- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- EUR/USD consolidates the biggest daily loss in a week after bouncing off short-term key supports.

- 50-SMA, five-week-old horizontal area appear to be strong supports.

- Bulls need validation from 200-SMA to retake control.

EUR/USD holds onto the corrective pullback from the 50-SMA around 1.0525 during Friday’s Asian session.

In doing so, the major currency pair also justifies Wednesday’s rebound from the key horizontal support zone comprising multiple levels marked since mid-May.

Given the sluggish MACD signals and steady RSI, coupled with the quote’s ability to recover from important supports, the EUR/USD pair is likely to run towards the 200-SMA hurdle surrounding 1.0585.

However, the quote’s upside past 1.0585 will need to cross the weekly peak of 1.0600 and early June’s low near 1.0630 to give control to buyers.

Meanwhile, the 50-SMA and aforementioned support area, respectively near 1.0495 and 1.0470-60, could challenge the EUR/USD bears.

During the pair’s weakness past 1.0460, multiple troughs near 1.0400 could test the bears before directing them to the yearly low of 1.0349.

To sum up, EUR/USD signals corrective pullback but the buyers need validation from 200-SMA.

EUR/USD: Four-hour chart

Trend: Further recovery expected

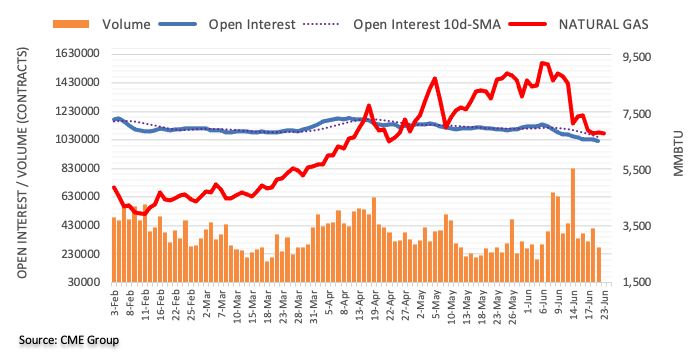

- Oil prices have failed to surpass the critical hurdle of $107.23 amid escalating recession fears.

- Higher interest rates by the global central banks have raised the oil demand worries.

- The EIA weekly oil inventory report is postponed to next week, as reported by Bloomberg.

West Texas Intermediate (WTI), futures on NYMEX, is portraying a mute performance in the Asian session after sensing significant offers while overstepping the critical hurdle of $107.23. The black gold has remained in the grip of bears this week after the market participants underpinned the demand worries over the supply constraints.

No doubt, the sanctions on Russia after it invaded Ukraine have settled a tight oil market for the global economy for a prolonged period. However, the recently grown recession fears after the global central banks started running towards policy tightening measures to fix the inflation mess are guiding the oil prices now. In June, most of the Western central banks announced a rate hike of 50 basis points (bps). The mighty Federal Reserve (Fed) went beyond the expectations and announced a 75 bps rate hike.

The announcement of higher interest rates has eventually slashed the extent of economic activities whose effect is clearly visible on the US Purchase Managers Index (PMI) numbers. The Manufacturing PMI has landed at 52.4 much lower than forecasts and the prior print of 56 and 57 respectively. Also, the Services PMI has slipped sharply to 51.6 from the consensus of 53.5 and the prior print of 53.4. Lower economic activities will result in lower demand for oil and henceforth lower oil prices.

Volatility has been accelerated in the oil counter amid a surprise delay in the weekly U.S. oil inventory report, which Bloomberg said was held up by “power issues” and unlikely to see publication until next week.

- USD/CHF stays defensive after refreshing multi-day low, bullish candlestick formation teases corrective pullback.

- Risk-aversion, lack of data could underpin the recovery moves.

- Second-tier US statistics, qualitative catalysts to direct intraday traders.

USD/CHF extends late Thursday’s rebound from a three-week low towards piercing the 0.9600 threshold, around 0.9610 during Friday’s initial Asian session.

In doing so, the Swiss currency pair not only justifies the risk-off mood but also takes clues from the technical analysis, as well as the lack of major data/events, to consolidate the weekly losses.

Federal Reserve (Fed) Chairman Jerome Powell cited inflation and recession woes as the challenges to ensure a smooth landing, despite expecting firmer growth this year, during his second round of Testimony. The central banker’s concern for recession joined downbeat US data to favor the risk-off mood.

On the same line were downbeat US PMIs as S&P Global Services PMI for the US slumped to 51.6 in June from 53.4 prior, not to forget missing the 53.5 forecasts. Further, the Manufacturing PMI not only missed the market expectation of 56 by a wide margin in June, to 52.4 versus 57.00 previous readings, but also slumped to a nearly two-year low.

Against this backdrop, the S&P 500 Futures drop 0.30% while the US 10-year Treasury yields remain unchanged at around 3.09% after dropping to a fortnight low the previous day.

Moving on, a light calendar may test the USD/CHF pair traders but risk catalysts and the second-tier US data for housing and activities may offer intermediate moves.

Technical analysis

Bullish candlestick formation joins the USD/CHF pair’s rebound from the 50-day EMA, around 0.9560 at the latest, to keep buyers hopeful. However, the 21-day EMA near 0.9715 guards the short-term advances of the pair.

- The GBP/JPY stays positive in the week, gaining 0.42%.

- A fragile sentiment triggered by recession fears might send the pair tumbling and erase the pound’s weekly gains.

- GBP/JPY Price Analysis: Upward biased in the medium term, but the short term is consolidating and might fall if sellers step in and could dive towards 164.00.

The GBP/JPY barely advances during the Asian session, up 0.02%. However, on Thursday, the GBP/JPY plunged from around 167.00 to 164.65, though it staged a comeback and lost only 160 pips. At 165.41, the GBP/JPY, albeit above the 20-day exponential moving average (EMA), remains under selling pressure amidst a mixed market sentiment.

The reflection of the above-mentioned is that Asian equity futures are rising while US indices are falling. Fears of a US and global recession increased after Thursday’s worldwide S&P Global PMIs, although in expansionary territory, dipped. Investors sounded the alarms and flew towards safe-haven assets, like the Japanese yen in the FX market.

Read also: Forex Today: Run to safety only beginning

GBP/JPY Price Analysis: Technical outlook

Daily chart

From a technical perspective, the GBP/JPY is upward biased, as the exchange rate failed to break below the 20-EMA. Also, the Relative Strength Index (RSI) dwells in bullish territory, meaning there’s some buying pressure on the pair, but solid resistance lies ahead.

4-hour chart

In the near-term, GBP/JPY price action shows consolidation lying ahead; though successive series of a Lower high (LH) and a Lowe low (LL), and with the pair meandering around the 50 and 100-4H-EMAs, a breach of them would open the door for a possible fall towards 164.47.

Therefore, the GBP/JPY first support would be 100-4h-EMA at 164.95. A breach of the latter exposes the 50-EMA at 164.64, followed by the swing low mentioned above at 164.47. If the pair clears the latter, the GBP/JPY might tumble to the 200-4H-EMA at 162.38.

- Silver portrays corrective pullback after refreshing eight-day low.

- Clear break of six-week-old ascending trend line joins impending bear cross on MACD to favor sellers.

- 10-DMA, three-week-old descending trend line adds to the upside filters.

Silver (XAG/USD) regains $21.00 amid a corrective pullback near the weekly low. Even so, the bright metal keeps the downside break of the previous key support line during Friday’s Asian session.

In addition to the support-turned-resistance from mid-May, around $21.10, a looming bear cross on the MACD and downbeat RSI also hint at the quote’s further downside.

Even if the XAG/USD manages to cross the $21.10 hurdle, the 10-DMA and a downward sloping trend line from May 06 could challenge the buyers around $21.40 and $21.75.

It’s worth noting, however, that the metal’s run-up beyond $21.75 enables it to rally towards the monthly high of $22.51.

On the flip side, the monthly low near $20.90 appears to be the immediate support for the silver traders to watch ahead of targeting the yearly bottom surrounding $20.45.

Following that, the $20.00 psychological manget could entertain XAG/USD bears before directing them to the 61.8% Fibonacci Expansion (FE) of the metal’s moves during late April to early June, around $19.40.

Overall, the metal’s rebound appears less convincing until the prices stay below $21.75.

Silver: Daily chart

Trend: Further downside expected

- EUR/JPY is balancing around 142.00 as investors are awaiting the release of the Japan Inflation.

- The downbeat eurozone PMI has weakened the shared currency bulls.

- Despite the prolonged ultra-loose monetary policy, the BOJ has failed to spurt the growth forecasts.

The EUR/JPY pair gave a downside break of the consolidation formed in a minor range of 141.93-142.07 in the early Tokyo session, however, a follow-back reversal has turned the asset sideways again. The asset remained in the grip of bears on Thursday after the IHS Markit reported a downbeat euro zone Purchase Managers Index (PMI) figures.

The IHS Markit reported the Composite PMI at 51.9, significantly lower than the estimates of 54 and the prior print of 54.8. Separate scrutiny of Manufacturing and Services PMI also displayed a vulnerable performance. The Manufacturing PMI landed at 52, much lower than the estimates and the prior print of 53.9 and 54.6 respectively. Also, the Services PMI released extremely lower at 52.8 than the consensus of 55.5 and the former figure of 56.1.

On the Tokyo front, investors are worried over lower demand prospects. The economy has yet not achieved its pre-pandemic growth levels. And now, an expected divergence in the plain vanilla and core Consumer Price Index (CPI) figures is creating headwinds for the economy. The annual CPI is seen at 2.9% much higher than the inflation target of 2% and the prior print of 2.5%. While the core CPI may slip vigorously to 0.4% from the prior print of 0.8%. A divergence in the composite and bifurcated CPI indicates that the price rise is significantly guided by higher fossil fuel and food prices. This means that despite the prolonged ultra-loose monetary policy, the Bank of Japan (BOJ) has failed to spurt the aggregated demand.

- AUD/USD picks up bids to refresh intraday high, snaps two-day downtrend around eight-day low.

- Markets consolidate recent losses amid a lack of major data/events.

- Fed Chair Powell’s testimony, US PMIs raised concerns over economic slowdown and drowned the pair.

- RBA’s Lowe may help buyers on repeating the latest hawkish bias.

AUD/USD pares recent losses around 0.6900 as recession fears stall, for the time being, amid a quiet Asian session on Friday. Also keeping the Aussie buyers hopeful is the scheduled speech from Reserve Bank of Australia (RBA) Governor Philip Lowe, around 11:30 GMT.

Fears of economic slowdown triggered the market’s rush to risk safety the previous day, which in turn weighed on the AUD/USD prices due to its risk-barometer status. In doing so, the Aussie pair couldn’t cheer upbeat PMIs at home, nor the softer US activity numbers, as the US dollar benefited from the risk-aversion wave.

That said, the preliminary readings of Australia’s S&P Global PMIs for June came in mixed as the Manufacturing and Services PMIs rose past market forecasts and priors but the Composite PMI eased below the previous readouts. The Manufacturing PMI rose to 55.8 versus 54.7 expected and 55.7 prior whereas the S&P Global Services PMI rose past 49.1 market consensus to 52.6, versus 53.2 previous readings. It should be noted that the Composite PMI eased below 52.9 to 52.6 in June.

On the other hand, S&P Global Services PMI for the US slumped to 51.6 in June from 53.4 prior, not to forget missing the 53.5 forecasts. Further, the Manufacturing PMI not only missed the market expectation of 56 by a wide margin in June, to 52.4 versus 57.00 previous readings, but also slumped to a nearly two-year low.

Elsewhere, Federal Reserve (Fed) Chairman Jerome Powell cited inflation and recession woes as the challenges to ensure a smooth landing, despite expecting firmer growth this year, during his second round of Testimony. The central banker’s concern for recession joined downbeat US data to favor the risk-off mood.

While portraying the mood, the S&P 500 Futures drop 0.30% while the US 10-year Treasury yields remain unchanged at around 3.09% after dropping to a fortnight low the previous day.

Moving on, RBA’s Lowe is likely to reiterate his hawkish bias, especially after the recently upbeat Aussie PMIs, which in turn could favor the AUD/USD bulls. However, any mentioning of economic fears could join the latest downbeat performance of iron ore, Australia’s key export item, to recall the bears.

Technical analysis

A six-week-old support line around 0.6855-60 puts a floor under the AUD/USD downside. Recovery moves, however, need validation from a downward sloping resistance line from June 07, at 0.6930 by the press time.

- USD/CAD suffers altitude sickness after rising for the last two days.

- Oil prices grind near six-week low amid recession fears, China underpins corrective pullback.

- Fed’s Powell appears thoughtful of growth and inflation as he cites challenges for smooth landing.

- Downbeat US PMIs magnified the risk of economic slowdown, second-tier data eyed.

USD/CAD flirts with the 1.3000 psychological magnet as bulls take a breather during Friday’s initial Asian session.

The Loonie pair managed to cheer softer oil prices and the market’s rush towards risk safety, amid economic fears, during the last two days. However, the recent pause in the WTI’s further downside, as well as a lack of market activity, appears to have underpinned the quote’s inaction.

Market sentiment remained sour in the last few days as traders fear recession as the major central banks rush for higher rates. On Thursday, Federal Reserve (Fed) Chairman Jerome Powell also cited the inflation and recession woes as the challenges to ensure a smooth landing, despite expecting firmer growth this year.

Elsewhere, S&P Global Services PMI for the US slumped to 51.6 in June from 53.4 prior, not to forget missing the 53.5 forecasts. Further, the Manufacturing PMI missed the market expectation of 56 by a wide margin in June, to 52.4 versus 57.00 previous readings.

Despite the market’s pessimism, the Wall Street benchmarks closed positively due to the downbeat Treasury yields. However, the US dollar regained its strength and exert downside pressure on the commodities and the Antipodeans.

It should be noted that the WTI crude oil, Canada’s main export item, forms a higher low pattern while recently defending $104.00, after refreshing the monthly low on Wednesday. That said, the black gold’s earlier losses could be linked to the recession fears and hopes of federal gas tax relief from the US while chatters that China’s traffic light data suggests improvement in energy demand seems to have probed the oil bears of late.

To sum up, USD/CAD bulls appear to have run out of steam and hence today’s second-tier US data, as well as chatters surrounding inflation/recession, becomes necessary for the pair to extend the run-up.

Technical analysis

A successful rebound from the 10-SMA, around 1.2955 by the press time, directs USD/CAD towards the double tops marked around 1.3080.

- USD/JPY is juggling marginally below 135.00 as investors await Japan's Inflation.

- A divergence is expected in the plain-vanilla CPI and Core CPI figures.

- The DXY is trading lackluster as the focus shifts to the US Durable Goods Orders.

The USD/JPY pair is displaying a lackluster performance in the early Asian session after sensing a decent rebound from a low of 134.27. The asset is oscillating in a 9-pips range near the critical hurdle of 135.00. A range-bound movement is expected to sustain for a minor period only as the Statistics Bureau of Japan is going to release the Consumer Price Index (CPI) at 11:30 GMT.

A preliminary estimate for the annual Japan inflation figure is 2.9%, higher than the prior print of 2.5%. If the core CPI that excludes food and oil prices is considered, a slippage to 0.4% is expected from the prior print of 0.8%. The FX domain is aware of the fact that the ongoing war between Russia and Ukraine and supply chain bottlenecks have resulted in soaring fossil fuels and food prices. The composite CPI figure is expected to extend further while the core CPI is seeing a slippage, which indicates that the composite figure is majorly being guided by the oil and food prices.

The Japanese economy is still facing the headwinds of lower aggregate demand. A higher spending situation on costly oil and food prices has actually reduced the demand for other durable and non-durable products. The huge divergence in plain vanilla CPI and core CPI is responsible for the dovish commentary from Bank of Japan (BOJ) policymakers in the June monetary policy meeting minutes released this week.

On the dollar front, the US dollar index (DXY) has turned sideways as investors are awaiting the release of the US Durable Goods, which are due on Monday. An improvement is expected in the economic data to 0.6% from the former figure of 0.5%.

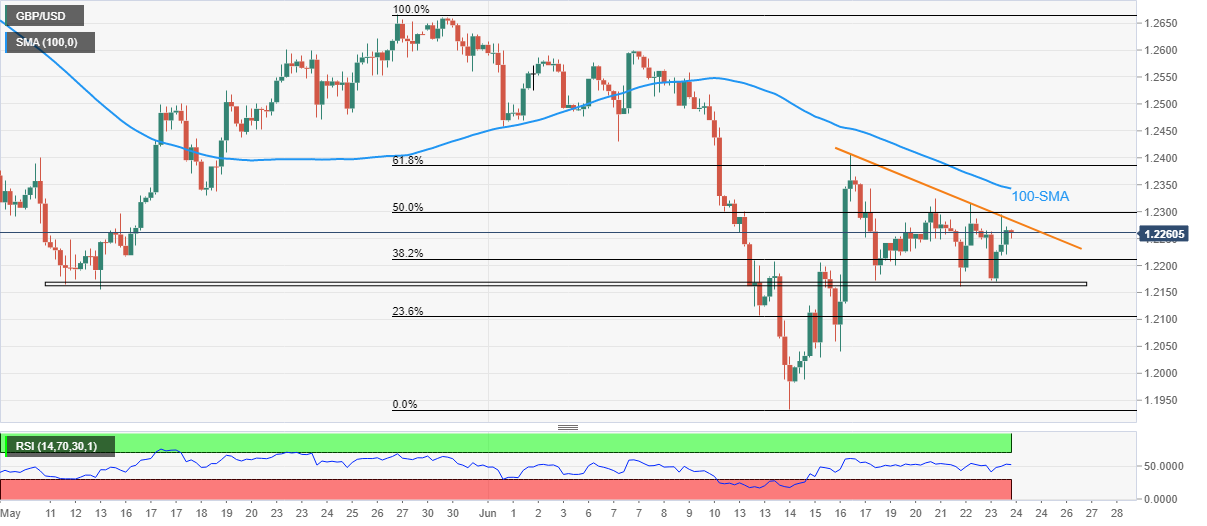

- GBP/USD dribbles inside a bullish chart pattern after two-day inaction.

- Firmer RSI, horizontal support add strength to the bullish bias.

- 100-SMA acts as an extra filter to the north, bears could aim for yearly low on breaking 1.2160.

GBP/USD treads water around 1.2260 during Friday’s Asian morning, following the last two days’ dormancy inside a falling triangle bullish formation.

Adding strength to the Cable pair’s upside bias is the firmer RSI and a six-week-old horizontal support area that also comprises the stated triangle’s lower line.

That said, the GBP/USD buyers need validation from 1.2285 to trigger the upside momentum. Even so, the 100-SMA could test the bulls around 1.2345.

In a case where the quote rises past 1.2345, the previous weekly top surrounding 1.2405 and multiple troughs marked during late May and early June, around 1.2470 could challenge the pair’s further advances.

On the contrary, a downside break of the 1.2160 could quickly fetch the GBP/USD prices towards the 23.6% Fibonacci retracement level of the May-June downside, near 1.2100.

The bearish bias, if persist past 1.2100, won’t hesitate to challenge the yearly low surrounding 1.1933. During the fall, the 1.2000 psychological magnet could offer an intermediate halt.

Overall, GBP/USD is up for consolidating recent losses ahead of the UK Retail Sales for May.

GBP/USD: Four-hour chart

Trend: Further upside expected

- AUD/JPY plummeted by 270 pips in two days and is losing in the week 0.54%.

- Worldwide S&P Global PMIs spurred global recession fears, as all missed estimations.

- AUD/JPY Price Analysis: It is still upward biased, but the price is closing to the bottom of a rising wedge which, once broken, may send the pair towards 85.00.

The AUD/JPY plunged on Thursday for the second straight day, diving 1.39%, reaching on its way south a daily low near 92.64, though on Friday, as the Asian session began, AUD/JPY buyers reclaimed the 93.00 mark. At the time of writing, the AUD/JPY is trading at 93.10.

The market sentiment seesawed throughout Thursday’s session. Meanwhile, Asian equity futures follows Thursday’s Wall Street mood, climbing between 0.05% and 1%. Dismal S&P Global PMIs reported from the Eurozone, the UK, and the US, threaten to derail growth, with readings accelerating towards the 50 midline, which, broken to the downside, depicts that the economy is entering a contraction phase.

AUD/JPY Price Analysis: Technical outlook

Daily chart

From a technical perspective, the AUD/JPY remains upward biased but under selling pressure. Price action in the last couple of days witnessed a 270 pip fall, from around weekly highs near 95.28, towards 92.64, June 23 lows.

It’s worth noting that AUD/JPY’s price is closing towards the rising wedge bottom trendline, meaning a break below would send the cross towards 85.00. However, on its way south, the AUD/JPY will need to breach crucial supports on its way south.

Therefore, if the above scenario plays out, the AUD/JPY first support would be the 50-day exponential moving average (EMA) at 92.44. Break below would send the cross aiming towards the 100-EMA at 89.83, followed by a fall to the 200-EMA at 86.13.

AUD/JPY Key Technical Levels

- EUR/USD has turned sideways after a vulnerable Eurozone/US PMI performance.

- Investors are keeping an eye on the release of the US Durable Goods Orders for further guidance.

- The asset has displayed a balanced market profile this week, which may bring an imbalance action further.

The EUR/USD pair has turned sideways to 1.0520 after facing barricades around 1.0550 in the New York session. In this entire week, the asset has displayed topsy-turvy moves in a range of 1.0444-1.0606 despite the availability of potential triggers, which were able to provide a decisive move to the asset. On Thursday, the major was expected to deliver an upside break of the consolidation range, however, the downbeat eurozone Purchase Managers Index (PMI) data weighed pressure on the shares currency bulls near the round-level resistance of 1.0600.

The IHS Markit reported the Composite PMI at 51.9, much lower than the estimates of 54 and the prior print of 54.8. Separate scrutiny of Manufacturing and Services PMI also displayed a vulnerable performance. The Manufacturing PMI landed at 52, significantly lower than the estimates and the prior print of 53.9 and 54.6 respectively. Also, the Services PMI released extremely lower at 52.8 than the consensus of 55.5 and the former figure of 56.1.

Meanwhile, the US dollar index (DXY) is following the footprints of the EUR/USD pair and has turned rangebound around 104.41 on lower-than-expected PMI data. The Manufacturing and Services PMI have landed at 52.4 and 51.6 respectively, however, their forecasts and prior prints were significantly higher.

Going forward, investors will keep an eye on the release of the US Durable Goods Orders, which are due on Monday. As per the market consensus, the economic data may improve to 0.6% from the prior print of 0.5%. This indicates a higher demand for those goods, which will last for at least three years.

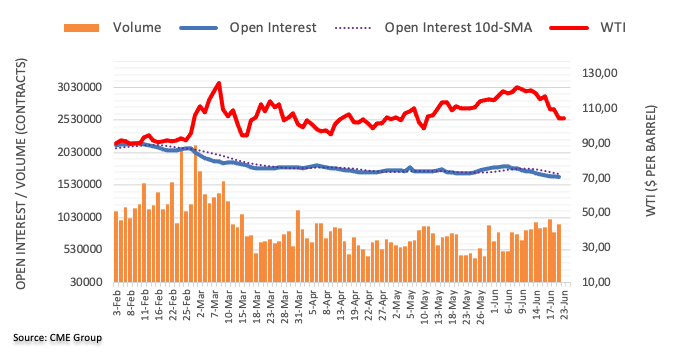

- Gold is on the back foot as the US dollar and risk step up a gear.

- The price is trading within a phase of consolidation between $1,810 and $1,875.

At $1,822, the price of gold has taken a step backwards despite a soft dollar bias in the markets. XAU/USD is down some 0.8% and has fallen from a high of $1,846.12 to a low of $1,822.60 so far. The US dollar bulls put in a potentially last-ditch effort to defend against a full-on break out to the downside in the latter part of the day on wall Street, but they are not out of the woods yet and are climbing walls within the bear's cage looking for a way out.

The dollar index (DXY), which measures the currency against six key rivals, slipped to 104.06 in the final hours of the day which took the price close to a critical level on the hourly chart, as illustrated below. However, the bulls managed to see that the dollar moved into positive territory, by some 0.2% at the time of writing around the close of the US forex session.

The DXY is already down to a decline since Friday to 0.5%. It has fallen 1.57% from the two-decade peak of 105.79 reached on June 15, when the Federal Reserve raised rates by 75 basis points, which was the biggest hike since 1994.

This is due to the concerns that the Fed's commitment to quelling red-hot inflation will spur a recession that has sent the 10-year Treasury yields sliding to an almost two-week low.

"Powell's semi-annual testimony has taken some steam out of the USD, his comments regarding elevated recession risk evidently weighing more than his unconditional commitment to restore price stability," Westpac analysts recently said.

"But with 75bp still on the table for July and Fed Funds set to rise above 3% by year’s end, USD interest rate support should ultimately continue to build."

The analysts at Westpac have observed the risks and forecast that the DXY will drop to as far as the 102 level in the near term.

Meanwhile, analysts at TD Securities argued that ''gold prices are overvalued relative to real rates, but the market has been hard-pressed to find a catalyst for a repricing.''

''Market pricing for Fed hikes has soared in recent months, leading real rates substantially higher amid an aggressive quantitative tightening program, without a commensurate meltdown in gold prices. Gold's outperformance is partially attributable to the massive amount of potentially complacent speculative length from proprietary traders in the yellow metal.''

On the second and last day of his testimony, Powell reiterated the Fed's commitment to bringing inflation under control. He said on Wednesday that a recession was "certainly a possibility" and that nothing was off the table in response to a question about the odds of a 100-basis-point hike.

US stocks have managed to end in the green on a volatile day with the Dow Jones Industrial Average adding 0.6% to 30,677.36. The S&P 500 was up 1% to 3,795.73 and the Nasdaq Composite climbed 1.6% to 11,232.19. This is all despite hawkish rhetoric at the Fed and dismal data.

The June flash reading of manufacturing conditions from S&P Global fell to 52.4 in June from 57 in May, compared with 56 expected in a survey compiled by Bloomberg. After falling 8.6% in February, 3.0% in March and 2.6% in April, existing-home sales dropped another 3.4% in the US in May to 5,410K (seasonally adjusted and annualized), bringing the total drawback over four months to 16.6%. This was also the lowest level of sales observed in nearly two years.

Gold technical analysis

In the prior day's analysis, the price of gold was anticipated to move lower in order into the $1,820s, albeit not quite as far as it has done so. Nevertheless, the break of structure is a compelling feature of the 4-hour time frame that gives rise to the prospects of a deeper advance towards $1,810 if the bulls throw in the towel:

The above analysis of the 4-hour time frame pinpoints the areas of liquidity in the order blocks (OBs), or the expected levels of demand and supply, and the areas where the price is yet to mitigate the price inefficiencies (PI), or 'price imbalances' (a miss-match in bids and offers). This leaves the price trapped between $1,810, or thereabout, on the downside and $1,875, or there about on the upside. If the bulls commit within the current ranges, then there will be a case for a move higher towards areas of imbalance above on the way towards $1,875.

- The New Zealand dollar is crawling in the week, down 0.61%.

- US Fed pace tightening, recession fears, and sentiment were headwinds for the NZD/USD.

- US S&P Global PMIs begin to show that the economy is slowing at a faster pace than estimated.

The NZD/USD dives for the second consecutive day, though late in the session recovered some ground, and bounced off daily lows around 0.6247 amidst a risk-off impulse, as shown by global equities fluctuating between gains and losses. At the time of writing, the NZD/USD is trading at 0.6276.

NZD/USD traders must be aware that New Zealand will observe a holiday on Friday, so beware of thin liquidity conditions during Asia’s session. Meanwhile, the NZD/USD slid due to a buoyant greenback, which, illustrated by the US Dollar Index, gained 0.22%, at 104.405.

Recession fears and sentiment kept the NZD/USD heavy

Sentiment shifted sour on US recession fears. Fed’s Chief Jerome Powell testified at the US House of Representatives, matching Wednesday’s speech and answers, reiterating the Fed’s commitment to tackle inflation and, albeit challenging, expects to achieve a “soft landing.” Further, Fed speaking, in the name of Michelle Bowman, a member of the Board of Governors, backed a 75 bps for July and stated that inflation is unacceptably high, showing no signs of moderating.

In the meantime, Thursday’s US calendar featured Initial Jobless Claims for the last week (ending June 17), which rose by 229K more than the 227K estimated. Later, June’s S&P Global PMIs were revealed, with all three readings missing expectations.

Chris Williamson, Business Economist at S&P Global Market Intelligence, said, “Businesses have become much more concerned about the outlook as a result of the rising cost of living and drop in demand, as well as the increasingly aggressive interest rate path outlined by the Federal Reserve and the concomitant deterioration in broader financial conditions. Business confidence is now at a level which would typically herald an economic downturn, adding to the risk of recession.”

In the week ahead, the NZ economic docket is absent on holiday. In the US, the calendar will feature the Michigan Consumer Sentiment Final for June, alongside May’s New Home Sales.

NZD/USD Key Technical Levels

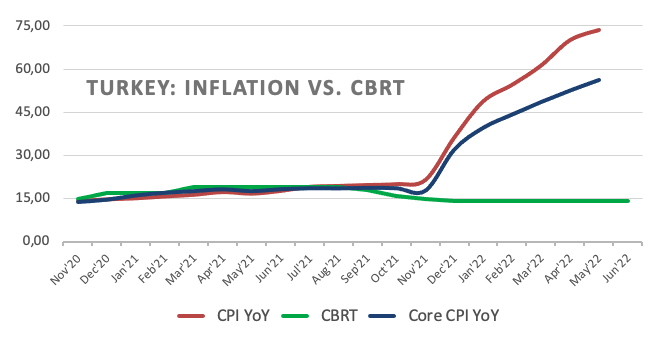

What you need to take care of on Thursday, June 23:

Fears continued to back the dollar, which ended the day with gains against most of its major rivals. The focus remained on overheating inflation and potential recessions among major economies.

German Economy Minister Robert Habeck announced the country would move to stage two of its three-stage gas plan amid reduced Russian flows. Ever since the war began in Ukraine, fuel shortages have been Europe's main concern. This particular phase does not mean state intervention, scheduled for the next one.

The EU flash S&P Global PMIs for June painted a gloomy picture as EU economic activity hit a 16-month low, reflecting a stalling of demand growth. The manufacturing PMI contracted to 52, while the services index shank to 52.8 from 56.1 in May. Australian data beat expectations while UK figures were mixed, although not much different from May ones. Finally, the US manufacturing index slowed to 52.4 in June, an almost two-year low, while the Services PMI contracted to 51.6 from 53.4 in the previous month, a five-month low. The reports fueled recession-related concerns.

FOMC Chairman Jerome Powell testified before the House Financial Services Committee on Monetary Policy and the State of the Economy. Fed's head said that a big part of inflation wouldn't be affected by the central bank's tools, although another part will be. On a positive note, he added that growth this year should still be fairly strong, but his comments clearly reflect concerns about inflation and growth, as he repeated that it would be "very challenging" to ensure a smooth landing.

Wall Street spent the day in the red but managed to post modest gains on Thursday. US Treasury yields, on the other hand, edged lower amid demand for safety.

Major pairs remained within familiar levels. The EUR/USD pair trades around 1.0530, while GBP/USD stands at around 1.2260. The AUD/USD pair struggles around 0.6900 while USD/CAD nears 1.3000. Safe-haven CHF and JPY posted modest advances against the dollar.

Gold finished the day near its weekly low, now trading at around $1,825 a troy ounce. Crude oil prices were stable, with WTI settling at $104.00 a barrel.

Like this article? Help us with some feedback by answering this survey:

- AUD/USD is finding solace in firmer stocks and in the weakness of the US dollar and prospects of lower levels in DXY to come.

- Analysts eye 102 for DXY near term, and this leaves AUD in limbo.

At 0.6896, AUD/USD is down some 0.4% on the day although the US dollar remains under pressure on Thursday as it looked set to extend declines against major peers to a fourth day. Nevertheless, the Aussie struggles across the board and vs the greenback, it has fallen from a high of 0.6927 to a low of 0.6869 so far as the Wall Street close approaches.

The greenback has been dented by Treasury yields wallowing near two-week lows amid rising concerns of a recession following two days of testimony from the Federal Reserves Chairman, Jerome Powell.

Powell said in testimony to Congress on Wednesday that the central bank is fully committed to bringing prices under control even if doing so risks an economic downturn. He said a recession was "certainly a possibility," reflecting fears in financial markets that the Fed's tightening pace will throttle growth.

On his second day of testifying before Congress, Powell said the Fed's commitment to reining in 40-year-high inflation is "unconditional" but also comes with the risk of higher unemployment. However, there has been less of an impact on Thursday from his comments as the narrative moved over from inflation and towards the rising likelihood of a recession following alarmingly poor US data.

Markit’s flash composite PMI cooled from 53.6 in May to a 5-month low of 51.2 in June. While still above the 50-point mark separating expansion from contraction, this result was the second weakest since July 2020, when the economy was emerging from a pandemic-induced lockdown. The manufacturing sector tracker fell from 57.0 to a 23-month low of 52.4, marking one of the largest monthly declines in data going back to 2007. The services sub-index, for its part, decreased from 53.4 to a 5-month low of 51.6.

After falling 8.6% in February, 3.0% in March and 2.6% in April, existing-home sales dropped another 3.4% in the US in May to 5,410K (seasonally adjusted and annualized), bringing the total drawback over four months to 16.6%. This was also the lowest level of sales observed in nearly two years.

Nevertheless, Wall Street's main indexes were mixed in choppy trading on Thursday and the benchmark S&P 500 is headed for a positive close as gains in defensive shares countered declines for economically sensitive groups amid growing worries about a recession. Benchmark U.S. Treasury yields fell to two-week lows, supporting tech and other growth stocks and keeping the Nasdaq in positive territory.

However, trading is set to remain volatile in the wake of the S&P 500 last week logging its biggest weekly percentage drop since March 2020. Investors are weighing how far stocks could fall after the index earlier this month fell over 20% from its January all-time high, confirming the common definition of a bear market, which is not going to be favourable for the high better currencies such as the Aussie.

US dollar bulls throwing in their towels

In the meantime, it can take refuge in the softness of the greenback and the prospects of lower levels to follow, as per the following technical analysis:

The dollar index (DXY), which measures the currency against six key rivals, slipped 0.14% to 104.06 in recent trade which is leaving an hourly H&S on the chart, taking it towards a test of the neckline at the time of writing:

A break of structure, BoS, will open risk to run on the price imbalances, PI, below and that will leave 103.13 (a mid-point of an important bullish order block, OB) and below exposed.

- US Dollar Price Analysis: Bears taking out short-term structure, 103 vulnerable of a test below

The DXY is already down to a decline since Friday to 0.5%. It has fallen 1.57% from the two-decade peak of 105.79 reached on June 15, when the Federal Reserve raised rates by 75 basis points, which was the biggest hike since 1994.

This is due to the concerns that the Fed's commitment to quelling red-hot inflation will spur a recession that has sent the 10-year Treasury yields sliding to an almost two-week low.

"Powell's semi-annual testimony has taken some steam out of the USD, his comments regarding elevated recession risk evidently weighing more than his unconditional commitment to restore price stability," Westpac analysts recently said.

"But with 75bp still on the table for July and Fed Funds set to rise above 3% by year’s end, USD interest rate support should ultimately continue to build."

The analysts at Westpac have observed the risks and forecast that the DXY will drop to as far as the 102 level in the near term.

As for the Aussie, analysts at Rabobank said, ''we expect AUD/USD to hold close to current levels on a 1-month view and rise moderately to the 0.73 area by year-end. ''

''The AUD is likely to be sensitive to risks regarding Chinese economic output and broader concerns regarding slowing global growth.''

- The white metal remains on the defensive and dives more than 2% on Thursday.

- Fed officials backed further rate hikes, though Fed chair Powell acknowledged that the US might get into a recession.

- Silver Price Forecast (XAG/USD): Stays downward biased, and a break below $21.00 might pave the way for fresh YTD lows.

Silver (XAG/USD) plunges in the mid-North American session, falling from daily highs around $21.50 just above the $21.00 figure, weighed by a buoyant greenback amidst a mixed market mood, portrayed by US equities advancing, while European bourses closed in the red. At the time of writing, XAG/USD is trading at $21.03.

Recession fears and robust greenback drag metals prices down

The US and global recession fears struck the white metal price and Gold also. On Wednesday, US Federal Reserve chief Jerome Powell admitted that achieving a “soft landing” would be challenging while accepting that the US economy might tip into a recession. Nevertheless, he reiterated Fed’s compromise to tame inflation, and Powell stated that he is not taking any size of rate increases off the table.

Today at the US House of Representatives, Powell reiterated his and the commitment of the Fed to tame inflation, and his narrative stuck around Wednesday’s speech. Meanwhile, one of his colleagues at the Fed, Governor Michelle Bowman, said that she supported a 75 bps in July and commented that inflation is unacceptably high, showing no signs of moderating.

Therefore, the greenback advanced as Fed officials laid the ground for another rate hike. The US Dollar Index, a measure of the buck’s value vs. a basket of currencies, climbs 0.15% to 104.339, contrarily to the US 10-year Treasury yield, which is sliding seven basis points, yielding 3.085%.

Elsewhere US 10-year TIPS (Treasury Inflation-Protected Securities), a proxy for US Real yields, slumps nine bps and is back below 0.60%. Usually, lower Real yields would mean that appetite for precious metals augments, but a strong US dollar puts a lid on precious metals prices.

Meanwhile, the US 10s-2s yield spread remains positive at 0.078%, though it remains to push towards 0%. A reading below 0% would imply that traders forecast a recession in the US.

Data-wise, the US economic docket reported Initial Jobless Claims, which rose by 229K higher than the 227K estimated, illustrating that the labor market is tight. Later US S&P Global PMIs, on its Manufacturing, Services, and Composite numbers for June, exposed that the US economy is slowing down, which unnerved investors.

Silver Price Forecast (XAG/USD): Technical outlook

Silver remains downward biased from a technical perspective, though facing strong support around the $21.00 figure. Oscillators, in this case, the Relative Strenght Index (RSI) is signaling that selling pressure is piling; but failure to achieve a daily close below $21.00 would keep XAG/USD buyers hopeful of a rebound towards the 20-EMA at $21.74.

So as the XAG/USD path of least resistance is downwards, the first support would be $21.00. Break below would send prices towards June 13 low at 20.96, followed by the YTD low at $20.45.

In what will be a long rd to membership, Ukraine has won its candidate status in a bid to gain EU membership.

EU leaders have accepted both Ukraine and Moldova as membership candidates of the European Union, European Council President Charles Michel said on Thursday evening.

"Agreement. #EUCO has just decided EU candidate status to Ukraine and Moldova. A historic moment", Michel said in a tweet referring to the European Council of EU leaders (EUCO).

Ukraine's Zelensky welcomed the EU move to grant candidacy status, calling it a unique and historic moment in the bilateral relationship

Meanwhile, in the latest updates with regards to the crisis, the BRICS countries, which include Brazil, Russia, India, China and South Africa, said they support talks between Russia and Ukraine in a joint statement published on the Kremlin's website on Thursday.

“We have discussed the situation in Ukraine and recall our national positions as expressed at the appropriate fora, namely the UN [Security Council] and UN [General Assembly]. We support talks between Russia and Ukraine,” the statement read.“We have also discussed our concerns over the humanitarian situation in and around Ukraine and expressed our support to efforts of the UN Secretary-General, UN Agencies and ICRC to provide humanitarian assistance in accordance with the basic principles of humanity, neutrality and impartiality established in UN General Assembly resolution 46/182,” they added.

The BRICS summit, hosted by Beijing, marks Russian President Vladimir Putin’s first international forum with other heads of major economies since he launched his invasion in Ukraine back in February.

Since the beginning of Russia's invasion, Ukraine's President Volodymyr Zelensky has indicated that he was willing to hold direct talks with Putin.

However, Russian forces have continued to pound Ukraine's second largest city Kharkiv and surrounding countryside with rockets.

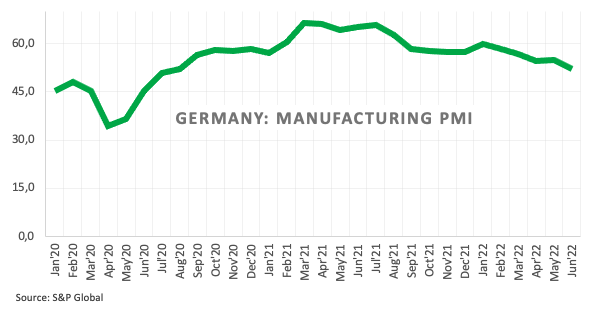

- For GBP, all eyes are on the sentiment surrounding the BoE.

- GBP/USD is stalled within a channel between 1.2160 and 1.2315.

- Should the bulls commit, then there will be prospects of a large area of imbalance (PI) between 1.2469 and 1.2414.

At 1.2220, GBP/USD is down on the day so far by some 0.33%, falling from a high of 1.2294 to a low of 1.2170 so far after UK PMIs came in roughly in line with expectations in June and in choppy market conditions.

It's been a two-way street in global equities, with a rally in the US session vs risk-off day overnight with European bourses pressured overall. The euro was impaired by poor local PMIs which lifted the US dollar index, DXY, to a 104.78 peak that pressured peers in turn, including the pound.

UK economy and BoE in focus

However, yesterday’s UK inflation print coupled with today's UK PMI outcome underpins sentiment that the UK's central bank, the Bank of England, BoE, is on track to hike by 50bps rate hike in the next meeting. The Bank of England is watching for signs that the recent jump in inflation, which hit a 40-year high of 9.1% in May, might turn into a permanent problem for the British economy.

However, observers will argue that Britain's economy is showing signs of stalling as high inflation hits new orders and businesses report levels of concern that normally signal a recession. This was evident in today's S&P Global's Purchasing Managers' Index (PMI), that was covering services and manufacturing firms. The data showed companies were raising pay and passing higher costs on to clients, which is a concern for the Bank of England.

The PMI's preliminary composite index held at 53.1 in June, above the median forecast of 52.6 in a Reuters poll of economists and unchanged from May. But the PMI's measure of new orders effectively stagnated as it fell to 50.8, the lowest in over a year. Factory orders dipped below the 50.0 growth threshold to 49.6.

"The economy is starting to look like it is running on empty," Chris Williamson, a chief business economist at S&P Global Market Intelligence, said, adding that the economy was likely to show a fall in output in the second quarter that could deepen in the third quarter. "Business confidence has now slumped to a level which has in the past typically signalled an imminent recession," he also explained. Growth was being propped up by previously placed orders. Manufacturers had reported especially weak demand for exports, and service firms were seeing their post-lockdown bounce reverse as the cost of living rose, Williamson explained further.

Moreover, the PMI's business expectations index fell by 4.6 points in June, the largest monthly decline since the start of the COVID-19 pandemic, with manufacturers and service providers both reporting their lowest business optimism levels since May 2020.

On the upside, job creation was the strongest in three months, in the latest sign of the strength in the labour market.

''The UK is in danger of being the slowest-growing major advanced economy next year, with the highest inflation rate and the biggest current account deficit,'' Kit Juckes at Societe Generale said.

''That's quite a collection, and it represents a clear threat to the pound. Sentiment is already poor and there are plenty of speculative shorts out there too, but further weakness is likely. Whether it falls more as the US dollar continues to rise, or under-performs a recovering euro, it will struggle. Longer-term, we will see sterling make new trade-weighted lows.''

Meanwhile, the BoE said last week it was ready to act "forcefully" if it saw signs of persistent inflation pressures, suggesting it might raise interest rates by more than its standard quarter-point increase despite fears of a recession. Overnight index swaps are continuing to price in 50bp moves by the BoE at the next 3 meetings. This lays out a path that would leave Bank Rate above 3% by year-end.

On the charts, this could see the pound steady from the monthly support area and there are upside prospects in the near term so long as the market structure on the four-hour chart holds up.

GBP/USD technical analysis

The monthly chart above is concerning given the strong bearish bias in 2022. However, there are some bullish features on the nearer-term charts that are encouraging as follows:

GBP/USD H4 chart, bullish mitigation prospects

As illustrated, the price recently moved sideways out of an uptrend but has since stalled within a channel between 1.2160 and 1.2315. Should the bulls commit, then there will be prospects of a large area of imbalance (PI) between 1.2469 and 1.2414 that could be mitigated giving way to chances of a move in to test 1.25 the figure thereafter, the highs o the order block (OB). However, there is still a slight inefficiency of price to the downside to 1.2154 that could be mitigated first of all as a last defence. If the bears commit through there, then the market structure will be broken and the bias will shift bearish again.

- The Swiss franc extends its weekly gains to almost 1%, as shown by the USD/CHF falling from weekly highs above 0.9700.

- Through the New York sesión, risk aversion pushed equities to negative territory and gave a fresh impulse to safe-haven assets, boosting the CHF.

- USD/CHF Price Analysis: The formation of a double tops looms and will target 0.9150.

The USD/CHF extends to four, its fall from around the 50-day moving average (DMA), at that time around 0.9707, aiming towards the 0.9600 figure, for the first time since early June. At the time of writing, the USD/CHF is trading at 0.9600.

The market sentiment shifted sour as US equities dwindled, trading in the red. The risk-off impulse boosted the Swiss franc, which has accumulated gains of almost 1% in the week, as the USD/CHF has fallen from 09712 to the 0.9600 area. Nevertheless, the uptick of the greenback, as shown by the US Dollar Index, a gauge of the buck’s value against a basket of six peers, gaining 0.24%, sitting at 104.440, capped any USD/CHF falls.

USD/CHF Price Analysis: Technical outlook

Daily chart

From a daily chart perspective, the USD/CHF remains neutral biased. However, once the Relative Strength Index (RSI) collapsed from overbought territory and broke below the RSI’s 7-day SMA, it opened the door for further losses. Besides, the formation of a double top that has failed to be confirmed so far, unless the USD/CHF breaches the necklines around 0.9544, will send the pair tumbling towards 0.9150.

Therefore, the USD/CHF first support would be the 0.9600 figure. A breach of the latter would pave the way towards the double top neckline at 0.9544. Once cleared, the major’s next support would be the 100-day moving average (DMA) around 0.9499.

USD/CHF Key Technical Levels

The New Zealand dollar is losing ground on a softer economic outlook warn analysts at CIBC. They forecast the NZD/USD pair at 0.62 during the third quarter and at 0.61 by year-end.

Key Quotes:

“The NZD is facing depreciation pressure sourced in a number of factors, including that from broad negative global risk sentiment. We see pressures continuing to build in coming weeks, and anticipate a retest of recent NZD/USD lows below 0.6200.”

“Already there has been evidence of slowing in consumer and business sentiment, and of a decline in house prices. Challenges to domestic activity from sharply higher rates are a negative that will be exacerbated by weak activity in China – New Zealand’s largest trading partner, and by the outrun of higher rates and softer outlooks globally. In this environment, higher policy rates in New Zealand will not support the currency beyond present levels.”

“A key area of resistance in NZD/USD is between 0.6530 (January low) and 0.6576 (June high). While spot is held below this band, risk is for another test of the downside.”

Analysts at CIBC see the USD/CAD pair trading around 1.29 during the third quarter and rising toward 1.31 by year-end. They consider markets are overpricing tightening this year from the Bank of Canada and the Federal Reserve.

Key Quotes:

“A likely 75 bp hike by the Bank of Canada in July, and the potential for another move of that magnitude in September if we don't see enough of an inflation deceleration by then, should be aggressive enough to allow USDCAD to remain around current levels over the next three months.”

“Contrary to market expectations, the BoC is unlikely to send Canada's overnight rate beyond the Fed's destination of 3.25%. Canada’s debtburdened households and mortgage renewals will see rate hikes weigh more on discretionary consumer spending in Canada. That points to a slightly lower terminal rate for the BoC overnight rate, although we're leaning towards a 3% peak rather than our prior 2.75% after the May inflation data.”

“Markets appear to be overpricing both BoC and Fed tightening this year, but comparatively more for the BoC, and that recalibration will lead the CAD to end the year weaker, with USDCAD expected to reach 1.31 by then.”

“All told, look for USDCAD to reach 1.33 in early 2023, before recouping some of that ground further into the year as the USD loses favour globally.”

- US S&P Global PMIs showed that the US economy is expanding at a slower pace.

- Worst than expected, Eurozone PMIs, tripped the EUR/USD towards daily lows below 1.0500.

- Fed’s Powell said he would be reluctant to cut rates when asked at the US House of Representatives.

The EUR/USD slides for the first day in the week, down by 0.30%, courtesy of a mixed market mood and dismal S&P Global PMIs figures on the Euro area reported in the European session, which tumbled the EUR/USD from daily highs around 1.0580s to daily lows near 1.0482. At 1.0509, the EUR/USD prints losses and is ready to continue its path towards the 1.0500 figure.

A risk-off impulse and dismal EU reported PMIs, tumbled the euro

Sentiment is mixed in the markets. Worst than forecasted EU S&P Global PMIs, all the readings missed expectations, though it weighed more in France. The slowdown in Europe gathers pace even as the European Central Bank (ECB) prepares to lift rates in the July meeting, aiming to tame inflation under control.

The EUR/USD fell on the back of the abovementioned, alongside a risk-off impulse that caused a jump in the greenback. In the meantime, the US S&P Global PMIs also failed to achieve expectations, showing that the US economy is also slowing, but Fed speaking, put a lid on the EUR/USD’s recovery.

The US Federal Reserve Chair Jerome Powell, in his appearance at the House of Representatives, said that the Fed has an “unconditional commitment to fighting inflation” and added that bringing inflation without impacting the labor market would be challenging.

Furthermore, when Jerome Powell was asked about cutting rates, he said he is reluctant to do it while adding inflation expectations are anchored, but that’s not enough as, over time, they will come under pressure.

In the meantime, the Fed’s Governor Michell Bowman said that another 75 bps rate hikes would be needed, and she added that further rate hikes would be required. Bowman said that inflation is unacceptably high and has shown no signs of moderating.

Elsewhere, the US Dollar Index, a gauge of the buck’s value against its peers, pops up 0.25% sitting at 104.445, while US Treasury yields, fall, reflecting investors are reassessing not as aggressive as expected Fed tightening, as the US S&P Global PMIs crossed wires.

In the week ahead, the EU calendar will feature ECB speaking, with McCaul, Fernandez-Bollo, Vice-President de Guindos, and Germany’s Ifo indices for June. Across the pond, US New Home Sales and Michigan Consumer Sentiment for June on its final reading will shed some light regarding the US economy

EUR/USD Key Technical Levels

- Swiss franc among top performers on Thursday.

- Eurozone and US data add to concerns about the growth outlook.

- EUR/CHF approaches parity again, bearish pressure intact while under 1.0150.

After moving sideways for four days, EUR/CHF broke to the downside falling to as low as 1.0067, the lowest level since early March. The cross remains under 1.0100, about to post the second-lowest daily close since 2015.

A recovery back above 1.0150 should alleviate the bearish pressure. On the downside, support levels might be seen at 1.0040 followed by the parity zone and then the February low at 0.9970.

Yields down for the wrong reasons

Eurozone June PMIs surprised sharply to the downside across the service and manufacturing indices. For the region, the headline manufacturing came in at 52.0 against a market consensus of 53.8 down from 54.6 while the service dropped from 54.8 to 51.9.

“June PMI data show Europe teetering on the brink of recession. We now expect the euro area to enter into a mild recession in 2022H2”, wrote analysts at TD Securities. They point out that central banks, including the European Central Bank are likely to continue down their plotted paths for now, but they expect them to turn more cautious in their tone into year-end.

Easing tightening expectations from the European Central Bank have eased following the negative economic reports. The German 10-year yield is falling more than 10%, as it stands at 1.42% (on Monday it was at 1.80%). Even Italian yields are lower with the 10-year at 3.48%, the lowest since June 9.

Technical levels

FOMC Chairman Jerome Powell is testifying before the House Financial Services Committee on "Monetary Policy and the State of the Economy."

Key takeaways

"Our tools affect inflation, not necessarily wage inflation."

"Some of these wage increases are substantially bigger than is consistent with 2% inflation."

"Fed isn't looking for new tools."

"A big part of inflation won't be affected by our tools, but a big part of it will be."

"Our tools are blunt but they are the right tools to deal with demand."

"That's a bigger piece than energy and food prices."

"We are not seeking deeper involvement in the economy."

"We are not seeking new tools, though it's up to Congress if it wants to change Fed mandate."

Market reaction

The US Dollar Index edged higher after these comments and was last seen rising 0.2% on the day at 104.38.

- USD/JPY drops almost two hundred pips on Thursday.

- US S&P Global PMI falls to monthly lows

- US yields collapse as recession fears increase.

The USD/JPY dropped further following the release of US economic data and bottomed at 134.21, reaching the lowest level in six days. Bonds are rising across the globe, supporting the Japanese yen.

The pair then rebounded modestly, and it is hovering around 134.60/70, down more than 200 pips from Wednesday’s multi-year high. Below 134.40, the next support is seen at 133.80.

Yen gains as growth outlook worsen

Earlier on Thursday, Eurozone PMIs came in below expectations and triggered a rally in European bonds and helped the yen. More recently, the US S&P Global PMI also showed a significant decline in activity. Both the manufacturing and service numbers fell to the lowest level in months at 52.4 (consensus: 56) and 51.6 (53.5), respectively. Despite the worrying data, Wall Street is rising, with the Nasdaq up 1.25% and the S&P 500 climbs 0.63%.

The report added to concerns about the economy and weighed on monetary policy expectations. The US 10-year yield fell to 3.00%, the lowest in two weeks; just on Friday, it was trading near 3.50%, while the 30-year fell to 3.15%.

The US lost momentum across the board after the report. The DXY erased daily gains and pulled back to 104.20/30. The dollar’s losses against the yen are offset by a slide of EUR/USD as German bonds have the best day in years.

Fed Chair Powell is testifying again at Congress. Regarding concerns about the economic outlook, he mentioned is possible to have a strong labor market while curbing inflation. Fed’s Bowman said another 75 bps rate hike will be appropriate in July.

Technical levels

Federal Reserve Governor Michelle Bowman said on Thursday another 75 basis points (bps) rate increase in July and at least 50 bps of hikes at the next few meetings would be appropriate, as reported by Reuters.

Additional takeaways

"Further rate hikes may be needed after that, depending on how economy evolves."

"I am committed to a policy that will bring real federal funds rate back into positive territory."

"With inflation unacceptably high, doesn't make sense to have nominal fed funds rate below near-term inflation expectations."

"Our number one responsibility is to reduce inflation."

"Labor market will remain strong as rates rise, though actions are not without risk."

"Makes sense to eventually sell Fed's MBS holdings."

"My longer-term goal is to get Fed out of indirectly intervening in real estate market."

"I strongly supported Fed's June rate hike."

"Inflation has shown little sign of moderating."

"Labor market tightness is contributing to inflation."

"Labor shortages will likely persist in many sectors."

"Inflation at these levels threatens sustained job growth, overall health of the economy."

"Little prospect of inflationary effects of Ukraine invasion abating soon."

"Global supply chain issues continue as China COVID lockdowns slow production, shipping."

"We need to use tools to address inflation before expectations become entrenched."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen posting small daily gains at 104.25.

FOMC Chairman Jerome Powell is testifying before the House Financial Services Committee on "Monetary Policy and the State of the Economy."

Key takeaways

"We need to get supply and demand back in better balance."

"Financial markets have been functioning well, banking system is very strong, well-capitalized."

"Liquidity in the treasury market has come down from where it was; looking at ways to address that."

"US is on an unsustainable fiscal path."

"There's a problem with longer-term housing supply."

"Housing market is slowing down to some extent now due to higher mortgage rates."

"Growth this year should still be fairly strong."

"We are trying to moderate demand so inflation can come down."

"We can't fail on getting inflation down."

"Would be reluctant to cut rates."

Market reaction

The greenback stays relatively quiet after these comments. The US Dollar Index was last seen posting small daily gains at 104.23.

- US stocks indices recover some ground after registering minimal losses on Wednesday.

- S&P Global PMIs indices missed expectations, dragging equities lower.

- The Nasdaq Composite leads the pack, followed by the S&P 500 and the Dow Jones.

- The greenback recovers some ground though US Treasury yields are falling as traders backpedaled against an aggressive Fed.

US equities opened in the green as Wall Street began within familiar ranges, though S&P Global PMIs where the three indices missed expectations, stocks seesawed and pullback from daily highs, but resumed the upward recovery.

The S&P 500 has regained composure, rising 0.53%, up at 3,777.04, though shy of Wednesday highs around 3800. Meanwhile, the tech-heavy index, the Nasdaq 100, again leads the pack to the upside, gaining 0.90%, up at 11,151.78, followed by the Dow Jones Industrial (DJIA) climbing 0.37%, advancing 30,595.05

Digging into the broader market index, the leading sectors are Consumer Staples, up by 1.60%, followed by Utilities, and Health, each recording gains of 1.148% and 1.46%, respectively. In negative territory stays commodity-related sectors like Energy, Materials, and Industrials, dropping by 1.12 %, 0.75%, and 0.68% each.

The greenback has recovered some territory and edges towards 104.374, up by 0.18%. Meanwhile, US Treasury yields remain on the defensive, with the US 10-year Treasury yield tumbling 14 bps, yielding 3.018%, retreating from weekly highs near 3.317%.

On Thursday, the S&P Global PMIs for the US missed expectations, showing that business activity in the manufacturing and services sector is expanding but at a weaker pace after sliding to 52.4 from 57 (Mfg.) and 51.6 from 53.4 (Services), with the latter readings in May. In the meantime, US Federal Reserve Chair Jerome Powell speaks at the US Congress for the second consecutive day.

At the time of writing, the Fed Board Governor Michelle Bowman stated that another 75 bps rate hike in July would be appropriate, followed by at least 50 bps at next subsequent meetings.

In the commodities complex, the US crude oil benchmark, WTI, slides 0.75%, exchanging hands at $105.47 BPD. At the same time, precious metals like gold (XAU/USD) rise 0.23%, trading at $1842.70 a troy ounce.

SP 500 Chart

Key Technical Levels

FOMC Chairman Jerome Powell is testifying before the House Financial Services Committee on "Monetary Policy and the State of the Economy."

Key takeaways

"Possible to have strong labor market while curbing inflation."

"Challenge now is we are tightening, which should drive growth down."

"We don't have precision tools."

"There is a risk that unemployment will move up."

"But remember, that's from a historically low level."

"Labor market is overheated."

"Our intention is to achieve a soft landing, path to do that has gotten more and more challenging.""

Market reaction

The US Dollar Index continues to edge higher after these comments and was last seen rising 0.22% on the day at 104.40.

"The risk of inflation expectations becoming de-anchored has risen over the past months," European Central Bank (ECB) Governing Council member and German central bank head Joachim Nagel said on Thursday, as reported by Reuters.

"If monetary policy falls behind the curve, even stronger hikes in interest rates could become necessary to get inflation under control," Nagel further added. "This would create much higher economic costs."

Market reaction

The shared currency stays on the back foot after these comments and the EUR/USD pair was last seen losing 0.45% on a daily basis at 1.0518.

FOMC Chairman Jerome Powell is testifying before the House Financial Services Committee on "Monetary Policy and the State of the Economy."

Key takeaways

"As economy returns to normal, we expect profit margins to also normalize."

"We have unconditional commitment to fighting inflation."

"Labor market is unsustainably hot."

"We need sustained period of maximum employment and bringing down inflation is necessary to do that."

"Significantly more challenging to bring down inflation without impacting the labor market."

"Effects of shrinking balance sheet will be marginal compared to impact of rising interest rates."

Market reaction

The greenback stays relatively resilient against its rivals after these comments and the US Dollar Index was last seen rising 0.13% on the day at 104.32.

- S&P Global Services PMI for the US fell sharply in June.

- Major equity indexes in the US trade modestly higher.

Business activity in the US service sector expanded at a very weak pace in early June with the S&P Global Services PMI falling to 51.6 from 53.4 in May. This print missed the market expectation of 53.5.

The report showed that contractions in output and new orders weighed heavily on the headline figure.

Assessing the survey, "having enjoyed a mini-boom from consumers returning after the relaxation of pandemic restrictions, many services firms are now seeing households increasingly struggle with the rising cost of living, with producers of non-essential goods seeing a similar drop in orders," noted Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "There has consequently been a remarkable drop in demand for goods and services during June compared to prior months."

Market reaction

Despite the disappointing data, Wall Street's main indexes cling to modest gains in the early American session. As of writing, the Dow Jones Industrial Average and the S&P 500 indexes were up 0.35% and 0.3%, respectively.

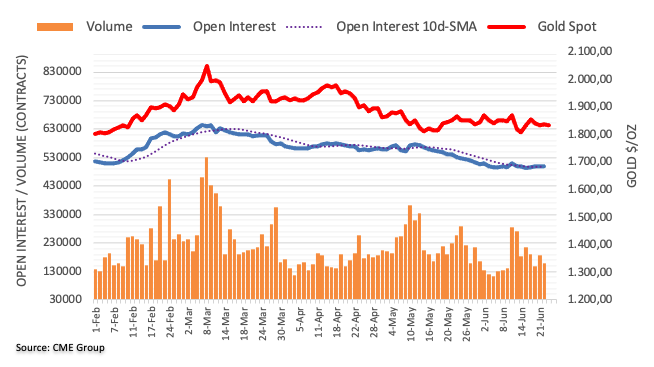

- Gold attracted some dip-buying in the vicinity of the weekly low and shot to a fresh daily high.

- The ongoing slide in the US bond yields capped the USD and offered support to the commodity.

- Hawkish Fed expectations might hold back bulls from placing aggressive bets around the metal.

Gold reversed an intraday slide to the $1,824 area, back closer to the weekly low touched the previous day and shot to a fresh daily high during the early North American session. The XAUUSD was last seen trading, around the $1,840-$1845 region, up 0.25% for the day, with bulls still awaiting a sustained move beyond the very important 200-day SMA.

The ongoing steep decline in the US Treasury bond yields forced the US dollar to trim a part of its intraday gains, which, in turn, offered support to the dollar-denominated commodity. That said, a combination of factors held back bulls from placing aggressive bets and kept a lid on any meaningful intraday upside for gold, for the time being.

A turnaround in the global risk sentiment - as depicted by a generally positive tone around the equity markets - acted as a headwind for the safe-haven precious metal. Apart from this, expectations that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation might also contribute to capping gains for the non-yielding gold.

The worsening global economic outlook, however, might continue to lend support to the XAUUSD and help limit any meaningful decline. Investors remain concerned that a more aggressive move by major central banks would pose challenges to the global economic recovery. Adding to this, Thursday's disappointing Eurozone PMIs further fueled fears about a possible recession.

The mixed fundamental backdrop warrants caution before positioning for any firm near-term direction for gold prices. This makes it prudent to wait for strong follow-through buying beyond the overnight swing high, around the $1,847-$1,848 region, to support prospects for additional near-term gains, possibly towards the $1,870-$1,880 supply zone.

Technical levels to watch

- EUR/USD remains under pressure below the 1.0600 mark.

- A drop to the June low at 1.0358 appears on the horizon.

EUR/USD reverses three consecutive daily retracements and opens the door to further downside in the short-term horizon.

So far, and as long as the 4-month line in the 1.0690/1.0700 region limits the upside, extra pullbacks in the pair should remain on the cards in the near term. Against that, the next support of note comes at the June low at 1.0358 (June 15) ahead of the 2022 low at 1.0348 (May 13).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1142.

EUR/USD daily chart

- US manufacturing sector lost growth momentum in early June.

- US Dollar Index clings to modest daily gains after the data.

The S&P Global Manufacturing PMI plunged to 52.4 (flash) in June from 57 in May, missing the market expectation of 56 by a wide margin. This report revealed that the business activity in the manufacturing sector expanded at a much weaker pace in early June than it did in May.

Further details of the publication revealed that the Composite PMI declined to 51.2 from 53.6, compared to analysts' estimate of 53.7.

Commenting on the data, "the pace of US economic growth has slowed sharply in June, with deteriorating forward-looking indicators setting the scene for an economic contraction in the third quarter," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Market reaction

The US Dollar Index edged slightly lower after this report and was last seen posting small daily gains at 104.30.

- DXY trades on a range bound theme above 104.00.

- Next on the upside comes the 2022 peak near 105.80.

DXY regains some composure above the 104.00 yardstick, reversing at the same time three consecutive daily pullbacks.

Ideally, the index should surpass the weekly highs at the 105.00 area in the near term to allow for the recovery to gather momentum and attempt a visit to the nearly 20-year peak in the 105.80 zone (June 15).

As long as the 4-month line around 102.00 holds the downside, the near-term outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen bullish while above the 200-day SMA at 97.79.

DXY daily chart

- EUR/JPY adds to Wednesday’s small loses and breaches 142.00.

- Further upside is likely while above the 138.00 area.

EUR/JPY flirts with new 3-day lows in the sub-142.00 region on Thursday.

Despite the corrective move, the cross keeps the upside momentum well and sound and the continuation of this move should retest the 2022 high at 144.25 (June 8) in the near term.

Once cleared, the next target of note should come at the 2015 high at 145.32 (January 2) prior to the 2014 high at 149.78 (December 8).

In the meantime, while above the 3-month support line around 138.00, the short-term outlook for the cross should remain bullish. This area appears reinforced by the proximity of the 55-day SMA.

EUR/JPY daily chart

- GBP/USD found decent support ahead of the weekly low following the release of UK PMIs.

- Some cross-driven strength stemming from a slump in EUR/GBP further benefitted the GBP.

- Hawkish Fed expectations continued acting as a tailwind for the USD and might cap the pair.

The GBP/USD pair attracted some dip-buying near the 1.2170 area on Thursday and recovered around 80-85 pips from the vicinity of the weekly low touched the previous day. The pair was seen trading just above mid-1.2200s during the early North American session, nearly unchanged for the day.

The British pound drew support from better-than-expected UK PMI prints for June and some cross-driven strength stemming from the dismal Eurozone PMIs-led turnaround in the EUR/GBP cross. This, in turn, was seen as a key factor that offered some support to the GBP/USD pair, though a combination of factors might hold back bulls from placing aggressive bets.

The US dollar was back in demand amid firming expectations that the Fed hike interest rates at a faster pace to combat stubbornly high inflation. In fact, the markets have been pricing in another 75 bps rate hike move at the upcoming FOMC meeting in July. Apart from this, the worsening global economic outlook offered additional support to the safe-haven buck.

On the economic data front, the US Department of Labor there were 229K initial jobless claims in the week ending June 18 as against 227K anticipated. The previous month's reading was also revised higher to 231K from the 229K reported earlier. This, however, did little to dent the intraday USD bullish tone, which acted as a headwind for the GBP/USD pair.

Apart from this, speculations that the Bank of England would opt for a more gradual approach towards raising interest rates further contributed to capping the GBP/USD pair. This, along with the UK-EU impasse over the Northern Ireland Protocol of the Brexit agreement, supports prospects for some meaningful downside for the major.

Technical levels to watch

- Initial Jobless Claims declined by 2,000 in the week ending June 18.

- US Dollar Index holds in positive territory near 104.50.

There were 229,000 initial jobless claims in the week ending June 18, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 231,000 (revised from 229,000) and came in slightly higher than the market expectation of 227,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 0.9% and the 4-week moving average was 223,500, an increase of 4,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending June 11 was 1,315,000, an increase of 5,000 from the previous week's revised level," the DOL's publication read.

Market reaction

There was no immediate market reaction to these figures and the US Dollar Index was last seen rising 0.25% on the day at 104.45.

- USD/JPY extended the overnight pullback from a 24-year high and edged lower for the second straight day.

- Speculations that authorities could intervene, along with recession fears underpinned the safe-haven JPY.

- Modest USD strength, the Fed-BoJ policy divergence support prospects for the emergence of some dip-buying.

The USD/JPY pair witnessed some selling for the second straight day on Thursday and moved further away from a 24-year high, around the 136.70 region touched the previous day. The pair maintained its offered tone through the mid-European session and was last seen trading just below mid-135.00s, down over 0.60% for the day.

Traders turned cautious and opted to lighten their bullish bets around the USD/JPY pair amid speculations that any further depreciation of the Japanese yen might force some form of practical intervention. Apart from this, the worsening global economic outlook drove haven flows towards the JPY and exerted downward pressure on the major.

Investors remain sceptic that major central banks could hike interest rates to curb soaring inflation without affecting economic growth. Adding to this, the disappointing release of the flash Eurozone PMI prints for June further fueled worries about a possible recession and boosted demand for traditional safe-haven assets.

Bearish traders further took cues from declining US Treasury bond yields, though the emergence of fresh US dollar buying helped limit deeper losses for the USD/JPY pair, at least for now. The USD drew support from firming expectations that the Fed would stick to its aggressive policy tightening path to combat stubbornly high inflation.

In fact, the markets have been pricing in another 75 bps rate hike move at the upcoming FOMC policy meeting in July. The bets were reaffirmed by Fed Chair Jerome Powell's remarks on Wednesday, saying that the ongoing rate increases will be appropriate. In contrast, the Bank of Japan remains committed to keeping interest rates very low.

It is worth recalling that the BoJ last week decided to maintain the massive stimulus programme and vowed to defend the 0.25% cap for the 10-year JGB yield to support a still-fragile economy. This, along with a turnaround in the global risk sentiment, assisted the USD/JPY pair to find support ahead of the 135.00 psychological mark.

The fundamental backdrop supports prospects for the emergence of some dip-buying around the USD/JPY pair. Hence, the negative move witnessed over the past two trading sessions might still be categorized as a corrective pullback and is more likely to be bought into, warranting some caution for aggressive bearish traders.

Next on tap is the US economic docket, featuring the release of the usual Weekly Jobless Claims data and the flash PMI prints for June. Traders will also take cues from Fed Chair Jerome Powell's second day of testimony. Apart from this, the US bond yields, the USD price dynamics and the broader risk sentiment might provide some impetus to the USD/JPY pair.

Technical levels to watch

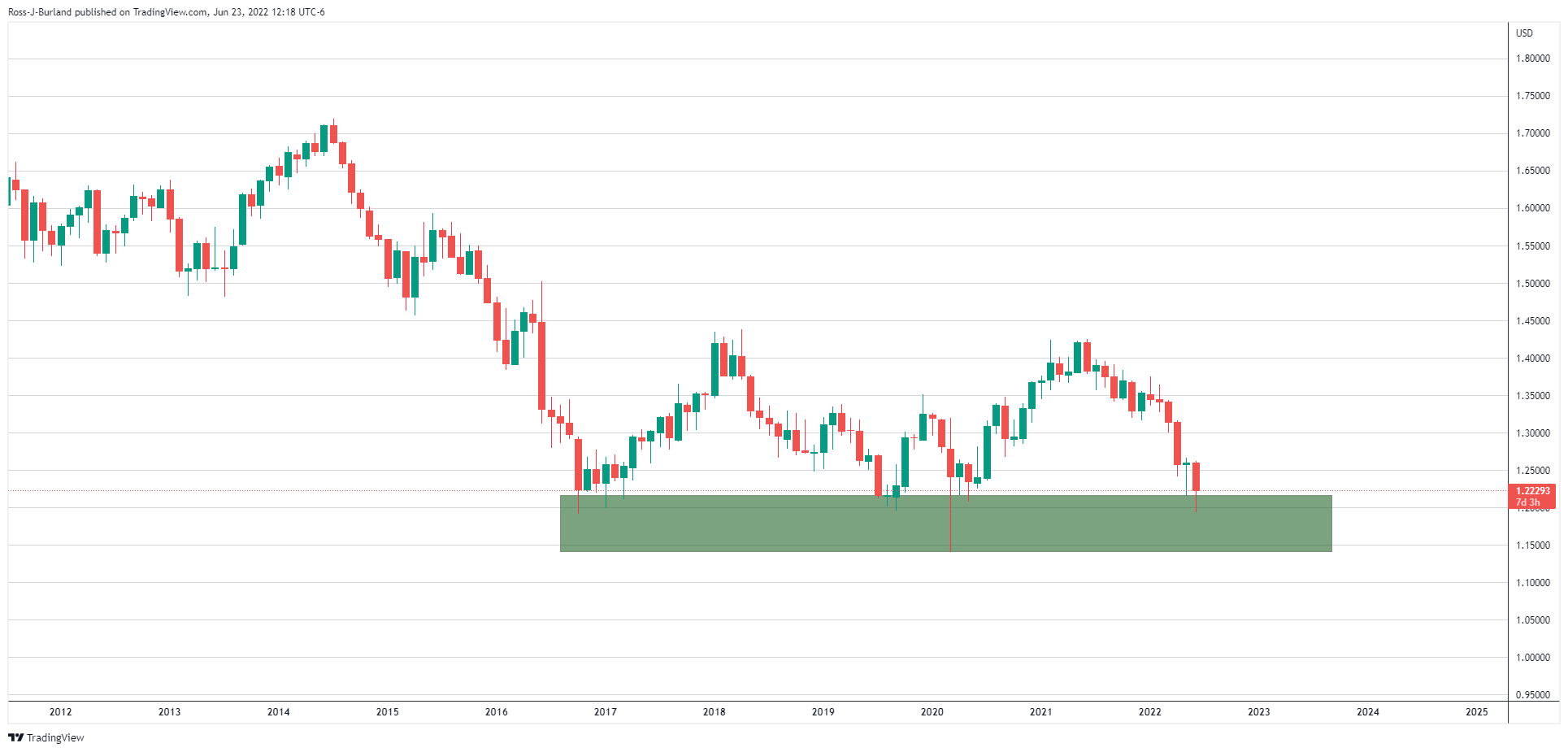

- USD/TRY trades close to the 2022 high near 17.40.

- The CBRT left the interest rate unchanged at 14.00%.

- Focus now shifts to the release of the CPI on July 4.

The Turkish lira retreats modestly and allows USD/TRY to trade at shouting distance from the 2022 highs near 17.40 on Thursday.

USD/TRY: Next on the upside comes 17.50

USD/TRY adds to Wednesday’s marginal gains and approaches the 17.40 region after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 14.00% at its meeting earlier in the session.

The lack of action from the CBRT surprised no one on Thursday, as it was well telegraphed by the bank’s authorities in past weeks as well as by President Erdogan’s usual comments against any tightening of the monetary policy.

There were no changes of note in the CBRT statement, where elevated domestic inflation remains largely due to the geopolitical conflict and high energy prices as well as supply-demand imbalances. The CBRT keeps favouring the “liraization” strategy and remains stubbornly attached to the 5% inflation target in the medium term.

Investors, in the meantime, should now shift their focus to the publication of June’s inflation figures due on July 4 (prev: 73.50% YoY).

What to look for around TRY