- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Bank of Japan's July meeting minutes state that members shared the view that market sentiment remains cautious and that global slowdown fears have heightened.

Key notes

A few members said price rises are broadening in Japan.

One member said wage pressures heightening.

A few members said consumer inflation to slow next fiscal year unless commodity prices continue to rise.

More to come ...

- USD/CHF seesaws around daily tops after snapping four-day uptrend.

- Sour sentiment joins firmer US data, hawkish Fedspeak to propel US dollar but CHF’s safe-haven appeal tests buyers.

- Bears need SNB’s signals for further rate hikes to defend the latest entry, bulls can cheer Powell’s hawkish remarks.

USD/CHF changes hands around 0.9920, after reversing the recent losses, as traders seek fresh clues during Wednesday’s Asian session. In doing so, the Swiss currency (CHF) pair also portrays the market’s anxiety ahead of the key events.

Tuesday’s pullback could be linked to the risk-off mood, as well as a light calendar in Switzerland. The same contrasts with the US dollar’s broad upside move amid firmer data and hawkish Fedspeak.

The US Dollar Index (DXY) remained mildly bid around the two-decade high as US Durable Goods Orders declined by 0.2% in August versus the market forecasts of -0.4% and the revised down prior reading of -0.1%. Additionally, US CB Consumer Confidence improved for the second consecutive month to 108.00 for September versus 104.5 expected and 103.20 prior.

Despite the upbeat data, Chicago Fed President Charles Evans said, “At some point, it will be appropriate to slow the pace of rate increases and hold rates for a while to assess the impact on the economy." However, markets cared more for St. Louis Federal Reserve Bank President James Bullard who mentioned that they have a serious inflation problem in the US, as reported by Reuters. "More rate rises to come in future meetings." Additionally, Minneapolis Fed President Neel Kashkari said the central bank is moving "very aggressively," and there is a high risk of "overdoing it."

Elsewhere, Multiple leaks in Russia’s gas pipeline in the Baltic Sea raise woes that the Eurozone’s energy supply problems are likely to be permanent. The same intensify fears of recession inside the bloc, especially amid an absence of impressive data and inflation fears. That said, Reuters quoted European Commission Chief Ursula von der Leyen on Tuesday saying, “The leaks of the Nord Stream pipelines were caused by sabotage, and warned of the "strongest possible response" should active European energy infrastructure be attacked.” This adds to the market’s fears of more geopolitical tension between the West and Russia.

Also weighing on the sentiment could be the multiple rating agencies, including Moody’s, as well as the international institutions like the International Monetary Fund (IMF), which criticized the UK government’s latest approach.

Amid these plays, Wall Street closed mixed but the yields remained firmer and underpinned the US dollar’s safe-haven demand.

To sum up, the risk-aversion wave keeps the pair buyers hopeful but the CHF’s safe-haven status challenges its upside momentum. That said, the Swiss National Bank’s (SNB) Quarterly Bulletin and a speech from Fed Chairman Jerome Powell will be important to watch for fresh impulse as the SNB has recently been aggressive in rate hikes and any such signs may help the bears. On the contrary, Fed Chair Powell’s hawkish comments should be enough to wake up bull.

Technical analysis

USD/CHF bulls remain hopeful unless witnessing a decisive downside break of the previous resistance line from mid-July, around 0.9845.

- NZD/USD has printed a fresh two-year low at 0.5619 on expectations of a hawkish Fed Powell’s speech.

- The current pace of hiking interest rates by the Fed is expected to slow down ahead.

- Kiwi’s Buildings Permit data is seen lower at 2% vs. the prior release of 5%.

The NZD/USD pair has slipped below the most traded auction area, which is placed in a range of 0.5624-0.5722 in the Asian session. The asset has refreshed its two-year low at 0.5619 and is expected to display more weakness amid negative market sentiment. The major is expected to find a cushion around 0.5476 as the speech from Federal Reserve (Fed) chair Jerome Powell will spook the sentiment of the market participants further.

As the Fed is bound to curtail the galloping inflationary pressures, the discussion will be more on hiking interest rates at the ongoing pace. The current pace of hiking interest rates is firmer and will continue this year.

Considering the deviation in current rates of 3-3.25% and the optimal terminal rate at 4.6%, the Fed is required to elevate its interest rates further to 1.35% by the conclusion of 2023. Two monetary policies are still to be announced in 2022 scheduled in November and December. A continuation of the current pace of hiking will cover the deviation in 2022 only. Therefore, the Fed is expected to slow down its current pace of hiking interest rates and will make gradual steps from now.

Meanwhile, the US dollar index (DXY) has recaptured its elevated arena after lower-than-expected US Durable Goods Orders data. The decline in demand for Durable Goods was recorded lower at 0.2% than the expectations of a decline of 0.4%. There is no denying the fact that accelerated interest rates will have their consequences on durables demand, so a lesser-than-expected decline is healthy for the economy.

On the kiwi front, the release of the monthly Building Permits data will be a key trigger. The economic data is expected to trim to 2% against the prior print of 5%. A lower-than-expected figure will weaken the antipodean.

- GBP/JPY trims some Monday losses and hovers above the 155.00 figure.

- The daily chart portrays the pair as downward biased, though a “bullish-harami” candle pattern could open the door for a re-test of the 200-day EMA.

- If the GBP/JPY clears the 154.00 figure, it could send the pair towards the daily low at 148.53.

The GBP/JPY recovered some ground on Tuesday courtesy of a slight improvement in sentiment, though, in the end, US equities finished in the red, while Asian bourses are set for a lower open as risk aversion got back. At the time of writing, the GBP/JPY is trading at 155.12

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart shows the pair remains bearish-biased once it cleared the 200-day EMA. Tuesday’s price action completed a “bullish harami” candle pattern, suggesting that the GBP/JPY might be headed upwards. Nevertheless, due to Monday’s volatile trading session, the GBP/JPY could trim some of its losses but would need to surpass some resistance levels on its way north.

Therefore, the GBP/JPY’s first resistance would be the September 27 daily high at 156.36. The break above will expose the September 26 high at 157.22, followed by the 200-day EMA at 160.30. If buyers surpass the latter, that would shift the bias to neutral and open the door for further gains.

On the flip side, the GBP/JPY’s first support will be the September 27 daily low at 154.07. Once cleared, the next demand zone would be the January 24 daily low at 152.90, followed by a re-test of the YTD low at 148.53, ahead of the September 2020 cycle high of 142.70.

GBP/JPY Key Technical Analysis

- USD/CAD grinds higher around two-year low, stays inside bullish chart formation.

- MACD signals hint at further grinding, one-week-old support challenge bears.

- Buyers could aim for 1.3850-55 resistance area on confirming the pennant formation.

USD/CAD remains sidelined around the 27-month high marked earlier in the week, steadies near 1.3730 during Wednesday’s Asian session. In doing so, the Loonie pair portrays the trader’s indecision amid a bullish chart pattern and bearish MACD signals.

Also keeping the quote on the buyer’s radar is the one-week-old ascending trend line.

However, the upside momentum needs validation from the pennant’s upper line, at 1.3770 by the press time.

Following that, an upward trajectory towards the yearly top near 1.3810 and then to the lows marked during April 2020, around 1.3850-55, can’t be ruled out.

Meanwhile, pullback remains unattractive beyond the stated pennant’s support line, close to 1.3720 at the latest.

Even if the quote drops below 1.3720, the 1.3700 threshold and an upward sloping support line from September 20, around 1.3660, will be crucial to challenge the USD/CAD bears.

In a case where the pair remains bearish past 1.3660, the odds favoring its slump to the last Thursday’s peak around 1.3545 can’t be ruled out.

USD/CAD: Hourly chart

Trend: Further upside expected

- EUR/JPY has turned sideways around 139.00 as the focus has shifted to BOJ policy minutes.

- A deliberate attempt to harm the Nord Stream 1 pipeline will accelerate chaos in the German energy market.

- ECB’s Lane has warned about a decline in corporate profits and wages in crushing price pressures.

The EUR/JPY pair is displaying a lackluster performance in the early Tokyo session as the cross is hovering around 139.00. The asset is expected to re-test the critical support of 137.36, recorded on Monday as the German energy crisis is deepening after a deliberate action to harm the active infrastructure of the Nord Stream 1 pipeline to Germany. Broadly, the asset is witnessing topsy-turvy moves in a narrow range of 138.63-139.54 for the past two trading sessions.

On Tuesday, European Commission chief Ursula von der Leyen cited that the leaks of the Nord Stream pipelines were a result of sabotage, and warned of the "strongest possible response" should active European energy infrastructure be attacked. He further added that any deliberate attempt to demolish an active European energy infrastructure is ‘unacceptable’. The group behind the toxic attempt will face retaliation.

Apart from that, the comments from ECB’s Chief Economist Philip Lane have also dampened the sentiment of Eurozone investors. ECB’s Lane has warned of a decline in corporate profits and a drop in wages in the fight against galloping inflation. However, the inflation rate will start decreasing significantly in 2023, with further decreases in 2024.

Going forward, the yen investors will react to the release of the Bank of Japan (BOJ)’s policy minutes. This will provide a detailed view of the rationale behind the continuation of a dovish stance by the BOJ. Meanwhile, BOJ’s unscheduled bond-buying program has not impacted the yen prices much unlike the prior pattern in which investors used to punish the yen on an occurrence of the same. It seems that the impact of BOJ’s intervention in the currency markets will stay for longer.

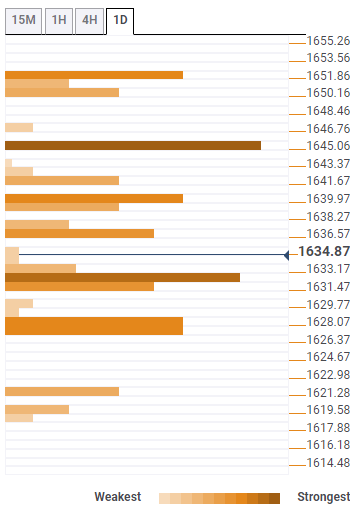

- Gold price defends corrective bounce off yearly low, sidelined of late.

- Risk-aversion intensified as Russian gas pipeline leak joins pessimism in the UK.

- Firmer US data, hawkish Fedspeak and stronger yields adds strength to the bearish bias for XAU/USD.

- Bullish candlestick can play its role if Fed’s Powell resists praising hawks.

Gold price (XAU/USD) struggles to find acceptance at around $1,630, despite bullish technical signals, as fears of the European energy crisis join firmer yields to propel the US dollar. That said, the cautious mood ahead of a speech from Fed Chairman Jerome Powell also weigh on the metal prices during early Wednesday in Asia.

Multiple leaks in Russia’s gas pipeline in the Baltic Sea raise woes that the Eurozone’s energy supply problems are likely to be permanent. The same intensify fears of recession inside the bloc, especially amid an absence of impressive data and inflation fears. That said, Reuters quoted European Commission Chief Ursula von der Leyen on Tuesday saying, “The leaks of the Nord Stream pipelines were caused by sabotage, and warned of the "strongest possible response" should active European energy infrastructure be attacked.” This adds to the market’s fears of more geopolitical tension between the West and Russia.

On the same line could be the multiple rating agencies, including Moody’s, as well as the international institutions like the International Monetary Fund (IMF), which criticized the UK government’s latest approach.

Furthermore, firmer US Durable Goods Orders and CB Consumer Confidence data joined hawkish Fedspeak to impress the greenback buyers. US Durable Goods Orders declined by 0.2% in August versus the market forecasts of -0.4% and the revised down prior reading of -0.1%. Additionally, US CB Consumer Confidence improved for the second consecutive month to 108.00 for September versus 104.5 expected and 103.20 prior.

"At some point, it will be appropriate to slow the pace of rate increases and hold rates for a while to assess the impact on the economy," Chicago Fed President Charles Evans said on Tuesday, as reported by Reuters. St. Louis Federal Reserve Bank President James Bullard said on Tuesday that they have a serious inflation problem in the US, as reported by Reuters. "More rate rises to come in future meetings." Minneapolis Fed President Neel Kashkari said the central bank is moving "very aggressively," and there is a high risk of "overdoing it."

It’s worth noting that the rally in the global bond yields, led by the UK’s gilt, joined downbeat equities to add strength to the bearish bias for the XAU/USD.

Looking forward, a light calendar could keep the metal pressured amid fears for the bloc, the UK and the market’s rush for risk safety. However, speeches from ECB President Christine Lagarde and Fed Chair Jerome Powell may entertain the pair buyers if they speak about matters relating to the monetary policy.

Technical analysis

Gold price prints mild gains around the two-year low marked the previous day as a bullish candlestick, inverted hammer, joins oversold RSI (14).

The recovery moves, however, need validation from a convergence of the 10-DMA and a two-week-old resistance line, around $1,655, to convince the XAU/USD buyers. Also challenging the metal buyers could be the bearish MACD signals.

Meanwhile, a downside break of the latest bottom surrounding $1,620 will defy the bullish signs and can direct the metal initially towards the $1,600 threshold before directing the bears to the lower line of the broad bearish channel stretched from March, near $1,572 by the press time.

Overall, the gold price may witness a corrective bounce but the trend reversal has a long way to go.

Gold: Daily chart

Trend: Limited upside expected

- Inside candle formation has bolstered the odds of a pullback move.

- Declining 10-and-20-EMAs still favor a downside bias.

- The RSI (14) is displaying signs of an oversold situation that could trigger a pullback.

The GBP/USD pair has turned sideways after a strong rebound from a fresh multi-decade low of 1.3565 on Monday. The cable is displaying back-and-forth moves in a range of 1.0661-1.0832 and is displaying a volatility contraction phase. This could result in a further decline in the asset as institutional investors might be distributing more inventories.

On the daily scale, the formation of an Inside candlestick pattern has cleared and the downside momentum has paused for a while. The above-mentioned candlestick formation indicates a volatility contraction amid exhaustion on the downside. A pullback move will get strengthened if the cable manages to overstep Monday’s high at 1.0931. The downward sloping trendline placed from June 14 low at 1.1934 will act as a major barricade for the counter.

Meanwhile, the declining 10-and 20-period Exponential Moving Averages (EMAs) at 1.1040 and 1.1267 respectively favor more weakness.

However, the Relative Strength Index (RSI) (14) is oscillating in an oversold territory around 17.00, which indicates that a pullback move cannot be ruled out. Even for a further downside, the momentum oscillator needs to cool down for once.

A break above Monday’s high at 1.0931 will activate the Inside Candle formation and will send the cable towards the round-level resistance at 1.1000, followed by 10-EMA at 1.1120.

On the flip side, the cable will lose significance further if drops below Monday’s low at 1.0339, which will drag the asset towards the round-level support at 1.0200. A slippage below the latter will direct the cable towards parity.

GBP/USD daily chart

-637999150427652966.png)

European Commission chief Ursula von der Leyen on Tuesday said the leaks of the Nord Stream pipelines were caused by sabotage, and warned of the "strongest possible response" should active European energy infrastructure be attacked.

Key quotes

Spoke to (Danish Prime Minister Mette) Frederiksen on the sabotage action Nordstream.

It was paramount now to investigate the incidents to get full clarity on the ‘events and why.’

Any deliberate disruption of active European energy infrastructure is unacceptable and will lead to the strongest possible response.

Market reaction

The news intensifies fears of more EU-Russia tussle ahead and hence exerts downside pressure on the EUR/USD prices, holding lower ground near the 20-year low.

Also read: EUR/USD braces for fresh multi-year low around 0.9600, ECB’s Lagarde, Fed’s Powell eyed

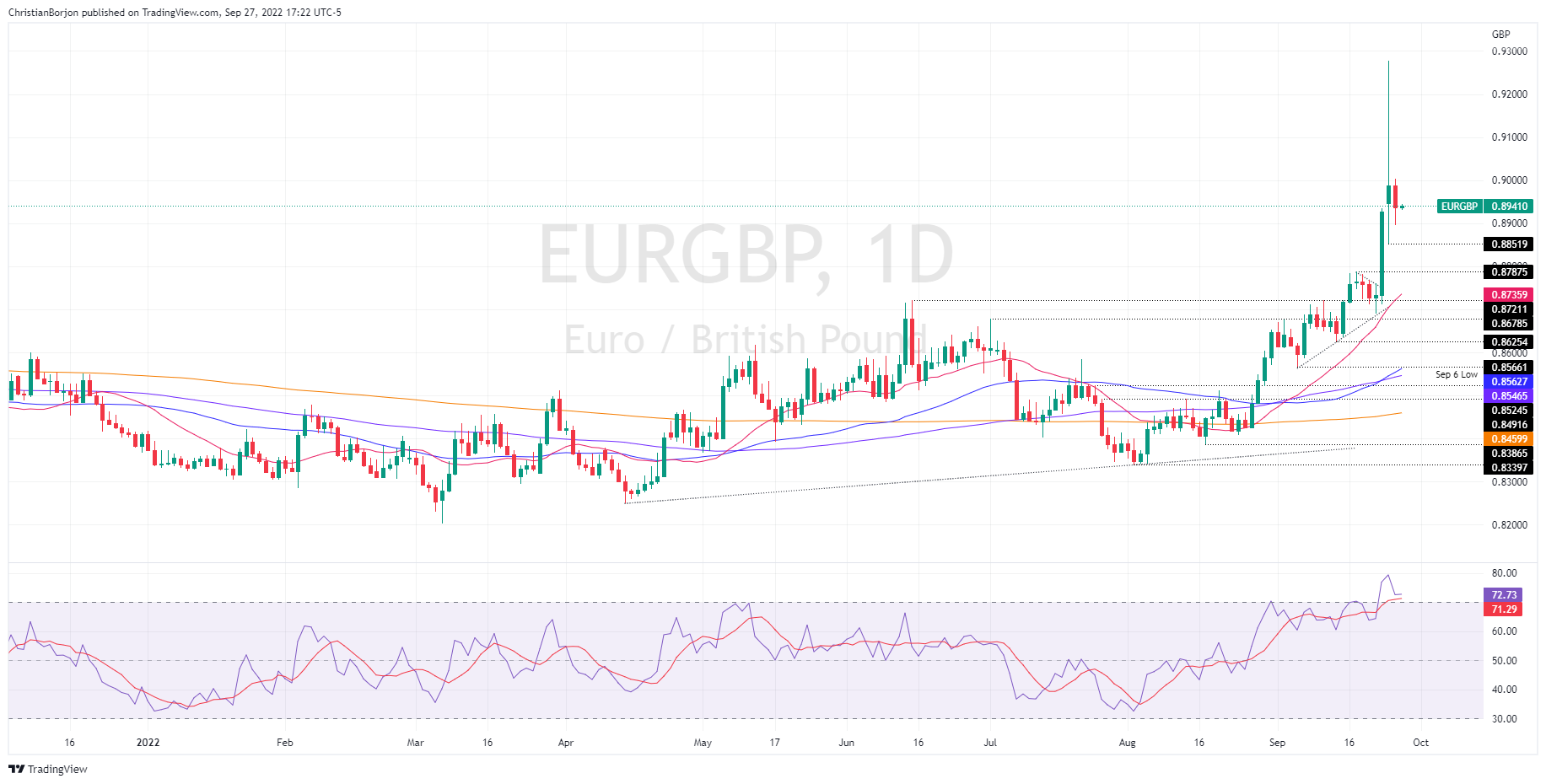

- As volatility decreased on Tuesday, EUR/GBP fell below 0.9000, which witnessed the cross jumping to a new one-and-a-half year high.

- The EUR/GBP formed a “bearish harami” candle pattern, which suggests sellers are gathering momentum.

- A break below 0.8896 would open the door towards the 0.8700 region; otherwise, a re-test of the 0.9000 figure is on the cards.

The EUR/GBP tumbles below the 0.9000 mark for the first time in the week after hitting a weekly high at 0.9254 on Tuesday, courtesy of growing fears about the UK’s “mini-budget” presented by the new UK Chancellor of the Exchequer Kwasi Kwarteng. However, investors’ worries have eased, and at the time of writing, the EUR/GBP is trading at 0.8938, slightly above its opening price.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP remains neutral to upward biased, though, after Monday’s monstrous 400-pip rally, which printed a fresh one-year and-half high at 0.9254, the pair was subject to a mean reversion move. Therefore, the EUR/GBP reversed some of its gains on Tuesday. Even though the EUR/GBP formed a “bearish harami” candle pattern, a break below the September 26 low at 0.8851 is needed to extend its losses further.

Therefore, the EUR/GBP’s first support would be the September 27 daily low at 0.8896. Once cleared, the next support would be the 0.8851 cycle low mentioned above, followed by a drop towards the September 19 daily high-turned-support at 0.8787.

Contrarily, if the EUR/GBP breaks above 0.9000, a re-test of the 0.9100 figure is on the cards, ahead of 0.9200, followed by the YTD high at 0.9254.

EUR/GBP Key Technical Levels

The International Monetary Fund (IMF) openly criticized Britain's new economic strategy on Tuesday, following another slide in bond markets that forced the Bank of England (BOE) to promise a "significant" response to stabilize the economy, reported Reuters.

Key quotes

The IMF said the proposals, which sent the pound to touch an all-time low of $1.0327 on Monday, would likely increase inequality and it questioned the wisdom of such policies.

Given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy.

We are closely monitoring recent economic developments in the UK and are engaged with the authorities.

The Fund said a budget due from Kwarteng on Nov. 23 would provide an ‘Early opportunity for the UK government to consider ways to provide support that is more targeted and reevaluate the tax measures, especially those that benefit high-income earners.’

FX implications

The news increases the market’s fears of recession, especially in the UK and weighs on the GBP/USD prices. That said, the quote remains pressured around 1.0720 by the press time of early Wednesday morning in Asia.

- EUR/USD teases two-decade low marked earlier in the week, pressured of late.

- Multiple leaks in Russia’s Nord Stream gas pipeline renewed fears of Europe energy crisis.

- Firmer US data, hawkish Fedspeak joined upbeat yields to weigh on prices.

- Second-tier economics to decorate calendar but risk catalysts are the key, bears may cheer hawkish comments from Powell.

EUR/USD holds lower grounds around the yearly bottom marked on Monday, despite picking up bids to 0.9600 during Wednesday’s Asian session, as risk-aversion intensifies. Also exerting downside pressure on the major currency pair could be the fears of more pain in terms of the energy supplies to the old continent, as well as the firmer US data.

Multiple leaks in Russia’s gas pipeline in the Baltic Sea raise woes that the Eurozone’s energy supply problems are likely to be permanent. The same intensify fears of recession inside the bloc, especially amid an absence of impressive data and inflation fears.

With this, the hawkish comments from the European Central Bank (ECB) policymakers failed to impress EUR/USD bulls. ECB Vice President Luis de Guindos said on Tuesday that they will continue to raise rates over the coming months and added that the number and size of the hikes will be determined by the data, as reported by Reuters. "We are facing an overlapped succession of shocks that have changed the context in a significant way," ECB Governing Council member Mario Centeno said and noted that the interest rate increase cycle will continue.

On the other hand, firmer US Durable Goods Orders and CB Consumer Confidence data joined hawkish Fedspeak to impress the greenback buyers. US Durable Goods Orders declined by 0.2% in August versus the market forecasts of -0.4% and the revised down prior reading of -0.1%. The Nondefense Capital Goods Orders ex Aircraft, however, improved by 1.3% during the stated period compared to 0.2% expected and 0.3% previous readouts. Further, US CB Consumer Confidence improved to 108.00 for September versus 104.5 expected and 103.20 prior. Consumer confidence has now improved for two consecutive months, bolstered by fuel prices falling to their lowest level since the beginning of the year.

"At some point, it will be appropriate to slow the pace of rate increases and hold rates for a while to assess the impact on the economy," Chicago Fed President Charles Evans said on Tuesday, as reported by Reuters. St. Louis Federal Reserve Bank President James Bullard said on Tuesday that they have a serious inflation problem in the US, as reported by Reuters. "More rate rises to come in future meetings." Minneapolis Fed President Neel Kashkari said the central bank is moving "very aggressively," and there is a high risk of "overdoing it."

It’s worth noting that the rally in the global bond yields, led by the UK’s gilt, joined downbeat equities to add strength to the bearish bias for the EUR/USD pair.

Moving on, a lack of major data/events could keep the EUR/USD weakness continued amid the prevailing fears for the bloc and the market’s rush for risk safety. However, speeches from ECB President Christine Lagarde and Fed Chair Jerome Powell may entertain the pair buyers if they speak about matters relating to the monetary policy.

Technical analysis

EUR/USD sellers poke the year 2001 peak surrounding 0.9590 to aim for the support line of a six-month-old bearish channel, at 0.9475 by the press time.

- AUD/USD is likely to drop to near 0.6400 after the demolition of a less-confident pullback.

- A lower-than-expected decline in the demand for US Consumer Durables supported the DXY.

- The roadmap of hiking interest rates for the remaining 2022 will be keenly watched.

The AUD/USD pair is displaying a less-confident pullback after dropping to a fresh two-year low at 0.6414. The asset is not witnessing any signs of exhaustion in the downside bias and the pullback move will be crushed sooner by the market participants. The pair is expected to decline further towards the round-level support of 0.6400 ahead of the speech from Federal Reserve (Fed) chair Jerome Powell.

Fed Powell’s speech is expected to remain extremely hawkish in order to fulfill its primary objective of crushing the price rise index and retrieve it to the desired level of 2%. What’s interesting will be the guidance on interest rates for the remaining 2022. The Fed sees interest rates to top at 4.6% from the current level of 3-3.25%. Bigger rate hike announcements in the remaining year will decline the margin for achieving the targeted rates and the world economy will see a slowdown in the pace of rate hikes later.

Apart from that, the US dollar index (DXY) is performing firmer on a lower-than-expected decline in the US Durable Goods Orders data. The decline in demand for Durable Goods landed at 0.2%, lower than the expectations of a decline of 0.4%. As the Fed is sticking to its path of hiking interest rates, a decline in demand for consumer durables cannot be ruled out. So a lower-than-expected reading cheered the DXY investors.

On the Australian front, investors are looking forward to the monthly Retail Sales data, which is expected to improve by 0.4% against the prior release of 1.3%. It seems that the retail demand is still in an increasing mode but is accelerating at a decreasing rate. A higher-than-expected Retail Demand will support the aussie bulls.

- Silver price gains 0.22% on Tuesday, following a loss of 2.82%.

- Fed officials reiterated their commitment to tackling inflation; most expect the FFR at around 4.50/4.75% and acknowledged a possible recession.

- XAG/USD Price Analysis: Failure to conquer the 20-day EMA was the reason for sellers to move in and send prices towards their lows.

Silver price is recovering some ground as Wall Street closes with substantial losses. Market sentiment continues to deteriorate as US Fed policymakers emphasize the need for more rate hikes, even if it spurs a deceleration in the economy. At the time of writing, the XAG/USD is trading at $18.38 a troy ounce after hitting a daily high at $18.78, up by 0.38%.

During the day, the XAG/USD began trading near the day’s lows before rallying to the daily high. However, as US Treasury bond yields, particularly the 10-year benchmark note rate, knocked on the 4% threshold, investors seeking safety bought the greenback, a headwind for the white metal.

Fed officials crossing newswires during the day reinforced the central bank’s stance. St. Louis Fed President James Bullard said he expects the Federal funds rate (FFR) to edge towards the 4.50% threshold. At the same time, his colleague and Chicago’s Fed President, Charles Evans, estimates the FFR to end at around the 4.50/4.75% mark.

Later, the Minnesota Fed President Neil Kashkari, in a Wall Street Journal interview, said that “There’s a lot of tightening in the pipeline” and added that even though there are risks of overdoing, “we are moving at an appropriately aggressive pace,” Kashkari said. Of late, the Philadelphia Fed President Patrick Harket said, “We will do what it takes to get inflation under control.” If there is a recession, it would be a shallow one.

Data-wise, the US economic calendar featured August’s Durable Good Orders, which contracted 0.2% but were better than the 0.3% shrinkage estimated, while New Home Sales for the same period jumped by 0.685M, exceeding forecasts of 0.5M.

Later, the CB Consumer Confidence improved in September for the second consecutive month, up at 108 vs. forecasts of 104.6.

XAG/USD Price Analysis: Technical outlook

Given the abovementioned fundamental backdrop, the white metal price is clinging to its early gains but well below the daily highs. Failure to reclaim the 20-day EMA at around $18.83 a troy ounce triggered sell orders, while the Relative Strength Index (RSI) is still aiming downwards, further cementing the XAG/USD downward bias. If XAG/USD closes below yesterday’s low at $18.32, that could open the door for further losses, exposing the $18.00 figure ahead of the 2022 year-to-date low at $17.56.

XAG/USD Key Technical Levels

- NZD/USD is pressured in a risk-off environment.

- US dollar and stocks dominant the bird.

NZD/USD is back to flat on the day while the price ranged between a low of 0.5624 and a high of 0.5721. The bird is a high beta currency and is being dictated by the stock markets in the absence of domestic data.

Meanwhile, markets were once again volatile on Tuesday leading to a mixed close in US stocks after hitting fresh 2022 lows in midday trade. US data was showing that consumer confidence was growing above expectations and new-home sales logged an unexpected rise. Elsewhere, Fed speakers were the driver. St. Louis Fed President James Bullard and Chicago Fed President Charles Evan advocated more interest rate hikes even at the risk of slowing economic growth.

Later in the day, Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday said in a WSJ Live interview that central bankers are united in their determination to do what needs to be done to bring inflation down, and financial markets understand that. "There's a lot of tightening in the pipeline," Kashkari said.

The benchmark S&P 500 erased gains of up to 1.7% by early afternoon trading to hit lows last seen in late November 2020 and was down some 0.2% by the close. The US dollar, as measured by the DXY index, is back to trading in the 114 area but is currently under pressure below the highs of the day of 114.47.

In terms of the kiwi, ''as to where we go from here – sentiment seems split two ways – with some saying this is an extreme move that will be unwound, and others saying that the rampant inflation/fiscal unsustainability “tinderbox” of market discontent was just waiting for a spark, and recent moves reflect markets belatedly re-pricing risk,'' analysts at ANZ Bank said. ''We think it’s more of the latter, and don’t expect the going to get any easier, or for volatility to die down, anytime soon.''

- Gold is attempting to recover but the bears are lurking below $1,640.

- A 61.8% resistance ratio could be the catalyst for the next bearish impulse.

The gold price is higher on the day as we head into the close of Wall Street. The yellow metal gained ground on Tuesday as bulls moved in at the lowest levels in more than two years scored on the back of a surging US dollar and bond yields that are both making multi-year highs. At the time of writing, the gold price is trading 0.38% higher having climbed from a low of $1,621.91 and reaching a high of $1,642.45 after falling a day earlier to the lowest since March 2020.

The gold price is trading below pandemic-era levels and as rates markets are now pricing the potential for higher interest rates to persist for some time, while a steady stream of Fedspeak is likely to hammer this point home, analysts at TD Securities argue that gold prices could still have further to fall in the next stage of the hiking cycle.

''Indeed, the increase in inflation's persistence suggests that a restrictive regime may last longer than historical precedents, which argues for a more pronounced weakness. The combination of surging real rates and USD, continued outflows from money managers and ETF holdings are all adding pressure on family offices and prop shops to finally capitulate on their length,'' the analysts explained.

A chorus of Fed speakers advocated more interest rate hikes even at the risk of slowing economic growth on Tuesday. Late in the day, a voter in 2023, Philadelphia Federal Reserve President Patrick Harker on Friday said he believes the US central bank can bring down inflation without triggering a deep recession and hefty unemployment.

"We don't want to do this in a way that squashes the job market right now," Harker told Bloomberg TV from Jackson, Wyoming, where Fed officials have gathered for a conference. "If there is a recession, it would be shallow," he said.

Federal Reserve policymakers St. Louis Fed President James Bullard and Chicago Fed President Charles Evan advocated more interest rate hikes even at the risk of slowing economic growth. Later in the day, Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday said in a WSJ Live interview that central bankers are united in their determination to do what needs to be done to bring inflation down, and financial markets understand that. "There's a lot of tightening in the pipeline," Kashkari said.

Meanwhile, the benchmark S&P 500 erased gains of up to 1.7% by early afternoon trading to hit lows last seen in late November 2020. It is headed for a negative close. The US dollar, as measured by the DXY index, is back to trading in the 114 area below 114.47 as the highs of the day.

Gold technical analysis

The price has corrected to a 4-hour resistance in a 61.8% ratio correction. This could lead to another test of the lows and a subsequent lower low if $1,621.20 gives way to the bears.

What you need to take care of on Wednesday, September 28:

Dollar buying paused early Tuesday but resumed following the release of better-than-expected US data, also helped by the poor performance of Wall Street. In addition, fears of a worldwide recession keep leading the market sentiment.

During the European morning, European Central Bank President Christine Lagarde and US Federal Reserve chief Jerome Powell attended an event about the opportunities and challenges of the tokenisation of finance. There was little reference to monetary policy, and they passed unnoticed. Both are scheduled to participate in different events on Wednesday, none directly linked to monetary policies.

US Federal Reserve officials tried to pour cold water into the dollar's recent strength. Fed's Charles Evans said he was getting concerned about going too far, too fast with rate hikes but added that his outlook is in line with the Fed's median assessment of rates at 4.25-4.50% at the end of 2022 and at 4.6% end of next year. Neel Kashkari said the central bank is moving "very aggressively," and there is a high risk of "overdoing it." Finally, James Bullard noted that inflation is a "serious" problem in the US.

US government bond yields started the day retreating from multi-year highs, picking up after the US opening. Hawkish comments from US policymakers on Monday sent yields to multi-year highs, and the yield on the 10-year Treasury note extended to 3.99% on Tuesday. The 2-year note currently yields 4.30%, slightly below its previous close.

The EUR/USD pair finished the day right below the 0.9600 mark, trading not far from the multi-year low posted at 0.9549. A steeper EU energy crisis adds pressure as early in the day, several leaks were detected in the Nord Stream pipelines, interrupting gas transportation from Russia to the EU.

The GBP/USD pair stabilized around 1.0700. Bank of England Chief Economist Huw Pill said that "normalizing monetary policy is not a race between countries and markets are sometimes uncomfortable with that," adding that it is hard not to draw conclusions that they will need significant monetary policy response.

AUD/USD finished the day in the 0.6420 price zone, while USD/CAD settled at 1.3725. The dollar advanced against safe-haven currencies, with USD/CHF now trading at around 0.9920 and USD/JPY at 144.85.

Gold eased and trades just below $1,630 a troy ounce. Crude oil prices ticked higher, and WTI now changes hands at $78.50 a barrel.

Shiba Inu Price Prediction: How many SHIB burned tokens will it take to spark a bull run?

Like this article? Help us with some feedback by answering this survey:

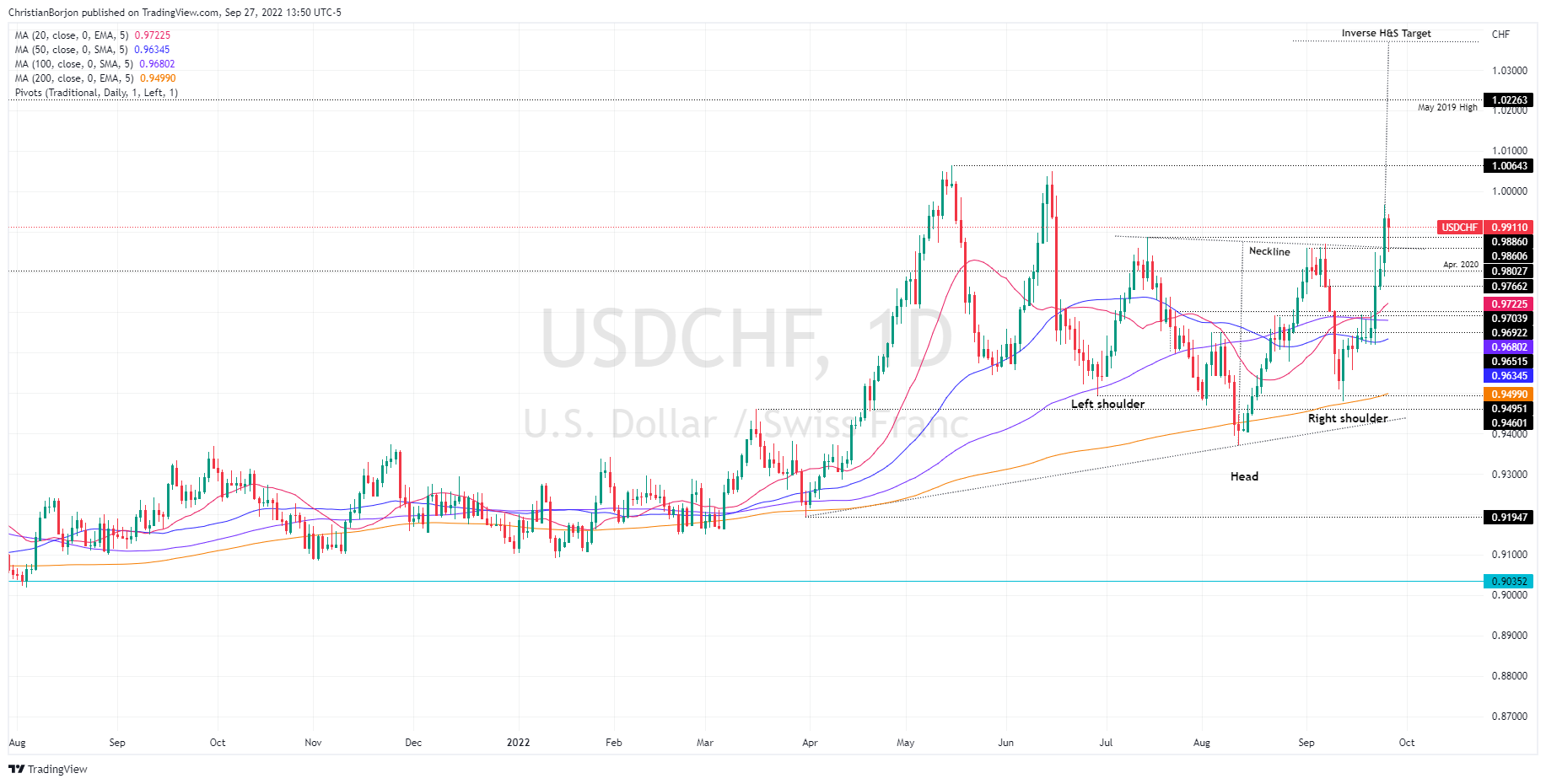

- The USD/CHF cuts some of its Tuesday’s losses, down 0.18% during the session.

- Once the USD/CHF broke above the 0.9900 figure, it paved the way for a parity re-test.

- An inverse head-and-shoulders in the USD/CHF daily targets 1.0370.

The USD/CHF is trimming some of the day’s earlier losses, bouncing off daily lows around 0.9849 and climbing above the 0.9900 figure, for the second consecutive day, as sentiment shifts negative, with the S&P 500 hitting a new two-year low during the day. At the time of writing, the USD/CHF is trading at 0.9913, slightly down by 0.18%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the major as upward biased, further cementing its bias once it clears the July 14 swing high at 0.9886. Earlier in the day, USD/CHF sellers tried to reclaim the latter, but buying pressure overcame sellers, and the USD/CHF edged above the 0.9900 threshold. It should also be noted that an inverse head-and-shoulders chart pattern is emerging, which could pave the way for further gains.

If the USD/CHF breaks above parity, that could put in play the YTD high at 1.0064. Once cleared, the next resistance level would be the 1.0100 figure, followed by the May 2019 swing high at 1.0226, ahead of the inverse head-and-shoulders target at 1.0369.

USD/CHF Key Technical Levels

A voter in 2023, Philadelphia Federal Reserve President Patrick Harker on Friday said he believes the US central bank can bring down inflation without triggering a deep recession and hefty unemployment.

"We don't want to do this in a way that squashes the job market right now," Harker told Bloomberg TV from Jackson, Wyoming, where Fed officials have gathered for a conference.

"If there is a recession, it would be shallow," he said.

Key notes

''We need to move methodically toward a clearly restrictive stance.''

''We will do what it takes to get inflation under control.''

''If there is a recession it would be shallow in my view.''

''Restrictive is clearly above 3%, how much more than that we'll have to see.''

''Not in the camp of unemployment needing to rise to 5% to get inflation under control.''

''We cannot let inflation expectations get unanchored, does not think they are now.''

US dollar and stocks update

Meanwhile, US stocks have attempted to turn around but remain pressured in a risk-off environment. An early rally in stocks faltered after Federal Reserve policymakers St. Louis Fed President James Bullard and Chicago Fed President Charles Evan advocated more interest rate hikes even at the risk of slowing economic growth.

Later in the day, Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday said in a WSJ Live interview that central bankers are united in their determination to do what needs to be done to bring inflation down, and financial markets understand that. "There's a lot of tightening in the pipeline," Kashkari said.

The benchmark S&P 500 erased gains of up to 1.7% by early afternoon trading to hit lows last seen in late November 2020.

The US dollar, as measured by the DXY index, is back to trading in the 114 area but is currently under pressure below the highs of the day of 114.47.

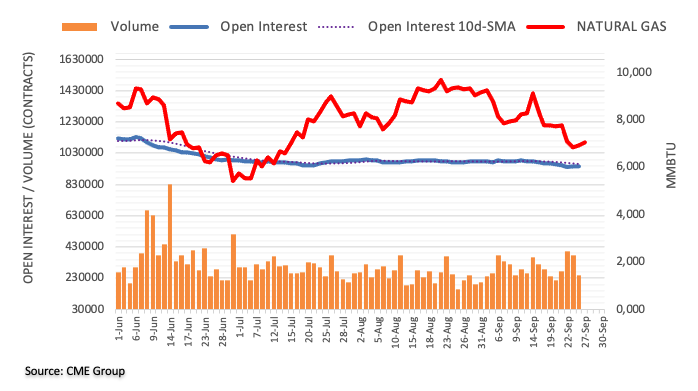

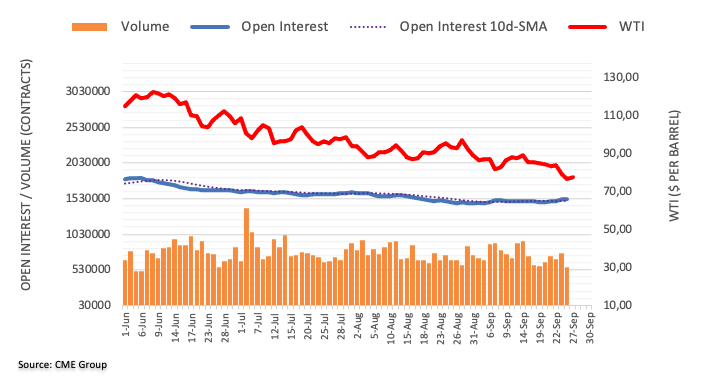

- WTI attempts to recover despite hawkish rhetoric from Fed officials.

- Analysts note that risks from structural supply issues are still present.

West Texas Intermediate crude oil was up 3.4% at $78.86bbl in afternoon trade during the New York session. The energy sector has been relieved a little by a slightly softer US dollar on Tuesday that eased off a 20-year high.

Additionally, oil producers suspended some production from Gulf of Mexico platforms threatened by the approach of Hurricane Ian. Nevertheless, DXY, an index that measures the greenback vs. a basket of currencies, has been attempting to recover in the US session on the back of firmly hawkish Federal Reserve speakers. The index has traded between a low of 113.332 and 114.472 on the day so far and is back to trading towards the highs of the days currently.

Federal Reserve policymakers St. Louis Fed President James Bullard and Chicago Fed President Charles Evan advocated more interest rate hikes even at the risk of slowing economic growth while Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday said in a WSJ Live interview that central bankers are united in their determination to do what needs to be done to bring inflation down, and financial markets understand that. "There's a lot of tightening in the pipeline," Kashkari said.

Overall, tighter monetary policy leads to weaker demand for crude oil and fuel products and has been partly to blame for the drop in Brent and WTI which both recently reached their lowest levels since January. The volatility in the price of oil has been leading to speculation that OPEC+ may be pushed to cut production when it meets next week to set monthly quotas.

''Risks from structural supply issues are still present, and the previously expected Iranian supply, which eroded supply risk premia, is now looking less likely. For now, in this current macro risk-off environment, these supply concerns appear to be largely ignored while demand expectations are at the low,'' analysts at TD Securities argued. ''A repricing of these market expectations will be required to lift crude prices out of their current funk. In this sense, attention is shifting toward potential OPEC cuts, given the cartel has shown to be nimble in their support of the global oil market.''

"The price slide ratchets up the pressure on OPEC+ - there are already calls on the market for greater production cuts of up to 1 million barrels per day," Commerzbank said in a note with respect to OPEC.

Elsewhere, the first hurricane of the season, Ian, in producing areas of the Gulf of Mexico is affecting supply. Reuters at the start of the week had reported that BP and Chevron were closing some platforms Ian approached Florida's west coast. ''The storm is the first this year to disrupt oil and gas production in the U.S. Gulf of Mexico, which accounts for about 15% of the nation's crude oil and 5% of dry natural gas production.''

Meanwhile, the European Union is reportedly struggling to reach an agreement on a price cap on Russian oil, with countries such as Cyprus and Hungary expressing opposition. ''A deal now looks unlikely despite earlier expectations that one will materialize this week'', ANZ Bank reported.

In general, the analysts at TD Securities explained that ''persistent demand worries have dampened sentiment in a low liquidity environment, and global macro risk-off has further driven the deterioration in recent sentiment. Fundamentally, the weakness may have been exaggerated in the immediate term, as physical demand indicators have not been declining at such a rapid pace''

"At the same time,'' the analysts continued, ''the high-frequency US demand data from the EIA, which has been extremely weak, has come under increasing scrutiny amid large adjustment factors and inconsistency with mobility and flight data. Furthermore, heading into the winter, demand may marginally improve relative to the weakness being priced in as Chinese run rates could rise to meet fuel export quotas, while re-opening and improved mobility, along with potential winter gas-oil substitution, could offer support.''

WTI H4 H&S in the making

As illustrated, the price is basing on $76.23 lows and could be in the process of firming the right-hand shoulder of an inverse head and shoulders, a bullish pattern that could lead to a significant breakout below $80.29 recent highs over the coming days.

- USD/CAD edges up but remains below the YTD highs at around 1.3730s, forming a doji.

- US economic data was positive, supportive of the Fed’s current policy stance.

- The US CB Consumer Confidence improved, supported by declining energy prices.

The USD/CAD edges higher during the North American session, but slightly below the YTD high at 1.3808, due to a risk-on impulse, which put a lid on the greenback’s rise. However, late in the day, as shown by the US Dollar Index, it recovered some ground back above the 114.00 thresholds, underpinned by further Fed hawkish commentary.

At the time of writing, the USD/CAD is trading at 1.3734, up 0.02%, after bottoming at around 1.3639 earlier in the session.

US economic data revealed during the day was better-than-expected, justifying the need for further rate increases. The US Department of Commerce reported that Durable Good Orders for August fell 0.2% but were better than the 0.3% contraction estimated. At the same time, the US Census Bureau revealed that New Home Sales for the same period jumped by 0.685M, exceeding forecasts of 0.5M.

Of late, the CB Consumer Confidence improved in September for the second consecutive month, up at 108 vs. forecasts of 104.6. Lyn Franco, Senior Director of Economic Indicators at the Conference Board, said, “Consumer confidence improved in September for the second consecutive month, supported in particular by jobs, wages, and declining gas prices.”

Elsewhere, other Fed policymakers crossing newswires, led by Chicago’s Fed Evans, said that rates need to get to the 4.50/4.75% range, higher than he initially thought. Evans added that a “recession-like” scenario is not seen and echoed his colleague, Susan Collins, saying that the job market should ease to curb inflationary pressures.

Later, the St. Louis Fed James Bullard said that the US has “a serious problem of inflation,” while adding that he expects rates to finish in 2022 at around 4.5%, which would slow down the economy and curb inflation down.

The lack of reported Canadian economic data left traders adrift to the US dollar dynamics and market sentiment. On Wednesday, the US economic docket will feature Pending Home Sales, and further Fed policymakers will be speaking, with Bostic, Bullard, Bowman Barking, and Evans, crossing newswires.

USD/CAD Key Technical Levels

Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday has crossed the wires as a chorus of Fed officials speak out to the public this week.

He has said US central bankers are united in their determination to do what needs to be done to bring inflation down, and financial markets understand that.

"There's a lot of tightening in the pipeline," Kashkari said in a WSJ Live interview.

"We are committed to restoring price stability, but we also recognize, given these lags, there is the risk of overdoing it on the front end, and so I think we are moving at an appropriately aggressive pace."

Key notes

Markets understand what Fed is doing.

Fed policymakers united and committed to bringing down inflation.

How much we need to do will be determined partly by the supply side.

We are committed to restoring price stability, and markets understand that.

We are moving very aggressively.

There is a lot of tightening in the pipeline.

There is the risk of overdoing it.

We are moving at an appropriately aggressive pace.

We need to see progress, not seeing it yet.

That makes me concerned that we have more work to do.

We need to keep tightening policy until we see compelling evidence that underlying inflation has peaked, heading down.

Then we need to sit there and pause.

Will not repeat the past mistakes of cutting rates once the economy weakens.

The policy stance is tight now.

Not sure the policy is tight enough.

High inflation is driven partly by the surge in demand, supply issues, and Russia's Ukraine invasion.

Has no interest in forecasting stock markets.

US dollar and stocks update

Meanwhile, US stocks have attempted to turn around but remain pressured in a risk-off environment. An early rally in stocks faltered after Federal Reserve policymakers St. Louis Fed President James Bullard and Chicago Fed President Charles Evan advocated more interest rate hikes even at the risk of slowing economic growth.

The benchmark S&P 500 erased gains of up to 1.7% by early afternoon trading to hit lows last seen in late November 2020.

The US dollar, as measured by the DXY index, is back to trading near the highs of the day of 114.47.

The reasons for the recent pound's sell-off are still on the table, so the currency remains extremely vulvnerable according to analysts at Rabobank. They point out the risk of GBP/USD hitting parity has firmed up.

Key Quotes:

“There has been a loose discussion in the market about the prospect of GBP/USD hitting parity for some months. This risk has firmed up in the wake of Friday’s tax giveaways from UK Chancellor Kwarteng, with both market pricing and some forecasters’ predictions now suggesting a tangible risk of GBP falling below 1.00. Of course, broad-based USD strength is an important element behind the softness of cable. In our view there will be no let-up in USD dominance for some months to come. The greenback continues to benefit from the hawkish position of the USD.”

“GBP/USD has edged higher in early European hours this morning, suggesting the extreme cheapening of UK assets over the past couple of sessions is attracting some interest. That said, the causes of the selloff in both gilts and in GBP have not been addressed and this suggests that the pound remains an extremely vulnerable currency.”

“In response to market turmoil, various UK lenders have confirmed that they are withdrawing a range of new home loans as deals are re-priced. Higher mortgage rates and higher prices of imported goods such as food and energy will increase the pain of the cost of living crisis for many UK households and threatens to undo any benefit from PM Truss’s tax breaks. This provides an opportunity for the Labour opposition which is currently holding its annual conference. As the 2024 general election nears, the pressure on Truss to appeal to voters will increase. Already speculation is appearing that she may not be able to hold on to office for very long. Political uncertainty in itself is a negative currency factor.”

Data released on Tuesday in the US showed a more pronounced than expected improvement in Consumer Sentiment in September. According to analysts at Wells Fargo, falling gasoline prices and a still-tight labor market are the main reasons for the rebound. They warn that as inflation persists and the Federal Reserve lifts rates to combat it, they don’t see confidence approaching pre-pandemic levels.

Key Quotes:

“The near five-point gain in consumer confidence in September lifted the index to 108.0. This marks the highest level in five months, and in conjunction with the sizable gain in August, puts the index 12.7 points higher than where it stood just two months ago.”

“The state of the labor market is of particular interest for the Confidence survey. Most measures of labor demand have shown some signs of topping out, with job openings and hiring plans moving sideways in recent months.”

“Still-elevated inflation and the aggressive tightening path from the Federal Reserve to combat it will likely weigh on consumers financial prospects. The recent gain in confidence may be supportive of spending in the near-term, but as long as inflation persists and risks of recession remain confidence is unlikely to return to pre-pandemic levels.”

According to analysts from Danske Bank, bond yield in Europe and in the US will top in 2022 and decline slightly in 2023. They expect long yields to continue rising over the next three months as amid high inflation, central bank tightening and concern about a growing government bond supply increases.

Key Quotes:

“10Y Bund yields are now trading around 2.1% compared with -0.18% at the start of 2022. During the same period, 10Y US Treasury yields have risen from 1.5% to around 3.85%.”

“Overall, we now expect 10Y US Treasury yields to rise by around 25bp to 4.05% in the course of the next 3 months. We expect 10Y Bund yields to increase to 2.35% on a 3-month horizon. That equates to a EUR 10Y swap rate of 3.20%.”

“Our baseline scenario is a recession in both Europe and the US. Hence, with central banks likely bringing forward rate hikes to H2 22, we expect markets to increasingly price inflation to come under control. Lower commodity prices point in the same direction. We therefore continue to see yields peaking in 2022 and declining slightly in 2023.”

- The USD/JPY oscillates around Tuesday’s open, above the 144.70 mark.

- The major remains upward biased but approaching the 20-day EMA, which, once cleared, could pave the way for further downside.

- Short term, the USD/JPY is downward biased, as a double-top emerged in the 1-hour chart.

The USD/JPY fluctuates around the week’s high 144.78, amidst a risk-on impulse, as portrayed by US equities sustaining decent gains following the sell-off of the last couple of trading sessions, courtesy of an upbeat sentiment. At the time of writing, the USD/JPY is trading at 144.80, almost flat.

USD/JPY Price Analysis: Technical outlook

The USD/JPY is range-bound in the 142.00-145.00 range following last week’s intervention. Even though the major remains upward biased, and the 20-day EMA is closing to price action, which means that a break below the latter would exert downward pressure on the pair in the near term.

Short term, the USD/JPY one-hour chart shows that a double-top chart pattern is emerging at around the 144.60-75 area, which could pave the way for further losses. Nevertheless, the 20 and the 50-EMAs, meandering around 144.51 and 144.16, respectively, would be difficult to surpass. But once cleared, a fall towards the S1 daily pivot at around 143.70 is on the cards.

On the flip side, the USD/JPY’s first resistance would be the 145.00 figure, the line in the sand imposed by the Bank of Japan, last week’s intervention. Break above will expose the YTD high at 145.90, ahead of the 146.00 figure.

USD/JPY Key Technical Levels

- US dollar recovers after September Consumer Confidence data.

- Stocks move off highs as US 10-year yield hits fresh highs.

- EUR/USD unable to sustain recovery, holds above lows.

The EUR/USD dropped further after the beginning of the American session and hit levels under 0.9600. It is hovering at 0.9620/25, around the 20-hour SMA without a clear intraday direction. A stronger US dollar weakened the recovery of pair.

Dollar cheers US data

Following the release of better-than-expected US Consumer Confidence data, the greenback started to recover from intraday losses across the board. The economic figures pushed US yields higher. The US 10-year yield climbed to 3.97%, hitting the highest since 2010.

At the same time, stocks in the US trimmed gains. The Dow Jones pulled back more than 300 points, and is down by 0.07% while the S&P 500 rises by 0.08%. Stock indices continue to be unable to sustain a rebound suggesting that fear and concerns are still present among market participants, which favors the greenback as investors look for a safe haven.

Comments from European Central Bank officials point to more rate hikes. De Guindos mentioned data will determine the trajectory. At the same time, in the US, Bullard warned they have a serious inflation problem.

The 0.9600 zone holds the key for the moment

If the euro manages to recover above 0.9630 it could gain momentum for another test of 0.9660, the last protection for 0.9700. On the flip side, a consolidation below 0.9600 would expose the cycle low at 0.9548 (Sep 26 low).

Technical levels

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 0.3% in the third quarter, unchanged from the previous estimate.

"After releases from the National Association of Realtors and the US Census Bureau, the nowcast of third-quarter gross private domestic investment growth decreased from -7.4% to -7.6%," the Atlanta Fed further explained in its publication.

Market reaction

The US Dollar Index largely ignored this report and was last seen trading in negative territory below 114.00.

- AUD/USD oscillates around 0.6440s, ahead of 2022 lows reached around 0.6436.

- Fed’s Evans: Expects the Federal funds rate (FFR) to be around 4.50-4.75%.

- Fed’s Bullard: Recession risks had risen but attributed to external shocks; expects the FFR to be at 4.50% by the end of 2022.

The AUD/USD is extending its losses during the day, down by 0.17%, bouncing off the YTD lows of 0.6436, reached on Monday, as markets calmed. Risk-aversion triggered by a bold move of the new UK government spurred a global bond sell-off, alongside broad GBP weakness, consequently bolstering the greenback, a headwind for risk-sensitive currencies. At the time of writing, the AUD/USD is trading at 0.6442, below its opening price.

AUD/USD drops by a minimal margin amidst a risk-on sentiment

As the North American session progresses, US equities are trading in the green. Fed officials led by Chicago’s Fed President Charles Evans and the St. Louis Fed James Bullard crossed newswires on Tuesday.

Charles Evans said that the Fed needs to hike rates to the 4.50-4.75% range, more aggressive than he previously thought, further cementing the central bank’s commitment to curb inflation. He did not see a “recession-like” scenario and echoed Boston’s Collins comments that the unemployment rate should rise to ease inflationary pressures.

Of late, the St. Louis Fed President James Bullard said that they have “a serious problem of inflation in the US,” while adding that risks of a recession had risen, but said that it could be caused by external factors, like Europe and China, pulling the world into a slowdown. He added that raising rates to around 4.5% by the year’s end would slow the economy and quell inflation.

Data-wise, the US economic calendar featured Durable Good Orders for August, which dropped 0.2% MoM, less than the estimated 0.3% contraction. Later, the CB Consumer Confidence jumped in September for the second consecutive month, up at 108 vs. estimates of 104.6.

Lyn Franco, Senior Director of Economic Indicators at the Conference Board, said, “Consumer confidence improved in September for the second consecutive month, supported in particular by jobs, wages, and declining gas prices.” Franco added, “Meanwhile, purchasing intentions were mixed, with intentions to buy automobiles and big-ticket appliances up, while home purchasing intentions fell.”

At the same time, the US Census Bureau reported that New Home Sales for August unexpectedly rose by 0.685M, higher than estimates of 0.5M. Sources cited by Bloomberg said, “The housing market has felt the biggest impact from higher borrowing costs; so, although I’ll gladly welcome an increase in sales, we know that the bigger picture shows slowing activity.”

AUD/USD Key Technical Levels

Bank of England (BOE) Chief Economist Huw Pill said on Tuesday that they will not sell gilts into a dysfunctional market, as reported by Reuters.

"We are not running faster than elsewhere in reducing our balance sheet but our process is different," Pill further explained. "As long as the market is an orderly repricing of fundamentals, quantitative tightening can continue."

Market reaction

The British pound gathered strength following these comments. As of writing, the GBP/USD pair was trading at 1.0780, where it was up 0.9% on a daily basis.

Gold plunged on Monday to a new two and a half year low around $1,620. A combination of factors are set to add further downside pressure on the yellow metal, strategists at TD Securities report.

Higher interest rates to persist for some time

“With the yellow metal trading below pandemic-era levels, a small number of family offices and proprietary trading shops are increasingly feeling the pressure to finally capitulate on their massively bloated and complacent length in gold.”

“Rates markets are now pricing the potential for higher interest rates to persist for some time, and a steady stream of Fedspeak is likely to hammer this point home. In this sense, our analysis suggests gold prices could still have further to fall in the next stage of the hiking cycle.”

“The increase in inflation's persistence suggests that a restrictive regime may last longer than historical precedents, which argues for a more pronounced weakness.”

USD/CAD has climbed above the 1.37 level. In the view of economists at the Bank of Montreal, the pair could reach in the next few weeks.

Loonie to gradually recover in 2023

“Currencies have a long and storied history of overshooting, and we suspect the loonie is at risk of a more intense short-term sell-off. A test of the 1.40 is certainly a risk in the weeks ahead.”

“Ultimately, we expect the US dollar to lose some of its formidable steam around the turn of the year as the end of Fed hikes comes into view. And, we thus expect the Canadian dollar to gradually recover in 2023, albeit ending next year lower than we previously expected at around 1.30.”

The yuan has seen its weakest valuation against the US dollar since 2008. Economists at Rabobank expect the USD/CNY to peak at 7.35 by the second quarter of 2023.

Limited further upward potential for USD/CNY

“Suppressed demand from the West will put further pressure on China’s export growth engine. However, a lot of bad news is already priced in and therefore we see limited further upward potential for USD/CNY.”

“We expect USD/CNY to reach 7.25 at the end of this year while gradually rising further to 7.35 at the end of Q2 next year. From then on we see room for the yuan to regain some strength which should bring USD/CNY back to 7 at the end of 2023 since we expect a recovery starting in the second half of 2023.”

"Normalizing monetary policy is not a race between countries and markets are sometimes uncomfortable with that," Bank of England (BOE) Chief Economist Huw Pill said on Tuesday.

Pill further argued that the UK government's fiscal response to the economic slowdown would free the monetary policy to address longer-term inflation dynamics.

Market reaction

These comments don't seem to be having a noticeable impact on the British pound's performance against its rivals. As of writing, the GBP/USD pair was trading at 1.0760, where it was up 0.7% on a daily basis.

The US dollar ratcheting higher while the negative revisions for earnings appear set to accelerate to the downside. Thus, strategists at Morgan Stanley expect the S&P 500 Index to decline towards the 3,000 level.

Every 1% change in USD has a 0.5% impact on S&P 500 earnings growth

“On a year-over-year basis, the US dollar is now up 21% and still rising. Based on our analysis that every 1% change in the dollar has a 0.5% impact on S&P 500 earnings growth, fourth quarter S&P 500 earnings will face an approximate 10% headwind to growth all else equal.”

“The bear market in stocks will not be over until the S&P 500 reaches the range of our base and bear targets, i.e. 3,000 to 3,400 later this fall.”

- Consumer sentiment in the US continued to improve in September.

- US Dollar Index rebounded to the 114.00 area with the initial reaction to the data.

The data published by the Conference Board showed on Tuesday that the Consumer Confidence Index rose to 108.00 in September from 103.6 in August (revised from 103.2).

Further details of the publication revealed that the Consumer Present Situation Index climbed to 149.6 from 145.3 and the Consumer Expectation Index rose to 80.3 from 75.8. Finally, the 1-year Consumer Inflation Rate Expectations declined to 6.8% from 7%.

Market reaction

With the initial reaction, the US Dollar Index extended its recovery and was last seen posting small daily losses at 114.02.

- GBP/USD gains some positive traction on Tuesday, though the uptick lacks bullish conviction.

- Concerns about the UK’s ballooning public debt act as a headwind for the British pound.

- Aggressive Fed rate hike bets help limit the USD corrective slide and contribute to capping.

The GBP/USD pair trims a part of its intraday gains and retreats to mid-1.0700s during the early North American session, though is still up over 0.50% for the day.

The new UK government's mini-budget announcement last week as well as the plan to subsidise energy bills for households and businesses sparked concern about spiralling public debt. This is evident from a fresh slump in the UK fixed-income market, which pushes the 30-year yield to its highest level since 2007. Furthermore, the fiscal package is expected to fuel already high inflation and create additional economic headwinds, which, in turn, is seen as acting as a headwind for the British pound.

That said, a modest US dollar weakness continues to lend support to the GBP/USD pair amid speculations that the Bank of England could intervene in the FX market to stabilise the domestic currency. The risk-on impulse, as depicted by the strong rally in the equity markets, turns out to be a key factor undermining the safe-haven greenback. That said, rising US Treasury bond yields, bolstered by expectations for a more aggressive policy tightening by the Fed limits any meaningful USD corrective pullback.

The mixed fundamental backdrop warrants some caution for aggressive traders and before placing fresh directional bets around the GBP/USD pair. From a technical perspective, the lack of strong buying interest, especially after the recent free-fall to an all-time low, suggests that the near-term bearish trend might still be far from being over. Hence, any further move up could be seen as a selling opportunity amid the lack of confidence in the UK government’s ability to manage the ballooning debt.

Technical levels to watch

Rising real rates and strong US dollar are crimping investment demand for gold. Strategists at ANZ Bank expect the yellow metal to hover around $1,620 by the end of the year.

Macroeconomic backdrop for gold remains challenging

“In the short-term, a combination of rising yields and strong USD will tarnish investment demand for gold.”

“With the US Fed continuing on its aggressive tightening path, we expect more outflows from gold ETFs, and further price downside to $1,620 by the end of the year.”

St. Louis Federal Reserve Bank President James Bullard said on Tuesday that they have a serious inflation problem in the US, as reported by Reuters.

"The credibility of inflation targeting regime is at risk," Bullard added and argued that they must no recreate the volatile 1970s era. "The labor market is very strong, this gives us room to take care of inflation as soon as we can."

Market reaction

These comments were largely ignored by market participants and the US Dollar Index was last seen losing 0.3% on the day at 113.76.

Additional takeaways

"US policy rate arguably now in restrictive territory."

"More rate rises to come in future meetings."

"Strict comparisons with Volcker are inappropriate now."

"Likely peak for policy rate is around 4.5%."

Bank of England (BOE) Chief Economist Huw Pill noted on Tuesday that they saw a significant repricing of financial assets following the finance minister's statement, as reported by Reuters.

Additional takeaways

"Repricing must be seen as part of a global trend."

"Repricing reflects normalisation after a decade of easy policy."

"There is clearly a UK-specific element to repricing."

"We are monitoring UK component very closely."

"Important change in asset prices is seen as repricing."

"BoE must ensure orderly and well-functioning markets."

"MPC is not indifferent to repricing of financial assets."

"Changes in asset prices have big impact on UK macro developments."

"We must fact market moves into outlook for monetary policy."

"MPC views market developments through price stability lens."

"MPC has very good understanding of price stability goal."

"Hard not to draw conclusion that we will need significant monetary policy response."

"These are quite challenging times for pursuing CPI target."

"Market developments must also be seen in context of last week's fiscal news, energy prices."

"In my view, fiscal announcement will act as stimulus."

"Best for monetary policy to take a lower frequency, more considered approach."

"Monetary policy has limitations for fine-tuning short-term developments."

"In the mean time, we are relying on communication in run-up to November meeting."

"This approach relies on respect for BoE independence."

Market reaction

GBP/USD edged slightly higher from daily highs after these comments and was last seen gaining 0.6% on the day at 1.0750.

European Central Bank (ECB) Vice President Luis de Guindos said on Tuesday that they will continue to raise rates over the coming months and added that the number and size of the hikes will be determined by the data, as reported by Reuters.

"For 2023, growth will be very low, below 1% in the base case," de Guindos added. "Higher interest rates will have a clear impact on corporate solvency."

Market reaction

The EUR/USD pair continues to trade in positive territory above 0.9600 after these comments.

- USD/CAD attracts some dip-buying near the 1.3630 region, though lacks follow-through.

- Positive oil prices underpin the loonie and act as a headwind amid overbought RSI (14).

- The set-up favours bullish traders and supports prospects for a further appreciating move.

The USD/CAD pair recovers a major part of its intraday losses and climbs back above the 1.3700 mark during the early North American session.

Expectations for a more aggressive policy tightening by the Federal Reserve assist the US dollar to attract some dip-buying and offers some support to the USD/CAD pair. That said, the risk-on impulse, along with a softer tone surrounding the US Treasury bond yields, seems to cap gains for the safe-haven buck. Furthermore, a goodish recovery in crude oil prices is seen underpinning the commodity-linked loonie and acting as a headwind for the major.

From a technical perspective, the overnight strong move up to the highest level since May 2020 pushed spot prices through the top end of a two-week-old ascending channel. This could be seen as a key trigger for bullish traders. That said, RSI (14) on the daily chart is flashing extremely overbought conditions and warrants some caution, making it prudent to wait for some near-term consolidation before positioning for any further appreciating move.

Nevertheless, the set-up still suggests that the path of least resistance for the USD/CAD pair is to the upside. Hence, a move back towards the 1.3745-1.3750 intermediate hurdle, en route to the 1.3800 round-figure mark, remains a distinct possibility. Some follow-through buying should pave the way for additional gains and an extension of the recent strong rally witnessed over the past two weeks or so.

On the flip side, the daily swing low, around the 1.3630 region, now seems to protect the immediate downside. Any further slide below the 1.3600 mark could be seen as a buying opportunity and find decent support near the lower end of the aforementioned trend channel, currently around the 1.3565 region. A convincing break below will negate the positive outlook and set the stage for a deeper corrective fall.

USD/CAD 4-hour chart

-637998817897213747.png)

Key levels to watch

- EUR/USD gathers some upside traction above 0.9600.

- Another test of the YTD low near 0.9550 stays on the cards.

EUR/USD meets some fresh buying interest and reclaims the area beyond the 0.9600 mark on Tuesday.

Rising bets for extra weakness in the European currency remain well on the table with the immediate target at the 2022 low at 0.9552 (September 26). A deeper drop could challenge the round level at 0.9500 ahead of the weekly low at 0.9411 (June 17 2002).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0676.

EUR/USD daily chart

- House prices in the US declined in July.

- US Dollar Index stays in negative territory below 114.00.

The monthly data published by the US Federal Housing Finance Agency showed on Tuesday that the Housing Price Index fell by 0.7% on a monthly basis in July. This print followed June's increase of 0.1% and came in lower than the market expectation of +0.7%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at 16.1% on a yearly basis in July, compared to analysts' estimate of 17%.

Market reaction

These numbers don't seem to be impacting the dollar's market valuation in a significant way. As of writing, the US Dollar Index was down 0.3% on the day at 113.78.

- DXY gives away part of Monday’s intense move above 114.00.

- Corrective move is expected to persist in the near term.

DXY comes under pressure and sheds some ground following recent cycle highs near 114.50 (September 26).

In the meantime, extra losses appear favoured in the current context of overbought levels and could extend further in the very near term at least.

That said, occasional bouts of weakness could be deemed as buying opportunities with the immediate target now emerging at the round level at 115.00 ahead of the May 2002 high at 115.32.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 106.90.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.21.

DXY daily chart

FX option expiries for September 27 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 0.9700 813m

- 0.9750 442m

- 0.9775 250m

- 0.9875 213m

- 0.9965-75 510m

- USD/JPY: USD amounts

- 144.00 274m

- USD/CHF: USD amounts

- 0.9700 690m

EUR/CHF: EUR amounts

- 0.9520 390m

- 0.9565 235m

- 0.9700 200m

- AUD/USD: AUD amounts

- 0.6500 220m

- 0.6625 359m

- Gold stages a goodish bounce from its lowest level since April 2020 touched earlier this Tuesday.

- A modest pullback in the US bond yields prompts USD profit-taking and underpins the XAU/USD.

- Aggressive Fed rate hike bets, the risk-on impulse might keep a lid on the safe-haven commodity.

Gold attracts some buyers near the $1,620 area and stages a goodish rebound from its lowest level since April 2020 touched earlier this Tuesday. The XAU/USD maintains its bid tone through the mid-European session and is currently placed around the $1,640 level, up over 1% for the day.

The US dollar pauses its recent blowout rally and eases from a fresh two-decade high touched on Monday amid some profit-taking on the back of a modest pullback in the US Treasury bond yields. This, in turn, is seen as a key factor offering support to the dollar-denominated gold. The USD bulls remain on the defensive following the release of the rather unimpressive US Durable Goods Orders data for August.

Despite a weaker USD, the XAU/USD lacks bullish conviction amid the prospects for aggressive policy tightening by global central banks, including the Federal Reserve. In fact, the US central bank last week signalled that it will hike interest rates at a faster pace at its upcoming meetings to tame surging inflation. This might continue to act as a tailwind for the US bond yields and the USD.

It is worth recalling that the yield on the rate-sensitive two-year US government bond rose to over a 15-year peak and the benchmark 10-year Treasury note to the highest level since April 2010 on Monday. This supports prospects for the emergence of some USD dip-buying. Apart from this, the risk-on impulse might further contribute to keeping a lid on any meaningful upside for the non-yielding gold.

Even from a technical perspective, Friday's breakdown below a one-week-old trading range support, around the $1,654 area, favours bearish traders. This, in turn, suggests that any subsequent move up might still be seen as a selling opportunity. Next on tap is the release of the Conference Board's Consumer Confidence Index, New Home Sales data and the Richmond Manufacturing Index from the US.

The data might do little to provide a fresh impetus. Nevertheless, the XAU/USD, for now, seems to have snapped a two-day losing streak and remains at the mercy of USD price dynamics. Apart from this, US bond yields and the broader market risk sentiment could allow traders to grab short-term opportunities around gold.

Technical levels to watch

- Durable Goods Orders in the US fell less than expected in August.

- US Dollar Index stays in negative territory at around 113.50 after the data.

Durable Goods Orders in the US declined by 0.2%, or by $0.6 billion, on a monthly basis in August to $272.7 billion, the monthly data published by the US Census Bureau revealed on Tuesday. This reading came in better than the market expectation for a decrease of 0.4%.

"Excluding transportation, new orders increased 0.2%," the publication read. "Excluding defense, new orders decreased 0.9%. Transportation equipment, also down two consecutive months, drove the decrease, $1.0 billion or 1.1% to $92.0 billion."

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen losing 0.4% on the day at 113.62.

EUR/USD is trading near 0.9630. Economists at BBH expect the pair to dip under 0.9555 towards the psychological 0.90 mark.

ECB President Lagarde is sounding less hawkish

“EUR/USD made a new cycle low yesterday near 0.9555. It should test that low soon and move on to the target at the psychological 0.90 level.”

“Lagarde said that the bank will consider Quantitative Tightening (QT) once interest rate normalization is completed. We think the ECB is being more cautious because it has to worry about fragmentation risks. Bottom line: a bit more dovish than anticipated. Lastly, Lagarde pledged that Outright Monetary Transactions (OMT or QE) is available if its Transmission Protection Instrument (TPI) fails. This is not exactly a strong vote of confidence in its newly created TPI.”

On Monday, gold price fell to $1,620. The strong US dollar is the main culprit of the yellow metal’s woes, strategists at Commerzbank note