- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- AUD/JPY is balancing above 92.00 on soaring market mood.

- As per the market consensus, the RBA may elevate its interest rates by 50 bps.

- The upbeat Caixin Manufacturing PMI has supported a rebound in the risk barometer.

The AUD/JPY pair is displaying back and forth moves in a narrow range of 92.07-92.30 in the early Tokyo session. The risk barometer has turned sideways after displaying a firmer rebound from Friday’s low around 91.50. This has also marked a rebound in the risk-on impulse.

Investors are underpinning the antipodean against the Japanese yen after testing the monthly low on soaring odds of an extreme hawkish tone by the Reserve Bank of Australia (RBA) in its July monetary policy meeting on Tuesday. RBA Governor Philip Lowe is likely to hike its Official Cash Rate (OCR) by 50 basis points (bps). This will elevate the OCR to 1.35%.

It is worth noting that the RBA also elevated its interest rates by 50 bps in June. Considering the soaring inflation rate in the aussie economy, a jumbo rate hike looks effective. The aussie agencies have reported the inflation rate for the first quarter of CY2022 at 5.1%.

Apart from the risk-on impulse, the upbeat Caixin Manufacturing Purchase Managers Index (PMI) has also supported aussie. The economic data has landed at 51.7, higher than the estimates and the former release of 50.1 and 48.1 respectively. A higher-than-expected economic data indicate that production activities are operating at a decent pace and the aggregate demand for manufactured products is advancing firmly. The Australian economy is a leading exporter to China and an improvement in Chinese data also supports the antipodean.

On the Tokyo front, the continuation of an ultra-loose monetary policy by the Bank of Japan (BOJ) will weigh pressure on the yen bulls as other nations are suiting up for more rate hike announcements this month. The economy is facing the headwinds of soaring oil and food prices, which have elevated their plain-vanilla inflation rate but not the core Consumer Price Index (CPI).

- EUR/GBP extends three-week uptrend during Monday’s quiet Asian session.

- Tories eye another attempt to oust UK PM Boris Johnson, BCC survey highlights recession fears.

- Bulls seek ECB’s hawkish bias after witnessing record EU inflation.

EUR/GBP justifies downbeat British fundamentals while stretching the previous three-week uptrend to 0.8620 during Monday’s Asian session. In doing so, the cross-currency pair also takes clues from the increasing hawkish bets on the European Central Bank’s (ECB) July rate hike.

Having failed to remove UK Prime Minister (PM) Boris Johnson in their first attempt, the Conservative Party members eye another effort to oust the British leader, as signaled by the UK Telegraph. The news mentioned, “Opponents of the Prime Minister will try to overhaul 1922 Committee rules so that another leadership challenge can be triggered immediately.”

Elsewhere, the latest survey from the British Chambers of Commerce (BCC) mentioned that 54% of more than 5,700 companies it surveyed between May 16 and June 9 expected turnover to increase over the next 12 months. This is down from 63% in the previous survey and the lowest share since late 2020, when many businesses were under some form of COVID restrictions, per Reuters. The news also stated, “British companies have turned increasingly glum about the outlook, with inflation surging and investment plans looking stagnant.”

On the other hand, the Financial Times (FT) stated that the ECB to discuss blocking banks from multibillion-euro windfall as rates rise. It’s worth noting that the bets on the ECB’s 50 basis points (bps) rate hike in July are on the rise of late, which in turn propels the EUR/GBP buyers ahead of this week’s ECB Minutes, up for publishing on Thursday.

That said, Monday’s German Trade Balance for May can entertain intraday traders amid a likely sluggish session due to the US holiday.

Technical analysis

Although fundamentals are in favor of the EUR/GBP bulls, Friday’s gravestone Doji candlestick hints at the pullback towards a seven-week-old support line of 0.8580.

- Silver rebounds from two-year low as Five-month-old support line challenges bears.

- Oversold RSI conditions add strength to the recovery moves.

- Previous support line from mid-June guards immediate recovery, 61.8% Fibonacci retracement of 2020-21 upside lure bears.

Silver (XAG/USD) picks up bids to $19.90 during Monday’s Asian session, bouncing off a two-year low after the five-week downtrend.

Even if the bright metal refreshed the multi-day low the previous day, it couldn’t provide a daily closing below a downward sloping support line from early February, around $19.60 by the press time.

In addition to the failure to break the key support line on a daily closing basis, the oversold RSI (14) also hints at the quote’s short-term recovery.

However, the support-turned-resistance line from mid-June, around $20.35, guards the metal’s immediate recovery.

Following that, the 10-DMA and a downward sloping resistance line from April 18, respectively around $20.60 and $21.00, will be important to recall the XAG/USD buyers.

On the contrary, the aforementioned multi-day-old support line, near $19.60, restricts silver’s immediate downside, not to forget the oversold RSI conditions.

Should the quote drop below $19.60, the odds of witnessing a 100-pip slump towards the 61.8% Fibonacci retracement of 2020-21 upside, near $18.50-55, can’t be ruled out.

Silver: Daily chart

Trend: Further recovery expected

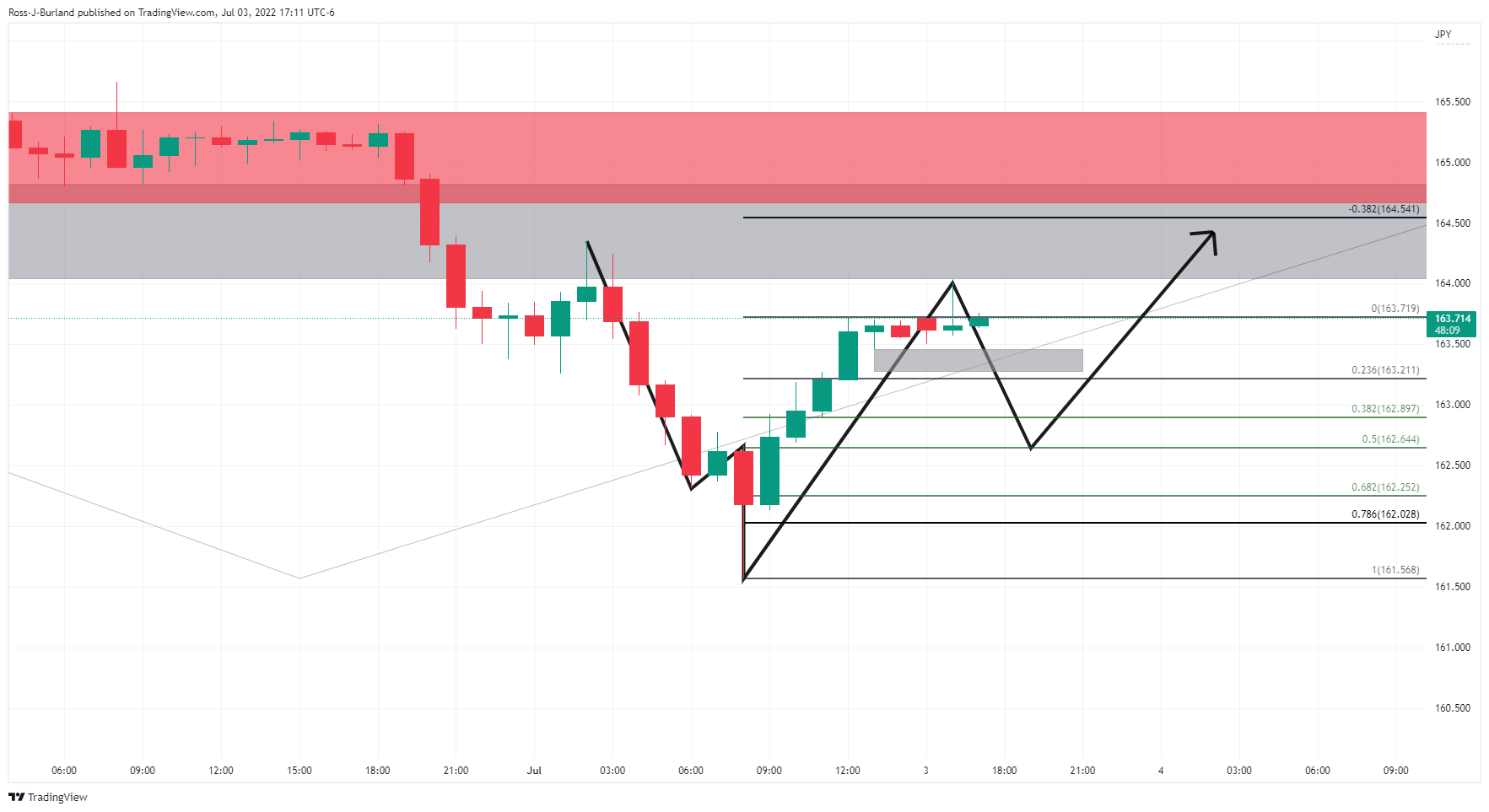

- GBP/JPY is at a crossroads and the downside is compelling as per the hourly timeframe.

- On a medium-term outlook, the bulls could take up the bias.

GBP/JPY is a compelling feature on the currency charts due to the two-way business opportunities it presents across the daily and hourly time frames.

The following illustrates the M and W formations that would be expected to play out in the coming sessions.

GBP/JPY daily chart

The M-formation is a bullish reversion pattern and the price is anticipated to revisit the neckline of the pattern in due course. This currently has a confluence with the price imbalance and a 61.8% ratio thereafter.

GBP/JPY hourly chart

The hourly W-formation, however, would be expected to draw in the price for the meantime as illustrated above. A 50% mean reversion aligns with the neckline of the pattern currently.

- USD/CAD is facing severe resistance above 1.2880 amid a broader sell-off in the DXY.

- The downbeat US ISM data has strengthened the odds of a recession situation.

- Canada’s Unemployment Rate may increase to 5.2% vs. 5.1% reported earlier.

The USD/CAD pair witnessed a minor reversal from around 1.2880 at the open, however, the broad-based selling in the US dollar index (DXY) has brought offers in the asset. The latter displayed extreme selling pressure after re-testing its 23-year high at 105.79, which acted as a supply zone for the asset. The supply zone got triggered after the market participants considered the DXY an expensive bet.

The release of the weak US Institute of Supply Management (ISM) economic data halted the victory chariot of the DXY on Friday. The downbeat US ISM figures on Manufacturing, Employment, and New Orders front escalated the recession fears in the US economy. Advancing recession fears may further trim the odds of an aggressive hawkish tone by the Federal Reserve (Fed) for its July monetary policy meeting.

As per the market consensus, the Fed is expected to maintain its status-quo and may announce a 75 basis point (bps) interest rate hike in July. Now, lower-than-expected to US ISM may compel the Fed to dictate a 50 bps rate hike or lower than that.

On the loonie front, investors are focusing on the employment data, which will release on Friday. A preliminary estimate for the Unemployment Rate is 5.2% vs. the prior print of 5.1%. This may keep the loonie bulls on the tenterhooks.

Meanwhile, the oil prices are oscillating minutely below $107.00 after a firmer recovery from $103.00 on Friday. The black gold is expected to remain sideways as investors are in a fix between the prolonged supply worries and renewed recession fears. The oil prices have reported negative monthly results in June after a spree of six monthly gains.

- WTI struggles to extend the previous week’s recovery, grinds higher of late.

- Iran announces price cuts to compete Russia, US PMIs propelled economic fears.

- US holiday to limit intraday moves but Fed Minutes, US NFP will be crucial to watch for clear directions.

WTI crude oil prices fail to extend Friday’s run-up, taking rounds to $106.75-80 during Monday’s Asian session, as traders seek fresh directions amid multiple challenges for bulls.

While fears of economic slowdown and the recent US dollar strength could be termed as the key hurdles for the oil buyers, the recent news from Bloomberg, conveying Iran’s readiness for price cuts, also weighs on the black gold. “Iran is being forced to discount its already cheap crude even more as a top ally gains a bigger foothold in the key Chinese market,” the news adds.

Bloomberg also mentioned that Iranian oil has been priced at nearly $10 a barrel below Brent futures to put it on par with Urals cargoes that are scheduled to arrive in China during August, according to traders. That compares with a discount of about $4 to $5 prior to the invasion. Iran’s Light and Heavy grades are most comparable to the Urals.

Elsewhere, US ISM Manufacturing PMI for June slumped to the lowest levels in two years, to 53.0 versus 54.9 expected and 56.1 prior. The details suggested the Employment Index declined to 47.3 from 49.6 and New Orders Index fell to 49.2 from 55.1. Finally, Prices Paid Index dropped to 78.5 from 82.2, versus market forecasts of 81.0. It should be noted that the final readings of the S&P Global Manufacturing PMI for June dropped to the lowest level since July 2020, to 52.7 versus the flash estimate of 52.4 and 57 in May.

To portray the mood, the US 10-year Treasury yields marked the biggest weekly fall since February but the US Dollar Index (DXY) didn’t lose its charm.

Given the fears of higher supplies and impending concerns over the recession, the black gold prices are likely to ease. However, the US dollar moves will be important to observe for clear directions, which in turn highlight this week’s Fed Minutes and US Nonfarm Payrolls (NFP). Additionally, Russia’s claim of having complete control over Lysychansk also needs to be confirmed for fresh impulse.

Technical analysis

A three-week-old ascending support line, around $105.00, restricts the short-term WTI downtrend. Recovery moves, however, need validation from late June’s swing high of $112.72.

- USD/CHF fades Friday’s bullish bias as traders pare recent moves amid US holiday.

- Recent statistics highlight recession fears but USD and CHF both have safe-haven appeal and trouble traders.

- Swiss CPI eyed for the day, FOMC Minutes, US NFP appear important for the week.

USD/CHF retreats to 0.9590, after printing the first positive week in three, as traders await the Swiss Consumer Price Index (CPI) for June during Monday’s Asian session. The Swiss currency (CHF) pair’s latest gains could also be linked to the market’s consolidation amid the US holiday.

The quote rallied the most in three weeks the previous day after the US ISM Manufacturing PMI propelled economic slowdown fears, underpinning the US dollar’s safe-haven demand.

However, an improvement in the S&P Global PMI and surprise gains in the Wall Street benchmarks appear to have probed the pair buyers afterward.

The US ISM Manufacturing PMI for June slumped to the lowest levels in two years, to 53.0 versus 54.9 expected and 56.1 prior. The details suggested the Employment Index declined to 47.3 from 49.6 and New Orders Index fell to 49.2 from 55.1. Finally, Prices Paid Index dropped to 78.5 from 82.2, versus market forecasts of 81.0. It should be noted that the final readings of the S&P Global Manufacturing PMI for June dropped to the lowest level since July 2020, to 52.7 versus the flash estimate of 52.4 and 57 in May.

Against this backdrop, the US 10-year Treasury yields marked the biggest weekly fall since February but the US Dollar Index (DXY) didn’t lose its charm.

Moving on, Swiss CPI for June, expected 3.2% YoY versus 2.9% prior, could direct intraday USD/CHF moves amid the US Independence Day. However, major attention will be given to the recession chatters and this week’s Fed Minutes, as well as Friday’s US jobs report for June, as Fed hawks struggle to gain acceptance.

Technical analysis

Unless providing a daily closing below the 100-DMA, around 0.9530 by the press, USD/CHF remains on the bull’s radar.

- EUR/USD pares recent losses around fortnight low, renews daily high.

- Higher low on prices, RSI hints at gradual building of bullish bias.

- 10-DMA, monthly resistance line limits immediate upside, ascending trend line from mid-May appears crucial support.

EUR/USD picks up bids to refresh intraday high near 1.0435 during Monday’s initial Asian session, after falling back to the bear’s radar during the last week.

Even if the major currency pair remains around a two-week low, flashed on Friday, its moves from May 13 appear not in favor of the sellers. That said, the higher low in the EUR/USD prices has gained support from the higher low in the RSI (14), which in turn suggests a gradual reduction in a bearish bias.

However, the 10-DMA hurdle surrounding 1.0500 restricts the quote’s immediate upside ahead of a downward sloping resistance line from early June, close to 1.0540 by the press time.

Should the EUR/USD pair manage to cross the 1.0540 hurdle, the odds of its run-up to late June’s swing high near 1.0615 and then to the previous monthly peak of 1.0774 can’t be ruled out.

On the contrary, the aforementioned support line from May, near 1.0365 appears the key level for the EUR/USD bears to watch before retaking the controls.

Following that, the yearly low marked in May at around 1.0348 and January 2017 bottom of 1.0340 could act as validation points for the further south-run.

EUR/USD: Daily chart

Trend: Further recovery expected

- AUD/USD is likely to extend its recovery above 0.6830 amid a weaker DXY.

- The FOMC minutes will display the agenda behind featuring a 75 bps rate hike in June.

- A consecutive 50 bps rate hike by the RBA is expected in July monetary policy meeting.

The AUD/USD pair is looking strong at open and is expected to extend its recovery after violating the critical hurdle of 0.6830. On Friday, the asset witnessed a strong rebound as the greenback bulls sensed exhaustion after failing to extend losses below 0.6763. A firmer recovery drove the asset above the psychological resistance of 0.6800 to a high of 0.6828 and more gains are expected from the counter on advancing downside risks for the US dollar index (DXY).

The DXY witnessed a steep fall after re-testing the year high at 105.79. Investors found the DXY an expensive bet at elevated levels after the release of the downbeat US Institute of Supply Management (ISM) data. The US ISM Manufacturing PMI landed at 53, lower than the expectations of 54.9 and the prior print of 56.1.

In addition to that, the Employment Index and New Orders Index remained vulnerable. So the all-together downbeat performance trimmed the odds of a consecutive 75 basis point rate hike announcement by the Federal Reserve (Fed) for its July monetary policy meeting.

This week, the release of the Federal Open Market Committee (FOMC) minutes will keep investors busy. The FOMC minutes will provide a detailed view of the agenda behind keeping an extreme hawkish stance on policy rates by the Fed in June.

On the aussie front, the spotlight will remain on the interest rate decision by the Reserve Bank of Australia (RBA), which is due on Tuesday. The RBA is expected to announce a consecutive 50 basis points (bps) rate hike in its monetary policy. This may elevate its Official Cash Rate (OCR) officially to 1.35%.

- GBP/USD at risk of a dip to 1.1800 for the quarter ahead.

- US dollar is picking up a safe haven bid despite a deteriorating economic outlook in the US.

At 1.2115, GBP/USD is up on the day as the US dollar gives some of the territory made at the end of the week to the bears, elevating sterling ahead of the Tokyo open and main equities hour. The US dollar is caught between the balance of risk-off and concerns over the US economy.

US data, such as that on Friday in the weakening manufacturing indicators have dominated markets and equities are vulnerable to the evidence of the slowdown. This makes this week's US jobs data as a key feature on the calendar.

Nonfarm Payrolls is expected to show that Employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400k in March-May, the analysts at TD Securities said. ''High-frequency data, including Homebase, still point to above-trend job creation. We also look for the UE rate to stay unchanged at 3.6% for a fourth straight month, and for wage growth to remain steady at 0.3% MoM (5.0% YoY).''

The minutes of the Federal Reserve's June meeting will also be eyed. ''Persistent high CPI inflation and nascent signs of de-anchoring inflation expectations forced the Fed to amp the pace of rate tightening. The meeting minutes are likely to offer further colour around the Fed's more hawkish reaction function,'' the analysts at TD Securities said.

Meanwhile, across the pond, analysts at Rabobank explained, arguably, that ''the challenges facing policymakers in the UK are among the most complex in the developed world.'' The analysts explained that the UK's inflation has not yet peaked, and labour market strife indicates that higher inflation expectations may be already entrenched.

''However, UK consumer confidence has plunged, and, more recently, measures of business sentiment have also started to dive. Additionally, if expectations regarding BoE policy moves do not keep step with the hawkish guidance of the Federal Reserve, it can be argued there is a risk that GBP could weaken further. Yet, GBP is also proving sensitive to fears regarding growth.'' The analysts see a risk of dips to GBP/USD1.18 on a 3-month view.

- NZD/USD consolidates losses near 26-month low, picks up bids of late.

- Fears of global recession keep haunting Antipodeans amid firmer USD, downbeat yields.

- Friday’s US ISM Manufacturing PMI strengthened economic slowdown concerns.

- No major data at home, US holiday could extend corrective pullback.

NZD/USD begins the week on a positive note, after falling to the two-year low the previous day, as traders pare recent losses amid a quiet Monday morning in Asia. In doing so, the Kiwi pair braces for this week’s key events/data from the US, while having no major catalysts at home, ahead of next week’s Reserve Bank of New Zealand (RBNZ) Monetary Policy Meeting.

The Kiwi pair dropped to the lowest level since April 2020 on Friday after the US ISM Manufacturing PMI propelled economic slowdown concerns. Also drowning the NZD/USD prices were firmer US dollar and bonds, as well as challenges for the RBNZ’s next rate hike.

That said, the US ISM Manufacturing PMI for June slumped to the lowest levels in two years, to 53.0 versus 54.9 expected and 56.1 prior. The details suggested the Employment Index declined to 47.3 from 49.6 and New Orders Index fell to 49.2 from 55.1. Finally, Prices Paid Index dropped to 78.5 from 82.2, versus market forecasts of 81.0.

It should be noted that the final readings of the S&P Global Manufacturing PMI for June dropped to the lowest level since July 2020, to 52.7 versus the flash estimate of 52.4 and 57 in May.

Considering the recent weakness in the US PMIs, as well as the questions the figures raise, the Australia and New Zealand Banking Group (ANZ) said, “Surveyed data from both PMIs and the US ISM are all pointing to faltering orders growth, lower backlogs of work indices and softer production over the summer. It is hard to escape the growing growth pessimism, which is also fanning expectations of a peak in both inflation and central bank hawkishness.”

Elsewhere, the RBNZ Official Cash Rate (OCR) expectations have also receded amid recession fears while China’s PMIs fail to renew market optimism.

Amid these plays, the US 10-year Treasury yields marked the biggest weekly fall since February whereas Wall Street benchmarks struggled for clear directions after Friday’s surprise gains.

Moving on, the US Independence Day holiday and a lack of major data/events may restrict NZD/USD moves during the day, while also allowing the traders to lick their wounds. However, this week’s Fed Minutes and Friday’s US Nonfarm Payrolls (NFP) will be crucial as traders remain divided over the US central bank’s next move.

Technical analysis

Despite the latest rebound, NZD/USD remains below 61.8% Fibonacci retracement of the 2020-21 rally near 0.6230, the support level broken on Friday, which in turn keeps bears hopeful of testing the April 2020 peak surrounding 0.6175.

- Gold price is expected to balance above $1,810.00 on a weaker DXY.

- The downbeat US ISM economic data has strengthened the recession fears.

- Advancing recession fears have trimmed the odds of a bumper rate hike by the Fed.

Gold price (XAU/USD) is likely to violate the critical hurdle of $1,810.00 and may establish above the same as the US dollar index (DXY) has entered into a corrective mode. On Friday, the previous metal displayed a responsive buying action after printing a fresh five-month low at $1,784.57. Usually, a responsive buying action in the asset indicates that the asset has become a value bet now.

A potential correction in the DXY on Friday resulted in a firmer recovery in the gold prices. The downbeat US Institute for Supply Management (ISM) data strengthened the DXY bears. The US ISM Manufacturing PMI landed at 53, lower than the expectations and the prior print of 54.9 and 56.1 respectively. Apart from that, the Employment Index and New Orders Index displayed a vulnerable performance.

The downbeat economic data has triggered recession fears in the US economy, which may trim the odds of a bumper rate hike by the Federal Reserve (Fed) for its July interest rate decision announcement. Going forward, the Federal Open Market Committee (FOMC) minutes will remain in focus, which is due on Wednesday. This will provide a detailed view of the decision-making by the Fed.

Gold technical analysis

On an hourly scale, gold prices have violated the critical hurdle of $1,805.44 and are oscillating above the same. The asset has crossed the 20-and 50-period Exponential Moving Averages (EMAs) at $1,803.57 and $1,807.30 respectively. It is worth noting that the asset’s price is auctioning above the short-term EMAs while the 20-EMA is trading lower than the 50-EMA. This indicates that the buying action in the asset is very much firmer. Meanwhile, the Relative Strength Index (RSI) (14) is attempting to breach 60.00, which will bring a fresh rally in the asset.

Gold hourly chart

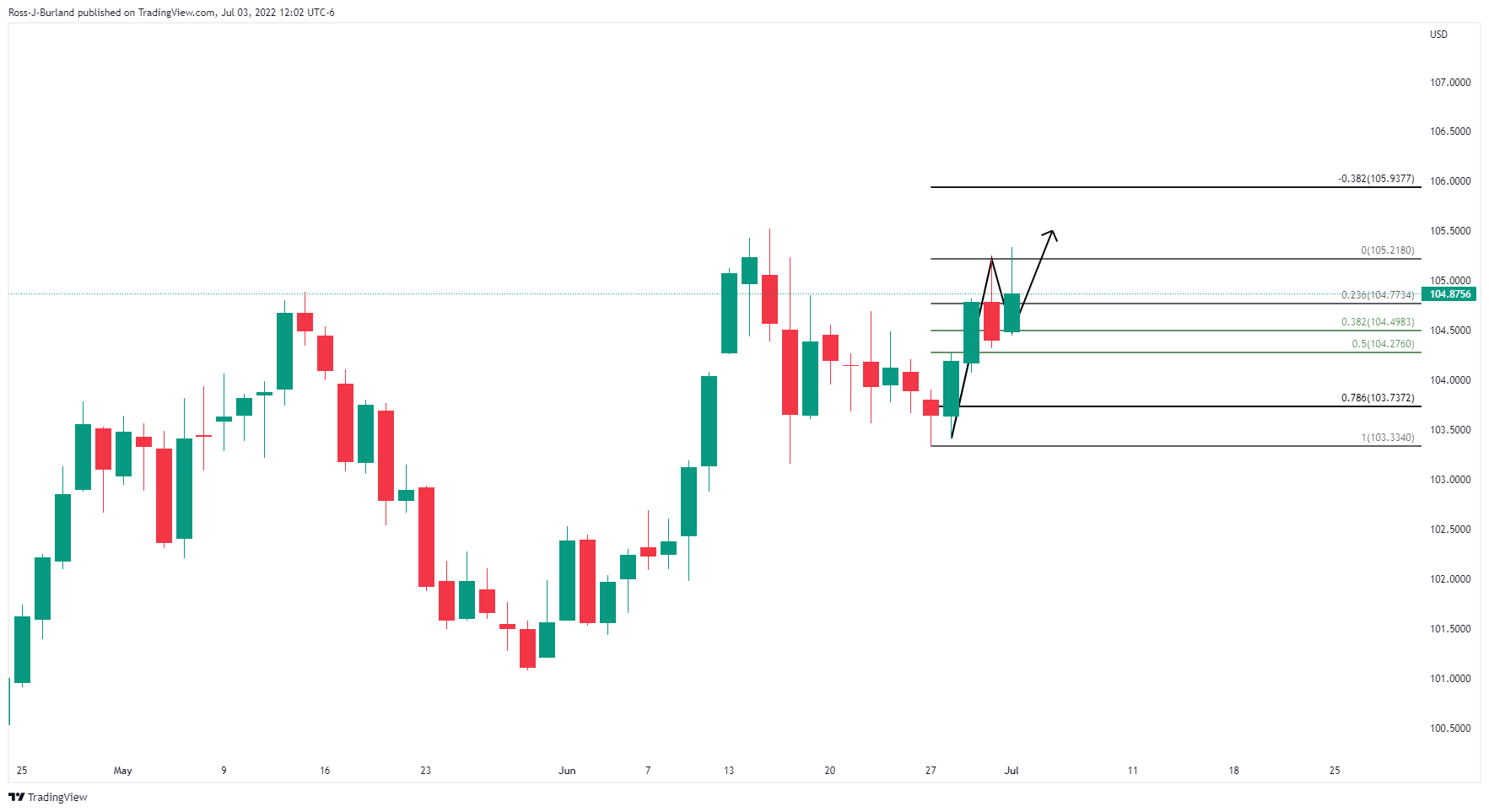

- US dollar bulls are moving back in and eye 105.50s.

- The market's sentiment is fickle which plays into the hands of the greenback.

- US data will be critical this week with NFPs and Fed minutes eyed.

The US dollar was in demand at the start of the new month and quarter for its safe-haven status, dragging a number of rivals back down to earth. The euro fell to a low of 1.0365 vs the greenback from a high close to the 1.05 area and the Aussie sank to fresh cycle bear lows at 0.6763.

Tighter monetary expectations in the face of higher in inflation are feeding a bid into the greenback due to the demand for US assets which has sent the benchmark 10-year US Treasury yields to one-month lows. The US 10-year yield dropped 8.5 basis points to 2.89%.

Nevertheless, US equity benchmarks were higher in the first session of the third quarter, recouping some of the ground lost in Thursday's session finished up the worst first half-seen in decades. The Dow Jones Industrial Average added 1.1% to 31,097.26, the S&P 500 was also up by 1.1% to 3,825.33, and the Nasdaq Composite was around 1% higher at 11,127.85. For the week, the Dow was 1.3% lower, the S&P 500 dropped 2.2%, and the Nasdaq fell 4%.

in data, which hampered down the risks of recession sentiment in global markets showed that the Institute for Supply Management's US manufacturing index fell to 53 from 56.1 in May, compared with expectations of 54.5. This was the weakest since June 2020, when the world was in the throes of the COVID-19 pandemic.

As a consequence, a flight to safety sent the US 10-year yield dropped 6.8 basis points to 2.91% as traders await the outcome of this week's minutes of the Federal Reserve's June meeting when it raised interest rates by 75 basis points. This was the most in almost three decades, amid concern that further projected rate hikes in the Fed pipeline are likely to tip the economy into a recession.

For the week ahead, Nonfarm Payrolls will be key and the data is expected to show that Employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400k in March-May, the analysts at TD Securities said. ''High-frequency data, including Homebase, still point to above-trend job creation. We also look for the UE rate to stay unchanged at 3.6% for a fourth straight month, and for wage growth to remain steady at 0.3% MoM (5.0% YoY).''

The minutes of the fed's June meeting will also be eyed. ''Persistent high CPI inflation and nascent signs of de-anchoring inflation expectations forced the Fed to amp the pace of rate tightening. The meeting minutes are likely to offer further colour around the Fed's more hawkish reaction function,'' the analysts at TD Securities said.

DXY daily chart

The bulls have made their move from key ratios along the Fobo scale and from near a 50% mean reversion. Eyes are on a move to test 105.50 for the weekend ahead for a daily extension towards bull cycle highs.

- EUR/USD will be vulnerable to critical events in the week ahead.

- US data will be watched closely as will the Fed and ECB minutes.

EUR/USD was down some 0.5% on Friday due to the pick-up in pessimism about the global economic outlook. The US dollar has found its feet yet again due to the demand for the safe-haven currency. The euro fell to a low of 1.0365 vs the greenback from a high close to the 1.05 area.

The potency of tighter monetary expectations in the face of higher in inflation is playing havoc on markets and supporting demand for US assets which has sent the benchmark 10-year US Treasury yields to one-month lows.

The Federal Reserve is expected to continue to hike rates in the face of soaring price pressures at the same time that investors are worrying over the economic outlook. Data on Friday did little to squash the concerns with US manufacturing activity slowing more than expected in June, with a measure of new orders contracting for the first time in two years.

Nevertheless, the US dollar index gained 0.36% against a basket of currencies to 105.12, albeit still trading shy of the 20-year high of 105.79 reached on June 15. This has crippled the euro, putting the focus back on the five-year low of $1.0349 printed on May 13 even though the European Central Bank is also expected to raise interest rates this month. This will be the first time in a decade, although economists are divided on the size of any hike.

The week ahead

The minutes of the ECB's June meeting will likely be eyed but analysts at TD Securities said they will be ''somewhat stale as we have since heard from many officials at the Sintra conference. That said, we will look for any indication of what is needed for an above 25bps hike in July, and how the risks of weaker growth could impact policy beyond that, given the further deterioration of growth prospects in the euro area.''

Instead, the major focus for the week ahead will lie in the US data once again. Nonfarm Payrolls is expected to show that Employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400k in March-May, the analysts at TD Securities said. ''High-frequency data, including Homebase, still point to above-trend job creation. We also look for the UE rate to stay unchanged at 3.6% for a fourth straight month, and for wage growth to remain steady at 0.3% MoM (5.0% YoY).''

Fed minutes will also be eyed after the Fed's meeting where it surprised markets with a 75bps hike at the June meeting. ''Persistent high CPI inflation and nascent signs of de-anchoring inflation expectations forced the Fed to amp the pace of rate tightening. The meeting minutes are likely to offer further colour around the Fed's more hawkish reaction function,'' the analysts at TD Securities said.

- All eyes will be o the RBA this week as the Aussie will depend on it.

- AUD/USD is setting up for a move higher as per the current market structure.

AUD/USD is one to watch this week ahead in the countdown to the Reserve Bank of Australia. Governor Lowe made it clear that the Board will discuss either a 25bps or 50bps hike this week, so there is fuel for a move one way or the other in AUD depending on the outcome of that meeting.

This draws us to the current structure on the charts in AUD/USD and the M-formation on the daily time frame is compelling for a meanwhile bid in the run-up to the meeting and the RBA's statement, July 5. If it is not particularly hawkish, meanwhile mitigation of any price imbalance to the upside could be the site up for fresh daily lows.

AUD/USD daily chart

The 0.6880s are often regarded as a psychological area on the charts and the M-formation's neckline, or older block, is lining up there which could draw in the price in the coming sessions ahead of the RBA.

However, the price imbalance on the hourly time frame is an area that could be mitigated first of all:

AUD/USD M15 chart

The price on the 15-min chart is also building up for a breakout one way or the other and given the nature of markets, the downside mitigation process could be perceived as the bias prior to the continuation move to the upside and imbalances along the way.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.