- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Weaker than estimated UK economic data and UK’s new budget fueled UK’s recession fears.

- A break below the 200-EMA officially shifted the GBP/JPY as bearish biased.

GBP/JPY plunged more than 450 pips or 2.93% on Friday, amidst risk-aversion, after PMIs reported by S&P Global showed that the EU and the UK could be headed into a recession. Also, news of a new GBP 161 Billion UK budget to stimulate growth might exert upward pressure on UK Inflation, threatening to deteriorate the already battered economy. At the time of writing, the GBP/JPY is trading at 155.48.

GBP/JPY Price Analysis: Technical outlook

On Friday, the GBP/JPY officially shifted to a bearish bias after tumbling sharply below the 200-day EMA at 160.25, reaching six-month-lows at around 155.33. Due to the size of the collapse, the Relative Strength Index (RSI) accelerated towards oversold conditions, with readings at 25.43, suggesting that the pair might be subject to a mean reversion move.

Nevertheless, if the GBP/JPY drops below the 155.00 figure, a fall towards the March 8 daily low at around 150.97 is on the cards. So the GBP/JPY first support would be the 155.00 figure. Once cleared, the next support would be the January 24 cycle low at 152.90, ahead of the 150.97 mark.

On the other hand, the GBP/JPY's first resistance would be the 156.00 mark. Break above will expose the May 27 daily low-turned-resistance at 157.87, ahead of the 158.00 mark.

GBP/JPY Key Technical Levels

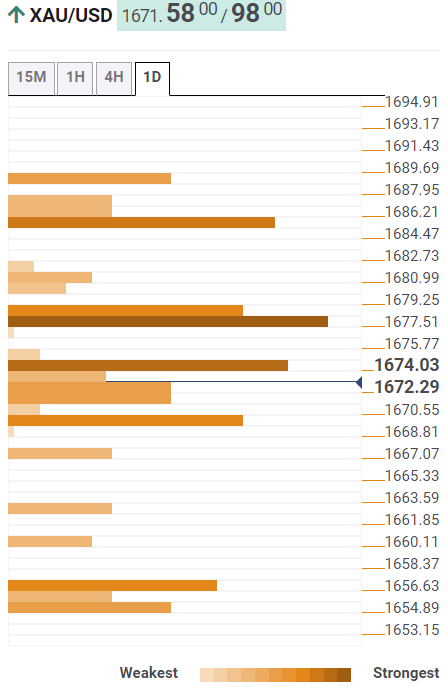

- Gold price tanked to new two-and-half years low at $1638.90.

- Global S&P PMIs revealed in the EU, UK, and the US sparked investors’ recession fears, increasing appetite for the safe-haven US dollar.

- Gold Price Analysis: A break below $1638 to send XAU/USD towards $1600.

Gold price slides to fresh two-and-half-year lows dampened by a risk-off mood and flows towards the US dollar, which rose to new two-decade highs. Overall, US dollar strength and higher US Treasury bond yields are two reasons for the fall in the precious metals complex, mainly the yellow metal. At the time of writing, XAU/USD is trading at $1643.50 a troy ounce.

US equities dropped as Wall Street closed with hefty losses between 1.62% and 1.80% on Friday. The US 10-year benchmark note rate retraced from yielding 3.829% and is set to end the week below the 3.70% threshold. On the same note, the US 10-year Treasury Inflation-Protected Securities (TIPS) bond yield weighed on the non-yielding metal, set to finish at 1.33%.

In the meantime, the greenback continues refreshing 20-year highs, with the US Dollar Index sitting at 112.990, up by 1.55%, after hitting the YTD high at 113.228.

Fed’s decision on Wednesday, lifting rates by 0.75%, and opening the door for another 120 bps increase, reignited US recession fears. A tranche of worldwide business activity measures revealed during the day foresees a recession in the Euro area and the UK. In the case of the US, S&P Global PMIs, improved, even though the Services and Composite readings remained in recessionary territory.

Sources cited by Reuters commented, “Gold and the other semi-investment metals like silver and platinum will likely continue to remain under pressure until the market reaches peak hawkishness.”

Aside from this, XAU/USD began trading at around the $1670 area and climbed to the daily high at $1675.93. Later, the yellow metal prices plummeted towards the fresh YTD low at $1638.90.

Gold Price Analysis (XAU/USD): Technical outlook

The falling wedge that emerged in the XAU/USD daily chart was invalidated once the spot price tumbled below the bottom trendline. Worth noting that even though the RSI is about to signal that gold is oversold, the yellow metal’s downtrend remains intact. Therefore, XAU/USD’s first support would be the YTYD low at $1638.90. Once cleared, the XAU/USD’s next support would be the $1600 psychological level, followed by March’s 2020 lows at $1451.41.

- USD/CHF extends its weekly gains to 1.98% after the Fed and SNB monetary policy decisions.

- The major break above the 0.9600-0.9700 range, registering a fresh weekly high at 0.9851.

- The USD/CHF path of least resistance is upwards; once it clears 0.9851, a re-test of 0.9900 is on the cards.

The USD/CHF advanced during Friday’s North American session, gaining 0.60%, courtesy of a risk-off impulse spurred by fears of a global economic slowdown and the Fed’s aggression as the US central bank struggles to temper inflation from around 40-year highs. At the time of writing, the USD/CHF is trading at 0.9836.

USD/CHF Price Analysis: Technical outlook

The central bank frenzy witnessed the Fed and the Swiss National Bank (SNB) hiking rates. Even though the SNB finished the period of negative rates, it wasn’t enough, according to market participants, which bought the USD/CHF, lifting the pair towards fresh weekly highs around 0.9851. Nevertheless, USD/CHF buyers have been unable to crack last week’s high at 0.9869, which could open the door for further gains.

Short term, the USD/CHF 4-hour chart, shifted from neutral to neutral-upward biased once the pair rallied above 0.9800, after trading sideways, in the 0.9600-0.9700 area throughout the week. Albeit the Relative Strength Index (RSI) got into overbought conditions, the USD/CHF upward bias remains intact.

Therefore, the USD/CHF first resistance is the weekly high at 0.9851. Break above will expose the R1 daily pivot at 0.9870, followed by the psychological 0.9900 mark.

On the other hand, the USD/CHF first support will be the daily pivot point at 0.9766. A breach of the latter will send the pair sliding to the 20-EMA at 0.9719, ahead of the 0.9700 figure.

USD/CHF Key Technical Levels

- WTI tumbles more than 7.50% weekly, registering a fresh 8-month low.

- Global S&P PMIs in September increased worries of a worldwide recession, weighing on WTI.

- WTI Price Analysis: A break below $78.00 could pave the way for a fall to $70.00.

The US crude oil benchmark, also known as WTI, drops below $80.00 per barrel on Friday, amid a buoyant US Dollar, with the US Dollar Index rising to levels last seen on May 2002, a headwind for the US dollar-denominated commodity. Therefore, WTI is trading at $78.80, below its opening price by almost 6%, after hitting a daily high of $83.90.

During the week, WTI is already down by 8%, extending its decline to the fourth consecutive week. On Wednesday, the US Federal Reserve’s decision to increase rates and emphasize the need to further hikes is weighing on the black gold. That, alongside a frenzy of other central banks lifting rates, raised worldwide recession fears. Therefore oil demand would diminish.

Sources cited by Reuters said, “The crude market is under heavy selling pressure as US dollar maintains strong upward trajectory amidst more reduction in risk appetite.”

In the meantime, sentiment shifted sour, bolstering the buck. US equities are dropping between 2.13% and 3.44%, extending their weekly losses. Contrarily the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, is rising 1.39% at 112.808, refreshing two-decade highs.

Adding to recessionary fears was a tranche of S&P Global PMIs, revealed during the day. The UK and the euro area PMIs, were below estimates and prepared to hit a recession, with most indices sitting in contractionary territory. In contrast, US PMIs, were mixed, though the three components improved, keeping hopes high that the US economy could dodge a recession.

Besides, as reported by a US official, the Iran nuclear deal has stalled as Tehran insists on the closure of the UN nuclear watchdog’s investigations.

WTI Price Analysis: Technical outlook

WTI’s daily chart depicts oil price sliding below the bottom trendline of a falling wedge, which is usually a bullish signal. Therefore, US crude oil might be headed towards re-testing the January 1 and also YTD, low at $65.94. Albeit, the Relative Strength Index (RSI) sits at 33.25, in negative territory, but not in oversold conditions. So a break below $75.00 could pave the way to $70 per barrel, on its way to $65.94.

The pound suffered on Friday the worst decline since at least March 2020, with GBP/USD losing more than 300 pips. Analysts at MUFG Bank, remain bearish on the pound and point out the loss of confidence in GBP is becoming more concerning.

Key Quotes:

“We now expect the BoE to hike by 75bps on 3rd November; a 100bp move can’t be ruled out. The OIS market is priced for a 4.00% Bank Rate by year-end. We don’t think we quite get there but it is clear where short-term rates are heading. The primary risk here relates to the timing of this huge fiscal stimulus on top of the lack of accountability.”

“We remain bearish GBP as it approaches levels closer to the all-time low of 1.0520 in 1985. There is certainly no ‘happy-feel’ to this fiscal give-away and appears if anything to have increased the level of uncertainties that were already very elevated.”

“At the same time the BoE’s decision to raise rates by “only” 50bps this week instead of 75bps like the ECB and Fed could be adding to concerns that the BoE is falling behind the curve in fighting inflation. We expect these policy concerns over the appropriateness of both fiscal and monetary policy to remain in place in the near-term weighing heavily on the GBP. Furthermore, the renewed sell-off in global equity markets and tightening of global financial conditions make it more challenging to finance the UK’s elevated current account deficit reinforcing downward pressure on the GBP.”

According to analysts from Danske Bank, the US dollar will continue to move higher versus the euro over the next months. They forecast the EUR/USD pair at 0.96 in a trhee months period and at 0.95 in a year.

Key Quotes:

“The large negative terms-of-trade shock to Europe vs US, a further cyclical weakening among trading partners, the coordinated tightening of global financial conditions, broadening USD strength and downside risk to the euro area makes us keep our focus on EUR/USD moving still lower (targeting 0.95) – a view not shared by the consensus.”

“The key risk to shift EUR/USD towards 1.15 is seeing global inflation pressures fade and industrial production increase. However, ‘transitory’ has substantially lost credibility and European industrial production continues to be weak. This will continue as manufacturing PMIs heads below 50. The upside risk also include a renewed focus on easing Chinese credit policy and a global capex uptick but neither appear to be materialising, at present.”

Data released on Friday showed a 2.5% decline in Canadian retail sales in July, a larger-than-expected slide. Analysts at CIBC, still see the Bank of Canada (BoC) raising the key interest rate by 50 basis points in October.

Key Quotes:

“After months of gains, Canadian retail sales fell more than expected in July as Canadians may have started to react to higher interest rates. Headline sales fell 2.5% in July, below consensus expectations for a 2% decline. In volume terms, retail sales pulled back 2%.”

“Retail sales had been more resilient than expected in the past couple of months given high inflation, rising interest rates and a shift to service consumption. The weaker-than-expected July data finally provides some evidence that the expected shift away from goods consumption and the impact of higher rates are starting to materialize more meaningfully. This is the type of data the Bank of Canada will be looking for as it enters what should be the last stage of its hiking cycle.”

“We continue to expect another 50 bps increase in October, before further evidence of a cooling economy allows the Bank to pause its rate increases.”

According to analysts at Wells Fargo, the strength of the US dollar could persist more than previously estimated after the events of this week that includes rate hikes from many central banks and the decline in stock markets.

Key Quotes:

“The takeaways from this week's central bank bonanza are clear to us. With the FOMC turning even more hawkish, combined with foreign central banks likely not able to keep pace with the Fed, the U.S. dollar should continue to strengthen. Right now, we forecast broad dollar strength against most G10 and emerging market currencies through the end of this year.”

“We now believe risks to our dollar view are tilted towards further upside. Given the hawkish Fed outlook on interest rates, dollar strength could persist into early 2023. The dollar's relentless rise should be most robust against the emerging market currencies, but risk sensitive currencies like the Australian and New Zealand dollar could also experience renewed downside.”

“Heading into this week, we believed the U.S. dollar would continue to strengthen through the end of this year. After the events of this week, we have increased conviction in that view, and now believe dollar strength could continue into the early part of 2023.”

Analysts at Danske Bank forecast the AUD/USD pair at 0.67 in a month, at 0.67 in three months and at 0.66 in six months. They point out the aussie could receive some support from a tight supply of several commodities.

Key Quotes:

“The persistent global inflation has increased the risk of more aggressive tightening especially by the Fed, which has consequently amplified recession odds and weighed on broad commodity FX, including AUD.”

“The Reserve Bank of Australia (RBA) hiked rates by 50bp in its September meeting, and will likely follow with another similar hike next month. However, in the current environment, the tighter monetary policy also means higher risk of a recession for Australian economy, and thus AUD will continue to gain only modest support from the rate hikes.”

“The combination of tightening global financial conditions and weakness in China continues to support broad USD vs. commodity exporters such as AUD. However, the persistent tight supply of several commodities and especially LNG, where Australia is a key global producer, will likely offer support for AUD vs. commodity importers, such as EUR.”

- Pound tumbles across the board on Friday.

- EUR/GBP is having best day since March 2020.

After a brief pullback, EUR/GBP resumed the upside and hit levels above 0.8900 for the first time since 2020. So far, the cross peaked at 0.8910. It is hovering around 0.8900, up 170 pips for the day, the best performance since March 2020. A sharp decline of the pound and risk aversion are driving the move.

Higher rates not helping GBP

On Thursday the Bank of England raised the key interest rate by half a percentage point to 2.25%. The UK government announced on Friday a massive tax cut package. The measures offered no real support for the pound. Also, UK bonds are collapsing on Friday.

“The implication is that a deteriorating budget deficit, and a persistently and likely continued deterioration in the current account will weigh negatively on GBP. In this environment, rising rates and favourable interest rate differentials are not supportive for GBP at this time. With risk sentiment and the global growth outlook worsening, the market may need to consider how non-trivial a move to parity for GBPUSD may be. Meanwhile, EUR looks better situated, for now, versus GBP. The move above 0.88 sets the stage for a higher new range bound by 0.90/0.92”, warned analysts at TD Securities.

Another weekly gain

The EUR/GBP is about to post the eighth weekly gains in a row. Initially, it was a hawkish European Central Bank and now is a weak pound that is driving the cross to the upside. The weekly close is set to be the highest since January 2020. The 0.8900/10 area is a strong resistance and a consolidation above could point to more gains even amid overbought conditions. No signs of stabilization or correction are seen at the moment.

Technical levels

Swiss National Bank (SNB) Chairman Thomas Jordan said on Friday that further rate rises cannot be ruled out, as reported by Reuters.

Key quotes

"Swiss inflation has risen much more than expected, considerably above price stability target."

"Central bank ready to be active in forex markets."

"Price increases hitting parts of economy not previously affected."

"Ensuring price stability demands full attention of the central bank."

Market reaction

The USD/CHF pair edged slightly lower on these comments and was last seen rising 0.42% on the day at 0.9808.

The European Central Bank (ECB) must continue to hike rates and halt bond purchases once their job is done, European Central Bank (ECB) Governing Council member and German central bank head Joachim Nagel said on Friday, per Reuters.

"The fight against inflation comes with burdens," Nagel added. "It is likely to dampen growth temporarily but doing nothing and letting things run their course is not an option."

Market reaction

EUR/USD showed no immediate reaction to these comments and was last seen losing 1.2% on the day at 0.9720.

- The EUR/USD hit a fresh 20-year low at 0.9700 during the North American session.

- Fed’s aggressive tightening cycle and UK’s plan to bolster the economy spurred a risk-off impulse.

- EUR/USD Price Analysis: A decisive break below 0.9700 could send the pair tumbling towards September 2002 lows around 0.9601.

The EUR/USD nosedives below the 0.9800 figure, extending its losses towards the 0.9700 figure, below its opening price by 1.32%, triggered by traders’ worries that Fed’s aggression would tip the US economy into a recession, while the UK announced a plan aimed to lift stimulate the economy.

The EUR/USD is falling off the cliff after reaching a daily high of 0.9851, but the aforementioned factors shifted sentiment sour. Therefore, the shared currency dropped to a fresh 20-year low at around 0.9700. When writing, the EUR/USD is trading around 0.9720.

EUR/USD sinks on upbeat US economic data and risk-off impulse

On Wednesday, the US Fed lifted the Federal funds rate (FFR) by 75 bps and emphasized that it will “keep at it” to tame inflation. In the same meeting, Fed officials estimated that the FFR would likely end at 4.4%, meaning that 125 bps of rate hikes are pending.

Data-wise, the US S&P Global PMIs for September flashed that the US economy is in contractionary territory but showed some improvement. The Manufacturing PMI expanded by 51.8, above forecasts, while the Services and Composite indices improved but fell short of expansionary territory.

Earlier, S&P Global reported PMIs for the Euro area, which persisted in recessionary territory, undermined by Germany’s PMIs. The Eurozone Manufacturing and Services PMI were lower than the previous reading; consequently, the Composite Index edged lower to 48.2, below the last reading, below estimations.

Nevertheless, business activity grew alongside the composite PMI in France, but manufacturing remained depressed. Earlier the ECB member Kazaks said that he would back a 75 bps rate hike, though he would not rule out a 50 bps increase in the October meeting.

EUR/USD Price Analysis: Technical outlook

The EUR/USD extended its losses towards the 0.9700 psychological level, set to finish the week with losses of almost 3%. Even though the euro’s fall has been fast, the Relative Strength Index (RSI) is in bearish territory but not at oversold conditions, opening the door for further losses. A break below 0.9700 could pave the way towards September 2002 lows at around 0.9601.

- US Dollar unstoppable amid risk aversion and positive US economic data.

- US yields moderate upside as Wall Street falls further.

- AUD/USD extends weekly losses and trades at its lowest since May 202.

The AUD/USD dropped further during the American session amid risk aversion and a stronger greenback. The pair is trading at 0.6540, the lowest level in more than two years, under pressure while the DXY printed fresh 20-year highs near 113.00.

All falling…

The dollar is the only king in town on Friday. Commodities are plunging, including a 6% slide in crude oil prices and a 4% decline in silver. Sovereign bonds are also lower, only finding some demand as investors fly to quality. In Wall Street, the Dow Jones is falling by 1.51% and the S&P 500 drops by 1.76%.

Fears about a global recession and higher interest rate continue to weigh on market sentiment that affects emerging and commodity currencies. The US dollar not only benefits from risk aversion on Friday but also from US economic data. The S&P Global PMI preliminary September reading showed a much larger than expected rebound, particularly in the service sector that boosted the greenback further.

The 100-pip slide on Friday in AUD/USD, adds to weekly losses that now are near 200 pips. The pair is about to post the lowest weekly close since May 2020. Despite oversold readings, the negative momentum remains firm.

Technical levels

AUD/USD continues losing ground. Holding above support at 0.6540/0.6465 is critical to avoid a deeper fall, analysts at Société Générale report.

Defending 0.6540/0.6465 can lead to an initial bounce

“The pair has now breached July lows and is close to the lower limit of a multi-month channel at 0.6540/0.6465 which is also a projection for the down move. Defending this can lead to an initial bounce.”

“It would be interesting to see if the pair can establish itself beyond the 200-DMA (now at 0.7100/0.7130).”

“Failure to hold 0.6465 can extend the decline towards next potential support at 0.6100, the 76.4% retracement from 2020.”

USD/JPY sticks to modest gains on Friday around the 143 level. A wide range of 140-145 may persist, according to economists at OCBC.

Risks skewed to the downside

“Daily momentum turned mild bearish while RSI fell. Risks skewed to the downside.”

“Resistance at 145 levels.”

“Support at 141.50 levels (23.6% Fibo retracement of Jul low to Sep high), 140.40 levels.”

“Trades in 140-145 range could still suffice for now.”

“Intervention may slow the pace of JPY depreciation but the move alone is not likely to alter the underlying trend unless USD/ UST yields turn lower or BoJ changes policy stance.”

EUR/USD has neared the 0.9700 level. The descending channel at 0.95 could be the next objective, economists at Société Générale report.

EUR/USD has to surpass 1.0200 to affirm a sustainable rebound

“EUR/USD is gradually drifting towards the lower limit of the channel at 0.9500. Defending this can lead to a bounce, however, the pair has to re-establish itself beyond the 50-DMA and recent high of 1.0200 to affirm a sustainable rebound.”

“In case the decline persists below 0.9500, the pair could test next projections at 0.9200/0.9150.”

- Dollar gains versus yen even as markets tumble.

- Higher Treasury yields offset risk aversion.

- USD/JPY slowly recovering ground after the intervention decline.

The USD/JPY is rising on Friday amid tensions across financial markets. The pair found support above 142.50 and it is testing daily highs near the 143.20 area. The rally of the dollar across the board remains solid and firm.

Usually, when markets drop sharply the yen is the best performer but is not the case on Friday. The dollar is the best performer. It confirmed gains following the better-than-expected PMI S&P Global numbers for September. The DXY is approaching 113.00, up 1.30% while EUR/USD and GBP/USD trade at fresh cycle lows.

Another weekly gain?

The USD/JPY is about to end the week with a modest gain and far from the top. The intervention from Japanese authorities to boost the yen explains the move away from the recent multi-year highs. The pair peaked at 145.89 before pulling back.

The key driver in the rally continues to be the divergence in monetary policy between the Bank of Japan and the Federal Reserve. The BoJ kept its accommodative policy unchanged on Thursday while the Fed raised interest rates by 75 basis points.

“The immediate reaction to the intervention announcement facilitated a sharp rally in the Japanese currency and brought the yen back from record low levels against the dollar. However, we view BoJ intervention as only a temporary respite for the yen. In our view, as long as the paths for monetary policy between the Fed and BoJ continue to diverge and interest rate differentials widen, the bias remains for the yen to continue to weaken and retest lows in the near future”, said analysts at Wells Fargo.

Technical levels

- GBP/USD tanks more than 2%, weighed by worse-than-expected UK economic data.

- The US Federal Reserve’s aggressive monetary policy is a headwind for the GBP/USD.

- US business activity contracted but gave signs of improvement.

- UK’s consumer confidence and business activity disappoint, increasing fears of a deep recession in the UK.

The GBP/USD is collapsing from 1.1200, eyeing a break below the 1.1000 figure, which was last seen in March 1985, courtesy of dismal market sentiment, spurred by worldwide central bank tightening to quell price pressures. The GBP/USD is trading at 1.0965, below its opening price by more than 2%, after hitting a daily high of 1.1273.

Given the backdrop that the Federal Reserve hiked rates by 75 bps on Wednesday and signaled that further increases are coming, investors growing fears heightened that it would hurt the company’s earnings and might tap the US economy into a recession. In the meantime, US business activity in September shrank, as reported by S&P Global, though it flashed some signs of recovering.

The S&P Manufacturing PMI expanded more than the 51 estimates, while the Services index jumped to 49.2 but fell short of expansionary territory. Consequently, the Composite Index persisted under 49, at contractionary territory, but above calculations.

Aside from US data, in the UK, the GfK consumer confidence showed that households feel “exasperated” with the UK’s double-digit inflationary readings. The GfK index dived to a record low of -44, which was last seen in 1974.

Later, S&P Global revealed the UK PMIs for September, with the Composite Index edging down from 49.6 in August to 48.4, reigniting recessionary fears. “UK economic woes deepened in September as falling business activity indicates that the economy is likely in recession,” said Chris Williamson, a chief business economist at S&P Global.

Further, the Services Index fell to 49.2 from 50.9 in August, while the Manufacturing PMI bounced from 47.3 to 48.5

All that said, the GBP/USD so far has extended its losses during the day, hitting the 1.0985 figure for the first time since 1985, opening the door for a retest of March’s lows at 1.0545.

GBP/USD Hourly Chart

GBP/USD Key Technical Levels

The loonie holds up relatively well against the stronger US dollar. However, economists at Scotiabank believe that the USD/CAD is set to test the 1.3650 resistance.

Minor dips to find support in the upper 1.34s/low 1.35s

“The CAD is finding a little support around the 1.3550 zone intraday but this all feels a bit arbitrary, with the USD operating with an extreme momentum tailwind.”

“Minor USD dips are likely to find support in the upper 1.34s/low 1.35s.”

“Risk remains to 1.3650 on the charts (Fib retracement resistance) but the chances of additional USD gains deeper into overshoot territory are high at this point.”

The USD is powering on, reaching a new 20-year high in the US Dollar Index (DXY). Now, there is no technical until the 121 level, economists at Scotiabank report.

USD gains as risk backdrop deteriorates

“Weak risk sentiment provides the essential drive behind the USD amid surging long-term yields and overwhelmingly bearish equity investor sentiment.”

“With the DXY trading well through the 109/110 area this week, there is nothing in terms of technical resistance on the long-term DXY chart now until the 121 point, the 2001 peak.”

GBP/USD has dived below the 1.10 level. Economists at ING believe that further losses toward parity could be on the cards.

Investors will continue to shun sterling

“Unless something can be done to address these fiscal concerns, or the economy shows some surprisingly strong growth data, it looks like investors will continue to shun sterling.”

“For reference, the FX options now price the chances of GBP/USD hitting 1.00 by year-end at 17%. That is up from 6% in late June.”

“Given our bias for the dollar rally going into over-drive as well, we think the market may be underpricing the chances of parity.”

See – GBP/USD: Calls for parity may begin to emerge – TDS

- Gold drops to over a two-year low on Friday as the USD rally remains uninterrupted.

- Bets for more aggressive Fed rate hikes, elevated US Bond yields underpin the buck.

- Geopolitical risks, the risk-off mood could lend some support to the safe-haven metal.

- A trading range breakdown supports prospects for an extension of the depreciating move.

Gold drops to its lowest level since April 2020, around the $1,641 area on Friday and confirms a fresh breakdown below a one-week-old trading range. The XAU/USD maintains its offered tone through the early North American session and seems vulnerable to slide further.

The relentless US dollar buying remains unabated on the last day of the week amid expectations for a more aggressive policy tightening by the Fed. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, hits a fresh 20-year peak and is seen driving flows away from the dollar-denominated gold.

The US central bank earlier this week signalled that it will hike interest rates at a faster pace to combat stubbornly high inflation. A number of other major central banks also delivered rate increases this week, which continues to lift government bond yields. This exerts additional downward pressure on the non-yielding gold.

That said, the risk of a further escalation in the Russia-Ukraine conflict offers some support to the safe-haven precious metal. Russian President Vladimir Putin announced an immediate partial military mobilization, which, along with recession fears, continues to weigh on investors' sentiment and could limit losses for gold.

From a technical perspective, a sustained break below the previous YTD low, around the $1,654-$1,653 region could be seen as a fresh trigger for bearish traders. This might have already set the stage for additional losses. Hence, a subsequent slide towards the next relevant support, around the $1,600 mark, remains a distinct possibility.

Technical levels to watch

- S&P Global Composite PMI and Services PMI rose sharply in early September.

- The US Dollar Index trades at fresh multi-decade highs above 112.00.

The data published by S&P Global showed on Friday that the business activity in the US manufacturing sector expanded at a stronger pace in early September than in August with the Manufacturing PMI rising to 51.8 from 51.5. This reading came in better than the market expectation of 51.5.

Further details of the monthly publication revealed that the Services PMI rose sharply to 49.2 from 43.7 and the Composite PMI improved to 49.3 from 44.6.

Commenting on the PMI surveys, "US businesses are reporting a third consecutive monthly fall in output during September, rounding off the weakest quarter for the economy since the global financial crisis if the pandemic lockdowns of early-2020 are excluded," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"However, while output declined in both manufacturing and services during September, in both cases the rate of contraction moderated compared to August, notably in services, with orders books returning to modest growth, allaying some concerns about the depth of the current downturn," Williamson added.

Market reaction

The greenback gathered strength on upbeat data and the US Dollar Index was last seen rising 1% on the day at 112.38.

The Japanese yen moved above 145 against the US dollar. This forced the Japanese government to step in to intervene. USD/JPY turned back lower but economists at Nordea expect the pair to move back higher as the Bank of Japan (BoJ) maintains its stimulative monetary policy.

Short-term relief for the JPY

“The intervention has provided short-term relief to the JPY and so does the announcement that Japan will reopen to foreign tourists, but with the discrepancy between rates in Japan and the rest of the G10 countries only rising in the months to come, we believe that the USD/JPY will turn higher ahead.”

“What will stop the weakening of the JPY is a shift in monetary policy from the BoJ or a 180-degree shift from all other G10 central banks. The shift from the BoJ could easily come when the current BoJ Governor Kuroda retires in April 2023. We thus expect the JPY, which is the worst G10 performer against the USD this year, to recover most of its losses next year.”

- USD/CAD continues to trade in positive territory above 1.3500 on Friday.

- The data from Canada showed that Retail Sales declined sharply in July.

- The dollar preserves its strength amid risk aversion ahead of the weekend.

The USD/CAD pair retreated toward 1.3500 during the European trading hours but managed to gather bullish momentum in the second half of the day. As of writing, the pair was up 0.6% on the day at 1.3565, on track to its highest weekly close since June 2020.

The broad-based dollar strength on Friday helped USD/CAD gain traction. Boosted by safe-haven flows, the US Dollar Index, which tracks the dollar's performance against a basket of six major currencies, climbed above 112.00 for the first time in two decades. With Wall Street's main indexes losing more than 1% after the opening bell, the greenback continues to outperform its rivals and not allowing USD/CAD to stage a downward correction.

Meanwhile, the data published by Statistics Canada revealed that Retail Sales contracted by 2.5% on a monthly basis in July, compared to the market expectation for a decline of 2%. On top of the disappointing data from Canada, crude oil prices are down more than 5% on the day, further weighing on the commodity-sensitive loonie.

Disappointing PMI data from the euro area and the UK earlier in the day revived concerns over a global economic slowdown, causing investors to price in a worsening energy demand outlook. At the time of press, the barrel of West Texas Intermediate was trading at its lowest level since January near $79.

Market participants now await S&P Global's preliminary September Manufacturing and Services PMI data for the US.

Technical levels to watch for

Economists at Nordea expect a stronger US dollar in the months to come. In their view, the EUR/USD pair could plunge towards the 0.90 level on the back of risk-off.

The USD will continue to outperform

“The USD will likely continue to benefit from the Fed continuing to hike rates and its status as the world’s predominant safe-haven currency during the coming volatile months for markets.”

“We see EUR/USD down to 0.95 towards year-end, but cannot exclude moves as low as 0.90 in the months ahead.”

- EUR/USD trades deep in negative territory below 0.9800.

- Safe-haven flows continue to dominate the financial markets ahead of the weekend.

- DXY holds above 112.00 ahead of S&P Global PMI data.

EUR/USD erased a small portion of its daily losses after having touched its lowest level in two decades at 0.9737 earlier in the day. The pair was last seen trading at 0.9770, where it was still down 0.65% on a daily basis. For the week, EUR/USD is down over 2%.

The data from the euro area and Germany showed that the business activity in the private sector continued to contract at an increasing pace in early September. S&P Global Composite PMI for the eurozone and Germany declined to 48.2 and 45.9, respectively.

Meanwhile, the dollar continued to benefit from safe-haven flows and put additional bearish pressure on EUR/USD. At the time of press, the Euro Stoxx 600 Index was down 2% on the day and the US stock index futures were losing between 1.1% and 0.9%.

Later in the session, S&P Global will release the Manufacturing and Services PMI data for the US. Inversors expect the Services PMI to remain well below 50 and see the Manufacturing PMI holding above 51.

Finally, FOMC Chairman Jerome Powell will speak at the virtual Fed Listens event hosted by the Federal Reserve Bank of Dallas at 1800 GMT.

Technical levels to watch for

Following the resignation of the Draghi government of national unity in July, a general election will be held in Italy on Sunday, September 25. In the view of strategists at ABN Amro, Italy is heading for a right-wing coalition.

BTP-Bund spread to widen during and post-election results

“Polls for the election have persistently given a comfortable majority (of around 245 of the 400 seats in the lower house and around 120 of the 200 seats in the upper house) to a right-wing coalition, with the far-right Brothers of Italy led by Georgia Meloni as the dominant party in the coalition.”

“There seems to be a significant risk of infighting within the government, meaning that Italy’s long history of political instability could very well continue.”

“We expect BTP-Bund spread to widen during and post-election results until the political uncertainty eases, which we do not expect to happen before at least H2 2023.”

- EUR/GBP gains strong positive traction on Friday and jumps to its highest level since February 2021.

- A bleak outlook for the UK economy weighs heavily on the British pound and remains supportive.

- A stronger USD, geopolitical risks, recession fears undermine the euro and cap gains for the cross.

The EUR/GBP cross catches aggressive bids on Friday and rallies to its highest level since February 2021 during the mid-European session. The momentum, however, falters near mid-0.8800s, forcing spot prices to trim a part of strong intraday gains and retreat to the 0.8800 mark.

A 50 bps rate hike by the Bank of England on Thursday disappointed market participants anticipating a more aggressive policy tightening. This comes amid a bleak outlook for the UK economy, which is seen as a key factor behind the British pound's relative underperformance. The already weaker sterling loses additional ground following the release of UK PMI prints, which showed that the downturn in British businesses steepened in September.

Adding to this, a survey from the Confederation of British Industry revealed that the retail balance fell to -20% in September from +37% in August and fueling recession fears. The UK government, meanwhile, unleashed historic tax cuts and huge increases in borrowing in a bid to boost growth. The prospect of more fiscal stimulus threatens to undermine the Bank of England’s goal to tame inflation and exerts additional pressure on the domestic currency.

The shared currency, on the other hand, is weighed down by relentless US dollar buying and the energy crisis in Europe amid the risk of a further escalation in the Russia-Ukraine conflict. Apart from this, the worse-than-expected flash Manufacturing PMI prints from France and Germany - the Eurozone's two largest economies - raise concerns about a deeper economic downturn. This continues to undermine the euro and caps the upside for the EUR/GBP cross.

From a technical perspective, acceptance above the 0.8800 mark could be seen as a fresh trigger for bullish traders and supports prospects for additional gains. Hence, any meaningful pullback might still be seen as a buying opportunity and is more likely to remain limited, at least for the time being.

Technical levels to watch

The forecast of 1.11 for cable now looks to be in need of re-examination, in the opinion of economists at TD Securities who believe that markets need to consider how non-trivial a move to parity for GBP/USD may be.

Higher new range for EUR/GBP within 0.90-0.92

“With the UK proposing to blow up its budget deficit, a weakening balance of payments backdrop should keep downside pressure on the currency.”

“Our year-end forecast of 1.11 for cable is now at risk of looking too high and we will not be surprised if calls for parity begin to emerge.”

“EUR looks better situated, for now, versus GBP. The move above 0.88 sets the stage for a higher new range bound by 0.90-0.92.”

Gold below $1,691/76 has confirmed a large double top. Therefore, strategists at Credit Suisse have changed their medium-term technical view on XAU/USD to negative.

Only a convincing break above $1,732 would ease the pressure

“Gold has recently broken below its two-year lows and the 200-week moving average at $1,691/76, marking the formation of a large ‘double top’ and we hence have changed our medium-term technical view on gold to negative.”

“We look for further deterioration to take place from here, with support seen at $1,618/16 initially. A close below here would then be seen to clear the way for a move to the 50% retracement of the whole 2015-2020 upmove at $1,560, a sustained break below which would open the door to extend the decline to the late 2019 and 2020 price lows as well as the 61.8% retracement at $1,451/40.”

“Conversely, only a convincing break above the 55-day moving average, currently at $1,732, would ease the pressure on the precious metal, with next resistance then seen at the even more important 200-day average, currently at $1,830.”

- Retail Sales in Canada fell more than expected in July.

- USD/CAD trades in positive territory above 1.3500 after the data.

The data published by Statistics Canada revealed on Friday that Retail Sales contracted by 2.5% on a monthly basis in July following June's increase of 1%. This reading came in weaker than the market expectation for a decline of 2%.

"Core retail sales—which exclude gasoline stations and motor vehicle and parts dealers—decreased 0.9%," the publication further read. "In volume terms, retail sales were down 2.0% in July."

Market reaction

The USD/CAD pair edged higher after the disappointing data and was last seen rising 0.25% on the day at 1.3532.

- GBP/JPY witnessed heavy selling for the third straight day and dived to a multi-month low.

- The bleak outlook for the UK economy, a sell-off in the UK debt market weighs on sterling.

- The global flight to safety lifts the JPY and further contributes to the steep intraday decline.

The GBP/JPY cross remains under intense selling pressure for the third straight day and plunges to over a four-month low, around mid-157.00s during the mid-European session on Friday.

The British pound continues with its relative underperformance amid the worsening outlook for the UK economy, which, in turn, is seen weighing heavily on the GBP/JPY cross. The fears were fueled by the disappointing release of the flash PMI prints, which showed that the downturn in British businesses steepened in September. Adding to this, a survey from the Confederation of British Industry revealed that the retail balance fell to -20% in September from +37% in August.

The selling bias around sterling picks up pace after the new UK government unveiled a radical economic plan in a bid to boost growth. Finance Minister Kwasi Kwarteng announced reductions in the top rate of income tax, national insurance, and stamp duty worth £45bn. The stimulus will be financed in large part by selling gilts, raising concerns over the cost of the government’s borrowing plans and triggering a sharp sell-off in the UK government debt market.

The spillover effect takes its toll on the global risk sentiment, which is evident from a sea of red across the equity markets. This comes a day after Japanese authorities intervened in the market for the first time since 1998 to stem the rapid decline in the domestic currency, which boosts the JPY's relative safe-haven status against its British counterpart. This was seen as another factor contributing to the heavily offered tone surrounding the GBP/JPY cross.

That said, extremely oversold conditions on intraday charts hold back traders from placing fresh bearish bets and assist spot prices to bounce back above the 158.00 mark. Nevertheless, the GBP/JPY cross remains on track to end the day deep in the red and record losses for the second successive week. This might have already set the stage for a further downfall towards the May monthly swing low, around the 155.60 region.

Technical levels to watch

- GBP/USD is down over 300 pips on the day.

- The risk-averse market environment provides a boost to the greenback.

- Disappointing data releases from the UK weigh heavily on GBP.

Following a consolidation phase during the Asian trading hours, GBP/USD came under heavy bearish pressure and lost more than 200 pips on the day. As of writing, the pair was trading at its lowest level since 1985 at 1.1045, down nearly 2% on a daily basis.

Earlier in the day, the data from the UK revealed that the business activity in the private sector continued to contract in early September with the preliminary Composite PMI dropping to 48.4 from 49.6 in August. This reading came in below the market expectation of 49.

Furthermore, the Confederation of British Industry's latest Distributive Trades Survey revealed that the Retail Sales Balance plunged to -20 in September from +37 in August and fueled the GBP selloff.

In addition to dismal UK data, the intense flight to safety provides a boost to the dollar and further weighs on the pair. US stock index futures were last seen losing between 1.3% and 1.6% on the day, suggesting that safe-haven flows are likely to continue to dominate the financial markets.

The US economic docket will feature S&P Global's Manufacturing and Services PMI reports later in the day.

Technical levels to watch for

- USD/JPY regains some positive traction on Friday amid aggressive USD buying.

- The USD hits a fresh 20-year peak amid bets for faster rate hikes by the Fed.

- The Fed-BoJ policy divergence supports prospects for further near-term gains.

The USD/JPY pair attracts some dip-buying near the 141.75 area on Friday and builds on the overnight rebound from over a two-week low. Spot prices refresh daily high during the first half of the European session, albeit quickly retreat to the 143.00 mark in the last hour.

The overnight knee-jerk reaction to the intervention of Japanese authorities to stem the rapid fall in the Japanese yen turned out to be short-lived amid a strong bullish sentiment surrounding the US dollar. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, hits a fresh 20-year peak and continues to draw support from rising bets for more aggressive Fed rate hikes. This turns out to be a key factor that provides a modest lift to the USD/JPY pair.

It is worth recalling that the Fed struck a more hawkish tone on Wednesday and signalled that it will undertake more aggressive rate increases to curb stubbornly high inflation. This remains supportive of elevated US Treasury bond yields and continues to act as a tailwind for the greenback. The yield on the rate-sensitive two-year US government bond touched a fresh 15-year high and the benchmark 10-year Treasury note jumped to its highest level since 2011 on Thursday.

The Bank of Japan (BoJ), on the other hand, aggressively defended its yield curve ceiling and reaffirmed its commitment to ultra-low interest rates on Thursday. This results in the widening of the US-Japan rate differential, which is weighing on the Japanese yen and offering additional support to the USD/JPY pair. That said, the prevalent risk-off environment helps limit losses for the safe-haven JPY and caps the upside for the major, at least for the time being.

That said, the Fed-BoJ policy divergence, which has been a key factor behind the yen's slump of over 25% against the USD since the beginning of 2022, suggests that the path of least resistance for the USD/JPY pair is to the upside. Market participants now look forward to the US PMI prints for some impetus ahead of Fed Chair Jerome Powell's speech. Traders will further take cues from the US bond yields and the broader risk sentiment to grab short-term opportunities.

Technical levels to watch

- AUD/USD drops to its lowest level since May 2020 amid broad-based USD strength.

- Bets for more aggressive Fed rate hikes, elevated US bond yields underpin the buck.

- The risk-off mood further benefits the USD and weighs on the risk-sensitive aussie.

The AUD/USD pair continues losing ground through the first half of the European session on Friday and drops to the 0.6565 area or its lowest level since May 2020.

The US dollar catches fresh bids on the last day of the week and hits a new 20-year peak, which turns out to be a key factor exerting downward pressure on the AUD/USD pair. The Federal Reserve struck a more hawkish tone on Wednesday and signalled that it will undertake more aggressive rate increases to cap inflation. This, in turn, remains supportive of elevated US Treasury bond yields and continues to act as a tailwind for the greenback.

In fact, the yield on the rate-sensitive two-year US government bond touched a fresh 15-year high and the benchmark 10-year Treasury note jumped to its highest level since 2011 on Thursday. Meanwhile, investors remain concerned that rapidly rising borrowing costs will lead to a deeper global economic downturn. This, in turn, tempers investors' appetite for riskier assets and is further underpinning demand for the traditional safe-haven buck.

Apart from this, economic headwinds stemming from China's zero-covid policy and the risk of a further escalation in the Russia-Ukraine conflict, have been fueling recession fears. This is seen as another factor contributing to driving flows away from the risk-sensitive aussie. With oscillators still far from being in the oversold territory, the fundamental backdrop supports prospects for an extension of the depreciating move for the AUD/USD pair.

Market participants now look forward to the release of the flash US PMI prints, due later during the early North American session. This, along with the US bond yields and Fed Chair Jerome Powell's speech at an event in Washington, will influence the USD price dynamics and provide some impetus to the AUD/USD pair. Traders will further take cues from the broader market risk sentiment to grab short-term opportunities heading into the weekend.

Technical levels to watch

- Gold meets with a fresh supply on Friday and is pressured by sustained USD buying.

- Aggressive Fed rate hike bets, elevated US bond yields continue to underpin the buck.

- Recession fears weigh on investors’ sentiment and could offer support to the XAU/USD.

Gold attracts fresh selling near the $1,675-$1.676 area on Friday and drops to a fresh daily low during the first half of the European session. The XAU/USD is currently placed just below the $1,665 level and remains confined in a familiar trading range held since the beginning of this week.

The US dollar hits a new 20-year peak on the last day of the week and is seen as a key factor exerting downward pressure on the dollar-denominated gold. Adding to this, the prospects for more aggressive policy tightening by the Fed further contribute to driving flows away from the non-yielding yellow metal.

In fact, the markets have been pricing in another supersized 75 bps Fed rate hike move in November. The bets were reaffirmed by the Fed's so-called dot plot, revealing that policymakers expect the benchmark lending rate to top 4% by the end of 2022. From there, central bank officials anticipate further hikes in 2023.

The Fed's hawkish outlook remains supportive of elevated US Treasury bond yields. The yield on the rate-sensitive two-year US government bond touched a fresh 15-year high and the benchmark 10-year Treasury note jumped to its highest level since 2011 on Thursday. This, in turn, should continue to act as a tailwind for the buck.

Meanwhile, faster interest rate hikes by major central banks have stoked concerns of a deeper global economic downturn. This, along with headwinds stemming from China's zero-covid policy and the risk of a further escalation of the war in Ukraine, have been fueling recession fears and weighing on investors' sentiment.

This is evident from the ongoing fall in the equity markets, which could extend support to the safe-haven gold and help limit deeper losses. Even from a technical perspective, the recent range-bound price action points to indecision among traders, warranting some caution before placing aggressive directional bets.

Market participants now look forward to the release of the flash US PMI prints, due later during the early North American session. The focus, however, will remain on Fed Chair Jerome Powell's speech at an event in Washington, which will influence the USD and produce some meaningful trading opportunities around gold.

Technical levels to watch

Gold is trading close to its yearly low. Economists at Commerzbank expect XAU/USD to remain under pressure. If at all, a brief countermovement might be seen on the gold market.

Gold has little to offer as a non-interest-bearing investment

“Amid rapidly rising interest rates, gold has little to offer as a non-interest-bearing investment, especially as the strong US dollar is weighing additionally on its price. This is why many ETF investors are continuing to withdraw their holdings.”

“Next week could see a small countermovement to the upside. However, no lasting turnaround can be expected until an end to the rate hikes is in sight.”

EUR/USD slumped to a fresh two-decade low below 0.9800. Next line of defence aligns at 0.9750, FXStreet’s Eren Segenzer reports.

Euro is likely to stay on the backfoot

“With a four-hour close below the 0.9750 level, additional losses toward 0.9700 and 0.9660 (August 2002 low) could be witnessed.”

“On the four-hour chart, the Relative Strength Index (RSI) indicator stays well below 30, suggesting that the pair could make a technical correction before the next leg lower. In that case, 0.9800 (static level, former support) could be seen as first hurdle before 0.9880 (static level, 20-period SMA) and 0.9900 (psychological level).”

During a fiscal statement to parliament, UK Finance Minister Kwasi Kwarteng said that "We need a new approach for a new era, focused on growth. Our aim over the medium term is to reach a trend rate of growth of 2.5%.”

Additional takeaways

Bonus cap pushed up bankers' basic salary, pushed activity outside Europe.

We will scrap bankers' bonus cap.

Will set out ambitious financial services reform later this year.

Will liberalise planning rules for new 'investment zones'.

Accelerated tax reliefs for investment in construction, plant and machinery.

New hires on investment zones will not pay national insurance on first 50,000 pounds of earnings.

National insurance exemption is for employer's national insurance contribution.

We will cut taxes for businesses in designated tax sites for 10 years.

We will review the tax system to make it simpler and more dynamic.

Corporation tax will remain at 19%.

UK will have lowest rate of corporation tax in G20.

We will extend the enterprise investment scheme. The venture capital trusts beyond 2025.

Will increase limits on company share option plans to make them more generous.

We have decided to introduce vat-free shopping for overseas visitors.

Will abolish additional rate of income tax.

Market reaction

GBP/USD was little impressed by the UK mini budget release, as it hovers near multi-decade lows of 1.1150, down 0.86% on the day.

- GBP/USD comes under renewed selling pressure and drops to a fresh low since 1985.

- The BoE’s 50 bps rate hike on Thursday and recession fears weigh on the British pound.

- The USD hits a fresh 20-year peak and further contributes to the downward trajectory.

The GBP/USD pair prolongs its recent bearish trend and weakens further below the 1.1200 mark, hitting its lowest level since 1985 during the early European session on Friday. The downward trajectory picks up pace following the release of flash UK PMIs and drags spot prices to mid-1.1100s.

A 50 bps rate hike by the Bank of England on Thursday disappointed market participants anticipating a more aggressive policy tightening. Furthermore, UK Prime Minister Liz Truss' energy relief package for households and businesses could help slow inflation and has set the stage for a dovish pivot from the UK central bank. This turns out to be a key factor that continues to undermine the British pound amid the looming recession risk.

The market fears were further fueled by the disappointing release of the flash UK PMI prints, which showed that business activity in both manufacturing and services sectors contracted in September. The US dollar, on the other hand, hits a fresh two-decade high and remains well supported by a more hawkish stance adopted by the Federal Reserve. This further contributes to the heavily offered tone surrounding the GBP/USD pair.

Meanwhile, the latest leg down witnessed could further be attributed to some technical selling below the 1.1200 round-figure mark. This might have already set the stage for an extension of the downward trajectory, though extremely oversold conditions on short-term charts warrant some caution for aggressive bearish traders. Market participants now look forward to the US flash PMI prints for some impetus ahead of Fed Chair Jerome Powell’s speech.

Technical levels to watch

- UK Manufacturing PMI rises to 48.5 in September, beats estimates.

- Services PMI in the UK drops to 49.2 in September, a big miss.

- GBP/USD tests multi-decade lows near 1.1150 on dismal UK PMIs.

The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) unexpectedly improves to 48.5 in September versus 47.5 expected and 47.3 – August’s final reading.

Meanwhile, the Preliminary UK Services Business Activity Index for September arrived at 49.2 when compared to August’s final score of 50.9 and 50.0 expected.

The first reading of the S&P Global/CIPS Composite PMI came in at 48.4 in September vs. 49.0 expected and 49.6 previous.

Chris Williamson, Chief Business Economist at S&P Global, commented on the survey

“UK economic woes deepened in September as falling business activity indicates that the economy is likely in recession.“

“Companies report that the rising cost of living, linked to the energy crisis, and growing concerns about the outlook are subduing demand and hitting output levels to an extent not seen since 2009, barring the pandemic lockdowns and initial 2016 Brexit referendum shock.”

FX implications

A slump in the UK Services PMI adds to the downside in the GBP/USD pair. The spot is trading at 1.1163, shedding 0.83% on the day.

- Eurozone Manufacturing PMI arrives at 48.5 in September vs. 48.7 expected.

- Bloc’s Services PMI drops to 48.9 in September vs. 49.0 expected.

- EUR/USD keeps the red near 0.9780 on the mixed Eurozone PMIs.

The Eurozone manufacturing sector fell further into contraction in September, the latest manufacturing activity survey from S&P Global research showed on Friday.

The Eurozone Manufacturing purchasing managers index (PMI) arrived at 48.5 in September vs. 48.7 expectations and 49.6 last. The index hit a 27-month low.

The bloc’s Services PMI dropped sharply to 48.9 in September vs. 49.0 expected and August’s 49.8. The indicator reached 19-month lows.

The S&P Global Eurozone PMI Composite fell to 48.2 in September vs. 48.2 estimated and 48.9 previous. The gauge clocked its lowest level in 20 months.

Comments from Chris Williamson, Chief Business Economist at S&P Global

“A eurozone recession is on the cards as companies report worsening business conditions and intensifying price pressures linked to soaring energy costs.”

“The early PMI readings indicate an economic contraction of 0.1% in the third quarter, with the rate of decline having accelerated through the three months to September to signal the worst economic performance since 2013, excluding pandemic lockdown months.”

FX implications

EUR/USD keeps its renewed downside intact near 0.9780 on mixed euro area PMIs. The spot is down 0.63% on the day.

USD/JPY achieved the upper limit of a multi month channel at 146 after which a sharp reaction has taken shape. The pair could fall as low as 136/135.50 on failure to hold above July peak 0f 139.40, analysts at Société Générale report.

Initial resistance aligns at 143.80

“Break below the lower band of recent range highlights possibility of a short-term pullback.”

“Next support is located at July peak of 139.40. In case the pair fails to defend it, the down move is likely to extend towards 138.10 and even towards the lower limit of the channel at 136/135.50.”

“First resistance is at 143.80.”

- A combination of factors drags EUR/USD to its lowest level since October 2002 on Friday.

- Aggressive Fed rate hike bets and the risk-off impulse lift the USD to a fresh 20-year high.

- Disappointing PMIs from France and Germany fuel recession fears and weigh on the euro.

The EUR/USD pair comes under some renewed selling pressure on Friday and drops to its lowest level since October 2002, around the 0.9765 region during the early European session.

Following the previous day's volatile price swings, the US dollar regains strong positive traction and is seen dragging the EUR/USD pair. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, hits a new 20-year peak and remains well supported by a more hawkish stance adopted by the Fed.

It is worth mentioning that the US central bank signalled on Wednesday that it will likely undertake more aggressive rate increases to cap inflation. This, along with the prevalent risk-off environment, offers additional support to the safe-haven greenback. The market sentiment remains fragile amid growing worries about a deeper global economic downturn.

The euro, on the other hand, is pressured by the risk of a further escalation in geopolitical tensions, especially after Russian President Vladimir Putin announced a partial military mobilization. Apart from this, the energy crisis in Europe, which could drag the region's economy deeper into recession, is also seen weighing on the shared currency.

The market fears were further fueled by the release of worse-than-expected flash Manufacturing PMI prints from France and Germany - the Eurozone's two largest economies. Furthermore, Friday's downfall could also be attributed to some technical selling below the 0.9800 round-figure mark, which might have already set the stage for further losses.

Technical levels to watch

- German Manufacturing PMI arrives at 48.3 in September vs. 48.3 expected.

- Services PMI in Germany contracts further to 45.4 in September vs. 47.2 expected.

- EUR/USD accelerates declines towards 0.9750 on mixed German PMIs.

The German manufacturing and services sectors’ contraction deepened in September as increasing energy costs weighed, the preliminary manufacturing activity report from S&P Global/BME research showed this Friday.

The Manufacturing PMI in Eurozone’s economic powerhouse came in 48.3 at this month vs. 48.3 expected and 49.1 prior. The index tumbled to 27-month lows.

Meanwhile, Services PMI dropped from 47.7 booked previously to 45.4 in September as against the 47.2 estimated. The PMI hit the lowest level in 28 months.

The S&P Global/BME Preliminary Germany Composite Output Index arrived at 45.9 in September vs. 46.0 expected and August’s 46.9. The gauge also reached 28-month troughs.

Key comments from Phil Smith, Economics Associate Director at S&P Global

“The German economy looks set to contract in the third quarter, and with PMI showing the downturn gathering in September and the survey’s forward-looking indicators also deteriorating, the prospects for the fourth quarter are not looking good either.”

“The deepening decline in business activity in September was led by the service sector, which has seen demand weaken rapidly as customers pull back on spending due to tightening budgets and heightened uncertainty about the outlook.”

FX implications

EUR/USD is accelerating the downside following the break of the 0.9800 level mixed German data. The spot was last seen trading at 0.9770, still down 0.60% on the day.

Japan’s Ministry of Finance (MoF) finally snapped today and ordered the Bank of Japan (BoJ) to intervene in support of the yen as the USD/JPY neared 146. Nonetheless, economists at Scotiabank believe that the JPY is unlikely to strengthen.

BoJ to the rescue

“Having initiated the intervention process, we think the BoJ will have to keep at it; the central bank has very deep pockets and can vary its tactics (asking the ECB, BoE or even the Fed to act as its agent out of Tokyo hours, for example). There is, in effect, a line in the sand for USD/JPY now around the 146 point which markets will likely challenge to test the BoJ’s resolve and which we think the BoJ will have to be prepared to spend billions (USD) to hold. In all likelihood, however, the BoJ will be alone in trying the beat back the USD.”

“Absent a major change in underlying fundamentals or (however unlikely) concerted action against the USD, the chances of a sustained rebound in the JPY are limited, however. The key issue here, of course, is the diverging monetary policy settings between the US and Japan which have prompted a sharp slide in the JPY since the Fed first started getting serious about raising interest rates in the spring.”

“Peak Fed pricing and a rebound in global stocks will work against the USD eventually but US 10-year yield rising to 3.63% today suggests the BoJ will have its work cut out in the coming days if the Japanese monetary authorities want to maintain credibility.”

- USD/CAD catches fresh bids on Friday and is supported by a combination of factors.

- Weaker crude oil prices undermine the loonie and act as a tailwind amid a bullish USD.

- Traders eye Canadian Retail Sales, US PMIs for some impetus ahead of Fed’s Powell.

The USD/CAD pair attracts fresh buying on the last day of the week and steadily climbs back above the 1.3500 psychological mark during the early European session. Spot prices, however, remain below the highest level since July 2020 touched on Thursday.

Despite worries about a tight global supply, a deteriorating fuel demand outlook continues to weigh on crude oil prices and undermines the commodity-linked loonie. Apart from this, the strong bullish sentiment surrounding the US dollar, bolstered by hawkish Fed expectations, acts as a tailwind for the USD/CAD pair.

It is worth recalling that the US central bank had signalled on Wednesday that it will likely undertake more aggressive rate increases to cap inflation. This remains supportive of the ongoing move up in the US Treasury bond yields, which along with the prevalent risk-off environment, is benefitting the safe-haven greenback.

The market sentiment remains fragile amid worries that rapidly rising borrowing costs will lead to a deeper global economic downturn. Furthermore, concerns that China's zero-covid policy will dent fuel demand exert pressure on oil prices. That said, geopolitical risks seem to lend some support to the black liquid.

Nevertheless, the fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside. Even from a technical perspective, this week's breakout through a resistance marked by the top end of a multi-month-old ascending channel supports prospects for an extension of the near-term appreciating move.

Market participants now look forward to the release of the Canadian monthly Retail Sales data, which, along with the flash US PMI prints, might provide some impetus to the USD/CAD pair. Traders will further take cues from Fed Chair Jerome Powell's speech, which will drive the USD demand and produce short-term opportunities.

Technical levels to watch

Economists at Westpac have lowered their forecast for the AUD/USD by year’s end from 0.69 to 0.65. However, they expect the pair to recover in the second half of the next year.

End-2023 forecast also lowered to 0.72 from 0.75

“We have significantly lowered our 2022 end year ‘target’ for the AUD/USD to 0.65. That means that over the remainder of 2022 there will be periods when the aussie will trade below the 0.65 level given the high volatility in currency markets to date.”

“We still expect the AUD to lift against the USD in 2023, with most of the recovery occurring in the second half of 2023 but have lowered our forecast for end-2023 for AUD/USD from 0.75 to 0.72.”

The German DAX index has fallen significantly since the beginning of the year. When comes the recovery? Strategists at Commerzbank show why the bottom has probably not yet been reached.

DAX trend reversal still a long time coming

“The German DAX index has already lost more than 20 percent during the year 2022. But the DAX bear market is probably not over yet.”

“Further increases in US key interest rates, too high expectations for DAX profit margins and a still elevated DAX price-to-book valuation argue against a quick turnaround of equity markets.”

The Bank of England (BoE) hiked by 50 bps for a second consecutive meeting, taking Bank Rate up to 2.25%. There is hope on the market that a larger rate step has merely been postponed but economists at Commerzbank remain sceptical. Therefore, sterling’s weakness is set to linger.

Sterling’s recent recovery to be only a short breather

“I would remain cautious as a sterling investor as market hopes that the BoE will act more decisively in the future might be disappointed once again. Moreover, the fiscal policy measures (more on this when the mini-budget is presented today) mean that government debt is rising – a further negative factor for sterling.”

“Sterling’s recent recovery is likely to be only a short breather, as the currency is likely to remain under downside pressure.”

The Swiss National Bank (SNB) hiked its policy rate by 75 bps, bringing the policy rate to positive territory. It would seem that this was still not enough for the market as the franc weakened. However, economists at Commerzbank expect CHF to remain bid.

Goodbye negative rates

“The SNB has upped the pace on its monetary policy tightening and hiked its key rate by 75 bps to 0.5% – and thus waved goodbye to almost 8 years of negative interest rates.”

“The Swiss franc eased following the decision. Clearly, there had been a number of market participants who had expected a more significant rate step. The fact that the statement and comments by SNB governor Thomas Jordan were not particularly hawkish probably did not help either.”

“The disappointment on the market might put further depreciation pressure on the franc, but the SNB once again confirmed yesterday that it would consider selling foreign currency reserves if the franc were to depreciate. A weak franc would increase the pressure on (imported) prices. The market is therefore likely to be cautious in this respect.”

“The environment is likely to remain difficult for EUR. I, therefore, think that external factors such as the war in Ukraine, a looming energy crisis and economic concerns will quickly gain the upper hand again, with the franc principally remaining in demand.”

Silver (XAG/USD) maintains the top. Therefore, economists at Credit Suisse expect the precious metal to plunge towards the $15.56 support.

Silver confirmed major top

“Silver has risen back above the crucial 61.8% retracement support of the whole 2020/21 upmove at $18.65/15, however still maintains a large top below $21.39 and we hence expect further downside from here towards the $15.56 support from a technical analysis perspective.”

“Next resistance is seen at $20.87 and above $21.39 remains needed to negate the top, which is not our base case.”

Here is what you need to know on Friday, September 23:

Markets seem to have cooled down early Friday following Thursday's wild fluctuations on Japan's intervention in the foreign exchange market, the Swiss National Bank (SNB) and the Bank of England's (BoE) rate hikes. The US Dollar Index moves up and down in a tight range above 111.00 and the US stock index futures trade flat in the early European morning. S&P Global will release the preliminary Manufacturing and Services PMI report for Germany, the eurozone, the UK and finally the US ahead of the weekend.

In a dramatic turn of events, Japan's top currency diplomat Masato Kanda announced on Monday that they have intervened in the fx market. In a press conference following that action, Japanese Finance Minister Shunichi Suzuki said that they were concerned about excessive fx moves but refrained from commenting on the size of the intervention. Meanwhile, Kanda added that further forex action can be taken any day, anywhere, including on holidays. Japanese markets are closed on Friday in observance of the Autumnal Equinox Day holiday. USD/JPY dropped to a two-week low of 140.35 on this development but managed to stage a rebound in the late American session. Nevertheless, the pair ended up losing 200 pips on Thursday before going into a consolidation phase slightly above 142.00 early Friday.

Following its September policy meeting, the SNB decided to hike its policy rate by 75 bps to 0.5%. Commenting on the policy outlook, Chairman Thomas Jordan noted that negative rates will remain an important instrument and be used if needed. Jordan also added that the SNB is ready to "intervene to prevent excessive weakening or strengthening of franc." The CHF suffered heavy losses against its major rivals and USD/CHF climbed to its highest level since early September at 0.9850 before retreating below 0.9800 later in the day. At the time of press, the pair was moving sideways at around 0.9780.

The BoE raised its policy rate by 50 bps to 2.25% as expected on Thursday. The initial market reaction caused the British pound to lose interest as futures markets were pricing in a strong chance of a 75 bps increase. Five MPC members voted in favour of the 50 bps hike while MPC members Haskel, Mann and Ramsden voted to raise rates to 2.5%; MPC's Dhingra voted for 2%." Regarding the fiscal measures introduced by British Prime Minister Liz Truss, the BoE argued in its policy statement that the energy price guarantee may reduce the risk of persistent domestic price and wage pressures but acknowledged that risk remains material. Although GBP/USD managed to hold above 1.1300 for the majority of the day, it came under heavy bearish in the American session and declined toward 1.1200. As of writing, the pair was trading little changed on the day slightly below 1.1250.

EUR/USD failed to reclaim 0.9900 and erased all of its earlier gains to close the day flat slightly below 0.9850 on Thursday. The pair stays relatively quiet above 0.9800 early Friday.

Gold managed to capture some of the outflows out of major currencies as investors looked for a safer alternative during Thursday's crazy action. Nevertheless, with the benchmark 10-year US Treasury bond yield gaining more than 5% and rising above 3.7%, XAU/USD struggled to preserve its bullish momentum. The pair was last seen moving up and down above $1,670.

Bitcoin snapped a two-day losing streak and gained 5% on Thursday before going into a consolidation phase at around $19,500 early Friday. Ethereum rose nearly 7% on Thursday and is already up over 1% so far on the day, trading above $1,300.

EUR/NOK is trading above the 10.20 mark. Economists at Commerzbank expect the pair to move back lower and dip under 10.

Concerns about a gas crisis is putting pressure on NOK

“I continue to assume that NOK will principally appreciate with EUR/NOK easing back below 10.”

“The negative market sentiment due to concerns about a gas crisis is putting pressure on NOK though. These concerns are likely to persist until it becomes clearer how Europe is going to get through the winter. As a result, NOK might only appreciate more notably during the later course of the year.”

After several rounds of warning and nearly 25 big figures later in USD/JPY, Japan finally stepped up to the plate and intervened on the yen. At this juncture, 140-145 in USD/JPY seems a plausible trading range for the time being, economists at TD Securities report.

Bank of Japan opens pandora's box

“Japan finally stepped in to intervene in the currency. We have long held the view that 'yentervention' is a losing proposition. Surely the MOF/BoJ look to their peers and recognize that this has indeed been the case.

“Lost in the noise of intervention was a rather notable shift in the BoJ's stance on inflation. Specifically, they noted that there are signs of underlying inflationary pressures building. We think this is a rather notable inclusion.”

“With the likely recognition that intervention is not a feasible long-term solution, the BoJ may be gearing up for an earlier shift in YCC than widely perceived by the market. As such, October should be viewed as closer to being a live meeting in a very long time.

“For now, we think USD/JPY will attempt to carve out a range in the 140-145 area for now.”

- NZD/USD edges lower on Friday and is pressured by a combination of factors.

- Bullish USD and the prevalent risk-off mood weigh on the risk-sensitive kiwi.

- Slightly overbought conditions turn out to be the only factor lending support.

The NZD/USD pair struggles to capitalize on the overnight bounce from the 0.5800 mark, or its lowest level since March 2020 and meets with a fresh supply on Friday. The pair remains on the defensive through the early European session and is currently trading around the 0.5835 region.