- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The Commodity Futures Trading Commission's weekly commitments of traders' report will be delayed due to a ransomware attack on ION trading UK.

The CFTC is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which include futures, swaps, and certain kinds of options.

- USD/JPY bulls eye the daily resistance zone where the 61.8% ratio meets the structure near 129.60.

- Bears need to get below the critical 127.50s.

USD/JPY was forced lower on a bout of US Dollar strength on Thursday in an extension of the drop from the mid-point of the 130s. The price has been supported in the midpoint of the 127s and has left no bias on the carts from an immediate directional perspective until the 129.50s or the aforementioned 127.40s are broken. However, there are prospects of a meanwhile correction for the day ahead as traders get set for the US Nonfarm Payrolls data as the last puzzle of the puzzle for this week.

USD/JPY daily chart

The price has met the 61.8% Fibonacci retracement at 127.588 of the move from between the November 2021 swing lows of 112.53 and the October swing highs of 151.95 highs range which is acting as a support which the bears need to break.

Zoomed in ...

The price is drifting out of the deciding channel having hit support and this leaves prospects of a phase of consolidation outside of the channel that could lead to accumulation for a move higher.

Zoomed in ...

In the meantime, a correction could be in order towards prior support that would be expected to act as a resistance zone where the 61.8% ratio meets the structure near 129.60.

- AUD/JPY has not shown a meaningful reaction to the upbeat Australian PMI data.

- The RBA is expected to slowly push its OCR higher to 4.1% to tame soaring inflation.

- The reason behind widening BoJ’s YCC band was to make them more sustainable.

The AUD/JPY pair has shown a muted response to the upbeat Australian S&P Global PMI. The Services PMI has landed at 48.6 higher than the consensus and the prior release of 48.3. Also, the Composite PMI has scaled to 48.5 against the former release of 48.2. An absence of a contraction in economic activities despite rising interest rates by the Reserve Bank of Australia (RBA) could keep Australian inflationary pressures intact.

The Australian Dollar is expected to remain volatile on Friday ahead of the release of the Caixin Services PMI (Jan). The economic data is seen at 47.3 lower than the former release of 48.0. A decline in the Services PMI could impact the Australian Dollar as Australia is a leading trading partner of China.

Next week, the Australian Dollar will remain in the spotlight due to the interest rate decision announcement by the RBA. The Australian inflation rate has not shown a peak yet as it has shown a fresh high of 7.8% in the fourth quarter of CY2022. RBA Governor Philip Lowe might not have another option than to hike interest rates further.

Analyst at Deutsche Bank Australia sees the RBA likely to drive the Official Cash Rate (OCR) to 4.1%, citing the most recent inflation update of a 7.8% increase in the CPI, which was slightly higher than expected. “While the RBA will likely move more slowly in 2023 than it did in 2022, we now expect four more 25 basis point hikes this year: 25 basis points in each of February and March, and 25 basis points each at the May and August meetings” as reported by Forbes Advisor.

On the Japanese Yen front, investors are awaiting the release of the Jibun Bank Services PMI for fresh cues. The economic data is seen steady at 52.4. The street is still confused about the rationale behind widening the Yield Curve Control (YCC) by the Bank of Japan (BoJ) in its December monetary policy meeting. Meanwhile, BoJ Deputy Governor Masazumi Wakatabe is back on the wires this Thursday, noting that the “BoJ's Dec decision to widen band was a necessary step to make YCC more sustainable, but the move alone may have had the effect of weakening stimulus effect.”

- USD/CAD tumbled to fresh YTD lows at around 1.3262 but recovered and reclaimed 1.3300.

- USD/CAD Price Analysis: Upward biased above 1.3250.

The USD/CAD recovered some ground, trimmed some of its Wednesday’s losses on Thursday, and rose by 0.19% after hitting a new YTD low at 1.3262. As the Asian session begins, the USD/CAD exchanges hands at 1.3313, below its opening price at the time of writing.

USD/CAD Price Analysis: Technical outlook

Technically speaking, the USD/CAD is still upward biased, once achieved to stay above the 200-day Exponential Moving Average (EMA) at 1.3256. However, it should be said that once the USD/CAD tumbled below a three-month-old upslope support trendline, it failed to clear the latter, exposing the USD/CAD pair to some selling pressure.

If the USD/CAD tumbles back below 1.3300, bears next target would be the 200-day EMA. Once broken, the USD/CAD could extend its losses towards 1.3200.

As an alternate scenario, if the USD/CAD extends its recovery beyond the trendline mentioned above that passes around 1.3350, that would exacerbate a rally to 1.3400. If the bulls moved in, the USD/CAD following target would be the 100-day EMA at 1.3409, followed by the 50-day EMA at 1.3440, ahead of the January 19 swing high at 1.3520.

USD/CAD Key Technical Levels

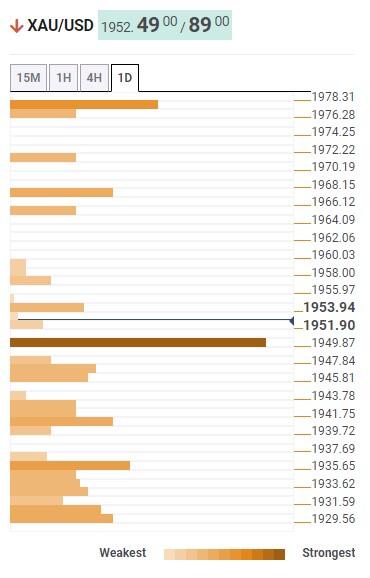

- Gold price is eyeing more weakness to near $1,900.00 after an inventory distribution breakdown.

- Higher US labor cost data could shrug off Fed’s policy tightening pause rumors ahead.

- S&P500 has displayed a three-day winning streak despite further policy tightening by the Fed.

Gold price (XAU/USD) nosedived to near $1,912.00 after a blockbuster recovery move from the US Dollar Index (DXY) on Thursday. The precious metal is staring at the round-level resistance of $1,900.00 as further downside looks possible ahead of the United States Nonfarm Payrolls (NFP) data.

The downside pressure in the USD Index led by rising expectations that the Federal Reserve (Fed) might consider a pause in the policy tightening as the US inflation is softening significantly has been shrugged off. The US labor cost index is still solid and carries the ability to dismantle the Fed policy pause context.

In the US NFP gamut, Analysts at TD Securities expect a 220K increase in payroll and a modest increase in the Unemployment Rate to 3.6%. As per the consensus, Average Hourly Earnings data is seen at 4.9% vs. the prior release of 4.6% on an annual basis. While monthly data is seen steady at 0.3%. Led by exceeding labor demand against the supply, higher negotiation power in favor of job seekers could dent the price index declining trend, which can shrug off the rumors calling for a pause in the policy tightening pace by the Fed.

Meanwhile, risk-perceived assets like S&P500 have displayed a three-day winning streak despite further policy tightening by the Fed.

Gold technical analysis

Gold price has demonstrated a perpendicular sell-off after an Inventory Distribution chart formation on an hourly scale. The inventory distribution in a minor range of $1,950-1,960 indicates a shift of inventory from institutional investors to retail participants. The 20-and 200-period Exponential Moving Averages (EMAs) have delivered a bear cross at $1,927.80, which indicates more weakness ahead.

In addition to that, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum has been triggered.

Gold hourly chart

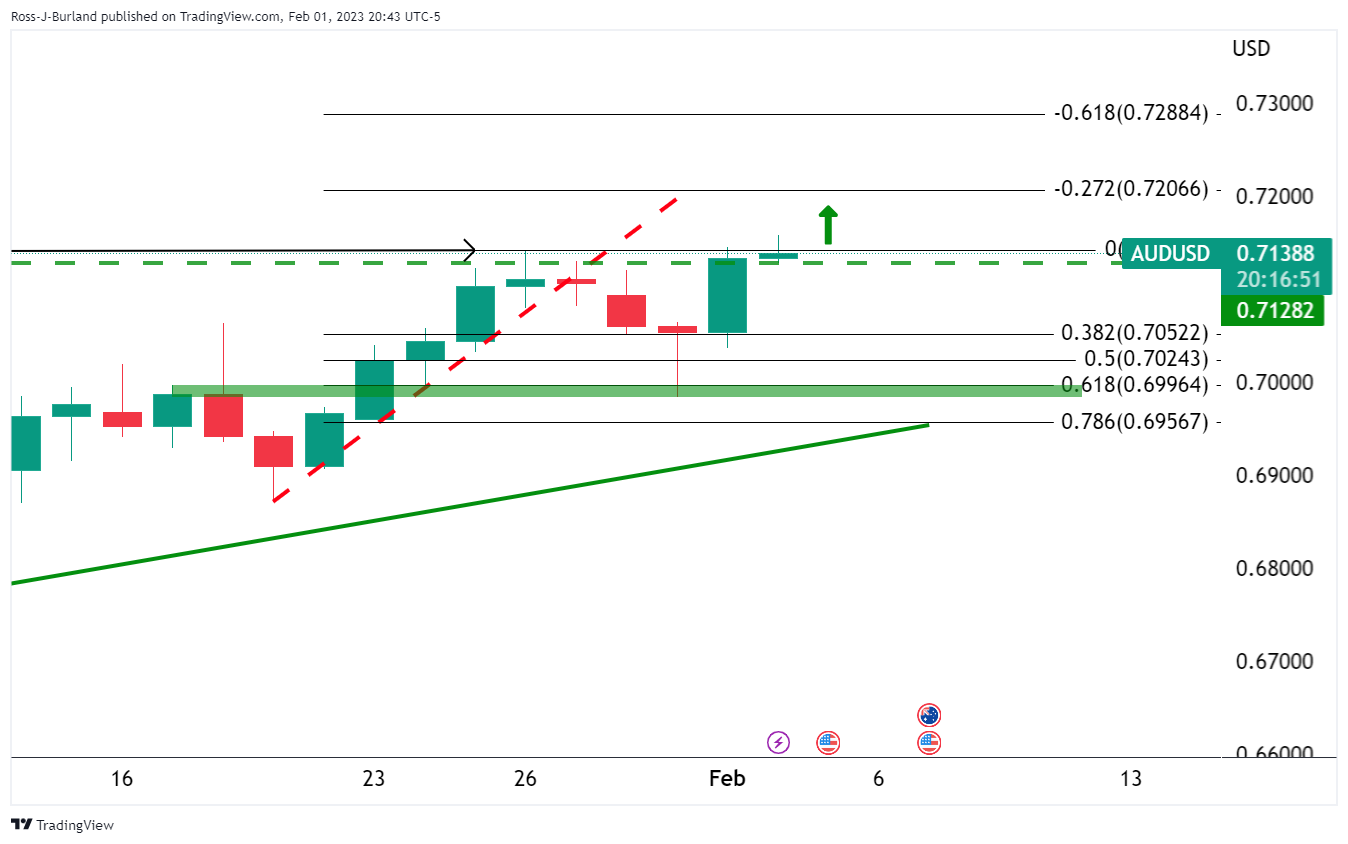

- The Aussie could not hold to its gains above 0.7100, outweighed by a strong US Dollar.

- US data showed the tightness of the labor market underpinned the greenback.

- Australia’s Services and Composite PMIs came more robust than the previous month’s data, though they remained in contractionary territory.

AUD/USD refreshed seven-month highs at around 0.7157 but collapsed as the US Dollar (USD) remained bid during Thursday’s session after market participants’ reaction to the US Federal Reserve (Fed) decision to lift rates weakened the greenback across the board. Nevertheless, the US Dollar stages a comeback, as shown by the AUD/USD exchanging hands at 0.7072 at the time of writing.

Upbeat US labor market data boosted the US Dollar

The AUD/USD dropped in the session, even though investors’ sentiment was upbeat. The US Federal Reserve decision hurt the US Dollar, as the Fed, led by Jerome Powell, stated that the US central bank has made progress curbing stubbornly high inflation amidst a tight labor market. Data revealed by the US Department of Labor (DoL) showed that Initial Jobless Claims for the last week ending on January 28 came at 183K below estimates of 200K, suggesting that companies had continued to hire personnel.

Therefore, the AUD/USD dwindled as traders brace for January’s US Nonfarm Payrolls report, with consensus at 185K, below the previous month’s reading of 223 K. Any readings above the consensus would keep the Fed on its tightening cycle. Still, Powell said that terminal rates are around the corner.

Regarding Australia, its economic calendar featured the Judo Bank Services and Composite PMI on its Final readings, at 48.6 and 48.5, respectively. Although the readings came higher than the previous month’s data, they remained in contractionary territory, portraying a gloomy scenario for the Australian Dollar (AUD).

What to watch?

The US economic calendar will feature employment data led by the Nonfarm Payrolls report, alongside the ISM Non-Manufacturing report, would update the US economy status.

AUD/USD Key Technical Levels

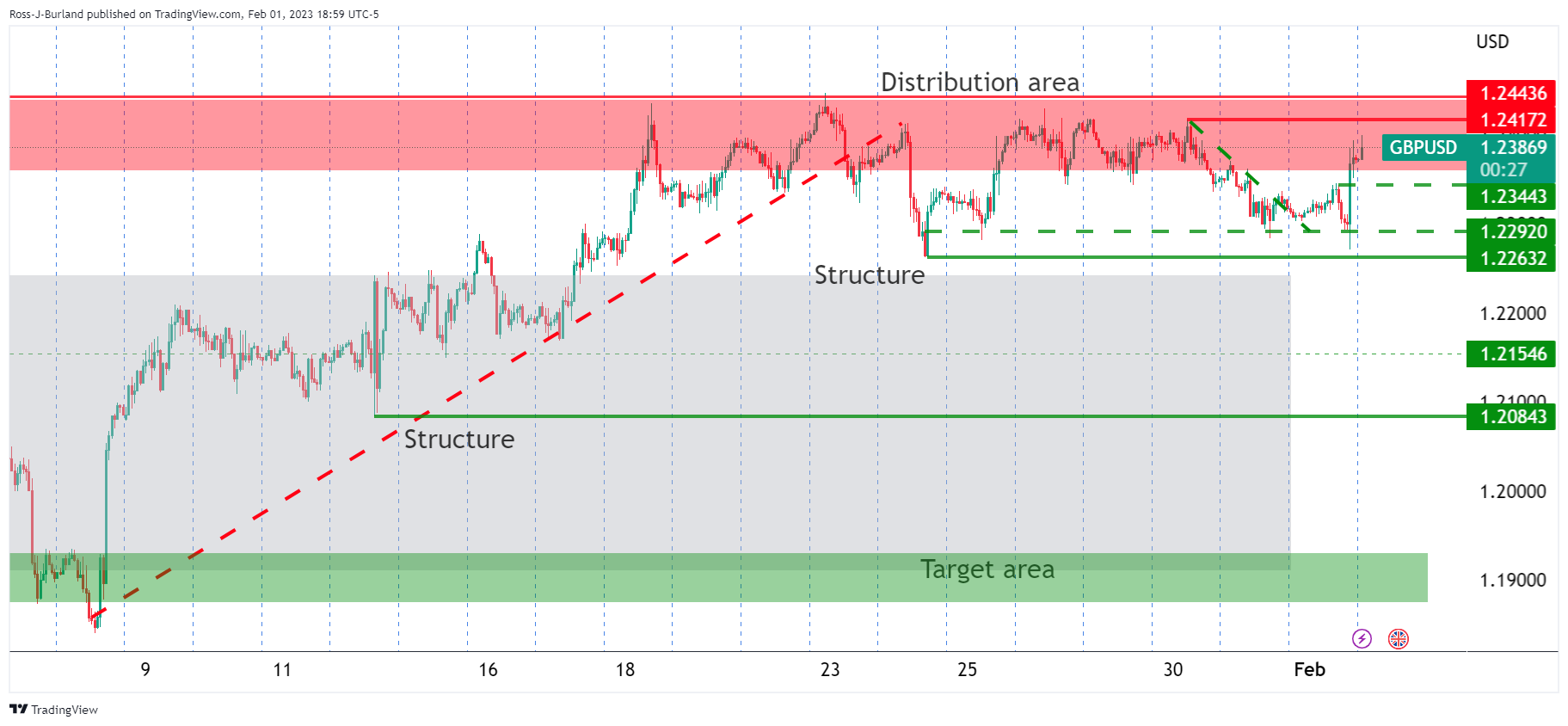

- GBP/USD is expected to continue its downside journey to near 1.2200 as focus shifts to US NFP data.

- To tame double-digit inflation, the BOE pushed interest rates by 50 bps to 4%.

- Investors will keep an eye on US Average Hourly Earnings data for further guidance.

The GBP/USD pair has shown a vertical sell-off to near 1.2225 and is expected to continue its downside journey to near the round-level support of 1.2200 ahead. The Cable witnessed a massive sell-off after investors shrugged off expectations that the Federal Reserve (Fed) will pause policy tightening ahead and poured funds into the US Dollar Index (DXY). Apart from that, investors dumped the Pound Sterling despite the Bank of England (BoE) continuing its hawkish stance on interest rates.

On Thursday, the USD Index recovered firmly after building a cushion around 100.50. The extremely oversold condition of the USD Index triggered buying interest among the market participants. The USD Index soared above 101.50 and has now turned sideways below 101.40 ahead of the United States Nonfarm Payrolls (NFP) data for further guidance.

To tame the double-digit inflation figure, BOE Governor Andrew Bailey announced an interest rate hike by 50 basis points (bps), which pushed borrowing rates to 4%. The BoE was an early adopter that started contracting its monetary policy after the pandemic period and has now announced its 10th consecutive interest rate hike. However, the inflation rate is still double-digit amid rising wage rates due to squeezed labor supply. Also, the softening energy prices are offset by the rising food price index, which was recorded at 16.8% for December.

There is no denying the fact that BoE policymakers have done much with interest rates to decelerate inflation, however, the United Kingdom economy is not responding, as expected, to extreme policy tightening.

On Friday, the release of the US NFP data will be of utmost importance. According to the consensus, the United States economy has added 185K jobs in the labor market in January vs. the former release of 223K in times when labor demand is exceeding supply. The Unemployment Rate is seen at 3.6% vs. 3.5% released earlier. The catalyst that will be critically monitored by investors for further action will be the Average Hourly Earnings data.

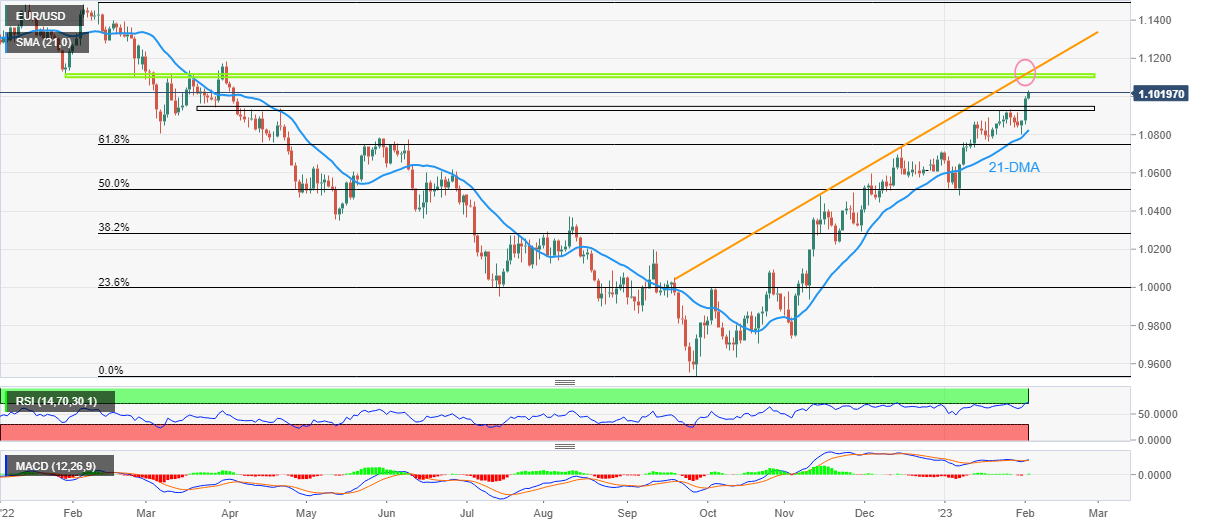

- EUR/USD is demonstrating a sideways auction ahead of the US NFP data.

- A 50 bps interest rate hike by the ECB has trimmed the Fed-ECB policy divergence.

- Eurozone core inflation has remained stubborn and demands more attention from ECB policymakers.

The EUR/USD pair is displaying a back-and-forth action around 1.0900 after a pullback move from 1.0885 in the early Asian session. The major currency pair has turned sideways ahead of the United States Nonfarm Payrolls (NFP) data, which will release on Friday. On Thursday, the Euro witnessed a massive sell-off after a sheer recovery move by the US Dollar Index (DXY) and the announcement of 50 basis points (bps) interest rate hike by the European Central Bank, which trimmed the Federal Reserve (Fed)-ECB policy divergence.

The USD Index is showing signs of volatility contraction after witnessing some volatile moves and has now shifted into a rangebound auction around 101.40. Meanwhile, S&P500 settled Thursday’s session on a bullish note, portraying that the risk-appetite theme is intact. The 500-US stock basket has already shown a three-day winning spell and is expected to continue its upside momentum further. The demand for US government bonds remained subdued, which led to a minor gain in the 10-year US Treasury yields above 3.40%.

On Thursday, ECB President Christine Larage pushed interest rates to 2.50% by announcing a 50 bps interest rate hike in line with the street estimates. No doubt, the Eurozone inflation has started softening after a sheer decline in energy prices and a recovery in supply chain disruptions. However, the ECB is required to restrict its monetary policy further as the inflation rate is extremely far from the desired rate of 2%.

Led by a deceleration in the energy price, the headline price index has come down for January month to 8.5% but the core inflation that strips oil and food prices has remained stubborn and is demanding exclusive attention from the ECB policymakers.

For further guidance, US NFP data will be keenly watched. The economic data is seen at 185K lower than the former release of 223K. Apart from that, the Unemployment Rate is expected to escalate to 3.6% vs. 3.5% in the prior release.

- NZD/USD bulls are being beaten back by a firmer US Dollar ahead of key data.

- The US NFP report will be the icing on the cake for a series of high-impact events form the last few days.

NZD/USD is on the way to a key support area with the US Dollar gathering pace in the North American session with eyes on 0.6450 having dropped from a high of 0.6537. The pair has reached a low of 0.6462 so far.

The Federal Reserve, Fed, yesterday concluded with a dovish tilt that sank the US Dollar to fresh bear cycle lows of 100.82 as per the DXY index that followed the Federal Reserve's chairman Jerome Powell's dovish comments. Markets jumped on he his statement that said he was seeing signs of disinflation. However, it was shortlived as the European Central Bank was not as hawkish as the bulls were hoping for, sinking the Euro and propelling the greenback into a forcible correction. The ECB raised key rates 50bp taking the MRO to 3.0%, and indicated it expects a repeat in March. Thereafter, any further hikes will be data-dependent the central bank said. Given the stretch positioning, however, the euro needed more from the event to stay up. ''EUR long positioning sits near the top of our tracking indicator, leaving it vulnerable to lofty market expectations,'' analysts at TD Securities said.

Looking ahead it will now be all about the Nonfarm Payrolls and as analysts at ANZ Bank explained, markets are clearly in no mood to embrace any hawkishness, ''and that could be a real limiting factor for the USD, they argued.'' Friday's Nonfarm Payrolls event will be a critical component of the US interest rate outlook and will drive sentiment in this regard.

Analysts at TD Securities are projecting payroll gains to have stayed largely unchanged vs December, posting a still solid 220k increase in January. ''Both the Unemployment Rate and average hourly earnings should have remained steady: the former at a decades-low 3.5%, and the latter printing a 0.3% MoM gain,'' the analysts explained. ''Note that the January jobs report will also include important revisions to the establishment survey data for 2022,'' they added.

Such an outcome could provide fuel to the US Dollar's correction from the bear cycle lows. Nonetheless, a weaker report, analysts at TD Securities warn, or an ''indication of softness will reinforce'' risk sentiment, which could be bullish for the Gold price and bearish for the US Dollar.

- GBP/JPY nosedives 200 pips or 1.30% on Thursday, courtesy of a BoE rate hike.

- GBP/JPY Price Analysis: Downward biased, but it could print a leg-up before the downtrend continues.

With the Bank of England (BoE) hiking rates by 50 basis points, the GBP/JPY surprisingly plummets across the board, more than 200 pips on Thursday. At the time of writing, the GBP/JPY exchanges hands at 157.39 after hitting a daily high of 159.60.

GBP/JPY Price Analysis: Technical outlook

The Pound Sterling (GBP) is losing traction against most G8 currencies. In the case of the GBP/JPY pair, price action dived sharply, towards new weekly lows, after smashing February’s 1 low of 158.90. That accelerated Sterling’s fall, extending below a one-month-old downslope trendline broken on January 20, that was acting as support and capped Wednesday’s drop.

On its way south, the GBP/JPY fell below the 158.00 figure, with bears eyeing to test the January 13 daily low at 155.64, followed by the YTD low at 155.35. But firstly, GBP/JPY bears would need to deal with the January 18 low of 157.27, ahead of the 157.00 figure, and followed by the January 17 low of 156.38.

On the other hand, the GBP/JPY reclaiming 158.00 could pave the way for a leg-up before resuming the downtrend. The GBP/JPY key resistance levels would be a downslope trendline at around 158.20-30, followed by the February 1 daily low of 158.90.

GBP/JPY Key Technical Levels

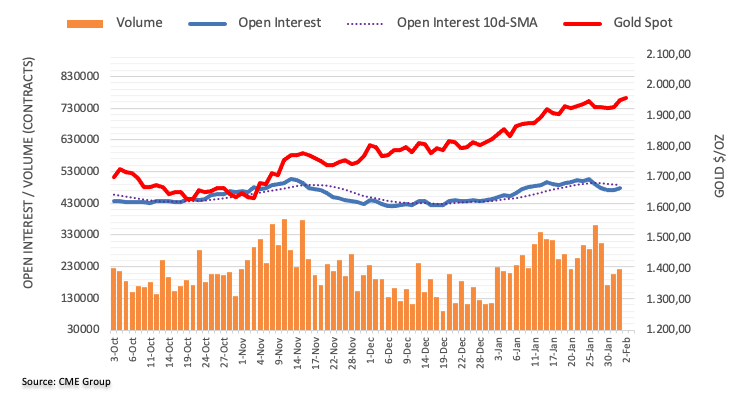

- Gold price dropped despite the Federal Reserve and European Central Bank combination.

- US Dollar is attempting to correct from multi-week lows.

- United States of America Nonfarm Payrolls could be a major event for the Gold price and US Dollar.

Gold price is tinkering on the edge of a significant blow-off to the downside in the coming days. At the time of writing, XAU/USD is trading down 1.85% and has done most of the leg work for a move much lower. In prior analysis, a downside case has been advocated given the length of the bull rally and the recent breakdown of the Gold price bullish structure is compelling.

The Gold price has dropped from a bull cycle high made on the same day of $1,959.77 and has marked a low of $1,911.87, so far. However, critically, the Gold price has broken $1,918 and should there be a close below here on a daily basis, the bears will have made an impressionable mark on the charts for the week ahead. See below for the technical analysis of the Gold price. M

eanwhile, it has been a game of two halves so far this week with a series of fundamentals playing into both the US dollar and the Gold price. We are now moving into extra time with the Nonfarm Payrolls that will possibly be the deciding factor for both assets.

Federal Reserve and European Central Bank did little to support Gold price

Firstly, the Federal Reserve, Fed, event concluded with a dovish tilt that sank the US Dollar to fresh bear cycle lows of 100.82 as per the DXY index that followed the Federal Reserve's chairman Jerome Powell's dovish rhetoric when he said he is seeing signs of disinflation. Consequently, US Treasury Bond yields were sharply lower, bullish for gold as it offers no interest. The yield on the US 10-year Treasury note dropped to a low of 3.334%.

- Federal Reserve: The rate peak is in sight – Commerzbank

The Federal Reserve raised its key interest rate corridor by 25 basis points to 4.50%-4.75%, as expected. In the view of economists at Commerzbank, the Federal Reserve is unlikely to do much more before it reaches its rate peak and that sentiment was weighing on the US Dollar.

Then, however, the European Central Bank, ECB, came in with a less hawkish than proffered rhetoric that the Euro bulls would have hoped for which sank the Euro, supporting the US Dollar, and propelling the Gold price lower for the day after previously touching a 10-month high.

All in all, Gold price markets are coming around to the fact that while the United States of America's inflation pace may be trending down, the Federal Reserve will have a much harder time getting it down to its desired 2% target considering the labour market shortages, which segues us into the Nonfarm Payrolls on Friday.

Nonfarm Payrolls, expectations for Gold price

The US labour market and Nonfarm Payrolls event is a critical component of the US interest rate outlook. Analysts at TD Securities are projecting payroll gains to have stayed largely unchanged vs December, posting a still solid 220k increase in January. ''Both the Unemployment Rate and average hourly earnings should have remained steady: the former at a decades-low 3.5%, and the latter printing a 0.3% MoM gain,'' the analysts explained. ''Note that the January jobs report will also include important revisions to the establishment survey data for 2022,'' they added.

Such an outcome could provide fuel to the US Dollar's correction from the bear cycle lows and would therefore be expected to weigh on the Gold price. However, a weaker report, analysts at TD Securities warn, or an ''indication of softness will reinforce'' risk sentiment, which could be bullish for the Gold price and bearish for the US Dollar.

Gold technical analysis

The Gold price is breaking down structure, (BoS) on the daily chart and a correction of the daily bearish impulse could result in further selling pressure from the bears. However, a commitment from the Gold price bulls to above $1,920/30 4-hour resistances could leave the bulls in play for the foreseeable future:

All will be revealed for the Gold price over the United States of America Nonfarm Payrolls event on Friday one way or another.

What you need to take care of on Friday, February 3:

The US Dollar recovered most of the ground lost post-Fed’s decision amid ECB and BOE monetary policy announcements. The American currency edged higher against most major rivals, with the JPY being its strongest rival and the GBP the weakest.

Earlier in the day, Bank of Japan Deputy Governor Mazasumi Wakatabe said there has been no change to the central bank’s determination to continue with its current monetary policy. USD/JPY finished the day at around 128.60 after extending its weekly decline to 128.07.

The Bank of England came first, and as widely anticipated, Bailey & co. hiked rates by 0.5 percentage points to 4%. Governor Bailey was quite optimistic, as he said that a potential recession will likely be less deep than previously expected. He also said that they would need to watch the path of inflation very closely. GBP/USD ended up falling to a multi-week low of 1.2330.

The European Central Bank also hiked by 50 bps and even confirmed another 50 bps for March. However, President Lagarde said that the following decisions will be a meeting-by-meeting matter and that it will be data-dependant. EUR/USD trades just above the 1.0900 threshold, as investors believe terminal rates are around the corner.

Stock markets advanced, partially limiting US Dollar gains. US Treasury yields eased from their post-Fed peaks and ended the day down.

Spot gold plunged from the $1,950 price zone and finished the day at around $1,913 a troy ounce. Crude oil prices lost some ground, but losses were moderated by the better tone of US indexes. WTI is currently changing hands at $75.80 a barrel.

The week will end with the release of the US Nonfarm Payrolls report on Friday.

Like this article? Help us with some feedback by answering this survey:

- The rate hike by the US Federal Reserve tumbled the USD/CAD to new YTD lows.

- Falling oil prices and solid US labor market data underpinned the USD/CAD.

- USD/CAD traders are eyeing Friday’s US Nonfarm Payrolls data alongside ISM Non-Manufacturing PMIs.

USD/CAD is recovering some ground after posting minimal losses Wednesday, which sent the pair into a tailspin to test the 200-day Exponential Moving Average (EMA) at 1.3255 after the US Federal Reserve decided to raise rates. At the time of writing, the USD/CAD is trading at 1.3312 after hitting a new YTD low of 1.3262.

Fed’s dovish perceived hike undermined the US Dollar

On Wednesday, the Fed lifted rates to the 4.50%-4.75% range as expected, and Fed’s Chair Jerome Powell took the stand. He said that ongoing increases to the Federal Funds rate (FFR) would be appropriate and emphasized the US central bank’s commitment to tame inflation to the 2% target. Even though he said that a couple of increases are likely in March and May, his acknowledgment that the disinflationary process had begun was perceived by market participants as a dovish signal.

In the meantime, Thursday’s US economic calendar revealed the unemployment claims for the last week that ended on January 28, with Initial Jobless Claims falling to 183K from 186K a week earlier and less than the 200K projected by polls. Labor market data added to Wednesday;’s JOLTs report, which showed that vacancies rose, signaling that the labor market remains tight.

In the meantime, the US Dollar Index (DXY) advances 0.45%, up at 101.62, a tailwind for the USD/CAD pair. The greenback’s recovery is due to the Euro and British Pound continuing to extend their losses vs. the buck, notably the Sterling, down by 1%.

On the Canadian front, the Loonie (CAD) remained soft on Thursday, influenced by factors like falling US crude oil prices, with WTI’s down 0.27%, at $76.46 per barrel. Another reason that weighed on the Canadian Dollar (CAD) was building permits, which shrank -7.3% in December, above the previous month’s plunge of -14.9% but above estimates of a -5% contraction, as reported by Statistics Canada.

What to watch?

On Friday, an absent Canadian economic docket would leave USD/CAD traders leaning on the dynamics of the United States (US). On the US front, employment data led by the Nonfarm Payrolls report, alongside the ISM Non-Manufacturing report, would update the US economy status.

USD/CAD Key Technical Levels

- EUR/JPY is offered in the aftermath of the ECB on Thursday.

- The euro is pressured by a lack of certainty with regard to the future path of rate hikes from the ECB.

The euro fell vs. the US Dollar on Thursday after the European Central Bank (ECB) hiked interest rates by a widely expected 50 basis points but failed to give the bulls any more ammunition nor incentive to hold on to the euro as it offered no new hawkish surprises. Expectations are that ECB rates will also be biased lower in Q4 which has also weighed on the euro. At the time of writing, EUR/JPY is trading at 140.33 and down 0.9% on the day after falling from a high of 141.93 to a low of 140.08 so far.

However, in the meantime, there are prospects of more to come from the ECB which should support the euro for the foreseeable future. Analysts at Rabobank explained that the meeting has pretty much confirmed a third 50bp hike in March. ''We expect a 50bp hike in March, followed by two 25bp hikes in Q2 to a terminal rate of 3.50%,'' but at the same time noted that ''markets ran away with the few dovish parts of the announcement.''

Looking further out, analysts at Danske Bank argued that the ECB governor Christine Lagarde's communication during the press conference was reflecting a very split governing council,'' where she also said that any decision is the fruit of compromise.''

''In the end'' the analysts said further, ''the ECB's intention to hike 50bp at the March meeting is not a 100% commitment.''

''Unsurprisingly, the ECB confirmed the data-dependent and meeting-by-meeting decision approach. This means that with markets trading on a narrative other than that which the ECB wants to convey on a more holistic plan (e.g. one of underlying inflation lingering, despite lower headline), we saw significantly lower yields to today's meeting.''

Swiss National Bank Chairman Thomas Jordan is crossing the wires and has stated the following:

Key comments

- Price stability does not happen automatically.

- We are seeing no wage-price spiral in Switzerland.

- Inflationary pressure stronger than SNB can tolerate, can't exclude more interest-rate increases.

- A strong swiss job market could affect a firm's cost inflation.

- In 2022 second-round effects rose, and inflation spread.

- Ready to be active in currency markets when necessary.

USD/CHF technical analysis

On the following daily chart,m we can see that the price is moving lower with a descending channel:

Zoomed in ...

The M-formation is pulling the bulls in from support with a focus on the 50% mean reversion target as the top of the channel resistance and neckline of the pattern near 0.9170.

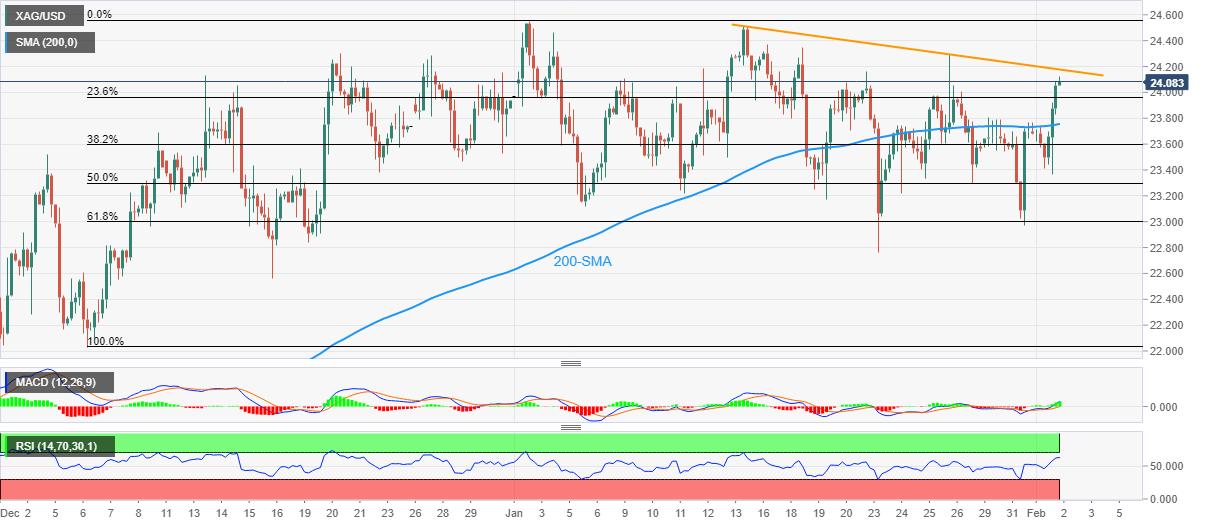

- Silver slumps after reaching a new YTD high at $24.62 and is back below $23.50.

- Gold Price Forecast: XAU/USD erases Wednesday’s gains, plunges below $1,920 post BoE, ECB decisions.

- Silver Price Analysis: Trapped within the $23.00-$24.50 range.

After hitting a new nine-month high of $24.62, Silver price nosedives, failing to break the $23.00-$24.50 range for the fourth consecutive day in the week, and exchanges hands at around $23.40s at the time of writing.

Wall Street continues to record gains bolstered by a big tech company projecting a positive outlook for 2023. The Federal Reserve rate hike of 25 bps weighed on the greenback during Wednesday and Thursday’s overnight session. However, the greenback is staging a comeback, albeit US Treasury yields fall. That has been a tailwind for the white metal, extending its losses toward the bottom of the range.

Silver Price Analysis: XAG/USD Technical Outlook

The XAG/USD is still range-bound, dropped below the 20-day Exponential Moving Average (EMA) at $23.69, which would act as a resistance level in the event of Silver attempting to rally back to $24.00. XAG/USD’s failure to decisively break the previous YTD high at $24.54 could pave the way for a re-test of $23.00, a psychological level. Once cleared, that will put in play the January 23 swing low of $22.76, followed by the December 16 daily low at $22.56.

As an alternate scenario, Silver’s reclaiming $24.00 would open the door for further upside and continuation after one month of consolidation, within the $23.00-$24.50 range. After XAG/USD climbs above the top of the range, the next ceiling would be the YTD high at $24.62, followed by the $25.00 figure.

Silver Key Technical Levels

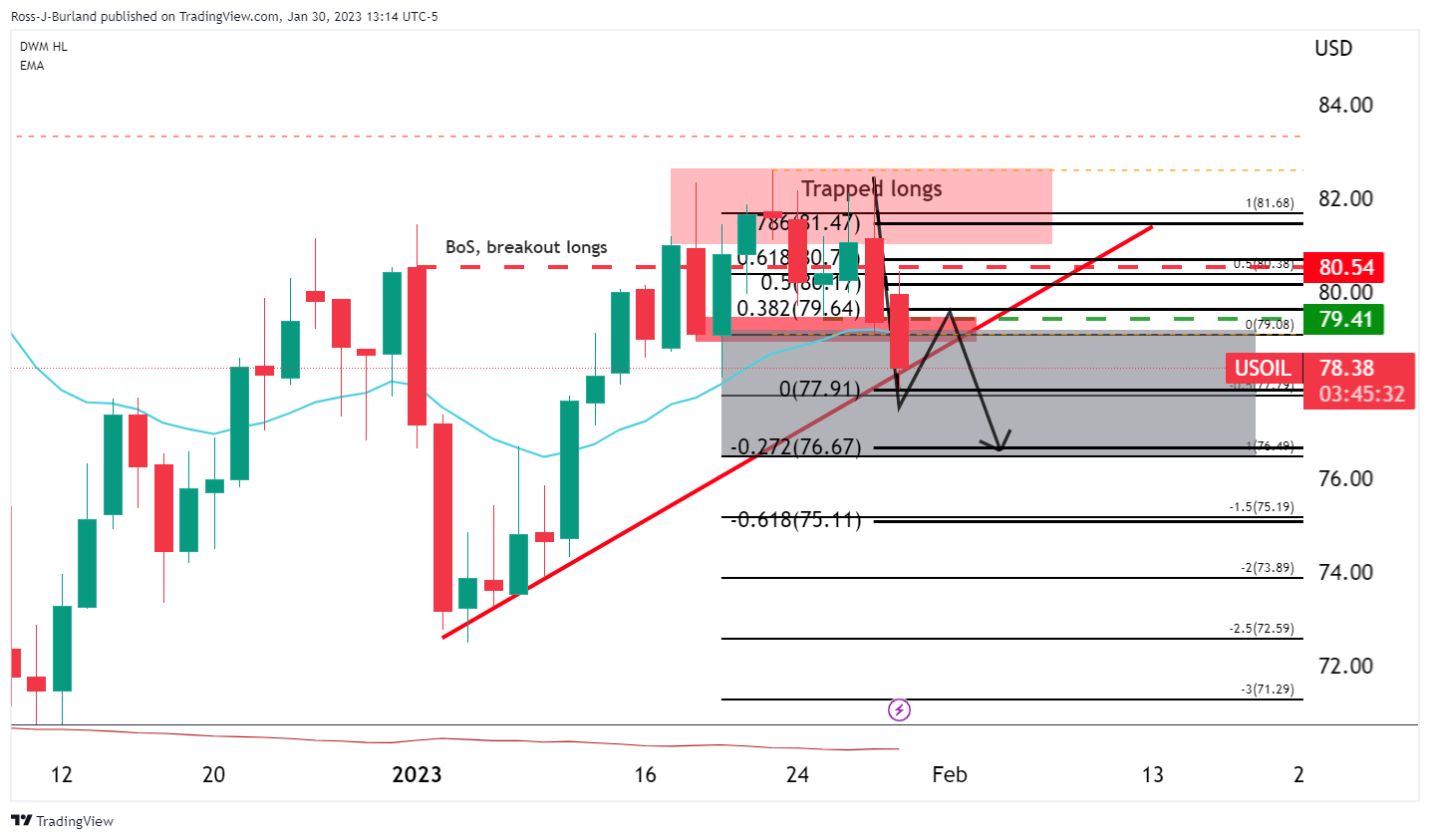

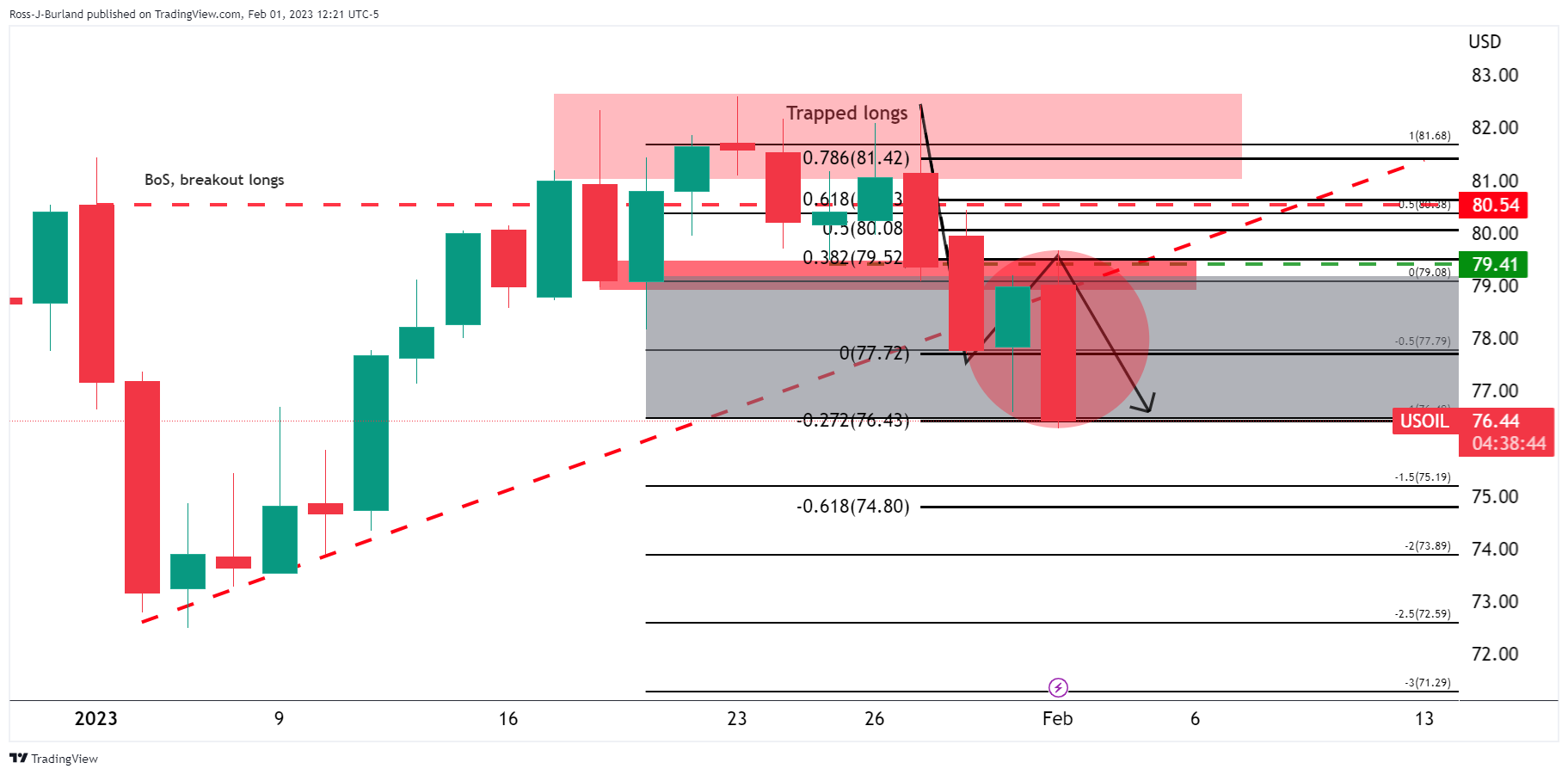

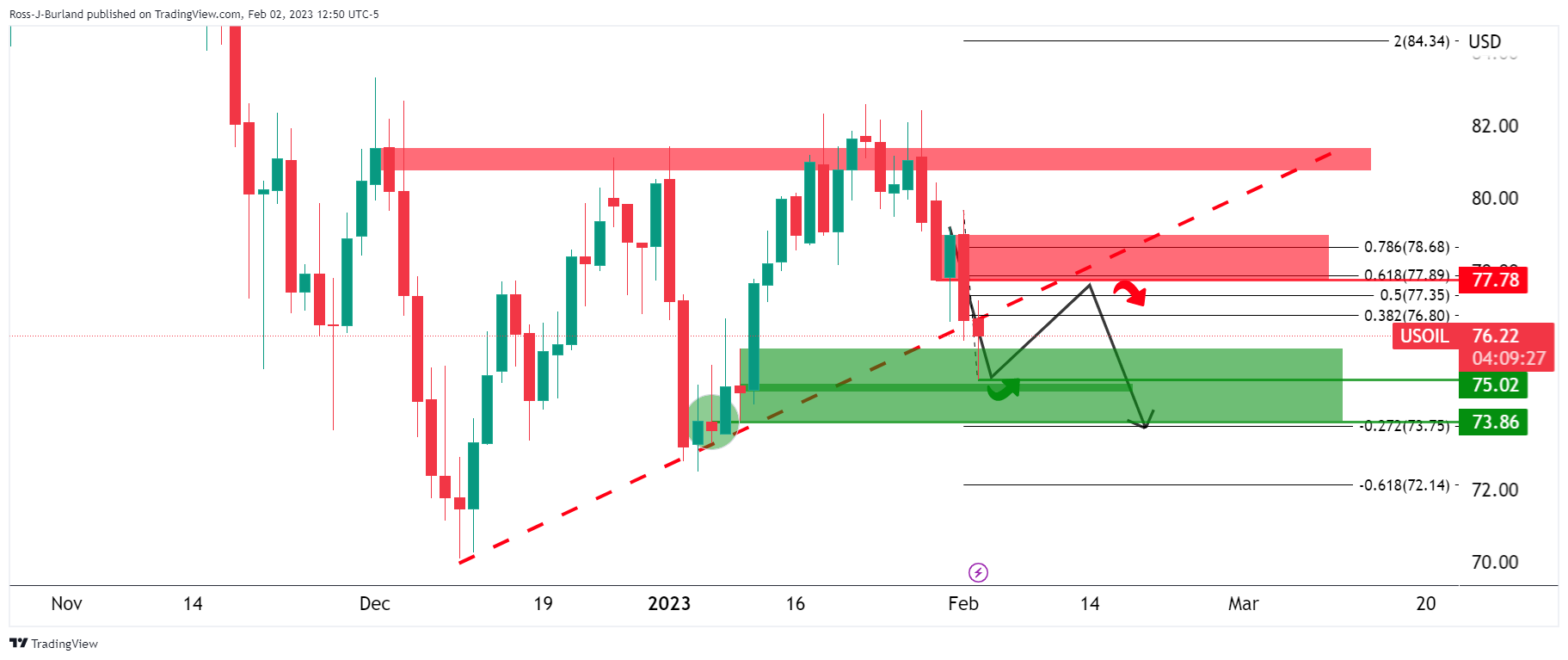

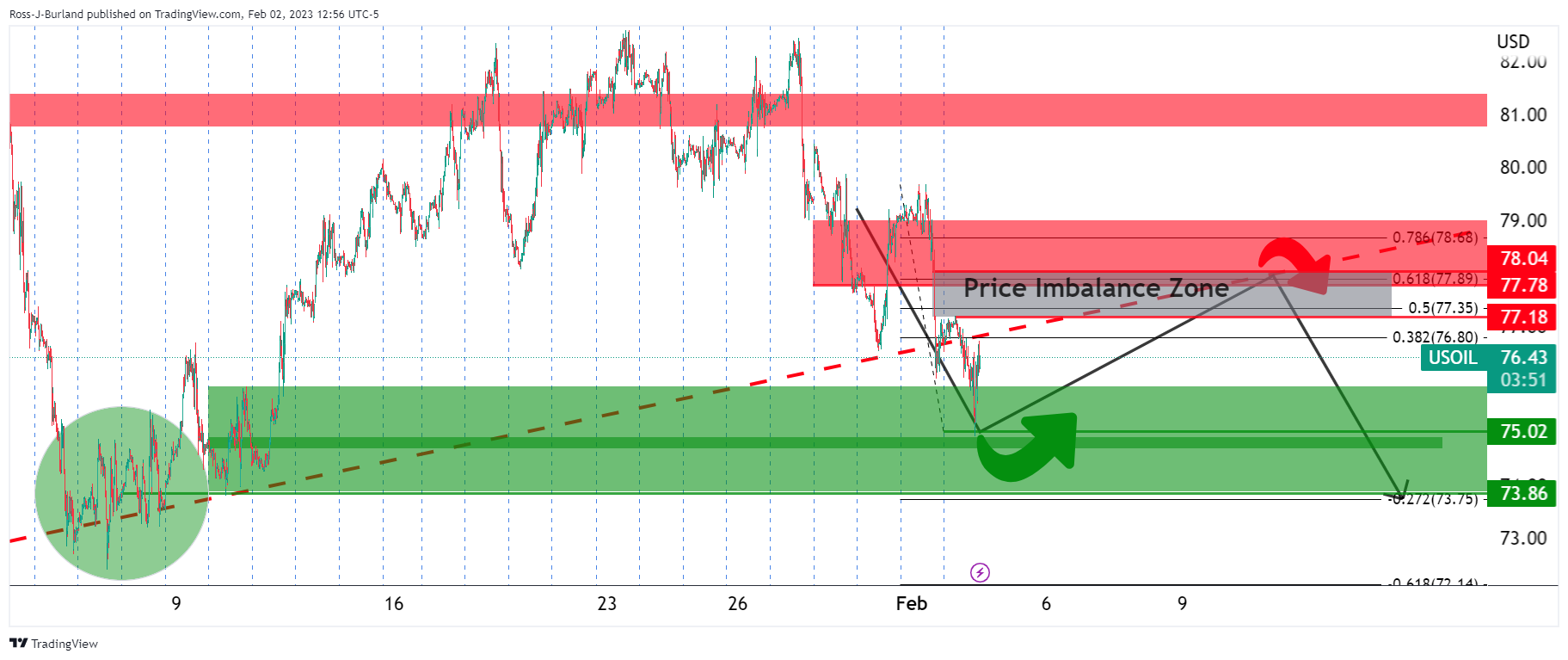

- WTI dropped to the %75s and now the daily chart shows the price breaking the trendline support.

- WTI, however, is now correcting higher to $76.70 resistance.

- The $77.70s are eyed as a 61.8% ratio target.

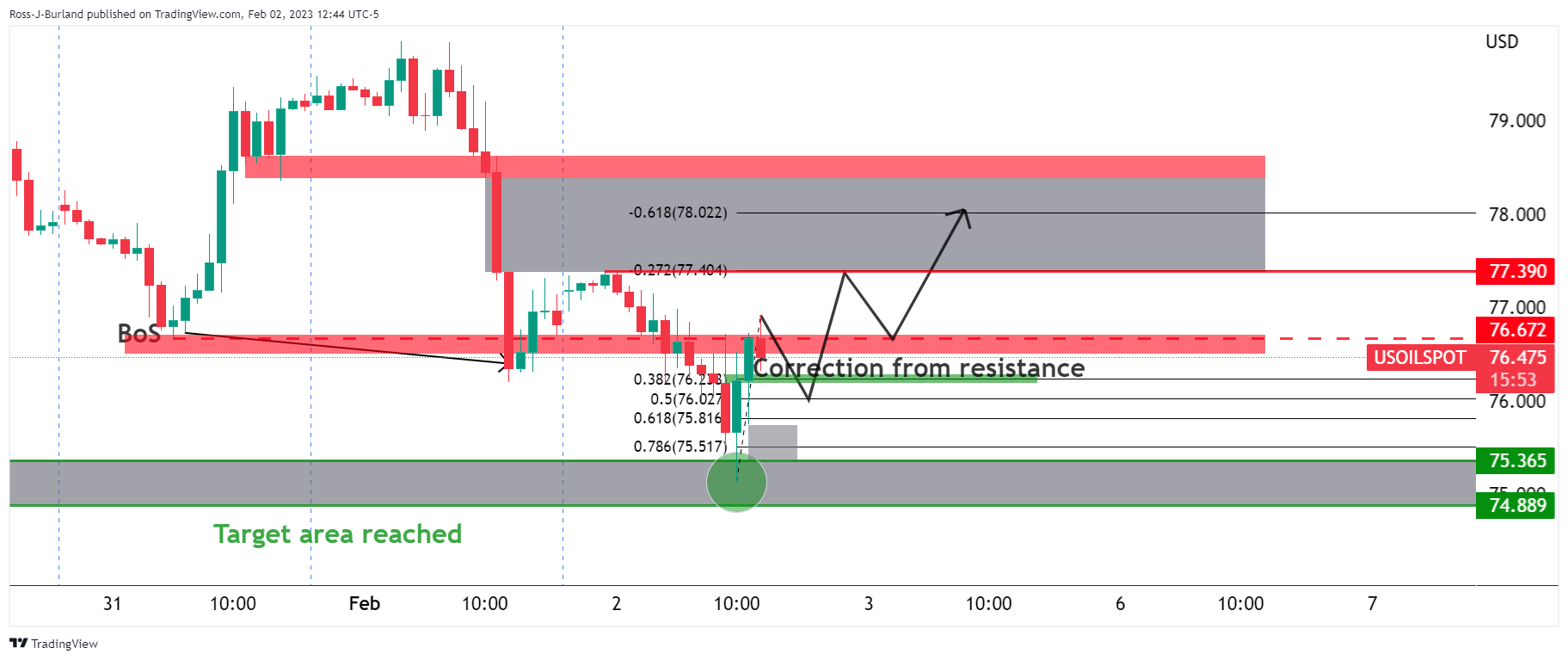

As per the prior analysis of the week, targetting the $75s target area, the objective was reached in the New york equities cash opening window with heightened volatility. The focus is now on the upside as the bulls move in for the kill to sweep the buy liquidity with a focus on the Asian highs that guard the price imbalances above. Targets are placed around $77.50 (50% mean reversion area), $77.70 (Mondayinitial balance lows) and a 61.8% Fibonacci retracement of the latest bearish impulse around $78.80 as the following analysis illustrates.

WTI, prior analysis

WTI bears taking control into the Fed, eyes on $75.00bbl

WTI Price Analysis: Bears break key hourly structure, eye $75.00bbls

It was suggested that ''a correction into resistance could entice trapped longs to get out of losing or breakeven positions and subsequently the shorts coming onto the market around 38.2% Fibonacci correction could see a move out of the consolidation below the trapped volume and into a 100% measured target towards $75.00 over the course of the coming week.''

As illustrated, the price sank into the target area following a correction into where shorts were looking to get in at a premium. The subsequent move had fulfilled the 100% measured move and $75.00 was beckoning:

WTI H1 charts, prior analysis

Zoomed in ...

The greyed areas were price imbalances while the red marking was a resistance zone that had a confluence with the 61.8% Fibonacci retracement level near $78.50. While below there, the bias was to the downside.

However, a more shallow correction may be all that was needed. Either way, bears were looking to target between $75.36 and $74.88 on a break of $75.50.

WTI Update

The price has reached the resistance and a correction is underway.

WTI daily and M15 charts

The daily chart shows the price breaking the trendline support but meeting horizontal support and correcting. If this is the start of a daily correction, then the $77.70s are eyed in a 61.8% ratio of the bearish impulse.

Moving down to the 15-minute chart we can see a price imbalance between $77.18 and $78.04 for the bulls to target:

On Thursday, the Bank of England (BoE) hiked the policy rate by 50 basis points to 4.00%. Analysts at Danske Bank expect the increasingly weak growth outlook to support a near-term ending to the hiking cycle.

Key quotes:

“EUR/GBP initially moved lower upon announcement but quickly retraced as expected with the more dovish nature of the statement. Followed by a less than expected hawkish ECB EUR/GBP is back close to opening levels. We continue see a case for the EUR/GBP cross to move modestly lower in the coming year as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.”

“We continue to expect the BoE to deliver a final 25bp hike in March. Our expectations fall below current market pricing (currently 34bps until June 2023) as we expect the rest of the BoE committee to increasingly turn less hawkish amid a weakening growth backdrop and easing labour market conditions. Markets is pricing in 40bp of cuts during H2, while we keep our forecast of the first cut to be delivered in the beginning of 2024.”

The European Central Bank (ECB) raised its key interest rates on Thursday by 50 basis points as expected and flagged another 50bp hike in March. Despite such decisions and Lagarde’s hawkish comments, European bond yields tumbled. Analysts at Rabobank point out the central bank continues to struggle with its image and credibility. They expect a 50bp hike in March, followed by two 25bp hikes in Q2 to a terminal rate of 3.50%.

Markets ran away with the few dovish parts of the announcement

“The ECB continues to struggle with its credibility issues ever since it started playing fast and loose with forward guidance. Despite an overall hawkish hike, markets largely ignored Lagarde’s attempts to clarify the ECB’s reaction function. Underlying inflation is “alive and kicking”, and the ECB will stay the course until there are convincing signs that inflation will converge back to the 2% target. We don’t think that the ECB gets this proof before summer, and we’ve accordingly increased our terminal rate forecast to 3.50%.”

“Despite the market not buying Lagarde’s message, we will bite. We have revised up our rate forecasts significantly to a 3.5% terminal rate. However, that is clearly a restrictive level that cannot be sustained by the Eurozone economy. We have pencilled in a first cut in 2024H2.”

- After hitting 18-month-lows, the USD/CHF is back above the 0.9100 threshold.

- USD/CHF Price Analysis: Remains downward biased below 0.9180, but once reclaimed, buyers would target 0.9280.

The USD/CHF climbs sharply after diving to fresh 18-month lows at 0.9059. However, it’s staging a comeback as the greenback gets bolstered following Wednesday’s US Federal Reserve’s decision to lift rates, which initially was perceived as dovish in the FX space. Nevertheless, the US Dollar (USD) had erased most of Wednesday’s losses, a tailwind for the USD/CHF. Therefore, the USD/CHF exchanges hand at 0.9221, above its opening price by 0.50%.

USD/CHF Price Analysis: Technical outlook

After the Fed’s decision, the USD/CHF fall continued on Wednesday, reaching new YTD lows, which were broken on Thursday. As the North American session progressed, USD/CHF bulls stepped in at 0.9050s and lifted the spot back above 0.91000.

Although the USD/CHF pair holds to gains in the day, it remains downward biased and is expected to extend its losses as long as it stays below 0.9180. A breach of 0.9059, the YTD low, would set the stage to challenge the 0.9000 psychological barrier.

On the other side, if the USD/CHF reclaims the February 1 high of 0.9182, that would exacerbate a test of the 0.9200 figure. Once cleared, the 20-day Exponential Moving Average (EMA) is next, followed by the January 31 high at 0.9288, ahead of 0.9300.

USD/CHF Key Technical Levels

On Friday, the US will release the official employment report for the month of January. Analysts at TD Securities expect a 220K increase in payroll and a modest increase in the unemployment rate to 3.6%.

A still resilient labor market

“We project payroll gains to have stayed largely unchanged vs December, posting a still solid 220k increase in January. Both the unemployment rate and average hourly earnings should have remained steady: the former at a decades-low 3.5%, and the latter printing a 0.3% m/m gain. Note that the January jobs report will also include important revisions to the establishment survey data for 2022.”

“Following Powell's flip in script, the market is asymmetric around this number. That is, a positive surprise is not likely to materially derail risk sentiment, while an indication of softness will reinforce it. That's key for the USD and other FX baskets which have more closely aligned itself to equity dynamics. That could prevent the USD from sinking to new lows in the near-term. Ultimately however, we expect to see dip buying interest in EURUSD towards 1.08.”

The European Central Bank, as expected, rose the key interest rates by 50 basis points on Thursday. Analysts at Danske Bank see another 50bp hike in March and a 25bp in May. They consider that medium-term drivers indicate that the EUR/USD pair is overvalued.

Markets conclude ECB is close to being done

“Markets took the ECB’s communication as a sign that the ECB is close to ending its hiking cycle, as bond yields rallied strongly. We judge that today’s communication reflects a very split governing council. We still expect the ECB to hike its policy rates by 50bp in March and 25bp in May.”

“In recent weeks, EUR/USD has defied the shift and sudden underperformance of Eurozone equities, which we otherwise deem to have been an important driver behind the EUR/USD rally since September (Eurozone equities overperforming during this period). Our tactical conviction on EUR/USD is not high, but we maintain a clear sell-on-rallies bias for the cross as we still think medium-term drivers indicate that EUR/USD is overvalued (and not undervalued).”

- GBP/USD dropped after the Bank of England lifted rates and gave no signals for further increases.

- The BoE foresees a shallow recession in the UK and expects inflation at around 4% by year’s end.

- US labor market data portrays the tightness of the job markets, with traders eyeing Friday’s Nonfarm Payrolls report.

The GBP/USD collapses after the Bank of England’s decision to raise the Bank Rate by 50 bps to the 4% threshold. Economic data revealed in the United States (US) reassured the tightness of the labor market, meaning that the US Federal Reserve, albeit hiked rates 25 bps on Wednesday, still has ways to go. At the time of typing, the GBP/USD exchanges hands at 1.2280 after hitting a high of 1.2401.

The Bank of England raised rates, but the Pound failed to rally

Before Wall Street opened, the Old Lady of Threadneedle lifted rates to its highest peak since 2008, from 3.50% to 4%, in a split 7-2 vote, as two members voted for no change to the Bank Rate. Following the BoE’s decision, its Governor Andrew Bailey said that “we’ve seen the first signs that inflation has turned the corner,” but commented that it’s too soon to declare victory, adding that members of the Monetary Policy Committee (MPC) would need to be “absolutely sure” that inflation is cooling.

On its statement, the BoE removed the “respond forcefully, as necessary” phrase, opening the door for speculations that Bailey and Co. could pause if needed. The BoE updated its forecasts in the monetary policy report and expects inflation to edge toward 4% by the end of 2023. The BoE added that a recession might hit the UK, but it would be “shallower,” with Gross Domestic Product (GDP) foreseen at -0.5% in 2023, vs. November’s -1.5%, projected by the BoE.

Given the backdrop, the GBP/USD extended its losses toward its daily low of 1.2238 before recovering some territory and reclaiming the 20-day EMA at 1.2289.

Aside from this, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the last week ending on January 28 dropped to 183K, slightly below the last week’s 186K and lower than the 200K estimated by street analysts, showing the labor market resilience. Today’s data added to Wednesday’s JOLTs report that showed vacancies rising, while an ISM report on Wednesday stated that manufacturers “are not substantially” reducing their personnel.

Meanwhile, on Wednesday, the US Federal Reserve raised rates to the 4.50-4.75% range as widely expected, though it kept the door open for more hikes as needed. Fed’s Chair Jerome Powell added that more rates “will be appropriate,” emphasized the FOMC’s commitment to bring inflation down to the 2% target, and acknowledged that the “disinflation process has started,” which sent equities rallying sharply.

What to watch?

The economic docket will feature the S&P Global/CIPS Services and Composite PMIs and BoE’s Huw Pill speech on Friday. On the US front, employment data led by the Nonfarm Payrolls report, alongside the ISM Non-Manufacturing report, would update the US economy status.

GBP/USD Key Technical Levels

- US Stocks extend post-FOMC rally.

- Dollar gains momentum during American session, DXY off monthly lows.

- AUD/USD corrects lower, hovers around 0.7100.

The AUD/USD dropped further during the American session hit a fresh daily low at 0.7068, slightly above the level it had before the FOMC statement. The pair is hovering around 0.7100, attempting to recover that area. The greenback gained momentum across the board during the last hours. The NFP is due on Friday.

Equity markets are up again on Thursday, extending the post-Fed rally and also following rate hikes from the Bank of England and the European Central Bank. At the same time, bond yields are down sharply. Despite risk appetite and lower yields, the US Dollar rose sharply on American hours.

The US Dollar Index is up by 0.30%, recovering from multi-month lows. At the same time, gold and silver are making a sharp reversal.

Weaker commodity prices and a stronger Dollar pushed AUD/USD away from the seven-month high it reached earlier on Thursday at 0.7157.

From a technical perspective, if the AUD/USD consolidates well below 0.710 there would be a deterioration in the outlook for the Aussie. The next support is seen at 0.7060 followed by 0.7030. The pair needs to recover initially 0.7100 and then hold above 0.7130 to keep the doors open to fresh cycle highs.

Technical levels

What is the outlook for Gold after the sharp moves in recent months? Economists at Standard Chartered see risks of a pullback.

Gold rally appears stretched

“Our proprietary indicator, fractals, is signalling that recent rally has led to stretched technicals for Gold, which has shot past our end-2023 price target of $1,890. Hence, we see elevated risk of a consolidation or even a pullback in Gold over the next few weeks.”

“We would prefer to wait for a pullback towards $1,840 area before adding further exposure to Gold.”

The outlook for the Brazilian Real has brightened. Economists at Commerzbank believe that the USD/BRL pair could challenge the 5 level.

Brazilian central bank remains BRL supportive

“While BCB kept the key interest rate unchanged at 13.75%, as expected, it left no doubt that it has its eye on inflation expectations, which had picked up in view of the government's planned support measures. The BCB is clearly committed to further tightening measures if inflation does not fall further toward its inflation target as expected.”

“As the real interest rate is expected to remain clearly positive, we see the Real remaining well supported.”

“If the USD weakness continues, a serious test of the 5 mark in USD/BRL is by no means out of the question.”

- Gold plunges across the board, even though US Treasury yields are dropping.

- The US Dollar recovered some ground, bolstered by the Euro and Pound Sterling fall.

- On Wednesday, the US Federal Reserve hiked rates by 25 bps and signaled it is about to end its cycle.

- Following the US central bank lead, the BoE and the ECB lifted rates by 50 bps.

Gold price retreats after hitting a nine-month high at $1959.74. However, it is below the $1950 barrier after the US Federal Reserve (Fed) hiked rates by 25 bps on Wednesday. Data revealed in the United States (US) economic docket showed the labor market remains resilient. In addition, two other central banks, namely the Bank of England (BoE) and the European Central Bank (ECB), added to the chorus of tightening policy. At the time of writing, the XAU/USD exchanges hands at around $1920, below its opening price.

US Federal Reserve lifted rates but sounded dovish

Walk Street is set to extend its Wednesday gains after Jerome Powell, and Co. lifted rates. He said “that ongoing increases in the target range will be appropriate” as the Federal Reserve battles to curb stubbornly high inflation and emphasized the Fed’s commitment to return inflation to “2% over time.” Powell said the “disinflation process has started,” giving the green light to risk-perceived assets, extending its rally as Powell spoke.

US Dollar benefits from EUR and GBP fall, a headwind for Gold

In the meantime, the US Dollar Index (DXY), a measure of the buck’s value against a basket of currencies, is trimming some of its losses, up 0.44%, at 101.61, bolstered by the market’s reaction to the BoE’s and ECB’s decisions. Meanwhile, global bond yields are plummeting, with the US 10-year benchmark note rate down six bps, at 3.354%. That said, Gold failed to gain traction, and continues to tumble even more after hitting $1944 at around 14:25 GMT, extending its losses towards the $1920s area.

Unemployment claims in the United States dropped

Data-wise, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ending on January 28 fell to 183K, three thousand below the last week’s 186K and well below the 200K estimated by street analysts, showing the labor market resilience. Today’s data added to Wednesday’s JOLTs report that showed vacancies improved, while an ISM report on Wednesday stated that manufacturers “are not substantially” reducing their personnel.

Central Banks in Europe tightened monetary conditions

On Thursday, the Bank of England decided to raise rates by 50 bps to 4%, marking the tenth time since the BoE hiked on December 2021. The BoE Governor Andrew Bailey said that since the November meeting, the BoE has seen the “first signs that inflation has turned the corner.” He added that “it’s too soon to declare victory just yet, inflationary pressures are still there.” Meanwhile, the European Central Bank added to the list of central banks lifting rates to 0.50%, leaving the deposit rate at 2.50%, and signaled that a 50 bps hike in March is possible.

Gold Technical Analysis

Technically speaking, XAU/USD had erased Wednesday’s gains, forming a bearish engulfing candle pattern, which, if confirmed, could exacerbate downward price action. The XAU/USD bullish scenario would remain above $1900; otherwise, the yellow metal could extend its losses. A breach of $1900 will expose the January 18 low of 1896.74, followed by the June 13 high-turned-support at $1879.45, ahead of the $1850 psychological support.

Economists at TD Securities like EUR upside versus USD, GBP, and CHF in the months ahead.

EUR moves a bit too far, too fast

“We’re wary of chasing EUR/USD higher here. Our GMPCA fair value sits just below 1.07, while HFFV rests around 1.09. In turn, we would look to use dips towards the 1.0750 level to position for a break of 1.10 in the months ahead. We’re forecasting a push towards 1.15 in Q2.”

“We see EUR/CHF to 1.06 and EUR/GBP through 0.90 in the months ahead.”

- Sovereign bond yields drop after central bank meetings.

- Risk appetite deteriorates after Wall Street’s opening bell.

- USD/JPY remains above key technical area above 128.00.

The USD/JPY dropped further on Thursday and bottomed at 128.07, reaching the lowest level in two weeks. It remained above 128.00 and trimmed losses after US markets opened.

The move-off lows took place amid a deterioration in market sentiment that offered support to the greenback across the board. The pair is back above 128.50, still down for the day, on its way to the third consecutive daily loss.

Bonds rally, yen benefits

The Bank of England and the European Central Bank both raised key interest rates by 50 basis points as expected. On Wednesday, the Federal Reserve raised it rate by 25 basis points. Central bankers showed more optimism in the economy. Powell signalled at more rate hikes to bring the rate to “appropriately restrictive”. The ECB announced it intends to raise by 50 bps in March.

Following the announcements, sovereign bonds rose, favoring the Japanese Yen across the board. The US 10-year yield fell to as low as 3.33%, the lowest in two weeks, before rebounding to 3.37%. The German 10-year yield stands at 2.10%, down 6.70% for the day. The 10-year UK bond yields drops 5.95% at 3.09%.

Despite USD/JPY moving off lows, the Yen is trading at daily highs across the board. The US Dollar has risen sharply during the last hours, erasing most of the FOMC losses.

US data was offset by central banks on Thursday but on Friday the Non-farm payroll report is due and will be watched closely. Data released on Thursday showed Initial Jobless Claims fell unexpectable to 183K, the lowest level since April. Factory Orders rose 1.8% in December, below the expected 2.2%.

Levels to watch

The USD/JPY was able to hold above 128.00, a key technical level. The US dollar needs to regain the 129.10 area in order to gain support. Above the next resistance stands at 129.80 followed by the weekly high at 130.55.

A consolidation under 128.00 would increase the bearish pressure, exposing the next support seen at 127.55.

Technical levels

The Canadian Dollar has gained ground on the greenback since the beginning of the year. Economists at the National Bank of Canada still expect the CAD to outperform the USD in 2023.

BoC unlikely to cut rates more aggressively than the Fed

“At this stage, we do not expect the Bank of Canada to cut rates more aggressively than the US in 2023, which would put downward pressure on the Loonie.”

“Speculators are currently the most bearish on the CAD since the Covid recession. A change of heart would certainly provide the impetus for the Loonie to appreciate.”

“We still expect the CAD to outperform the USD in 2023.”

USD/JPY quickly turned back lower yesterday. The focus is back onto Credit Suisse’s 127.53/27 prior core objective, which now looks set to be broken more imminently.

USD/JPY looks to be turning back lower

“With US Yields failing to follow through on the recent reversal back higher, the short-term risk for USD/JPY quickly looks to be turning lower again, in line with our broader negative view.”

“Below 127.53/23 then would open up a move to next support at 126.36 and eventually the 61.8% retracement of the 2021/2022 uptrend at 121.44.”

“Resistance is seen at 130.36, which is the key 21-day exponential average, then 131.12, before the recent high at 131.58. A break above here would suggest a deeper recovery to 132.28, potentially 132.88, where we would look for a cap if reached.”

The Federal Reserve raised its key interest rate corridor by 25 basis points to 4.50%-4.75%, as expected. In the view of economists at Commerzbank, the Fed is unlikely to do much more before it reaches its rate peak.

The Fed returns to "normal" rate hikes

“The Fed raised its key interest rates by 25 bps, as expected. The federal funds target corridor is now at 4.50% to 4.75%.”

“In the statement published after the meeting, the Fed did not indicate an imminent end to the rate hikes.”

“Fed Chair Powell emphasized that the US is only at the beginning of a disinflationary process. However, the Fed is probably not too far away from the rate peak.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in February.

Key takeaways

"I can't think of scenarios where 50 bps hike would not happen unless they're quite extreme."

"Bank lending survey shows good transmission of ECB monetary policy."

"In all Reasonable scenarios, significant hikes are needed."

"We have to be attentive to energy components and pass-through."

"Wouldn't say that disinflationary process is already at play."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Economists at TD Securities remain constructive on EUR/GBP and expect a re-entry to 0.90/0.92 in the weeks ahead.

GBP will become a laggard in broad terms

“The BoE appears to be joining the Fed and BoC in nearing a pause in the hiking cycle. This, we think, means that GBP will become a laggard in broad terms.”

“In crosses, we look for GBP to extend weakness against EUR and JPY.”

“EUR/GBP remains rather constructive after a punch above 0.89. We expect a re-entry into a new higher trading range marked by 0.90/0.92.”

“We remain medium-term bulls on the JPY as we believe that the BoJ is on borrowed time and will need to make more changes to YCC soon; 155 is near-term support, but we see extension risk to 150.”

Quek Ser Leang, Markets Strategist at UOB Group, assesses the recent price action around EUR/USD.

Key Quotes

“In our Chart of the Day update from about 3 weeks ago (13 Jan 2023, when EUR/USD was trading at 1.0840), we held the view that EUR/USD is likely to continue to advance. We highlighted that, ‘a break above the top of the weekly Ichimoku cloud at 1.0930 would suggest further upside risk in the months ahead’. We indicated, ‘The next resistance level above 1.0930 is at 1.1120’.”

“EUR/USD subsequently rose but did not break 1.0930 until yesterday (01 Feb 2023) when it blew past 1.0930 and moved above the top of the weekly Ichimoku cloud for the first time since Jun 2021. The price actions have improved the technical outlook for EUR/USD further. Not surprisingly, we continue to expect EUR/USD to advance. While EUR/USD is likely to break above 1.1120, it remains to be seen whether the 2022 high of 1.1495 is within reach in the next few months.”

“On the downside, 1.0785 is a solid support level. However, only a breach of the 55-week exponential moving average (currently at 1.0615) would indicate that the rally that started in Sep 2022 is not extending further.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in February.

Key takeaways

"Discussion was marked by contuinity and consistency."

"Very very large consensus today."

"We haven't reached the peak in rate, we have ground to cover."

"We will need to assess pace and level."

"There was general agreement on 50 bps in February and March."

"There was discussion and not full agreement on communication."

"Underlying inflation pressures, fiscal measures, wages all warrant 50 bps hike in March."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- EUR/USD probes the area of daily lows near 1.0930.

- ECB said it will hike by another 50 bps in March.

- Lagarde noted that the bloc’s economic activity slowed markedly.

EUR/USD retreats further and flirts with the 1.0930 region, or daily lows, on Thursday.

EUR/USD: Initial resistance emerges around 1.1030

EUR/USD now accelerates its daily losses and hovers around the 1.0930 region as, Chair Lagarde’s press conference is under way.

Following the telegraphed 50 bps rate hike at today’s ECB event, Chairwoman C.Lagarde said another 50 bps rate raise is on the cards at the March meeting before evaluating the subsequent moves by the bank regarding its policy.

Lagarde also noted that the economic activity in the region slowed markedly and growth is expected to remain weak, while elevated inflation and tighter financial conditions remain a headwind for spending and production.

Lagarde also highlighted the resilience of the economy and suggested that a recovery is expected in the next months, while inflation risks have become more balanced.

What to look for around EUR

The pronounced upside pushed EUR/USD north of the key 1.1000 hurdle on Thursday, although the pair retreated markedly in the wake of the ECB event.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the central bank delivered a 50 bps at its meeting on Thursday.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Balance of Trade, ECB Interest Rate Decision, ECB Lagarde (Thursday) - Germany, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.32% at 1.0952 and the breakdown of 1.0930 (low February 2) would target 1.0802 (weekly low January 31) en route to 1.0766 (weekly low January 17). On the flip side, the next up barrier emerges at 1.1032 (2023 high February 2) followed by 1.1100 (round level) and finally 1.1184 (weekly low March 31 2022).

EUR/GBP is trying to break out above the top of its range at 0.8896/8904, which would open up a move to 0.8993 next, economists at Credit Suisse report.

Break below 0.8800 to signal a false breakout attempt

“A clear and closing break above key resistance at the recent high and 50% retracement of the fall from September at 0.8899/8904 would rekindle thoughts of a basing process, with resistance then seen next at 0.8993/9006, which is the 61.8% retracement of the fall from September, then 0.9066, which is a key price high.”

“Key support moves to 0.8904/8899, then 0.8880. Below here would signal a false breakout attempt, with more important support then seen all the way back at the 55DMA and price support at 0.8742/15. Only a break below here would turn the risks lower within the range.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in February.

Key takeaways

"Energy prices are lower than expected in December."

"Price pressures remain strong."

"While weakening, pent-up demand still driving up prices."

"Recent data on wage dynamics in line with ECB forecasts."

"Risks to growth are more balanced."

"Risks to inflation outlook are more balanced."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- GBP/JPY continues losing ground for the third straight day and drops to a two-week low.

- Expectations for a hawkish shift by the BoJ underpin the JPY and exert some pressure.

- The BoE’s dovish outlook weighs heavily on the GBP and contributes to the sharp decline.

The GBP/JPY cross extends the previous day's bearish breakdown momentum below the 160.00 psychological mark and remains under heavy selling pressure for the third straight day on Thursday. The downward trajectory picks up pace after the Bank of England announced its policy decision and drags spot prices to a two-week low, around mid-157.00s.

The British Pound weakens across the board in reaction to a dovish assessment of the BoE's policy outlook and turns out to be a key factor dragging the GBP/JPY cross lower. In the accompanying policy statement, the UK central bank removed the phrase that they would "respond forcefully, as necessary". Furthermore, BoE Governor Andrew Bailey said that inflation will continue to fall this year and more rapidly during the second half of 2023. This, in turn, suggests that the BoE might be nearing the end of the current rate-hiking cycle amid looming recession risks and weighs on the GBP.

The Japanese Yen (JPY), on the other hand, is drawing support from expectations that high inflation may invite a more hawkish stance from the Bank of Japan (BoJ) later this year. The bets were lifted by recent data, which showed that Nationwide core inflation in Japan reached its highest annualized print since December 1981. This is seen as another factor exerting downward pressure on the GBP/JPY cross. That said, a goodish intraday recovery in the equity markets acts as a headwind for the safe-haven JPY and assists the cross to bounce back to the 158.00 round-figure mark in the last hour.

The fundamental backdrop, meanwhile, seems tilted firmly in favour of bearish traders and suggests that the path of least resistance for the GBP/JPY cross is to the downside. Hence, any subsequent recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Technical levels to watch

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in February.

Key takeaways

"We expect growth to stay weak."

High inflation, tighter financing conditions dampen spending and production."

"Supply bottlenecks are gradually easing."

"Supply of gas has become more secure."

"Rising wages to restore some purchasing power."

"Economy more resilient than expected, should recover in coming quarters."

"Job creation may slow, unemployment could rise."

"Important to start rolling back fiscal support."

"Fiscal measures could exacerbate inflationary pressures, necessitate stronger ECB response."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- EUR/USD trims initial gains and drops to the 1.0970/60 band.

- ECB raised rates by 50 bps, as broadly expected.

- Market participants now look at Lagarde’s press conference.

The buying bias in the European currency run out of further steam and forced EUR/USD to return to the negative ground after climbing as high as the 1.1030 zone earlier in the session.

EUR/USD now focuses on Lagarde’s presser

EUR/USD now trades with humbles losses after the ECB matched estimates and raised the policy rate by half percentage point at its meeting on Thursday.

Indeed, the central bank raised the interest rate on the main refinancing operations, the interest rate on the marginal lending facility and the deposit facility to 3.0%, 3.25% and 2.50%, respectively.

The ECB reiterated that further rate hikes remain on the cards – with another 50 bps “scheduled” at the March gathering - and the decision on future rate raises will remain data-dependent and in a meeting-by-meeting approach.

Moving forward, market participants will now closely follow the usual press conference by Chairwoman Lagarde and the subsequent Q&A session.

EUR/USD levels to watch

So far, the pair is retreating 0.05% at 1.0982 and the breakdown of 1.0802 (weekly low January 31) would target 1.0766 (weekly low January 17) en route to 1.0639 (55-day SMA). On the flip side, the next up barrier emerges at 1.1032 (2023 high February 2) followed by 1.1100 (round level) and finally 1.1184 (weekly low March 31 2022).

- Unit Labor Costs in the US rose at a softening pace in Q4.

- US Dollar Index continues to fluctuate slightly above 101.00.

Unit Labor Costs in the nonfarm business sector rose by 1.1% in the fourth quarter of 2022, the US Bureau of Labor Statistics (BLS) reported on Wednesday. This reading followed 2% increase recorded in the third quarter.

Further details of the publication revealed that Nonfarm Productivity rose by 3% in the same period, compared to the market expectation of 2.4%.

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen posting small daily losses at 101.12.

- Initial Jobless Claims in the US decreased by 3,000 in the week ending January 28.

- US Dollar Index stays slightly above 101.00 after the data.

There were 183,000 initial jobless claims in the week ending January 28, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 186,000 and came in better than the market expectation of 200,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 191,750, a decrease of 5,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending January 21 was 1,655,000, a decrease of 11,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index showed no immediate reaction to this data and was last seen trading virtually unchanged on the day at 101.15.

Bank of England (BoE) Governor Andrew Bailey is delivering his remarks on the policy outlook and responding to questions from the press following the bank's decision to hike the policy rate by 50 basis points to 4% in February.

Key takeaways

"We are hearing from businesses that consumers are becoming more resistant to higher prices."

"Firms are saying they expect pay demands to ease over the course of 2023."

"Important that we have sustainable fiscal policy."

"We welcome government's focus on boosting labour force participation."

About Andrew Bailey (via bankofengland.co.uk)

"Andrew Bailey previously held the role of Deputy Governor, Prudential Regulation and CEO of the PRA from 1 April 2013. While retaining his role as Executive Director of the Bank, Andrew joined the Financial Services Authority in April 2011 as Deputy Head of the Prudential Business Unit and Director of UK Banks and Building Societies. In July 2012, Andrew became Managing Director of the Prudential Business Unit, with responsibility for the prudential supervision of banks, investment banks and insurance companies. Andrew was appointed as a voting member of the interim Financial Policy Committee at its June 2012 meeting."

- EUR/JPY meets with a fresh supply on Thursday and slides back closer to the weekly low.

- Expectations for a hawkish shift by the BoJ underpin the JPY and exert some pressure.

- The intraday selling picks up pace after the ECB announced its monetary policy decision.

The EUR/JPY cross attracts fresh selling in the vicinity of the 142.00 mark on Thursday and continues losing ground through the mid-European session. Spot prices weaken further below the 141.00 round figure and drop to the lower end of the weekly range after the European Central Bank (ECB) announced its policy decision.

As was widely expected, the ECB raises key rates by 50 bps at the end of the February monetary policy meeting. The accompanying policy statement showed that the central bank intends to raise interest rates by another 50 bps in March. The ECB, however, added that it will evaluate the subsequent path of the policy and future rate decisions will continue to be data-dependent, following a meeting-by-meeting approach. This seems to be the only factor that might have disappointed the Euro bulls and exerted fresh downward pressure on the EUR/JPY cross.

The Japanese Yen (JPY), on the other hand, is drawing support from expectations that high inflation may invite a more hawkish stance from the Bank of Japan (BoJ) later this year. The bets were lifted by recent data, which showed that Nationwide core inflation in Japan reached its highest annualized print since December 1981. This further contributes to the offered tone surrounding the EUR/JPY cross and supports prospects for additional losses. Market participants now look to the post-meeting press conference, where comments by ECB President Christian Lagarde will influence the shared currency and provide some impetus to the cross.

Technical levels to watch

EUR/USD has broken above major resistance at 1.0944, suggesting further gains, economists at Credit Suisse report.

Support moving to 1.0944/30

“EUR/USD has broken decisively above our prior target at 1.0944/63 – the 50% retracement of the 2021/2022 fall and the upper end of the trend channel from last September, even earlier than we had expected. We believe this breakout should hold and open up an eventual move to 1.1185, then 1.1275, which is the 61.8% retracement of the 2021/22 fall.”

“Short-term support now moves to the 1.0944/30 breakout point, which should ideally hold.”

Christine Lagarde, President of the European Central Bank (ECB), is scheduled to deliver her remarks on the monetary policy outlook at a press conference at 13:45 GMT.

Follow our live coverage of ECB's policy announcements and the market reaction.

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

The European Central Bank (ECB) announced on Thursday that it raised its key rates by 50 basis points (bps) following the February policy meeting, as expected.

With this decision, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 3%, 3.25% and 2.5%, respectively.

In its policy statement, the ECB noted that in view of underlying inflation pressures, it intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March and evaluate subsequent path of the monetary policy.

Follow our live coverage of the market reaction to the ECB's policy announcements.

Market reaction

As markets assess the ECB's policy decisions, EUR/USD clings to small daily gains at around 1.1000.

Key takeaways from policy statement via Reuters

" In any event, ECB's future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach."

"Also decided on modalities for reducing Eurosystem’s holdings of securities under APP."

"As communicated in December, APP portfolio will decline by €15 billion per month on average from beginning of March until end of June 2023, and subsequent pace of portfolio reduction will be determined over time."

"Partial reinvestments will be conducted broadly in line with current practice."

"In particular, remaining reinvestment amounts will be allocated proportionally to share of redemptions across each."

"Eurosystem’s corporate bond purchases, remaining reinvestments will be tilted more strongly towards issuers with a better climate performance."

"Without prejudice to ECB’s price stability objective, this approach will support gradual decarbonisation of Eurosystem’s corporate bond holdings, in line with goals of Paris Agreement."

"Detailed modalities for reducing APP holdings are described in a separate press release to be published at 15:45 CET."

"ECB will continue applying flexibility in reinvesting redemptions coming due in PEPP portfolio, with a view to countering risks to monetary policy transmission mechanism related to pandemic."

"Refinancing operations as banks are repaying amounts borrowed under TLTRO, ECB will regularly assess how targeted lending operations are contributing to its monetary policy stance."

"ECB stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its 2% target over medium term."

"Transmission protection instrument is available to counter unwarranted, disorderly market dynamics that pose a serious."

"Threat to transmission of monetary policy across all euro area countries, thus allowing ECB to more effectively deliver on its price stability mandate."

A potential prolonged pause in the BoC’s tightening cycle may open the door to some risk appetite-related upside for the CAD, in the view of economists at HSBC.

The BoC signals a pause in rate hikes

“With the BoC now potentially pausing its rate hikes, the risk of over-tightening has retreated and the risk of domestic recession has reduced, somewhat supporting the CAD.”

“More broadly, the BoC provides the first example of an end, albeit still a conditional one, to a developed market’s tightening path in the current cycle. Others are likely to join it in the coming months, building a ‘risk on’ narrative that the headwind to activity from global rates is not set to intensify further. This should support the CAD.”

Bank of England (BoE) Governor Andrew Bailey is delivering his remarks on the policy outlook and responding to questions from the press following the bank's decision to hike the policy rate by 50 basis points to 4% in February.

Key takeaways

"I don't think ill-health is the main reason why people have left the labour market."

"Main difference between BOE and IMF forecast is IMF expects UK growth to pick up faster after this year."

"Private-sector wage settlements have been higher than we expected in November."

"Pay settlements will be very important for future inflation and BOE policy."

"We are hearing from businesses that consumers are becoming more resistant to higher prices."

About Andrew Bailey (via bankofengland.co.uk)

"Andrew Bailey previously held the role of Deputy Governor, Prudential Regulation and CEO of the PRA from 1 April 2013. While retaining his role as Executive Director of the Bank, Andrew joined the Financial Services Authority in April 2011 as Deputy Head of the Prudential Business Unit and Director of UK Banks and Building Societies. In July 2012, Andrew became Managing Director of the Prudential Business Unit, with responsibility for the prudential supervision of banks, investment banks and insurance companies. Andrew was appointed as a voting member of the interim Financial Policy Committee at its June 2012 meeting."

Bank of England (BoE) Governor Andrew Bailey is delivering his remarks on the policy outlook and responding to questions from the press following the bank's decision to hike the policy rate by 50 basis points to 4% in February.

Key takeaways

"Significant and lingering fall in labour supply from 50-65 year olds weighs on UK economic potential."

"If wholesale energy prices remain at current levels, CPI could be nearly 1 percentage point higher in 3 years' time."

Asked if rates might have peaked, says "we have changed the language we used."

"Change in language reflects a turning in the corner but very early days."

"If risks emerge and we continue to get overshoots in wage data and services inflation, we will have to respond."

"If economy evolves in line with central forecast, we will need to re-evaluate."

About Andrew Bailey (via bankofengland.co.uk)