- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Late on Wednesday, Morgan Stanley (MS) conveyed its bearish bias on the EUR/USD pair, targeting the 0.9300 level. The US bank highlights stagflation and geopolitical concerns as the key catalysts favoring their view.

Key quotes

Market implied terminal rates for the ECB may be elevated (3%) compared to a more plausible outcome like 2%.

The upcoming inflation print will be an important market event as investors seek to gauge the path for Eurozone inflation.

EUR/USD fades bounce off yearly low

The bank report joins hands with the market’s latest cautious move to trim the EUR/USD pair’s biggest daily gains in six months.

Also read: EUR/USD struggles to extend rebound beyond 0.9700, German Inflation, US GDP eyed

- NZD/USD fades recovery moves from a two-year low.

- Convergence of previous resistance line, 100-HMA challenges sellers.

- RSI retreat favor pullback in prices but bullish MACD, 0.5700 breakout keeps buyers hopeful.

NZD/USD retreats to 0.5718 while snapping a two-day uptrend during Thursday’s quiet Asian session. In doing so, the Kiwi pair reverses the previous day’s bounce off the yearly bottom as the RSI (14) eases from the overbought region.

Even so, the quote keeps Wednesday’s upside break of the 0.5700 resistance confluence comprising the 100-HMA and a downward sloping trend line from September 13, now acting as immediate support.

Also adding strength to the 0.5700 support level is the 23.6% Fibonacci retracement of September 13-28 moves. It should be noted that the bullish MACD signals also keep the NZD/USD buyers hopeful.

That said, the 50-HMA acts as the last defense of the pair buyers around 0.5660, a break of which won’t hesitate to recall the bears targeting the fresh yearly low, currently near 0.5565.

Meanwhile, recovery moves need to cross the latest swing high surrounding 0.5740 to recall the NZD/USD buyers. Following that, the September 22 swing low near 0.5800 will be in focus.

However, the traders can doubt the recovery unless the pair remains below the 61.8% Fibonacci retracement level of 0.5935.

NZD/USD: Hourly chart

Trend: Further upside expected

- EUR/JPY is comfortably established above 140.00 after hawkish guidance by ECB Lagarde.

- German energy market regulators are preparing stockpiles ahead of the winter season.

- Japan’s labor market data is expected to remain upbeat ahead.

The EUR/JPY pair has established above the psychological resistance of 140.00 as the risk-on market profile favored risk-sensitive currencies. The asset has turned sideways and is awaiting more market participants for making bullish bets. On Wednesday, the shared currency bulls rebound firmly after dropping to near 138.00. The cross delivered an upside break of the four-day long consolidation formed in a 137.38-139.53 range.

It seems that investors have shrugged-off uncertainty over the energy stockpiles ahead of the winter season, which soars the energy demand to run electrical appliances. Earlier, the Eurozone bulls were facing tremendous pressure after reporting a deliberate attack on the infrastructure of the Nord Stream 1 pipeline. German administration is preparing sufficient energy stockpiles ahead of the winter season and a decline in the same will deepen the energy crisis further.

Also, the speech from European Central Bank (ECB) President Christine Lagarde strengthened the shared continent bulls. ECB Lagarde sees rate hikes by 125 basis points (bps) in upcoming several meetings.

Going forward, investors will focus on the Eurozone Consumer Confidence data. As per the preliminary estimates, the sentiment data will remain steady at -28.8. It is worth noting that the economic data is getting more vulnerable over the past year.

On the Tokyo front, investors have shrugged off the impact of the Bank of Japan (BOJ)’s intervention in the currency markets to support the depreciating yen. The market participants believe that the impact of intervention remains short-lived, therefore, only restrictive measures could be a tailwind for the Japanese yen.

This week, the Japanese employment data will hog the limelight. The Unemployment Rate is expected to decline to 2.5% vs. the prior release of 2.6%. While the Jobs/Applicants Ratio will improve to 1.30 against the 1.29 reported earlier.

- EUR/GBP picks up bids to reverse the post BOE pullback.

- Hawkish ECB jostled with the BOE’s bond-buying plan but failed to recall the bears.

- Looming economic fears for the UK join hawkish ECBspeak to keep buyers hopeful.

- German inflation may allow traders to witness further upside with firmer HICP numbers.

EUR/GBP prints mild gains around 0.8950 during Thursday’s Asian session, after a volatile day that ended on a positive note.

The cross-currency pair’s latest gains could be linked to the regional currency’s comparative strength considering the hawkish comments from the European Central Bank (ECB). However, softer yields and hopes of the UK’s more efforts to restrict trader confidence could challenge the pair bears.

That said, the Bank of England (BOE) announced a bond-buying program to defend the British Pound (GBP) on Wednesday. The details suggest that the BOE will buy bonds with a maturity of over 20 years and up to 5 billion sterling worth per auction initially. On the other hand, ECB President Christine Lagarde reiterated on Wednesday that they will continue to raise rates in the next several meetings, as reported by Reuters. There were several other ECB Governing Council members namely Olli Rehn, Peter Kazimir, and Robert Holzmann who openly favored a 0.75% rate hike in the next meeting.

Elsewhere, the US 10-year Treasury bond yields slumped the most in six months and allowed equities to consolidate recent losses, which in turn propelled the EUR and drowned the US dollar.

Looking forward, preliminary readings of Germany’s Harmonized Index of Consumer Prices (HICP) for September, expected 10% YoY versus 8.8% prior, will be important to watch for fresh impulse. Also important will be the ECBSpeak and the comments from various BOE policymakers. Above all, risk catalysts are crucial to determine short-term EUR/GBP moves.

Considering the less likely immediate end of the UK’s financial problems, the EUR/GBP prices are likely to remain firmer and can rise further if the Germany data offers a positive surprise.

Technical analysis

A three-day-old bullish triangle restricts immediate EUR/GBP moves between 0.9030 and 0.8850.

- USD/CAD bears have moved in but there could be prospects of a bullish correction.

- A retest of the NY open's range could be in order for the day ahead.

The chart below chart illustrates the key levels that include the opening hour's range of the New York session that could see the price drawn to in the coming sessions for a retest where the lows of the range meet a 38.2% Fibonacci retracement near 1.3660.

USD/CAD H1 chart

On the way there, trapping breakout shorts, the price will need to break back above Tuesday's low of 1.3640. If this area were to hold, then there will be prospects of a deeper move through last week's high again of 1.3612 and Wednesday's low of 1.3602 to retest this week's low of 1.3559 that could be broken should month-end flows accelerate the squeeze on long dollar positions.

USD/CAD weekly chart

If the price continues to deteriorate, as per the above thesis, then a 38.2% Fibonacci correction of the weekly bullish impulse aligns with around 1.35 the figure. This could be a feasible target should this week's low, so far, give out for a fresh low for the current week. Following the shake-out, there could be prospects of a surge higher again if markets commit to the US dollar again as fundamentals once again take over.

- GBP/JPY recovered some ground on Wednesday and trimmed most of its weekly losses.

- However, if the GBP/JPY fails to reclaim 157.00, that would pave the way for sellers, and the pair could drop towards the 38.2% Fibonacci retracement at 154.67.

- A break above 157.00 might open the door for a rally towards the 61.8% Fibonacci at 158.40.

On Wednesday, the GBP/JPY finished the day with solid gains of 1%, as the Bank of England intervention bolstered UK bonds and alleviated the markets. However, as the Asian Pacific session takes over, the GBP/JPY is trading at 156.59, down 0.21%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart portrays the pair as downward biases, as mentioned yesterday, “once it cleared the 200-EMA.” GBP/JPY’s Wednesday price action registered a daily high at 157.09, above the 50% Fibonacci retracement, drawn from the high/low of September 22 and 26, respectively, paving the way for a move towards the 61.8% retracement at 158.40. If the GBP/JPY breaks 158.00, then a move to the latter is on the cards, followed by the figure at 160.00, ahead of the 200-day EMA at 160-33

Otherwise, the GBP/JPY might be headed downwards, aligned with its current bias. Therefore, the GBP/JPY’s first support will be the 50% Fibonacci retracement at 156.53. Once cleared, the next support would be the 38.2% Fibonacci at 154.67, followed by the September 27 daily low at 154.07. A breach of the latter might send the GBP/JPY towards the January 24 daily low of 152.90.

GBP/JPY Key Technical Levels

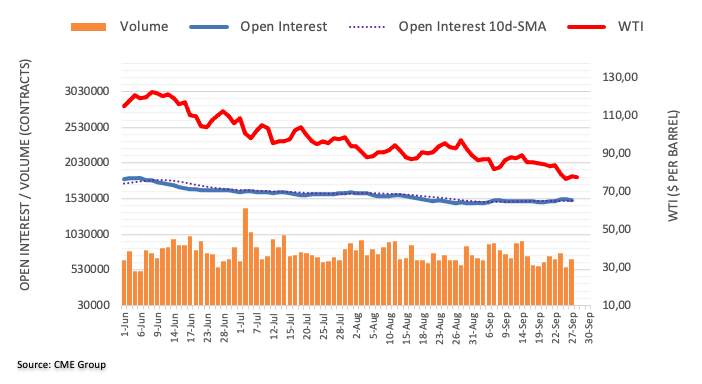

- WTI snaps two-day uptrend, pares daily gains after rising the most since May.

- Bullish chart pattern, upside oscillators keep buyers hopeful but 100-SMA adds to the upside filters.

- Multiple supports to challenge bears above $75.00 level.

WTI crude oil prices fade the previous day’s upside momentum, the biggest in four months, as bulls take a breather at around $82.00 during Thursday’s Asian session. That said, the black gold retreats to $81.30 by the press time.

In doing so, the quote eased from the previous support line from September 07 while staying inside the monthly falling wedge bullish chart pattern.

Given the recently firmer RSI and the bullish MACD signals, the commodity prices are likely to extend the latest hurdle surrounding $82.00.

However, the quote’s further upside will hinge on the capacity to confirm the wedge formation with a clear break of $82.80, as well as cross the 100-SMA hurdle surrounding $83.55.

On the contrary, pullback moves may revisit the $80.00 threshold ahead of weekly horizontal support near $78.00.

In a case where the quote drops below $78.00 support, the latest multi-month low near $76.00 and the lower line of the stated wedge, around $75.20, could challenge the further downside of WTI crude oil.

WTI: Four-hour chart

Trend: Further upside expected

- USD/CHF is oscillating around 0.9750 after a sheer fall and is preparing for further drop ahead.

- A risk-on market profile has sent the DXY into a corrective mode.

- Swiss Real Retail Sales data is seen higher at 3.6% vs. the prior release of 2.4%.

The USD/CHF pair has sensed a sigh of relief after a continuous drop from a high above 0.9950. The asset is trying a develop a base around 0.9750 after a vertical fall, however, the downside seems to favor on cheerful market mood. The major is expected to decline further to near the round-level support of 0.9700 as the market sentiment turned positive after investors found the risk-perceived assets a ‘value bet’.

On Wednesday, the US dollar index (DXY) declined sharply below 113.00 after investors shrugged-off clouds of uncertainty about a further escalation in interest rates by the Federal Reserve (Fed). Investors have started realizing the fact that soaring inflation is attracting policy tightening measures from the Fed. And, the terminal rate is heading towards the optimal figure of 4.6% as discussed in September’s monetary policy meeting.

Atlanta Fed President Raphael Bostic started to cross wires on Wednesday stating that the baseline scenario right now includes a 75 basis points (bps) rate hike in November followed by a 50 bps increase in December, as reported by Reuters. Should that materialize, the pace of hiking interest rates will slow down vigorously.

In today’s session, the spotlight will be on US Gross Domestic Product (GDP) data. As per the consensus, the growth rate in the US economy has declined by 0.6% in the second quarter on an annualized basis. A weaker-than-expected release will weigh more pressure on the DXY.

Meanwhile, the Swiss franc bulls are awaiting the release of the Real Retail Sales data. The economic data is expected to improve by 3.6% vs. the prior improvement of 2.4% on an annual basis. This is going to delight the Swiss National Bank (SNB) to sound hawkish on interest rates in the fourth quarter monetary policy unhesitatingly.

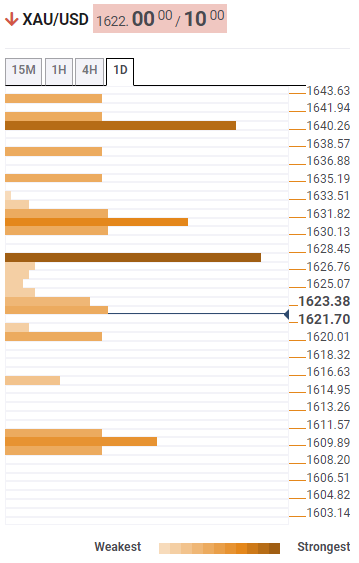

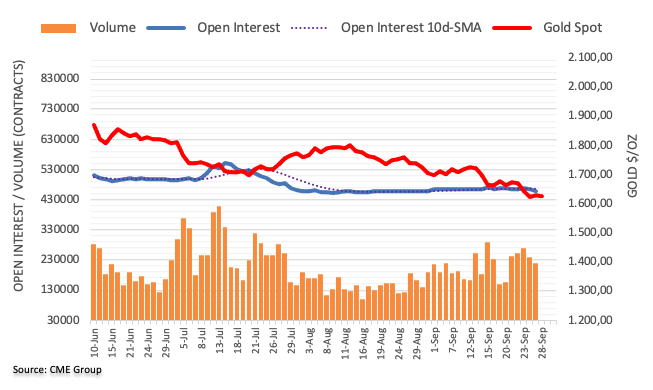

- Gold price fades bounce off yearly low, pares the biggest daily jump since early March.

- XAU/USD buyers returned as yields slumped the most in six months, DXY printed biggest daily fall since March 2020.

- BOE, ECB managed to trigger DXY’s corrective pullback.

- Challenges to risk, hawkish Fedspeak keeps gold sellers hopeful, softer US GDP could help extend metal’s recovery.

Gold price (XAU/USD) retreats to $1,658, after posting the biggest daily jump in six months to recover from the two-year low, as buyers reassess the bullish move considering the presence of the risk-negative catalysts. That said, the metal’s hesitance in extending the latest rise could also be linked to the cautious mood ahead of final readings of the US Q2 Gross Domestic Product (GDP).

The quote began Wednesday on the back foot and refreshed the two-year low as the US dollar cheered the market’s rush for risk safety. However, the Bank of England’s (BOE) bond-buying plan to restore market confidence joined hawkish comments from the European Central Bank (ECB) policymakers to weigh on the US dollar and trigger the yields’ slump, which in turn pleased the XAU/USD bulls afterward.

That said, the Bank of England (BOE) announced a bond-buying program to defend the British Pound (GBP) on Wednesday. The details suggest that the BOE will buy bonds with a maturity of over 20 years and up to 5 billion sterling worth per auction initially. On the other hand, ECB President Christine Lagarde reiterated on Wednesday that they will continue to raise rates in the next several meetings, as reported by Reuters. There were several other ECB Governing Council members namely Olli Rehn, Peter Kazimir, and Robert Holzmann who openly favored a 0.75% rate hike in the next meeting.

Elsewhere, the US international trade deficit narrowed by $2.9 billion to $87.3 billion in August from $90.2 billion in July. Details suggest that the Exports dropped for the first time since January while Imports marked the fifth consecutive monthly decline. Further, Atlanta Fed President Raphael Bostic said on Wednesday that the baseline scenario right now includes a 75 basis points (bps) rate hike in November and a 50 bps increase in December, as reported by Reuters. Additionally, Chicago Federal Reserve President Charles Evans also emphasized the need to address inflation and tried to renew the US dollar buying but could not due to the softer yields.

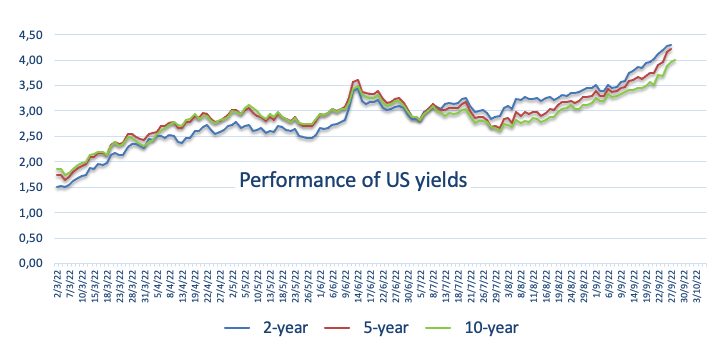

That said, the US 10-year Treasury bond yields slumped the most in six months and allowed equities to consolidate recent losses, which in turn dragged the US Dollar Index (DXY) from the multi-year high.

It’s worth noting, however, that the market’s doubts over the BOE-led optimism and the fears of the European energy crisis could join the hawkish Fedspeak to renew the gold’s selling if today’s US GDP data offer a positive surprise.

Technical analysis

Gold price remains sidelined inside a short-term trend-widening bearish megaphone chart pattern.

The quote’s latest break of the $1,654-55 resistance confluence including the 50-SMA and a fortnight-old horizontal area, now support, directs XAU/USD buyers towards the stated formation’s upper line, at $1,669 by the press time.

It should, however, be noted that the bullish MACD signals and the RSI run-up is teasing the buyers and hence a clear upside break of the $1,669, also crossing the $1,670 hurdle, won’t hesitate to direct the bulls towards the previous weekly top surrounding $1,690.

Meanwhile, a downside break of $1,655-54 resistance-turned-support could quickly direct the gold bears towards $1,640 and the latest low near $1,615. Though, the support line of the aforementioned megaphone, close to $1,611, appears a tough nut to crack for the sellers afterward.

Gold: Four-hour chart

Trend: Limited upside expected

- Pound bulls have poked the crucial demand zone in a 1.0905-1.0931 range.

- A bull cross, represented by the 20 and 50-EMAs, adds to the upside filters.

- The RSI (14) has shifted into the bullish range of 60.00-80.00, which favors an upside momentum.

The GBP/USD pair is displaying topsy-turvy moves around the immediate hurdle of 1.0900 in the early Asian session. Earlier, the cable displayed a perpendicular upside move after sensing a responsive buying action from 1.0540. The asset is aiming to refresh its weekly high above 1.0931 as risk sentiment has turned positive.

On an hourly scale, the cable has poked the demand zone placed in a narrow range of 1.0905-1.0931. The asset is not displaying signs of exhaustion after a juggernaut rally but is preparing for an upside break ahead as investors are pouring funds amid the establishment of an upside bias.

A bull cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at 1.0764 signals more upside ahead.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which has activated pound bulls for upside momentum.

A break above Monday’s high at 1.0931 will send the cable towards the round-level resistance at 1.1000, followed by Friday’s average price at 1.1100.

On the flip side, the cable will lose significance further if it drops below Monday’s low at 1.0339, which will drag the asset towards the round-level support at 1.0200. A slippage below the latter will direct the cable towards parity.

GBP/USD hourly chart

-638000004563011449.png)

- EUR/USD steadies after bouncing off 20-year low, pares the biggest daily gains since early March.

- BOE’s re-stimulation act via bond buying joined hawkish ECBSpeak to trigger corrective bounce.

- German inflation will be eyed closely to confirm the 0.75% rate hike and favor buyers.

- Firmer prints of the Final Q2 US GDP could offer US dollar rebound as Fed policymakers remain optimistic.

EUR/USD bulls take a breather after posting the biggest daily jump in six months during the turnaround Wednesday. That said, the quote treads water around 0.9730-40 during the early Thursday morning in Asia.

The major currency pair began Wednesday on the back foot and refreshed the 20-year low amid broad US dollar strength as the market’s pessimism fuelled the US dollar. However, the Bank of England’s (BOE) bond-buying plan to restore market confidence joined hawkish comments from the European Central Bank (ECB) policymakers to please the EUR/USD bulls afterward.

That said, the Bank of England (BOE) announced a bond-buying program to defend the British Pound (GBP) on Wednesday. The details suggest that the BOE will buy bonds with a maturity of over 20 years and up to 5 billion sterling worth per auction initially.

On the other hand, ECB President Christine Lagarde reiterated on Wednesday that they will continue to raise rates in the next several meetings, as reported by Reuters. There were several other ECB Governing Council members namely Olli Rehn, Peter Kazimir and Robert Holzmann who openly favored a 0.75% rate hike in the next meeting.

Elsewhere, the US international trade deficit narrowed by $2.9 billion to $87.3 billion in August from $90.2 billion in July. Details suggest that the Exports dropped for the first time since January while Imports marked the fifth consecutive monthly decline. Further, Atlanta Fed President Raphael Bostic said on Wednesday that the baseline scenario right now includes a 75 basis points (bps) rate hike in November and a 50 bps increase in December, as reported by Reuters.

It should be noted that the European Commission President Ursula von der Leyen announced on Wednesday that they will propose new import bans on Russian products that will deprive Russia of another €7 billion in revenue, as reported by Reuters.

Amid these plays, the bond yields slumped and allowed equities to consolidate recent losses, which in turn dragged the US Dollar Index (DXY) from the multi-year high.

However, the hawkish Fed and the West versus Russia tussles, as well as likely inflation fears in the bloc, could keep the EUR/USD traders on their toes. As a result, today’s German inflation gauge and the final readings of the US Q2 Gross Domestic Product (GDP) will be crucial for immediate direction. That said, firmer numbers are likely to favor more to the US dollar than the EUR.

Technical analysis

Although an upside break of the one-week-old resistance line, now support near 0.9620, favors EUR/USD buyers, a convergence of the one-month-old previous support and the 50-SMA on the four-hour chart, near 0.9800, challenges the upside momentum.

- Silver prices recovered from weekly lows at $17.94 and gained almost $1 on Wednesday.

- The British pound crisis augmented the appetite for precious metals, a headwind for the greenback.

- US Fed officials emphasized that the US Federal funds rate (FFR) might peak at around 4% by the year’s end.

Silver price bounces off weekly lows at around $18.00 a troy ounce as the greenback plunges from YTD lows above the 114.00 figure, undermined by US Treasury bond yields sliding, amid a risk-on impulse as shown by US equity markets finishing in the green. At the time of writing, the XAG/USD is trading at $18.87 a troy ounce, 2.50% above its opening price.

XAG/USD pares weekly losses buyers eye $19.00

Recent developments in the financial markets finally triggered safe-haven flows toward precious metals. The British pound currency crisis, triggered by PM Liz Truss’s new government plagued with tax cuts, increased worries that inflation in the UK might get out of control. Therefore, the Bank of England stepped into the bond markets, buying 30-year gilts to ease investors’ fears, and postponed the Quantitative Tightening (QT) by the end of October.

The greenback’s fall from 20-year highs opened the door for the white metal recovery, despite US central bank hawkish rhetoric, led by Atlanta’s Fed President Raphael Bostic, who said that inflation is “too high” and he backed up a 75 bps rate hike in November and 50 in December.

Of late, the Chicago Fed President Charles Evans said that the Fed is increasing rates at a faster pace to tame “very high and persistent inflation” and expected the Federal funds rate (FFR) to peak around 4.50-4.75%.

The US Dollar Index, a gauge for the buck’s value against its peers, plunged 1.29%, down at 112.711, refreshing its weekly lows, undermined by the US 10-year T-bond yield, dropping 22 bps, at 3.737%.

Given the scenario mentioned above, the US dollar fall was a tailwind for XAG/USD price. Even though the white metal began trading around the $18,30s region and reached a daily low at $17.84, it bounced off and rallied sharply to current spot prices.

Data-wise, the US economic docket featured August’s Pending Home Sales, which shrank 2% more than the 1.5% decrease estimated, contracting to its lowest level since 2011.

What to watch

The US economic calendar will feature the Gross Domestic Product (GDP) for the second quarter on its final reading, estimated at -0.6%, alongside the Initial Jobless Claims, for the week ended on September 24.

XAG/USD Key Technical Levels

- AUD/USD is marching towards 0.6600 amid upbeat market sentiment.

- The DXY has plummeted below 113.00 despite hawkish commentary from the Fed policymaker.

- Aussie dollar has benefitted from higher-than-expected monthly Retail Sales data.

The AUD/USD pair is witnessing a mark-up inventory accumulation phase after displaying a juggernaut rally to near 0.6530. The asset is expected to extend its recovery and will march towards the critical hurdle of 0.6600. Earlier, the commodity-linked currency rebounded firmly after dropping to near 0.6360. The major advanced vertically as investors shrugged off pessimism and poured funds into the risk-sensitive currencies.

The US dollar index (DXY) plummeted like there is no tomorrow after failing to sustain above the critical hurdle of 114.50. A failure in hitting the round-level resistance of 115.00 dragged the DXY sharply to near 112.71. This indicates that risk sentiment has turned positive for a while as a ‘value bet’ context doe risk-perceived assets kicked in.

Comments from Federal Reserve (Fed) policymakers are advocating a continuation of the current pace of hiking interest rates. Atlanta Fed President Raphael Bostic started to cross wires on Wednesday stating that the baseline scenario right now includes a 75 basis points (bps) rate hike in November followed by a 50 bps increase in December, as reported by Reuters. He further cited that the inflation thing is too high and has not responded well to the policy tightening measures.

Going forward, the US Gross Domestic Product (GDP) data will be keenly watched. The annualized data for the second quarter is expected to decline by 0.6%, similar to the prior reading.

On the Australian front, aussie dollar has benefitted from better-than-projected monthly Retail Sales data. The economic data landed at 0.6%, higher than the estimates of 0.4%, but lower than the prior release of 1.3%. As the Reserve Bank of Australia (RBA) is tightening its policy heavily to combat the galloping inflation, higher-than-expected Retail Sales data has delighted the central bank.

- NZD/USD bulls have moved in as the US dollar sells off into month end.

- The greenback and US yields were underwater on Wednesday and the high beta currencies took off.

NZD/USD rallied on Wednesday following a strong sell-off in the US dollar as the month-end approaches. NZD/USD rallied by some 1.8% from a low of 0.5564 to a high of 0.5733 the high.

This came on the back of the US dollar index melting through a cascade of market orders across the major currency complex from 114.778 to as low as 112.561 in a matter of half a day of trade between the late London session and New York opening hours.

''The Kiwi is back above 0.57 this morning, having regained a touch of composure alongside a plethora other risk assets in the wake of the Bank of England’s decision to “temporarily” buy bonds and to delay plans for QT,'' analysts at ANZ Bank explained:

''It’s all a bit of a mess and very contradictory, and how long the calm/fresh optimism lasts remains to be seen. For one, this re-stimulation will lift, not quell UK inflation, and that’s bad for bonds and sterling. Prior to that, the US White House had said that it isn’t in favor of a new Plaza Accord-type deal to cap the USD’s strength. Those looking to politicians to end the dollar’s reign may be looking in the wrong place.''

''Amid opposing short and long-term influences, we think it pays to keep a very open mind, brace for volatility, and manage risk carefully,'' the analysts added.

What you need to take care of on Thursday, September 29:

The dollar stretched its rally throughout the first half of the day but changed course dramatically after Wall Street's opening. US government bond yields plummeted with that on the 10-year note, down roughly 20 bps, taking its toll on the American currency. The Dollar Index hit a record high of 114.78, later retreating towards the 112.60 price zone.

Several US Federal Reserve officials were on the wires, repeating the well-known message of another 75 bps coming up next, aiming for a top to Fed funds rate between 4.25% and 4.75% in the first quarter of 2023.

The EUR/USD pair plummeted to a 22-year low of 0.9535, extending later its intraday recovery to 0.9750, trading a handful of pips below the latter at the end of the day. The EU energy crisis maintains local authorities on their toes, and the EU Commission released a paper assessing gas price measures.

Also, ECB President Christine Lagarde participated in a US-European GeoEconomics forum and said they would continue to hike rates in the next several meetings. Additionally, Governing Council member Peter Kazimir and Bank of Latvia Governor, and ECB governing council member, Martins Kazaks were on the wires supporting a 75 bps rate hike in the October meeting.

The GBP/USD pair was quite volatile amid back and forth from the Bank of England. It managed to settle at around 1.0880 amid the broad greenback's weakness. The BOE decided to buy long-dated UK government bonds starting today to restore market conditions. It later confirmed that it could buy just £1.025 billion in the emergency QE operation, well below the planned £5 billion. Long-term yields plummeted with the announcement. The central bank also postponed the first gilt sale operations, supposed to start next week, to October 31 and proceed after that. The fiscal strategy was strong international criticism.

USD/JPY show little signs of life despite high volatility across the FX board, ending the day marginally lower at 114.10. Commodity-linked currencies beat the greenback, with AUD/USD trading at 0.6515 and USD/CAD at 1.3635. The USD/CHF pair also edged firmly lower, now hovering at around 0.9765.

Gold prices soared, and XAUUSD trades at $1,660 a troy ounce, its highest for the week. Crude oil prices recovered, and WTI settled at $82.00 a barrel.

Technically, the sharp downturns in major pairs seem corrective amid the last dollar's overbought conditions. However, the rallies need to continue in the upcoming session to confirm interim bottoms.

On Thursday, the focus will be on German inflation, expected to have raised by 9.4% YoY in September.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Whale Watching 102 - Don't become the bait

Like this article? Help us with some feedback by answering this survey:

- Gold has rallied hard through the high of the week.

- The US dollar has sunk from 20-year highs and has tripped a cascade of market orders across the board.

The price of gold has soared on the back of a move by the bears in the US dollar on Wednesday. XAU/USD is rallying to $1,662.78 the high for the day so far after printing a fresh bear cycle low of $1,614.92 in mid-London morning trade.

The jump in the gold price came about when the US dollar fell sharply from a 20-year high, easing pressure on gold in what has been described a month-end fixing model. There are still plenty of fundamentally sound reasons for a recovery in gold as it is seen as a safe haven at times of geopolitical tensions. Additionally, the US treasury yield also fell after climbing to the highest since January 2008. The yield on the US 10-year note was last seen down 24.2 basis points to 3.705%, after earlier touching 4.01%, the first rise above 4% in nearly 15 years while money markets girded for higher interest rates that could possibly remain for longer than anticipated.

However, in recent trade on Wednesday, US traders piled into the stock market as the yield on US Treasuries came off decade highs that in recent sessions made interest rate-sensitive companies less attractive to investors. The tumble in yields followed the Bank of England's intervention into the UK's gilt market when it said it would buy long-dated British bonds in a move aimed at restoring financial stability in the wake of the new UK Government’s mini-budget, which had triggered a sharp sell-off in UK gilts.

In turn, the greenback has crumbled from a fresh 20-year high scored ahead of the New York open at 114.778 before falling to the current low of 112.561. The move has dug into a lot of long positioning into other currencies vs. the US dollar this week which has led to a cascade of market orders being triggered along the way, propelling gold and the pound higher.

''While this policy is under the umbrella of financial stability, it effectively amounts to undertaking temporary quantitative easing (ie policy easing), at a time when the Monetary Policy Committee is trying to contain rampant inflation,'' analysts at ANZ Bank said, adding, ''it’s therefore difficult to see how the BoE can deliver anything less than a 100bp rate hike at their November meeting.''

Nonetheless, analysts at TD Securities argue, ''we still see the risk of capitulation growing for the yellow metal. With prices trading below pandemic-era levels, a small number of family offices and proprietary trading shops are increasingly feeling the pressure to finally capitulate on their massively bloated and complacent length in gold.''

''Rates markets are pricing the potential for higher interest rates to persist for some time, and a steady stream of Fedspeak is likely to hammer this point home.''

In this regard, we heard from Fed speakers Charles Evans again on Wednesday as well as Ralph Bostic. ''The Federal Reserve is raising interest rates expeditiously to address very high, persistent inflation, and will likely get US short-term borrowing costs to where they need to be by early next year,'' Evans said. ''Most Fed policymakers are penciling in a top Fed policy rate of 4.5% to 4.75% by end of next year, based on their projections published last week, and "by March we will be at that point," Evans added at an event on current economic conditions hosted by the London School of Economics. Meanwhile, Atlanta Fed President Raphael Bostic said on Wednesday that ''the lack of clear progress on inflation means the Federal Reserve needs "moderately restrictive" interest rates that should reach a level between 4.25% and 4.50% by the end of this year.''

The Federal Reserve has aggressively hiked interest rates by 3 percentage points this year, taking its target range to 3.00%-3.25%. It carried out its third consecutive 75 basis point increase last week and signaled that rates are likely to rise to the 4.25%-4.5% range by the end of the year.

Gold technical analysis

The gold price has shot through the week's high of $1,649 and now eyes Friday's high at $1,675. On the downside, a correction to Monday's highs will have a confluence with a 38.2% Fibonacci level that guards the price imbalances, the greyed areas on the hourly chart above.

- USD/CAD nosedives below 1.3700, eyeing a break below 1.3600 as the US dollar falls.

- US Pending Home Sales for August disappointed investors, reflecting the Fed’s policy stance.

- Fed’s Bostic and Evans coincided that further rate hikes are needed, and both expected rates to peak around 4.25% by the end of 2022.

The USD/CAD plunges in the North American session after hitting a two-decade high at 1.3832 as the US dollar weakened, spurred by falling US bond yields, while US equities got a respite after the last six-day sell-off, which kept stocks nearby 2022 YTD low levels. Factors like the GBP’s currency crisis, alongside Europe’s energy woes, and hawkish Fed rhetoric, were the main reasons driving the markets.

Therefore, the USD/CAD is trading at 1.3622, well below its opening price, after hitting a daily high of 1.3832, down 0.74%.

US economic data revealed during the day flashed the impact of the Fed’s policy, as the National Association of Realtors revealed that Pending Home Sales for August. The figures showed a contraction f 2%, the lowest since 2011 and lower than 1.5% estimated by economists. According to Lawrence Yun, NAR’s chief economist, higher rates are weighing on the housing market, and she added, “Only when inflation calms down will we see mortgage rates begin to steady.”

In the meantime, Fed speakers led by Atlanta’s Fed Bostic said that inflation is “too high” and commented that his base case for the November meeting is to hike by 75 bps on December 50. At the time of typing, the Chicago Fed President, Charles Evans, said that the Fed is raising rates expeditiously to tackle very high and persistent inflation.

Evans added that he sees the Fed policy rate peaking at around 4.50-4.75%, while by the year’s end estimates, it would end at around 4.25-4.75%.

The lack of Canadian economic data left the Loonie adrift to US dollar dynamics and rising commodity prices. US crude oil prices were up 1.8% at $79,87 per barrel as production cuts spurred by Hurricane Ian, bolstering the Canadian dollar.

Elsewhere, the US Dollar Index, a gauge of the buck’s value vs. a basket of currencies, is plummeting sharply, more than 1.30%, down at 112.64, refreshing weekly lows.

USD/CAD Price Analysis: Technical outlook

Given the fundamental backdrop that the Fed might raise rates beyond what the Bank of Canada would do, it will likely keep the Loonie on the back foot. Therefore, the USD/CAD fall towards current exchange rates and beyond, probably the 38.2% Fibonacci retracement at 1.3500, would offer USD bulls opportunities to engage on the USD/CAD way towards a re-test of the YTD highs.

USD/CAD Key Technical Levels

Chicago Federal Reserve President Charles Evans is starting to cross the wires by saying, so far, ''we need to address inflation.'' Yesterday, he said the Fed will need to raise interest rates by at least another percentage point this year, and came with a more aggressive stance than he has previously embraced.

More to come...

Reuters reports that the United States will not recognize Russian-annexed areas across Ukraine amid what the White House on Wednesday called "illegal and illegitimate" referendums that were manipulated by Moscow and would be challenged internationally.

"Based on our information, every aspect of this referanda process was pre-staged and orchestrated by the Kremlin," White House spokesperson Karine Jean-Pierre told reporters at a briefing, adding that Washington would rally opposition to recognizing the annexed territories, "including at the UN."

"Regardless of Russia's claims, this remains Ukrainian territory," she said.

Key notes

- White House says Russian-backed referenda in Ukraine were straight from the kremlin playbook.

- Says Ukraine referenda were manipulated and manufactured.

- Says referendum in Ukraine were staged and orchestrated.

- Says these referenda are illegitimate and outrageous.

- Says referenda are pretext for Russia to try to annex Ukrainian territory.

- Says will work to impose additional economic costs on Russia.

- Announces $1.1 billion package of weapons and equipment for Ukraine.

- Says if Russia moves forward with annexation, we will be prepared.

- Says the consequences of Russian annexation will be real and extraordinary.

Such rhetoric will not do risk sentiment any favors with already very nervous financial markets that have propelled the safe-haven dollar to a two-decade peak on Wednesday.

According to analysts at Wells Fargo, the EUR/USD pair could drop to 0.91 by the first quarter of next year. They point out that the European Central Bank will lag well behind the Federal Reserve and also consider that economic conditions in the Eurozone are worsening.

Key Quotes:

“The fact that some key foreign central banks are set to lag the Fed in terms of the pace of rate hikes, as well as fall short of the tightening currently priced into financial markets, should also weigh on foreign currencies and support the U.S. dollar for the time being. In fact, we have revised our forecast lower for the EUR/USD exchange rate to $0.9100 by end Q1-2023 and lowered our forecast for the GBP/USD exchange rate to $1.0200 over the same period. More broadly, we see the Fed's U.S. dollar index against the advanced foreign economies gaining around a further 5% over the next six months. That would lift this particular trade-weighted dollar index to new 22-year highs.”

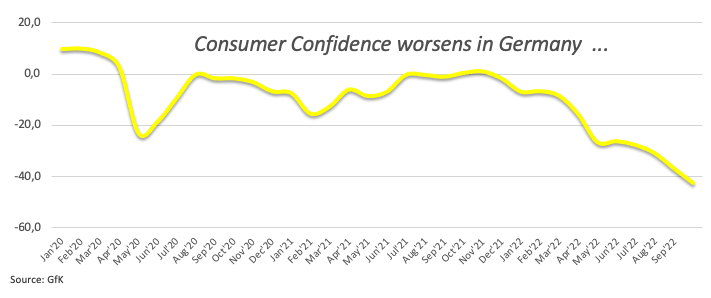

“We now forecast a slightly deeper recession for the Eurozone region than previously. Elevated inflation, reduced consumer purchasing power, energy supply disruptions and central bank tightening are all factors that we see contributing to Eurozone contraction. Confidence surveys are also now more clearly pointing to a Eurozone slowdown. We now expect the Eurozone economy to contract a cumulative 1.25% between late 2022 and mid-2023.”

“We expect weakness in the euro to persist. High and rising inflation should continue to weigh on the consumer, and energy supply disruptions could more directly impact manufacturing activity. Confidence surveys are now clearly pointing to contraction, especially for Germany—the region's largest economy. While the European Central Bank should raise rates further, underwhelming Eurozone growth should see it lag well behind the Fed, another factor that could see the EUR/USD exchange rate reach $0.9100 by Q1-2023.”

- Bank of England buys gilts to stabilize the bond market.

- Pound strengthens after the initial impact of BoE announcement.

- EUR/GBP unable to hold firm above 0.9000.

The EUR/GBP is hovering around 0.8940 practically flat for the day after moments of extreme volatility following a surprise announcement from the Bank of England. The cross bottomed at 0.8838, the lowest in three days and then jumped to 0.9066, before pulling back. GBP/USD rose from 1.0535 to levels above 1.0900.

The Bank of England announced it will by long-term gilts and delayed the beginning of sales. The collapse in UK bonds forced action from the BoE to avoid more tensions across financial markets. The BoE said it purchased on Wednesday £1.025B of gilts.

The decision was a positive for equity markets and also made bond yields pullback across the globe. Still the situation in the UK is still complex. The blowup in UK bonds and the quick depreciation of the pound also triggered political instability to the new administration of PM Liz Truss. Her tax-cutting plan is being criticized.

Markets continue to digest BoE’s announcement. The current calm will likely be short-lived and EUR/GBP continues to look for the next equilibrium level. So far, that area appears to be under 0.9000. A close above could open the doors to more gains.

Technical levels

- GBP/USD bulls move in for a significant run on shorts.

- The short squeeze could run as high as the 1.1050s.

It has been another volatile day in the US session and GBP/USD has rallied from a low of 1.0538 to a high of 1.0911 so far in what has been a massive turnaround for the pair, surpassing the prior day's highs and now embarking on the highs of the week.

Sterling initially fell more than 1% against the dollar and euro on Wednesday after the Bank of England, worried about margin calls in the gilt market, said it would step in to calm the UK's frenzied bond markets. The pound was on track for its biggest monthly fall since October 2008, just after Lehman Brothers collapsed. However, the greenback has collapsed from multi-year highs of 114.778 to print a fresh low of 112.588 for the session so far as US yields sink with the benchmark 10-year yield losing over 5.4% at the time of writing.

UK financial markets have been roiled by the moves by Finance Minister Kwasi Kwarteng who announced plans to slash taxes and ramp up borrowing. The fiscal statement - and Kwarteng's vow that there was more to come -sent global markets into panic mode and the pound crashing on Monday to a record low despite soaring gilt yields. However, the Old Lady's intervention appeared to calm the market when the yield on the 30-year benchmark gilt dropped by more than 50 basis points at one point despite the BoE only buying GBP1b concentrating on the July 2051 bond in the main.

Nevertheless, the aggressive fiscal program is likely to continue to weigh on the pound in febrile market conditions with attention now turning to a UK mortgage crisis as well as the energy crisis. "Mortgage deals for new customers now feature rates at around 5%-6% - a steep increase from the norm of around 2% for the last five years which is prompting rising concern of a collapse in the property market further down the line," Reuters reported on Wednesday.

The housing market is the backbone of the UK economy, and a leading economic indicator closely liked to the UK's consumer spending all of which go into the value of the pound that to date, has fallen almost 22% against the dollar this year, the most since 2008, and more than 7% against the euro. Sterling dropped by more than 15% in 2016, when the Brexit vote took place.

GBP/USD technical analysis

GBP/USD has rallied towards Monday's highs of 1.0931, taking out yesterday's highs of 1.0836 that could be retested in the coming hours that have a confluence of the 23.6% Fibonacci ratio. This level guards a deeper correction towards the 50% mean reversion area that has a confluence with the London structure around 1.0730. In such a move, the price will mitigate the price imbalances (greyed areas) of the strong bullish impulse. On the flip side, the 1.1050s and price imbalances can be targetted to the upside, completing a 61.8% Fibonacci retracement on the daily chart following the 50% mean reversion:

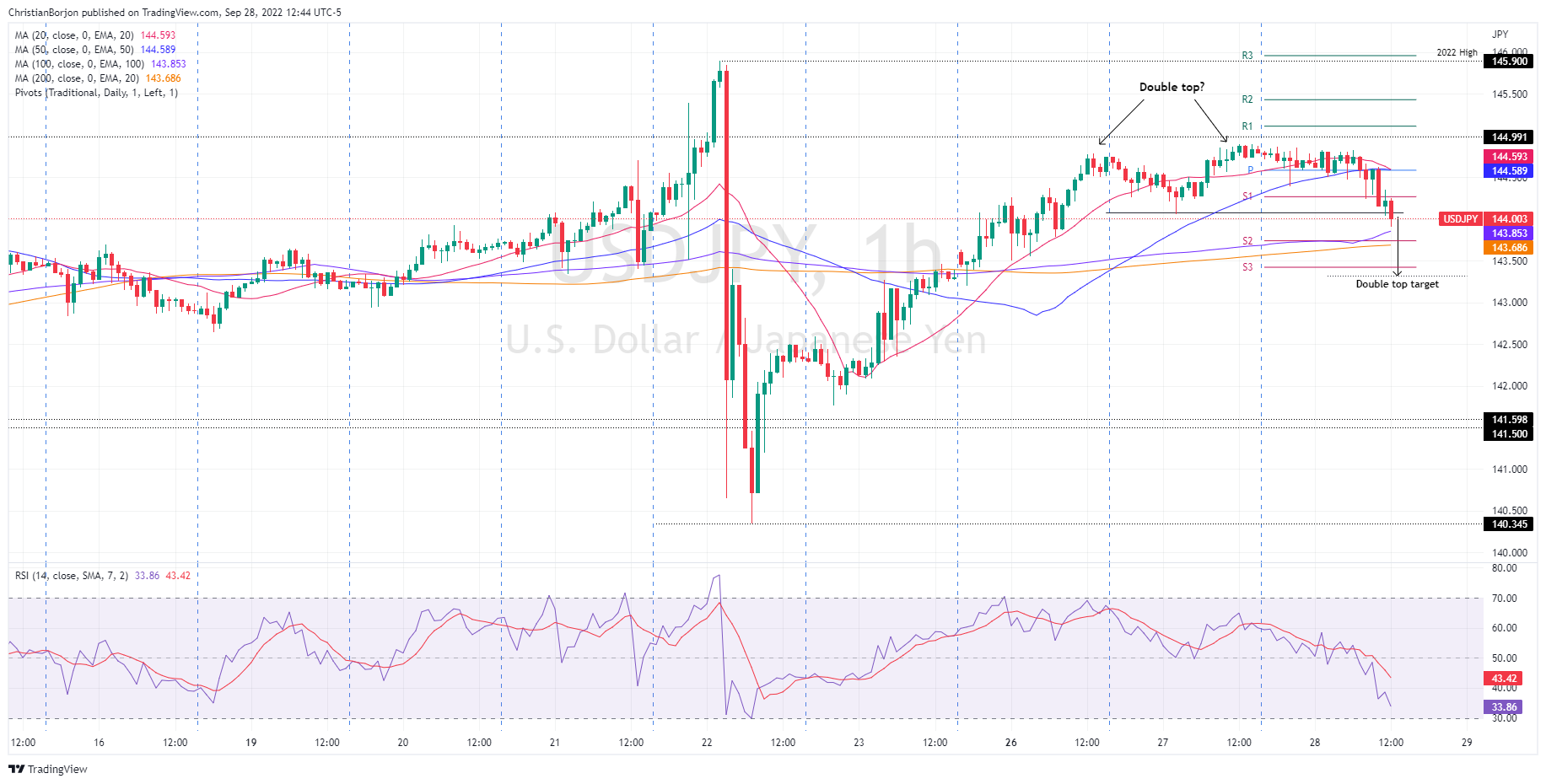

- USD/JPY stumbles below the 144.00 figure due to US bond yields dropping.

- A triple top in the USD/JPY one-hour chart exerted downward pressure on the major, which cleared the 20 and 50-EMAs.

- The USD/JPY triple top targets a fall to 143.30.

The USD/JPY drops from weekly highs around 144.90 due to improved market sentiment and also falling US bond yields, with the US 10-year T-note plunging 23 bps, from around 4.01% to 3.73%. At the time of writing, the USD/JPY is trading at 143.99, below its opening price by 0.57%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart depicts the pair as neutral-downward biased once Tuesday’s price action printed a doji. Worth noting that the Relative Strength Index (RSI) keeps pushing downwards while price action is below the September 27 daily low at 144.05, exacerbating a fall towards the 143.00 figure and beyond.

In yesterday’s article, “a double-top chart pattern is emerging at around the 144.60-75 area, which could pave the way for further losses. Nevertheless, the 20 and the 50-EMAs, meandering around 144.51 and 144.16, respectively, would be difficult to surpass.” It should be noted that the USD/JPY initially edged towards the weekly high, forming a “triple top” instead of a “double top,” and fell below the 20 and 50-day EMAs, accelerating the USD/JPY fall below the 144.00 mark.

Therefore, the USD/JPY first support would be 50-EMA at 143.85, immediately followed by the S2 daily pivot at 143.74, ahead of the 200-EMA at 143.68. A break below will expose the S3 pivot point at 143.42 and the triple top target at 143.30.

USD/JPY Key Technical Levels

- EUR/USD climbs sharply by more than 1% due to a soft US dollar.

- The energy crisis in the Euro area keeps the shared currency under pressure.

- EUR/USD Price Analysis: Stills downward biased but subject to a mean reversion move towards 0.9800.

The EUR/USD bounces from two-decade lows reached during the European session, gaining some 1.34% in the day, spurred by an improvement in market sentiment and a weaker US dollar, despite the Fed’s hawkish rhetoric, opening the door for aggressive tightening by the end of the year.

The shared currency began trading nearby the day’s lows, just below the 0.9600 figure, and dived towards a fresh two-decade low at around 0.9538 before rallying sharply towards the daily high at 0.9726 before settling around current spot prices. At the time of writing, the EUR/USD is trading at 0.9722.

The energy crisis keeps the Eurozone under pressure. On Tuesday, news that the Nord Stream pipelines 1 and 2 showed leaks sent energy prices higher. Some countries’ officials said it could be sabotage, and even Danish PM Frederiksen said it was “hard to imagine that these are coincidences.” German officials expressed concern that a “targeted attack” had caused a sudden pressure loss.

Given the backdrop, Norway was looking to increase security around its infrastructure, according to Bloomberg.

Earlier, the EU’s economic calendar featured the GfK Consumer confidence, which tumbled to -42.5 heading into October, from a -36.8 September reading, well below analysts’ estimates. According to the GfK institute, improvement in consumer morale is closely tied to lowering inflation.

In the meantime, ECB officials have expressed the need for another 75 bps rate hike at its October meeting, led by ECB member Kazimir, Rehn, and uber-hawk Austria’s central bank governor Robert Holzmann.

Aside from this, the US economic docket featured US Pending Home Sales for August, which fell by seven months in a row, decreasing by 2%, exceeding the 1.5% contraction estimated. “The direction of mortgage rates -- upward or downward -- is the prime mover for home buying, and decade-high rates have deeply cut into contract signings,” Lawrence Yun, NAR’s chief economist, said.

Meanwhile, the Fed parade continues, with Atlanta’s Fed Bostic saying that the lack of progress in inflation means that the US central bank needs to get into restrictive territory, between 4.25 and 4.50%.

EUR/USD Price Analysis: Technical outlook

Given the fundamental backdrop, the EUR/USD remains downward biased, though recent price action suggests an upward correction is likely. Cementing the case is the Relative Strength Index (RSI) exiting oversold conditions, aiming upwards, crossing above its 7-day RSI’s SMA. Therefore, a test of the 0.9800 figure is on the cards, but the overall bias favors the greenback.

EUR/USD Key Technical Levels

- US dollar tumbles as bonds rise sharply.

- BoE buys bonds, triggers global rebound in stocks and commodities.

- USD/CHF accelerates correction from three-month highs.

The USD/CHF dropped sharply from the highest level in three months, near the parity area and bottomed at 0.9743, a one-week low. The pair remains below 0.9800 with a negative tone as the US dollar slides across the board.

The greenback weakened amid a rally in Treasuries and in equity markets. The announcement of the Bank of England buying gilts triggered sharp moves and activated a recovery in bonds. The BoE said it purchased on Wednesday £1.025B of gilts. US yields pulled back sharply from multi-year highs. The US 10-year yield dropped from above 4.00% to 3.76%.

The Swiss franc also rose versus the euro and the pound favored by the moves in the bond market.

Double top at 0.9960 and collapses

The USD/CHF rose earlier to test Monday’s top at 0.9965 and failed to break it, and then retreat sharply breaking below 0.9860, confirming a double top formation. The target of the formation is around 0.9730, near Wednesday’s low at 0.9744. A few pips below, awaits the 20-day Simple Moving Average at 0.9725.

A daily close under the 20-day SMA could change the bearish short-term bias to neutral or bearish. The US dollar needs to recovers levels above 0.9880 in order to strengthen again.

Technical levels

- GBP/USD is registering minimal gains in a volatile trading session as the BoE stepped in to calm investors.

- Due to dysfunctional market conditions, the BoE’s QT program will be delayed until the end of October.

- GBP/USD Price Analysis: Range-bound around 1.0550-1.0750, with traders ready to step in an upwards/downwards break.

The GBP/USD recovered some ground as the North American session progressed, switching to positive territory amidst the Bank of England’s (BoE) efforts to cap the fixed income market, buying long mature bonds, as traders’ confidence in the new UK government seems to falter.

At the time of writing, the GBP/USD is trading at 1.0748, above its opening price amidst a volatile trading session, after hitting a daily high/low of 1.0837/1.0537 as concerns over the UK economy increased.

The Bank of England entered the bond market on Wednesday to calm the markets, committing to buy GBP 65 Billion of long-dated gilts following the new Primer Minister Liz Truss’s “mini-budget” release, plagued with substantial tax cuts, aimed to stimulate the economy. At the same time, the BoE postponed the beginning of the Quantitative Tightening program for the end of October.

The result of the BoE’s intervention helped to drop yields in the 30-year bond rate falling 100 bps or 1 one percent, its most significant drop dating back to 1992. At the same time, the GBP/USD has recovered some ground so far, though it would likely remain fragile unless the government calms investors.

Elsewhere, the International Monetary Fund (IMF) expressed that the new UK government plan would likely increase inequality in the UK and could undermine the current monetary policy. Due to large inflationary readings, the IMF expressed that “we do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy.”

Aside from this, the US economic calendar revealed US Pending Home Sales for August decreased by 2%, more than the expected 1.5% contraction, falling for the seventh straight month. “The direction of mortgage rates -- upward or downward -- is the prime mover for home buying, and decade-high rates have deeply cut into contract signings,” Lawrence Yun, NAR’s chief economist, said.

Also read: UK's Kwarteng won't resign, no reversal in policy – Sky News

GBP/USD Price Analysis: Technical outlook

The GBP/USD one-hour chart depicts the pair probed the R1 daily pivot around 1.0831, which is also the confluence of the 100-EMA, though the rally was quickly rejected, sending the exchange rate towards 1.0670. Of late, the Sterling reclaimed the daily pivot above the 1.0750 area, but solid resistance around the 1.0830-50 would be challenging to surpass for buyers aiming to reclaim the 200-EMA at around 1.1120. On the flip side, a break below the S2 daily pivot point at 1.0548 could pave the way for a YTD retest at 1.0356.

GBP/USD Key Technical Levels

Citing Treasury sources, Sky News Political Editor Beth Rigby tweeted out on Wednesday that British Finance Minister Kwai Kwarteng will not resign over the market reaction to the fiscal plan and added that there will no reversal of policy.

Meanwhile, ky News Economics Editor Ed Conway reported that the Bank of England announced the gilt market intervention amid growing fears overs insolvencies of pension funds by as early as this afternoon.

Market reaction

The GBP/USD pair showed no immediate reaction to this headline and was last seen posting small daily gains near 1.0750.

Gold stages a solid recovery from its lowest level since April 2020. Nonetheless, the upside potential for the yellow metal seems limited amid the prospects for a more aggressive policy tightening Federal Reserve, strategists at TD Securities report.

Risk of capitulation growing for gold

“Gold is seeing some relief as the UK's plan to buy long-end Gilts sees yields weaken, while the elevated rates volatility of late has also seen Fed pricing reduced to a terminal rate of 4.47% vs 4.7% just days ago. Nonetheless, we still see the risk of capitulation growing for the yellow metal.”

“Rates markets are pricing the potential for higher interest rates to persist for some time, and a steady stream of Fedspeak is likely to hammer this point home. In this sense, our analysis suggests gold prices could still have further to fall in the next stage of the hiking cycle. Indeed, the increase in inflation's persistence suggests that a restrictive regime may last longer than historical precedents, which argues for a more pronounced weakness.”

Analysts at Credit Suisse extend their bearishness across the cyclical G10 FX spectrum for Q4. They now target 0.62 in AUD/USD (prev. 0.6550), 1.42 in USD/CAD (prev. 1.30), 10.70 in EUR/NOK (prev. 10.00) and 11.30 in EUR/SEK (prev. 10.80).

Extension of the bearish trend in Q4

“Looking ahead into Q4, our core view is that the theme of FX underperformance vs the USD has space to play out further in the cyclical G10 space. As such, we now set our Q4 targets at 0.62 in AUD/USD, 1.42 in USD/CAD, 1.17 in AUD/NZD, 0.53 in NZD/USD, 10.70 in EUR/NOK and 11.30 in EUR/SEK.”

“Along with the theme of broad divergence vs the USD, we also anticipate realized volatility to stay elevated in Q4, which leads us to set wider trading range for these pairs. Specifically, we now see AUD/USD trading between 0.67 and 0.60 in Q4, we see USD/CAD in a 1.3250-1.43 range, AUD/NZD between 1.13 and 1.19, EUR/NOK in a 10.00-10.90 range and EUR/SEK between 10.65 and 11.40.”

Atlanta Fed President Raphael Bostic said on Wednesday that the baseline scenario right now includes a 75 basis points (bps) rate hike in November and a 50 bps increase in December, as reported by Reuters.

Additional takeaways

"Inflation is too high and not moving with enough speed back to target."

"Lack of progress means Fed will need to be moderately restrictive with rates in the 4.25% to 4.5% range by year's end."

"Supply-side improvements have not come in as fast as expected."

"Watching international events but feels like the US has considerable momentum, less susceptible to contagion."

"Some evidence of improvement on the demand side but it is preliminary."

"No evidence of dysfunction in Treasury market at this point."

"Beyond the housing market, signs of cooling demand include businesses reporting a steep decline in consumer discretionary purchases, easier hiring."

"Below trend growth, more rational labor markets, weak demand for a wider range of products would be signals of weakening inflation."

"Rents levelling off would be a really positive development for Fed."

"I do not believe a US recession is a foregone conclusion, expecting the unemployment rate to increase to only 4.1%."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.1% on the day at 114.07.

European Commission President Ursula von der Leyen announced on Wednesday that they will propose new import bans on Russian products that will deprive Russia of another €7 billion in revenue, as reported by Reuters.

Additional takeaways

"We do not accept sham referenda or any kind of annexation in Ukraine."

"New individuals and entities targeted in sanctions."

"Will further restrict trade."

"New export ban to hit additional aviation items, electronic components, specific chemical substances."

"EU will prohibit EU nationals from sitting on governing bodies of Russian state-owned companies."

"New package of sanctions will lay out the legal basis for the oil price cap."

"Will add new categories to list individuals if they circumvent our sanctions."

Market reaction

The EUR/USD pair retreated from session highs following these comments and was last seen posting small daily gains at 0.9600.

The GBP's recent decline has been dramatic. Wider deficits and bigger debt burdens need to be financed by foreign inflows – which may require further FX adjustment, according to economists at HSBC.

UK’s structural concerns dominate

“The UK’s public finance position (in terms of relative debt dynamics) is going to worsen materially in the year ahead. The GBP does not enjoy any special privilege in terms of financing this burden.”

“The UK’s core balance has seen a large decline from a 2% of GDP surplus to an 8% of GDP deficit in the last two years (Bloomberg, 30 June 2022). This requires greater short-term capital inflows just to keep the GBP on an even keel.”

“If foreign investors fear an unsustainable debt burden being ‘paid for’ through inflation or FX depreciation, they may not be as willing to finance it in the first place. This points to the potential for an ever weaker currency valuation.”

- Gold stages a solid recovery from a two-and-half-year low touched earlier this Wednesday.

- A sharp pullback in the US bond yields prompts some USD profit-taking and offers support.

- The prospects for more aggressive central banks, the risk-on mood could cap the XAU/USD.

Gold rebounds swiftly from its lowest level since April 2020 touched earlier this Wednesday and turns positive for the second successive day. The momentum lifts the XAU/USD to a fresh weekly high, around the $1,652 region during the early North American session.

The UK gilt yields retreat sharply after the Bank of England said it would buy bonds at whatever scale is necessary to restore orderly market conditions. The spillover effect triggers a steep decline in the US Treasury bond yields, which forces the US dollar to surrender its early gains to a new two-decade high. This turns out to be a key factor that prompts aggressive intraday short-covering around the dollar-denominated gold.

The upside potential, however, seems limited amid the prospects for a more aggressive policy tightening by global central banks, including the Federal Reserve. Investors seem convinced that the US central bank will continue to hike interest rates at a faster pace to combat stubbornly high inflation. This could act as a tailwind for the US bond yields and favours the USD bulls, which, in turn, should cap gains for the non-yielding gold.

Apart from this, a positive turnaround in the global risk sentiment - as depicted by a strong recovery in the equity markets - should keep a lid on the safe-haven XAU/USD. Even from a technical perspective, last week's breakdown below a short-term trading range supports prospects for an extension of a multi-month-old downtrend. This makes it prudent to wait for strong follow-through buying before confirming that gold has formed a near-term bottom.

Market participants now look forward to speeches by influential FOMC members, including Chair Jerome Powell. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to gold. Apart from this, traders will take cues from the broader risk sentiment to grab short-term opportunities around the XAU/USD. The fundamental backdrop, however, suggests that the intraday recovery runs the risk of fizzling out quickly.

Technical levels to watch

Economists at Rabobank see scope for further USD gains vs. the EUR and note that the EUR/USD pair could slide below the 0.95 level.

Concerns over growth to underpin the greenback

“Since the USD is a safe haven, concerns that the US could tip into recession next year are set to be USD supportive.”

“The USD is set to remain firm until the Fed are content that US inflation is falling and that inflation expectations are well anchored. That is likely to be some months away.”

“We remain USD bulls. We are targeting EUR/USD 0.9500 but see risk of break below this level.”

- USD/TRY finally trespasses the 18.50 region to a new record high.

- The rally in the dollar keeps the upside pressure well in place in the pair.

- Next on tap in Türkiye comes the Economic Confidence Index (Thursday).

Extra depreciation in the lira sustains another uptick in USD/TRY to the area above 18.50 on Wednesday.

USD/TRY now looks to CPI

USD/TRY extends the march north on the back of the unabated rally in the greenback, which in turn appears well underpinned by investors’ repricing of the Fed’s tightening plans.

Nothing scheduled data wise in Türkiye on Wednesday should leave the attention to Thursday’s release of the Economic Sentiment Index for the month of September ahead of the key publication of inflation figures gauged by the CPI on Monday.

On the latter, finmin N.Nebati said earlier in the week that inflation pressures will start to ease towards year-end. His comments fell in line with those from President Erdogan made in previous days, who said prices would drop to “reasonable” levels by February 2023.

It is worth recalling that Ankara’s hopes of taming inflation are based on an economic programme that prioritizes low interest rates to support exports, production and investment, all aimed at restoring the current account surplus.

What to look for around TRY

USD/TRY keeps its move upwards well and sound, surpassing the key 18.50 level to clinch another all-time peak on Wednesday.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: Economic Confidence Index (Thursday) – Trade Balance (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.73% at 18.5119 and faces the next hurdle at 18.5375 (all-time high September 28) followed by 19.00 (round level). On the downside, a break below 18.0197 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

S&P 500 could hold its 200-week average and 2022 lows temporarily. Big picture though, analysts at Credit Suisse look for a fall to 3235/3195.

S&P 500 to hold the 200-week average at 3590 at first

“With the key 200-week average at 3590, we see scope for a fresh hold here near-term. This though will be seen as a temporary hold and a clear and closing break below 3590 in due course should reinforce the bear market, with support then seen next at the 50% retracement of the 2020/2021 uptrend and Q1 2020 pre-pandemic high at 3505/3494. Whilst we would look for better support to show here, a break can clear the way for a fall to our core target of a cluster of supports at 3235/3195.”

“Near-term resistance moves to the price gap from the end of last week at 3727/58, with 3907 ideally capping further strength if seen.”

- A combination of factors assists AUD/USD to rebound from over a two-year low.

- Retreating US bond yields prompts some USD profit-taking and offers support.

- A positive turnaround in the risk sentiment also benefits the risk-sensitive aussie.

The AUD/USD pair stages a goodish recovery from its lowest level since April 2020 touched earlier this Wednesday, albeit lacks bullish conviction. The pair is currently placed around the 0.6425-0.6430 area and remains at the mercy of the US dollar price dynamics.

The spillover effect from the Bank of England's intervention to prop up the gilt market triggers a sharp fall in the US Treasury bond yields. This, along with a positive turnaround in the global risk sentiment, forces the safe-haven USD to trim a part of its intraday gains to a new 20-year peak and benefits the risk-sensitive aussie.

That said, growing worries about a deeper economic downturn and the risk of a further escalation in the Russia-Ukraine conflict should keep a lid on any optimistic move in the markets. Apart from this, bets that the Fed will stick to its aggressive monetary policy tightening path continues to act as a tailwind for the buck and caps the AUD/USD pair.

From a technical perspective, the downfall on the first day of the week confirmed a bearish breakdown below downward sloping channel support extending from May. The said support breakpoint, around the 0.6500 psychological mark, should now act as a pivotal point. Any subsequent move up might face hurdle near the weekly high, around the 0.6535-0.6540 area.

A sustained strength beyond the latter could trigger a short-covering move and allow the AUD/USD pair to aim back to reclaim the 0.6600 round-figure mark. Some follow-through buying will suggest that spot prices have formed a bottom and pave the way for an extension of the recovery towards the next relevant barrier near the 0.6655-0.6670 supply zone.

On the flip side, weakness back below the 0.6400 mark will negate prospects for any meaningful upside and make the AUD/USD pair vulnerable to retesting the YTD low, around the 0.6365 region. The downward trajectory could further get extended towards the 0.6300 round figure, though the oversold RSI (14) on the daily chart warrants caution for bearish traders.

AUD/USD daily chart

Key levels to watch

- US international trade deficit narrowed by $29 billion in August.

- US Dollar Index clings to small daily gains above 114.00.

The data published by the US Census Bureau showed on Wednesday that the US international trade deficit declined by $2.9 billion to $87.3 billion in August from $90.2 billion in July.

"Exports of goods for August were $179.8 billion, $1.7 billion less than July exports," the publication read. "Imports of goods for August were $267.1 billion, $4.6 billion less than July imports."

Moreover, the report revealed that the Wholesale Inventories rose by 1.3% in August, higher than the market expectation for an increase of 0.7%.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen posting small daily gains at 114.25.

The Bank of England has unveiled the details surrounding the recently announced bond-buying programme.

Key takeaways

"Will buy bonds with maturity over 20 years."

"Will buy up to 5 billion sterling of bonds per auction initially."

"Parameters will be kept under review."

"First auction will be on Wednesday between 1400-1430 GMT."

"Subsequent auctions will be each weekday from 1315 GMT to 1345 GMT until October 14."

"Will buy gilts through competitive reverse auction."

"Will set reserve prices for gilts."

Market reaction

GBP/USD recovered from session lows with the initial reaction and was last seen losing 0.85% on the day at 1.0645.

- GBP/USD witnessed an intraday turnaround and tumbles nearly 300 pips from the daily high.

- The reaction to the BoE announcement to buy government bonds fizzles out rather quickly.

- Concerns about rising UK public debt act as a headwind for sterling amid a looming recession.

- Aggressive Fed rate hike bets, the risk-off mood boosts the USD and contributes to the slide.

The GBP/USD pair plunges nearly 300 pips from the daily high and slips below mid-1.0500s heading into the North American session on Wednesday, though lacks follow-through. The pair is currently placed just below the 1.0600 round-figure mark, still down over 1.25% for the day.

The British pound did get a minor lift after the Bank of England announced that it will start buying long-dated UK government bonds to help restore orderly market conditions. The UK central bank's

intervention appeared to calm the market, sending the yield on the 30-year benchmark gilt down by more than 50 bps at one point. The initial market reaction, however, fades rather quickly, which is evident from the GBP/USD pair's dramatic intraday turnaround from the 1.0840 region.

The new UK government's historic tax cuts worth £45 billion, along with plans to subsidize energy bills, could stretch Britain's finances to their limits. Investors seem less confident about the government’s ability to manage the ballooning debt. Furthermore, the fiscal package threatens to derail the BoE's efforts to contain sky-high inflation and create additional economic headwinds. This, in turn, acts as a headwind for sterling and caps the upside for the GBP/USD pair.

The US dollar, on the other hand, hits a fresh two-decade high and continues to draw support from growing acceptance that the Fed will hike interest rates at a faster pace to tame inflation. The bets were reaffirmed by the overnight hawkish remarks by FOMC members. Apart from this, the prevalent risk-off environment - amid worries about a deeper global economic downturn - provides an additional lift to the safe-haven buck and contributes to the GBP/USD pair's sharp intraday downfall.

That said, a modest pullback in the US Treasury bond yields is holding back the USD bulls from placing fresh bets and lending some support to the GBP/USD pair. The fundamental backdrop, however, suggests that the path of least resistance for spot prices is to the downside. That said, sustained strength beyond the 1.0840 region, which now seems to have emerged as an immediate strong barrier, will negate the near-term bearish outlook and trigger an aggressive short-covering move.

Technical levels to watch

Sterling is underperforming again today despite plans for emergency Bank of England (BoE) bond purchases. Economists at BBH expect the GBP/USD pair to test the low of 1.0350.

BoE to carry out temporary purchases of long-dated gilts

“The BoE noted that to achieve its objective of maintaining financial stability, ‘the Bank will carry out temporary purchases of long-dated UK government bonds from 28 September. The purpose of these purchases will be to restore orderly market conditions.”

“Yet neither higher rates nor the emergency bond-buying plan have done anything for sterling. Market confidence, once lost, is always difficult to regain.”

“We look for an eventual test of this week’s new all-time low near 1.0350.”

On Thursday, September 22, the Turkish central bank surprised markets on the dovish side by delivering a second consecutive policy rate cut of 100 bps. Analysts at Credit Suisse stick to the view that the lira will continue to weaken gradually for now as the central bank prioritizes a smooth FX path.

Smooth path for USD/TRY is a priority

“Our base case for USD/TRY remains one where the pair continues to rise relatively orderly.”

“We expect a break above the 19.00 mark to occur in the first half of the Q4.”

“We assume that the central bank will use the latest increase in its gross reserves to meet the coming balance of payments financing needs as lira stability remains a priority.”

“Further ad hoc measures aiming to engineer a smooth path of depreciation will probably be used as a second line of defence if needed – such as a new deposit scheme that incentive locals to keep their cash in lira.”

The Bank of England (BoE) made a surprise intermeeting policy announcement to address a dysfunctional Gilt market. Some stability may emerge for GBP near-term, but likely temporary, in the opinion of economists at TD Securities.

Consolidation likely to be shallow and temporary

“The BoE announced the start of a temporary QE programme to target long-dated Gilts, and delayed the start of its Gilt sales programme to the end of October. The MPC will need to take this abrupt shift into account when it sets policy in November.”

“Stability around 1.07 for cable would be a win but ultimately tactical, with 1.0520/1.0350 keys supports below and 1.0931 key resistance above.”

- EUR/USD drops for the seventh straight session and tests 0.9535.

- Below the 2022 low at 0.9535 comes the 0.9500 region.

EUR/USD extends the leg lower to the proximity of 0.9530 earlier on Wednesday, an area last traded back in June 2002.

Odds for extra weakness in the European currency remain well on the table so far with the immediate target at the 2022 low at 0.9552 (September 26). A deeper drop could challenge the round level at 0.9500 ahead of the weekly low at 0.9411 (June 17 2002).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0667.

EUR/USD daily chart

Gold has confirmed a major “double top.” Strategists at Credit Suisse expect further weakness.

Important resistance seen at the 55-DMA

“Gold below $1,691/76 has confirmed a large ‘double top’, which turns the risks lower over at least the next 1-3 months, with the precious metal also now hovering clearly below both the 55-day and 200-day averages, currently seen at $1,726/1,827.”

“We note that the next support is seen at $1,618/16, then $1,560 and eventually $1,451/40.”

“Only a convincing break above the 55-day average at $1,726 would ease the pressure on the precious metal, with next resistance then seen at the even more important 200-day average, currently at $1,827.”

- DXY keeps the rally well in place and flirts with 114.80.

- Extra gains should meet the next hurdle at the 115.00 level.

DXY keeps pushing higher and clinches new 2-decade peaks in the 114.75/80 band on Wednesday.

The index seems to ignore the current extreme overbought levels and could extend the march north to, initially, the round level at 115.00 prior to the May 2002 top at 115.32.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line just above 107.00.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.30.

DXY daily chart

- EUR/JPY adds to Tuesday’s retracement and retests the 138.00 zone.

- Further decline could see the September low near 137.30 retested.

EUR/JPY extends the weekly corrective downside to the vicinity of 138.00 the figure on Wednesday.

Considering the ongoing price action, further weakness should not be ruled out, particularly against prospects for further weakness in the euro and the spectre of more FX intervention by the BoJ/MoF.

Against that, a breach of the September low at 137.36 (September 26) could put a visit to the 200-day SMA at 135.71 back on the radar in the short-term horizon.

EUR/JPY daily chart