- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, print a two-day south-run to refresh the four-month low by the end of Tuesday’s North American session. That said, the inflation gauge’s latest print is 2.48%, the lowest since February 22.

It’s worth noting, however, that the one-year consumer inflation rate expectations climbed to 8% from May's revised print of 7.5%, per the latest details from the US Conference Board (CB).

Amid these plays, the fears of inflation prevail on the table, as well as join the recession woes to weigh on the market sentiment.

The risk-off mood also takes clues from the anxiety ahead of the key central bankers’ panel discussion at the European Central Bank (ECB) Forum. Also important for the day are the quarterly releases of the US Core Personal Consumption Expenditure (PCE) for Q1 2022, expected to remain unchanged at 5.1%.

Also read: Forex Today: Inflation and recession fears continue to drive financial markets

- AUD/USD holds lower grounds at weekly low, stays pressured during three-day downtrend.

- Sour sentiment weigh on the risk barometer pair, updates concerning China put a floor under the prices.

- Australia Retail Sales for May, central bankers’ panel discussion at the ECB Forum will be important for fresh impulse.

AUD/USD remains depressed around 0.6900, after a two-day downtrend, as traders await key Aussie data during Wednesday’s Asian session. That said, the risk barometer pair refreshed its weekly high before closing in the red for the second consecutive day on Tuesday.

Headlines surrounding China’s easing of quarantine rules for travelers joined mixed concerns to favor the AUD/USD pair in refreshing the weekly top around 0.6965 the previous day. However, fresh fears of recession joined the market’s anxiety ahead of the key data/events to weigh on the quote afterward.

That said, “China will halve to seven days its COVID-19 quarantine period for visitors from overseas, with a further three days spent at home, health authorities said on Tuesday,” per Reuters.

On the other hand, the US Conference Board (CB) Consumer Confidence Index dropped for the second consecutive month in June, to 98.7 versus 100.0 expected and 103.2 in May. In doing so, the widely followed consumer sentiment gauge dropped to the lowest level since February 2021. Further details revealed that the one-year consumer inflation rate expectations climbed to 8% from May's revised print of 7.5%, which in turn renewed hawkish hopes from the Fed and propelled the USD. It should be noted that the US trade deficit dropped to the lowest in a year, to $104.3 billion, per the latest release for May.

While portraying the mood, the US 10-year Treasury yields snapped a two-day uptrend whereas Wall Street closed in the red. The S&P 500 Futures, however, print mild gains and it seems to probe the AUD/USD bears of late.

Moving on, the flash readings for Australia’s Retail Sales for May, expected 0.4% versus 0.9%, could direct immediate AUD/USD moves amid fears of receding hawkish bets on the Reserve Bank of Australia (RBA) rate hikes. Following that, the US Core Personal Consumption Expenditure (PCE) for Q1 2022, expected to remain unchanged at 5.1%, will precede the central bankers’ discussions at the ECB Forum to offer important insights.

Technical analysis

The 10-DMA restricts immediate AUD/USD upside to around 0.6945. However, a two-week-old support line precedes the ascending trend line from May 12, respectively around 0.6875 and 0.6860, to challenge the pair’s short-term downside.

"Monetary policy’s transmission channel may change in a rapidly changing world with uncertainties," said Bank of Japan (BOJ) Governor Haruhiko Kuroda.

More to come

- USD/JPY is aiming to recapture its two-decade high at 136.71 on firmer DXY.

- The DXY is scaling higher on expectations of stable US PCE figures.

- Japan’s Retail Trade may outperform on an annual basis but will underperform on a monthly basis.

The USD/JPY pair displayed a vertical upside move after violating the three-day high of 135.50. The major has turned into a consolidation phase and may turn into imbalance after giving an upside break of the balance formed in a range of 136.06-136.38. An upside break of the consolidation will unleash the greenback bulls to recapture its two-decade high at 136.71.

The major is performing well in the FX domain as the US dollar index (DXY) has been captured by the bulls on expectations of a stable US Personal Consumption Expenditure (PCE). A preliminary estimate for the US PCE for the first quarter of CY22 is 7%, similar to its prior release. The US economy is facing the headwinds of a higher inflation rate. For that, the Federal Reserve (Fed) has already elevated its interest rates to 1.50-1.75%. However, not even a minute impact has been reflected on the inflation mess. Therefore, an unchanged PCE figure will also dampen the sentiment of the households in the US.

Considering the stable forecast for the US PCE figures, Fed chair Jerome Powell is expected to dictate a hawkish stance on July monetary policy. The speech from Fed Powell on Wednesday will provide insights about the likely monetary policy action by the Fed in July.

On the Tokyo front, investors are awaiting the release of Japan’s Retail Trade. The economic data may improve to 3.3% vs. 2.9% recorded earlier on an annual basis. While the monthly figure may decline to -0.1% from the former release of 0.8%.

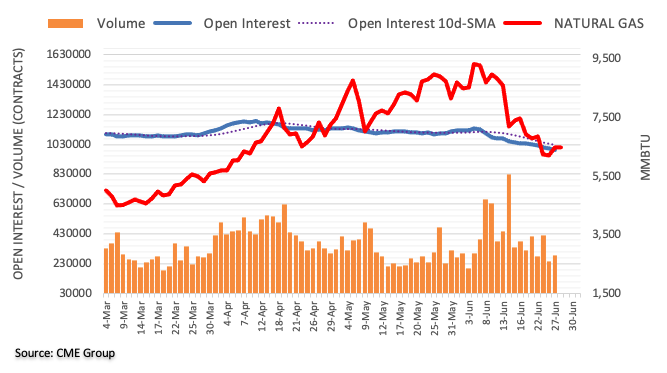

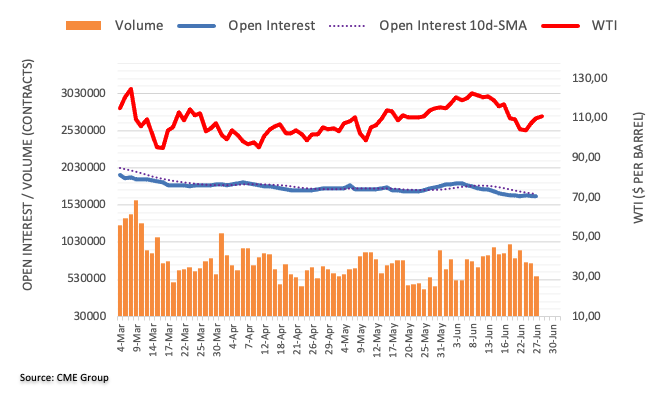

- WTI seesaws around an eight-day high as bulls seek more clues.

- API Weekly Crude Oil Stock dropped 3.799M for the week ended on June 24.

- G7 agreed to cap Russian oil prices but the capacity limits of major producers favor oil buyers.

- Delayed release of EIA stockpile data, risk catalysts will be important for fresh impulse.

WTI remains on the front foot, grinding higher around $110.50-60 during the initial Asian session on Wednesday. The black gold rose during the last three consecutive days as supply-crunch fears battle the Group of Seven (G7) announcements to cap the Russian oil prices.

That said, the energy benchmark’s latest uptick could be linked to the surprise draw in weekly inventory data from the industry source. The weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data for the period ended on June 24 flashed a reduction of 3.799 million barrels versus the previous addition of 5.607M, not to forget expectations of -0.106M.

It’s worth noting that the G7 pressure on Russia failed to tame the WTI crude oil prices amid chatters that major oil producers are already operating at the peak of their capacities and hence further output increase is less likely.

“G7 leaders have agreed to explore imposing a ban on transporting Russian oil that has been sold above a certain price, aiming to deplete Moscow's war chest,” said Reuters. The news also mentioned, “Saudi Arabia and the UAE have been seen as the only two members of the Organization of the Petroleum Exporting Countries with spare capacity to make up for lost Russian supply and weak output from other member nations.”

It should, however, be noted that the fears of economic slowdown challenge the upside momentum but the latest easing of travel restrictions in China appears to have helped the black gold buyers.

Moving on, the already-delayed release of the official weekly oil inventory data from the Energy Information Administration (EIA) for the week ended on June 17 and 24 will be important for oil traders to watch. Additionally, the OPEC meeting on Thursday and risk catalysts, as well as the central bankers’ speeches at the ECB Forum are some extra catalysts to take note of for clear directions.

Technical analysis

The 21-day EMA level surrounding $110.75 challenges WTI buyers even if the quote managed to cross the 50-day EMA hurdle, near $109.20, the previous day. That said, the receding bearish bias of the MACD and recently firmer RSI favor the upside momentum.

“A clear US response on China tariffs is coming soon,” said US Deputy Commerce Secretary Don Graves in a Bloomberg TV interview.

The diplomat also mentioned that the US will take a balanced approach on China tariffs, per the news.

Additional comments

Expect Congress to pass competition bill in next weeks.

Export restrictions are having a significant impact on Russia.

Market reactions

The news fails to gain any major reaction from the traders even if the S&P 500 Futures pare recent losses around 3,830, up 0.10% intraday, during the initial hour of Wednesday’s trading.

Also read: Forex Today: Inflation and recession fears continue to drive financial markets

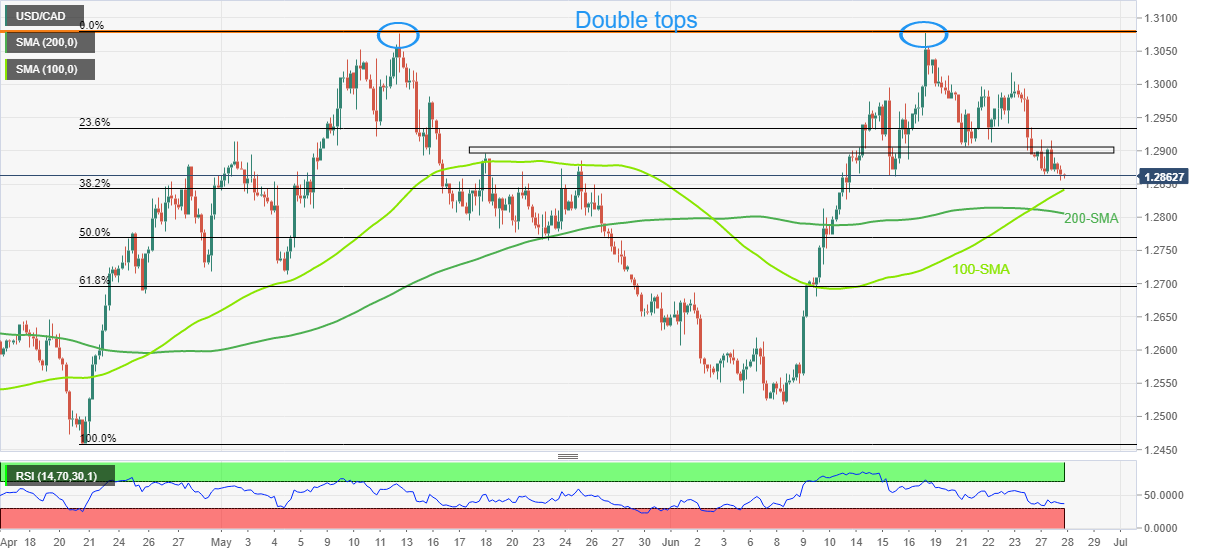

- USD/CAD is juggling in a narrow range of 1.2867-1.2880 as investors await Fed Powell.

- An unchanged US PCE will also escalate recession fears in the US economy.

- Oil prices are balancing above $110.00 as focus shifts to supply worries.

The USD/CAD pair is hovering around 1.2870 after a mild correction from the critical hurdle of 1.2880 in the early Tokyo session. Earlier, the asset rebounded firmly after hitting a low of 1.2820 on Tuesday. The major picked bids amid a firmer rebound in the US dollar index (DXY).

The DXY is attempting to overstep the current hurdle of 104.50 backed by higher expectations of extreme hawkish comments from Federal Reserve (Fed) chair Jerome Powell in his speech. The Fed has already elevated its interest rates to 1.50-1.75% along with the balance sheet reduction program, however, their impact has not been reflected yet on the inflation rate. Therefore, a consecutive rate hike by 75 basis points (bps) is expected to be discussed in his speech.

In addition to Fed Powell’s speech, investors’ focus will also remain on the release of the US Personal Consumption Expenditure (PCE), which is expected to remain stable at 7% for the first quarter. Also, the core PCE is seen unchanged at 5.1%. It is worth noting that as per the ongoing situation a stable of higher side PCE figures are vulnerable for the US economy as it will escalate recession fears.

On the oil front, oil prices have established themselves comfortably above the psychological resistance of $110.00. The market participants are worried about the supply constraints as it won’t be a cakewalk to substitute Russian oil with any other exporter. It is worth noting that Canada is the largest producer of oil to the US, therefore higher oil prices fetch higher funds for the Canadian economy.

- USD/CHF grinds higher after taking a U-turn from the key EMA, horizontal support.

- 50% Fibonacci retracement of January-May upside guards recovery moves.

- Descending RSI line, bearish MACD signals challenge buyers, eight-day-old resistance line adds to the upside filters.

USD/CHF holds onto the previous day’s bounce off the 100-day EMA around 0.9575 during Wednesday’s initial Asian session. In doing so, the Swiss currency (CHF) pair jostles with the 50% Fibonacci retracement (Fibo.) of its January-May upside.

Although monthly horizontal support near 0.9520-45 adds strength to the downside filters, descending RSI (14) line, not oversold, joins the bearish MACD signals to hint at the USD/CHF pair buyer's hardships.

That said, a weekly resistance line near 0.9620 also challenges the short-term USD/CHF recovery, apart from the 50% Fibo. level of 0.9578.

Even if the quote rises past 0.9620, the 0.9700 round figure and multiple hurdles surrounding 0.9715 may test the bulls before giving them control.

On the contrary, a downside break of the 0.9520 support could direct the USD/CHF sellers towards the 61.8% Fibonacci retracement level near 0.9465.

Following that, the 200-day EMA level of 0.9430 will challenge the pair’s further downside, a break of which won’t hesitate to direct the quote towards January’s high near 0.9345.

USD/CHF: Daily chart

Trend: Limited upside expected

- EUR/USD bulls move in as the US dollar struggled to keep up the bid.

- Markets are choppy with no clear sense of direction.

EUR/USD is trading around 1.0520 in early Asia following a choppy Tuesday on the back of a firmer US dollar, China relaxing its rigid COVID protocols coupled with disappointing US consumer sentiment data and central bank rhetoric.

'' As quarter-end fast approaches, markets are becoming desensitised to Fed speak in the very short term. The FOMC has laid out its broad strategy for tackling inflation,'' analysts at ANZ Bank argued. ''The debate over whether the Federal Reserve will raise by 50 or 75bps at the 26-27 July meeting and the eventual peak in the fed funds rate will very much depend on the path of the data and how quickly the economy decelerates.''

''New data is needed; more words add limited value at this point. Markets are therefore consolidating within established price ranges but primary trends remain intact.''

Federal Reserve officials downplayed the risk of the US economy entering a recession, despite raising rates by 75 basis points this month and another 75 basis points next month. Both New York Fed President John Williams and San Francisco Fed President Mary Daly acknowledged the need to reduce inflation but insisted that a soft landing was still possible.

A key set of rates that the Fed is focusing on to help judge financial conditions is still a long way from reaching levels that would prompt officials to abandon their tightening plans. Adjusted for inflation rates at the short end of the curve remain below zero, despite real rates on longer-term securities reaching levels not seen since 2019.

On Tuesday, the US dollar shot higher from below 104, making gold more expensive for international buyers. US dollar bulls moved in on euro weakness as European Central Bank (ECB) President Christine Lagarde offered no fresh insight into the central bank's policy outlook. Lagarde said the central bank would move gradually but with the option to act decisively on any deterioration in medium-term inflation, especially if there were signs of a de-anchoring of inflation expectations. The US dollar index (DXY), which had made a two-decade high of 105.79 this month, was last up 0.46% at 104.42. The DXY had been as low as 103.77 and as high as 104.60.

Meanwhile, favourable to risk sentiment is the fact that China made the greatest change yet to a pandemic policy that has isolated the nation and spurred economic worries by halving the amount of time new immigrants must spend in isolation. However, data in the US nipped the cheer in the bid and this was followed by a sell-off in big tech that weighed heavily on stocks. A measure of expectations, which reflects a six-month outlook, has fallen to a nearly decade low. ''The data comes at a time when analysts are still optimistic about corporate earnings, with net-margin estimates for S&P 500 companies at an all-time high,'' Reuters reported.

- The AUD/JPY stays in positive territory, bolstered by a dovish Bank of Japan stance.

- Risk aversion dominates the headlines as worries about recession and inflation increase.

- The AUD/JPY’s inability to reclaim 95.30 leaves the pair vulnerable to selling pressure.

- A break below 91.96 to send the AUD/JPY tumbling towards 90.10s.

The AUD/JPY advanced on Tuesday for the first day in the week though it remains below the 20-day EMA, which lies around 94.20, amidst a dampened market mood, courtesy of renewed fears of stagflation, meaning recession and inflation at the same time. At 93.98, the AUD/JPY begins the Asian session with minimal losses of 0.01% at the time of writing.

US equities finished with substantial losses due to portfolio rebalancing, as half/quarter/month-end flows dominated the markets. However, the AUD/JPY printed gains due to the dovish monetary policy stance by the Bank of Japan (BoJ), which is trying to anchor inflation above the 2% threshold.

On Tuesday, the AUD/JPY registered a daily low in the Asian session around 93.00 and rallied towards a June 22 swing low around 94.68. Nevertheless, buyers’ lack of strength to lift the cross-currency above 95.00 opened the door for selling pressure, as sellers entered around that area and dragged the pair towards the 94.00 mark.

AUD/JPY Daily chart

This time frame portrays the AUD/JPY trading within a rising wedge. Additional to that factor, which favors AUD sellers, it’s worth noting that the last two higher highs were lower than the YTD one, at around 96.88, suggesting that selling pressure is piling on the pair. Furthermore, the pair’s breaking below the 20-day EMA and the Relative Strength Index (RSI) is almost horizontal, but below the RSI’s 7-day SMA might pave the way for further losses.

If that scenario plays out, the AUD/JPY first support would be the June 23 daily low at 92.64. Once cleared, the next support would be the 50-day EMA at 92.42. A breach of the latter would expose the June 16 daily low at 91.96, which, once cleared, will send the pair tumbling towards the 100-day EMA at 90.18.

AUD/JPY Key Technical Levels

- GBP/USD stays pressured around weekly low after falling the most in eight days.

- Brexit woes join, inflation/recession fears to recall bears ahead of the key events.

- US Core PCE, Final reading of Q1 GDP may entertain traders ahead of key discussions at the ECB Forum.

GBP/USD dribbles around the weekly low of 1.2180, after declining the most in over a week, as sellers take a breather ahead of the key data/events. However, pessimism surrounding Brexit, economic slowdown and inflation woes keep the downside bias intact.

Although the Northern Ireland Protocol (NIP) passed the first hurdle to becoming the law in the UK’s House of Commons, the Brexit protests gain momentum in Britain of late. The same exert more pressure on Prime Minister Boris Johnson as Brexit is considered the core of Conservatives’ winning recipe.

On the other hand, fears of economic slowdown and inflation renewed the US dollar demand after the greenback gauge slumped to the lowest in two weeks on Tuesday. Additionally helping the USD buyers were cautious mood ahead of today’s key penal discussion by the US Federal Reserve (Fed) Chairman Jerome Powell, Bank of England (BOE) Governor Andrew Bailey and the European Central Bank (ECB) President Christine Lagarde at the ECB Forum.

That said, the US Conference Board (CB) Consumer Confidence Index dropped for the second consecutive month in June, to 98.7 versus 100.0 expected and 103.2 in May. In doing so, the widely followed consumer sentiment gauge dropped to the lowest level since February 2021. Further details revealed that the one-year consumer inflation rate expectations climbed to 8% from May's revised print of 7.5%.

Amid these plays, the US 10-year Treasury yields snapped a two-day uptrend whereas Wall Street closed in the red.

Moving on, updates from the ECB Forum will be crucial for the GBP/USD pair. Ahead of that the US Core Personal Consumption Expenditure (PCE) for Q1 2022, expected to remain unchanged at 5.1%, will be important. On the same line will be the final readings of the US Q1 GDP, which is likely to confirm 1.5% Annualized contraction.

Technical analysis

A clear downside break of the two-week-old support, now resistance around 1.2305, directs GBP/USD prices towards the yearly bottom surrounding 1.1935, which is also the monthly low. During the fall, the 1.2000 psychological magnet may offer an intermediate halt.

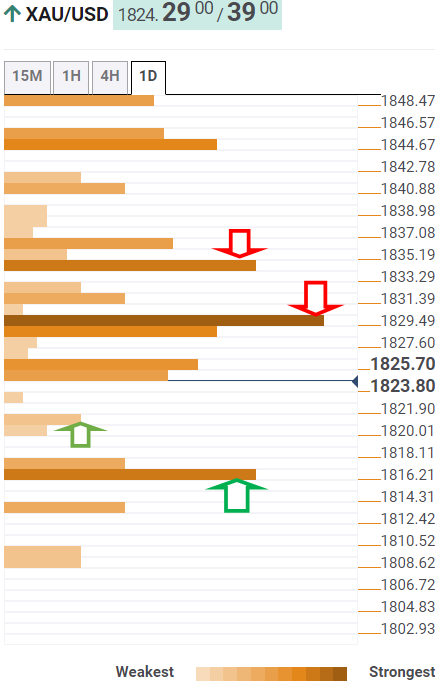

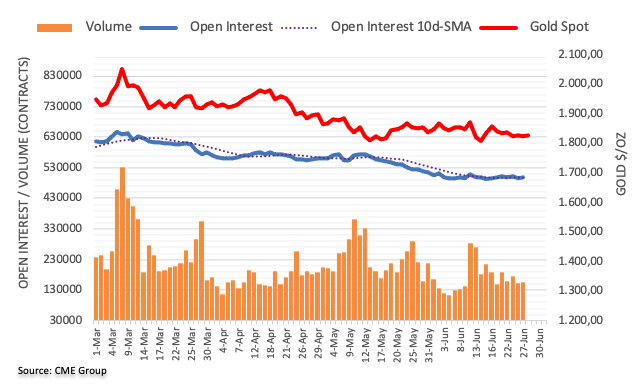

- Gold price is eyeing downside to near weekly lows at $1,816.98.

- The DXY has advanced firmly on expectations of hawkish Fed Powell and stable PCE.

- The precious metal is displaying signs of volatility contraction amid Descending Triangle formation.

Gold price (XAU/USD) is auctioning around a two-day low at $1,818.64 and is expected to slip further to near the weekly low at $1,816.98. The precious metal has failed to capitalize on the event of banning the imports of gold from Russia, which generates the second-highest revenue for Moscow after oil and gas. The gold prices have remained vulnerable for the past few trading weeks i.e. declining gradually and are expected to slip swiftly now.

Meanwhile, the US dollar index (DXY) is attempting to surpass 104.50. The asset has scaled firmly above the critical hurdle of 104.00 as investors are bracing for a hawkish commentary from Federal Reserve (Fed) chair Jerome Powell. The speech from Fed Powell will provide hints about the likely monetary policy action in July. For sure, a rate hike will be announced in July monetary policy meeting but what needs to gauge is the extent of a rate hike.

Apart from that, the release of the quarterly US Personal Consumption Expenditure (PCE) will remain in focus. As per the market consensus, the PCE is seen stabled at 7%.

Gold technical analysis

The gold prices are trading in a Descending Triangle pattern that signals a volatility contraction. The downward sloping trendline is plotted from June 16 high at $1,857.58 while the horizontal support is placed from June 16 low at $1,815.73. The precious metal is balanced below the 200-period Exponential Moving Average (EMA) at $1,831.25. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which adds to the downside filters.

Gold hourly chart

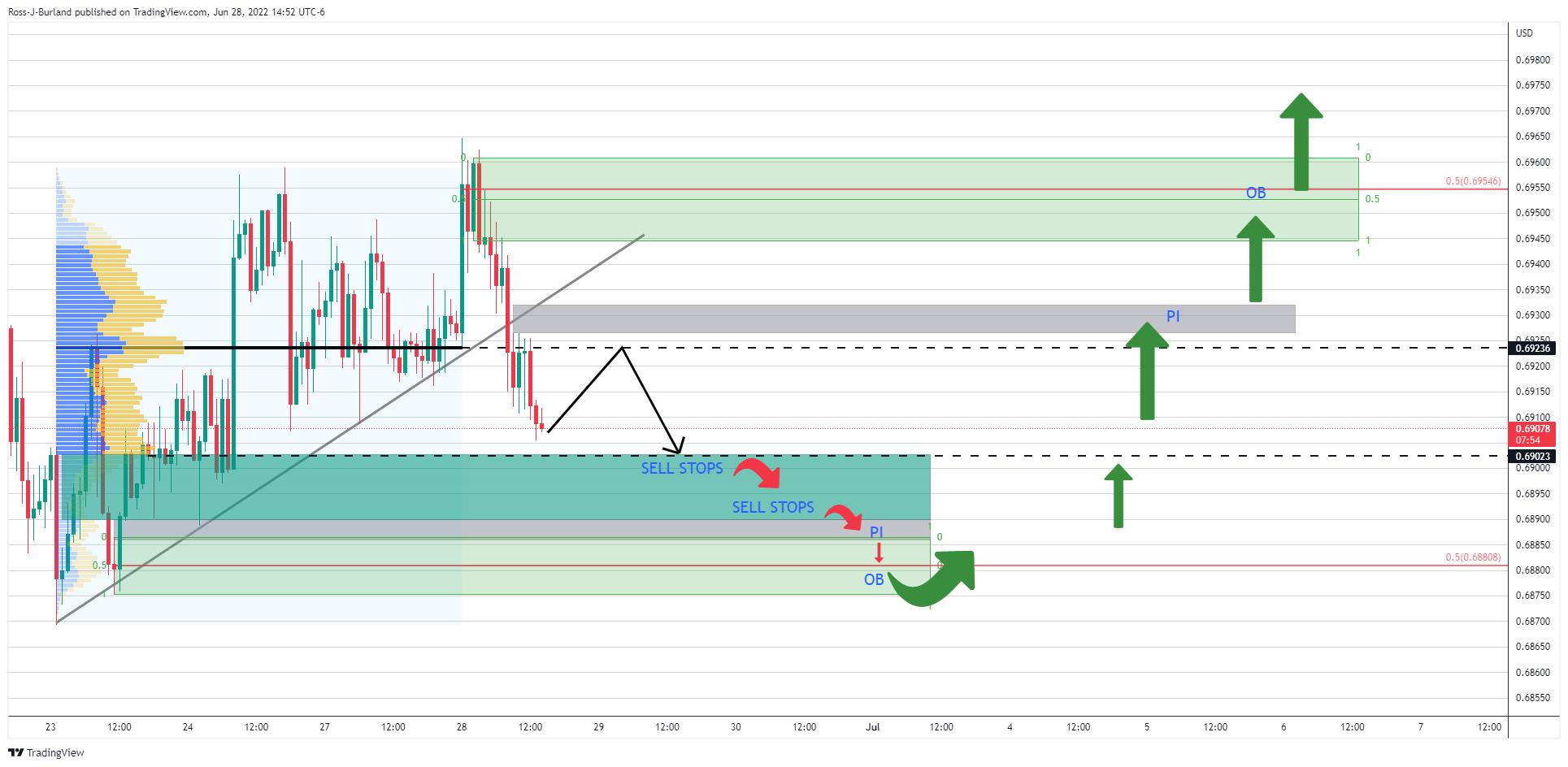

- AUD/USD bears are in control, for now, and target a break of 0.6900.

- The bulls could be lurking not far below.

As per the prior series of analyses this week so far, AUD/USD Price Analysis: A break from 0.6950 is on the cards, AUD/USD bulls seek a break of 0.6925 for 0.6950 target area, AUD/USD Price Analysis: The break into 0.6930s has summoned the bulls to target the 0.6950s, the pair continues to play the ranges but the bias stays with the upside longer-term.

AUD/USD daily chart scenarios

The M-formation's neckline failed to fend off the bulls and the high lows may have invalidated the bearish prospects of a move towards 0.67 and 0.66 in the meantime.

Instead, as illustrated below, the volume profile and price imbalances to the upside could make for a path of least resistance as follows:

AUD/USD H1 chart sell-buy scenario

From a shorter-term outlook, there is the possibility of a liquidity grab from below high volume areas into buyer's protective stops and fresh sell orders in anticipation of a longer-term bear trend, encouraged by the moves lower from 0.6950.

If this were to play out, then 0.6870/80 could be an area of renewed demand as per the mod point of the bullish order block. A short squeeze could eventuate in a surge higher and a bullish trend into higher liquidity and price imbalance mitigations on the daily chart.

- The USD/JPY extends its weekly gains to 0.74% on Tuesday.

- Falling US Treasury yields capped any U¨SD/JPY’s attempts towards the YTD highs near 136.70s.

- A rising wedge in the USD/JPY daily chart looms; if it plays out, it will send the pair tumbling towards 132.00.

The USD/JPY extends its string of days, advancing to three straight, and registers a new weekly high near the 136.30s after bouncing from daily lows at around 135.10s earlier in the Asian session, gaining close to 80 pips in the day. At the time of writing, the USD/JPY is trading at 136.10.

Wall Street’s Tuesday session ended with substantial losses, between 1.56% and 3.09%. A risk-off mood impulse, usually a headwind for the major, backfired on the Japanese yen, which remains heavy on the Bank of Japan’s (BoJ) pledging for an ultra-loose monetary policy stance, despite dealing with a weaker JPY, which makes inflation less tolerable.

In the meantime, US Treasury yields receded from weekly highs. The US 10-year benchmark note rate edges down one basis point and sits at 3.183%, putting a lid on higher USD/JPY prices.

USD/JPY Daily chart

The USD/JPY is still upward biased, albeit closing to YTD highs and “verbal” intervention by Japanese authorities. However, price action begins to show the possible formation of a rising wedge, which would pave the way for a pullback. If that scenario plays out, the USD/JPY first target would be the 20-EMA at 133.92, followed by the June 16 swing low at 131.49. USD/JPY traders should be aware that once the latter’s cleared, the 50-EMA at around 130.80 would be in play.

USD/JPY Hourly chart

The USD/JPY consolidates around the 135.00-136.20 area, clinging to Tuesday’s R2 daily pivot at 136.21. Traders should notice that the Relative Strength Index (RSI), albeit at 63.26, is aiming lower and trending below RSI’s 7-period SMA, a bearish signal suggesting downward pressure lying ahead.

USD/JPY buyers’ failure to break above 136.21 might open the door for further losses. That said, the major’s first support would be 136.00. Break below would expose the 20-EMA at 135.88, followed by the confluence of the 50 and 100-EMA around 135.45-34, respectively, and then the 200-EMA at 135.16.

Conversely, a USD/JPY’s upward break above 136.21 might open the door for a YTD test at 136.71.

USD/JPY Key Technical Levels

- The New Zealand dollar tumbles courtesy of a negative market mood and a bid US dollar.

- US June’s CB Consumer Confidence dipped to a 10-year low on US citizens’ concerns about high inflation and slower growth.

- The US Dollar Index is back above the 104.000 thresholds, courtesy of quarter and month-end flows.

The NZD/USD ticks down and extends its losses to 1% in the week, amidst a negative market sentiment, spurred by weaker than expected US consumer confidence slid to a decade low, as pessimism grows in North Americans about the US economic outlook. At 0.6242, the NZD/USD is also trading at new two-week lows at the time of writing.

NZD/USD falls due to a negative mood amidst a buoyant US dollar

US equities remained under heavy pressure as the portfolio rebalancing continued. In the FX space, sentiment bolstered the safe-haven peers, in this case, the greenback and the CHF. That said, the NZD/USD proceeded to dive after reaching a daily high in the mid-European session around 0.6313, sliding afterward below the June 27 daily low at 0.6281, followed by a fall to the 0.6240s area.

In the meantime, the US Dollar Index, a measure of the greenback’s value against its peers, edges up 0.54% at 104.504, boosted by quarter and month-end flows. Contrarily, the US 10-year benchmark note rate is at 3.192%, almost flat.

During the North American session, Fed Regional indices were released. The Richmond Fed’s Manufacturing Index dipped below the expectations, contracting from -19.0 vs. -12.0 foreseen, while the Dallas Fed Services Index shrank.

Additionally to that, Fed officials were crossing newswires. Mary Daly, the San Francisco Fed President, said that the Fed could address inflation while adding that, according to her, demand is “half of the cause of inflation” and said that the US would have slower growth.

Before Wall Street opened, the New York Fed President John Williams said that officials would discuss whether to hike 50 or 75 bps the Federal funds rate in the next month on Tuesday. Williams added that policymakers would be data-dependent and do not foresee a recession in his baseline, though he acknowledged that the US economy might slow down.

NZD/USD Key Technical Levels

What you need to take care of on Wednesday, June 29:

The American dollar resumed its advance on Tuesday and finished the day with gains against most major rivals amid renewed inflation and recession-related fears. The CB Consumer Confidence Index fell in June to 98.7,t its lowest level since February 2021. More relevantly, the survey showed that consumer expectations were sharply down, falling to their lowest in almost a decade, amid increased concerns about inflation, expected to keep climbing.

Earlier in the day, the European Central Bank President Christine Lagarde spoke at the Central Banking Forum organized by the ECB in Portugal. She reaffirmed the central bank intends to raise rates by 25 bps in July but added that her team is ready to hike at a faster pace if needed. She also downplayed recession risks, noting that policymakers are still expecting positive growth rates. Also, ECB Pierre Wunsch said he would be comfortable with a 50 bps hike in September, as 200 bps of hikes are needed relatively fast.

The EUR/USD pair flirted with the 1.0500 level and settled at 1.0520. The GBP/USD pair is below 1.2200. Commodity-linked currencies edged lower, undermined by the sour tone of Wall Street. US indexes are once again flirting with bearish territory.

The AUD/USD pair is now around 0.6900, while USD/CAD advanced to 1.2875. The USD/JPY pair is back above 136.00 and nearing multi-decade highs.

Gold shed some ground and settled around $1,820 a troy ounce, but crude oil prices kept rising amid supply concerns. G7 leaders discussed an agreement to impose a price cap on Russian oil, as sanctions on the crypto sent crude prices skyrocketing. WTI is now at around $111.60 a barrel.

Focus shifts to inflation, as the US will publish the Q1 core PCE Price Index on Wednesday, the Federal Reserve's favorite inflation figure, while Germany will unveil the preliminary estimate of June CPI data.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Summertime bull-run a multi-year bear market?

Like this article? Help us with some feedback by answering this survey:

- Gold is on the verge of a move to test $1,812 as the greenback remains firm.

- The US dollar has risen on Tuesday and is firmly back above 104.00, DXY.

The gold price is slightly lower in afternoon trade on Wall Street, losing some 0.13% to the greenback at $1,820.32. The price fell from a high of $1,829.50 to a low of $1,818.48 and is being pressured out of a bullish scenario on the charts.

''It's a snoozefest in gold markets,'' analysts at TD Securities note.

The price of the metal has been mostly rangebound for the month of June which has made for shorter-term two-way business between the final weeks of the month between $1,848 and $1,820 in the main. However, rather than rebounding from down here, the price is starting to eat into liquidity below with bulls checked by gains in the US dollar and inflationary pressures that are running at a 40-year high. Higher US yields, as a consequence, are detrimental for the yellow metal since gold does not offer investors yield.

''The yellow metal is being pulled in two directions as a hawkish Fed regime clashes with recession fears,'' analysts at TD Securities explained.

''After all, a Fed hiking cycle tends to be associated with rising recession risks, with the US5-30s curve already pointing to an elevated probability of a recession in the next twelve months. Gold has benefited from this narrative, as highlighted by substantial safe-haven inflows recorded in past weeks. Notwithstanding, this hiking cycle differs from recent historical analogs as the Fed's ability to control inflation is limited, given that the supply-side is disrupted.''

On Tuesday, the US dollar shot higher from below 104, making gold more expensive for international buyers. US dollar bulls moved in on euro weakness as European Central Bank (ECB) President Christine Lagarde offered no fresh insight into the central bank's policy outlook. Lagarde said the central bank would move gradually but with the option to act decisively on any deterioration in medium-term inflation, especially if there were signs of a de-anchoring of inflation expectations. The US dollar index (DXY), which had made a two-decade high of 105.79 this month, was last up 0.46% at 104.420. The DXY had been as low as 103.77 and as high as 104.606.

Inflation fears have advanced again and choppy trading persists, sinking US stocks midday at the same time that a consumer confidence gauge sank amid rising inflation expectations, undermining the improvement in investor sentiment after China relaxed certain COVID-19 restrictions. The Conference Board's measure of consumer confidence fell to 98.7 in June from 103.2 in May while the Board's inflation expectations index rose to 8% from 7.5%, the highest since the series began in 1987. The Dow Jones Industrial Average slid over 1.48% with the S&P 500 down 1.92% and the Nasdaq Composite 2.94% lower by Tuesday afternoon. All three indexes traded higher earlier in the session.

''Gold trading will likely remain a snoozefest while bears wait for a catalyst to shake-out this complacent length. In the meantime, continued whipsaws from CTA trend followers reflect the range-bound price action.

Gold technical analysis

There is an imbalance of price below which could be mitigated in the coming sessions for a test of $1,812.

- The British pound is losing 0.63% in the week.

- Soft US Consumer Confidence dropping to 20-year lows, augmented appetite for the buck.

- The GBP/USD falls due to a stronger buck, and weak US economic data.

The British pound extends its losses to two consecutive days, trading below the 1.2200 figure, after printing a daily high shy of the 1.2300 mark and stumbling towards the 1.2190s area in the North American session. At the time of writing, the GBP/USD is trading at 1.2189.

The GBP/USD fell due to a stronger buck, and weak US data

Sentiment shifted sour after a disappointing US Consumer Confidence reading dropped to a decade low, to 98.7 from a 103.2 downward revision in May. US equities tumbled on the headline, which sparked a counter-cyclical move in the greenback, rising instead of falling, and advanced back above the 104.000 mark, as shown by the US Dollar Index.

At the same time, further US economic data was unveiled led by the Richmond Fed’s Manufacturing Index fell below the expectations, shrinking from -19.0 vs. -12.0 foreseen, while the Dallas Fed Services Index contracted.

The GBP/USD reacted negatively and had the same fate as US equities, tumbling below June’s 27 low at 1.2238, exacerbating the downward move later, through the 1.2200 figure, registering a fresh weekly low at 1.2180.

Elsewhere, more Fed policymakers hit the media. The San Francisco Fed President Mary Daly commented that the Fed could address inflation, which according to her, is “half of the cause of inflation,” and said that the US would have slower growth.

Earlier, the New York Fed President John Williams said that officials would discuss whether to hike 50 or 75 bps the Federal funds rate in the next month on Tuesday. Williams added that policymakers would be data-dependent and does not foresee a recession in his baseline, though he acknowledged the US economy might slow down.

Regarding growth, the Fed’s Atlanta GDPNow, a forecast of the US GDP, rose from 0% to 0.3% on its last update, June 27.

Concerning the UK economic docket, the house of commons approved the North Ireland Protocol bill, which would allow the UK to scrap the Brexit deal, which would trigger a trading war with the EU, and weighed on the GBP/USD.

The US Dollar Index, a gauge of the buck’s value against six currencies, underpinned by the rise in the US 10-year yield up by four bps at 3.234%, advances firmly above the 104.000 thresholds, at around 104.560, gaining 0.62%.

The US economic docket will feature the Fed Chair Jerome Powell on Wednesday at an event organized by the European Central Bank.

GBP/USD Key Technical Levels

- USD/CAD slides from the dollar rally tops and consolidates awaiting the next catalyst.

- Oil prices are elevated and support the Canadian dollar.

At 1.2853, the Canadian dollar is down by some 0.15% at the time of writing after sliding from a high of 1.2894 to a low of 1.2819 following a rise in the price of oil on Tuesday. The Canadian dollar is ultimately holding on to its gains from Friday, as the recent pullback in bond yields bolstered investor sentiment at the start of the week.

However, the inflation fears have advanced again and choppy trading persists, sinking US stocks midday at the same time that a consumer confidence gauge sank amid rising inflation expectations, undermining the improvement in investor sentiment after China relaxed certain COVID-19 restrictions. The Dow Jones Industrial Average slid over 1% with the S&P 500 down 1.5% and the Nasdaq Composite 2.44% lower by Tuesday afternoon. All three indexes traded higher earlier in the session.

The Conference Board's measure of consumer confidence fell to 98.7 in June from 103.2 in May while the Board's inflation expectations index rose to 8% from 7.5%, the highest since the series began in 1987.

Perky oil

Nevertheless, a booster for the commodity currency that is strongly linked to the energy sector, oil prices rose early on Tuesday after the G7 countries agreed to explore capping the price of Russian oil sold on the world market.

Additionally, French President Emmanuel Macron, citing a United Arab Emirates dignitary, reportedly said the UAE was producing crude at maximum capacity and that Saudi Arabia could only scale up its oil output by 150,000 barrels per day. At its annual summit in Germany, G7 leaders agreed to explore the possibility of capping the price of Russian oil to cut the country's take from exports as its invasion of Ukraine continues. West Texas Intermediate crude oil futures advanced 2.1% to $111.78 per barrel.

As for the greenback, bulls moved in on euro weakness as European Central Bank (ECB) President Christine Lagarde offered no fresh insight into the central bank's policy outlook. Lagarde said the central bank would move gradually but with the option to act decisively on any deterioration in medium-term inflation, especially if there were signs of a de-anchoring of inflation expectations.

The US dollar index (DXY), which had made a two-decade high of 105.79 this month, was last up 0.46% at 104.420. The DXY had been as low as 103.77 and as high as 104.606.

For the Canadian economy, the Canadian Finance Minister Chrystia Freeland on Sunday said the economy still has a path to a "soft landing," where it could stabilize economically after the blow by the COVID-19 pandemic, without facing a severe recession that many fear.

In this regard, traders are in anticipation of Industry Level Gross Domestic product month on month for April this week, 30 June. Analysts at TD Securities expect industry-level GDP to rise by 0.3% in April, slightly above the flash estimate for a 0.2% rise. ''Look for increases in activity in both the goods and services sectors, but with goods leading the way. The flash estimate for May will be of particular interest, particularly given recent deterioration in consumer confidence.''

Nevertheless, speculators have cut their bullish bets on the Canadian dollar, data from the US Commodity Futures Trading Commission showed on Friday. As of June 21, net long positions had fallen to 4,105 contracts from 23,202 in the prior week.

Reuters has reported that San Francisco Federal Reserve Bank President Mary Daly on Tuesday said she believes the US economy will slow to below 2% annual growth as the Fed raises interest rates, but there's enough momentum that it won't stop growing.

"I do expect the unemployment rate to rise slightly, but nothing (like).... what people would think of as a recession," Daly said in an interview on LinkedIn.

Key comments

The fed can address inflation, at least partly.

Supply is still very short, made shorter by war in Ukraine.

Fed can reduce demand, which is about half of the cause of inflation.

Inflation bridles the economy.

getting price stability is a fundamental factor in achieving full employment.

The labor market is really strong right now.

The economy has a lot of momentum, that puts us in a better position of achieving a softer landing.

We will have slower growth, perhaps below 2%, but it won't be negative.

Expect unemployment rate to rise slightly, but not like in a recession.

We are tapping on the brakes to get to a more sustainable pace.

Global economy won't grow as fast because of Ukraine, and that will be a headwind for the u.s. economy.

Consumer and small business sentiment show pervasive effect of inflation.

I'm worried that left unbridled inflation would continue to threaten u.s. economy.

It is tough right now, but it will get better in part because of fed rate hikes, and signs of life in supply chains.

Mass layoffs in tech are not only related to slowing in the economy; tech is always repositioning itself.

Labor market is strong right now, despite layoffs; if you are in tech, you'll be able to continue to get jobs.

US dollar update

The US dollar bulls moved in on euro weakness as European Central Bank (ECB) President Christine Lagarde offered no fresh insight into the central bank's policy outlook.

Lagarde said the central bank would move gradually but with the option to act decisively on any deterioration in medium-term inflation, especially if there were signs of a de-anchoring of inflation expectations.

The US dollar index (DXY), which had made a two-decade high of 105.79 this month, was last up 0.462% at 104.517. The DXY had been as low as 103.77 and as high as 104.606.

- US: CB Consumer sentiment falls to a 16-month low.

- Stocks turned lower, main indexes fall by 1% on average.

- AUD/USD falls from six-day highs toward 0.6900.

US stocks turned to the downside on Tuesday and boosted the US dollar. The AUD/USD dropped to 0.6909, hitting a fresh daily low. It remains under 0.6930 with a bearish intraday bias. Earlier it climbed to a six-day high of 0.6964.

Since last Friday, AUD/USD is moving sideways between 0.6910 and 0.6960 with a modest bullish bias. Still unable to move significantly away from the 2-year low at 0.6823 it reached during May.

Risk-off weighs on AUD

The AUD/USD found support so far on Tuesday above the support area of 0.6905/10. A break lower could trigger more losses; the next strong support stands at 0.6870, around last week’s low. On the upside the immediate resistance could be seen at the 20-hour Simple Moving Average at 0.6930.

Stocks erased earlier gains. The S&P 500 is falling by 1.07%. The decline in Consumer Sentiment weighed on sentiment. Conference Board’s index dropped to the lowest level in 16 months in June amid rising inflation and a negative growth outlook.

On Wednesday, retail sales data is due in Australia at 01:30 GMT (market consensus: 0.4%). Analysts at TD Securities see a 0.5% increase. “A strong retail beat will strengthen the case for another aggressive move by the RBA (Reserve Bank of Australia) in July after their outsized 50bps hike this month.”

Technical levels

- USD/CHF bounces off near-daily lows and stays above the 50% Fibonacci retracement in the H1 chart.

- Disappointing US economic data sparks a counter-cyclical move with the US dollar rising instead of falling.

- The USD/CHF daily chart formed a double top that is in play, but USD/CHF sellers’ failures to breach 0.9520, might open the door for a rally towards 0.9600.

The USD/CHF is trying to stage a recovery after falling for six straight days, though it failed to break below the June 24 daily low of around 0.9561 and remains trapped within that day’s price action amidst the lack of a fresh impulse above/below the 0.9520-9630 range. At 0.9563, the USD/CHF advances barely by 0.07% in the North American session.

US equities are beginning to tumble as market sentiment shifted sour. During the Asian session, positive news from China that cut quarantine for travelers was overshadowed by a dismal read in US consumer confidence, triggering a counter-cyclical move in the greenback, with the US Dollar Index advancing sharply near last Friday’s high around 104.377, up by 0.42%.

USD/CHF traders should notice that negative US data from the growth perspective can sometimes boost the greenback, as is happening today.

USD/CHF Daily chart

A double top in the USD/CHF daily chart is still in play. However, since last Friday, CHF buyers could not achieve a fresh swing low, below the 0.9520-0.9630 range, keeping the major trapped. In the meantime, the Relative Strength Index (RSI) at 39.72 begins to show some signs of aiming slightly up, but unless it breaks the 50-midline, the bias remains negative, and the USD/CHF might probe the 100-day moving average (DMA) at 0.9508 in the near term.

USD/CHF 1-Hour chart

The USD/CHF is seesawing around the daily pivot near 0.9573, with the 50, 100, and 200-simple moving averages (SMAs) above the exchange rate. Nevertheless, the pullback from daily highs at around 0.9586 might be short-lived, as the price jumped from around the 50% Fibonacci retracement at 0.9560 after the London fix.

If the USD/CHF breaks above the 50-SMA at 0.9568, a re-test of the daily highs is on the cards. That said, the major next resistance would be the daily pivot at 0.9573, followed by the confluence of the 100-SMA, and the daily high near 0.9586-88, followed by the R1 daily pivot at 0.9600.

USD/CHF Key Technical Levels

The US dollar should remain strong against more currencies; however, the peak may be approaching earlier than initially expected, according to analysts at Wells Fargo. They believe medium-term dollar strength will be most pronounced against emerging market currencies.

Key Quotes:

“Our short to medium term view on the U.S. dollar is unchanged, and we continue to forecast a stronger greenback against most foreign currencies through early 2023. With the U.S. economy now likely to fall into recession and the Fed to start cutting policy rates, we now believe the dollar will peak in mid-2023 and start to gradually weaken in the second half of next year.”

“Dollar strength should persist through early 2023; however, peak dollar strength may be approaching earlier than we initially expected. As the Fed eases monetary policy in late 2023, we believe the dollar's rise should slow by the middle of next year and the greenback should eventually start to weaken against most foreign currencies. We continue to believe Latin American currencies will be the outlier. Political risks and mature tightening cycles should keep Latin American currencies from strengthening during our forecast horizon.

“We believe the Fed will act more aggressively than the European Central Bank as well as the Bank of England, which should keep the dollar on sound footing against the euro and the pound for at least the next few quarters. In addition, with the Bank of Japan unlikely to adjust monetary policy settings for the foreseeable future or intervene meaningfully to halt depreciation, we believe the yen can continue to reach new lows against the greenback. We do, however, believe the Canadian dollar could be more resilient to broad U.S. dollar strength. As mentioned, BoC policymakers have turned more hawkish, and we look for Canadian policymakers to broadly match Fed rate hikes in the short term.”

The pound may not receive a lasting support from the Bank of England, even if it accelerates rate hikes, as investors override concerns about UK investment and growth, explain analysts at Rabobank.

Key Quotes:

“The BoE was quicker out of the blocks on policy tightening than many other G10 central banks this cycle. However, the five interest rate hikes announced by the BoE already have not prevented the pound from being one of the poorest performing G10 currencies in the year to date. A step up in the pace of BoE rate hikes, may not provide the pound with much lasting support given investors overriding concerns about UK investment and growth. We see scope for EUR/GBP to end the year around 0.88.”

“A current account deficit in a country where fundamentals are perceived to be poor is likely to trigger a downward adjustment in its currency. Higher interest rates could bring a short-term boost, but ultimately may only serve to weaken the environment for investment and growth in the medium-term which could thicken the clouds over the outlook for the pound.”

“By the end of the year, it is possible that the BoE’s window of opportunity for rate hikes could have closed completely as the cost of living crisis grows. This could leave the pound further disadvantaged.”

- The yellow metal is near the day’s lows and aiming lower, extending Monday’s losses.

- Risk-on mood, spurred by China’s news, decreased appetite for safe-haven assets.

- US consumer confidence fell the most since February 2021.

- Gold Price Forecast (XAUUSD): To remain downward pressured below the 200-DMA

Gold spot (XAUUSD) prolonged its losses for the second straight day, struggling to stay above the $1820 mark amidst a positive market mood that witnessed a jump in riskier assets, weighing on safe-haven assets, particularly in the precious metal segment. At the time of writing, XAUUSD is trading at $1820.72, recording minimal losses of 0.10%.

XAUUSD’s Tuesday’s price action illustrates that the yellow metal entered a consolidation phase before resuming Monday’s downtrend, seesawing around its low at $1820.61. Nevertheless, it should be noted that XAUUSD will face solid support around the June 24 low at $1816.64.

Sentiment and a strong US dollar weighed on the gold price

Global equities rallied on positive news from China. Beijing cut the Covid-19 quarantine for travelers, which was greatly cheered by investors, shifting from the negative sentiment of Monday’s Wall Street session. In the meantime, US consumer confidence fell in June to its lowest level in 12 months, as inflation dampened US citizens’ economic conditions.

Elsewhere, Fed speakers will continue to cross newswires. On Tuesday, the NY Fed President John Williams said that officials would discuss whether to hike 50 or 75 bps the Federal funds rate in the next month. Williams added that policymakers would be data-dependent and that he does not foresee a recession in his baseline, though he acknowledged the US economy might slow down.

The US Dollar Index, a gauge of the buck’s value against six currencies, underpinned by the rise in the US 10-year yield up by four bps at 3.234%, advances firmly above the 104.000 thresholds, at around 104.560, gaining 0.62%.

Also, the US 10-year TIPS (Treasury Inflation-Protected Securities), a proxy for Real yields, climbs six basis points, up to 0.707%, a headwind for gold prices.

In the meantime, outflows from gold ETFs could add some pressure on gold. Commerzbank analysts wrote, “holdings in the gold ETFs tracked by Bloomberg were reduced by 6 tons yesterday. The momentum of outflows has picked up pace again of late.”

Meanwhile, the Richmond Fed Manufacturing Index added to the ongoing Fed regional indices displaying negative readings and could be a prelude to July’s ISM Manufacturing PMI.

The US economic docket will feature later the San Francisco’s Fed Mary Daly, and by Wednesday, Cleveland’s Fed President Loretta Mester and Fed Chair Jerome Powell will cross wires.

Gold Price Forecast (XAUUSD): Technical outlook

XAUUSD is still downward biased, consolidating in the $1820-50 range. However, a daily close below $1820 would open the door for further losses. Besides, the daily moving averages (DMAs) above the spot price and the RSI at bearish territory bolstered the seller’s hopes for lower prices.

Therefore, the XAUUSD’s first support would be June 16 low at 1814.68. Break below will expose the June 14 low at $1804.95, followed by $1800.

- US dollar gains momentum during American session.

- Euro prints fresh lows versus USD, CHF and GBP.

- Stocks erase gains in Wall Street, US yields move off highs.

The EUR/USD dropped further and bottomed at 1.0501, the lowest level since Thursday. It then trimmed losses, rising to 1.0530. The move lower took place amid a stronger US dollar across the board.

The greenback gained ground as Wall Street indexes turned negative. The Dow Jones is falling by 0.51% and the Nasdaq by 1.74%. US yields pulled with the US 10-year at 3.20% and the 30-year at 3.31%.

US economic data came in below expectations. The Conference Board’s Consumer Confidence Index dropped to 98.7 in June, the lowest level in 16 months. The Richmond Fed Manufacturing Index tumbled to -19 in June from -9, against market consensus of -11. The S&P/Case Shiller Price Index rose 1.6% in April. The numbers did not affect the dollar.

The euro is among the worst performers of the American session. EUR/CHF dropped to test last week's lows near 1.0050 and EUR/GBP pulled back to 0.8620. The common currency did not benefit from hawkish comments by European Central Bank officials.

The annual ECB forum in Portugal will have its last day on Wednesday. A discussion panel will include Lagarde (ECB), Powell (Fed) and Baily (BoE).

Short-term outlook

The EUR/USD moved off lows and is back above 1.0530. The pair will likely continue to move sideways between 1.0500 and 1.0600. Earlier on Tuesday the euro traded above 1.0600 but again it was rejected from those levels; it needs to consolidate above those levels to open the doors to more gains.

The immediate resistance is seen at 1.0550 (20-SMA in four hour chart); while below EUR/USD could test 1.0500 again. The next level to watch is last week’s low at 1.0467.

Technical levels

The United States will prohibit Russian gold imports in the latest round of sanctions, the Treasury Department announced on its website on Tuesday, as reported by Reuters.

Additional takeaways

"US imposes Russia-related sanctions on dozens of entities and individuals."

"Latest sanctions target Russia's state-owned defense conglomerate Rostec and affiliated entities."

"Latest sanctions target multiple banks including Bank of Moscow."

"US imposes sanctions on United Aircraft Corp."

Market reaction

This headline doesn't seem to be having a significant impact on gold's valuation. As of writing, XAU/USD was down 0.15% on the day at $1,820.

- Consumer confidence in the US continued to weaken in June.

- US Dollar Index clings to strong daily gains near mid-104.00s.

The data published by the Conference Board showed on Tuesday that the Consumer Confidence Index dropped to 98.7 in June from 103.2 in May. This print came in weaker than Reuters' estimate of 100.00.

Further details of the press release revealed that the Present Situation Index fell to 147.1 from 147.4 and the Expectations Index plunged to its lowest level since March 2013 at 66.4 from 73.7.

Additionally, the one-year consumer inflation rate expectations climbed to 8% from May's revised print of 7.5%.

Market reaction

The greenback continues to outperform its major rivals after this report and the US Dollar Index was last seen rising 0.5% on the day at 104.45.

- A combination of supporting factors pushed USD/JPY higher for the second successive day.

- The risk-on impulse, the Fed-BoJ policy divergence, rising US bond yields extended support.

- Resurgent USD demand provided an additional lift, taking along stops near the 136.00 mark.

The USD/JPY pair built on its steady intraday ascent through the early North American session and shot to a fresh three-day high, around the 136.30 region in the last hour.

The markets turned optimistic amid hopes that inflation is nearing its peak, bolstered by the recent decline in commodity prices. Furthermore, China announced to relax COVID-19 quarantine requirements for international travellers and raised expectations for a revival in global growth. This, in turn, boosted investors' confidence and undermined the safe-haven Japanese yen.

The risk-on flow pushed the US Treasury bond yields higher, widening the gap between the US-Japanese bond yields. This, along with the divergent monetary policy stance adopted by the Bank of Japan and the Federal Reserve, weighed heavily on the JPY. Apart from this, a strong pickup in the US dollar demand also contributed to the strong bid tone surrounding the USD/JPY pair.

The intraday bullish momentum, also marking the third successive day of a positive move, could further be attributed to some technical buying above the 136.00 round-figure mark. This, in turn, might have already set the stage for an extension of the upward trajectory, back towards retesting a 24-year high, around the 136.70 region touched last week.

Moving ahead, the market focus now shifts to Fed Chair Jerome Powell's appearance on Wednesday. Market participants will look for clues about the US central bank's policy tightening path. This will play a key role in influencing the near-term USD price dynamics and help investors to determine the next leg of a directional move for the USD/JPY pair.

Technical levels to watch

Julia Goh, Senior Economist at UOB Group and Economist Loke Siew Ting comment on the June BSP event.

Key Takeaways

“Bangko Sentral ng Pilipinas (BSP), as expected, raised its overnight reverse repurchase (RRP) rate for the second straight meeting by 25bps to 2.50% today (23 Jun). Accordingly, both the overnight deposit and lending rates were also hiked to 2.00% and 3.00% respectively.”

“The latest move came after the national inflation hit above BSP’s 2.0%-4.0% medium-term target range in May (at 5.4%) and the government approved PHP1 provisional fare hike for jeepneys in mid-Jun that will likely intensify second-round effects on headline inflation. In view of inflation risks still tilting to the upside, BSP revised its inflation forecasts higher to 5.0% for 2022 (from 4.6% previously, UOB est: 5.0%) and 4.2% for 2023 (from 3.9% previously, UOB est: 4.0%), and introduced a 3.3% inflation outlook for 2024.”

“The accompanying statement revealed BSP’s top priority now is to bring inflation back to its 2.0%4.0% target range over the medium term, which is in line with our expectations. Hence, we continue to expect BSP to raise rates by a measured 25bps at every remaining meeting of this year in Aug, Sep, Nov, and Dec. This will bring the RRP rate to 3.50% by the end of 2022.”

- EUR/USD reverses the positive start of Tuesday’s session.

- Further gains look initially limited by the 55-day SMA near 1.0615.

EUR/USD fades part of the recent 2-day advance and quickly retreats to the low-1.0500s on Tuesday.

In the very near term, occasional bullish attempts need to surpass the 55-day SMA near 1.0615, which also coincides with the weekly highs. If surpassed, then the next hurdle of note emerges at the 4-month line near 1.0660. The pair is expected to see its downside pressure alleviated on a close above the latter, with the next target at the June top at 1.0773 and the May peak at 1.0786.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1125.

EUR/USD daily chart

It is a snoozefest in gold markets. Strategists at TD Securities expect this regime to continue for the time being.

Hawkish Fed regime clashes with recession fears

“The yellow metal is being pulled in two directions as a hawkish Fed regime clashes with recession fears. After all, a Fed hiking cycle tends to be associated with rising recession risks.”

“This hiking cycle differs from recent historical analogs as the Fed's ability to control inflation is limited, given that the supply-side is disrupted. In turn, gold bugs sniffing out a potential stagflationary outcome associated with lower growth but lingering inflation should consider that central banks, facing a credibility crisis, could also continue to raise rates for longer than they otherwise would.”

“Gold trading will likely remain a snoozefest while bears wait for a catalyst to shake-out this complacent length.”

- The emergence of aggressive USD dip-buying assisted USD/CAD to pare its intraday losses.

- Bullish crude oil prices continued underpinning the loonie and caped any meaningful upside.

- Investors now look forward to the US economic data for some short-term trading impetus.

The USD/CAD pair recovered a few pips from over a two-week low touched earlier this Tuesday and was last seen trading just below mid-1.2800s, still down over 0.25% for the day.

Bullish crude oil prices underpinned the commodity-linked loonie and dragged the USD/CAD pair lower for the third successive day. G7 leaders agreed to explore price caps on imports of Russian oil and gas, fueling supply concerns. Apart from this, the easing of COVID-19 curbs in China lifted hopes for demand recovery and lifted crude oil prices to a one-week high.

On the other hand, the US dollar made a solid comeback and snapped a two-day losing streak to over a one-week low amid a goodish pickup in the US Treasury bond yields. This, in turn, assisted the USD/CAD pair to find decent support near the 1.2820-1.2815 region and stall its intraday bearish trajectory, though any meaningful upside still seems elusive.

Investors turned optimistic amid hopes that inflation is nearing its peak, which was evident from the prevalent risk-on mood around the equity markets. The softening inflation expectations also seem to have forced investors to scale back their expectations for a more aggressive policy tightening by the Fed, which might keep a lid on any further gains for the buck.

Hence, it will be prudent to wait for strong follow-through buying before confirming that the recent pullback from the YTD peak has run its course and placing fresh bullish bets around the USD/CAD pair. Market participants now look forward to the US economic docket - featuring the release of the Conference Board's Consumer Confidence Index and Richmond Manufacturing Index.

The data, along with the US bond yields and the broader market risk sentiment, will drive the USD demand and provide some impetus to the USD/CAD pair. Traders will further take cues from oil price dynamics to grab short-term opportunities around the major. The focus, however, would remain on the OPEC+ meeting and Fed Chair Jerome Powell's appearance on Wednesday.

Technical levels to watch

GBP/USD awaits the Bank of England’s Governor Andrew Bailey's speech at the ECB forum in Sintra, Portugal on Wednesday. Hawkish remarks are needed to lift the pound, economists at Scotiabank report.

Markets set a high bar for the BoE with 165 bps expected by year-end

“There are no domestic drivers for GBP price action until tomorrow’s address by BoE Gov Bailey where we’re looking for confirmation that the bank will tighten by 50 bps in Aug. With weak UK growth and global recession fears, the GBP will need the support of a hawkish central bank.”

“Markets have set a high bar for the BoE with 165 bps in hikes expected by year-end, so further downside on the crosses for the GBP looks more likely.”

Enrico Tanuwidjaja, Economist at UOB Group, assesses the recent BI interest rate decision.

Key Takeaways

“Bank Indonesia (BI) kept its benchmark rate (7-Day Reverse Repo) unchanged at 3.50% at its June MPC meeting. Consequently, BI maintained the Deposit Facility rate at 2.75% as well as the Lending Facility rate at 4.25%.”

“The policy of liquidity normalisation has been accelerated through a gradual increase in Reserve Requirement (RR) for Conventional Bank from the current 5% to 6% starting this month, and further to 7.5% starting next month and to reach 9.0% starting on 1 September 2022.”

“We keep our view for BI to start hiking in 2H22, with two 25bps hikes in 3Q 2022 to 4.00%, followed by another two 25bps hikes in 4Q, taking its benchmark rate to 4.5% by the end of 2022.”

Japanese Prime Minister Fumio Kishida said on Tuesday that they will extend an additional $100 million in humanitarian aid to Ukraine, as reported by Reuters.

Additional takeaways

"G7 agreed Russia is to blame for global price increases."

"Japan will extend support to expand Ukraine's grain storage capacity as harvest season nears."

"Will do utmost to secure enough power supply in Japan."

"Will work hard to realise continued wage hikes."

"G7 agreed that unilateral attempt to change status quo by force is unacceptable."

Market reaction

USD/JPY preserves its bullish momentum after these comments and was last seen rising 0.57% on a daily basis at 136.20.

- DXY leaves behind two daily pullbacks in a row.

- Further up comes the weekly peak near 105.00.

DXY regains the smile and manages to stage quite a moderate bounce to the area well north of the 104.00 mark on Tuesday.

Ideally, the index should surpass the weekly high near 105.00 (June 22) in the near term to allow for the recovery to gather momentum and attempt a visit to the nearly 20-year peak in the 105.80 zone (June 15). On the flip side, a breach of the lower bound of the range carries the potential to force the index to challenge the weekly low at 103.42 (June 16).

As long as the 4-month line near 102.20 holds the downside, the near-term outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen bullish while above the 200-day SMA at 97.95.

DXY daily chart

The USD/CAD finally cracked retracement support at 1.2865 to edge back to the low 1.28s. Economists at Scotiabank expect the pair to extend its decline towards the 1.2730 mark.

USD/CAD can push on to the low/mid 1.27s

“Short-term trends suggest building bearish momentum behind the USD’s decline and price patterns point to USD losses extending to the 1.2730/35 zone after spot rejected the 1.3075 area again earlier this month.”

“We spot interim support at 1.2795/00 ahead of 1.2730 (61.8% retracement of the June rally in the USD).”

“Look to fade minor USD gains to the upper 1.28s.”

- House prices in the US rose by 1.6% on a monthly basis in April.

- US Dollar Index clings to daily gains near 104.30.

The monthly data published by the US Federal Housing Finance Agency showed on Tuesday that the Housing Price Index rose by 1.6% on a monthly basis in April. This print matched March's reading and came in slightly higher than the market expectation for an increase of 1.5%.

On a yearly basis, home prices in the US increased by 18.8%.

Additionally, the S&P/Case-Shiller Home Price Index edged higher to 21.2% annually in April from 21.1%.

Market reaction

There was no immediate market reaction to these figures and the US Dollar Index was last seen rising 0.37% on a daily basis at 104.33.

New York Fed President John Williams told CNBC on Tuesday that recession was not his base case, as reported by Reuters.

Additional takeaways

"Economy is strong, financial conditions have tightened."

"GDP expected to grow 1% 1.5% for the year."

"We have a path forward to bring inflation down."

"Some downside risks are from abroad."

"Watching effects of tightening financial conditions."

"Seeing slowing in interest-rate sensitive sectors."

"Unemployment rate will move up in next few years."

"Unemployment will rise to a little over 4% over the next couple of years."

"Longer-run neutral rate has not changed, still quite low."

"Nominal neutral rate is higher, that's one reason we need to raise rates quite a bit this year, next year."

"We need to get real rates above zero."

"We need to get to somewhat restrictive territory next year."

"The data may tell us something different."

"Reasonable to get to 3.5% - 4% fed funds rate."

"75 bps rate move was exactly right."

"Next meeting 50 bps or 75 bps will be the debate."

"Not seeing signs of the taper tantrum, markets are functioning well."

Market reaction

The greenback holds its ground after these comments with the US Dollar Index rising 0.35% on the day at 104.30.

- US' international trade deficit narrowed modestly in May.

- US Dollar Index holds in positive territory above 104.00.

The data published by the US Census Bureau revealed on Tuesday that the United States' international trade deficit narrowed by $2.4 billion to $104.3 billion in May from $106.7 billion in April.

"Exports of goods for May were $176.6 billion, $2.0 billion more than April exports," the publication further read. "Imports of goods for May were $280.9 billion, $0.4 billion less than April imports."

Market reaction

The US Dollar Index continues to edge higher after this report and was last seen rising 0.3% on a daily basis at 104.25.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest inflation figures in Malaysia.

Key Takeaways

“Headline inflation accelerated to 2.8% y/y in May (from 2.3% in Apr), surpassing our estimate (2.6%) and Bloomberg consensus (2.7%). Approximately 67% of 12 consumer price index (CPI) components recorded a larger annual gain in prices as compared to the preceding month, led by food & non-alcoholic beverages, transport, recreation services & culture, restaurants & hotels, as well as housing, utilities & other fuels segments. This suggests broader second-round effects on consumer prices from higher energy prices, raw material and labour shortages.”

“Going into 2H22, we expect CPI growth to trend higher as low-base effects kick in and the government has begun to gradually adjust prices of administered item amid elevated global commodity prices, currency weakness, and recovering domestic demand. Headline CPI growth may breach 5.0% at some point in 3Q22 should headwinds persist and the government further adjust subsidies for other price-administered items, posing upside risks to our 2022 full-year headline inflation outlook which is at 3.0% currently (BNM est: 2.2%-3.2%, 2021: 2.5%).”

“Given signs of broader second-round effects on consumer prices, ongoing domestic recovery, and latest developments in global financial markets, we think there is room for Bank Negara Malaysia (BNM) to follow-through with another 25bps rate hike at both the 6 Jul and 8 Sep monetary policy meetings. Hence, our updated OPR projection is 2.50% by end-2022.”

- Silver gained some positive traction on Tuesday, though lacked follow-through buying.

- The technical set-up favours bearish traders and supports prospects for further losses.

- Sustained strength beyond the $22.00 mark is needed to negate the negative outlook.

Silver attracted some dip-buying near the $21.10 area on Tuesday, albeit lacked bullish conviction and remained below a three-day high touched the previous day.

Given the recent repeated failures to find acceptance above the 200-period SMA on the 4-hour chart, the near-term bias remains tilted in favour of bearish traders. The negative outlook is reinforced by the fact that technical indicators on short-term charts are holding deep in the bearish territory and are still far from being in the oversold zone.

Some follow-through selling below the $21.00 round-figure mark will reaffirm the bearish bias and drag the XAG/USD back towards the monthly swing low, around the $20.60 area touched last week. The downward trajectory could further get extended towards the YTD low, around the $20.45 region en-route the next relevant support near the $20.00 psychological mark.

On the flip side, the overnight swing high, around the $21.55 region now seems to act as an immediate resistance ahead of the 200-period SMA on the 4-hour chart, currently near the $21.65 area. Sustained strength beyond could trigger a short-covering move, though the momentum runs the risk of fizzling out rather quickly and remain capped near the $22.00 mark.

The latter should act as a pivotal point, which if cleared decisively might negate the bearish outlook and pave the way for a further near-term appreciating move. The XAG/USD might then accelerate the move towards an intermediate resistance near the $22.30 area en-route the $22.50-$22.60 hurdle, above which bulls might aim to reclaim the $23.00 round-figure mark.

Silver 4-hour chart

-637920162022886555.png)

Key levels to watch

The yen has been significantly under pressure. Nonetheless, if it becomes foreseeable that the Federal Reserve will lower its key rate again in 2023, Japan's currency has recovery potential, according to economists at Commerzbank.

When will the yen depreciation end?

“We expect the interest rate outlook for other G10 central banks to stay elevated in the near term, keeping the yen under depreciation pressure.”

“Quite quickly, however, the USD/JPY trend is likely to reverse again. As the probability of a US recession increases, the realization that the Fed will have to cut its key rate again in the foreseeable future should increasingly mature.

”We expect the USD/JPY exchange rate to stabilize even without MOF intervention and the yen to recover moderately once a US recession and falling US interest rates are going to be more widely expected.”

- EUR/JPY clinches new 2022 peak near 144.30 on Tuesday.

- Further up appears the 2015 top near 145.30.

EUR/JPY prints gains for the third session in a row and records new cycle highs near 144.30 on Tuesday.

The bullish bias in the cross remains well and sound and the continuation of the recovery now targets the round level at 145.00 prior to the 2015 high at 145.32 (January 2). Further up is the 2014 top at 149.78 (December 8).

In the meantime, while above the 3-month support line around 138.40, the short-term outlook for the cross should remain bullish. This area appears reinforced by the proximity of the 55-day SMA.

EUR/JPY daily chart

- GBP/USD witnessed some intraday selling on Tuesday and dropped to a three-day low.

- Brexit woes, less hawkish BoE expectations continued acting as a headwind for sterling.

- Rising US bond yields revived the USD demand and contributed to the intraday selling.

The GBP/USD pair retreated nearly 60 pips from the daily swing high touched during the early European session and dropped to a three-day low, around the 1.2235-1.2230 region in the last hour.

The latest Brexit-related development over the Northern Ireland Protocol has raised the risk of fresh tension between Britain and the European Union. In fact, the UK House of Commons on Monday voted 295 to 221 in favour of a controversial bill that would unilaterally overturn part of Britain's divorce deal from the EU agreed in 2020.

Apart from this, speculations that the Bank of England (BoE) will adopt a more gradual approach towards raising interest rates amid fears of a UK recession acted as a headwind for the British pound. This, along with the emergence of some US dollar buying dragged the GBP/USD pair away from over a one-week high touched the previous day.

The risk-on flow pushed the US Treasury bond yields higher, which, in turn, assisted the USD to reverse its modest intraday losses. That said, reduced bets for a more aggressive policy tightening by the Fed might hold back the USD bulls from placing aggressive bets and help limit deeper losses for the GBP/USD pair, at least for the time being.

The recent decline in commodity prices now seems to have eased concerns about the persistent rise in inflation. This, along with the worsening economic outlook, forced investors to reassess expectations for a faster policy tightening by the Fed. Hence, the market focus will remain glued to Fed Chair Jerome Powell's appearance on Wednesday.

The BoE Governor Andrew Bailey is also due to speak at the ECB forum in Sintra, Portugal on Wednesday, which would help investors determine the next leg of a directional move for the GBP/USD pair. In the meantime, traders on Tuesday will take cues from the US macro data - the Conference Board's Consumer Confidence Index and Richmond Manufacturing Index.

Technical levels to watch

USD/IDR could likely face extra consolidation in the short-term horizon, noted Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last Monday (20 Jun, spot at 14,830) that USD/IDR ‘is likely to strengthen further but the major resistance at 14,950 is likely out of reach’. We added, ‘there is another resistance at 14,900’”.

“USD/IDR rose to a high of 14,872 on Wednesday before pulling back. Shorter-term upward pressure has eased and USD/IDR is likely to trade sideways for this week, expected to be within a range of 14,720/14,870.”

- Gold Price rebound lacks follow-through bias, as Treasury yields firm up.

- USD stays sluggish amid a better mood, ahead of NATO, ECB Forum.

- Oil price surge keeps the demand for XAUUSD underpinned.

Optimism prevails, pointing to a turnaround Tuesday for the financial markets, as the previous week’s upbeat global momentum returns and caps the broad US dollar recovery. Investors, however, remain wary ahead of the key NATO Summit and a policy panel of the heads of the Fed, BOE and ECB due later this week. The sluggish price action in the dollar is helping Gold Price recoup a part of Monday’s sharp decline. The upside in the yellow metal lacks traction, as the US Treasury yields resume their gradual recovery mode amid lingering recession fears and an aggressive Fed rate-hike track. Buyers also remain cautious, as a slew of key US economic data are due for release later this week, which may prompt markets to re-price the hawkish Fed expectations, in turn impacting gold valuations.

Also read: Gold Price Forecast: Can XAUUSD bulls defend the critical $1,820 support?

Gold Price: Key levels to watch

The Technical Confluence Detector shows that Gold Price is approaching the strong support around $1,820, where the previous day’s low and the Bollinger Band four-hour Lower merge.

Selling interest may pick up steam below the latter, exposing the convergence of the previous week’s low, Fibonacci 23.6% one-month and pivot point one-day S1 at $1,816.

The line in the sand for gold optimists is seen at the pivot point one-week S1 at $1,813.

On the flip side, bulls need to find a strong foothold above the $1,829 barrier, which is the confluence of the SMA5 one-day, Fibonacci 38.2% one-day and one-week.

The next stop for bulls is aligned at the SMA10 one-day at $1,832, above which the Fibonacci 61.8% one-day at $1,835 will come to sellers’ rescue.

Further up, the intersection of the Fibonacci 61.8% one-week and pivot point one-day R1 at $1,837 will offer stiff resistance.

Here is how it looks on the tool