- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

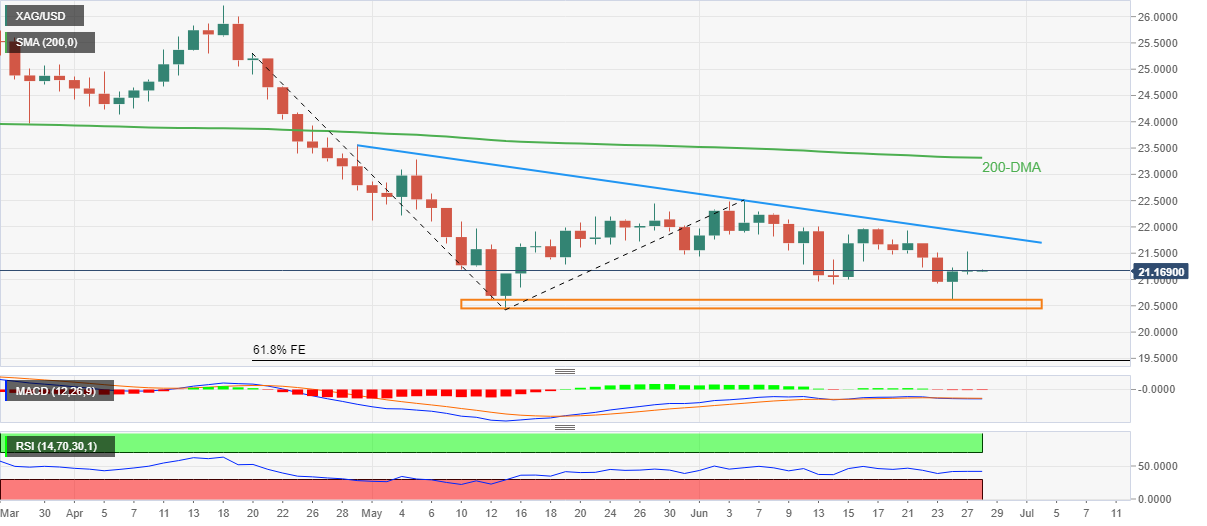

- Silver holds lower ground as it fades Friday’s rebound from six-week low.

- Sluggish MACD, downbeat RSI favor sellers targeting fresh yearly lows.

- Two-month-old resistance line, monthly high and 200-DMA challenge buyers.

Silver (XAG/USD) prices remain pressured around $21.15, after reversing from $21.53 the previous day, as bears keep reins during Tuesday’s quiet Asian session.

In doing so, the bright metal remains below the downward sloping resistance line from late April amid sluggish MACD and RSI conditions, which in turn suggest the metal’s further downside.

That said, a mid-June swing low near $20.90 can offer immediate support to the XAG/USD before directing it to the $20.60-45 horizontal support area including the yearly low.

Although the RSI (14) may challenge the silver bears around the $20.60-45 zone, a clear break of the same support region won’t hesitate to direct the quote towards the 61.8% Fibonacci Expansion (FE) of April 20 to June 06 moves, near $19.45.

Meanwhile, recovery remains elusive below the aforementioned two-month-old resistance line, at $21.85 by the press time.

Following that, the monthly high and the 200-DMA, respectively near $22.51 and $23.30, will be important to watch.

In a case where the silver buyers keep reins past $23.30, the odds of witnessing a rally towards April’s peak of $26.22 can’t be ruled out.

Silver: Daily chart

Trend: Further downside expected

- USD/JPY is failing to surpass 135.50 as the DXY is trading lackluster.

- The US Consumer Confidence will bring a significant action in the asset.

- A mixed performance is expected from Japan's Retail Trade.

The USD/JPY pair has slipped below 135.40 after struggling to overstep the critical hurdle of 135.50 multiple times on Monday. On a broader note, the asset is oscillating in a range of 134.27-135.55 for the past week amid the unavailability of any potential trigger that could fetch significant bids/offers on the counter.

The US dollar index (DXY) is struggling to contain the round-level resistance of 104.00 despite the upbeat US Durable Goods Orders. The US Census Bureau reported the economic data at 0.5%, significantly higher than the forecasts of 0.1% and the former release of 0.5%.

Investors were worried over the aggregate demand structure as lower estimates for the Durable Goods Orders were intensifying the recession fears. Now, the upbeat figures may provide more freedom to the Federal Reserve (Fed) to announce more policy tightening measures without much hesitation.

Going forward, investors will keep an eye over the release of the US Consumer Confidence data, which will dictate the confidence of the consumers in the economic activities. A higher print determines strong demand from the households, which will further support the greenback.

On the Tokyo front, Wednesday’s Retail Trade data will keep investors busy. A preliminary estimate for the yearly Retail Trade is 3.3%, higher than the former print of 2.9%. While the monthly Retail Trade may drop to -0.1% vs. 0.8% recorded earlier.

- WTI picks up bids to refresh intraday high, pokes one-week high during three-day uptrend.

- OPEC+ forecasts, US emergency oil reserve updates join fears of ban on Russian oil imports to favor bulls.

- Risk-off sentiment, US dollar rebound challenge upside momentum.

- Weekly inventory numbers, US CB Consumer Confidence to direct intraday moves, risk catalysts are the key.

WTI bulls attack $109.00 during a three-day uptrend to the initial Asian session on Tuesday. The black gold’s latest advances could be linked to the headlines concerning fears of a supply crunch, mainly emanating from the US and due to the sanctions on Russia. Adding to the energy benchmark’s strength could be the chatters surrounding OPEC+ forecasts for 2022 market surplus.

As per the latest updates from Reuters, “US crude inventory in the Strategic Petroleum Reserve (SPR) fell by 6.9 million barrels in the week to June 24, according to data from the Department of Energy.” The news also mentioned that stockpiles in the Strategic Petroleum Reserve (SPR) fell to 497.9 million barrels, the lowest since April 1986, according to the data.

Elsewhere, Reuters came out with the news citing an internal report prepared for the upcoming Joint Technical Committee (JTC) meeting, scheduled for Thursday, to report a revised down forecast of the oil market surplus for 2022. “OPEC+ trimmed its oil market surplus forecast for 2022 to 1 million barrels per day (bpd) from 1.4 million bpd previously,” said the news.

Furthermore, the Group of Seven (G7) leaders showed readiness to increase hardships for Russian oil and gold while political turmoil in Libya also contributed to the black gold’s upside momentum.

On the contrary, recession fears join the likely US-Iran talks to challenge the WTI crude oil buyers. On the same line are concerns surrounding central bank aggression.

Moving on, weekly prints of the oil inventories by the American Petroleum Institute (API) and the Energy Information Administration (EIA), as well as the US CB Consumer Confidence for June, could entertain oil traders. However, major attention will be given to risk catalyst and OPEC meeting for clear directions.

Technical analysis

A clear upside break of the previous support line from early April, around $107.50 by the press time, keeps WTI bulls hopeful. However, the 50-DMA hurdle surrounding $109.30 guards the recovery moves.

- GBP/USD extends pullback from one-week high as NIP Bill passes the UK’s House of Commons vote.

- Convergence of 50-SMA, two-week-old ascending trend line restricts immediate downside.

- RSI retreat, pullback from 100-SMA adds strength to the bearish bias.

- 200-SMA adds to the upside filters, sellers can aim for fresh monthly low.

GBP/USD remains pressured around 1.2260 as bears jostle with the short-term key supports following the fresh Brexit news during late Monday, early Tuesday for Asia.

That said, the UK’s House of Commons had enough votes to pass the controversial Northern Ireland Protocol (NIP) even as the European Union (EU) warned of trade wars if the British policymakers progress with the actions.

Read: Northern Ireland Protocol (NIP) Bill passes UK House of Commons vote

Technically, the cable pair keeps the previous day’s pullback from the 100-SMA towards challenging a convergence of the 50-SMA and a fortnight-long support line, near 1.2255 by the press time.

Given the RSI (14) retreats and the failure to cross key SMA, not to forget Brexit news, the GBP/USD prices are likely to break the immediate support.

Following that, the 1.2200 round figure and 23.6% Fibonacci retracement (Fibo.) of May 27 to June 14 downside, near 1.2108, could probe the bears on their way to refresh the monthly low, currently around 1.1935.

Meanwhile, the 100-SMA level near 1.2310 guards the immediate recovery of the GBP/USD pair ahead of the 61.8% Fibonacci retracement level near 1.2390.

In a case where the Cable pair rises past 1.2390, the 200-SMA level of 1.2400 could act as the last defense of the bears.

GBP/USD: Four-hour chart

Trend: Further weakness expected

- A slippage below 0.9545 will trigger the M-formation and eventually strengthen the Swiss franc bulls.

- The Falling Channel formation indicates that the asset is biased towards the south-side move.

- Declining 50-EMA at 0.9652 adds to the downside filters.

The USD/CHF pair is displaying back and forth moves in a narrow range of 0.9552-0.9556 in the early Tokyo session. The major has turned sideways after a perpendicular downside move, which signals a phase of inventory distribution.

The formation of a Falling Channel on a four-hour scale is advocating the Swiss franc bulls. The upper portion and lower portion of the chart pattern are plotted from June 17 high and & low at 0.9733 and 0.9628 respectively. Investors should keep May 27 low at 0.9545 on their radar as a violation of the same may trigger the formation of the M-pattern.

The 50-period Exponential Moving Average (EMA) at 0.9652 is declining strongly, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which indicates more downside ahead.

Should the asset drop below Friday’s low at 0.9522, the M-formation will get activated, which will strengthen the Swiss franc bulls for a downside move towards April 21 low at 0.9458, followed by April 14 low at 0.9413.

On the flip side, the Swiss franc bulls could lose their grip if the asset oversteps Wednesday’s high at 0.9690. This will drive the asset towards June 17 high at 0.9733. A breach of the June 17 high will expose the asset to more upside towards June 9 high at 0.9817.

USD/CHF four-hour chart

-637919670185914036.png)

- The Loonie extended its gains on Monday, as shown by the USD/CAD falling 0.16%.

- The USD/CAD fell courtesy of a dismal sentiment and higher crude oil prices.

- USD/CAD Price Forecast: Might further extend its losses once it breaks below 1.2860.

The USD/CAD extends its losses to two consecutive days, bolstered by rising US crude oil prices, which benefits the Canadian dollar, a headwind for the USD/CAD. At around 1.2875, the USD/CAD reached a fresh two-week low on Monday.

Sentiment remains negative after Wall Street’s finished with minimal losses. Portfolio rebalancing, amongst news of Russia’s default, dragged equities lower. In the meantime, the Loonie benefitted from WTIs extended recovery, with the US crude oil benchmark clinging to the $109.90s area after reaching a weekly high of around $110.22 per barrel.

In the meantime, the US Dollar Index is heavy, losing 0.17%, at around 103.944, as it tries to stage a recovery above the 104.000.

Over the weekend, the Canadian Finance Minister Chrystia Freeland said the economy still has a path to a “soft landing,” where it could stabilize economically after the blow of the COVID-19 pandemic without facing a severe recession that many fear.

In the meantime, US economic data, which market participants mainly ignored, US Durable Good Orders surprised to the upside, rising 0.7% MoM, higher than the 0.1% estimations. Additionally, US Pending Home Sales rose in May by 0.7% MoM, smashing the expectations of a -3.9% contraction, as mortgage applications remain down weighed by higher mortgage rates, spurred by the US Federal Reserve tightening cycle.

In the week ahead, the Canadian docket will feature the GDP on Thursday. Markets anticipate further monetary policy tightening at the Bank of Canada’s July 13 meeting after June’s 50 basis point increase.

On the US front, the docket will feature CB Consumer Confidence for June, estimated at 100.4, less than May’s 106.4. that alongside Wholesale inventories, Trade Balance, Regional Fed Indices reports, and Fed speakers.

USD/CAD Price Forecast: Technical outlook

Daily chart

At the time of writing, the USD/CAD is pressing towards the June 16 daily low at 1.2860, a level that, once broken, would pave the way for further losses, exposing the confluence of the 20 and 50-day exponential moving averages (EMAs) around 1.2807-09. A decisive break would send the pair tumbling to the May 24 swing low at 1.2765, followed by a test of the 100-EMA at 1.2730.

“Proposed legislation to allow the UK to unilaterally rip up Brexit arrangements for Northern Ireland at the risk of a trade war with the EU passed the second reading stage in the House of Commons on Monday night,” said The Guardian (TG).

Key quotes

As expected the Northern Ireland protocol bill passed its first hurdle, with MPs voting 295 to 221 in favor despite heavy criticism from some Conservative backbenchers, including former Prime Minister Theresa May, who said the move is illegal and unnecessary.

The second reading was the first opportunity MPs have had to vote on the controversial proposals, which the Foreign Secretary, Liz Truss, said were “legal and necessary”.

It is now expected to be fast-tracked through parliament with a condensed committee stage of just three days, instead of the usual two or three weeks.

The bill would create a “green channel”, free of checks, for goods passing from Great Britain to Northern Ireland that are not destined for the Irish republic; allow products to be sold in Northern Ireland under either EU or UK rules; and give UK ministers more power to alter tax and spending policies in Northern Ireland.

Market reaction

GBP/USD extends pullback from over a week’s high towards refreshing intraday low near 1.2265 following the news.

- EUR/USD bulls take a breather around two-week high, pauses two-day uptrend.

- US dollar recovers on fresh fears of inflation/recession emanating from the US data.

- Headlines surrounding Russia, anxiety ahead of ECB Forum adds strength to the risk-off mood.

- US CB Consumer Confidence, comments from ECB policymakers eyed for intraday directions.

EUR/USD holds onto the pullback from a two-week high as bulls get rejections from short-term key resistances, as well as risk-off mood, during Tuesday’s Asian session. That said, the major currency pair remains pressured around 1.0585 by the press time, after reversing from a fortnight top before a few hours.

The quote managed to extend Friday’s recovery moves amid cautious optimism in the markets, considering mixed US data and optimism ahead of this week’s key European Central Bank (ECB) Forum. However, challenges to risk appetite emanated from the headlines surrounding Russia and China, which later on joined upbeat US economics to weigh on the sentiment and exerted fresh downside pressure on the EUR/USD.

Russia rejects default on paying external debt by saying Euroclear not accepting Russia’s euro bond transaction 'is not our problem'. “Russian gold and forex reserves are blocked unlawfully. Russia made payment on euro bond coupons in May,” adds Kremlin in a statement.

Recently, global rating agency Moody’s mentioned that Russia's failure to make its coupon payment results in a default. Additionally, former Russian President Dmitry Medvedev also crossed wires, via Reuters, while saying, “Any attempt by a NATO nation to encroach upon Crimea constitutes a declaration of war against Russia and may trigger the outbreak of world war III.”

Elsewhere, US Durable Goods Orders rose to 0.7% in May, versus 0.1% expected and 0.4% prior. That said, the widely tracked Nondefense Capital Goods Orders ex Aircraft also cross 0.3% market forecasts and previous readings to increase by 0.5% during the stated month. Further, the US Pending Home Sales also surprised the USD bulls with 0.7% MoM figures for May versus -3.7% expected and -4.0% prior. The YoY figures, however, came in negative to -13.6% versus -9.8% prior. Further, Dallas Fed Manufacturing Business Index for June dropped to the lowest level since May 2020, to -17.7 versus -3.1 forecasts and -7.3 prior.

Amid these plays, Wall Street closed in the red, after an upbeat start, whereas the US 10-year Treasury yields gained nearly seven basis points (bps) to end Monday at around 3.20%.

Moving on, US CB Consumer Confidence for June, prior to 106.4, will join the ECB policymakers’ comments, including President Christine Lagarde, to entertain EUR/USD traders.

Technical analysis

EUR/USD battles the 21-DMA hurdle around 1.0585 following a failure to cross a four-month-old descending resistance line, at 1.0161 by the press time. Also acting as an upside hurdle is the 1.0640-45 horizontal area comprising multiple level marked since early March. That said, the gradual recovery of the RSI (14) line hints at the EUR/USD pair’s further upside.

Meanwhile, pullback moves remain elusive until breaking a two-week-old support line near 1.0545.

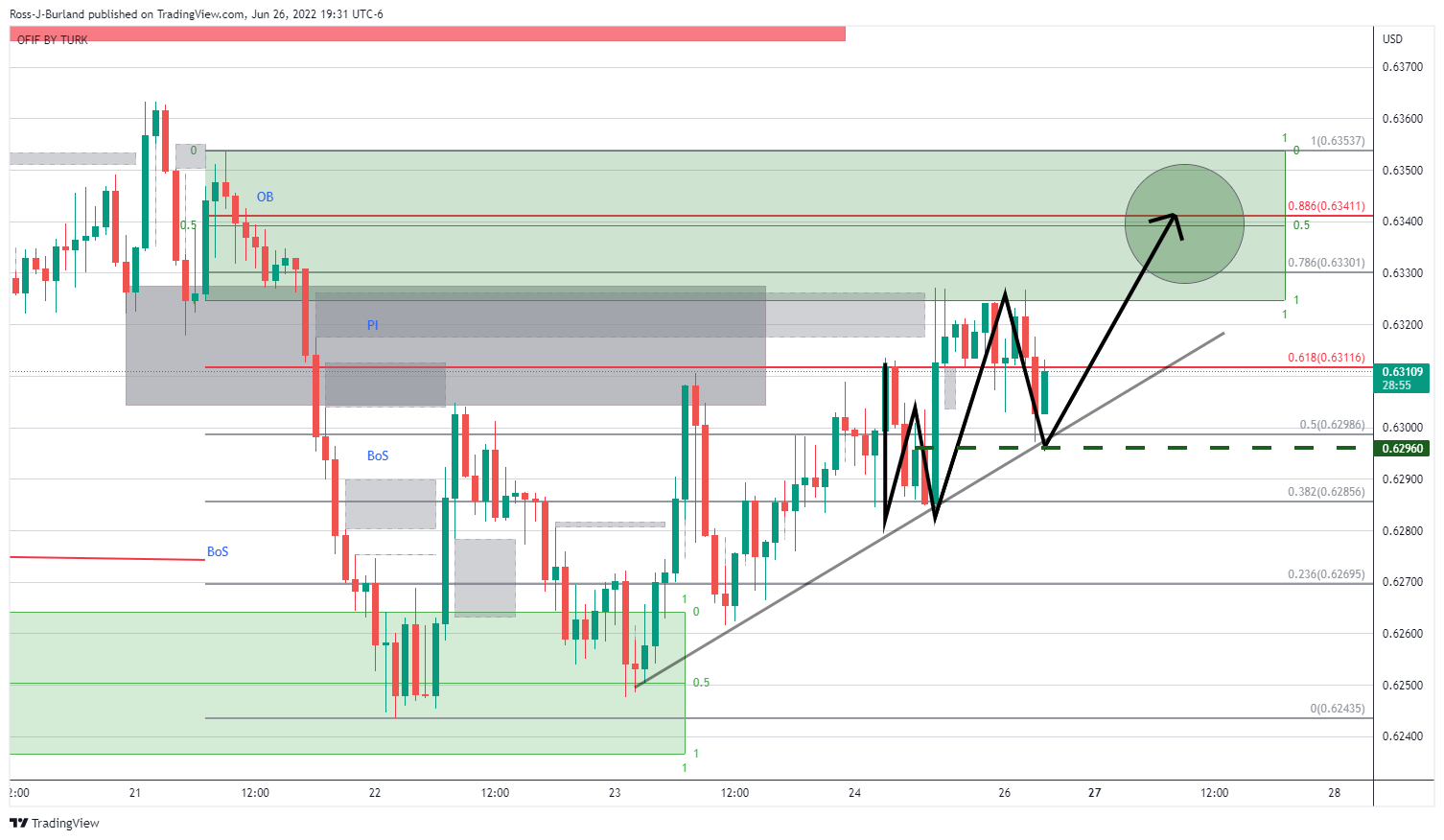

- AUD/USD is leaning bullish for the day ahead as the greenback toys with 104 DXY.

- A break of current highs 0.6925 will put the bias in the bull's hands.

AUD/USD is consolidated at the start of the Asian day following some back and forth at the start of the week. The Aussie is trading at 0.6922 and will be dependent on the trajectory of the greenback in the absence of domestic data this week other than Retail Sales tomorrow.

''While consumer sentiment has slumped given rising inflation and a lower confidence around the economic outlook, household balance sheets are in good shape,'' analysts at TD Securities said in respect of today's data. ''Further, a strong labour market should keep household spending elevated. A strong retail beat will boost the case for another aggressive move by the RBA in July after their outsized 50bps hike.''

Meanwhile, the greenback has been a head-turner. Speculators’ net long USD index positions ticked a little higher having surged to their highest levels since March 2017 the previous week as the market prepared for this month’s 75 bp rate hike from the Fed. However, the spot market, as per the DXY, has been testing below 104 which opens the risk of a deeper move into 103.

''Speculation is beginning to emerge that the market may have over-estimated the extent to which the Fed may have to hike rates. This could soften net USD positions in forthcoming data,'' analysts at Rabobank argued.

DXY H1 chart

The price of DXY has been breaking structure (BoS) to the downside and the latest formation could be the makings of an M-formation's resistance and a buy-to-sell scenario from the neckline to the price imbalance (PI) and order block (OB) below. In turn, this would be expected to support AUD in a bullish correction out of consolidation for the sessions ahead:

Zooming in:

The short-term schematic is bullish on a break of the 0.6925 resistance for a run to 0.6950.

- Gold price is trading near the demand zone placed in a narrow range of $1,821.45-1,823.57.

- The impact of prohibiting Russian gold exports by the G7 countries is faded now.

- The upbeat US Durable Goods Orders have strengthened the DXY.

Gold price (XAU/USD) displayed a failed attempt to sustain above the critical resistance of $1,840.00 on Monday. The precious metal has turned sideways after a sheer downside move and is expected to extend its losses after violating the crucial support of $1,820.85. It looks like the headline of banning Russian gold exports by the G7 countries has lost its significance and investors have started focusing on the solid fundamentals of the US dollar index (DXY) again.

The DXY is hovering below the round-level resistance of 104.00 after displaying a responsive buying action around 103.70. The release of the upbeat Durable Goods Orders has supported the DXY bulls. The economic data landed at 0.7%, higher than the estimates of 0.1% and the prior release of 0.5%. This has cleared that the overall demand structure in the US economy is rock solid. The demand prospects are resilient despite the headwinds of soaring price pressures.

Going forward, investors’ focus will remain on the speech from Federal Reserve (Fed) chair Jerome Powell, which is due on Wednesday. Fed Powell is expected to dictate the likely monetary policy action of July.

Gold technical analysis

Gold prices are oscillating near the potential demand zone, which is placed in a narrow range of $1,821.45-1,823.57 on an hourly scale. The precious metal is auctioning below the 200-period Exponential Moving Average (EMA) at $1,833.56, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which signals that a fresh leg of selling is on its way.

Gold hourly chart

- The AUD/JPY finished almost flat down by 0.06% on Monday.

- Quarter and month-end flow dominated the session weighing on US equities and also in risk-sensitive currencies.

- AUD/JPY Price Forecast: The cross is upward biased, but downside risks remain if it stays below 94.00.

The AUD/JPY began the week on the wrong foot, slightly down in the day, though recovered from daily lows at 92.97 and reached a daily high at around 93.94, finally settling near 93.74, as market sentiment turned sour and US equities recorded losses.

As quarter and month-end approached, Monday’s session witnessed portfolio rebalancing. That sparked the fall in equities, while US Treasury yields bounced off daily lows, led by the US 10-year Treasury yield, which gained eight basis points and is back above the 3.20% threshold.

In the meantime, the AUD/JPY opened near 93.70 and dipped sharply below the 93.00 mark once the Monday Asian session began. Nevertheless, late in the same session, the cross marched firmly and was finally lifted near the 94.00 figure.

AUD/JPY Daily chart

The cross-currency faced strong support at the 20-EMA around 94.15, capping AUD/JPY upward intentions, as the pair continues its consolidation within familiar ranges around 92.60-94.30. Further confirmation of the previously mentioned is the Relative Strenght Index (RSI) at 52.38 flat for the last couple of trading sessions, meaning that despite that the moving averages (MAs) are below the exchange rate, the lack of a fresh upward impulse, keeps the pair constrained in the area mentioned above.

AUD/JPY 1-Hour chart

The AUD/JPY hourly chart illustrates the pair is consolidating but slightly moving to the upside, though at the time of writing, AUD/JPY buyers unable to break above the 200-EMA at 93.77 will leave the pair vulnerable to selling pressure. If that scenario plays out, the AUD/JPY first support would be the daily pivot at 93.60. Break below will expose the 50-EMA at 93.49, followed by the S1 pivot at 93.20.

On the other hand, and on the path of least resistance, the AUD/JPY’s first resistance would be the 200-EMA at 93.77. A breach of the latter would expose 94.00, followed by the R1 daily pivot at 94.23, followed by the confluence of June 22, and the R2 daily pivot at 94.68.

AUD/JPY Key Technical Levels

- NZD/USD bears are moving in despite the softness in the greenback.

- The week is premature and we are yet to see the bias unfold.

At 0.6295, NZD/USD has been pressured despite the growing consensus of a weaker US dollar. The bird is down some 0.28% at the time of writing and has fallen from a high of 0.6326 to a score a low of 0.6281.

The US session was mixed and the greenback was bought back across the board in the absence of anything fundamentally bearish for the greenback on the day other than a terrible miss in the manufacturing data. The Dallas Fed Manufacturing Index fell to -17.7 in June, down from -7.3 in May, putting it at its lowest level since May 2020. ''However, labour market indicators continue to show robust growth in employment and longer workweeks. Prices and wages both continued to increase, but manufacturers are less optimistic about the future,'' analysts at ANZ Bank explained.

''The Kiwi is lower this morning as risk assets take a breather and US bond yields resume their slow upward march,'' analysts at ANZ Bank added. Indeed, US stocks pulled back, lacking a catalyst while investors remain concerned over inflation and tightening Fed policy.

The Dow Jones Industrial Average, which is down 13.5% so far in 2022, is on pace for its worst first half of a year since 2008 and the higher beta currencies continue to be at risk. The Nasdaq, as well, is down 26.5% so far this year and is on track for its biggest first-half of a year slide ever. Nevertheless, the NZD remains fairly range-bound, bouncing around with the general vibe of global sentiment and there are limited data releases. Investors will instead keep an eye on the risk associated with Russia which has now technically defaulted on its external sovereign bond payments.

NZD/USD technical analysis

There are a couple of scenarios besides sideways consolidation and the following illustrate the bearish and bullish prospects:

Above and below are the bullish outlooks.

The following is noting of the M-formation's neckline and prospects of a sell-off below the structure.

What you need to take care of on Tuesday, June 28:

Major pairs seesawed between gains and losses but held on to familiar levels. The dollar is down against most of its rivals, but no technical breakout has taken place. The EUR/USD pair trades just below the 1.0600 level, while GBP/USD stands in the 1.2260 area.

Market players are juggling with mounting inflation and recession concerns, and central bankers juggling to tame inflation without halting economic progress. The mood was generally positive at the weekly opening but soured after S&P downwardly reviewed economic growth. It now expects the EU economy to advance a modest 2.6%, while foresees US growth at 1.6%, well below the estimated potential growth rate of around 2%.

Stock markets managed to hold on to positive territory in Europe and Asia, but Wall Street closed in the red. US government bond yields continue to seesaw up and down alongside market fears. The yield on the 10-year Treasury note peaked at 3.21%, now hovering nearby, up for the day.

The USD/CAD pair edged lower, now trading at around 1.2870, helped by higher crude oil prices, as WTI is now changing hands at $109.50 a barrel. AUD/USD, on the other hand, is under pressure, trading at around 0.6920.

Gold advanced at the beginning of the day, but finishes it in the red at around $1,824.00 a troy ounce.

The European Central Bank hosts this week the Forum on Central Banking in Portugal. President Christine Lagarde offered the welcoming remarks. On Tuesday, several ECB members will be on the wires as per their participation in the aforementioned forum, while leaders from around the world will speak on Wednesday.

Like this article? Help us with some feedback by answering this survey:

- On Monday, the EUR/JPY is advancing some 0.47%.

- The sentiment is mixed, which helped put a lid on EUR/JPY elevated prices.

- EUR/JPY Price Analysis: The formation of a double top in the daily chart would open the door for further losses.

The EUR/JPY advances for the second consecutive day and is looking to extend to its seven straight week rally, which would lift the cross-currency pair towards fresh yearly highs above 144.25. At 143.29, the EUR/JPY is printing gains of 0.54% at the time of writing.

The optimism generated by the Asian and European sessions faded as the North American session winds down. US equities seesaw between gainers/losers as sentiment shifted mixed, on the back of money managers' portfolio reshuffling on quarter-month end, amidst a jump in global bond yields.

EUR/JPY Daily chart

In the meantime, the EUR/JPY daily chart illustrates a double top formation. Nevertheless, EUR/JPY sellers' failure to drag prices lower, courtesy of an ultra-dovish Bank of Japan, keeps prices elevated and threatening of breaking to new YTD highs.

Additionally, the Relative Strenght Index (RSI) at 60.91 aims higher. Besides that, it just crossed above the RSI 7-day SMA (line in red), indicating that buying pressure is accumulating.

EUR/JPY 1-Hour chart

The EUR/JPY 1-hour chart depicts the cross-currency pair upwards but is about to face solid resistance around the R2 daily pivot point at 143.63. That, alongside June's 23 daily high at 143.67, would be solid ceiling areas to break. Nevertheless, once broken, the EUR/JPY's next resistance is June 22, high at 144.24.

On the flip side, the EUR/JPY first support would be the R1 pivot at 143.12. A break below would expose the confluence of the 20 and the 100-EMAs around the 142.83-97 area. Once cleared, the next support would be the 50-EMA at 142.50.

EUR/JPY Key Technical Levels

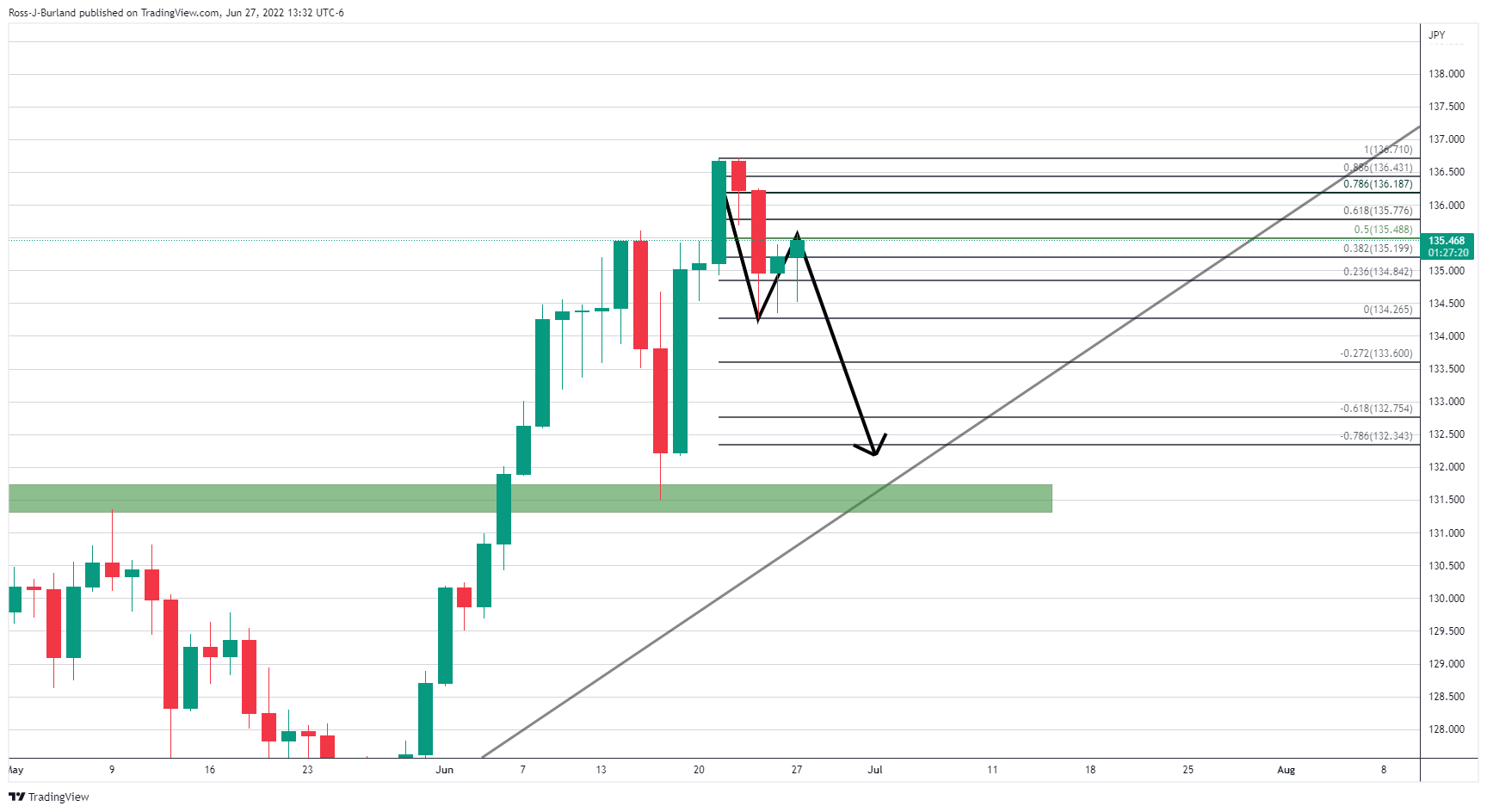

- USD/JPY bears moving in for the kill but the structure is key.

- The bears have their eyes on the lower bound support.

USD/JPY is under pressure and falling in a classic reversal topping pattern on the daily chart. The following illustrates the bearish bias from a weaker US dollar perspective. However, there are also prospects of a move higher from here and until the price breaks the lower bound support, the bullish daily structure remains in tact.

USD/JPY daily charts

There are two scenarios. The above illustrates the potential for a move higher from current support while the lower bound support remains intact. The other scenario shows the price running into a 50% mean reversion of the last bearish impulse and prospects of a move towards the lower bound support area:

This thesis would marry up with the weakness in the US dollar, as displayed in the following DXY chart:

DXY H1 chart

The price of the US dollar has been pressured and continues to show signs of weakness given the breaks of structures of late as per the hourly analysis above.

- The lack of a fresh catalyst kept the pound within familiar ranges.

- A mixed market mood, spurred by higher global bond yields, put a lid on GBP/USD gains.

- GBP/USD Price Forecast: Remains tilted to the downside, but a test towards 1.2300 is on the cards.

The British pound remains to trade in a narrow range vs. the greenback, though it stays trading with minimal gains after probing the 1.2300 mark reaching daily highs at 1.2313, followed by a dip towards daily lows near 1.2238. At 1.2277, the GBP/USD is up 0.05% in the North American session.

The market mood is mixed, as US equities fluctuate between gainers and losers. The GBP/USD remains almost flat amidst the lack of a catalyst, leaving traders adrift on last week’s news and sentiment. Last Friday, the Bank of England’s chief economist Huw Pill said that interest rates would be the primary monetary policy tool as the bank prepares to begin its Quantitative Tightening.

Given the backdrop that UK’s inflation rose to a 40-year high at 9.1%, analysts expect that the central bank will hike rates by 25 bps in August. The BoE Monetary Policy Committee is due to consider the plan of selling bonds in the same meeting, after which it could decide to start the asset sales.

Meanwhile, global bond yields, which were lower in the session as recession fears faded, pushed to the upside, shifting the market sentiment to mixed. That said, the US 10-year Treasury yield is moving higher by six basis points, yielding 3.200%-

In the meantime, the US Dollar Index, a measure of the buck’s value vs. its peers, give in some territory on Monday, down 0.18%, back under the 104.000 mark.

Calendar-wise, the UK docket would feature BoE speakers with Jon Cunliffe, crossing the wires on Tuesday. Across the pond, the US docket will feature CB Consumer Confidence for June, estimated at 100.4, less than May’s 106.4. that alongside Wholesale inventories, Trade Balance, Regional Fed Indices reports, and Fed speakers.

GBP/USD Price Forecast: Technical outlook

Consolidation is what the GBP/USD daily chart shows, within the 1.2150-1.2300 area, though it is skewed to the downside. Confirmation of the previously mentioned is the exponential moving averages (EMAs), above the exchange rate, while the Relative Strength Index (RSI) at 44.97, remains in bearish territory.

If GBP/USD buyers need to regain control, they must reclaim 1.2500. Nevertheless, on its way north, they would face resistance at the 1.2300 mark. Once cleared, the 50-EMA at 1.2353 would be the next ñeveñ to challenge, followed by June’s 16 high at 1.2405, and then the 100-EMAR at 1.2463.

On the major’s path of least resistance, the first support would be 1.2200. Breach below would expose June 22 daily low at 1.2160, followed by the figure at 1.2000.

- Gold bears move in despite weakness in the US dollar.

- Bulls lurking in familiar support, eyes towards $1.840s.

Gold is under pressure despite the weakness in the US dollar. At $1,823, the price is down by some 0.23% while the US dollar is also underwater, currently down by 0.18%. The greenback has struggled versus its major rivals at the start of the week due to the prospects of softening inflation which has given cause for a reassessment of the projected path of the Federal Reserve.

As a consequence, the greenback has been tipped over to the edge of the abyss as per the technicals illustrated in the prior analysis as follows:

In the above analysis, the greenback was forecasted to break the structure and head lower to the area of imbalance of price towards 103.00.

The price has followed the trajectory and is currently mitigating some of the imbalance following a fresh break of structure and this could be significant in the schematic of the gold price on the charts below.

Key US and ECB events

Meanwhile, the week ahead is going to be focused on Core PCE prices that have likely advanced firmly in May. Wjwta will be important is whether or not they will still be at a somewhat slower pace than the core Consumer Price Index (0.5% vs 0.6%). Additionally, US manufacturing surveys that have already been released point to a notable deceleration in activity in June. The Dallas survey today was very poor, -17.7 vs -3.1. Tomorrow we will have the Richmond report that is expected to show a move to -5 vs. -9 in May. Overall, the outcome of these data points this week will serve to move the needle with respect to the Federal Reserve's tightening expectations.

Currently, the WIRP suggests a 75 bp hike at the next meeting July 27 is 85% priced in, about the same as the start of last week, while 50 bp hikes at the subsequent meetings on September 21 and November 2 are almost fully priced in, analysts at Brown Brothers Harriman noted. ''Looking ahead, the swaps market is pricing in 200 bp of tightening over the next 12 months that would see the policy rate peak between 3.50-3.75%, down from nearly 4.0% at the start of last week.''

Meanwhile, there will be a focus on the European Central Bank and the euro. Hawkkishness there could see the dollar weaker and support gold higher. The ECB forum begins tonight in Sintra, Portugal. which is the ECB’s version of the Fed’s Jackson Hole Symposium. Euro-area inflation will be coming out this week as well and this likely rose further in June due to broadening price pressures and investors will look to this to cement sentiment of a likelihood of a 50bps hike from the ECB in September and set the tone for more to come at later meetings.

Analysts at TD Securities argued that ''gold prices are also being pulled higher as rising recession risks drive inflows into the yellow metal. In turn, while gold bears are looking for catalysts to shake out the massive amount of potentially complacent speculative length from proprietary traders, recession fears have started to spark a bid for safe-havens, given this historically has led a pivot in Fed policy.''

Gold technical analysis

As for the prior pre-open analysis this week, the bullish case for gold, it was stated that ''a bullish case for gold comes above the current consolidation rage above 1,832 towards the prior highs in the prior two US sessions and then $1,850 as follows:

We have seen two way price action since:

The move lower has coincided with a bid on US yields yet there is a probability that the bulls will be enticed by weakness in the greenback. The price imbalance on the hourly time frame below is located near the neckline of the M-formation at 1,839.

- Euro gains as European yields move higher.

- US dollar weakens as markets avoid a correction after last week’s rally.

- EUR/USD rises back above the 20-day SMA.

The EUR/USD rose further during the American session and climbed to 1.0614, reaching the highest level in two weeks. The euro was unable to consolidate above 1.0600 and pulled back underneath the psychological level, still holding onto holding daily gains.

The improvement in risk sentiment weakened the greenback. The DXY is falling 0.25% on Monday, trading at 103.85. US bond yields are modestly higher, but European yields rose even further. The German 10-year yield jumped 7% to 1.54%. The divergence helped EUR/USD to move higher.

US economic data came in above expectations, with Durable Goods Orders and Pending Home Sales rising more than market consensus. The dollar did not benefit from the numbers. On Thursday, the Core PCE is due.

In Portugal, the European Central Bank started its annual conference. The highlight will be on Wednesday with a panel including ECB President Lagarde, Bank of England’s Governor Bailey and Fed’s Chair Powell.

Bullish short-term outlook

The EUR/USD is trading above 1.0580 but is showing difficulties running above 1.0600. The euro is back above the 20-day Simple Moving Average (1.0588). A daily close above 1.0600 should strengthen the recovery. The 55-day SMA awaits at 1.0620.

A decline under 1.0580 would alleviate the bullish pressure. The next support might be located at 1.0530, followed by 1.0490.

Technical levels

- US crude oil extends its gains to two consecutive days, though it faces solid resistance at the 50-EMA, around $110.33.

- OPEC+ reduced its 2022 market surplus to 1 million BPD, while Libya’s political turmoil cut production by 600K BPD.

- WTI Price Analysis: Despite breaking an upslope trendline, oil's price has recovered those losses, and now targets $110.00.

Western Texas Intermediate, aka WTI, records a solid bounce after testing the 100-EMA on the downside near $105.88 a barrel near the daily low and got bolstered late, as OPEC+ cuts 2022 market surplus from 1.4 million BPD to 1 million BPD according to sources cited by Reuters. At the time of writing, WTI exchanges hand at $109.86 per barrel.

Oil is rising to several factors striking the global economy. Over the weekend, the G7 is weighing on putting a lid on Russian oil prices and looking for other ways to supplant Russian oil and gas, as long as Russia keeps battling Ukraine. Meanwhile, Libya’s state oil company reported that it might suspend exports from the Gulf of Sirte amidst a worsening political crisis. Libya’s inability to resolve its political turmoil will shrink the oil market by 600,000 BPD.

In the meantime, talks between the US and Iran will restart in the coming days, according to EU chief diplomat Josep Borrell. If there is progress in Iran’s nuclear deal, crude from the country will begin to flow into the markets as a sign of relief due to the petrol shortage and high energy prices.

At the time of writing, it crossed wires that France President Macron told US President Biden that UAE is producing oil at near-maximum capacity after a conversation with UAE’s crown prince. At the same time, the Department of Energy (DOE) reported that strategic petroleum reserve oil stock dropped to 497.9 million barrels, the lowest level since April 1986.

In the meantime, the US Energy Information Administration said the timeline of publication of its Petroleum Status report that was scheduled to come out last week is still unclear but will not be published Monday, according to Bloomberg.

WTI Price Analysis: Technical outlook

The US crude oil benchmark price is trapped within the 50 and 100-EMA’s in the daily chart, each at $110.33 and $105.88, respectively. Nevertheless, WTI is upward biased, as sellers could not drag prices below the psychological $100 level.

WTI traders should be aware that despite WTI’s falling below a six-month-old upslope trendline last Tuesday, it does not mean that WTI’s trend shifted; it is just slowing, and oil is already trading near last Tuesday’s prices as WTI consolidates.

Upwards, WTI’s first resistance would be the 50-EMA at $110.00. Break above would expose the 20-EMA at $114.94, followed by the last swing high on June 14, at $123.66 per barrel.

Data released on Monday showed Durable Goods Orders rose more than expected in May. Analysts at Wells Fargo point out the report presented gains despite softening demand for goods and signs of slowing activity in regional Fed manufacturing surveys. According to them, a broad-based gain in core capital goods shipments should lift estimates for second-quarter equipment spending.

Key Quotes:

“If you are looking for signs of slowing in the manufacturing sector, you won't find many in the May durable goods report. A stout 0.7% monthly increase handily exceeded consensus expectations for a scant 0.1% gain. The strength was broadly based, with most categories in the black for the month.”

“Nondefense capital goods shipments (including aircraft), which are a good proxy for equipment spending in GDP accounts, rose 1.6% in May. This marked the seventh consecutive gain in core shipments and signals equipment spending should hold up during the quarter.”

“With every category of durables, besides computers and related equipment, seeing stronger shipments last month, this report suggests broad-based improvement across industries.”

British Foreign Minister Liz Truss said on Monday that they don't rule out using Article 16 further down the line, as reported by Reuters.

"Triggering Article 16 would not resolve fundamental issues in the Northern Ireland Protocol," Truss added.

Regarding the upcoming vote on proposed legislation to override parts of the post-Brexit agreement, "It is our expectation that the passage of this bill will result in the institutions being established," Truss told parliament earlier in the day.

Market reaction

These comments don't seem to be hurting the pound. As of writing, the GBP/USD pair was up 0.4% on the day at 1.2308.

- Stocks in Wall Street rebound back to positive.

- US Dollar Index drops to weekly lows during the American session.

- USD/CHF heads for the lowest daily close in two months.

The USD/CHF dropped to 0.9541 in American hours, hitting a fresh daily low. Earlier the pair peaked at 0.9620 before turning to the downside amid a weaker US dollar.

The greenback failed to hold onto gains as Wall Street rebounded back to positive territory. The improvement in market sentiment weighed on the dollar. The US Dollar Index has fallen 0.37% and trades at 103.75, the lowest level in a week. The US 10-year yield stands at 3.19% and the 30-year at 3.31%.

Economic data from the US came in above expectations on Monday. Durable Goods Order rose by 0.7% in May. Above the 0.1% expected. Pending Home Sales climbed unexpectedly by 0.7%. The numbers did not help the greenback. The key data of the week will be the Core PCE on Thursday. In Portugal, the annual European Central Bank forum starts on Monday; on Wednesday a discussion panel will include Lagarde (ECB), Powell (Fed) and Bailey (BoE).

Bearish bias

The USD/CHF continues to move with a bearish bias. The failure to hold above 0.9600 confirms the momentum. As of writing, the pair is testing levels under 0.9550. If it consolidates clearly below, more losses seem likely. The next target might be located at the 100-day Simple Moving Average at 0.9505.

A recovery above 0.9620 should face resistance at 0.9680, followed by 0.9715 (20-day SMA).

Technical levels

- The AUD/USD reports minimal gains of 0.03% on Monday.

- Higher global bond yields shifted Wall Street sentiment mixed, a headwind for the AUD.

- AUD/USD Price Forecast: Range-bound but skewed to the downside.

The AUD/USD seesaws from daily highs around 0.6958 printed during the Asian session and dipped towards daily lows near 0.6910, in a narrow trading range that witnessed the Aussie dollar losing some ground vs. the greenback. At 0.6944, the AUD/USD trades above the middle of the aforementioned 0.6910-0.6960 region during the North American session.

The AUD/USD dropped due to falling Iron Ore prices, from $131.45 to $129.71. Additionally, global bond yields, which ticked lower on news that global recession fears faded, pushed to the upside after one hour of the Wall Street open, which has shifted the sentiment to mixed, with US equities fluctuating between gains and losses.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, give in some territory on Monday, down 0.32%, back under the 104.000 mark. Contrarily, the US 10-year Treasury yield grinds higher close to four basis points and sits at 3.162%.

Analysts at Westpac expect that the AUD/USD could remain afloat at 0.6830

“The Aussie and Kiwi are softest in the G10 over the past week. Fragile risk sentiment and a startling slide in commodity prices are taking a toll. A relatively quiet global calendar suggests that equity sentiment could be pivotal in determining whether AUD/USD can remain clear of May’s lows around 0.6830,” analysts wrote.

In the week ahead, the Australian economic docket will feature Retail Sales for May on its preliminary reading, expected at 0.4%, less than the previous reading. On the US front, on Tuesday, CB Consumer Confidence for June is estimated at 100.4, less than May’s 106.4. that alongside Wholesale inventories, Trade Balance, Regional Fed Indices reports, and Fed speakers.

AUD/USD Price Forecast: Technical outlook

In the daily chart, the Aussie dollar is still headed to the downside as the week begins. If AUD/USD buyers would like to regain control, they need to reclaim 0.7000 to ease the ongoing selling pressure on the pair. If that is achieved, AUD buyers’ next target would be the 20-EMA at 0.7047, immediately followed by the 50-EMA at 0.7078.

On the flip side, and the AUD/USD path of least resistance, the first support would be 0.6900. A breach below would expose June 23 low at 0.6869, followed by the June 14 swing low at 0.6850.

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to expand by 0.3% in the second quarter, up from the June 16 forecast of 0%.

"After recent releases from the Federal Reserve Board of Governors, the National Association of Realtors, and the US Census Bureau, the nowcast of second-quarter real gross private domestic investment growth increased from -9.0% to -8.1%," Atlanta Fed's publication read.

Market reaction

The US Dollar Index continues to push lower after this report and was last seen losing 0.4% on the day at 103.70.

Citing an internal report prepared for the upcoming Joint Technical Committee meeting, Reuters reported on Monday that OPEC+ trimmed its oil market surplus forecast for 2022 to 1 million barrels per day (bpd) from 1.4 million bpd previously.

Market reaction

Crude oil prices gained traction after this report. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $109.47, where it was up 1.75% on a daily basis. Similarly, the barrel of Brent was up 2% at $114.65.

- Dallas Fed Manufacturing Index fell sharply in June.

- US Dollar Index continues to fluctuate near 104.00 after the data.

The headline General Business Activity Index of the Federal Reserve Bank of Dallas' Texas Manufacturing Survey plunged to -17.7 in June from -7.3 in May. This print missed the market expectation of -3.1 by a wide margin.

The New Orders sub-index dropped to 3.3 from 19.8, the Prices Paid for Raw Materials component fell to 57.5 from 61.8 and the Employment sub-index declined to 15.2 from 20.9.

Market reaction

There was no immediate market reaction to this report and the US Dollar Index was last seen posting small daily losses at 103.98.

- Pending Home Sales in the US rose modestly in May.

- US Dollar Index stays in negative territory below 104.00.

The monthly data published by the National Association of Realtors showed on Monday that Pending Home Sales rose by 0.7% on a monthly basis in May following April's decline of 4%. This print came in better than the market expectation for a contraction of 3.7%.

Despite this monthly increase, Pending Home Sales were down 13.6% on a yearly basis.

Market reaction

These figures don't seem to be having a noticeable impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was down 0.2% on the day at 103.90. Meanwhile, The Dow Jones Industrial Average and the S&P 500 indexes were both flat on the day.

AUD/NZD has been following a regular bullish trend since the end of last year. Economists at Société Générale expect the pair to reach new highs above the 1.12 top seen in 2018.

AUD/NZD to benefit from a rates differential switch

“As the RBNZ started to hike earlier than the RBA, the latter is now proving more aggressive in the catch-up, so that the rates differential is likely to switch soon in the favour of Australian rates.”

“AUD/NZD could break the 1.12 top seen in 2018 and reach new highs.”

G7 members are set to ban imports of Russian gold to tighten the sanctions squeeze on Moscow. Nonetheless, the yellow metal is expected to shrug off these headlines, economists at TD Securities report.

Fed pivot less associated with recession odds than in prior episodes

“G-7 ban on new Russian gold imports isn't expected to impact gold trading considering the LBMA's ban has already cut off new Russian output from major markets within the G-7. In turn, price action is reversing to reflect the minor impact on gold. However, gold prices are also being pulled higher as rising recession risks drive inflows into the yellow metal.”

“Gold bugs sniffing out a potential stagflationary outcome associated with lower growth but lingering inflation should also consider that central banks, facing a credibility crisis, could also continue to raise rates for longer than they otherwise would. In this scenario, pricing for a Fed pivot would be less associated with recession odds than in prior episodes.”

“In the near-term, continued whipsaws from CTA trend followers reflect the range-bound price action in the yellow metal as macro pressures build.”

See – Gold Price Forecast: XAUUSD to shrug off a G7 ban on imports from Russia – Commerzbank

- USD/JPY gained some positive traction on Monday, though lacked any strong follow-through buying.

- The risk-on mood undermined the safe-haven JPY and extended support amid rising US bond yields.

- Upbeat US Durable Goods Orders failed to impress the USD bulls or provide any impetus to the pair.

The USD/JPY pair attracted some dip-buying on the first day of a new week and rallied over 100 pips from the daily swing low, around mid-134.00s. Spot prices shot to a two-day high during the early North American session, though seemed struggling to capitalize on the move amid modest US dollar weakness.

The greenback did attract some buying following the release of upbeat US Durable Goods Orders, which unexpectedly rose by 0.7% in May. Adding to this, orders excluding transportation items also surpassed estimates and recorded a growth of 0.7% during the reported month. That said, reducing odds for more aggressive Fed rate hikes kept the USD bulls on the defensive and acted as a headwind for the USD/JPY pair, at least for the time being.

The fundamental backdrop, however, supports prospects for the resumption of the recent strong bullish run to a 24-year peak touched. The recent sharp decline in commodity prices eased fears about a further rise in inflationary pressures and boosted investors' confidence. This was evident from a generally positive tone around the equity markets, which might continue to undermine the safe-haven Japanese yen and act as a tailwind for the USD/JPY pair.

The risk-on impulse pushed the US Treasury bond yields and resulted in the widening of the US-Japan yield differential. Apart from this, a big divergence in the policy stance adopted by the Bank of Japan (dovish) and the Federal Reserve (hawkish) favours bullish traders. Hence, any meaningful pullback could be seen as a buying opportunity and is more likely to remain limited ahead of Fed Chair Jerome Powell's appearance on Thursday.

Technical levels to watch

USD/JPY has established itself above the May peak of 131.30. Economists at Société Générale expect the pair to reach next projections at 138 and 141.

Watch out for support at 131.30

“Monthly MACD is firmly anchored within positive territory, which denotes upside momentum is still prevalent.”

“USD/JPY is fast heading towards the upper limit of a multi-month channel at 138 and projections of 141. If these objectives are achieved, it could result in a consolidation, although signals of reversal are still not visible.”

“The next significant resistance could be at projections of 148/150 which is also the high formed in 1998.”

“Only a break below May peak of 131.30 would denote a phase of pullback.”

GBP/USD is gradually approaching potential support at 1.1840/1.1740. A break below this region would clear the way towards the low carved out in 2020 near 1.1410, strategists at Société Générale report.

Recent pivot high of 1.2670 must be overcome to affirm an extended rebound

“The pair is drifting gradually towards potential support of 1.1840/1.1740, representing the lows of 2016 and projections. Defending this zone could result in a short-term bounce.”

“The recent pivot high of 1.2670 is an important resistance. This must be overcome to affirm an extended rebound towards 1.2810, the 38.2% retracement from June 2021 and December low of 1.3100/1.3160.”

“In the event that the ongoing decline persists below 1.1740, the pair could revisit the low carved out in 2020 near 1.1410.”

EUR/USD has extended its downtrend after breaking below the trend line drawn since 2000. This violation has led the pair towards the lows of 2016/2017 near 1.0340. A break under here would open up additional losses towards 1.0070/1.0000, analysts at Société Générale report.

Break above 1.0790/1.0810 essential to affirm a phase of rebound

“The neckline at 1.0790/1.0810, which is also the low of March, is an important resistance. So long as crossover beyond this doesn’t materialize, the downtrend is expected to persist.”

“Failure to defend 1.0340 would affirm a continuation in decline. The next potential objectives could be at 1.0070/1.0000, the 76.4% retracement of the whole uptrend during 2000 and 2008.”

The CAD edged fractionally higher to the 1.2865/70 area before ceding gains and trading back to near flat on the session. This movement indicates that the loonie lacks positive momentum, in the view of analysts at Scotiabank

Break under 1.2865 to tip funds back to the low/mid 1.27s

“Spot’s soft-ish close on the week through last Friday puts a tentative top on the USD rally after spot’s rejection of the upper 1.30s in the prior week. But the fact that support around 1.2865 continues to hold the market up suggests very limited, positive momentum behind the CAD at this point.”

“A break under 1.2865 should tip funds back to the low/mid 1.27s.”

“Intraday, we spot resistance at 1.2935/45.”

See – USD/CAD: Break below 1.2864/58 to prompt further weakness – Credit Suisse

The US Dollar Index stays relatively quiet near 104.00. In the view of economists at Société Générale the steady uptrend is in force, therefore, DXY is set to clib as high as 111.

Only a break under 101 would signal a risk of a deeper downtrend

“We expect the index to head higher gradually towards next projections at 109 and the upper band of the multiyear channel near 111/112.”

“Shorter-term, we cannot rule out a phase of consolidation roughly within limits of 101.30/101 and 106. Eventually, a move beyond 106 would lead to the next leg of uptrend.”

“Only if the recent pivot low near 101 is violated would there be a risk of a deeper downtrend. If this break materializes, the next potential support levels would be at 99.40 and the 200-DMA near 97.50.”

EUR/USD strengthens into high-1.05s. A break above the 1.06 level would open up further gains towards the next big figure, economists at Scotiabank report.

EUR/USD holds in a minor upward trend since mid-month

“The EUR is heading into a test of its 50-day MA at exactly the 1.06 figure, as it holds in a minor upward trend since mid-month.”

“The EUR is now aiming for a test of the big figure that quickly triggered selling pressure earlier this month and is a key zone to beat to preserve the EUR’s ascent.”

“Beyond the figure, the 1.0640/50 zone is resistance followed by the next big figure.”

“Support is the daily low of 1.0550 followed by 1.0520 and the 1.05 figure area.”

- Gold once again faced rejection near 200-DMA and has now filled the weekly bullish gap.

- The risk-on impulse and rising US bond yields acted as a headwind for the commodity.

- The emergence of some USD dip-buying further contributed to the intraday selling bias.

Gold continued with its struggle to make it through the very important 200-day SMA and witnessed some intraday selling near the $1,840 area on Monday. The intraday downtick dragged spot price to the lower end of the daily trading range, around the $1,828 region during the early North American session and was sponsored by a combination of factors.

Investors turned optimistic amid hopes that inflation is nearing its peak, bolstered by the recent sharp decline in commodity prices. This was evident from a generally positive tone around the equity markets, which acted as a headwind for the safe-haven gold. The risk-on flow pushed the US Treasury bond yields and further contribute to capping gains for the non-yielding yellow metal.

A goodish pickup in the US bond yields allowed the US dollar to reverse its modest intraday losses to over a one-week low. The greenback drew additional support from upbeat US Durable Goods Orders, which unexpectedly increased by 0.7% in May. Orders excluding transportation items also surpassed estimates and rose 0.7%. A stronger USD exerted additional pressure on the dollar-denominated gold.

The downside, however, seems cushioned, at least for the time being, amid growing recession fears and expectations that some G7 countries plan to ban bullion imports from Russia. This might tighten supplies and continue lending support to gold prices. This makes it prudent to wait for strong follow-through selling before positioning for any further near-term depreciating move.

Nevertheless, gold has now filled a weekly bullish gap and repeated failures near a technically significant moving average suggest an eventual breakdown to the downside. Hence, any attempted recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the $1,848-$1,850 region, which should act as a pivotal point for gold prices.

Technical levels to watch

EUR/USD has been stuck in the 1.04-1.08 range since April. Economists at Société Générale expect the pair to remain below the 1.10 throughout the rest of the year.

Fundamentals suggest a higher EUR/USD

“Over the past four years, EUR/USD has tracked the spread of economic surprises between Europe and the US. This correlation recently broke, but the cross used to be around 1.15 when the spread was flat like it is now. Fundamentals thus suggest a higher EUR/USD, which, however, has been stuck in the 1.04-1.08 range since April.”

“The war in Ukraine remains a serious tail risk that should continue to anchor the euro in the second semester, likely postponing the take-off above 1.10 to next year.”

NZD/USD recovered on Friday. Nonetheless, analysts at Credit Suisse stay bearish and look for an eventual break below 0.6230/6194.

NZD/USD remains capped at 0.6329

“We remain tactically bearish on the back of the 55-day and 200-day moving averages continuing to fall and look for a move below 0.6194. A break here would support further medium-term weakness and open up an eventual move to the next significant support at 0.5919/5841.”

“A close above 0.6329 would prompt near-term upward pressure and see potential to reach a notable near-term resistance at the recent price high and the minor breakdown point at 0.6395/6435.”

“A close above the 0.6435 level would likely trigger a stronger move to the May/June highs at 0.6568/76, though we would look for a ceiling here to maintain the core downtrend.”

- EUR/USD shot to a three-day high on Monday, albeit struggled to make it through the 1.0600 mark.

- Repeated failures near the 50-day SMA warrants caution before positioning for any meaningful gains.

- Break below a two-week-old ascending trend-line would shift the bias in favour of bearish traders.

The EUR/USD pair gained traction for the second successive day on Monday and climbed to a three-day peak, though struggled to capitalize on the move.

A goodish pickup in the US Treasury bond yields assisted the US dollar to reverse an intraday dip to over a one-week low. Apart from this, upbeat US Durable Goods Orders offered additional support to the greenback and capped the EUR/USD pair just ahead of the 1.0600 round-figure mark.

From a technical perspective, the aforementioned handle now coincides with the 50-day SMA and should now act as a pivotal point. Sustained strength beyond would be seen as a fresh trigger for bullish traders and pave the way for an extension of a nearly two-week-old upward trajectory.

The EUR/USD pair might then accelerate the momentum towards the 1.0650 horizontal support breakpoint, now turned resistance, before aiming to reclaim the 1.0700 mark. The next relevant hurdle is pegged near the 1.0745-1.0750 area ahead of the May high, around the 1.0780-1.0785 zone.

Meanwhile, the recent bounce from the vicinity of mid-1.0300s, or the YTD low has been along an upward-sloping trend-line. The said support, currently around the 1.0535-1.0530 region, should continue to protect the immediate downside, which if broken might prompt some technical selling.

The subsequent fall has the potential to drag spot prices towards the 1.0500 psychological mark, which is closely followed by support near the 1.0480 region. Some follow-through selling would shift the bias back in favour of bearish traders and make the EUR/USD pair vulnerable.

EUR/USD 4-hour chart

-637919312947961808.png)

Key levels to watch

- Durable Goods Orders in the US rose unexpectedly in May.

- US Dollar Index holds above 104.00 after the data.

Durable Goods Orders in the US increased by 0.7%, or by $1.9 billion, on a monthly basis in May to $267.2 billion, the monthly data published by the US Census Bureau revealed on Monday. Investors were expecting the data to remain unchanged.

"Excluding transportation, new orders increased 0.7%. Excluding defense, new orders increased 0.6%," the publication further read. "Transportation equipment, up two consecutive months, led the increase, $0.7 billion or 0.8% to $87.6 billion."

Market reaction

The US Dollar Index edged slightly higher after this data and was last seen posting small daily losses at 104.08.

- USD/CAD reversed an early dip to over a one-week low amid the emergence of some USD buying.

- Bullish crude oil prices could underpin the loonie and keep a lid on any further gains for the major.

- The markets reacted little following the release of upbeat US Durable Goods Orders data for May.

The USD/CAD pair attracted some dip-buying near the 1.2865-1.2860 congestion zone and bounced nearly 40 pips from a one-and-half-week low touched earlier this Monday. The pair was last seen trading with modest intraday gains, around the 1.2900 round-figure mark heading into the North American session.

The US dollar reversed an intraday dip to over a one-week low amid a goodish pickup in the US Treasury bond yields, bolstered by the risk-on impulse in the markets. The emergence of some USD buying at lower levels turned out to be a key factor that offered some support to the USD/CAD pair. That said, an uptick in crude oil prices underpinned the commodity-linked loonie and might keep a lid on any meaningful upside for spot prices, at least for the time being.

Moves against Russian oil and gas exports that might come out of a meeting of leaders of the Group of Seven (G7) nations in Germany acted as a tailwind for the black liquid. That said, the prospects for a revival of the Iran nuclear deal, which might lead to more Iranian oil exports, could cap gains for the commodity. Traders might also be reluctant to place aggressive bets and prefer to move on the sidelines ahead of the OPEC+ meeting later this week.

Apart from this, investors will take cues from Fed Chair Jerome Powell's remarks in a panel discussion on Thursday that might help determine the near-term trajectory for the USD/CAD pair. In the meantime, the markets reacted little to the US macro data, which showed that Durable Goods Orders unexpectedly increased by 0.7% in May. Orders excluding transportation items also surpassed estimates and rose 0.7%, though failed to provide any impetus to the USD/CAD pair.

Nevertheless, spot prices, for now, seem to have stalled the recent pullback from the YTD peak, around the 1.3075-1.3080 region touched earlier this month and recovered a part of Friday's losses. Some follow-through buying has the potential to lift the USD/CAD pair towards the 1.2945 resistance zone, above which bulls might aim back to reclaim the 1.3000 psychological mark.

Technical levels to watch

In the view of strategists at Credit Suisse, the S&P 500 is expected to see a deeper recovery to 3974, potentially the top of the early June price gap and 38.2% retracement of the fall from March at 4017/19.

Initial support seen at 3872

“The recovery is set to extend further yet with resistance seen next at 3943, then the price gap from earlier in June, starting at 3974 and stretching up to 4017/19, also the 38.2% retracement of the March/June fall. With the top of the trend channel from April seen not far above at 4039, we would look for a cap here for an eventual resumption of the broader downtrend.”

“Support is seen at 3872 initially, then 3848/38, with the price gap from Friday ideally holding to keep the immediate risk higher, seen starting at 3822 and stretching down to 3796.”

USD/CAD fell sharply on Friday and has tested significant near-term support at 1.2864/58 on Monday. A break below here would signal a swing lower within the channel, analysts at Credit Suisse report.

Immediate resistance moves to 1.2933/34

“A sustained close below the recent price low at 1.2864/58 would signal a failure to break above 1.3077/3100 and prompt another swing back lower within the gently upward sloping mean-reverting channel, with next support seen at 1.2680/71.”

“Should weakness extend directly below 1.2680/71 as well, this would promote further downside towards a major support zone at the bottom of the channel at 1.2515/2400, which we would certainly expect to hold.”

“Immediate resistance moves to 1.2933/34 and next to the recent price high and retracement resistance at 1.3017/38. A move above here would open the door to the top of the channel at 1.3077/3104, which has to hold to maintain the mean-reverting regime and prevent a major medium-term breakout to the upside. Should this take place though, we would look for a quick move to the next resistance at 1.3334.”

EUR/USD consolidation stays seen as temporary ahead of an eventual sustained break below the 2017 and YTD lows at 1.0350/41, in the view of economists at Credit Suisse.

Further consolidation looks likely

“EUR/USD extends its consolidation but remains capped below its recent high at 1.0601. With more important price resistance and the falling 55-day average seen not far above at 1.0621/27 our bias remains for a cap here and for a fresh turn lower and an eventual resumption of the broader downtrend.”

“Support moves to 1.0512 initially, then 1.0469, below which should see the risk turn lower again for a retest of key price support from the YTD and 2017 lows at 1.0350/41. We continue to look for eventual break below here, which should act as the catalyst for a resumption of the core downtrend, with support seen next at 1.0217/09 and eventually parity/0.99.”

US durable goods orders overview

Monday's US economic docket highlights the release of Durable Goods Orders data for May. The US Census Bureau will publish the monthly report at 12:30 GMT and is expected to show that headline orders remained flat during the reported month as compared to the 0.5% rise in April. Orders excluding transportation items, which tend to have a broader impact, are anticipated to have increased by 0.3% in May, down slightly from a 0.4% in the previous month.

How could it affect EUR/USD?

A weaker-than-expected report would further fuel concerns that the growth momentum in the US is starting to cool and force investors to scale back their expectations for more aggressive Fed rate hike moves. This would be enough to exert some downward pressure on the US dollar and allow the EUR/USD pair to make it through the 50-day SMA resistance.

Conversely, upbeat figures are more likely to be overshadowed by a goodish recovery in the global risk sentiment, which should continue undermining the safe-haven greenback. The fundamental backdrop suggests that the path of least resistance for the USD is to the downside and up for the EUR/USD pair, which has been trending higher over the past two weeks or so.

Eren Sengezer, Editor at FXStreet, outlined important technical levels to trade the EUR/USD pair: “As of writing, EUR/USD was trading slightly above the 200-period SMA on the four-hour chart, which is currently located at 1.0580. In case the pair starts using that level as support, 1.0600 (Fibonacci 61.8% retracement of the latest downtrend, psychological level) aligns as interim resistance ahead of 1.0640 (static level) and 1.0660 (static level, former support).”

“On the downside, key support seems to have formed at 1.0560 (Fibonacci 50% retracement, 100-period SMA). A four-hour close below that level could attract bears and cause the pair to retreat toward 1.0520 (Fibonacci 38.2% retracement, 50-period SMA) and 1.0500 (psychological level),” Eren added further.

Key Notes

• EUR/USD Forecast: Euro could push higher as long as 1.0560 support holds

• EUR/USD closes in on 1.0600 amid risk flows-led USD slide

• EUR/USD bulls approach 1.0600 hurdle, US Durable Goods Orders, ECB’s Lagarde eyed

About US durable goods orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

- GBP/USD climbed to over a one-week high on Monday amid modest USD weakness.

- Dovish BoE expectations, Brexit woes acted as a headwind and capped the upside.

- Investors now look forward to the US economic data for short-term opportunities.

The GBP/USD pair gained some positive traction on Monday and shot to over a one-week high during the early part of the European session. Spot prices, however, struggled to capitalize on the move or find acceptance above the 1.2300 mark and have now surrendered a major part of the intraday gains.

The recent slump in commodity prices seems to have eased worries about the persistent rise in inflation and forced investors to scale back expectations for a more aggressive policy tightening by the Fed. Apart from this, a goodish recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - undermined the safe-haven US dollar. This, in turn, was seen as a key factor that offered some support to the GBP/USD pair, though the uptick lacked bullish conviction.

The incoming softer UK macro data has raised concerns over the British economic growth and been fueling recession fears. This, along with expectations that the Bank of England would opt for a more gradual approach towards raising interest rates, held back traders from placing aggressive bullish bets around the British pound. Apart from this, the UK-EU impasse over the Northern Ireland Protocol of the Brexit agreement further contributed to capping the gains for the GBP/USD pair, at least for the time being.

Hence, it will be prudent to wait for strong follow-through buying beyond last week's swing high, around the 1.2325 region, before positioning for any further appreciating move. Market participants now look forward to the US economic docket, featuring the release of Durable Goods Orders and Pending Home Sales data. This, along with the US bond yields and the broader market risk sentiment, might influence the USD price dynamics and produce short-term trading opportunities around the GBP/USD pair.

Technical levels to watch

- AUD/USD kicked off the new week on a weaker note, though lacked follow-through selling.

- The recent slide in commodities, Chinese economic woes acted as a headwind for the aussie.

- The risk-on impulse undermined the safe-haven USD and helped limit losses for the major.

The AUD/USD pair struggled to capitalize on Friday's goodish rebound from sub-0.6900 levels and met with a fresh supply on the first day of a new week. The pair maintained its offered tone through the first half of the European session and was last seen trading around the 0.6920 area, just a few pips above the daily low.

The recent slump in commodity prices turned out to be a key factor that continued acting as a headwind for the resources-linked Australian dollar. Adding to this, the fact that the Chinese economy is facing headwinds amid the resurgence of COVID-19 cases exerted additional downward pressure on the China-proxy aussie. That said, a combination of factors held back traders from placing aggressive bearish bets around the AUD/USD pair and helped limit deeper losses.

Investors turned optimistic amid hopes that inflation is nearing its peak and now seem to have scaled back their expectations for more aggressive rate hikes by the Fed. This was reinforced by a sharp corrective pullback in the US Treasury bond yields, which kept the US dollar bulls on the defensive. Apart from this, a generally positive risk tone around the equity markets further undermined the safe-haven greenback and offered some support to the risk-sensitive aussie.

From a technical perspective, the emergence of fresh selling at higher levels suggests that the recent downward trajectory witnessed since the beginning of this month is still far from being over. Hence, a subsequent fall back towards the monthly low, around the 0.6850 region, now looks like a distinct possibility. The AUD/USD pair could extend the fall further and eventually drop to challenge the YTD low, around the 0.6830-0.6825 region touched in May.

Market participants now look forward to the US economic docket, featuring the release of the Durable Goods Orders and Pending Home Sales data later during the early North American session. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the AUD/USD pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities around the major.

Technical levels to watch

Russia does not accept that it has defaulted on its external debt, the Kremlin said in a statement on Monday.

Additional takeaways

Russian gold and forex reserves are blocked unlawfully.

Russia made payment on euro bond coupons in May.

Euroclear not accepting Russia’s euro bond transaction 'is not our problem'.

Early Monday, Bloomberg reported that Russia has ''defaulted on its foreign-currency sovereign debt for the first time since 1918.

Market reaction

USD/RUB was last seen trading at 53.26, down 0.25% on the day.

GBP/USD has gained traction early Monday. As FXStreet’s Eren Sengezer notes, the pair faces next hurdle at 1.2360.

1.2280 aligns as first support

“GBP/USD is facing next resistance at 1.2360, where the Fibonacci 61.8% retracement of the latest downtrend is located. In case the pair manages to clear that hurdle, it could target 1.2400 (200-period SMA on the four-hour chart) and 1.2460 (static level, former support).”

“On the flip side, 1.2280 (Fibonacci 50% retracement) aligns as first support before 1.2250 (50-period SMA) and 1.2200 (Fibonacci 38.2% retracement).”

See: GBP/USD could edge up to the recent highs at 1.24 – ING

Gold has climbed to $1,840. Nonetheless, G7 planning import ban on gold from Russia is set to have a limited market impact, in the view of strategists at Commerzbank.

Inflation pressure to remain high in the short term

“The seven leading industrialised countries are planning at their summit to ban imports of gold from Russia. This may indeed explain the immediate market reaction. However, the actual impact on the gold market is likely to be too small to have any lasting influence on the price trend.”

“The development of inflation and interest rates will continue to have a greater bearing on the gold price. The inflation pressure is likely to remain high in the short term. This is positive for gold per se in its role as an inflation hedge. However, it also keeps up the pressure on central banks to raise interest rates more steeply, which is negative for gold per se as a non-interest-bearing investment. Much therefore points to a continuation of volatile sideways trending depending on which of the two influential factors happens to have the upper hand.”

- EUR/USD is extending gains to test 1.0600 in the European session

- The US dollar loses further ground amid a risk-on mood at full steam.

- Markets re-price central banks’ tightening plans ahead of US data, Lagarde.

EUR/USD is nearing 1.06000, building onto the Asian rebound in the European session on Monday, as positive global momentum continues and weighs heavily on the safe-haven US dollar.

European stocks climb over 1%, taking the upbeat cues from their Asian and US peers, as investors rethink whether the central banks’ will continue with their aggressive rate-hike track, in the face of slowing economic growth.

Futures pricing shows traders now anticipating the US Fed’s benchmark funds rate stabilizing around 3.5% from March next year, a revision lower from peviously pricing in rates zooming to around 4% in 2023.