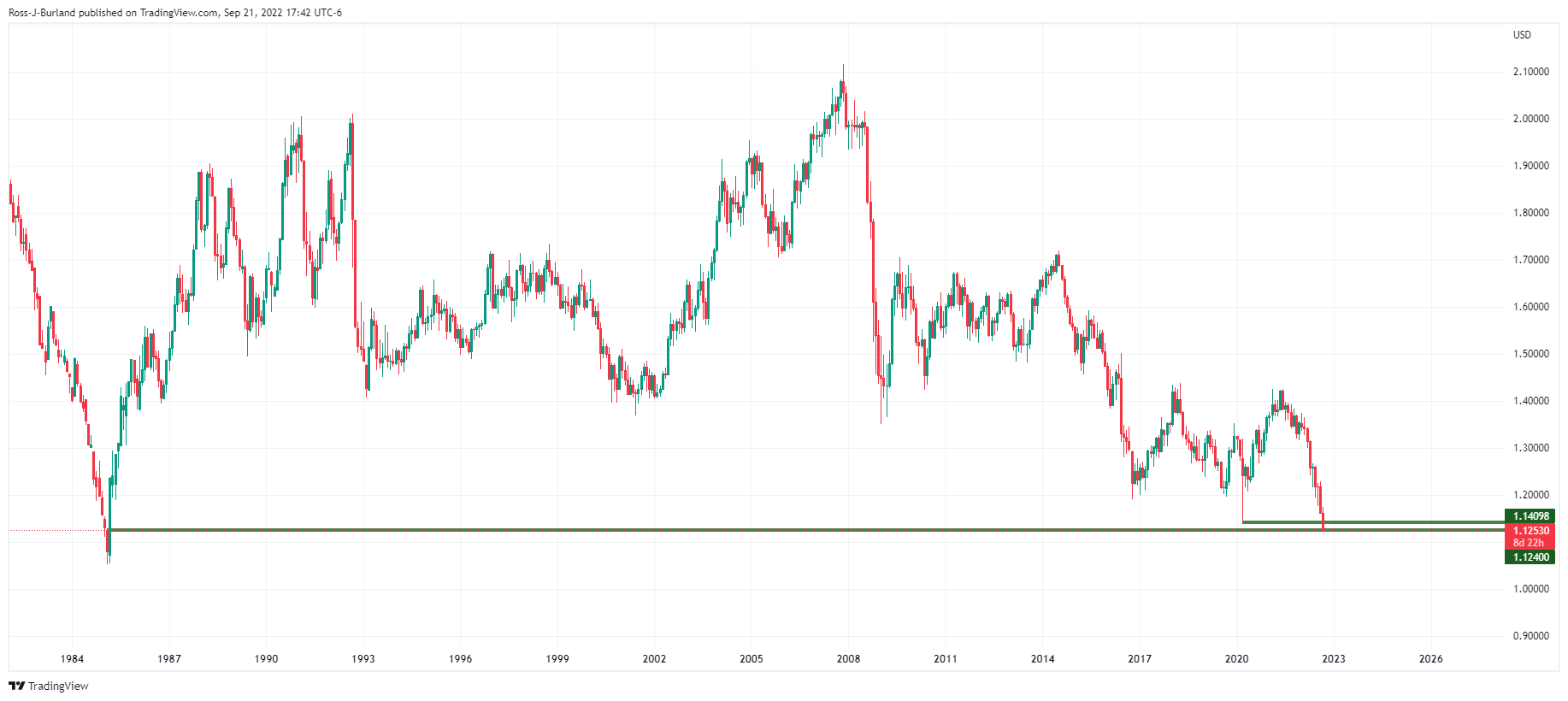

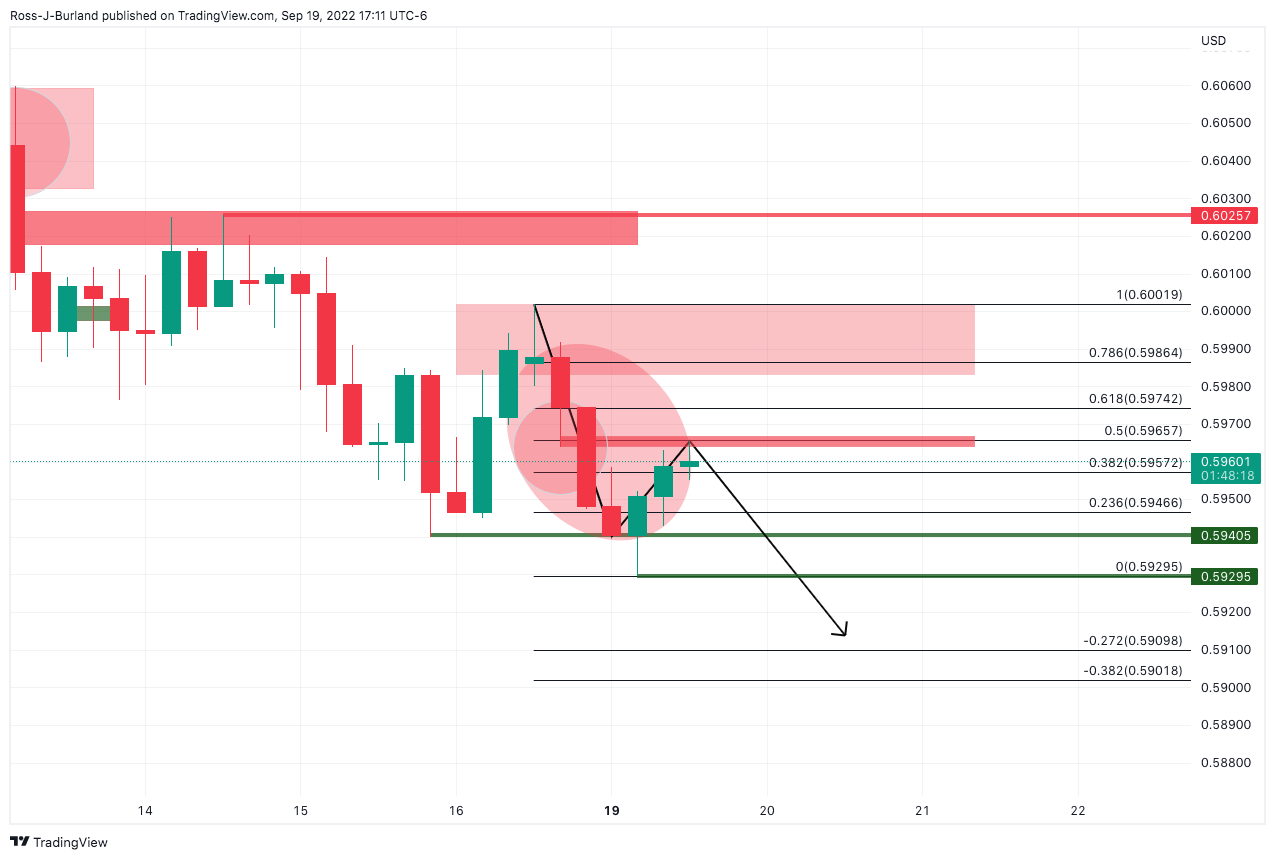

- GBP/USD bears stay in charge and eye the edge of the abyss.

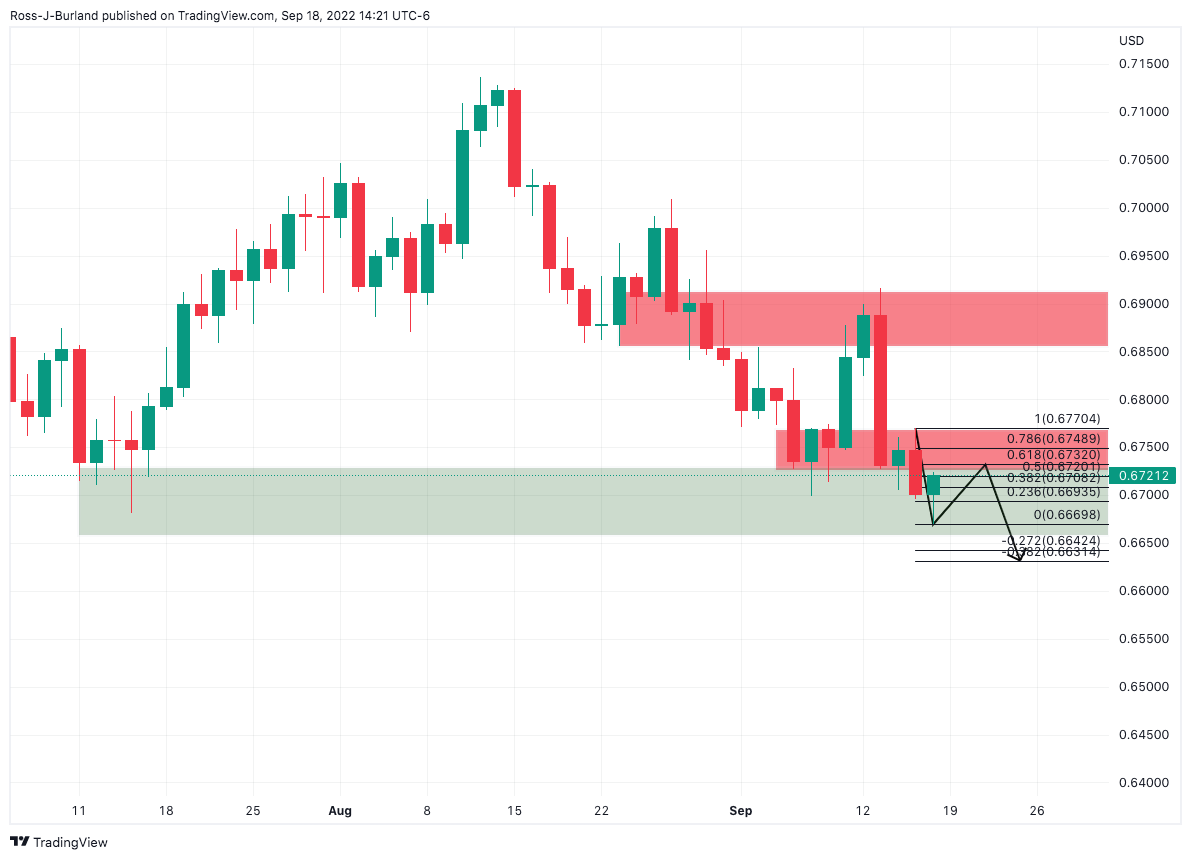

- The pound will depend on the US dollar moving towards a monthly target.

GBPUSD fell as the US dollar surged to a fresh two-decade high on Wednesday after the Federal Reserve raised interest rates by another 75 basis points and signaled more large increases at its upcoming meetings. This has pushed GBP to the edge of the abyss on a longer-term chart view as the following illustrates:

GBPUSD daily, monthly, hourly chart

There really is very little structure to go on at this juncture. Either the bulls commit to the strong dollar and tip the pound over the 1.1240s or we will see a move back into a consolidation ahead of the Bank of England.

DXY monthly chart

The US dollar is embarking on the 112.27 monthly target as illustrated above.

- USD/CAD prints three-day uptrend as it rises to the fresh high since July 2020.

- US Dollar cheers risk-off mood, Fed’s rate hike to favor the pair buyers.

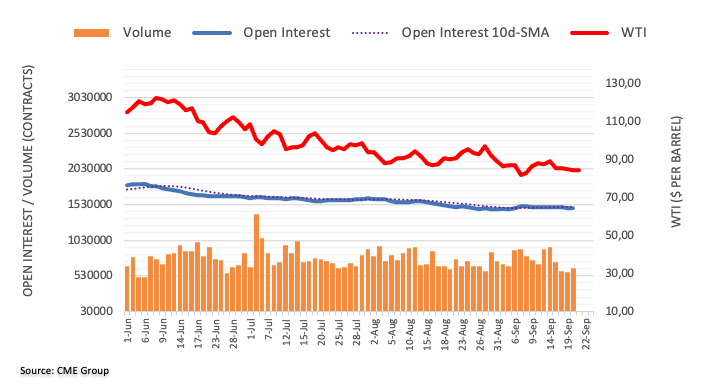

- WTI crude oil drops towards the short-term key support on demand-supply fears.

- Qualitative catalysts will be important for fresh impulse.

USD/CAD takes the bids to refresh the multi-day high around 1.3485, up for the third consecutive day, as bulls take a breather during Thursday’s Asian session. In doing so, the Loonie pair justifies a firmer US dollar and the softer prices of Canada’s key export item WTI crude oil.

US Dollar Index (DXY) renews a two-decade top around 111.50 as hawkish Fed actions joined the recession woes. On the other hand, the WTI crude oil prices bear the burden of US President Joe Biden’s push for energy projects and the fears of economic slowdown due to the rate increases.

Fed matched the market’s expectations of announcing 75 basis points (bps) rate hike. The Fed’s action was the third one in a line of such kind, as it wants to tame inflation fears even at the cost of a “sustained period of below-trend growth” and a softening in the labor market. Fed Chairman Jerome Powell also signaled that the way to tame inflation isn’t painless ahead. While the Fed matched market forecasts, the economic fears surrounding the rate hikes and expectations of another 0.75% increase in November kept the US Dollar on the front foot, despite marking heavy volatility around the announcements.

Elsewhere, Russian President Vladimir Putin’s announcement to mobilize partial troops also reignited the Ukraine-linked geopolitical fears and the supply-crunch fears, which offered an initial run-up to oil prices before the latest downside. Recently, Ukrainian President Volodymyr Zelensky said Ukrainian neutrality is out of the question and he rules out that a settlement can happen on a different basis than the Ukrainian peace formula.

Amid these plays, Wall Street ended the day on a negative tone while the US Treasury yields also dropped amid the market’s rush for risk safety. It’s worth noting that the S&P 500 Futures print 0.50% losses at the latest.

Moving on, USD/CAD traders should pay attention to the second-tier US data and the risks emanating from the geopolitical headlines for fresh impulse.

Technical analysis

USD/CAD stays on the way to June 2020 peak near 1.31715 unless declining back below the September 2020 top near 1.3420.

- AUD/NZD has remained muted around 1.1336 after a downbeat NZ Trade Balance data.

- NZ imports have accelerated and exports have declined for the third quarter.

- RBA’s light hawkish September policy is still keeping optimism for aussie bulls.

The AUD/NZD pair has not responded in anticipation amid the release of downbeat NZ Trade Balance data. On a session basis, the asset is extending its recovery above 1.1336 after a firmer rebound from 1.1315. Observing the broader note, the asset is displaying a balanced profile in a 1.1315-1.1367 range after a juggernaut rally from the round-level support of 1.1200.

The deficit in NZ Trade Balance data has widened further to -$12.28B vs. the prior release of -$11.97B on an annual basis. Also, the monthly deficit has widened to -$2,447M against the former figure of -$1,406M. The August report on Trade Balance dictates that the imports have advanced to $7.93B vs. the prior print of $7.76B. However, the export numbers have declined to $5.48 in comparison with the former release of $6.35B.

Apart from the Trade Balance data, NZ Westpac Consumer Survey data has also been released. Reading for the third quarter has remained in line with the estimates at 87.6 and higher than the prior figure of 78.7.

The cross is still in the markup phase despite less-hawkish dictations in the Reserve Bank of Australia (RBA) monetary policy minutes release on Tuesday. RBA policymakers discussed rate hikes of 25 or 50 basis points (bps) for the September monetary policy meeting. This indicates that the central bank is not interested in turning much more aggressive and is quite satisfied with the current pace of hiking the Official Cash Rate (OCR).

Also, the alternative of 25 bps was discussed, which signals that the current pace of hiking terminal rates could trim ahead. Investors should be aware of the fact that the RBA elevated its OCR to 2.35% by announcing a fourth consecutive 50 bps rate hike. Adding to that, the RBA has set a target for the OCR at 3.85% and believes that the inflation rate will start declining after making top around 7%.

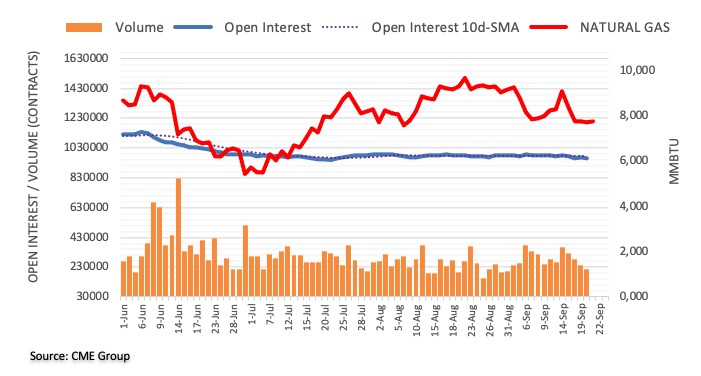

- WTI prints four-day downtrend as it approaches two-week-old support line on demand fears, supply concerns.

- US President Biden pushes for energy projects, Fed amplified recession fears with 0.75% rate hike.

- Russia’s mobilization of troops renewed supply fears, EIA reported softer inventory build.

- Risk catalysts are the key, central banks and Moscow-Kyiv tension are important to watch for fresh impulse.

WTI crude oil prices remain depressed for the fourth consecutive day amid fears of energy demand during early Thursday morning in Asia. The black gold’s latest weakness could be linked to the US Federal Reserve’s rate hike and President Joe Biden’s push for more energy projects. While portraying the same, the black gold declines to $82.40 by the press time.

Fed announced 75 basis points (bps) of a rate hike, the third one in a line of such kind, as it wants to tame inflation fears even at the cost of a “sustained period of below-trend growth” and a softening in the labour market. Fed Chairman Jerome Powell also signalled that the way to tame inflation isn’t painless ahead. While the Fed matched market forecasts, the economic fears surrounding the rate hikes and expectations of another 0.75% increase in November kept the recession fears on the table, despite marking heavy volatility around the announcements.

Elsewhere, the White House recently conveyed that US President Biden supports Senator Joe Manchin's permitting bill to speed energy projects.

It should be noted, however, that Russian President Vladimir Putin’s announcement to mobilize partial troops also reignited the Ukraine-linked geopolitical fears and the supply-crunch fears, which offered an initial run-up to oil prices before the latest downside. Russian President Putin threatened the West on Wednesday, noting that “We have lots of weapons to reply, it is not a bluff.” Following him was Russian Defence Minister Sergei Shoigu who said that “We are fighting not only with Ukraine but the collective west.” In a reaction, German Economy Minister Robert Habeck said, “Partial mobilization of Russian troops is a bad and wrong development,” adding that the “Government is in consultations on next step.” Jens Stoltenberg, NATO's Secretary General, told Reuters that Russian President Putin's announcement of military mobilization and threat to use nuclear weapons was "dangerous and reckless rhetoric."

Also likely to have challenged the black gold’s south-run, but failed, could be the weekly oil inventory details from the US Energy Information Administration (EIA). As per the latest EIA Crude Oil Stocks Change for the week ending on September 16, the inventories eased to 1.142M versus 2.161M forecasts and 2.442M prior.

Technical analysis

An upward sloping trend line from September 08, around $82.00, appears crucial for the short-term direction as a break of which will direct bears towards the monthly low near $81.00. Buyers need validation from the 21-DMA, around $87.10 at the latest.

- NZD/JPY fades bounce off six-week low after mixed NZ data.

- New Zealand’s Q3 Westpac Consumer Survey improved, trade deficit widened in August.

- Clear break of 100-DMA, weekly resistance line direct sellers towards four-month-old support.

- BOJ is likely to buck the trend of hawkish central bank announcements.

NZD/JPY retreats to 84.40 after a slew of New Zealand data failed to impress the pair buyers during Thursday’s Asian session. In doing so, the cross-currency pair defends the previous day’s downside break of the 100-DMA while also respecting the one-week-old descending resistance line.

New Zealand’s trade deficit widened to $12.28B during August versus $11.97B prior. Further details suggest that the Imports grew to $7.93B from $7.76B previous readings while the Exports dropped to $5.48B compared to $6.35B previous announcements. Earlier in the day, the nation’s Westpac Consumer Survey data for the third quarter (Q3) probed the NZD/USD bears while matching 87.6 forecasts versus 78.7 prior. “Consumer confidence in New Zealand improved in the third quarter but the mood in the country remains grim,” said Reuters following the data release.

On the other hand, the majority of the global central banks have been hawkish in lifting their benchmark rates so far but the Bank of Japan (BOJ) isn’t expected to do so, which in turn keeps the room for a surprise favor and weigh on the prices.

Also read: BOJ Preview: One day, it will surprise us all, but not today

Given the bearish MACD signals and the downbeat RSI (14), not oversold, joining the aforementioned catalysts, the NZD/JPY is on the way to testing an upward sloping support line from May, close to 83.85 by the press time.

Following that, the 50% and 61.8% Fibonacci retracement levels of May-September advances, respectively near 83.65 and 82.60, could lure the pair bears.

Meanwhile, recovery moves will need to cross the 100-DMA and the immediate resistance line, around 84.55 and 84.65 in that order, to convince NZD/JPY buyers.

In a case where the quote remains firmer past 84.65, a run-up towards June’s peak surrounding 86.80 can’t be ruled out.

NZD/JPY: Daily chart

Trend: Further weakness expected

- NZD/USD fails to overcome Fed-inspired losses even if trade, sentiment numbers at home are upbeat.

- New Zealand’s Q3 Westpac Consumer Survey came in firmer, trade deficit increased in August.

- Fed’s rate hike, fears of economic pain join pessimism from Russia, China to favor the US dollar buying.

- Light calendar at home, emphasizes risk catalysts for fresh impulse.

NZD/USD holds lower ground at 0.5845 while keeping the Fed-inspired losses after a slew of New Zealand (NZ) data during early Asian session on Thursday. The kiwi pair’s lack of respecting the mixed outcome could be linked to the market’s pessimism amid fears of recession and geopolitical woes.

New Zealand’s trade deficit widened to $12.28B versus $11.97B prior during August. Further details suggest that the Imports grew to $7.93B from $7.76B previous readings while the Exports dropped to $5.48B compared to $6.35B previous announcements.

Earlier in the day, the nation’s Westpac Consumer Survey data for the third quarter (Q3) probed the NZD/USD bears while matching 87.6 forecasts versus 78.7 prior. “Consumer confidence in New Zealand improved in the third quarter but the mood in the country remains grim,” said Reuters following the data release.

Elsewhere, the Fed matched market’s expectations of announcing 75 basis points (bps) of rate hike. The Fed’s action was the third one in a line of such kind, as it wants to tame inflation fears even at the cost of a “sustained period of below-trend growth” and a softening in the labor market. Fed Chairman Jerome Powell also signaled that the way to tame inflation isn’t painless ahead. While the Fed matched market forecasts, the economic fears surrounding the rate hikes and expectations of another 0.75% increase in November kept the US Dollar on the front foot, despite marking heavy volatility around the announcements.

It should be noted that the Russian President Vladimir Putin’s announcement to mobilize partial troops also reignited the Ukraine-linked geopolitical fears and drowned the GBP/USD prices. Russian President Putin threatened the West on Wednesday, noting that “We have lots of weapons to reply, it is not a bluff.” In a reaction, German Economy Minister Robert Habeck said, “Partial mobilization of Russian troops is a bad and wrong development,” adding that the “Government is in consultations on next step.” Jens Stoltenberg, NATO's Secretary General, told Reuters that Russian President Putin's announcement of military mobilization and threat to use nuclear weapons was "dangerous and reckless rhetoric."

While portraying the mood, Wall Street ended the day on a negative tone while the US Treasury yields also dropped amid the market’s rush for risk safety. It’s worth noting that the S&P 500 Futures print 0.50% losses at the latest.

Moving on, NZD/USD traders may witness a lack of action amid a light calendar and the post-Fed calm. Even so, risk catalysts surrounding Russia and China might entertain the pair traders ahead of the US session wherein the second-tier numbers may direct intraday moves.

Technical analysis

NZD/USD is vulnerable to refreshing the multi-month low unless bouncing back beyond the support-turned-resistance line from May, around 0.5915 by the press time.

- AUD/JPY dropped on Wednesday, courtesy of a dampened market sentiment.

- The AUD/JPY daily chart shifted from upwards to neutral biased as the pair fell below the 20-day EMA and reached fresh weekly lows.

- Short term, the AUD/JPY is downward biased; it could fall below 95.00 if it clears the 200-EMA on the downside.

The AUD/JPY is slightly advancing as the Asian Pacific session begins after the US Federal Reserve decided to raise rates as widely expected. Nevertheless, on Wednesday, the cross-currency dropped by 0.62% as market sentiment shifted sour, as market participants sought safe-haven assets, meaning the US dollar and the Japanese yen. At the time of writing, the AUD/JPY is trading at 95.56.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart delineated the pair sliding below the 20-day EMA, hitting fresh weekly lows at 95.40. That said, the pair bias shifted from upward biased to neutral as sellers began gathering momentum, as shown by the Relative Strength Index (RSI) crossing below the 50-midline into bearish territory. Therefore, an extension towards fresh weekly lows on the AUD/JPY is on the cards.

Near term, the AUD/JPY is downward biased, as portrayed by the four-hour chart. Higher rates in the US spurred a sell-off in US equities, meaning that flows seeking safety are increasing. Therefore, the AUD/JPY could be headed to the downside due to the Japanese yen's safe-haven status, opening the door for a test of the 200-EMA.

Hence, the AUD/JPY first support would be the 200-EMA at 95.37. Break below will expose the S1 daily pivot at 95.20, followed by the S2 pivot point at 94.91, and then a challenge of the September 2022 low at 94.76.

AUD/JPY Key Technical Levels

- USD/CHF is auctioning around 0.9660 ahead of a decisive move post-Fed policy scrutiny.

- The Fed’s roadmap for fighting inflation will impact the growth rate, job opportunities, and housing space.

- A rate hike of 75 bps will shift SNB’s interest rates into positive territory after a decade.

The USD/CHF pair is juggling around 0.9660 in the early Tokyo session as volatility oscillators are having a sigh of relief after a notably higher volatile session. The asset gyrated in an extreme range of 0.9620-0.9700 and has turned sideways as investors are busy with the task of Federal Reserve (Fed)’s monetary policy scrutiny for a decisive move ahead.

Wednesday’s monetary policy from the Fed has turned out a nightmare for the risk-sensitive assets. The roadmap put forward to combat inflation is full of barricades for growth rate, employment generation, and housing sector in the US economy.

The Fed has laid down a target for the interest rate at 4.6% and is looking to reach 4.4% by the end of 2023, much higher than the prior peak estimation of 3.8%. This builds a case for two possibilities either the inflation rate is not responding well to the current pace of hiking interest rates or the inflation chaos is extremely huge and is need to be contained sooner.

Meanwhile, the US dollar index (DXY) is set to recapture the fresh two-decade high at 111.58. The DXY will continue its dream run as the labor market is extremely tight and has been supporting the Fed in hiking the interest rates unhesitatingly.

On the Swiss franc front, investors are awaiting the release of the interest rate decision by the Swiss National Bank. SNB Chairman Thomas J. Jordan is expected to hike the interest rates by 75 basis points. A bigger rate hike is expected from the SNB as the central bank announces its monetary policy once a quarter. A rate hike of 75 bps will turn the interest rates positive at 0.5%. SNB’s interest rate will shift into a positive trajectory after a decade.

- GBP/USD seesaws around multi-year low after a volatile day in favor of the bears.

- US dollar rises after Fed matched market forecasts with 75 bps rate hike, Powell predicts painful journey to tame inflation.

- Fears from Russia’s announcement of mobilization of troops, China supersede stimulus efforts from the UK’s new government.

- BOE is likely to announce 0.50% rate hike can offer positive surprise to Cable buyers while following friends in the line.

GBP/USD bears take a breather at the fresh low since 1985, portrayed after Fed-inspired losses, as traders brace for the Bank of England’s (BOE) monetary policy decision on Thursday. Also restricting the Cable pair’s immediate moves could be the lack of major catalysts during the initial Asian session.

The quote dropped the fresh 37-year low after the US Federal Reserve (Fed) announced 75 basis points (bps) of a rate hike. The Fed’s action was the third one in a line of such kind, as it wants to tame inflation fears even at the cost of a “sustained period of below-trend growth” and a softening in the labor market. Fed Chairman Jerome Powell also signaled that the way to tame inflation isn’t painless ahead. While the Fed matched market forecasts, the economic fears surrounding the rate hikes and expectations of another 0.75% increase in November kept the US Dollar on the front foot, despite marking heavy volatility around the announcements.

Other than the Fed-linked moves, Russian President Vladimir Putin’s announcement to mobilize partial troops also reignited the Ukraine-linked geopolitical fears and drowned the GBP/USD prices. Russian President Putin threatened the West on Wednesday, noting that “We have lots of weapons to reply, it is not a bluff.” Following him was Russian Defence Minister Sergei Shoigu who said that “We are fighting not only with Ukraine but the collective west.” In a reaction, German Economy Minister Robert Habeck said, “Partial mobilization of Russian troops is a bad and wrong development,” adding that the “Government is in consultations on next step.” Jens Stoltenberg, NATO's Secretary General, told Reuters that Russian President Putin's announcement of military mobilization and threat to use nuclear weapons was "dangerous and reckless rhetoric."

At home, UK Business Department announced on Wednesday that said it would cap the cost of electricity and gas for businesses. Following that, British Prime Minister Liz Truss also mentioned that they will be introducing low-tax investment zones across the UK, as reported by Reuters. It should be noted that the UK PM Truss also reiterated that they are open to negotiating a trade deal when the US is ready to do so.

Against this backdrop, Wall Street ended the day on a negative tone while the US Treasury yields also dropped amid the market’s rush for risk safety.

Looking forward, GBP/USD traders will pay attention to the BOE moves as the “Old Lady”, as it is popularly known, is expected to announce 50 basis points (bps) rate hike amid increasing inflation fears. However, the BOE’s peers from the US, Sweden and Brazil have recently announced a 0.75% rate increase and the central bank is under pressure to take a big move, even if the latest UK statistics don’t support the claim, which in turn hints at a positive surprise from the British central bank and a corrective bounce of the Cable.

Technical analysis

Unless bouncing back beyond the lower line of a four-month-old bearish channel, around 1.1300 by the press time, GBP/USD is vulnerable to printing more downside. In that case, the 1.1000 psychological magnet and the year 1985 low near 1.0520 will be in focus.

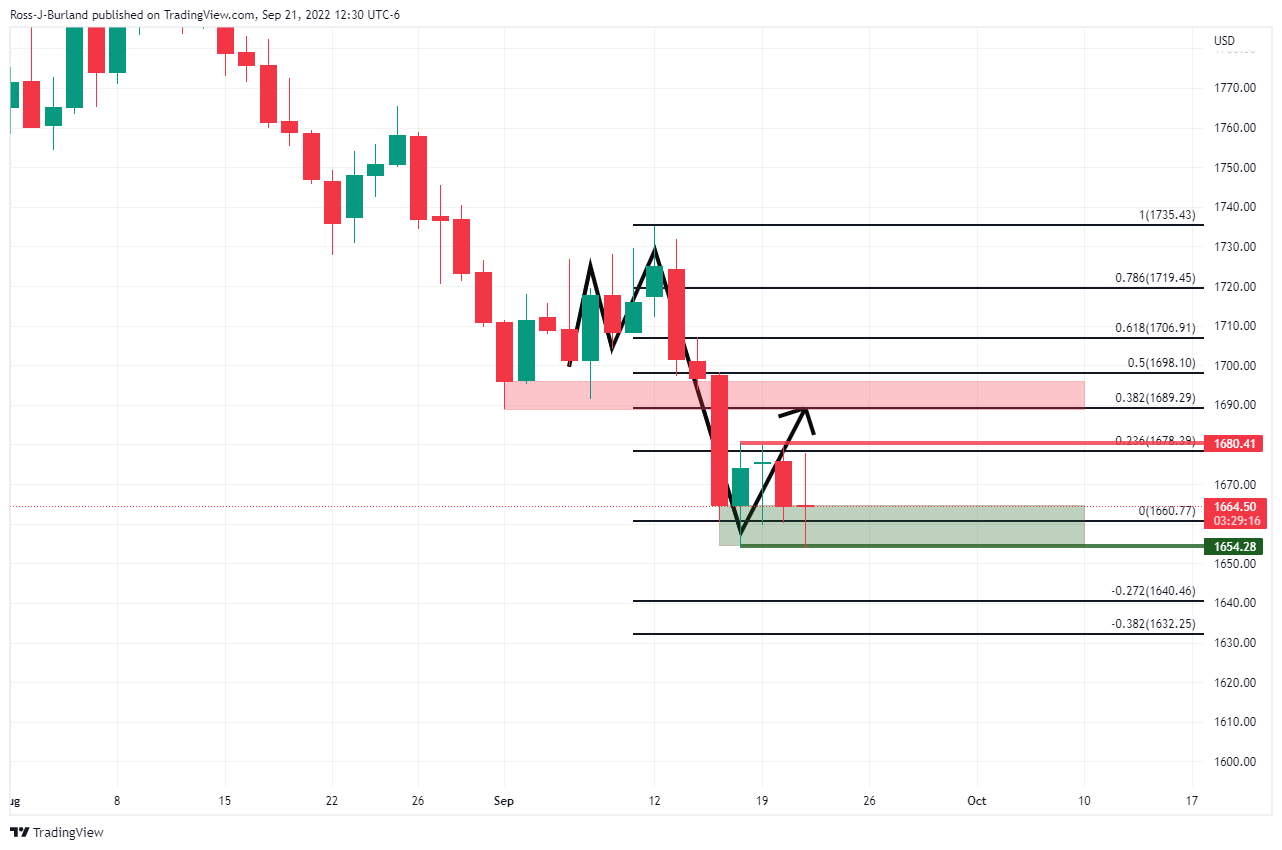

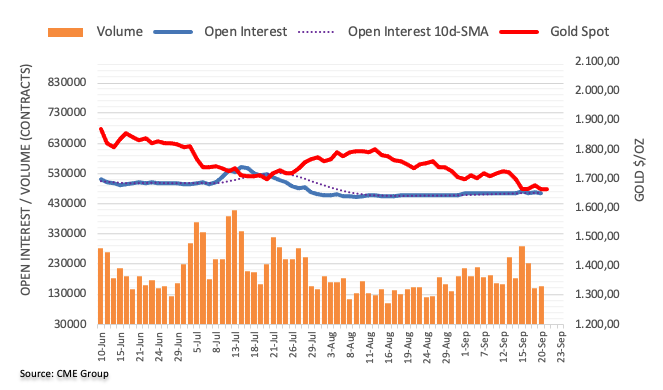

- Gold price has turned sideways after a solid volatile session amid Fed monetary policy announcement.

- Fed’s hawkish guidance on interest rates has spoiled the market mood.

- The DXY is advancing to recapture its fresh two-decade high at 111.58.

Gold price (XAU/USD) is displaying back-and-forth moves in a narrow range of $1,670.33-1,674.78 in the early Tokyo session. The precious metal is having a sigh of relief after a volatile session amid Federal Reserve (Fed) monetary policy meeting. A firmer rebound from around a two-year low at $1,654.00, followed by an extreme sell-off around $1,690.00 and now a volatility contraction is building a base for a decisive move ahead.

Fed chair Jerome Powell has hiked the interest rates as expected by 75 basis points (bps), escalating it to 3.00-3.25% with the old objective of bringing price stability. However, the roadmap plotted to tame the roaring inflation through policy tightening has spilled blood on Wall Street.

With the ultimate target of 4.6% terminal rates to combat inflationary pressures and reaching 4.4% by next year, the roadmap for wiping out add-over inflation seems gloomy for the growth outlook, employment opportunities, and wage rates.

Meanwhile, the US dollar index (DXY) is aiming to recapture the fresh two-decade high at 111.58, recorded on Wednesday. The asset is expected to sustain at elevated levels until signs of legitimate decline in the Consumer Price Index (CPI).

Gold technical analysis

Gold price is oscillating in a tad wider range of $1,654.00-1,690.50 on an hourly scale. The precious metal is expected to display a lackluster performance until the volatility indicators get cooled-off. The 50-period Exponential Moving Average (EMA) is overlapping with the asset price, which signals a consolidation ahead.

Also, the Relative Strength Index (RSI) (14) has shifted back into the 40.00-60.00, which seeks further trigger for a decisive move.

Gold hourly chart

- AUD/USD bears take a breather at multi-month low after a volatile day.

- Fed matches market forecasts of 75 bps Fed rate hikes.

- Powell defends rate hike trajectory, suggests more pain ahead.

- Second-tier US data, risk catalysts will be important for fresh impulse.

AUD/USD holds lower ground at a 28-month low surrounding 0.6620, after refreshing the multi-day bottom the previous day, as traders catch a pause after a volatile day thanks to the Fed and Russia. Also keeping the Aussie pair unchanged is the lack of major data/events on the calendar during early Wednesday.

The US Federal Reserve (Fed) announced 75 basis points (bps) of a rate hike, the third one in a line of such kind, as it wants to tame inflation fears even at the cost of a “sustained period of below-trend growth” and a softening in the labour market. Fed Chairman Jerome Powell also signalled that the way to tame inflation isn’t painless ahead. While the Fed matched market forecasts, the economic fears surrounding the rate hikes and expectations of another 0.75% increase in November kept the US Dollar on the front foot, despite marking heavy volatility around the announcements.

Elsewhere, Russian President Vladimir Putin threatened the West on Wednesday, noting that “We have lots of weapons to reply, it is not a bluff.” Following him was Russian Defence Minister Sergei Shoigu who said that “We are fighting not only with Ukraine but the collective west.” In a reaction, German Economy Minister Robert Habeck said, “Partial mobilization of Russian troops is a bad and wrong development,” adding that the “Government is in consultations on next step.” Jens Stoltenberg, NATO's Secretary General, told Reuters that Russian President Putin's announcement of military mobilization and threat to use nuclear weapons was "dangerous and reckless rhetoric."

It should be noted that a snap lockdown in China’s steel hub Tangshan and the Asian Development Bank’s (ADB) cut in the growth forecasts for developing Asia for 2022 and 2023 also played as risk-negative catalysts.

Amid these plays, Wall Street ended the day on a negative tone while the US Treasury yields also dropped amid the market’s rush for risk safety, which in turn drowned the AUD/USD prices due to the pair’s risk-barometer status.

Looking forward, AUD/USD traders may witness a lack of major moves as the Fed has played its role. However, risk catalysts surrounding Russia and China might entertain the pair traders ahead of the US session wherein the second-tier numbers may direct intraday moves.

Technical analysis

The lower line of the four-month-old bearish channel, around 0.6560 by the press time, lures AUD/USD bears unless the prices remain below a two-month-old support line, near 0.6710 at the latest.

President Volodymyr Zelensky said Ukrainian neutrality is out of the question and he rules out that a settlement can happen on a different basis than the Ukrainian peace formula.

The headline comes following earlier news that Russian president Vladamir Putin had said he will mobilize an additional 300,000 troops to shore up the country's flagging invasion of Ukraine, where it is steadily surrendering territory to counter attacks from Ukrainian forces while making nuclear threats as well.

Ukrainian President said that while he thought Putin wouldn't use nuclear weapons and that "the world" would not "allow him to use those weapons," he could not fully rule out the possibility of a nuclear strike by Moscow.

"We cannot look into Putin's head," Zelensky said. "There are risks."

The US dollar picked up a safe haven bid on the latest escalations as did gold and oil rallied on the threats.

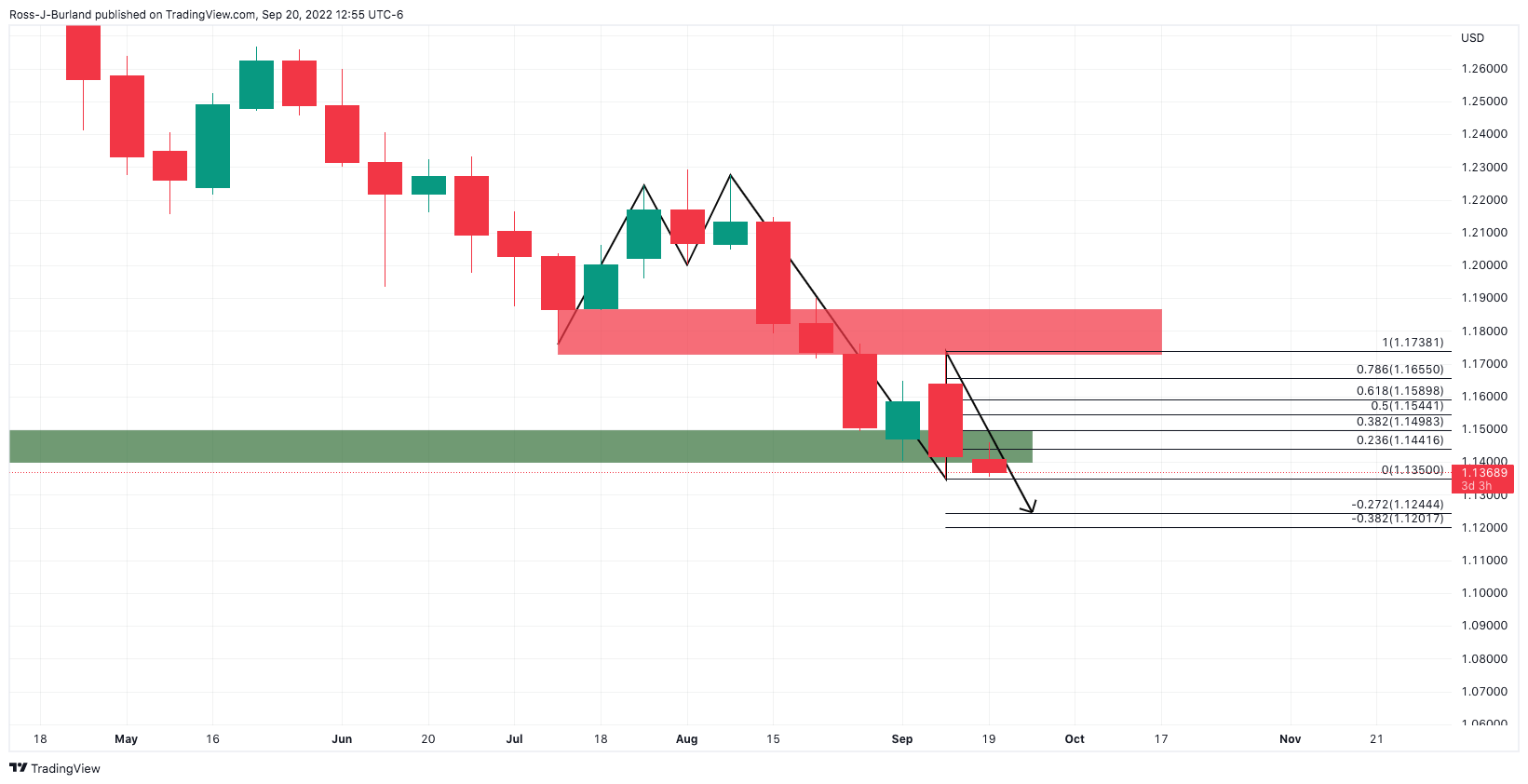

- EUR/USD is expecting more weakness below 0.9800 on hawkish guidance by the Fed.

- Fed’s Powell has announced a third consecutive rate hike by 75 bps to tame inflation sooner.

- The interest rates are seen at 4.6% by the end of 2023

The EUR/USD pair has displayed a less-confident pullback after refreshing the multi-year low at 0.9813 in the late New York session. The fragile pullback is expected to demolish sooner and the asset will resume its downside journey. A decisive slippage below the critical support of 0.9813 will drag the asset with full power towards the south.

Investors had already discounted the announcement of the third consecutive 75 basis points (bps) rate hike by the Federal Reserve (Fed). However, the delivery of extreme ‘hawkish’ guidance on interest rates to respect the objective of bringing price stability has weakened the risk-perceived assets. What is killing the market mood is the escalation in interest rates target and jobless rates, and the unavailability of a time period in which the inflation chaos will be fixed.

Fed chair Jerome Powell is seeing interest rates at 4.6% by the end of 2023. The guidance has shifted much higher from 3.8%. Also, the Unemployment Rate is seen higher at 4.1%. Big tasks come with big sacrifices and the economic growth will face severe pain from the pace of hiking interest rates. No doubt, Fed’s Powell and his colleagues are following the pattern adapted by Fed’s Paul Volcker four decades ago.

On the Eurozone front, the German government is exploring its all measures to make sure that the administration must have sufficient energy inventories to cater to the elevated demand during the winter season. The government has promised to bail out the giant German gas importer Uniper but taking a 30% stake in the board. The company delivered extreme losses after Russia cut off gas supplies to Germany deliberately.

Also, the European Central Bank (ECB) is providing hawkish guidance on interest rates so that the higher inflation rate should not settle in the economic behavior.

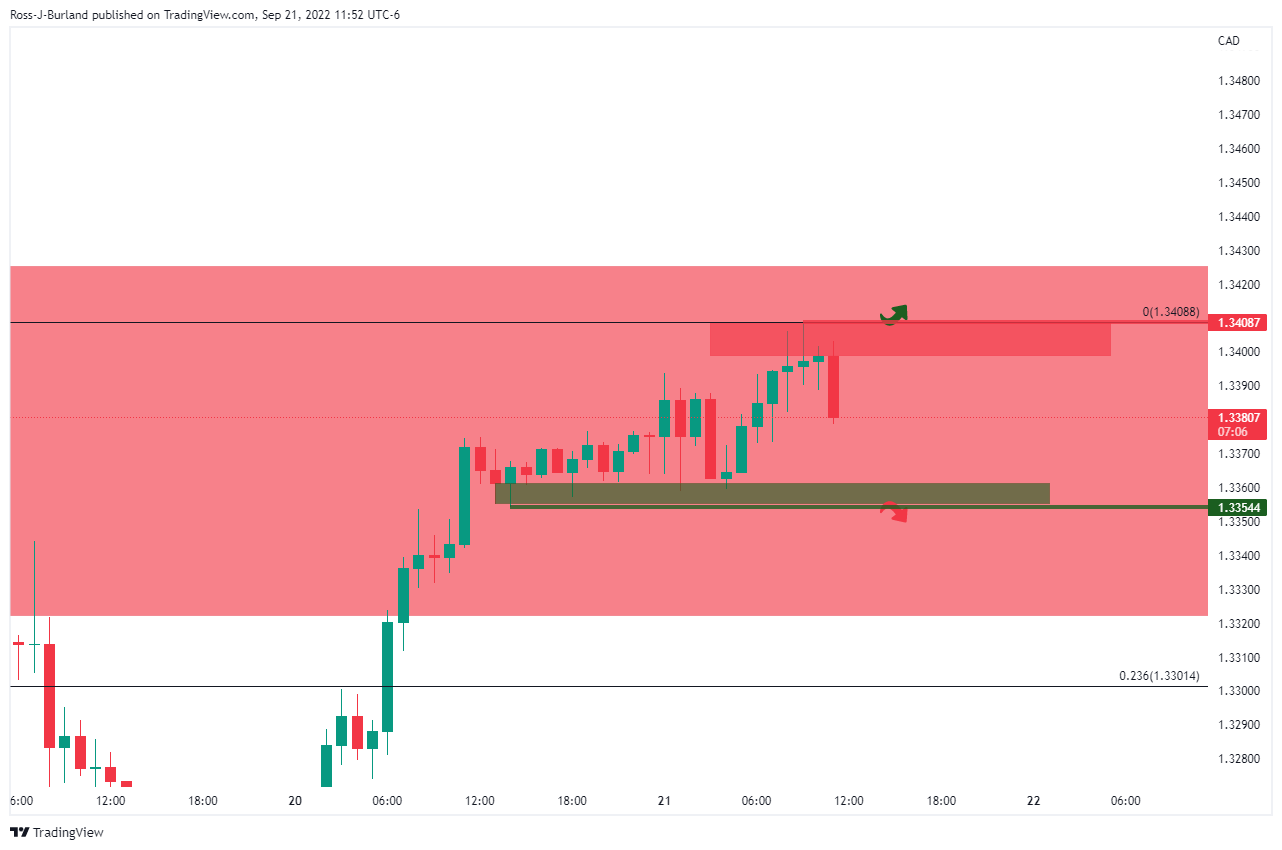

- As widely expected, an aggressive Fed rate hike bolstered the greenback.

- FOMC’s members updated their projections for the end of 2022 of the Federal funds rate (FFR) to 4.4%.

- The USD/CAD extended its gains after Chair Powell’s press conference, climbing towards its daily high above 1.3460s.

The USD/CAD advances for the second straight day after the US Fed Chair Jerome Powell and Co. decided to hike rates by 0.75% at their September meeting, as expected. Worth noting that Fed policymakers opened the door for further tightening, as shown by the Summary of Economic Projections (SEP) median, with most participants expecting rates to end in 2022 at around 4.4%. At the time of writing, the USD/CAD is trading at 1.3464, above its opening price by 0.76%.

USD/CAD climbed to two-year highs amidst a buoyant US dollar

During the day, the financial markets got what they were expecting: a hefty rate hike by the Fed. Additionally, Fed officials acknowledged that spending and production are moderating while emphasizing the robustness of the labor market. The committee expressed that inflation remains high due to imbalances between supply and demand.

At the meeting, Fed officials updated its economic projections for the rest of 2022, alongside adding projections for 2025. In 2022, the FOMC estimates that the Federal funds rate (FFR) would finish at 4.4%, growth is estimated at around 0.2%, while the unemployment rate is expected to rise by 3.8%.

At the same time, the committee estimates that inflationary pressures could peak at around 5.4% in the PCE reading, while core PCE is estimated to rise by 4.5%.

In the press conference, Jerome Powell expressed that “we have got to get inflation behind us” while reiterating that he would do it in a “painless” way if there were one. Nevertheless, he said that “there isn’t” while adding that “failing to restore price stability” would be more painful than what the Fed has done.

As a reflection of that, the US Dollar Index, a gauge of the buck’s value vs. a basket of six currencies, edged higher by 1%, refreshing two-decade highs at around 111.578, while US Treasury bond yields in the short end of the curve rose, with 2s finishing above the 4% threshold.

Therefore, the USD/CAD extended its gains during the day, after diving towards its daily low at 1.3357, before gaining more than 100 pips towards the end of the trading session.

What to watch

An absent Canadian calendar would keep USD/CAD traders leaning towards further US economic data. On Thursday, the US docket will feature unemployment claims alongside the US Current Account and the Kansas City Fed Manufacturing Index.

USD/CAD Key Technical Levels

- NZD/USD injured by the Fed's hawkish meeting.

- NZD/USD bulls could be about to regather themselves for a measured move higher.

As per the prior analysis, NZD/USD Price Analysis: Bears seek a move to take the bulls on at the 0.5850s, the price moved to the target around the centerpiece event of the week in the Federal Reserve. The following illustrates the market structure and bias from here on.

NZD/USD prior analysis, weekly chart

It was argued that the price would be expected to correct at some stage soon but perhaps not until a challenge of the 0.5850s.

The M-formation is a reversion pattern that could see the price correct towards at least the prior lows near what would be a 38.2% Fibonacci retracement from the aforementioned 0.5850s that were hit during Fed volatility on Wednesday.

NZD/USD update

The weekly outlook has played out so far according to the prior analysis. Meanwhile, on an hourly basis, there is the bullish scenario illustrated as follows:

A v-shaped peak could be forming here that may give way to a break of the trendline for a measured move higher to the midway point of the 0.59 area again for the end of the week.

- US dollar bulls move in again on a volatile day.

- The markets are attempting to price the Fed following its two-day meeting.

The US dollar has been moving like a yo-yo during the centerpiece event of the week which was the Federal Reserve on Wednesday. As measured by the DXY index, the price of the dollar vs. a basket of currencies has ranged between 111.57 and 110.612, initially spiking on the Fed announcements before dropping and recovering again in a 78.6% retracement of the range. At the time of writing, DXY is trading at 111.30, 1.00% higher on the day.

The US dollar has been in demand on Wednesday on two main counts. The expectations for higher rates and the decision by Russian President Vladimir Putin to mobilize more troops for the conflict in Ukraine had already pushed the dollar to a two-decade high before the Fed announced its hawkish projections following a 75bps rate hike, as expected.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

Fed chairman presser

Meanwhile, Fed's chairman, Jerome Powell has been speaking to the press:

-

Powell speech: MBS sales not something I expect to be considering in near term

-

Powell speech: There is no painless way to bring inflation down

- Powell speech: No one knows if we will get a recession

-

Powell speech: Just moved into lowest levels of what we consider restrictive today

-

Powell speech: Dot plot projections do not represent plan or commitment

-

Powell speech: No grounds for complacency on inflation

-

Powell speech: Economy does not work without price stability

The markets are anticipating for the US dollar to stay strong but some analysts argue that the greenback is significantly overvalued. After all, since the beginning of the year, the dollar index has soared by nearly 16% in the biggest yearly percentage gain since 1972.

"We expect the U.S. dollar to remain firm in the short run but we remain reluctant to factor in additional, sustained US dollar gains from here and we think it would be complacent to dismiss out-of-hand downside risks here," said Shaun Osborne, chief FX strategist, at Scotiabank in Toronto.

DXY technical analysis

From a near-term perspective, if the bears commit at the 78.6% ratio, then there are considerable arguments for a downside scenario. The trendline support could come under pressure and if this gives, we will see key 110.50 under pressure again. On the other hand, from a weekly perspective, the bias is to the upside towards 112.50:

What you need to take care of on Thursday, September 22:

The dollar stands victorious after the US Federal Reserve spurred volatility across the FX board. As widely anticipated, the American central bank hiked the benchmark rate by 75 bps to 3.25%, while policymakers maintained their determination to bring inflation down to target. However, there was no innovation in monetary policy; generally speaking, they are confident about economic progress.

At the same time, the Fed upwardly reviewed its inflation projections, with the PCE price index now seen at 5.4% this year and at 2.8% in 2023. It won’t be until 2024 when it will reach the 2% target. Growth suffered downward revisions, the steeper one in the near term. For this year, the Gross Domestic Product is now seen at 0.2%, down from 1.7%, but for the upcoming years, it is seen above 1%. Finally, the median expectation for the federal funds rate at the end of 2023 is 4.6% from 3.8%.

Chief Jerome Powell was cautiously optimistic about economic progress, which put a cap on the dollar’s appreciation. Nevertheless, as Wall Street plunged to fresh lows, the greenback recovered ground.

Risk aversion led the way during the European session, as Russian President Vladimir Putin announced a mobilization of reserve forces. Additional 300,000 citizens have been called to serve in Ukraine as Moscow loses ground in Ukraine. Putin claimed that the West wanted to destroy Russia and reiterated the plan to annex more of its neighbor country. EU member states held a meeting to discuss a coordinated response to the continuation of the war, according to European Commission spokesman Peter Stano.

The EUR/USD pair plunged to 0.9812, its lowest since October 2002, and currently hovers around 0.9860. GBP/USD also plummeted, now trading at 1.1280. Commodity-linked currencies are among the weakest, weighed by the poor performance of Wall Street. The AUD/USD pair trades at around 0.6640, while USD/CAD pressures highs in the 1.3440 price zone.

Safe-haven assets retain modest gains against the greenback. The USD/JPY pair hovers around 144.00 while spot gold jumped to $1,690 a troy ounce but gave up some $20 ahead of the close. Finally, WTI settled at $83.20 a barrel, marginally lower in the day.

Near-term US Treasury yields soared. The 2-year Treasury note currently offers 4.03% after reaching an intraday peak of 4.12%. The yield on the 10-year note eased to settle at 3.51%.

The Bank of Japan is next in line, as the monetary policy decision is coming up in the next Asian session. Finally, the Bank of England and the Switzerland National Bank will announce their decisions during European trading hours.

Cardano price: ADA is ready to explode, final stretch before Vasil hard fork

Like this article? Help us with some feedback by answering this survey:

- AUD/USD bulls have eyes on the 0.6720s despite hawkish Fed.

- The US dollar has dropped from the post-Fed rate hike highs.

AUD/USD has rallied following a 30 pip drop below the round 0.6650 level that came on the back of the knee-jerk reaction to the Fed's interest rate hike. AUD/USD, however, recovered from a session low of 0.6621 to 0.6705 during the Fed's presser and back into the Tokyo highs in an explosive move vs. the bearish creeping trend. Technically, the rally came on the back of a harmonic pattern as illustrated below.

Meanwhile, Federal Open Market Committee's conclusion to its two-day meeting resulted in the Federal Reserve deciding unanimously between its board members to hike interest rates by 75bps. The decision and further details surrounding the Fed's dot plot and economic forecasts have pressured the US yields and the dollar higher initially, however, there has been a turnaround with the greenback now trading back below the 111 area.

The expectations for higher rates and a decision by Russian President Vladimir Putin to mobilize more troops for the conflict in Ukraine had already pushed the dollar to a two-decade high before the Fed. The DXY index that measures the US dollar against a basket of currencies was breaching into the 111 area but on a post-Fed announcement, the index shot up to a high of 111.578. It has since stumbled back to test a trendline support area near 110.60.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

Fed chairman presser

Meanwhile, Fed's chairman, Jerome Powell has been speaking to the press:

-

Powell speech: MBS sales not something I expect to be considering in near term

-

Powell speech: There is no painless way to bring inflation down

- Powell speech: No one knows if we will get a recession

-

Powell speech: Just moved into lowest levels of what we consider restrictive today

-

Powell speech: Dot plot projections do not represent plan or commitment

-

Powell speech: No grounds for complacency on inflation

-

Powell speech: Economy does not work without price stability

AUD/USD technical analysis

The price completed a deep crab harmonic pattern. Following the sell-off to 0.6620's, the price rallied back to engage buyers and to trip stops at and around the 0.6650s for a run on positions accumulated towards the 0.67 area in what has been a creeping bearish trend established since the open of the week.

The price would now be expected to complete a measured move to the 0.6720s following a correction to the upper quarter of the 0.66 area if not back to 0.6650 following the break of those structures and the trendline resistance that would be now be expected to act as a counter trendline support.

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"Higher interest rates, slower growth, softening labor market are all painful for public but they are not as painful as failing to restore price stability."

"We want to act aggressively now and keep at it until we get inflation down."

"In housing market, we have to go through a correction to get back to normal price growth."

"This difficult correction should put housing market back into better balance."

"Likely rates will get to levels in the Summary of Economic Projections."

"We've written down a plausible path for fed funds rate and the actual path will be enough to bring down inflation."

- GBP/USD tanked to fresh multi-year lows at around 1.1234 as a reaction to the Fed’s 75 bps rate hike.

- According to the SEP, the US Federal Reserve would likely lift rates by an additional 125 bps.

- The SEP reported that growth might dip towards 0.2%, while inflation is projected to end at around 4.5 to 5.4%.

The GBP/USD sank and refreshed 37-year lows, sliding below the 1.1300 figure, hitting a 2022 YTD low at 1.1235 after the US Federal Reserve hiked rates by 75 bps in the September meeting. According to the Summary of Economic Projections (SEP), officials opened the door for another 75 bps in November and a 25 bps interest rate increase in December. At the time of writing, the GBP/USD seesaws around the 1.1300-50 area in a volatile trading session as Fed Chair Powell speaks.

Some remarks of Fed Chair Jerome Powell’s press conference

In the Q&A session, Chair Powell said that the Fed has moved into the lowest level of restriction and added that it would take some time to see the full effects of changing financial conditions. Powell said that longer-run inflation expectations remained somewhat anchored and added that supply shocks had caused part of the inflation, and if they abate, it could help ease elevated prices.

Furthermore, regarding a soft landing, he said it would be challenging, but no one knows if the current Fed tightening process would lead to a recession and how deep it would be.

Summary of the monetary policy statement

According to its mandate, the US Federal Reserve decided to hike rates to the 3-3.25% range on Wednesday, bringing inflation towards its 2% target. In the monetary policy statement, the FOMC reiterated that it’s strongly committed to reaching the Fed’s goal and mentioned that further rate hikes are needed.

Fed officials acknowledged that economic indicators point to modest economic growth while spending is getting hit by higher rates. Participants mentioned that the labor market remains “robust,” and the unemployment rate has remained low.

Concerning inflation, Fed officials mentioned that inflation remains elevated due to reflecting imbalances between supply and demand.

Aside from this, the Summary of Economic Projections (SEP) policymakers expects the Federal funds rate to increase to 4.4% by the year’s end, as reported by the median. Meanwhile, as reported by the PCE, inflation is estimated to reach 5.4%, while the core PCE figure, which is the benchmark for Fed members, is estimated to end at 4.5%. The unemployment rate is calculated to uptick to 3.8%.

Notably, most inflation readings were revised upwards, alongside interest rate projections.

Markets reaction

The GBP/USD dropped below the 1.1200 mark as the headline crossed newswires and reached a YTD low at 1.1234. However, bids entered around the year’s lows and climbed toward current price levels, jumping almost 100 pips, as the US Federal Reserve Chair Jerome Powell took the stand.

GBP/USD Key Technical Levels

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"There is no painless way to bring inflation down."

"We haven't given up the idea we can have just a modest increase in the jobless rate while bringing inflation down."

"Think of price stability as an asset that delivers benefits to the public."

"Delay in getting inflation down would only lead to more pain."

"Once you are on path to lower inflation, things will start to feel better."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"There is a fairly large group that would see 100 bps by year-end."

"Median policymaker sees 125 bps hikes by year-end."

"Core PCE inflation readings are not where we expected or wanted to be."

"MBS sales not something I expect to be considering in the near term."

"We are very aware of what's going on in other economies around the world and vice versa."

"Labor market in particular has been very strong."

"We are having an effect on interest-sensitive spending, exports and imports."

"There is still very significant savings out there to support growth."

"There is a possibility that growth could be stronger than we forecast, and that's a good thing."

"We cannot fail to get inflation down to 2%."

"Very high likelihood of period of much lower growth."

"We need to have a rise in unemployment, softer labor market conditions."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"Plausible that job openings could come down without as much of increase in unemployment."

"Longer run inflation expectations this cycle have remained fairly well anchored."

"That will also make it easier to bring inflation down."

"Part of inflation caused by supply shocks."

"Commodity prices look like they may have peaked."

"If supply shocks also abate, could also ease pressures on inflation."

"Restoring price stability while achieving soft landing is challenging."

"No one knows if we will get a recession, or if so, how deep it would be."

"Chances of a soft landing also likely to diminish to the extent that policy needs to be more restrictive or restrictive for longer."

"But not bringing down inflation would bring far greater pain."

"We believe we need to raise policy stance to restrictive level."

"By restrictive, I mean putting meaningful downward pressure on inflation."

"It needs to meaningfully put downward pressure on inflation."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"My main message is that FOMC is strongly resolved to bring inflation down."

"Our focus is getting inflation back down. To do that, we think we'll need softening in labor market, below trend economic growth."

"So far, only modest evidence labor market cooling off."

"In light of high inflation, we think we will need to bring funds rate to restrictive level, keep it there for some time."

"Before reducing rates would want to be very confident inflation moving back down to 2%."

"No certainty on how the economy will unfold, need to move policy to restrictive level."

"There is a possibility we would go to a certain level on rates and stay there, but not there yet."

"We've just moved into lowest levels of what we consider restrictive today."

"Still a ways to go on rates."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"Pace of rate increases will depend on data, outlook."

"At some point, will become appropriate to slow pace of rate hikes."

"We will continue to make decisions meeting by meeting."

"We'll need restrictive policy stance likely for some time."

"Dot plot projections do not represent plan or commitment."

"We are taking forceful, rapid steps."

"Reducing inflation is likely to require a sustained period of below-trend growth."

"We will keep at it until confident the job is done on inflation."

"We will do everything we can to achieve our goals."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"We expect supply and demand conditions in labor market to come into better balance over time."

"Inflation remains well above our 2% goal."

"Price pressure evident across broad range of goods and services."

"Participants continue to see upside risks to inflation."

"No grounds for complacency on inflation."

"Highly attentive to risks of inflation."

"Over coming months, we'll be looking for compelling evidence inflation is moving down."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3-3.25% following the September policy meeting.

Key quotes

"Strongly committed to bringing inflation down."

"Price stability is our bedrock."

"Economy does not work without price stability."

"We are moving our policy stance purposefully."

"Housing sector has weakened significantly."

"Weaker economic growth abroad restraining exports."

"Labor market has remained extremely tight, wage growth is elevated."

"Job gains have been robust."

"Labor market continues to be out of balance."

- Gold is moving between highs and lows of the day post-Fed.

- Fed hikes rates by 75bps as expected, and remains committed to hiking rates further.

The gold price has extended its bear cycle trend to a fresh low following the Federal Open Market Committee's conclusion to its two-day meeting that resulted in the Federal Reserve deciding unanimously between its board members to hike interest rates by 75bps. The decision and further details surrounding the Fed's dot plot and economic forecasts have pressured the US yields and dollar higher which has weighed on gold. XAU/USD dropped from a pre-rate hike announcement of $1,669 to a low of $1,653.87 so far.

The expectations for higher rates while at the same time, investors fled for safety after a decision by Russian President Vladimir Putin to mobilize more troops for the conflict in Ukraine had already pushed the dollar to a two-decade high. The DXY index that measures the US dollar against a basket of currencies was breaching into the 111 area before the Fed. It has now gone on to print a post-Fed announcement high of 111.578 so far.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

The focus will now turn to the Fed's chairman, Jerome Powell who will speak to the press:

Watch live: Fed Powell presser

Elsewhere, geopolitical tensions have been offering some support to gold.

The Russian president Vladamir Puti said he will mobilize an additional 300,000 troops to shore up the country's flagging invasion of Ukraine, where it is steadily surrendering territory to counter attacks from Ukrainian forces while making nuclear threats as well.

Gold technical analysis

There are still prospects of a move higher from out of the sideways channel as per the M-formation which is a reversion pattern.

- The Federal Reserve raised rates by 75 bps and expects rates to finish at around 4.4% in 2022.

- In the Summary of Economic Projections, the median of Fed officials estimates growth at 0.2% by the year’s end.

- EUR/USD Reaction: Tumbled to fresh multi-year lows at around 0.9812.

The EUR/USD collapsed to fresh multi-year lows as the US Federal Reserve hiked rates by 75 bps, and anticipated ongoing increases to the Federal fund’s rates (FFR) will be appropriate. Also, the Federal Reserve Open Market Committee (FOMC), decided to continue reducing the Balance Sheet, as planned in May. At the time of writing, the EUR/USD oscillates around the 0.9810-50 area, due to increased volatility, after the Fed’s decision.

Summary of the monetary policy statement

In its monetary policy statement, Fed officials acknowledged that indicators point to modest growth in spending and production. Additionally mentioned that the labor market remains “robust” and that inflation is still reflecting imbalances between supply and demand.

Policymakers reiterated the Fed’s commitment to return inflation to its 2% objective and would assess incoming data, including readings on public health, labor market conditions, inflation pressures, and inflation expectations.

Regarding the Summary of Economic Projections, FOMC members estimate the Federal funds rate (FFR) at 4.4% by the end of 2022, according to the median, while growth in the US for the same period is estimated to finish at 0.2%.

Concerning inflation data, Fed officials estimate that plain vanilla inflation, known as the PCE, will end at 4.5% in 2022 while excluding volatile items, and the Fed’s favorite gauge of inflation, the core PCE, to remain around 4.5% by the year’s end.

Markets reaction

Once the headline crossed newswires, the EUR/USD dropped below the 0.9870 mark and reached a daily low of 0.9812. However, it bounced off those lows, and so far, the EUR/USD has recovered some ground, at around 0.9839, ahead of the Federal Reserve Chair Jerome Powell’s press conference at around 18:30 GMT

EUR/USD Key Technical Levels

The US Federal Reserve's Summary of Economic Projections, the so-called dot plot, revealed on Wednesday that officials' median view of the Fed's policy rate at the end of 2023 stands at 4.6%, compared to 3.8% in June's dot plot.

Key takeaways via Reuters

"Fed officials' median view of fed funds rate at end-2022 4.4% vs 3.4% in June projection."

"Fed officials' median view of fed funds rate at end-2024 3.9% (prev 3.4%)."

"Fed officials' median view of fed funds rate at end-2025 2.9%."

"Fed officials' median view of fed funds rate in longer run 2.5% (prev 2.5%)."

"Ffed officials see year-end US jobless rate at 3.8% in 2022 (prev 3.7%); 4.4% in 2023 (prev 3.9%); 4.4% in 2024 (prev 4.1%); 4.3% in 2025; long-run at 4.0% (prev 4.0%)."

"Fed officials see PCE inflation at 5.4% in 2022 (prev 5.2%); 2.8% in 2023 (prev 2.6%); 2.3% in 2024 (prev 2.2%); 2.0% in 2025; long-run at 2.0% (prev 2.0%)."

"Fed officials see GDP growth at 0.2% in 2022 (prev 1.7%); 1.2% in 2023 (prev 1.7%); 1.7% in 2024 (prev 1.9%); 1.8% in 2025; long-run at 1.8% (prev 1.8%)."

"One Fed official sees US GDP contracting in 2023."

"Summary of economic projections implies at least one more 75-basis-point rate hike in 2022, no rate cuts until 2024."

The US Federal Reserve on Wednesday announced that it raised the policy rate, federal funds rate, by 75 bps to the range of 3-3.25%. This decision came in line with the market expectation.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Market reaction

With the initial reaction, the US Dollar Index jumped to its highest level in two decades above 111.50, gaining more than 1% on a daily basis.

Key takeaways from policy statement

"Fed is highly attentive to inflation risks, strongly committed to returning inflation to 2%."

"Job gains have been robust, unemployment rate has remained low."

"Recent indicators point to modest growth in spending and production."

"Inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, broader price pressures."

"War in Ukraine creating additional upward pressure on inflation, weighing on global economic activity."

"Prepared to adjust policy as appropriate."

"Vote in favor of policy was unanimous."

- EUR/GBP dropped after failing to break above the 0.8787 area.

- The EUR/GBP daily chart remains upward biased, but a negative divergence is looming, having risks skewed to the downside.

- In the short term, the EUR/GBP is already downward biased and could break below the 0.8700 mark.

The EUR/GBP dropped from daily highs after hitting a YTD high on Monday at 0.8787. Still, renewed fears of tensions arising between Ukraine and Russia weighed on the shared currency, which is trading below its opening price by 0.41% on Wednesday. At the time of writing, the EUR/GBP is trading at 0.8719.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP daily chart illustrates the cross-currency pair that, albeit tumbling from around YTD highs, the pair encountered support above the June 15 daily high at 0.8721. During the day, the EUR/GBP dived towards its daily low at 0.8711, but bids lifted the pair towards current exchange rates. EUR/GBP traders should be aware that a negative divergence is forming, with the EUR/GBP price action registering higher highs, contrary to the RSI, which printed lower lows.

Therefore, in the near term, traders could expect a correction before resuming the uptrend.

Short term, the EUR/GBP is downward biased, as depicted by the 4-hour chart. The negative divergence in this time frame sent the cross sliding below the 20-EMA, but the 50-EMA at 0.8711, was a difficult support level to hurdle. Nevertheless, with the RSI getting into negative territory and further weakness expected by the euro, a fall below the 0.8700 mark is likely.

Therefore, the EUR/GBP first support would be the 50-EMA at 0.8711, which, once cleared, could send the pair sliding towards the S1 pivot at 0.8696. A breach of the latter will expose the 100-EMA at 0.8672, followed by the last week’s low at 0.8625.

EUR/GBP Key Technical Levels

- USD/CAD bulls need to break 1.3410 and the bears 1.3350 around the Fed event.

- The Fed is expected to hike 75bps or even deliver 1 full basis point.

USD/CAD is starting to decelerate on the bid as we approach the Federal Reserve's interest rate decision at the top of the hour. At the time of writing, the pair is still higher by some 0.2% at 1.3395 after rallying on the day so far from a low of 1.3357 to a two-year high of 1.3408. Apart from the anticipation around a hawkish Fed, geopolitical tensions have bolstered safe-haven assets, weighing on the CAD despite an attempted recovery in the price of oil.

Russian President Vladimir Putin called up 300,000 reservists to fight in Ukraine and hinted to the West he was prepared to use nuclear weapons to defend Russia which has fuelled demand for the safe haven US dollar and Treasuries. In turn, however, the price of oil, one of Canada's major exports, has also jumped momentarily on the back of the escalation of the war that has raised concerns of tighter oil and gas supply.

However, the focus quickly turned back to the Federal Open Market Committee which concludes a two-day meeting today. The Fed is widely expected to lift interest rates by three-quarters of a percentage point for a third straight time. There is some speculation of a 1bp hike to borrowing costs in order to tame a potentially corrosive outbreak of inflation.

''We expect the FOMC to deliver its third consecutive 75bp rate hike, bringing the policy stance decidedly above its estimate of the longer-run neutral level,'' analysts at TD Securities said.

''We also look for the Committee to provide more hawkish signals through the update of its economic projections and for Chair Powell to build on his Jackson Hole message.''

''Treasuries should respond to the size of the hike, the 2023/2024 dots, and Powell's tone on further tightening. Given the hawkish market positioning, a "sell the rumor, buy the fact" reaction is possible.''

''Buy the rumor, sell the fact is a tempting play for the USD, but we are wary that the messaging at this meeting will be more hawkish than usual. Neutral bias and reassess after.''

Meanwhile, the Bank of Canada's Deputy Governor Paul Beaudry said that inflation in Canada remains "too high" but is headed in the right direction. This followed an inflation report that missed the mark but the deputy governor remained adamant that the central bank needed to do whatever is needed to bring price increases back to target.

USD/CAD technical analysis

The weekly charts show the price is attempting to break out of the chennel. If the Fed disappoints the hawks, then the greenback could come under pressure and see USD/CAD snapping back into the channel from resistance towards prior support near a 50% retracement or even to a 61.8% ratio for the coming days.

For the Fed event, the following hourly support and resistances are key:

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- The USD/JPY broke out of the 142.60-143.60 area on Wednesday, gaining some 0.43%.

- From a long-term perspective, the USD/JPY is still upward biased, further confirmed by the RSI’s remaining in bullish territory.

- Short term, the USD/JPY is also upward biased and could aim towards the 145.00 area if the Fed hikes 75 bps and keeps its hawkish stance.

The USD/JPY slightly advances for the third consecutive day, hitting a fresh weekly high at around 144.31, ahead of the US Federal Reserve monetary policy decision, where the US central bank is awaited to lift rates above the 3% threshold. Therefore, the USD/JPY is trading at 144.31, above the opening price by 0.41%, at the time of writing.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY remains upward biased, underpinned by the US 10-year Treasury bond yield movement. Worth noting that the Relative Strength Index (RSI) got a respite after reaching the YTD high at 144.99. though at the time of typing, RSI’s just crossed above its 7-day SMA, depicting that buyers are gathering momentum ahead of the US Fed decision.

Short term, the USD/JPY four-hour chart portrays the same scenario as the daily chart, upward biased. Once the USD/JPY hit the YTD high, it dived towards 141.50, September’s low, forming a base. Since then, the major began trading around the 141.50-144.90 area, but lately, stuck in the 142.60-143.60 range. However, during Wednesday’s session, the USD/JPY broke upward, opening the door for a test of the August 1998 high of 147.67.

Therefore, the USD/JPY’s first resistance would be the YTD high at 144.99. A break above will expose the R3 daily pivot at 145.09, followed by the 146.00 psychological level, ahead of August’s 1998 high at 147.67. On the flip side, the USD/JPY first support would be the R1 daily pivot at 144.12. A breach of the latter will expose the confluence of the daily pivot and the 20-EMA at 143.54, followed by the 50-EMA at 143.33, ahead of the S1 pivot at around 143.00.

USD/JPY Key Technical Levels

- The GBP/USD fell to a fresh 37-year high at around 1.1300.

- Most economists prepare for another hefty Fed hike alongside the update of the US economy projections.

- The Bank of England will meet on Thursday, and analysts estimate a 50 bps rate hike.

The GBP/USD refreshes 37-year lows during the North American session, tumbling 0.38%, ahead of the FOMC’s decision, as geopolitical tensions in Eastern Europe arise. A risk-off impulse in the FX complex keeps the greenback in the driver’s seat, reaching a two-decade high above the 111.00 mark, while most G8 currencies are dropping.

Earlier, the GBP/USD hit the daily high at 1.1384, but Russian President Vladimir Putin’s commentary spurred a flight to safety, sending the major sliding towards a fresh YTD low at 1.1304. At the time of writing, the GBP/USD is trading at 1.1333.

GBP/USD drops on buoyant US dollar ahead of the Fed and BoE’s decision

Sentiment remains upbeat ahead of the FOMC’s decision, with European and US equities rising. US Treasury bond yields remain depressed, except for the US 2-year yield, which crossed the 4% threshold during the day. Today, the US Federal Reserve is expected to raise the Fed funds rate (FFR) by 75 bps, to the 3-3.25% area, into restrictive territory, according to the last Summary of Economic Projections (SEP) revealed in June. Nevertheless, don’t discount a 100 bps move, with odds of lifting rates of that size at an 18% chance.

Alongside revealing the monetary policy statement, the Fed would update the SEP, which could give us some clues regarding Fed officials’ projections of US growth, unemployment, inflation, and interest rate levels. Regarding interest rates, most investors are waiting for the “dot-plot,” where all the policymakers delieate the future path for the Federal funds rate (FFR). A large part of Wall Street estimates a hawkish tilt towards finishing 2022 at around the 3.75-4% range and, by 2023, to move towards the 4-4.50% area.

The US Dollar Index, a measure of the greenback vs. six peers, is trading at two-decade-highs at around 111.000, up by 0.74%, breaching for the first time the 111.000 mark. Contrarily, US T-bond yields are getting a respite, with the US 10-year bond yield almost flat at 3.571%.

Elsewhere. the US economic docket revealed that Existing Home Sales for August dropped 0.4%, less than expectations for a 2.29% contraction estimated and also better than July’s 5.9% fall.

On Thursday, the Bank of England (BoE) will meet, and the consensus estimates the central Bank will hike 50 bps the Bank’s rate. At the same meeting, the BoE is expected to begin its Quantitative Tightening (QT), with outright sales from its GBP 838 billion gilt on its balance sheet at a pace of GBP 10 billion a quarter.

Also read: BoE Preview: Forecasts from 10 major banks, a close call between 50 bps and 75 bps

What to watch

The US economic docket will feature the US Federal Reserve monetary policy decision at 18:00 GMT, followed by Chair Jerome Powell’s press conference at 18:30 GMT.

GBP/USD Key Technical Levels

- Another leg lower in EUR/USD brings price near multi-year lows.

- Euro remains under pressure as traders await Fed’s decision.

- FOMC meeting set to trigger volatility across financial markets.

The EUR/USD dropped further during the American session and bottomed at 0.9865, the lowest level in two weeks, and just one pip above the YTD low. The pair remains near the lows as traders await the FOMC decision.

First Russian, then the dollar… now the Fed?

The euro was already hit by rising geopolitical tensions. Russian President Vladimir Putin announced earlier on Wednesday a partial mobilization to support the Ukraine war.

Despite the cautious tone among investors, yields in Europe and in the US kept rising. The US 10-year yield stands at 3.56% while the 2-year yield rose above 4.00% for the first time since 2007. In Germany, the 5 and 30-year curve inverted for the first time since 2008.

Economic data released on Wednesday showed a decline in US Existing Home Sales in August for the seventh month in a row. The 0.4% slide pushed the annual rate to 4.7 million, better-than-expectations of a 4.8 million reading.

Despite Putin and US data, attention is set on the FOMC that in a few minutes, at 18:00 GMT will announce its decision on monetary policy. The Fed will also release new macroeconomic projections from the FOMC staff and Chairman Powell will held a press conference.

The decision, the tone, the dot plot and Powell’s words are expected to have a significant impact on financial markets including the US dollar. The DXY arrives to the meeting trading at the strongest level since June 2002, above around 111.00.

Technical levels

- US dollar remains firm on a quiet session ahead of the Fed.

- Focus remains on the FOMC meeting; statement at 19:00 GMT.

- AUD/USD at the lowest level since May 2020.

The AUD/USD failed to recover ground and printed a fresh two-year low at 0.6652. It is hovering around the lows as market participants look at the Federal Reserve.

The combination of a stronger US dollar supported by higher US yields and a cautious tone across financial markets, keeps the AUD/USD under pressure.

Stocks in the Wall Street are up 040% on average, but risk sentiment does not look so positive, particularly after Russian President Putin speech announcing partial military mobilization to fight Ukraine war and mentioned and threatened with a nuclear response.

The focus is set on the Federal Reserve that will announce its decision at 18:00 GMT. A 75 bps rate hike is expected. Chairman Powell's press conference is at 18:30 GMT. A hawkish tone is priced in. US yields and the greenback have been rising prior to the event. The DXY is at multi-year highs above 111.00 and the 2-year yield is above 4.00% for the first time since 2007.

Economic data released on Wednesday showed the seventh consecutive monthly decline in US Existing Home Sales in August. The 0.4% slide pushed the annual rate to 4.7 million, better-than-expectations of a 4.8 million reading.

The AUD/USD continues under pressure. Below 0.6650, the next support might be seen at 0.6600 followed by 0.6580 and 0.6565. To alleviate the bearish pressure, the aussie needs to recover and remain above 0.6680. The next resistance is seen at 0.6730/35 followed by 0.6770.

Technical levels

- Gold gets a respite, bolstered by increasing tensions between Russia-Ukraine.

- The US Dollar Index, hits a two-decade high above 111.000, the highest since 2007.

- Gold Price Analysis: Downward biased, despite jumping from weekly lows, boosted by Putin’s commentary.

Gold price snaps two-days of consecutive losses and climbs, despite broad US dollar strength, courtesy of increasing tensions between Ukraine-Russia. Therefore, investors seeking safety, bolstered the yellow metal. At the time of writing, XAU/USD is trading at $1667.15 a troy ounce, above its opening price.

US equities are slightly up, ahead of the Fed’s decision. US Treasury bond yields are retreating from their YTD highs, augmenting the appetite for precious metals, after newswires reported that Russian President Vladimir Putin is preparing to deploy 300K additional troops towards “defending” the regions of Donbas and Luhansk.

Aside from this, traders are laser focus with the Fed’s decision. The US central bank is widely expected to raise rates by 75 bps, though there’s a slim 18% chance of going for a 100 bps. Alongside the monetary policy decision, Fed officials would update the Summary of Economic Projections (SEP), which would shed some light, regarding US growth, unemployment rate, and inflation measures.

Additionally to that, in the so-called “dot-plot” in which the eighteen policymakers delineate the Federal funds rate (FFR) for the foreseeable future, most economists are expecting a hawkish tilt, towards finishing 2022 at around the 3.75-4% range, and by 2023, to move towards the 4-4.50%.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, is trading at two-decade-highs at around 111.000, up by 0.73%, breaching for the first time the 111.000 mark. Contrarily, US T-bond yields, are getting a respite, with the US 10-year bond yield, almost flat at 3.561%.

Of late as reported by Reuters, the US 2-year Treasury bond yield, surpassed the 4% threshold for the first time, since 2007, displaying expectations of an aggressive Fed.

Data wise, the US economic docket featured Existing Home Sales for August, dropping 0.4% less than estimates of a 2.29% contraction expected, and also better than July’s 5.9% fall. Analysts cited by Reuters commented that “High prices and Fed rate hikes will likely remain constraints for sales going forward.”

What to watch

Later, the US economic docket, will feature the US Federal Reserve monetary policy decision at 18:00 GMT, followed by the Chair Jerome Powell’s press conference, at 18:30 GMT.

Gold Price Analysis (XAU/USD): Technical outlook

From a technical analysis perspective, XAU/USD daily chart, illustrates the pair as downward biased, though it should be noted, that as price action reached lower-lows, the Relative Strength Index (RSI) does the opposite. This means that a positive divergence might be forming. However, gold’s early gains are mainly attributed to Putin’s commentary, meaning that once the Fed’s decision crosses newswires, noise would dissipate, giving a clear look of the yellow metal price action.

Resistance levels lie at the weekly high at $1679.51, followed by July 21 low at $1681, and then the $1700 mark. On the flip side, the XAU/USD first support would be the weekly low at $1659, followed by the YTD low at $1654, and then a fall towards $1600.

British Prime Minister Liz Truss said on Wednesday that they will be introducing low-tax investment zones across the UK, as reported by Reuters. "Alongside the tax statement that the Chancellor (finance minister) will lay out, he’ll also lay out a series of supply-side reforms to make our economy more productive over the long-term, in areas like financial services," Truss added.

Regarding a potential trade agreement with the US, Truss reiterated that they are open to negotiating a trade deal when the US is ready to do so.

Market reaction