- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Retail Sales Overview

Early Tuesday, the market sees preliminary readings of Australia's seasonally adjusted Retail Sales for December month at 00:30 GMT. Market consensus suggests a softer seasonally adjusted MoM print of -0.3% versus 1.4% prior, suggesting the lack of sustained improvement in economic activity.

Given the recently stronger Aussie inflation data and the previously downbeat comments from the Reserve Bank of Australia's (RBA) cautious mood, not to forget the challenges to sentiment ahead of this week’s key data/events, today’s Aussie Retail Sales appear crucial for the AUD/USD traders.

It should be noted that China’s official NBS Manufacturing PMI and Non-Manufacturing PMI, up for publishing around 01:00 AM GMT, also increases the importance of the Asia-Pacific economic calendar on Tuesday. Forecasts suggest that the former is likely to remain below 50, close to 49.7, despite improving from 47.0 prior while the latter could regain above 50 level of 51.0 after slumping to 41.6 the previous month. It should be noted that the above 50 prints describe the activity increase while the below 50 numbers hint at a contraction in the activities.

Ahead of the data, Westpac said,

After a strong 1.4% gain in November, Australia nominal retail sales are expected to post a modest decline in December as interest rate pressures continue to build (Westpac f/c: -0.3%mth, median forecast -0.2%). Meanwhile, the gradual slowdown in private credit growth should continue to crystalise in December (Westpac f/c: 0.5%).

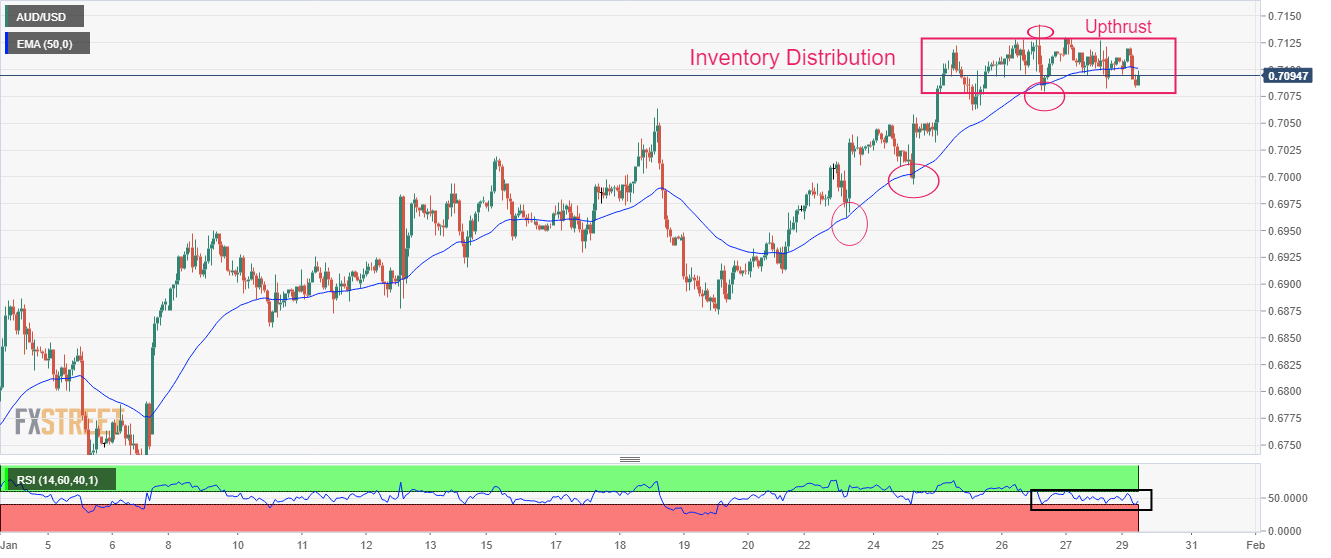

How could it affect AUD/USD?

AUD/USD remains pressured around 0.7050 after beginning the week’s trading with a downside gap. Although the Covid updates from China and the US have recently been trying to stop the Aussie pair bears, the market’s fears ahead of the top-tier US data and events, as well as China’s official activity numbers, exert downside pressure on the Aussie pair as of late.

That said, the likely easy economics from Australia and China may add losses to the AUD/USD prices amid recently sluggish sentiment and doubts over the RBA’s next move, despite firmer inflation data. It’s worth noting, however, that a strong print will join the upbeat Aussie Consumer Price Index (CPI) figures and could enable the Aussie pair to better position for this week’s volatile session.

Technically, a one-month-old bullish channel restricts AUD/USD pair’s downside near the 0.7000 round figure.

Key Notes

AUD/USD Forecast: Aussie weakens ahead of first-tier Asian figures

AUD/USD finds intermediate support around 0.7050, risk-off mood still intact

About Australian Retail Sales

The Retail Sales released by the Australian Bureau of Statistics is a survey of goods sold by retailers based on a sampling of retail stores of different types and sizes and it's considered an indicator of the pace of the Australian economy. It shows the performance of the retail sector over the short and mid-term. Positive economic growth anticipates bullish trends for the AUD, while a low reading is seen as negative or bearish.

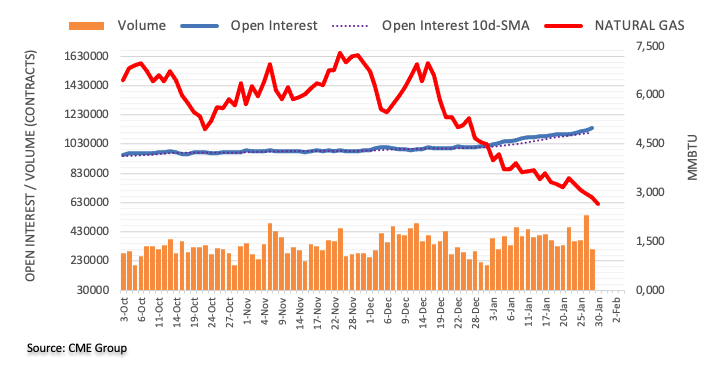

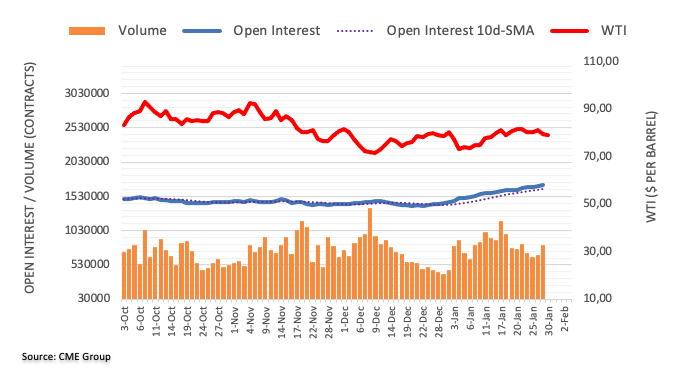

- Oil price has shifted its business below $78.00 as western central banks stare a fresh rate hike.

- The continuation of hawkish monetary policy by the central banks might advance global recession fears.

- China’s Caixin Manufacturing PMI might remain upbeat as the economy is now operating at full capacity levels.

West Texas Intermediate (WTI), futures on NYMEX, have shifted their auction below the crucial support of $78.00 in the early Asian session. On Monday, the oil price extends its losses after failing to hold the psychological resistance of $80.00. Rising fears of a global recession as western central banks are expected to hike their interest rates further have weakened oil demand projections dramatically.

Various developed economies have been demonstrating contraction in the scale of economic activities as western central banks are on a mission to tame soaring inflation in achieving price stability.

Starting from the mighty Federal Reserve (Fed) which is expected to hike interest rates by 25 basis points (bps) to the 4.50-4.75% range to the European Central Bank (ECB), which is worried about rising wages is likely to push interest rates by 50 bps to 2.50%. And, last, the Bank of England (BoE) which is struggling to ease the double-digit inflation figure in the United Kingdom economy might follow the footprints of the ECB ahead and will accelerate global recession fears after continuing their interest rates hiking sage of CY2022 this year.

Apart from that, investors will also look toward the release of the Caixin Manufacturing PMI data, which is scheduled for Wednesday. The economic data is expected to expand to 49.5 from the former release of 49.0 as the Chinese economy is open for operating at full capacity after remaining locked due to pandemic controls. It is worth noting that China is the largest importer of oil and accelerating manufacturing activities in that region might express optimism for the oil price.

On the supply front, oil flows from Russia are advancing despite sanctions from the western cartel after its invasion of Ukraine. Earlier, the oil price was rising on expectations that Russia might not be ready in delivering oil at deeply discounted prices. However, Moscow’s oil outflows have risen, which has trimmed supply worries firmly.

- The Nasdaq 100, the S&P 500, and the Dow Jones registered losses between 0.77% and 2% due to a risk-off impulse that bolstered the US Dollar.

- Last week’s US economic data supported some Fed officials’ calls for lifting rates by 25 bps on Wednesday.

- A busy US economic calendar will feature Fed’s decision, PMIs, and the Nonfarm Payrolls report.

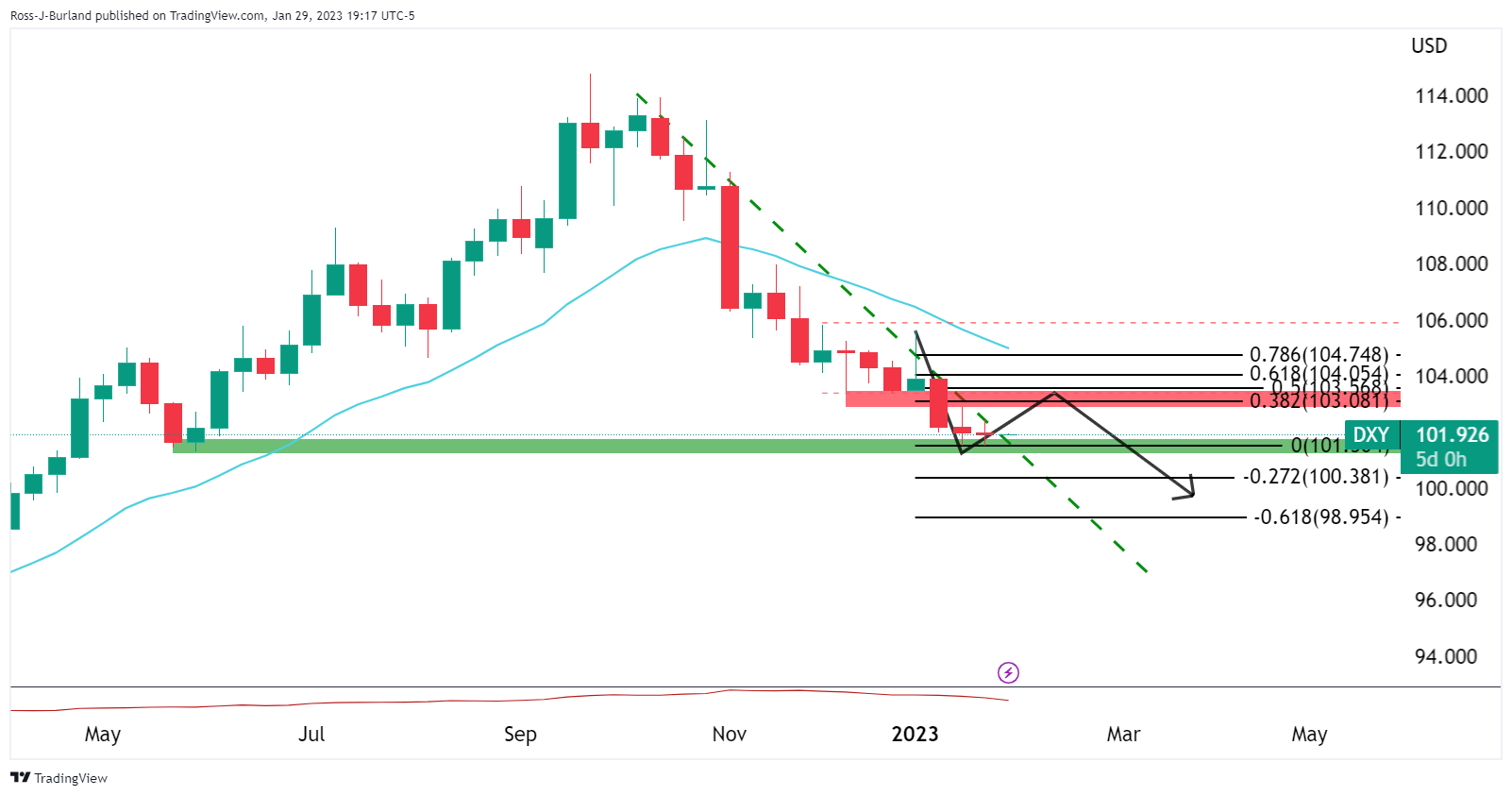

The US Dollar Index (DXY), a measure of the greenback’s value against a basket of six currencies, continues to recover and prints gains for three straight days, finishing Monday’s session with gains of 0.30% amidst risk aversion. At the time of writing, the DXY exchanges hand at 102.224.

US Dollar appreciates the courtesy of risk-off impulse

Wall Street finished with hefty losses, led by the Nasdaq 100, tumbling almost 2%. The S&P 500 and the Dow Jones slashed 1.30% and 0.77% of their value as traders prepared for the US Federal Reserve Open Market Committee (FOMC) decision on Wednesday. Hence, a busy US economic calendar was one of the main reasons for the US Dollar (USD) to appreciate against most G8 currencies.

Data from the previous week, dominated by the Q4 Advanced GDP release, indicated a robust economy with a growth rate of 2.9%, exceeding predictions of 2.6% QoQ. Nevertheless, the pace was slower than the previous quarter’s 3.2%, as confirmed by the US Department of Commerce. Also, the release of the US Core Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred measure of inflation, came within expectations and below November’s 4.7% YoY data, indicating inflation has declined for four consecutive months. Therefore, some Fed officials advocated for a slower pace of interest rate increases but stressed that no reductions are anticipated for 2023.

Reflection of the aforementioned is US Treasury bond yields, precisely the US 10-year benchmark note rate, finished Monday with gains of three and a half basis points (bps). Up at 3.542%, underpinned the greenback.

In the meantime, the CME FedWatcth Tool, odds for a 25 bps rate hike by the Fed stand at 97.6%, above last Friday’s 99% chances, though it’s priced in by the markets.

What to watch?

Ahead of the week, the US economic calendar will feature the Conference Board (CB) Consumer Confidence, alongside the S&P Global and ISM Manufacturing PMI readings for January, ahead of the Fed’s decision on Wednesday. On Thursday, Initial Jobless Claims and the ADP report, and the US Nonfarm Payrolls report on Friday.

US Dollar Index Key Technical Levels

- Silver price remains pressured despite softer start of the key week.

- Failure to keep the bounce off 50-DMA, bearish MACD signals underpin downside bias.

- Monthly resistance line appears crucial for buyer’s entry.

Silver price (XAG/USD) holds lower ground near $23.60 as it fades the previous day’s attempt to recover during early Tuesday.

That said, the bright metal refreshed the monthly low the last week but bounced off $22.76. The recovery moves, however, failed to cross a downward-sloping resistance line from January 03, close to $24.30 by the press time, which in turn keeps the bears hopeful.

Not only does the XAG/USD retreat from the key resistance line but bearish MACD signals also favor the sellers.

As a result, the quote is likely to market another attempt at breaking the 50-DMA support, close to $23.30 at the latest.

Even so, upward-sloping support lines from November 03 and 21, respectively near $23.20 and $23.05, as well as the $23.00 round figure, will challenge the bright Silver bears afterward.

If at all the XAG/USD price remains weak past $23.00, the odds of witnessing a fresh monthly low, currently around $22.75, can’t be ruled out.

On the flip side, the $24.00 round figure may entertain the Silver buyers ahead of directing them to the aforementioned monthly resistance line, close to $24.30 by the press time.

Also acting as the short-term key hurdle is the monthly high near $24.50, a break of which could quickly propel Silver price towards the $25.00 threshold and then to the April 2022 peak surrounding $26.25.

Silver price: Daily chart

Trend: Further weakness expected

- AUD/JPY has slipped sharply below 92.00 as the focus has shifted to Australian Retail Sales data.

- Australian monthly Retail Sales data might show resilience due to revenge buying after three straight Covid Christmases.

- In addition to higher Australian CPI (Q4CY2022), higher Retail Sales might bolster the odds of a hawkish RBA policy.

The AUD/JPY pair has corrected firmly below the crucial support of 92.00 in the early Asian session. The risk barometer witnessed a steep fall after failing to extend recovery above 92.30. Considering the downside traction in the AUD/USD pair, AUD/JPY is following the footprint and is demonstrating a risk-off mood.

The cross is expected to meet sheer volatility ahead as the Australian Bureau of Statistics will report monthly Retail Sales (Dec) data. Global Strategy Team at TD Securities (TDS) sounds optimistic and expects Australian Retail Sales to rise by 0.5% in December. A note from TD Securities indicates that the Australian economy will continue November’s outperformance as three straight COVID Christmases have forced individuals to revenge buying.

An incline in consumer spending might create more troubles for the Reserve Bank of Australia (RBA) policymakers. The recent surge in fourth-quarter Consumer Price Index (CPI) figures in Australia is already compelling RBA Governor Philip Lowe to continue hiking interest rates further. And, now higher consumer spending might force the RBA to sound more hawkish than casual.

On the Japanese Yen front, investors are keeping an eye on the release of the employment data. The Job/Applicant ratio is expected to escalate to 1.36 from the prior release of 1.35. While the Unemployment Rate is seen unchanged at 2.5%. Apart from that, Retail Trade data is in focus. The annual Retail Trade (Dec) is seen higher at 3.0% vs. the prior release of 2.6%.

Early Tuesday morning in Asia, an Associated Press (AP) reporter quotes the White House statement suggesting that US President Joe Biden will end COVID-19 emergency declarations in the United States on May 11.

The news also mentions US President Biden’s pledge to use the veto if congress passes a bill to eliminate Covid vaccine mandate on healthcare providers working on certain federal programs.

On the previous day, China’s Center for Disease Control and Prevention (CDC) said, reported by Reuters, “China's current wave of COVID-19 infections is nearing an end, and there was no significant rebound in cases during the Lunar New Year holiday.”

Also read: China CDC: Current wave of COVID infections nearing an end

AUD/USD remains pressured

Despite the upbeat news, the risk-barometer AUD/USD pair remains depressed around 0.7050, down for the third consecutive day, as traders await Aussie Retail Sales for December and China’s official activity data for January.

Also read: AUD/USD finds intermediate support around 0.7050, risk-off mood still intact

- NZD/USD bears take a breather ahead of data from the key customer.

- China’s official PMIs seem crucial to defend the early 2023 optimism.

- Mixed New Zealand trade numbers joined risk-off mood to welcome bears the previous day.

- Federal Reserve’s monetary policy meeting will be most important, NZ employment eyed as well.

NZD/USD holds its place on the bear’s radar, after confirming the seat on the previous day, as the Kiwi pair traders remain cautious ahead of the key data/events. That said, the quote seesaws near 0.6470 following the downbeat start to the crucial week comprising the US Federal Reserve’s (Fed) monetary policy meeting, as well as New Zealand’s (NZ) quarterly employment data. It should be noted that China’s officials NBS Manufacturing PMI and Non-Manufacturing PMI could offer immediate directions to the pair traders.

The major currency pair failed to cheer the return of Chinese traders after a one-week-long Lunar New Year (LNY) holiday as market sentiment worsened ahead of the top-tier data/events. Adding strength to the risk-off mood could be the cautious risk profile before the equity heavyweights like Amazon, Alphabet, Apple and Metal release their quarterly earnings. It should be noted that mixed NZ trade numbers also offered a reason for the Kiwi pair traders to probe the previous three-week uptrend.

On Monday, New Zealand’s headline Trade Balance improved to $-475M MoM for December versus $-2,108M prior while the yearly figure rose to $-14.46B compared to $-14.98B previous readings. Further details suggest that the Imports eased to $7.19B compared to $8.52B whereas the Exports increased to $6.72B for December compared to $6.34B prior.

That said, the US 10-year Treasury bond yields rose 2.4 basis points (bps) to 3.542% while Wall Street benchmarks closed in the red as market players rushed to risk safety ahead of the key front-line catalyst. Also challenging the sentiment could be the mixed headlines over China’s capacity to justify the latest optimism surrounding the world’s biggest commodity user even if it signals upbeat holiday spending and nearness to the current Covid wave.

Given the mixed mood and a light calendar at home, the NZD/USD price may remain depressed ahead of China’s NBS Manufacturing PMI and Non-Manufacturing PMIs for January. Forecasts suggest that the former is likely to remain below 50, close to 49.7, despite improving from 47.0 prior while the latter could regain above 50 level of 51.0 after slumping to 41.6 the previous month. It should be noted that the above 50 prints describe the activity increase while the below 50 numbers hint at a contraction in the activities. Other than the China PMI, Australia’s Retail Sales for December could also entertain NZD/USD traders ahead of the US Conference Board Consumer Confidence gauge for January. Also important will be the fourth quarter (Q4) Employment Cost Index (ECI).

Technical analysis

A sustained daily closing below the three-week-old support line, now resistance around 0.6520, directs NZD/USD price towards the 21-DMA level of .6405.

- USD/CAD is testing the strength of the breakout above the downward-sloping trendline from 1.3520.

- Investors have underpinned the risk aversion theme ahead of the Fed’s monetary policy.

- A bullish range shift by the RSI (14) indicates that the upside momentum is active.

The USD/CAD pair has turned sideways after a juggernaut rally near 1.3400 in the early Asian session. A sheer drop in investors’ risk appetite amid rising volatility ahead of the interest rate decision by the Federal Reserve (Fed) strengthened the US Dollar.

The US Dollar Index (DXY) has delivered a confident breakout above the crucial resistance of 101.80 amid the risk-aversion theme. Also, the 10-year US Treasury yields moved above 3.54% on expectations of a further hike in the interest rates.

USD/CAD delivered a stalwart rally after forming a volatility divergence on an hourly chart. The Loonie asset tested January 26 low at 1.3300 with less volatility on January 27 as the asset remained inside the Bollinger Bands. After demonstrating signs of a bullish reversal, the major rode the rally with the upper Bollinger Band to near 1.3390.

The US Dollar has pushed the asset above the downward-sloping trendline plotted from January 19 high at 1.3520 and is now testing the waters before resuming the upside trend.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

Should the asset break above January 26 high at 1.3408, US Dollar bulls will drive the asset toward January 19 low at 1.3446 followed by January 19 high at 1.3521.

On the contrary, a break below January 30 low at 1.3300 will drag the Loonie asset toward a fresh 10-week low around 1.3226. A slippage below the latter will further drag the asset toward Septermber 1 high around 1.3300.

USD/CAD hourly chart

-638107152567638820.png)

- EUR/USD remains pressured after breaking short-term key support.

- Bearish MACD signals, downbeat RSI adds strength to the downside bias targeting 100-SMA.

- Double tops around 1.0930 also favor sellers to keep the reins.

EUR/USD seesaws around 1.0850 as bears take a breather after breaking important support. With this, the major currency pair confirms its place on the seller’s radar even if it probes the three-day downtrend with its latest inaction.

Not only the trend line breakdown but the bearish MACD signals and the downbeat RSI (14), not oversold, also keep the EUR/USD sellers hopeful. On the same line could be the double-top bearish formation marked around 1.0930.

As a result, the quote’s further downside towards the 100-bar Simple Moving Average (SMA), close to 1.0825 by the press time, appears imminent.

However, the 200-SMA and January 10 low, respectively near 1.0720 and 1.0710, could challenge the EUR/USD bears afterward.

In a case where the EUR/USD pair remains bearish past 1.0710, its slump toward the monthly low near 1.0480 can’t be ruled out.

Alternatively, recovery moves must cross the support-turned-resistance line from January 10, close to 1.0860 at the latest, to tease EUR/USD buyers.

Even so, the aforementioned double tops near 1.0930 will be a tough nut to crack for the pair bulls, a break of which could quickly propel the price towards the 1.1000 round figure.

Should the EUR/USD pair remains firmer past 1.1000, its rally toward January 2022 low near 1.1120 can’t be ruled out.

EUR/USD: Four-hour chart

Trend: Further downside expected

- GBP/USD began the key week on a back foot, stays pressured of late.

- Market sentiment dwindles amid trader’s anxiety ahead of top-tier data/events.

- Mixed concerns surrounding UK’s tax cuts, workers’ strikes keep bears hopeful even as BoE hawks flex muscles.

- No major from Britain but US CB Consumer Confidence, Employment Cost Index may gain attention.

GBP/USD holds lower grounds after a two-day downtrend, making rounds to 1.2350 during early Tuesday morning in Asia. In doing so, the Cable pair takes clues from the broad US Dollar rebound as the market mood sours ahead of the key data/events. Adding strength to the quote’s from the key 1.2450 hurdle could be the economic problems and challenges for the UK policymakers.

At home, UK Treasury Secretary Jeremy Hunt’s indecision over the tax cuts and the economic complications due to the workers’ strikes weigh on the GBP/USD prices. Even so, the policymakers propose the fight to tame inflation as a cure to overcome the workers’ halting of workers and generate problems surrounding the same, including higher inflation and low productivity.

On the other hand, the US Dallas Fed manufacturing index for January jumped to -8.4 while adding 11.6 points and marking the highest reading since May 2022.

Not only the downbeat US data but firmer US Treasury bond yields and softer equities also weighed on the GBP/USD prices. That said, the US 10-year Treasury bond yields rose 2.4 basis points (bps) to 3.542% while Wall Street benchmarks closed in the red.

It’s worth noting that China’s return from a week-long Lunar New Year (LNY) holiday also couldn’t impress markets as traders received mixed signals surrounding the dragon nation’s economic transition during the holiday period, which in turn weighed on the risk appetite and the GBP/USD prices.

Having witnessed a sluggish start to the key week, mostly favoring the GBP/USD bears, the pair traders will pay attention to today’s US Conference Board Consumer Confidence gauge for January. Also important will be the fourth quarter (Q4) Employment Cost Index (ECI). That said, the Cable pair may witness a comparatively more active day than the previous one but a cautious mood can keep challenging the traders ahead of the monetary policy meeting of the US Federal Reserve (Fed) and the Bank of England.

Technical analysis

The GBP/USD pair’s failure to cross the 1.2450 hurdle joins the clear downside break of the three-week-old ascending trend line, around 1.2370 by the press time, to direct the Cable bears towards the 21-DMA support near 1.2250.

- AUD/USD has found an intermediate cushion around 0.7050, however, more downside is on cards.

- Investors have turned risk-averse ahead of the release of the interest rate policy by the Fed.

- A decline in monthly Australian Retail Sales might ease some troubles for the RBA.

The AUD/USD pair has managed to gauge an intermediate cushion around 0.7050 in the early Asian session. The Aussie asset has witnessed immense selling pressure and is showing a less-confident pullback move, however, the downside is still favored as the risk profile is still negative. Federal Reserve (Fed)’s monetary policy-inspired volatility has forced investors to dump risk-perceived assets vigorously.

S&P500 tumbled on Monday as investors are worried that further interest rate hikes by Fed chair Jerome Powell will escalate recession fears. Consumer spending will get trimmed, employment opportunities will get limited and producers might operate on the lower capacity to augment higher interest rates by the Fed. The US Dollar Index (DXY) delivered a breakout above the critical resistance of 101.80 and drove to near 101.90 as investors underpinned the risk aversion theme. Also, the return generated by 10-year US Treasury bonds scaled above 3.54%.

The Fed is highly likely to announce a hike in interest rates by 25 basis points (bps) to 4.50-4.75% as a significant decline in the Consumer Price Index (CPI) has infused confidence among Fed policymakers that the roadmap of achieving price stability in demonstrating desired results. Also, the street is expecting that the Fed might pause hiking interest rates after pushing them to 4.75-5.00% for the remaining year.

On the Australian front, investors are keeping an eye on Tuesday’s monthly retail sales data, which is expected to display de-growth of 0.3% from the prior release of 1.4%. This might ease some troubles for the Reserve Bank of Australia (RBA), which is struggling the cap the stubborn inflation in the Australian economy.

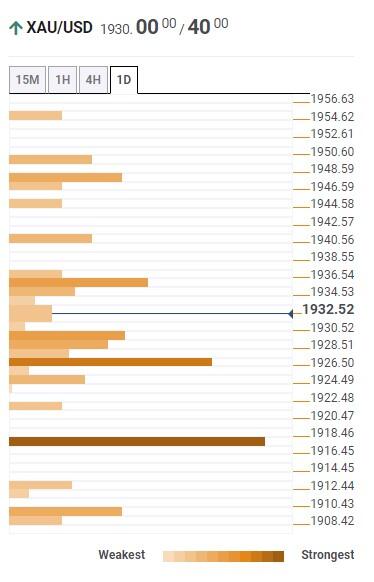

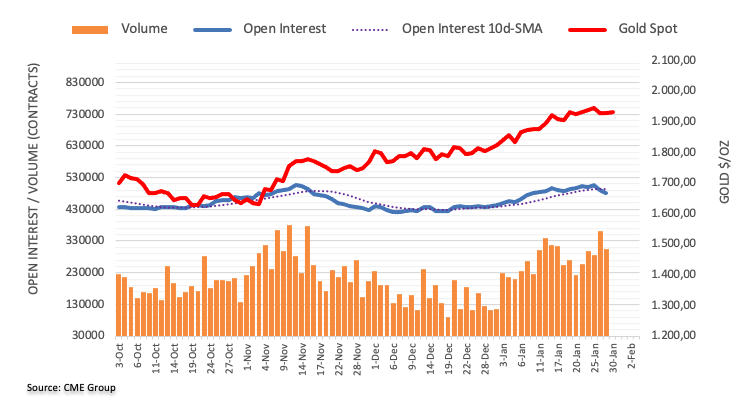

- Gold price hourly chart shows that the price is being jammed into the lows of the day.

- Gold price could see a short squeeze for the day ahead as traders get set for the Federal Reserve.

The Gold price has drifted lower for a third day and is testing structure as we head towards key events this week, including the Federal Reserve and the European Central Bank as the key events, the Bank of England and also the United States of America jobs data. The Gold price is down some 0.29% so far having lost territory from a high of $1,934.56 and running into a low of $1,920.74 so far.

The US Dollar and US Treasury bond yields rose ahead of this week's meeting of the Federal Reserve's policy committee. The markets are pricing in a 25 basis point hike but they are also looking for the benchmark rate to peak at 4.93% in June, up from 4.33% now. There are also calls for the central bank to cut it to 4.52% by December.

Gold price depends on US Nonfarm Payrolls and the Federal Reserve

However, if the market is wrong considering how tight the labour market is, then there could be a surge in the US Dollar and that would weigh on the Gold price. On the other hand, a move representing a second consecutive downshift in the Federal Reserve's hiking pace would be deemed positive for the Gold price but the post-meeting communication could still emphasize that the Fed is not done yet in terms of tightening its policy stance. Some Federal Reserve officials have been pushing back against market calls for a pivot and said that they will need to keep rates in restrictive territory for a period of time in order to bring down inflation.

Analysts at Brown Brothers Harriman argued that headline Personal Consumption Expenditure inflation of 5.0% YoY in December is still running more than double the Fed’s 2% target. ''As we’ve said many times before, getting inflation down from 8% to 4% is the easy part; getting it from 4% to 2% is the hard part and that’s what markets continue to miss,'' the analysts argued, adding, 'the Fed needs to continue reminding the markets that the road ahead remains difficult and full of surprises.''

We also get the US Nonfarm Payrolls employment report that likely continued to rise in January, although the expectations of 175k increase in payrolls would not be far off the smallest gain since a drop in December 2020. Nevertheless, the labour market remains tight and layoffs are still very low. However, the Unemployment Rate will be key and the expectation is a rise to 3.6% from 3.5% in December which would be likely damaging to the US Dollar and supportive of the Gold price.

Gold price technical analysis

As per the start of the week's ore-open analysis, a weekly article written before the open each Monday in early Asia, we are seeing the makings of a move lower in Gold price.

Gold price daily chart, pre-open

As illustrated, there were a number of compelling features to the Gold price daily chart highlighted in the reopen analysis. There are two positive monthly closes and we could be headed for the third monthly rise this week by the close of January's business having made a fresh high for the cycle last Thursday.

However, we have also made for three weeks of interrupted weekly gains for Gold price and the price action is trapping stubborn bulls:

Zooming in we can see that we had a 3-line strike in play for the Gold price:

This was a Gold price trend continuation candlestick pattern consisting of four candles. In this particular scenario, we did not have the close below the first of the four candles, but this was a bearish scenario nonetheless for Monday and bears capitalized on it as follows:

The Gold price hourly chart shows that the Gold price is being jammed into the lows o the day which could open the risk of a squeeze for the day ahead as traders get set for the Fed on Wednesday and ECB on Thursday.

- EUR/JPY stages a comeback and hits a three-day new high at 141.97, shy of the 142.00 mark.

- EUR/JPY Price Analysis: Sideways awaiting a catalyst to gather direction.

The Euro (EUR) is recovering some ground against the Japanese Yen (JPY), as the Wall Street close looms, after hitting two-week lows of 140.55, though it staged a comeback and traveled back to the day’s high at 141.97. At the time of writing, the EUR/JPY exchanges hands at 141.50, above its opening price.

EUR/JPY Price Analysis: Technical outlook

After rallying from the January 19 daily low of 137.91 towards the January 25 daily high of 142.29, the USD/JPY remains trapped in a 250 pip range within the 140.75-142.39 range for the last five days. Furthermore, the 20-day Exponential Moving Average (EMA) at 140.94 and the 50-day EMA at 141.70 acted as the support/resistance of the range. Therefore, the EUR/JPY is trendless amid the lack of a catalyst.

Oscillator-wise, the Relative Strength Index (RSI) at bullish territory backed today’s price action, contrary to the Rate of Change (RoC), which indicates sellers are beginning to gather momentum.

Therefore, the EUR/JPY first resistance would be the 50-day EMA at 141.70 and might rally once broken. The next resistance would be the 142.00 psychological level, ahead of the Wednesday 25 high at 142.29, followed by the 143.00 figure.

In an alternate scenario, if the USD/JPY pair breaks downwards, it would expose key support levels. First, the 20-day EMA at 140.94, followed by the 200-day EMA at 140.24, and then the psychological 140.00 mark.

EUR/JPY Price Analysis

- EUR/USD bears on board into the final stretch on Wall Street.

- US stocks are sinking ahead of earnings this week and major calendar events such as the ECB, Fed and US NFP.

EUR/USD has been sent onto the backfoot as US stocks slide to fresh session lows led by the tech-focused Nasdaq which is down by more than 1% on Monday. At the time of writing, EUR/USD is losing around 0.2% and dropped from a high of 1.0913 to a low of 1.0839 recently printed.

It's a big week ahead and the markets are squaring up before major events such as the Federal Reserve, European Central Bank and the US nonfarm, Payrolls as the showdown and grand finale. Firstly, the Federal Reserve has been price din by the markets for a 25 basis point hike but they are also factoring in a benchmark rate to peak at 4.93% in June, up from 4.33% now. there are also calls for the central bank to cut it to 4.52% by December. However, some analysts are of the mind that the market is wrong considering how tight the labour market is. Some Fed officials have been pushing back against market calls for a pivot and said that they will need to keep rates in restrictive territory for a period of time in order to bring down inflation.

ECB will be key

As for the ECB, markets have been starved of comments from ECB officials in recent times and there has not been much in the way of data to go by either,. Instead, the sentiment is for a 50 basis point hike followed by hawkish commentary from governor Christine Lagarde. '' There is room for things to get interesting during the press conference,'' analysts at TD Securities argued, adding ''and here we think Lagarde will sound more hawkish than expected and repeat her earlier guidance of possibly further 50bps hikes in March and May.''

Analysts at Danske Bank ultimately see the ECB's terminal rate at 3.25% in May but argued that risks remain tilted to the upside. They note also that the January Flash HICP figures will be released just ahead of the meeting on Wednesday. ''We look for an uptick both in the headline (9.6%; from 9.2%) and core (5.4%, from 5.2%) terms.''

The grand finale will come with the US Nonfarm Payrolls on Friday whereby the consensus sees 185k jobs added vs. 223k in December, as analysts at Brown Brothers Harriman said, explaining that the Unemployment Rate is seen up a tick to 3.6% and average hourly earnings at 4.3% YoY vs. 4.6% in December. ''All in all, the labour market remains tight and it’s hard to see how wage pressures can fall that much further given this tightness,'' the analysts argued.

What you need to take care of on Tuesday, January 31:

The US Dollar posted a modest advance at the beginning of the week, backed by a dismal market mood. The Greenback retains its positive bias ahead of the Asian opening, although caution dominates the scenes as the macroeconomic calendar offers multiple first-tier events this week.

Early on Tuesday, Australia will release December Retail Sales, foreseen down by 0.3% in the month. Additionally, China will unveil the NBS Manufacturing and Non-Manufacturing PMIs. The first is expected to improve from 47 in November to 49.7, while services output is foreseen jumping from 41.6 to 51.

Between Wednesday and Thursday, the US Federal Reserve, the European Central Bank and the Bank of England will unveil their monetary policy decisions. At the time being, market players are betting on a 25 basis points (bps) rate hike. For the ECB, a 50 bps rate hike is fully priced in, while the BoE is expected to hike its benchmark rate by 50 bps.

Earlier in the day, the focus was on the Bank of Japan, as a panel of academics and business executives urged the BoJ to make its 2% inflation target a long-term goal. The proposal reportedly also included the need to have interest rates rise more in line with economic fundamentals and normalize Japan's bond market function. BOJ Gov Haruhiko Kuroda stated that its biggest responsibility was price stability and reiterated it is possible to achieve 2% inflation with wage growth and the current easy policy. USD/JPY declined to 129.19 but ended the day at around 130.50 amid broad US Dollar demand.

EUR/USD briefly traded above 1.0900 but settled at around 1.0840. European data failed to impress as the German economy grew at an annualized pace of 1.1% in the last quarter of 2022, missing expectations of 1.3%. Also, as reported by the Harmonized Index of Consumer Prices (HICP), Spanish inflation unexpectedly rose by 5.8% YoY in January, an alarm bell ahead of the ECB monetary policy meeting later this week.

GBP/USD is down to 1.2340, while AUD/USD hovers around 0.7050. The USD/CAD pair advanced towards the current 1.3390 price zone.

Spot gold eased modestly and currently trades at around $1,922 a troy ounce. Crude oil prices edged sharply lower, with WTI currently hovering around $77.70 a barrel.

Ripple Price Forecast: XRP in dire need of nearby support in order to avoid imploding

Like this article? Help us with some feedback by answering this survey:

- USD/JPY recovers some ground as traders brace for a busy US economic calendar.

- Buyers are eyeing a test of the 20-day EMA, as the RSI and RoC suggest the USD/JPY could print a leg-up in the near term.

- SUD/JPY Price Analysis: Remains downward biased, but it could aim higher.

USD/JPY erases last Friday’s losses and reaches a new session high at 130.49, though slightly beneath the 20-day Exponential Moving Average (EMA), used as a barometer for short-term bias, which remains above the exchange rate. Therefore, the USD/JPY remains bearish despite trading at 130.49, above its opening price by 0.56%.

USD/JPY Price Analysis: Technical outlook

From a price action point of view, the USD/JPY remains bearish biased, even though it printed new daily highs. However, USD/JPY buyers need to clear the 20-day EMA at 130.57, to open the door for further gains. Traders should be aware the Rate of Change (RoC) depicts the buyer gaining momentum, while the Relative Strength Index (RSI) is about to turn bullish, suggesting that upward pressure is building.

Therefore, the USD/JPY first resistance would be the 131.00 figure. A breach of the latter will expose a one-month-old downslope trendline at around 131.330-40, followed by the January 18 daily high at 131.57, and then January’s 11 swing high

As an alternate scenario, if the USD/JPY tumbles below 130.00. the next support would be the January 30 daily low of 129.19. A breach of the latter will expose the psychological 128.00, followed by the YTD low at 127.21.

USD/JPY Key Technical Levels

- NZD/USD slides in tandem with the Aussie and US stocks into the final hours of Wall Street.

- Investors are nervous ahead of critical events, including the Fed, NFP and NZD about market data.

NZD/USD is melting in the latter part of the US session as US stocks slide ahead of the close in a choppy start to the week ahead of critical events. At the time of writing, NZD/USD is losing 0.13% and has fallen from a high of 0.6508 to a low of 0.6472 having just printed a fresh low for the New York day.

The moves on Wall Street have been led by The tech-focused Nasdaq which is down by more than 1% on Monday as mega-cap growth stocks including Apple, Amazon and Alphabet dropped before earnings reports this week. The antipodeans are high beta currencies that tend to track the performance of global equities, hence the slide in the bird.

Key events ahead

The main focus in markets will be the Federal Reserve and US Nonfarm Payrolls, both of which could be pivotal for the forex space. Equally, there is domestic labour market data on the calendar for the Kiwi. ''We expect another firm labour market print in Q4 though we don't think it is a game-changer to nudge the Reserve Bank of New Zealand towards a 75bps point hike after the Q4 CPI print last week squarely missed the RBNZ's forecast,'' analysts at TD Securities argued. ''However, we see a terminal rate of 5% as necessary to quell the risk of a wage-price spiral as quarterly wages growth rise and set a new record for annual wage growth.''

As for the Fed, the markets are pricing for the Fed's benchmark rate to peak at 4.93% in June, up from 4.33% now, and then for the central bank to cut it to 4.52% by December. However, Fed officials have been pushing back against market calls for a pivot and said that they will need to keep rates in restrictive territory for a period of time in order to bring down inflation.

Meanwhile, analysts at ANZ Bank said in a note today that ''the Kiwi has been doing well but the economic cycle broadly is turning, and US markets have scope to “price out” a lot of cuts, which should help the USD. But let’s get through tomorrow’s NZ labour data.''

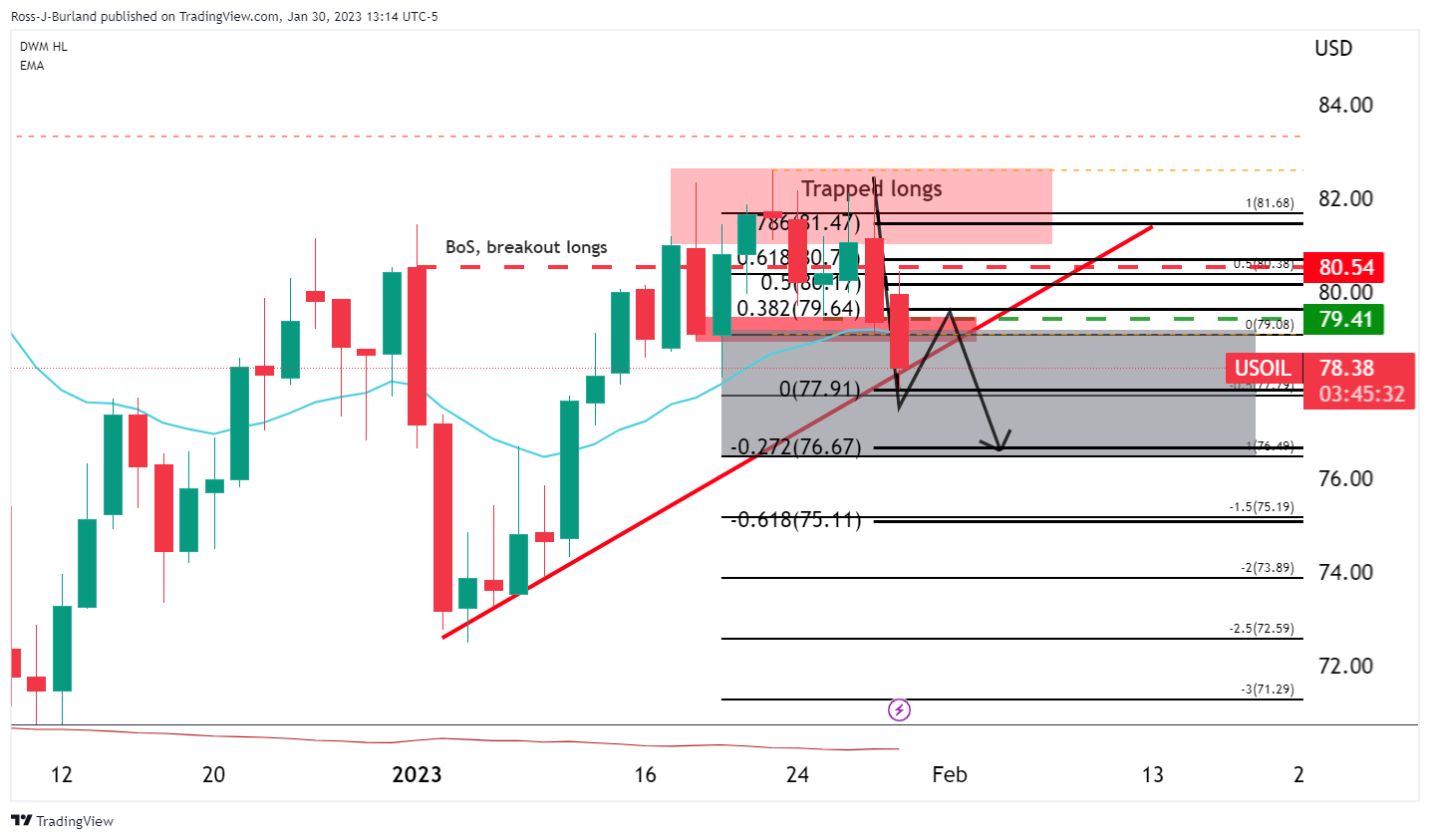

- trapped longs are panicking as bears take control.

- A 38.2% Fibonacci correction could result in further fresh supply.

- A 100% measured target towards $75.00 is eyed for over the course of the coming week:

West Texas Intermediate has dropped by over 1% on the day and is trading around $78.50 at the time of writing after falling from a high of $80.44 and reaching a low of $77.91 so far on the day, ending a bullish start to the year towards month-end and following its fi4rst weekly loss last week for the year so far,

Analysts at ANZ Bank argue that technical factors have been in play, with Brent futures failing to hold above the 100-day moving average. Nevertheless, they said, ''the market remains buoyed by what China’s reopening will mean for demand.''

''Money managers increased their bullish positions on Brent to its highest level in 11 months. Spot prices moved back into a premium with futures, signalling expectations that demand will outstrip supply,'' the analysts added noting that in China, ''travel surged to 90% of pre-pandemic levels over the Spring Holiday. Domestic air travel was also up 80% y/y last week.''

Meanwhile, prices on Monday are lower as investors turned cautious ahead of an expected rise in US interest rates this week. The Federal Reserve is meeting and a hawkish pushback against the notion of the market that a Fed pivot is due is keeping investors sidelined and keen to cash in on positions before the event. The Federal Reserve is expected to result in a 25-basis point rise to US interest rates, keeping recession fears top of mind for investors.

The drop in prices comes despite geopolitical risk in the Middle East rising following a drone attack on an ammunition manufacturing plant facility in the Iranian city of Isfahan. The attack is being blamed on Israel, according to the New York Times.

Elsewhere, there are ongoing concerns that markets will struggle to adjust to European sanctions on oil products. TotalEnergies warned that Europe is still at risk of diesel shortages.

Analysts at TD Securities argued that CTA trend followers are better positioned in petroleum products including heating oil and RBOB gasoline ahead of the EU's import bans on Russian fuels, although recent algo liquidations have still helped to weaken gasoline crack spreads. ''The EU's fuel ban continues to provide uncertainty with respect to fuel availabilities in coming months, but resilient Russian exports are defying expectations for imminent disruptions,'' the analysts explained. ''Nonetheless, additional CTA long acquisitions could be expected above the $2.62/gal range in gasoline, although CTAs are already nearing their effective max length in heating oil.''

WTI technical analysis

Meanwhile, New York traders were getting short of the trapped volume accumulated around $79.40/50. while led to a sell-off in the opening hours of trade before a short squeeze in the cash open on Wall Street:

However, with the Fed coming up this week, and considering the daily M-formation and trendline support,m we could be in for some consolidation for the forthcoming sessions:

With that being said, a correction into resistance could entice trapped longs to get out of losing or breakeven positions and subsequently the shorts coming onto the market around 38.2% Fibonacci correction could see a move out of the consolidation below the trapped volume and into a 100% measured target towards $75.00 over the course of the coming week:

- GBP/USD was rejected at 1.2400 for the fifth straight day as traders brace for a busy calendar.

- The US Federal Reserve and Bank of England monetary policy decisions, are looming and would keep investors at bay.

- GBP/USD Price Analysis: Sideways, trapped within the 1.2340-1.2430 range.

GBP/USD losses ground in the New York session, ahead of a busy week in the global economic docket, with major central banks hosting monetary policy decisions. The US Federal Reserve (Fed) is expected to raise rates by 25 bps, while the Bank of England (BoE) would likely lift rates by 50 bps, with analysts estimating that after February’s decision, the BoE would pause. At the time of writing, the GBP/USD is trading at 1.2367.

GBP/USD Price Analysis: Technical outlook

Consolidation is the game’s name in the case of the GBP/USD failing to break above/below the top/bottom of the 1.2430/1.2344. Even though it’s sliding to a fresh day’s low at 1.2367, it would keep range-trading in the previously mentioned area. However, the GBP/USD is closing into a 13-day upslope support trendline, which, once cleared, the GBP/USD could tumble to the 1.2300 figure, followed by the 20-day Exponential Moving Average (EMA) at 1.2277.

As an alternate scenario, the GBP/USD’s reclaiming 1.2400, then the GBP/USD could rally towards the 1.2500 area, but on its way north, it would need to face the December 14 high of 1.2446.

Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest further downside is expected.

GBP/USD Key Technical Levels

- US Dollar up modestly amid higher US yields ahead of Fed and key data.

- Equity and crude oil prices trim losses during the American session.

- USD/CAD holds above 1.3300, risks remain tilted to the downside.

The USD/CAD peaked during Monday’s American session at 1.3357, the highest level since Thursday. It is hovering around 1.3350, slightly away from the critical support area of 1.3300.

The January low around 1.3300 is the key level to the downside: a break lower could open the doors to an extension toward to 1.3220 (November low) and the 200-day Simple Moving Average (SMA) today at 1.3204. On the upside, a consolidation above 1.3360 would set the attention on 1.3400 and the 20-day SMA at 1.3420.

The US Dollar is rising on Monday amid higher US yields and risk aversion. The 10-year Treasury yield stands at 3.54% and the 2-year at 4.26%, the highest since January 12. The Dow Jones is falling by 0.39% and the Nasdaq slides by 1.48%.

Price action remain limited on Monday ahead of busy days. On Tuesday, Canada will report November GDP data, expected at 0%. Analysts at TD Securities look for a flat print on industry-level GDP with a muted performance across both goods and services “with new flash estimates expected to show a modest expansion in December.” They point out the “ultra sensitivity to data releases is on hold” with the Bank of Canada moving towards a pause. “We expect cuts to start in January and expect the data to deteriorate in the coming months.”

In the US will be a busy week, with the FOMC meeting on Wednesday and the Non-farm payrolls report on Friday. The Federal Reserve is expected to raise interest rates by 25 basis points. Fed’s outlook will be critical and could trigger volatility across the FX board.

Technical levels

- The AUD/USD falls below the 0.7100 psychological level amidst the lack of fresh impetus.

- The US Federal Reserve’s monetary policy decision keeps traders at bay, dampening their mood.

- Later, Australian Retail Sales are eyed by traders, while US Chicago PMI and CB Consumer Confidence would update the US economy’s status.

The AUD/USD retreats after hitting a daily high at 0.7120, as the US Dollar (USD) recovers some ground against most G8 currencies, underpinned by high US Treasury bond yields and a sour sentiment, as shown by US equities sliding. At the time of writing, the AUD/USD is trading at 0.7076.

US economic data begins to support the Fed’s soft landing

A risk-off impulse keeps investors sidelined ahead of Wednesday’s US Federal Reserve (Fed) monetary decision. The AUD/USD continues to drop, eyeing a January 25 daily low test at 0.7032, which, once conquered, could put into play the 0.7000 mark. Last week’s US economic data, with US Gross Domestic Product (GDP) for Q4 exceeding estimates but lower than Q3’s data, justified a group of Fed officials backing lower-sized rate increases.

In addition, a Fed inflation gauge known as the core Personal Consumption Expenditure (PCE) dropped from 4.7% in November to 4.4% in last month’s annually based. Also, US consumer sentiment improved, as a University of Michigan (UoM) poll reported, while inflation expectations edged lower.

That said, the US Federal Reserve (Fed) is expected to raise rates by a quarter percentage point (0.25%) on Wednesday, ending the era of 75 plus hikes, which lifted the Federal Funds rate (FFR) to the 4.25-4.50% range.

The US Dollar Index (DXU), which measures the buck’s value against a basket of currencies, continued to gain ground and reclaims the 102.000 figure, up 0.15% at 102.079. in the meantime, the US 10-year benchmark note rate extends its gains, up by four basis points (bps) at 3.546%.

What to watch?

The Australian economic docket will feature housing data and the last update of Retail Sales, which are expected to drop to -0.3% MoM. The US calendar will feature the Employment Cost Index (ECI), housing data, the Chicago PMI, and the CB Consumer Confidence Tuesday.

AUD/USD Key Technical Levels

- Gold is subdued, though barely above its opening price, ahead of the Federal Reserve meeting.

- United States last week’s data justifies the Fed’s case to slow the size of interest rate increases.

- Gold Price Forecast: Choppy trading, still mostly sideways with traders sidelined ahead of the Fed’s decision.

Gold price trades mostly sideways due to investors preparing for the US Federal Reserve Open Market Committee (FOMC) meeting, which will begin on Tuesday. Most analysts estimate the US Federal Reserve (Fed) would increase rates by 25 bps, though they will be looking for cues about future meetings. Therefore, the XAU/USD exchanges hands at $1,928.45 a troy ounce at the time of writing.

US Q4 GDP supports Fed’s decision to go 25 bps

Wall Street opened mixed ahead of an important week for the economy of the United States (US). Last week’s data, led by the Advanced Gross Domestic Product (GDP) release for Q4, stood at 2.9%, above estimates of 2.6% QoQ, portraying a strong economy. Nevertheless, it decelerated compared to Q3’s 3.2%, further confirmed by data from the US Department of Commerce (DoC). That said, financial analysts have priced in a 25 bps rate increase to the US Federal Funds rate (FFR).

Fed’s inflation measure, core Personal Consumer Expenditure, stumbles for four consecutive months

Another reason that justifies lower-size moves is inflation. The Fed’s preferred inflation gauge, the US Core Personal Consumption Expenditures (PCE), came at 4.4% YoY, aligned with estimates but lower than November’s 4.7%. Inflation has fallen for four straight months, supporting some Fed officials expressing the need to lower the pace of rate hikes but emphasizing that no cuts are foreseen for 2023.

The University of Michigan’s Consumer Sentiment improved, and inflation expectations fell

Additionally, inflation expectations reported by a survey of the University of Michigan (UoM), portrayed American consumers estimated elevated prices would fall. Inflation in one year is expected at 3.9%, while for a 5-year horizon, it would fall from 3% to 2.9%. Consumer Sentiment improved as well, from 59.7 to 64.9 in January.

Given the backdrop, a Fed’s pause on its tightening cycle could bolster demand for Gold. Furthermore, if US Treasury bond yields commence edging lower, that would undermine the Greenback and boost XAU/USD, which could rally towards the $2,000 mark.

At the time of typing, US Treasury bond yields rise three basis points (bps), and edge up to 3.535%, while the Greenback is almost unchanged. The US Dollar Index (DXY), which tracks the buck’s value against a basket of peers, is up 0.01%, at 101.930.

Gold Price Analysis: Technical outlook

XAU/USD’s price action remains subdued, influenced by fundamental reasons. After peaking at $1,949.16, Gold slumped towards $1,916.72 last Friday, and prices remain trapped within the $1,920-35 range. In addition, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) are slightly skewed to the downside, but the RSI’s still in bullish territory.

If the XAU/USD extends its gains above the top of the range, the next stop would be the YTD high at $1,949.16, followed by the $2,000 psychological level. On the other hand, the XAU/USD breaking support would send the yellow metal slumping towards $1,900, followed by the 20-day Exponential Moving Average (EMA) at $1,899.75, and then January’s 18 low of $1,896.74

- Euro gains momentum following Spain’s inflation data, ahead of ECB.

- EZ bond yields rise, German 10-year climbs to 2.32%, the highest since January 6.

- EUR/GBP challenges 0.8800 after finding support at 0.8755.

The EUR/GBP is rising on Monday after falling for three consecutive days. The euro is rebounding from weekly lows near 0.8755 and is testing the 0.8800 area, supported by the latest round of Eurozone economic data and ahead of monetary policy decisions.

Busy week

Data released on Monday showed Inflation in Spain surprised to the upside. The Harmonised Consumer Price Index in Spain rose to 5.8% in January from 5.5% in December and above the market consensus of 4.8%. It was the first acceleration since July supporting expectations of a hawkish European Central Bank (ECB). More Euro Zone inflation data is due on Tuesday.

In Germany, the economy contracted 0.4% during the fourth quarter, against expectations of a flat reading, according to preliminary data. On the positive side, Consumer Confidence in the Eurozone improved to -20.9 in January, while the Economic Sentiment also ticked higher to 99.9.

After the numbers, Eurozone government bond yields rose, supporting the Euro across the board. The German 10-year yield rose to 2.32%, the highest since January 6.

On Thursday, the ECB will have its monetary policy meeting. A 50 basis points rate hike is priced in. The statement and clues about the future path will be the critical factors of the meeting.

In the UK, UK Prime minister Rishi Sunak said he will not raise taxes in order to fund pay raises for Health Service workers. During the weekend, Sunak fired Conservative Party chairman Nadhim Zahawi over a tax row.

The Bank of England is expected to raise its key interest rate by 50 basis points on Thursday, although many analysts expected a smaller increase. There is a division at the Monetary Policy Committee that will likely continue this week.

The EUR/GBP cross will likely have a volatile week, particularly on Thursday, the central bank’s day. Ahead of those critical events, the cross is moving sideways, testing the 20-day Simple Moving Average and the 0.8800 area. On the upside, the immediate strong resistance is seen around 0.8860. On the flip side, a close below 0.8730 should open the doors to more losses.

Technical levels

- EUR/USD advances to 2-day highs near 1.0915.

- Flash German GDP figures disappointed in Q4.

- EMU Consumer Confidence, Economic Sentiment improved in January.

The optimism around the single currency remains well and sound in the European afternoon, with EUR/USD posting decent gains near the 1.0900 hurdle.

EUR/USD: Daily gains capped near 1.0915

EUR/USD remains firm near the 1.0900 neighbourhood on the back of the small retracement in the dollar and inconclusive risk appetite trends at the beginning of the week.

So far, persistent cautiousness dominates the mood among investors ahead of key monetary policy meetings by the Fed and the ECB on Wednesday and Thursday, respectively.

Earlier in the session, the German economy is seen contracting 0.2% QoQ in Q4 and expanding 1.1% over the last twelve months, as per preliminary GDP readings. In addition, the final Consumer Confidence in the euro area improved to -20.9in January, while the Economic Sentiment also ticked higher to 99.9 in the same period.

Later in the NA session, the Dallas Fed Manufacturing Index will be the sole release on Monday.

What to look for around EUR

The sharp yearly rally in EUR/USD appears to have met an initial and decent barrier around the 1.0930 for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next steps from the ECB and the Federal Reserve at their upcoming gatherings in the next week.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Flash Q4 GDP Growth Rate, EMU Final Consumer Confidence, Economic Sentiment (Monday) – Germany Retail Sales/Unemployment Rate/Flash Inflation Rate, EMU Flash Q4 GDP Growth Rate (Tuesday) – Germany, EMU Final Manufacturing PMI, EMU Flash Inflation Rate/Unemployment Rate (Wednesday) – Germany Balance of Trade, ECB Interest Rate Decision, ECB Lagarde (Thursday) - Germany, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.29% at 1.0896 and faces the next resistance at 1.0929 (2023 high January 26) followed by 1.0936 (weekly high April 21 2022) and finally 1.1000 (round level). On the other hand, the breakdown of 1.0766 (weekly low January 17) would target 1.0608 (55-day SMA) en route to 1.0481 (monthly low January 6).

- USD/JPY gains some positive traction, though remains confined in a familiar trading range.

- The mixed fundamental backdrop is seen holding back traders from placing aggressive bets.

- A convincing break below ascending trend-line support will set the stage for deeper losses.

The USD/JPY pair attracts some dip-buying near the 129.20 region on Monday and climbs to a fresh daily top heading into the North American session. Spot prices, for now, seem to have stabilized above the 130.00 psychological mark, though remain well within a familiar trading range held over the past one-and-half week or so.

A goodish pickup in the US Treasury bond yields widens the US-Japan rate differential, which, in turn, is seen weighing on the Japanese Yen (JPY) and lending support to the USD/JPY pair. That said, a weaker risk tone, along with speculation that high inflation may invite a more hawkish stance from the Bank of Japan later this year, limit losses for the JPY. Apart from this, the underlying bearish sentiment surrounding the US Dollar keeps a lid on any meaningful upside for the major.

From a technical perspective, the recent recovery from the 127.20 area, or a multi-month low touched on January 16, has been along upward-sloping trend-line support. The USD/JPY pair, however, seem to struggle to capitalize on the move beyond the 100-period SMA on the 4-hour chart. This is followed by a stiff hurdle near the 130.60-130.65 heavy supply zone, which should now act as a key pivotal point. A sustained strength beyond should pave the way for some meaningful appreciating move.

Given that oscillators on hourly charts have again started gaining positive traction, the USD/JPY pair might then aim to reclaim the 131.00 round-figure mark. The momentum could get extended further towards the post-BoJ swing high, around the 131.55-131.60 area, en route to the 132.00 mark and the next hurdle near the 132.40-132.50 region.

On the flip side, the aforementioned ascending trend-line support, currently around the 129.15 area, might continue to protect the immediate downside. Some follow-through selling below the 129.00 mark will be seen as a fresh trigger for bearish traders and make the USD/JPY pair vulnerable. The subsequent slide could drag spot prices to the 128.00 round figure en route to the multi-month low, around the 127.20 region.

USD/JPY 4-hour chart

Key levels to watch

Commerzbank's Chief Economist, Dr Jörg Krämer, offers a brief analysis of the Preliminary German GDP, which showed that the Eurozone's largest economy contracted by 0.2% during the fourth quarter. This was below consensus estimates for a flat reading and the 0.4% growth recorded in the previous quarter.

Key Quotes:

“Contrary to guidance by the Federal Statistical Office, the Q4 German GDP declined somewhat on Q3 (-0.2%). This was mainly due to private consumption. Consumers are not immune to the erosion of their purchasing power by record high inflation. Another argument for an – albeit mild – recession is that the central banks in many countries had to massively raise their interest rates because of inflation. In addition, German companies have probably already worked off a good part of the high order backlog created during Corona. We still expect German GDP to shrink by 0.5%.”

- Gold price oscillates in a narrow range and is influenced by a combination of diverging forces.

- Bets for smaller rate hikes by the Federal Reserve undermine the US Dollar and lend support.

- Looming recession risks weigh on investors’ sentiment and also contribute to limiting losses.

- Rising US Treasury bond yields act as a headwind ahead of this week’s central bank meetings.

Gold price kicks off the new week on a subdued note and oscillates in a narrow trading band through the mid-European session. Currently placed around the $1,925 region, the XAU/USD remains confined within Friday's trading range as investors await this week's key central bank event risks before placing fresh directional bets.

Weaker US Dollar continues to lend support to Gold price

The Federal Reserve (Fed) will announce its decision at the end of a two-day monetary policy meeting on Wednesday. The markets have been pricing in a greater chance of a 25 basis points (bps) rate hike amid signs of easing inflationary pressures in the United States (US). The bets were lifted by the release of the US Core Personal Consumption Expenditures (PCE) Price Index, which decelerated to the 4.4% YoY rate in December from the 4.7% previous. This, in turn, keeps the US Dollar (USD) bulls on the defensive near a multi-month low and lends some support to the Gold price.

Pickup in US Treasury bond yields acts as headwind for Gold price

That said, the US fourth quarter Gross Domestic Product (GDP) print released last week pointed to a resilient economy, which could allow the Fed to stick to its hawkish stance for longer. This triggers a fresh leg up in the US Treasury bond yields and keeps a lid on the non-yielding Gold price. Hence, investors will look for clues about the Fed's future rate hikes. Apart from this, the focus will be on the European Central Bank (ECB) and the Bank of England (BoE) policy meetings on Thursday. This, in turn, will play a key role in determining the near-term trajectory for the XAU/USD.

Weaker risk tone contributes to limiting losses for Gold price

In the meantime, the prevalent risk-off environment - as depicted by a generally weaker tone around the equity markets - should act as a tailwind for the safe-haven Gold price. The worst yet COVID-19 outbreak in China raised uncertainty over a strong economic recovery and tempers investors' appetite for riskier assets. This, along with the protracted Russia-Ukraine war, has been fueling recession fears and taking its toll on the global risk sentiment. Hence, any subsequent dip in Gold price could be seen as a buying opportunity and is more likely to remain limited, at least for now.

Gold price technical outlook

From a technical perspective, Friday's swing low, around the $1,917-$1,916 area, now seems to protect the immediate downside. Any further decline is likely to attract fresh buyers near the $1,900 round figure, which should act as a pivotal point. A convincing break below might shift the near-term bias in favour of bearish traders and pave the way for a meaningful corrective pullback.

On the flip side, immediate strong resistance is pegged near the $1,949 area, or a multi-month top touched last Thursday. Some follow-through buying will be seen as a fresh trigger for bulls and lift the Gold price to the $1,969-$1,970 region. The momentum could get extended further, allowing the XAU/USD bulls to surpass an intermediate hurdle near the $1,980 zone and reclaim the $2,000 psychological mark for the first time since March 2022.

Key levels to watch

- EUR/USD regains the smile after two daily pullbacks in a row.

- Another test of the 2023 high near 1.0930 appears likely.

EUR/USD picks up upside traction and reclaims the area beyond 1.0900 the figure on Monday.

Bets for further advance are seen rising while above the 2-month support line around the 1.0700 mark.

Indeed, the continuation of the uptrend now needs to rapidly clear the 2023 high at 1.0929 (January 26) to allow for a test of the weekly top at 1.0936 (April 21 2022). A sustainable break above this level could pave the way for a challenge of the key barrier at 1.1000 sooner rather than later.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0310.

EUR/USD daily chart

Senior Economist at UOB Group Alvin Liew reviews the latest US GDP figures during the October-December period.

Key Takeaways

“The advance estimate of the 4Q 2022 GDP surprised on the upside with a 2.9% q/q SAAR expansion (versus Bloomberg est +2.6%), from an unchanged 3.2% in 3Q. Compared to one year ago, the US GDP grew by +1.0% y/y in 4Q, easing from 1.9% in 3Q. For the full year, US GDP grew by 2.1% in 2022, from 5.9% in 2021.”

“The 2.9% expansion in 4Q was due to the volatile private inventories which contributed to half of the gain while government spending rose the fastest pace since 1Q 2021. While private consumption expenditure (PCE) rose in 4Q, it came in below expectations and together with the disappointment from the inflation adjusted sales to private domestic buyers, raised concerns about US consumer, under the weight of an elevated inflation environment. Non-residential fixed investment (business spending) also rose at a much slower pace in 4Q while net exports contributed mainly due to weak imports, which again pointed to concerns about US domestic demand.”

“US GDP Outlook - For 2023, we continue to expect the US economy to fall into a shallow recession due to the combination of elevated inflation, aggressive Fed rate hikes and global growth slowdown with a European recession. We keep our projection for US GDP to contract by 0.5% in 2023. The US labor market remains incredibly resilient and we do not expect the US to fall into a deeper recession unless we get a more protracted and sharper Fed tightening cycle.”

- The index comes under pressure and breaches 102.00 on Monday.

- Bouts of weakness could retest the 101.50 region near term.

DXY leaves behind two consecutive daily advances and returns to the sub-102.00 region at the beginning of the week.

In case sellers regain the upper hand, another test of the YTD low at 101.50 could start gathering momentum prior to the May 2022 low around 101.30 (May 30). Further south comes the psychological 100.00 level.

In the longer run, while below the 200-day SMA at 106.47, the outlook for the index remains negative.

DXY daily chart

Global Strategy Team at TD Securities (TDS) sounds optimistic and expects Australian Retail Sales to rise by 0.5% in December. The data is due for release during the Asian session on Tuesday.

Key Quotes:

“After the stunning rebound in November, we expect retail sales to continue its outperformance. We project sales to rise by 0.5% m/m in December (Nov: +1.4%), contrary to consensus which expect a 0.3% decline. Consumers may feel the urge to spend and splash the cash and credit card after spending the last three straight COVID Christmases under lock and key. However, we don't expect consumers to keep up this spending spree as higher interest rates and inflation will shrink household real incomes soon. More importantly, the Q4 CPI affirms another 25bps hike from the RBA next week though a stronger retail print may give the Bank more room to take the terminal rate higher.”

The continuation of the downtrend looks likely in USD/IDR in the short term, comments Markets Strategist at UOB Group Quek Ser Leang.

Key Quotes

“USD/IDR dropped sharply and rapidly over the last couple of weeks. While further USD/IDR weakness is not ruled out, any further decline is unlikely to challenge the major support at 14,770 this week.”

“On a shorter-term note, 14,850 is already quite a strong support level. Resistance is at 15,100, followed by 15,200.”

- EUR/JPY starts the week with strong gains well north of 141.00

- Extra choppiness remains on the cards for the time being.

EUR/JPY extends the erratic performance for yet another session on Monday, this time advancing sharply beyond the 141.00 barrier.

Extra consolidation should not be ruled out in the very near term. In case the downside accelerates, the next support of note emerges at the 200-day SMA, today at 140.84. A sustainable drop below the latter exposes extra weakness to, initially, the 138.00 neighbourhood.

The constructive outlook for EUR/JPY is seen unchanged above the 200-day SMA for the time being.

EUR/JPY daily chart

According to Markets Strategist at UOB Group Quek Ser Leang, USD/MYR faces a solid support around 4.20 for the time being.

Key Quotes

“USD/MYR dropped to a fresh 9-1/2month low of 4.2200 last week before closing lower by 0.98% (Friday’s close of 4.2410).”

“Further USD/MYR weakness is not ruled out but in view of the deeply oversold conditions, any decline is unlikely to break the support at 4.2000 (4.2200 is likely to offer strong support already). Resistance is at 4.2650.”

FX option expiries for January 30 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- USD/JPY: USD amounts

- 130.00 435m

- AUD/USD: AUD amounts

- 0.7050 419m

Reuters notes: "A programming glitch means Refinitiv SDRV is only showing DTCC trades done before 03 Dec 2022. Specialists are working on a fix and apologise for the inconvenience."

- Silver struggles to capitalize on a modest uptick and fails near the $23.80 support breakpoint.

- The mixed technical setup warrants some caution before placing aggressive directional bets.

- A sustained move beyond the $24.50 area is needed to negate any near-term negative outlook.

Silver builds on Friday's modest bounce from the $23.30 area and gains some positive traction on the first day of a new week. The white metal, however, struggles to capitalize on the strength and remains capped near the $23.70-$23.80 confluence support breakpoint, comprising the 200-hour SMA and the lower end of a short-term ascending channel.

From a technical perspective, last week's break below the aforementioned confluence support suggests that the near-term bias might have already shifted in favour of bearish traders. That said, oscillators on daily/hourly charts - though have been losing momentum - are yet to confirm the negative outlook. This, in turn, warrants some caution before positioning for any further depreciating move.

In the meantime, Friday's swing low, around the $23.30 region, now seems to act as immediate support. A convincing break below will make the XAG/USD vulnerable to weaken below the $23.00 mark and test the next relevant support near the $22.75 area. The downward trajectory could eventually drag the white metal towards the $22.20-$22.15 intermediate support en route to the $22.00 round figure.

On the flip side, momentum beyond the $23.70-$23.80 support-turned-resistance, might confront hurdle near the $24.00 mark. This is followed by last week's peak, around the $24.30 region, and the $24.50-$24.55 supply zone, or a multi-month peak touched on January 3. A sustained above should allow the XAG/USD to aim back to reclaim the $25.00 psychological mark for the first time since April 2022.

Silver 1-hour chart

Key levels to watch

- Economic Sentiment Indicator improved at a stronger pace than expected in Eurozone.

- EUR/USD gained traction after the data and climbed above 1.0900.

The data published by the European Commission revealed on Monday that the Economic Sentiment Indicator in the Euro area and the EU improved to 99.9 and 98, respectively.

Further details of the publication showed that the Industrial Confidence in the Euro area rose to 1.3 from -0.6 in December, the Services Sentiment advanced to 10.7 from 7.7. Finally, the Consumer Confidence Index came in at -20.9, matching the flash estimate.

Market reaction

EUR/USD edged higher with the initial reaction and was last seen trading in positive territory above 1.0900.

Markets Strategist at UOB Group Quek Ser Leang suggests USD/THB could navigate within the 32.55-33.05 range in the next few weeks.

Key Quotes

“After dropping to a low of 32.57 last Monday (23 Jan), USD/THB traded sideways for the rest of the week. The combination of waning downward momentum and oversold conditions suggests USD/THB has moved into a consolidation phase.”

“In other words, USD/THB is expected to trade sideways, likely between 32.60 and 33.05. Looking ahead, if USD/THB breaks and holds below 32.55, it could signal a decline to 32.35.”

- USD/CAD stages a modest recovery from over a two-month low touched earlier this Monday.

- A softer tone around crude oil prices undermines the Loonie and acts as a tailwind for the pair.

- Subdued USD price action holds back bulls from placing aggressive bets and caps the upside.

The USD/CAD pair attracts some buyers near the 1.3300 mark and stages a goodish intraday bounce from over a two-month low touched earlier this Monday. The pair sticks to the recovery gains through the first half of the European session and is currently placed near the top end of the daily range, just below mid-1.3300s.

Crude oil prices remain depressed for the second straight day, which, in turn, is seen undermining the commodity-linked Loonie and acting as a tailwind for the USD/CAD pair. An indication of a rise in crude exports from Russia's Baltic ports in early February, to a larger extent, offsets the optimism over a demand recovery in China. Adding to this, expectations that OPEC+ will likely keep output unchanged during a meeting this week weighs on the black liquid.

The upside for the USD/CAD pair, meanwhile, seems capped amid the underlying bearish sentiment around the US Dollar. The prospects for a less aggressive policy tightening by the Fed keep the USD bulls on the defensive near a nine-month low touched last week. Traders, however, seem reluctant and prefer to move to the sidelines ahead of the highly-anticipated FOMC monetary policy decision, scheduled to be announced at the end of a two-day meeting on Wednesday.

In the absence of any relevant market-moving economic releases, either from the US or Canada on Monday, the aforementioned fundamental backdrop warrants caution before placing directional bets. Nevertheless, the USD/CAD pair, for now, manages to hold above the 1.3300 round-figure mark and remains at the mercy of the USD/oil price dynamics. The said handle could act as a pivotal point, which if broken decisively should pave the way for a further near-term depreciating move.

Technical levels to watch

- German economic activity contracted in the last quarter of the year.

- EUR/USD clings to modest daily gains, trades below 1.0900.

The preliminary data published by Germany's Destatis revealed on Monday that the German economy contracted by 0.2% on a quarterly basis in the second quarter. At an annualized rate, the Gross Domestic Product grew 1.1%, down from 1.3% recorded in the third quarter, and missed the market expectation of 1.3%.

"After the German economy managed to perform well despite difficult conditions in the first three quarters, economic performance slightly decreased in the fourth quarter of 2022", Destatis noted in its publication. "Especially the price, seasonally and calendar adjusted private consumption expenditure, which had supported the German economy in the first three quarters, was lower than in the previous quarter."

Market reaction

EUR/USD showed no immediate reaction and was last seen posting modest daily gains on the day at around 1.0880.

Another probable visit to the 6.6985 level still remains in the pipeline in USD/CNH, comment UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia.

Key Quotes

24-hour view: “We expected USD to ‘weaken further’ last Friday. However, after dipping to a low of 6.7226, USD rebounded strongly to 6.7720 before pulling back to close at 6.7555. The price movements are likely part of a broad consolidation range and USD is expected to trade between 6.7300 and 6.7700 today.”

Next 1-3 weeks: “Last Friday (27 Jan, spot at 6.7310), we highlighted that downward momentum is building quickly and we expect USD to weaken toward the month-to-date low near 6.6985. While there is no change in our view for now, the rebound to a high of 6.7720 has dented the downward momentum. Overall, only a breach of 6.7760 (‘strong resistance’ level) would indicate that the build-up in downward momentum has faded.”

- GBP/USD struggles to gain any meaningful traction and oscillates in a narrow band on Monday.

- Traders now seem reluctant to place fresh bets ahead of this week’s key central bank event risks.

- Bets for smaller Fed rate hikes continue to undermine the USD and lend some support to the pair.

The GBP/USD pair kicks off the new week on a subdued note and seesaws between tepid gains/minor losses through the early European session. The pair remains confined in a multi-day-old trading range and is currently placed just below the 1.2400 round-figure mark.

Traders now seem to have moved to the sidelines ahead of this week's central bank event risks, which, in turn, fails to provide any meaningful impetus to the GB/USD pair. The Federal Reserve is scheduled to announce its decision at the end of a two-day policy meeting on Wednesday. This will be followed by the latest monetary policy update by the Bank of England (BoE) on Thursday and will help determine the next leg of a directional move for the major.

In the meantime, speculations that elevated consumer inflation will force the Bank of England (BoE) to continue lifting rates offer some support to the British Pound. This, along with the underlying bearish sentiment surrounding the US Dollar, acts as a tailwind for the GBP/USD pair. In fact, the USD Index, which tracks the Greenback against a basket of currencies, languishes near a nine-month low amid bets for smaller rate hikes by the Fed.

Investors now seem convinced that the US central bank will soften its hawkish stance amid signs of easing inflationary pressures. The expectations were reaffirmed by Friday's release of the Fed's preferred inflation gauge - the Core PCE Price Index from the US, which fell to the 4.4% YoY rate in December from 4.7% previous. Other US macro data released recently, however, backed the case for the Fed to maintain its hawkish stance for longer.

Hence, investors will look for cues about the Fed's future rate hikes, which will play a key role in influencing the USD price dynamics and provide a fresh directional impetus to the GBP/USD pair. Heading into the key event risk, spot prices seem more likely to prolong the consolidative price move in the absence of any relevant market-moving economic releases, either from the UK or the US on Monday.

Technical levels to watch

- EUR/USD picks up pace and retargets the 1.0900 barrier.

- Advanced German Q4 GDP Growth Rate next on tap.

- US Dallas Fed index, short-term auctions come later in the NA session.

The European currency starts the new trading week on the positive foot and lifts EUR/USD back to the vicinity of the key barrier at 1.0900 the figure on Monday.

EUR/USD remains focused on the FOMC, ECB events