- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

US inflation expectations remain pressured on Thursday, despite the rush to risk safety and hawkish Fedspeak, which in turn propelled the US Treasury bond yields.

That said, the inflation precursors, as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, dropped to the lowest levels since early March 2021.

While noting the details, the longer-term inflation expectations dropped to the lowest level since March 01, 2021, whereas the 5-year benchmark slumped to the lowest levels since February 2021 with the latest figures being 2.19% and 2.78% respectively.

The US Dollar Index (DXY) justifies the downbeat inflation expectations while marking another negative day to refresh the weekly low of around 111.95.

Moving on, the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index for August, expected 4.7% YoY versus 4.6% prior, will be crucial for the market players to watch for fresh impulse.

Also read: Forex Today: Gear up for more market turmoil

- EUR/GBP remains pressured around weekly low, snaps four-week uptrend.

- Bulls cheer strong comments from BOE’s Pill, failed to respect hawkish ECBspeak, record high German inflation.

- UK GDP will be eyed for confirming recession woes and can pare weekly losses of the pair.

- Record high inflation in Eurozone can add strength to the corrective bounce.

EUR/GBP holds lower ground near 0.8810 as it braces for the first weekly loss in five during Friday’s Asian session. The cross-currency pair’s latest weakness contrasts with the UK’s economic pessimism amid hawkish comments from the Bank of England (BOE) policymakers. In doing so, the quote also ignores the European Central Bank (ECB) members’ aggression.

BOE Economist Huw Pill amplified pessimism surrounding Britain as the policymaker said, “It’s hard to avoid the conclusion that fiscal easing announced will prompt a significant and necessary monetary policy response in November.” Recently, UK Trade Secretary Kemi Badenoch stated that the chancellor is `working well' with the Bank of England.

On the other hand, most of the ECB policymakers, including Olli Rehn, Mario Centeno and Pablo Hernandez de Cos, have recently backed the idea of increasing the benchmark rate by 0.75%. “ECB policymakers voiced more support on Thursday for another big interest rate hike as inflation in the euro zone's biggest economy hit double digits, blasting past expectations and heralding another record reading for the bloc as a whole,” said Reuters in this regard.

It should be noted that Germany’s Consumer Price Index (CPI) rose to 10% in September compared to 7.9% in August and the market expectation of 9.4. Additionally, the Harmonised Index of Consumer Prices (HICP) for the nation, the European Central Bank's (ECB) preferred gauge of inflation, jumped to 10.9% during the stated month compared to 8.8% prior and 10% expected. Furthermore, Eurozone Economic Sentiment Indicator (ESI) declined to 93.7 in September versus the market expectation of 95 and 97.3 in August. Also, the Consumer Confidence for the said month matched -28.8 forecasts and prior readings.

Against this backdrop, the Wall Street benchmarks reversed all of the gains made on Wednesday while the Treasury yields recovered.

Moving on, the final readings of the UK’s second quarter (Q2) Gross Domestic Product (GDP) and the first impressions of Eurozone inflation data for September will be crucial for the EUR/GBP pair traders. As grim expectations from the scheduled data are favoring the pair buyers, any surprises can extend the latest weakness of the quote.

Technical analysis

A three-week-old ascending trend line joins the 21-DMA to highlight the 0.8750 level as crucial downside support for the EUR/GBP traders to watch during the pair’s further downside. Alternatively, the 10-DMA restricts immediate recovery moves near 0.8845.

- GBP/JPY has reacted much to the upbeat Japanese employment data.

- Japan’s jobless rate has matched the expectations at 2.5% while Job/Applicants has improved to 1.32.

- UK Truss is closely working with the BOE to stabilize financial markets.

The GBP/JPY pair dropped below 161.00 in the early Tokyo session after failing to sustain above the same. The intermittent hurdles seem to lack strength and will fade sooner just after the market participants will jump to capitalize on the minor correction.

Meanwhile, an upbeat Japan’s employment data has not made much impact on the cross. The Unemployment Rate has remained in line with the estimates of 2.5% but lower than the prior release of 2.6%. While the Jobs/Applicants Ratio has improved to 1.32 vs. the projections of 1.30.

This week, the cross has displayed a juggernaut rally from a low of 148.57 after the Bank of Japan (BOJ) announced an unscheduled bond-buying program.

The BOJ sees the necessity of infusing liquidity into the economy as the nation has still not revived from the consequences of the Covid-19 pandemic. Investors have been dumping the Japanese yen for a prolonged period amid its ultra-dovish monetary policy and now more leakage of liquidity has vanished after the impact of BOJ’s intervention in the currency markets. It seems that only a ‘neutral’ stance on interest rates could save the yen from further carnage.

On the UK front, the Bank of England (BOE) also announced a surprise bond-purchase program to stabilize financial markets. A 13-day bond-buying program has been announced in which the BOE will purchase GBP 5 billion worth of long-dated bonds each day. The surprise BOE move has still kept it solid against the yen bulls.

On Thursday, UK PM Liz Truss cited that they are working closely with the Bank of England. "We have seen difficult markets around the world, I am clear that the government has done the right thing,", as reported by Reuters.

In today’s session, the UK Gross Domestic Product (GDP) data will be of utmost importance. The annual and quarterly data is expected to remain steady at 2.9% and -0.1% respectively.

- AUD/JPY braces for the first weekly gain in three, grinds higher of late.

- Convergence of 50-day EMA, 13-day-old resistance line and previous support line challenge the upside moves.

- Bearish MACD signals, downbeat RSI favor sellers, bulls have a bumpy road ahead.

AUD/JPY grinds higher around 94.00, on the way to snapping a two-week downtrend, during Friday’s Asian session. In doing so, the cross-currency pair pays little heed to the downbeat oscillators while staying above the key Fibonacci retracement levels.

It’s worth noting that the RSI (14) and the MACD both flash bearish signals but a convergence of the 50-day EMA, the previous support line from May and a three-week-old resistance confluence, near 94.80, appears a tough nut to crack for the AUD/JPY bulls.

Also acting as an upside hurdle is June’s peak near 96.90, a break of which could quickly propel the pair prices towards the recently flashed multi-day high near 98.60.

Alternatively, 50% and 61.8% Fibonacci retracement of the AUD/JPY pair’s May-September upside, respectively near 93.00 and 91.60, could challenge the downside moves.

In a case where AUD/JPY remains bearish past 91.60, the odds of witnessing a south-run towards the 90.00 threshold can’t be ruled.

Above all, today’s release of China’s official and Caixin PMIs for September and the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index for August, expected 4.7% YoY versus 4.6% prior, are crucial for AUD/JPY pair.

Also read: AUD/USD pierces 0.6500 hurdle ahead of China PMIs, US PCE Inflation

AUD/JPY: Daily chart

Trend: Limited upside expected

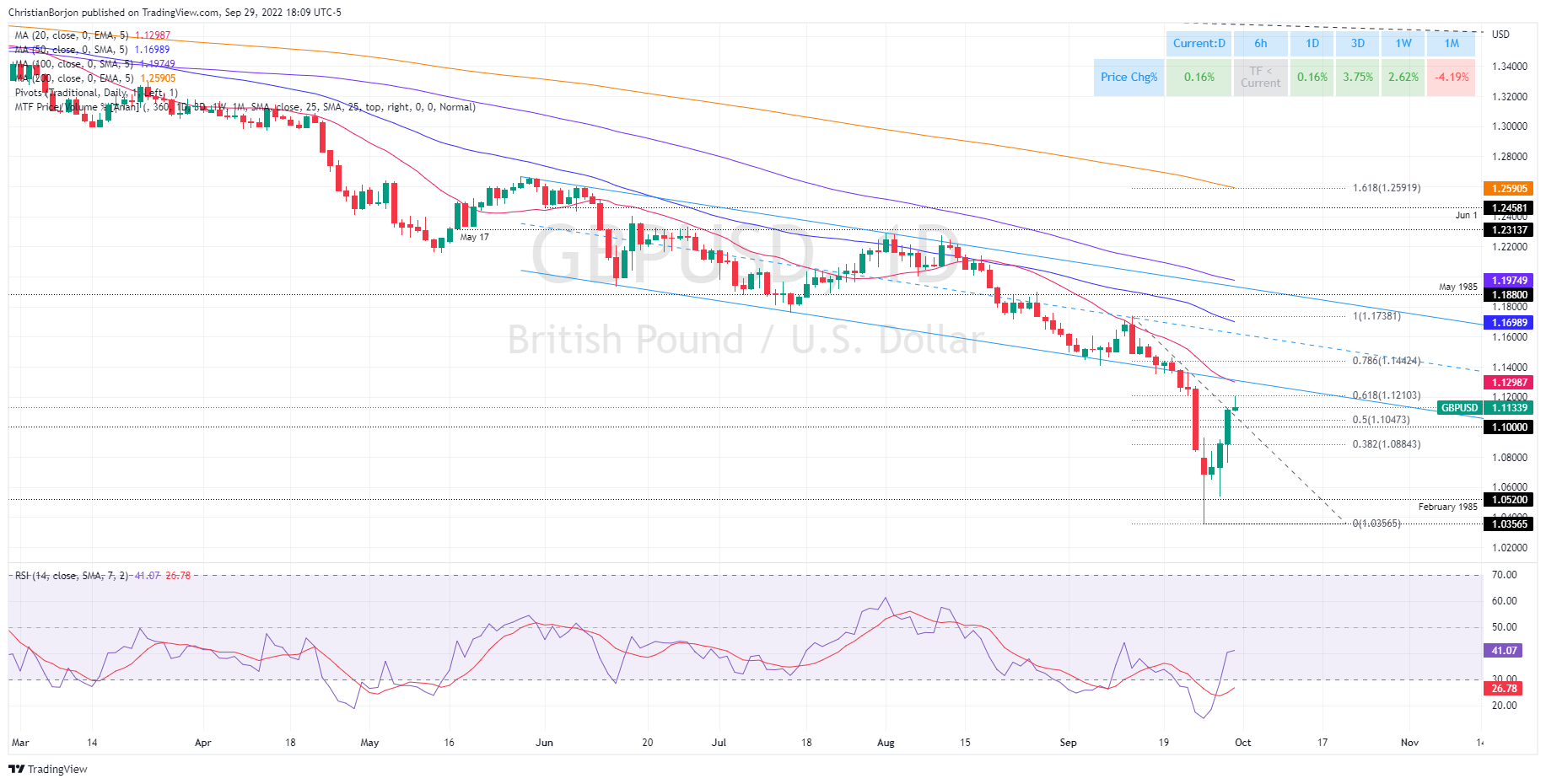

- During the week, the British pound has recovered 3.84% from the last week’s loss.

- The GBP/USD failure to clear 1.1200 sent the pair sliding toward current exchange rate levels.

- If it clears the 1.1050, it could pave the way towards the 38.2% Fibonacci retracement at around 1.0880s.

The GBP/USD rallies sharply, trimming some of the last week’s losses, closing to the 1.1200 figure after being at the brink of testing parity when the pound fell to its lowest at 1.0356. At the time of writing, the GBP/USD is trading at 1.1133, 0.25% above its opening price, as the Asian session begins.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD is downward biased, despite the astonishing recovery in the week. Due to last Friday’s 600 pip volatile session, a mean reversion move was expected. The Relative Strength Index (RSI), exited from oversold conditions at 41.59 but shifted almost horizontally, meaning buyers’ momentum is dissipating.

Given the previously mentioned scenario and the GBP/USD failure to clear the 61.8% Fibonacci retracement at 1.1210, a fall towards 1.1050, the 50% Fibonacci level, drawn from the high/low of 1.1738/1.0356, is on the cards.

Therefore, the GBP/USD first support would be the 1.1100 mark. Once cleared, the next support would be the 50% Fibonacci retracement at 1.1050, which, once hurdle, could pave the way for a re-test of the 38.2% Fibonacci retracement at 1.0884.

GBP/USD Key Technical Levels

- The smart money has been channelizing after a pullback move from 1.3600.

- USD/CAD is hovering around the 50-EMA, therefore, the explosion will be crucial.

- A bearish range shift by the RSI (14) will trigger a downside momentum.

The USD/CAD pair is declining firmly in the early Tokyo session after failing to cross the 1.3750 hurdles on Thursday. Broadly, the asset has turned sideways after a pullback move from 1.3600. The major is oscillating in a 1.3656-1.3756 range.

On an hourly scale, the asset witnessed a steep fall after sensing exhaustion in the uptrend. The major was on a spree of making higher highs while the momentum oscillator, Relative Strength Index (RSI) (14) made a lower high, which indicates a loss in the upside momentum. And, the downside bias got strengthened after dropping below Tuesday’s low at 1.3640.

It is worth noting that the pullback move after hitting a low of 1.3600 seems to conclude where investors have poured smart money by supporting the loonie bulls. The asset has formed a consolidation range around the 50-period Exponential Moving Average (EMA) at 1.3684 and a breakdown of the same will result in sheer weakness in the counter.

Also, the 200-EMA at 1.3564 is looking turn flat, which indicates a loss of momentum in the longer-term trend.

The RSI (14) has shifted into the 40.00-60.00 range and a breakdown into the bearish trajectory of 20.00-40.00 will trigger a downside momentum.

A decisive break below the round-level support placed at 1.3600, which is Wednesday’s low will drag the asset towards the psychological support at 1.3500, followed by September 19 high at 1.3344.

On the flip side, a break above Thursday’s high at 1.3755 will drive the asset towards Wednesday’s high at 1.3833. A breach of the latter will result in a fresh two-year high at 1.4000.

USD/CAD hourly chart

-638000894403766798.png)

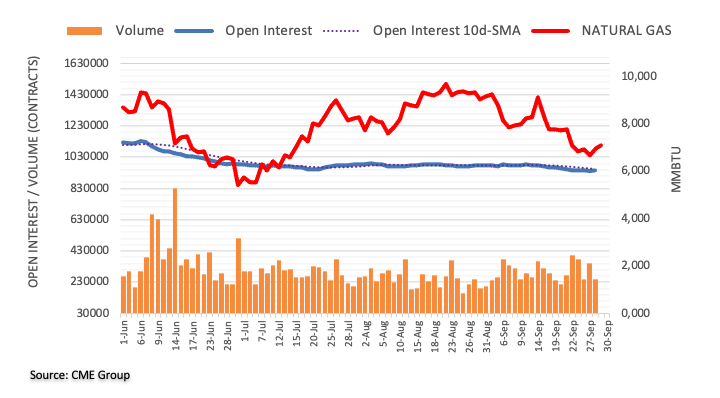

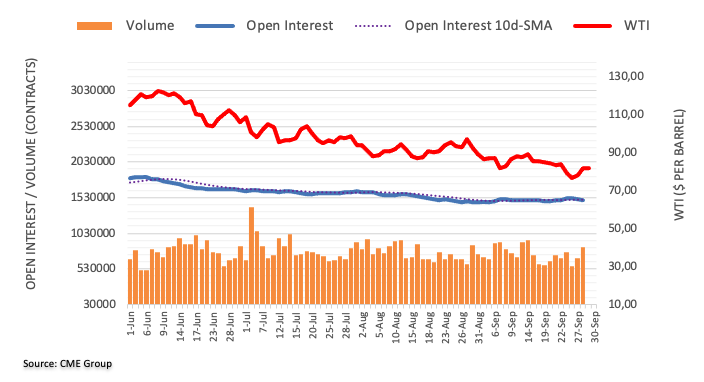

- WTI pares the first weekly gains in five as traders await more clues.

- Supply crunch fears from Russia, chatters over OPEC+ output cut favor buyers.

- Concerns surrounding economic slowdown, aggressive rate hikes challenge upside momentum.

- Risk catalysts are the key, China PMIs, US inflation may also entertain oil traders.

WTI crude oil prices remain pressured towards $81.00 after retreating from the weekly top surrounding $82.50 the previous day. In doing so, the black gold portrays the oil market’s indecision amid mixed clues while bracing for the first positive week in five.

Among the key catalysts recession woes and supply crunch fears gained the major attention while the US dollar weakness may have been ignored as traders brace for the key catalysts.

That said, Reuters quotes anonymous sources to report that the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, have started to discuss a potential output cut for the next meeting. Also likely to have favored the oil buyers could be Russia’s readiness to annex more parts of Ukraine.

On the other hand, recession woes amplified as majority of the central banks remain aggressive despite the recently downbeat economics and supply crunch fears. Additionally, the chatters over China’s inability to tame recession woes and the UK’s fears of more economic pain due to the latest fiscal policies appear negative for the energy benchmark.

That said, the commodity traders are in dilemma and hence will pay close attention to the upcoming activity data for September from the world’s largest commodity user China. Following that, the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index for August, expected 4.7% YoY versus 4.6% prior, will be important for fresh directions.

Also read: US August PCE Inflation Preview: Will it trigger a dollar correction?

Above all, risk catalysts and central bankers’ comments could direct the quote, mostly towards the south, amid a likely volatile Friday.

Technical analysis

WTI crude oil’s failure to cross the monthly resistance line, around $81.80 by the press time, joins challenges fundamental challenges to the price to tease sellers.

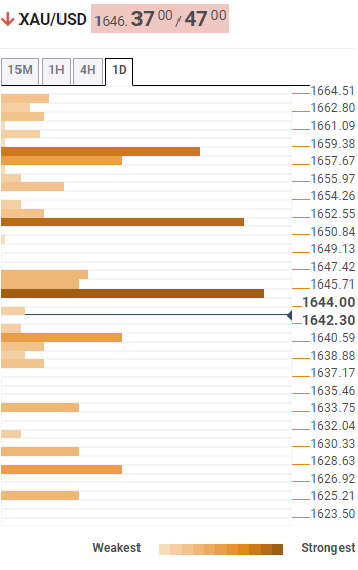

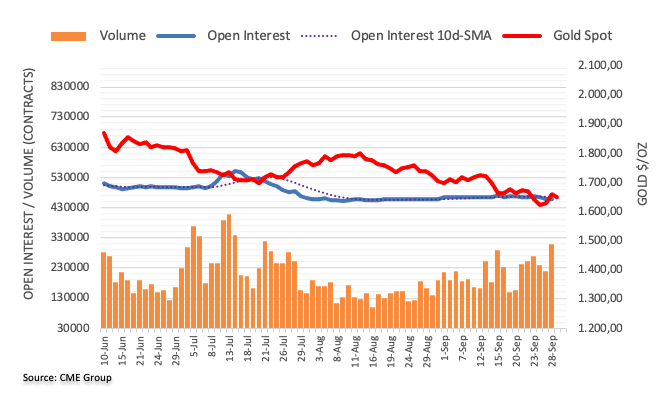

- Gold price picks up bids on confirming a bullish chart formation.

- Firmer yields, downbeat equities failed to tame XAU/USD buyers amid softer DXY.

- Geopolitical risks join recession woes, hawkish central bankers to probe gold buyers.

- Fed’s favorite inflation data can challenge the upside momentum on firmer readings.

Gold price (XAU/USD) braces for the first weekly gain in three as the metal buyers poke $1,663 after witnessing a confirmation of the falling wedge bullish chart pattern the previous day. In doing so, the yellow metal cheers softer US dollar but fails to respect the market’s grim conditions.

That said, US Dollar Index (DXY) marked another negative day to refresh the weekly low of around 111.95. The greenback’s gauge versus the major six currencies dropped after the final readings of the US Q2 Gross Domestic Product (GDP) confirmed the initial forecasts of -0.6%.

It should be noted that the firmer prints of the US Weekly Initial Jobless Claims, which dropped to 193K for the period ended on September 24, versus the 209K previous (revised from 213K) and the market expectation of 215K, also might have weighed on the DXY. The US Jobless Claims slumped to the lowest levels since April.

While respecting the data, St. Louis Federal Reserve Bank President James Bullard praised the slump in the weekly Initial Jobless Claims and mentioned, "We will push inflation to 2% in a reasonable compact time frame." Elsewhere, Federal Reserve Bank of Cleveland President Loretta Mester said on Thursday that they are not yet at a point where they could start thinking about stopping interest rate hikes, as reported by Reuters.

In addition to the hawkish Fedspeak, fears emanating from the UK, Russia and China also challenge the sentiment and the XAU/USD bulls but couldn’t chain the prices.

Comments from Bank of England Chief Economist Huw Pill amplified pessimism surrounding Britain as the policymaker said, “It’s hard to avoid the conclusion that fiscal easing announced will prompt a significant and necessary monetary policy response in November.” On the other hand, record high German inflation, Russia’s readiness to annex more parts of Ukraine and the chatters over China’s inability to tame recession woes were also challenging the risk appetite.

Amid these plays, the Wall Street benchmarks reversed all of the gains made on Wednesday while the Treasury yields recovered.

Given the recently surprising gold price strength, may be due to the quarter-end positioning, the traders will pay close attention to the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index for September, expected 4.7% YoY versus 4.6% prior. Should the actual outcome arrives stronger, the XAU/USD prices may witness hardships in rising.

Also read: US August PCE Inflation Preview: Will it trigger a dollar correction?

Technical analysis

Contrary to the grim fundamentals, gold price confirms a three-week-old falling wedge bullish chart pattern recently. The yellow metal’s run-up also takes clues from the steady RSI (14) and an impending bull cross on the MACD, which in turn suggests further advances of the bullion.

That said, the 21-DMA hurdle surrounding $1,681 could challenge the immediate upside ahead of the seven-week-old resistance line, near $1,693.

In a case where the XAU/USD remains firmer past $1,693, it can aim for the theoretical target of the wedge breakout, i.e. near $1,780, wherein the monthly high and the late August peak, respectively around $1,75 and $1,765, can test the bulls.

Alternatively, pullback remains elusive beyond $1,647, a break of which could defy the bullish bias and drag the quote towards the $1,600 threshold.

It should be noted that a downward sloping support line from mid-May, around $1,568 by the press time, could restrict the XAU/USD weakness past $1,600.

Gold: Daily chart

Trend: Further upside expected

- USD/CHF is expected to fall to near 0.9700 as DXY has lost its appeal on weaker US GDP data.

- An expectation of a slowdown in the pace of hiking rates by the Fed is weakening the DXY.

- In today’s session, US Michigan CSI is seen to stabilize at 59.5.

The USD/CHF pair is eyeing more weakness in the Asian session amid a drop below the critical support of 0.9750. The asset is declining towards the round-level support of 0.9700 as the US dollar index (DXY) is going through severe pain on expectations of a slowdown in the pace of hiking interest rates by the Federal Reserve (Fed).

Currently, the Fed is busy preparing a monetary policy roadmap for the remaining 2022. Fed policymakers are of the view that bigger rate hikes are still in vision as price pressures have not shown a significant decline yet.

In case of bigger rate hike announcements in the first week of November and the mid of December when the Fed has scheduled policy meetings, the deviation from a terminal rate of 4.6% will remain extremely low. This will force the Fed to calm down the rate hike spree and stay with the rates for a longer period till the observation of a decline in inflationary pressures for several months.

Apart from that, weaker US Gross Domestic Product (GDP) data brought weakness to the DXY. The US Bureau of Economic Analysis reported a decline in the extent of economic activities consecutively by 0.6% on an annualized basis. Going forward, the US Michigan Consumer Sentiment Index (CSI) data will remain in focus. The sentiment data is expected to remain steady at 59.5.

Meanwhile, the Swiss franc bulls are awaiting the release of the Real Retail Sales data. The economic data is expected to improve by 3.6% vs. the prior improvement of 2.4% on an annual basis. This is going to delight the Swiss National Bank (SNB) to sound hawkish on interest rates in the fourth quarter monetary policy unhesitatingly.

- AUD/USD picks up bids to cross the resistance line of a falling wedge bullish formation.

- US dollar pullback trimmed losses even as risk-aversion, downbeat equities weighed on prices.

- Softer Aussie inflation, geopolitical fears and hawkish Fedspeak keep bears hopeful.

- China’s PMI could please bears on downbeat outcome as recession woes intensify.

AUD/USD struggles to justify the market’s risk-off mood as it renews its intraday high around 0.6515, after reversing most of the previous day’s losses amid the US dollar’s pullback. The risk-barometer pair, however, stayed on the bear’s radar as fears emanating from China, Russia and the UK joined downbeat equities and softer inflation numbers at home.

US Dollar Index (DXY) marked another negative day to refresh the weekly low of around 111.95. The greenback’s gauge versus the major six currencies dropped after the final readings of the US Q2 Gross Domestic Product confirmed the initial forecasts of -0.6%.

It should be noted, however, that the US Weekly Initial Jobless Claims dropped to 193K for the period ended on September 24, versus the 209K previous (revised from 213K) and the market expectation of 215K.

Following the data, St. Louis Federal Reserve Bank President James Bullard praised the slump in the weekly Initial Jobless Claims and mentioned, "We will push inflation to 2% in a reasonable compact time frame." Elsewhere, Federal Reserve Bank of Cleveland President Loretta Mester said on Thursday that they are not yet at a point where they could start thinking about stopping interest rate hikes, as reported by Reuters.

At home, the first monthly CPI data from the Australian Bureau of Statistics (ABS), the headline price pressure eased in August to 6.8% from 7.0% in July. The same joins the Reserve Bank of Australia’s (RBA) recently cautious statements to challenge the AUD/USD buyers after the data release.

Elsewhere, the escalating energy crisis in Europe, Russia’s readiness to annex more parts of Ukraine and the chatters over China’s inability to tame recession woes were the extra challenges to the market sentiment, as well as to the AUD/USD pair.

Amid these plays, the Wall Street benchmarks reversed all of the gains made on Wednesday while the Treasury yields recovered.

Moving on, China is up for publishing the September month PMIs, the official one and also from Caixin, while the market forecasts aren’t that grim, the actual outcome will be crucial amid calls of recession in Australia’s biggest customer.

Technical analysis

A three-week-old falling wedge bullish chart pattern keeps AUD/USD buyers hopeful even if the RSI (14) and MACD joins the bearish fundamentals. That said, a successful upside break of the 0.6500 threshold appears necessary for the bulls whereas the 0.6440 and the latest multi-month low near 0.6365 can lure bears during the fresh downside.

- EUR/USD is marching towards 0.9900 as the current upside momentum is extremely strong.

- The DXY has surrendered 112.00 on a consecutive decline in the US GDP by 0.6%.

- German Retail Sales are expected to remain vulnerable ahead.

The EUR/USD pair is aiming to recapture the critical resistance of 0.9900 as it has comfortably established above 0.9800 and the upside momentum is extremely firmer. The asset extended its gains on Thursday after surpassing the hurdle of 0.9750 as the risk-on market profile strengthened further amid more weakness in the US dollar index (DXY).

The DXY concluded its pullback move and resumed its downside journey after failing to sustain above 113.00. The asset picked offers after the US Gross Domestic Product (GDP) data remained in line with the estimates and the prior release. The US economy has reported an annualized de-growth of 0.6% in the second quarter. Apart from that core Personal Consumption Expenditure (PCE) data expanded further by 4.7%, against the estimates and the prior release of 4.4%.

Federal Reserve (Fed) Bank of Cleveland President Loretta Mester cited on Thursday that they are not yet at a point where they could start thinking about stopping interest rate hikes, as reported by Reuters. If interest rates are set to rise further, the US economic fundamentals should be supportive to bear the consequences of policy tightening. And, a consecutive reading of a negative growth rate is not a measure of support for the US economy.

On the Eurozone front, German Retail Sales data will hog the limelight. The economic data is expected to decline firmly by 5.1% vs. the prior release of a decline of 2.6% on an annual basis. In times when price pressures are accelerating in the German region, a decline in Retail Sales data indicates an extreme vulnerability in the retail demand. A higher-than-expected decline in the economic data could dampen the mood of Eurozone investors.

As European Central Bank (ECB) President Christine Lagarde is looking to hike interest rates by 125 basis points in the coming monetary policy meetings, weaker demand will not let them hike rates unhesitatingly.

- Silver price stumbled on risk-aversion as traders turned to cash.

- Fed’s Bullard: Traders understood the Fed’s commitment to tackle inflation.

- NATO expressed that Nord Stream 1 and 2 pipeline attack was caused by sabotage.

Silver price slides for the second time in the week amid falling US Treasury bond yields as Fed officials’ “aggressive” tone, the Europe energy crisis, and UK’s mini-budget presented by Kwasi Kuarteng, UK’s finance minister under Liz Truss government, shifted sentiment sour. Therefore, the XAG/USD is trading at $18.81 a troy ounce, 0.40% below its opening price.

On Thursday, Fed officials led by Regional Fed Presidents, with Cleveland’s Mester and St. Louis Bullard, reiterated that the Federal Reserve is compromised to tackle inflation, even though it could trigger a recession. James Bullard said traders understood that the Fed was serious about achieving the price stability mandate and added the need for higher rates for a “longer period.”

In the meantime, Loreta Mester commented that inflation is the primary concern, added that there is no “case for slowing down,” and foresees rates to peak at around 4.6%.

At the time o typing, the San Francisco Fed Mary Daly said there’s no need to tap the US economy into a recession to curb inflation while adding that “additional interest rates are necessary and appropriate.”

In the meantime, NATO said that the leaks of the Nord Stream pipelines were caused by sabotage and noted that “NATO is committed to deter and defend against hybrid attacks,” and “any deliberate attack against Allies’ critical infrastructure would be met with a united and determined response.”

Although news of the Nord Stream 1 and 2 pipelines spurred a jump in energy prices, WTI and Brent’s crude oil sustained losses of 0.46% and 0.54%, respectively.

Aside from this, the UK’s new Prime Minister Liz Truss, doubled down on its tax-cut budget, saying that she was willing to take “controversial” decisions, though recent reports by the Guardian said that she would hold an emergency meeting with the Office for Budget Responsibility (OBR) on Friday.

Given the fundamental backdrop, XAG/USD prices slid as traders seeking safety preferred to liquidate its positions and braced for cash. Portraying the previously mentioned, US Treasuries remained contained during the session, while the US Dollar Index registered losses of 0.69%, down at 111.040.

Silver (XAG/USD) Key Technical Levels

- NZD/USD bears denied as the US dollar continues to bleed out.

- NZD/USD reaches fresh recovery highs for the week.

NZD/USD ended the day on the front foot as the US dollar continued to bleed out into month-end. The DXY index, which measures the greenback vs. a basket of currencies, initially tracked gains in treasury yields as fresh data showed weekly claims fell to a 5-month, and PCE prices were revised higher in Q2. Hawkish remarks from Federal Reserve officials and the rejection of a possible currency agreement among major economies also supported the dollar. However, DXY was thrown back onto the backfoot and extended losses to below 112.00 to print a fresh low of 111.916. NZD/USD ended the day around 0.5270.

The White House National Economic Council Director Brian Deese rejected the idea of another 1985-type currency accord to weaken the dollar and added that the US economy’s relative strength was a significant factor driving the dollar higher. In data, Gross Domestic Product in the US fell at an unrevised 0.6% annualized rate in the second quarter. In other data, Initial Jobless claims for state unemployment benefits dropped to 193,000, versus expectations of 215,000 applications for the latest week.

''The Kiwi is a tad stronger this morning, but having been led higher by EUR and GBP (which may incidentally turn out to be a dead cat bounce), it has underperformed on those crosses,'' analysts at ANZ Bank said, adding: ''nothing local is really driving the Kiwi at the moment, and instead it’s drifting like a cork in the tide.''

''That’s unlikely to change today either, but next week’s RBNZ MPR may provide a degree of support, especially if the RBNZ remain hawkish, which is appropriate given the inflation backdrop. But until then, the Kiwi is at the mercy of global forces, and the pull-back in the USD DXY looks a bit odd against geopolitical developments in Ukraine, given the strength of US jobless claims (pointing to bumper payrolls next week), hawkish Fedspeak, and the very real cracks in the UK that can’t be papered over.''

Reuters has reported that the San Francisco Fed chief Mary Daly said on Thursday, that the Federal Reserve needs to slow the US economy and take the heat out of the strong jobs market to bring down corrosively high inflation.

"Navigating the economy toward a more sustainable path necessitates higher interest rates and a downshift in the pace of economic activity and the labor market," Daly said in remarks prepared for delivery to Boise State University in Idaho, a view also expressed last week by Fed Chair Jerome Powell and several Fed policymakers since.

"But for now, inducing a deep recession does not seem warranted by conditions, nor is it necessary to achieve our goals."

Key quotes

- Downshift in economic activity, labor market needed to bring down inflation.

- A deep recession isn't warranted or necessary.

- Additional interest rate increases are necessary and appropriate.

- 'Myriad of risks' narrows path to smooth landing, but do not close it.

- Already seeing effects of higher rates; full impact of policies will unfold over time.

- Need to remain attentive to data; the costs of errors are high.

What you need to take care of on Friday, September 30:

Fears remain the same, but the market does not. The dollar ended the day unevenly across the FX board, despite Wall Street resuming its slump and trimming all Wednesday’s gains. Treasury yields remained stable, with the 10-year note yielding 3.75% and the 2-year note 4.17%.

Tensions between the Union and Moscow over gas deliveries escalated after the suspected sabotage of the Nord Stream pipelines. Germany launched a relief package in response to higher gas and electricity prices, while Hungary announced it would not support new energy sanctions on Russia.

Additionally, Bank of England Chief Economist Huw Pill noted that “it’s hard to avoid the conclusion that fiscal easing announced will prompt a significant and necessary monetary policy response in November,” following the controversial measures adopted by the government and the central bank in the last few days.

According to preliminary estimates, the German Harmonized Consumer Price Index rose at an annual pace of 10.9%. The EU will publish the first estimate of the Consumer Price Index on Friday, while the US will release the PCE Price Index, the Fed’s favorite inflation measure.

European currencies were firmly up, despite bad news that kept coming from the old continent. The EUR/USD pair flirts with 0.9800, while GBP/USD trades in the 1.1070 price zone. The USD/CHF pair is down to 0.9760.

The USD/JPY pair remains lifeless at around 144.30, while commodity-linked currencies shed some ground against their American rival. AUD/USD changes hands at 0.6490 while USD/CAD is just below 1.3700.

Spot gold trades near its weekly high in the $1,660 price zone, while crude oil prices saw little intraday change. The barrel of WTI currently stands at $81.50.

The focus will be on China early Friday. The country will publish the September official NBS Manufacturing PMI and the non-manufacturing index, while Caixin will publish the Manufacturing PMI. The sector is foreseen holding in contraction territory, while services output is expected to have contracted in the month. Worse-than-anticipated numbers may spur risk aversion and weigh on the pair.

Bitcoin price: BTC could double on one condition, says US Government Agency Chairman

Like this article? Help us with some feedback by answering this survey:

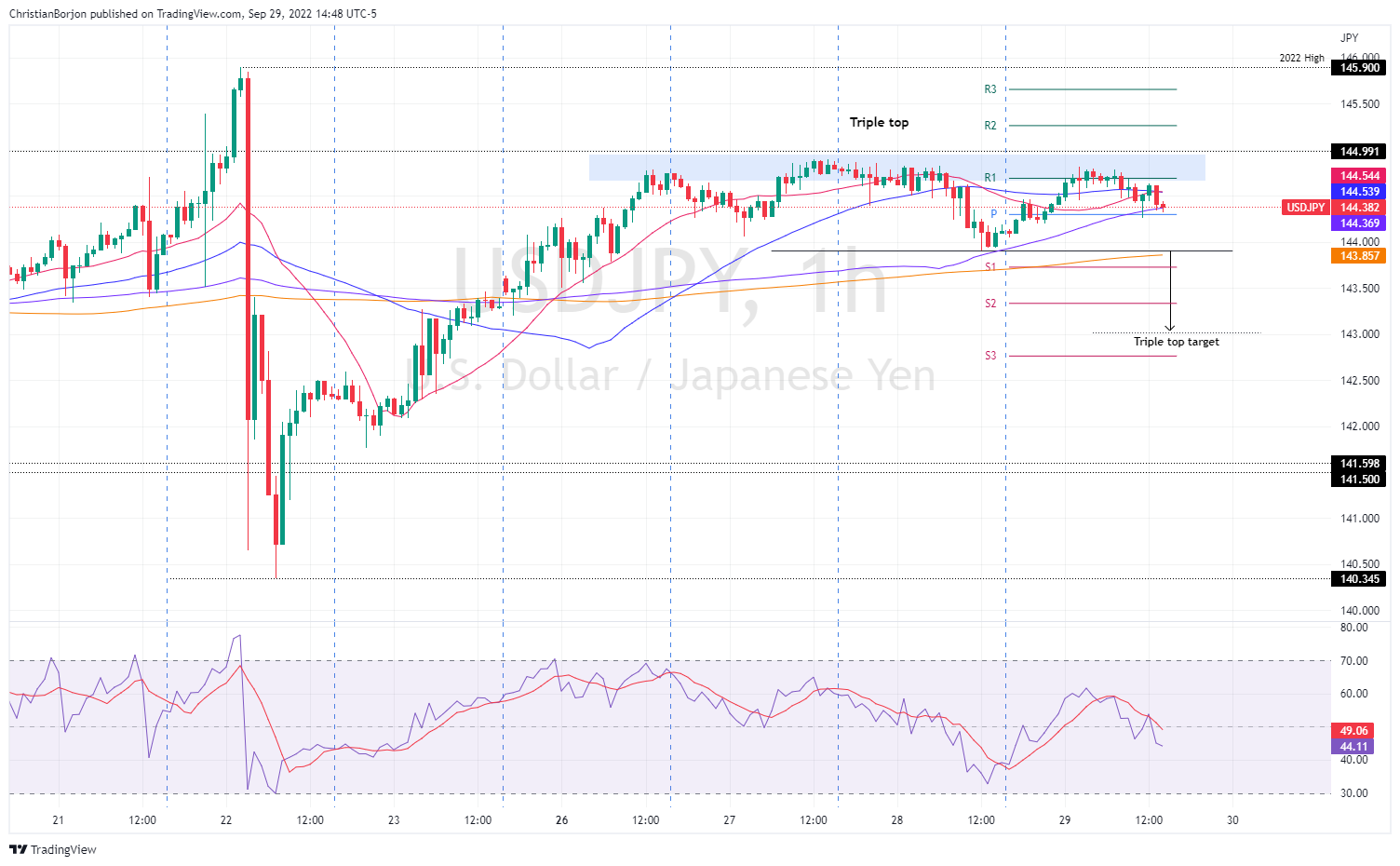

- USD/JPY marches firmly above 144.30, up by 0.16%.

- During the week, the USD/JPY has been unable to break the BoJ’s line on the sand at 145.00.

- The USD/JPY one-hour chart depicts the formation of a triple top, targeting a fall towards 143.00.

The USD/JPY is recouping on Thursday, following 0.47% Wednesday losses, courtesy of falling US Treasury bond yields, which weighed on the greenback. However, fundamental factors like US central bank officials reiterating the need for higher rates to tame inflation bolstered the USD/JPY. Therefore, the USD/JPY st trading at 144.37, above its opening price by 0.18%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY has been unable to break above/below the September 22 Bank of Japan intervention in the Forex markets, with price action staying in the 140.34-145.90 range. Even though the weekly high meandered ten pips shy of the 145.00 figure, traders remain nervous about another BoJ incursion in the FX space. Worth noting that the USD/JPY is trading sideways while the Relative Strength Index (RSI) keeps heading south. Therefore, the likelihood of a test of the 20-day EMA ar 143.27 is on the cards.

The one-hour chart portrays the USD/JPY as neutral-to-downward biased. At the time of writing, the USD/JPY is testing the 100-EMA, which, once broken, could pave the way towards 143.90, the September 28 daily low. Once cleared, the next support would be the 200-EMA at 143.85, followed by the S1 daily pivot at 143.72, ahead of the triple top target at 143.00.

Contrarily, if the USD/JPY clears the 145.00 figure, expect a re-test of the YTD high at 145.90 unless Japanese authorities re-enter the markets.

USD/JPY Key Technical Levels

- Gold bulls in charge and eye mitigation towards $1,670 that guard $1,675 and $1,688.

- The US dollar continues to bleed out into month-end flows.

The gold price has started to find support in the correction of the recent bullish impulse but is back to trading near flat on the day at around $1,660 following a run from a low of $1,641.57 to the day's high of $1,664.89. The US dollar continued to ease despite bond yields rising and concerns rising interest rates will lead to a global recession. Month-end flows could be the culprit that is moving out of a heavily committed play by long positioning of late.

What would usually be weighing on the price of gold, bond yields have been moving up amid rising interest rates. The US 10-year note's yield was last seen higher by some 0.37% to 3.7510%. The high of the day, however, was at 3.868%. To date, rising yields have weighed on the unyielding precious metal. However, its safe-haven allure has kicked in as market turmoil has led to an unwind of the greenback late in the month, falling sharply from a 20-year high. The US DXY index, which measures the greenback vs. a basket of currencies dropped again on Thursday, making gold more affordable for international buyers. Trading at 112.20, the index is down 0.45% on the day, balancing above the lows of 112.104.

However, as soft as the US dollar is in comparison to the recent highs, analysts at TD Securities still argue that ''The risk of capitulation remains prevalent for the yellow metal moving into an October with key labor market and inflation data on tap before the next Fed meeting.''

''With prices trading below pandemic-era levels, a small number of family offices and proprietary trading shops are increasingly feeling the pressure to finally capitulate on their massively bloated and complacent length in gold. Rates markets are pricing the potential for higher interest rates to persist for some time, and a steady stream of Fedspeak is likely to hammer this point home,'' the analysts explained.

''In this sense,'' they said, ''our analysis suggests gold prices could still have further to fall in the next stage of the hiking cycle. Indeed, the increase in inflation's persistence suggests that a restrictive regime may last longer than historical precedents, which argues for a more pronounced weakness. The combination of surging real rates and USD, continued outflows from money managers and ETF holdings are all adding pressure on family offices and prop shops to finally capitulate on their length.''

Meanwhile, on the day, data showed that Gross Domestic Product in the US fell at an unrevised 0.6% annualized rate in the second quarter. In other data, Initial Jobless claims for state unemployment benefits dropped to 193,000, versus expectations of 215,000 applications for the latest week.

Gold technical analysis

As per the prior analysis, Gold Price Forecast: XAU/USD bulls bounce back to life as US dollar gets slammed, the price has continued higher and there could be more to come from the gold bulls before the week is out:

In the prior analysis above on the hourly chart, the price was expected to correct to Monday's highs will have a confluence with a 38.2% Fibonacci level that guarded the price imbalances:

We have seen this play out as shown above.

Meanwhile, the price then went on to make a W-formation that led to a continuation after the retest of the neckline, which is a typical scenario in the hourly W and M formations. They tend to act as reversion patterns and if the neckline holds, then a continuation can be expected. Traders can seek out optimal entries on the lower time frames, such as the 15 or 5 min charts in anticipation of a continuation trade:

Meanwhile, the price is correcting again and the Fibonaccis drawn on the latest bullish impulse are targeted. If support holds, then a continuation of the bullish trend would be anticipated for the forthcoming month-end sessions. The greyed area is a price imbalance that would be subsequently mitigated at around $1,670 guard $1,675 and $1,688:

- AUD/USD is trimming some of its Wednesday gains on Thursday.

- Mixed US economic data, a headwind for the Aussie, which tumbled despite broad US dollar weakness.

- US central bank restrictive monetary policy commentary continued, led by Mester and Bullard.

- Australia’s inflation eased ahead of the RBA’s October meeting.

The AUD/USD retraces from weekly highs reached on Wednesday, when the Aussie hit a weekly high at 0.6530, though positive US economic data, showing that the labor market remains robust, would not deter the Federal Reserve from continuing tightening monetary conditions. Therefore, the AUD/USD is falling..

At the time of writing, the AUD/USD is trading at 0.6474, after hitting a daily high of 0.6524, below its opening price, by a solid 0.74%.

Before Wall Street opened, US economic data released by the US Departments of Commerce and Labor flashed mixed signals regarding the current economic status of the US. According to the former, the US Gross Domestic Product (GDP) for the second quarter was confirmed at a 0.6% contraction, aligned with forecasts and the previous reading, confirming that the US economy is in a technical recession.

Contrarily, US Initial Jobless Claims for the past week, ending on September 24, decelerated at a 193K pace to a five-month low, crushing estimates of 215K. Worth noting that a smoother reading for claims, namely the four-week moving average, dropped for the fifth consecutive week to 207K.

In the meantime, Fed officials remained active during the day. Cleveland’s Fed Loretta Mester said Trade-offs with growth would become more relevant as inflation comes back down. She added that given inflation persistence, she “still puts more weight on being sure the fed does enough.”

“We’re still not even in the restricted territory on the funds rate,” she added.

Earlier, the St. Louis Fed President James Bullard said that the Fed is determined to get inflation to the right level of policy rates, so they can achieve the Fed’s inflation goal. He acknowledged that the US might get into a recession as the Fed brings inflation down, though he emphasized that it’s not “his base scenario.”

Earlier, in the Asian session, Australia reported inflation for August, which dropped slightly due to falling gasoline prices, as data have shown, ahead of the Reserve Bank of Australia (RBA) monetary policy meeting next week. Australia CPI rose by 6.8% YoY, less than July’s 7%,

On Friday, the Australian economic calendar will feature Housing Credit and Private Sector Credit readings. On the US front, the Fed’s favorite inflation gauge is the Core PCE Price Index, the Chicago PMI index, and the University of Michigan Consumer Sentiment will be reported.

AUD/USD Key Technical Levels

UK Trade Secretary Kemi Badenoch has crossed the wires again saying:

- The UK is facing global economic pressures.

- The chancellor is `working well' with Bank of England.

- Will not contradict pm Truss on US trade deal.

Badenoch has used her first overseas visit as UK trade secretary to spruik the government's economic strategies as "going for growth in a big way".

The pound was sold off heavily to record lows following the controversy since the chancellor last week announced his mini-Budget, which included plans to cut taxes to the benefit of the most wealthy.

However, Badenoch told investors at the fifth annual Atlantic Future Forum hosted on the HMS Queen Elizabeth, moored in New York, the strategies were necessary due to a "global growth slow-down".

"Right now, there's a global growth slow-down underway," she said.

"And if you'll forgive the pun, we need all hands on-deck to get the world economy's wheels spinning again.

"And that's why in the UK we're going for growth in a big way. And in fact some of you may have heard some major reforms we announced on Friday, to achieve this."

GBP/USD has since recovered a significant amount over the past few days reaching as high as 1.1108 on Thursday in a 62% ratio retracement.

The Mexico central bank, Banxico, said the board was unanimous on the rate decision where it raised the benchmark interest rate to 9.25% from 8.50%.

Key notes

- Says the balance of risks for the trajectory of inflation within the forecast horizon remains biased significantly to the upside.

- Says the board will thoroughly monitor inflationary pressures as well as all factors that have an incidence on the foreseen path for inflation and its expectations.

- Says the board will assess the magnitude of the upward adjustments in the reference rate for its next policy decisions based on the prevailing conditions.

- Says an environment of uncertainty prevails, while the balance of risks for economic activity remains biased to the downside.

- Says the accumulated inflationary pressures associated with both the pandemic and the military conflict continue affecting headline and core inflation.

- Sees average annual headline inflation of 8.6% for the fourth quarter of 2022.

Meanwhile, USD/MXN is 0.25% bid on the day at 20.1570.

The exchange rate channel is not significant enough to influence monetary policy the European Central Bank’s chief economist, Philip Lane said.

Key notes

- ECB still trying to reach neutral, not yet taking a stand on whether that will be enough.

- No "fixed formula" for TPI, is meant to address situations where there is dysfunction or overshooting.

- Important ECB "retain judgment" over circumstances in which TPI is triggered.

Earlier in the week, Lane said “our interest rate hikes will slow demand in the economy.”

''I would strongly warn firms not to expect the same level of profitability in times of high inflation.

Because of the war and the high energy prices, there are many indicators that the economy is going to slow down.

We are now making sizeable interest rates increases. This should make it clear to businesses and workers that demand conditions will become less favorable.''

Nevertheless, the euro has seen a significant turnaround on the back of a sell-off of the US dollar from 20-year highs into month end. A hot German inflation print has also underpinned renewed demand for the single currency that is trading some 0.5% higher on the day.

Federal Reserve Bank of Cleveland President Loretta Mester said that the Fed's median path does not envision recession but does have "quite a bit" of slow down in growth

Key notes

Trade-offs with growth will become more relevant as inflation comes back down.

Given the persistence of inflation, still puts more weight on being sure the fed does enough.

Fed "got the persistence and magnitude" of inflation "wrong".

Earlier, she said Thursday in an interview on CNBC that “real interest rates -- judged by the expectations over the next year of inflation -- have to be in positive territory and held there for a time.”

“We’re still not even in the restricted territory on the funds rate,” she added.

The US dollar ran to a 20-year high in September following the move by Fed officials that raised interest rates by 75 basis points on Sept. 21 for the third straight meeting, bringing the target for the benchmark federal funds rate to a range of 3% to 3.25%.

- USD/CAD is gaining some 0.82% courtesy of Fed officials on Thursday.

- US unemployment claims keep heading lower, while Q2 GDP fell 0.6% as estimated.

- Fed’s Mester and Bullard estimate the Federal funds rate (FFR) to peak around 4.5%.

- The economy in Canada grew 0.1% MoM in July, exceeding estimations.

The USD/CAD marches firmly towards the 1.3700 figure after diving close to 0.90% on Wednesday, after hitting a two and half-year high at 1.3833. Sentiment shifts sour due to continuing Fed’s hawkish rhetoric, while US labor market data confirmed that the economy could survive further central bank tightening.

Therefore, the USD/CAD is trading at 1.3717, above its opening price, after hitting a daily low of 1.3604 at the time of writing.

Early, the US Department of Labor reported that unemployment claims reported for the last week ending on September 24 fell 197K, lower than estimates of 215K, a signal of the labor market resilience.

In the meantime, the US Department of Commerce revealed the Q2 final GDP reading, coming at -0.6%, as foreseen. It’s worth noticing that the government revised GDP data from 2016 Q4 to 2021 Q4, which showed that the economy’s recovery from the Covid-19 pandemic was more substantial than initially reported.

Earlier, some Fed officials led by Cleveland’s Fed President Loretta Mester and the St. Louis Fed President James Bullard crossed newswires.

Loretta Mester said that she still sees inflation as the economy’s main problem and commented that she does not see the case for slowing down. Furthermore, expects rates to peak around 4.6%. Later, St Louis Fed President James Bullard expressed that the Fed would need to keep rates “higher for longer” and added that real rates in the positive territory are an “encouraging sign.” However, he acknowledged the high recessionary risks while adding that the unemployment rate at 4.5% “would still be healthy for the economy.”

The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, remained heavy, down by 0.35%, at 112.317, well below the YTD high at 114.778.

Aside from US dollar dynamics, Canada’s economy surged higher unexpectedly in July, as shown by data released by Statistics Canada. July’s GDP grew 0.1% MoM, higher than the 0.1% contraction estimated by analysts. “After a solid first half of the year, momentum appears to be slowing as multi-decade-high inflation and rapidly rising interest rates weigh on the economy,” according to sources cited by Reuters.

Given the backdrop that the Bank of Canada hiked rates 75 bps earlier in September, today’s data and high inflation would likely keep the BoC on the pedal to tame inflation.

USD/CAD Key Technical Levels

- US dollar under pressure for the second day in a row.

- Wall Street off lows, Treasuries erase losses and DXY drops by 0.50%.

- EUR/USD looking at 0.9800, technical favor more gains.

The EUR/USD is trading at the highest level since last Wednesday slightly below the 0.9800 mark. It is up by more than 250 pips from Wednesday low as it continues to recovery on the back of a weaker US dollar.

The greenback is suffering as Wall Street moves off lows and also as US yields approach daily lows. Another negative for the dollar is the recovery of the offshore Chinese yuan that is having the best day in months with USD/CNH below 7.10.

Everybody says down but is going up

Despite most of the current forecasts projecting the EUR/USD to move south over the next weeks to fresh multi-year lows, the pair is rising for the second day in a row on Thursday, accumulating a gain of more than 200 pips. The impact of Bank of England’s surprise announced on Wednesday (temporary purchase of long-term gilts at whatever scale is necessary) is still being digested by market participants.

The dollar received a brief and short-lived relief earlier on Thursday following the release of US economic data that confirmed a 0.6% GDP contraction during the second quarter and a larger-than-expected decline in initial jobless claims to the lowest level in months below 200K.

Fed officials continue to point toward more rate hikes. Bullard argued the rates will likely be at higher levels for a longer period of time. Mester said inflation remains the main economic problem. The US central bank is expected to continue rising rates with odds favoring a 75 basis points rate hike in November.

The European Central Bank is also expected to continue rising rates further as inflation remains at decade highs. According to preliminary data released on Thursday, the Consumer Price Index in Germany reached 10% in September, the first time 70 years to hit double digits.

Short-term technical indicators favor the upside. More gains seem likely while above 0.9750. The positive tone would be affected with a slide back under 0.9640 (20-Simple Moving Average in four-hour charts). On the upside, the next resistance is the 0.9800/05 area, followed by a stronger barrier around 0.9880.

Technical levels

"It’s hard to avoid the conclusion that fiscal easing announced will prompt a significant and necessary monetary policy response in November,” Bank of England Chief Economist Huw Pill said on Thursday, as reported by Reuters.

Additional takeaways

"We will come to our more complete assessment in November."

"I recognise that, as of today, November might seem a long time away but monetary policy needs to be framed on a more considered or lower frequency basis."

"Inflation target is a lens through which we view recent market developments."

"MPC commitment to achieving the inflation target is unwavering."

Market reaction

GBP/USD preserves its bullish momentum after these comments and was last seen rising more than 1% on the day at 1.1045.

- GBP/USD reached a daily high at 1.1074 due to the London Fix.

- US Initial Jobless Claims fell, cementing the case for further Fed rate hikes.

- GBP/USD Technical Analysis: Testing the 50% Fibonacci, once cleared, could rally towards 1.1210; otherwise, it could retest 1.0538.

The GBP/USD advances for the third consecutive day as the global equities sell-off continues. However, in the FX space, a slight improvement in sentiment keeps most G8 currencies higher against the greenback, despite upbeat US economic data.

At the time of writing, the GBP/USD is trading at 1.1024, above its opening price by 1%, after hitting a daily low of 1.0759.

GBP/USD rallies on mixed US economic data

In the North American session, US economic data was mixed, with GDP for the second quarter coming at -0.6%, as estimated by street analysts. Worth noticing that the government revised GDP data from 2016 Q4 to 2021 Q4, which showed that the economy’s recovery from the Covid-19 pandemic was stronger than initially reported.

At the same time, the US Department of Labor reported Initial Jobless Claims for the week ending on September 24, dropping by 193K less than 215K, showing the labor market resilience, despite headwinds spurred by the Federal Reserve’s restrictive stance.

Meanwhile, Fed officials are keeping to its hawkish narrative. Cleveland’s Fed President Loretta Mester expressed she does not see distress in the US financial markets when asked about what’s happening in the UK. She acknowledged that the Bank of England’s actions pledged to stabilize the bonds market.

Aside from that, Mester added that she still sees inflation as the economy’s main problem and commented that she does not see the case for slowing down. Furthermore, expects rates to peak around 4.6%.

Of late, St Louis Fed President James Bullard said the Fed would need to keep rates “higher for longer” and added that real rates in the positive territory are an “encouraging sign.” Nevertheless, he acknowledged the high recessionary risks while adding that the unemployment rate at 4.5% “would still be healthy for the economy.”

As a backdrop, the US Federal Reserve hiked rates in September by 75 bps, to 3.25%. Odds for the November meeting lie at a 70% chance of another increase of the same size, pushing interest rates to the 4% threshold.

Earlier, the UK’s Prime Minister Liz Truss said that she was willing to take “controversial” decisions, doubling down on its economic plan, laid out by her finance Minister Kwasi Kwarteng.

GBP/USD Price Analysis: Technical outlook

During the last three days, the GBP/USD has recovered some ground vs. the greenback, though today’s rally is testing 1.1047, the 50% Fibonacci retracement, drawn from the last swing high at 1.1738, towards the lowest low, being the YTD low at 1.0356. Therefore, if the pair surpasses the former, the next resistance level to test would be the 61.8% Fibonacci at 1.1210. On the other hand, failure to hurdle it, then a fall towards 1.0884, the 38.2% Fibonacci retracement is likely followed by the September 28 low at 1.0538.

- Pound recovers further ground across the G10 space.

- EUR/GBP having the worst day in months.

The EUR/GBP dropped further during the American session and hit the lowest level in almost a week at 0.8836. It is hovering around 0.8850, down almost 90 pips, having the worst performance in months as the pound extends its recovery.

The surprise announcement of the Bank of England on Wednesday helped gilts and also the pound that is rising across the board on Thursday. UK PM Liz Truss defended her economic plan today amid mounting criticism. Recent events created instability on Truss’s administration.

Data released on Thursday showed the Consumer Price Index in Germany reached 10% in September, the first time 70 years to hit double digits. “The main drivers remain energy and food prices, but prices are also rising faster and faster in most other goods groups. There is no easing in sight, and next year the inflation rate is only likely to fall because energy prices are unlikely to rise again as strongly as this year, partly due to government intervention. However, the underlying price pressure is likely to remain strong”, point out Commerzbank analysts.

The inflation numbers have no impact on the euro. Markets continue to expect the ECB and the BoE to keep rising interest rates. Afterwards EUR/GBP dropped further as GBP/SUD rose back above 1.1000. EUR/USD also printed fresh highs but rose a slower pace.

Technical levels

St. Louis Federal Reserve Bank President James Bullard said on Thursday that the Federal Reserve is having to raise rates pretty rapidly to get to a minimally appropriate level to tackle inflation, as reported by Reuters.

Additional takeaways

"Fed always watches global market developments but is focused on US market and fundamentals."

"Fed determined to get to the right level of policy rate."

"Other central banks will have to react to Fed's intentions."

"Disinflation will come more through inflation expectations than demand adjustment."

"Inflation will start to come down in 2023 but how fast is uncertain."

"It is possible US will get a recession as Fed brings inflation down, but it is not my base case."

"If US unemployment rises to 4.5%, that would still be a healthy labor market."

Market reaction

The greenback stays on the backfoot after these comments and the US Dollar Index was last seen losing 0.27% on the day at 112.40.

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (Core PCE), will be published on Friday, September 30 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of six major banks.

The market expectation is for the monthly core PCE inflation to rise by 0.5% in August following July’s 0.1% increase. On a yearly basis, the PCE inflation and the core PCE inflation, which excludes volatile food and energy prices, are forecast to rise to 6.6% and 4.7%, respectively.

Commerzbank

“Excluding food and energy, the deflator probably increased by 0.4% MoM. This is a bit less than the recently released core CPI rate. This is because rents have a lower weight in the deflator than in the CPI basket (15% vs. 32.6%); rents rose quite strongly in the CPI in August. In addition, medical services have a much higher weighting in the deflator, and here the government health services included in the deflator, in contrast to the CPI, have a dampening effect on prices.”

TDS

“Core PCE prices likely gained speed again in August following a strong CPI report where core inflation surprised significantly to the upside at 0.6%. The YoY pace likely bounced back to 4.8% (same as in June), suggesting prices remain sticky at an elevated level. Separately, personal spending likely advanced at a modest 0.2% MoM pace following an even weaker 0.1% gain in July.”

NBF

“The annual PCE deflator may have moderated from 6.3% to 6.0%, but core PCE deflator may have increased one tick to 4.7%.”

Deutsche Bank

“We expect core PCE to edge higher by +0.5% MoM (vs +0.1% in July) which won’t allow the Fed to take the foot off the tightening pedal.”

CIBC

“The Fed’s preferred measure of prices, core PCE prices, could have accelerated more modestly than its CPI counterpart, to 4.7% YoY, given the lower weighting of shelter in the index.”

Citibank

“We expect a solid 0.47% MoM increase in core PCE inflation in August. The YoY reading is likely to rise to 4.7%, with further increases likely over the next three months as base effects are likely to push YoY core PCE higher through November.”

Gold has failed to build on Wednesday's gains as US yields have reversed back higher. Economists at TD Securities expect the yellow metal to remain under pressure as the US dollar is also in demand.

Capitulation risk is growing

“After a brief period of relief, recovery in the USD and increasing yields have started to weigh on precious metals once again.”

“The risk of capitulation remains prevalent for the yellow metal moving into October with key labour market and inflation data on tap before the next Fed meeting.”

“With prices trading below pandemic-era levels, a small number of family offices and proprietary trading shops are increasingly feeling the pressure to finally capitulate on their massively bloated and complacent length in gold.”

“The combination of surging real rates and USD, continued outflows from money managers and ETF holdings are all adding pressure on family offices and prop shops to finally capitulate on their length.”

- Gold recovers a part of its intraday losses amid the emergence of some selling around the USD.

- Aggressive Fed rate hike bets lift the US bond yields and should act as a tailwind for the buck.

- The prospects for more aggressive central banks could also contribute to capping the XAU/USD.

Gold attracts some buying in the vicinity of the $1,640 level on Thursday and recovers a major part of its early lost ground. The XAU/USD climbs back closer to the weekly high touched the previous day and is trading around the $1,655 region during the early North American session, still down over 0.30% for the day.

The US dollar struggles to preserve its intraday gains and drops to a fresh daily low in the last hour, which turns out to be a key factor offering support to the dollar-denominated gold. The USD downtick could be solely attributed to a goodish pickup in demand for the British pound, though a combination of factors could help limit deeper losses.

Investors seem convinced that the Federal Reserve will continue to hike interest rates at a faster pace to combat stubbornly high inflation. The bets were reaffirmed by the recent hawkish comments by a slew of FOMC officials. This, in turn, triggers a fresh leg up in the US Treasury bond yields and should act as a tailwind for the greenback.

Furthermore, the prospects for a more aggressive policy tightening by other major central banks might also contribute to capping the upside for the non-yielding gold. This makes it prudent to wait for strong follow-through buying before confirming that the XAU/USD has formed a near-term bottom and positioning for any further appreciating move.

That said, the prevalent risk-off mood, amid growing worries about a deeper global economic downturn and geopolitical risk, could extend support to the safe-haven precious metal. The mixed fundamental backdrop warrants some caution for aggressive traders and placing fresh directional bets around gold.

Technical levels to watch

St. Louis Federal Reserve Bank President James Bullard noted on Thursday that the weekly Jobless Claims reported earlier was a "super low number," as reported by Reuters.

US: Weekly Initial Jobless Claims drop to 193K vs. 215K expected.

"The labor market is very tight no matter how you cut it.," Bullard added. "I have a hard time seeing the unemployment rate going up that much with so many job openings."

Market reaction

These comments don't seem to be having a noticeable impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was up only 0.08% on the day at 112.80.

Aluminum (LME) remains capped by its 55-day moving average (DMA), currently seen at $2,355, and is establishing fresh YTD lows. Strategists at Credit Suisse stay biased towards further weakness.

Aluminum remains in a clear downtrend

“We identify the next significant medium-term support at the 78.6% retracement of the 2020/2022 uptrend and key psychological mark at $2,015/2,000. In case this long-term support area would break as well, we then identify next key supports at the $1,945 January 2021 low and then the October 2020 low at $1,725.”

“Above the 55-DMA, currently at $2,355, would stabilize Aluminum in the short-term, but above the 200-DMA, currently seen at $2,830, is needed for a more profound medium-to long-term stabilization, which is not our base case.”

- AUD/USD comes under renewed selling pressure on Thursday amid resurgent USD demand.

- Aggressive Fed rate hike bets trigger a fresh leg up in the US bond yields and lift the buck.

- The risk-off impulse further contributes to driving flows away from the risk-sensitive aussie.

The AUD/USD pair recovers a few pips from the daily low and climbs to the 0.6480-0.6485 region during the early North American session, still down nearly 0.60% for the day.

The US dollar regains positive traction on Thursday and prompts fresh selling around the AUD/USD pair, forcing spot prices to reverse a part of the overnight recovery move from its lowest level since April 2020. The recent hawkish comments from a slew of FOMC members reaffirm expectations that the US central bank will continue to hike interest rates at a faster pace to curb inflation. This, in turn, triggers a fresh leg up in the US Treasury bond yields and helps revive demand for the greenback.

Apart from this, the risk-off impulse offers additional support to the safe-haven buck and further contributes to driving flows away from the risk-sensitive aussie. The prospects for a more aggressive policy tightening by the Fed, along with growing worries about a deeper global economic downturn, continue to temper investors' appetite for riskier assets. This is evident from a sea of red across the global equity markets, which tends to boost demand for the traditional safe-haven greenback.

On the economic data front, the final US GDP report showed that the world's largest economy contracted by 0.6% during the second quarter, matching the previous estimate. Separately, the US Weekly Initial Jobless Claims fell from 209K to 193K during the week ended September 22. The data, however, did little to provide any meaningful impetus. That said, a pickup in demand for the British pound exerts some pressure on the greenback and lends some support to the AUD/USD pair. The fundamental backdrop, however, remains tilted firmly in favour of bearish traders.

Technical levels to watch

In the view of economists at TD Securities, it is hard to see the fundamentals shifting favourably in the EUR's direction anytime in the near-term. Therefore, the EUR/USD pair is forecast at 0.92 by the end of the year.

EUR likely to remain under pressure

“We don't think the EUR is out of the woods yet and managed to make another forecast downgrade for the months ahead.”

“The biggest driver relates to the feedback loop between the ongoing terms of trade shock and the growth outlook. The ECB has helped to cushion the downside but the EUR remains the shock absorber for these lingering shocks.”

“Our tracking of global and EZ growth drivers points to a push towards 0.92 now.”

- EUR/USD partially fades Wednesday’s robust uptick to 0.9750.

- If bears regain the initiative, the pair could revisit the YTD low.

EUR/USD’s bullish attempt faltered once again at weekly highs around 0.9750, sparking a marked sell-off afterwards.

Odds for extra weakness in the European currency remain well on the table so far with the immediate target at the 2022 low at 0.9535 (September 28). A deeper drop could challenge the round level at 0.9500 ahead of the weekly low at 0.9411 (June 17 2002).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0660.

EUR/USD daily chart

Federal Reserve Bank of Cleveland President Loretta Mester said on Thursday that they are not yet at a point where they could start thinking about stopping interest rate hikes, as reported by Reuters.

Additional takeaways

"All the indicators we have from businesses is that demand for labor exceeds supply of labor."

"We're basically back to trend on labor force participation given demographics."

"Not expecting a big bump up in labor force participation."

"We're still not even in restrictive territory on the funds rate."

"The dollar is among the conditions that have tightened, it's is helpful on inflation."

"Money supply hasn't been a reliable indicator for a long time."

"I'd like to see long-term inflation expectations down from where they are now."

"Would also want to see continued progress on realized inflation."

Market reaction

The greenback preserves its strength following these comments. The US Dollar Index was last seen rising 0.5% on the day at 113.28.

- USD/CAD regains positive traction on Thursday and moves little post-US/Canadian macro data.

- A modest bounce in crude oil prices underpins the loonie and acts as a headwind for the major.

- Rising US bond yields offer some support to the USD and remain supportive of the bid tone.

The USD/CAD pair retreats a few pips from the daily high and is currently placed just above the 1.3700 mark, still up over 0.80% for the day.

The US dollar surrenders a major part of its strong intraday gains and turns out to be a key factor acting as a headwind for the USD/CAD pair. Apart from this, an intraday bounce in crude oil prices offers some support to the commodity-linked loonie and further contributes to capping the upside for spot prices.

That said, a combination of factors underpins the greenback and remains supportive of the bid tone surrounding the USD/CAD pair. Expectations that the Fed will stick to its aggressive policy tightening path triggers a fresh leg up in the US Treasury bond yields. This, along with the risk-off impulse, benefits the safe-haven buck.

The market sentiment remains fragile amid worries about the potential economic fallout from the rapidly rising borrowing costs and the risk of a further escalation in the Russia-Ukraine conflict. Moreover, concerns that a deeper global economic downturn will dent fuel demand should cap any meaningful upside for oil prices.

The USD/CAD pair, meanwhile, reacts little to mostly upbeat macro data from the US and Canada. The final GDP report showed that the world's largest economy contracted by 0.6% annualized pace during the second quarter, matching expectations. Furthermore, the US Weekly Initial Jobless Claims fell more than anticipated last week.

From Canada, the monthly GDP print surpasses consensus estimates and records a modest 0.1% growth in July, though fails to provide any impetus. That said, the fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside and any corrective pullback could be seen as a buying opportunity.

Technical levels to watch

- Real GDP in Canada grew by 0.1% in July as expected.

- USD/CAD posts strong daily gains, trades above 1.3700.

Real Gross Domestic Product (GDP) in Canada grew by 0.1% on a monthly basis in July, Statistics Canada reported on Thursday. This reading followed June's expansion of 0.1% and came in better than the market expectation for a contraction of 0.1%.

"Advance information indicates that real GDP was essentially unchanged in August," Statistics Canada further noted in ints press release. "Increases in retail and wholesale trade, as well as in agriculture, forestry, fishing, and hunting were offset by decreases in manufacturing and oil and gas extraction."

Market reaction

The USD/CAD pair edged higher after this report and was last seen gaining 0.8% on the day at 1.3715.

- Initial Jobless Claims in the US fell by 16,000 in the week ending September 24.

- US Dollar Index clings to daily gains above 113.00 after the data.

There were 193,000 initial jobless claims in the week ending September 24, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 209,000 (revised from 213,000) and came in better than the market expectation of 215,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 207,000, a decrease of 8,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending September 17 was 1,347,000, a decrease of 29,000 from the previous week's revised level," the DOL reported.

Market reaction

The dollar preserves its strength following the upbeat data and the US Dollar Index was last seen rising 0.5% on the day at 113.25.

- DXY fades initial gains to the 113.80 region on Thursday.

- Further downside appears in store in the very near term.

DXY looks to reverse part of Wednesday’s sharp pullback, although the bullish attempt seems to have met a tough resistance near 113.80.

Despite the bounce, further decline remains in the pipeline for the dollar. Against that, the corrective leg lower could extend to the weekly low at 109.35 (September 20) ahead of the 55-day SMA at 108.41.

On the broader scenario, prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line around 107.10.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.38.

DXY daily chart

- Real GDP in the US declined by 0.6% in the second quarter.

- US Dollar Index stays in positive territory above 113.00.

The US economy contracted at an annualized rate of 0.6% in the second quarter, the US Bureau of Economic Analysis' (BEA) third and final estimate showed on Thursday. This reading came in line with the market expectation and the previous estimate.

"In the second estimate, the decrease in real GDP was also 0.6%," the BEA noted in its publication. "The update primarily reflected an upward revision to consumer spending that was offset by a downward revision to exports. Imports, which are a subtraction in the calculation of GDP, were revised down."

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen gaining 0.4% on the day at 113.15.

Bank of England (BOE) Deputy Governor Dave Ramsden said on Thursday that the emergency purchase programme of the long-dated government bonds will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided.

"The UK financial assets saw significant repricing since the start of this week," Ramsden noted and added that were dysfunction in this market to continue or worsen, there would be a material risk to financial stability, as reported by Reuters.

Market reaction

The GBP/USD pair showed no immediate reaction to these comments and was last seen losing 0.15% on the day at 1.0872.

German Finance Minister Christian Lindner said on Thursday that they will mobilise Germany's economic strength when necessary, as reported by Reuters.

Regarding the German government's decision to implement a price brake on gas and electricity while providing funding of up to €200 billion for an "economic defence shield," Linder said that these measures should not fuel inflation.

"We are not following the British down the path of expansionary fiscal policy," the minister explained.

Market reaction

The EUR/USD pair retreated from session highs following these comments and was last seen trading at 0.9705, where it was down 0.33% on a daily basis.

According to a German government document published on Thursday, nuclear power plants in southern Germany will be allowed to run until spring 2023, as reported by Reuters.

The government will also implement an emergency price brake on gas and electricity while providing funding of up to €200 billion for an "economic defence shield."

Commenting on government measures, "the energy crisis threatens to grow into a social and economic crisis," German Economy Minister Robert Habeck said.

"Gas consumption has to come down," Habeck added and said that Germany is still in a critical situation.

Market reaction

Germany's DAX 30 showed no reaction to these announcements and it was last seen losing 1.35% on a daily basis.

Eurostat will release Harmonised Index of Consumer Prices (HICP) data for September on Friday, September 31 at 09:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks regarding the upcoming EU inflation print.

For the eurozone as a whole, headline inflation is expected at 9.7% YoY vs. 9.1% in August and core is expected at 4.7% YoY vs. 4.3% in August. On a monthly basis, the HICP is expected to rise to 1.2% vs. 0.1% booked in August while the core HICP is foreseen at 1% against the previous figure of 0.5%.

Commerzbank

“In the euroarea, the inflation rate is likely to have jumped from 9.1% in August to 9.9% in September, and in Germany, it may even already be in double digits. Once again, energy and food were the price drivers. But the inflation rate excluding energy, food and luxury goods is also likely to have jumped from 4.3% to 4.6% in the euroarea.”

Nomura

“We see EA flash inflation rising to what we think will be a peak of 9.7% in September.”

TDS

“The end of the subsidies that artificially lowered German inflation in June will provide a substantial boost to German HICP inflation in September. This combined with continued food pressures will likely push aggregate euro area headline inflation close to 10% YoY.”

SocGen

“We think HICP will increase to 9.6% YoY in the September flash, up from 9.1% in August, and we believe this could be the peak in euro area inflation. Even if it isn’t the peak, we don’t think inflation will increase much from this level in 4Q and inflation is almost certain to fall in early 2023 due to the negative base effects in the energy component.”

Deutsche Bank

“We expect the measure to hit a record +9.5%, up from the previous record of +9.1% in August.”

- Inflation in Germany rose at a stronger pace than expected in September.

- EUR/USD trades above 0.9700 after hot German CPI data.

Annual inflation in Germany, as measured by the Consumer Price Index (CPI), climbed to 10% in September from 7.9% in August, Germany's Destatis reported on Thursday. This reading came in higher than the market expectation of 9.4.

Meanwhile, the Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, jumped to 10.9% from 8.8%, compared to analysts' estimate of 10%.

On a monthly basis, the CPI and the HICP arrived at 1.9% and 2.2%, respectively, surpassing market forecasts.

Market reaction

The EUR/USD pair continues to trade above 0.9700 after the German inflation data.

Will the fourth quarter bring an end to the bear market? Morgan Stanley’s Global Investment Committee believes this bear market is far from over and recommends investors consider three key dynamics to inform their equity investments going forward.

Stock investors should demand a greater premium for taking on risk