- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- GBP/JPY surges to year's high, up by 0.18%, amid positive market sentiment.

- Expectations of a dovish Fed and resolution of the US debt-ceiling imbue strength to high beta currencies.

- Despite the overall upward bias, the technical outlook suggests potential downside pressure on GBP/JPY.

GBP/JPY climbed to fresh year-to-date (YTD) highs at 174.68 before a pullback that dragged the exchange rate toward the 174.10s area. A risk-on impulse caused expectations for a dovish US Federal Reserve (Fed) amongst geopolitical issues like the US debt-ceiling resolution underpinned high beta currencies. Therefore, safe-haven peers persisted pressured, as the GBP/JPY traded at 174.12, up 0.18%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is still upward biased, confirmed by price action widening its distance from the Tenkan-Sen and Kijun-Sen lines below the exchange rate. In addition, price action is another bullish signal above the Ichimoku cloud.

Nevertheless, an upslope resistance trendline from the May 2 highs cushioned the GBP/JPY rally; while a support trendline, drawn from the April and May lows, indicates a rising wedge forming. That means further downside pressure is expected.

If GBP/JPY falls below the 174.00 figure, the next support would be the Tenkan-Sen at 172.95. A breach of the latter will expose the 2022 high turned support at 172.13 before testing April 28 daily high at 171.16. Conversely, the uptrend would continue above the YTD high at 174.68 once cleared, and the GBP/JPY could rally to the 175.00 mark, followed by the 2016 high at 177.37.

GBP/JPY Price Action – Daily chart

- The EUR/JPY trades for a second consecutive day with gains.

- Cross ends week with gains, but below 150.00.

- Yield divergence favours the Euro.

The EUR/JPY closes the week trading with gains above 149.80 as the Yen weakened across the board on Friday, against its major rivals, including the Sterling Pound, Swiss, the US and Australian Dollars. On the other hand, the Euro is getting traction on the back of rising German bond yields following ECB Lagarde's hawkish comments in Thursday's session.

Yield divergence between Japanese and German bonds traction the Euro

Following the Eurozone's inflation figures during Thursday's session, European Central Bank (ECB) President Christine Lagarde expressed her ongoing concerns about persistent high inflation and its prolonged duration. She emphasized that the interest rate hikes implemented by the ECB have already had a notable impact on bank lending conditions. Despite these efforts, Lagarde expressed dissatisfaction with the current inflation outlook and hinted at further rate hikes.

As a response, the German yields exhibit a mixed performance. The 10-year bond yield is trading at 2.32%, reflecting an increase of 3.65% for the day. In addition, the 2-year yield stands at 2.84%, experiencing a gain of 3.98%, while the 5-year yield sits at 2.35%, demonstrating a slight decline of 0.49%.An improvement in global market sentiment also weighed on bond demand.

On the other hand, the Japanese yields have witnessed a decline. The 10-year bond yield has retraced to 0.41%, indicating a decline of 1.56%. Similarly, the 2-year yield stands at -0.07%, reflecting a loss of 9.7%, and the 5-year yield is at 0.07%, showing a decline of 6.76% and applying further pressure on the Japanese Yen.

Levels to watch

On the weekly and daily charts, the technical outlook for the EUR/JPY appears to be bullish in the short term. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain in both charts in positive territory. Only on the daily chart, the MACD remains weak and print decreasing red bars.

Moving above the 149.90 zone would suggest continuing the bullish trend for the EUR/JPY, with the next resistances at the 150 psychological mark area and the 150.50 level. On the other hand, the 20-day Simple Moving Average (SMA) at 149.00 level stands as the critical support level for EUR/JPY. If broken, the 148.50 area and 148.00 zone could come into play.

- Silver price pulls back as robust US jobs report strengthens Treasury bond yields.

- Expectations for a July rate hike by the Fed mount, pressuring precious metals.

- Resolution of US debt-ceiling drama provides potential respite for Silver.

Silver price makes a U-turn following the path of Gold, as precious metals weighed by high US Treasury bond yields edge lower. XAG/USD opened around the daily highs and printed a weekly high of $24.00 before retreating past the 50- and 20-day Exponential Moving Averages (EMAs) confluence at the time of writing. XAG/USD is trading at $23.61, down 0.01%.

XAG/USD retreats amid strong US jobs data and anticipation of Fed rate hike

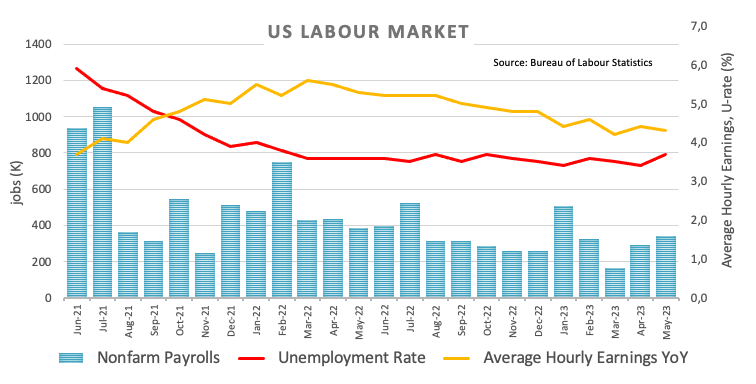

XAG/USD slid on a hotter-than-expected US Nonfarm Payrolls report in May, which revealed that 339K Americans entered the workforce, more than one and a half expected of 190K. The headline data suggests the Federal Reserve (Fed) still has some work. Still, the Unemployment Rate saw signs of upward pressure, from 3.4% to 3.7% YoY, while Average Hourly Earnings, seen as wages inflation, stood at 4.3% YoY, a tick lower than April’s.

Given the amount of data revealed, traders brace for a July rate hike by the Fed, aligning themselves with recent Fed officials’ commentary, led by the Chair Jerome Powell, saying the US central bank could skip a meeting to see the effects of 500 bps of tightening. Vice-Chair nominee Philip Jefferson and the Philadelphia Fed President Patrick Harker reinforced the message.

Therefore US Treasury bond yields exploded to the upside, a headwind for the precious metals segment. US Treasury bond yields climbed, with 2s up 16 bps to 4.501%, while 10s stand at 3.689%, gaining nine bps. The US Dollar Index (DXY), which tracks the greenback’s value against a basket of six currencies, rose 0.46%, up at 104.041, but set to finish the week on the wrong foot.

On the geopolitical sphere, the US debt-ceiling saga finished with a happy ending, with both chambers, the US House and the Senate passing the bill, easing fears of a possible US government default. The bill would be signed into law by US President Joe Biden over the weekend.

XAG/USD Price Analysis: Technical outlook

Given the fundamental backdrop, the XAG/USD shifted from neutral upward biased to neutral. The Relative Strength Index (RSI) indicator dodged the 50-midline and aimed downwards, suggesting that sellers are still in place. But the 3-day Rate of Change (RoC) indicates that selling pressure is beginning to fade. It means the white metal could remain sideways, awaiting the next catalyst.

Upwards, resistance levels lie at the 20-day EMA at $23.79, the 50-day EMA at $23.91, and the $24.00 figure. Conversely, XAG/USD support levels are the 100-day EMA at $23.47, the $23.00 psychological price level, and the 200-day EMA At $22.85.

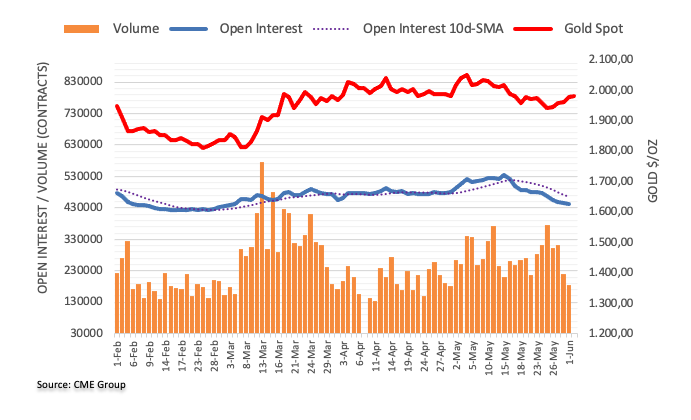

- Gold price dips despite week’s strong showing; US job growth exceeds expectations.

- Rising US Treasury bond yields and a robust USD exert downward pressure on gold.

- US debt-ceiling resolution eases bond yields, potential respite for gold.

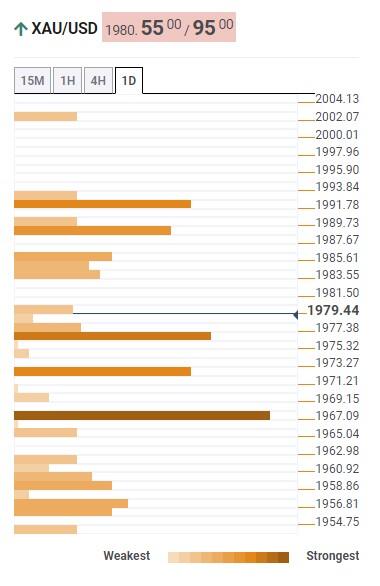

Gold price slumps after hitting a daily high of $1977.87, as the release of a solid US jobs data report underpinned US Treasury bond yields, a headwind for the yellow metal. That, alongside a strong US Dollar (USD), keeps XAU/USD downward pressured but still set to end the week with decent gains. At the time of writing, the XAU/USD is trading below the $1950 area.

XAU/USD falters amidst robust US data, Treasury yields surge and heightened Fed rate hike expectations

A risk on impulse keeps safe-haven assets under pressure, as Wall Street shrugged off a solid employment report from the United States (US). On Friday, the US Department of Labor revealed May’s Nonfarm Payrolls report, which crushed estimates of 190K, as the economy created 339K jobs. Regardings to the Unemployment Rate grew by 3.7% YoY from 3.4%.

US Treasury bond yields reacted to the upside, with 2s jumping 16 bps to 4.501%, while 10s stand at 3.689%, gaining nine bps. The greenback edged up 0.43% as shown by the US Dollar Index at 104.026, ready to post its first weekly loss, snapping three weeks of gains.

Bets that the US Federal Reserve will keep rates unchanged at the June meeting increased, although, in July, it is almost sure that the US central bank will raise rates by 25 bps.

Should be said that once the US House and Senate approved the US debt-ceiling bill, US bond yields dropped. The bill would be signed by US President Joe Biden during the weekend, ending the soap opera.

XAGU/USD Price Analysis: Technical outlook

XAU/USD is neutral to downward biased, even though the Gold spot remains trading above the 200-day Exponential Moving Average (EMA) at $1886.98. As the yellow metal registered successive series of lower highs, despite pending confirmation for a second lower-low, it turned the bias slightly downwards.

Oscillators like the Relative Strength Index (RSI) and the 3-day Rate of Change (RoC) suggests sellers are in charge though a decisive break below $1950 would put them in the driver’s seat to challenge the 200-day EMA.

XAU/USD first support would be $1950, followed by the 100-day EMA at $1936.30. Once cleared, $1900 is up next. On the other hand, the XAU/USD first resistance would be the 50-day EMA at $1970.78, closely followed by the 20-day EMA at $1972.86. Upside risks lie at $2000.

- The Kiwi peaked at a five-day high at 0.6111 and then fell to the 0.6065 area.

- Despite labor demand in the US showing a deceleration, the figures showed a robust employment growth.

- The Greenback gained interest on the back of increasing US yields.

The NZD/USD pair erased gains which saw the Kiwi surging to the 0.6111 area at the end of the week and fell towards the 0.6065 area, in response to strong labor market data from the US. The data suggested a potential reassessment of additional rate hikes by the Federal Reserve (Fed) which consequently favored the US Dollar amid rising US bond yields.

Greenback gains on rising US bond yields following NFP

According to the US Bureau of Labor Statistics, employment in the United States surpassed expectations by increasing by 339k in May, exceeding the consensus forecast of 190k. However, the Unemployment Rate rose slightly, reaching 3.7% instead of the expected 3.5%. Average Hourly Earnings, which serves as a gauge of wage inflation, stood at 4.3% YoY, slightly below the projected 4.4%.

The overall labor market outlook suggests that labor demand is showing some deceleration but the robust employment growth and the increasing inflationary pressures indicate that these developments make a case for the Fed to reconsider a 25 basis points (bps) hike in the upcoming June meeting. As a result, US bond yields are experiencing an upward trend. The 10-year bond yield has increased to 3.68%, reflecting a gain of 2.70% for the day. Similarly, the 2-year yield stands at 4.51% with an increase of 3.64%, and the 5-year yield is at 3.84% up by 3.81%.

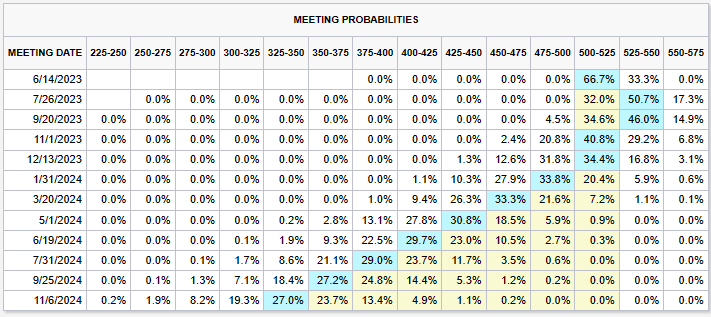

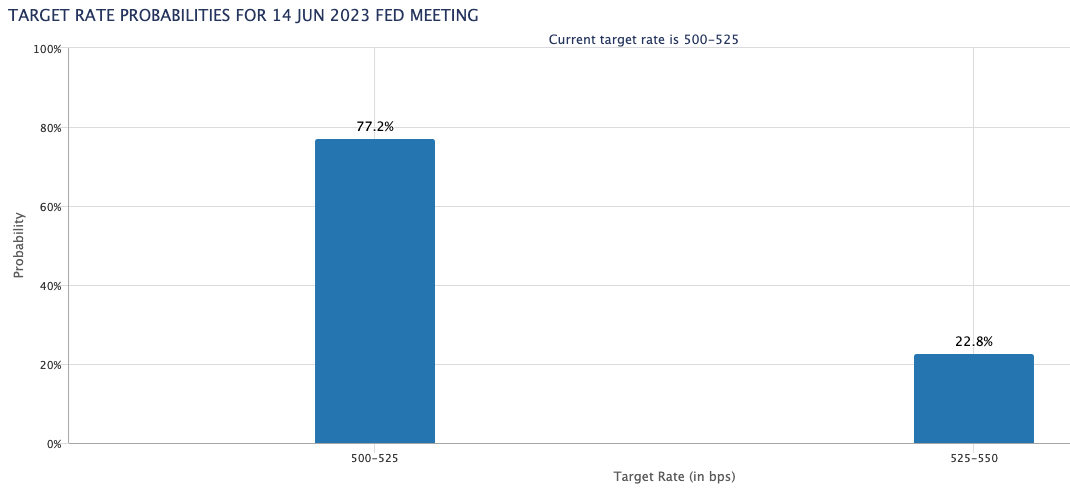

As the Fed officials mention, their ultimate goal is to assure full-employment and price stability, so the May Consumer Price Index (CPI), to be release next week, will play a crucial role in influencing the expectations and considerations of the Federal Open Market Committee (FOMC) regarding the next interest rate decision. As for now, the CME FedWatch tool suggests markets are still discounting higher probabilities of no hike for the next June 13-14 meeting but the case of a 25 bps hike gained some relevance.

Levels to watch

According to the daily chart, the NZD/USD holds a bearish outlook for the short term as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that the sellers are in control while the pair trades below its main moving averages.

In case of further downside, support levels line up at the 0.6050 area and below at the 0.6025 zone and the 0.60 psychological mark. On the upside, resistances line up at the daily high around 0.6111 followed by the 200 and 20-day Simple Moving Average (SMA) at 0.6150 and 0.6180 respectively.

Federal Reserve (Fed) Chair Jerome Powell will testify at the U.S. Senate Banking Committee on June 22, panel chief Sherrod Brown said on Friday, Reuters reported. The testimony will come a week after the June 13-14 FOMC meeting.

Data released on Friday, showed Nonfarm Payrolls rose by 339K in May surpassing expectations. Analysts at TD Securities point out payroll strength keeps the door open for another rate hike from the Federal Reserve.

Key quotes:

“The two-month net revisions also added a notable 93k jobs to the employment series, which resulted in the 3-month moving average moving significantly higher to 283k in May from 222k in April. Not really the direction the Fed's is hoping for. With that said, the unemployment rate unexpectedly rose by 0.3pp to 3.7%, though the details behind that move were more nuanced.

“The May jobs report should leave the hike option fully on the table for the Fed. If Fed officials were looking for clear signs of labor-market slowing, we do not think this reports clearly offers that perspective despite the rise in the UE rate. We continue to look for the Fed to lift rates by a final 25bp to 5.25%-5.50% range in June, but also acknowledge that the FOMC's decision will be a very close call.”

Next week, the Reserve Bank of Australia (RBA) is set to announce its decision on monetary policy. The market consensus is for the central bank to keep rates unchanged. However, analysts at Wells Fargo are expecting the RBA to deliver another 25 basis point rate hike.

Key quotes:

“On the inflation front, this week's monthly CPI data showed that inflation jumped to 6.8% year-over-year in April, up from 6.3% in March, boosted by the end of a government fuel subsidy put into place in April 2022, as well as price gains in housing, food and transportation.”

“Lowe mentioned he believes risks to inflation are tilted to the upside and that the central bank is “not going to declare victory until victory’s achieved.” Overall, given that inflation dynamics remain stubbornly high in Australia, we believe the RBA will deliver another 25 bps rate hike at its June meeting to 4.10%.”

- US jobs growth exceeds estimates, yet USD/MXN slips by 0.12%.

- US Treasury bond yields’ increase lends some support to USD/MXN.

- Bank of Mexico’s stand on record high-interest rates adds resilience to the Peso.

USD/MXN trims some of its losses but remains trading negatively, despite a solid US jobs report revealed before Wall Street opened, which did not stop the Mexican Peso from reaching new weekly lows. Traders’ mood improvement, seen as US equities post gains, cushioned the MXN from falling against its counterpart, the US Dollar (USD). At the time of writing, the USD/MXN is trading at 17.5308, down 0.10%.

MXN holds its ground amidst strong US jobs data and rising US Treasury bond yields

The USD/MXN dropped sharply from around 17.5000s toward the lows of the week of 17.4190 after the US Bureau of Labor Statistics (BLS) revealed Nonfarm Payrolls in May crushed analysts’ estimates of 190K, with the economy adding 339K jobs. Although the headline figure is impressive, digging a little deep, the Unemployment Rate jumped from 3.4% to 3.7%. Regarding wages, inflation, known as Average Hourly Earnings, rose 0.3% MoM but edged down from April 4.4% to 4.3%.

Later, the USD/MXN rallied, about to erase its earlier losses, as traders digested the US jobs report, underpinned by rising US Treasury bond yields. The 10-year benchmark note rate is 3.69%, ten basis points (bps) higher than Thursday’s close.

In the meantime, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, advances 0.47%, up above 104.000, set to finish the week with losses of 0.17%.

Across the border, Mexico’s Unemployment Rate for April was 2.8%, above estimates of 2.7%. Aside from this, the latest meeting minutes of the Bank of Mexico (Banxico) showed inflation and inflationary pressures cooling down after the bank held rates at 11.25%. On Wednesday, Banxico{s Governor Victoria Rodriguez Ceja said that the institution she commands would keep rates at record high for at least the two following meetings.

USD/MXN Price Analysis: Technical outlook

Given the fundamental backdrop, the USD/MXN remains downward biased, but recent price action could form a double bottom. Even though it’s just a double dip toward the 17.4000 area, it’s worth considering due to the latest downtrend, which started in November 2021, with the USD/MXN plunging 20%. If USD/MXN surpasses that support, the next stop would be the 17.0000 figure. Otherwise, if USD/MXN reclaims the 18.0000 figure, it will conform to the double bottom. Above this area, the USD/MXN’s next stop would be the 100-day EMA at 18.2563, followed by the April 5 daily high of 18.4010.

- Cable fell below the 20-day SMA toward the 1.2450 area.

- The US added 339k new jobs in May vs 190k expected.

- US bond yields increased as a reaction to the employment figures.

The GBP/USD fell more than 0.50% to a daily low of 1.2453 at the end of the week, following robust labor market data from the US, indicating a possible reconsideration of further rate hikes by the Federal Reserve (Fed). As a result, the US Dollar strengthened due to rising US bond yields, while the Sterling Pound continued to face selling pressure while the British economic calendar had nothing relevant to offer.

Robust labor market made markets reconsider a possible hike by the Fed

The US Bureau of Labor Statistics revealed that employment in the US increased by 339k, surpassing the consensus forecast of 190k. However, the Unemployment rate rose to 3.7% compared to the expected 3.5%. Wage inflation, measured by Average Hourly Earnings, stood at 4.3% YoY, slightly lower than the anticipated 4.4%.

Despite labor demand beginning to exhibit signs of deceleration, the robust employment growth and ongoing inflationary pressures are exerting force on the Fed to contemplate interest rate hikes. This has resulted in an upswing in US bond yields, reflecting heightened market expectations for a 25 basis points hike in the upcoming June meeting. In that sense, the US bond yields are experiencing increases across the curve. The 10-year bond yield increased by 2.33%, reaching 3.68%. Similarly, the 2-year yield stands at 4.50% with a gain of 4.69%, and the 5-year yield is at 3.83% up by 3.53%.

However, as per the CME FedWatch tool, markets are still discounting higher odds of no hike, although the case for a 25 bps gain has strengthened. Before the meeting, the Federal Open Market Committee will know the May inflation reading, which will finally model the expectations for their next interest rate decision.

Levels to watch

The GBP/USD holds a slightly bearish outlook for the short term, as per the daily chart. The Relative Strength Index (RSI) fell towards its midpoint while Moving Average Convergence Divergence (MACD) turned flat. However the pair still holds above the 100 and 200-day Simple Moving Averages (SMA) while bulls try to retake the 20-day rolling average at the 1.2460 zone.

If the Cable falls, immediate support levels are seen at the daily low area around 1.2350 and the 1.2400 level. Furthermore, to regain traction the bulls must consolidate the 20-day SMA at the 1.2461 area. Above, resistances stand at 1.2480 and 1.2500.

- US adds 339K jobs, beating estimates; EUR/USD slips by 0.43%.

- Federal Reserve’s hawkish outlook hints at a possible July FFR increase.

- Positive economic indicators from Europe, including Italy’s Industrial Production and Spain’s Unemployment Change.

EUR/USD slumps from weekly highs reached as a knee-jerk reaction to a solid US jobs report, driving the pair towards 1.0779 before sliding toward daily lows. The labor market in the United States (US) stayed strong but saw slight signs of weakness. At the time of writing, the EUR/USD is trading at 1.0715, printing losses of 0.43%.

EUR/USD pair exhibits a weak response to robust US jobs data; US Federal Reserve’s future rate decisions loom

In early trading, before Wall Street opened, the US Department of Labor revealed May employment figures, with the economy adding 339K jobs, above estimates of 190K. Even though the figure is positive for the economy, the Unemployment Rate ticked to 3.7%, from 53-year lows of 3.4%, sought by the Fed as a sign that can undermine consumer spending. Average Hourly earnings rose 0.3%, up 4.3% YoY, less than April’s figure of 4.4%.

Given the backdrop, traders pricing in a hawkish US Federal Reserve (Fed), despite skipping the June monetary policy meeting, expect another increase to the Federal Funds Rate (FFR) in July toward the 5.25%-5.50% area. But, the rising unemployment rate would make the Fed’s job easier as it scrambles to tame high inflation and double its target.

Since the data release, the EUR/USD pair lost 40 pips or 0.40% intraday, threatening to get toward the 1.0700 figure as the greenback limps its wounds. The US Dollar Index (DXY) climbs 0.44%, again above the 104.000 figure.

Events that took the headlines over the last couple of weeks, like the US debt-ceiling crisis, were solved late Thursday night, with the US Senate passing the bill, set to be signed by US President Joe Biden. The ceiling would be raised, though we would witness the same soap opera by January 1, 2025.

Across the pond, the latest European Central Bank (ECB) meeting minutes showed that hawks were striving for a 50 bps, but “consensus” voted for a 25 bps at the expense of further tightening ahead. Data-wise, the economic docket showed Industrial Production in Italy, at 0.8% MoM, above estimates of 0.3%, while the Unemployment Change in Spain hit -49.3K, above forecasts of -40.1 K.

EUR/USD Technical Levels

- Headline employment growth in the US rose by 339k in May.

- The US Unemployment rate rose to 3.7%.

- Wage inflation slightly decreased.

The USD/JPY gained more than 60 pips on Friday, spiking to the 139.70 zone following the labor market data from the US which suggested that the Federal Reserve (Fed) may reconsider a further hike. As a reaction, the US Dollar gained traction on the back of rising US bond yields while Japanese yields continue to decline.

Yield divergence post NFP favors the Greenback

The US Bureau of Labor Statistics released that employment in the US measured by the Nonfarm payrolls (NFP) increased by 339k, way above the consensus of 190k. The Bureau stated that job gains were seen across various sectors, with notable increases in professional and business services and government employment. Other figures show that the Unemployment rate picked up to 3.7% in the same period of time vs the 3.5% expected while wage inflation measured by the Average Hourly Earnings, came in at 4.3% YoY vs the 4.4% expected.

In that sense, while signs of slowing labor demand have emerged, the strong employment growth and persistent inflation are pressuring the Fed to consider further rate hikes which fueled an increase of the US bond yields. The US bond yields experienced an increase as a result of strong employment growth and persistent inflation, putting pressure on the Federal Reserve to consider raising interest rates. The 10-year bond yield in the US increased by 1%, reaching 3.67%. Additionally, the 2-year yield in the US rose by 1.98% to stand at 4.47%, while the 5-year yield increased by 1.29% to reach 3.79% and the increase of the US rates seem to be attracting foreign investors and hence supporting the US Dollar.

However, the CME FedWatch tool suggests that markets still discount higher odds of a no hike by the Fed in the June 13-14 meeting, while the probabilities of a 25 basis point (bps) hike increased slightly to 30%.

In contrast, Japanese bond yields declined. The 10-year yield decreased by 1.68% to 0.41%, while the 2-year yield fell by 9.7% to stand at -0.07%. Furthermore, the 5-year yield in Japan experienced an 8.78% decrease, reaching 0.07% and applied further pressure on the Yen..

Levels to watch

According to the daily chart, the USD/JPY holds a bullish outlook for the short term as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) both suggest that the buyers are in control while the pair trades above its main moving averages. The 4-hour chart also suggests bulls dominance as the mentioned indicators jumped from negative territory to positive zone.

The 140.00 level is key for USD/JPY to gain further traction. If cleared, we could see a more pronounced move towards the 140.50 zone and the psychological mark at 141.00. On the other hand, immediate support for USD/JPY is seen at the 138.90 zone level, followed by the 138.50 level and the psychological mark at 138.00.

- US adds 339K jobs, beating estimates, but USD/CAD stays tepid.

- CAD gains momentum on a 1.70% surge in WTI Crude Oil prices.

- Uncertain Fed rate hike in July overshadows USD’s future trajectory.

USD/CAD registers modest losses after an outstanding jobs report in the United States (US) would likely keep the US Federal Reserve (Fed) hitting the economy’s brakes, despite recent dovish comments supporting a pause. Nevertheless, the US Dollar (USD) continued to weaken while the Loonie (CAD) strengthened. At the time of writing, the USD/CAD is trading at 1.3428, down 0.16%.

Strong job growth figures unable to buoy USD; WTI Crude Oil surge lifts CAD, sparking a USD/CAD shake-up

The USD/CAD stopped its fall at around the 200-day Exponential Moving Average (EMA) at 1.3417 on the release of May’s US Nonfarm Payrolls report, revealed by the US Department of Labor. The US economy created 339K jobs in the economy, crushing estimates of 190K, though the Unemployment Rate ticked higher to 3.7% from 3.4%, a 53-year low level.

Although the data supported a stronger US Dollar, the USD/CAD treads water after printing a daily low of 1.3406 ahead of the Nonfarm Payrolls release.

Given the backdrop, crude oil prices were another factor that boosted the CAD, with Western Texas Intermediate (WTI), the US crude oil benchmark, recovering ground gaining 1.70%, at $71.33 per barrel, along with a risk-on impulse, that keeps the greenback pressured through pairing some losses.

The US Dollar Index (DXY), a measure that tracks the buck’s value vs. six currencies, edges up 0.31%, at 103.888, underpinned by increased bets for a July rate hike by the Fed. According to the recent update from the CME FedWatch Tool, the Federal Reserve will likely maintain the current interest rates steady for the month. However, the forecast for July is considerably less definitive, with the likelihood of a rate change teetering at approximately 50.7%.

Source: CME Fed Watch Tool

An absent Canadian economic docket left USD/CAD traders leaning on the dynamics of the US Dollar. But recent data showing strong growth in the Canadian economy puts pressure on the Bank of Canada (BoC) to further tighten the economy, at the threat of elevated inflationary pressures.

USD/CAD Price Analysis: Technical outlook

From a technical perspective, USD/CAD faced solid support at the 200-day EMA, with buyers piling in, driving the price 30 pips up. Nevertheless, the Relative Strength Index (RSI) indicator and the 3-day Rate of Change (RoC) in bearish territory suggest downside action in the near term. Therefore, the USD/CAD could be pressured, with support back at the 200-day EMA at 1.3417, before testing 1.3400. Break below will expose May’s low of 1.3314. Conversely, the USD/CAD first resistance would be the 1.3500 figure, followed by the 100-day EMA at 1.3510.

Economists at Commerzbank discuss Gold (XAU/USD) outlook.

Central banks planning further Gold purchases

Gold price dipped to a two-month low this week, but has recovered noticeably again in the meantime. Though it now seems likely that the Fed will take a break from its rate hike cycle in mid-June after all, a further rate increase is not off the table entirely. This should keep the gold price in check for the time being.

According to a survey conducted by the World Gold Council, central banks are planning to buy further Gold following their record purchases last year. Central bank purchases do not necessarily drive up the Fold price – but they could help prevent any fall in prices.

Economists at the Bank of Montreal discuss the Fed policy outlook following the US Nonfarm Payrolls report.

Fed will take further comfort from the gradual moderation in wage growth

The acceleration in payrolls, coupled with a recent upturn in job openings, suggests that American businesses are still aggressively hiring, likely to meet resilient consumer demand. However, the other areas of softness in this report suggest that the labour market is losing steam.

In light of a recent downward revision to unit labour costs data, the Fed will take further comfort from the gradual moderation in wage growth.

There's likely enough pockets of softness in this report for the FOMC to pass on raising rates at the next meeting, though another strong payrolls gain in June, coupled with another disappointing inflation report, could set the stage for a rate increase in July.

The BoE's stance seems too hesitant, which is likely to weigh on the Pound in the coming quarters, economists at Commerzbank report.

GBP weakness will probably continue next year as well

The door remains open for further rate hikes, but the BoE is likely to hope that the upcoming data releases will give it room to pause. The financial markets apparently do not share the BoE's optimistic view. The terminal rate is now seen at 5.5%. This seems excessive in view of the BoE's hesitant stance.

The market will probably have to scale back its interest rate expectations, which is why we are sticking to our forecast that the Pound will weaken against the EUR in the coming months. After all, in contrast to the BoE, the ECB appears much more determined in its statements, which should support the EUR.

GBP weakness will probably continue next year as well, as the BoE is likely to cut its key rate in view of the weak economy and somewhat lower inflation.

Source: Commerzbank Research

According to SG’s FX team, the USD/JPY could drop to 130 again.

Yen should appreciate when money returns to Japan

If the BoJ adjusts its Yield Curve Control (YCC) range at its June policy meeting as we expect, the USD/JPY could drop to around 130 again as the JGB yield rises.

Moreover, as a rule, the unwinding of foreign assets is bullish for the Yen. Net inflows into long-term bonds typically fuel Yen appreciation. We also think the USD/JPY could drop to 110 after 2025.

The Turkish Lira appears to be going exponential once again. Economists at Commerzbank have revised up their USD/TRY forecast path significantly.

Inflation-FX spiral may have restarted

We have revised up our USD/TRY forecast path significantly, with a target of 25.00 for end-2023 and 30.00 for end-2024.

Now that the exchange rate has started to depreciate once again, the FX pass-through to inflation will re-accelerate – the apparently falling inflation could begin to reverse.

The outlook for the real interest rate will deteriorate, which will further intensify exchange rate depreciation – this is the familiar inflation-FX spiral – the reason why we have significantly weakened our lira forecasts in the election aftermath.

Source: Commerzbank Research

- AUD/USD gains strong traction for the second straight day and climbs to a nearly two-week high.

- The uncertainty over the Fed’s rate-hike path weighs on the USD and lends support to the major.

- The mixed US NFP report does little to impress the USD bulls or provide any impetus to the pair.

The AUD/USD pair stands stall near a one-and-half-week high, around the 0.6625-0.6630 region through the early North American session on Friday and moves little in reaction to the mixed US monthly employment details.

The US Dollar (USD) did get a minor lift after the headline NFP print showed that the US economy added 339K new jobs in May, smashing consensus estimates by a big margin. Adding to this, the previous month's reading was also revised higher. That said, the uncertainty over the Federal Reserve's (Fed) next policy moves keeps a lid on any further gains for the Greenback and remains supportive of the strong bid tone surrounding the AUD/USD pair for the second successive day.

It is worth recalling that the markets have been pricing in the possibility of another 25 bps lift-off at the next FOMC meeting on June 13-14. A slew of influential Fed officials this week, however, backed the case for skipping an interest rate hike. Apart from this, the risk-on impulse - led by the optimism over the passage of legislation to lift the government's $31.4 trillion debt ceiling and avert an unprecedented American default - undermines the USD and benefits the risk-sensitive Aussie.

The Australian Dollar (AUD) further draws support from hopes of a recovery in the world's second-largest economy, bolstered by a private survey on Thursday that showed China’s manufacturing sector unexpectedly registered modest growth in May. This, along with speculations that the Reserve Bank of Australia (RBA) could tighten its monetary policy further, favours the AUD/USD bulls and suggests that the path of least resistance for spot prices is to the upside.

Technical levels to watch

The Mexican Peso is the only larger currency that was able to appreciate against the US Dollar in May. Economists at Commerzbank expect MXN to remain strong.

USD/MXN target remains at 17.50

The Peso was able to appreciate even in times of rising Fed rate hike expectations in May.

We assume that the Peso might be able to appreciate a little bit further as a result of Banxico’s hawkish approach, the promising growth environment and record high remittances.

Our target in USD/MXN remains 17.50.

- The index maintains the vacillating trade around 103.50.

- Further improvement in the risk space weighs on the buck.

- May Nonfarm Payrolls have hammered expectations at 339K.

The USD Index (DXY), which measures the greenback vs. a basket of its main competitors, alternates gains with losses in the mid-103.00s, as investors continue to assess the results from the US jobs report.

USD Index remains apathetic post-Payrolls

Following an ephemeral bout of strength soon after US Nonfarm Payrolls surprised to the upside in May, the index slowly returned to its current comfort zone around the 103.50 zone at the end of the week.

In fact, the greenback briefly revisited the 103.70/75 band, or daily highs, after the US economy created 339K jobs in May and the jobless rate rose to 3.7%. Further results saw Average Hourly Earnings rise 0.3% MoM and 4.3% from a year earlier, while the Participation Rate remained unchanged at 62.6%.

In the meantime, Thursday’s vote to pass the US debt ceiling bill in the US Senate continues to underpin the better tone in the risk complex and therefore keeps the dollar price action depressed, all in combination with the now-firm consensus around a Fed’s pause at the June gathering.

What to look for around USD

The index keeps the trade around the 103.50 zone amidst a vacillating price action on Friday.

In the meantime, bets of another 25 bps at the Fed’s next gathering in June suddenly reversed course in spite of the steady resilience of key US fundamentals (employment and prices, mainly), denting the recent rally in the dollar and favouring a further decline in US yields.

Bolstering a pause by the Fed instead appears to be the extra tightening of credit conditions in response to uncertainty surrounding the US banking sector.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is losing 0.04% at 103.52 and faces the next support at the 100-day SMA at 102.91 followed by the 55-day SMA at 102.41 and finally 101.01 (weekly low April 26). On the upside, the breakout of 104.69 (monthly high May 31) would open the door to 105.58 (200-day SMA) and then 105.88 (2023 high March 8).

Economists at Wells Fargo expect only modest gains in the Canadian Dollar against the US currency over time.

BoC could be among the first of the major central banks to begin easing monetary policy

We expect only modest gains in the CAD against the US currency over time. While growth was resilient in early 2023, an overall slowing inflation trend means we believe the Bank of Canada has already ended its tightening cycle.

Should growth and inflation slow further as we expect, Canada could also be among the first of the major central banks to begin easing monetary policy, by Q1-2024. That should act as a headwind for the Canadian dollar, while energy prices that are well below their peaks should also be a restraining factor for the currency.

Against this backdrop, we expect the Canadian Dollar to underperform relative to most of its G10 peers over the medium term.

- GBP/USD edges lower in reaction to the upbeat headline NFP print, albeit lacks follow-through.

- The mixed US jobs data adds to uncertainty over the next policy move by the Federal Reserve.

- The risk-on impulse to cap the US and lend support to the pair amid bets for more BoE rate hikes.

The GBP/USD pair pulls back from a two-and-half-week high, around the 1.2545 region, touched this Friday and extends its steady intraday descent through the early North American session. Spot prices slip below the 1.2500 psychological mark, hitting a fresh daily low in reaction to the mixed US employment details, albeit lacks follow-through and recovers a few pips in the last hour.

The US Dollar (USD) gains some positive traction in reaction to the upbeat headline NFP print and turns out to be a key factor exerting downward pressure on the GBP/USD pair. In fact, the US Bureau of Labor Statistics (BLS) reported that the economy added 339K new jobs in May as compared to the 170K estimated and the previous month's upwardly revised reading of 294K. Additional details, however, revealed that the Unemployment Rate, meanwhile, rose to 3.7% as compared to an expected uptick to 3.5% from 3.4% in April.

Furthermore, Average Hourly Earnings, edged lower to 4.3% from 4.4%, further raising uncertainty over the Federal Reserve's (Fed) next policy move. It is worth recalling that the markets have been pricing in the possibility of another 25 bps lift-off at the June FOMC policy meeting. That said, a slew of influential Fed officials this week backed the case for skipping an interest rate hike. This, along with the risk-on impulse, holds back traders from placing aggressive bullish bets around the safe-haven buck and lends support to the GBP/USD pair.

The British Pound, on the other hand, continues to draw support from rising bets for additional interest rate hikes by the Bank of England, bolstered by stronger-than-expected UK consumer inflation figures for May. This makes it prudent to wait for strong follow-through selling before confirming that the GBP/USD pair's recent bounce from the 1.2300 mark, or a two-and-half-month low touched last week has run its course. Nevertheless, spot prices remain on track to register strong weekly gains and snap a three-week losing streak.

Technical levels to watch

Economists at Commerzbank discuss Fed policy outlook after the latest Nonfarm Payrolls report.

A mixed picture

The US employment report for May shows a mixed picture. While payrolls surprised with a strong 339 thousand increase, other details point to a slowdown.

Apart from the robust job creation, the data indicate a cooling of the labor market. This allows the Fed to sit tight at the FOMC meeting on 13/14 June and at least pause on rate hikes.

The US central bank can then wait and see how things develop and, if necessary, tighten more at a later date.

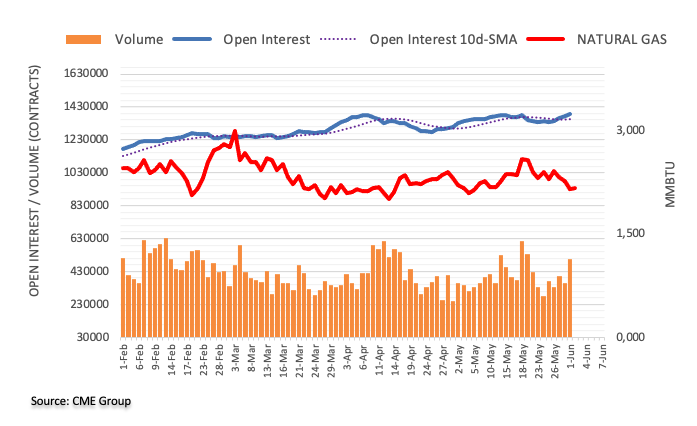

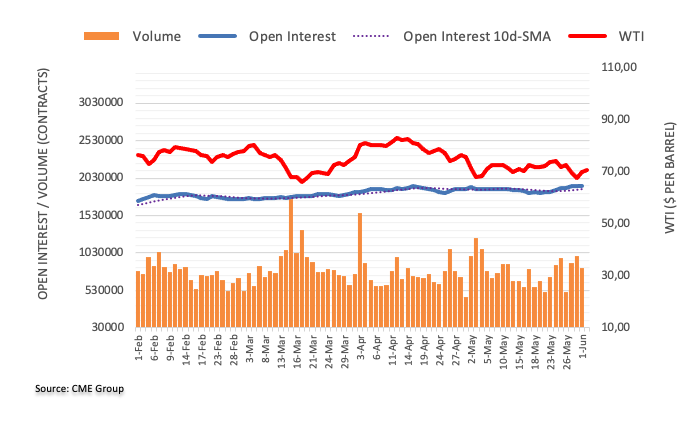

- Oil price recovers for the second day after the debt-ceiling bill gets voted through by the US Senate.

- The possibility of OPEC+ announcing more production cuts at its June 4 meeting further supports Oil.

- The breakeven price for the Saudis is $80 a barrel despite Russia downplaying the need for cuts.

Oil price rallies for the second day on Friday as global markets breathe a sigh of relief after the US Senate votes through the debt-ceiling extension bill, vaulting the final hurdle prior to implementation. Increasing expectations that the US Federal Reserve (Fed) will pause on hiking rates at the next Fed meeting in mid-June caps the US Dollar’s progress, further helping Oil, which is priced in USD.

Oil news and market movers

- Oil recovers for the second consecutive day after the debt-ceiling extension deal gets passed by the US Senate and lands on the President’s desk for sign off.

- The bill means the US debt limit will be raised and averting a US default, which would have led to market mayhem, potentially causing a slowdown in the global economy.

- The possibility that the Federal Reserve (Fed) will pause hiking interest rates at their June 14 meeting is a headwind for the US Dollar and a backdraft for Oil price.

- On Wednesday Fed’s Philip Jefferson said he thought a pause before more hikes later might allow the economy time to digest current tightening and avoid bank stress.

- Jefferson’s view of ‘pausing’ in June was echoed by Philadelphia Fed President Patrick Harker.

- Cleveland Fed President, Loretta Mester, however, said she saw no “compelling” reason to pause, in an interview with the Financial Times on Wednesday.

- The CME FedWatch Tool, which provides an insight into the market view of the probability of future rate hikes, has flipped from previously showing odds favoring a 0.25% hike in June to an over 75% chance the Fed will leave rates unchanged.

- Two of OPEC+’s largest members, Russia and Saudi Arabia, appear to be clashing over policy ahead of the next OPEC meeting on June 4.

- According to sources in Riyadh, the Saudis are unhappy with the way Russia is allegedly flaunting quotas agreed at the October meeting, a report on Oilprice.com says.

- Although there is no official data available on Russian production, shipping data appears to corroborate the allegation they may have increased their Oil exports despite the OPEC+ limits agreed.

- Last week, representatives of the two countries gave conflicting messages about the likely trajectory of the up-and-coming OPEC+ meeting.

- The Saudis are likely to continue to apply pressure for OPEC+ to cut production given analysts estimate its breakeven level is $80 per barrel, which is still above the current low price levels.

Crude Oil Technical Analysis: Price recovers from 200-week SMA, still in downtrend

WTI Oil price is still broadly speaking in a longer-term downtrend that started in July 2022. Given the old saying that the trend is your friend, this favors short sellers over longs.

WTI Oil is trading below all the major daily and weekly Simple Moving Averages (SMAs) except the 200-week SMA at $66.90. On Wednesday it found support at this MA and began its recovery.

-638213066824046023.png)

WTI US Oil: Weekly Chart

A bullish hammer candlestick is in the process of forming on the weekly chart but until the week is over it is impossible to say if it will fix. Even if it does, it would have to be followed by a bullish green bar next week to confirm the reversal.

Given the downtrend remains intact more downside is still possible, however, it would require a break below the year-to-date lows at $64.31 to confirm more downside.

Such a break could lead to the next target at around $62.00, where trough lows from 2021 will come into play, followed by support at $57.50.

-638213067329248157.png)

WTI US Oil: Daily Chart

Oil price needs to climb back above the $74.70 May 24 highs to raise significant doubts about the dominance of the bear trend.

Such a break might lead to a potential target in the $79.70s, which roughly coincides with the 200-day SMA and the main trendline for the bear market, heightening its importance as a key resistance level.

The long hammer Japanese candlestick pattern that formed at the May 4 (and YTD) lows is a sign that Oil price may have formed a strategic bottom at that level and raises the suspicion the bear trend may be reaching a conclusion.

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- USD/JPY struggles to capitalize on its modest intraday gains and hands near a one-week low.

- The mixed NFP report reaffirms an imminent Fed rate hike pause and continues to cap the USD.

- The risk-on impulse undermines the safe-haven JPY and is seen lending some support to the pair.

The USD/JPY pair jumps to a fresh daily high, around the 139.45 region, during the early North American session, albeit meets with a fresh supply at higher levels. Spot prices quickly retreat to the lower end of the daily range and currently trade just above the 139.00 mark following the release of the mixed US monthly jobs data.

The US Dollar (USD) did get a minor boost in reaction to the upbeat headline NFP print, showing that the US economy added 339K new jobs in May. The reading consensus estimates pointing to an addition of 190K jobs and well above the previous month’s upwardly 294K, which, in turn, benefits the Greenback and provides a modest lift to the USD/JPY pair.

Further details of the report, however, revealed that the Unemployment Rate shot to 3.7%, missing expectations for a modest uptick to 3.5% from 3.4%. Moreover, Average Hourly Earnings also fall short of estimates, reaffirming market expectations that the Federal Reserve (Fed) will likely skip an interest rate hike in June. This, in turn, caps the buck and the USD/JPY pair.

The downside, meanwhile, remains cushioned, at least for the time being, amid a more dovish stance adopted by the Bank of Japan (BoJ). This, along with the risk-on impulse, as depicted by a generally positive tone around the equity markets, undermines the safe-haven Japanese Yen (JPY) and acts as a tailwind for the USD/JPY pair, warranting some caution for bearish traders.

Nevertheless, spot prices, for now, seem to have stalled this week's retracement slide from the 141.00 neighbourhood, or the YTD low, though remain on track to register losses for the first time in the previous four weeks.

Technical levels to watch

- US Nonfarm Payrolls rose by 339K in May, exceeding expectations of 190K.

- The Unemployment Rate increased more than expected from 3.4% to 3.7%.

- US Dollar gained momentum, US yields moved higher, and Gold printed fresh daily lows.

Gold prices dropped from the $1,980 area to $1,971 following the release of the US official employment report, which showed an increase in Nonfarm Payrolls above expectations.

The US economy created 339K jobs in May, exceeding the market consensus of 190K, marking the highest reading in four months. Additionally, April’s figures were revised higher from 253K to 294K. The unemployment rate rose from 3.4% to 3.7%, with the Labor Force Participation holding steady at 62.6%.

The US Dollar initially rose across the board, hitting fresh highs versus the EUR, GBP, and JPY, and trimmed losses against the CAD, NZD, and AUD. However, the Dollar's momentum started to fade.

US yields spiked but then pulled back as markets analyze whether the job numbers were strong enough to pressure the Federal Reserve for another rate hike. The increase in Treasury yields weighed on Gold, causing it to tumble to $1,971. Currently, the yellow metal trades at $1,975 in a volatile environment post-NFP.

On the upside, Gold faces strong resistance around the $1,980/85 area. A break higher could drive prices towards $2,000. Conversely, a slide under $1,970 would weaken the outlook, with the next support standing at $1,960.

Technical levels

- EUR/USD now reverses initial gains and revisits 1.0980.

- US Non-farm Payrolls surprised to the upside in May.

- The unemployment rate edged higher to 3.7%.

EUR/USD now returns to the negative territory on the back of the post-Payrolls bout of strength in the greenback on Friday.

EUR/USD: Daily upside capped near 1.0780

EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 339K jobs during May, surpassing initial expectations for a gain of 190K jobs. In addition, the April reading was revised up to 294K (from 253K).

Further data saw the Unemployment Rate ticking higher to 3.7% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 4.3% from a year earlier. Additionally, the Participation Rate held steady at 62.6%.

What to look for around EUR

EUR/USD attempts to consolidate the recent breakout of the 1.0700 barrier following the resumption of the selling pressure in the greenback.

In the meantime, the pair’s price action is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB speak continues to favour further rate hikes, although this view appears to be in contrast to some loss of momentum in economic fundamentals in the region.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (and September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.03% at 1.0758 and faces initial contention at 1.0635 (monthly low May 31) seconded by 1.0516 (low March 15) and finally 1.0481 (2023 low January 6). On the upside, the break above 1.0779 (weekly high June 2) would target 1.0812 (100-day SMA) en route to 1.0886 (55-day SMA).

Gold has stabilized above the 100-Day Moving Average, reasserting its outperformance trend. Strategists at Credit Suisse analyze the yellow metal technical picture.

A break below $1,938 would open up a move back to $1,893

Gold has stabilized over the past week after the hold above the 100-DMA at $1,938. Although this is not an average we typically track, it did floor the market during the February setback earlier this year.

We still expect pivotal resistance at the $2,063/75 record highs posted in 2020 and 2022 will prove a tough barrier given the tiring short-term momentum picture, with a triple bearish momentum divergence still in place. This suggests further rangebound price action is the most likely outcome for the now. Post this phase, we believe the market will eventually move to new record highs.

Above $2,075 on a weekly closing basis would be seen to mark a significant break higher, opening up a move to our next core upside objective at $2,330/2,360. In contrast, a break below $1,938 would open up a move back to $1,893.

Economists at Wells Fargo expect the Yen to be a key beneficiary from US Dollar weakness.

Japanese Yen strength later this year

Against a backdrop of aggressive global monetary tightening, the Yen has underperformed so far in 2023. However, our expectation for the Bank of Japan to adjust its policy settings in Q4-2023 to further normalize the government bond market leads us to believe the Japanese currency has scope to outperform later this year.

Yen strength should also be supported by the end of global central bank tightening cycles and a transition toward global easing, as well as a US recession in the second half of 2023.

We target a USD/JPY exchange rate 136.00 by end 2023, and 129.00 by late 2024.

- EUR/USD clings to the positive territory near 1.0770 on Friday.

- Extra upside impulse should challenge the 1.0800 barrier.

EUR/USD trades in a cautious note near 1.0760/70 ahead of the key release of US Nonfarm Payrolls.

Despite Thursday’s rebound, the pair remains under pressure. Against that, the breach of the May low at 1.0635 (May 31) could pave the way to a drop to 1.0600 prior to the March low at 1.0516 (March 15). On the upside, the breakout of 1.0800 the figure could rapidly see the 100-day SMA at 1.0811 revisited ahead of the 55-day SMA at 1.0886.

A deeper pullback to the 2023 low at 1.0496 (January 6) would likely need a sharp deterioration of the outlook, which appears not favoured for the time being.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0500.

EUR/USD daily chart

Economists at Commerzbank analyze the Brazilian Real outlook.

Strong growth supports the Brazilian Real

With a plus of 1.9% QoQ the Brazilian economy grew much more significantly at the start of the year than expected (consensus: +1.2%). This was mainly due to the strong agricultural sector.

We assume that the BCB is likely to remain cautious regarding rate cuts following yesterday’s data, and we therefore continue to expect that for the time being the Real will be able to defend current strong levels vs. the US Dollar.

Economists at Rabobank discuss AUD/USD outlook.

Scope for AUD/USD to reach 0.70 next year

While the expectation of further policy tightening should lend the AUD support, on the downside concerns over the sluggish recovery in China and the drop in iron ore prices from their March highs will dampen the outlook for the AUD.

Given our view that the USD will continue to garner support as the market prices out Fed rate hikes this year, we expect that AUD/USD will struggle to move beyond 0.67 on a three-month view.

We see scope for AUD/USD to reach 0.70 next year as the Fed prepares to reduce interest rates and risk appetite increases.

After dropping some nineteen percent from its mid-April high, Oil surged over three percent alongside the equity markets. Nonetheless, economists at TD Securities do not expect the rally to endure.

Rally hard to sustain

WTI jumped north of $70, with Brent nearing $75 after straddling the lows found back in mid-March.

The impressive rally is very likely the result of traders covering their short exposure and rebuilding their long bets, after recent aggressive moves to the short end of exposure. This suggests that the rally may be fragile and lose momentum.

- DXY keeps the bearish note unchanged in the 103.50/40 region.

- Further decline could extend to the 100-day SMA near 102.90.

DXY accelerates the decline south of the 104.00 barrier and records new multi-session lows near 103.40 on Friday.

Considering the current price action, extra pullbacks should not be ruled out. That said, the continuation of the decline could face the next support at the 100-day SMA at 103.91 ahead of another the interim 55-day SMA at 102.41.

A deeper drop to the May lows near 101.00 is not favoured for the time being.

Looking at the broader picture, while below the 200-day SMA at 105.57, the outlook for the index is expected to remain negative.

DXY daily chart

- EUR/JPY adds to recent gains and approaches 150.00.

- The continuation of the upside could revisit the 151.00 area.

EUR/JPY extends the recovery following Thursday’s advance and trades closer to the key 150.00 yardstick on Friday.

Further recovery appears a plausible near-term scenario, and a convincing breakout of the round level at 151.00 could encourage the cross to confront the 2023 top at 151.61 (May 2) in the not-so-distant future.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 143.95.

EUR/JPY daily chart

- US Dollar struggles to stage a rebound following Thursday's selloff.

- US Dollar Index stays below 104.00 and looks to snap a three-week winning streak.

- US May jobs data could impact US Dollar's valuation ahead of the weekend.

The US Dollar (USD) is having a hard time staying resilient against its rivals on the last trading day of the week. The US Dollar Index, which tracks the USD's valuation against a basket of six major currencies, stays in negative territory below 104.00 after having lost more than 0.5% on Thursday.

May jobs report from the United States (US) will be watched closely by market participants due to its potential impact on the market pricing of the US Federal Reserve's (Fed) next policy decision.

Daily digest market movers: US Dollar continues to lose value against its peers

- Nonfarm Payrolls (NFP) in the US are expected to rise 190,000 in May. The Unemployment Rate is forecast to rise slightly to 3.5% from 3.4%.

- The economic activity in the US manufacturing sector continued to contract at an accelerating pace in May with the ISM Manufacturing PMI dropping to 46.9 from 47.1 in April. This reading came in worse than the market expectation of 47. More importantly, the inflation component of the PMI survey, Prices Paid Index, fell sharply to 44.2 from 53.2, compared to analysts' estimate of 52.

- The data published by Automatic Data Processing (ADP) showed on Thursday that private sector employment in the US rose by 278,000 in May. This reading surpassed the market expectation of 170,000 by a wide margin. Underlying details of the publication revealed that the annual wage inflation for 'job stayers' declined to 6.5% from 6.7% in April.

- The US Bureau of Labor Statistics revised the change in Unit Labor Costs for the first quarter lower to 4.2% from 6.3% in the advanced estimate.

- Other data from the US revealed that there were 232,000 initial claims for unemployment benefits in the week ending May 27, compared to 230,000 in the previous week.

- Philadelphia Fed President Patrick Harker noted on Wednesday and Thursday that he was leaning toward a pause in rate hikes in June but noted that incoming data may change his mind.

- Federal Reserve Governor Philip Jefferson said that pausing rate hikes at the next FOMC meeting would offer time to analyse more data before making a decision about the extent of additional tightening.

- According to the CME Group FedWatch Tool, the probability of one more 25 basis points (bps) Fed rate hike at the upcoming meeting declined below 30% from nearly 70% earlier in the week.

- The House of Representatives passed a bill to suspend the debt limit through January 1, 2025. US stock index futures trade modestly higher on Thursday.

- The US Bureau of Labor Statistics reported on Wednesday that the number of job openings on the last business day of April stood at 10.1 million, compared to 9.74 million in March. This reading came in higher than the market expectation of 9.37 million and provided a short-lasting boost to the USD.

- In an interview with the Financial Times, Cleveland Federal Reserve (Fed) Bank President Loretta Mester said that she doesn't necessarily see a compelling reason for pausing rate increases amid a "really embedded, stubborn inflationary pressure.”

- Consumer sentiment in the US weakened slightly in May with the Conference Board's (CB) Consumer Confidence Index edging lower to 102.3 from 103.7 in April (revised from 101.3). The Present Situation Index declined to 148.6 from 151.8 and the Consumer Expectations Index stayed virtually unchanged at 71.5. Finally, the one-year consumer inflation expectations ticked down to 6.1% in May from 6.2% in April.

Technical analysis: US Dollar Index stays below key technical level

The US Dollar Index (DXY) broke below 104.00 on Thursday, where the Fibonacci 23.6% retracement of the November-February downtrend is located. On the downside, 103.00 (100-day SMA) aligns as critical support. A weekly close below that level could bring in additional sellers and open the door for an extended decline toward 102.40 (50-day SMA) and 102.00 (psychological level). where the 100-day Simple Moving Average (SMA) and the 20-day SMA meet.

On the flip side, DXY could gather bullish momentum and rise toward 104.50 (static level) and 105.00 (psychological level) if it manages to rise above 104.00 and use that level as support.

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

- Gold price climbs to over a one-week high on Friday and is supported by a weaker US Dollar.

- Diminishing odds for another Federal Reserve rate hike in June continue to weigh on the buck.

- The upbeat market mood caps gains for the safe-haven XAU/USD ahead of the US NFP report.

Gold price builds on this week's goodish rebound from the $1,932 area, or its lowest level since March 17 and gains some follow-through traction for the fourth successive day. The XAU/USD sticks to its positive tone through the first half of the European session and currently trades around the $1,980 region, just below a one-and-half-week high touched earlier today.

Weaker US Dollar lends some support to Gold price

The US Dollar (USD) remains under some selling pressure on the last day of the week and retreats further from a two-and-half-month high touched on Wednesday amid hopes for a pause in the Federal Reserve’s (Fed) rate-hiking cycle. In fact, comments by a slew of influential Fed officials this week forced investors to scale back their expectations for another 25 basis points (bps) lift-off at the next Federal Open Market Committee (FOMC) on June 13-14. This has been a key factor behind the recent sharp decline in the United States (US) government bond yields, which continues to weigh on the Greenback and is seen benefitting the US Dollar-denominated Gold price.

A positive risk tone acts as a headwind for the XAU/USD

The upside for the XAU/USD, however, remains capped, at least for the time being, amid a generally positive tone around the equity markets, which tends to dent demand for traditional safe-haven assets. A slightly better-than-expected private survey on Thursday, showing that China's manufacturing sector unexpectedly registered modest growth in May, raised hopes for hopes of a recovery in the world's second-largest economy. The passage of bipartisan legislation to lift the government's $31.4 trillion debt ceiling and avert an unprecedented American default boosts investors' confidence. This, in turn, is acting as a headwind for the safe-haven Gold price.

Focus remains glued to US monthly jobs report (NFP)

Traders also seem reluctant to place aggressive bets and prefer to wait for the release of the US monthly employment details, due later during the early North American session. The popularly known Nonfarm-Payrolls (NFP) report will influence market expectations about the Fed's next policy move, which will drive the USD demand in the near term and provide some meaningful impetus to the non-yielding Gold price. Nevertheless, the XAU/USD remains on track to register its biggest weekly gain in nearly two months and snap a three-week losing streak.

Gold price technical outlook

From a technical perspective, some follow-through buying beyond the $1,985-$1,986 region should pave the way for additional gains and allow Gold price to reclaim the $2,000 psychological mark. The momentum could get extended towards the next relevant hurdle near the $2,008-$2,010 area, above which the XAU/USD could climb further towards the $2,035-$2,037 resistance zone.

On the flip side, the $1.970 static support could protect the immediate downside ahead of the $1,954-$1,952 region and the 100-day Simple Moving Average (SMA), currently pegged near the $1,940-$1,939 area. This is followed by the multi-month low, around the $1,932 zone, which if broken will be seen as a fresh trigger for bears and make the Gold price vulnerable to weaken further towards the $1,900 mark.

Key levels to watch

Analysts at Credit Suisse discuss US Dollar Index (DXY) technical outlook.

Looking for an eventual test of key resistance at 105.68/106.13

DXY continues to appreciate steadily following the completion of a near-term base above the 55-DMA and April high, itself on the back of the repeated successful defence of its 100.82 YTD January low. We are now also seeing a range of breaks of major levels across a range of USD crosses and with daily and weekly momentum positive we maintain our view the potential for a broad and large ‘double bottom’ continues to increase markedly.

We continue to look for strength back to the March highs, 200-DMA and 38.2% retracement of the 2022/2023 fall at 105.63/106.13. Above here though stays seen needed to see a ‘double bottom’ reversal confirmed to open the door to a more sustained and material phase of USD strength with next resistance seen at 107.78/99.

Support is seen at 103.88 initially, beneath which can see a pullback to the 13-day exponential average at 103.25. With price support seen not far below at 102.96 we would though look for a good floor here.

EUR/USD managed to rebound yesterday. Economists at MUFG Bank discuss the pair’s outlook.

ECB minutes point to two more hikes

The minutes (known as the accounts) from the ECB meeting on 4th May were released yesterday and again the take-away here also reinforces the prospect of at least two more rate hikes by the ECB.

ECB President Lagarde stated yesterday that there was ‘no clear evidence’ that underlying inflation had peaked. Expect that rhetoric to be repeated when President Lagarde speaks in the policy press conference on 14th June after a likely hike of 25 bps.

The ECB minutes, the comments from Lagarde and the fact that services inflation could well drift higher over the summer on tourism-related inflationary pressures, we see limited scope for lower yields at the front-end in the Eurozone which will provide EUR with support at these lower levels.

Economists at MUFG Bank discuss how the US Nonfarm Payrolls report could impact the greenback.

Fed will pause this month

We maintain our view that the Fed will pause this month and that the tightening cycle is likely over.

A consensus print today will likely remove the lingering pricing for a rate hike this month (OIS implies about 7bps) and propel the Dollar further weaker into the weekend. That could mean the 100-DMA for DXY (102.91) comes into play and is tested this afternoon.

See – Nonfarm Payrolls Preview: Banks expect labor market to lose momentum only slowly

- GBP/USD touches a nearly three-week high and draws support from sustained USD selling.

- Diminishing odds for another Fed rate hike in June and a positive risk tone weigh on the buck.

- Speculations for further tightening by the BoE remain support ahead of the US NFP report.

The GBP/USD pair enters a bullish consolidation phase near a two-and-half-week high touched on Friday and oscillates in a narrow band, around the 1.2530-1.2535 region through the first half of the European session.

The US Dollar (USD) extends the overnight sharp retracement slide from the vicinity of its highest level since mid-March set on Wednesday and remains depressed for the second successive day, which, in turn, acts as a tailwind for the GBP/USD pair. A slew of influential Federal Reserve (Fed) officials this week backed the case for skipping an interest rate hike and forced investors to scale back their expectations for another 25 bps lift-off in June. This, along with a positive risk tone, weighs on the safe-haven buck.

A slightly better-than-expected private survey on Thursday, showing that China's manufacturing sector unexpectedly registered modest growth in May, raised hopes for hopes of a recovery in the world's second-largest economy. Adding to this, the passage of bipartisan legislation to lift the government's $31.4 trillion debt ceiling and avert an unprecedented American default boosts investors' confidence. This, along with expectations that the Bank of England (BoE) could raise rates further, lends support to the GBP/USD pair.

Bullish traders, however, seem reluctant to place aggressive bets and prefer to wait for fresh cues from Friday's release of the closely-watched US monthly employment details. The popularly known NFP report is due for release later during the early North American session and will influence market expectations about the Fed's next policy move. This, in turn, will drive the USD demand and provide a fresh impetus to the GBP/USD pair. Nevertheless, spot prices remain on track to snap a three-week losing streak.

Technical levels to watch

European Central Bank (ECB) Governing Council member, Gabriel Makhlouf, said on Friday that they are “likely to see another rate increase at the next meeting.“

Additional comments

Fall in Eurozone inflation very welcome, not definitive with underlying pressures quite strong.

Likely to see another rate increase at next meeting.

Have not reached the moment where we can say let's now stop.

Picture a lot less clear beyond probably rate increases in June and July.

Related reads

- ECB’s Vasle: More rate hikes needed to get inflation to 2% target

- EUR/USD appears cautious near 1.0780 ahead of US NFP

Economists at Rabobank analyze USD/CAD outlook.

The 1.35 magnet

USD/CAD remains in a technical bull trend that began in the middle of 2022. Momentum has stalled since Q4, with the pair trading sideways in a 1.3280 to 1.3880 range, but without a close below 1.3260, that bull trend remains in place, and we do not expect to see USD/CAD trade through that level.

In the coming months, we expect USD/CAD to continue trading around 1.35 with the majority of price action taking place within the 1.34-1.36 range. We remain of the view that a break to the upside is likely by year-end, although we don’t expect an extension beyond the 1.3880 topside of the broader range.

- AUD/USD scales higher for the second straight day and jumps to a nearly two-week high.

- Reduced bets for another 25 bps Fed rate hike in June continue to weigh on the Greenback.

- A positive risk tone further benefits the risk-sensitive Aussie ahead of the key US NFP report.

The AUD/USD pair builds on this week's recovery from its lowest level since November 2022 and gains strong follow-through traction for the second successive day on Friday. The momentum remains uninterrupted through the first half of the European session and lifts spot prices to a nearly two-week high, around the 0.6625-0.6630 region in the last hour.

The US Dollar (USD) adds to the overnight heavy losses and remains depressed on the last day of the week, which, in turn, is seen as a key factor pushing the AUD/USD pair higher. The recent comments by a slew of influential Federal Reserve (Fed) officials forced investors to scale back their expectations for another 25 bps lift-off in June. This, along with a generally positive risk tone, drags the safe-haven buck to over a one-week low and benefits the risk-sensitive Aussie.

A private survey showed on Thursday that China’s manufacturing sector unexpectedly registered modest growth in May. Furthermore, the passage of bipartisan legislation to lift the government's $31.4 trillion debt ceiling and avert an unprecedented American default boosts investors' confidence. Apart from this, speculations that the Reserve Bank of Australia (RBA) could tighten its monetary policy support prospects for a further appreciating move for the AUD/USD pair.

That said, the Relative Strength Index (RSI) on the 1-hour chart is already flashing overbought conditions and acting as a headwind for spot prices. Traders might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of the release of the US monthly employment details, due later during the early North American session. The popularly known NFP report will play a key role in driving the USD demand and provide some meaningful impetus to the AUD/USD pair.

Technical levels to watch

Economists at ING discuss USD outlook ahead of US NFP job data.

Dollar bias looks lower unless NFP comes in strong

We would say that an on-consensus +195K increase in jobs, a 3.5% unemployment rate and a 0.3% MoM increase in hourly earnings would not be enough to shift the needle from the view that the Fed pauses in June and the Dollar can stay gently offered.

High dollar deposit rates will stop the Dollar from selling off too quickly, but unless the May NFP surprises on the upside we would say today's DXY bias lies towards the 103.20 area.

See – Nonfarm Payrolls Preview: Banks expect labor market to lose momentum only slowly

European Central Bank (ECB) policymaker, Boštjan Vasle, said on Friday, “more rate hikes needed to get inflation to the 2% target.”

Vasle added, “core inflation remains high and persistent.”

Market reaction

At the time of writing, EUR/USD is keeping its upside intact at around 1.0775, up 0.11% on the day.

- EUR/USD looks to extend Thursday’s sharp uptick well past 1.0700.

- Improved sentiment in the risk complex bolsters the pair so far.

- The US economy is expected to have added nearly 200K jobs in May.

EUR/USD trims part of the earlier advance to multi-day highs near 1.0780 as a more cautious tone emerges ahead of the release of the US jobs report.

EUR/USD: Next on the upside comes the 100-day SMA

EUR/USD so far maintains the bid bias amidst a mildly offered tone in the greenback and a persistent appetite for the risk-associated universe at the end of the week.

In addition, the risk-on mood derives extra support after the US Senate passed the debt ceiling bill late on Thursday. The legislation is now on its way to the White House, where President Joe Biden will sign it into law. This action prevents the occurrence of an unprecedented default, as the Treasury Department had cautioned that it would be incapable of meeting all financial obligations on June 5 if Congress did not take action before that date.

Still contributing to the upside bias in spot is the persevering hawkish narrative from ECB President Lagarde and many of her colleagues at the Council, who insisted that inflation remains elevated and that further tightening remains well on the cards for the next couple of months. On this, investors continue to pencil in a quarter-point rate raise at both the June and July meetings, leaving the door open to a similar move in September.

Second-tier releases in the domestic docket saw Industrial Production in France expand more than estimated by 0.8% MoM in April.