- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- NZD/USD fades bounce off two-week low amid sluggish markets.

- RBNZ Chief Economist Conway justifies rate hikes as positive for NZ housing market fundamentals.

- Fears of economic slowdown join anxiety ahead of China’s PMIs, US Core PCE Price Index to exert downside pressure.

NZD/USD struggles to defend the corrective pullback from a fortnight low during Thursday’s Asian session. That said, the Kiwi pair takes rounds to 0.6220 as traders await key data from China and the US, while also showing no major reaction to comments from Reserve Bank of New Zealand (RBNZ) policymaker.

RBNZ Chief Economist Paul Conway defends the New Zealand (NZ) central bank’s hawkish monetary policy as he said, “Policy tightening will likely see actual house prices move back towards sustainable levels more in line with market fundamentals.”

However, RBNZ’s Conway couldn’t impress momentum traders amid the market’s cautious mood ahead of top-tier data from China and the US.

That said, the Kiwi pair dropped to a fortnight low during a three-day downtrend the previous day as Fed Chair Jerome Powell’s hawkish comments propelled the risk-off mood and the US dollar. Fed Chairman Jerome Powell mostly repeated his latest pledge to battle inflation with readiness to announce another 0.75% rate hike if needed. The Fed Boss also praised the US economic strength and helped the US dollar to remain firmer.

It should be noted that the final readings of the Q1 US Gross Domestic Product Annualized dropped to -1.6% versus the initial forecasts of -1.5%. The Personal Consumption Expenditure (PCE) Prices, on the other hand, rose more than 7.0% expected and prior readings to 7.1% during the stated period.

Against this backdrop, Wall Street closed mixed and the US Treasury yields dropped for the second day. It’s worth noting that the S&P 500 Futures remain downbeat and the US bond coupons also stay pressured by the press time.

Having failed to react to RBNZ’s Conway, NZD/USD traders await China’s NBS Manufacturing PMI and Non-Manufacturing PMI for June amid fears of recession. Forecasts suggest the headline NBS Manufacturing PMI rise to 50.5 from 49.6 whereas the Non-Manufacturing PMI could also jump to 52.5 versus 47.8 prior. Additionally, the Fed’s preferred version of inflation, namely the Core Personal Consumption Expenditure (PCE) Price Index, for May, expected to rise to 0.4% from 0.3% MoM, will also be important to watch for clear directions.

Technical analysis

Although a seven-week-old horizontal support area surrounding 0.6215-20 restricts the immediate downside of the NZD/USD, the pair buyers remain skeptical unless witnessing a clear break of the monthly resistance line, near 0.6280 by the press time.

- The oil prices have turned balance after a 4% fall ahead of the OPEC meeting.

- Western central banks have raised concerns over growth forecasts amid higher inflation rates.

- The expectations of additional oil output by the OPEC won’t be able to offset the supply worries.

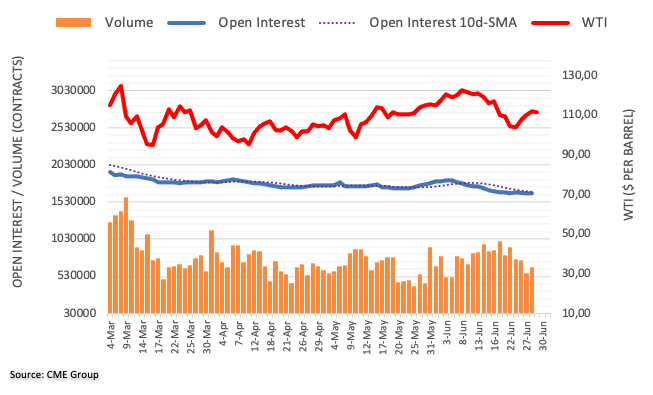

West Texas Intermediate (WTI), futures on NYMEX, is oscillating in a narrow range of $108.10-108.41 in the early Tokyo session. The black gold has turned sideways after displaying a steep fall from Wednesday’s high at $112.73. Investors have surrendered their longs from the oil counter amid optimism on additional oil supply in the OPEC meeting on Thursday. The oil prices have fallen more than 4% in the Asian session as Western central banks have shown concerns over the growth forecasts due to the rapid rate hike process.

Traders must be aware of the fact that the global economy is operating on an already tight oil market. The sanctions on Russia after it invaded Ukraine have restricted a significant amount of oil in the global supply. Fixing the imbalance in the demand-supply mechanism is not a cakewalk. However, the OPEC cartel will do its best to reduce the imbalance and may focus on bringing price stability.

It is worth noting that only two countries from the OPEC cartel carry the potential to release more oil: Saudi Arabia and United Arab Emirates (UAE). The dual is already enjoying more fund inflows due to higher prices and higher supply. Despite the merits of the two catalysts, the economies are unable to produce more oil due to production capacity constraints.

On the inventories front, the Energy Information Administration (EIA) has reported a significant fall in the oil inventories by US firms. The oil stockpiles slipped by 2.762 million barrels for the week ending June 24. However, the inventories of gasoline and distillates rose by 2.6 million barrels in total for the last two weeks.

The Reserve Bank of New Zealand's chief economist Paul Conway said the tide may well have turned against housing being a one-way bet for a generation of kiwis.

Immigration is unlikely to return quickly to pre-pandemic levels, contributing to slower population growth overall.

Longer-term, fundamentals that determine sustainable house prices may be changing.

More to come

- AUD/USD seeks fresh clues as bears flirt with seven-week-old support line.

- Fears of recession exert downside pressure amid inactive session.

- China’s official PMIs for June will be crucial considering the economic slowdown chatters.

- Fed’s preferred version of inflation to be eyed closely amid increasing hawkish bets.

AUD/USD holds onto the previous day’s bounce off important support while taking rounds to 0.6870 during Thursday’s inactive early Asian session. In addition to defending the corrective pullback, the Aussie pair also portrays the market’s anxiety ahead of important data from a major customer China.

Alike other major currency pairs, the AUD/USD also dropped versus the US dollar on Wednesday, printing a three-day south-run, amid a broad risk-off mood due to the fears of recession. In doing so, the quote failed to cheer firmer-than-expected Aussie Retail Sales for May, to 0.9% versus 0.4% market forecasts and 0.9% previous readouts.

Market sentiment worsened as traders fear that the central bankers’ aggression will lead to a slowing of economic growth. Adding to the sour sentiment were geopolitical and trade-linked fears surrounding Russia and China. While the West remains determined to levy more sanctions on Moscow, chatters over China’s likely failure to meet the optimistic growth target also gained attention and weighed on the AUD/USD prices, due to its risk barometer status.

That said, Fed Chairman Jerome Powell mostly repeated his latest pledge to battle inflation with readiness to announce another 0.75% rate hike if needed. The Fed Boss also praised the US economic strength and helped the US dollar to remain firmer.

Talking about data, the final readings of the Q1 US Gross Domestic Product Annualized dropped to -1.6% versus the initial forecasts of -1.5%. The Personal Consumption Expenditure (PCE) Prices, on the other hand, rose more than 7.0% expected and prior readings to 7.1% during the stated period.

Amid these plays, Wall Street closed mixed and the US Treasury yields dropped for the second day. It’s worth noting that the S&P 500 Futures remain downbeat and the US bond coupons also stay pressured by the press time.

To conclude, AUD/USD traders await China’s NBS Manufacturing PMI and Non-Manufacturing PMI for June amid fears of economic slowdown in the largest trading partner. A softer reading may weigh on the quote. Forecasts suggest the headline NBS Manufacturing PMI rise to 50.5 from 49.6 whereas the Non-Manufacturing PMI could also jump to 52.5 versus 47.8 prior.

Following that, the Fed’s preferred version of inflation, namely the Core PCE Price Index, for May, expected to rise to 0.4% from 0.3% MoM, will be crucial to watch for clear directions.

Also read: US PCE Inflation May Preview: Inflation becomes moot

Technical analysis

Given the AUD/USD pair’s sustained trading below a two-week-old descending resistance line and the 10-DMA, not to forget the bearish MACD signals, the quote is likely to break the adjacent key support line from May 12, near 0.6860. The same could direct the sellers towards the yearly low near 0.6830 and then to the 0.6800 round figure.

On the contrary, the 10-DMA and aforementioned resistance line, respectively around 0.6920 and 0.6935, guard the short-term recovery of the quote.

- USD/CHF is holding itself around 0.9550 and is expected to extend its recovery.

- Fed’s commitment to bringing price stability is supporting one more 75 bps rate hike.

- Lower Swiss ZEW Survey- Expectations have weakened the Swiss franc.

The USD/CHF pair is attempting to hold itself around 0.9550 after a responsive buying action on Wednesday. The asset witnessed a firmer rebound after slipping minutely below the psychological support of 0.9500. A responsive buying action indicates that the market participants found the asset a value buy and initiated fresh longs on the counter.

Considering the firmer fundamentals, bids will remain in favor of the greenback as the market participants have started bracing for a consecutive 75 basis point (bps) rate hike by the Federal Reserve (Fed) in July. The Fed is committed to bringing price stability to the US economy and the concept will demand a significant pace in hiking interest rates.

The commentary from Fed chair Jerome Powell in European Central Bank (ECB)'s annual Forum on Central Banking that delighted investors is that the US economy is strong enough and the labor market is so tight that they could bear the consequences of stepping up rates at a much faster pace. However, the issue with the rapid rate hiking process is that there is no guarantee that the interest rates will reverse to the targeted rate. Therefore, the market participants should start establishing in their subconscious mind that higher inflation for a prolonged period is for real now.

On the Swiss franc front, the underperformance from the ZEW Survey- Expectations have weakened the Swiss franc. The economic data landed at -72.7, lower than the expectations and the prior print of -70.7 and -52.6 respectively. Going forward, investors will keep an eye on the Real Retail Sales, which are seen at 3.8%, significantly higher than the prior release of -6%.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, drop for the third consecutive day by the end of Wednesday’s North American session. In doing so, the inflation gauge slumped to the lowest since January while flashing 2.36% level at the latest.

It’s worth noting that the one-month consumer inflation expectations, as per the data from the US Conference Board jumped to 8.0% versus 7.5%.

Given recent easing in the longer-term inflation expectations, the US dollar may find it difficult to extend the north-run. However, escalating fears of global economic slowdown, coupled with the hawkish Fedspeak, hints at the market’s rush towards the greenback.

That said, the US Dollar Index (DXY) refreshed its two-week top the previous day while piercing the 105.00 level.

Moving on, the Fed’s preferred version of inflation, namely the Core PCE Price Index, for May, expected to rise to 0.4% from 0.3% MoM, will be important to watch for clear directions.

Also read: US PCE Inflation May Preview: Inflation becomes moot

- USD/CAD fades bounce off 200-EMA, pares the biggest daily gains in a week.

- 50-EMA, seven-day-long horizontal area guards immediate upside.

- Three-week-old ascending trend line adds to the downside filters.

- Bullish MACD signals, sustained trading beyond key EMA favor buyers.

USD/CAD retreats from 1.2900 as buyers take a breather after the biggest daily jump in a week. In doing so, the Loonie pair eases from the 50-EMA and a short-term horizontal resistance during Thursday’s Asian session.

Given the quote’s sustained rebound from the 200-EMA, backed by the bullish MACD signals, USD/CAD prices are likely to extend the latest run-up.

However, a convergence of the 50-EMA and one-week-old horizontal area, surrounding 1.2900-05, becomes necessary for the buyers to keep reins.

Following that, a downward sloping resistance line from early June, around 1.2960, will act as an additional filter to the north before directing buyers towards the monthly top of 1.3078.

It should be noted that the 1.3000 psychological magnet and the previous weekly peak of 1.3017 could act as buffers during the rise.

On the contrary, a three-week-long rising trend line, at 1.2850 by the press time, restricts the USD/CAD pair’s immediate downside ahead of the 200-EMA level of 1.2832.

Should the pair drop below 1.2832, the latest swing low near 1.2820 and the 1.2800 threshold may test bears before giving them control.

USD/CAD: Four-hour chart

Trend: Further upside expected

- GBP/USD is expected to record more losses on downsizing growth prospects in the UK economy.

- The UK economy is facing the headwinds of a severe slippage in the real income of the households.

- Higher US PCE has escalated the odds of a consecutive 75 bps rate hike by the Fed.

The GBP/USD pair has witnessed a sigh of relief after nosediving to near the critical support of 1.2100 as the asset has started balancing around 1.2121. However, this doesn’t warrant a halt in the downside move as more downside is on the cards. The pessimist commentary from Bank of England (BOE) Governor Andrew Bailey on the growth prospects of the UK economy has weakened sterling against the greenback.

As per the commentary from BOE’s Bailey, that “We are being hit by a very large real income shock" signifies that the accelerating inflation rate has squeezed the ‘paychecks’ of the households in the pound area. Their heavy personal spending expenditures are now weighed by higher prices rather than higher quantities as the inflation rate has climbed above 9%.

Meanwhile, the extended recovery in the US dollar index (DXY) has dented the appeal of the risk-perceived currencies. The DXY is balancing above 105.00 and is expected to test its 19-year high at 105.79. The odds of a consecutive 75 basis point (bps) interest rate hike by the Federal Reserve (Fed) have advanced on the higher-than-expected US Personal Consumption Expenditure (PCE). The economic data has improved to 7.1% from the prior print of 7%.

Going forward, investors will focus on the release of the UK Gross Domestic Product (GDP) numbers. As per the market consensus, the UK GDP is seen stable at 8.7% and 0.8% on an annual and quarterly basis respectively. On the dollar front, the release of the US ISM PMI on Friday will be of key importance. A preliminary estimate for the economic data is 55 vs. 56.1 recorded earlier.

- EUR/USD holds lower ground near two-week low after falling the most in 13 days.

- Risk-off mood, measurably hawkish comments from Fed’s Powell underpinned US dollar strength.

- ECB’s Lagarde, mixed EU data failed to impress Euro bulls amid recession fears in the bloc.

- US Core PCE Price Index will be the key data to watch for today.

EUR/USD bears take a breather around mid 1.0400s, pressured near 1.0440 by the press time, as sour sentiment joins anxiety ahead of the Fed’s preferred inflation version. The latest inaction, however, could be linked to the general market dormancy during the initial hours of the Asian session.

Risk appetite remains weak as traders fear that the central bankers’ aggression will lead to a slowing of economic growth. Adding to the sour sentiment were geopolitical and trade-linked fears surrounding Russia and China.

Fed Chairman Jerome Powell mostly repeated his latest pledge to battle inflation with readiness to announce another 0.75% rate hike if needed. The Fed Boss also praised the US economic strength and helped the US dollar to remain firmer.

ECB President Christine Lagarde, on the other hand, signaled chances of a heavier rate increase in September while also expecting positive growth rates. However, ECB Chief Economist Philip Lane warned about a double-sided risk of higher inflation for longer and an upcoming recession, in an interview with CNBC on Tuesday.

Talking about the data, Eurozone Consumer Confidence remained static at around -23.6 for June while preliminary readings of Germany’s Harmonized Index of Consumer Prices eased to 8.2% YoY versus 8.8% expected and 8.7% prior for June.

On the other hand, the final readings of the Q1 US Gross Domestic Product Annualized dropped to -1.6% versus the initial forecasts of -1.5%. The Personal Consumption Expenditure (PCE) Prices, on the other hand, rose more than 7.0% expected and prior readings to 7.1% during the stated period.

It should be noted that the risk-aversion wave drowned Wall Street and the US Treasury yields while fueling the US Dollar Index (DXY).

Looking forward, German Retail Sales for May, expected -2.0% versus -0.4% prior, will precede the Fed’s preferred version of inflation, namely Core PCE Price Index, for May, expected to rise to 0.4% from 0.3% MoM.

Given the fears of economic slowdown, a stronger print of inflation-linked data could weigh on the pair.

Technical analysis

A sustained reversal from the 21-DMA, around 1.0560 by the press time, directs EUR/USD bears towards the seven-week-old support line near 1.0420.

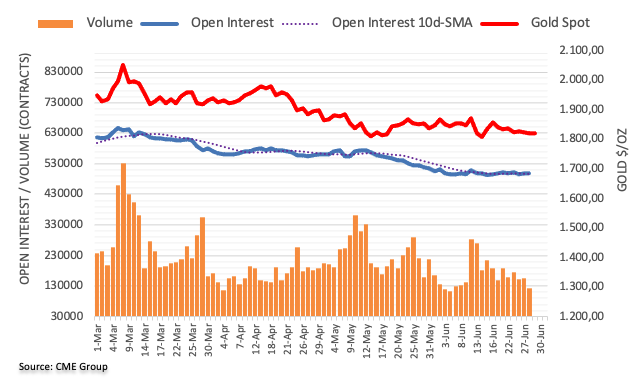

- Gold price is establishing below $1,820.00 on hawkish commentary from Western central banks.

- The DXY is aiming to recapture its 19-year high as US PCE has climbed to 7.1%.

- The precious metal is hovering around the lower portion of the Descending Triangle.

Gold price (XAU/USD) has turned sideways after displaying wild swings in the New York session. The precious metal is oscillating in a narrow range of $1,814.96-1,819.13 after reversing its gains. The speech from Federal Reserve (Fed) chair Jerome Powell brought a sense of volatility in the gold prices and his hawkish commentary was committed to bringing price stability to the US economy.

Investors should start discounting a consecutive rate hike of 75 basis points (bps) as accelerating inflation has become invincible for the US households and they have to face its consequences. The comments from European Central Bank (ECB) President Christine Lagarde that returning to a lower inflation rate is not possible now. The commentary spooked the FX arena and risk-sensitive currencies took a hit.

Meanwhile, the US dollar index (DXY) is aiming to recapture its 19-year high at 105.79 on an improvement in US Personal Consumption Expenditure on a quarterly basis. The US PCE landed at 7.1% from the prior print of 7%. No wonder, the improvement in PCE must bank upon higher prices rather than higher demand. Going forward, the focus will remain on the Core PCE Price Index, which may decline to 4.7% from the prior print of 4.9% on an annual basis.

Gold technical analysis

The gold prices are trading near the potential support of the Descending Triangle pattern. The downward sloping trendline of the above-mentioned chart pattern is plotted from June 16 high at $1,857.58 while the horizontal support is placed from June 16 low at $1,815.73. The 20-period Exponential Moving Average (EMA) at $1,819.36 is acting as a major resistance for the counter. Meanwhile, the Relative Strength Index (RSI) (14) is holding itself above 40.00 levels, however, a slippage below the same will bring more weakness in the bright metal.

Gold hourly chart

- AUD/USD pressured on the strength in the greenback.

- Investors weigh the rhetoric of the Fed's chair, Powell.

At 0.6880, AUD/USD is under pressure into the final moments pre rollover and is down some 0.37%. The bears were in town despite the prior day's positive Retail Sales. Instead, markets were driven by comments from the Federal Reserve's Chairman, Jerome Powell. He explained that there is a risk the US central bank's interest rate hikes will slow the economy too much. the central banker added that the bigger risk, however, is persistent inflation.

Powell made these comments at a European Central Bank conference. The dollar index (DXY), which measures the greenback against six counterparts, rallied to a high of 105.149 from a low of 104.356 as investors sought safety in US assets as stocks declined globally due to the mounting risk of a recession.

Meanwhile, the Aussie had otherwise found some support on Wednesday as upbeat domestic data provided a temporary distraction from worries about a global recession. reuters reported that Australian Retail Sales surprised with a strong increase of 0.9% in May handily topping forecasts of a 0.4% gain. The news agency reported that Sales were up a sizable 10.4% on May last year, though some of that is due to higher prices rather than volumes.

The fresh insight into the consumer has encouraged demand for the local currency due to the expectations that the Reserve Bank of Australia (RBA) will have more confidence that consumers can handle higher interest rates as it prepares for another likely hike at its July policy meeting next week. RBA Governor Philip Lowe has previously suggested that drastic tightening would seriously damage the economy. Rates are seen up around 3.25% by the end of the year and near 4% in 2023 and investors are odds-on for another rise of 50 basis points to 1.35%, and for a similar move in August.

For the day ahead, both the Manufacturing Purchasing Managers Index (PMI) and the official Non-Manufacturing PMI are released for China.

Here is what you need to know for the day ahead, Thursday June 30:

The forex space was driven by comments from the Federal Reserve's Chairman, Jerome Powell. He explained that there is a risk the US central bank's interest rate hikes will slow the economy too much. He added that the bigger risk, however, is persistent inflation. Powell made these comments at a European Central Bank conference.

Investors continue to worry that an aggressive push by the Fed to dampen inflation will drag the economy into recession and that has put a bid back into the safe-haven US dollar, sinking all other ships. Inflation fears are being fanned further by oil prices, which extended their rise into the fourth day.

The dollar index (DXY), which measures the greenback against six counterparts, rallied to a high of 105.149 from a low of 104.356 as investors sought safety in US assets as stocks declined globally due to the mounting risk of a recession. Nevertheless, the US dollar index stayed below the two-decade high of 105.79 pinged two weeks ago.

The euro fell to 1.0435 from a high of 1.0535 with EU consumer confidence slipping further below the breakeven point in June. Markets are looking to the EU Unemployment on Thursday and inflation on Friday. These data points will be key ahead of next month's July 21European Central Bank's monetary policy committee meeting when the central bank is expected to begin its tightening cycle.

GBP/USD also fell, sliding to a low of 1.2105 ahead of UK Gross Domestic Product data that will be released Thursday. The Northern Ireland protocol noise coupled with the sentiment surrounding the Bank of England are critical features in the outlook for sterling in the near term. The Bank of England is expected to maintain its tightening cycle to tamp down inflation after a 25 basis point increase at the last meeting. However, it will not necessarily have to act "forcefully" to get inflation under control, according to Governor Andrew Bailey who spoke on Wednesday, adding there were signs of an economic slowdown taking hold in Britain.

USD/CAD rallied to a high of 1.2900 ahead of Canada's GDP which will be released Thursday. traders will look ahead to next month's July 13 interest rate decision from the Bank of Canada where the expectations are for further monetary policy tightening at after June's 50 basis point increase.

USD/JPY was an up and down day trading between 135.76 and 137.00 and ended the day in a phase of consolidation in a key area on the hourly chart around 136.60.

Gold for August delivery closed down US$3.70 to US$1,817.50 per ounce and spot stuck to a narrow range between $1,812 and $1,833 while US bond yields fell, which helped to buoy the non-yeilding precious metal. The yield on the US 10-year note fell to a low of 3.089%. Bitcoin was a touch stronger. Its price now tightly fluctuates around the $20,000 level – support that Bitcoin bulls hope to continue holding. WTI was lower by 2.4% around the Wall Street close even after a report showed an unexpectedly large drop in US inventories last week.

For the day ahead, both the Manufacturing Purchasing Managers Index (PMI) and the official Non-Manufacturing PMI are released for China.

- USD/JPY is under pressure within a bullish trend.

- The bears need a break of the hourly structure but the bulls remain in control.

USD/JPY is under pressure in the latter part of the North American session and there are a couple of scenarios identified according to the market structure on the hourly time frames as follows:

USD/JPY H1 bullish scenario

The price is in an ascending trend but the W-formation in a reversion pattern that would be expected to draw in the price towards the neckline and the trend line support as illustrated above.

There are two areas of hourly price imbalances (PI) above and below the current market and it is a question of which area will be mitigated first. In a bullish scenario, the price could move lower to collect liquidity from the imbalance of price to fill buy orders leading to a subsequent rally and potential upside continuation.

USD/JPY H1 bearish scenario

In a bearish scenario, the price could move higher to fill the sell orders which could lead to a surge lower for a test of support. If the offers overwhelm the bids at that juncture, then a continuation lower could evolve on a break of structure, BoS.

EU's Sefcovic has crossed the worse saying that the EU cannot accept Northern Ireland protocol being illegally scrapped. He has explained that zero checks on Great Britain and Northern Ireland trade are 'not an option'.

This followed the NI protocol bill being passed in its first hurdle, with MPs voting 295 to 221 in favour despite heavy criticism from some Conservative backbenchers, including former prime minister Theresa May, who said the move is illegal and unnecessary.

The second reading was the first opportunity MPs have had to vote on the controversial proposals, which the foreign secretary, Liz Truss, said were “legal and necessary”. Boris Johnson predicted earlier on Monday that the laws could go through “fairly rapidly” and be on the statute books by the end of the year. It is now expected to be fast-tracked through parliament with a condensed committee stage of just three days, instead of the usual two or three weeks.

News related to this situation is seen as negative for the pound.

- AUD/USD bears are moving in as the US dollar strengthens in risk-off.

- DXY has rallied to beyond 105 the figure, dragging commodity currencies lower.

At 0.6875, AUD/USD is lower on the day by some 0.4% as the US dollar springs back to life, rallying through the 105 figure as measured against a basket of currencies via the DXY index. The dollar index (DXY), which measures the greenback against six counterparts, ticked up 0.51% to 105.08. The two-decade high of 105.79 was struck on June 15. Quarter-end rebalancing of portfolios is also feeding into higher volatility in financial markets.

The greenback has edged higher on Wednesday as the euro gave back earlier gains despite European Central Bank President Christine Lagarde saying the era of ultra-low inflation that preceded the pandemic is unlikely to return. The ECB is widely expected to raise interest rates in July for the first time in a decade, following its global peers, to try to cool accelerating inflation, though economists are divided on the magnitude of any hike.

Federal Reserve chair Jerome Powell said there was a risk that interest rate increases will slow the economy too much, but persistent inflation was the bigger worry. Additionally, US stocks fell on Wednesday as traders' concern over the impact of hefty rate increases on the US economy bites. US data showed that growth contracted in the first quarter amid a record trade deficit. This is on the heels of a report from Tuesday that showed consumer confidence hit a 16-month low.

Eyes on the RBA

Meanwhile, the Aussie had otherwise found some support on Wednesday as upbeat domestic data provided a temporary distraction from worries about a global recession. reuters reported that Australian Retail Sales surprised with a solid increase of 0.9% in May handily topping forecasts of a 0.4% gain. The news agency reported that Sales were up a sizable 10.4% on May last year, though some of that is due to higher prices rather than volumes.

The data has encouraged demand for the Aussie due to the expectations that the Reserve Bank of Australia (RBA) will have more confidence that consumers can handle higher interest rates as it prepares for another likely hike at its July policy meeting next week. RBA Governor Philip Lowe has previously suggested that drastic tightening would seriously damage the economy. Rates are seen up around 3.25% by the end of the year and near 4% in 2023 and investors are odds-on for another rise of 50 basis points to 1.35%, and for a similar move in August.

Net AUD short positions fell for a third consecutive week following the hawkish comments from RBA Governor Lowe and more optimism regarding the outlook for China’s economy could bring further support in the next set of data. In this regard, we saw the Aussie rally when China slashed the quarantine time for inbound travellers by half on Tuesday. Higher commodity prices have also had a positive impact on Australia’s terms of trade.

''We expect AUD/USD to hold close to current levels on a 1-month view and rise moderately to the 0.73 area by year-end,'' analysts at Rabobank said.

St. Louis Fed President James Bullard said in an essay written on Tuesday that lessons from 1974 and 1983, when the Federal Open Market Committee face similar inflation levels to today's, demand that policymakers get "ahead of inflation."

"In particular, the takeaway is that getting ahead of inflation will keep inflation low and stable and promote a strong economy," the central banker wrote.

"From early 1994 to early 1995, the FOMC raised the policy rate by 300 basis points (going from 3% to 6%) in an environment where inflation was generally moderate," Bullard said.

"Similar to the 1983 experience, the associated ex-post real interest rate at that time was high. Again, the result was not a recession but instead an expansion, which lasted until 2001."

"The FOMC kept the policy rate relatively high above the inflation rate, and therefore real interest rates were relatively high. The subsequent macroeconomic performance—with respect both to inflation and to output and labour markets—was very good, which shows the merits of staying ahead of inflation as opposed to falling behind."

DXY update

The dollar index (DXY), which measures the greenback against six counterparts, ticked up 0.51% to 105.08. The two-decade high of 105.79 was struck on June 15.

The greenback has edged higher on Wednesday as the euro gave back earlier gains despite European Central Bank President Christine Lagarde saying the era of ultra-low inflation that preceded the pandemic is unlikely to return.

The ECB is widely expected to raise interest rates in July for the first time in a decade, following its global peers, to try to cool accelerating inflation, though economists are divided on the magnitude of any hike.

- Gold reversed from two-day highs and is back near weekly lows.

- US dollar rises across the board following comments from Portugal.

Gold prices dropped sharply during the American session, erasing daily gains. XAU/USD peaked at $1833, the highest level in two days and then turned lower, falling to $1814, slightly above the daily low of $1811.

The reversal took place amid a rally of the US dollar. The DXY jumped toward 105.00, the highest level in a week. It is rising for the second day in a row as market concerns remain in place.

US yields eased on Wednesday even as central bankers offered a hawkish tone from Portugal where the European Central Bank is having its annual meeting. Fed Chair Powell warned about the risk to the economy from higher interest rates; however made it clear the biggest risk is losing price stability. ECB President Lagarde said they will consider the “anti-fragmentation” tool at the July meeting.

Short-term outlook

The bounce from $1811 weakened before reaching at $1835, a short-term downtrend line. A break above the mentioned level should open the doors to more gains, targeting initially $1845 and then levels above $1850.

While under $1835 the outlook is biased to the downside, with rising risks of more losses below the 20-Simple Moving Average in four-hour charts (currently at $1825).

XAU/USD is testing $1815 and below attention would turn to $1811 (June 29 low) and then to $1804 (June 14 low), the last defense of $1800.

Techincal levels

- GBP/USD witnessed heavy follow-through selling and dropped to a nearly two-week low.

- Fed Chair Powell’s hawkish remarks boosted the USD and exerted downward pressure.

- Comments by BOE Governor Bailey did little to impress bulls or lend support to the pair.

The GBP/USD pair added to the previous day's heavy losses and remained under intense selling pressure for the second successive day on Wednesday. The downward trajectory picked up pace during the early North American session and dragged spot prices to the 1.2100 neighbourhood, or a nearly two-week low.

The US dollar attracted some buying in reaction to hawkish remarks by Fed Chair Jerome Powell and shot to its highest level since June 17. This, in turn, exerted downward pressure on the GBP/USD pair. Speaking at the ECB Forum in Sintra, Powell reaffirmed bets for more aggressive rate hikes and said the US economy is well-positioned to handle tighter policy.

Powell further added that the Fed remains focused on getting inflation under control and the market pricing is pretty close to the dot plot. In contrast, the Bank of England Governor Andrew Bailey sounded cautious and noted that there were clear signs that the economy is slowing. "We are being hit by a very large real income shock," Bailey added further.

Bailey also said that it's very hard to separate the effects of Brexit from covid. This suggested that the BoE would opt for a more gradual approach towards hiking interest rates, which, in turn, weighed on the British pound. Bailey, however, said that the BOE would have to act more forcefully if it saw persistent inflation and the situation left no other options on the table.

Apart from this, sliding US Treasury bond yields, along with a generally positive tone around the US equity markets, might cap gains for the safe-haven USD and limit deeper losses for the GBP/USD pair. That said, sustained weakness below the 1.2100 round-figure mark would be seen as a fresh trigger for bearish traders and set the stage for a further depreciating move.

Technical levels to watch

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Lagarde: "Fragmentation is a threat inherent in the eurozone structure."

Lagarde: "Will consider anti-fragmentation tool at July policy meeting."

Powell: "There's certainly a threat of de-globalization."

Powell: "The Fed’s revised policy framework is based on old environment."

Market reaction

The EUR/USD pair continues to edge lower and was last seen losing 0.35% on the day at 1.0482.

- USD/TRY trades with modest losses near 16.60.

- Türkiye Economic Confidence Index eased to 93.60 in June.

- Investors continue to monitor the recent move by the government.

Further gains in the Turkish currency now motivates USD/TRY to hover around the 16.60 region, down marginally for the day.

USD/TRY appears supported near 16.00

USD/TRY gives away part of Tuesday’s advance and seems to resume the downside despite the better mood surrounding the greenback on Wednesday.

Indeed, the lira looks bid as investors continue to closely follow the effects of Friday’s new government’s measure to boost the domestic currency. It is worth recalling that the Turkish bank regulator announced on Friday a ban on lira loans to companies holding more than TL15M if that amount surpasses 10% of the company’s total assets or annual sale revenues.

In the wake of the publication of this new interventionist measure, USD/TRY tumbled to the 16.00 area on Monday from Friday’s tops near 17.40, or nearly 8%.

In the calendar, Türkiye Economic Confidence Index dropped to 93.60 in June (from 96.70).

What to look for around TRY

USD/TRY keeps digesting the recent sharp decline following another intervention in the FX markets by Ankara.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine, although the effects of this new measure aimed at supporting the de-dolarization of the economy will also have its say in the price action around spot.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Türkiye this week: Economic Confidence (Wednesday) – Trade Balance (Thursday) – Manufacturing PMI (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is losing 0.01% at 16.6373 and a breach of 16.0365 (monthly low June 27) would aim to 15.6684 (low May 23) and finally 15.2057 (100-day SMA). On the flip side, the next up barrier emerges at 17.3759 (2022 high June 23) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level).

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Powell: "Dollar strength is disinflationary at the margins."

Powell: "We working hard to get smarter about the supply side."

Bailey: "We do not target foreign exchange rate."

Bailey: "We are not surprised by the path of sterling."

Market reaction

GBP/USD stays on the back foot after these comments and was last seen losing 0.55% on the day at 1.2115.

While testifying before the Treasury Committee on Wednesday, Swati Dhingra, who is due to become a Bank of England policymaker in August, said that sterling weakness does not tend to boost UK exports, as reported by Reuters.

Additional takeaways

"UK's trade openness appears to have declined more than peers, hard to be fully certain that is due to Brexit."

"I do not think Brexit has yet caused the boe to pursue a more aggressive interest rate policy."

"Brexit unlikely to change UK economic structure, will drag on real wages."

"Brexit trade agreement likely to lead to 1.8% fall in real wages in medium-term."

Looks like there is more to come on inflation, from higher import costs being passed on."

"I am most uncertain whether quantitative tightening will reduce inflation."

"QT is a very new policy, we do not yet know its impacts, past QE impact on inflation unclear."

"Best to take a gradual approach to QT, learn as we go along."

"Giving interest rate paths for individual MPC members would cause confusion."

Market reaction

GBP/USD continues to push lower and was last seen losing nearly 0.6% on the day at 1.2112.

- USD/JPY scaled higher for the fourth straight day and shot to a fresh 24-year peak on Wednesday.

- Fed Chair Jerome Powell’s hawkish remarks boosted the USD and remained supportive of the move.

- Retreating US bond yields might turn out to be the only factor capping the upside for spot prices.

The USD/JPY pair prolonged a multi-day-old ascending trend and gained follow-through traction for the fourth successive day on Wednesday. The buying interest picked up pace during the early North American session and pushed spot prices to a fresh 24-year high, with bulls now aiming to conquer the 137.00 round-figure mark.

The US dollar caught fresh bids and shot to a one-week high after Fed Chair Jerome Powell reaffirmed bets for a more aggressive policy tightening by the US central bank. Speaking at the ECB Forum in Sintra, Powell said that the US economy is in strong shape and is well-positioned to handle tighter policy. He further added that the Fed remains focused on getting inflation under control and the market pricing is pretty close to the dot plot.

This helped offset a downward revision of the US Q1 GDP, showing that the economy contracted by 1.6% against the 1.5% fall estimates previously, and provided a goodish lift to the buck. Furthermore, Powell's hawkish remarks validated a big divergence in the policy stance adopted by the Fed and the Bank of Japan. This, in turn, weighed on the Japanese yen and further contributed to the strong bid tone surrounding the USD/JPY pair.

That said, declining US Treasury bond yields has resulted in the narrowing of the gap between the US-Japan rate differential. Apart from this, worries about a possible global recession might offer some support to the safe-haven JPY and hold back traders from placing fresh bullish bets around the USD/JPY pair, at least for the time being.

Nevertheless, the bias still seems tilted firmly in favour of bullish traders and any meaningful pullback might still be seen as a buying opportunity. Even from a technical perspective, move beyond the previous YTD peak might have set the stage for an extension of the USD/JPY pair's upward trajectory towards the 138.00 round-figure mark.

Technical levels to watch

A barrel of Brent Oil last traded at around $110. In mid-June, the price was still around $125. Economists at Commerzbank expect prices to drop towards $95 by end-2022.

Oil market between supply risks and demand concerns

“In the short-term, the massive release of oil reserves by the major consuming countries will provide relief.”

“The demand outlook remains uncertain: China's strict Zero-Covid strategy still threatens to hamper oil demand with new lockdown measures. High energy prices and tighter monetary policy are also expected to leave their mark.”

“The price of a barrel of Brent oil should continue to trade above $100 for now, but fall back again in the second half of the year to $95 by year-end.”

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Powell: "We are very strongly committed to our tools to bring down inflation."

Powell: "Is there a risk we would go too far? Yes. Not the biggest risk."

Powell: "The bigger risk is failing to restore price stability."

Powell: "Once deanchoring can be observed, the cost of fighting inflation is too high."

Powell: "If deanchoring observed, the fed has fallen behind the curve."

Bailey: "Clear that the economy is slowing."

Bailey: "War and energy are the major risk factors."

Bailey: "There will be a further step up in UK inflation."

Market reaction

The US Dollar Index continues to push higher and was last seen rising 0.37% at 104.87.

Metals prices have been under pressure for weeks. Although the market could suffer further falls, economists at Commerzbank expect metals prices to soar in the coming year.s

Supply will not be able to keep pace with demand in the long term

“If the economy does lose momentum or even slides into recession in the major economies, this is unlikely to leave metals unscathed. In this scenario, we expect metals prices to fall further in the coming months. However, metals prices should also turn upward again at a correspondingly early stage if, for example, the view prevails that the US Federal Reserve is attempting to push the US economy out of recession again with interest rate cuts in the coming year.”

“We firmly believe that many metals prices will rise significantly in the coming years and mark new record highs. This is because metals such as copper, aluminium and nickel are essential in the desired decarbonization of the economy.”

“Supply will not be able to keep pace with demand in the long term, which justifies significantly higher metals prices.”

Central bank governors are set to speak at the European Central Bank’s (ECB's) Sintra conference. However, gold is unlikely to break its recent trading range, strategists at TD Securities report.

Hawkish Fed regime clashes with recession fears

“Central banker headlines will hit the wire today with Fed Chair Powell set to speak on a panel at the ECB's Sintra conference, but gold markets are set to remain locked firmly in the recent trading range.”

“The yellow metal is being pulled in two directions as a hawkish Fed regime clashes with recession fears. After all, a Fed hiking cycle tends to be associated with rising recession risks, with the US5-30s curve already pointing to an elevated probability of a recession in the next twelve months. Notwithstanding, this hiking cycle differs from recent historical analogs as the Fed's ability to control inflation is limited, given that the supply-side is disrupted.”

“Gold bugs sniffing out a potential stagflationary outcome associated with lower growth but lingering inflation should consider that central banks, facing a credibility crisis, could also continue to raise rates for longer than they otherwise would. In this scenario, pricing for a Fed pivot would be less associated with recession odds than in prior episodes.”

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Powell: "Markets since last fall, by and large, have been pretty well aligned with where the Fed is going."

Powell: "Market pricing indicates investors understand where the Fed is aiming to go."

Powell: "The shape of the yield curve is not a top-line worry."

Market reaction

The dollar continues to gather strength against its rivals and the US Dollar Index was last seen rising 0.3% on the day at 104.80.

Economists at TD Securities expect industry-level GDP to rise by 0.3% in April. The Canadian data will have little to no impact on the loonie, with the USD/CAD pair expected to find solid support at 1.28.

Relief in risk assets to be short-lived

“We expect industry-level GDP to rise by 0.3% in April, in line with the market consensus and slightly above the flash estimate for a 0.2% rise.”

“April's data, let alone an on-consensus GDP print, will have no meaningful impact on the CAD.”

“Data will inevitably get worse as the impact of higher rates filters in. Reprieves in risk assets are also likely to be short-lived. Thus, USD/CAD dips should ultimately be faded. Support near 1.28.”

- EUR/USD adds to the weekly leg lower around 1.0500.

- Extra losses appear likely in the short-term horizon.

EUR/USD adds to the recent weakness and revisits the 1.0480 region on Wednesday, where some initial support turned up.

The inability to leave behind the 4-month line near 1.0650 should keep the downside pressure unchanged around the pair. Against that, extra losses are predicted to remain in the pipeline, although another visit to the June low at 1.0358 seems out of favour for the time being.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1119.

EUR/USD daily chart

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Bailey: "Task is to return to low inflation."

Bailey: "We are being hit by a very large real income shock."

Bailey: "If we see greater persistence of inflation, we will have to act more forcefully."

Bailey: "Situation leaves options on the table."

Lagarde: "Recovery in services is underway, supporting the economy."

Lagarde: "Hopeful fiscal policy will target supporting most vulnerable, not broad segments of the population."

Market reaction

The GBP/USD stays under bearish pressure and was last seen losing 0.3% on the day at 1.2145.

GBP/USD slumps to mid-1.21s. Economists at Scotiabank note that cable could fall as low as the mid-1.20s.

Resistance aligns at the 1.22 area

“The technical picture for sterling points to losses to the 1.21 figure amid its ongoing failure to hold the 1.23 handle on the five occasions it has broken above the figure in the past week – and the quick selloffs that have followed some of these moves.”

“Aside from the daily low of 1.2154, there are no obvious support markers until the 1.2100/10 zone and losses can quickly follow to the mid-1.20s.”

“Resistance is the 1.22 area with the daily high at ~1.2215 and the mid-1.22s subsequently.”

- Gold reversed an intraday dip to a two-week low and climbed back closer to the $1,835 level.

- Retreating US bond yields kept the USD bulls on the defensive and extended some support.

- The dismal US Q1 GDP print added to recession fears and further benefitted the safe-haven metal.

- Hawkish Fed expectations turned out to be the only factor that capped gains for the XAUUSD.

Gold attracted some dip-buying near the $1,812 region, or a two-week low touched earlier this Wednesday and rallied to a fresh daily high during the early North American session. The XAUUSD was last seen trading just below the $1,835 level, up over 0.65% for the day.

Uncertainty over the pace of rate hike by the Federal Reserve dragged the US Treasury bond yields lower and failed to assist the US dollar to capitalize on its modest intraday gains. This, along with growing recession fears, acted as a tailwind for the safe-haven gold.

Investors remain concerned that a more aggressive move by major central banks would pose challenges to the global economic recovery. The worries were further fueled by a downward revision of the US Q1 GDP, showing that the economy contracted by 1.6% against the 1.5% estimated.

That said, the overnight hawkish comments by New York Fed President John Williams and San Francisco’s Mary Daly lifted bets for a faster policy tightening. Furthermore, Fed Chair Jerome Powell said that the US economy is in strong shape and is well-positioned to handle tighter policy.

Speaking at the ECB Forum in Sintra, Powell added that our aim is to have growth moderate and there are pathways, though have gotten narrower, to get back to 2% inflation with a strong labor market. This was seen as the only factor cap gains for the non-yielding gold.

Even from a technical perspective, the recent repeated failures near the very important 200-day SMA favours bearish traders. Hence, any subsequent move could be seen as a selling opportunity and runs the risk of fizzling out rather quickly, warranting caution for bulls.

Technical levels to watch

Economists at Rabobank expect the Riksbank to hike its policy rate by 50 basis points (bps) at Thursday’s meeting. Nevertheless, this move it is improbable to lift the krona in the short-term.

50 bps?

“We expect that the Riksbank will opt for a 50 bps move tomorrow, not least to prevent the value of the SEK plunging (a situation which could worsen the inflationary outlook). However, it is possible that the Riksbank’s window of opportunity for rate hikes could be shorter than it appeared in the spring.”

“An ‘as expected’ 50 bps move may not be sufficient to inject much strength into the SEK near-term.”

“On balance we expect EUR/SEK to edge back towards the 10.40/10.30 area on a three to six-month view.”

See – Riksbank Preview: Forecasts from five major banks, joining the 50 bps club

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Powell: "Households are overall in a strong state, the same is true for businesses."

Powell: "The labour market is tremendously strong."

Powell: "The economy can withstand monetary policy moves."

Powell: "Our aim is to have growth moderate."

Powell: "There are pathways to go back to 2% inflation with a strong labour market; no guarantee."

Powell: "Events of the last few months made the Fed's job more challenging."

Powell: "The pathway has gotten narrower."

Market reaction

The EUR/USD pair struggles to gain traction and was last seen posting small daily losses at 1.0508.

EUR/USD is on the back foot. The pair is set to extend its downfall, however, the 1.05 level holds for now, economists at Scotiabank report.

Bullish progress dented

“Multiple failures to hold a bid above 1.06 (and above its 50- day MA) and the correction over the past 24 hours would suggest the EUR will continue on its multi-month downtrend. But it is still too early to call for a significant leg lower while the 1.05 level (and high 1.04s) continues to hold.”

“Support is the daily low of 1.0486 followed by 1.0469 and the mid-1.04s.”

“Resistance is 1.0535/40 and ~1.0560 ahead of the big figure.”

Europen Central Bank (ECB) President Christine Lagarde, FOMC Chairman Jerome Powell and Bank of England (BOE) Governor Andrew Bailey speak on the policy outlook at the ECB's annual Forum on Central Banking.

Key quotes

Lagarde: "We are unlikely to go back to an environment of low inflation."

Lagarde: "Inflaiton expectations are much higher than before."

Powell: "Our job is to find price stability even during new forces of inflation."

Powell: "Reversal of globalisation could mean lower growth in places."

Powell: "The US economy is strong shape."

Market reaction

The EUR/USD pair struggles to gain traction and was last seen posting small daily losses at 1.0508.

- DXY retreats to the 104.50 region after failing near 104.70.

- The surpass of 105.00 should expose a test of the 2022 high.

DXY looks to add to Tuesday’s gains, although the bull run seems to have faltered around the 104.70 zone on Wednesday.

Ideally, the index should surpass the weekly high near 105.00 (June 22) in the near term to allow for the recovery to gather momentum and attempt a visit to the nearly 20-year peak in the 105.80 zone (June 15).

As long as the 4-month line near 102.25 holds the downside, the near-term outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen bullish while above the 200-day SMA at 98.01.

DXY daily chart

- AUD/USD trimmed a part of its intraday losses to a two-week low, though lacked follow-through.

- Sliding US bond yields acted as a headwind for the USD and offered some support to the major.

- Recession fears capped the upside for the risk-sensitive aussie ahead of Fed Chair Powell’s speech.

The AUD/USD pair stalled its intraday decline near the 0.6960 area and recovered a few pips from a two-week low touched earlier this Wednesday. The pair was last seen trading just below the 0.6900 mark, still down nearly 0.20% for the day.

A fresh leg down in the US Treasury bond yields failed to assist the US dollar to capitalize on its modest uptick, which, in turn, was seen as a key factor that offered support to the AUD/USD pair. That said, growing worries about a possible recession continued weighing on investors' sentiment and acted as a headwind for the risk-sensitive aussie.

Traders also seemed reluctant and might prefer to move on the sidelines ahead of the key event risk - Fed Chair Jerome Powell's speech at the ECB forum in Sintra. Market participants remain divided about the prospects for more aggressive Fed rate hikes. Hence, Powell's comments will be scrutinized for clues about the policy tightening path.

This will play a key role in influencing the USD price dynamics and provide a fresh directional impetus to the AUD/USD pair. From a technical perspective, spot prices bounced from the vicinity of the monthly swing low, making it prudent to wait for some follow-through selling below the 0.6850 region before positioning for any further depreciating move.

Nevertheless, the fundamental backdrop still seems tilted in favour of bearish traders, suggesting that any attempted recovery move runs the risk of fizzling out rather quickly. The AUD/USD pair remains vulnerable to sliding further beyond the YTD low, around the 0.6830-0.6825 region touched in May, and aim to test the 0.6900 round-figure mark.

Technical levels to watch

- BEA revised annualized US GDP growth to -1.6% from 1.5% in previous estimate.

- US Dollar Index holds steady near 104.50 after the data.

The real Gross Domestic Product (GDP) of the United States contracted at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis (BEA) announced on Wednesday. This print came in slightly worse than the previous estimate and the market expectation for a decrease of 1.5%.

"The update primarily reflects a downward revision to personal consumption expenditures (PCE) that was partly offset by an upward revision to private inventory investment," the BEA explained in its press release.

Market reaction

This report doesn't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was posting small daily gains at 104.55.

- USD/CHF witnessed heavy selling on Wednesday and dropped to over a two-month low.

- The SNB’s surprise rate hike in June and recession fears underpinned the safe-haven CHF.

- Sliding US bond yields kept the USD bulls on the defensive and did little to lend support.

- Investors now look forward to Fed Chair Powell’s speech for a fresh directional impetus.

The USD/CHF pair came under heavy selling pressure on Wednesday and confirmed a fresh bearish breakdown through a nearly one-week-old consolidative trading range. The downward trajectory dragged spot prices to the lowest level since April 21, with bears now awaiting sustained weakness below the key 0.9500 psychological mark.

The Swiss National Bank shocker on June 16, when it unexpectedly raised interest rates by 50 bps to curb soaring inflation, continued underpinning the Swiss franc. Apart from this, growing worries about a possible recession drove some haven flows towards the CHF and exerted additional downward pressure on the USD/CHF pair.

On the other hand, a fresh leg down in the US Treasury bond yields kept the US dollar bulls on the defensive and failed to offer any support to the USD/CHF pair. With the latest leg down, spot prices have retreated over 500 pips from the vicinity of the YTD peak, around the 1.0050 region touched earlier this month.

It, however, remains to be seen if bears are able to maintain their dominant position or opt to lighten their positions ahead of Fed Chair Jerome Powell's speech at the ECB forum in Sintra. Powell's comments will be scrutinized for clues about the policy tightening path amid division over the need for more aggressive rate hikes.

This, in turn, will play a key role in influencing the USD price dynamics and help investors to determine the next leg of a directional move. Meanwhile, a convincing break through the 0.9500 mark would be seen as a fresh trigger for bearish traders and set the stage for an extension of the USD/CHF pair's a nearly two-week-old downtrend.

Technical levels to watch

- HICP inflation in Germany declined unexpectedly in June.

- EUR/USD continues to fluctuate above 1.0500 after the data.

Inflation in Germany, as measured by the Harmonised Index of Consumer Prices (HICP), declined to 8.2% on a yearly basis in June's flash estimate from 8.7% in May. This print came in lower than the market expectation of 8.8%. On a monthly basis, HICP declined by 0.1%.

Similarly, the annual Consumer Price Index (CPI) declined to 7.6% from 7.9% in the same period, compared to analysts' estimate of 8%.

Market reaction

The EUR/USD pair showed no immediate reaction to these figures and was last seen trading flat on the day at 1.0522.

- USD/CAD attracted fresh selling on Wednesday and turned lower for the fourth straight day.

- Bullish oil prices underpinned the loonie and exerted some downward pressure on the pair.

- Sliding US bond yields capped the USD and failed to lend any support ahead of Fed’s Powell.

The USD/CAD pair struggled to capitalize on its modest intraday gains and met with a fresh supply near the 1.2890 region on Wednesday. The intraday downfall - marking the fourth successive day of a slide - dragged spot prices to a fresh daily low, around the 1.2850-1.2845 region during the mid-European session.

Crude oil prices reversed an intraday dip and shot to a fresh one-and-half-week high amid concerns about tight global supplies, which offset worries about a weaker global economy. The Group of Seven (G7) economic powers agreed on Tuesday to explore price caps on imports of Russian oil and gas. Furthermore, Saudi Arabia and the United Arab Emirates reportedly would not be able to raise output significantly to make up for the lost Russian supply. This, in turn, acted as a tailwind for the black liquid, which underpinned the commodity-linked loonie and capped the upside for the USD/CAD pair.

On the other hand, a fresh leg down in the US Treasury bond yields held back the US dollar bulls from placing aggressive bets. This was seen as another factor that exerted some downward pressure on the USD/CAD pair. That said, the prevalent cautious mood around the equity markets - amid growing recession fears - continued lending support to the safe-haven buck and should limit any deeper losses for the major. Traders might also be reluctant to place aggressive bets ahead of Fed Chair Jerome Powell's speech at the ECB forum in Sintra, Portugal, later during the early North American session.

Given that market participants remains divided about the prospects for more aggressive Fed rate hikes, Powell's comments will be scrutinized for clues about the policy tightening path. This will play a key role in driving demand for the USD in the near term. Apart from this, traders will take cues from oil price dynamics to determine the next leg of a directional move for the USD/CAD pair.

Technical levels to watch

- EUR/JPY regains the upside and the upper-143.00s.

- The breakout of 2022 highs should allow for extra gains.

EUR/JPY fades Tuesday’s retracement and advances further north of the 143.00 mark midweek.

The bullish bias in the cross remains well in place for the time being. That said, the surpass of the YTD top at 144.27 (June 28) is predicted to pave the way to, initially, the round level at 145.00 ahead of the 2015 high at 145.32 (January 2). Further up is the 2014 top at 149.78 (December 8).

In the meantime, while above the 3-month support line around 138.50, the short-term outlook for the cross should remain bullish. This area appears reinforced by the proximity of the 55-day SMA.

EUR/JPY daily chart

- GBP/USD turned lower for the third straight day and dropped to a nearly two-week low.

- Hawkish Fed expectations and the cautious mood offered support to the safe-haven USD.

- The downside seems cushioned as the focus remains on Fed Chair Powell and BoE’s Bailey.

The GBP/USD pair prolonged this week's retracement slide from the 1.2330-1.2335 region and edged lower for the third successive day on Wednesday. The downward trajectory dragged spot prices to a nearly two-week low, closer to mid-1.2100s during the first part of the European session, though lacked follow-through selling.

The market sentiment remains fragile amid concerns that a more aggressive move by major central banks to curb soaring inflation would pose challenges to global economic growth. This assisted the US dollar to capitalize on the previous day's strong move up and gain some follow-through traction, which, in turn, exerted some downward pressure on the GBP/USD pair.

The British pound was further weighed down by Brexit woes and expectations that the Bank of England would opt for a more gradual approach towards raising interest rates. It is worth recalling that the UK House of Commons on Monday voted in favour of a controversial bill that would unilaterally overturn part of Britain's divorce deal from the EU agreed in 2020.

The latest development raised the risk of fresh tensions with the EU amid the cost of living crisis in the UK and growing recession fears. This might continue to undermine sterling and supports prospects for a further near-term depreciating move for the GBP/USD pair. That said, retreating US bond yields might cap the USD and help limit any deeper losses, at least for now.

Traders might also refrain from placing aggressive bets and prefer to wait on the sidelines ahead of the key event risk. Fed Chair Jerome Powell and BoE Governor Andrew Bailey are due to speak at the ECB forum in Sintra. Investors will look for cues about the central bank's policy tightening path before determining the next leg of a directional move for the GBP/USD pair.

Technical levels to watch

"If inflation expectations become unanchored, monetary policy would have to act more forcefully to return inflation to goal," Cleveland Federal Reserve President Loretta Mester said while speaking at the European Central Bank's annual forum on Wednesday.

Additional takeaways

"More costly error is assuming inflation expectations are anchored when they are not."

"There is some risk in the US that longer-term inflation expectations of businesses and households will continue to rise."

"Policymakers cannot be complacent about a rise in longer-term inflation expectations."

"Central banks need to be resolute, intentional in acting to bring inflation down."

"Current situation calls into question the wisdom that monetary policy should look through supply shocks."

"Current inflation situation is a very challenging one."

"In some cases, such shocks threaten the stability of inflation expectations, require policy action."

"Price changes in gasoline and food can have an outsized effect on households' inflation expectation."

"Our policy communications are important for keeping inflation well anchored."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen posting small daily gains at 104.53.

- AUD/USD lost ground for the third successive day and dropped to a two-week low on Wednesday.

- Recession fears weighed on investors’ sentiment and drove flows away from the risk-sensitive aussie.

- Sliding US bond yields capped the USD and might help limit losses ahead of Fed Chair Powell’s speech.

The AUD/USD pair witnessed some selling for the third successive day on Wednesday and dropped to a two-week low, around the 0.6865 region during the early part of the European session.

The worsening global economic outlook continued weighing on investors' sentiment, which was evident from the prevalent cautious mood around the equity markets. This overshadowed upbeat Australian Retail Sales data and continued acting as a headwind for the risk-sensitive aussie.

On the other hand, the US dollar drew some support from the overnight hawkish remarks by New York Fed President John Williams and San Francisco’s Mary Daly, which lifted bets for aggressive Fed rate hikes. This was seen as another factor that exerted pressure on the AUD/USD pair lower.

Market participants, however, remain divided about the prospects for a faster policy tightening by the Fed amid growing recession fears. This, along with a fresh leg down in the US Treasury bond yields, capped the USD and might help limit deeper losses for the AUD/USD pair.

Traders also seemed reluctant to place aggressive bets and preferred to wait for Fed Chair Jerome Powell's speech at the ECB forum in Sintra. Powell's comments would be scrutinized for clues about the Fed's policy outlook, which would provide a fresh impetus to the AUD/USD pair.

Nevertheless, the fundamental backdrop seems tilted in favour of bearish traders and supports prospects for a further near-term depreciating move for the AUD/USD pair. Hence, some follow-through slide to mid-0.6800s, en-route the YTD low touched in May, remains a distinct possibility.

Technical levels to watch

Following their Q2 monetary policy meeting, the People’s Bank of China (PBOC) noted the following:

They are to step up the implementation of prudent monetary policy.

Will work on stabilizing employment and consumer prices.

Will be proactive and boost confidence.

Vows to better meet reasonable housing demand.

Will keep consumer prices basically stable.

Related reads

- China mulls massive Special Treasury Issuance to perk GDP – MNI

- China’s President Xi: Should try our best to promote stable, healthy economic development

China is expected to issue over CNY1 trillion of Special Treasury Bonds (STBs) in the third quarter to fill a fiscal gap and to help meet economic and employment targets, MNI reports, quoting policy advisors and market analysts.

The industry experts also called on the central bank to increase liquidity in order to accommodate the massive debt sale.

According to a recent report from Renmin University, the government would see a gap of about CNY2.6 trillion as fiscal income may decrease for the whole year.

To cover the extra spending, analysts predict the government may launch CNY1 trillion to CNY2 trillion of STBs in the third quarter if the State Council proposes the same.

The STBs are likely to be a necessary move if the country insists on a GDP growth target of around 5.5%, MNI notes.

Market reaction

AUD/USD fails to find any inspiration from the above headlines, as it loses 0.39% on the day at 0.6878, at the press time. Meanwhile, USD/CNY drops 0.14% to 6.6972.

Senior Economist at UOB Group Alvin Liew comments on the latest Inflation Production figures in Singapore.

Key Takeaways

“Singapore’s industrial production (IP) enjoyed another strong month in May as it rose by 10.9% m/m SA, 13.8% y/y (from the revised Apr readings of 2.1% m/m, 6.4% y/y) well exceeding Bloomberg survey estimates.”

“The main sources of IP growth were from electronics (of which semiconductor drove the upside with a 45.7% y/y spike), transport engineering, general manufacturing and precision engineering, more than offsetting the continued weakness in biomedical (of which pharmaceuticals production plunged -14.8% y/y) and chemicals (of which the main drag came from petrochemicals).”

“Accounting for the May’s increase, Singapore’s IP expanded a decent 8.7% in the first 5 months of 2022. We continue to be positive on the outlook for electronics, transport engineering, general manufacturing, and precision engineering, to drive overall IP growth but we are also cognizant about the external risks including (1) Russia-Ukraine conflict, (2) global supply disruptions, (3) monetary policy tightening stance in the advanced economies slowing growth and (4) resurgence of COVID19 infections and/or new variants. In addition, another dampener to headline growth is the relatively higher base levels for the rest of 2022, as IP expanded by double digit growth rates between May and Dec 2021 (except for Sep 2021). We now expect IP growth to increase by 4.5% in 2022 (up from previous forecast of 4%).”

- Gold remained on the defensive for the third straight day and dropped to a nearly two-week low.

- Modest USD strength was seen as a key factor that undermined the dollar-denominated metal.

- Recession fears, sliding US bond yields might help limit losses ahead of key central bank speakers.

Gold prolonged this week's rejection slide from the very important 200-day SMA and edged lower for the third successive day on Wednesday. The downtick dragged spot prices to a nearly two-week low, around the $1,816-$1,815 region during the early European session.

The overnight hawkish remarks by New York Fed President John Williams and San Francisco’s Mary Daly lifted bets for a faster policy tightening by the US central bank. This assisted the US dollar to build on the previous day's strong move up, which, in turn, undermined demand for the dollar-denominated gold.

Market participants, however, remain divided over the need for a more aggressive Fed rate hike amid growing recession fears. This, along with a fresh leg down in the US Treasury bond yields and the prevalent cautious market mood, could offer some support to the non-yielding yellow metal and help limit deeper losses.

Traders might also refrain from placing aggressive bets and prefer to move on the sidelines ahead of the key event risk. Fed Chair Jerome Powell, the Bank of England Governor Andrew Bailey and the European Central Bank President Christine Lagarde are due to speak at the ECB forum in Sintra, Portugal on Wednesday.

Investors will look for fresh clues about the central bank's tightening path, which will play a key role in driving gold price in the near term. Apart from this, the broader market risk sentiment, the US bond yields, and the USD price dynamics would help determine the next leg of a directional move for the XAUUSD.

Technical levels to watch

European Central Bank (ECB) policymaker and Governor of the Central Bank of Cyprus Constantinos Herodotou expressed his take on inflation, in an interview with CNBC on Wednesday.

Herodotou said that he sees euro area inflation peaking this year.

Nothing further is reported on the same.

Related reads

- EUR/USD holds on around 1.0500 ahead of German CPI, Sintra

- Eurozone Final Consumer Confidence steadies at -23.6 in June, matches estimates

- EUR/USD briefly dipped below 1.0500 on USD strength.

- German Flash June CPI next on tap in the domestic docket.

- Lagarde, Bailey, Powell will meet in Sintra later in the session.

The single currency remains under pressure and prompts EUR/USD to navigate the 1.0500 neighbourhood on Wednesday.

EUR/USD looks to data, ECB Forum

EUR/USD so far loses ground for the second session in a row on Wednesday on the back of the resumption of the risk aversion and the better sentiment surrounding the greenback.

In the meantime, the German money markets show the 10y Bund yields trimming part of the recent 2-day advance and retest the 1.60% region amidst the equally flat performance in the US peers.

In the domestic calendar, advanced inflation figures in Spain showed the CPI is seen rising 10.0% in the year to June. Further June data saw the final EMU Consumer Confidence at -23.6 and the Economic Sentiment at 104. Later in the session, markets’ attention will be on the release of the German preliminary inflation data ahead of the discussion panel between Powell, Bailey and Lagarde at the ECB Forum in Sintra.

What to look for around EUR

EUR/USD faces the re-emergence of the risk-off mood and the subsequent drop to the sub-1.0500 area midweek.

In the meantime, the single currency continues to closely follow news from the ECB Forum in Portugal as well as any developments surrounding the bank’s plans to design a de-fragmentation tool in light of the upcoming start of the hiking cycle.

However, EUR/USD is still far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, persistent elevated inflation in the euro area and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: ECB Forum on Central Banking, EMU Final Consumer Confidence, EMU Economic Sentiment, Germany Flash Inflation Rate, ECB Lagarde (Wednesday) – Germany Retail Sales, Unemployment Change, Unemployment Rate. EMU Unemployment Rate, ECB Lagarde (Thursday) – EMU, Germany Final Manufacturing PMI, EMU Flash Inflation Rate (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is retreating 0.05% at 1.0511 and faces immediate contention at 1.0358 (monthly low June 15) followed by 1.0348 (2022 low May 13) and finally 1.0300 (psychological level). On the upside, a break above 1.0615 (weekly high June 27) would target 1.0773 (monthly high June 9) en route to 1.0786 (monthly high May 30).

Eurozone's Final Consumer Confidence Index arrived at -23.6 in June vs. -23.6 recorded previously, according to the latest data release from the European Commission. The data confirmed to the consensus forecast of 23.6.

Meanwhile, the bloc’s Economic Sentiment Indicator for June dropped to 104.0 vs. 103.0 expected and 105.0 previous.