- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- WTI consolidates the biggest daily jump in six weeks, pressured around intraday low.

- German official hints at G7 eyeing to cap Russian oil prices, US confident of ‘strong’ NATO strategy on China.

- Fears of global recession, higher rates also exert downside pressure on the commodity prices.

- US Durable Goods Orders, central bankers’ debate and Friday’s OPEC meeting will be important for fresh impulse.

WTI crude oil prices remain pressured around $105.50, despite rising the most in 1.5 months the previous day, as fears surrounding demand slowdown weigh on the energy benchmark. It’s worth noting, however, that geopolitical headlines appear to limit the black gold’s downside.

That said, the comments from a German Official suggesting the Group of Seven (G7) leaders’ preparedness for capping Russia's oil prices seem to recently weigh on the WTI. “Leaders of the Group of Seven rich democracies are having "very constructive" discussions on a possible cap on Russian oil imports, a German government official said on Saturday shortly before the start of the annual three-day G7 summit,” said Reuters.

Elsewhere, the US anticipates strong comments on China from the North Atlantic Treaty Organization (NATO), which in turn adds bearish bias to the oil prices due to Beijing’s position among the world’s top oil consumers. “The US is confident that NATO's new strategy document will include "strong" language on China, a White House official said on Sunday, adding that negotiations on how to refer to Beijing were still underway,” per the news from Reuters.

On a different page, International Monetary Fund (IMF) Managing Director Kristalina Georgieva crossed wires during the weekend while saying, “Further negative shocks would inevitably make US economic situation ‘more difficult’.” The IMF revised down US 2022 GDP forecasts to 2.9% versus 3.7% predicted earlier. The same helps to recall the oil sellers even after exerting downside pressure on the US dollar.

It’s worth noting that the US housing numbers and a record low sentiment figures managed to favor the market’s mood and helped Antipodeans during Friday. That said, the US New Home Sales for May, by 10.7% versus April’s revised figures of -12.0%, joined the record low print of the final reading of the University of Michigan's Consumer Sentiment Index for June, to 50.0 from 50.2 initial estimates, also drowned the US dollar on Friday.

Moving on, this week’s verdict from the Organization of the Petroleum Exporting Countries (OPEC) will be important for the oil traders amid speculations of more output. Ahead of that, today’s US Durable Goods Orders for May, expected 0.1% versus 0.5% prior, as well as Wednesday’s debate of the US and the UK and the European central bankers at the ECB Forum on Central Banking will be crucial.

Technical analysis

WTI jostles with a two-week-old resistance line, around $105.85 by the press time, as sellers trying to cheer a downside break of the previous key support line from early April, near $107.70 at the latest.

- AUD/USD is expected to extend the intraday rally after violating the hurdle of 0.6960.

- The DXY has tumbled below 104.00 on lower forecasts for the US Durable Goods Orders.

- Aussie bulls will dance to the tunes of the Retail Sales data this week.

The AUD/USD pair has witnessed a decent upside move in the early Tokyo session and is expected to extend its gains after overstepping the critical hurdle of 0.6960. The asset is performing better as the US dollar index (DXY) is declining sharply and has surrendered the crucial support of 104.00.

The DXY is underperforming as the last week’s downbeat performance from the US PMI figures is expected to be carry-forwarded by the Durable Goods Orders on Monday. Poor performance by the US economy on the Manufacturing and Services PMI front has already dented the sentiment of the market participants towards the DXY.

Investors believe that the price pressures and policy tightening have started affecting the overall demand structure. Last week, PMI figures remained vulnerable. This week, lower estimates from US Durable Goods Orders are expected to add fuel to the fire. A preliminary estimate for the economic data is 0.1% vs. 0.5% in the prior release. Investors should be aware of the fact that the weak performance of the US economy on the economic data front will make the Federal Reserve (Fed) more hesitant in featuring extreme policy tightening measures.

On the aussie front, investors are focusing on the release of the Retail Sales, which are due on Wednesday. Australian Bureau of Statistics is expected to report the monthly Retail Sales at 0.4%, lower than the prior print of 0.9%. This may weaken the aussie bulls against the greenback.

Bloomberg gas reported that Russia has ''defaulted on its foreign-currency sovereign debt for the first time in a century, the culmination of ever-tougher Western sanctions that shut down payment routes to overseas creditors.

For months, the country found paths around the penalties imposed after the Kremlin’s invasion of Ukraine. But at the end of the day on Sunday, the grace period on about $100 million of snared interest payments due May 27 expired, a deadline considered an event of default if missed.''

More to come...

- Silver fades Friday’s corrective pullback from six-week low.

- Convergence of the 61.8% Fibonacci retracement, 20-SMA challenges the buyers.

- Monthly bearish channel joins steady RSI to keep sellers hopeful.

Silver (XAG/USD) prices remain pressured around a 1.5-month low as sellers attack the $21.00 threshold during Monday’s Asian session.

In doing so, the brighter metal pulls back from a convergence of the 61.8% Fibonacci retracement of May 13 to June 06 upside, as well as the 20-SMA, around $21.25.

Also keeping the sellers hopeful is the metal’s failure to cross a weekly resistance line, around $21.25 by the press time, not to forget the downward sloping trend channel from June 01.

That said, the XAG/USD bears may aim for the $21.00 as immediate support ahead of the yearly low near $2.45.

Following that, the stated channel’s lower line, near $20.40, precedes the $20.00 psychological magnet to lure the sellers.

Alternatively, a clear upside break of the $21.25 resistance confluence guards the short-term upside momentum of the silver prices.

Even if the bullion rises past $21.25, the aforementioned channel’s resistance line, at $21.60 by the press time, will be crucial for the short-term XAG/USD buyers as a break of which could direct the advances towards the monthly high near $22.50.

Silver: Four-hour chart

Trend: Bearish

- USD/JPY has witnessed a minor selling pressure around 135.20 on weak DXY.

- The DXY has surrendered the critical support of 104.00 on expectations of weak US Durable Goods Orders.

- The seldom price pressures from oil and food prices do not warrant an overall increase in the inflation rate.

The USD/JPY pair is facing barricades around 135.20 and is expected to display a steep fall after violating the psychological support of 135.00. A downbeat performance from the asset is expected on lower estimates for the US Durable Goods Orders.

Last week, the major witnessed a downside move after failing to sustain near all-time-highs at 136.70. Despite the intentions of the Bank of Japan (BOJ) policymakers to support the ultra-loose monetary policy, the yen bulls gained strength and slipped lower.

The minutes from the BOJ’s monetary policy meeting dictated that the majority of the policymakers were in favor of continuing a prudent monetary policy. The BOJ has achieved the targeted inflation rate at or above 2%, however, the aggregate price pressure is majorly contaminated by the costly oil and food prices. This doesn’t warrant a healthy rise in the inflation rate.

On the US dollar front, the US dollar index (DXY) is declining sharply in the Asian session. The asset has slipped below the round-level support of 104.00 and is expected to slip further on the lower forecast for the US Durable Goods Orders. A preliminary estimate for the economic data is 0.1%, significantly lower than the prior print of 0.5%. A lower-than-expected figure from the economic data will hurt the DXY more as poor economic data will restrict the Federal Reserve (Fed) to remain extremely hawkish on the interest rates.

- NZD/USD prints mild losses after snapping three-week downtrend.

- Fears surrounding China, Russia and the global recession seem to weigh on the pair.

- Increasing odds of RBNZ’s 0.75% rate hike join downbeat US data to favor buyers.

- US data, central bankers’ comments at the ECB forum will be crucial for fresh directions.

NZD/USD struggles to extend the first weekly gain in four around 0.6315, down 0.10% intraday during the initial hours of Monday’s Asian session. The Kiwi pair cheered the US dollar weakness the last week to convince the buyers but the fears surrounding China, Russia and the global recession seem to weigh on the quote of late.

Reuters came out with the news suggesting that the Bank for International Settlements (BIS) calls for interest rates to be raised "quickly and decisively" to prevent the surge in inflation from turning into something even more problematic.

The news also joins comments from US President Joe Biden urging the Group of Seven (G7) leaders to stay together as leaders target Russian gold and oil price. “At the start of the meeting in the Bavarian Alps, four of the Group of Seven rich nations moved to ban imports of Russian gold to tighten the sanctions squeeze on Moscow and cut off its means of financing the invasion of Ukraine,” said Reuters.

Additionally, the US anticipates strong comments on China from the North Atlantic Treaty Organization (NATO), which in turn weighs on the NZD/USD prices due to New Zealand’s trade ties with Beijing.

Elsewhere, International Monetary Fund (IMF) Managing Director Kristalina Georgieva crossed wires during the weekend while saying, “Further negative shocks would inevitably make US economic situation ‘more difficult’.” The IMF revised down US 2022 GDP forecasts to 2.9% versus 3.7% predicted earlier.

It should be noted that a jump in the US housing numbers and a record low sentiment figures managed to favor the market’s mood and helped Antipodeans during Friday. That said, the US New Home Sales for May, by 10.7% versus April’s revised figures of -12.0%, joined the record low print of the final reading of the University of Michigan's Consumer Sentiment Index for June, to 50.0 from 50.2 initial estimates, also drowned the US dollar on Friday.

Looking forward, the US Durable Goods Orders for May, expected 0.1% versus 0.5% prior, as well as the Pending Home Sales, expected -2.0% versus -3.9% prior, will be important for daily directions. However, Wednesday’s debate of the US and the UK and the European central bankers at the ECB Forum on Central Banking will be a crucial event for the week to note.

Above all, the increasing odds of the Reserve Bank of New Zealand’s (RBNZ) 0.75% rate hike adds strength to the NZD/USD prices.

Technical analysis

Friday’s clear upside break of a three-week-old resistance line, now support around 0.6260, directs NZD/USD buyers towards the 21-DMA hurdle surrounding 0.6375.

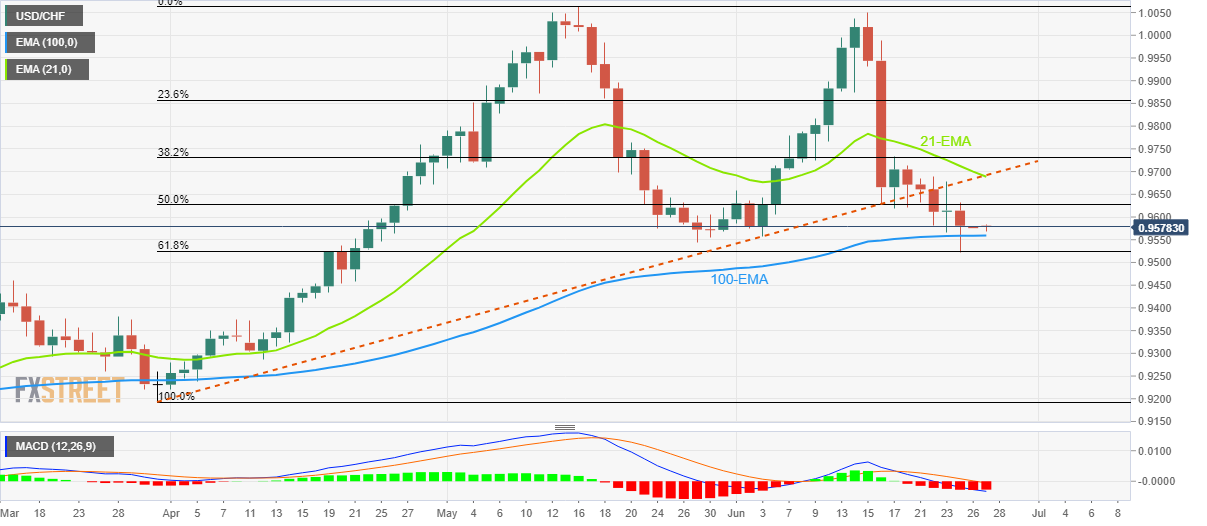

- USD/CHF fails to extend the corrective pullback from two-month low.

- Bearish MACD signals, sustained break of previously key support line favor sellers.

- 21-EMA adds strength 0.9690 hurdle, 100-EMA offers immediate support.

USD/CHF remains pressured around 0.9580, after declining for the last two weeks, as it fades bounce off the 61.8% Fibonacci retracement level of April-May upside. In doing so, the Swiss currency (CHF) pair eyes to refresh the two-month low during Monday’s initial Asian session.

Not only the failures to rebound but the bearish MACD signals and successful trading below the support-turned-resistance line from late March also keep sellers hopeful.

That said, the 100-EMA level of 0.9560 appears to restrict the short-term USD/CHF downside ahead of the aforementioned key Fibonacci retracement (Fibo.) level near 0.9525.

In a case where the quote drop below 0.9525, March’s high near 0.9460 will be important to watch as a break of which won’t hesitate to direct bears towards refreshing a three-month low, currency around 0.9195.

On the contrary, recovery remains elusive until the quote stays below the confluence of the 21-EMA and the previous support line from March, around 0.9690.

It’s worth noting, however, that the 50% Fibo. near 0.9630 restricts the immediate upside of the USD/CHF pair.

Should the pair rise past 0.9690, the 0.9700 and the 38.2% Fibonacci retracement level around 0.9730 could challenge the upside momentum.

USD/CHF: Daily chart

Trend: Further downside expected

The Wall Street Journal reported that San Francisco Fed President Mary Daly A said Friday she was prepared to support another rate increase of 0.75 percentage point at the central bank’s next meeting, on July 26-27, to counter inflation, which is at a 40-year high.

Several other Fed officials endorsed such a move over the past week.

Daly said that the central bank needs to raise interest rates to levels designed to slow economic growth and combat inflation and that those levels will depend on factors outside of the Fed’s control.

US inflation has accelerated to an 8.6% annual rate in May, its fastest pace in 41 years and is a factor raising the risk of US recession.

Meanwhile, the US dollar has been pressured of late as markets reaccess the Fed's path and the greenback posted its first weekly decline this month.

DXY update

A significant factor this week has been the fall in oil and commodity prices, which has eased inflation fears leading to a return to risk appetite. This has eroded the safe-haven bid that has been boosting the dollar against major currencies:

We have seen the price action in DXY play out as follows:

A break of structure, BoS, would be expected to lead to a sell-off as illustrated above.

- USD/CAD is establishing below 1.2900 on an expectation of weak performance from the DXY.

- A downbeat US Durable Goods Orders after weak PMI figures will drag the greenback bulls.

- Oil prices are displaying a minor rebound, downside remains favored on soaring recession fears.

The USD/CAD pair is auctioning below the round-level support of 1.2900 on expectations of a vulnerable performance from the US Durable Goods Orders. The asset traded in a range of 1.2907-1.3017 last week and gave a downside break in the last trading hours of Friday’s session. A carry-forward performance is expected from the asset as the greenback will remain under pressure on lower expectations from the US Durable Goods Orders data.

A preliminary estimate for the economic data is 0.1%, significantly lower than the prior print of 0.5%. An underperformance from the catalyst will strengthen the loonie. It is worth noting that the spell of the underperformance from the US economy on the economic events front will keep the greenback under significant pressure.

Last week, the downbeat Manufacturing and Services PMI dictated the consequences of firmer price pressures, which have started cornering consumer confidence. A continuation of underperformance in the economic indicators will send the US dollar index (DXY) into a negative trajectory for a prolonged period.

Meanwhile, the odds of consecutive 50 basis points (bps) interest rate hike by the Bank of Canada (BOC) have increased sharply. Last week, the release of the Canada Consumer Price Index (CPI) at 7.7% on a YoY basis has dictated that the BOC’s policy tightening measures from the past few months have failed to bring a significant impact on the price pressures. Therefore, one more jumbo rate hike by the BOC looks visible now.

On the oil front, a rebound in the oil prices was recorded last week. The black gold has picked some bids after slipping near the psychological support of $100.00. The market participants are discounting the impact of recession in the oil prices currently and a reversal in the oil prices is not been confirmed yet.

- GBP/USD defends the first weekly gain in four.

- Risk-on sentiment underpinned the corrective pullback despite absence of major positives from the UK.

- Political jitters in Britain, Brexit woes and economic hardships for the UK probe buyers.

- US Durable Goods Orders, Pending Home Sales awaited for today, central bankers’ speeches at ECB Forum will be the key.

GBP/USD manages to begin the week’s trading on a positive side around 1.2280, after witnessing the first weekly gain in four. That said, the Cable pair’s latest gains have more to do with the US dollar weakness and the risk-on mood than the improved fundamentals relating to the UK.

Starting with the latest news concerning the UK’s readiness to alter the Brexit deal, especially relating to the Northern Ireland Protocol (NIP), despite the European Union’s (EU) opposition. “British Prime Minister Boris Johnson's government will press ahead on Monday with legislation to scrap rules on post-Brexit trade with Northern Ireland, setting up further clashes with the European Union,” said Reuters.

UK Foreign minister Liz Truss said during the weekend, per Reuters, “A negotiated solution has been and remains our preference, but the EU continues to rule out changing the Protocol itself – even though it is patently causing serious problems in Northern Ireland – which therefore means we are obliged to act." In a reaction, the EU's ambassador to Britain said on Sunday, per Reuters, that Britain's plans were illegal and unrealistic.

Elsewhere, UK PM Boris Johnson mentioned that he aims to remain in power until the middle of the next decade despite calls to quit. The Conservatives lost two parliamentary by-elections and the same exerted more pressure on UK PM Johnson to leave the position after the partygate scandal. “The by-election defeats suggest the broad voter appeal which helped Johnson win a large parliamentary majority in December 2019 may be fracturing after a scandal over illegal parties held at Downing Street during coronavirus lockdowns,” said Reuters.

Talking about data, the UK Retail Sales for April improved from -0.7% expectations to -0.5% MoM, versus downwardly revised 0.4% prior. However, the slump in the yearly figures, to -4.7% from -5.7% previous readings and -4.5% forecast, seems to weigh on the GBP/USD prices of late.

On the other hand, International Monetary Fund (IMF) Managing Director Kristalina Georgieva crossed wires during the weekend while saying, “Further negative shocks would inevitably make US economic situation ‘more difficult’.” The IMF revised down US 2022 GDP forecasts to 2.9% versus 3.7% predicted earlier. It’s worth noting that the jump in the US New Home Sales for May, by 10.7% versus April’s revised figures of -12.0%, joined the record low print of the final reading of the University of Michigan's Consumer Sentiment Index for June, to 50.0 from 50.2 initial estimates, also drowned the US dollar on Friday.

It should be noted that the recently softer US data and inflation expectations seemed to have weighed on the greenback while fueling the risk appetite. However, the optimists are still away from the table ahead of the US Durable Goods Orders for May, expected 0.1% versus 0.5% prior, as well as the Pending Home Sales, expected -2.0% versus -3.9% prior.

Above all, Wednesday’s debate of the US and the UK and the European central bankers at the ECB Forum on Central Banking will be a crucial event for the week to note.

Technical analysis

Although a six-week-old horizontal support zone around 1.2165-55 challenges short-term GBP/USD sellers, a downward sloping resistance line from late April, close to 1.2390 by the press time, restricts the buyer’s entry.

reuters has reported on the Bank for International Settlements (BIS), calling for interest rates to be raised "quickly and decisively" to prevent the surge in inflation from turning into something even more problematic.

"The key for central banks is to act quickly and decisively before inflation becomes entrenched," Agustín Carstens, BIS general manager, said as part of the body's post-meeting annual report published on Sunday. Carstens, former head of Mexico's central bank, said the emphasis was to act in "quarters to come".

"A lot of it will depend on precisely on how permanent these (inflationary) shocks are," Carstens said, adding that the response of financial markets would also be crucial.

"If this tightening generates massive losses, generates massive asset corrections, and that contaminates consumption, investment and employment - of course, that is a more difficult scenario."

Setting up further clashes with the European Union and something for GBP trades to pay attention to, the United Kingdom's Prime Minister Boris Johnson's government will press ahead on Monday with legislation to scrap rules on post-Brexit trade with Northern Ireland.

The legislation, which would unilaterally replace parts of the post-Brexit deal that was agreed in 2020 by Britain and the EU, is due to be sent back to parliament's lower house for a so-called second reading.

The risk for GBP is that the European Commission has launched legal proceedings against Britain, potentially leading to a trade war.

In general, GBP/USD is at risk of an offer from the highs of the hourly consolidation area near 1.2300.

- Gold price is expected to display an upside movement above $1,830.00.

- A downbeat performance looks likely from the US Durable Goods Orders.

- The gold prices are expected to display a lackluster performance on symmetrical triangle formation.

Gold price (XAU/USD) has displayed topsy-turvy moves in a range of $1,821.88-1,831.87 on Friday. The precious metal is expected to witness a decisive move as investors await US Durable Goods Orders data. As per the market consensus, the data is expected to slip to 0.1% from the prior print of 0.5%.

A decent slippage in the economic data is expected to underpin the gold prices going forward. The economic data carries a proper relation with the aggregate demand in the US economy. A higher Durable Goods Orders dictate that the household's demand is resilient. The lower estimates for the economic data could be the outcome of soaring inflation, which is hurting the paychecks of the households and henceforth the demand for the Durable Goods.

It is worth noting that the US economy reported the downbeat Purchase Managers Index (PMI) data. The Manufacturing and Services PMI, both aspects displayed a vulnerable performance. So, the downbeat estimates for the Durable Goods Orders after a vulnerable PMI may hurt the US dollar index (DXY) significantly. The DXY remained lackluster last week and is expected to perform weak on the continuous downbeat performance from the economic data.

Gold technical analysis

On an hourly scale, the gold prices are trading in a symmetrical triangle that signals a slippage in the volatility. The upward sloping trendline is placed from June 14 low at $1,805.11 while the downward sloping trendline is plotted from June 16 high at $1,857.88. The greenback bulls are defending the 50-period Exponential Moving Average (EMA) at $1,828.75. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a 40.00-60.00, which bolsters a rangebound move ahead.

Gold hourly chart

- AUD/USD bears lurking at short-term support in the open.

- Eyes on the lower quadrant of the New York session range.

AUD/USD is consolidated in the upper quadrant of the New York range. However, the price is coiling and a breakout in the near term could be imminent on either side of 0.6950.

AUD/USD, the M5 & M15 open

For the open, the price imbalance to the downside between 0.6930 and 0.6914 is compelling. However, there could be a push higher toward the New York highs, especially if the 0.6940 structure does not break. If it does, then this will be the equivalent of a 15-min move from the resistance of the M-formation:

Meanwhile, the following is a top-down analysis outlining the price imbalances that can be watched for mitigation.

AUD/USD monthly chart

There is a case for the downside to mitigate the price imbalances below the market, as illustrated above.

AUD/USD daily chart

The price is testing the M-formation's neckline which could be the last defence before the bears move in.

However, there are price imbalances to the upside and a break of the neckline around 0.6950 opens risk to the upside.

From an hourly perspective, there could be some mitigation to the downside first as follows:

The 15-min chart's M-formation is so far resisting the bulls:

Meanwhile, the US dollar will be key:

If there is more to come from the DXY bears, as the price breaks structure and heads towards the price imbalances and order block below near 103.10, the Aussie can enjoy a spell to the upside. This puts 0.7100 on the map for the week ahead.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.