- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

New Zealand's Finance Minister, Grant Robertson, has commented following the recent jobs data and said, ''while unemployment remains low, there’s still plenty to do. We will continue to invest heavily in training up New Zealanders.''

NZ jobs data

- New Zealand Unemployment Rate Q4: 3.4% (est 3.3%; prev 3.3%).

- Employment Change (QoQ) Q4: 0.2% (est 0.3%; prev 1.3%).

- Employment Change (YoY) Q4: 1.3% (est 1.5%; prev 1.2%).

- Participation Rate Q4: 71.7% (est 71.7%; prev 71.7%).

''We are seeing a significant number of people coming into New Zealand through the Accredited Employer Work Visa and the Working Holiday Visa schemes and we are constantly assessing our immigration settings to help fill vacancies in what is a competitive global market for workers,” Grant Robertson said.

“This year is expected to be a tough year for the global economy and New Zealand won’t be immune to the impacts of that. However, we are in a strong starting position with low unemployment and government debt levels substantially below the countries with which we compare ourselves,'' he added.

“The Government will keep the economy moving in the right direction in this challenging environment and continue to invest in creating a stronger, inclusive and more resilient economy to withstand future shocks,” Grant Robertson said further.

NZD/USD update

NZD/USD dropped following the New Zealand jobs data:

The data is not as strong as the Reserve Bank of New Zealand expected and hence the sell-off in the kiwi.

NZD/USD is on the brink of a move to test lower and 0.6360 is key, but in doing so, an M-formation will be left on the charts which is a reversion pattern.

- USD/CAD has turned sideways around 1.300 ahead of the interest rate decision by the Fed.

- The USD Index and Treasury yields dropped as the Fed is highly expected to announce a smaller interest rate hike.

- Oil prices recovered dramatically after upbeat China’s official PMI data.

The USD/CAD pair is displaying a back-and-forth move around the immediate support of 1.3300 in the early Tokyo session. The Loonie asset witnessed an immense sell-off on Tuesday after a decline in the United States Employment Cost Index improved the risk appetite of the market participants. The US Dollar Index (DXY) sensed intensified selling as a decline in the labor cost index bolstered the expectations of a smaller interest rate hike by the Federal Reserve (Fed).

The USD Index dropped firmly below 101.70 after failing to sustain an auction above the 102.00 resistance. Meanwhile, S&P500 futures are showing some losses after a fantastic Tuesday, portraying a caution in the overall upbeat market mood. The 10-year US Treasury yields have dropped to near 3.51%.

The FX domain is going through sheer volatility as investors are awaiting the release of the interest rate decision by the Fed. Fed chair Jerome Powell is highly expected to hike interest rates by 25 basis points (bps) to the 4.50-4.75% range, therefore investors are much concerned about the further roadmap of achieving a 2% inflation target.

Analysts at TD Securities are of the view that The Federal Open Market Committee (FOMC) is likely to emphasize that despite slowing the pace of rate increases it is still determined to reach the terminal rate projected in the December dot plot.”

On the Loonie front, monthly Gross Domestic Product (GDP) (Nov) expanded by 0.1% while the street was expecting flat growth. A minor change in the GDP numbers might not force the Bank of Canada (BoC) to change its stance of remaining paused on interest rates. Last week, BoC Governor Tiff Macklem announced a pause in their interest rate hiking spell after pushing interest rates by 25 bps to 4.5%.

Meanwhile, oil prices recovered sharply on Tuesday after investors shrugged off uncertainty about global recession as the western central banks are set to announce fresh hikes to contain stubborn inflation. Also, upbeat China’s official PMI data-infused fresh blood into the oil price. It is worth noting that Canada is a leading exporter of oil to the United States and higher oil prices strengthen the Canadian Dollar.

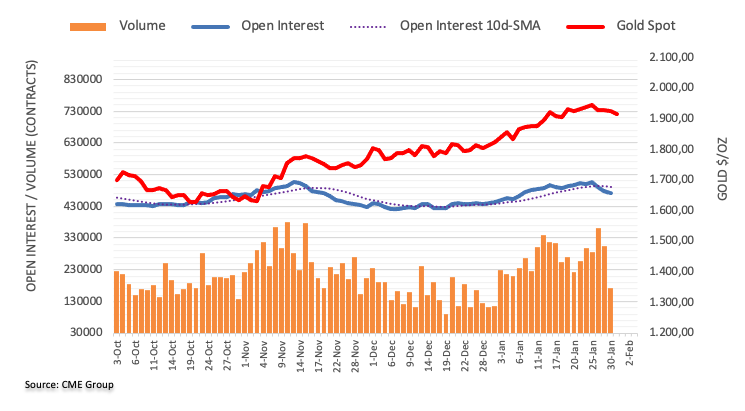

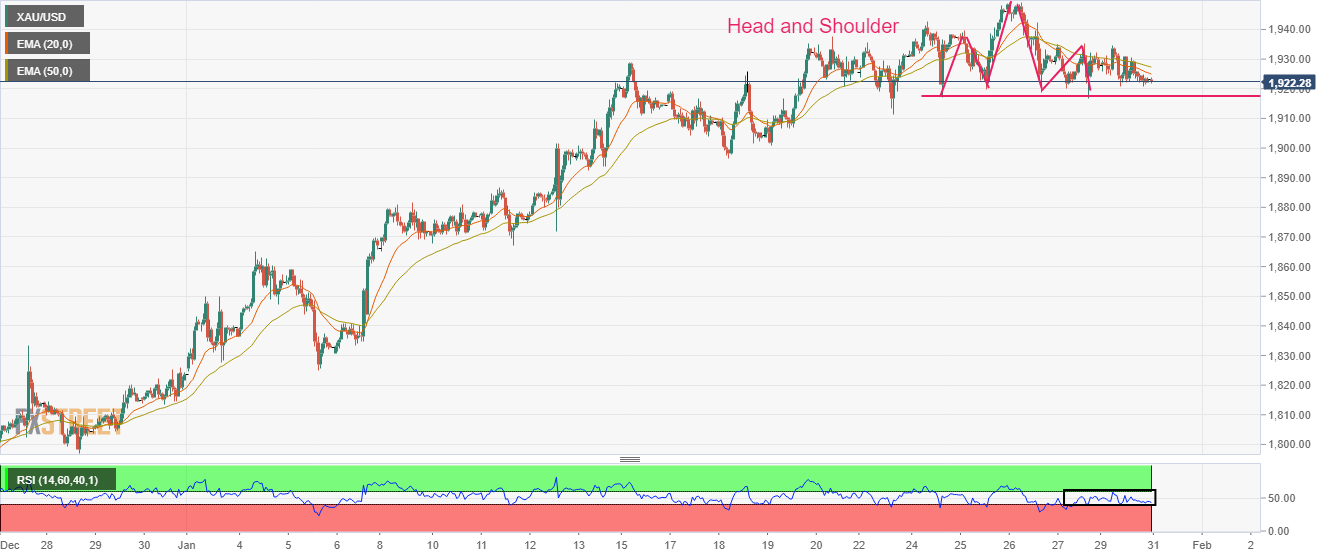

- Gold price steadies after bouncing off short-term key support confluence, snapping three-day downtrend.

- United Stated economics exert downside pressure on US Dollar, favoring XAU/USD buyers.

- US Treasury bond Yields also retreat after three-day uptrend while equities’ recovery underpins Gold demand.

- Federal Reserve’s dovish hike is on the cards but Chairman Jerome Powell can please the Gold bears.

Gold price (XAU/USD) struggles to extend the previous day’s recovery beyond $1,930-28 as the market braces for the key Federal Reserve (Fed) verdict on Wednesday. The yellow metal managed to cheer the broad US Dollar weakness, backed by the United States data and firmer equities, as traders brace for a dovish hike from the US central bank.

US Dollar weakness teases Gold buyers

Gold price snapped a three-day downtrend and bounced off a two-week low the previous day after the US Dollar Index (DXY) reported the first daily loss in four, around 102.10 by the press time. In doing so, the greenback’s gauge versus the six major currencies justified downbeat market expectations from the US Federal Reserve (Fed) amid softer United States statistics.

Among them, the Employment Cost Index (ECI) for the fourth quarter (Q4) gained major attention as it eased to 1.0% versus 1.1% market forecasts and 1.2% prior readings. Further, the Conference Board (CB) Consumer Confidence eased to 107.10 in January versus 108.3 prior. It should be noted that no major attention could be given to the US Chicago Purchasing Managers’ Index (PMI) for January which rose to 44.3 versus 41 expected and 44.9 previous readings.

Softer United States Treasury bond yields propel XAU/USD

Not only the downside United States data but the upbeat Wall Street performance, backed by firmer earnings from industry majors like General Motors, Exxon and McDonalds, also seemed to have weighed on the US Treasury bond yields and favored Gold buyers. That said, the benchmark 10-year Treasury bond yields snapped a three-day uptrend while revisiting 3.51% while the two-year counterpart also dropped to 4.20%, near the same levels by the press time.

China economics, Covid news also propel Gold price

Apart from the US Dollar driven recovery, the upbeat China Purchasing Managers’ Indexes (PMI) for January and news surrounding COVID-19 from the US also seemed to have favored the Gold buyers. That said, the news suggesting US President Joe Biden’s administration’s readiness to revoke the Covid-led emergencies appeared to have favored the sentiment of late. On Monday, China’s Center for Disease Control and Prevention (CDC) said, reported by Reuters, “China's current wave of COVID-19 infections is nearing an end, and there was no significant rebound in cases during the Lunar New Year holiday.”

Furthermore, China’s NBS Manufacturing PMI rose to 50.1 versus 49.7 market forecasts and 47.0 prior whereas Non-Manufacturing PMI also came in upbeat with 54.4 figure compared to 51.0 expected and 41.6 previous readings.

All eyes on the Federal Reserve Chairman Jerome Powell

Although the Gold sellers have been pushed back ahead of the key Federal Reserve (Fed) Interest Rate Decision, the XAU/USD bears aren’t off the table as the Fed has ammunition to bolster the US Dollar with hawkish rate bias. In doing so, Fed Chair Jerome Powell’s press conference will be crucial amid a widely expected 0.25% rate hike. That said, clues for a further rate increase and no policy pivot in the near term should weigh on the Gold price.

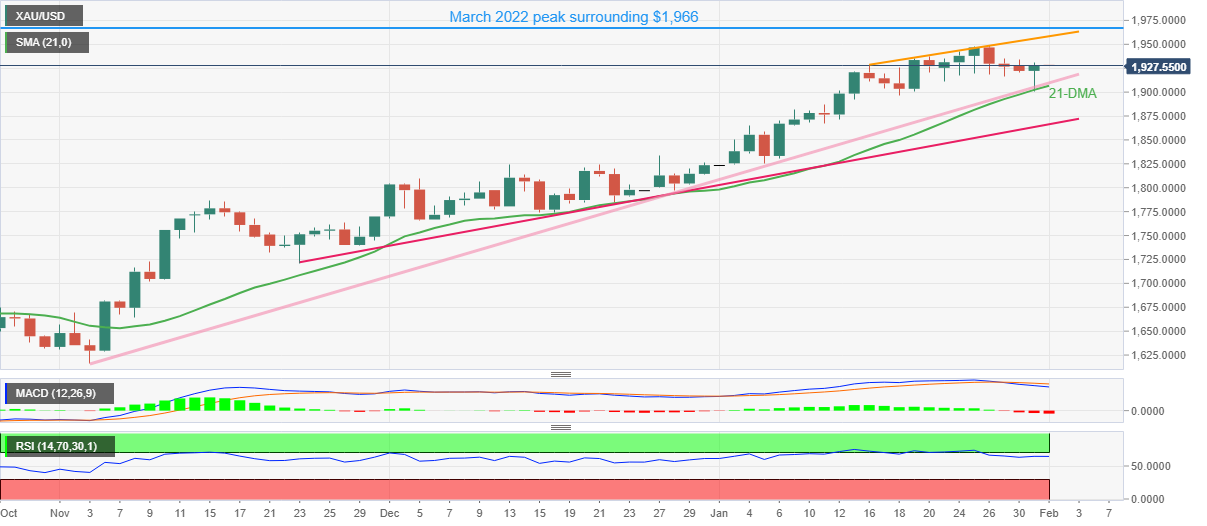

Gold price technical analysis

Gold price bounced off a convergence of the 21-Daily Moving Average (DMA) and an upward-sloping trend line from early November 2022 while portraying the previous day’s recovery.

However, the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator join the absence of an overbought Relative Strength Index (RSI) line, placed at 14, to keep sellers hopeful.

With this, the XAU/USD pullback towards the $1,906 support confluence appears imminent.

Following that, the $1,900 threshold and a 10-week-old ascending support line near $1,866 will gain the Gold seller’s attention.

Alternatively, the metal’s further upside could aim for an ascending resistance line stretched from mid-January, close to $1,960 at the latest.

Even if the XAU/USD manages to cross the $1,960 hurdle, the tops marked during March 2022 near $1,966 will challenge the metal ahead of highlighting the $2,000 psychological magnet.

Overall, Gold buyers appear running out of steam but the bears have a tough task ahead.

Gold price: Daily chart

Trend: Downside expected

- GBP/JPY is scaling south towards 160.00 as the UK public inflation projections have cooled off.

- The BoE is expected to hike its interest rates by 50 bps to 4.0%.

- An upbeat Japan retail trade data might add to the BoJ’s 2% inflation target.

The GBP/JPY pair sensed selling interest after a pullback to near 160.60 and is declining toward the round-level support of 160.00 in the early Tokyo session. The cross has faced selling pressure despite rising odds of a bigger interest rate hike announcement by the Bank of England (BoE) on Thursday.

In the interest rate week, investors are watching closely for the interest rate decision by the BoE as the inflation rate in the United Kingdom economy is in a double-digit figure despite being the early adopter of restrictive monetary policy after the pandemic period.

A poll from Bloomberg showed that BoE Governor Andrew Bailey will announce an interest rate hike by 50 basis points (bps) to 4.0%. And, the BoE will reach to the terminal rate of 4.50% by the summer. The poll also revealed that the BoE will start cutting its key interest rate later this year to shore up a flagging economy.

Strategists at Jefferies cited “We are turning more positive on the economic prospect for Europe, but still remain negative on the UK.” For the BoE, even if we get a 50 basis point (bps) hike in February, it would be a dovish 50 basis points.”

Meanwhile, a monthly survey conducted by Citi and YouGov showed that the UK public's inflation expectations cooled off consecutively for the second month in January. British public expectations for five to 10 years ahead fell to 3.5% in January from 3.6% in December, just short of the 3.0%-3.4% range seen ahead of the COVID-19 pandemic. For 12 months ahead, the UK public inflation expectations declined to 5.4% in January from 5.7% in the previous survey. This might provide a sigh of relief to BoE policymakers.

On the Japanese Yen front, upbeat Retail Trade (Dec) data is going to add up to the Bank of Japan (BoJ)’s target of achieving 2% inflation on a sustainable basis. The annual Retail Trade data soared to 3.8% from the consensus of 3.0% and the former release of 2.5%. While the monthly data expanded by 1.1% vs, the expectations of 0.5%. Japan's Finance Minister Shunichi Suzuki reiterated on Tuesday that “wage increases are important to both the government and the BoJ.

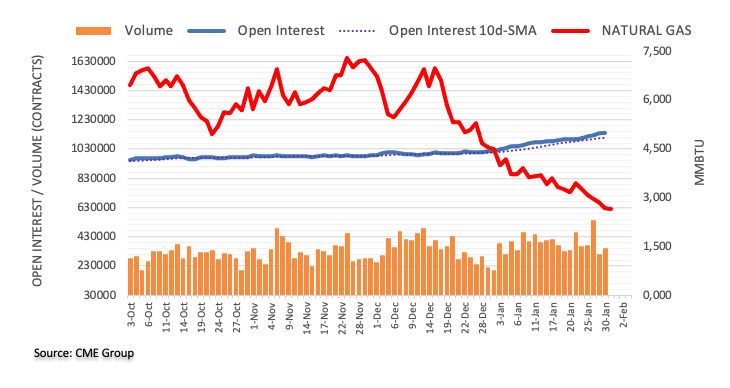

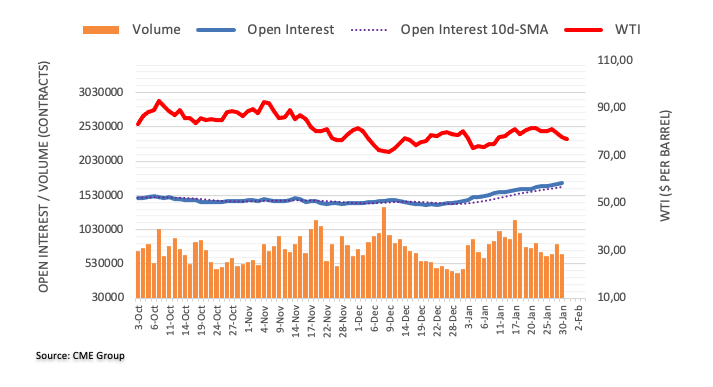

- WTI grinds higher after posting the biggest daily gains in two weeks.

- Bearish MACD signals, steady RSI (14) probes rebound from 50-DMA.

- 100-DMA, fortnight-old horizontal hurdle also challenge Oil buyers.

- Ascending support line from December 2022 adds to the downside filters.

WTI crude oil buyers appear unconvinced from the previous day’s recovery moves as the quote seesaws near $79.20 amid the early hours of the key Wednesday. In doing so, the black gold fades the bounce off the 50-DMA while taking a breather after rising the most in a fortnight.

Although the 50-DMA puts a floor under the Oil price at around $77.80, the bearish MACD signals and the steady RSI (14), fail to appreciate the quote’s rebound. The reason could be linked to the commodity’s sustained trading below the key hurdles.

Among them, the $80.00 round figure gains immediate attention ahead of the 100-DMA level surrounding $81.30.

Following that, a horizontal area comprising multiple tops marked since January 18, near $82.70, appears as the last defense of the black gold bears.

On the contrary, a daily closing below the 50-DMA level near $77.80 could quickly direct the WTI bears towards challenging the key support line from early December, close to $76.50 by the press time.

Should the energy benchmark remains bearish past $76.50, the odds of its slump to January 2023 low near $72.60 can’t be ruled out.

WTI: Daily chart

Trend: Further downside expected

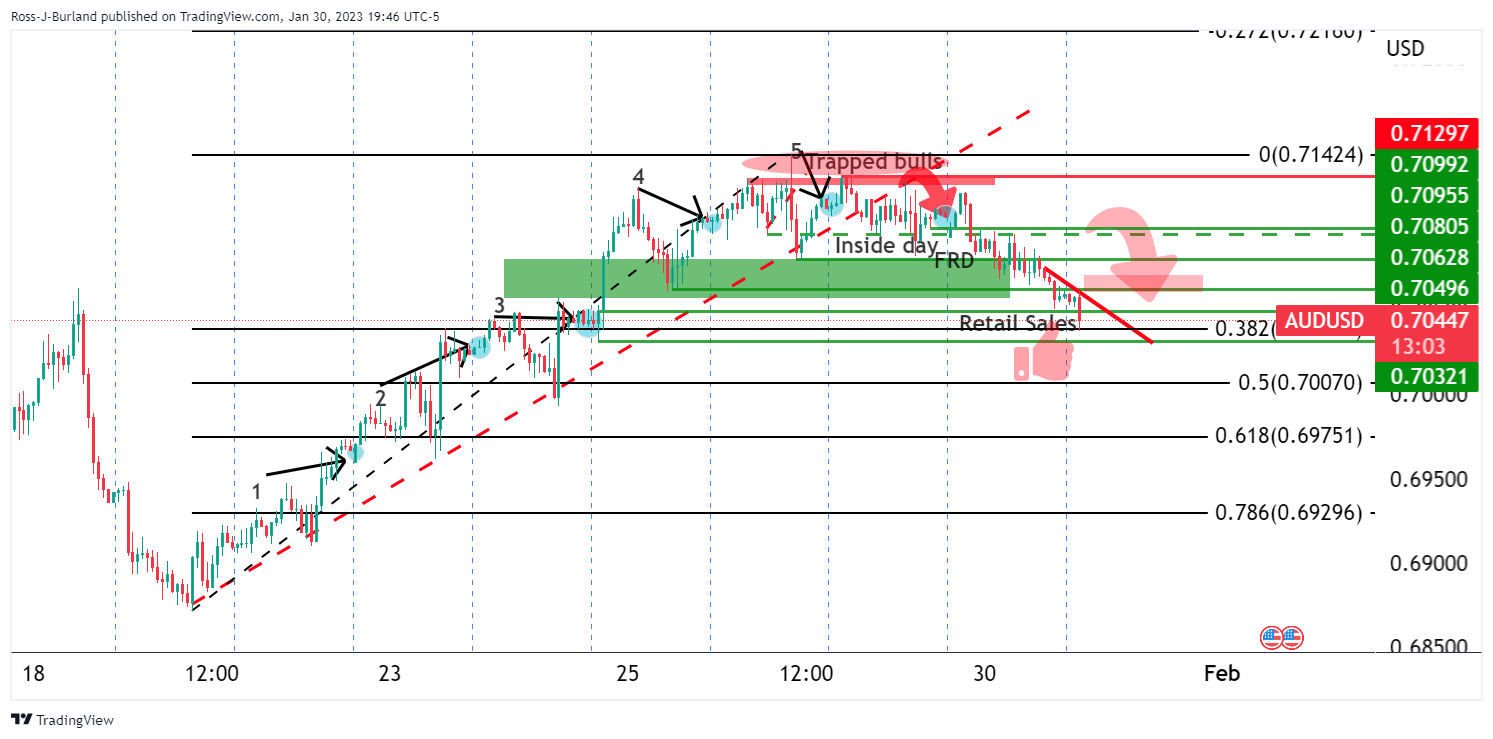

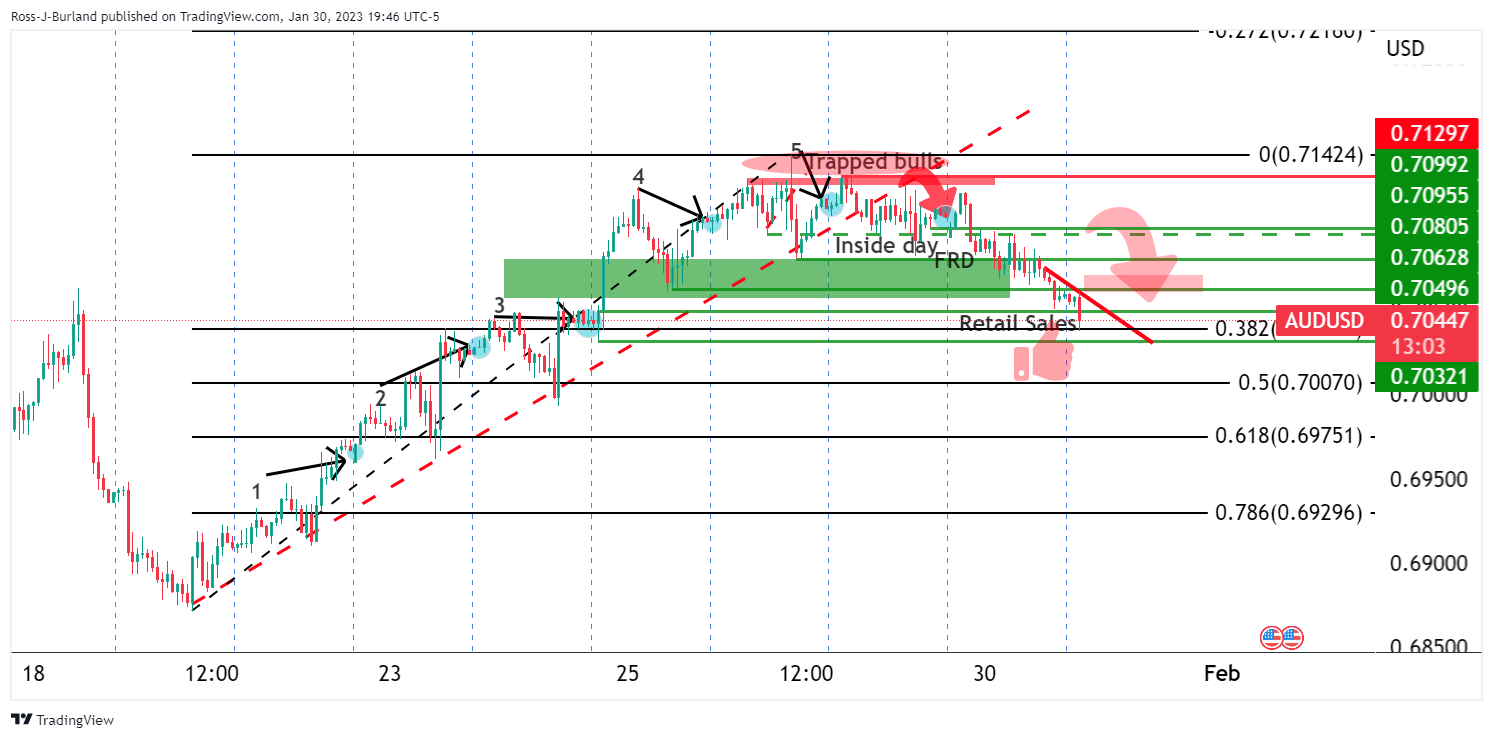

- Sentiment remains upbeat, as shown by US equities finishing with gains.

- The US Dollar dropped on the back of expectations that the Fed might slow the pace of rate increases.

- Australian Retail Sales capped the AUD rally towards 0.7200.

- AUD/USD Traders eye Aussie PMIs, and a busy US calendar led by FOMC’s monetary policy decision.

The AUD/USD is recovering some ground after falling to weekly lows of 0.6938, courtesy of a dismal Retail Sales report from Australia. Nevertheless, the Australian Dollar (AUD) stages a recovery, and although finished with losses, they were minimal. As the Asian session begins, the AUD/USD is trading at 0.7053, almost flat.

Risk appetite improvement weighed on the US Dollar

Wall Street finished on a higher note in January. US corporate earnings and recent economic data revealed by the Labor Department weighed on the greenback, which is losing, as the US Dollar Index shows, 0.15%, down at 102.089. The Employment Cost Index (ECI), a measure of wage inflation, cooled as data showed, down from 1.2% to 1% QoQ. That data, along with the US Core PCE, the Federal Reserve’s (Fed) favorite inflation gauge, edging lower for the fourth consecutive month, increased the likelihood of a Fed pivot.

The greenback tumbled on the data release, as shown by the US Dollar Index, dipping towards its daily lows of 102.008 before recovering some ground. The AUD/USD paired some of its losses, though mostly towards Wall Street’s close.

Aside from this, Australian Retail Sales for December disappointed analysts, tumbling to -3.9% MoM vs. -0.3% estimations, reported the Australian Bureau of Statistics (ABS). Even though it was the first drop in 2022 after eleven months of consecutive monthly rises, sales fell sharply, with department stores, among other sectors like clothing, footwear, and personal accessories, sliding to -27%. That said, it was a headwind for the AUD/USD, which extended its losses toward the day’s lows, slumping below the 0.7000 figure.

What to watch?

Ahead of the week, the Australian economic docket will feature Manufacturing PMIs, alongside Governor Kohler’s Reserve Bank of Australia (RBA) speech. On the US front, the calendar will reveal S&P Global and ISM Manufacturing PMIs, JOLTs Openings, and the US Federal Reserve’s monetary policy decision on Wednesday.

AUD/USD Key Technical Levels

- USD/CHF holds lower grounds after declining the most since late November.

- Broad US Dollar weakness favored bears despite downbeat Swiss Retail Sales.

- Softer US Employment Cost Index, Consumer Confidence joined firmer equities to weigh on USD ahead of Fed’s verdict.

- Fed’s 0.25% rate hike is almost given and hence Powell need to save the USD with his hawkish statements.

USD/CHF steadies around 0.9160 after marking the biggest daily slump in nearly 2.5 months the previous day. The Swiss currency pair’s fall on Tuesday could be linked to the broad US Dollar weakness and the firmer equities, which in turn enabled the quote to ignore downbeat data at home.

That said, the Swiss Retail Sales for December slumped to -2.8% YoY versus 2.6% expected and -1.4% prior.

On the other hand, the US Employment Cost Index (ECI) for the fourth quarter (Q4) gained major attention as it eased to 1.0% versus 1.1% market forecasts and 1.2% prior readings. Further, the Conference Board (CB) Consumer Confidence eased to 107.10 in January versus 108.3 prior. It should be noted that no major attention could be given to the US Chicago Purchasing Managers’ Index (PMI) for January which rose to 44.3 versus 41 expected and 44.9 previous readings.

Further, upbeat Wall Street closing, due to firmer earnings from industry majors like General Motors, Exxon and McDonalds, also exert downside pressure on the US Treasury bond yields and favored the US Dollar bears.

Amid these plays, the US Dollar Index (DXY) snapped a three-day rebound, staying defensive near 102.00 by the press time.

Moving on, multiple US PMIs for January may entertain USD/CHF pair traders ahead of the Federal Reserve’s (Fed) interest rate decision. Even so, major attention will be on how Fed Chairman Jerome Powell could defend his hawkish bias as the 0.25% rate hike is already priced-in.

Also read: Federal Reserve Preview: The Good, the Bad and the Ugly, why the US Dollar would rise

Technical analysis

A clear downside break of the two-week-old ascending trend line, now immediate resistance around 0.9205, directs USD/CHF towards the previous monthly low of 0.9085.

- AUD/NZD has refreshed its four-day high at 1.0970 as NZ Employment has missed estimates.

- A decline in labor demand higher jobless rate might trim inflation projections in the NZ region ahead.

- The Australian Dollar remained extremely volatile this week after the release of the downbeat Retail Sales data.

The AUD/NZD pair has printed a fresh four-day high at 1.0970 in the early Asian session. The cross has got strength after the release of downbeat New Zealand Employment (Q4) data. The Employment Change dropped to 0.2% from the expectations of 0.3% and the former release of 1.3%. While the Unemployment Rate has increased to 3.4% from the consensus and the prior release of 3.3%.

Signs of losing threads in the tight labor market of New Zealand indicate that inflation projections will trim further as retail demand may get dents. Meanwhile, the Labor cost index has remained mixed, which will still be a concern for the Reserve Bank of New Zealand (RBNZ) ahead. The quarterly Labor cost index has landed at 1.1% lower than the estimates of 1.3% but similar to the prior release of 1.1%. On an annual basis, the economic data has remained in line with the expectations of 4.3% and higher than the 3.8% the prior release.

The interest rate hike spell by the RBNZ Governor Adrian Orr is not paused yet as the Consumer Price Index (CPI) is still beyond 7%. However, lower employment generation might trim inflation projections ahead.

On the Australian front, the Australian Dollar has picked strength on upbeat S&P Global Manufacturing PMI data. The economic data has climbed to 50.0 vs. the consensus and the former release of 49.8. This week, the Australian Dollar remained extremely volatile after the release of the downbeat monthly Retail Sales (Dec) data. Lower retail demand might force the firms to look for easing prices of goods and services at factory gates. This would also delight the Reserve Bank of Australia (RBA) ahead.

For further guidance, the New Zealand Dollar and the Australian Dollar will dance to the tunes of the Caixin Manufacturing PMI (Jan) data, which is seen higher at 49.5 from the former release of 49.0. It is worth noting that the antipodeans are the leading trading partners of China.

- GBP/USD struggles to defend the bounce off one-week low despite upbeat Brexit news.

- UK inflation expectations drop for the second month in a row, Mortgage Approvals slump to financial crisis era.

- Data driven weakness of US Dollar put a floor under the Cable price.

- Fed’s 0.25% rate hike is almost given but Chairman Powell’s play will be crucial to watch.

GBP/USD fails to cheer the US Dollar weakness much as Cable’s recovery from the weekly low fades around 1.2320 during early Wednesday. In doing so, the quote seems to justify the downbeat catalysts at home, mainly relating to inflation and housing markets.

That said, a monthly survey conducted by Citi and YouGov showed on Tuesday that the 12 months ahead UK public inflation expectations declined to 5.4% in January from 5.7% in the previous survey. This was the second straight decline in the UK public's inflation expectations. Following the data, Reuters reports, citing the survey that the declining trend in the UK public inflation expectations should further comfort to the Bank of England that high prices will not become permanently embedded in expectations.

Further, Reuters also quotes the Bank of England’s (BOE) housing market numbers to state that Mortgage approvals in Britain slumped in December to levels seen during the global financial crisis. The news also raised concerns over the housing market’s weakness which is faster than the consensus predicted. “The BoE said 35,612 mortgages were approved last month, compared with 46,186 in November,” the news said.

Alternatively, The Times reported the European Union (EU) and the UK’s breakthrough in the customs deal as a positive catalyst for Brexit and should have helped the GBP/USD but could not.

On the same line, the US Dollar Index (DXY) snapped a three-day rebound amid downbeat US data and firmer equities. Among them, the Employment Cost Index (ECI) for the fourth quarter (Q4) gained a major attention as it eased to 1.0% versus 1.1% market forecasts and 1.2% prior readings. Further, the Conference Board (CB) Consumer Confidence eased to 107.10 in January versus 108.3 prior. It should be noted that no major attention could be given to the US Chicago Purchasing Managers’ Index (PMI) for January which rose to 44.3 versus 41 expected and 44.9 previous readings.

In addition to the softer US data, upbeat Wall Street closing, due to firmer earnings from industry majors like General Motors, Exxon and McDonalds, also exert downside pressure on the US Treasury bond yields and should have weighed on the GBP/USD prices. The benchmark 10-year Treasury bond yields snapped a three-day uptrend by easing 3.51% on Tuesday.

Looking forward, US economic calendar has a slew of data to watch but major attention will be given to how the Federal Reserve (Fed) Chairman could push back market chatters over policy pivot. That said, the US central bank is widely expected to announce a 0.25% rate hike.

Also read: Federal Reserve Preview: The Good, the Bad and the Ugly, why the US Dollar would rise

Technical analysis

A first daily closing below the 10-DMA, around 1.2370 by the press time, in a monthly directs GBP/USD towards the 21-DMA support surrounding 1.2260.

“Britain and the European Union have struck a customs deal that could pave the way to ending years of post-Brexit wrangling over Northern Ireland,” said The Times late Tuesday.

The Times also stated that it understood that Brussels has accepted a proposal that would avoid the need for routine checks on products destined for the province.

“Separately the EU has conceded for the first time that the European Court of Justice could rule on issues relating to the province only if a case was referred by the Northern Irish courts,” adds The Times.

Previously Brussels had insisted that the European Commission should be able to take cases straight to the court.

GBP/USD remains sidelined

GBP/USD fails to cheer the upbeat news, as well as the softer US Dollar, as downbeat UK inflation expectations and housing data raise fears of dovish Bank of England (BOE) actions.

- EUR/USD is facing hurdles in extending the rally above 1.0870 ahead of Fed-ECB policy.

- A decline in US Employment Cost Index has bolstered the odds of a smaller interest rate hike by the Fed.

- Investors should brace for a bigger interest rate hike by the ECB as the inflationary pressures are still solid.

The EUR/USD pair is showing signs of a loss in the upside momentum after reaching to near the immediate resistance of 1.0870 in the early Tokyo session. The shared currency pair has already displayed a responsive buying action after dropping to near the round-level support at 1.0800 but is failing to bring initiative buyers on board, however, more upside is still on cards.

The rationale behind the strength of the Euro is the improved risk appetite of the market participants. Risk-perceived assets like S&P500 witnessed stellar demand after the United States Bureau of Labor Statistics showed that the Employment Cost Index for the fourth quarter of CY2022 has landed lower than expectations. The economic data was recorded at 1.0% lower than the consensus of 1.1% and the prior release of 1.2%.

Easing negotiation power for labor costs is music to the ears of the Federal Reserve (Fed), which is working hard to achieve price stability in the United States. A decline in the labor cost is going to leave less liquidity in the palms of households for disposal, which will further squeeze their spending and will trim inflation projections.

The US Dollar Index (DXY) fell heavily to near 101.70 from Tuesday’s high around 102.20 on the fact that the easing labor cost index has bolstered the odds of a decline in the policy tightening pace by the Fed. According to the projections, Fed chair Jerome Powell is expected to announce a 25 basis point (bps) interest rate hike to 4.50-4.75%.

On the Eurozone front, investors are awaiting the interest rate decision by the European Central Bank (ECB). Labor cost in the shared continent is still upbeat and the inflation rate is hovering above 9%, therefore, a bigger interest rate hike is expected by the market participants. ECB President Christine Lagarde might announce an interest rate hike of 50 bps ahead.

- NZD/USD under pressure as jobs miss the mark.

- All eyes turn to the Fed for the day ahead.

NZD/USD has dropped following the New Zealand jobs data:

- New Zealand Unemployment Rate Q4: 3.4% (est 3.3%; prev 3.3%).

- Employment Change (QoQ) Q4: 0.2% (est 0.3%; prev 1.3%).

- Employment Change (YoY) Q4: 1.3% (est 1.5%; prev 1.2%).

- Participation Rate Q4: 71.7% (est 71.7%; prev 71.7%).

The data is not as strong as the Reserve Bank of New Zealand expected and hence the sell-off in the kiwi. Prior to the data, NZD/USD was around flat on the day and traded between a low of 0.6413 and 0.6479, recoiling some of the day's losses as the US Dollar piped down ahead of critical events for the remainder of the week.

The greenback was softer on eh back of slightly slower-than-expected wage gains. The market is focussed on the Nonfarm Payrolls event this Friday where there is less certainty around the data, as compared to the expectations of the Federal Reserve. A 25 basis point hike is fully price din following the series of disinflationary data. The Federal Open Market Committee is likely to emphasize that despite slowing the pace of rate increases it is still determined to reach the terminal rate projected in the Dec dot plot which is also expected by the markets, so there will be no shocks in this regard. However, if the Fed overall emphasises this point, there could be a pick-up in demand for the greenback and a sell-off in risk assets.

NZD/USD technical analysis

NZD/USD is on the brink of a move to test lower and 0.6360 is key, but in doing so, an M-formation will be left on the charts which is a reversion pattern. There is no telling what will come of the Fed.

Statistics New Zealand has released the employment as follows:

- New Zealand Unemployment Rate Q4: 3.4% (est 3.3%; prev 3.3%).

- Employment Change (QoQ) Q4: 0.2% (est 0.3%; prev 1.3%).

- Employment Change (YoY) Q4: 1.3% (est 1.5%; prev 1.2%).

- Participation Rate Q4: 71.7% (est 71.7%; prev 71.7%).

NZD/USD is breaking structures in a 27 pips drop:

The data is not as strong as the market was expecting and hence the Kiwi is losing ground at a rapid pace.

About New Zealand employment data

Statistics New Zealand releases employment data on a quarterly basis. The statistics shed a light on New Zealand’s labor market, including unemployment and employment rates, demand for labor and changes in wages and salaries. These employment indicators tend to have an impact on the country’s inflation and Reserve Bank of New Zealand’s (RBNZ) interest rate decision, eventually affecting the NZD. A better-than-expected print could turn out to be NZD bullish.

- The EUR/JPY lost almost 0.05% after hitting a high at around 141.60s.

- EUR/JPY Price Analysis: To remain sideways, ahead of the ECB’s decision.

The EUR/JPY trims some of its earlier gains after hitting a daily high of 141.61, shy of the 100-day Exponential Moving Average (EMA) at 141.79, and drops towards the 141.40 area, holding to its gains. At the time of writing, the EUR/JPY is trading at 141.47, above its opening price by a slight margin of 0.02%.

EUR/JPY Price Analysis: Technical outlook

During the last seven days, the EUR/JPY pair has been unable to reach new highs, above the January 25 daily high at 142.29, exacerbating a consolidation within the 20 and 50-day EMA. Backed by the Relative Strength Index (RSI) and the Rate of Change (RoC) almost flat at neutral levels, the EUR/JPY pair would remain trendless, awaiting the Europen Central Bank (ECB) monetary policy on Thursday.

A bullish scenario would trigger once the EUR/JPY breaks above the 50-day EMA At 141.68, closely followed by the 100-day EMA at 141.79. A breach of those two EMAs will set the EUR/JPY to test the January 11 daily high of 142.85 and the 143.00 figure.

On the other hand, the EUR/JPY would resume its bearish bias, below the 20-day EMA at 140.98. Once cleared, the 200-day EMA at 140.25 would be tested by EUR bears, followed by a dip towards the 140.00 mark.

EUR/JPY Key Technical Levels

- USD/CAD bulls look to the 50% mean reversion target of the bearish impulse.

- Bears eye supports below 1.3300, targeting 1.3250/20 and then 1.3200 / 1.3150.

USD/CAD has blown off on Tuesday as preliminary domestic data showed the economy growing at a slightly faster pace than the Bank of Canada expected in the fourth quarter. This brings us to the Federal Reserve meeting on Wednesday with the technicals well entrenched for a breakout to the downside if the market gets what it's looking for from the meeting.

The following illustrates a bearish outlook for the short term to 1.3150 based on the daily and 4-hour charts:

USD/CAD daily charts

Zoomed in ...

USD/CAD has started to make its way to the bull cycle's supportive trendline by breaking down structures along the way.

It failed to stay above the near-term bearish dynamic resistance as illustrated above which keeps the focus on the downside, for now.

USD/CAD H4 charts

The price could stall here and correct towards the 50% mean reversion of the bearish impulse before meeting resistance again and dropping into test the supports below 1.3300, targetting 1.3250/20 and then 1.3200 / 1.3150.

- Gold price is testing the bull's commitments into highly important events for the rest of this week.

- Gold bears are waiting to pounce, chipping away at critical support structures.

- Federal Reserve and European Central Bank meetings will start off the chorus of expected volatility before the showdown, Nonfarm Payrolls.

Gold price had given two-way business on Tuesday as markets get set for the Federal Reserve, Fed, at month-end making for a particularly choppy day. However, the Gol price is headed for a third straight monthly gain, with the US Dollar and bond yields weakening despite higher interest rates expected from this week's meetings of the Federal Reserve's policy committee.

Federal Reserve and central bank meetings to impact Gold price

The US Dollar index was last seen down 0.2% at 102.03 after falling from a high of 102.607 and 102.013 while the US Treasury 10-year note is paying 3.523%, down 0.54% on the day as we move into the Federal Reserve interest rate decision and accompanying announcements. We also have the European Central Bank, ECB, which is also expected to increase rates on Thursday as both central banks look to slow their economies to combat high inflation. As a result, the Gold prices during the events are likely to be volatile.

First up, we have the US central bank policy decision that is due at 1900 GMT on Wednesday, followed by a news conference from Federal Reserve Chair Jerome Powell and while markets have priced in a 25 basis point Fed rate hike to a range of 4.5-4.75% and expect rates to peak at 4.9% in June, some analysts are sceptical. For instance, analysts at Brown Brothers Harriman said the hard part for the Fed will be convincing the markets that they are wrong about its perceived pivot.

''The Federal Reserve will leave the door wide open for further rate hikes and Federal Reserve Chair Powell will stress that the Fed is prepared to continue hiking rates beyond 5% and keep them there until 2024, as the December Dot Plots showed,'' the analysts argued. ''As things stand, the Fed is seen starting an easing cycle in H2 and we view that as highly unlikely,'' they said.

New Federal Reserve Dot Plots and macro forecasts won’t come until the March 21-22 meeting, so the Fed official's rhetoric between this meeting and the next will be important, starting with the Federal Reserve's Chairman, Jerome Powell, when he speaks to the press. For instance, while we have been in a blackout period ahead of the Fed, where Fed speakers go quiet, prior to this, Federal Reserve's James Bullard said he expects inflation to recede this year but not as fast as the market sees. He said the Fed policy is almost restrictive but not quite there yet, adding that his 2023 rate projection last month was for 5.25-5.50%. He stressed that rates need to remain above 5% in order to push inflation down. He would prefer that the Fed policy were to err on the tighter side as insurance. This is bearish for the Gold price and bullish for the US Dollar.

Additionally, the European Central Bank and Bank of England are expected to hike rates by 50 basis points on Thursday. These too could be a spanner in the works for the Gold price as lower rates tend to be beneficial for bullion, decreasing the opportunity cost of holding the non-yielding asset. If the outcomes of both meetings a determined by hawkish rhetoric, then this in turn could be bad news for the Gold price bugs among us.

United States of America Nonfarm Payrolls and data in general are key

Markets also await Friday's US Nonfarm Payrolls report for January, with weakening in the labour market translating to decreasing inflation. Job creation likely remained solid, with payrolls gains staying above the 200k mark in Jan, analysts at TD Securities expect. ''We look for the Unemployment Rate rate to stay put at 3.5%.''

In this regard, analysts at ANZ Bank said that the weaker economic data recently released in the United States of America does raise the question as to when the Federal Reserve will start to ease rates, or pause their hikes. However, they added that they '' think that the Federal Open Market Committee, FOMC, will acknowledge there has been some progress in weakening demand but we do not think that trends are yet sufficiently established in the labour market or service prices for the Federal Reserve to be able to step back from its hawkish disposition just yet.''

Depending on the outcome of these events this week, the technical outlook for Gold price will be just as key as the yellow metal tinkers on the edge of falling below $1,900. Analysts at TD Securities said that a move below $,1890 would likely spark a notable selling program totalling -6% of the trend following cohort's maximum historical position size. ''Upside trend signals continue to deteriorate across the complex, pulling the thresholds for trend reversals closer.''

Gold price technical analysis

As per the prior analysis, Gold Price Forecast: XAU/USD bulls could emerge ahead of Federal Reserve, the Gold price has been forced out of a geometrical pattern and dropped to test $1,900 on what could have been clear out of stale sell-stops:

Prior Gold price analysis

We can see that we had a 3-line strike in play for the Gold price:

This was a Gold price trend continuation candlestick pattern consisting of four candles. In this particular scenario, we did not have the close below the first of the four candles, but this was a bearish scenario nonetheless for Monday and bears capitalized on it as follows:

The Gold price hourly chart showed that the Gold price is being jammed into the lows and a subsequent sell-off occurred as follows:

At this juncture, we are likely to see consolidation as we head into the Federal Reserve. however, for a full analysis of the Gold price that was made at the start of the week and remains valid for the events, see here: Gold, Chart of the Week: XAU/USD trapped bulls into the Fed and NFP, and here: Gold, Chart of the Week: XAU/USD trapping longs for a significant squeeze ahead of key red-hot events.

What you need to take care of on Wednesday, February 1:

Financial markets were quite volatile on Tuesday, as market players aimed to anticipate the upcoming US Federal Reserve decision. The United States central bank will be the first but not the last as the European Central Bank and the Bank of England will do the same on Thursday.

The US Dollar surged throughout the first half of the day helped by risk aversion. Asian stocks spent the day on the back foot, while European ones trimmed losses ahead of the close, led by gains in Wall Street. The mood improved after the release of US data signaling easing inflationary pressures. The Employment Cost Index rose in the last quarter of 2022 by 1%, below the 1.1% expected and easing from 1.2% in the previous quarter. Afterwards, the US Dollar gave up its intraday gains, ending the day unevenly across the FX board.

The Canadian Dollar was the strongest USD rival, helped by firmer oil prices, while the British Pound was the weakest. USD/CAD settled at near the 1.3300 figure, while GBP/USD stands in the 1.2330/40 price zone.

The EUR/USD pair tested the 1.0800 price zone, to end the day at around 1.0860. The Euro Zone the Q4 Gross Domestic Product (GDP) showed the economy grew at an annualized pace of 1.9%, better than the 1.8% anticipated by financial markets. On a negative note, German Retail Sales plunged by 5.3% MoM in December, much worse than expected.

Australian data released at the beginning of the day was disappointing, with AUD/USD bottoming at 0.6983 during the European session. The pair later recovered to end the day unchanged in the 0.7050 price zone.

USD/JPY remain steady, now trading at around 130.15.

Gold met buyers around the $1,900 figure and finished the day at $1,929, while crude oil prices posted modest intraday advances and WTI currently changes hands at $78.50 a barrel.

Polygon Price Forecast: What crypto traders are looking for from Jerome Powell on Wednesday

Like this article? Help us with some feedback by answering this survey:

- Silver is trapped within the 20 and 50-day Exponential Moving Averages, trendless.

- Silver Price Analysis: Sideways but slightly tilted upwards, with buyers eyeing $25.00.

Silver price extended its consolidation around the $23.00-$24.50 during the week, capped by the 20 and 50-day Exponential Moving Averages (EMAs), and remains unable to break the range decisively. However, XAG/USD erased some of its earlier losses and shifted positively in the day, trading at $23.71, gaining 0.53%.

Silver Price Analysis: Technical outlook

XAG/USD’s price action has remained sideways for almost a month, around the $23.00-$24.50 range, in the near term. The lack of a catalyst keeps the white metal at around a peak, though it’s too early to call it like that, with the US Federal Reserve’s decision on Wednesday. At the time of typing, the XAG/USD hovers around the 20-day EMA at $23.69, which has been used as a pivot in the last 19, with the price fluctuating around it.

As the XAG/USD continues to rally in the session, a break above the 20-day EMA could pave the way for further upside, being the psychological $24.00 figure, the first supply area. Once cleared, the XAG/USD would be poised to challenge the YTD high at $24.54, followed by the $25.00 mark.

On the flip side, XAG/USD’s fall below the 50-day EMA at $23.10, and Silver will soon test the $23.00 mark. A breach of the latter will send Silver slumping to the YTD low at $22.76, followed by the 100-day EMA at $22.24 and then the 200-day EMA at $21.90.

Silver Key Technical Levels

- Inflation in the United States continues to fall, as the ECI showed, sparking talks about a Fed pivot.

- Canada’s economy stalled and grew at a 0.1% pace in December.

- USD/CAD Price Analysis: It would likely extend its downtrend and test the 200-day EMA.

The USD/CAD retreated on Tuesday, as the US Dollar (USD), extended its losses following a report by the US Department of Labor (DoL), which showed that employment costs cooled down. At the same time, Canada’s economy grew as expected. Therefore, the USD/CAD is trading at 1.3319 after hitting a daily high of 1.3471.

US data weighed on the USD and boosted the CAD

The US Dollar continued its downtrend, weighed by the US Employment Cost Index (ECI), which measures workers’ compensation, decelerated after printing 1.2%, resting at 1%, below estimates of 1.1%. After the data was released, the greenback slashed some of its earlier gains against most G8 currencies, particularly the Loonie (CAD). Speculations arise that the US Federal Reserve (Fed) could pause after February and March’s meetings, as another inflation gauge revealed last week data showed the inflation downtrend extended to four straight months. Meanwhile, financial analysts estimate the US Fed would end lifting rates once they hit the 4.75% to 5% peak.

At the same time, Statistics Canada revealed that the economy in December grew at a 0.1% pace, unchanged compared to November’s data. On an annual basis, the Gross Domestic Product (GDP) likely gained 1.6% in Q4. If the flash estimate proves correct, the economy will expand by 3.8% in 2022 from the previous year, above the central bank’s 3.6% forecast.

Reflecting on the abovementioned, the USD/CAD dropped from around daily highs and extended its losses towards 1.3340, while the US Dollar Index, a gauge for measurement of the buck’s value vs. six peers, slides 0.13%, clings above 102.00 for the second day in a row.

Ahead of the week, the US economic docket will feature the S&P Global and ISM Manufacturing PMIs and the US Federal Reserve’s (Fed) decision. If the Fed sounds dovish, that would likely weaken the USD/CAD pair, which could extend its losses below 1.3300.

USD/CAD Technical Analysis

The USD/CAD, Tuesday’s candle, shows that the trading range has been wide throughout the session. Even though the pair reclaimed the 20 and 50-day Exponential Moving Averages (EMAs), each at 1.3406 and 1.3457, dropped sharply beneath both, and formed a candle with a considerable up-wick, suggesting that sellers are in charge. Therefore, the USD/CAD first support would be the YTD low at 1.3300, followed by the 200-day EMA at 1.3255, before sliding towards the psychological 1.3200 mark. On the other hand, if USD/CAD buyers reclaimed 1.3400, a test of the 100-day EMA is on the cards.

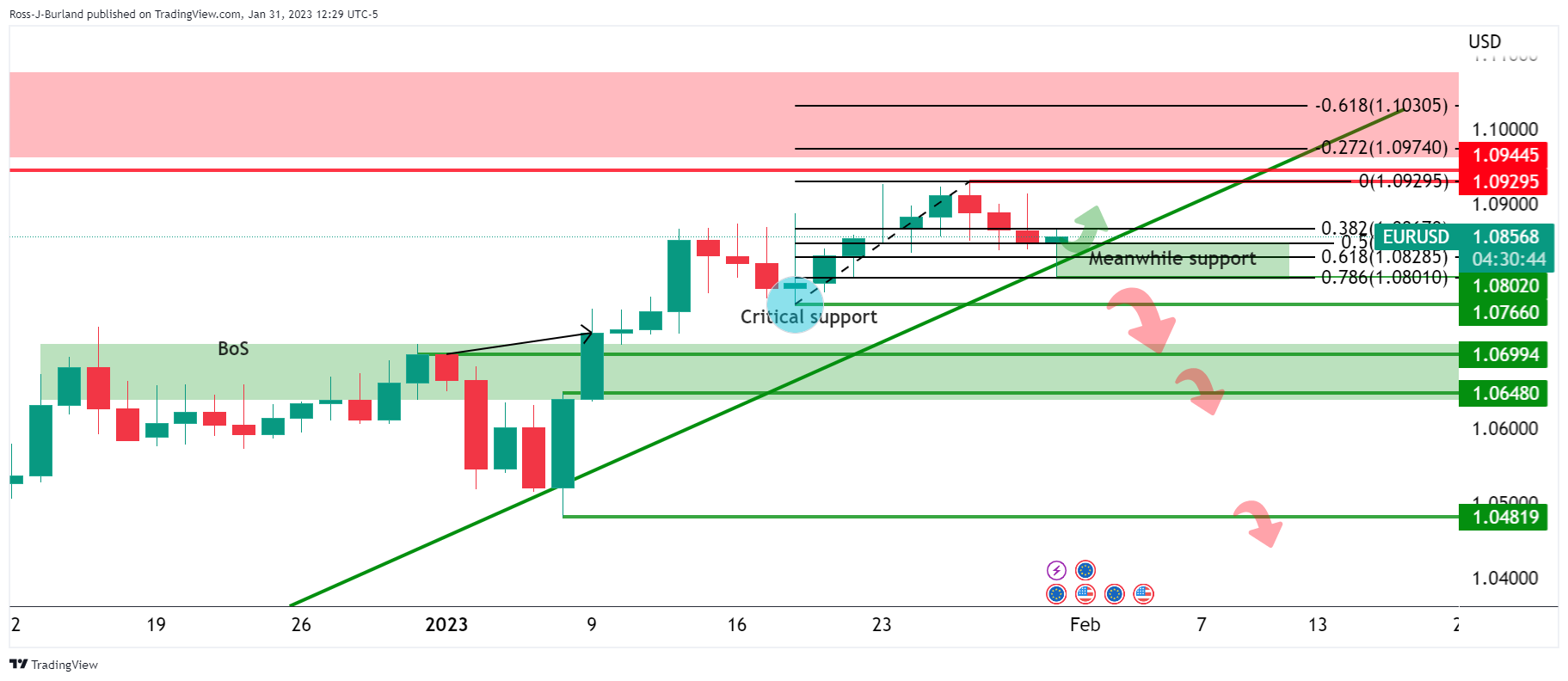

- EUR/USD is now about the key events coming up for the rest of the week, including the Fed and ECXB as well as NFP.

- For the time being, the meanwhile support of the 78.6% Fibonacci and the 50% mean reversion areas between 1.0800 and 1.0850 are keeping the bulls in play.

EUR/USD is at a crossroads trading around 1.0863 and slightly up on the day by .015% having ranged between a low of 1.0802 and 1.0867 in what has been a two-way business day ahead of central bank meetings.

The Federal Reserve showdown on Wednesday is the first major risk for EUR/USD and then the European Central Bank will be on Thursday, but the icing on the cake could be the US nonfarm Payrolls on Friday, especially if there are any surprises to come from that event. The central bank outcomes are expected to see the Federal Reserve hike by no more than 25 basis points and the European Central Bank by 50 basis points.

The communication leading up to these interest rates decisions has pretty much sealed the deal in this respect and markets are also expecting hawkish rhetoric from the central bank governors, Jermoe Powell and Christine Lagarde respectively. However, their tone around growth and inflation as well as guidance on further potential hikes could be market-moving. Indeed, the Federal Open Market Committee will want to flag the fact that we are going to see higher rates for a little bit longer, but it’s all about whether or not the market believes that narrative.

With respect to the US Dollar, analysts at TD Securities argued that it is not as sensitive to STIR pricing, ''so a higher for longer stance may not resonate as much. USD is stretched, though the catalyst for reversal by the Fed seems like a high bar. Parts of FX are displaying signs of rally fatigue, however. ''

EUR/USD technical analysis

EUR/USD is at a critical juncture on the charts ahead of the Federal Reserve event. The bulls remain in play but there are prospects of a significant correction if the market finds itself wrong on the Fed. A break of the bull cycle's trendline support and a hawkish outcome at the Fed would see the price plummet over time for a test all the way down to 1.0650/00.

EUR/USD daily charts

Zoomed in...

For now, the price is holding on the front side of the trendline so the bias remains bullish with eyes on 1.0930/50 and then the upper quarter area of the 1.09s and 1.10s after that.

Zoomed in x2 ...

As we can see, the critical horizontal support is located at 1.0765, just below the quarter level that guards a run on 1.0700 and into 1.0650 and even 1.0600 as a 100% measured move of the current consolidation range:

.

For the time being, the meanwhile support of the 78.6% Fibonacci and the 50% mean reversion areas between 1.0800 and 1.0850 are keeping the bulls in play on the front side of the bullish trendline, so again, the bias remains bullish at this point.

On Wednesday, the Federal Reserve will announce its decision on monetary policy with a 25 basis points hike already priced in. Analysts at TD Securities point out that the tone of the FOMC regarding growth and inflation and the guidance on future potential hikes could be what moves markets.

Key quotes:

“We expect the FOMC to deliver a 25bp rate increase at its February meeting, down from 50bp in December. The FOMC is likely to emphasize that despite slowing the pace of rate increases it is still determined to reach the terminal rate projected in the Dec dot plot.”

“Markets are already priced for a 25bp rate hike, but pricing for coming months and the terminal rate remains less certain. The Fed's tone around growth and inflation as well as guidance on further potential hikes could be market-moving.”

“USD is not as sensitive to STIR (Short-term interest rate) pricing, so a higher for longer stance may not resonate as much. USD is stretched, though catalyst for reversal by the Fed seems like a high bar. Parts of FX are displaying signs of rally fatigue however.”

Data released on Tuesday showed the Canadian economy grew 0.1% in November, with Q4 GDP estimated to have increased at a 1.6% annualized pace. Analysts at CIBC point out that the Canadian economy cooled during the final quarter of last year but was far from ice cold.

Key quotes:

“A 0.1% increase in GDP during November, combined with a marginal upward revision to the prior month and a flat estimated reading for December, resulted in a 1.6% annualized growth rate for the quarter as a whole. While that is a clear deceleration relative to the pace of growth seen earlier in the year, it is still better than most forecasters were anticipating before the quarter began.”

“While the Canadian economy hasn't cooled as quickly as we (and others) previously expected given the rapid rise in interest rates, there are growing signs of fragility. The recovery in many services has slowed even with activity still well below pre-pandemic levels, and a dip in restaurant activity could be an early sign of consumers changing their behaviour in the face of inflationary pressures and rising interest rates. Because of that we suspect that the economy will stall and possibly even contract modestly in Q1, which will keep the Bank of Canada on the sidelines.”

The Employment Cost Index (ECI) report released on Tuesday had an unusual impact across financial markets, with the US Dollar weakening after the numbers. Analysts at Well Fargo point out that the figures are one more in the list of inflation readings over which the Federal Reserve is breathing a little easier. They point out that while the report further supports inflation moving back toward the 2% target, labor cost growth remains too strong to be consistent with it staying there for the long haul. They think more slowing will be needed before the FOMC feels comfortable declaring victory on inflation.

ECI slowed for a third consecutive quarter

“The ECI report offers the FOMC one of its cleanest looks at how a tight labor market is translating into elevated wage pressures. Before the pandemic, employment cost growth was running at just shy of a 3% pace alongside core PCE inflation that was similarly just below 2%. The 5.1% increase in the ECI over the past year and 4.0% annualized increase in Q4 suggest that labor costs are still growing about a percentage point above what would be consistent with the FOMC's 2% inflation target given trend-like productivity growth.”

“But when it comes to inflation, easing labor cost growth should not be conflated with benign labor cost growth. The labor market remains incredibly tight. Plenty of household-name companies have announced layoffs over the past few months, but initial jobless claims continue to hover near record lows, and more independent businesses report having a hard time to filling jobs than at any point before COVID. Therefore, while the deceleration in labor costs is a welcome development from the Fed's perspective and further sign that inflation is headed back toward 2%, it is too soon to declare that it will stay there for the long-haul.”

- USD/CHF dips below 0.9200 as the US Dollar weakens and tumbles below the 20-day EMA.

- USD/CHF Price Analysis: Downward biased and might test the YTD low if it slides below 0.9100.

The USD/CHF stumbles sharply after hitting a two-week new high at 0.9288 and drops beneath 0.9200, to fresh two-day lows around 0.9174, before settling at around the current exchange rate. The USD/CHF changes hands at 0.9173, below its opening price by 0.75%.

USD/CHF Price Analysis: Technical outlook

During Tuesday’s session, the USD/CHF was quickly rejected, slightly above the January 24 daily high of 0.9279, with bears stepping in aggressively, sending the USD/CHF sliding firstly towards the 0.9200 figure, followed by a dip towards the 0.9180 area.

On its way downward, the USD/CHF pair cleared the 20-day Exponential Moving Average (EMA) at 0.9230 and also was seen back below downslope resistance trendlines, drawn since November and January. Therefore, the USD/CHF is downward biased in the short term and might test crucial demand levels.

The USD/CHF first support would be the January 26 high at 0.9158. The break below will expose the 0.9100 psychological level, followed by the YTD low at 0.9085.

As an alternate scenario, the USD/CHF reclaiming the 0.9200 figure, that would open the door for further gains. The next ceiling level would be the 20-day EMA at 0.9230, followed by the January 31 high at 0.9288

USD/CHF Key Technical Levels

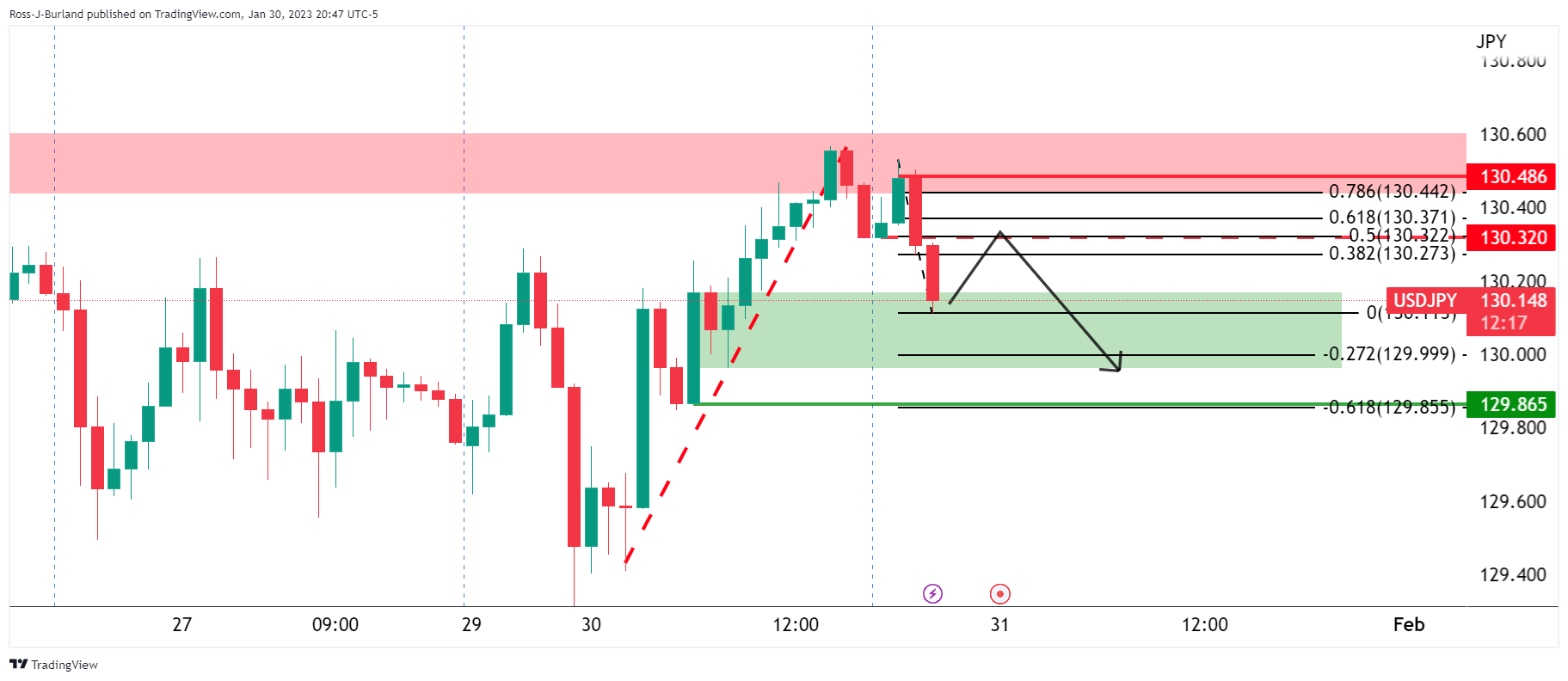

- US Dollar tumbles during the American session as FOMC meeting kicks off.

- US yields move down, then rebounds, making USD/JPY volatile.

- The pair trades above 130.00 after hitting a fresh daily low at 129.73.

The USD/JPY tumbled and then redounded during the American session, but overall it remained in a familiar range, hovering around 130.00

Mixed US data

The surprise of the day so far was the influence of the Employment Cost Index (ECI). The numbers triggered price action across financial markets. The ECI rose 1% in the fourth quarter, below the 1.1% of market consensus. It points to a continuation of the slowdown in inflation. Following the report, the Dollar tumbled, Wall Street soared and Treasury yields rose.

A different economic report showed the S&P/Case-Shiller Home Price Index rose by 6.8% (y/y) in November below the 6.9% of market consensus and the 8.7% of the previous month. Conference Board announced the Consumer Confidence Index came in at 107.1 in January below the expected 109.0.

The two-day FOMC meeting has started. Market participants expect the Federal Reserve to raise interest rates by 25 basis points. The focus will be on the statement and the projections. Analysts will look for clues about the future path of monetary policy.

USD/JPY down, then trims losses

The USD/JPY bottomed at 129.73 after the ECI. It was rejected from under 130.00 as US yields rebounded amid risk appetite. It climbed to the 130.20 area. Despite the moves, the pair continues to trade within last week’s range.

A consolidation above the upper limit around 130.50 should clear the way to more gains while below 129.00, the slide could accelerate. Before the 129.00 zone, an intermediate support is located at 129.60.

Technical levels

Economists at UBS expect the US Dollar to travel along a weaker path, with limited and short-lived bouts of strength.

US Dollar on a weaker path

“The Fed is getting closer to the end of its rate-hiking cycle. With markets growing comfortable with a terminal fed funds rate close to or at 5%, and US inflation likely to quickly roll over in the first half of this year, downward pressure on the USD should continue to mount.”

“Reduced carry advantage could weigh on the Dollar over the medium term. Last year, an increasing US-Germany 10-year interest rate differential was a tailwind for the strong Dollar rally. However, the yield differential is likely to be less supportive this year.”

“Better growth outlook ex-US supports other currencies. We believe that a rebound in global growth expectations for the second half of 2023 and 2024 should support the Euro and the currencies of Asia’s major exporters.”

S&P 500 carved out a higher trough at 3765 as compared to the one in October near 3490. The index could test 4218/4310 on a move above 4120, economists at Société Générale report.

Defending the 50DMA at 3930 would be crucial for persistencein up move

“It is worth noting that the index is about to witness a golden crossover (i.e. the 50DMA crossing beyond the 200DMA); this highlights potential upside.”

“S&P 500 is now close to the upper limit of the range since September at 4120. If this hurdle is overcome, ongoing bounce could extend towards previous bearish gap at 4218 and projections of 4310/4370.”

“Defending the 50DMA at 3930 would be crucial for persistence in up move.”

NZD/USD stays on the back foot and trades in negative territory near 0.6450. The pair is set to extend its decline towards 0.62 in the coming months, economists at Rabobank report.

Strong print for wage data is likely to give the NZD/USD a fillip

“A strong print for wage data this evening is likely to give the NZD/USD a fillip. However, the impact is likely to be soon overwhelmed by the response to the FOMC meeting tomorrow.”

“On the basis that we expect the market to price out expectations of a Fed rate cut this year, we see the potential for NZD/USD to dip back to its January low in the 0.62 area on a three-to-six month view. However, we expect NZD/USD to end the year on a stronger note.”

See – NZ Labour Market Preview: Forecasts from four major banks, unemployment around record low

- The Pound Sterling continued to soften vs. the US Dollar ahead of the Fed’s decision.

- US inflation continues to grind lower as the Employment Cost Index drops.

- The International Monetary Fund expects the UK economy to hit a recession in 2023.

The Pound Sterling (GBP) extended its losses to three straight days against the US Dollar (USD), albeit a report from the Commerce Department showed that inflation continued to ease, incrementing expectations that US Federal Reserve’s (Fed) rate hikes would moderate. At the time of typing, the GBP/USD is trading at 1.2291.

US data slightly weakened the US Dollar, though it remains stronger than the GBP

Wall Street advances after employment costs data cooled down. The US Department of Labor (DoL) revealed that the Employment Cost Index (ECI) used by Fed officials as a measure of inflation in the labor market eased from 1.2% to 1% QoQ. Today’s data added to last week’s US Core Personal Consumer Expenditure (PCE), another inflation indicator used by the Fed, edged lower by the fourth straight month, from 4.7% YoY to 4.4%. All that said, speculations had mounted that the Fed will increase rates by 25 bps at its two-day meeting, which begins today and finishes on Wednesday when the US central bank releases its monetary policy statement.

In the meantime, the US Dollar Index, a measure of the American Dollar (USD) value versus its peers, has paired some of its losses and is up 0.08%, at 102.316, a tailwind for the GBP/USD.

Across the pond, the UK’s economic docket was absent. However, newswires reported that the International Monetary Fund (IMF) revealed that Britain’s economy would slide into a recession. The IMF foresees the economy to shrink 0.5% between the 2022 Q4 and the final quarter of 2023.

It should be said that the IMF updated its forecasts and expects the global economy to grow by 2.9% compared to its last projections of 2.7%, citing economic resilience and China’s reopening.

Given the backdrop, the GBP/USD would be greatly influenced by monetary policy decisions by the Federal Reserve and the Bank of England (BoE). On Wednesday, the Fed would be the first to act, while the BoE is estimated to raise rates by 50 basis points (bps), leaving the Bank Rate at 4%. Most analysts expect this would be the last increase by the BoE, which could lead to some Sterling weakness, as rates in the US are expected to peak at 5%.

GBP/USD Key Technical Levels

Gold price registered gains in the first three days of the last week. However, the yellow metal lost its traction and erased its gains to close the week virtually unchanged. The Federal Reserve's (Fed) policy announcements and January jobs report this week could help investors decide whether the XAU/USD's bullish rally has more legs.

Fed policy announcements and US January jobs report could ramp up volatility

“The Fed is widely expected to raise its policy rate by 25 bps to the range of 4.5-4.75%. In case Powell continues to push back against the 'Fed pivot' narrative and tries to convince markets that they have no plans of cutting the policy rate before 2024, US T-bond yields could edge higher and weigh on XAU/USD. However, investors are unlikely to bet on a steady USD rebound before seeing the employment and inflation figures for January.”

“On the last trading day of the week, the wage inflation of the labour market data could influence the US Dollar's valuation. If the data reveals a further softening of wage inflation in January, the greenback could come under selling pressure and help XAU/USD push higher.”

“Finally, the Prices Paid sub-index of the ISM's PMI report will be watched closely. The component is expected to decline to 65.5 from 67.6 in December. A lower-than-consensus print should hurt the USD and provide a boost to XAU/USD and vice versa.”

- Consumer confidence in the US weakened modestly in January.

- US Dollar Index posts small daily gains above 102.30 after the data.

Consumer sentiment in the US deteriorated modestly in January with the Conference Board's Consumer Confidence Index declining to 107.1 from 109.0 in December. This reading came in below the Reuters estimate of 109.0.

Further details of the publication revealed that the Jobs Hard-to-Get Index edged lower to 11.3 from 11.9 and the one-year consumer inflation rate expectations rose to 6.8% from 6.6% in December.

Market reaction

US Dollar Index gained traction with the initial reaction and was last seen posting small daily gains at 102.35.

- The index fades the initial spike to the 102.60 zone.

- US Employment Cost Index disappoints at 1.0% in Q4.

- CB Consumer Confidence surprised to the downside in January.

The USD Index (DXY), which gauges the greenback vs. a bundle of its main rivals, comes all the way down to the 102.30 region after climbing to as high as the 102.60 area earlier on Tuesday.

USD Index surrenders gains post-labour data

The index saw its earlier uptick to multi-day highs around 102.60 suddenly trimmed after the US Employment Cost Index rose 1.0% QoQ in Q4, less than estimated and down from the previous 1.2%.

Indeed, that disheartening results seem to have given extra legs to the Fed’s pivot narrative and therefore forced the buck to give away almost all of the earlier advance to the 102.60 area.

Additional US data saw the House Price Index tracked by the FHFA contract at a monthly 0.1% in November, while the Chicago PMI receded to 44.3 in January (from 44.9) and the Conference Board’s Consumer Confidence retreated marginally to 107.1, also for the current month.

What to look for around USD

The dollar picks up pace and manages to leave behind the key 102.00 mark against the backdrop of persistent prudence ahead of the imminent FOMC gathering (Wednesday).

The idea of a probable pivot in the Fed’s policy continues to hover around the greenback and keeps the price action around the DXY somewhat subdued. This view, however, also comes in contrast to the hawkish message from the latest FOMC Minutes and recent comments from rate setters, all pointing to the need to advance to a more restrictive stance and stay there for longer, at the time when rates are seen climbing above the 5.0% mark.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and the continuation of its hiking cycle.

Key events in the US this week: Employment Cost Index, FHFA House Price Index, CB Consumer Confidence (Tuesday) – MBA Mortgage Applications, ADP Employment Change, Final Manufacturing PMI, ISM Manufacturing, Construction Spending, FOMC Interest Rate Decision (Wednesday) – Initial Jobless Claims, Factory Orders (Thursday) – Nonfarm Payrolls, Unemployment Rate, Final Services PMI ISM Non-Manufacturing (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Prospects for extra rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.04% at 102.27 and the immediate hurdle comes at the weekly high at 102.89 (January 18) followed by 105.63 (monthly high January 6) and then 106.47 (200-day SMA). On the flip side, the breach of 101.50 (2023 low January 26) would open the door to 101.29 (monthly low May 30 2022) and finally 100.00 (psychological level).

- US Dollar weakens following Q4 US Employment Cost Index.

- Data points to more evidence of a slow down in inflation.

- XAU/USD erases daily losses with a rebound of more than $10.

Gold prices bounced sharply higher following the release of US labor costs data for the fourth quarter. More evidence of a slowdown in inflation pushed US yields to the downside and Wall Street to the upside, weakening the greenback.

The Employment Cost Index (ECI) rose 1% in the fourth quarter, below the 1.1% of market consensus and marked the third consecutive slowdown. Still the index is up by 4% compared to a year ago. The evidence of an improvement in the inflation outlook boosted US yields ahead of Wednesday’s FOMC decision.

Still the numbers are high, suggesting that inflation is still not consistent with Fed’s target. “Even as supply chain pressures ease, commodity prices cool and housing costs temper, we think the FOMC still wants to see a bit more slowing in wage growth before the Committee feels confident inflation is firmly headed to 2% over the medium term”, said analysts at Wells Fargo.

The greenback tumbled after the report and also did Treasuries, boosting gold. Also equity and crude oil price rose. XAU/USD erased all losses and it is hovering around daily highs at $1,927.

Earlier on Tuesday, gold bottomed at $1,900 a critical support. Now price is back above the $1,920 zone, another relevant technical area. If it remains above, a test of $1,935 will be on the cards.

Technical levels

Eurostat will release the Eurozone Harmonised Index of Consumer Prices (HICP) data for January on Wednesday, February 1 at 10:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of seven major banks regarding the upcoming EU inflation print.

Headline is expected at 9.1% year-on-year vs. 9.2% in December, while core is expected at 5.1% YoY vs. 5.2% in December. On a monthly basis, the HICP in the old continent is expected to fall by -0.3% in the reported period while the core HICP is also down by -0.2%.

Commerzbank

“The ECB expects the rate to rise again in January. In fact, however, it is likely to remain at 9.2%. As is often the case at the beginning of a year, the inflation rate for January 2023 will also be influenced by a number of special factors. This time, various measures taken by governments to curb the rise in energy prices complicate matters further, in addition to the usual update of the goods basket. Although some effects dampening the rise in energy prices lost influence, the contribution of energy prices to the overall inflation rate is unlikely to increase much. The same applies to food prices. By contrast, the inflation rate excluding energy, food, alcohol and tobacco is likely to have fallen slightly from 5.2% to 5.1%. However, this decline is solely attributable to the change in the basket of goods. There can therefore be no talk of a weakening of underlying inflation.”

Danske Bank

“We look for an uptick both in headline (9.6%; from 9.2%) and core (5.4%, from 5.2%) terms.”

Nomura

“We forecast a large fall in the annual rate of euro area inflation in January from 9.2% to 8.4%.”

TDS

“New energy subsidies likely pulled down German headline HICP for the third consecutive month. Combined with further household support in the Netherlands and the impact of lower wholesale energy prices, this should push EZ headline inflation down to 8.4% YoY. Core is what will matter for the ECB though, and here we see no indication of a softening of the recent strong momentum.”

SocGen

“The euro area January flash HICP is likely to print down 0.4pp at 8.8% YoY, with core 0.2pp lower at 5.0% YoY, temporarily dragged down by the annual weighting changes.”

Citibank

“HICP Inflation, January: Citi Forecast 8.9% YoY, Prior 9.2% YoY; Core Inflation, January: Citi Forecast 5.3% YoY, Prior 5.2% YoY.”

Deutsche Bank

“We expect Eurozone HICP to decline to 8.4% in January and continue falling to c.3.5% in Q4 this year. Core inflation is seen staying in a 5.0-5.5% range throughout the first half of this year.”

EUR/SEK challenges critical levels around 11.30. If Swedish economic data disappoints, the Krona could come under further downside pressure.

The Riksbank’s work is not getting any easier

“Some important economic data, such as the PMI tomorrow or household consumption next week, is on the agenda ahead of the rate decision next week, and the Riksbank is going to keep a close eye on it too.”

“For now, the market is pricing in a 50 bps rate step. If the data disappoints it might lower its expectations though, putting pressure on SEK as a result.”

S&P 500 backed away from the brink yesterday after being capped below ‘last resort’ resistance at 4101. This keeps the market with the long-term downtrend still intact whilst below this level, in the view of analysts at Credit Suisse.

Key short-term support is at 3956/49

“S&P 500 backed away from the brink yesterday, reversing its recent close above the important 2022 downtrend after being capped below ‘last resort’ resistance at the 4101 December bearish ‘reversal week’ high. This keeps the market finely poised into this week’s FOMC meeting, with the long-term downtrend still intact whilst below this level.

“We reverse into a tactically bearish stance, with first key support at 3956/49. Back below here would be the first step to reasserting the still intact, at least at this stage, bear market. Next supports thereafter are seen at 3926/25 and then 3886/77.”

“We are still very wary of the potential for an aggressive short-covering rally. However, we remain of the view that a weekly closing break above the 4101 December high is needed to trigger a capitulation-driven move higher, whilst also confirming that we have seen an important change of longer-term trend from down to sideways.”

GBP has weakened in line with the overall gain in the USD against its core European peers. However, more significant losses look technically unlikely, in the view of analyst at Scotiabank.

GBP eases but holds range

“Sterling has slipped and short-term technical signals have turned more negative but price action has not extended to a point where more significant losses look technically likely.”

“Cable is essentially holding within its recent trading range and while the Pound holds above last week’s 1.2265 low, downside risks should remain limited. A break below that point would, however, indicate growing risk of a dip to the lows 1.21s.”

- House prices in the US declined modestly in November.

- US Dollar Index continues to stretch lower toward 102.00.

House prices in the US declined by 0.1% on a monthly basis in November, the monthly data published by the US Federal Housing Finance Agency showed on Tuesday. This reading came in below the market expectation for an increase of 0.8%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at 6.8% on a yearly basis in November, down from 8.7% in October.

Market reaction

US Dollar Index stays under modest bearish pressure after this data and was last seen posting small daily losses at 102.19.

- EUR/USD bounces off lows near the 1.0800 mark.

- Bets for another test of the 2023 high seem to be losing ground.

EUR/USD manages to reverse the earlier pullback to 2-week lows near the 1.0800 region on Tuesday.

If the downside picks up pace, then the next support of note is seen emerging at the weekly low at 1.0766 (January 18) prior to the 3-month support line just above 1.0700.

The continuation of the uptrend now needs to clear the 2023 high at 1.0929 (January 26) to allow for a test of the weekly top at 1.0936 (April 21 2022). A sustainable break above this level could pave the way for a challenge of the key barrier at 1.1000

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0311.

EUR/USD daily chart

- USD/JPY remains capped near a two-week-old descending trend-line hurdle.

- The formation of a bearish pennant supports prospects for a fresh leg down.

- A sustained move beyond mid-130.00s is needed to negate the bearish outlook.

The USD/JPY pair struggles to capitalize on the previous day's rally of over 135 pips from the 129.20 area and oscillates in a narrow range through the early North American session on Tuesday.

From a technical perspective, a descending trend-line extending from January 18, currently around the 130.50 area, caps the upside for the USD/JPY pair. This, along with another upward-sloping trend line, constitutes the formation of a symmetrical triangle and points to a consolidation phase.

Given the recent sharp decline from over a three-decade high, the aforementioned triangle might now be categorized as a bearish pennant. This, in turn, favours bearish traders and supports prospects for the resumption of the well-established declining trend witnessed over the past three months or so.

That said, it will still be prudent to wait for a convincing break below the triangle support, 129.25 region, before placing fresh bearish bets. The USD/JPY pair might then turn vulnerable to weaken below the 129.00 mark and test intermediate support near the 128.75-128.70 horizontal zone.

The downward trajectory could get extended further towards the 128.00 round-figure mark, below which the USD/JPY pair seems all set to challenge the multi-month low, around the 127.20 zone touched on January 16.

That said, a sustained strength beyond mid-130.00s, or the top end of the symmetrical triangle, will negate the negative outlook and prompt some near-term short-covering rally. The USD/JPY pair might then accelerate the momentum towards the 131.00 mark, en route to the post-BoJ swing high, around the 131.55-131.60 area. Some follow-through buying should pave the way for additional near-term gains.

USD/JPY 4-hour chart

Key levels to watch

At the start of the week USD/MXN traded further sideways below the 19 mark. Mexican GDP data for Q4 2022 will be published today. A downside surprise could put pressure on the Peso, economists at Commerzbank report.

Economic momentum likely to have weakened

“Today, the Mexican office of statistics (INEGI) will publish a first estimate of growth in Q4 2022 – which will provide a backward glance. Bloomberg consensus expects that economic momentum will have weakened and expects seasonally adjusted QoQ growth of 0.3%, following 0.9% the previous quarter. Year-on-year consensus expects growth of 3.4% (in Q3 the rate stood at 4.3%). As a result, growth would be below Banxico’s projections.”

“If the data were to surprise on the downside and come in well below Banxico’s projections that is likely to put pressure on the Peso, above all in a more risk-averse market environment.”

- The index extends the corrective upside beyond 102.00.

- The breakout of the 102.90 region could lend extra legs to the index.

DXY advances for the fourth consecutive session well north of the 102.00 hurdle on Tuesday.

Further recovery faces the immediate hurdle at the 3-month resistance line around 102.90. If the index manages to clear this region it could accelerate gains to the provisional 55-day SMA at 104.22.

Below this line, the dollar is expected to keep the short-term bearish bias unchanged.

In the longer run, while below the 200-day SMA at 106.47, the outlook for the index remains negative.

DXY daily chart

- Employment Cost Index in the US rose less than expected in Q4.

- US Dollar Index lost its traction and erased daily recovery gains after the data.

The data published by the US Bureau of Labor Statistics revealed on Tuesday that the Employment Cost Index, compensation costs for civilian workers, increased by 1.1% in the fourth quarter.

This reading came in below the market expectation of 1% and followed the 1.2% increase recorded in the third quarter.

"Wages and salaries increased 1.0% and benefit costs increased 0.8% from September 2022," the BLS further noted in its publication.

Market reaction

With the initial reaction, the US Dollar lost some strength against its major rivals and the US Dollar Index was last seen trading virtually unchanged on the day at 102.22.

- Canadian economy grew by 0.1% on a monthly basis in November.

- USD/CAD holds in positive territory slightly below 1.3450 after the data.

Real Gross Domestic Product (GDP) in Canada grew by 0.1% on a monthly basis in November, the data published by Statistics Canada revealed on Tuesday.

This reading matched October's expansion of 0.1% and came in slightly better than the market expectation of 0%.

"Advance information indicates that real GDP was essentially unchanged in December," Statistics Canada noted in its publication. "Increases in the retail, utilities, and public sectors were offset by decreases in the wholesale, finance and insurance, and mining, quarrying, and oil and gas extraction sectors."

Market reaction

USD/CAD pair edged slightly lower with the initial reaction and was last seen trading at 1.3437, gaining 0.4% on a daily basis.

- AUD/USD continues losing ground for the second straight day and drops to a one-week low.

- The dismal Australian data weighs on the domestic currency amid a modest USD strength.

- Traders look to the US macro data for a fresh impetus ahead of the FOMC on Wednesday.

The AUD/USD pair remains under heavy selling pressure for the second straight day on Tuesday and drops to over a one-week low heading into the North American session. The pair is currently placed around the 0.7000 psychological mark and seems vulnerable to prolonging its recent pullback from the highest level since June 2022 touched last week.

The Australian Dollar weakens across the board in reaction to the dismal domestic macro data, which showed that Retail Sales slumped 3.9% in December amid the persistent rise in prices. Furthermore, investors are increasingly pessimistic about the economic outlook amid expectations that additional rate hikes by the Reserve Bank of Australia (RBA) will contribute to the cost of living crisis. This, along with a modest US Dollar strength, exerts downward pressure on the AUD/USD pair.