- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- GBP/JPY registered hefty gains of 3.96% during the week.

- Long-term, the GBP/JPY is neutral upwards, though if it clears 162.57, that could open the door for further gains.

- Per the daily chart, if the GBP/JPY clears 162.25, the pair can rally towards 164.00.

The GBP/JPY advanced for the fourth straight day and reclaimed the 200-day EMA after hitting a daily low at around 159.43, though buyers stepped, sending the cross-currency pair towards its daily high of 162.17. At the time of writing, the GBP/JPY is trading at 161.54, above its opening price by 0.62%.

GBP/JPY Price Analysis: Technical outlook

From a weekly chart perspective, the GBP/JPY is neutral-to-upward biased after a volatile trading week that witnessed the pound sliding towards a YTD low of 148.63 before recovering close to 1200 pips. GBP/JPY traders should be aware of oscillators shifting to positive territory. Therefore, a re-test of the 20-week EMA, around 162.57, is on the cards.

The GBP/JPY daily chart shows that Friday’s rally was capped at a “packed” supply zone, with the 20, and the 50-day EMAs hoovering around 162.15-162.25, ahead of the 100-day EMA at 162.88. Worth noting that, albeit solid resistance lie above, the GBP/JPY pierced the 78.6% Fibonacci retracement at 161.05, opening the door for further upside.

Therefore, the GBP/JPY first resistance would be the 162.00 figure. Once cleared it would expose the aforementioned 162.15-162.25 area, followed by the 100-day EMA at 162.88 ahead of the 163.00 mark. A breach of the latter will expose the September 22 daily high at 164.43.

GBP/JPY Key Technical Levels

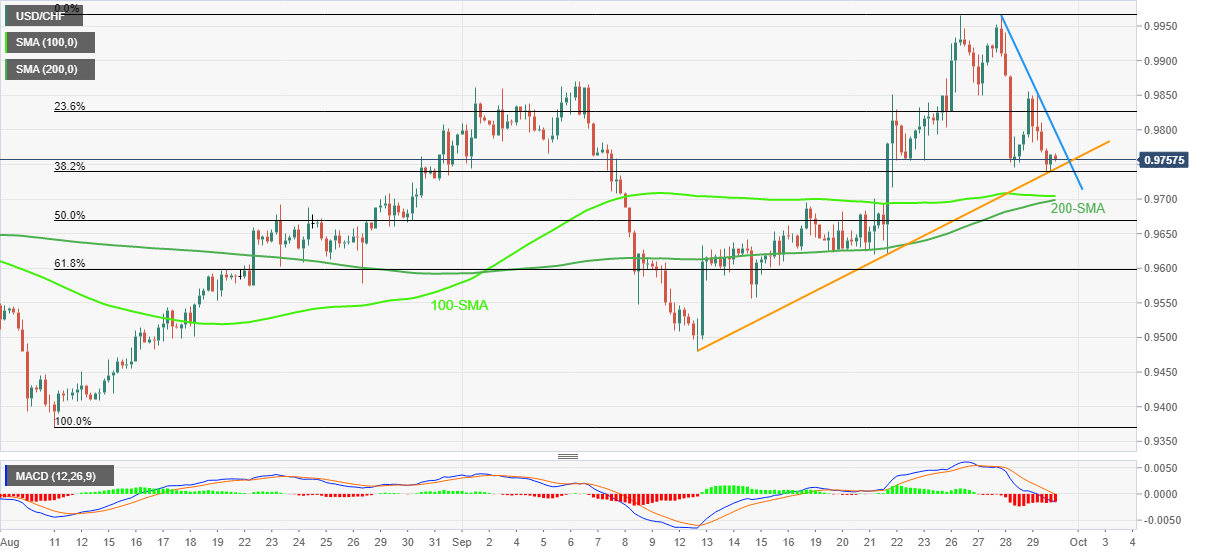

- USD/CHF prepares to finish the week with decent gains of 0.65%.

- The weekly chart depicts the pair as neutral-to-upward biased, further extending the uptrend but unable to crack 0.9900.

- The USD/CHF daily chart portrays the major as upward biased, and once it clears the 0.9886 mares, the 0.9900 figure would be next.

The USD/CHF finished the week with substantial gains on Friday, up by 1.20% in the day, due to Federal Reserve officials crossing newswires, reiterating that the Fed would not pivot in the near term and will keep rates elevated to temper inflation. At the time of writing, the USD/CHF is trading at 0.9870.

USD/CHF Price Analysis: Technical outlook

The USD/CHF weekly chart shows the majors closing just below the July 11 week high of 0.9886, keeping the neutral-to-upward bias unchanged. Traders should be aware that, albeit closing below the aforementioned July 11 high, the USD/CHF extended the successive series of higher highs/lows, opening the door for further gains. If the USD/CHF clears 0.9886, the 0.9900 figure is the next supply zone, followed by the parity.

When reviewing the USD/CHF daily chart, the bias is also upward biased, and price action escalating above the “neckline” of an inverted head-and-shoulders chart pattern could pave the way for further gains. Oscillators are in positive territory, with the RSi at 60.79 about to cross above its 7-day RSI SMA, which would mean that buyers are gathering momentum, opening the door for further gains.

Therefore, the USD/CHF first resistance would be the 0.9900 figure. Break above will expose the September 28 high at 0.9965, followed by parity, and then the YTD high at 1.0064.

USD/CHF Key Technical Levels

- GBP/USD is set to finish the week with gains close to 3%, despite the UK’s bond crisis.

- US PCE figures increased the likelihood of the Fed going 75 bps as Fed officials reinforced their hawkish rhetoric.

- The GBP/USD remains downward biased, and once it clears 1.1050, it could fall towards the 1.0800 mark.

The GBP/USD is recovering from earlier losses as the North American session progresses, even though the market sentiment shifted sour as Fed officials reinforced their “hawkish” message of keeping interest rates higher for longer. Therefore, the GBP/USD is trading at 1.1168, gaining 0.46%, after reaching a daily low of 1.1024.

US equities are trading in the red. On Friday, a slew of Fed officials led by the Fed’s Vice-Chair Lael Brainard crossed the news wires after critical US economic data was released.

The US Department of Commerce revealed that the Federal Reserve preferred inflation measure, the PCE, rose by 0.3% MoM in August, above estimates of 0.1%, while the annual reading decelerated from 6.3% to 6.2%. In the meantime, the so-called Core PCE, which strips volatile items like food and energy, exceeded estimates at 0.6% MoM, while the YoY rose by 4.9%, also above forecasts.

During the day, US central bank policymakers reiterated the need for higher interest rates and emphasized that it would remain more elevated as long as inflation remains above its 2% goal. The Fed’s Vice Chair, Lael Brainard, echoed the aforementioned and reiterated that “it would be premature to pivot” as it’s too soon to declare victory on inflation. Later her colleague Mary Daly of the San Francisco Fed continued with the same “hawkish” rhetoric while adding that the Fed is “resolute” in tackling inflation.

In the meantime, Richmond’s Fed President Thomas Barkin said that he’s “comfortable” with the pace of rates, adding that it’s uncertain how much the Fed will have to do to lower demand to reach its inflation target.

On the Uk side, the British pound has recovered from reaching 1.0300 levels on a YTD low last Friday, courtesy of new Primer Minister Liz Truss’ tax-cutting plans to stimulate the economy. That triggered one of the most volatile sessions, sending the GBP/USD tumbling from daily highs of 1.0900 to 37-year lows of 1.0356.

According to a Reuters poll, ”Nineteen of the 36 economists surveyed said the Bank would add 75 basis points in November while 13 said it would go for a super-sized 100 bps lift. Only three said it would add 50 bps as it did in its last two meetings while one opted for a mega 125 bps increase.”

GBP/USD Technical Analysis

The GBP/USD fluctuates around the 61.8% Fibonacci retracement, but some 40 pips shy, at 1.1170s, after piercing the 1.1200 figure in the overnight session. Nevertheless, sellers stepped in around the aforementioned 1.1203 daily high and sent the Sterling sliding, towards its daily low, before recovering some ground. It should be noted that the GBP/USD remains downward biased, and unless the exchange rate surpasses the 1.1740 area to shift to a neutral stance, risks are skewed to the downside.

Therefore, the GBP/USD first support would be the 50% Fibonacci retracement at 1.1047, followed by the 38.2% Fibonacci retracement at 1.0884, and then the 1.0800 mark.

GBP/USD Key Technical Levels

- EUR/USD trips down ahead of the end of the week, month and Q3.

- US Fed officials continued with their “restrictive policy” rhetoric, agreeing that further hikes are coming.

- US Core PCE surpassed analysts’ expectations, paving the way for another 75 bps Fed hike.

- EU’s inflation jumped above the 10% threshold, and money market futures expect another 0.75% increase.

The EUR/USD retraces from daily highs of around 0.9853 due to Fed officials expressing the necessity of higher rates for longer, as the US central bank battles elevated inflationary pressures above the 6% threshold, as shown by the Fed’s preferred gauge of inflation, on Friday. At the time of writing, the EUR/USD is trading at 0.9788, below its opening price by 0.29%.

A bunch of Fed policymakers crossing news wires, led by Vice-Chair Lael Brainard, expressed that the Fed needs to keep interest rates higher-for-longer, so the bank can attain its goal. She added that the Fed would not pull back prematurely while echoing other colleagues’ expression of not knowing where rates would peak. Later in the same tone, San Francisco’s Mary Daly commented that further hikes were coming and that the Fed is “resolute” in taming inflation.

At the time of typing, Richmond’s Fed President Thomas Barkin said that he’s “comfortable” with the pace of rates, adding that it’s uncertain how much the Fed will have to do to lower demand to reach its inflation target.

Aside from this, the US Commerce Department revealed that the US Federal Reserve’s favorite measure of inflation, known as the PCE, increased more than estimated in August, at a 0.3% MoM pace, 6.2% YoY, while core PCE, which excludes volatile items, accelerated at a 0.6% MoM, up 4.9% YoY.

Of late, the University of Michigan Consumer Confidence Final reading was 58.6, less than previously reported. In the same report, inflation expectations for one year jumped to 4.7% from 4.6%, while for five years, it decelerated to 2.7% from 2.8% previously.

Given US economic data revealed in the week, even though it’s not outstanding, showed resilience. With Fed policymaker’s hawkish rhetoric, the US central bank might be headed for the fourth-consecutive 75 bps rate hike in November.

Across the pond, the EU reported inflation data surpassing the 10% threshold, headwinds for the economy of the block. Analysts are expecting another large hike by the ECB and coupled with factors like the escalation of the Russia-Ukraine conflict, with Vladimir Putin’s signing of a decree to annex four Ukrainian regions, will exert extra pressure on the euro.

EUR/USD Key Technical Levels

Next week, the Reserve Bank of New Zealand (RBNZ) will have its monetary policy meeting. Analysts at Westpac expect the central bank to hike by 50 basis points next week, and to repeat in NOvember and February meetings.

Key Quotes:

“With inflation risks escalating and domestic activity remaining resilient, another 50 basis point rise in the cash rate is in the bag for next Wednesday’s review.”

“Next week’s decision won’t include a new set of forecasts, so any change in the projected path for the OCR will have to be conveyed verbally. We expect the RBNZ to repeat its recent language that it will continue to tighten monetary policy “at pace”, and may say that the Committee anticipates a higher OCR path than what was projected in the August statement.”

“Markets have priced in some possibility of a 75 basis point increase, in keeping with the supersized moves by other central banks like the US Federal Reserve in recent months. We can’t completely rule that out: with the OCR currently at 3%, our updated forecast implies another 150 basis points to go, and with no time to be complacent about it.”

“We’ve revised up our forecast of how high the Official Cash Rate will need to go in the Reserve Bank’s battle against inflation. We now expect a peak of 4.5%, compared to our previous forecast of 4%.”

Analysts at Danske Bank see the EUR/USD pair moving to the downside over the next months at a more gradual speed. They have a target of 0.95 in a twelve months perspective.

Key Quotes:

“Fundamentally, the US should continue to be a high(er) interest rate market and equities continue to appeal to foreign investors. This means the US is likely to attract capital, which helps the USD.”

“The large negative terms-of-trade shock to Europe vs US, a further cyclical weakening among trading partners, the coordinated tightening of global financial conditions, broadening USD strength and downside risk to the euro area makes us keep our focus on EUR/USD moving still lower (targeting 0.95) – a view not shared by the consensus.”

“The key risk to shift EUR/USD towards 1.15 is seeing global inflation pressures fade and industrial production increase. The upside risk also include a renewed focus on easing Chinese credit policy and a global capex uptick but neither appear to be materialising, at present.”

The Reserve Bank of Australia (RBA) will have its monetary policy meeting next week. Analysts at Wells Fargo look for the central bank to hike by 25 basis points at its October meeting and they expect two more 25 bps hikes in November and December.

Key Quotes:

“We expect the central bank to deliver a 25 bps hike, bringing the Cash Rate to 2.60%. In September, the RBA raised its Cash Rate by 50 bps to 2.35% and signaled that further rate hikes would be needed to bring inflation back to target, repeating that policy is not on a pre-set path. In our view, the announcement had a less hawkish tone than prior announcements. The RBA dropped previous wording that rate hikes were a further step in the normalization of monetary conditions, which could indicate that the central bank believes monetary policy is close to neutral, and any further moves could be seen as moving toward restrictive territory.”

“In another less hawkish comment, the RBA said the path for bringing inflation back to target while keeping the economy on an even keel is "narrow" and "clouded in uncertainty." This cautious tone leads us to believe the RBA will move in smaller magnitude rate hikes going forward. More specifically, after a 25 bps hike at its October meeting, we expect two more 25 bps hikes in November and December, bringing the Cash Rate to 3.10%.”

Next Friday, the key US official employment report is due. Analysts at Wells Fargo look for another solid increase in payrolls of 275K, a forecast above the 250K of market consensus.

Key Quotes:

“The U.S. labor market continues to be one of the strongest parts of the global economy. Nonfarm payrolls rose by 315K last month with industry gains once again widespread. This pace of job growth marks a downshift from the 402K average recorded in the prior three months, but it is nonetheless a robust gain in its own right. For context, nonfarm payrolls increased by an average of 167K per month in the 2010s.”

“The extremely tight labor market is keeping wage growth above what is consistent with the Fed's 2% inflation target. To achieve a soft landing, the Federal Reserve needs labor demand to cool enough that wages decelerate but not so much that the economy is tipped into a nasty recession.”

“In the near term, we look for another solid 275K increase in nonfarm payrolls in next week's employment report. Another sizable increase in labor force participation would be a welcome development for Fed officials as they attempt the high wire act of bringing labor supply and demand into a healthy balance.”

The pound remains a very vulnerable currency according to analysts from Rabobank. They have a 3-6 month target of the GBP/USD pair at 1.04 and they cannot rule out a move to parity dependent on the decisions taken by the UK government.

Key Quotes:

“The ferocity of the market reaction which greeted the Chancellor’s mini-budget on September 23 has triggered a broad range of criticisms. Among them is the accusation that the Chancellor and his advisers naively failed to read market conditions. UK economic fundamentals have been souring for some time and GBP has been performing poorly for a while, not just against the mighty USD but against the beleaguered EUR too.”

“The signals from the budget imply that the UK government has put a low priority on fiscal prudence clearly pushed the market’s patience over the edge. While GBP/USD has scrambled back above the 1.10 level following intervention from the Bank of England, we continue to view the pound as a very vulnerable currency.”

“While the BoE’s fire-fighting policies can hold the market fairly steady for now, without some change in the government’s fiscal position, the pound is on borrowed time. We have a 3-6 month target of GBP/USD1.04 and cannot rule out a move to parity dependent on the direction of UK fiscal policies.”

- Loonie suffers the worst monthly decline since March 2020 versus the US dollar.

- US dollar holds firm on Friday, despite lower US yields.

- USD/CAD remain bullish and overbought.

The USD/CAD is about to end Friday trading around 1.3750/60, with a weekly gain of 175 pips, on the back of risk aversion that boosted the greenback against most currencies.

The rally of the greenback lost momentum on Friday amid an extension of the retreat in US yields and also as stocks stabilized. But ongoing concerns about global growth and geopolitical tensions weigh on market sentiment. With the Federal Reserve well decided to continue tightening, the upside of the dollar continues.

During the last three weeks, USD/CAD rose almost 800 pips. After such a move, the question about how much can it keep rising in the short-term seem normal. These are volatile times and in those circumstances anything can happen.

Even as markets calm down, moves larger than average in USD/CAD are likely next week. Market participants will continue to look particularly at the bond market, stocks and the pound. Next Friday, Canada and the US will release the official employment reports.

From a technical perspective, USD/CAD is moving with a bullish bias. The only bearish sign is the extreme overbought readings. The next strong barrier is the 1.3900 area. During the last days, the pair has been moving sideways between 1.3750 and 1.3600, holding onto most of the recent gains.

Technical levels

- USD/JPY remains subdued around the 144.40-80 area as traders brace for the weekend.

- The interest rates differential, and central bank monetary policy divergence, are tailwinds for the USD/JPY.

The USD/JPY consolidates in the 144.00-145.00 area following last week’s Bank of Japan (BoJ) intervention, which had kept the major directionless, as traders remain on the sidelines. Despite the solid correlation with the US 10-year T-bond yield, piercing the 4% threshold during the week, the USD/JPY did not attempt to clear the 145.00 figure. At the time of writing, the USD/JPY is trading at 144.70, above its opening price.

USD/JPY Price Analysis: Technical outlook

Given the backdrop that, fundamentally speaking, the interest rates differential between both economies, the central bank divergency with the Bank of Japan’s dovish stance is a tailwind for the USD/JPY.

From a technical analysis perspective, the USD/JPY is range-bound, though it remains upward biased, based on where the daily moving averages (DMAs) are located. During the week, the USD/JPY trading range has been the 143.50-144.90 area, so any breaks below would likely send the major towards the 140.00 figure. Conversely, a re-test of the 145.00 is possible, but with the BoJ vigilance around it, traders are not challenging the central bank.

The USD/JPY one-hour chart depicted a triple-top formation that extended to a multi-top, with the major remaining trendless. On the downside, the confluence of the 20, 50, and 100-EMA at around 144.47/53 are support levels, which, once cleared, will send the USD/JPY towards the S1 daily pivot at 144.02, shy of the 200-EMA. A breach of the latter will expose the S2 pivot at 143.50, followed by the S3 daily pivot point at 143.27.

USD/JPY Key Technical Levels

The pound is about to end the week on a positive mood, after an extreme volatile week. The GBP/USD rebounded almost a thousand pips, rising back above 1.1000. Analysts at MUFG Bank point out that the downside in cable is not over yet and the recent bounce is an opportunity to short again.

Key Quotes:

“The GBP’s recent gains are built on shaky foundations. Risks remain titled to the downside for the cable.”

“Rebounded of course on the back of the intervention by the BoE to bring order to the Gilts market. But the speech by PM Liz Truss yesterday suggests the government will stick to its plans despite the financial market fallout and some opposition voiced by Conservative party backbenchers.”

“The reluctance of the BoE to hike inter-meeting continues to paint a picture of a central bank less enthusiastic for rushing to tighten monetary policy. This likely reflects genuine concerns over growth but if rates are being constrained from going higher due to weak fundamentals and given the close to record current account deficit, the likely channel of adjustment therefore will be GBP. Confidence remains fragile and based on the signs of limited desire for any U-turn, we suspect GBP/USD will begin to decline once more.”

European Central Bank (ECB) must continue to raise rates even though long-term inflation expectations remain anchored, ECB Governing Council member Ignazio Visco said on Friday, as reported by Reuters.

Key takeaways

"Approach to policy tightening will be defined meeting by meeting based on data."

"Euro area mid-term economic prospects important to establish more appropriate final level, proceeding gradually."

"No obvious reason at present to tie our hands with idea of exceptionally high rate increases."

"Rate hikes could have the biggest impact on inflation once economy has already significatly slowed down."

"Significant worsening of economic outlook is cause for concern."

"Impossible to fully offset impact of energy shock on wages, profits."

"Fiscal policy can redistribute impact, but increasing debt would unfairly shift burden on future generations."

Market reaction

These comments don't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, EUR/USD was down 0.2% on the day at 0.9795.

European Central Bank (ECB) Governing Council member Isabel Schnabel said on Friday that further increases in the ECB's key rates will be needed, as reported by Reuters.

"The risks of a wage-price spiral are contained, provided inflation expectations remain anchored," Schnabel further added. ECB policymaker explained that she continues to call for a “robust control” approach to monetary policy amid uncertainty about the persistency of inflation.

Market reaction

EUR/USD largely ignored these comments and was last seen trading at 0.9790, where it was down 0.23% on a daily basis.

- AUD/USD stumbles below 0.6500, set to finish the week at around the mid 0.6400-0.6500 range.

- US Core PCE exceeded estimations, opening the door for further Fed tightening.

- Fed’s Brainard and Daly reiterated that further hikes are expected and commented that the FFR peak is unknown today.

- Strong resistance around the 0.6468-87 area might cap any AUD/USD rallies.

The AUD/USD drops in the North American session as market sentiment improved, portrayed by US equities advancing, amid Fed officials crossing wires reiterating the need for higher rates after the Fed’s gauge of inflation for August surprisingly jumped.

At the time of writing, the AUD/USD is trading at 0.6445 below its opening price by 0.83%, after hitting a daily high of 0.6523 earlier during the European session.

The US Federal Reserve’s favorite measure of inflation, known as the PCE, jumped more than estimated, rising 0.3% MoM on August, 6.2% YoY, while core PCE, which strips volatile items, accelerated at a 0.6% MoM pace, up 4.9% YoY, the US Commerce Department said.

Therefore, given that unemployment claims for the last week edged lower and inflation keeps heading north, it cements the case for further tightening by the Federal Reserve. Meanwhile, money market futures see a 68% chance of the Fed hiking 75 bps at the November meeting, up from 61% before the US inflation report.

Later, the Fed’s Vice-Chair Lael Brainard said that the Fed needs to keep interest rates elevated for quite some time as part of the central bank’s effort to bring inflation towards the 2% goal. Brainard added that It’s too early to declare victory over inflation, said that they (Fed) would note pull back prematurely, and commented that the Federal funds rate (FFR) peak is not clear now.

Echoing her comments, the San Francisco Fed’s Mary Daly said that in inevitable to keep raising rates and emphasized that the Fed is “resolute” in its mission to bring inflation down.

Elsewhere, the University of Michigan Consumer Confidence Final reading came at 58.6, lower than previously reported. However, inflation expectations for one year jumped to 4.7% from 4.6%, while for five years, it decelerated to 2.7% from 2.8% previously.

On the Australian dollar side, China’s PMI was mixed, with the official report remaining in expansionary territory. Contrarily, the Caixin Manufacturing PMI missed expectations, in contractionary territory, blamed on Covid-19 containment measures.

AUD/USD Technical Analysis

The AUD/USD dropped from around weekly highs to around 0.6500, extending its losses, though it is headed to end the week near the mid-part of the weekly range. Nevertheless, it should be noted that the RSI is again pointing south, suggesting that sellers are gathering momentum. Short term, the AUD/USD one-hour scale might cap any rallies around the 0.6468-87 area, busy with the 100, 50, and 20-EMAs confluence around that region, further reinforced by the daily pivot point. Therefore, AUD/USD is bearish biased.

AUD/USD Key Technical Levels

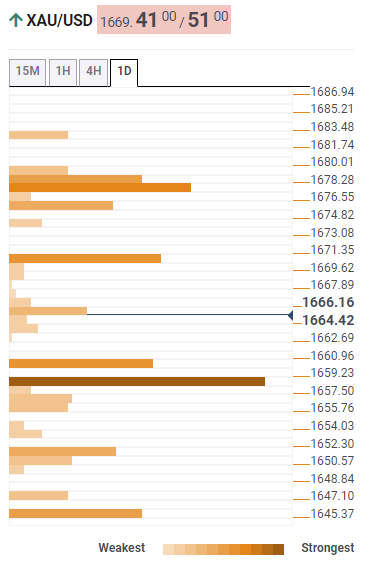

Gold prices remain in a strengthening downtrend, despite the recent respite afforded by the slump in USD. This trend is set to last, in the opinion of strategists at TD Securities.

The pain trade is still to the downside

“The risk of capitulation remains prevalent for the yellow metal moving into October, with strong data continuing to point to a more aggressive Fed rate path ahead.”

While rates markets are increasingly discounting a higher terminal, we find that gold prices aren't pricing in the next stage of the hiking cycle. Historically, gold prices tend to display a systematic and significant underperformance in the latter stage of hiking cycles, as rates enter into restrictive territory.”

“Considering the increase in inflation's persistence this cycle, a restrictive regime may last longer than historical precedents with the Fed likely to keep rates elevated for some time, even as recession risks rise, which argues for a prolonged period of pronounced weakness in precious metals.”

Recent indicators suggest a broad-based sharply deteriorating growth outlook. Therefore, economists at Danske Bank expect the EUR/NOK to edge higher over the next few months before easing back lower in 2023.

Q4 headwinds looming for NOK

“We still think EUR/NOK is heading higher over the coming 3-6M driven by a slowdown in growth, a European recession, volatile asset markets and further spread tightening in the short-end of rates curves.”

“For 2023, we still pencil in a NOK rebound – but timing is tricky. Until we see global central banks signal a shift of policy towards a more dovish direction we prefer to play the weak leg in NOK.”

“We forecast EUR/NOK at 10.60 in 3M and 9.80 in 12M.”

Economists at Wells Fargo expect weakness in the euro to persist. They believe that the EUR/USD could fall as low as 0.91 by the first quarter of the next year.

Confidence surveys are now clearly pointing to contraction

“High and rising inflation should continue to weigh on the consumer, and energy supply disruptions could more directly impact manufacturing activity.”

“Confidence surveys are now clearly pointing to contraction, especially for Germany– the region's largest economy.”

“While the European Central Bank should raise rates further, underwhelming Eurozone growth should see it lag well behind the Fed, another factor that could see the EUR/USD exchange rate reach 0.9100 by Q1-2023.”

- Gold struggles to preserve its intraday gains to a fresh weekly high touched this Friday.

- The prospects for aggressive policy tightening by the Fed continue to act as a headwind.

- The emergence of fresh USD buying exerts additional downward pressure on the metal.

Gold surrenders a major part of its intraday gains to a fresh weekly high touched earlier this Friday and retreats below the $1,665 level during the early North American session.

Despite growing recession fears and geopolitical risk, the safe-haven XAU/USD has been struggling to gain any meaningful traction amid the Federal Reserve’s commitment to getting inflation under control. Investors seem convinced that the US central bank will stick to its aggressive rate hiking cycle and have been pricing in the possibility of another supersized 75 bps rate hike in November. The bets were reaffirmed by Friday's release of the US Personal Consumption Expenditures (PCE) data, which continues to act as a headwind for the non-yielding gold.

Apart from this, resurgent US dollar demand turns out to be another factor exerting additional downward pressure on the dollar-denominated commodity. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, stages a solid recovery from the weekly low and for now, seems to have stalled this week's sharp pullback from a two-decade high. That said, the spill-over effect of the Bank of England's move to calm the markets drags the benchmark 10-year US Treasury note further away from a 12-year high set on Wednesday.

This, in turn, is seen holding back the USD bulls from placing aggressive bets. Apart from this, the prevalent risk-off environment offers some support to gold and should help limit the downside, at least for the time being. Nevertheless, the precious metal remains on track to register the sixth successive month of losses and the biggest quarterly fall since early 2021.

Technical levels to watch

"Additional rate hikes are the right thing to do but how high we will go depends on data," San Francisco Fed President Mary Daly said on Friday, as reported by Reuters.

Additional takeaways

"Our number one priority is to get inflation down."

"We are starting to see the benefits of rate increases with housing market cooling."

"We need to see a lot more relief on inflation."

"Rate increases we have taken and project will bring inflation down."

"The economy is not teetering on recession; it needs to slow."

"The economy is moving from frenetic to something more sustainable."

Market reaction

The greenback preserves its strength after these comments and the US Dollar Index was last seen rising 0.8% on the day at 112.65.

Economists at Danske Bank continue to expect EUR/SEK to move higher in the coming 12 months to 11.20 on the back of rising concerns for global recession and the expectation of a substantial drag on domestic demand and real asset prices.

Weakness in store

“We are negative on the krona as the SEK usually underperforms in a global, in particular European, recession risk-off environment and also since the Riksbank’s tightening of financial conditions will (is intended to) be a substantial drag on domestic demand and real asset prices.”

“We look for weaker SEK in the 6-12M perspective, forecasting 11.20 in 12M.”

- EUR/USD meets some selling pressure following tops near 0.9850.

- Extra weakness could open the door to the 2022 low at 0.9535.

EUR/USD partially fades the strong weekly bounce to multi-day highs near 0.9850 on Friday.

Odds for extra weakness in the European currency remain well in store so far with the immediate target at the 2022 low at 0.9535 (September 28). A deeper drop could challenge the round level at 0.9500 ahead of the weekly low at 0.9411 (June 17 2002).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0653.

EUR/USD daily chart

Federal Reserve Vice Chair Lael Brainard reiterated on Friday that the monetary policy will need to be restrictive for some time to have confidence inflation is moving back to 2%, as reported by Reuters.

Additional takeaways

"Fed is committed to avoiding pulling back prematurely."

"Fed recognizes risks may become more two-sided at some point."

"Proceeding deliberately and in data-dependent manner will let Fed learn how economy and inflation are adjusting to tightening and update its assessment of policy rate needed."

"Uncertainty is currently high, there are range of estimates on peak fed funds rate."

"Policymakers taking risk-management posture to guard against risks of longer-term inflation expectations moving above target."

"Entire real yield curve will soon move into positive territory."

"Will take time for tighter financial conditions to fully impact different sectors and bring inflation down."

"As monetary policy tightens globally, important to consider how cross-border spillovers might impact financial vulnerabilities."

"Risk of additional inflationary shocks cannot be ruled out."

"There is risk that supply disruptions could be prolonged by Ukraine war, China's covid lockdowns or weather disruptions."

"Spillovers of monetary policy surprises between tightly linked advanced economies could be half the size of own-country effect on local currency bond yields."

Market reaction

The US Dollar Index clings to strong daily gains above 112.50 following these comments.

- DXY reverses recent weakness and reclaims 112.00 and above.

- Further upside pressure keeps targeting the YTD high near 114.80.

DXY advances moderately beyond the 112.00 hurdle following two consecutive daily pullbacks at the end of the week.

The index retreated from recent extreme overbought levels and seems to have met some contention around 111.50 so far. The continuation of the ongoing rebound could see the 2022 peak at 114.77 (September 28) revisited.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 107.20.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.45.

DXY daily chart

- GBP/USD retreats over 100 pips from the weekly high touched earlier this Friday.

- The emergence of fresh USD buying turns out to be a key factor exerting pressure.

- The US PCE data does little to provide any impetus, though favours the USD bulls.

The GBP/USD pair retreats sharply from the 1.1235 region, or the weekly high touched this Friday and refreshes the daily low during the early North American session. Spot prices, however, recover a few pips and hold steady just above the 1.1050 area post-US macro data.

The US dollar makes a solid comeback on the last day of the week and stalls its recent sharp corrective decline from a two-decade high. This turns out to be a key factor behind the GBP/USD pair's intraday turnaround. The USD sticks to its intraday gains following the release of stronger-than-expected US Personal Consumption Expenditures (PCE) data.

The US Bureau of Economic Analysis reported that PCE Price Index eased to 6.2% YoY in August from 6.4% in the previous month, missing expectations for a rise to 6.6%. The disappointment from the headline print, however, was offset by the Core PCE Price Index (the Fed's preferred inflation gauge, which rose by 0.6% and to a 4.7% YoY rate during the reported month.

The data all but reaffirmed market bets that the Federal Reserve will stick to a more aggressive rate hiking cycle to curb persistently high inflation. This triggers an intraday recovery in the US Treasury bond yields, which, along with the prevalent risk-off environment, underpins the safe-haven greenback and continues to weigh on the GBP/USD pair.

That said, the lack of any follow-through selling warrants some caution before confirming that the strong recovery from an all-time low touched on Monday has run out of steam. Nevertheless, the GBP/USD pair, for now, seems to have snapped a three-day winning streak, though remains on track to register strong weekly gains.

Technical levels to watch

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, declined to 6.2% on a yearly basis in August from 6.4% in July, the US Bureau of Economic Analysis announced on Friday. This reading came in below the market expectation of 6.6%. On a monthly basis, the PCE Price Index rose 0.3% as expected.

The Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, edged higher to 4.9% on a yearly basis from 4.7% in July, compared to analysts' estimate of 4.7%, and was up 0.6% in August.

Market reaction

The US Dollar Index showed no immediate reaction to these data and was last seen rising 0.65% on the day at 112.50.

Gold price has climbed to $1,670 this morning. A breather could be followed by another correction if the USD appreciation continues after the US labour market report is published, economists at Commerzbank report.

Considerable selling of gold ETFs

“If the Purchasing Managers’ Index remains fairly stable as expected, markets will probably take a breather until the new US labour market data are published on Friday. If the figures cause the US dollar to appreciate further, metals prices are likely to continue falling.”

“ETF investors are continuing to withdraw from gold ETFs, which is exerting additional pressure on the gold price. The majority of speculative financial investors are now betting on a further price slide again.

“In July, when speculators were last positioned net short, a price recovery began shortly afterward. That said, for this to happen the USD would probably have to stop appreciating for the time being, as was the case a good two months ago.”

There is a clear debate still ongoing over whether the European Central Bank (ECB) rate hike should match the September move of 75 bps or be reduced to 50 bps. In the latter case, the euro could come under further downward pressure, economists at MUFG Bank report.

Higher risks of conditions worsening in Europe

“If financial market conditions continue to worsen, there is every chance the ECB could revert back to a 50 bps hike.”

“We certainly see far higher risks of conditions worsening and hence EUR/USD downside momentum will likely return quickly.”

- EUR/JPY comes under some pressure and fades two daily gains in a row.

- There is still room for a potential rebound to the 144.00 region.

EUR/JPY seems to have met decent resistance around daily highs near 142.30 at the end of the week.

The continuation of the bounce off last week’s lows remains on the table in the very near term. That said, the cross could therefore extend the bullish attempt to the weekly top at 144.04 (September 20), which is deemed as the last defense for a move to the 2022 peak at 145.63 (September 12).

In the meantime, while above the key 200-day SMA at 135.84, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

US PCE Price Index Overview

Friday's US economic docket highlights the release of the Personal Consumption Expenditure (PCE) Price Index for August, scheduled later during the early North American session at 12:30 GMT. The gauge is foreseen to rise by 0.3% during the reported month against the 0.1% fall recorded in July. The yearly rate is anticipated to have accelerated to 6.6% in August from 6.3% previous. Meanwhile, the Core PCE Price Index - the Fed's preferred inflation measure - likely edged up to a 4.7% YoY rate in August from the 4.6% in the previous month.

Analysts at Commerzbank offer a brief preview of the report and explain: “Excluding food and energy, the deflator probably increased by 0.4% MoM. This is a bit less than the recently released core CPI rate. This is because rents have a lower weight in the deflator than in the CPI basket (15% vs. 32.6%); rents rose quite strongly in the CPI in August. In addition, medical services have a much higher weighting in the deflator, and here the government health services included in the deflator, in contrast to the CPI, have a dampening effect on prices.”

How Could it Affect EUR/USD?

The markets started pricing in the possibility of another supersized 75 bps Fed rate hike move in November following the release of hotter-than-expected August US consumer inflation figures. A stronger-than-expected PCE report will reaffirm expectations and boost the US dollar. Conversely, a softer print could force the USD to prolong this week's sharp retracement slide from a two-decade high amid a further descent in the US Treasury bond yields. The immediate market reaction, however, is more likely to be short-lived, warranting some caution before placing aggressive directional bets around the EUR/USD pair.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview and outlines important technical levels to trade the EUR/USD pair: “The Relative Strength Index (RSI) indicator on the four-hour chart holds above 50 and the pair continues to trade above the 50-period SMA, confirming the bullish bias. On the upside, 0.9850 (Fibonacci 61.8% retracement of the latest downtrend) aligns as initial resistance. With a four-hour close above that level, the pair could target 0.9900 (psychological level, 100-period SMA) and 0.9950 (200-period SMA).”

“Supports are located at 0.9800 (Fibonacci 50% retracement), 0.9750 (Fibonacci 38.2% retracement, 50-period SMA) and 0.9700 (psychological level, 20-period SMA),” Eren adds further.

Key Notes

• US August PCE Inflation Preview: Will it trigger a dollar correction?

• Core PCE Preview: Forecasts from six major banks, strong price pressures

• EUR/USD Forecast: Quarter-end flows could boost the euro

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

The overheated US economy is gradually cooling off. Economists at ABN Amro expect the fed funds rate upper bound to hit 4.5% by December, but still expect rate cuts in 2023.

Fed funds rate to end 2023 at 3.5%

“The Fed tilted further in a hawkish direction at the September FOMC meeting, with the upper bound of the fed funds rate projected to reach 4.5% by the end of the year. The projections also showed policy staying restrictive throughout the forecast horizon, with no rate cuts seen until 2024, and policy still above neutral even in 2025. Despite this, we continue to think the Fed is likely to modestly cut rates in H2 2023.”

“We expect a steeper rise in unemployment than the FOMC projects, to c.5% by end-2023. Given the lags with which monetary policy affects the economy – the labour market being the last domino to fall – we think the Fed will be confident that the economy is cooling sufficiently by the middle of next year.”

“We continue to expect around 100 bps in rate cuts in H2 2023, although the higher level from which the Fed would be cutting means we are now likely to end 2023 at 3.5% in the upper bound of the fed funds rate, up from our previous 3% expectation.”

- USD/CAD gains traction for the second straight day, though lacks follow-through.

- Subdued crude oil prices undermine the loonie and act as a tailwind for the pair.

- Retreating US bond yields, a positive risk tone weighs on the USD and caps gains.

The USD/CAD pair attracts some dip-buying in the vicinity of the mid-1.3600s and sticks to modest intraday gains through the first half of the European session. The pair maintains its bid tone for the second successive day and is currently trading just above the 1.3700 mark, well within this week's broader trading band.

A combination of factors drags the US dollar to a one-week low, which, in turn, acts as a headwind for the USD/CAD pair. The spill-over effect of the UK central bank's move to calm the markets drags the benchmark 10-year US Treasury note away from a 12-year high touched on Wednesday. Apart from this, a goodish recovery in the global risk sentiment further weighs on the safe-haven greenback.

That said, subdued price action around crude oil prices undermines the commodity-linked loonie and continues to lend some support to the USD/CAD pair, at least for the time being. Worries that a deeper global economic downturn will dent fuel demand offset global supply concerns and fail to assist the black liquid to capitalize on this week's goodish recovery from the lowest level since January 2022.

Furthermore, firming expectations for a more aggressive policy tightening by the Fed should limit the fall in the US bond yields and favours the USD bulls. Investors seem convinced that the US central bank will hike interest rates at a faster pace to curb inflation. Hence, the focus remains on the release of the US Personal Consumption Expenditures (PCE) - the Fed's preferred inflation gauge.

Friday's US economic docket also features the release of the Chicago PMI and the revised Michigan Consumer Sentiment Index. The data, along with the US bond yields and the broader risk sentiment, will influence the USD and provide a fresh impetus to the USD/CAD pair. Traders will further take cues from oil price dynamics to grab short-term opportunities on the last day of the week.

Technical levels to watch

EUR/GBP briefly touched a high around the EUR/GBP 0.9260 level on Monday, September 26 before pulling back below 0.90. Economists at Rabobank forecast the pair at 0.92 by mid-2023.

GBP remains a very vulnerable currency

“The UK is burdened with a record current account deficit/GDP ratio meaning that GBP is vulnerable to a downward adjustment if foreign investors are reluctant to fund the deficit.”

“UK’s fundamentals are currently characterised by high levels of debt and debt issuance, low growth/recession, high inflation and weak productivity. It is hardly an attractive backdrop for investors, which explains why GBP remains a very vulnerable currency.”

“We now see EUR/GBP trending higher to 0.92 by the middle of next year.”

EUR/USD has gone into a consolidation phase above 0.9800. Quarter-end flows could help the pair extend its rebound ahead of the weekend, FXStreet’s Eren Sengezer reports.

0.9850 aligns as initial resistance

“In case the risk rally stays intact, the dollar is likely to continue to lose interest ahead of the weekend. Profit-taking on the last trading day of the third quarter could also help EUR/USD preserve its bullish momentum.”

“On the upside, 0.9850 (Fibonacci 61.8% retracement of the latest downtrend) aligns as initial resistance. With a four-hour close above that level, the pair could target 0.9900 (psychological level, 100-period SMA) and 0.9950 (200-period SMA).”

“Supports are located at 0.9800 (Fibonacci 50% retracement), 0.9750 (Fibonacci 38.2% retracement, 50-period SMA) and 0.9700 (psychological level, 20-period SMA).”

- EUR/GBP cross extends its recent corrective slide from a two-year high for the fourth straight day.

- The BoE’s intervention, an upward revision of the UK GDP underpins sterling and exerts pressure.

- Weaker USD, hotter-than-expected Eurozone CPI offer support to the euro and helps limit losses.

The EUR/GBP cross extends this week's sharp retracement slide from a two-year peak and remains under some selling pressure for the fourth straight day on Friday. The steady downfall remains uninterrupted through the first half of the European session and drags spot prices to mid-0.8700s or a fresh weekly low.

The British pound's relative outperformance comes on the back of the Bank of England's intervention in the UK debt market for the second day on Thursday. This, along with an upward revision of the UK Q2 GDP print, further underpins sterling on Friday and continues exerting downward pressure on the EUR/GBP cross. In fact, the UK Office for National Statistics reported this Friday that the economy expanded by 0.2% during the second quarter against a modest 0.1% contraction estimate, easing recession fears.

That said, a combination of factors assists the EUR/GBP cross to find some support at lower levels. Investors remain worried that the new UK government's historic tax cuts could stretch Britain's finances to their limits. This, in turn, threatens to derail the BoE's efforts to contain inflation and create additional economic headwinds. The shared currency, on the other hand, draws support from the weaker US dollar and hotter-than-expected Eurozone CPI, which, in turn, limits the downside for the cross.

According to the official data released by Eurostat on Friday, inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), climbed to 10% on a yearly basis in September. This marks a notable rise from 9.1% in August and was also higher than market expectations for a reading of 9.7%. This reaffirms markets bets for another jumbo interest rate hike by the European Central Bank and could lend some support to the EUR/GBP cross, warranting caution for aggressive bearish traders.

Technical levels to watch

Norges Bank just announced that they will raise their NOK selling to 4.3bn from 3.5bn NOK per day. This change points toward an even weaker krone ahead, economists at Nordea report.

Norges Bank steps up the ante

“Norges Bank just announced that they will sell 4.3bn NOK/day in October from 3.5bn today. The higher NOK selling from Norges Bank combined with lower NOK purchases from oil companies and continued uncertainty in financial markets means that the NOK could weaken even further towards year-end, with EUR/NOK up to 11 and USD/NOK around 11.50.”

“For the NOK to fare better than we expect, we need risk sentiment to improve markedly in the coming months, which is unlikely given central bank's fight against inflation.”

FX option expiries for September 30 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

EUR/USD: 0.9690-00 (1.3BLN), 0.9750 (650M), 0.9795-00 (1.65BLN), 0.9850 (644M), 0.9900 (1.1BLN), 0.9930-35 (403M), 0.9950 (256M), 1.0020 (418M)

USD/JPY: 143.00 (509M), 144.00 (675M), 144.95-00 (1.13BLN), 146.00 (361M)

EUR/JPY: 141.00 (300M). USD/CHF: 0.9780 (214M)

EUR/CHF: 0.9500 (306M), 0.9600 (931M), 0.9650 (450M), 0.9700 (361M)

GBP/USD: 1.1050 (518M), 1.1200 (521M), 1.1350 (210M)

EUR/GBP: 0.8800 (530M), 0.8850 (303M), 0.8875 (411M)

AUD/USD: 0.6500 (310M), 0.6575 (325M)

USD/CAD: 1.3500 (515M), 1.3550 (270M), 1.3700 (270M), 1.3725 (250M), 1.3850 (250M)

GBP/USD has gathered further bullish momentum. Pound bulls eye 1.1300 next, FXSTreet’s Eren Sengezer reports.

Buyers retain control of cable’s action

“On the upside, 1.1300 (Fibonacci 61.8% retracement of the latest downtrend, 100-period SMA) aligns as the next target. In case buyers flip that level into support, the pair could continue to push higher toward 1.1400 (static level) and 1.1500 (200-period SMA).”

“First support is located at 1.1130 (Fibonacci 50% retracement) before 1.1100 (psychological level) and 1.1000 (psychological level, 50-period SMA, Fibonacci 38.2% retracement).”

- AUD/USD reverses an intraday dip on Friday and climbs back closer to the weekly high.

- Retreating US bond yields, a positive risk tone undermines the USD and offers support.

- Recession fears, aggressive Fed rate hike bets to limit the USD losses and cap the major.

The AUD/USD pair attracts some dip-buying around the 0.6475 area on Friday and climbs to a fresh daily high during the early European session. The pair is now placed above the 0.6500 psychological mark, though lacks bullish conviction.

A combination of factors drags the US dollar lower for the third successive day and offers some support to the AUD/USD pair. The spill-over effect of the UK central bank's move to calm the markets drags the benchmark 10-year US Treasury not away from a 12-year high touched earlier this week. Apart from this, a goodish recovery in the global risk sentiment weighs on the safe-haven greenback and drives some flows towards the perceived riskier aussie.

Despite the supporting factors, the AUD/USD pair struggles to gain meaningful traction. Mixed business activity data from China adds to worries about a deeper global economic downturn and should keep a lid on any optimism in the markets. Furthermore, hawkish Fed expectations could revive the USD demand and cap the AUD/USD pair, warranting caution before positioning for an extension of this week's bounce from the lowest level since April 2020.

Investors seem convinced that the US central bank will continue to hike interest rates at a faster pace to curb persistently high inflation. Hence, the focus remains glued to the release of the US Personal Consumption Expenditures (PCE) - the Fed's preferred inflation gauge. The data, along with the US bond yields and the broader risk sentiment, will influence the USD and provide a fresh impetus to the AUD/USD pair later during the early North American session.

Friday's US economic docket also features the release of the Chicago PMI and the revised Michigan Consumer Sentiment Index. This could further allow traders to grab short-term opportunities around the AUD/USD pair on the last day of the week.

Technical levels to watch

Inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), climbed to 10% on a yearly basis in September from 9.1% in August, Eurostat announced on Friday. This reading came in higher than the market expectation of 9.7%.

Developing story...

The European Central Bank (ECB) raised its key policy rates by 75 bps at its September meeting. In their revised base case, economists at ABN Amro see another 75 bps hike in October, followed by a 50 bps step in December.

Risks to the new forecast are balanced

“We now expect the ECB to raise its deposit rate to 2% most likely by end-2022. In our revised base case, we see another 75 bps hike in October, followed by a 50 bps step in December. The policy rate then settles at 2% through 2023.”

“The most likely alternative to this base, is three steps of 50 bps, with the terminal rate being reached in February 2023.”

“We had previously signalled a peak rate of 1.5%. We saw the risks to our previous peak rate call as being skewed to the upside, but we see the risks to our new forecast as being balanced.”

FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang now see USD/CNH navigating within the 7.0500-7.2200 range in the next few weeks.

Key Quotes

24-hour view: “We stated yesterday that ‘further volatility is not ruled out but USD is likely to trade within a narrower range of 7.1450/7.2250’. Our view was incorrect as USD rose to 7.2144 before staging a sharp and swift sell-off (low has been 7.0890). The sharp and rapid decline appears to be overdone and USD is unlikely to weaken much further. For today, USD is more likely to trade between 7.0800 and 7.1500.”

Next 1-3 weeks: “We have expected USD to strengthen for more than 2 weeks now. After USD surged to 7.2668 and retreated, we indicated yesterday (29 Sep, spot at 7.1800) that the odds of USD rising to 7.3000 have diminished. However, we did not expect the subsequent sharp sell-off as USD plunged to a low of 7.0890. The breach of our ‘strong support’ at 7.1400 indicates that the USD rally from more than 2 weeks ago has topped for now. The current movement is likely the early stages of a consolidation phase. In view of the recent high volatility, USD could trade within a broad range of 7.0500/7.2200 for a period of time.”

- EUR/USD extends the weekly recovery and revisits the 0.9850 region.

- Germany labour market report surprised to the upside in September.

- EMU Flash Inflation Rate next of importance in the euro docket.

The optimism around the European currency remains well in place for another session and this time lifts EUR/USD to fresh tops in the mid-0.9800s on Friday.

EUR/USD focuses on EMU, US data

EUR/USD advances for the third session in a row on Friday and extends further the bounce off the recent 20-year lows in the proximity of 0.9530 (September 28), always against the backdrop of the renewed and strong corrective decline in the dollar.

Indeed, the dollar comes under extra pressure and keeps correcting lower amidst the ongoing technical retracement and intense improvement in the risk complex, which eventually lends extra legs to the pair.

Moving forward, advanced inflation figures in the euro area are expected to take centre stage later in the session. Earlier in the day, the German Unemployment Rate stayted unchanged at 5.5% in September and the Unemployment Change rose by 14K persons in the same period.

Across the pond, the August’s PCE will be in the centre of the debate seconded by Personal Income/Spending along with the final print of the Consumer Sentiment for the current month.

Additionally, FOMC’s T.Barkin, L.Brainard, L.Mester, J.Williams and M.Bowman will speak later in the NA session.

What to look for around EUR

EUR/USD’s upside momentum appears unabated for the time being and already breaks above the key 0.9800 hurdle.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The latter has been exacerbated further following the latest rate hike by the Fed and the persevering hawkish message from Powell and the rest of his rate-setters peers.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: EU Emergency Energy Meeting, EMU Flash Inflation Rate, Germany Unemployment Change/Unemployment Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian post-elections developments. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.21% at 0.9836 and a break above 0.9853 (weekly high September 30) would target 1.0050 (weekly high September 20) en route to 1.0197 (monthly high September 12). On the flip side, the next support emerges at 0.9535 (2022 low September 28) ahead of 0.9411 (weekly low June 17 2002) and finally 0.9386 (weekly low June 10 2002).

The greenback came under heavy selling pressure and the US Dollar Index (DXY) corrected more deeply than analysts at ING thought. But any further losses as seen as corrective.

Quarter-end flows and position adjustments

“While the macro risks remain skewed for a stronger dollar, over the short term the dollar does look to be getting caught up with quarter-end re-balancing flows and the de-leveraging of tightly held positions – including long dollars. Our fear is that some disorderly moves in equity markets could prompt a little more of this position adjustment – even though the macro-driven dollar bull trend remains firmly in place.”

“Any further losses should be corrective (outside risk to 110?) and we would still favour 120 later in the year as the Fed tightens conditions still further.”

- GBP/USD gains traction for the fourth successive day and climbs to a one-week high on Friday.

- The BoE’s intervention in the markets, an upward revision of the UK GDP underpins sterling.

- Retreating US bond yields, a positive risk tone weighs on the USD and offers additional support.

The GBP/USD pair reverses an intraday dip to the 1.1070 area and climbs back closer to a one-week high touched earlier this Friday. The pair sticks to its positive bias for the fourth successive day, with bulls now awaiting a sustained move beyond the 1.1200 round-figure mark.

The Bank of England's intervention for the second day on Thursday restores stability in the UK debt market. Furthermore, an upward revision of the UK GDP print underpins the British pound and acts as a tailwind for the GBP/USD pair. The UK Office for National Statistics reported this Friday that the economy expanded by 0.2% during the second quarter against a modest 0.1% contraction estimates and eased recession fears.

The US dollar, on the other hand, languished near the weekly low and turns out to be another factor offering support to the GBP/USD pair. The spill-over effect of the UK central bank's move to calm the markets drags the benchmark 10-year US Treasury not away from a 12-year high touched earlier this week. Apart from this, a goodish recovery in the global risk sentiment is seen weighing on the safe-haven greenback.

With the latest leg up, the GBP/USD pair has now rallied over 850 pips from an all-time low set on Monday. It, however, remains to be seen if bulls can capitalize on the move amid worries that the new UK government's historic tax cuts could stretch Britain's finances to their limits. Furthermore, the fiscal package threatens to derail the BoE's efforts to contain inflation and create additional economic headwinds.

Nevertheless, the GBP/USD pair remains on track to snap a two-week losing streak. Traders now look forward to the US Personal Consumption Expenditures (PCE) - the Fed's preferred inflation gauge. The US economic docket also features the release of the Chicago PMI and the revised Michigan Consumer Sentiment Index, which might influence the USD and provide some impetus to the GBP/USD pair later during the early North American session.

Technical levels to watch

Sustainable gains in USD/JPY need to leave behind the 145.00 yardstick in the next weeks, comment FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the current price movement is likely part of a consolidation phase’ and we expected USD to ‘trade sideways between 143.70 and 144.70’. Our view of sideway-trading was not wrong even though USD traded within a narrower range than expected (144.04/144.79). Further sideway-trading appears likely, expected to be within a range of 144.00 and 145.00.”

Next 1-3 weeks: “Two days ago (27 Sep, spot at 144.30), we noted that upward momentum is building but USD has to close above 145.00 before a sustained advance is likely. While USD traded in a quiet manner the past couple of days, the underlying tone still appears to be firmed. That said, unless USD breaks above 145.00 within these 1 to 2 days, the build-up in momentum would fizzed out. Overall, only a break of 143.40 (no change in ‘strong support’ level from yesterday) would indicate that the risk of USD closing above 145.00 has subsided.”

Economists at Bank of America Global Research make a round of G10 FX revisions into Q4. The EUR/USD and GBP/USD are now forecast at 0.95 and 1.00 by year-end, respectively.

USD to stay at multi-decade highs for the near and medium-term

“We adjust our G10 FX forecasts, led by shifting lower our EUR/USD profile with a 0.95 target for the end of the year.”

“We now look for GBP/USD to move towards parity at the end of the year.”

“Even though we do not look for a new multi-year secular trend to the upside, the dollar is likely to stay at multi-decade highs for the near and medium-term, as per our forecasts."

- Unemployment Rate in Germany held steady at 5.5% in September.

- EUR/USD trades in positive territory above 0.9800 after the data.

The data published by Destatis showed on Friday that the Unemployment Rate in Germany stayed unchanged at 5.5% in September as expected.

Further details of the report revealed that the Unemployment Change was up 14K in the same period, down from 28K in August and below the market consensus of 20K.

Market reaction

The EUR/USD pair preserves its bullish momentum after these data and was last seen trading at 0.9843, where it was up 0.3% on a daily basis.

- The index reclaims some ground lost around 112.00 on Friday.

- US yields come under pressure and reverse Thursday’s advance.

- US inflation figures tracked by the PCE comes next in the docket.

The USD Index (DXY), which measures the greenback vs. a basket of its main rival currencies, looks to leave behind recent weakness and reclaims the 112.00 neighbourhood at the end of the week.

USD Index now looks to data

Following two consecutive sessions with strong losses, the index now manages to regain some buying interest and flirt with the 112.00 zone on Friday amidst a corrective decline in US yields and some loss of momentum in the risk complex.

Lower US yields across the curve also accompany the daily rebound in the greenback, while the hawkish rhetoric around the ongoing normalization process by the Federal Reserve remain unchanged, although it appears more and more priced in by market participants.

In the US data space, all the attention is expected to be on the inflation figures gauged by the PCE, seconded by Personal Income/Spending and the final Michigan Consumer Sentiment for the month of September.

In addition, Richmond Fed T.Barkin (2024 voter, centrist), Vice Chair L.Brainard (permanent voter, dove), Cleveland Fed L.Mester (voter, hawk), NY Fed J.Williams (permanent voter, centrist) and FOMC M.Bowman (permanent voter, centrist) are all due to speak later in the session.

What to look for around USD

Bears appear in control of the sentiment surrounding the dollar so far this week, dragging the index back below the 112.00 mark, where some contention seems to have emerged.

Propping up the dollar’s underlying positive stance appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: PCE/Core PCE, Personal Income/Spending. Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is advancing 0.06% at 111.82 and a breakout of 114.76 (2022 high September 28) would expose 115.00 (round level) and then 115.32 (May 2002 high). On the downside, the next contention aligns at 109.35 (weekly low September 20) seconded by 107.68 (monthly low September 13) and finally 107.58 (weekly low August 26).

One week realised GBP/USD volatility is now 34%. Therefore, the GBP/USD could slump to the 1.07/08 area later in the day, economists at ING report.

400 pip ranges now the norm for cable

“Today the focus is on the PM and Chancellor meeting the Office for Budget Responsibility (OBR) to discuss spending plans. While the involvement of the OBR will be welcomed by the markets, the government still has to find a way to balance the books and avoid a very negative assessment from the rating agencies – two of which provide UK sovereign rating outlooks on 21 October.”

“A Conservative party conference this weekend suggests it is far too early for a U-turn on fiscal policy and, combined with a very difficult external environment, sterling should stay vulnerable.”

“4 big figure ranges could easily put cable back at 1.07/1.08 later today!”

- USD/JPY continues with its struggle to gain any meaningful traction on the last day of the week.

- Retreating US bond yields drags the USD to the weekly low and acts as a headwind for the pair.

- The Fed-BoJ policy divergence continues to lend support to the major and favours bullish traders.

The USD/JPY pair prolongs its consolidative price move on Friday and remains confined in a four-day-old trading range through the early European session. The pair is currently placed just below mid-144.00s, down less than 0.10% for the day, and is influenced by a combination of diverging forces.

The US dollar surrenders its modest intraday gains and languishes near the weekly low amid a further pullback in the US Treasury bond yields, which, in turn, acts as a headwind for the USD/JPY pair. The UK debt market seems to have stabilized following the Bank of England's intervention for the second day on Thursday. The spillover effect drags the benchmark 10-year US Treasury note away from a 12-year high set earlier this week and weighs on the greenback.

The Japanese yen, on the other hand, draws support from mostly upbeat macro releases. In fact, official data showed that Industrial Production rose 2.7% in August from the prior month, surpassing estimates. A separate reading revealed that Japanese retail sales grew more than anticipated during the reported month. Furthermore, the unemployment in Japan edged down to 2.5% from the 2.6% previous, matching expectations and underpinning the domestic currency.

That said, a modest recovery in the risk sentiment - as depicted by a turnaround in the US equity futures - acts as a headwind for the safe-haven JPY. This, along with a big divergence in the monetary policy stance adopted by the Bank of Japan (dovish) and other major central banks, including the Federal Reserve, supports prospects for the emergence of fresh buying around the USD/JPY pair. Hence, any downtick could still be seen as a buying opportunity.

Market participants now look forward to the release of the Fed's preferred inflation gauge - the US Personal Consumption Expenditures (PCE). Friday's US economic docket also features the Chicago PMI and revised Michigan Consumer Sentiment Index. This, along with the US bond yields, will influence the USD price dynamics and provide a fresh impetus to the USD/JPY pair.

Technical levels to watch

In the opinion of FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang, chances for a deeper retracement in AUD/USD appears to be dwndling.

Key Quotes

24-hour view: “We expected AUD to ‘trade between 0.6420 and 0.6540’ yesterday. AUD subsequently traded within a narrower range than expected (0.6436/0.6524). The price actions still appear to be part of a consolidation and we expect AUD to trade within a 0.6440/0.6540 range for today.”

Next 1-3 weeks: “Our update from yesterday (29 Sep, spot at 0.6490) still stands. As highlighted, downward momentum is beginning to wane and this coupled with the strong bounce from the low of 0.6364 suggests the weakness in AUD could stabilize soon. All in, only a break of 0.6555 (no change in ‘strong resistance’ level from yesterday) would indicate AUD is unlikely to weaken further.”

- Gold price grinds higher during four-day uptrend, eyes first weekly gain in three.

- DXY pullback, quarter-end positioning favor XAU/USD buyers despite fears of recession.

- Failure to cross the $1,680 hurdle, backed by upbeat US Core PCE Inflation, could recall gold sellers.

Gold price (XAU/USD) remains on the front foot for the fourth consecutive day while cheering the pullback in the US dollar. That said, the quarter positioning and hopes of stimulus from China, Japan and the UK, are some extra catalysts that could have underpinned the yellow metal corrective bounce off the yearly low, teasing $1,667 by the press time.

However, the firmer yields and fears of global economic slowdown, not to forget the geopolitical woes surrounding Russia and China, keeps XAU/USD buyers on dicey grounds. Furthermore, upbeat US data and hawkish central banks are likely to keep the metal prices down. As a result, today’s US Core Personal Consumption Expenditure (PCE) Price Index for August, expected 4.7% YoY versus 4.6% prior, mostly known as the Fed’s preferred inflation gauge, will be important for clear directions.

Also read: Gold Price Forecast: XAU/USD needs to make it through $1,674-75 hurdle to confirm a bottom

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price approaches short-term key hurdles to the north while staying beyond the $1,660-58 strong support zone, comprising Fibonacci 38.2% on one week and SMA10 on one day.

That said, the $1,671 level comprising the Pivot Point one day R1 and Fibonacci 61.8% on weekly, appears immediate challenge for the XAU/USD buyers.

Following that, multiple levels between $1,678-80 could test the metal buyers. The resistance zone includes the previous yearly bottom, SMA100 on 4H, Pivot Point one week R1 and Pivot Point one month S1.

In a case where the gold price rally beyond $1,680, the bulls can aim for the $1,700 threshold.

On the flip side, a sustained trading below $1,658 becomes necessary to recall the gold sellers.

Failing to do so can quickly fetch the quote to $1,650 support, SMA50 one hour and 23.6% on one week.

If at all the XAU/USD prices remain weak past $1,650, the $1,645 level encompassing Pivot Point one-month S2 could act as the last defense of the buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

EUR/USD has bounced over the last hours. However, economists at ING expect the pair to face stubborn resistance around the 0.9850/70 area and move back lower towards 0.95.

Noisier period for FX

“0.9850/0.9870 may prove intra-day resistance for EUR/USD – but high volatility and tighter liquidity mean that we're in a noisier period for FX.”

“Ultimately, however, we think the pressure remains for EUR/USD to break below 0.95 later in the year.”

- NZD/USD struggles to capitalize on its early modest uptick to a one-week high.

- Recession fears weigh on investors’ sentiment and act as a headwind for the pair.

- The emergence of some USD dip-buying further contributes to capping the upside.

The NZD/USD pair retreats a few pips from the weekly high touched earlier this Friday and is currently placed near the lower end of its daily trading range, just above the 0.5700 mark.

The prevalent risk-off environment - as depicted by a generally weaker tone around the equity markets - turns out to be a key factor acting as a headwind for the risk-sensitive kiwi. Apart from this, the emergence of some US dollar buying caps the NZD/USD pair's modest uptick to the mid-0.5700s.

The prospects for a more aggressive policy tightening by global central banks, along with the risk of a further escalation in the Russia-Ukraine conflict, have been fueling recession fears. Mixed business activity data from China adds to the concerns and tempers investors' appetite for riskier assets.

In fact, the official Chinese PMI released this Friday showed that the country’s manufacturing sector unexpectedly expanded in September. The private survey, however, revealed that the downfall in the manufacturing sector deepened during the reported month amid headwinds from COVID lockdowns.

Apart from the anti-risk flow, elevated US Treasury bond yields help revive the USD demand and further contribute to keeping a lid on the NZD/USD pair. The recent hawkish comments by several FOMC members reinforced expectations that the Fed will hike rates at a faster pace to curb inflation.

This, in turn, lifts the yields on the benchmark 10-year US government bond to inch closer to a 12-year high and favours the USD bulls. The fundamental backdrop warrants some caution before positioning for an extension of the NZD/USD pair's recovery move from its lowest level since March 2020.

Market participants now look to the US Personal Consumption Expenditures (PCE) - the Fed's preferred inflation gauge, due later during the early North American session. The US economic docket also features the release of the Chicago PMI and revised Michigan Consumer Sentiment Index.

This, along with speeches by influential FOMC members and the US bond yields, will drive the USD demand and provide some impetus to the NZD/USD pair. Traders will further take cues from the broader market risk sentiment to grab short-term opportunities on the last day of the week.

Technical levels to watch

Here is what you need to know on Friday, September 30:

The greenback came under heavy selling pressure and the US Dollar Index (DXY) closed the second straight day in negative territory, losing over 2% in that period. Markets stay relatively quiet early Friday as investors await the HICP inflation data from the euro area and the Personal Consumption Expenditures (PCE) Price Index figures from the US. Ahead of the weekend, the University of Michigan (UoM) will release the final version of its Consumer Sentiment Index for September. On the last trading day of the third quarter, position readjustments and profit taking could ramp up the market volatility in the second half of the day.

Earlier in the day, the data from China showed that the NBS Manufacturing PMI recovered slightly above 50 in September and the Non-Manufacturing PMI edged lower to 50.6 from 52.6 in August. The Shanghai Composite Index failed to stage a rebound after these data and closed in negative territory.

Meanwhile, the market mood remains cautious ahead of the above-mentioned data releases. US stock index futures trade mixed and the 10-year US Treasury bond yield fluctuates in a tight range above 3.7%. The DXY stays in positive territory slightly above 112.00.

EUR/USD climbed to a fresh weekly high above 0.9830 early Friday but lost its bullish momentum. The pair was last seen posting small daily losses at around 0.9800. Annual HICP inflation in the euro area is expected to rise to 9.7% in September from 9.1% in August. On Thursday, Germany's Destatis reported that the annual Consumer Price Index jumped to 10% in September, surpassing the market expectation of 9.4%.