- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- USD/JPY has shown a sharp decline to near 139.00 amid weakness in the USD Index.

- A collaboration of upbeat US Employment and job market data would leave no reason for the Fed to a neutral policy consideration.

- BoJ Ueda confirmed that bond-buying operations by the central bank would continue in order to keep inflation steadily above 2%.

The USD/JPY pair has witnessed an intense sell-off and has dropped to near 139.00 in the Asian session. The asset attracted significant offers as the US Dollar Index (DXY) extended its downside below 104.20. The USD Index has dropped to near 104.15 as investors are optimistic that US debt-ceiling proposal would secure sufficient votes.

S&P500 futures have posted some gains in early Asia after a bearish Wednesday. The risk appetite of the market participants has improved amid a drop in appeal for the USD Index.

On Wednesday, US JOLTS Job Openings data outperformed expectations. Despite higher interest rates from the Federal Reserve (Fed) and tight credit conditions by US regional banks, the US job market seems healthy.

Going forward, the US Nonfarm Payrolls (NFP) data (May) will be of utmost importance. As per the preliminary report, fresh 190K payrolls were added in the labor market in May, lower than the additions of 253K made in April. The Unemployment Rate is increased to 3.5% vs. the former release of 3.4%. Annual Average Hourly Earnings are seen steady at 4.4%.

A collaboration of better-than-anticipated US Employment and job market data would leave no reason for Fed chair Jerome Powell for a neutral interest rate policy consideration.

On the Japanese Yen front, Bank of Japan (BoJ) Governor Kazuo Ueda has confirmed that bond-buying operations by the central bank would continue in order to keep inflation steadily above 2%.

About USD/JPY’s outlook, Economists at MUFG Bank believe that “The debt ceiling issue has been resolved and a strong jobs report at the end of the week would likely see markets price more fully a Fed rate hike on 13th June that would likely then lead to further USD/JPY buying.”

“If events fuel another quick move to the 145 level, above there would certainly be in the range of intervention. It would in addition serve to highlight another unwelcome by-product of YCC and could play a role in swaying Governor Ueda to scrap YCC later this year.”

- Gold price remains on the front foot amid improvement in risk, US Dollar’s retreat.

- Easing fears of United States default, hopes of pause in Federal Reserve’s rate hike trajectory underpin XAU/USD demand.

- Uncertainty about US debt ceiling bill’s passage, market’s hawkish Fed bets weigh on the Gold Price amid mixed US data.

- US ADP Employment Change, PMI and US politics eyed for clear XAU/USD directions.

Gold Price (XAU/USD) picks up bids to refresh intraday high near $1,967 amid the early hours of Thursday’s Asian session as the US Dollar’s retreat joins hopes of the United States debt-ceiling bill’s passage through the House of Representatives. Adding strength to the XAU/USD upside could be the latest shift in the Federal Reserve (Fed) bias amid mixed data and unimpressive comments from the policymakers. Even so, the Gold buyers need validation from today's US ADP Employment Change for May, known as the early signal for Friday’s Nonfarm Payrolls (NFP), as well as from the multiple Purchasing Managers’ Indexes for the previous month.

Gold Price cheers United States debt ceiling optimism

Gold Price benefits from the receding fears of the United States default as some of the prominent US policymakers recently backed hopes of the US debt-ceiling bill’s passage through the House of Representatives during its vote at 00:30 GMT on Thursday.

Late on Wednesday, Republican leader Mitch McConnell conveyed expectations of the US debt ceiling bill passing and reaching the Senate on Thursday. The policymaker’s comments become the key for the debt-limit extension as Republicans control the House where the bill is currently discussed.

“A bill to suspend the U.S. government's $31.4 trillion debt ceiling and avert a disastrous default cleared a key procedural hurdle in the House of Representatives on Wednesday, setting the stage for a vote on the bipartisan debt deal itself,” said Reuters as the debate on the debt-ceiling bill began.

While the receding expectations of the US default underpin the Gold price upside, there are hardline Republicans like Chip Roy and Rand Paul who can delay the much-awaited announcements and can trigger the market’s risk-off mood. The same keeps the Gold buyers on their toes.

Federal Reserve hawks’ retreat, mixed US data also favor XAU/USD bulls

Apart from the hopes that the United States will be able to push back the default concerns, the recently mixed US data and comments suggesting a pause in the Federal Reserve’s (Fed) rate hike trajectory seem to also allow the Gold buyers to remain positive of late.

On Wednesday, US JOLTS Job Openings rose to 10.103M in April versus 9.375M expected and 9.745M prior whereas Chicago Purchasing Managers’ Index dropped to 40.4 for May from 48.6 prior and 47.0 market forecasts. Earlier in the week, the US consumer sentiment gauge improved but the details were unimpressive, which in turn teases the Gold buyers.

Considering the mixed data, Federal Reserve (Fed) Governor Michelle Bowman cited recovery in the residential real estate market while also adding, “The leveling out of home prices will have implications for the Fed's fight to lower inflation,” per Reuters. Before him, Cleveland Fed President Loretta Mester suggested that the Fed must go for a rate hike in June. Additionally, Fed Governor and vice chair nominee Philip Jefferson said that skipping a rate hike would allow the Fed "to see more data before making decisions about the extent of additional policy firming,” per Reuters. On the same line was Federal Reserve Bank of Philadelphia President Patrick Harker who also said on Wednesday that he is inclined to support a "skip" in interest rate hikes at the central bank's next meeting in June.

While justifying the same, Wall Street Journal’s (WSJ) Nick Timiraos signaled that Federal Open Market Committee (FOMC) is likely to hold interest rates steady in June, which in turn propel the XAU/USD price.

US data, risk catalysts are the key for Gold price

Moving on, the US House of Representatives is debating the US debt ceiling extension and will vote on it at around 00:30 GMT, which will be key to watching for clear directions of the Gold price. Should the policymakers manage to push the much-awaited bill towards the Senate voting on Thursday, they may be able to avoid the ‘disastrous’ US default, which in turn can allow the XAU/USD to remain firmer.

Additionally, early signals for Friday’s United States Nonfarm Payrolls (NFP) will decorate the calendar and hence will be crucial for the Gold Price watchers to observe. Among them, the ADP Employment Change, ISM Manufacturing PMI and S&P Global PMIs for May will be crucial to watch.

Also read: US ADP Employment, ISM Manufacturing PMI Preview: First down, then up for US Dollar?

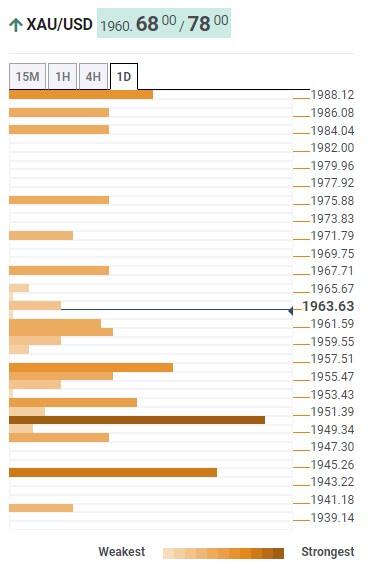

Gold price technical analysis

Gold price justifies recovery from an 11-week-old horizontal support area, as well as an upside break of a descending trend line from early May, while bracing for the first weekly gain in three.

That said, the XAU/USD’s upside also takes clues from the Moving Average Convergence and Divergence (MACD) indicator’s bullish signals and the upbeat Relative Strength Index (RSI) line, placed at 14.

However, the RSI is quickly approaching the overbought territory and hence highlights a fortnight-long horizontal resistance zone surrounding $1,985 as the short-term key hurdle.

Following that, the 200-Simple Moving Average (SMA) level of around $1,992 and the $2,000 round figure can prod the Gold price upside before giving back control to the bulls.

On the contrary, XAU/USD pullback needs validation from the resistance-turned-support line stretched from May 03, close to $1,945 at the latest.

Even so, the previously stated horizontal support zone around $1,935-33 may challenge the Gold bears before welcoming them.

To sum up, the Gold price remains on the front foot but the road towards the north appears long and bumpy.

Gold price: Four-hour chart

Trend: Further upside expected

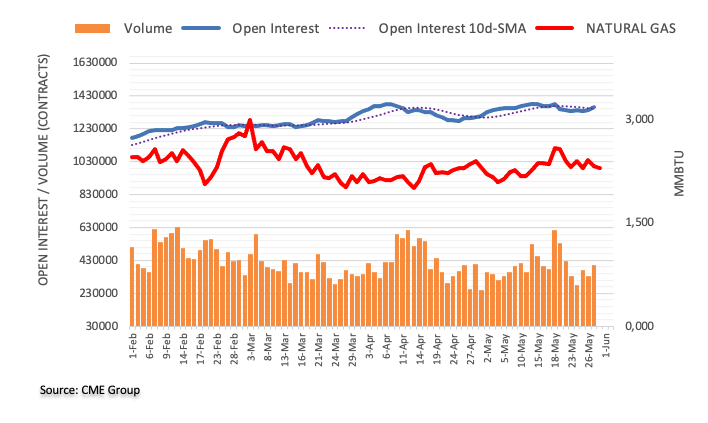

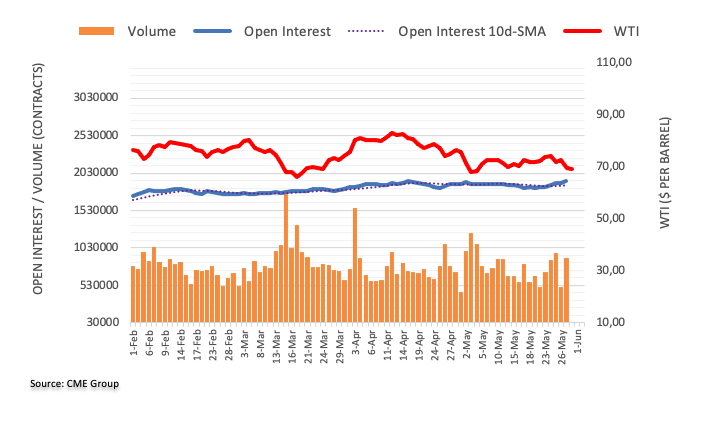

- The oil price is gauged intermediate support around $67.50, however, the downside seems favored as Fed to raise rates further.

- A sharp decline in China’s factory activity indicated a bleak outlook for oil demand.

- OPEC meeting will remain in focus as oil-producing nations are expected to announce more supply cuts to support energy prices.

West Texas Intermediate (WTI), futures on NYMEX, have gauged intermediate support around $67.50 in the Asian session. The pullback move in the oil price to near $69.50 was capitalized by the market participants as a selling opportunity amid multiple bearish catalysts.

As United States consumer spending turned out to be resilient in April and their labor market conditions are still healthy, it seems that the Federal Reserve (Fed) is preparing for a fresh rate hike despite announcing that more rate hikes are less certain amid tight credit conditions by the US regional banks. Further monetary policy tightening by the Fed would deepen hopes of a recession in the US economy, which will have a significant impact on the oil demand.

On Wednesday, a sharp decline in China’s factory activity displayed a bleak outlook for oil demand. China’s National Bureau of Statistics (NBS) reported Manufacturing PMI at 48.8, lower than the estimates of 49.4 and the former release of 49.2. A figure below 50.0 is itself considered a contraction. It is worth mentioning that China is the largest importer of oil in the world and weak economic activities in China would have a significant impact on the oil price.

Meanwhile, the US Dollar Index (DXY) has found some cushion near 104.20 ahead of the US Employment data, which will provide guidance about the Fed’s interest rate policy.

Later this weekend, the OPEC meeting will remain in focus as oil-producing nations are expected to announce more supply cuts to support energy prices. Tensions between Russia and Saudi Arabia have remained elevated as the former has disrespected the pledge and pumping cheap oil into the global economy. The notion of production cuts by OPEC+ could be faded if Moscow continues to deliver oil at cheaper rates.

Regarding oil outlook, economists at Rabobank cited “Right now, we see OPEC+ staying the course and continuing the April cuts of 1.6m bpd. The surprise April cut boosted prices by $5-$7 for about three weeks. A second cut would display their fears more openly and indicates greater weakness; we construe a second cut as a bearish signal unless the cuts are extremely substantive.”

Going forward, oil inventory data for the week ending May 26 by the US Energy Information Administration (EIA) will be keenly watched. Investors should note that US American Petroleum Institute (API) reported a build-up of oil stockpiles on Tuesday by 5.202M barrels.

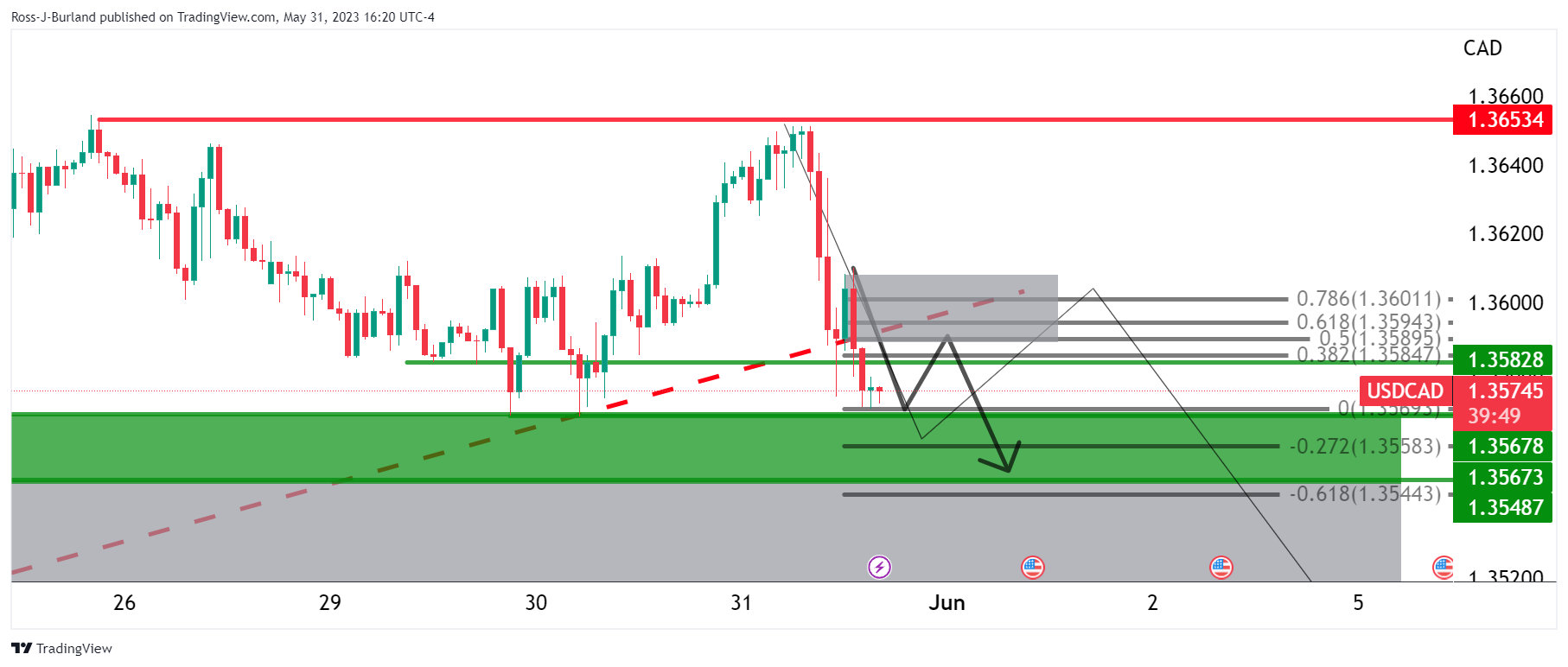

USD/CAD takes offers to refresh the intraday low near 1.3560 amid the early hours of Thursday’s Asian session. In doing so, the Loonie pair takes clues from the options market, as well as the latest retreat in the US Dollar, ahead of a slew of top-tier data and events from the US.

One-month Risk Reversal (RR) of the USD/CAD pair, a measure of the spread between call and put prices, dropped the most in a month by the end of Wednesday’s Asian session. That said, the RR dropped to -0.093 in its latest readings per the options market data from Reuters.

Not only on a daily basis, but the monthly RR also flashed red marks with a -0.110 figure whereas the weekly numbers pleased the USD/CAD sellers with a -0.093 level.

Additionally, the upbeat Canadian GDP and the latest shift in the Federal Reserve (Fed) officials’ push for a pause in the rate hike trajectory, as well as hopes that members of the US House of Representatives will support the debt ceiling bill’s passage, also weigh on the pair.

Also read: USD/CAD Price Analysis: Bears are in the market, but bulls flexing

- US Dollar Index retreats from the highest levels in 11 weeks.

- Positive expectations about US debt ceiling bill, mixed US data weigh on DXY.

- Recent Fed talks suggest pain for hawks as June rate hike concerns pushed back.

- US House of Representatives voting on debt ceiling bill, ADP Employment Change and PMIs eyed.

US Dollar Index (DXY) remains sidelined after retreating from the highest levels since mid-March 2023 amid early Thursday morning in Asia. The DXY initially rose to the highest levels since March 15 before retreating from 104.70 by the end of Wednesday’s North American trading session.

In doing so, the greenback’s gauge versus the six major currencies justifies the latest shift in the Federal Reserve (Fed) officials’ push for a pause in the rate hike trajectory, as well as hopes that members of the US House of Representatives will support the debt ceiling bill’s passage.

That said, the hope of US debt ceiling passage from the House of Representatives increased after US Senate Republican Leader McConnell conveyed expectations of the US debt ceiling bill passing and reaching the Senate on Thursday.

On the other hand, US JOLTS Job Openings rose to 10.103M in April versus 9.375M expected and 9.745M prior whereas Chicago Purchasing Managers’ Index dropped to 40.4 for May from 48.6 prior and 47.0 market forecasts.

The mixed US data allowed the Federal Reserve (Fed) officials to retreat from the previously hawkish bias and weighed on the US Dollar late Wednesday. That said, Federal Reserve (Fed) Governor Michelle Bowman cited recovery in the residential real estate market while also adding, “The leveling out of home prices will have implications for the Fed's fight to lower inflation,” per Reuters. Before him, Clevland Fed President Loretta Mester suggested that the Fed must go for a rate hike in June.

Additionally, Fed Governor and vice chair nominee Philip Jefferson said that skipping a rate hike would allow the Fed "to see more data before making decisions about the extent of additional policy firming,” per Reuters. On the same line was Federal Reserve Bank of Philadelphia President Patrick Harker who also said on Wednesday that he is inclined to support a "skip" in interest rate hikes at the central bank's next meeting in June.

While justifying the same, Wall Street Journal’s (WSJ) Nick Timiraos signaled that Federal Open Market Committee (FOMC) is likely to hold interest rates steady in June.

Against this backdrop, Wall Street closed with minor losses and the yields were down while the US Dollar Index (DXY) ended Wednesday’s North American trading on the positive side despite the latest retreat.

Looking ahead, the US House of Representatives is debating the US debt ceiling extension and will vote on it at around 00:30 GMT, which will be key to watch ahead of a slew of the US employment and activity data.

Also read: US ADP Employment, ISM Manufacturing PMI Preview: First down, then up for US Dollar?

Technical analysis

US Dollar Index (DXY) bulls need a sustained upside break of a downward-sloping resistance line from late November 2022, close to 104.20 by the press time, to lure the DXY bulls.

- USD/CHF is oscillating above 0.9100 as the USD Index has gauged an intermediate cushion around 104.20.

- Fed’s interest rates are already above 5% and effectively weighing on firms in augmenting fixed and working capital requirements.

- Retail demand by Swiss households has sharply contracted due to the burden of a higher cost of living.

The USD/CHF pair is demonstrating a back-and-forth action above the round-level support of 0.9100 in the Asian session. The Swiss Franc asset has turned sideways as investors are awaiting the release of the United States Employment data.

S&P500 witnessed selling pressure amid rising expectations of one more interest rate hike from the Federal Reserve (Fed). Interest rates are already above 5% and effectively weighing on firms in augmenting fixed and working capital requirements and an escalation in already restrictive policy would weigh more pressure on firms.

The US Dollar Index (DXY) displayed a vertical sell-off from 104.70 as Republican leaders are confident that the US debt-ceiling bill will get passage in Congress. This has led to a sheer decline in US Treasury yields. The yields offered on 10-year US government bonds have dropped below 3.65%.

On Thursday, US Automatic Data Processing (ADP) Employment Change (May) will remain in the spotlight. As per the expectations, the US economy added fresh 170K personnel in the labor market lower than the prior addition of 296K. Currently, labor market conditions are pretty decent and are supporting one more interest rate hike from the Fed.

Apart from the US Employment data, US ISM Manufacturing PMI (May) will be in focus. The economic data is expected to soften marginally to 47.0 vs. the former release of 47.1. While the New Orders Index that indicates forward demand is expected to drop to 44.9 from the prior release of 45.7.

On the Swiss Franc front, annual Real Retail Sales (April) contracted significantly by 3.7% while the street was anticipating a contraction of 1.4%, and previous data was contracted by 1.9%. A sharp decline in retail demand by households due to the burden of a higher cost of living could force the Swiss National Bank (SNB) to go light on interest rates.

- GBP/JPY remains unchanged mainly but sustains its bullish bias, ending Wednesday’s session at 173.30 after a dip to 172.51.

- Candlestick patterns hint at a potential decline, pending confirmation with a close below the Tenkan-line.

- The RSI and 3-day RoC suggest a sustained upward trend, highlighting critical levels for price shifts.

GBP/JPY ended Wednesday’s session almost flat after traveling from its daily low/high of 172.51-173.64. However, as the Asian session begins, the GBP/JPY floats around 173.24, unchanged but maintaining its bullish bias.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY remains upward biased, per the daily chart, but it could have dipped lower. Thankfully, the Tenkan-Sen level at 172.73, which briefly pierced, opened the door for a GBP/JPY dip toward a new weekly low of 172.51 but acted as support as the GBP/JPY bounced off that price level, closing Wednesday’s session at 173.30.

During the last three days, the GBP/JPY candlestick chart portrays two dojis, followed by one hanging-man, suggesting further downside is expected. But, the GBP/JPY must achieve a daily close below the Tenkan-line. A breach of the latter will expose the May 2 daily high shifted support at 172.33 before reaching the Chikou-Span peak of March 27 at 171.69. Once cleared, the GBP/JPY can fall toward the Kijun-Sen at 170.29.

Conversely, for a GBP/JPY bullish continuation, the cross needs to conquer the 174.00 mark. Clearance of that level could pave the way to test the YTD high of 174.24 before opening the door to the 2016 high of 177.37.

Oscillators like the Relative Strength Index (RSI) indicator and the 3-day Rate of Change (RoC) warrant further upside expected. Therefore, the trend I set to continue upward.

GBP/JPY Price Action – Daily chart

- NZD/USD fades bounce off three-month-old descending support line, stays pressured at the lowest levels since November 2022.

- Oversold RSI backs corrective bounce off the key support but bearish MACD signals turn down recovery hopes.

- Convergence of 200-DMA, 38.2% Fibonacci retracement restricts short-term upside.

- US ADP Employment Change, multiple PMIs eyed for clear directions.

NZD/USD fades bounce off a three-month-old key support line while dropping back to 0.6015 during early Thursday in Asia.

In doing so, the Kiwi pair justifies the bearish MACD signals to extend the previous week’s downside break of the 200-DMA while keeping the bears in the driver’s seat at the lowest levels in seven months. It’s worth noting, however, that the RSI (14) line is almost oversold and hence can offer intermediate bounces during the south-run.

With this, the NZD/USD price may again test the aforementioned support line stretched from March, close to 0.5980 by the press time. However, the quote’s further downside appears elusive.

In a case where the Kiwi pair breaks the stated support line, it can quickly drop to the 61.8% Fibonacci retracement level of October 2022 to February 2023 upside, near 0.5900.

On the other hand, recovery remains unimpressive below an upward-sloping previous support line from mid-November 2022, surrounding 0.6100.

Even so, the NZD/USD pair buyers remain off the table unless witnessing a daily closing beyond a convergence of the 200-DMA and 38.2% Fibonacci retracement, near 0.6150.

NZD/USD: Daily chart

Trend: Limited downside expected

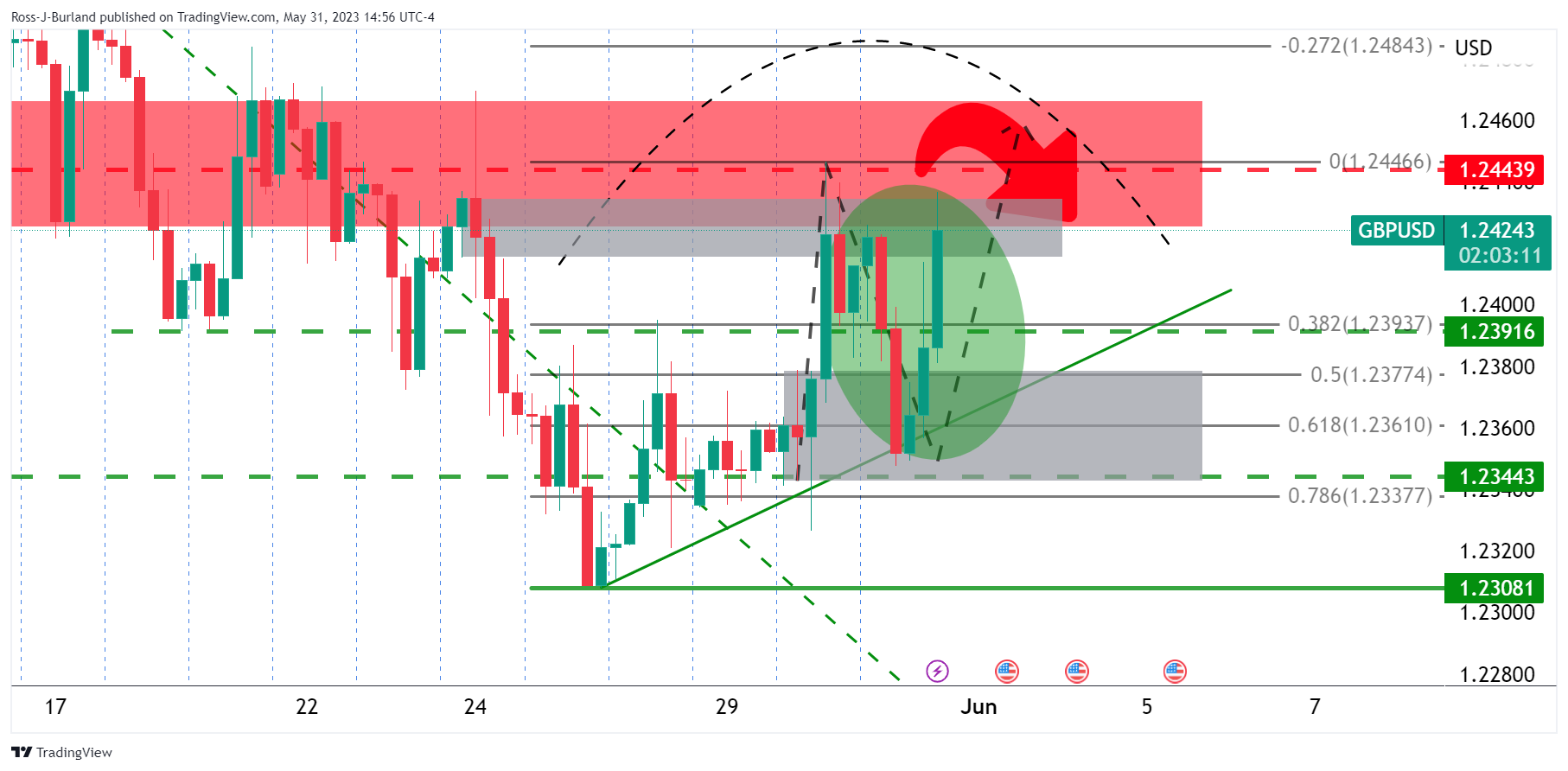

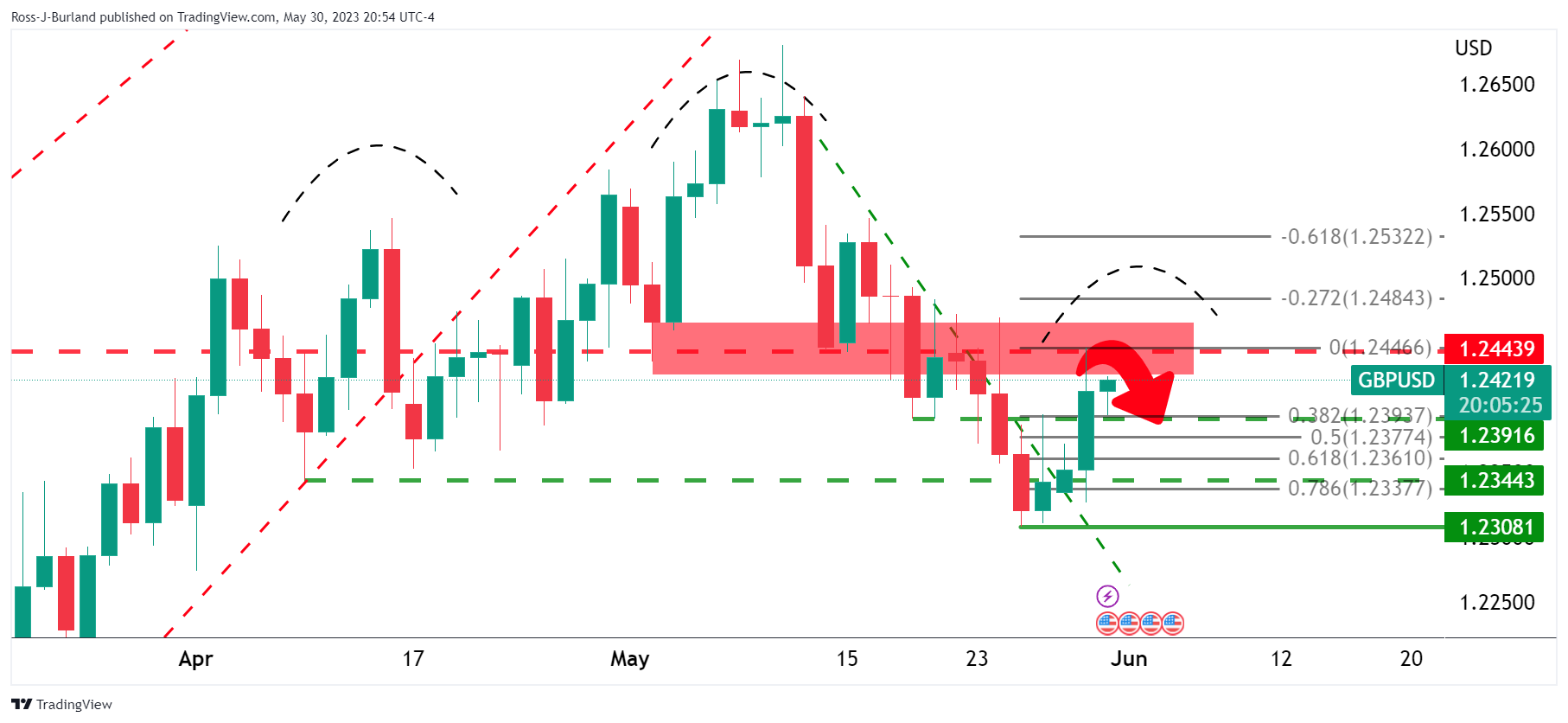

- GBP/USD grinds higher at weekly top after four-day uptrend.

- Recent data, BoE talks underpin concerns of UK’s sticky inflation, suggest more rate lifts from “Old Lady”.

- Hopes of debt ceiling deal passage in US House, mixed US data prod US Dollar bulls after refreshing DXY peak.

- US ADP Employment Change, PMIs in focus for clear directions.

GBP/USD bulls stay in the driver’s seat for the fifth consecutive day, despite the Asian-session latest inaction around 1.2440 during early Thursday. In doing so, the Cable pair not only cheers the latest retreat of the US Dollar but also benefits from the hints that the UK’s inflation problem is bigger and can push the Bank of England (BoE) towards more rate hikes.

On Wednesday, Lloyds Bank unveiled monthly releases of its business sentiment gauge and inflation signals for May. On the same line, Bank of England (BoE) Monetary Policy Committee member Catherine Mann said that the gap between the headline and core inflation in the UK is more persistent than in the US and the Euro area, per Reuters.

On the other hand, the US Dollar Index (DXY) initially rose to the highest levels since March 15 before retreating from 104.70. The greenback’s latest pullback could be linked to the recently mixed US data and receding fears that the US will default on its government debt payment.

The hope of US debt ceiling passage from the House of Representatives increased after US Senate Republican Leader McConnell conveyed expectations of the US debt ceiling bill passing and reaching the Senate on Thursday.

Elsewhere, US JOLTS Job Openings rose to 10.103M in April versus 9.375M expected and 9.745M prior whereas Chicago Purchasing Managers’ Index dropped to 40.4 for May from 48.6 prior and 47.0 market forecasts.

It should be noted that the mixed comments from the Federal Reserve (Fed) officials also weighed on the US Dollar late Wednesday. That said, Federal Reserve (Fed) Governor Michelle Bowman cited recovery in the residential real estate market while also adding, “The leveling out of home prices will have implications for the Fed's fight to lower inflation,” per Reuters. Before him, Clevland Fed President Loretta Mester suggested that the Fed must go for a rate hike in June.

Furthermore, Fed Governor and vice chair nominee Philip Jefferson said that skipping a rate hike would allow the Fed "to see more data before making decisions about the extent of additional policy firming,” per Reuters. On the same line was Federal Reserve Bank of Philadelphia President Patrick Harker who also said on Wednesday that he is inclined to support a "skip" in interest rate hikes at the central bank's next meeting in June.

With this in mind, Wall Street Journal’s (WSJ) Nick Timiraos signaled that Federal Open Market Committee (FOMC) is likely to hold interest rates steady in June.

Amid these plays, Wall Street closed with minor losses and the yields were down while the US Dollar Index (DXY) ended Wednesday’s North American trading on the positive side despite the latest retreat.

Moving on, the US House of Representatives is debating the US debt ceiling extension and will vote on it at around 00:30 GMT, which will be key to watch ahead of a slew of the US employment and activity data.

Also read: US ADP Employment, ISM Manufacturing PMI Preview: First down, then up for US Dollar?

Technical analysis

Despite the GBP/USD pair’s successful recovery from the 100-DMA support of around 1.2300, the buyers need validation from the 50-DMA hurdle of near 1.2450.

- EUR/USD is marching towards 1.0700 amid a sell-off in the USD index.

- S&P500 remained in a bearish trajectory amid a cautious market mood ahead of the US Employment data.

- The collective efforts of softening inflation in Germany, Spain, and France would also impact Eurozone inflationary pressures.

The EUR/USD pair is marching towards the round-level resistance of 1.0700 in the early Toyo session. The major currency pair showed a sharp recovery from 1.0640 on Wednesday after the US Dollar Index (DXY) faced intense selling pressure post refreshing a 10-week high at 104.70. The USD Index has dropped to near 104.23 and is looking vulnerable above the immediate support.

S&P500 remained in a bearish trajectory on Wednesday amid a cautious market mood ahead of the United States Employment data. Investors are worried that healthy US labor conditions would strengthen the odds of one more interest rate hike from the Federal Reserve (Fed), which could push the US economy further toward a recession.

US JOLTS Job Openings data beat estimates with a decent margin. The economic data landed at 10.103M, higher than the estimates of 9.375M and the former release of 9.745M. Kathy Jones, chief fixed income strategist at Charles Schwab, said in a tweet that job openings numbers indicate that "the job market is still healthy."

On Wednesday, Cleveland Federal Reserve Bank President, Loretta Mester, in an interview with Financial Times, cited “I don’t really see a compelling reason to pause — meaning wait until you get more evidence to decide what to do.”

Meanwhile, the Euro showed an impressive recovery despite a sheer slowdown in German inflation. The preliminary German Harmonized Index of Consumer Prices (HICP) surprisingly softened to 6.3% vs. the estimates of 6.8% and the former release of 7.6%. Monthly HICP showed a deflation of 0.2% which infused confidence among European Central Bank (ECB) policymakers that the restrictive monetary policy is dignifying its job effectively.

Investors should note that inflationary pressures in Spain and France have also softened well than expectations, which indicates that the preliminary Eurozone HICP will also show a decent pace of decline.

However, ECB President Christine Lagarde has already cleared that more interest rate hikes are in the pipeline to contain stubborn Eurozone inflation.

- The EUR/JPY fell to the 148.88 area to test the 20-day SMA

- Weak inflation figures from European countries weigh on the Euro amid falling German yields

- Yen’s gains remain capped by lower Japanese yields

The EUR/JPY fell to its lowest level since May 17 as weak inflation figures released by Germany and Spain from May made the Euro bulls lose interest in Wednesday's session. On the other hand, the latest Japanese economic data released in the early Asian session came in weak, limiting the Yen’s upside potential.

German yields decline amid weak Japanese economic data

The May data for the German Harmonized Index of Consumer Prices (HICP) indicated a deceleration to 6.3% year-on-year (YoY), down from the previous reading of 7.6% and below the consensus forecast of 6.8%. Similarly, Spain reported a decrease in its HICP to 2.9%, lower than the expected 3.4%. In that sense, the shorter-term German bond yields declined with the 2- and 10-year bond rates, seeing more than a 2% decrease while the 5-year yield managed to increase slightly . On the other hand, Japanese rates decreased, with the 5-year yield seeing a 12% decline on the day, and applied further pressure on the Yen.

Anticipated data for Thursday indicates a potential decline in the EU's HICP and a contraction in German retail sales, signaling a weakening economy. If inflation continues to decrease, there is a possibility that the ECB might adopt a less strict monetary policy stance, which could negatively impact on the Euro.

On the other hand, Japan reported that Industrial Production unexpectedly contracted in the month of April while Retail Sales from the same month also failed to live up to the market expectations, contracting 1.2% vs the consensus which expected a stagnation. The Large Retailer Sales was the only economic report which surpassed expectations, coming in at 4.8% MoM, in April vs the 3.8% expected.

Levels to watch

According to the daily chart, the EUR/JPY holds a bearish outlook for the short term as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that the sellers are in control while the pair trades below its main moving averages.

The 20-day Simple Moving Average (SMA) at 148.80 level remains the key support level for EUR/JPY. If broken, the 148.50 area and 148.00 zone could come into play. Alternatively, a move above the 149.30 zone would suggest a boost for the pair’s upside momentum, with next resistances at the 149.50 area and 149.80 level.

- Amid the uncertainty, the gold price stays above the $1960 mark, even preparing for over 1.3% monthly losses in May.

- Expectations of resolving the US debt ceiling issue spark a dip in US Treasury bond yields, offering a lift to the XAU/USD price.

- Dovish tones from Fed officials and robust US job openings data paint a mixed economic picture, potentially impacting gold’s future trajectory.

Gold price advances during the day but remains set to achieve monthly losses of more than 1.30% in May, portraying modest gains, and is trading back above the $1960 area. Factors like confidence for removing the debt ceiling in the United States (US), with the US House set for a vote on Wednesday night, spurred a plunge in US Treasury bond yields, a tailwind for XAU/USD prices.

XAU/USD finds support in plunging US Treasury yields, despite the impending monthly loss

The US House of Representatives held a procedural vote, “which allows for the start of the debate and then a vote on the bill itself, passed by a vote of 241-187, with 52 Democrats needed to overcome the opposition of 29 Republicans,” according to Reuters.

US bond yields dropped on investors’ trust in US politicians. The US 2-year Treasury note plummeted 20 bps in the last few days, from around 4.60% to 4.409%. As shown by US 10-year TIPS, US real yields remained unchanged compared to Tuesday’s session at 1.483%, a headwind for the US Dollar (USD).

In early data, the labor market in the United States is showing its resilience, as revealed by the JOLTs report, with job openings crushing estimates of 9.375M, expanding came at a 10.1M pace in April, signaling the tightness of the labor market.

Additionally, dovish comments from the US Federal Reserve (Fed) nominee for Vice-Chairman Philip Jefferson, open to skipping a rate hike at the upcoming June meeting, put additional pressure on US bond yields, with the swaps market estimating a 30% chance for a 25 bps rate hike in June.

Of late, echoing some of his comments was Philadelphia’s Fed President Patrick Harker commenting that he’s inclined to “skip” a rate hike in June. Nonetheless added that incoming data “may change my mind.”

In the latest data, the Fed’s Beige Book revealed that inflation had slowed and that “expectations for future growth deteriorated a little.”

XAU/USD Price Analysis: Technical outlook

XAU/USD remains neutrally biased, slightly tilted upwards but cushioned upwards, in the confluence of the 50 and 20-day Exponential Moving Averages (EMAs) each at $1971.39 and $1975.01, respectively. Downwards, the yellow metal will clash with the 100-day EMA at 1935.17 before challenging the $1900 figure. Once cleared, sellers could drag Gold spot prices toward the 200-day EMA at $1885.43.

- AUD/USD bears are in the market but bulls are flexing.

- The bulls need to get over the line, or face seller commitments below trendline resistance.

The Australian dollar fell below 0.65 the figure and is hovering around the worst levels in over six months growing expectations that the US Federal Reserve would raise interest rates further. The Aussie was also weighed by poor China data. This leaves the technical outlook in question as the price remains on the front side of the bearish trend as the following will illustrate.

AUD/USD H4 chart

The price is trying to correct within a broadly bearish environment. So far, 0.6500 is holding as resistance.

AUD/USD H1 charts

The bears could be interested at this juncture given the premium they will collect in selling higher while in the front side of the bearish market.

The W-formation is a compelling feature on the hourly chart. This is a reversion pattern and the price would be expected to come back into the neckline in due course. This area could act as a support and lead to an onward bullish impulse to retest recent highs and resistance. However, a break of the neckline and then the lows will likely lead to a downward continuation in line with the bearish trend.

The final PMIs from Australia and Japan, Q1 Australian Capital Expenditure, and the Chinese Caixin Manufacturing PMI are the highlights of the Asian session. Markets remain cautious, awaiting a positive resolution to the US debt-ceiling drama. Later on Thursday, US employment data will be watched closely ahead of Friday's Nonfarm Payrolls report.

Here is what you need to know on Thursday, June 1:

Wall Street indexes lost ground again on Wednesday as markets remain cautious. Equity prices finished off their lows. The rebound in stocks weighed on the US Dollar, which was also affected by comments from Federal Reserve officials that signaled a preference for a pause at the next FOMC meeting. A positive outcome of the debt-limit drama is expected from the ongoing debate in the US Congress.

Analysts at Brown Brother Harriman wrote:

We believe passage of the deal leaves the door wide open for a 25 bp hike at the June 13-14 FOMC meeting. With banking sector stresses fading, a potential default was really the only thing that could have prevented a hike next month. That said, the decision will ultimately depend on the data between now and that meeting, starting with the jobs report this Friday.

US employment data (JOLTS report) kept the door open to another rate hike. On Thursday, the ADP employment report and the weekly Jobless Claims will be watched closely. The key report will be on Friday with Nonfarm Payrolls. The Beige Book indicated that "economic activity was little changed overall in April and early May".

The US Dollar Index (DXY) rose 0.15% on Wednesday, ending far from its peak. The DXY hit a two-month high at 104.70 and then pulled back to 104.20.

Inflation data from Germany and France showed a decline in annual rates. On Thursday, the same is expected from the Eurozone Consumer Price Index (CPI). The Euro weakened following inflation figures. Market participants and European Central Bank (ECB) officials still expect rate hikes, but tightened expectations eased. The EUR/USD bottomed at 1.0630 and then rebounded, driven by a broad-based correction of the US Dollar. The pair rebounded towards 1.0700. The trend is down, but the bearish momentum has abated.

The Pound continues to perform well as more rate hikes are expected from the Bank of England to curb inflation. GBP/USD finished at a daily high after erasing losses, climbing toward 1.2450. EUR/GBP accelerated to the downside, falling for the fourth consecutive day. The cross closed below 0.8600, the weakest since December.

USD/JPY dropped for the third consecutive day, falling below 139.50. Lower government bond yields in Europe and the US continue to support the Japanese Yen. Additionally, comments from Japanese officials regarding Yen strength are helping the currency.

The Australian Dollar did not benefit from higher-than-expected inflation in Australia, nor from Reserve Bank of Australia Governor Lowe's comments suggesting that rates could rise further. AUD/USD finished practically flat, hovering around 0.6500, after reaching fresh six-month lows at 0.6456.

NZD/USD trimmed losses during the American session and rose back above 0.6000, after trading under that area for the first time since mid-November.

During the American session, the Canadian Dollar outperformed, supported by better-than-expected Canadian data. Real Gross Domestic Product grew at an annual rate of 3.1% in Q1, surpassing the expected 2.5% and recovering from a 0.1% contraction in Q4. April advance GDP rose 0.2%. Those numbers increased the odds of a rate hike from the Bank of Canada next week. USD/CAD posted the lowest close in a week around 1.3570. Again, the pair ran into resistance at the 1.3650 area. The short-term outlook is starting to favor the downside.

The Turkish Lira was again the worst performer as it continued to depreciate after Erdogan's victory at the presidential elections. USD/TRY reached new record highs above 20.70. A week ago, it was trading at 19.70.

Gold rose moderately on the back of lower yields but pulled back to $1,960 after reaching $1,974. Silver rose to its highest in a week above $23.50. Cryptocurrencies lost ground, with BTC/USD falling 2.35% to $27,120. Crude oil prices continued to trend lower, affected by the gloomy economic outlook, losing more than 2%.

Like this article? Help us with some feedback by answering this survey:

- USD/CAD bears are in the market which leaves prospects of a correction on the cards.

- Support is playing its role and there is a focus on the Fibo scale.

The Canadian Dollar strengthened on the back of data showing the domestic economy grew stronger than expected in the first quarter. USD/CAD is now breaking important structures as the following will illustrate.

Meanwhile, Canada's economy expanded at an annualized rate of 3.1% in the first quarter, eclipsing forecasts for an increase of 2.5%, and likely accelerated further in April.

USD/CAD H4 chart

The price is sinking below prior support and is now heading toward the next area of support as illustrated on the charts. A pullback could be on the verge of a correction.

USD/CAD H1

The hourly chart shows that the price is decelerating at this point. This leaves a focus on the upside with 1.36 eyed. However, we may see a commitment from the bears before then.

- The Euro weakened against its major rivals on Wednesday

- Germany and Spain reported inflation figures below the market expectations

- German bond yields decline, with the 10-year yield falling to weekly lows.

The Euro lost ground against the US Dollar, Japanese Yen and the Sterling Pound on Wednesday following inflation data from Germany and Spain which came in below the market consensus. For Thursday’ session, investors will eye Retail Sales data from Germany and the inflation figures from the European Union (EU).

Weak inflation figures weight on the German Bond yields

The German Harmonized Index of Consumer Prices (HICP) from May decelerated to 6.3% (YoY) from its previous reading of 7.6% and below the consensus of 6.8%. Likewise, Spain reported on Tuesday that its HICP fell to 2.9% vs the 3.4% expected.

Lower inflation means it is less likely the European Central Bank (ECB) will have to raise interest rates to quell surging prices. This would be negative for the Euro since global investors tend to prefer parking their money where interest rates are relatively higher.

As a result of the lower inflation data, the German yields have weakened across the curve. The 10-year bond yield fell to 2.26% seeing 4.18% decrease on the day, while the 2-year yield stands at 2.72% with having lost 3.41% on the day, and the 5-year yielding 2.39% seeing a 3.38 % decline. Conversely, the British yields are edging higher and the divergence between the rates applied further pressure on the pair with the 2, 5 and 10-year seeing an increase of more than 0.80%.

For Thursday, markets are expecting the EU’s HICP to have further declined in May to 6.3% (YoY) from its previous figure of 7%. Retail sales from Germany have contracted in the same period of time and show that the German economic activity continues to weaken. This is a further indication the ECB could ease its monetary policy stance as long as inflation continues to fall – a negative for the Euro.

Levels to watch

The EUR/GBP holds a bearish outlook for the short term, as per the daily chart. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both showing weakness standing in negative territory, and the pair trades below its main moving averages indicating that the sellers are in charge.

In case of further downside, support levels line up at the 0.8550 zone and below around the 0.8545 area and the 0.8520 level. In case the EUR/GBP exchange rate consolidates gains, resistance lines up at the 0.8600 level followed by the 0.8650 zone and the 0.8700 area.

-638211567043094817.png)

- XAG/USD ascends past the 100-day EMA, powered by dovish remarks from Fed officials and reduced US Treasury yields.

- The technical outlook indicates potential resistance at 20-day and 50-day EMA, respectively, and support at 100-day and 200-day EMAs

- Further upside is expected based on the RSI and 3-period RoC, although key pivot points and daily highs need to be breached for significant gain.

Silver price climbs past the 100-day Exponential Moving Average (EMA) and trades back above the $23.50 area, sponsored by several factors. Firstly, US Federal Reserve (Fed) Vice-Chairman nominee Philip Jefferson delivered dovish remarks alongside Philadelphia Fed’s Patrick Harker, while confidence about passing the US debt-ceiling bill triggered a fall in US Treasury bond yields.

XAG/USD Price Analysis: Technical outlook

From a daily chart perspective, XAG/USD is neutral to upward biased, capped on the upside by the confluence of two daily EMAs: the 20-day at $23.80 and the 50-day at $23.93. Upside risks lie above those levels, exposing the $24.00 figure. Conversely, XAG/USD sellers claiming the 100-day EMA at $23.46 could threaten to challenge the 200-day EMA at $22.84 for the third time.

The XAG/USD hourly chart indicates the white metal is upward biased but facing solid resistance at the R2 pivot point at 23.54, with upside risks at the May 23 daily high of 23.63. A breach of the latter, XAG/USD could climb toward the May 22 high of $23.91. Conversely, the XAG/USD first support would be the R1 daily pivot at $23.36 before slumping toward the central pivot at $23.14. Once cleared, the daily low of $23.07 would be up for grabs, ahead of falling to the S1 pivot point at $22.96.

Of note, oscillators like the Relative Strength Index (RSI) indicator suggest further upside expected alongside the 3-period Rate of Change (RoC).

XAG/USD Price Action – Hourly chart

- GBP/USD bulls in the market and eye 1.2500.

- Bears will be looking for a deceleration of the rally.

As per the prior day´s analysis, GBP/USD Price Analysis: Bulls meet key resistance, bears lurking, whereby the price was anticipated to continue forming the right-hand shoulder of the head and shoulders, we have seen just that.

GBP/USD prior analysis

It was stated that the price has rallied into a high-volume candle and had met resistance. This left the meanwhile focus on a correction into the 1.2370s and then the trendline support into the congestion towards 1.2350. Bulls were anticipated to be encouraged to reengage at a discount and that might have been the fuel for the next bullish impulse for a higher high within the right-hand shoulder.

GBP/USD updates

We have seen just that and now the focus is back on the downside. However, there is room to go yet as the equal highs could be mitigated first:

The W-formation would be a reversion pattern, should it come to fruition as the price continues towards 1.2500.

- NZD/USD lost over 80 pips as the US Dollar benefits from a sour market mood.

- Uncertainty over the passing of the debt-ceiling bill and the US labor market outlook contribute to a negative market sentiment.

- Dovish Fed speakers helped the pair erase part of the daily losses.

The NZD/USD has reached its lowest levels in several months due to the increasing strength of the US Dollar. This is primarily driven by uncertainties surrounding the latest US data from the US and concerns about the passage of the debt-limit bill, which is facing resistance in both chambers of the US Congress. In addition Patrick Harker from the Philadelphia Federal Reserve (Fed), commented that the Fed doesn’t have to hike at every meeting and seems to be limiting the Greenback’s gains. On the other hand, the New Zealand economic calendar won’t have any relevant news to offer for the rest of the week.

US bond yields trading lower but the Dollar holds its foot

Reacting to the uncertainty regarding the latest US debt-ceiling bill passing, the US bond yields are edging lower, signaling a higher demand for American bonds. The 10-year bond yield is trading at 3.66%, down by 1.33% on the day. The 2-year yield stands at 4.38% with 2.12 % losses; and the 5-year yield is at 3.77% with 1.33% losses. However, the Greenback as measured by the US Dollar index (DXY) is holding its ground at the 104.35 level, trading with 0.30% gains on the day.

Furthermore, the JOLTS Job Openings report for April from the US, released on Wednesday, exceeded expectations at 10.10 million compared to the anticipated 9.37 million.On the other hand, the Beige Book, published by the Federal Reserve, which provides a varied assessment of the current state of the US economy showed a mixed outlook. According to the report, there was minimal overall change in economic activity during April and early May. However, it highlighted that consumer spending maintained a consistent upward trend, while the service sector experienced a moderate decline in the most recent reporting period.

Automatic Data Processing Inc. will disclose May's employment change figures on Thursday. The US Bureau of Labor Statistics will release the Nonfarm Payrolls (NFP) report for the same month on Friday and these reports are expected to reflect ongoing challenges in the US labor market. They could influence the Federal Reserve's decision and the dynamics of the US Dollar. The CME FedWatch tool shows a 32% odds of a rate hike at the next FOMC meeting.

Levels to watch

The NZD/USD has a clear bearish outlook for the short term, as per the daily chart. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both in negative territory, and the pair trades below its main moving averages indicating that the sellers are in control.

The daily low at 0.5985 level remains the key support level for USD/NZD. If broken, the 0.5980 zone and the 0.5960 level could come into play. Furthermore, a move above the 0.6000 zone would fuel bullish momentum for the Kiwi, with next resistances at the psychological mark at 0.6050 and the 0.6100 level.

US Senate Republican Leader Mitch McConnell is helping to steer crucial legislation to raise the debt ceiling past Senate conservatives but he says:

´´We anticipate debt ceiling bill passing,´´ and claims that the bill is expected to come to the Senate as soon as Thursday.

The US House of Representatives is due to vote on a bill to lift the government's $31.4 trillion debt ceiling in a critical step to avoid a destabilizing default that could come early next week without congressional action.

Republicans control the House by a narrow 222-213 majority, but the bipartisan deal will need support from both Speaker Kevin McCarthy's Republicans and President Joe Biden's Democrats to pass, as members of both parties object to significant parts of the bill.

- USD/JPY bears are in the market and eye a downside extension.

- The bulls need to commit or face pressures in the 138s.

USD/JPY is under pressure with a focus on the 138.80s and then the 138.20s thereafter and the following analysis illustrates this.

USD/JPY H4 chart

As can be seen, the market is on the backside of the prior bullish trend and is starting to break down prior lows within the consolidation phase, aka, structure. the structure of interest in this example was the 139.50 mark that was recently taken out.

Zooming in, we can see that the price is heavily offered and there are prospects of a move toward the said levels.

According to Federal Reserve’s Beige Book, “economic activity was little changed overall in April and early May”. The expectations for future growth deteriorated a little, “though contacts still largely expected a further expansion in activity.”

“Employment increased in most Districts, though at a slower pace than in previous reports”, said the Beige Book. On Friday, the Nonfarm payrolls report is due.

The reaction in the currency market to the Beige Book was muted. The US Dollar continued to trim losses, affected by comments from Federal Reserve officials Harker and Jefferson, who suggested that they will vote to keep rates unchanged at the next meeting.

Key takeaways from the Beige Book:

Economic activity was little changed overall in April and early May. Four Districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. Consumer expenditures were steady or higher in most Districts, with many noting growth in spending on leisure and hospitality. Education and healthcare organizations saw steady activity on balance.

Financial conditions were stable or somewhat tighter in most Districts. Contacts in several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels.

Employment increased in most Districts, though at a slower pace than in previous reports. Overall, the labor market continued to be strong, with contacts reporting difficulty finding workers across a wide range of skill levels and industries.

Staffing firms reported slower growth in demand. As in the last report, wages grew modestly.

Prices rose moderately over the reporting period, though the rate of increase slowed in many Districts. Contacts in most Districts expected a similar pace of price increases in the coming months. Consumer prices continued to move up due to solid demand and rising costs, though several Districts noted greater price sensitivity by consumers than in the prior report.

Home prices and rents rose slightly on balance in most Districts, after little growth in the prior period.

Philadelphia Federal Reserve Bank President Patrick Harker said on Wednesday that the US economy is incredibly resilient. He added that their model forecasts no recession ahead. According to him, the Unemployment Rate is going to tick up toward 4.4%.

Regarding interest rates, Harker favored pausing at the next meeting. He warned that incoming data “may change” his mind.

Market reaction:

Harker and Jefferson’s comments favoring a pause at the next meeting weighed on the US Dollar, which trimmed gains across the board. US stocks moved off lows. The DXY stands at 104.40, up 0.35% for the day.

- USD/MXN rides on risk aversion and strong US data, marking two straight days of gains.

- Stellar US JOLTs report fuels potential Fed rate hike speculations, strengthening USD.

- Anticipated Mexico’s Business Confidence and US job data may sway the currency pair further.

USD/MXN prints two consecutive days of gains, bouncing off the weekly lows of 17.5401, and reached the 17.7700 area as risk-aversion spurred outflows from the emerging market currency. Factors like China’s weak recovery, US debt-ceiling discussions, and solid data from the United States (US) weighed on the Mexican Peso (MXN). At the time of writing, the USD/MXN is trading at around 17.6860, above its opening price by 0.15%.

Emerging markets feel the pinch as US data underscores resilience and prompts hawkish Fed outlook

Wall Street extended its losses portraying a risk-off environment. Weaker than expected manufacturing PMI in China, US debt-ceiling woes, and upbeat US economic data underpinned the USD/MXN to new weekly highs of 17.7724.

The labor market in the United States is proving its resilience, as shown by data in the calendar. As revealed by the JOLTs report, job openings crushed estimates of 9.375M, which came at 10.1M in April, signaling the tightness of the labor market. Following the release, the USD/MXN jumped from around 17.60 toward the 17.7500 area. The reaction is attributed to speculations that the US Federal Reserve (Fed) could raise interest rates in the upcoming June meeting

That triggered a re-pricing towards a more hawkish Federal Reserve (Fed), with odds at 69.8%, for a 25 bps rate hike.

Federal Reserve speakers have begun crossing the wires, with the Vice-Chairman nominee by the US President Joe Biden, Philip Jefferson, saying that keeping rates unchanged. However, they should not be taken as a peak for the tightening cycle. Echoing some of his comments was Philadelphia Fed Patrick Harker, who commented that he’s on the camp of “skipping” a meeting and added that incoming data could change his point of view.

Upcoming events

The agenda in Mexico will feature the Business Confidence for May after April’s numbers came to 52.6. Across the borders, the US economic docket will feature the ISM and S&P Global PMIs, jobs data with jobless claims, and the ADP Report.

USD/MXN Price Analysis: Technical outlook

The USD/MXN pair is downward biased. During the day, buyers tested the waters at the 20-day Exponential Moving Average (EMA), at 17.7511, before retracing from around that area, dropping below 17.7000 after Fed speakers’ remarks. For a bullish continuation, the USD/MXN buyers must claim the 20-day EMA and the April 2018 lows-turned-support at 17.9388 before challenging the 50-day EMA at 17.9483. Conversely, if USD/MXN slips below 17.60, a test of the YTD low of 17.4238 is likely.

Federal Reserve Governor Philip Jefferson said in speech on Wednesday that pausing rate hikes at the next FOMC meeting would offer time to analyze more data before making a decision about the extent of additional tightening. He added that a pause, does not mean that rates peaked.

Key takeaways from the speech:

“While it is reasonable to expect that the recent banking stress events will lead banks to tighten credit standards further, the amount of tightening and the magnitude of the effect such tightening might have on the U.S. economy is not yet clear, and this uncertainty complicates economic forecasts.”

“A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle. Indeed, skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming.”

“While my base case forecast for the U.S. economy is not a recession, higher interest rates and lower earnings could test the ability of businesses to service debt. In addition, and perhaps more in focus given the recent events affecting certain areas of the banking sector, higher interest rates could further exacerbate stress at banking organizations, especially those that are highly exposed to longer-duration assets and have a relatively high ratio of uninsured deposits to total deposits.”

Market reaction

The US Dollar is up across the board but is moving off daily highs, as market sentiment recovers. Comments from Fed’s Jefferson and Harker sounded dovish. US yields are at fresh lows and DXY is at 104.35, retreating from monthly highs.

- The AUD/USD fell to its lowest point since November 2022.

- The monthly Consumer Price Index from Australia accelerated in April.

- Investors await labor market data from the US.

The Australian dollar dropped to multi-month lows due to the strong US Dollar and uncertainties surrounding US labor market data and the debt-limit bill facing resistance in Congress. On the other hand, Australian inflation in April picked up somewhat but bond yields are declining adding further pressure on the Australian Dollar.

Australian and American yields are weak ahead of NFP data

Following Monday’s release of the sharp decline in Australian Building permits of 8% vs the 2% increase expected, Australian yields continue to decline. The 10-year bond is yielding 3.60% and showing 0.24% losses.The 2-year rate stands at 3.55% down by 0.51% , while the 5-year yield is at 3.37% losing 0.24% .

On the flip side, US bond yields are declining, indicating a bearish market sentiment driven by heightened demand for American bonds. The 10-year yield retraced to 3.66% with a loss of 1.13%, while the 2-year yield stands at 4.38% reflecting a decline of 2.12%. Similarly, the 5-year yield sits at 3.77% with losses of 1.33%.

That being said, the American bonds market may face some volatility ahed the release of key labor market data from the US. On Thursday, the Automatic Data Processing Inc., will release the employment change figures from May and on Friday, the US Bureau of Labor Statistics will release Non Farm Payrolls (NFP) from the same month. In that sense both reports are expected to hint at more pain in the US labor market which may have an impact on the upcoming Federal Reserve (Fed) decision. At the time being, market participants expect a 25 basis points (bps) hike.

In addition, the JOLTS Job Openings released on Wednesday, from the US, for April, came in at 10.10M vs the 9.37M expected. For the rest of the session, investors will eye the release of the Fed Beige book to have a better understanding of the current economic situation in the US.

Levels to watch

The AUD/USD has a bearish outlook for the short term as indicators on the daily chart suggest that the sellers have the upperhand while the pair trades well below its main Simple Moving Averages (SMA).

In addition, If the Aussie continues to lose ground, immediate support levels are seen at the 0.6440 zone followed by the 0.6300 area, and then at the 0.6250 level. On the other cand, in case the Aussie gains traction, the following resistance line up at the 0.6500 zone followed by the 0.6550 and 0.6600 levels.

-638211479963318250.png)

- The EUR/USD slips to the 1.0660s region as robust US economic data, including an unexpected surge in April’s JOLTs report, bolstered the US Dollar, erasing previous gains.

- Easing inflation in Germany and France lessens the pressure on the ECB for further aggressive actions, contributing to the Euro’s downward trajectory.

- Upcoming economic events could further impact the currency pair, with EU members’ S&P Global PMIs and US job data in the spotlight.

EUR/USD stumbles past the 1.0700 mark erasing last Tuesday’s gains, and extends its fall toward the 1.0660s area after upbeat economic data from the United States (US) boosted the greenback. Earlier, Eurozone (EU) data showed that inflation is easing, hence the Euro’s (EUR) weakness. At the time of writing, the EUR/USD is trading at 1.0663m, down by more than 0.60%.

Risk aversion drives investors toward the greenback while easing inflation pressures in the EU cast a shadow on the Euro

Risk aversion has been the main driver since the beginning of the trading day. Further exacerbated by weak manufacturing activity in China and US debt-ceiling jitters, it triggered a flight to safety, namely the US Dollar (USD). Data-wise, the US economic agenda featured a surprising JOLTs report for April, with vacancies climbing the most in three months, cane at 10.1M, exceeding estimates of 9.375M, 300K more than March.

That triggered a re-pricing towards a more hawkish Federal Reserve (Fed), with odds at 69.8%, for a 25 bps rate hike. Therefore, the EUR/USD tumbled 30 pips, from around 1.0690, toward the 1.0660 area, Following the data release. As of writing, the EUR/USD continued to fall as the day advanced.

Across the pond, inflation in Germany came below estimates in May, easing off pressure on the ECB to continue its aggression cycle. German inflation rose by 6.1%, beneath forecasts of 6.5%, lower than April’s 7.2%. Earlier France revealed that prices slowed to 5.1%, from the 5.5% foresaw by analysts.

Upcoming events

The Eurozone economic data will reveal the EU’s members’ S&P Global PMIs on Thursday, alongside Retail Sales in Germany and the release of the Harmonised Index of Consumer Prices (HICP). On the US front, ISM and S&P Global PMIs and jobs data, with jobless claims and the ADP Report, would be revealed.

EUR/USD Technical Levels

Swiss National Bank (SNB) Chairman Thomas Jordan said on Wednesday that Credit Suisse situation was caused by a lack of trust by market participants in the bank rather than rising interest rates, per Reuters.

Jordan further reiterated that they have to bring inflation back below 2% as soon as possible and noted that sees inflation risks higher than deflation in the future, due to deglobalisation.

Market reaction

USD/CHF retreated modestly from the multi-month high it set near 0.9150 earlier in the day and was last seen trading at 0.9125, where it was still up 0.75% on a daily basis.

- The USD/CAD pair teetered around the 1.3600 figure after the Canadian GDP Q1 results exceeded estimates, prompting anticipations of BoC policy tightening.

- The US labor market reported an unexpected surge in job openings (JOLTs), supporting the case for additional interest rate hikes by the US Federal Reserve.

- Crude oil’s declining prices and a resilient US Dollar Index supported the greenback, offsetting the pressure from solid Canadian economic performance.

USD/CAD climbs for two straight days, though reclaiming the 1.3600 figure after solid Canadian economic data increased the odds for further tightening by the Bank of Canada (BoC). Nevertheless, recent data in the United States (US), alongside a risk-off impulse, cushioned the pair’s fall and trades at 1.3594, down by 0.06%.

Canada’s economy growing faster than estimates, takes a potential rate hike back into the table for the BoC

Statistics Canada reported that Gross Domestic Product (GDP) for the first quarter (Q1) rose above estimates, accelerating further in April, according to data. The Canadian economy expanded by 3.1% YoY, smashing 2.5% estimates, and month-over-month (MoM) in March stood at 0%, against the above forecasts—the preliminary figure for April stood at 0.2%.

After the data was released, the USD/CAD tumbled from around 1.3640 toward 1.3606 before data from the US sponsored a short-lived recovery.

In the US, the April job openings report, known as JOLTs, unexpectedly soared to its highest level in three months, justifying the need for additional interest rate hikes by the US Federal Reserve (Fed). Vacancies grew to 10.1M, above estimates of 9.375M, and posted more than 300K compared to March. Although it cushioned the USD/CAD fall and reclaimed 1.3600, the pair extended its losses below the latter.

The greenback stood afloat as falling crude oil prices threw a lifeline, as it extended its losses by 1.32%, with the US crude oil benchmark, WTI exchanging hands at $68.53 per barrel.

Meanwhile, the US Dollar Index (DXY), which tracks the buck’s value vs. a basket of six peers, stands at 0.48%, up at 104.557, bolstered by recently released jobs data and increasing odds for another rate hike in June. The CME FedWatch Tool’s chances for an increase lie at 69.8%, above yesterday’s 66.6%.

USD/CAD Price Analysis: Technical outlook

From a technical perspective, the USD/CAD persists upward biased, despite the ongoing pullback, with sellers eyeing a test of the weekly low of 1.3567. Further deep beneath that level will immediately expose the 20-day Exponential Moving Average (EMA) at 1.3542, followed by the 50-day EMA at 1.3530. Conversely, if USD/CAD buyers reclaim 1.3600, that will exacerbate a continuation of the ongoing rally, but a decisive break above the weekly high of 1.3651 is needed to challenge 1.3700.

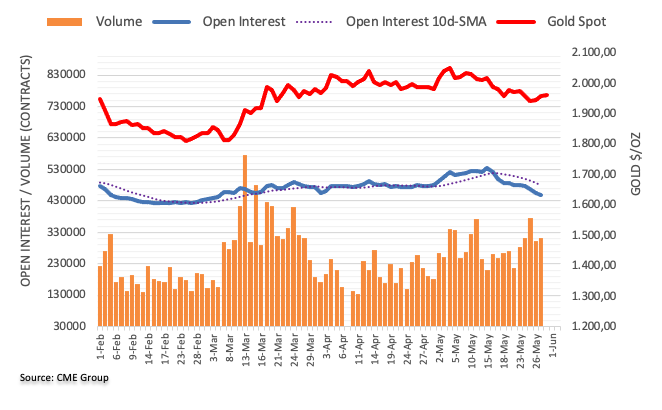

- Gold prices rise slide in Wall Street, supported by a decrease in government bond yields.

- Following a brief pullback in response to the US Job Openings report, XAU/USD rebounded to weekly highs.

Gold prices are up for the second consecutive day on Wednesday, driven by lower government bond yields. The yellow metal reached its highest level in a week and is trading above $1,970.

Gold keeps shinning

After the opening bell on Wall Street, XAU/USD gained momentum and rose above $1,970. However, following the release of the US Job Openings report, it pulled back to $1,960, only to rebound later to $1,974, hitting a fresh weekly high.

US data released so far on Wednesday has been mixed. The JOLTS Job Openings came in at 10.10 million in April, against expectations of a decrease to 9.73 million. Meanwhile, the Chicago PMI showed a sharp decline in May from 48.6 to 40.4, against expectations of 47. These economic figures triggered market volatility. On Thursday, the ADP Employment report and the weekly Jobless Claims are due, while on Friday, the official Employment report will be released.

Although the US Dollar Index is up by 0.45%, it is not limiting Gold's gains. The key driver on Wednesday has been government bond yields. The 10-year Treasury yield is at 3.65%, the lowest in more than a week, while the German 10-year reference dropped to 2.24%, the lowest in two weeks. Market jitters and easing inflation in Europe are supporting the rally in bonds.

The short-term outlook for Gold looks positive while trading above $1,955, with resistance expected around $1,970. A clear consolidation above this level would keep the door open for further gains. The next strong resistance could be seen at the 20 and 55-day Simple Moving Averages, currently at $1,988.

Technical levels

Strategists at Crédit Agricole have made an upward revision to their Gold price forecast for 2024.

Three factors behind the revised outlook

“We now expect Gold to peak at $2,050 by Q1 2024 and then ease back to $2,000 by the end of Q2 2024. We continus to hold our previous target of $2,000 for the precious metal by the end of 2023.”

“The ongoing US debt-ceiling debacle has prompted investors to flock to Gold, viewing it as a safe haven and a reserve asset in times of uncertainty. Gold has historically performed well during past debt ceiling incidents, often holding onto and even extending its gains in the months following a debt ceiling resolution.”

“US political risks could continue to boost Gold's appeal, even after the current debt ceiling issue is resolved. If the statutory debt limit is extended until January 2025, the ensuing political wrangling could amplify risks surrounding the 2024 US presidential election.”

“We predict a weakening USD in late 2023 and early 2024, due to expectations of the Federal Reserve entering an easing cycle amidst a potential US recession and subsiding inflation. This scenario is likely to further enhance Gold's attractiveness.”

The Brazilian Real depreciated again yesterday after further inflation indicators signaled a faster decline in inflation. The showdown between the Brazilian government and the central bank (Banco Central do Brasil, BCB) is getting closer. Economists at Commerzbank analyze its implication for the USD/BRL pair.

August meeting of the BCB is looking more and more like the date for a first rate cut

“In June, the planning minister, finance minister and central bank governor will meet to set the inflation target for 2026. BCB governor Campos Neto has recently repeatedly warned against changes, stressing that they would not widen the current scope for rate cuts.”

“We also see the discussions as a potentially destabilizing factor for the Brazilian Real. The August meeting of the BCB is looking more and more like the date for a first rate cut. At the same time, the Fed's rate cut expectations are being pushed further into the future. No wonder the USD/BRL exchange rate is trending higher.”

“However, if discussions about inflation targeting leave even the slightest doubt that the government is trying to influence monetary policy in this way, BRL weakness could quickly take on much greater proportions.”

EUR/USD has today sunk to its lowest levels since mid-March. Economists at Rabobank discuss the pair’s outlook for the coming weeks.

USD is likely to find support amid risk-averse environment

“The currency pair is comfortably on course for hitting our H2 target of EUR/USD 1.06.”

“The market is already comfortably priced for further rate hikes and moderating price data and the threat that the Eurozone is facing stagnation in H2 suggest that the EUR can sink further vs. the USD in the coming weeks.”

“The risk that the US may fall in recession this year, combined with a disappointing recovery in China and stagnation risks in the Eurozone do not bode well for risk appetite. In this environment the USD is likely to find support.”

Gold price recovers after slumping to two-month low. Econmists at Commerzbank discuss XAU/USD outlook.

US Dollar is priced at its highest level since mid-March

“The market apparently still sees a small risk that the compromise found at the weekend to raise the debt ceiling in the US will not pass Congress. Voting is set to take place in the House of Representatives today; afterwards the Senate will need to give its approval.”

“The Fed Fund Futures are still pricing in another 25 bps Fed rate increase at the next meeting in June with a probability of roughly 60%. A rate hike on this scale is still fully priced in at one of the next two meetings. In the market’s view, this is likely to be reversed again by year’s end. Against this backdrop, the Gold price has been showing relative strength of late, especially as the US Dollar is priced at its highest level since mid-March.”

- JOLTS Job Openings in the US rose modestly in April.

- US Dollar Index posts strong daily gains above 104.50.

The data published by the US Bureau of Labor Statistics (BLS) revealed on Wednesday that the number of job openings on the last business day of April stood at 10.1 million, compared to 9.74 million in March. This reading came in higher than the market expectation of 9.37 million.

"Over the month, the number of hires changed little at 6.1 million. Total separations decreased to 5.7 million," the BLS noted in its publication. "Within separations, quits (3.8 million) changed little, while layoffs and discharges (1.6 million) decreased."

Market reaction

The US Dollar gathered strength against its rivals after this report and the US Dollar Index was last seen rising 0.5% on the day at 104.58.

- GBP/USD reverses an intraday dip amid a modest USD pullback from over a two-month high.

- The disappointing release of the Chicago PMI prompts some profit-taking around the USD.

- Bets for more Fed rate hikes and the risk-off impulse should act as a tailwind for the buck.

The GBP/USD pair attracts some dip-buying near the 1.2350-1.2345 area on Wednesday and climbs to the top end of its daily trading range during the early North American session. The pair is currently placed around the 1.2400 mark, below the 50-day Simple Moving Average (SMA) hurdle tested the previous day.

The US Dollar (USD) trims a part of its intraday gains to the highest level since mid-March in reaction to the disappointing release of the Chicago PMI, which fell to 40.4 in May from the 48.6 previous. The British Pound, on the other hand, continues to draw some support from the possibility of additional interest rate hikes by the Bank of England (BoE), bolstered by stronger-than-expected consumer inflation figures released last week. This, in turn, lends some support to the GBP/USD pair, though the lack of follow-through buying warrants caution before positioning for an extension of the recent bounce from the 1.2300 neighbourhood, or a nearly two-month low set last Thursday.

Investors now seem convinced that the Federal Reserve (Fed) will keep interest rates higher for longer and have been pricing in another 25 bps lift-off at the next FOMC policy meeting in June. The bets were reaffirmed by the US Core PCE Price Index released on Friday, which indicated that inflation remains sticky. Apart from this, the risk-off impulse supports prospects for a further near-term appreciating move for the safe-haven buck and might contribute to capping any meaningful upside for the GBP/USD pair. The global risk sentiment takes a hit in the wake of weaker Chinese PMI prints, which adds to worries about a global economic downturn and benefits safe-haven assets.

The aforementioned fundamental backdrop warrants some caution for aggressive bullish traders ahead of important US macro releases scheduled at the beginning of a new month, including the closely-watched Nonfarm-Payrolls (NFP) on Friday. In the meantime, a generally weaker tone around the equity markets might continue to act as a tailwind for the Greenback and keep a lid on any meaningful upside for the GBP/USD pair, at least for the time being.

Technical levels to watch

Bank of England (BoE) Monetary Policy Committee member Catherine Mann noted on Wednesday that the gap between the headline and core inflation in the UK is more persistent than in the US and the Euro area, as reported by Reuters.

Mann further added that firms will use it if they have a high pricing power and said that they will remain on a path that has an "awful a lot of volatility."

Market reaction

GBP/USD edged slightly higher with the immediate reaction to these comments. As of writing, the pair was trading at 1.2380, where it was still down 0.3% on a daily basis.

- USD/TRY extends the sharp advance to the vicinity of 20.80.

- The lira remains well on the defensive and approaches 21.00.

- President Erdogan is expected to announce a cabinet reshuffle.

Another day, another record low of the Turkish lira vs. the greenback, this time prompting USD/TRY to trade at shouting distance from the 20.80 zone.

USD/TRY looks at domestic politics

USD/TRY maintains the bullish move unchanged and approaches the round level at 21.00, as market participants continue to digest Erdogan’s victory at Sunday’s elections and latest news of potential changes to his cabinet.

On the latter, and according to officials, it is highly likely that M. Simsek, the former economy chief who is well-respected by financial markets for his orthodox policy expertise, will be appointed to the cabinet, potentially as either the finance minister or a vice president.

Some positive news from the calendar showed the economy expanded more than estimated by 4.0% YoY in the January-March period.

USD/TRY key levels

So far, the pair is gaining 1.45% at 20.6919 and faces the next hurdle at 20.7372 (all-time high May 31) followed by 21.00 (round level). On the downside, a break below 19.4286 (55-day SMA) would expose 19.1559 (100-day SMA) and finally 18.8321 (200-day SMA).

Eurostat will release the preliminary estimate of Eurozone Harmonised Index of Consumer Prices (HICP) data for May on Thursday, June 1 at 09:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of four major banks regarding the upcoming EU inflation print.

Headline HICP is expected to decelerate at 6.3% year-on-year vs. 7.0% in April and annual core HICP is seen softening marginally to 5.5% against the former release of 5.6%. If so, headline would be the lowest since February 2022 and would also be the first deceleration in core since June 2022.

Commerzbank

“Inflation is expected to have fallen from 7.0% in April to 6.0% in May. Half of the decline is due to lower energy prices. The price correction for food pushed down the inflation rate by an estimated 0.3 percentage points. However, the inflation rate excluding energy and food is also expected to have fallen by 0.2 percentage points to 5.4% in May. The main reason for this is the introduction of the 49-Euro ticket for regional public transport in Germany.”

Nomura

“We forecast headline Euro-area HICP inflation to fall to 6.2% YoY in May (0.8ppt lower than in April), and core HICP inflation to remain unchanged at 5.6% YoY. Core price momentum is likely to remain strong enough to unnerve the ECB. We think it will remain concerningly high owing to strong labour market pressures, revived inflation expectations and survey evidence of continued upward inflationary pressures. We think a robust core inflation print lends support to our forecast for two further 25 bps hikes from the ECB at its next meetings, bringing its terminal rate to 3.75%.”

SocGen

“We expect the May inflation data to deliver another massive decline in headline inflation from 7% yoy in April to 6% in May. Meanwhile, we think easing goods inflation will help core inflation fall from 5.6% to 5.5%, with a downside risk of 5.4% – which is set to increase the pressure on the ECB to do more rate hikes.”

Citi

“Headline inflation should make another major step down in May as base effects in energy kick in, down to 6.3% from 7.0% in April. We project core HICP inflation to also have eased from 5.6% to 5.5% YoY, with a sub-trend 0.2% MoM gain in seasonal adjusted terms, with temporary factors behind the drop. We though see core CPI re-accelerating in June following the acceleration in negotiated wages in 1Q to 4.3% and likely to pick up further in 2Q.”